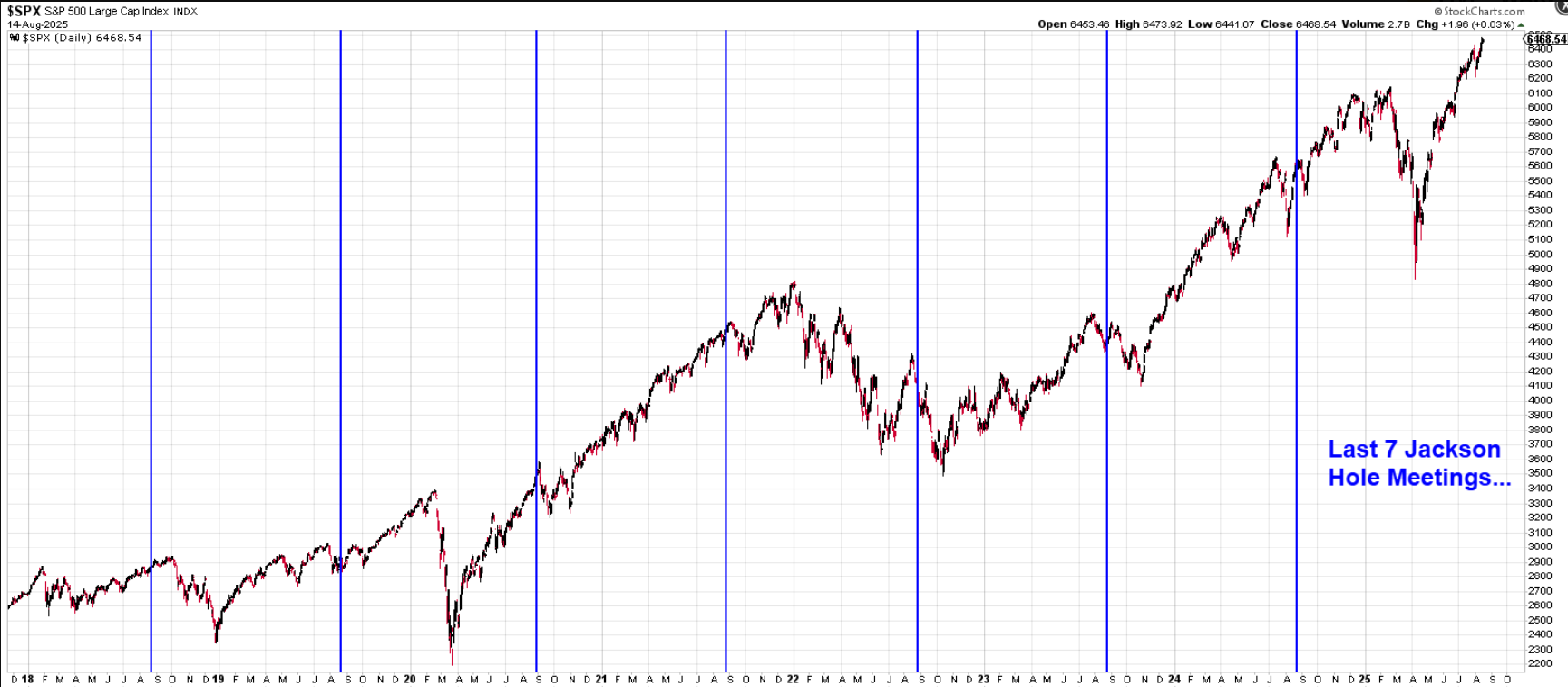

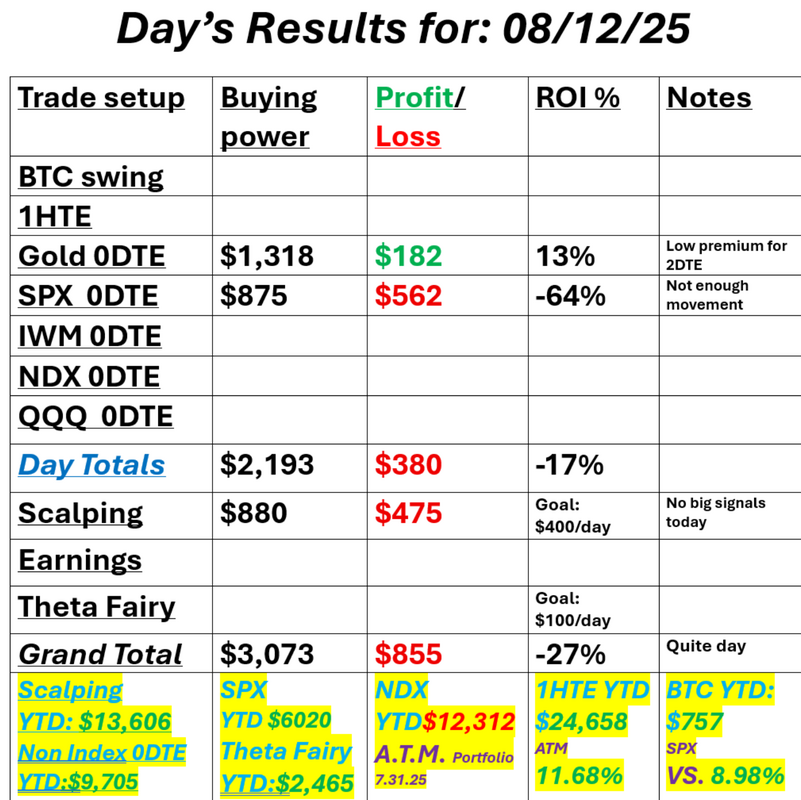

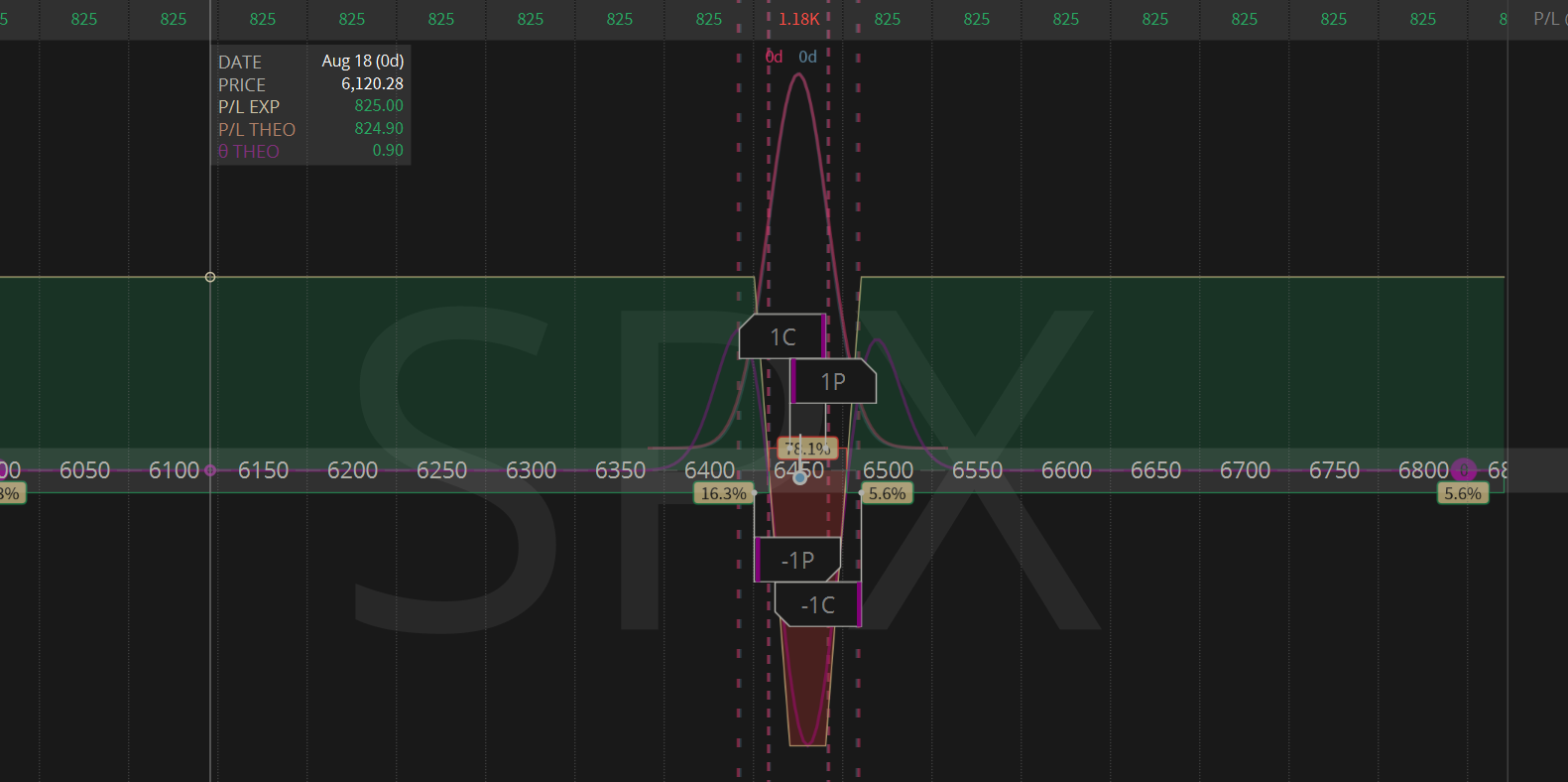

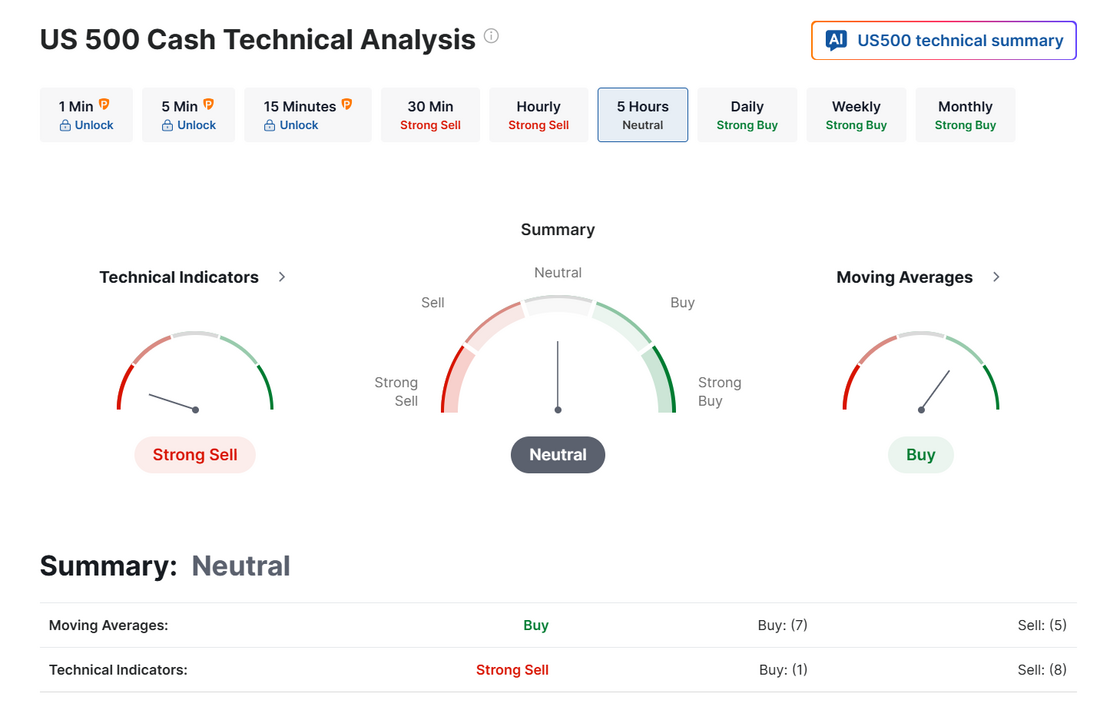

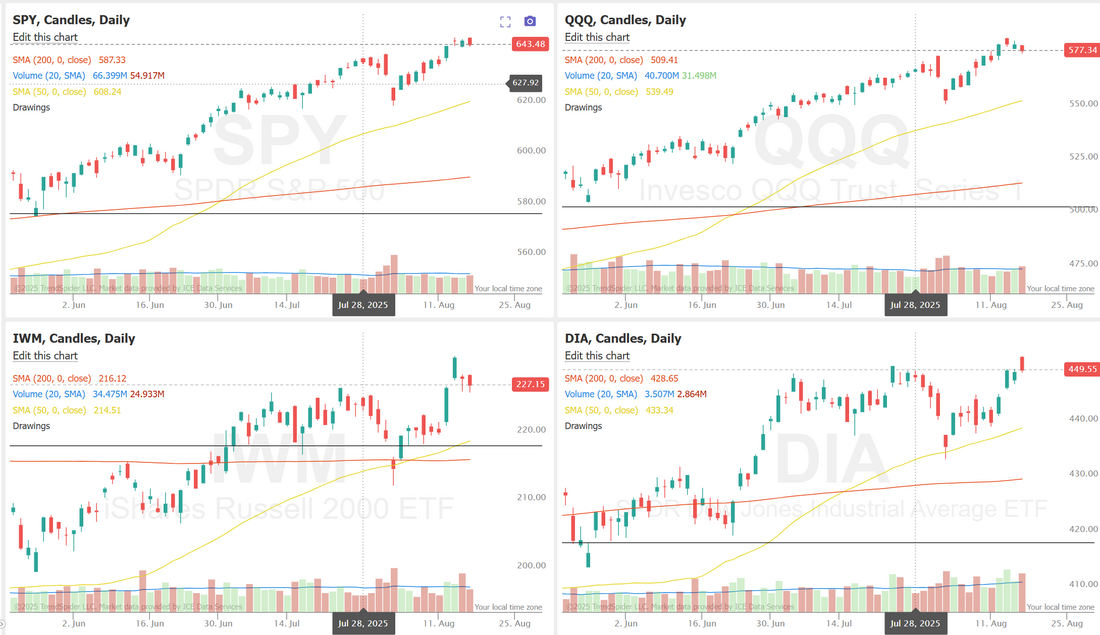

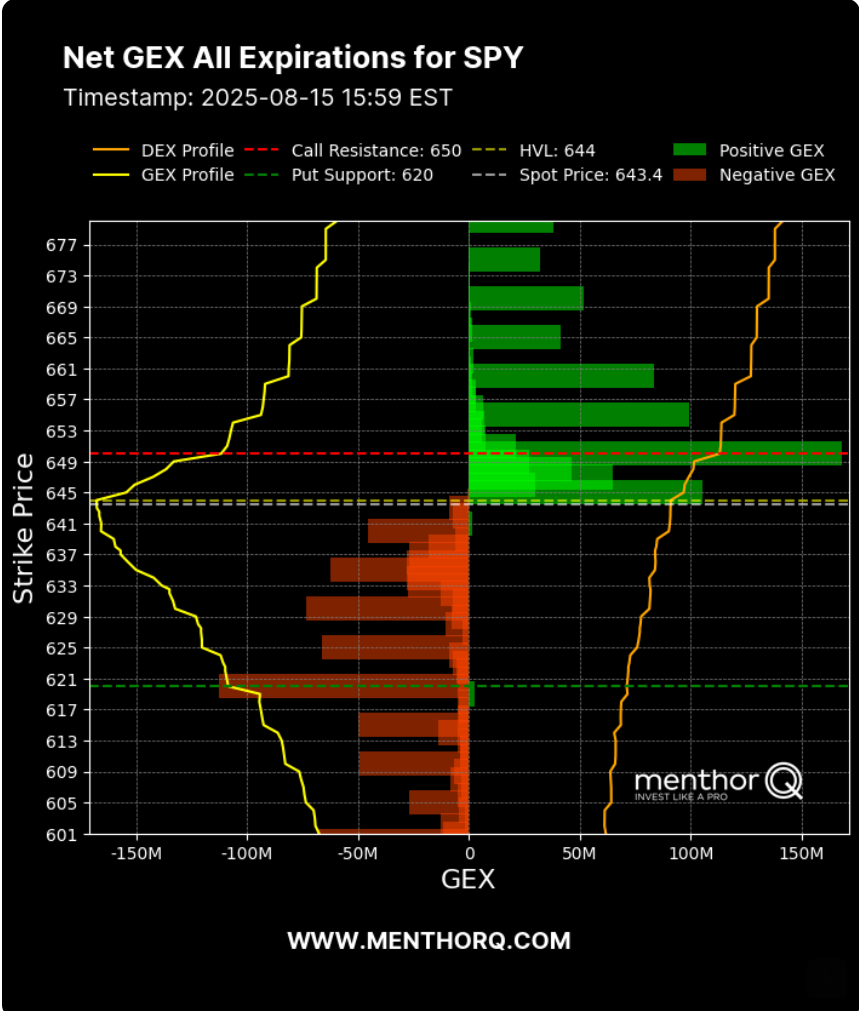

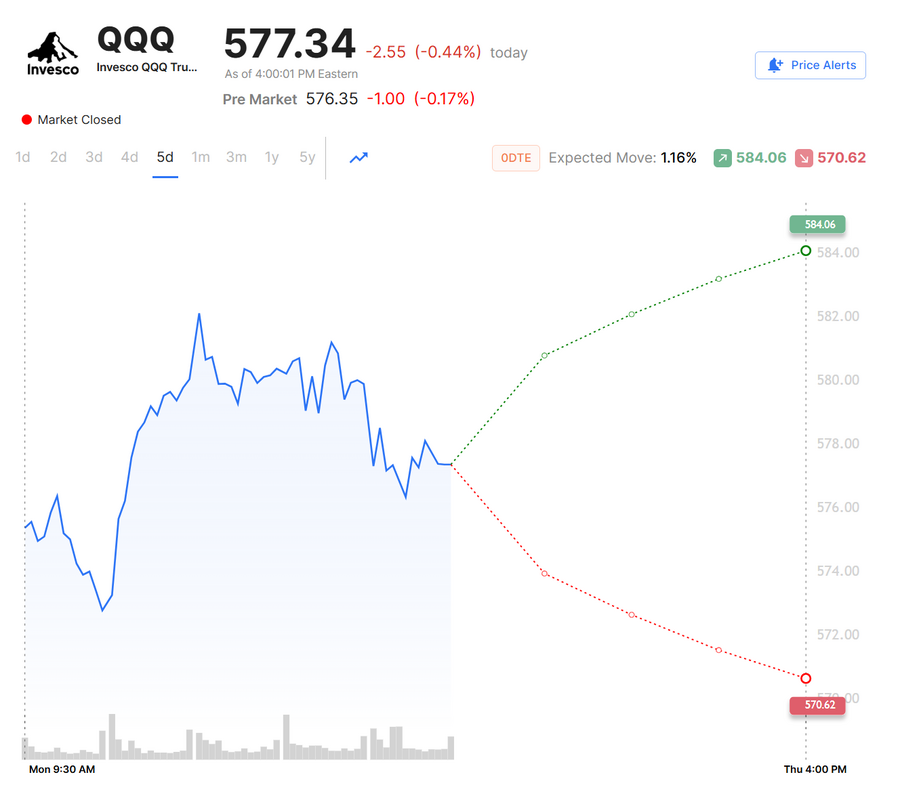

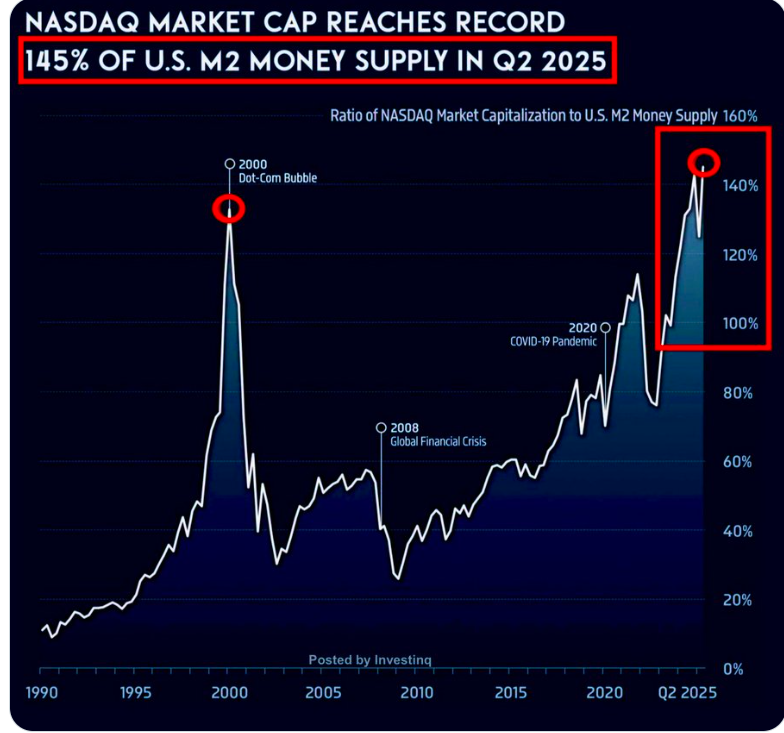

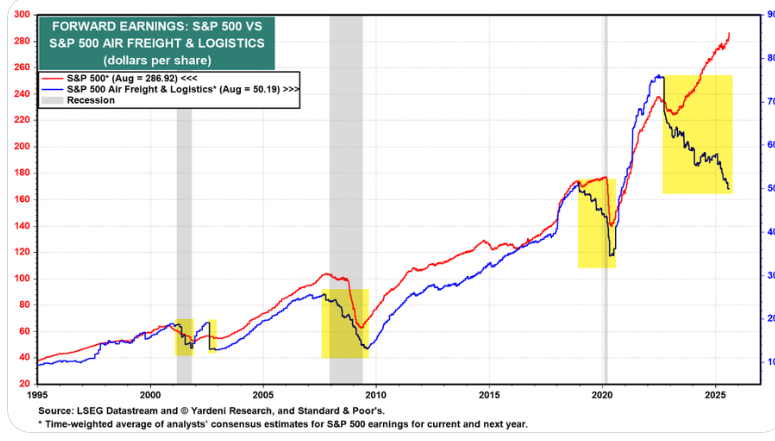

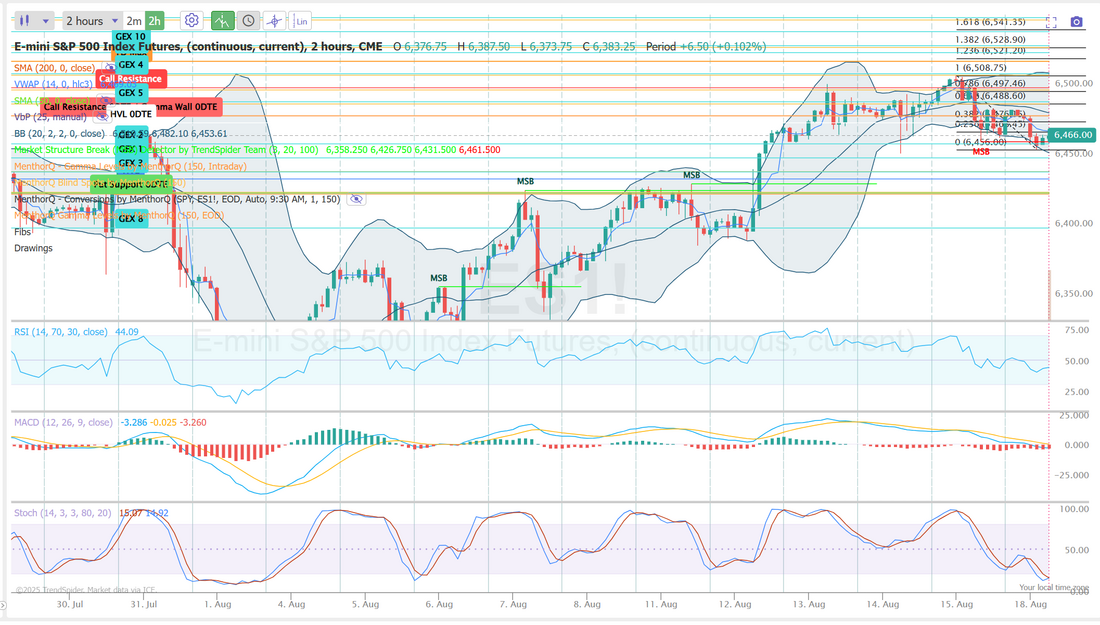

Powells weekWe've got FOMC minutes release on Weds. and Powell Speaking at the Jackson Hole summit at the end of the week. How will the market react? It's just speculation at this point but past Jackson Hole meeting paint an interesting picture. I think, after three pretty solid weeks this may be a down week for us. I wasn't able to generate anything worthwhile on Friday. There just wasn't enough movement. We continue to look for movement. This consolidation phase will eventually come to an end. We already have the basis for our SPX 0DTE working for today. See below: We've got about $1,100 BP with $800 max profit potential. If we can get movement today, this may be all we need. Otherwise, we'll need to trade around it. Let's take a look at the markets: After a lot of bullish technicals we start today at a neutral rating. Possibly time for a reversal? Markets look a little tired here. Is this just a pause or the start of the retace we are all looking for? The SPX chart highlights a steady climb toward recent highs, with the option score showing a recovery from early-August lows after briefly touching zero. Short-term momentum remains constructive, but the recent dip in the option score from 4 to 3 suggests traders are moderating their positioning after the latest push higher. Price action is consolidating just below the 6,450 level, with buyers showing resilience after pullbacks. In the near term, keeping an eye on whether the option score stabilizes or weakens further could provide signals on the strength of participation behind this rally. The SPY gamma exposure (GEX) chart highlights key zones where option flows may influence near-term price dynamics. The spot price sits at 643.4, positioned close to the hedging volatility line (HVL) at 644, suggesting that market makers’ hedging flows could help stabilize movement in this area. On the downside, there is notable put support near 620, while the 650 strike shows strong call resistance, marking it as a key overhead barrier. The concentration of positive GEX above current levels may help dampen volatility as SPY trades higher, while the cluster of negative GEX below 630 could amplify moves lower if breached. In the short term, this setup points to a market trading within a defined range, with 644 acting as a pivotal level to watch for shifts in momentum September S&P 500 E-Mini futures (ESU25) are down -0.13%, and September Nasdaq 100 E-Mini futures (NQU25) are down -0.15% this morning, starting the week on a cautious note as investors await U.S. President Donald Trump’s talks with Ukrainian President Volodymyr Zelenskyy. Trump will host Zelenskyy and several European leaders to outline terms for a potential peace agreement he discussed with Russian President Vladimir Putin at last Friday’s meeting in Alaska. After arriving in Washington, the Ukrainian president said that Russia must bring this war to an end. Meanwhile, on Sunday night, Trump wrote on social media that the responsibility lies with Zelenskyy to make concessions, declaring there is “no getting back” Crimea and “NO GOING INTO NATO BY UKRAINE.” Bloomberg reported that while the U.S. is expected to focus on territorial concessions demanded by Russia, Kyiv will aim to secure possible security guarantees. Investor focus this week is also on Federal Reserve Chair Jerome Powell’s most important policy speech of the year at Jackson Hole, the minutes of the Fed’s latest policy meeting, and earnings reports from retail heavyweights. In Friday’s trading session, Wall Street’s major equity averages closed mixed. Applied Materials (AMAT) plunged over -14% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the largest chip-equipment maker in the world provided downbeat FQ4 guidance. Also, SanDisk (SNDK) slid more than -4% after the company issued below-consensus FQ1 adjusted EPS guidance. In addition, Target (TGT) fell over -1% after BofA downgraded the stock to Underperform from Neutral with a price target of $93. On the bullish side, UnitedHealth Group (UNH) jumped about +12% and was the top percentage gainer on the S&P 500 and Dow after Warren Buffett’s Berkshire Hathaway disclosed in a regulatory filing that it purchased about 5 million shares of the health insurer last quarter. Economic data released on Friday showed that U.S. retail sales grew +0.5% m/m in July, slightly weaker than expectations of +0.6% m/m, while core retail sales, which exclude motor vehicles and parts, rose +0.3% m/m, in line with expectations. Also, U.S. July industrial production fell -0.1% m/m, weaker than expectations of no change m/m, while manufacturing production was unchanged m/m, stronger than expectations of -0.1% m/m. At the same time, the University of Michigan’s preliminary U.S. consumer sentiment index unexpectedly fell to 58.6 in August, weaker than expectations of 61.9. In addition, the U.S. import price index climbed +0.4% m/m in July, stronger than expectations of +0.1% m/m. “Consumers are no longer bracing for the worst-case scenario for the economy feared in April. However, consumers continue to expect both inflation and unemployment to deteriorate in the future,” said Peter Boockvar, author of The Boock Report. Chicago Fed President Austan Goolsbee said on Friday he wants to see at least one more inflation report to confirm that persistent price pressures aren’t picking up. “It’s been a little mixed,” Goolsbee said in an interview on CNBC, referring to recent inflation data. “I feel like we still need another one, at least, to figure out if we’re if we’re still on the golden path.” Meanwhile, U.S. rate futures have priced in an 84.8% chance of a 25 basis point rate cut and a 15.2% chance of no rate change at the conclusion of the Fed’s September meeting. Investor attention this week will be focused on the Kansas City Fed’s annual Economic Policy Symposium, which begins Thursday evening in Jackson Hole, Wyoming. Chair Jerome Powell, in remarks on Friday, is expected to outline the central bank’s new policy framework. Mr. Powell may also provide a fresh update on how much support exists for a September rate cut, at a time when the Trump administration is intensifying pressure to begin easing. Powell’s comments “are likely to be decisive in answering the question of how firmly the monetary authorities are actually heading for an interest rate cut in September,” according to strategists at LBBW. Earlier in the week, Fed Governors Michelle Bowman and Christopher Waller, as well as Atlanta Fed President Raphael Bostic, will be making appearances. Market watchers will also closely monitor preliminary purchasing managers’ surveys on U.S. manufacturing and services sector activity for August. They will give an up-to-date snapshot of how tariffs have impacted both activity and prices. Other noteworthy data releases include U.S. Existing Home Sales, Building Permits (preliminary), Housing Starts, Initial Jobless Claims, the Philadelphia Fed Manufacturing Index, and the Conference Board’s Leading Economic Index. Retailers Walmart (WMT), Home Depot (HD), TJX (TJX), Lowe’s (LOW), Target (TGT), and Ross Stores (ROST), along with notable tech players such as Intuit (INTU), Analog Devices (ADI), Workday (WDAY), and Keysight Technologies (KEYS), are among the prominent companies set to release their quarterly results this week. In addition, market participants will pay close attention to the publication of the Fed’s minutes from the July 29-30 meeting on Wednesday, which will provide insight into the Fed’s stance on interest rates and the economy and could shed more light on the decision by Fed Governors Waller and Bowman to support a rate cut. The U.S. economic data slate is largely empty on Monday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.294%, down -0.76%. Let's take a look at the expected moves for the week: It's hard to imagine I.V. getting any lower than it is. These are levels we rarely see and hope we don't see for very long. It puts us in a difficult spot for day trading. The premium received on a credit trade is just horrible and created very poor risk/reward. Debits however are relatively cheap BUT...you need movement to make them work and we aren't getting that. I'll stick with debit focus for now because I have to if I want to keep a decent risk/reward but man...we need some movement. The Nasdaq is now worth 145% of ALL the money in America (M2). That’s the highest level in history. Each one was followed by a major market swing. Forward earnings: SPY vs Air Freight & Logistics. Air Freight, much like rail car, gives us a pretty good idea of how the economy is really going. Again...I know all my thoughts lately are dour. I'm not a perm bear. I try to be a critical thinker but all I'm seeing are warning signs. Todays trade docket is solely focused on the SPX. We need to get one to the finish line profitably and then we can expand our vision. Gold 0DTE has been great for us but the premium was not there for today. Maybe tomorrow. I'll likely pull the cover on our LULU shares. As we get closer to earnings I want to be uncovered. Let's take a look at the intra-day levels on /ES: Lot's of levels to watch today. 6475, 6480, 6488 are all resistance with the big level being 6500. 6456, 6450, 6440, 6435 are support with the big level of support sitting at 6425. My lean or bias today is neutral. Until we get some catalyst that pushes us directionally there is just too low of volume and too little action to make a directional bias with confidence. I look forward to seeing you all in the live trading room shortly! We missed our training session on Thurs. We'll make sure and get it in today.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |