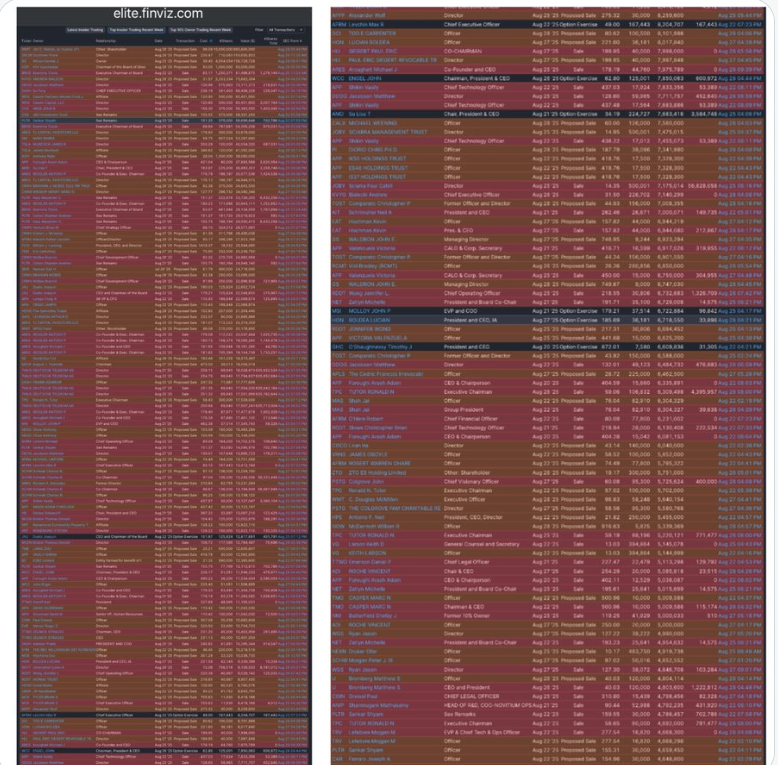

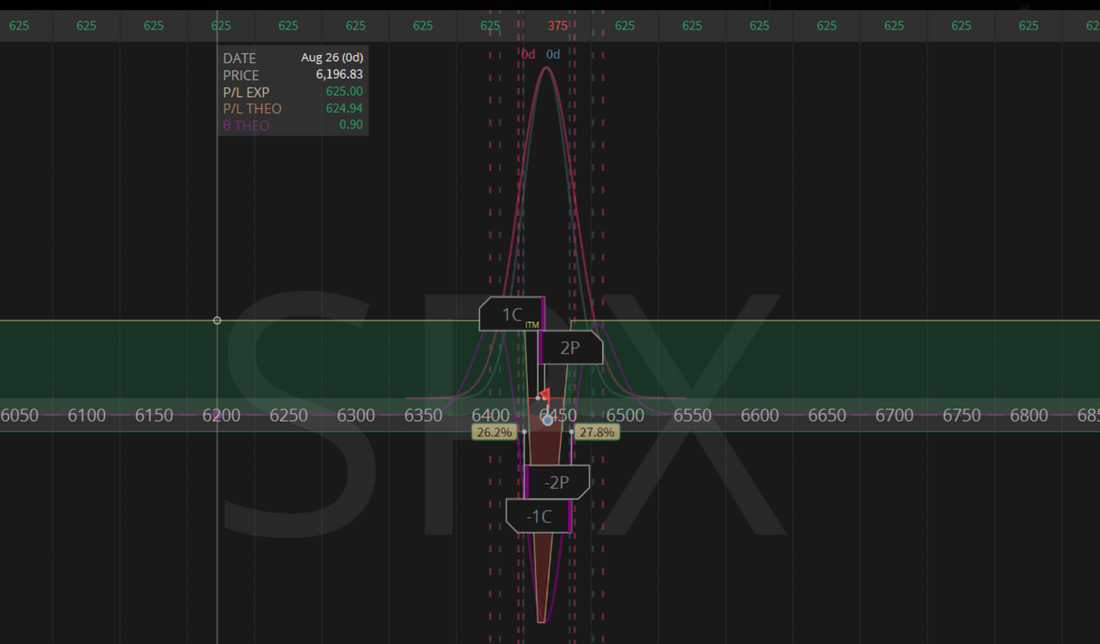

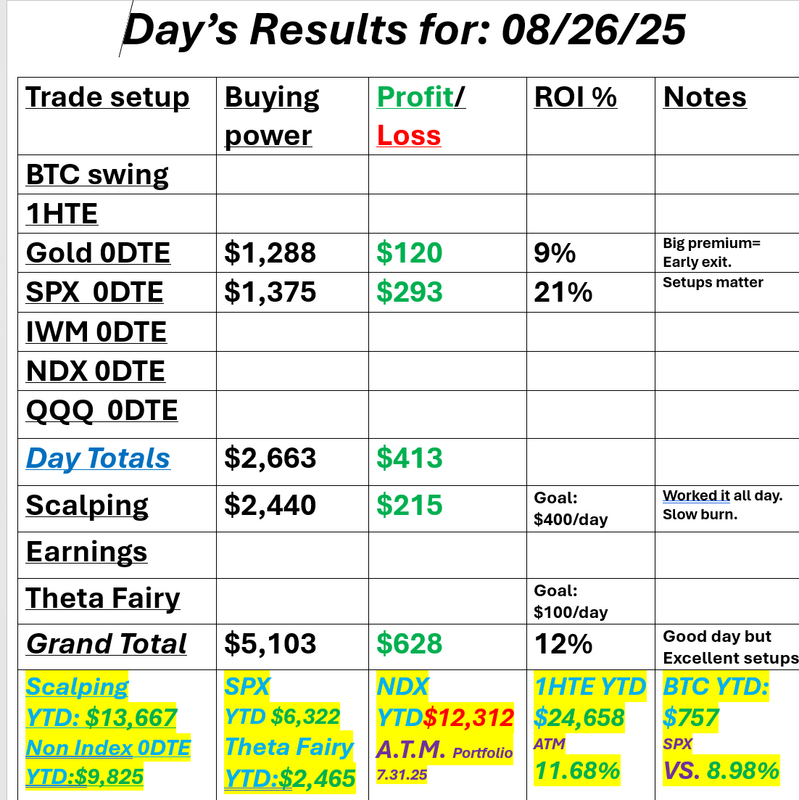

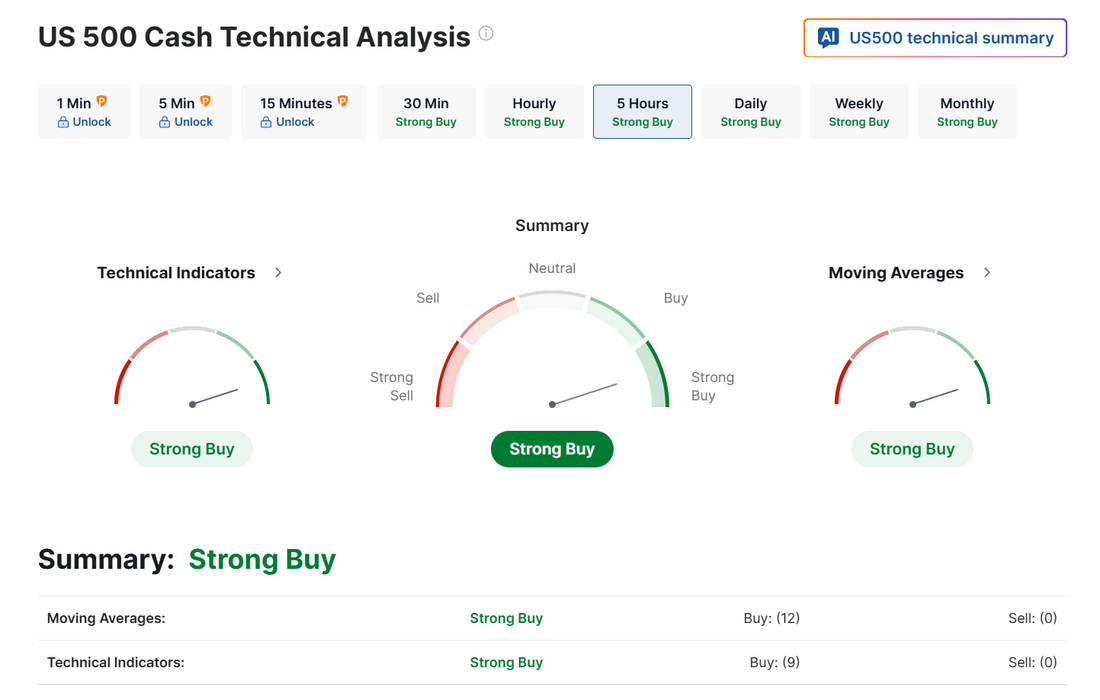

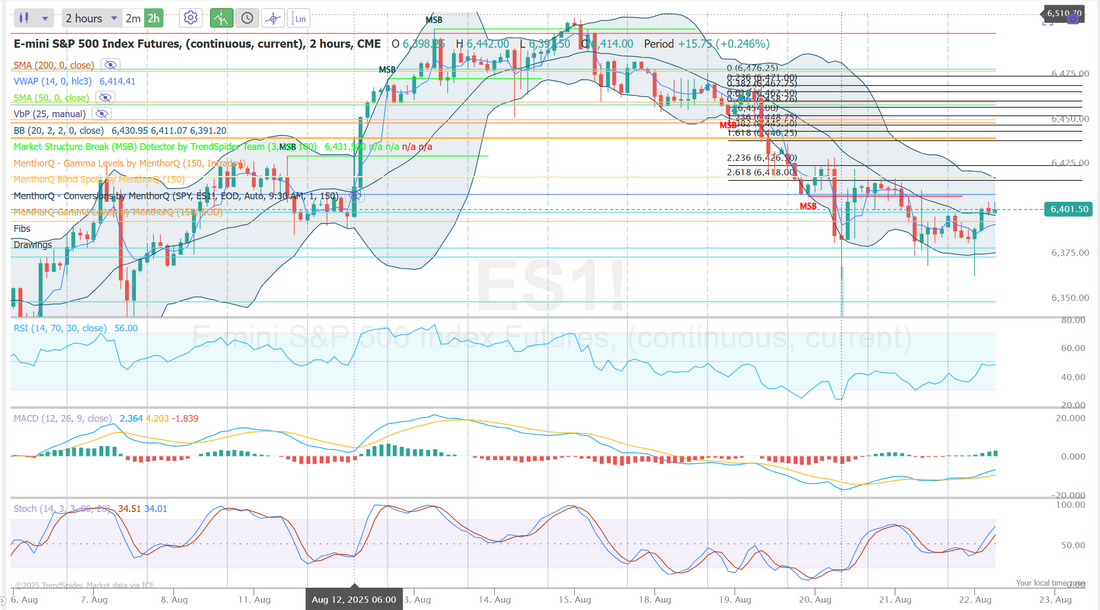

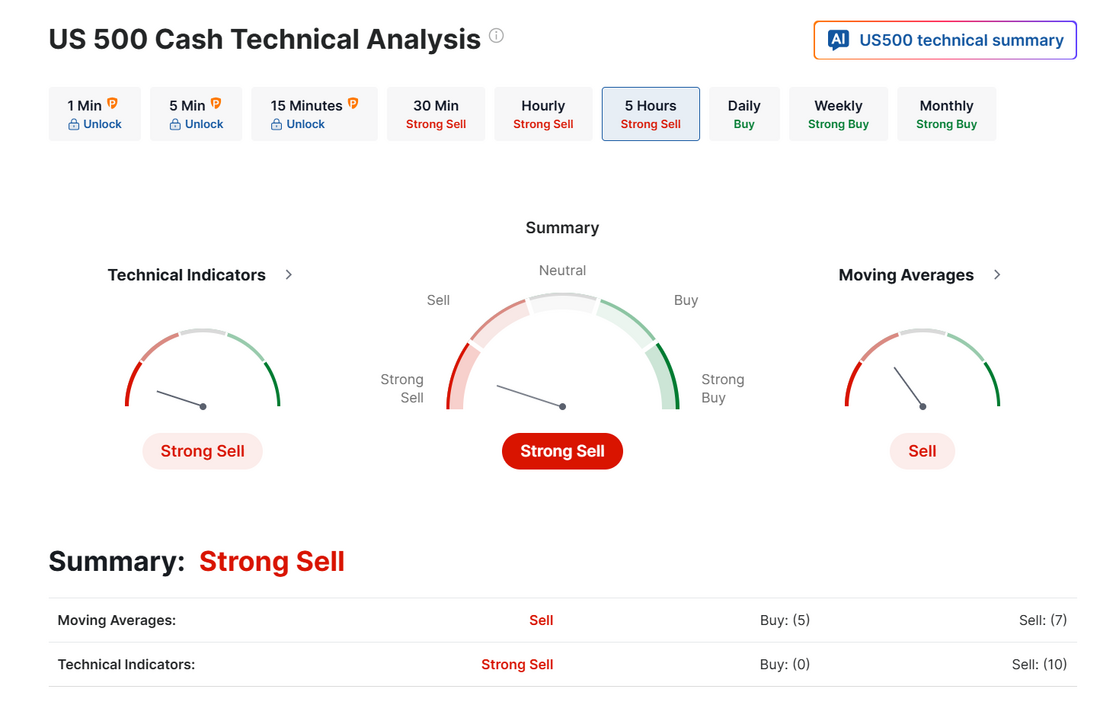

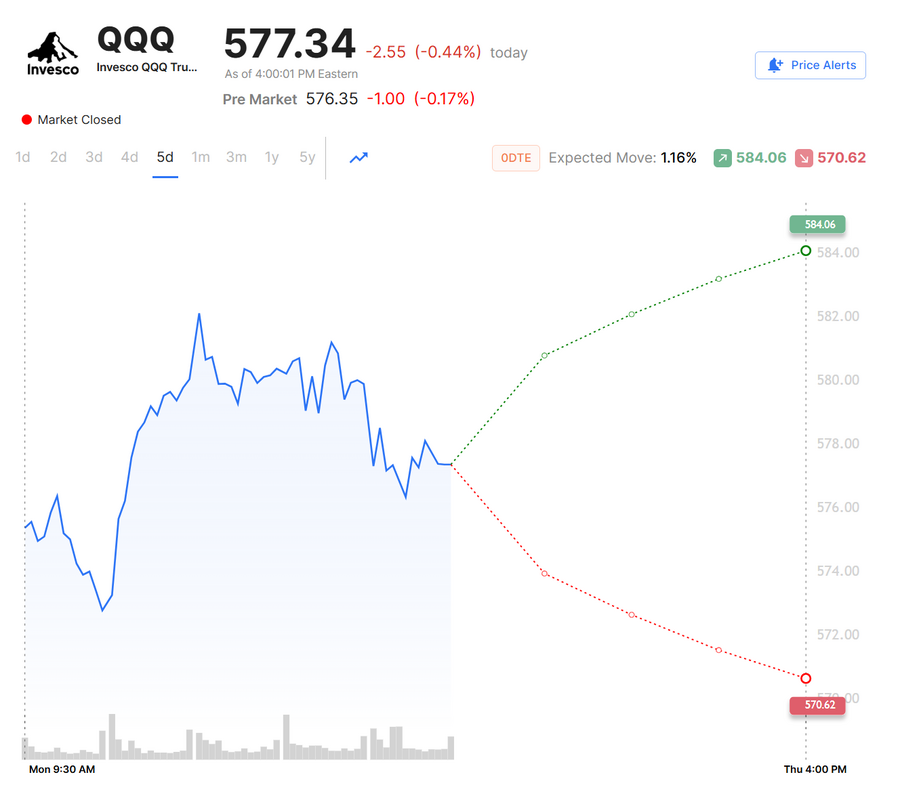

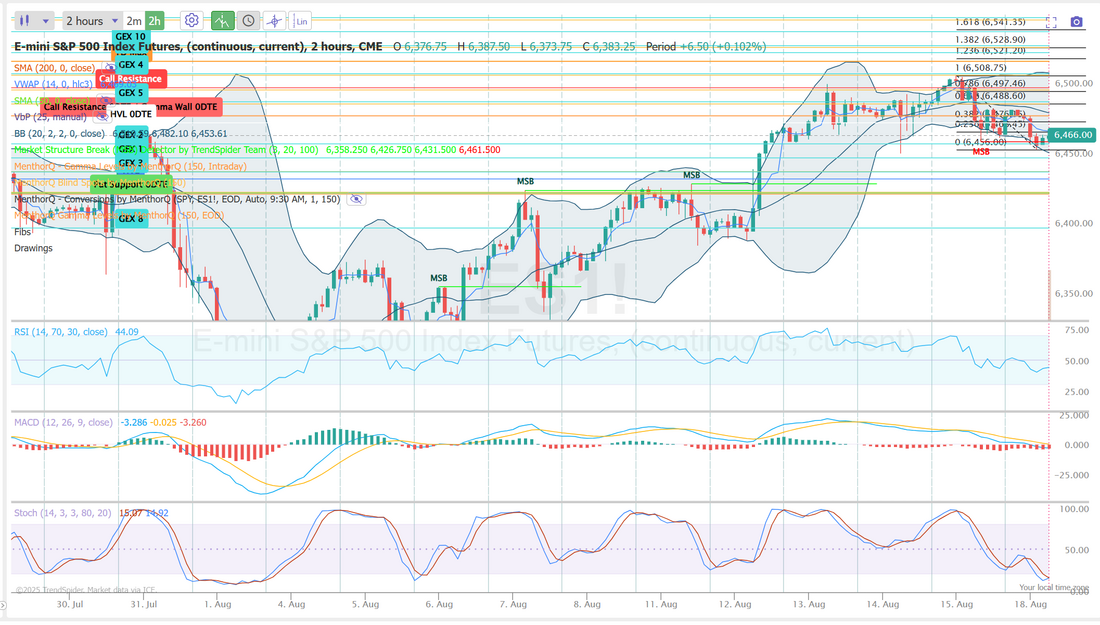

PCE dayI'm very interested to see the PCE numbers today. We've got more and more FED members leaning towards a Sept. rate cut. PCE is a much better inflation indicator over CPI. It could be a market catalyst today. Futures are dersking as I type. with the long weekend most traders are looking to pull back some risk. We had a good day yesterday. We got stuck in a QQQ that we couldn't exit the day before and that cost us but overall it was a pretty clean day of profits. Let's take a look at the markets. I didn't think we'd get such bullish price action but the market wants what it wants and it wanted to go higher yesterday. New ATH's incoming again? September S&P 500 E-Mini futures (ESU25) are down -0.27%, and September Nasdaq 100 E-Mini futures (NQU25) are down -0.47% this morning as investors trimmed risk ahead of the release of the Federal Reserve’s first-line inflation gauge, which could offer more insight into the interest-rate outlook. Some negative corporate news is weighing on stock index futures, with Marvell Technology (MRVL) tumbling over -14% in pre-market trading after the chip designer posted in-line Q2 results and provided tepid Q3 revenue guidance. Also, Dell Technologies (DELL) slumped more than -6% in pre-market trading after reporting a slowdown in AI server orders in Q2 and a weaker-than-expected operating margin in its infrastructure unit. Higher bond yields today are also weighing on stock index futures. In yesterday’s trading session, Wall Street’s major indices closed higher, with the S&P 500 notching a new all-time high. Snowflake (SNOW) jumped over +20% after the provider of cloud-based data-warehouse software posted upbeat Q2 results and raised its full-year product revenue guidance. Also, chip stocks gained ground, with Micron Technology (MU) and Marvell Technology (MRVL) rising more than +3%. In addition, Pure Storage (PSTG) soared over +32% after the company reported stronger-than-expected Q2 results and boosted its annual guidance. On the bearish side, Hormel Foods (HRL) plunged more than -13% and was the top percentage loser on the S&P 500 after the company posted weaker-than-expected FQ3 adjusted EPS and gave disappointing FQ4 guidance. The U.S. Bureau of Economic Analysis said on Thursday that Q2 GDP growth was revised higher to +3.3% (q/q annualized) from the initial estimate of +3.0%, stronger than expectations of +3.1%. Also, the number of Americans filing for initial jobless claims in the past week fell -5K to 229K, compared with the 231K expected. In addition, U.S. pending home sales fell -0.4% m/m in July, in line with expectations. “Slowing job growth indicates the economy will not keep up with the above-trend growth from the previous quarter. Economic growth will likely flatline in the third quarter. Softer growth in the third quarter will add fuel to those calling for rate cuts,” said Jeff Roach at LPL Financial. Fed Governor Christopher Waller reiterated his call for lower interest rates on Thursday, saying he would back a quarter-point cut in September and expects further reductions over the next three to six months. “With underlying inflation close to 2%, market-based measures of longer-term inflation expectations firmly anchored, and the chances of an undesirable weakening in the labor market increased, proper risk management means the FOMC should be cutting the policy rate now,” Waller said. Meanwhile, U.S. rate futures have priced in an 85.2% probability of a 25 basis point rate cut and a 14.8% chance of no rate change at the Fed’s monetary policy committee meeting next month. Today, all eyes are focused on the U.S. core personal consumption expenditures price index, the Fed’s preferred price gauge, which is set to be released in a couple of hours. Economists, on average, forecast that the core PCE price index will stand at +0.3% m/m and +2.9% y/y in July, compared to the previous figures of +0.3% m/m and +2.8% y/y. “In-line or lower results will likely cement investors’ confidence in a September rate cut. While a higher-than-expected print may not take a rate cut off the table next month, it could sour Wall Street’s mood as inflation concerns grow,” said Bret Kenwell at eToro. U.S. Personal Spending and Personal Income data will also be closely monitored today. Economists anticipate July Personal Spending to rise +0.5% m/m and Personal Income to grow +0.4% m/m, compared to the June figures of +0.3% m/m and +0.3% m/m, respectively. The University of Michigan’s U.S. Consumer Sentiment Index will be released today. Economists expect the final August figure to be revised slightly higher to 58.7 from the preliminary reading of 58.6. The U.S. Chicago PMI will come in today. Economists forecast the August figure at 46.6, compared to the previous value of 47.1. U.S. Wholesale Inventories data will be released today as well. Economists expect the preliminary July figure to rise +0.1% m/m, the same as in June. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.221%, up +0.33%. Trade docket today: We've got the AFRM earnings trade to unwind. /MNQ scalping. SPX 0DTE and Gold 0DTE Out of the top 200 insider trades over the last week (by value). 0/200 were buy orders. I have never seen anything like this in my life. Let's take a look at the intra-day levels on /ES. 6510, 6519, 6525 are resistance with 6525 being the big one. 6488, 6485, 6479, 6474 working as support with 6474 being the big one. Let's finish off the week strong! See you all in the live trading room!

0 Comments

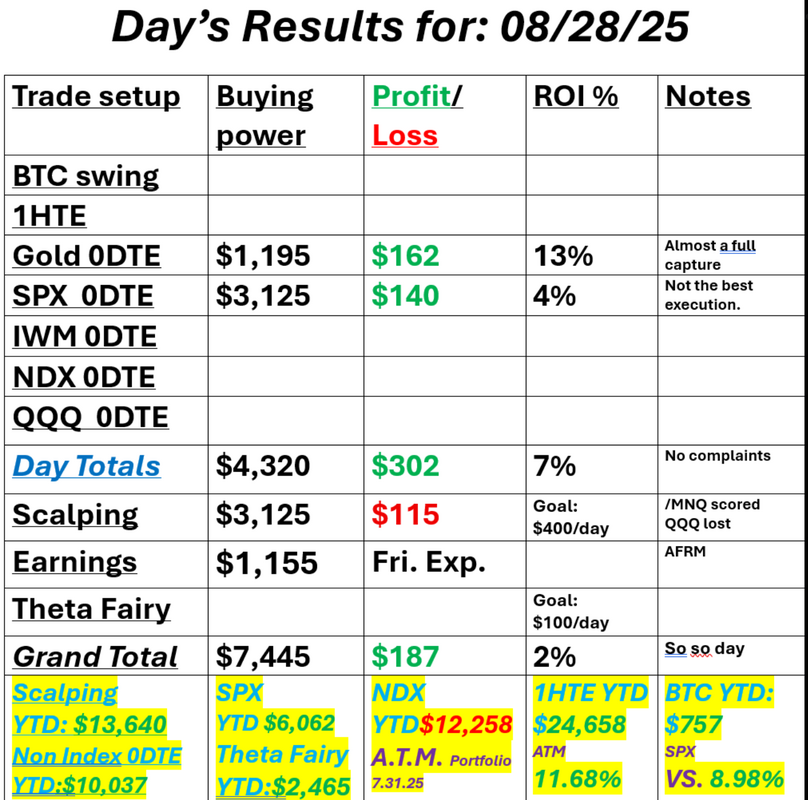

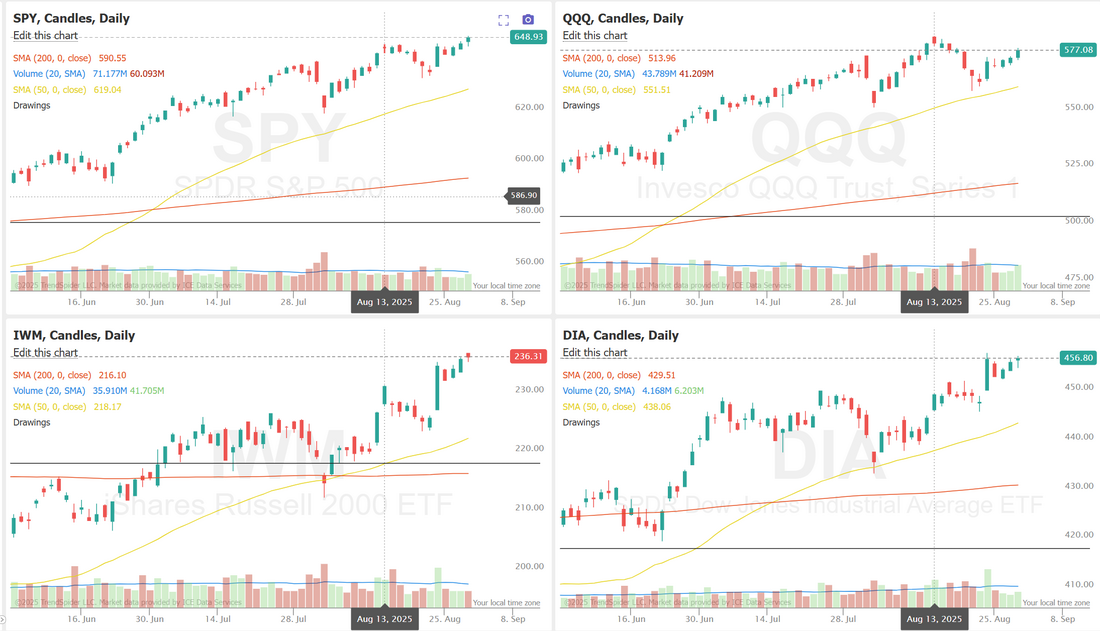

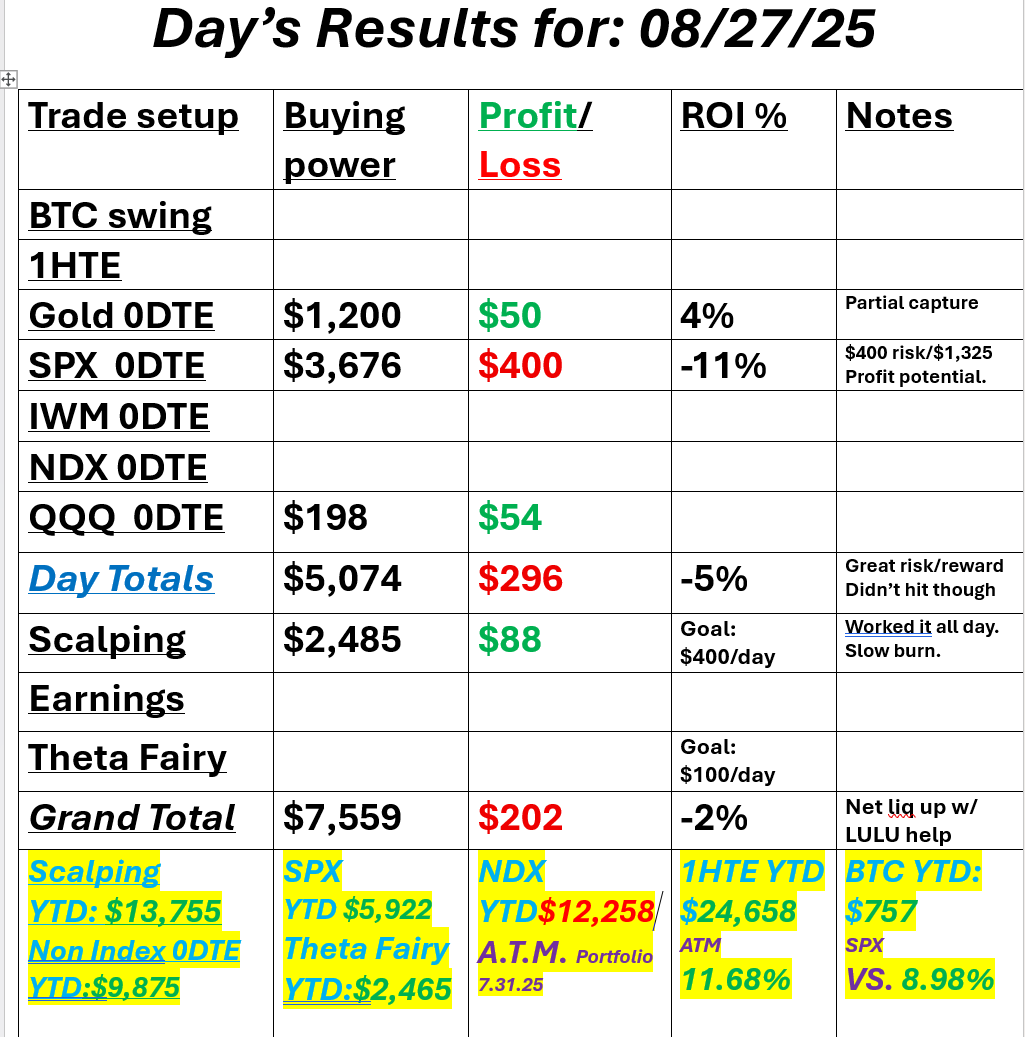

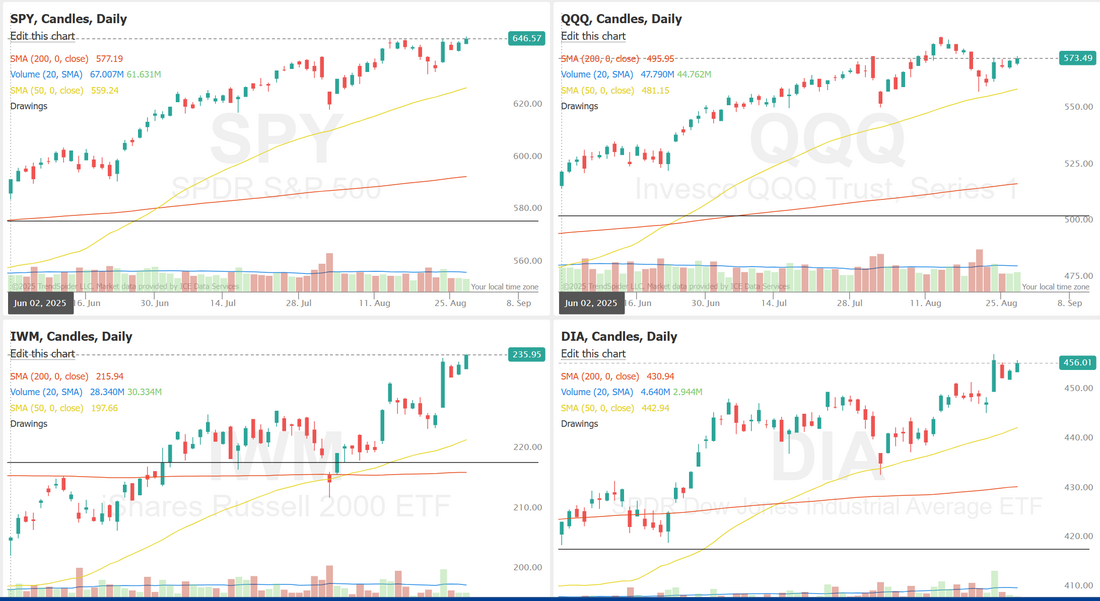

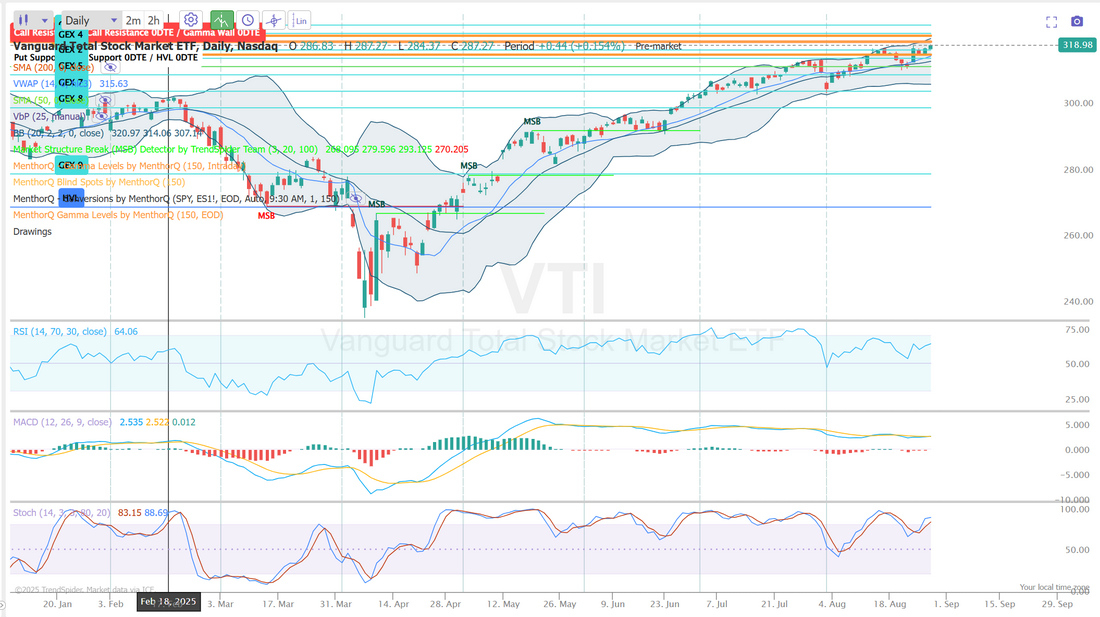

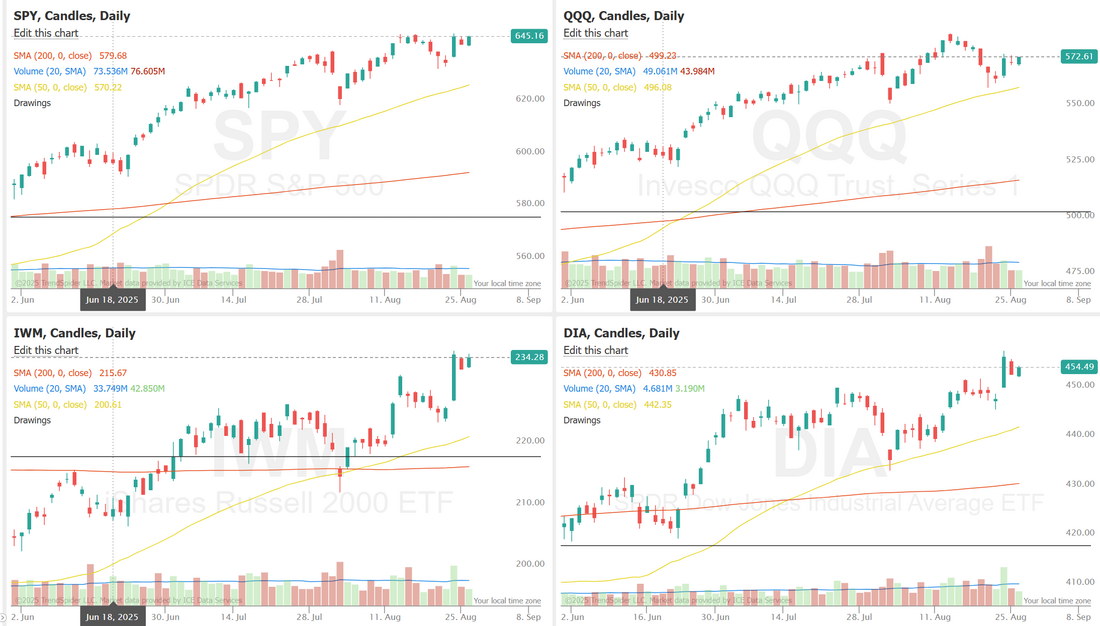

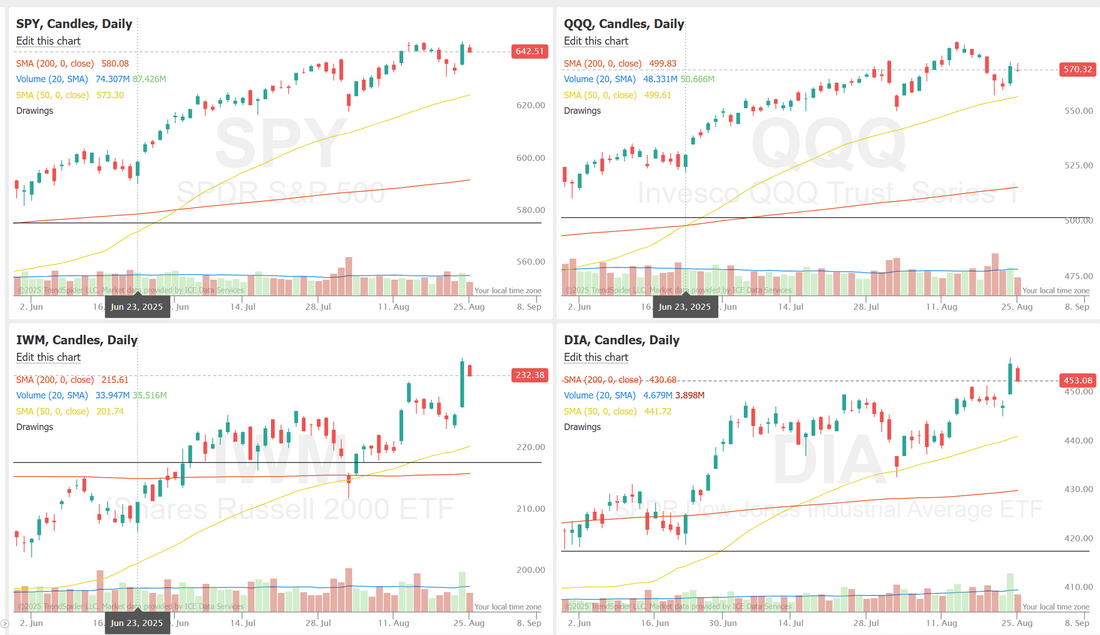

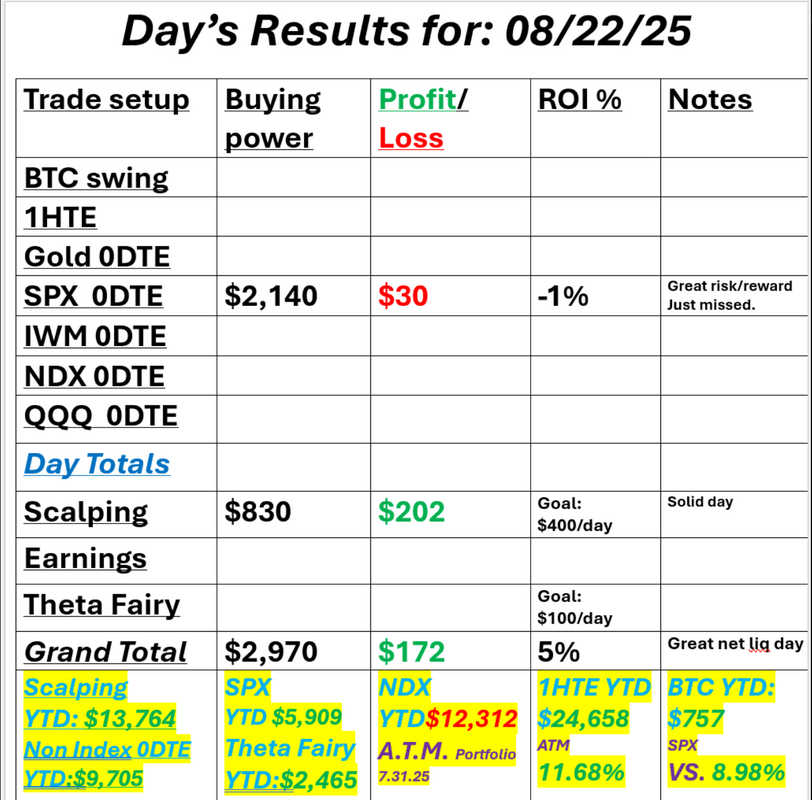

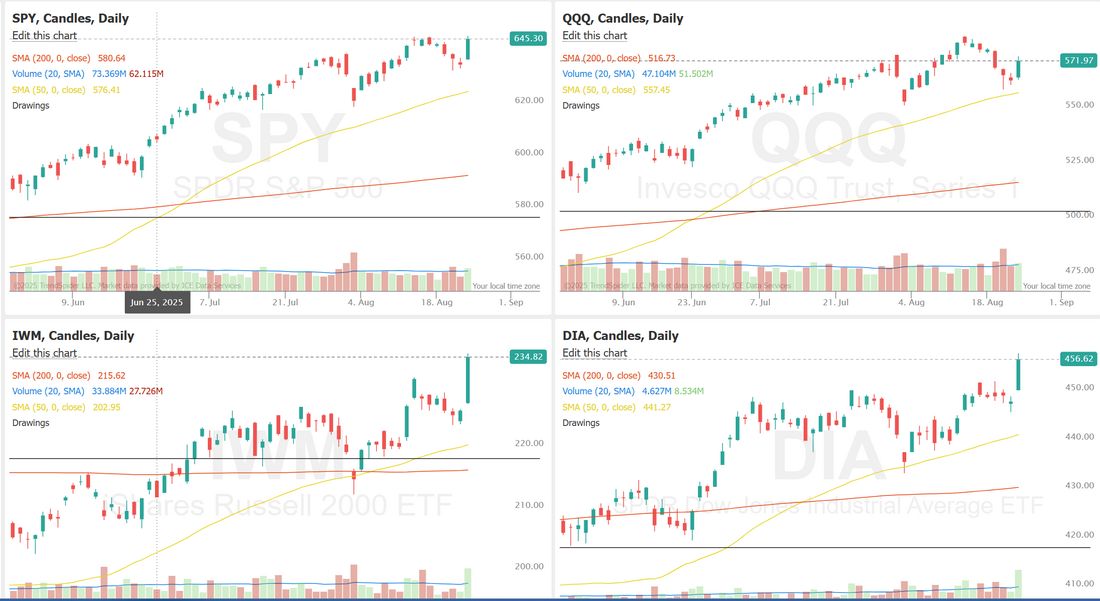

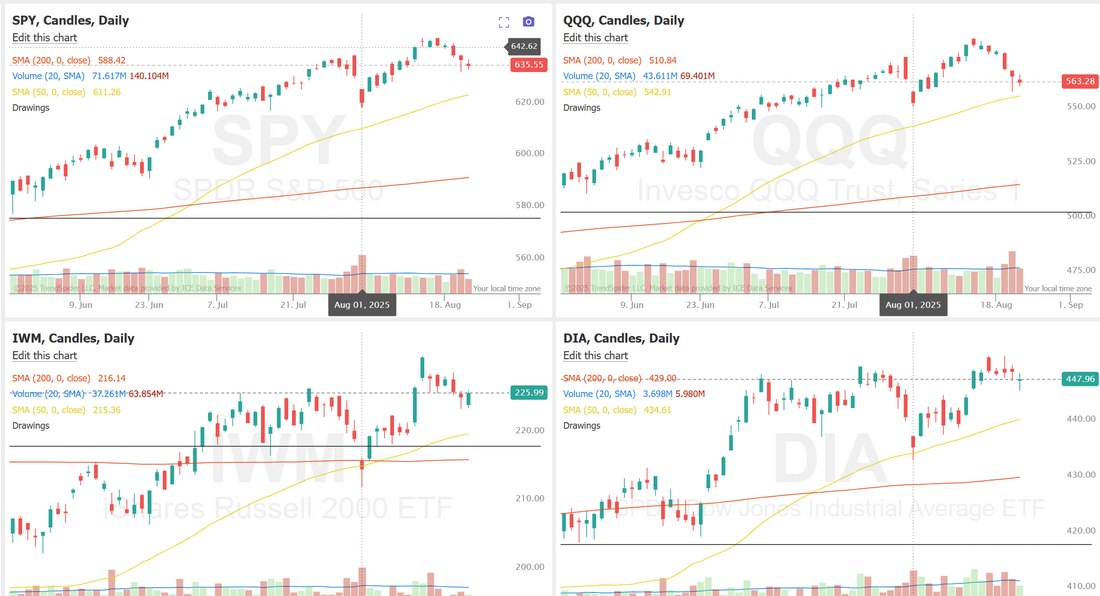

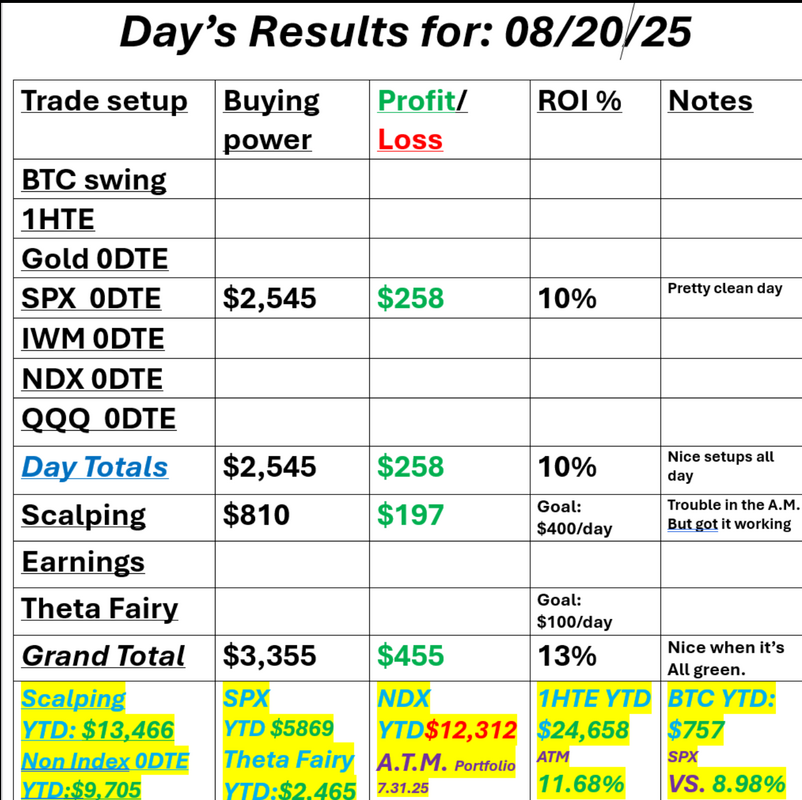

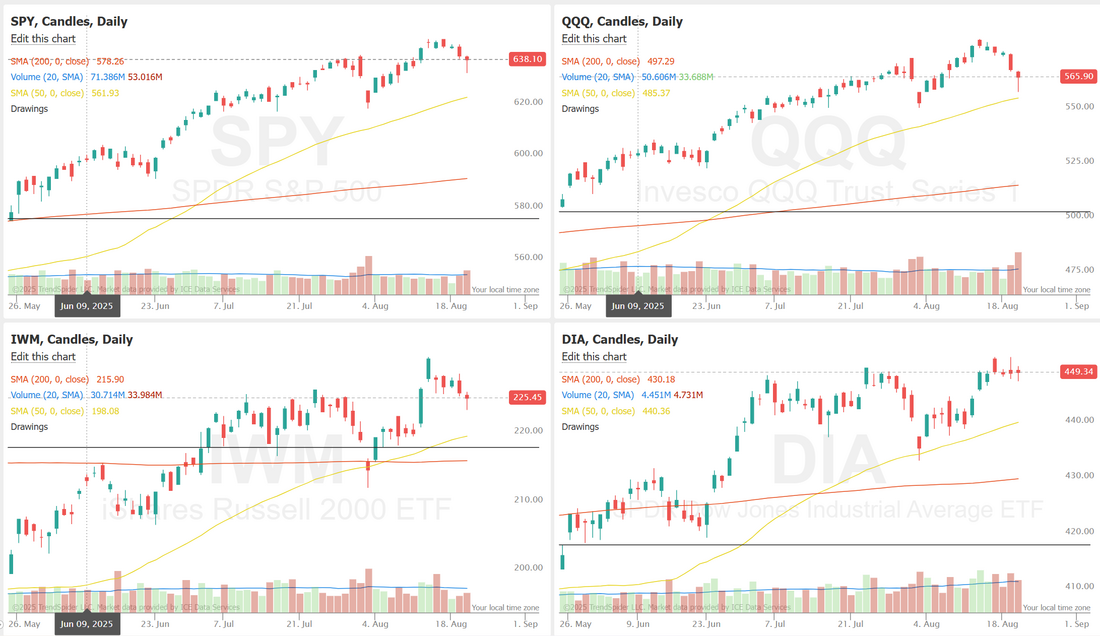

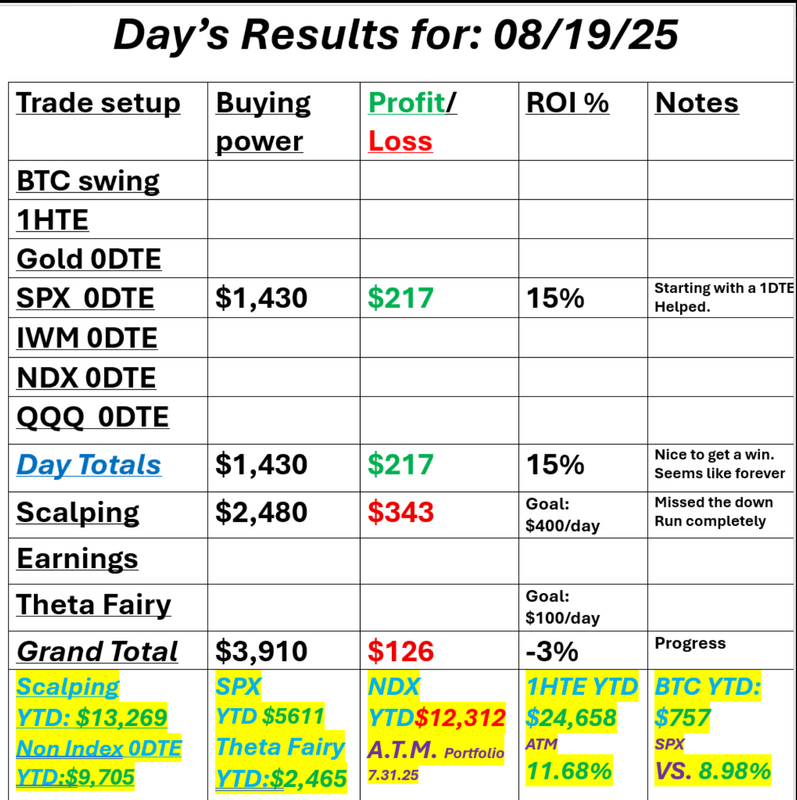

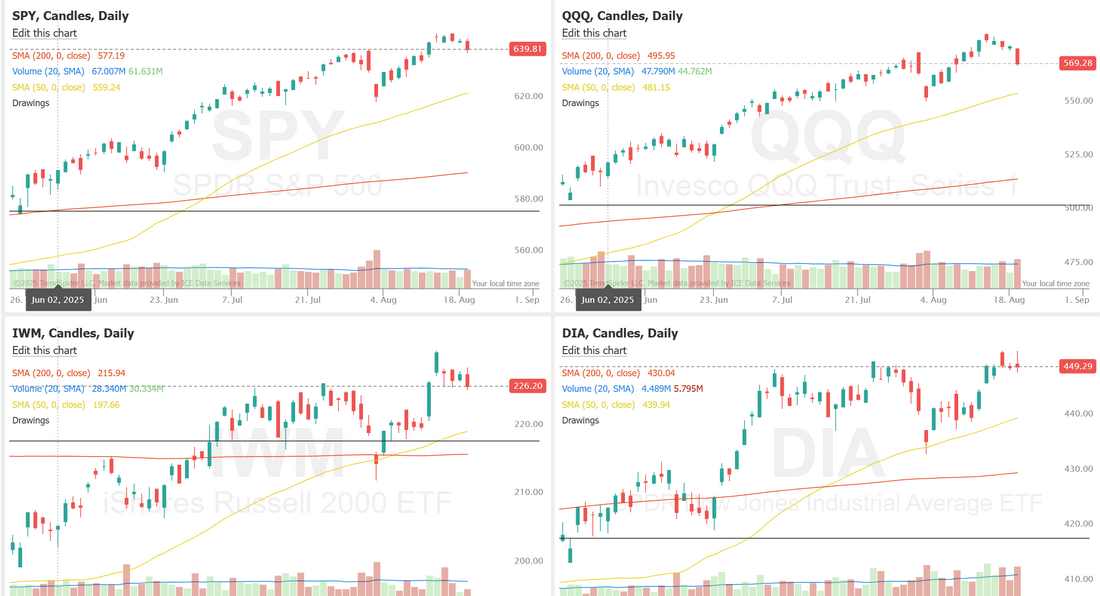

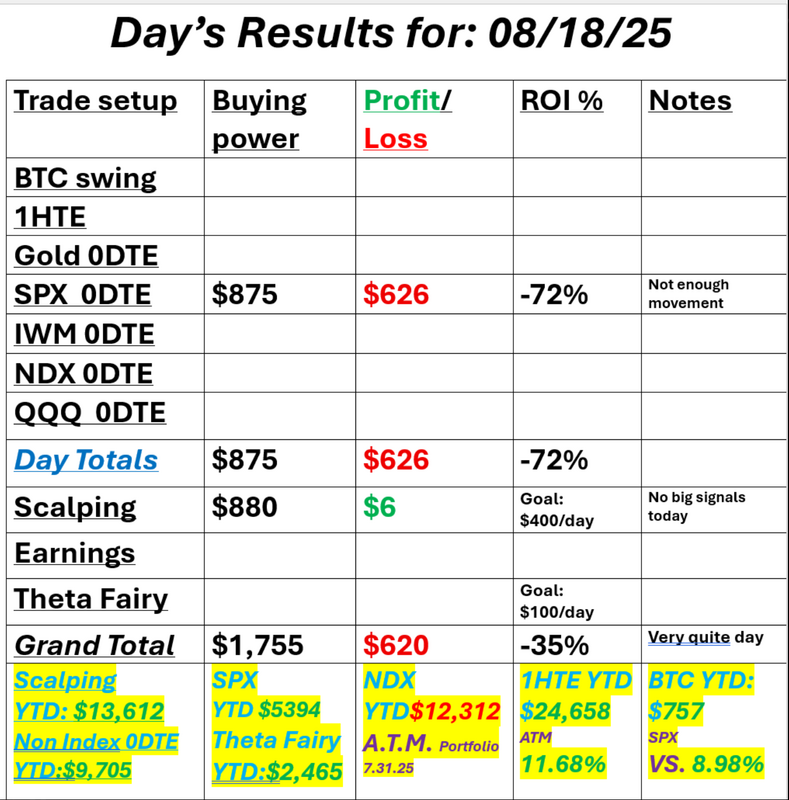

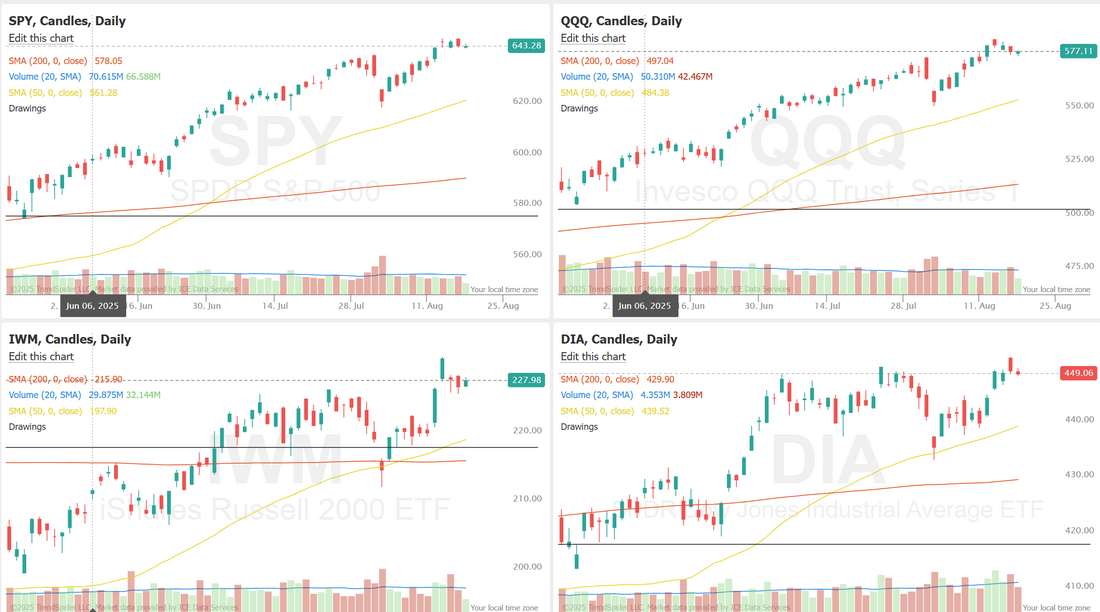

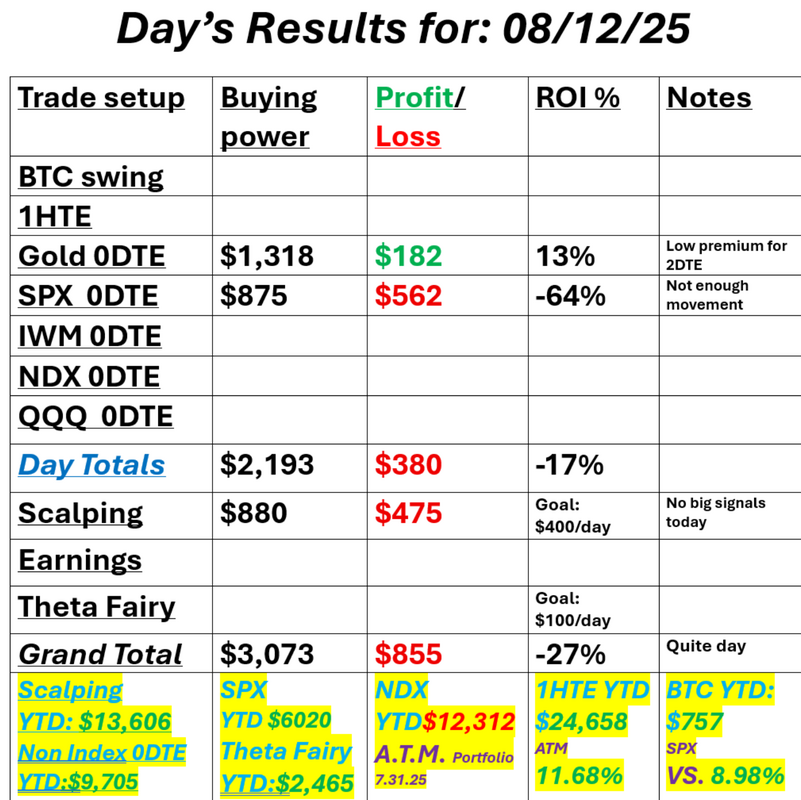

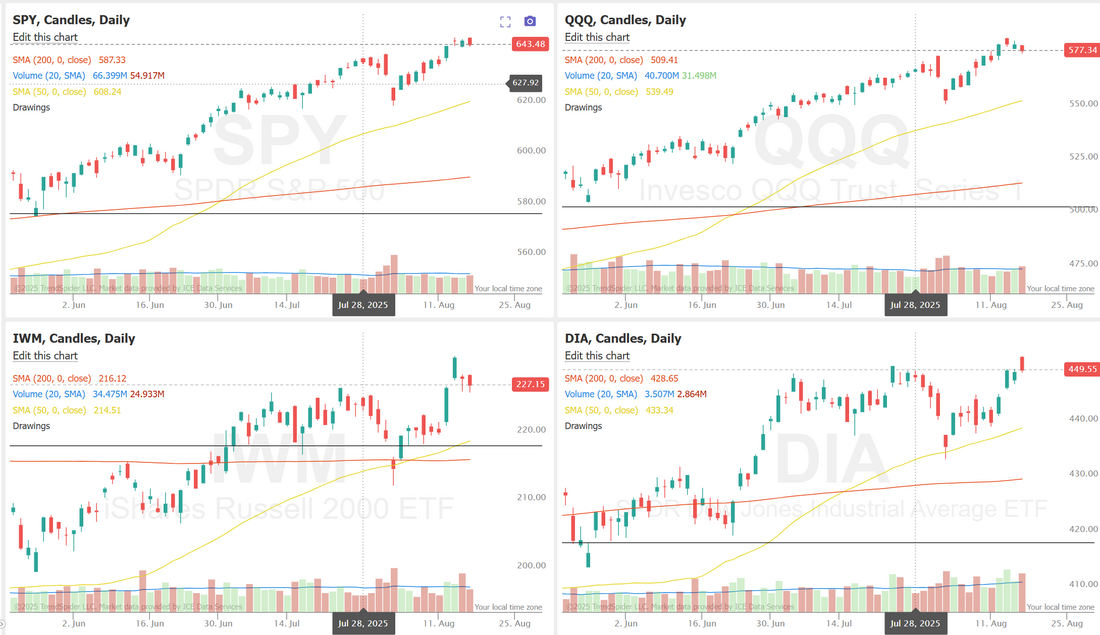

New ATH's on our ATM portfolioLet me start off with a little pump of our A.T.M. (Asymmetric Trade Management) asset allocation portfolio. We hit a new ATH yesterday on that portfolio and it continues to produce for us. Five years in we have tripled our investment and met our dual fold mandate of besting the SP500 and doing it with less risk/volatility. It's a somewhat passive approach that takes 5 min each morning to adjust and then you're done for the day. If you are either not out performing the SP500 and or you want a portfolio with downside hedges to protect you I'd encourage you to check it out. Click the link below. You can try it for free. I'll schedule a zoom call with you to answer any questions. The results speak for themselves. I'm excited for next weeks training module on H.E.A,T. approach to building your portfolio to beat the market. It should be a good one with about two hours of information. Make sure to mark your calendar for next Weds. zoom session. We had a good day yesterday net liq wise with our LULU position continuing to perform as it nears its earnings report but our SPX 0DTE didn't hit. It was still a good setup with $400 risk for $1,325 max profit potential but it didn't hit. Here's a look at our days results. Let's take a look at the markets. Small caps continue to rock higher with the other major indices hitting a wall or resistance. Looking at the VTI it paints the same picture. Bullish bias with some strong overhead resistance. September S&P 500 E-Mini futures (ESU25) are up +0.03%, and September Nasdaq 100 E-Mini futures (NQU25) are down -0.06% this morning, pointing to a muted open on Wall Street as investors digest Nvidia’s underwhelming earnings report. Nvidia (NVDA) fell nearly -2% in pre-market trading after the chipmaker reported slightly weaker-than-expected Q2 revenue from the important data center segment and gave Q3 revenue guidance that, while still strong in absolute terms, fell short of lofty expectations. Adding to investors’ disappointment, the company said its sales forecast does not factor in shipments of its H20 chip to China. Investor focus now turns to fresh U.S. economic data, including the second estimate of second-quarter GDP and jobless claims figures, earnings reports from several major companies, as well as remarks from a Federal Reserve official. In yesterday’s trading session, Wall Street’s three main equity benchmarks ended in the green. MongoDB (MDB) soared over +37% after the database software company posted upbeat Q2 results and raised its full-year guidance. Also, Kohl’s (KSS) surged +24% after the retailer reported better-than-expected Q2 adjusted EPS and lifted its full-year adjusted EPS guidance. In addition, nCino (NCNO) climbed over +13% after the company posted stronger-than-expected Q2 results and boosted its annual guidance. On the bearish side, Paramount Skydance (PSKY) slumped more than -6% and was the top percentage loser on the S&P 500 after Morgan Stanley lowered its price target on the stock to $10 from $12. New York Fed President John Williams said on Wednesday that the September FOMC meeting would be a “live” one. Williams said the current level of rates is “modestly restrictive,” meaning the Fed could “reduce interest rates and still be somewhat restrictive going forward, but again, we’re going to have to figure out exactly what’s happening in the economy.” Meanwhile, U.S. rate futures have priced in an 87.2% chance of a 25 basis point rate cut and a 12.8% chance of no rate change at September’s monetary policy meeting. Today, all eyes are focused on the U.S. Commerce Department’s second estimate of gross domestic product. Economists expect the U.S. economy to expand at an annual rate of 3.1% in the second quarter, slightly above the initial estimate of 3.0%. Investors will also focus on U.S. Initial Jobless Claims data. Economists expect this figure to be 231K, compared to last week’s number of 235K. U.S. Pending Home Sales data will be released today as well. Economists forecast the July figure at -0.4% m/m, compared to the previous figure of -0.8% m/m. In addition, market participants will be looking toward a speech from Fed Governor Christopher Waller. On the earnings front, notable companies like Dell Technologies (DELL), Marvell Technology (MRVL), Autodesk (ADSK), Affirm Holdings (AFRM), and Dollar General (DG) are slated to release their quarterly results today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.226%, down -0.26%. My lean or bias today is undecided. Futures got taken out to the wood shed last evening after the NVDA report and they have not only recovered from that swoon but are back in the green now as I type. Everything leans bullish with heavy overhead resistance. That makes it tough so I'll watch the ORB again and base off that. Trade docket for the day: We've already got our daily Gold 0DTE started with call side only. We've got a QQQ put scalp carry over from yesterday. We'll keep scalping with /MNQ. That seems to be working well for us. SPX 0DTE. AFRM earnings trade. Let's take a look at our intra-day levels on /ES. They have changed a bit. 6500, 6510, 6520 are near term resistance with 6494, 6490, 6485, 6475 are support. Today should have potential in both our scalping and 0DTE effort. I look forward to trading with you in the live trading room shortly!

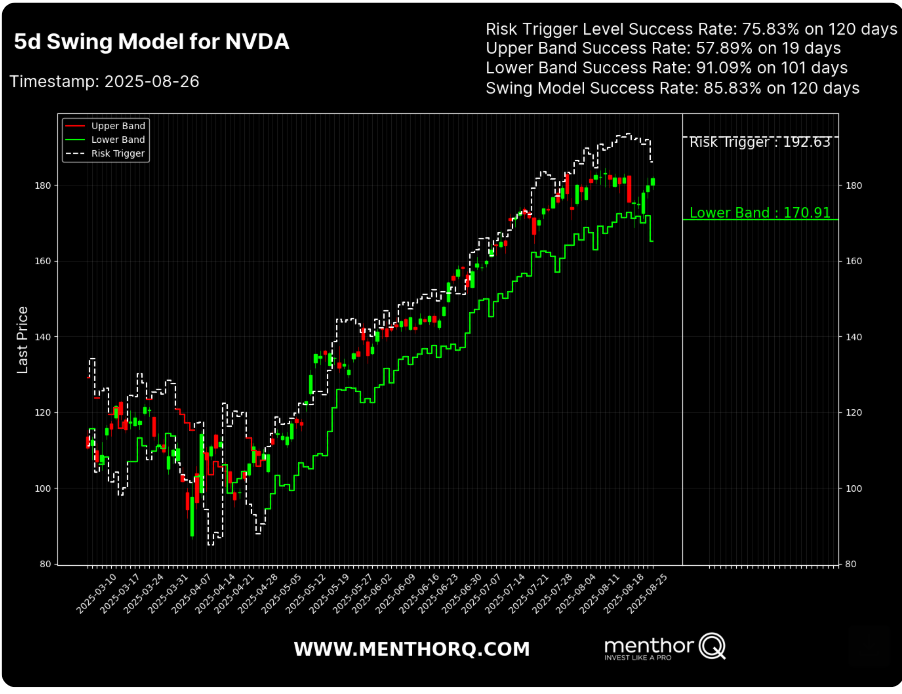

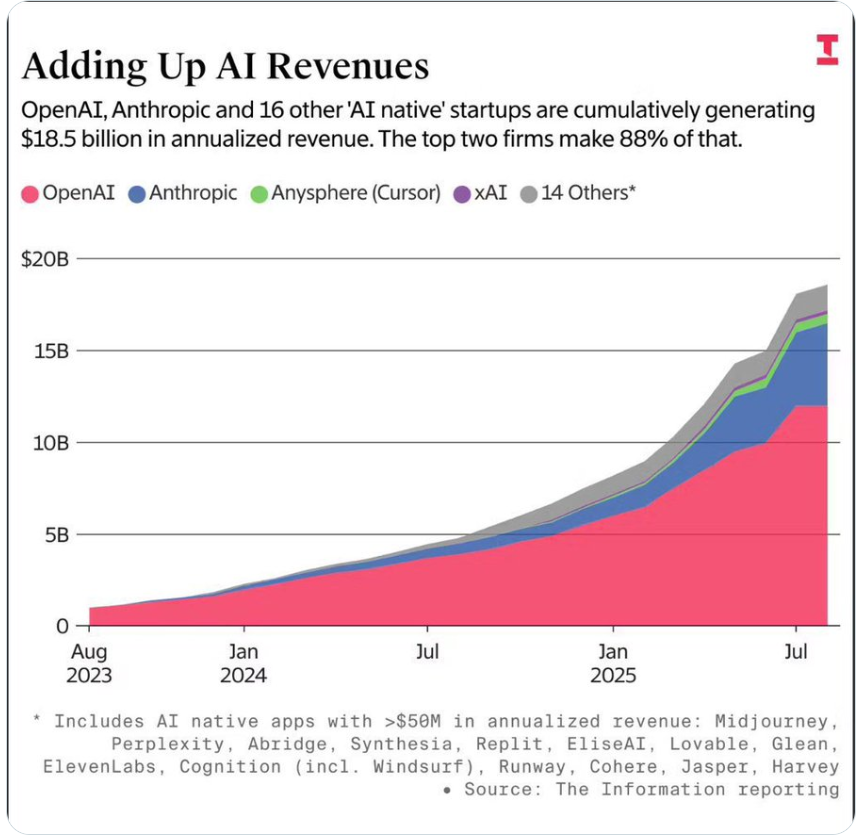

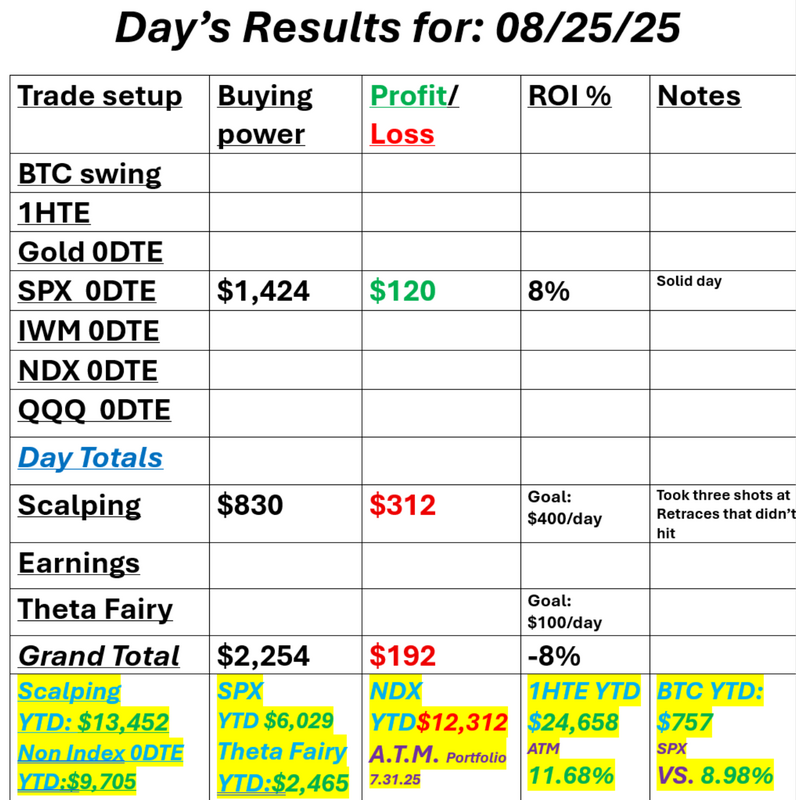

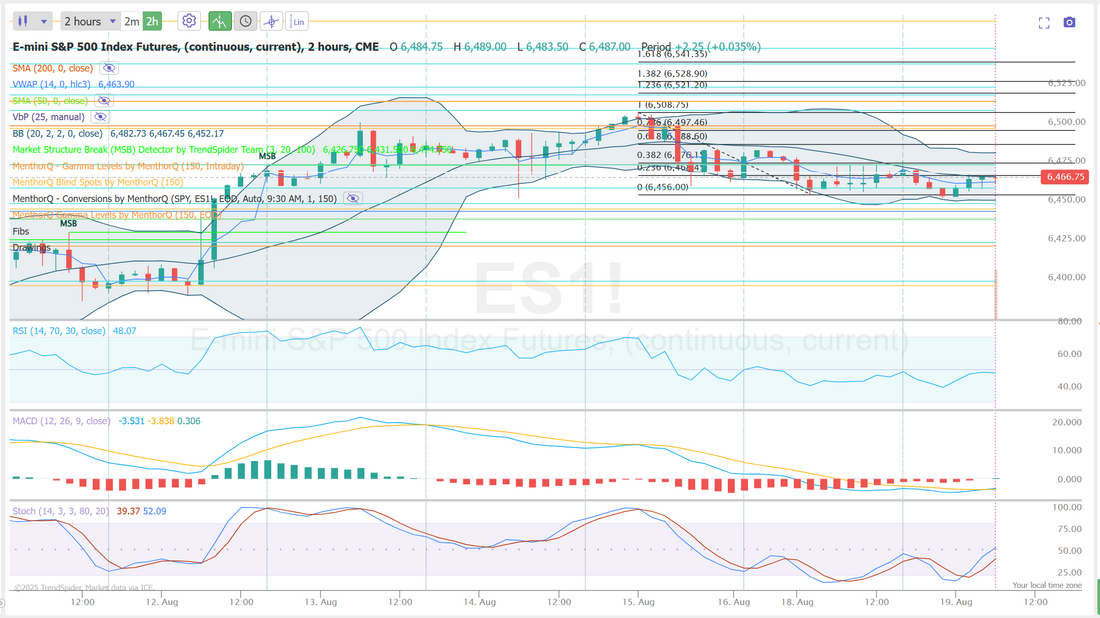

Good setups trump intelligenceI've never been one of those individuals that walks into a room and thinks, "hey I'm probably the smartest person here!" I've found that actually is good for trading. Super smart people get lots of "paralysis by analysis". It's not about being smart if you can utilize good setups. What a good setup? Something with low risk. great risk/reward ratio. Something that is scalable and adjustable. All three of our trades yesterday met that criteria. Let's start with our scalping. We scalp using the /MNQ futures. I try to keep my stop loss to about $50 each scalp. Four losing scalps in I was down $250 dollars. Scalping is all directional so you're only losing if you're wrong. I was wrong most of the day but we were able to scale and DCA and that made the difference. We made money when we were wrong because our approach overcame it. Next was our Gold 0DTE. I wasn't happy with our strikes but we got twice the premium we usually get. That allowed us get out early at a great profit when gold started to go crazy. Our last setup was our SPX 0DTE. We didn't have any movement at the open and that also meant we didn't have a directional bias. Most traders just wait or walk away but our setup once again came to the rescue. There's always a setup for every day and every market. Sometimes they are not initially apparent and it's easy to get in a rut with your "favorite" setup but setups trump everything. Get it right and you have a good chance of making money. Here's a look at my day yesterday. Let's take a look at the markets. Bullish bias is holding. Bulls are trying to get some new ATH's. September Nasdaq 100 E-Mini futures (NQU25) are trending up +0.02% this morning, with investors in wait-and-see mode ahead of a highly anticipated earnings report from AI darling Nvidia. In yesterday’s trading session, Wall Street’s major indexes closed higher. Eli Lilly (LLY) climbed over +5% and was the top percentage gainer on the S&P 500 after the drugmaker announced positive results from a late-stage trial of its experimental weight-loss pill. Also, chip stocks advanced, with Marvell Technology (MRVL) and Qualcomm (QCOM) rising more than +1%. In addition, Boeing (BA) rose more than +3% and was the top percentage gainer on the Dow after the planemaker announced that Korean Air ordered 103 planes. On the bearish side, Keurig Dr Pepper (KDP) slid over -6% and was the top percentage loser on the S&P 500 and Nasdaq 100 after HSBC downgraded the stock to Hold from Buy Economic data released on Tuesday showed that the U.S. Conference Board’s consumer confidence index fell to 97.4 in August, stronger than expectations of 96.4. Also, U.S. July durable goods orders fell -2.8% m/m, better than expectations of -3.8% m/m, while core durable goods orders, which exclude transportation, unexpectedly climbed +1.1% m/m, stronger than expectations of +0.2% m/m. In addition, the U.S. June S&P/CS HPI Composite - 20 n.s.a. eased to +2.1% y/y from +2.8% y/y in May, in line with expectations. Finally, the U.S. Richmond Fed manufacturing index unexpectedly rose to a 5-month high of -7 in August, stronger than expectations of -11. “Consumers don’t appear afraid, but perhaps restrained. Corporate conference calls reveal what appears to be a resilient consumer, while retail sales echo similar reassurances,” said Bret Kenwell at eToro. Richmond Fed President Tom Barkin said on Tuesday that he expects only a modest adjustment in interest rates, given his outlook for little variation in economic activity over the rest of the year. Meanwhile, U.S. rate futures have priced in an 87.3% probability of a 25 basis point rate cut and a 12.7% chance of no rate change at the September FOMC meeting. On the trade front, U.S. President Donald Trump imposed a hefty 50% tariff on certain Indian goods, the highest in Asia, to punish the country for purchasing Russian oil. The new tariffs, which double the existing 25% duty, took effect at 12:01 a.m. in Washington on Wednesday and will hit more than 55% of goods shipped to the U.S. Investors are eagerly awaiting Nvidia’s second-quarter earnings report, scheduled for release after the market close. The chipmaker’s earnings reports have been market-moving since May 2023, when it delivered the revenue growth forecast that reverberated globally. Analysts expect another record in sales, driven by the continued robust demand for the company’s GPU chips used in generative AI applications. Investors will be listening closely to what CEO Jensen Huang says about demand in the current AI market after AI stocks were hit last week amid fears of a bubble. “Today’s focus would be on Nvidia earnings, which is likely to set the tone for risky assets over the coming days,” said Mohit Kumar, chief European strategist at Jefferies International. Prominent companies like Snowflake (SNOW), Veeva Systems (VEEV), Agilent Technologies (A), and HP Inc. (HPQ) are also set to report their quarterly figures today. On the economic data front, investors will focus on U.S. Crude Oil Inventories data, which is set to be released later in the day. Economists expect this figure to be -2.000M, compared to last week’s value of -6.014M. In addition, market participants will parse comments today from Richmond Fed President Tom Barkin. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.257%, up +0.05%. Wonder how soon until markets remember the start of a Fed cutting cycle marked the top of both the Dot Com bubble and Great Recession? This time is different tho, obviously NVDA reports today after the close. It represents 8% of the market cap of the market! Keep an eye on not only how it reacts but how the futures flow after the announcement overnight. The NVDA 5-day swing model chart highlights short-term dynamics within defined trading bands. The lower band, currently near 170.91, has been a strong area of support, with the model showing a 91% success rate when tested over the past 120 days. On the upper end, the risk trigger sits around 192.63, with a more moderate success rate near 76%, suggesting this level has frequently capped moves in recent months. The swing model’s overall success rate of 85.8% underscores that price has generally respected these boundaries. In the short term, NVDA’s positioning near the middle of its range means traders will likely watch whether momentum builds toward retesting the risk trigger level or drifts back toward the lower support zone. Something to think about today as NVDA reports. $1 trillion of AI Capex spend. $20 billion of revenue. AI is a bubble. Let's take a look at the intra-day levels on /ES that I'll be focusing on today. 6491, 6500, 6510 are resistance levels. 6500 is the big one and will be my starting point for our SPX 0DTE today. 6475, 6461, 6455, 6450, 6436 are support. 6436 is the big one below that the flood gates open for downside potential. My lean or bias today is bearish. I don't think we get above the 6500 level today. Trade docket today: Gold 0DTE. We have a chicken I.C. working already with 7.10 credit received. We'll set a NVDA earnings play before the close. Scalping with /MNQ and SPX 0DTE as well.

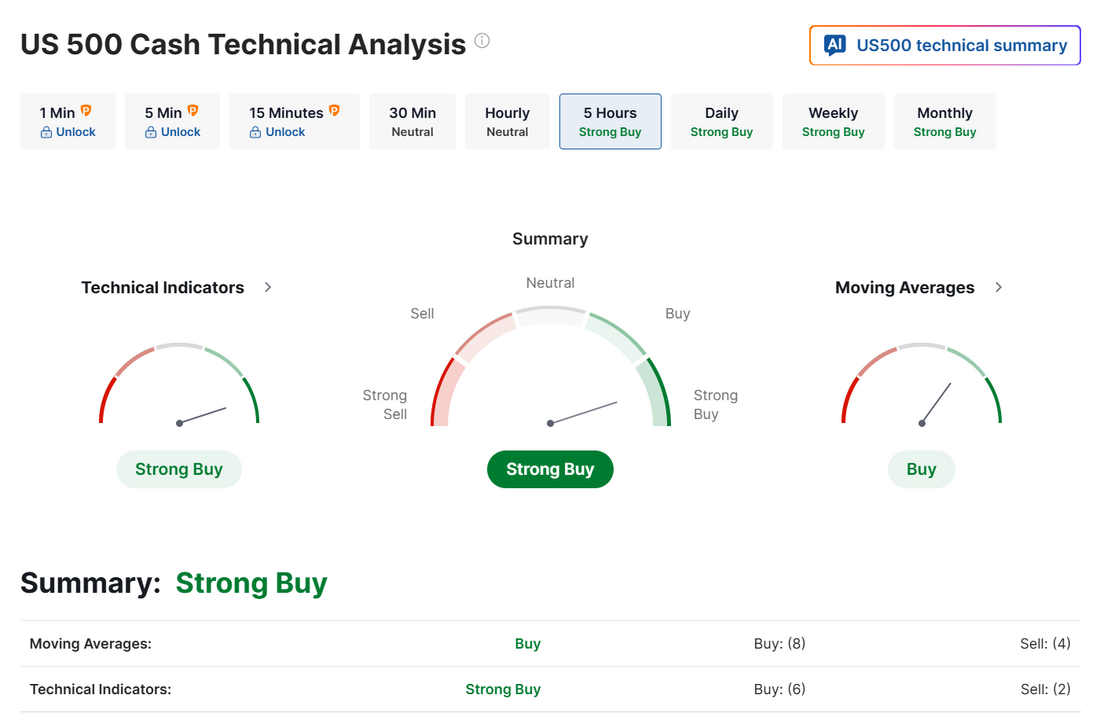

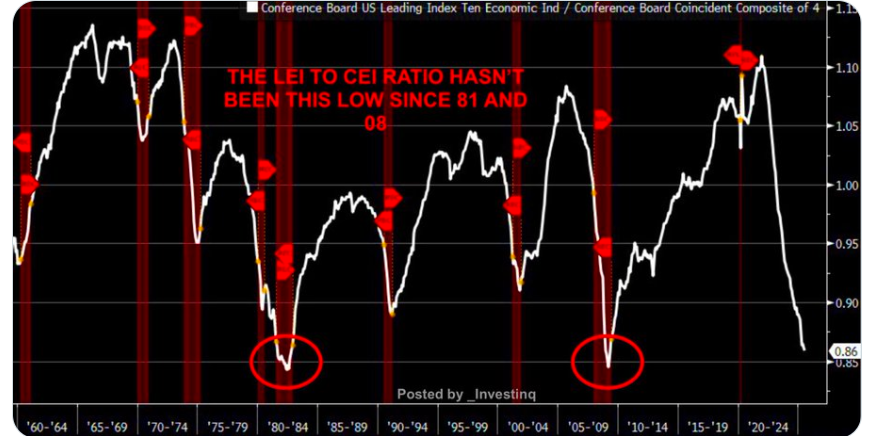

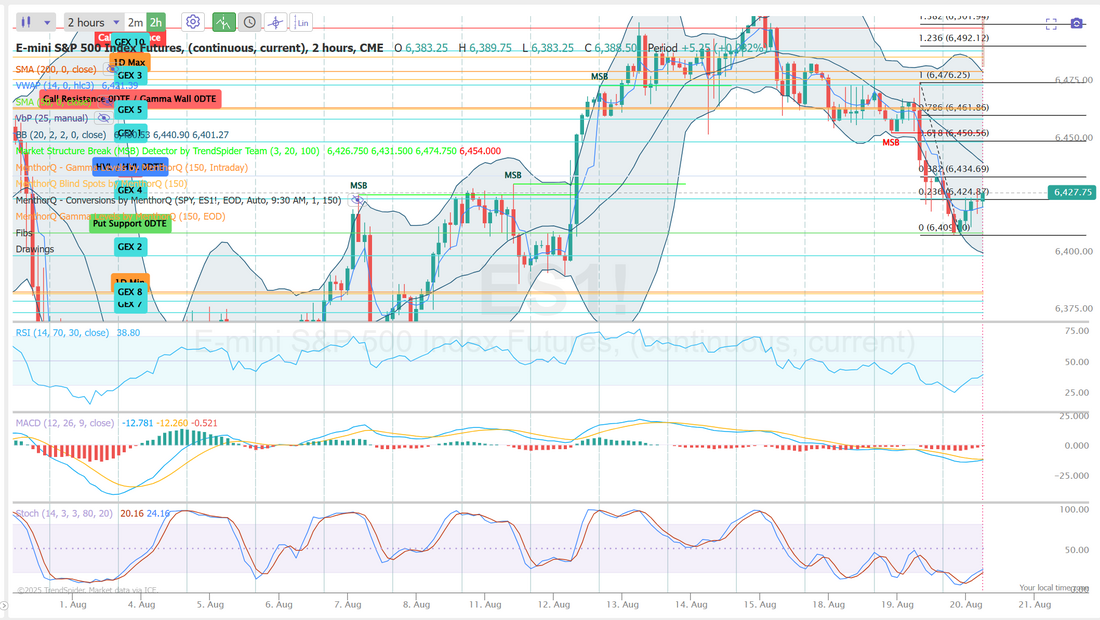

Is Lisa Cook really gone?I was working on the entry to our Gold trade last night when the futures went crazy on the indices and gold. The news had hit the wire that Trump was firing Cook from her FED post. We've learned with Trumps beef with Powell that a FED member CAN be fired, "for cause". There's got to be some dereliction of duty or malfeasance which seems to be a high bar. Cook said yesterday she's not leaving. Grab the popcorn because this should get interesting. I had a quiet day yesterday. Our SPX trade was good and ended up going to a full profit for those that held. I locked in a small gain before the close. With scalping, I tried three retrace setups that didn't work and that was that for the day. Let's take a look at the markets this morning. We are still clinging to a buy mode. It looks like we may be back to stalling out. I think it may take some big catalysts to get us up to new ATH's. My lean or bias yesterday was bearish which played out well. Futures are down this morning after the Cook news as well as new tariff news. I'm looking for more of a neutral day today. It doesn't look like the overnight news is tanking the futures and I don't see a big catalyst to take us much higher. September S&P 500 E-Mini futures (ESU25) are down -0.16%, and September Nasdaq 100 E-Mini futures (NQU25) are down -0.19% this morning as investors weigh U.S. President Donald Trump’s move to oust Federal Reserve Governor Lisa Cook and fresh tariff threats. President Trump announced on Monday that he was dismissing Cook “effective immediately.” The move is based on allegations from one of Trump’s allies that Cook engaged in mortgage fraud, though the claims have not been confirmed. Cook said Trump had no authority to fire her, and she would not resign. Cook’s lawyer, Abbe Lowell, said they intend to take “whatever actions are needed to prevent” Trump’s “illegal action.” Analysts said the episode sounded alarm bells over the central bank’s independence. Trump also threatened new tariffs and export restrictions on advanced technology and semiconductors in retaliation against digital services taxes abroad. In addition, Trump told reporters on Monday that China must supply the United States with magnets or “we have to charge them 200% tariffs or something.” Investors now await a fresh batch of U.S. economic data. In yesterday’s trading session, Wall Street’s main stock indexes ended lower. Keurig Dr Pepper (KDP) plunged over -11% and was the top percentage loser on the S&P 500 and Nasdaq 100 after it agreed to buy Dutch coffee firm JDE Peet’s for $18.4 billion. Also, furniture stocks slumped after President Trump announced last Friday that the U.S. would launch an investigation into tariffs on furniture imports, with Wayfair (W) and RH (RH) sliding more than -5%. In addition, CSX Corp. (CSX) fell over -5% after CNBC’s Becky Quick reported that Warren Buffett told her Berkshire Hathaway has no interest in acquiring another railroad. On the bullish side, chip stocks gained ground, with Nvidia (NVDA) rising more than +1% to lead gainers in the Dow and Lam Research (LRCX) advancing over +1%. Economic data released on Monday showed that U.S. new home sales unexpectedly fell -0.6% m/m to 652K in July from 656K in June (revised from 627K), though the figure was still stronger than expectations of 635K. Today, all eyes are focused on the U.S. Conference Board’s Consumer Confidence Index, which is set to be released in a couple of hours. Economists, on average, forecast that the August CB Consumer Confidence index will stand at 96.4, compared to last month’s figure of 97.2. Investors will also focus on U.S. Durable Goods Orders and Core Durable Goods Orders data. Economists expect July Durable Goods Orders to drop -3.8% m/m and Core Durable Goods Orders to rise +0.2% m/m, compared to the prior figures of -9.4% m/m and +0.2% m/m, respectively. The U.S. S&P/CS HPI Composite - 20 n.s.a. will be reported today. Economists expect the June figure to ease to +2.1% y/y from +2.8% y/y in May. The U.S. Richmond Fed Manufacturing Index will be released today as well. Economists foresee this figure coming in at -11 in August, compared to the previous value of -20. In addition, market participants will be anticipating a speech from Richmond Fed President Tom Barkin. On the earnings front, notable companies like MongoDB (MDB), Okta (OKTA), and Box (BOX) are slated to release their quarterly results today. U.S. rate futures have priced in an 84.3% chance of a 25 basis point rate cut and a 15.7% chance of no rate change at the next central bank meeting in September. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.302%, up +0.63%. The U.S. just triggered its fourth straight recession signal. The LEI vs. CEI ratio hasn’t been this low since ‘81 and ‘08. The last time it looked like this? Right before the economy broke. Trade docket today: BTC is still a bit sketchy for a 1DTE. We did get a new Gold 0DTE working for today. We'll also focus on an SPX 0DTE and /MNQ scalping. Let's take a look at the intra-day /ES levels. 6462, 6469, 6489, 6500 are resistance levels. 6439, 6430, 6425, 6409, 6400 are support. We had a good training session yesterday. We'll have another good one next week. I look forward to sharing these with you. I'll see you all in the live trading room shortly. Today could be a "mover day" which is what we look for.

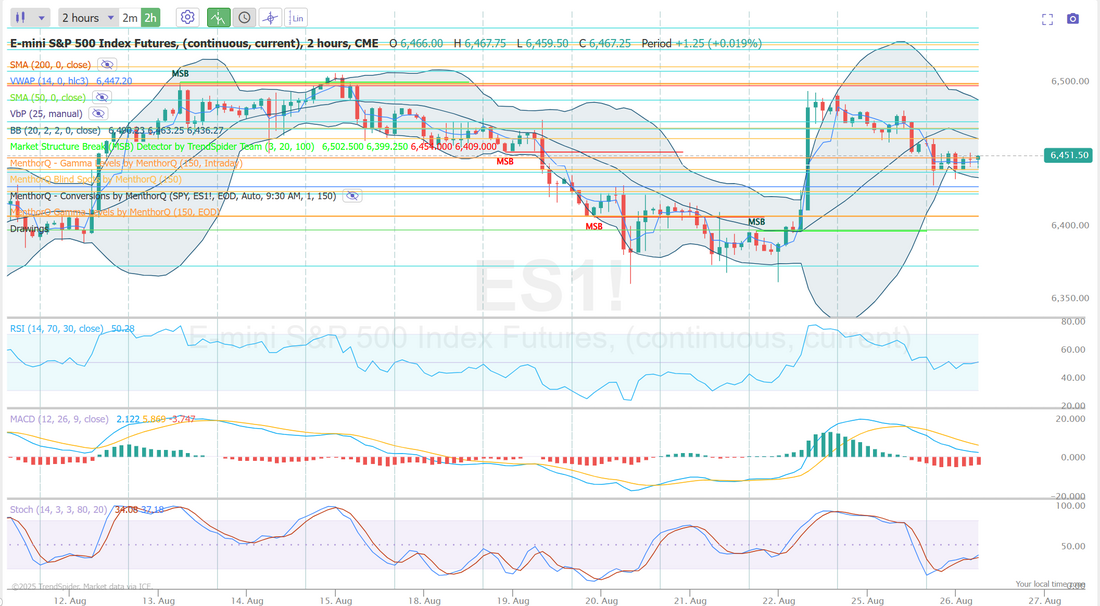

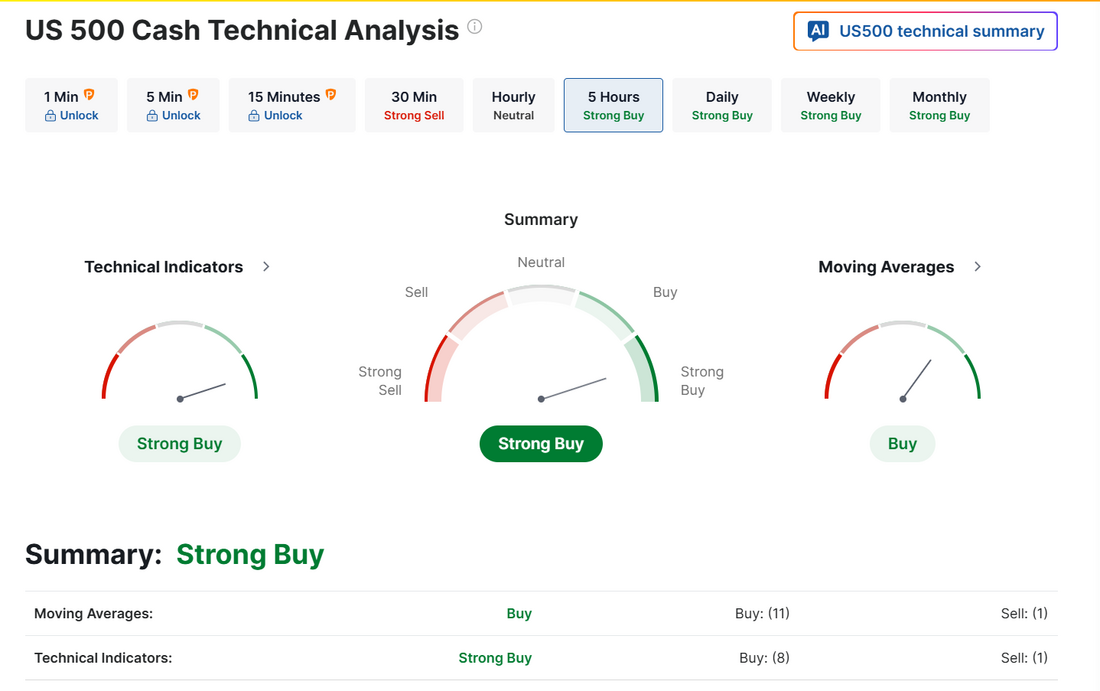

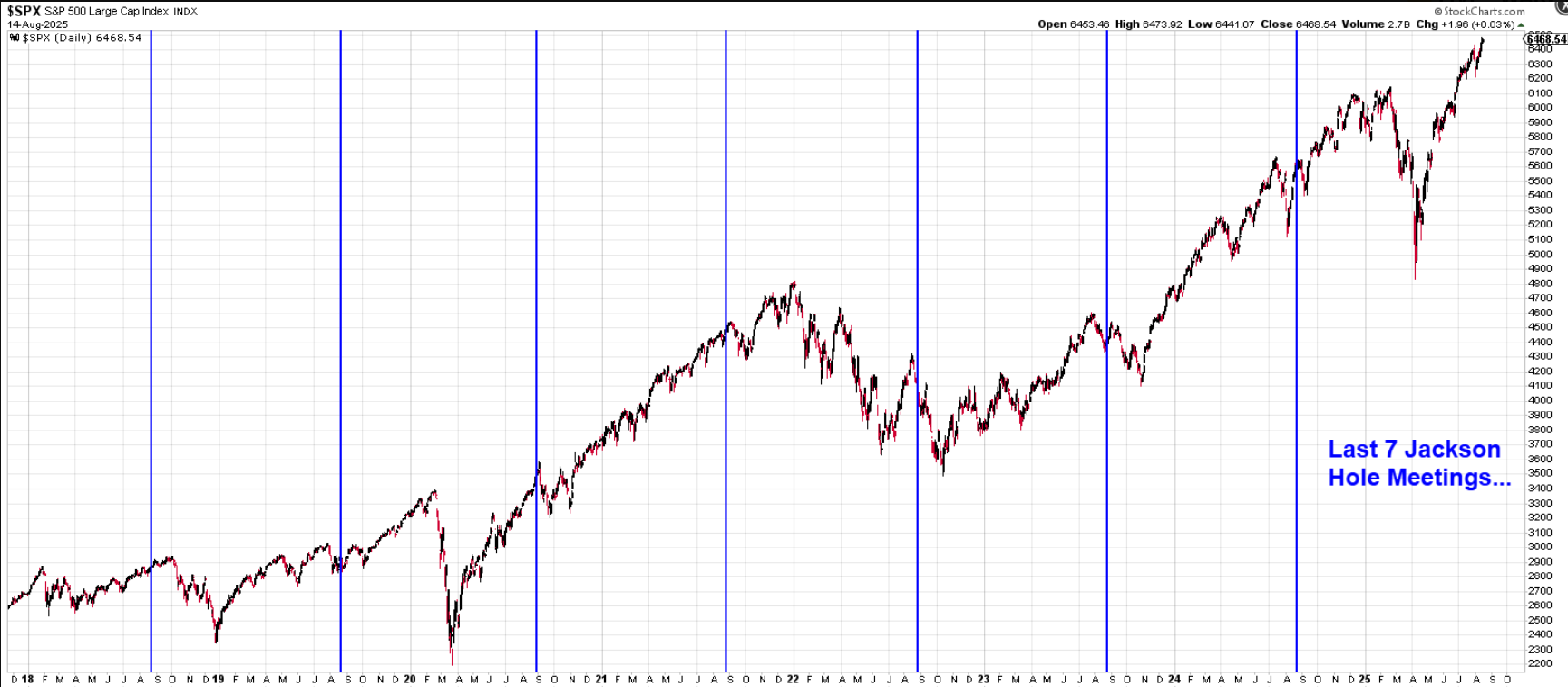

Back to ATH'sFriday was a big one with Powell hinting that a rate cut may finally be incoming. Markets loved it and pushed back to ATH levels. We had a really solid day, net liq wise with our LULU position continuing to push higher and our ATM portfolio pushing back towards it's ATH's. Scalping went well for us, as you would expect on a day like we had. Our SPX 0DTE didn't hit but it had great risk/reward with $135 risk and $865 max profit potential. These are the types of setups we want, even when they don't hit. Here's a look at my day Friday. Let's take a look at the markets: Slight bullish lean holding after Fridays push. Will the ATH's now be support or resistance? The SPX option score chart as of August 22, 2025, highlights an interesting short-term setup. After a steady uptrend in spot price from late June through mid-August, the index has recently shown some choppiness, with prices pulling back slightly from their highs. At the same time, the option score, which had been holding mid-range for weeks, dropped sharply twice in August before bouncing back toward higher levels again. This pattern suggests that short-term sentiment and positioning have been more volatile than the underlying index movement. The recent rebound in the option score indicates renewed interest and activity in the options market following brief periods of hesitation. In the near term, the focus will likely be on whether SPX can maintain stability around the 6,400 zone while option sentiment consolidates or strengthens further. September S&P 500 E-Mini futures (ESU25) are down -0.24%, and September Nasdaq 100 E-Mini futures (NQU25) are down -0.32% this morning, pointing to a slightly lower open on Wall Street after last Friday’s rally as some of the optimism around expectations for Federal Reserve interest rate cuts faded. Investor focus this week is on an earnings report from semiconductor stalwart Nvidia, comments from Fed officials, and the release of the Fed’s preferred inflation gauge. In Friday’s trading session, Wall Street’s major equity averages closed sharply higher, with the Dow notching a new all-time high. The Magnificent Seven stocks rallied, with Tesla (TSLA) climbing over +6% and Alphabet (GOOGL) gaining more than +3%. Also, chip stocks advanced, with ON Semiconductor (ON) surging over +6% and GlobalFoundries (GFS) rising more than +5%. In addition, Zoom Communications (ZM) jumped over +12% after the videoconferencing platform posted upbeat Q2 results and raised its full-year guidance. On the bearish side, Intuit (INTU) slid more than -5% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the company issued disappointing full-year guidance. Speaking Friday at the Fed’s annual conference in Jackson Hole, Wyoming, Chair Jerome Powell cautiously signaled the possibility of a September interest rate cut, citing rising risks to the labor market even as concerns over inflation persist. “The stability of the unemployment rate and other labor market measures allows us to proceed carefully as we consider changes to our policy stance. Nonetheless, with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance,” Powell said. “Powell has thrown the door wide open to a September cut with his Jackson Hole speech that sends a clear, strong signal the Fed is on track to reduce rates by 25 basis points at that meeting,” said Krishna Guha at Evercore. Meanwhile, U.S. rate futures have priced in an 87.3% probability of a 25 basis point rate cut and a 12.7% chance of no rate change at the conclusion of the Fed’s September meeting. On the trade front, U.S. President Donald Trump announced on Friday a “major” tariff probe targeting imported furniture. In a Truth Social post, President Trump stated, “Furniture coming from other Countries into the United States will be Tariffed at a Rate yet to be determined.” This week, market participants will focus on earnings reports from several major companies, with semiconductor giant Nvidia’s (NVDA) report on Wednesday attracting the most attention. Nvidia’s earnings reports have been market-moving since May 2023, when the company delivered the revenue growth forecast that reverberated globally. Analysts expect another record in sales, driven by the continued robust demand for the company’s GPU chips used in generative AI applications. Prominent companies like CrowdStrike Holdings (CRWD), Snowflake (SNOW), Dell Technologies (DELL), Marvell Technology (MRVL), HP Inc. (HPQ), and Autodesk (ADSK) are also set to release their quarterly results this week. Market watchers will also keep a close eye on a slew of U.S. economic data releases this week to assess whether tariffs are driving inflation higher and to gauge the extent to which the economy is slowing. The July reading of the U.S. core personal consumption expenditures price index, the Fed’s preferred inflation gauge, will be the main highlight. If the core PCE price index comes in strong, then the Fed may need another weak jobs report for August to justify lowering interest rates, according to Pepperstone head of research Chris Weston. Other data will provide insight into the state of the U.S. economy, including U.S. GDP (second estimate), the Conference Board’s Consumer Confidence Index, Durable Goods Orders, Core Durable Goods Orders, Initial Jobless Claims, Personal Income, and Personal Spending. In addition, investors will follow comments from Fed officials to gauge their appetite for a rate cut in September. Fed Governor Christopher Waller, Dallas Fed President Lorie Logan, New York Fed President John Williams, and Richmond Fed President Tom Barkin are scheduled to speak this week. Today, investors will focus on U.S. New Home Sales data, which is set to be released in a couple of hours. Economists, on average, forecast that July new home sales will stand at 635K, compared to 627K in June. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.273%, up +0.31%. The SPY hit another new all-time high last week and closed at $645.31 (+0.28%). The week began with a pullback, and the GoNoGo Trend Indicator shifted to aqua candles, signaling a deceleration in bullish momentum. That changed quickly on Friday, as Powell’s comments at Jackson Hole reignited buying pressure. SPY rallied back above the 1.236 Fibonacci extension, accompanied by a return to strong dark blue candles, confirming renewed strength at record highs. Let's look at expected moves. We were just building back some I.V. and then Fridays push up wiped it all out. My bias or lean today is bearish. Generally we get a retrace off days like Friday. Even with futures down, as I type, there is a chance the markets get one more push higher before the retrace. That's how I'm playing it today. Over the last 48 days, the US Federal Debt has surged by +$1 TRILLION, or +$21 billion PER DAY. Since August 11th, the US has added +$200 billion in debt. Why is US government spending running at WW2 levels in a "strong" economy? Trade docket: Scalping /MNQ with a SPX 0DTE and LULU cover. Gold still lacks premium for a 0DTE and BTC is too crazy right now to get a 1HTE working. Let's look at the intra-day levels. 6470, 6476, 6482, 6493 resistance with 6454, 6448, 6439, 6426 are support. We've got a great part-II training today to address some tendencies we have as traders. I look forward to seeing you all in the live trading room shortly!

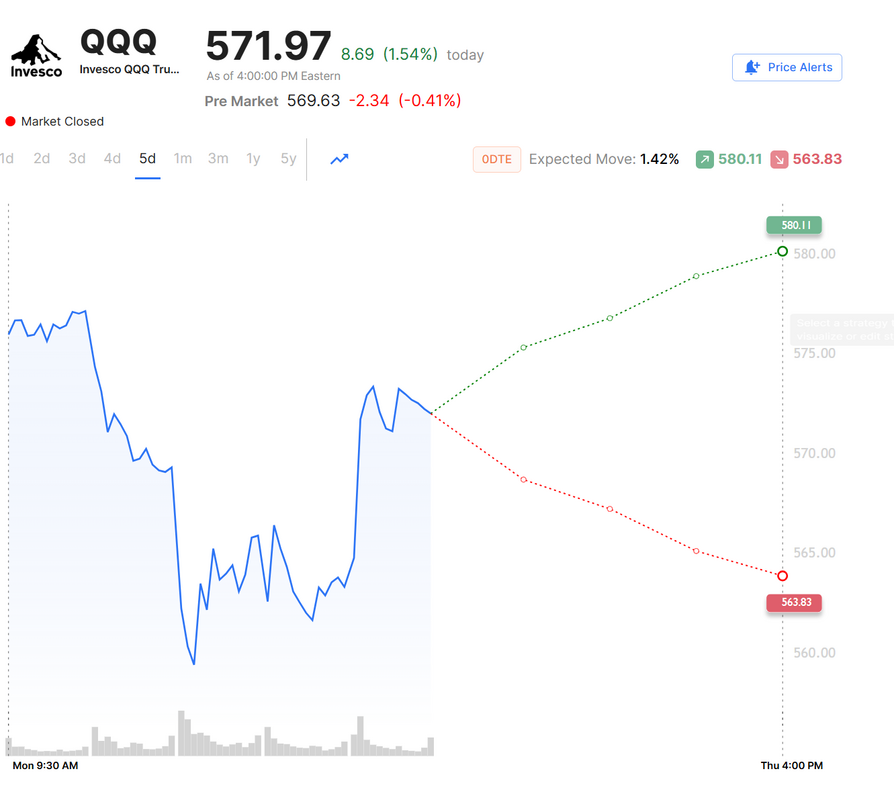

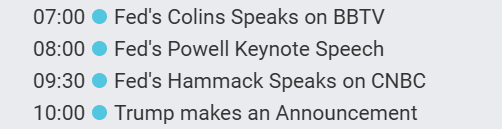

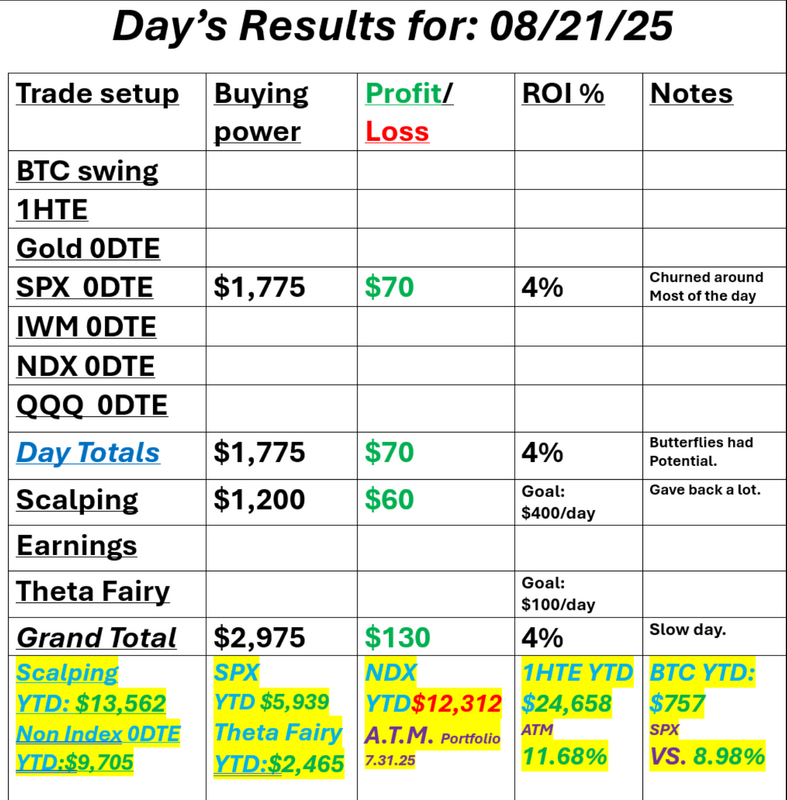

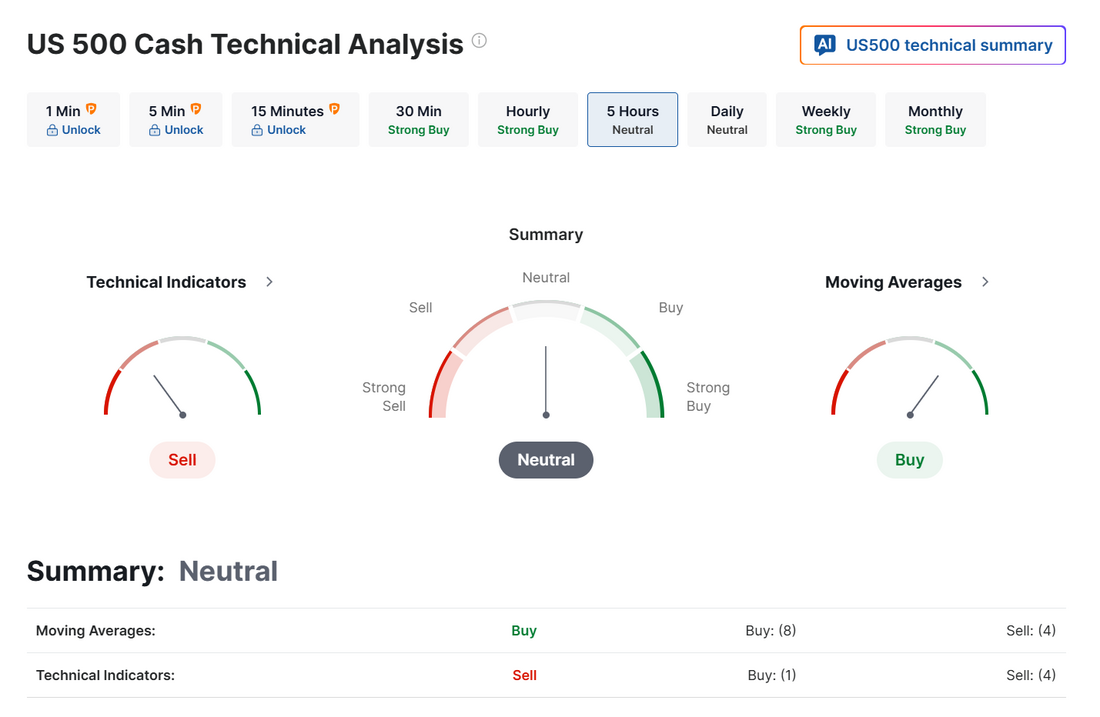

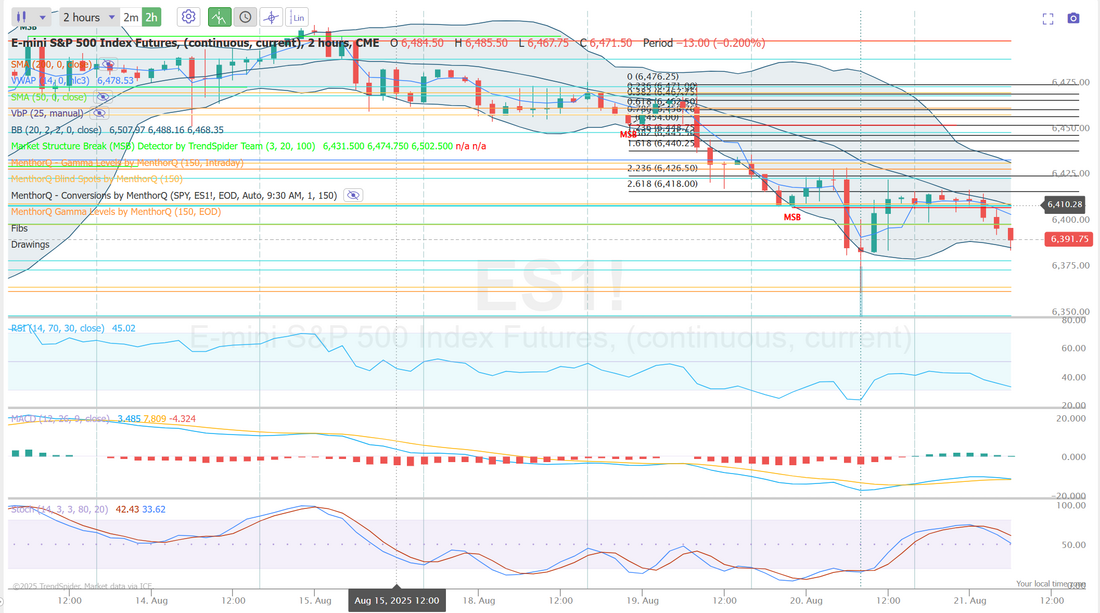

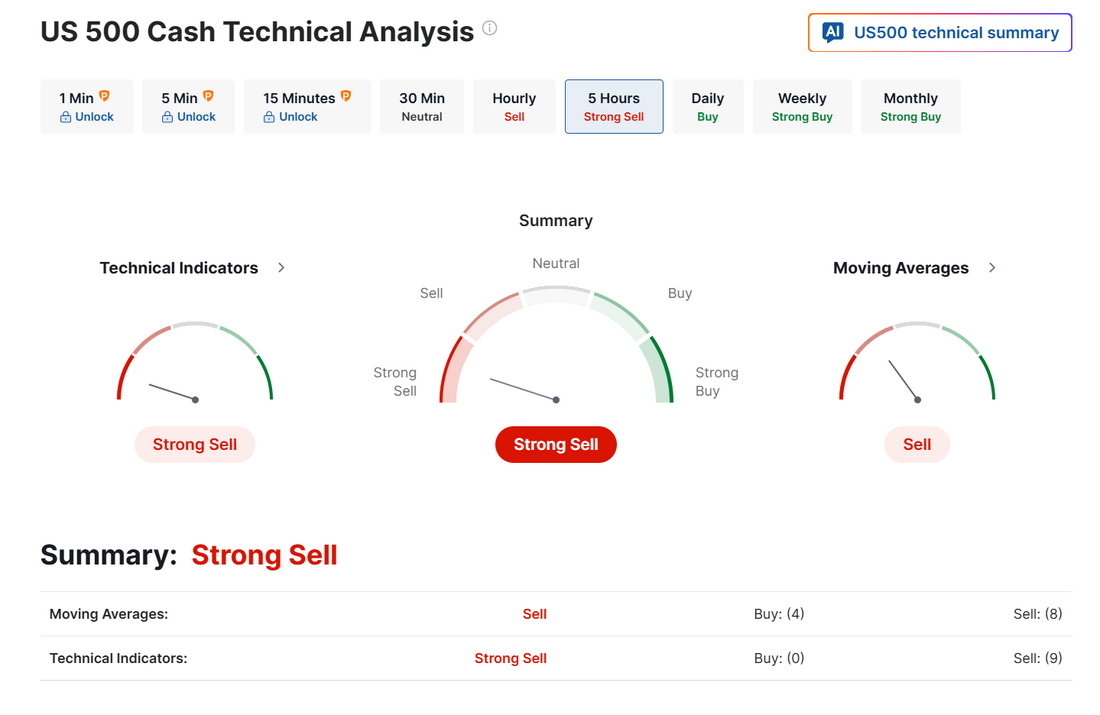

Jackson Hole timeWe don't have a lot to discuss this morning. Powell's speech this morning should set the tone for the day. It's a busy morning of speeches: We'll be patient this morning and wait to see if we get a trend to develop. Our day yesterday was slow. We had a nice opportunity late in the day with a couple of butterflies. We just caught the corner of one which helped us get some green on the day. We had a great start to scalping but I ended up giving most of it back. Here's a look at my day. September S&P 500 E-Mini futures (ESU25) are trending up +0.26% this morning, attempting to snap a five-session losing streak, with focus squarely on a highly anticipated speech from Federal Reserve Chair Jerome Powell. In yesterday’s trading session, Wall Street’s major indices ended in the red. Renewable energy stocks slumped after President Trump said in a social media post that the U.S. would not approve solar or wind power projects, with First Solar (FSLR) sinking about -7% to lead losers in the S&P 500 and Sunrun (RUN) sliding more than -4%. Also, Walmart (WMT) fell over -4% and was the top percentage loser on the Dow after the world’s largest retailer posted weaker-than-expected Q2 adjusted EPS. In addition, Coty (COTY) tumbled more than -21% after the cosmetics company posted an unexpected quarterly loss and projected that steep sales declines would continue in FQ1. On the bullish side, Nordson (NDSN) rose +3% after the manufacturing company reported better-than-expected FQ3 results and raised its full-year earnings guidance. Economic data released on Thursday showed that the U.S. S&P Global manufacturing PMI unexpectedly rose to a 3-year high of 53.3 in August, stronger than expectations of 49.7. Also, U.S. existing home sales unexpectedly rose +2.0% m/m to 4.01 million in July, stronger than expectations of 3.92 million. At the same time, the number of Americans filing for initial jobless claims in the past week rose by +11K to a 2-month high of 235K, compared with the 226K expected. “The great PMI numbers have made it more difficult for Powell to pivot to employment weakness... No fun in the equity space either,” said Andrew Brenner at NatAlliance Securities. Cleveland Fed President Beth Hammack said on Thursday that she would not support lowering interest rates if policymakers were making a decision tomorrow. “We have inflation that’s too high and has been trending upwards over the past year,” Hammack said. Also, Atlanta Fed President Raphael Bostic said he still views just one rate cut as appropriate for this year, but added that the labor market’s trajectory is “potentially troubling” and warrants close attention. In addition, Kansas City Fed President Jeffrey Schmid said that inflation risks still outweigh risks to the labor market. Finally, Chicago Fed President Austan Goolsbee said that although some recent inflation data have come in better than expected, he hopes one “dangerous” reading proves to be just a temporary blip. Meanwhile, U.S. rate futures have priced in a 69.3% chance of a 25 basis point rate cut and a 30.7% chance of no rate change at September’s policy meeting. Today, all eyes are focused on Fed Chair Jerome Powell’s speech at the central bank’s annual Economic Policy Symposium in Jackson Hole, Wyoming. Investors are watching to see whether Powell provides any signal about what the Fed might do at the September meeting. However, it may be difficult for him to give a clear signal, especially with some of his colleagues still not in a rush to cut rates. A survey conducted by 22V Research revealed that 43% of investors expect the market reaction to Jackson Hole to be “neutral,” 39% anticipate “risk-off,” and only 18% expect “risk-on.” “Key to the Jackson Hole symposium will be whether Fed Chair Powell updates his monetary policy reaction function. In our base case, Powell sticks to his reaction function laid out in July. We think this would surprise markets hawkishly,” said Calvin Tse at BNP Paribas. The U.S. economic data slate is empty on Friday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.340%, up +0.21%. Let's take a look at the market: With no idea how the market will react to Powell today it seems appropriate that we start the day technically at a neutral rating. With a five day downtrend developing it seems more and more likely that we get a downtrend continuation. There's no real benefit to starting the day with a pre-concieved lean or bias as Jackson Hole will likely direct the price action. We'll be patient and wait to see if a trend develops. Let's take a look at the main key, intra-day levels today which could dictate todays trend. 6410 is the first resistance level I'm watching with 6441 being the big one. Above that bulls could be back in charge. 6380 is the first support zone I'm watching with 6349 the big one. Below that the bears continue to build downside momentum. I'm routing for the bears. Today is a perfect day to focus on scalping futures and an SPX 0DTE. I don't think we need anything else to give us a good potential result...assuming we get some movement today. We had a good training session yesterday. I'm looking forward to Monday when we'll have part two! Make sure to tune in to the zoom then. I'll see you all in the live trading room shortly. Let's see is Powell can deliver for us today.

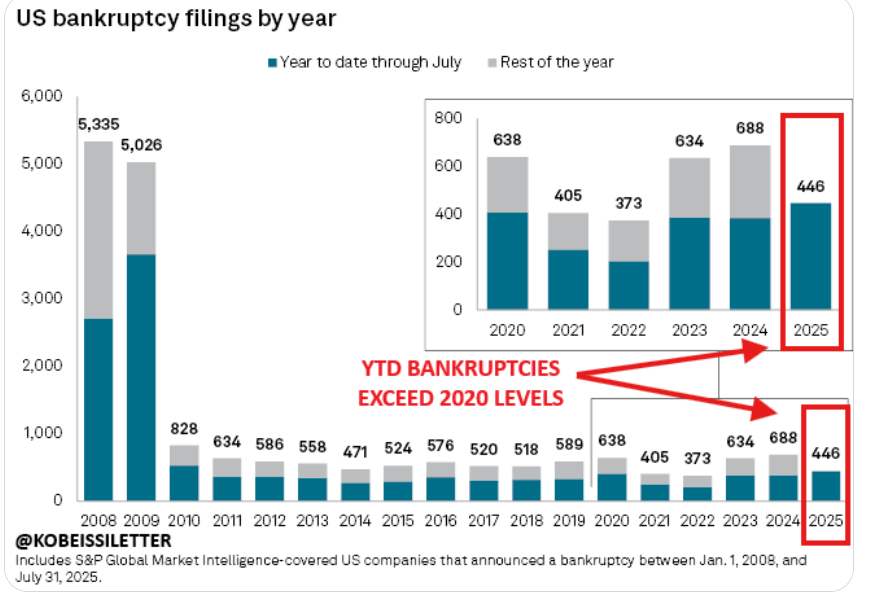

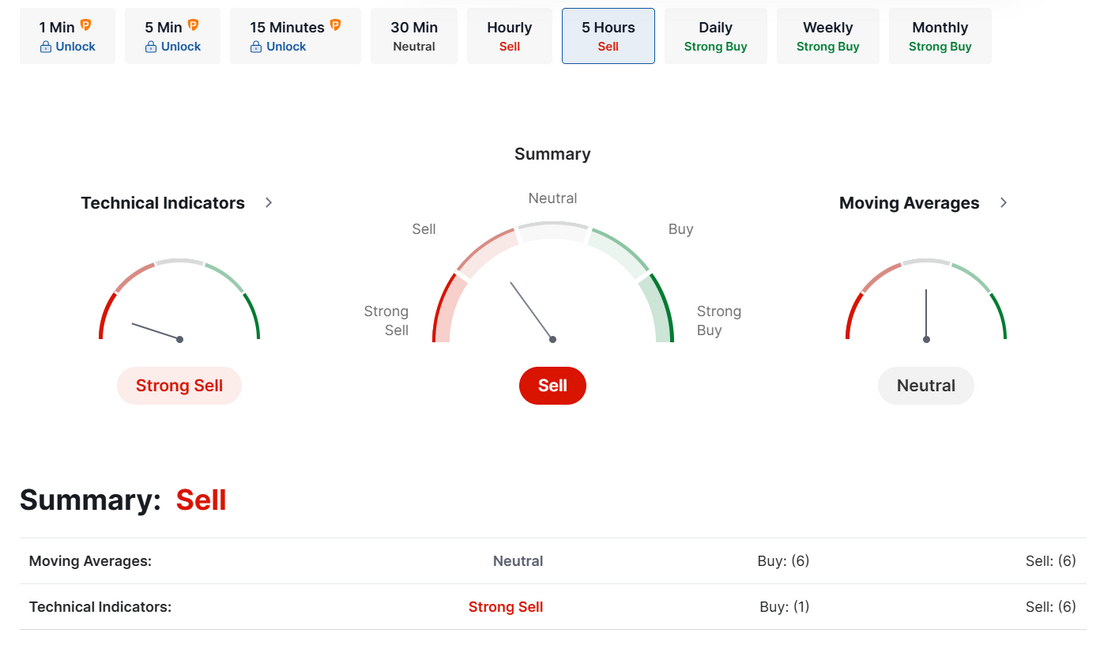

Market movement = Happy tradersThank you, thank you, thank you. As traders we just want movement. We don't even care what direction! We haven't had any for a while so the last couple of days have been heaven sent. Powell and Jackson Hole are in focus for Friday so I'm not sure how much action we'll get today but I am excited about the market potentially positioning, over the last few days for a roll over. We had a solid day yesterday. Not just that we made money but primarily that we were done well before the power hour. The first two hours of the day are really where we need to work our scalping. After that it's just too easy to get chopped up. Here's a look at my day yesterday: Let's take a look at the markets: Sell signals continue to hold. The roll over is looking more and more solid. September S&P 500 E-Mini futures (ESU25) are down -0.22%, and September Nasdaq 100 E-Mini futures (NQU25) are down -0.10% this morning, pointing to further losses on Wall Street, while investors await the Federal Reserve’s gathering at Jackson Hole, U.S. business activity data, and an earnings report from retail giant Walmart. The minutes of the Federal Open Market Committee’s July 29-30 meeting, released Wednesday, showed that most officials emphasized the risk of inflation as outweighing concerns about the labor market. Policymakers acknowledged concerns about higher inflation and weaker employment, but “a majority of participants judged the upside risk to inflation as the greater of these two risks,” according to the FOMC minutes. Also, officials debated whether tariffs would cause a one-time price increase or a more lasting inflation shock. “Several participants emphasized that inflation had exceeded 2% for an extended period and that this experience increased the risk of longer-term inflation expectations becoming unanchored in the event of drawn-out effects of higher tariffs on inflation,” the minutes said. In addition, many officials noted that it might take some time before the full impact of tariffs is reflected in consumer goods and services prices. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed mixed, with the S&P 500 dropping to a 1-1/2-week low and the Nasdaq 100 falling to a 2-week low. The Magnificent Seven stocks fell, with Tesla (TSLA) and Amazon (AMZN) sliding over -1%. Also, chip stocks slumped, with Intel (INTC) sinking about -7% to lead losers in the S&P 500 and Nasdaq 100, and Micron Technology (MU) slipping nearly -4%. In addition, Target (TGT) dropped more than -6% after the retailer appointed veteran Michael Fiddelke as its next chief executive officer, disappointing investors who had been hoping for an external hire to provide a fresh perspective. On the bullish side, Analog Devices (ADI) climbed over +6% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the semiconductor company posted upbeat FQ3 results and issued above-consensus FQ4 guidance. “Today feels like a test for the dip-buyers with data on PMIs on Thursday and Federal Reserve Chair Jerome Powell at Jackson Hole may prove to be market movers/narrative changers,” Andrew Tyler, head of global market intelligence at JPMorgan, wrote in a note to clients on Wednesday. The Kansas City Fed’s annual Economic Policy Symposium kicks off today in Jackson Hole, Wyoming. Chair Jerome Powell, in remarks on Friday, is expected to outline the central bank’s new policy framework. Investors are watching to see whether Powell confirms the market’s pricing for a September rate cut or pushes back by stressing that incoming data before the next policy meeting could change the outlook. They’re also seeking signals about the longer-term path of Fed cuts heading into next year. U.S. rate futures have priced in an 81.2% probability of a 25 basis point rate cut and an 18.8% chance of no rate change at the next FOMC meeting in September. On the economic data front, all eyes are focused on S&P Global’s flash U.S. purchasing managers’ surveys, set to be released in a couple of hours. They will give an up-to-date snapshot of how tariffs have impacted both activity and prices. Economists, on average, forecast that the August Manufacturing PMI will come in at 49.7, compared to last month’s value of 49.8. Also, economists expect the August Services PMI to be 54.2, compared to 55.7 in July. Investors will also focus on U.S. Existing Home Sales data. Economists foresee this figure coming in at 3.92 million in July, compared to 3.93 million in June. The U.S. Philadelphia Fed Manufacturing Index will be reported today. Economists anticipate the Philly Fed manufacturing index to stand at 6.8 in August, compared to last month’s value of 15.9. U.S. Initial Jobless Claims data will be released today. Economists estimate this figure will come in at 226K, compared to last week’s number of 224K. The Conference Board’s Leading Economic Index for the U.S. will be released today as well. Economists expect the July figure to drop -0.1% m/m, compared to the previous number of -0.3% m/m. On the earnings front, retail giant Walmart (WMT), along with notable tech players such as Intuit (INTU), Workday (WDAY), and Zoom Video (ZM), are set to report their quarterly figures today. Investors will keep a close eye on Walmart’s earnings following a mixed bag of results from retailers earlier this week. In addition, market participants will be anticipating a speech from Atlanta Fed President Raphael Bostic. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.309%, up +0.26%. The US has now seen 446 LARGE bankruptcy filings in 2025, officially +12% ABOVE pandemic levels in 2020. In July alone, the US saw 71 bankruptcies, marking the highest single-month total since July 2020. The gap between retail and professional investors have rarely been greater: Mom-and-pop investors have purchased ~$190 billion in US equity ETFs so far in 2025. At the same time, institutional investors have sold ~$40 billion. Remarkable divergence.  My lean or bias today is bearish. This rollover is starting to take hold (hopefully) and I don't think too many traders are wanting to take big positions before Powell's statement tomorrow. Trade docket for today: We've got another day where Gold and BTC (1HTE) are not in the premium range we want. That's o.k. Scalping and the SPX have offered enough potential for us to shoot for our $1,000 profit target. We are already off to a good start with an early morning /NQ scalp putting us up $360 dollars. I'll continue to look for scalping opportunities today with /MNQ and make SPX the main 0DTE focus. Let's take a look at the new intra-day /ES levels: 6400 is the big demarcation point. Above looks bullish. Below is bearish. 6409, 6417, 6426, 6435 are resistance levels. 6380, 6375, 6364, 6350 are support levels. I've got another great training module today on building your mental side of trading plus a couple cool (free) tools to help you be your best so make sure and tune in today. I look forward to seeing you all in the live trading room shortly. We've got some good stuff today!

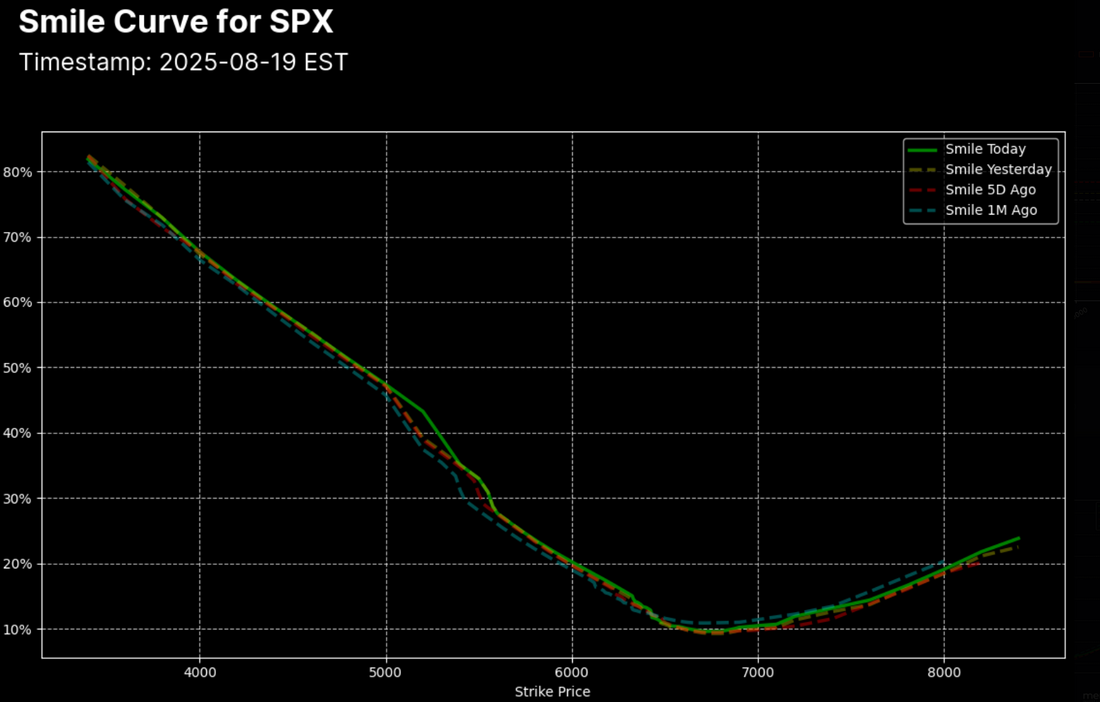

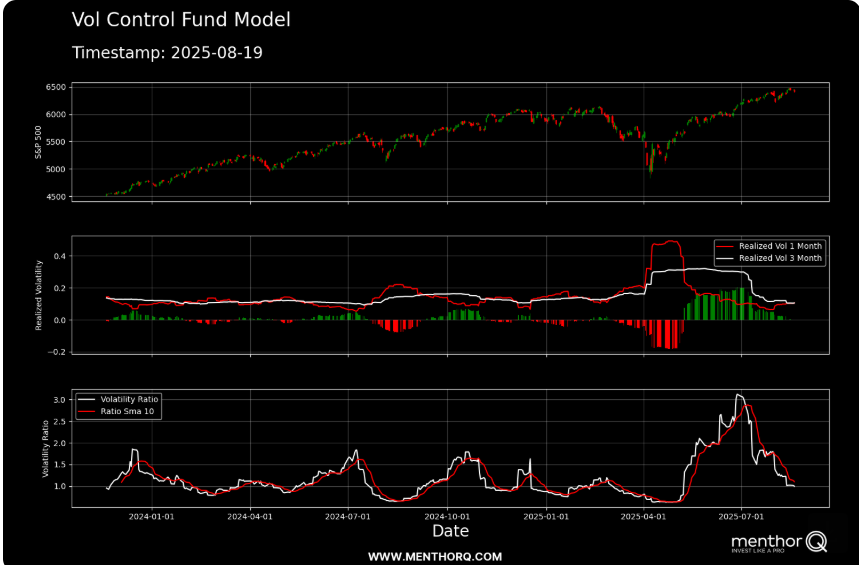

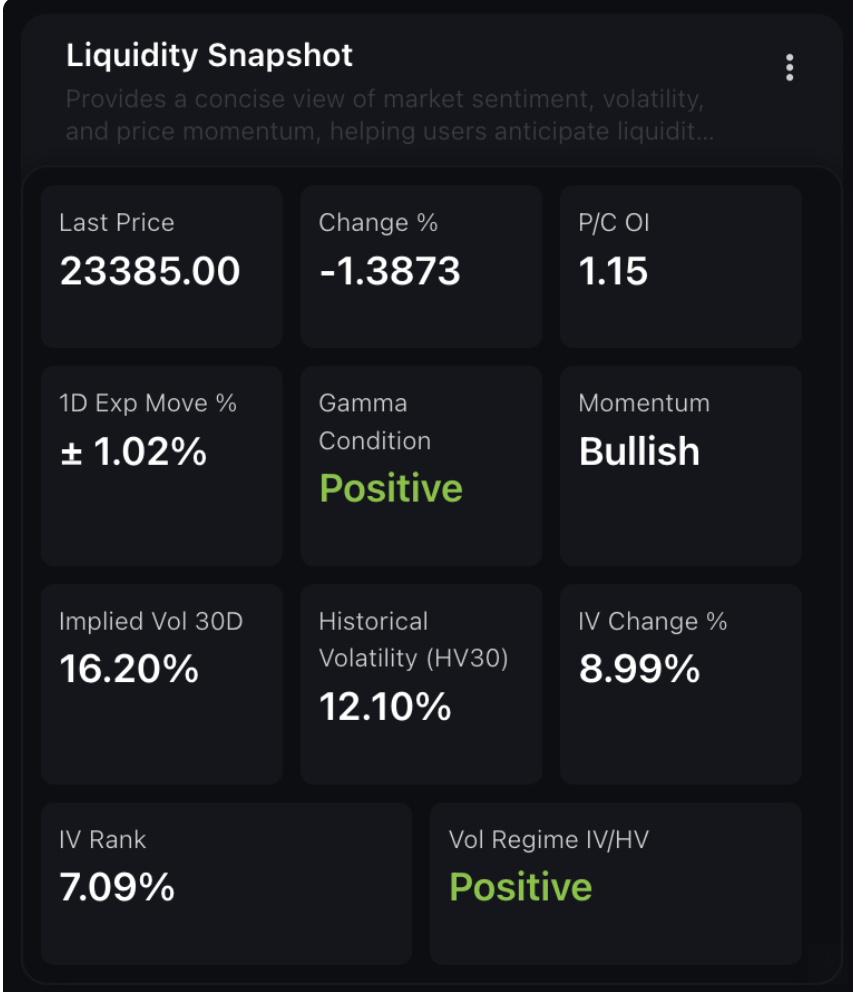

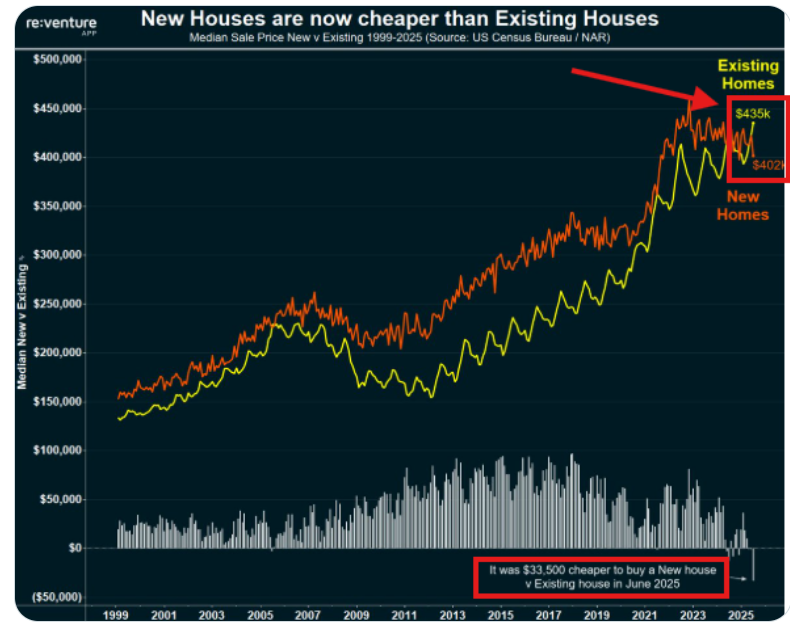

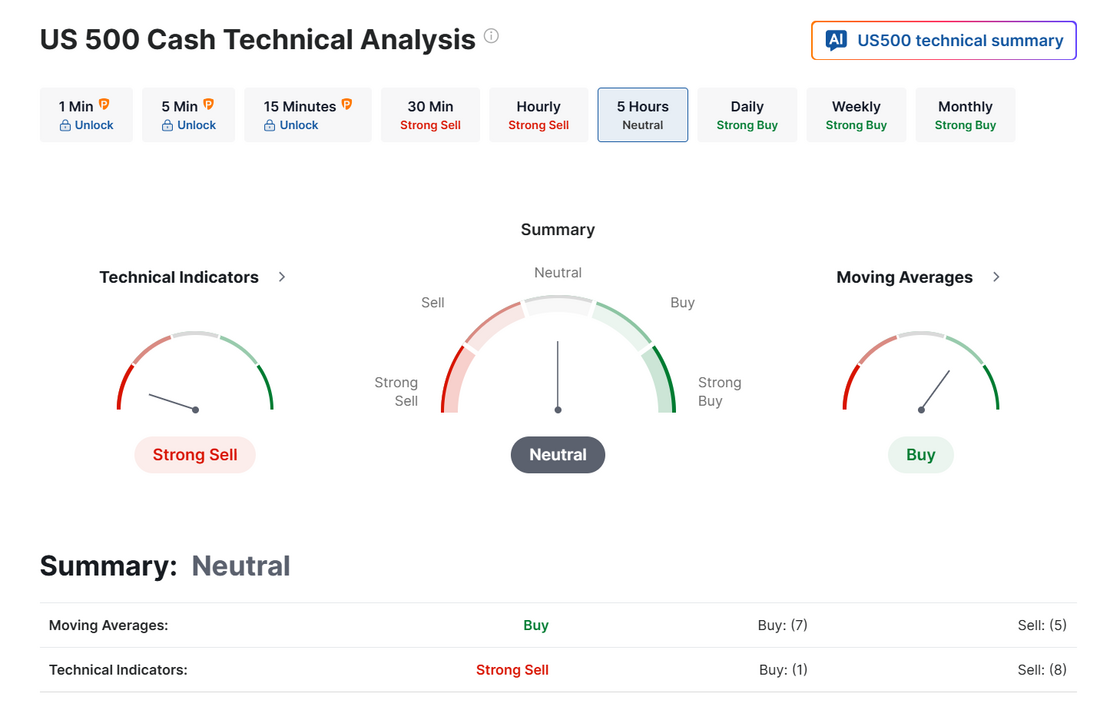

Movement finally?Traders just want movement, any movement. Down is better than up for size of moves and premium but up is good too. We just need something to happen. That hasn't been the case for a week. Yesterday finally brought some action. Hopefully we will break out and start the next wave of directional bias. We finally got a profit on our SPX 0DTE yesterday. It was a pretty easy day and we stayed in the green all day. I wasn't quite as good on execution with scalping. I really just needed to stay short all day and it would have been lovely. Here's a look at my day: Let's take a look at the markets: We start the day with a sell signal. This weakening trend is starting to take hold. The option smile is interesting as we see a decent sized ramp up in put tail risk coverage. The SPX chart from the Vol Control Fund Model shows that short-term realized volatility (1M) has continued to trend lower after the elevated levels seen earlier this year, now converging toward the 3M realized volatility. The decline in realized vol has also been mirrored by the volatility ratio, which is coming off its mid-year highs and now moving closer to its longer-term mean. This cooling of volatility suggests the market is in a more stable regime compared to recent months. In the short term, the spot price remains near highs, and the key watchpoint is whether the volatility ratio continues to compress further, which could reinforce steady price action, or if it begins to rebound, signaling a potential pickup in movement. The latest NDX liquidity snapshot highlights a short-term pullback, with price down -1.39% to 23,385 while maintaining a bullish momentum backdrop. Despite the drop, gamma remains in a positive regime, which can help dampen further downside volatility. Implied volatility (16.2%) has jumped nearly 9%, widening the gap over realized volatility (12.1%) and suggesting increased demand for protection. The put/call open interest ratio at 1.15 indicates relatively balanced positioning, while the IV rank of 7% shows that current vol levels remain low compared to historical extremes. Overall, the setup reflects short-term pressure within a still supportive gamma and momentum environment, with volatility dynamics worth monitoring closely in the near term. Looking at the VTI ( I think it gives the best "overall" view of the market) it's a pretty clear sell signal here. My lean or bias today is bearish. That's how everything is leaning. We've got FOMC minutes release today but I don't think it changes sentiment. Feels good to get back on the bear train! The heat map for the week shows tech starting to roll over. What leads us up usually leads us down. We haven't taken a look lately at one of the biggest economic drivers in the economy. That's real estate. For the first time in history, a NEW home in the US costs $33,500 LESS than an EXISTING home, per Reventure. Not even June 2005 saw such a large gap, right before the 2008 Financial Crisis. Is real estate due for a correction? "Experts" have been calling for one for over a year. Who knows but we do know the saying "As residential real estate goes, so goes the economy" has been true, over time. Trade docket for today: Gold still lacks premium and BTC is still to volatile for any 1HTE entries so I'll stick with our SPX 0DTE and scalping using the /mnq futures or QQQ options. There should be enough potential in those two to achieve our $1,000 profit goal IF...we can execute. Let's take a look at the intra-day levels on /ES: Lot's of great levels to watch today. 6434, 6450, 6454, 6462 are new resistance zones. 6409, 6400, 6384, 6380 are new support zones. We've lacked opportunity lately in the market. I think today could open that back up. I look forward to seeing you all in the live trading room.

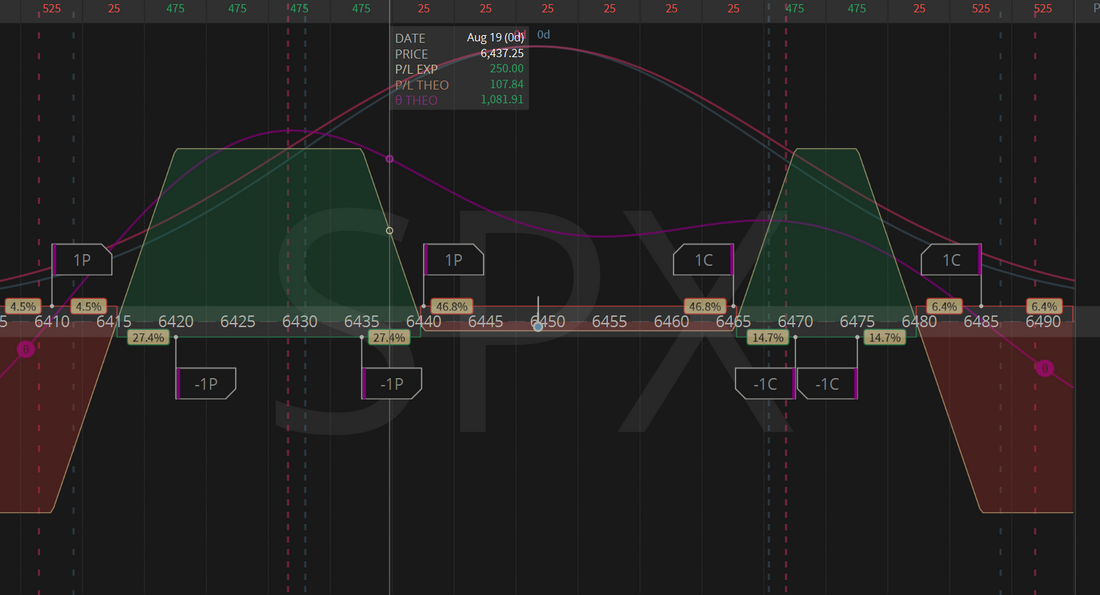

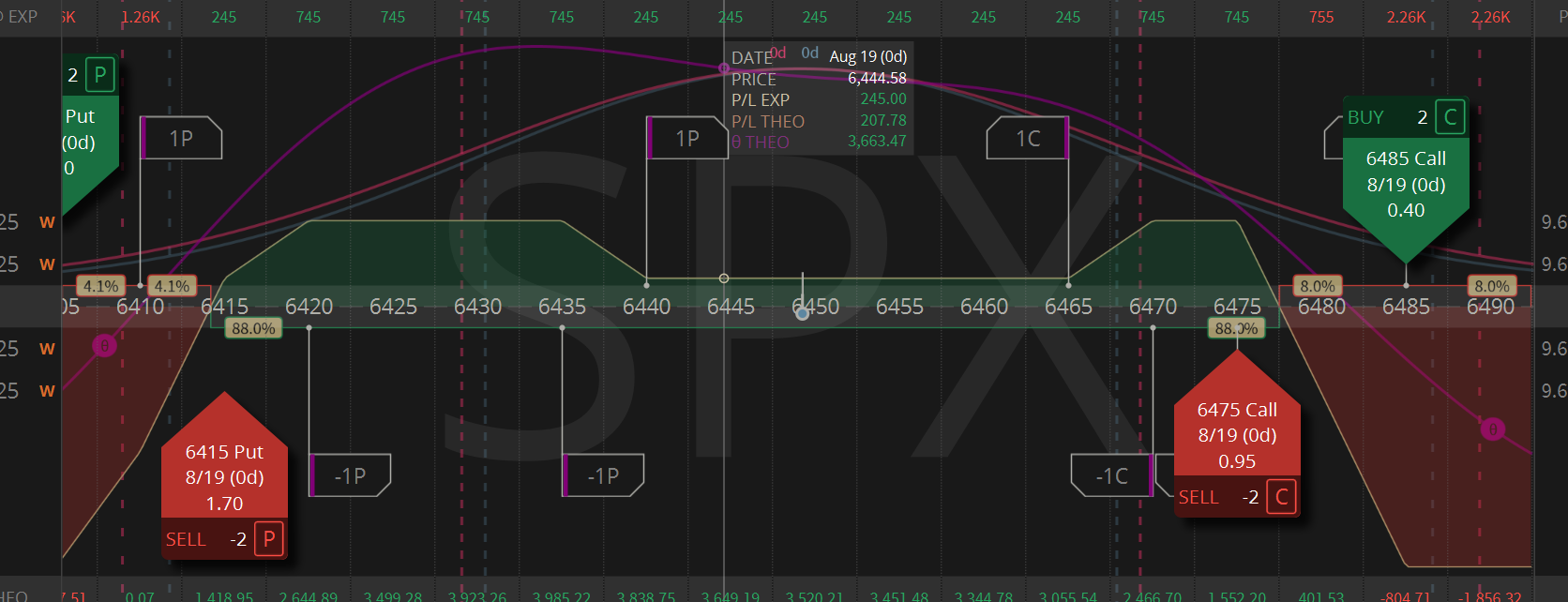

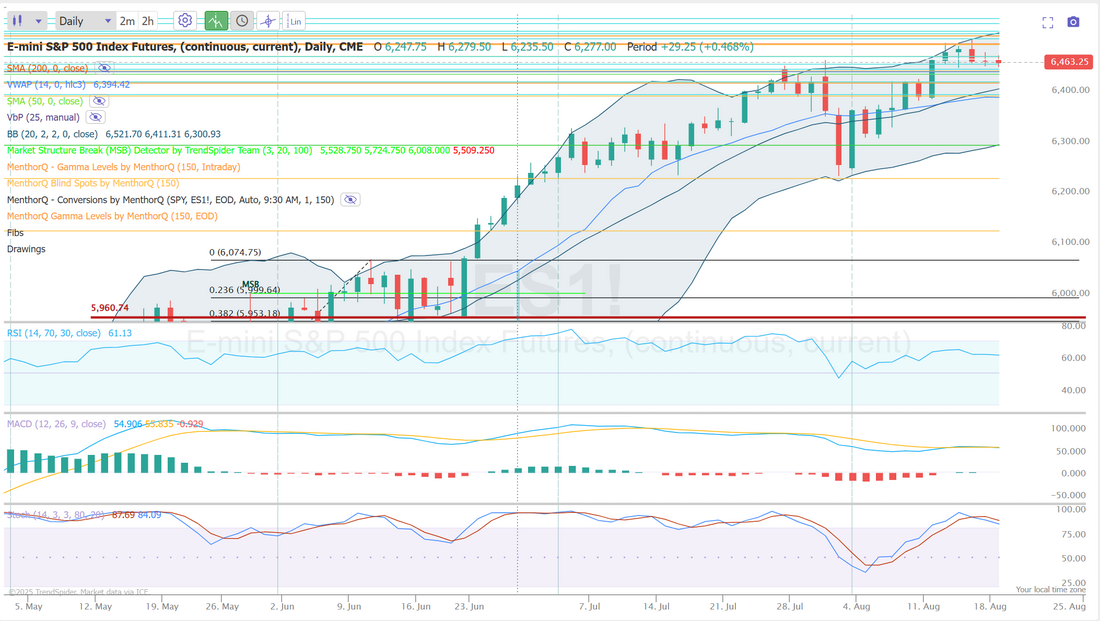

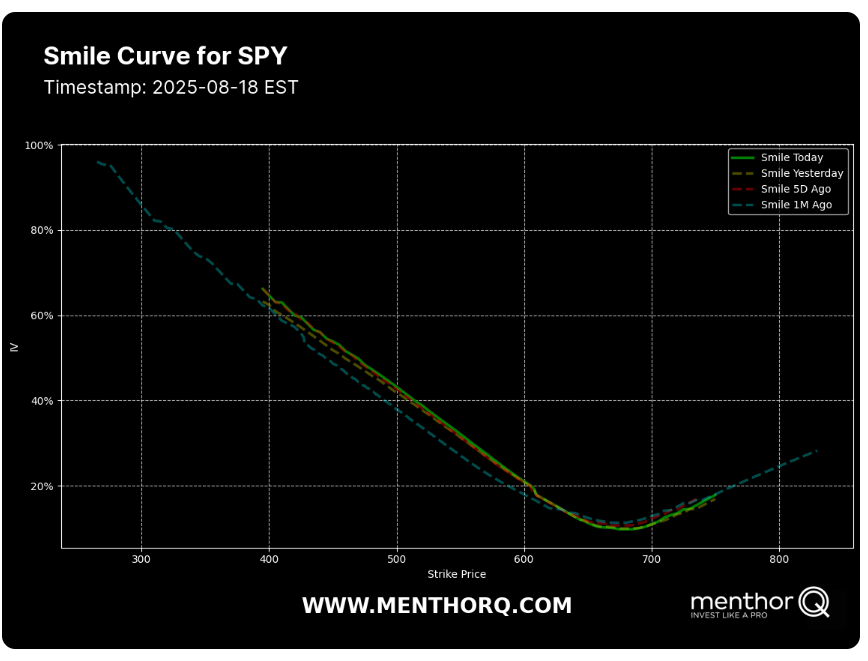

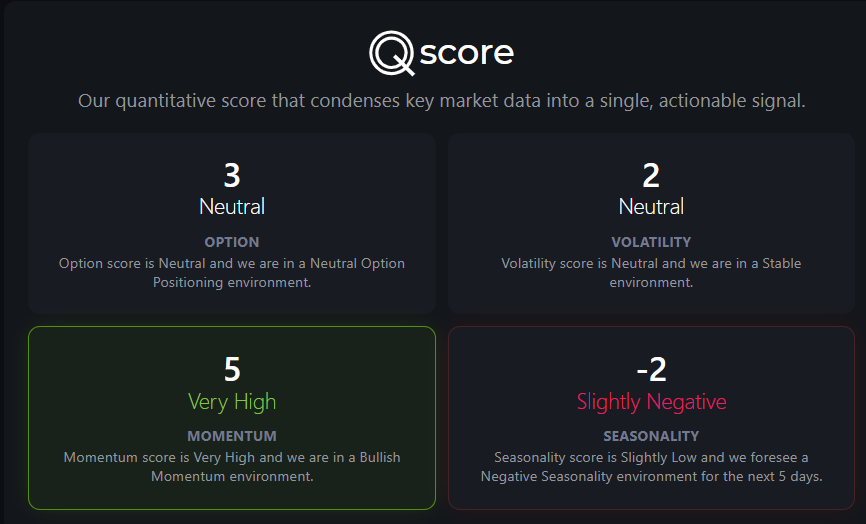

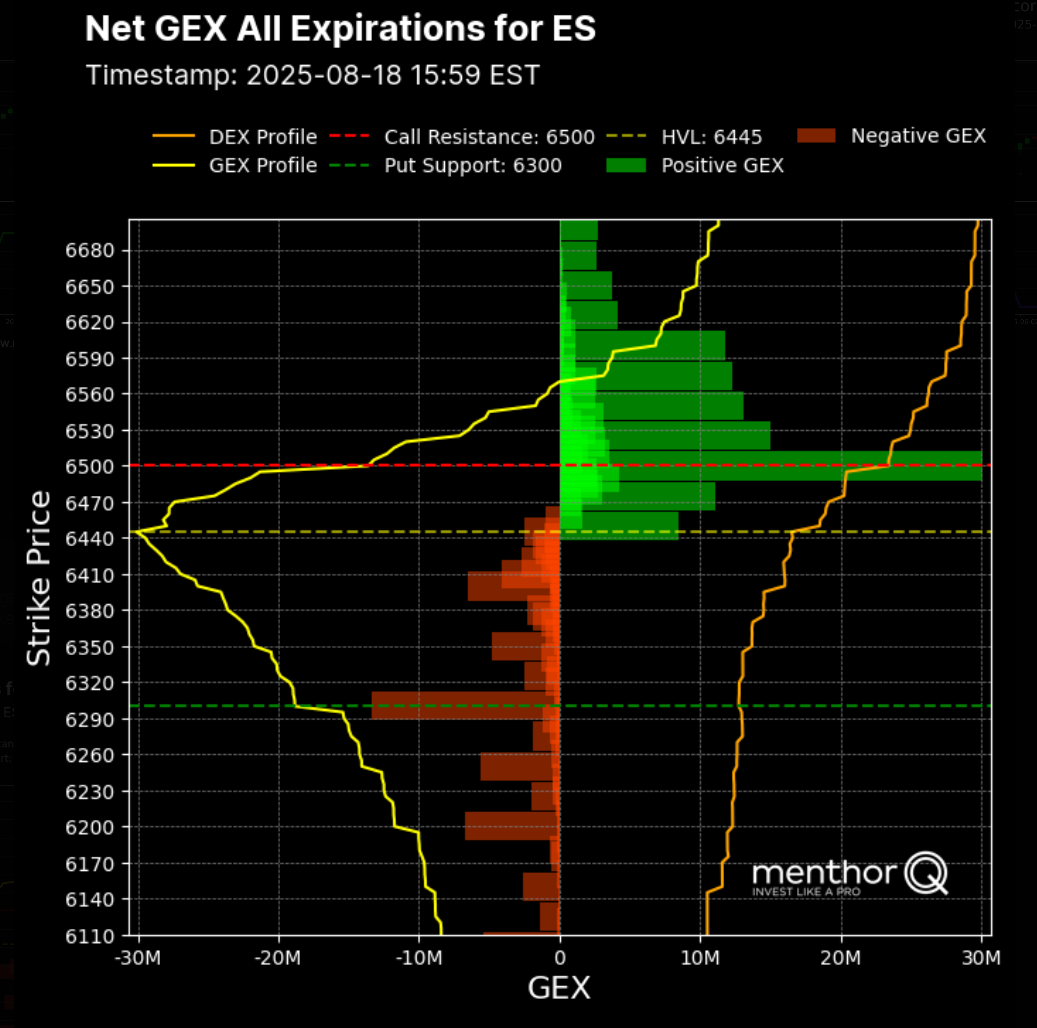

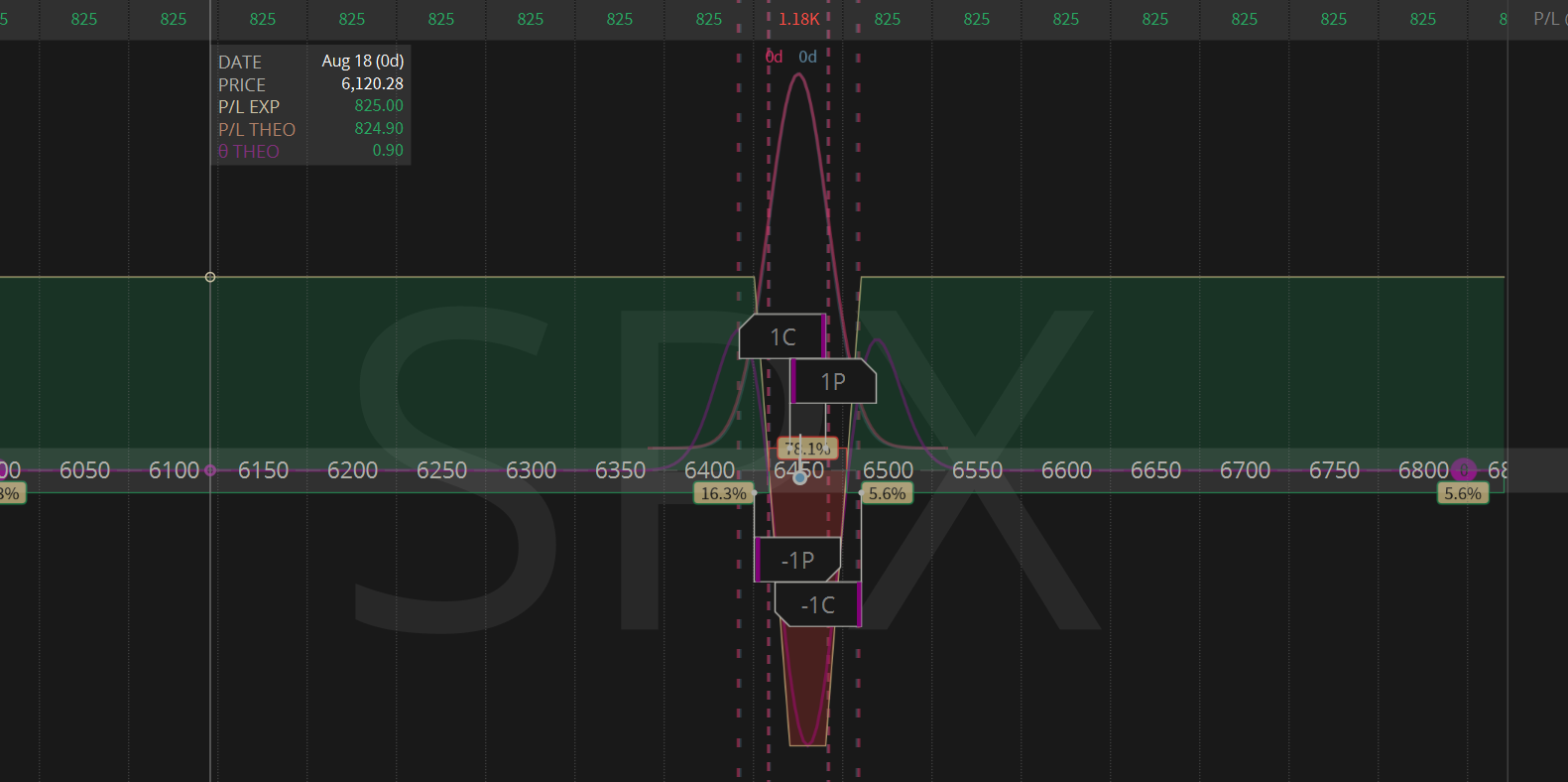

How long do we coil?The last five trading days have been a big nothing burger. We know that consolidation flows into expansion. When and how much and what direction? Who knows but we do know it's coming. We put on a 1DTE setup late afternoon yesterday with a debit (long) Iron condor. Which we will wrap this morning, with a credit (short) Iron condor...something like this. We have tried credit trades, debit trades, directional, non-directional, you name it. This seems to be the best way to play this "dead" market. As some point we'll get some movement. We just don't know when. Yesterday I focused solely on the SPX that we put on last Fri. It didn't hit...again. This low vol environment with no movement it tough to trade. We took a stab as several scalps but yesterday wasn't really a day for scalping. Here's a look at my day. Let's take a look at the markets: We start the day with slightly weak technicals. Five days now of a soft market. Not really rolling over yet but a downturn could be promising for those of us who would benefit from higher premiums. The markets are definitely in "pause" mode. The question is, are we resting before the next push up or forming the basis to roll over? One thing is certain. Volatility...and premiums couldn't be worse. Prepare for a spike up...that's my advice. September S&P 500 E-Mini futures (ESU25) are down -0.09%, and September Nasdaq 100 E-Mini futures (NQU25) are down -0.08% this morning as earnings from the nation’s retail heavyweights kicked off, shifting the focus to the strength of the American consumer. Home Depot (HD) rose over +1% in pre-market trading after the giant home-improvement retailer reiterated its full-year guidance. However, the company reported slightly weaker-than-expected Q2 results. Investors also assess the latest efforts to end the Russia-Ukraine war. U.S. President Donald Trump’s meeting with Ukrainian President Volodymyr Zelenskyy and European leaders concluded with a call for a summit with Russia. President Trump said he had spoken with Russian President Vladimir Putin and was working to set up a direct meeting between Putin and Zelenskyy, followed by a potential trilateral summit involving all three leaders. Zelenskyy said talks were positive and covered sensitive issues such as security guarantees, adding that he was prepared to meet with Putin bilaterally. NATO Secretary-General Mark Rutte said that Putin has agreed to meet with Zelenskyy. In yesterday’s trading session, Wall Street’s main stock indexes closed mixed. EQT Corp. (EQT) slid more than -4% and was the top percentage loser on the S&P 500 after Roth Capital downgraded the stock to Neutral from Buy. Also, Intel (INTC) fell more than -3% and was the top percentage loser on the Nasdaq 100 after Bloomberg reported that the Trump administration was in discussions to take a 10% stake in the company. In addition, Meta Platforms (META) dropped over -2% after the Information newsletter reported that the company is undertaking its fourth restructuring of its AI organization in the past six months. On the bullish side, Dayforce (DAY) soared over +25% and was the top percentage gainer on the S&P 500 after Bloomberg reported that private-equity firm Thoma Bravo was in talks to acquire the human resources management software provider. Meanwhile, S&P Global Ratings reaffirmed its AA+ long-term rating for the U.S. and its A-1+ short-term rating, while maintaining a stable outlook. “The stable outlook indicates our expectation that although fiscal deficit outcomes won’t meaningfully improve, we don’t project a persistent deterioration over the next several years,” it said in a statement. The ratings agency noted it expects strong revenues from the Trump administration’s newly implemented tariff regime to help offset the anticipated fiscal deterioration stemming from recent legislative changes. Investors face a crucial week as the Kansas City Fed’s annual Economic Policy Symposium kicks off Thursday evening in Jackson Hole, Wyoming, potentially providing signals on the direction of interest rates. Chair Jerome Powell, in remarks on Friday, is expected to outline the central bank’s new policy framework. Mr. Powell may also provide a fresh update on how much support exists for a September rate cut, at a time when the Trump administration is intensifying pressure to begin easing. “If the Fed is going to cut next month, expect hints out of this week’s Jackson Hole Symposium,” said Scott Wren at Wells Fargo Investment Institute. U.S. rate futures have priced in an 83.1% probability of a 25 basis point rate cut and a 16.9% chance of no rate change at September’s monetary policy meeting. Today, market watchers will focus on U.S. Building Permits (preliminary) and Housing Starts data, set to be released in a couple of hours. Economists expect July Building Permits to be 1.390 million and Housing Starts to be 1.290 million, compared to the prior figures of 1.393 million and 1.321 million, respectively. Investors will also look forward to earnings reports from home improvement chain Home Depot (HD), medical device firm Medtronic (MDT), and semiconductor electronics manufacturing firm Keysight Technologies (KEYS). In addition, market participants will parse comments today from Fed Governor Michelle Bowman. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.329%, down -0.25%. The SPX chart with momentum scoring highlights a steady uptrend over the past few months, with prices moving from below 5,900 to consolidating near 6,450. The momentum score has remained consistently elevated, holding around 4–5 for much of July and August after recovering from a brief dip in late July. This sustained strength suggests that near-term momentum continues to support the trend, even as price action has flattened slightly in recent sessions. From a short-term lens, the key observation is whether momentum can stay above 4 as dips in this score have historically aligned with brief pauses or retracements. In the immediate term, the consolidation phase may signal a build-up for the next directional move, with momentum levels providing a useful gauge for potential follow-through. The SPY smile curve chart highlights how implied volatility is distributed across strike prices, offering insight into current option market dynamics. Today’s curve (green) sits slightly above yesterday’s and the 5-day profile, showing a marginal uptick in implied volatility across strikes, especially in the wings. Compared with one month ago (blue), volatility is still elevated at deep out-of-the-money puts, but the overall curve is tighter, suggesting less extreme downside hedging pressure than previously. The at-the-money zone around the 640–660 strikes remains anchored near the trough of the curve, while skew toward both ends indicates traders are paying more for protection in tails. Short-term, the incremental steepening signals a modest shift in sentiment toward hedging activity rather than complacency. Gamma is low and positive. Quant score is turning more neutral. 6500 on /ES remains a huge gamma wall resistance area. Today looks to be starting our much like yesterday and the previous five days. Slow moving. Futures are slightly down but no real indication of directional movement today. We are set up for a neutral day and that's what I'm looking for. Trade docket today is fairly simple. I'll focus on scalping the /MNQ futures contracts and getting our SPX 0DTE to the finish line. We'll likely initiate another 1DTE SPX for tomorrow, much like we did yesterday. This seems to be the best approach for a market like this. There is no premium in Gold right now so we'll look at that again later today. Let's take a look at the intra-day levels. They haven't changed much in the last five trading days. With price action subdued, the levels are close and many. 6477, 6487, 6495, and 6500 are the closest resistance levels. 6460, 6455, 6450, 6444 are support. It seems like a big goal, lately but let's see if we can get our SPX to a green finish today! I'll see you all in the live trading room shortly.

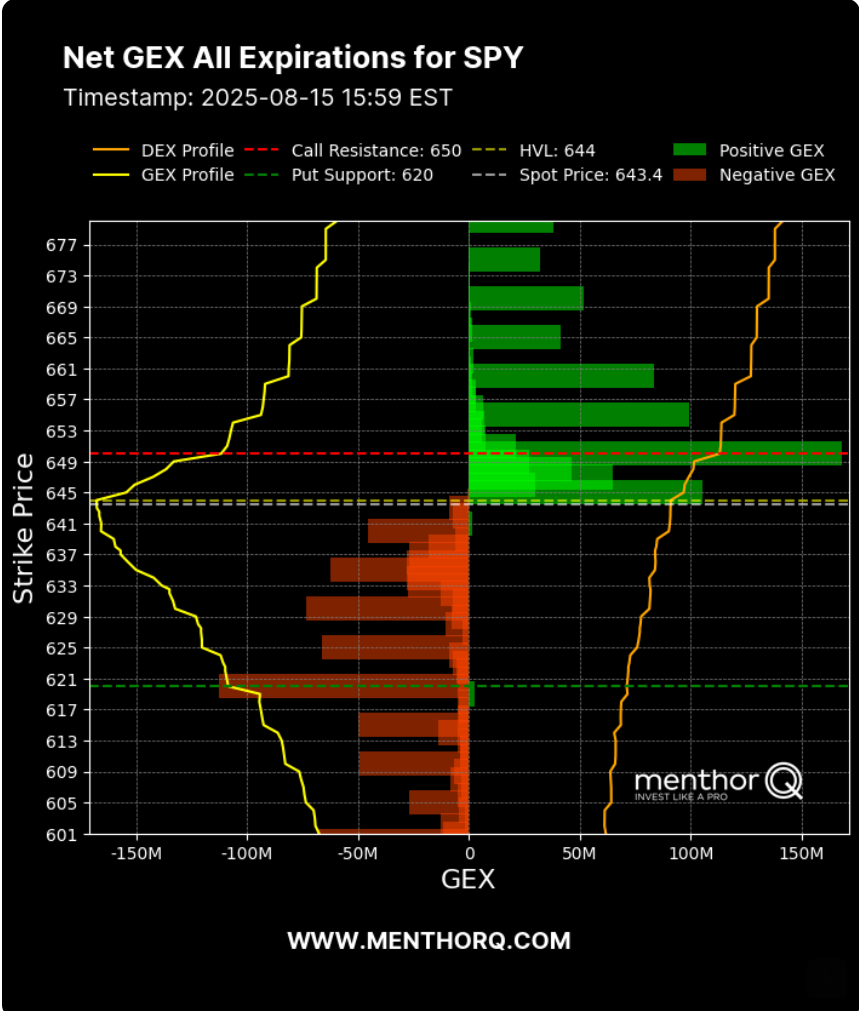

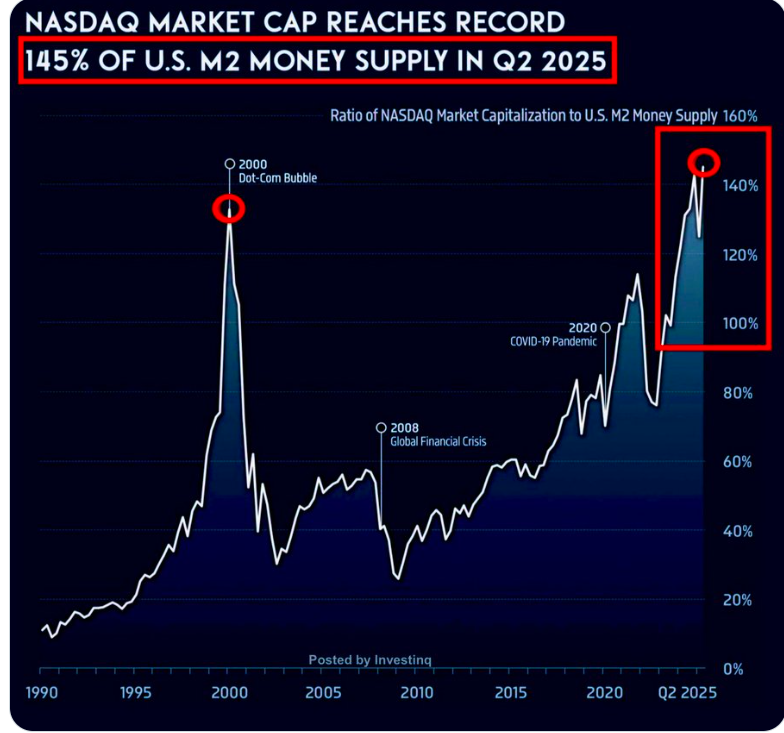

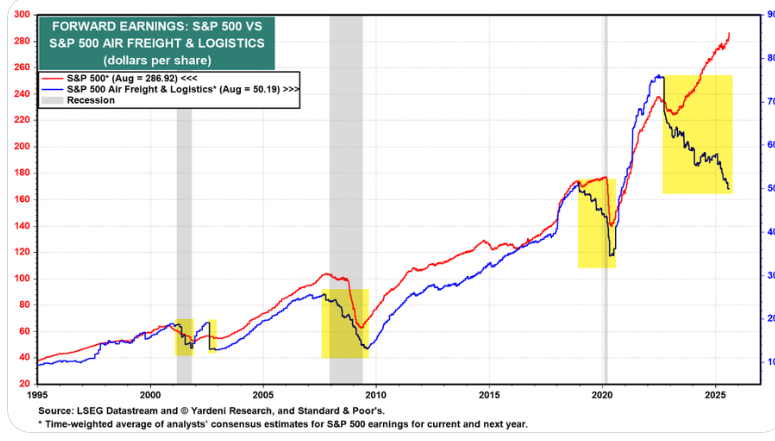

Powells weekWe've got FOMC minutes release on Weds. and Powell Speaking at the Jackson Hole summit at the end of the week. How will the market react? It's just speculation at this point but past Jackson Hole meeting paint an interesting picture. I think, after three pretty solid weeks this may be a down week for us. I wasn't able to generate anything worthwhile on Friday. There just wasn't enough movement. We continue to look for movement. This consolidation phase will eventually come to an end. We already have the basis for our SPX 0DTE working for today. See below: We've got about $1,100 BP with $800 max profit potential. If we can get movement today, this may be all we need. Otherwise, we'll need to trade around it. Let's take a look at the markets: After a lot of bullish technicals we start today at a neutral rating. Possibly time for a reversal? Markets look a little tired here. Is this just a pause or the start of the retace we are all looking for? The SPX chart highlights a steady climb toward recent highs, with the option score showing a recovery from early-August lows after briefly touching zero. Short-term momentum remains constructive, but the recent dip in the option score from 4 to 3 suggests traders are moderating their positioning after the latest push higher. Price action is consolidating just below the 6,450 level, with buyers showing resilience after pullbacks. In the near term, keeping an eye on whether the option score stabilizes or weakens further could provide signals on the strength of participation behind this rally. The SPY gamma exposure (GEX) chart highlights key zones where option flows may influence near-term price dynamics. The spot price sits at 643.4, positioned close to the hedging volatility line (HVL) at 644, suggesting that market makers’ hedging flows could help stabilize movement in this area. On the downside, there is notable put support near 620, while the 650 strike shows strong call resistance, marking it as a key overhead barrier. The concentration of positive GEX above current levels may help dampen volatility as SPY trades higher, while the cluster of negative GEX below 630 could amplify moves lower if breached. In the short term, this setup points to a market trading within a defined range, with 644 acting as a pivotal level to watch for shifts in momentum September S&P 500 E-Mini futures (ESU25) are down -0.13%, and September Nasdaq 100 E-Mini futures (NQU25) are down -0.15% this morning, starting the week on a cautious note as investors await U.S. President Donald Trump’s talks with Ukrainian President Volodymyr Zelenskyy. Trump will host Zelenskyy and several European leaders to outline terms for a potential peace agreement he discussed with Russian President Vladimir Putin at last Friday’s meeting in Alaska. After arriving in Washington, the Ukrainian president said that Russia must bring this war to an end. Meanwhile, on Sunday night, Trump wrote on social media that the responsibility lies with Zelenskyy to make concessions, declaring there is “no getting back” Crimea and “NO GOING INTO NATO BY UKRAINE.” Bloomberg reported that while the U.S. is expected to focus on territorial concessions demanded by Russia, Kyiv will aim to secure possible security guarantees. Investor focus this week is also on Federal Reserve Chair Jerome Powell’s most important policy speech of the year at Jackson Hole, the minutes of the Fed’s latest policy meeting, and earnings reports from retail heavyweights. In Friday’s trading session, Wall Street’s major equity averages closed mixed. Applied Materials (AMAT) plunged over -14% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the largest chip-equipment maker in the world provided downbeat FQ4 guidance. Also, SanDisk (SNDK) slid more than -4% after the company issued below-consensus FQ1 adjusted EPS guidance. In addition, Target (TGT) fell over -1% after BofA downgraded the stock to Underperform from Neutral with a price target of $93. On the bullish side, UnitedHealth Group (UNH) jumped about +12% and was the top percentage gainer on the S&P 500 and Dow after Warren Buffett’s Berkshire Hathaway disclosed in a regulatory filing that it purchased about 5 million shares of the health insurer last quarter. Economic data released on Friday showed that U.S. retail sales grew +0.5% m/m in July, slightly weaker than expectations of +0.6% m/m, while core retail sales, which exclude motor vehicles and parts, rose +0.3% m/m, in line with expectations. Also, U.S. July industrial production fell -0.1% m/m, weaker than expectations of no change m/m, while manufacturing production was unchanged m/m, stronger than expectations of -0.1% m/m. At the same time, the University of Michigan’s preliminary U.S. consumer sentiment index unexpectedly fell to 58.6 in August, weaker than expectations of 61.9. In addition, the U.S. import price index climbed +0.4% m/m in July, stronger than expectations of +0.1% m/m. “Consumers are no longer bracing for the worst-case scenario for the economy feared in April. However, consumers continue to expect both inflation and unemployment to deteriorate in the future,” said Peter Boockvar, author of The Boock Report. Chicago Fed President Austan Goolsbee said on Friday he wants to see at least one more inflation report to confirm that persistent price pressures aren’t picking up. “It’s been a little mixed,” Goolsbee said in an interview on CNBC, referring to recent inflation data. “I feel like we still need another one, at least, to figure out if we’re if we’re still on the golden path.” Meanwhile, U.S. rate futures have priced in an 84.8% chance of a 25 basis point rate cut and a 15.2% chance of no rate change at the conclusion of the Fed’s September meeting. Investor attention this week will be focused on the Kansas City Fed’s annual Economic Policy Symposium, which begins Thursday evening in Jackson Hole, Wyoming. Chair Jerome Powell, in remarks on Friday, is expected to outline the central bank’s new policy framework. Mr. Powell may also provide a fresh update on how much support exists for a September rate cut, at a time when the Trump administration is intensifying pressure to begin easing. Powell’s comments “are likely to be decisive in answering the question of how firmly the monetary authorities are actually heading for an interest rate cut in September,” according to strategists at LBBW. Earlier in the week, Fed Governors Michelle Bowman and Christopher Waller, as well as Atlanta Fed President Raphael Bostic, will be making appearances. Market watchers will also closely monitor preliminary purchasing managers’ surveys on U.S. manufacturing and services sector activity for August. They will give an up-to-date snapshot of how tariffs have impacted both activity and prices. Other noteworthy data releases include U.S. Existing Home Sales, Building Permits (preliminary), Housing Starts, Initial Jobless Claims, the Philadelphia Fed Manufacturing Index, and the Conference Board’s Leading Economic Index. Retailers Walmart (WMT), Home Depot (HD), TJX (TJX), Lowe’s (LOW), Target (TGT), and Ross Stores (ROST), along with notable tech players such as Intuit (INTU), Analog Devices (ADI), Workday (WDAY), and Keysight Technologies (KEYS), are among the prominent companies set to release their quarterly results this week. In addition, market participants will pay close attention to the publication of the Fed’s minutes from the July 29-30 meeting on Wednesday, which will provide insight into the Fed’s stance on interest rates and the economy and could shed more light on the decision by Fed Governors Waller and Bowman to support a rate cut. The U.S. economic data slate is largely empty on Monday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.294%, down -0.76%. Let's take a look at the expected moves for the week: It's hard to imagine I.V. getting any lower than it is. These are levels we rarely see and hope we don't see for very long. It puts us in a difficult spot for day trading. The premium received on a credit trade is just horrible and created very poor risk/reward. Debits however are relatively cheap BUT...you need movement to make them work and we aren't getting that. I'll stick with debit focus for now because I have to if I want to keep a decent risk/reward but man...we need some movement. The Nasdaq is now worth 145% of ALL the money in America (M2). That’s the highest level in history. Each one was followed by a major market swing. Forward earnings: SPY vs Air Freight & Logistics. Air Freight, much like rail car, gives us a pretty good idea of how the economy is really going. Again...I know all my thoughts lately are dour. I'm not a perm bear. I try to be a critical thinker but all I'm seeing are warning signs. Todays trade docket is solely focused on the SPX. We need to get one to the finish line profitably and then we can expand our vision. Gold 0DTE has been great for us but the premium was not there for today. Maybe tomorrow. I'll likely pull the cover on our LULU shares. As we get closer to earnings I want to be uncovered. Let's take a look at the intra-day levels on /ES: Lot's of levels to watch today. 6475, 6480, 6488 are all resistance with the big level being 6500. 6456, 6450, 6440, 6435 are support with the big level of support sitting at 6425. My lean or bias today is neutral. Until we get some catalyst that pushes us directionally there is just too low of volume and too little action to make a directional bias with confidence. I look forward to seeing you all in the live trading room shortly! We missed our training session on Thurs. We'll make sure and get it in today.

|

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |