|

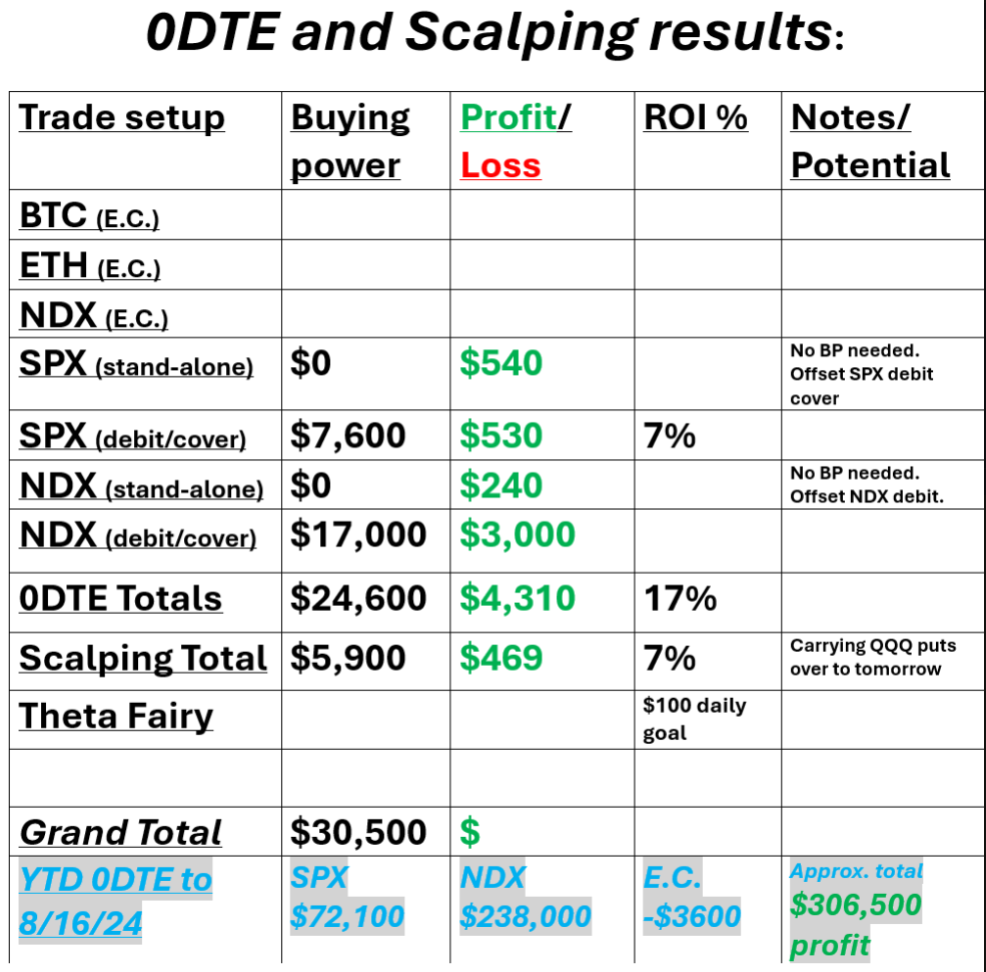

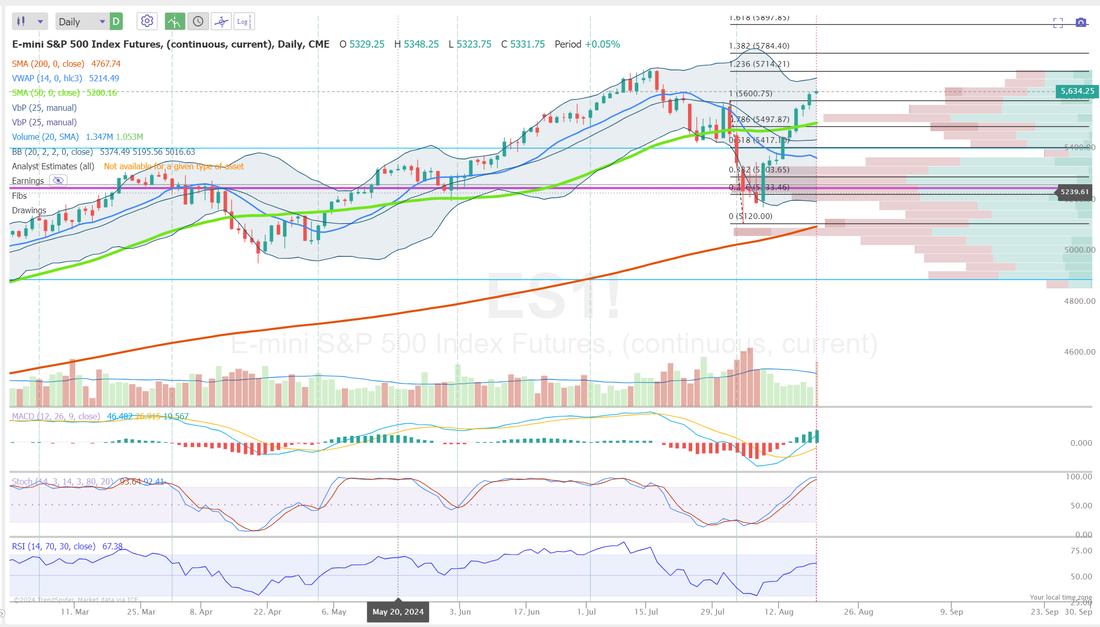

Welcome back to Friday! You're gateway to the weekend! I had a bad day at the office yesterday. We know the statistics....start pulling your profits as you get to 70% capture rates. We've become a bit of a victim of our own success as of late. Everythings been working so well that we get lulled into a sense of calm. The move up yesterday morning was something we planned and traded well. The retrace in the afternoon was not! Here's my results from yesterday. That's roughly about 4 days of profit down the drain. We rolled the biggest part of the NDX and that looks like its in a good position to recover $12,000 of yesterdays drawdown. Here's the roll. It's a 6DTE so I'll need to bring in 4K a day in profits on the call side IF the roll doesn't hit. I'll need to bring in $1,600 a day if it does. Clearly better if the roll works. We did have some bright spots yesterday and a fun one was the NVDA earnings trades we did. We put on a Bullish, Bearish and Neutral trade setup, pre-earnings and booked profit on two of the three yesterday and it sure looks like we'll be booking profits on the third this morning. That's whats amazing about options. You can build a trade so that whether you're bullish or bearish you can BOTH make money! Let's take a look at the markets: Bullish bias and I buy it. Things look supportive here after the NVDA induced slide. September S&P 500 E-Mini futures (ESU24) are trending up +0.45% this morning as the prospect of lower interest rates and a slew of upbeat earnings reports boosted sentiment, while investors geared up for the release of the Fed’s first-line inflation gauge. In yesterday’s trading session, Wall Street’s major indexes closed mixed, with the blue-chip Dow posting a new record high. Best Buy (BBY) surged over +14% and was the top percentage gainer on the S&P 500 after the consumer electronics retailer posted upbeat Q2 results and lifted its full-year adjusted EPS guidance. Also, Crowdstrike Holdings (CRWD) gained nearly +3% after the cybersecurity company reported better-than-expected Q2 revenue. In addition, Affirm Holdings (AFRM) soared over +31% after reporting stronger-than-expected Q4 results and providing above-consensus Q1 revenue guidance. On the bearish side, Dollar General (DG) plummeted more than -32% and was the top percentage loser on the S&P 500 after the discount retailer posted downbeat Q2 results and cut its FY24 same-store sales growth guidance. Also, Nvidia (NVDA) slumped more than -6% after the chipmaker’s Q3 revenue forecast fell short of the highest expectations. The U.S. Department of Commerce’s second estimate of Q2 GDP growth was revised higher to +3.0% (q/q annualized) from the initial estimate of +2.8% due to an upward revision of consumer spending. Also, the Q2 core PCE price index was revised lower to +2.80% (q/q annualized) from +2.90%. In addition, U.S. pending home sales unexpectedly fell -5.5% m/m in July, weaker than expectations of +0.2% m/m. Finally, the number of Americans filing for initial jobless claims in the past week fell -2K to 231K, compared with 232K expected. “The message of [Thursday’s] data is ‘steady as she goes’,” said Chris Larkin at E*Trade from Morgan Stanley. “Weekly jobless claims were slightly lower than last week and GDP was revised slightly higher. The economy doesn’t appear to be falling off a cliff, and in the current market, good news is good. There was nothing here to make the Fed rethink its plan to cut rates next month.” Meanwhile, U.S. rate futures have priced in a 67.5% chance of a 25 basis point rate cut and a 32.5% chance of a 50 basis point rate cut at the next central bank meeting in September. Today, all eyes are focused on the U.S. core personal consumption expenditures price index, the Fed’s preferred price gauge, set to be released in a couple of hours. Economists, on average, forecast that the core PCE price index will stand at +0.2% m/m and +2.7% y/y in July, compared to the previous figures of +0.2% m/m and +2.6% y/y. Also, investors will focus on the U.S. Chicago PMI, which arrived at 45.3 in July. Economists foresee the August figure to be 45.0. U.S. Personal Spending and Personal Income data will be closely monitored today. Economists forecast July Personal Spending to be at +0.5% m/m and July Personal Income to come in at +0.2% m/m, compared to the June numbers of +0.3% m/m and +0.2% m/m, respectively. The U.S. Michigan Consumer Sentiment Index will be reported today as well. Economists estimate this figure to arrive at 67.8 in August, compared to 66.4 in July. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.853%, down -0.24%. My bias for today is bullish. The market absorbed the NVDA results well. Onward and upward. Trade docket for today: /MCL, CRWD, DELL, DIA, FSLR?, IWM, LULU, NVDA, PYPL, QQQ, SMCI, Just a stand alone SPX and NDX 0DTE today. We booked profits on our debit portion yesterday. We'll re-start those Monday. Let's take a look at some intra-day levels: /ES: Coming into this session nicely balanced right at PoC. 5649 is first resistance then 5660. 5623 is first support then 5613. /NQ; It continues to be weaker than the SP500. First resistance is at PoC at 19605 with 19696 next. 19557 is first support with 19476 next. Let's have a strong finish to the week folks! Have a good weekend.

0 Comments

Welcome back traders! Well..I should be calling myself Nostradamus. I laid out my whole plan for yesterday. I said it would be bearish. I said it would get worse as the day went on and, I laid out, what I thought was a very sound rationale around NVDA beating estimates and yet it goes down. I then built three trades around NVDA (bullish, bearish and neutral) and while it's too early to tell, it looks like all three have a shot at profits! I should be proud of the work and research I put in yesterday, and I would, except I had a hard time following my own convictions! We had a short /MNQ and long QQQ puts in our scalping room going into the open. I had said that I wanted to let the QQQ's run and I wasn't going to cover the /MNQ. I didn't do either! Both cost me. We also got so much premium today on our 0DTE's that we had no need to ever try to sell the put side. I thought I was patient. Even though I waited until we were down 100 points on NDX, it was still too early and not really needed. Look, we had a wonderful day. Most traders would love to get these types of daily profits but...we've got to learn. What did I learn yesterday? #1. Sitting on your hands is a skill. Be patient. #2. If you have a plan and have conviction in your plan then FOLLOW YOUR PLAN! Let's take a look at our day yesterday: Let's take a look at the market. This is so typical (and predictable) on events like the NVDA earnings. It's a large cap which moves markets. We get the futures selling off after the report and then is slowly digests it and bounces back. We bought a long call on /MNQ last night looking for the rebound and just cashed it in. Once again, we find ourselves just stuck in a massive consolidation zone. We don't really have a sentiment bias here with the fear and greed index. Market internals still look pretty darn healthy September S&P 500 E-Mini futures (ESU24) are up +0.27%, and September Nasdaq 100 E-Mini futures (NQU24) are up +0.22% this morning as market participants shrugged off Nvidia’s underwhelming sales forecast and looked ahead to a raft of U.S. economic data. Nvidia (NVDA) fell over -2% in pre-market trading as an underwhelming Q3 sales forecast as well as issues in the production of its highly anticipated Blackwell chips overshadowed strong Q2 results and a $50 billion share buyback program. In yesterday’s trading session, Wall Street’s major indices ended lower. Super Micro Computer (SMCI) plummeted over -19% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the AI server maker said it would delay filing its annual financial disclosures. Also, chip stocks slumped, with Arm (ARM) falling more than -4% and Micron Technology (MU) sliding over -3%. In addition, Foot Locker (FL) plunged more than -10% after lowering its FY24 gross margin forecast. On the bullish side, Chewy (CHWY) surged over +11% after the online retailer of pet products reported stronger-than-expected Q2 adjusted EPS and lifted its full-year adjusted EBITDA margin guidance. Also, Box (BOX) climbed more than +10% after the company posted upbeat Q2 results and boosted its FY25 guidance. Atlanta Fed President Raphael Bostic stated Wednesday that it “may be time” to lower rates, but he is still waiting for more data to justify cutting interest rates next month. “I don’t want us to be in a situation where we cut and then we have to raise rates again. So, if I’m going to err on one side, it’s going to be waiting longer just to make sure that we don’t have that up and down,” Bostic said. Meanwhile, U.S. rate futures have priced in a 63.5% chance of a 25 basis point rate cut and a 36.5% probability of a 50 basis point rate cut at the September FOMC meeting. On the earnings front, notable companies like Dell Technologies (DELL), Marvell Technology (MRVL), Autodesk (ADSK), Lululemon Athletica (LULU), Dollar General (DG), Best Buy (BBY), Ulta Beauty (ULTA), and Gap (GAP) are slated to release their quarterly results today. On the economic data front, all eyes are on the Commerce Department’s second estimate of gross domestic product, due later in the day. Economists, on average, forecast that U.S. GDP will stand at +2.8% q/q in the second quarter, compared to the first-quarter figure of +1.4% q/q. Also, investors will focus on U.S. Pending Home Sales data, which came in at +4.8% m/m in June. Economists foresee the July figure to be +0.2% m/m. U.S. Initial Jobless Claims data will be reported today. Economists predict this figure will hold steady at 232K, consistent with last week’s number. U.S. Wholesale Inventories preliminary data will come in today as well. Economists expect July’s figure to be +0.3% m/m, compared to +0.2% m/m in June. In addition, market participants will be anticipating a speech from Atlanta Fed President Raphael Bostic. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.824%, down -0.49%. Trade docket today: PDD, CRWD, NVDA, PYPL, QQQ, SMCI, SMH, /ZN, GLD, /MCL, LULU, DELL, 0DTE's. Quick note: all three of our NVDA trades from yesterday look to cash flow today! My bias today is neutral to bullish. I think we absorb the NVDA move and flatten out then move higher. Let's take a look at the intra-day 0DTE levels that I'm looking at. /ES; Two key levels for me today. 5638 is the resistance for bulls. It's also the PoC on 2hr. chart. 5595 is a decent support level from yesterday. /NQ; Nasdaq is still a little more beaten up than SP500. Two key levels for me today. 19578 to the upside. That's close to the 50 period M.A. 19271 to the downside. That's the 200 period M.A. Let's make it happen today folks. We've got a lot of good setups to add to today that we initiated yesterday.

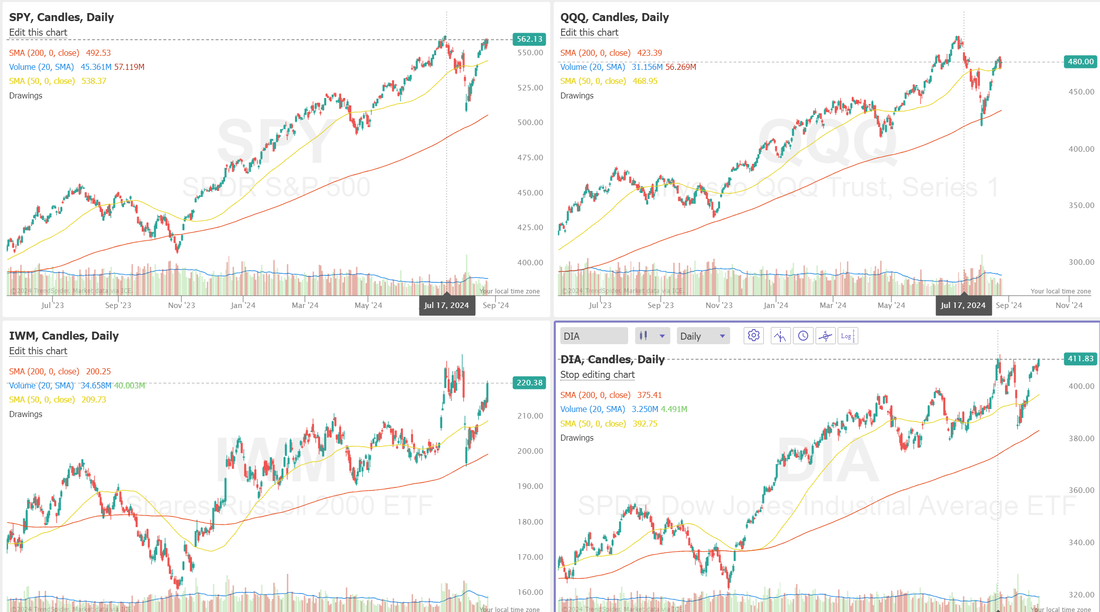

Good morning traders! Welcome to NVDA earnings day. More on that in a bit. We had a really productive day yesterday. Check out my results below: Let's take a quick look at the markets then talk about NVDA. The DOW hit another ATH while the other indices languished. Everyones waiting for that NVDA shoe to drop. It will be interesting to see what the price action will be today. I'm looking for a down day. Technicals are still holding in there. Stretched to the upside, to be sure but still bullish. Let's talk NVDA. It's the biggest earnings announcement of the week. It should announce another blowout quarter however, expectations are sky high. The stock is already up 160% YTD. The key numbers to watch are revenue and forward guidance. NVDA is projecting a $28 billion revenue number. They have beat expectations by $2 billion each of the last four quarters. To me this means they need to hit at least $30 billion in revenue or the market will be dissapointed. Expectations for Q3 will be important as well. Since Q2 of last year NVDA's earnings surprise has continually dropped from 31% to 9.8% is Q1 of this year. I believe the chance for a pullback is great here. Expectations are really setting a high bar. Additionally its strange to me that the "smart money" seems to be walking away from the trade all together. After Monday's close NVDA traded 2.22 million option contracts against 26.28 million open contracts. This figure represents a 50% decline from the trailing one month average. Call volume was 1.39 million contracts with put volume 829,000 contracts. NVDA’s earnings release on Wednesday has the potential to impact the major indices. 22% of the Semiconductor ETF (SMH) weight is in NVDA. It also makes up 7% of the S&P 500 (SPY) and 8% of the Nasdaq (QQQ). Last earnings, NVDA’s price moved 9% after its release, and the earnings before that was 16%. High volatility is expected. We are going to build two and maybe three "NVDA" trades today. One will be on NVDA with a bearish slant. Another will be on NVDA looking to take advantage of a big "nothing burger" potential outcome. A 16% move is a lot. What if it doesn't move, or moves way less? We'll have a trade for that. Additionally I've got a setup on the SMH that I think is the best way to play the NVDA earnings from a strict, risk/reward view. Another interesting ticker to keep an eye on is SMCI. We've traded this a bunch. Hindenburg research just put out a scathing report on them. https://hindenburgresearch.com/smci/ Our trade docket for today; /MNQ, QQQ scalping, SMCI? AFRM, CRWD, CRM, NVDA, DDD?, /MCL, CHWY, DJT, ETH, FSLR, IWM, QQQ, SMH, /ZC, 0DTE's. Again, my lean is bearish today. I don't see the buyers for NVDA like we've seen in the past four quarters. Let's take a look at the Intra-day levels for our 0DTEs today: /ES; We scored a nice little profit on a butterfly yesterday, placing it right on the PoC. There's no real reason to expect much today. Chop zone is 5669-5618. Anything in this zone is not meaningful to me. /NQ; Same goes for the Nasdaq. Chop zone is a little tighter at 19693-19573 Let's have a great day folks. We'll have trades on today that cover a bullish, neutral or bearish move in NVDA so no matter what the move is tomorrow morning...we'll have something to talk about!

Welcome back traders! We had a really nice start to the week. Our net liq on our model portfolio was up over 3K on the day and, most importantly we have hit a new All Time High, YTD result for our 0DTE's. We are very close to $330,000 of documented profits on less than $50,000 of capital deployed each day. This is by and far our best year ever with the 0DTES and I believe it is directly attributable to the fact that we have seven opportunites each day with unique setups that others simply aren't using. We realized the loss on our last NDX debit spread yesterday but that's really just an accounting issue. That trade generated over $47,000 in cash flow for us over the last month. I've always thought trading was the best career in the world. I like the idea that money can make the money, not our physical efforts. I also love the satisfaction, when it goes well, that sure, all you did was push some buttons but you pushed the right ones! Our next goal is to get to $400,000 in profits. These setups are changing lives, if you can learn them and deploy them responsibly. Here's a look at our results from yesterday. Let's take a look at the markets. The bullish bias hasn't diminished but we see to be getting a little tired here. The DIA hit a new ATH yesterday with most of the other indices down slightly. Where do we go from here? Well, it seems everyone is setting up for the most anticipated earnings result of the year. NVDA reports tomorrow, after the close. We'll be trading it, as I assume everyone will. For me that means another day of neutral bias for me. We could rise of fall a bit but that big action is priming for after the close on Weds. and Thurs. cash markets. September S&P 500 E-Mini futures (ESU24) are down -0.04%, and September Nasdaq 100 E-Mini futures (NQU24) are up +0.05% this morning as investors awaited a fresh batch of U.S. economic data and braced for Nvidia’s financial report due on Wednesday. In yesterday’s trading session, Wall Street’s major indexes ended mixed, with the blue-chip Dow posting a new record high and the tech-heavy Nasdaq 100 dropping to a 1-week low. PDD Holdings (PDD) plummeted over -28% and was the top percentage loser on the Nasdaq 100 after the Temu-owner reported weaker-than-expected Q2 revenue. Also, chip stocks slumped, with Arm (ARM) sliding nearly -5% and Marvell Technology (MRVL) dropping more than -4%. In addition, Tesla (TSLA) fell over -3% after Canada announced it would levy a new 100% tariff on Chinese-made electric vehicles, which includes Teslas manufactured in China. On the bullish side, energy stocks gained ground as the price of WTI crude climbed over +3% to a 1-week high, with Marathon Oil (MRO) and ConocoPhillips (COP) rising more than +1%. Also, BJ’s Wholesale (BJ) advanced over +1% after JPMorgan upgraded the stock to Neutral from Underweight. The U.S. Census Department said on Monday that U.S. durable goods orders surged +9.9% m/m in July, topping the +4.0% m/m consensus and rebounding from a -6.9% m/m slump in June (revised from -6.6% m/m). At the same time, U.S. July core durable goods orders unexpectedly fell -0.2% m/m, weaker than expectations of 0.0% m/m. Richmond Fed President Thomas Barkin said on Monday that he still sees upside risks for inflation, though he supports “dialing down” interest rates amid a cooling labor market. Also, San Francisco Fed President Mary Daly stated that she believes it’s appropriate for the Fed to begin reducing interest rates and indicated that a larger rate cut remains on the table if the labor market weakens further. “Hard to imagine anything that could derail the September rate cut,” Daly said. U.S. rate futures have priced in a 71.5% chance of a 25 basis point rate cut and a 28.5% chance of a 50 basis point rate cut at the next FOMC meeting in September. Meanwhile, investors are awaiting an earnings report from AI-darling Nvidia (NVDA) on Wednesday. Expectations heading into the chipmaker’s quarterly results are high, with analysts forecasting another strong consensus beat that could lead to an upward revision in the company’s profit guidance. The July reading of the U.S. core personal consumption expenditures price index, the Fed’s first-line inflation gauge, set to be released on Friday, will also be on investors’ radar. Today, all eyes are focused on the U.S. Conference Board’s Consumer Confidence Index, set to be released in a couple of hours. Economists, on average, forecast that the August CB Consumer Confidence index will stand at 100.9, compared to last month’s figure of 100.3. Also, investors will focus on the U.S. S&P/CS HPI Composite - 20 n.s.a., which arrived at +6.8% y/y in May. Economists foresee the June figure to be +6.2% y/y. The U.S. Richmond Manufacturing Index will be reported today as well. Economists estimate this figure to come in at -14 in August, compared to the previous value of -17. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.834%, up +0.45%. Our trade docket for today: CHWY, /MNQ,QQQ scalps, /NG, /ZC, FSLR, NEM, 0DTE's. I'm holding some cash in prep for NVDA Weds./Thurs. setup. Let's take a look at the intra-day levels that are important to me today: /ES; We've been stuck on the PoC (purple line) since the 19th! We push up. We drop down but we seem glued to it. I'm sure NVDA earnings will shake things loose later this week but for today? I'm going to be throwing a couple butterflies on with our 0DTE's today. Between 5658-5619 is just meaningless chop. Above 5658 we could get bullish. Below 5619 we could get bearish. /NQ; The Nasdaq, while weaker than the SP500, is doing the same thing as well. Stuck around it's PoC going all the way back to Aug. 15th. There seems to be a tad more weakness in the Nasdaq. Ranges are tight today. Above 19637 could lead to bullish action. Below 19505 and there could be significant downside. Let's go have another great day! We've got a new NDX debit working now to replace our expired one. It's another juicy one! $5,736 debit could produce $24,264 profit IF it hits. We haven't had much success with our debit setups hitting their profit zones but they sure have paid off on the cash flow side.

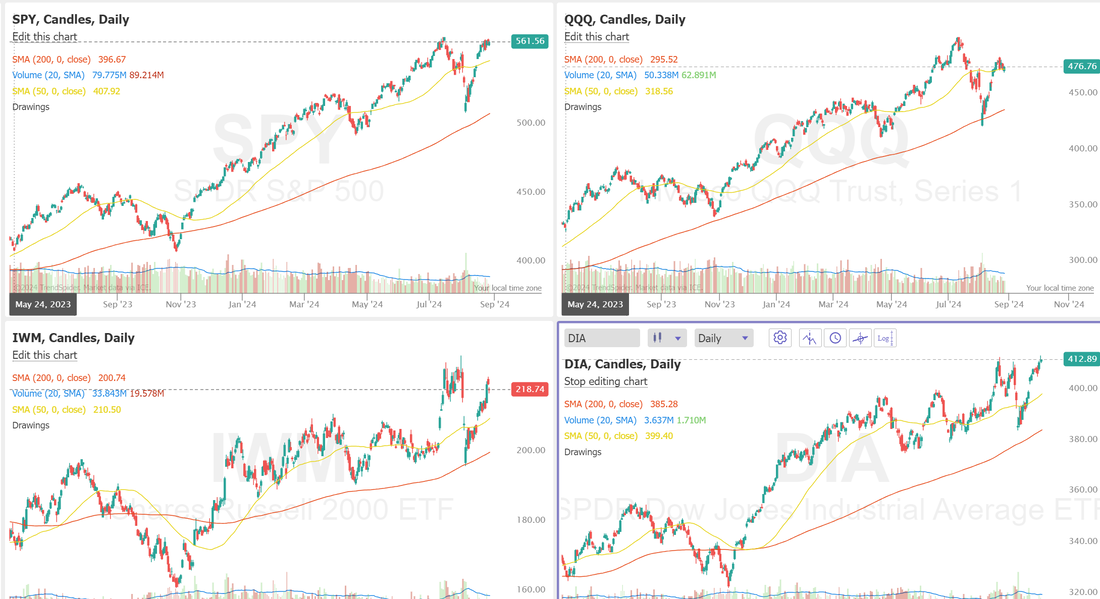

Welcome back to a new week of trading folks! We got a confirmation from Powell last week that curs are coming. Now the question is, how big? Our Friday was epic. Thursday was tough. I booked losses on two NDX put legs and we rolled a lot of other positions. My net liq was down 20K Thurs. Friday was the payday for a lot of the seeds we planted Thurs. My net liq bounced back 27K and we booked some amazing profits on most of our rolls. We are pushing $320,000 of 0DTE profits. I have now idea if there is another 0DTE program showing these type of results but regardless...I'm super proud of our results. Scalping was a huge help. We've locked in most of the work we did on Thurs but still have almost $1,000 of ext. sitting in our /MNQ scalp that expires today. We have the chance to book over $6,200 of profits from those trades we set up Thurs. Sometimes your days are just about setting up for future potential. Thurs of last week wasn't fun but it paid off for us in the end. If you'r not scalping you're leaving a very valuable tool out of your tool box. Let's take a look at the markets: Over the past few weeks, the SPY has mounted one of the most impressive V-shaped recoveries in recent memory. The index closed just 1/2 a percent below the all-time high at $562.13 (+1.41%), filling the gap from July 17th and consolidating just above the 8-period EMA. Much like the SPY, the QQQ filled a key gap from July 24th and closed the week at $480.03 (+1.05%). The price is currently finding support at the 8-period EMA, and bulls are likely eyeing the July 17th gap as the next target higher. Perhaps NVDA earnings on Wednesday will be the catalyst for that move. The IWM did a bit of catching up this week, getting the bullish 8/21 EMA and MACD crosses that its peers got last week and closing at $220.38 (+3.66%). While the lion’s share of the recent volume lies just above the current price, if QQQ and SPY performance is any indication, this index should continue its move higher next week. Technicals continue to be bullish: I would like to look at the RSP and VTI as well: While both look clearly bullish, they also both look overstretched technically to the upside. Most of the indices we trade are close to their ATH's. Let's look at the expected moves this week. 1.3% expected move and 16% IV for the SPY is not bad. It's enough for us to get some good risk/reward this week. 2.1% expected move and 26% I.V. in the NDX! Do you think NVDA earnings Weds are being anticipated? My bias today in more neutral. Technicals are all bullish but most are getting overstretched to the upside. September S&P 500 E-Mini futures (ESU24) are up +0.16%, and September Nasdaq 100 E-Mini futures (NQU24) are up +0.23% this morning as market participants awaited an earnings report from semiconductor stalwart Nvidia as well as the release of the Fed’s preferred inflation gauge later in the week. In Friday’s trading session, Wall Street’s major averages closed higher, with the blue-chip Dow notching a 3-week high. Workday (WDAY) climbed over +12% and was the top percentage gainer on the Nasdaq 100 after the back-office software provider reported better-than-expected Q2 results and said it would sharply increase profitability over the next three years. Also, chip stocks gained ground, with Nvidia (NVDA), Marvell Technology (MRVL), and Arm (ARM) advancing more than +4%. In addition, CAVA Group (CAVA) soared over +19% after the company posted upbeat Q2 results and boosted its full-year guidance for adjusted EBITDA and restaurant comparable sales growth. On the bearish side, Intuit (INTU) slid more than -6% and was the top percentage loser on the S&P 500 and Nasdaq 100 after providing below-consensus Q1 adjusted EPS guidance. Economic data on Friday showed that U.S. new home sales rose +10.6% m/m to a 14-month high of 739K in July, stronger than expectations of 624K. Fed Chair Jerome Powell said Friday that “the time has come” for the U.S. central bank to lower its key policy rate. The Fed chief acknowledged recent progress on inflation and stated that the cooling in labor market conditions is “unmistakable.” Powell also mentioned that he observes the economy expanding at a “solid pace.” “The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks,” Powell said in the text of a speech at the Kansas City Fed’s annual conference in Jackson Hole, Wyoming. Also, Atlanta Fed President Raphael Bostic said it is possible that more than one interest rate cut may now be required by year-end following data indicating falling inflation and a slowing labor market. In addition, Chicago Fed President Austan Goolsbee said it’s time to focus more on the employment side of the Fed’s dual mandate now that inflation is moderating toward the 2% target. “We’re not just fighting inflation now, inflation’s on a path to 2%,” Goolsbee said. “The market should be happy with [Powell’s] speech because it wasn’t hawkish in any way, gave the green light for 25 basis-point rate cuts - and left the door open for even larger cuts if that becomes necessary,” said Chris Zaccarelli at Independent Advisor Alliance. Meanwhile, U.S. rate futures have priced in a 63.5% chance of a 25 basis point rate cut and a 36.5% chance of a 50 basis point rate cut at the conclusion of the Fed’s September meeting. Market participants will focus on earnings reports from several leading technology and retail companies this week, with chipmaker Nvidia’s (NVDA) report on Wednesday drawing the most attention. Prominent tech firms like Salesforce (CRM), Dell Technologies (DELL), HP (HPQ), and CrowdStrike (CRWD), along with retailers including Dollar General (DG), Lululemon (LULU), Best Buy (BBY), and Ulta Beauty (ULTA), are also scheduled to release their quarterly results this week. On the economic data front, the July reading of the U.S. core personal consumption expenditures price index, the Fed’s preferred inflation gauge, will be the main highlight in the coming week. Also, investors will be monitoring a spate of other economic data releases, including U.S. GDP (second estimate), CB Consumer Confidence Index, S&P/CS HPI Composite - 20 n.s.a., Richmond Manufacturing Index, Crude Oil Inventories, Goods Trade Balance (preliminary), Initial Jobless Claims, Wholesale Inventories (preliminary), Pending Home Sales, Personal Income, Personal Spending, Chicago PMI, and Michigan Consumer Sentiment Index. In addition, San Francisco Fed President Mary Daly, Fed Governor Christopher Waller, and Atlanta Fed President Raphael Bostic will be making appearances this week. Today, investors will focus on U.S. Durable Goods Orders data, set to be released in a couple of hours. Economists, on average, forecast that July Durable Goods Orders will stand at +4.0% m/m, compared to -6.6% m/m in June. U.S. Core Durable Goods Orders data will also be reported today. Economists foresee this figure to be unchanged m/m in July, compared to the previous number of +0.5% m/m. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.788%, down -0.32%. Our Trade docket is busy, as it is most Mondays. /MCL, /MNQ scalping, /ZC, DELL, DIA, DJT, FSLR, IWM, WYNN, UPST, ORCL, CCL, CRM?, SHOP, /ZN, GLD/NEM, SPY/QQQ 4DTE. 0DTE's. Let's take a look at some key intra-day levels for our 0DTE's today: /ES; There are some key levels that are very tight today. 5664 is the first resistance. Its super close as I type but still shows as a major overhang. Then comes 5684 and then big resistance at 5697. Support is close at 5650. Below that we could push down to 5637 which is PoC on the 2hr. chart. /NQ: The NDX hasn't moved much in the last six trading sessions! Today I have two clear levels I'm watching. 19807 on the upside is PoC on the 2 hr. chart and a key resistance level for the bulls. 19750 is strong support. If bears can break that down we could get some downside. Let's have a great day folks! We'be got 9K of extrinsic right now in our scalping and NDX positions. We don't need to be greedy! I'd take half of that to start the week off!

Welcome back to Friday and Jackson Hole day! Yesterday was a tough one for me. As you can see below, I had some good and some bad and a lot of undetermined going into today. The good was scalping! We banked $2,300 of profit but our efforts yesterday could result in almost a $6,000 total payoff come Monday. We loaded up on put covers on our short /MNQ position (as you can see by the higher buying power). We also left one long call yesterday going into today. That looks to cash flow for us at the open today. Our other 0DTE's were all challenged on the put side. Most were rolled to today. One was taken as a loss and one rolled at a debit so even with futures up nicely this morning, working the call sides today will be important to get back to green. Here's a look at my results. Markets retraced yesterday and briefly bounced our technical matrix to a neutral rating but with the futures rebounding this morning its back to bull mode. I think all of us were thinking we were due for a retrace. 10 days of straight up (technically 9 our of 10) means we are usually streched and need a break. We got it yesterday. It seemed like a big move but the NDX came down and held it's 50DMA. All yesterday really did was bring us back to a previous consolidation zone. September S&P 500 E-Mini futures (ESU24) are up +0.51%, and September Nasdaq 100 E-Mini futures (NQU24) are up +0.60% this morning as market participants awaited Federal Reserve Chair Jerome Powell’s Jackson Hole speech for more clues on the amount and timing of interest rate cuts. In yesterday’s trading session, Wall Street’s major indexes ended in the red. Snowflake (SNOW) tumbled over -14% after the company reported weaker-than-expected Q2 billings and provided Q3 product revenue guidance that failed to impress investors. Also, chip stocks lost ground, with Intel (INTC) slumping more than -6% to lead losers in the Dow and Advanced Micro Devices (AMD) falling over -3%. In addition, Urban Outfitters (URBN) slid more than -9% after reporting weaker-than-expected Q2 retail comparable sales growth. On the bullish side, Zoom Video (ZM) surged about +13% after the company posted upbeat Q2 results and raised its full-year guidance. Economic data on Thursday showed that the U.S. S&P Global manufacturing PMI fell to an 8-month low of 48.0 in August, weaker than expectations of 49.5. Also, the number of Americans filing for initial jobless claims in the past week rose +4K to 232K, in line with expectations. At the same time, the U.S. August S&P Global services PMI unexpectedly rose to 55.2, stronger than expectations of 54.0. In addition, U.S. existing home sales increased +1.3% m/m to 3.95M in July, stronger than expectations of 3.94M. “The U.S. economy overall has, thus far, been robust enough to take an extended Fed rate pause,” said Don Rissmiller at Strategas. “But there’s a clear case for rate cuts soon.” Boston Fed President Susan Collins stated on Thursday that it would soon be appropriate for the U.S. central bank to start a rate-cutting cycle. “I think a gradual, methodical pace once we are in a different policy stance is likely to be appropriate,” Collins said. Also, Philadelphia Fed President Patrick Harker said that upcoming economic data will guide the appropriate magnitude of the Fed’s first interest rate reduction. “In September, we need to start a process of moving rates down,” Harker said. At the same time, Kansas City Fed President Jeffrey Schmid stated that he wants to see more economic data before backing any decision to start lowering interest rates. “I still think we could see a little bit of a demand pickup if we’re not careful with the decisioning,” Schmid said. Meanwhile, U.S. rate futures have priced in a 75.5% probability of a 25 basis point rate cut and a 24.5% chance of a 50 basis point rate cut at the September FOMC meeting. Today, all eyes are focused on Fed Chair Jerome Powell’s address at the central bank’s annual economic symposium in Jackson Hole, Wyoming. Market participants will be keenly focused on what he indicates about the pace and timing of rate cuts in the coming months. On the economic data front, investors will focus on U.S. New Home Sales data, set to be released in a couple of hours. Economists, on average, forecast that July New Home Sales will stand at 624K, compared to the previous figure of 617K. The U.S. Building Permits data will also be reported today. Economists expect July’s figure to be 1.396M, compared to 1.454M in June. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.857%, down -0.13%. My bias today is bullish. My bias yesterday was bullish. That didn't pan out very well! I think Powell says all the right things today and I think yesterdays retrace was a healthy "base building" exercise vs. a wholesale change of direction. Let's take a look some key intra-day 0DTE levels for me. /ES; You can see on the daily chart 5599 is a key level of support. As long as we hold that I stay bullish. On the 2 hr. chart the last 18 hrs. have been supportive. Bulls need to break above 5633 first then 5647. Bears need to break back below 5614 and if they can drive down below 5582 then look out below. /NQ; The Nasdaq pulled it off yesterday (kind of). It basically held its 50DMA. That's a key "line in the sand" area. /NQ; On an intra-day 2 hr. chart, once again, the last 18 hrs. have been supportive. There are two key levels for me today. 19805 for bulls. This is the 50 period M.A. on the 2 hr. chart. For the bears it's 19613 which is PoC. These are THE two key levels for me. Between them is just chop. Our trade docket for today: Fridays are for #1. Locking in any profits. #2. De-risking the acct. #3. Raising buying power so we can do it all over again next Monday. /MCL, /ZC, /ZN, CAVA, CRM, DELL, DIA, DJT, GLD/NEM, INTU, IWM, NVDA, SPY/QQQ, SHOP, 0DTE's. Scalping is a question mark today. We've already got a long call going into the open and a big cover on our /MNQ for Monday exp. I always like to have a solid Friday to kick off the weekend. Let's see what we get today. We need some help with our rolled puts. We'll be patient and not do anything with our 0DTE's until after Powell starts speaking.

Welcome back traders! We had a pretty picture perfect day yesterday. Everything landed for a full profit. Check out our results below: We've got our NDX debit position expiring this Friday. It's been good to us but time to say goodbye. It will be interesting to see if the next one is a bullish or bearish setup. Let's take a look at the markets. Bullish indicators are holding strong. The major indices continue to break up through resistance after resistance zones. The SP and DIA in particular are trying to get back to those ATH's. September S&P 500 E-Mini futures (ESU24) are up +0.16%, and September Nasdaq 100 E-Mini futures (NQU24) are up +0.25% this morning as investors looked ahead to U.S. business activity data and the start of the Jackson Hole Symposium. The minutes of the Federal Open Market Committee’s July 30-31 meeting, released Wednesday, revealed that several Federal Reserve officials acknowledged there was a “plausible case” for reducing the central bank’s policy rate. “All participants supported maintaining the target range for the federal funds rate at 5.25 to 5.50 percent, although several observed that the recent progress on inflation and increases in the unemployment rate had provided a plausible case for reducing the target range 25 basis points at this meeting or that they could have supported such a decision,” according to the FOMC minutes. Policymakers noted at the July meeting that inflation had moderated and that there had been “some further progress” toward the 2% goal in recent months. “The vast majority observed that, if the data continued to come in about as expected, it would likely be appropriate to ease policy at the next meeting,” the minutes said. “The Fed minutes removed all doubt about a September rate cut,” said Jamie Cox at Harris Financial Group. “The Fed’s communication strategy is to make its meetings less of a market-moving event, and they are following the script to the letter.” In yesterday’s trading session, Wall Street’s major indices closed higher. Keysight Technologies (KEYS) surged over +13% and was the top percentage gainer on the S&P 500 after the company reported upbeat Q3 results and issued solid Q4 guidance. Also, Target (TGT) climbed more than +11% after the retailer reported stronger-than-expected Q2 results and raised its full-year adjusted EPS forecast. In addition, Take-Two Interactive Software (TTWO) gained over +3% after revealing that its Borderlands 4 video game will be released next year. On the bearish side, American Express (AXP) fell more than -2% and was the top percentage loser on the Dow after BofA downgraded the stock to Neutral from Buy. Also, Macy’s (M) tumbled nearly -13% after reporting weaker-than-expected Q2 revenue and lowering its FY24 net sales outlook. The Bureau of Labor Statistics said Wednesday that the U.S. payrolls benchmark was revised down by -818,000 for the year through March, a steeper decline than the anticipated -600,000, marking the largest downward revision since 2009. This was a preliminary estimate. The final revision is set to be released in February 2025. “The main message from the revisions in my mind is to reinforce just how silly it is to let the next jobs number be the determinant in whether to go 25 or 50 in September. What this revision data implies is that whatever the next jobs number is going to be, it’s probably lower in reality,” said Neil Dutta at Renaissance Macro Research. U.S. rate futures have priced in a 69.5% probability of a 25 basis point rate cut and a 30.5% chance of a 50 basis point rate cut at the next central bank meeting in September. Meanwhile, the Jackson Hole Economic Symposium kicks off later today, with investors looking forward to a speech by Fed Chair Jerome Powell on Friday. Market participants will be keenly focused on what he indicates about the pace and timing of rate cuts in the coming months. On the earnings front, notable companies like Intuit (INTU), Workday (WDAY), Ross Stores (ROST), BJ’s Wholesale Club (BJ), and Peloton Interactive (PTON) are set to report their quarterly figures today. On the economic data front, all eyes are focused on the U.S. S&P Global Manufacturing PMI preliminary reading, set to be released in a couple of hours. Economists, on average, forecast that the August Manufacturing PMI will come in at 49.5, compared to last month’s value of 49.6. Also, investors will focus on the U.S. S&P Global Services PMI, which arrived at 55.0 in July. Economists foresee the preliminary August figure to be 54.0. U.S. Existing Home Sales data will come in today. Economists foresee this figure to stand at 3.94M in July, compared to 3.89M in June. U.S. Initial Jobless Claims data will be reported today as well. Economists estimate this figure to be 232K, compared to last week’s value of 227K. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.826%, up +1.27%. Our Trade docket for today: /MCL, ?MNQ, CRM?, DIA, DJT?, IWM, SNOW, WOLF, ZM, INTU, 0DTE's. My bias today is bullish. It's hard not to be with resistance zones being broken through and holding. Let's take a look at my key intra-day 0DTE levels: /ES; 5665/5671/5681 are new resistance levels. 5645/5639/5630 are support. /NQ; 20032/20061/20111 are the new resistance zones. 19938/19900/19863 are support. Let's go have another great day out there folks. Remember...everyday doesn't need to be a home run! We've had some tremendous days recently. $1,000 a day is pretty impressive for most traders. We don't need to swing for the fences!

Welcome to Weds. traders! We had a good day yesterday. We left quite a bit of potential profit on the table but we also had two rolls we were working and they were getting to be a pretty big size so booking what we could made sense. Here's a look at how we did. One advantage of the way we trade multiple 0DTE's is that a new 0DTE that is offsetting another can sometimes be done without using additional Buying power, as was the case yesterday. Taking a look at the markets. We took a pause yesterday but it wasn't too meaningful on the technicals. My bias today remains the same as yesterday. Neutral to slightly bullish. We've got FOMC mins. release today. I don't think that should be much of a catalyst but, you never know, until you know. Again, you can see, there wasn't much accomplished yesterday by the bulls or bears. September S&P 500 E-Mini futures (ESU24) are trending up +0.17% this morning as market participants awaited an annual review of U.S. jobs data as well as the Federal Reserve’s July meeting minutes for further clues on the path of interest rates. In yesterday’s trading session, Wall Street’s main stock indexes ended in the red. Boeing (BA) slid over -4% and was the top percentage loser on the Dow after the aircraft manufacturer paused flight tests of its 777X jetliner while it inspects cracks in a crucial structural component. Also, diabetes stocks lost ground on the news that Eli Lilly’s weight-loss drug Zepbound reduced the risk of diabetes by 94% in obese and pre-diabetic patients, with Insulet (PODD) slumping more than -6% to lead losers in the S&P 500 and Dexcom (DXCM) plunging over -6% to lead losers in the Nasdaq 100. In addition, Bank of America (BAC) fell more than -2% after an SEC filing revealed Berkshire Hathaway sold $550.7 million of its Bank of America stock holdings between August 15-19. On the bullish side, Palo Alto Networks (PANW) climbed over +7% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the cybersecurity company posted upbeat Q4 results and provided solid FY25 guidance. “The momentum guys are driving the bus,” said Kenny Polcari at SlateStone Wealth. “Now the volumes have been trending lower as we move into the end of the month. Moves will be and are exaggerated as a result. And I think the recent rally is proof of that exaggeration.” Fed Governor Michelle Bowman said Tuesday that she remains cautious about any shift in the Fed’s policy due to what she perceives as continued upside risks for inflation, warning that overreacting to any single data point could jeopardize the progress already achieved. “I still see some upside risks to inflation as supply conditions have now largely normalized and any further improvements to supply seem less likely to offset price pressures arising from increasing geopolitical tensions, additional fiscal stimulus, and increased demand for housing due to immigration,” Bowman said. Meanwhile, U.S. rate futures have priced in a 69.5% probability of a 25 basis point rate cut and a 30.5% chance of a 50 basis point rate cut at the next FOMC meeting in September. Today, investors will monitor the release of the Federal Reserve’s minutes from the July meeting, which may offer additional insights into the Fed’s next steps. Also, market participants will be closely watching the release of preliminary benchmark revisions to U.S. employment data for the 12 months through March, scheduled for later in the day. Signs of weakness in the annual recalibration of U.S. payrolls could underscore the need for aggressive Fed rate cuts and evoke memories of the market turmoil in August following a disappointing payrolls report. Goldman Sachs and Wells Fargo economists anticipate that payroll growth in the year through March was at least 600,000 weaker than currently estimated. While JPMorgan Chase forecasters predict a decrease of about 360,000, Goldman suggests it could be as large as a million. On the economic data front, investors will likely focus on U.S. Crude Oil Inventories data, set to be released in a couple of hours. Economists estimate this figure to be -2.000M, compared to last week’s value of 1.357M. On the earnings front, notable companies like TJX Companies (TJX), Analog Devices (ADI), Target (TGT), Snowflake (SNOW), Agilent (A), and Macy’s (M) are slated to release their quarterly results today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.825%, up +0.08%. Trade docket for today: /MCL, /MNQ scalping+QQQ's, CRM?, DELL?, FSLR, IWM, LEVI, M, PANW, PYPL, TGT, TJX, SNOW, ZM, WOLF, 0DTE's. Let's take a look at some key, intra-day 0DTE levels for me: /ES; Super tight range. Bulls need to push through 5646. Bears need to break down below 5614. /NQ; As you can see, we've been in a very tight zone for a while now. Bulls need to break above 19940 and bears need to push below 19770. Let's have a great day!

Good Tues. to you all! The bullish sentiment continued yesterday. It's been quite a run. 8 straight days of green and almost a 10% move on the SPX! The main question now is, can it continue? Eight days is a long run and a 10% move is pretty big inside that timeframe. Technicals still look strong and none of our indicators are particularly overstretched to the upside. Futures are green, as I type so I guess we'll see. Yesterday was a decent day for us. We needed to roll two call sides to today so those will form our starting point this morning. Here's a look at our results. Bullish mode technically is still in place, as I mentioned. Taking a look at the major indices we trade, you can see that the SPY and DIA are pushing back to their ATH's. QQQ and IWM still have a bit more work to do. Technically yesterday, we broke through the key levels of resistance I laid out and once that happened the buying accelerated. September S&P 500 E-Mini futures (ESU24) are up +0.01%, and September Nasdaq 100 E-Mini futures (NQU24) are up +0.09% this morning as market participants geared up for the release of the minutes of the Federal Reserve’s latest meeting and comments from Fed Chair Jerome Powell later in the week. In yesterday’s trading session, Wall Street’s major indexes closed higher, with the benchmark S&P 500 posting a 1-month high, the tech-heavy Nasdaq 100 notching a 3-1/2 week high, and the blue-chip Dow posting a 2-week high. ZIM Integrated Shipping Services (ZIM) surged over +16% after the shipping giant reported better-than-expected Q2 results and raised its FY24 adjusted EBITDA guidance. Also, Advanced Micro Devices (AMD) climbed more than +4% and was the top percentage gainer on the Nasdaq 100 after announcing the acquisition of AI infrastructure provider ZT Systems in a deal valued at about $4.9 billion. In addition, McDonald’s (MCD) advanced over +3% and was the top percentage gainer on the Dow after Evercore ISI raised its price target on the stock to $320 from $300. On the bearish side, HP Inc. (HPQ) fell more than -3% and was the top percentage loser on the S&P 500 after Morgan Stanley downgraded the stock to Equal Weight from Overweight. Economic data on Monday showed that the Conference Board’s leading economic index for the U.S. dropped -0.6% m/m in July, weaker than expectations of -0.4% m/m. Minneapolis Fed President Neel Kashkari told the Wall Street Journal in an interview released on Monday that it was appropriate to discuss potentially lowering U.S. interest rates in September due to the increasing likelihood of a weakening labor market. “The balance of risks has shifted, so the debate about potentially cutting rates in September is an appropriate one to have,” he said. Kashkari stated inflation was making progress, but the labor market was exhibiting “concerning signs,” according to the Journal. Also, San Francisco Fed President Mary Daly told the Financial Times in an interview published on Sunday that recent U.S. economic data have provided her “more confidence” that inflation is under control and it is time to consider adjusting benchmark borrowing costs. Daly advocated for a “prudent” approach to policy, dismissing concerns about the risk of a sharp slowdown in the U.S. economy. Meanwhile, investors are awaiting the Federal Reserve’s minutes from the July meeting on Wednesday and Fed Chair Jerome Powell’s speech at Jackson Hole, Wyoming, on Friday to gain further clarity on the outlook for rate cuts. U.S. rate futures have priced in a 75.5% probability of a 25 basis point rate cut and a 24.5% chance of a 50 basis point rate cut at the conclusion of the Fed’s September meeting. On the earnings front, notable companies like Lowe’s Companies (LOW), Medtronic (MDT), Keysight Technologies (KEYS), Toll Brothers (TOL), and Amer Sports (AS) are set to report their quarterly figures today. The U.S. economic data slate is empty on Tuesday. However, investors will likely focus on speeches from Fed Vice Chair for Supervision Michael Barr and Atlanta Fed President Raphael Bostic. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.870%, down -0.03%. My bias for today: I continue to be neutral to slightly bullish here. All our technicals and the price action itself are bullish but the eight days of green in a row is starting to get a little long in the tooth (IMHO). Trade docket for today: I'm traveling home today from my in-laws. They live in Port Ludlow which is an island just outside of Seattle. It's beautiful but also quite a treck. Taking ferries etc. to get to the airport so today will be broken up into two segments. Early morning right out of the gate well get as much done as we can and then later today, once I get to the airport, which should be one hour before the close. TJX, TJT, M, /MNQ scalp, BABA?, CCL, CRM, FSLR, IWM, LOW, MDT, PANW, 0DTE's. Let's look at the key intra-day levels for me today: /ES; We are at another critical level as we start today. Technicals are still bullish, as I mentioned but they are starting to wane. 5679 is the key level bulls need to break through to contiue the bullish sentiment. 5587 is the support the bears need to break. /NQ; The Nasdaq is a bit more overbought on the Stoch and you can see that buying vol on both the SPX and NDX is starting to trail off. The key levels for /NQ are 20063 first then if it can break that, 20279 to the upside. 19705 is first support level and then comes 19685 (50DMA). Let's see if we can have another good day at "the office" folks!

Welcome back to a new week of trading! One of the things I love about trading is that, for good or bad, no matter how your week went, it all starts over again today! Last Thursday was amazing for us. We crossed over $300,000 in YTD profits on our 0DTE's and our 31% gain on the day was a record as well. That being said, Friday was really a better day for us. Pretty mellow. We had an SPX rolled call side to deal with and with the Vampire trade that also means we didn't have any NDX 0DTE options to works with. Big up days are great but they usually come with more buying power and more stress. Our Friday effort didn't quite hit our $1,000/day goal but it was close and if we can do that consistenty that's all we need to justify our time and effort here. Let's take a look at our results from Friday. We are slowly getting back into our "normal" setups. This Weds. we'll be back on the QQQ's for Scalping, in addition to our new /MNQ addition. This will mean I'm committing more capital to the scalping effort. We'll also get back to our Event contracts as the setups are starting to look a little better. There's also a good chance we can get a Theta fairy on tonight! Let's look at the markets for this week. We had the best week of the year last week! Buy mode is clinging on. It's tenious but...bullish is bullish. You can see how explosive the bullish retrace was on all the major indices last week. It's also brought us up to another level of consolidation. Let's take a look at the I.V. and expected moves this week: We look to be starting the week in a "sweet spot". I.V. isn't elevated but it's not in the dumps either. It could be a good week for our 4DTE SPY/QQQ setups. Oh what a difference a few days make. Our shorting of the VIX was such a great trade and one of my favorites. Unfortunately, those setups don't come along very often. VIX is back to a normal range. September S&P 500 E-Mini futures (ESU24) are down -0.02%, and September Nasdaq 100 E-Mini futures (NQU24) are down -0.21% this morning as investors looked ahead to the release of the minutes of the Federal Reserve’s latest policy meeting, Fed Chair Jerome Powell’s speech at Jackson Hole, and earnings reports from a diverse group of prominent companies. In Friday’s trading session, Wall Street’s major averages ended in the green, with the benchmark S&P 500 and blue-chip Dow rising to 2-week highs and the tech-heavy Nasdaq 100 climbing to a 3-week high. H&R Block (HRB) surged over +12% after the tax preparation company reported upbeat Q4 results, provided an above-consensus FY25 forecast, and announced a new $1.5 billion share repurchase program. Also, Coherent (COHR) climbed more than +7% after the company reported better-than-expected Q4 results and issued solid Q1 revenue guidance. In addition, Fox Corp. (FOXA) gained over +1% after Wells Fargo double-upgraded the stock to Overweight from Underweight with a price target of $46. On the bearish side, Applied Materials (AMAT) fell more than -1% after giving an in-line Q4 net sales forecast that disappointed investors looking for a bigger payoff from AI spending. Economic data on Friday showed that the University of Michigan’s U.S. consumer sentiment index stood at 67.8 in August, stronger than expectations of 66.7. At the same time, U.S. July housing starts fell -6.8% m/m to a 4-year low of 1.238M, weaker than expectations of 1.340M. In addition, U.S. building permits, a proxy for future construction, fell -4.0% m/m to a 4-year low of 1.396M in July, weaker than expectations of 1.430M. Chicago Fed President Austan Goolsbee supported rate cuts on Friday after noting that the U.S. labor market and some leading economic indicators are showing warning signs and expressing concerns that unemployment will continue to increase. Goolsbee stated that the speed of transmission of lower rates would “depend on many factors” and indicated his support for a “gradual” rather than rapid pace of rate cuts. U.S. rate futures have priced in a 71.5% chance of a 25 basis point rate cut and a 28.5% chance of a 50 basis point rate cut at September’s monetary policy meeting. In other news, Goldman Sachs over the weekend reduced the probability of a U.S. recession in the next year to 20% from 25%, citing last week’s healthy economic data. Meanwhile, Fed Chair Jerome Powell is scheduled to deliver the keynote address at the central bank’s annual economic symposium in Jackson Hole, Wyoming, on Friday. Market participants will be keenly focused on what he indicates about the pace and timing of rate cuts in the coming months. Earlier in the week, Fed Governor Christopher Waller, Fed Vice Chair for Supervision Michael Barr, and Atlanta Fed President Raphael Bostic will be making appearances. “We look for Powell to signal that given recent progress, the Fed is likely to ease policy next month - without fully committing to the size of the rate cut. We expect a 25 basis-point reduction,” according to TD Securities’ strategists. Investors will also be monitoring a spate of economic data releases this week, including the U.S. S&P Global Composite PMI (preliminary), S&P Global Manufacturing PMI (preliminary), S&P Global Services PMI (preliminary), Crude Oil Inventories, Initial Jobless Claims, Existing Home Sales, Building Permits, and New Home Sales. Retailers Lowe’s (LOW), Target (TGT), TJX (TJX), and Ross Stores (ROST), along with notable tech players such as Zoom Video (ZM), Snowflake (SNOW), Palo Alto Networks (PANW), Workday (WDAY), and Analog Devices (ADI), are among the prominent companies set to release their quarterly results this week. In addition, market participants will pay close attention to the publication of the Federal Reserve’s minutes from the July meeting on Wednesday, during which Fed Chair Jerome Powell acknowledged progress on inflation and left the door open for a rate cut in September. Today, investors will focus on the U.S. Conference Board Leading Index, set to be released in a couple of hours. Economists expect July’s figure to be -0.4% m/m, compared to the previous number of -0.2% m/m. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 3.868%, down -0.70%. We don't have any really big news catalysts today so I'm leaning to a neutral to slightly bullish day today, After the massive push last week I think we are due for a pause. Trade docket for today: /MNQ scalping. /ZN, DELL, DIA, GLD, DJT?, IWM, NVDA, PLTR, PYPL, SHOP, SPY/QQQ 4DTE's, 0DTE's. PANW, LOW, MDT potential earnings setups. Open interest. You can see a big target on the 5630 SPX level. Let's take a look at some key, intr-day 0DTE levels for me today. /ES; From a bigger perspective their is a 100 point trading zone right now on the /ES. 5603 is a clear resistance zone that we broke through in July and hit again in Aug. 5503 is the 50DMA (green line) and could provide support in a drawdown. Intra-day on the 2 hr. chart shows we've been coiled up since last Thurs. in a very tight range. A break above 5593 or below 5558 might get us moving again. /NQ; The Nasdaq continues to be a tad weaker than the SP500. It's been clinging to it's 50DMA for a few trading sessions now. On an intra-day basis we would need to push above 19688 or drop below 19463 to get a new directional move going. Let's have a great day folks! There's a lot worse ways we could be out there slogging away, trying to make a living! Enjoy the process.

|

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |