|

We had another really solid day yesterday. Our re-set NVDA trade has a goal of producing $3,500 a week in income for us. After blowing that number away last week, it looked like this week would be below our goal but yesterdays adjustments brought us to close to $4,000 of potential income for the week. Yesterday was all about asymmetric trade setups. We put a lot of small, low probability but high profit potential trades on. Only one of them hit (SPX chicken Iron condor) but the risk was so small that it ended up being a great success. We had MU report after the close with dissapointing results. This knocked the futures down but we are still holding to a slight bullish bias technically. Once again, yesterdays price action refused to give us any clarity or directional bias. The markets continue to coil here, building kinetic energy and preparing for their next move. It's still unclear when and what direction that will take. If you follow our trades you'll know that one of our all time favorite trades is the Theta fairy. Unfortunately we rarely get enough I.V. to get one on. A quick rule of thumb is we want $7.00+ of credit showing on a one standard deviation stike. As you can see, if are far from that. That, of course, is due to the low market I.V. as measured via the VIX1D. We may have found a work around by replacing the /ES for the /MNQ. It's scalable, unlike the /ES and it has much better I.V.. Look for more Theta fairys in the near future as we switch our efforts to this new underlying. Apex is currently running another of their specials. This is one of the best. Apex Milestone Celebration 80% Off any size Evaluation! One Day To Pass! $35 Resets! Only $40 for the $150k- $250k - $300k Evaluation Account!! Also, if you want to trade crypto with 0DTE setups. Some with 300% daily potential payouts you'll need the Kalshi tradomg platform. It's free. You can trade as little as $10 dollars and it will give you another tool to diversify your trading. Click the link below to get started. We've got some market catalysts incoming this morning. Micron Technology (MU) slumped over -6% in pre-market trading after the memory chipmaker provided Q4 sales guidance that trailed the estimates of some investors, overshadowing its stronger-than-expected Q3 results. In yesterday’s trading session, Wall Street’s main stock indexes closed in the green. FedEx (FDX) surged over +15% and was the top percentage gainer on the S&P 500 after the shipping giant posted upbeat Q4 results, provided a strong 2025 adjusted EPS forecast, and said it would buy back $2.5 billion of its stock over the next year. Also, Apple (AAPL) gained +2% after Rosenblatt Securities upgraded the stock to Buy from Neutral with a price target of $260. In addition, Whirlpool (WHR) climbed over +17% following a report from Reuters that Robert Bosch GmbH is contemplating an offer for the appliance maker. On the bearish side, Moderna (MRNA) plunged about -11% and was the top percentage loser on the S&P 500 and Nasdaq 100 following new data indicating that the efficacy of its RSV vaccine declined significantly in the second year and was inferior to that of rival vaccines. Economic data on Wednesday showed that U.S. new home sales fell -11.3% m/m to a 6-month low of 619K in May, weaker than expectations of 636K. Also, U.S. May Building Permits were revised higher to 1.399M from a preliminary estimate of 1.386M, yet still marked the lowest level since June 2020. The Federal Reserve said on Wednesday that the largest U.S. banks passed the annual stress test, clearing the path for higher shareholder payouts. The results indicated that while large banks would face greater losses compared to the 2023 test, they remain well-positioned to weather a severe recession, according to the central bank. “While the severity of this year’s stress test is similar to last year’s, the test resulted in higher losses because bank balance sheets are somewhat riskier and expenses are higher,” said Fed Vice Chair of Supervision Michael S. Barr. Fed Governor Michelle Bowman on Wednesday reiterated her baseline view that “inflation will decline further with the policy rate held steady,” and she also stated that rate cuts would be “eventually” appropriate if inflation moves sustainably toward 2%. U.S. rate futures have priced in a 10.3% chance of a 25 basis point rate cut at the July FOMC meeting and a 56.3% probability of a 25 basis point rate cut at September’s policy meeting. Meanwhile, market participants will be keeping an eye on the first U.S. presidential debate of the 2024 election later today, featuring Democratic President Joe Biden and his Republican challenger Donald Trump. On the earnings front, notable companies like Nike (NKE), McCormick (MKC), Walgreens Boots Alliance (WBA), and Acuity Brands (AYI) are slated to release their quarterly results today. On the economic data front, all eyes are on the Commerce Department’s final estimate of gross domestic product, set to be released in a couple of hours. Economists, on average, forecast that U.S. GDP will stand at +1.3% q/q in the first quarter, compared to +3.4% q/q in the fourth quarter. Also, investors will focus on U.S. Durable Goods Orders data, which came in at +0.7% m/m in April. Economists foresee the May figure to be -0.5% m/m. U.S. Core Durable Goods Orders data will be reported today. Economists estimate this figure to come in at +0.2% m/m in May, compared to the previous number of +0.4% m/m. U.S. Pending Home Sales data will come in today. Economists expect May’s figure to be +0.6% m/m, compared to the previous figure of -7.7% m/m. U.S. Initial Jobless Claims data will be reported today as well. Economists estimate this figure to be 236K, compared to last week’s number of 238K. Trade docket for today: NKE, WBA, LEVI, MU, /ZC, /ZN?, DELL, FDX, MSTR?, 0DTE's, PLTR, PYPL, Theta Fairy using /MNQ. My lean for today: Slighty bullish even with the futures down. I think the market shrugs off MU's dissapointing earnings. Of course Jobless claims/ GDP/ Durable goods numbers may change all that. No initial intra-day levels for me yet as we have lots of news catalysts incoming shortly. We'll talk about levels in our live chat room later in the day once we get some price action. Have a great day everyone! Let's see if we can get a repeat of yesterday.

0 Comments

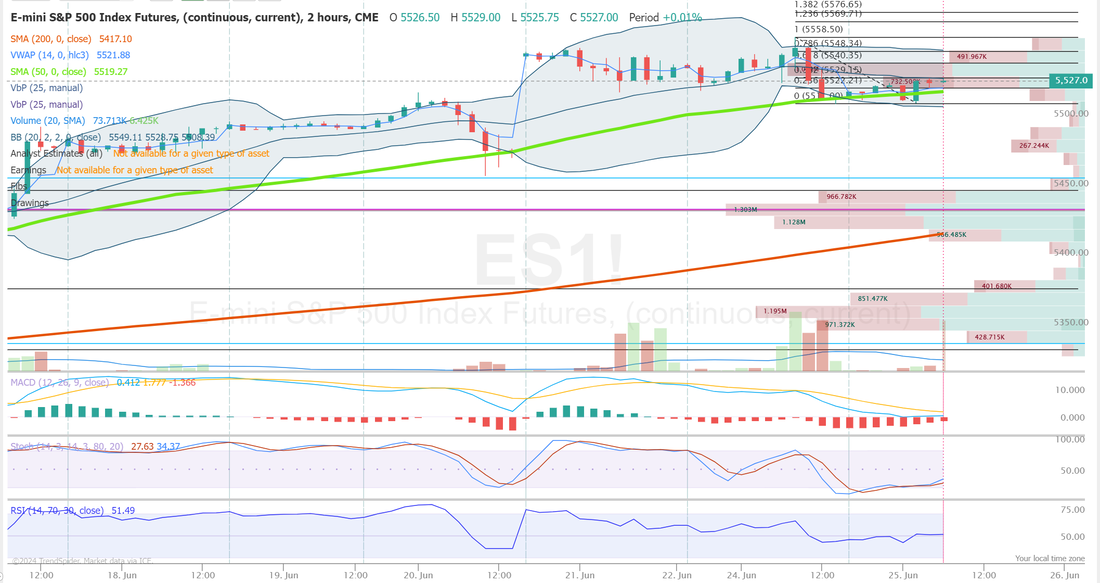

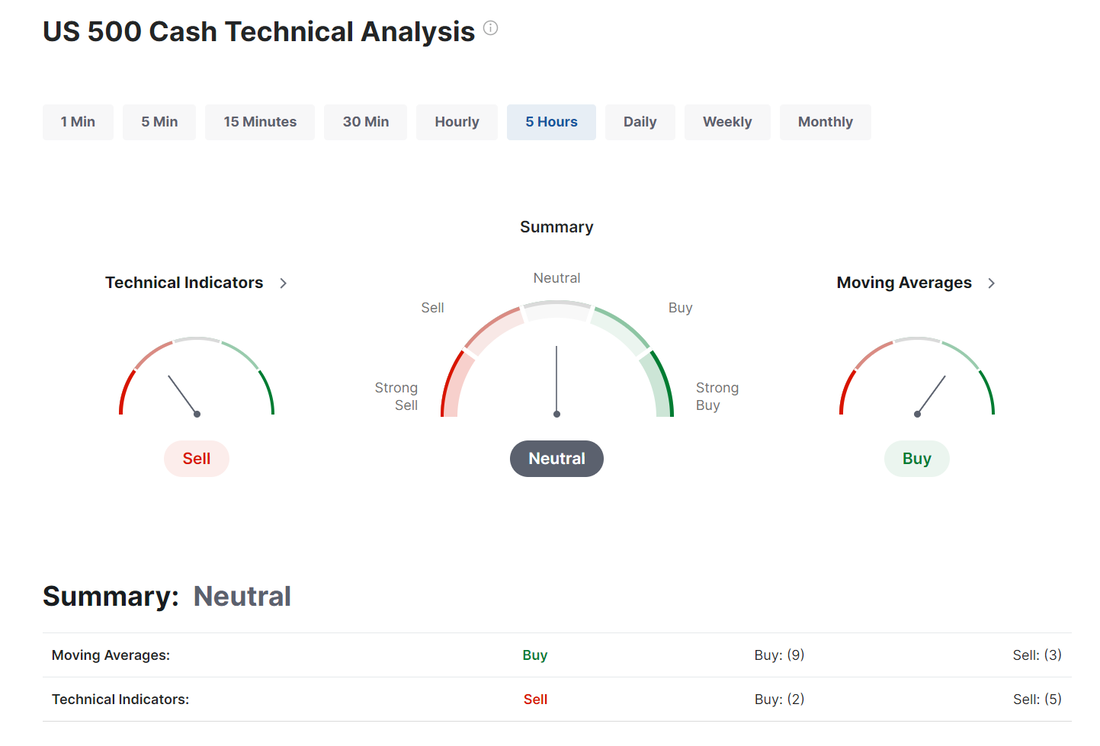

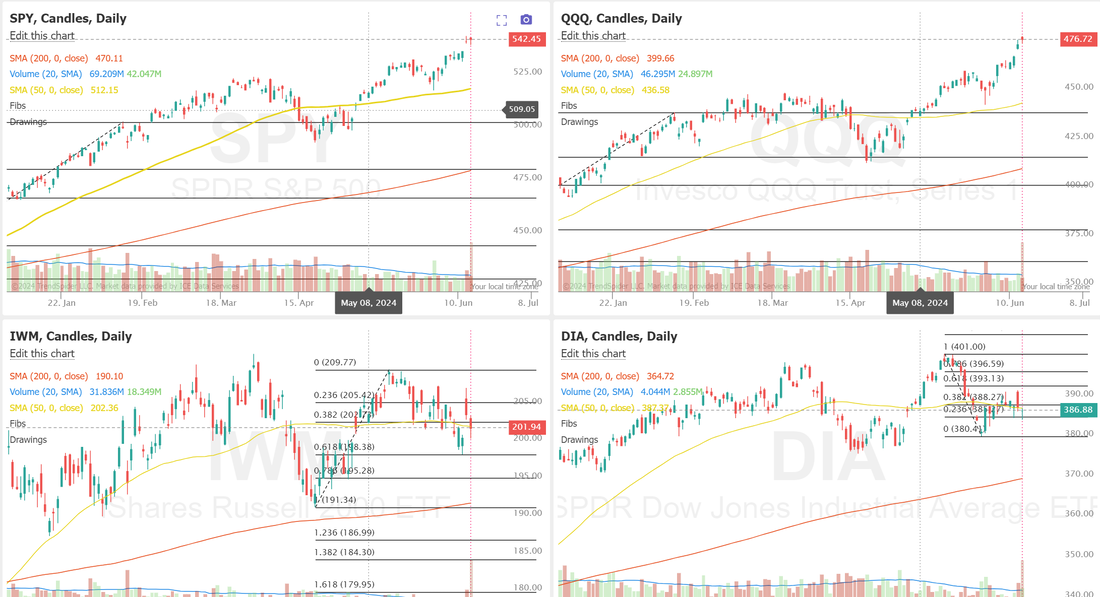

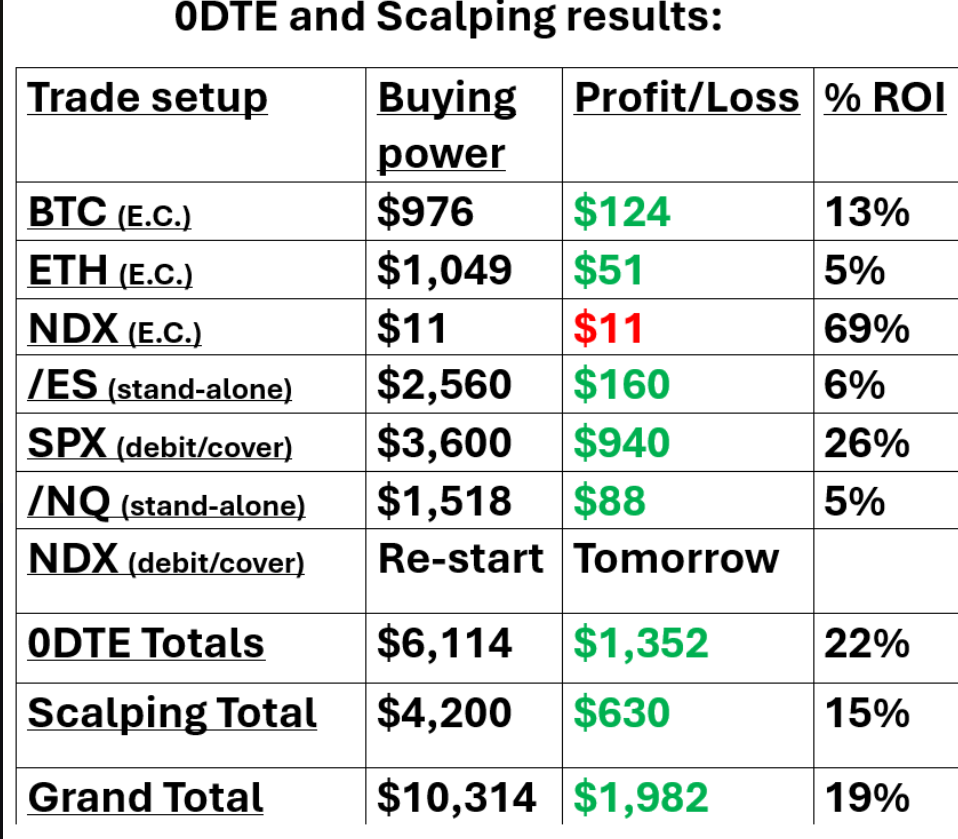

Well, I had a much better day yesterday than Monday! It was really what we strive to call a "normal" day. Most, but not all our trades worked. Nothing crazy big on the win side. Nothing crazy big on the loss side and at the end of the day we made some good money on the overall capital deployed. It sounds strange but I don't really like the $10,000 profit days because that also implies we could have a $20,000 down day. Steady, consistent upward movement is what we desire. Let's take a look at our results. The market continues to keep us waiting for a new trend to follow. We had two days in a row of neutral ratings. Those are incredibly hard days for me to find solid levels to trade. We are back now to a buy rating. Even so. Yesterday was another "mixed bag" day. Yes the SPY and QQQ turned in green days but the IWM struggled and is now back below the 50DMA and the DIA seems to have lost all its recent steam. This is a market that is coiling and looking for its next breakout. I.V. as measured by the VIX1D is still ridiculously low. Anything in the single digits is horrible for option sellers. We'd prefer it closer to 17 than 8. In yesterday’s trading session, Wall Street’s major indexes ended mixed. Carnival (CCL) surged over +8% and was the top percentage gainer on the S&P 500 after the company reported upbeat Q2 results and provided above-consensus Q3 adjusted EBITDA guidance. Also, mega-cap technology stocks gained ground, with Nvidia (NVDA) climbing more than +6% to lead gainers in the Nasdaq 100 and Meta Platforms (META) rising over +2%. In addition, Capri Holdings (CPRI) advanced more than +1% after Wells Fargo upgraded the stock to Overweight from Equal Weight with a price target of $43. On the bearish side, Pool Corp. (POOL) slumped over -8% and was the top percentage loser on the S&P 500 after the company cut its full-year EPS forecast on weaker-than-expected demand. Economic data on Tuesday showed that the U.S. CB consumer confidence index edged down to 100.4 in June, stronger than expectations of 100.0. Also, the U.S. June Richmond Fed manufacturing survey fell to -10, weaker than expectations of -3. In addition, the U.S. S&P/CS HPI Composite - 20 n.s.a. eased to +7.2% y/y in April from +7.5% y/y in March (revised from +7.4% y/y), stronger than expectations of +7.0% y/y. Fed Governor Michelle Bowman stated Tuesday that she sees several upside risks to the inflation outlook and reiterated the necessity of maintaining elevated borrowing costs for an extended period. “We are still not yet at the point where it is appropriate to lower the policy rate,” Bowman said. During a moderated discussion following her speech, the Fed governor stated that she does not foresee any interest rate cuts this year. At the same time, Fed Governor Lisa Cook indicated that she sees it as appropriate to lower interest rates “at some point,” noting her expectation of gradual inflation improvement this year followed by more rapid progress in 2025. “The timing of any such adjustment will depend on how economic data evolve and what they imply for the economic outlook and balance of risks,” Cook said. Meanwhile, U.S. rate futures have priced in a 10.3% chance of a 25 basis point rate cut at the next FOMC meeting in July and a 57.9% chance of a 25 basis point rate cut at the September FOMC meeting. The focus this week will be on the May reading of the U.S. core personal consumption expenditures price index, the Fed’s first-line inflation gauge, set to be released on Friday. On the earnings front, notable companies like Micron Technology (MU), General Mills (GIS), Paychex (PAYX), Levi Strauss (LEVI), and AeroVironment (AVAV) are set to report their quarterly figures today. On the economic data front, investors will direct their attention to U.S. New Home Sales data, set to be released in a couple of hours. Economists, on average, forecast that May new home sales will come in at 636K, compared to the previous number of 634K. The U.S. Building Permits data will come in today. Economists expect May’s figure to be 1.386M, compared to 1.440M in April. U.S. Crude Oil Inventories data will be reported today as well. Economists estimate this figure to be -2.600M, compared to last week’s value of -2.547M. Later today, the Federal Reserve will release the results of its annual stress test for the biggest U.S. banks. In spite of the technicals I'm leaning bearish today. FDX earnings pumped the futures initially but they've since lost all that momentum. Trade docket for today: /MCL, /NG, CCL, CRM?, FDX, GIS, GLD/NEM?, ODTE's, NVDA, ORCL?, PAYX, SMCI?, MU, LEVI, SPY/QQQ. Intra-day levels for me: /ES; 5542/5551/5558/5570 to the upside. 5532/5526/5519/5510 to the downside. /NQ; 20067/20085/20172/20223 to the upside. 19946/19915/19863/19808 to the downside. Bitcoin; Slide continues. Resistance now 63,550 and support is 60,357 with 58,423 the next level down if we break 60,357 Lets have another "normal" day today!

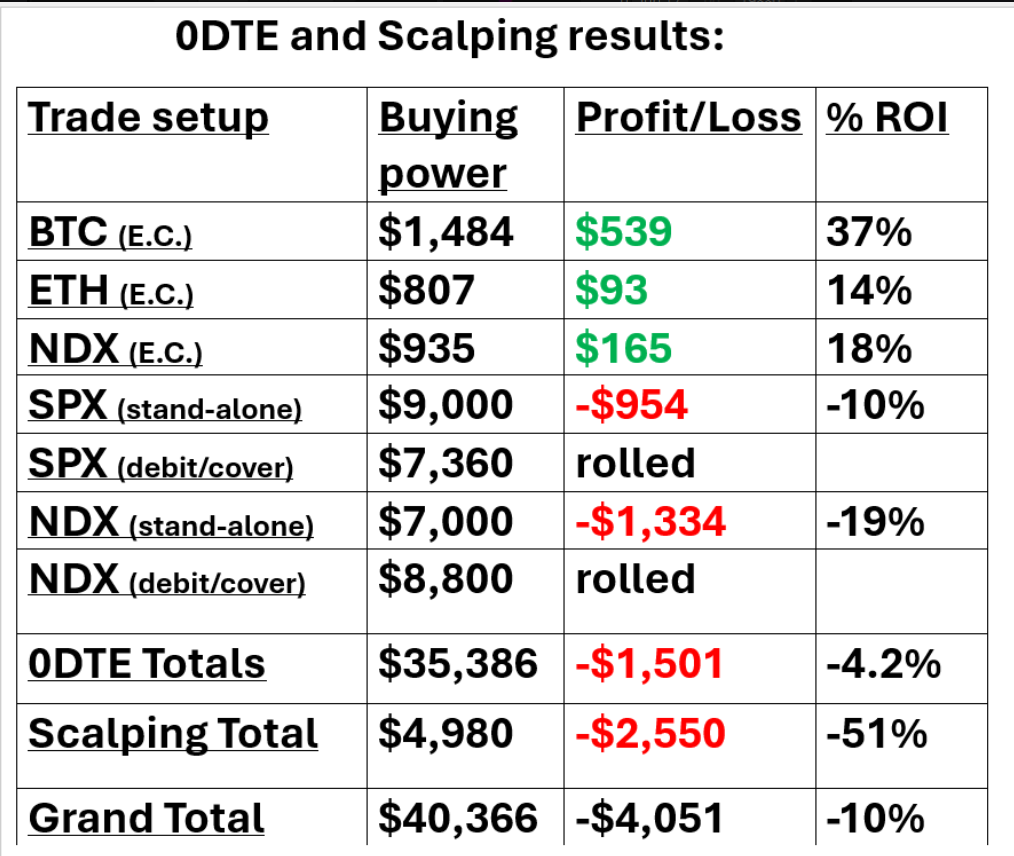

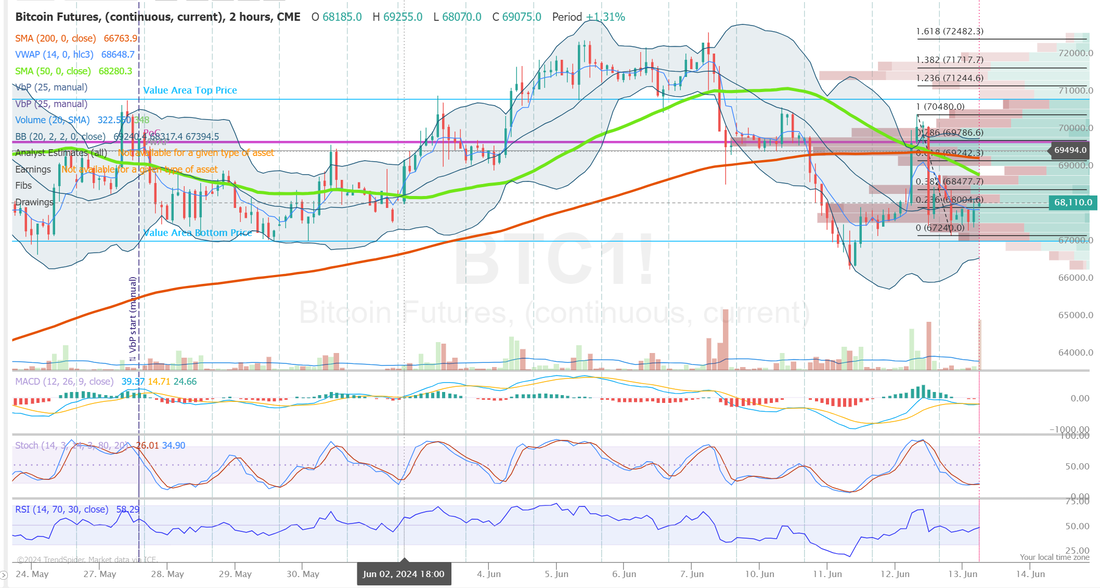

Yesterday was one of those days I should have just stayed in bed. I gave back almost 10 days of profits in the last 30 mins. of the day with the selloff. Here's my results. BTC missed a full profit by $7 dollars! SPX went perfect but I didn't have enough leverage in that to offset the selloff in NDX. Scalping helped but again, not enough. My lean yesterday was bearish as I mentioned but I didn't anticipate a selloff like that going into the close. I'll try to get quicker exits today to avoid the power hour all together. Lets look at the markets: We did see some slight rotation with weakness in the SPY and QQQ and strength in the IWM and DIA. This is a reversal from previous sessions. We continue to look for a sell confirmation in the VTI. The market enters today with another neutral rating. That makes it tough to find proper levels when the market is trying to make up its mind. My lean today is more neutral. The strenght in the laggards (IWM, DIA) should help outweight the weakness from the SPY, QQQ. Trade docket for today: /HG, CCL, 0DTE's, NVDA, PFE, FDX, PAYX, GIS. Dovish comments Monday from Chicago Fed President Goolsbee knocked T-note yields lower and supported stocks when he said it might be appropriate for the Fed to start thinking about whether restrictive policy is putting too much pressure on the economy. San Francisco Fed President Daly said if inflation falls more slowly than expected, it would be appropriate for the Fed to hold interest rates higher for longer, but if inflation falls quickly or the labor market cools more than expected, cutting rates would be necessary. The US Jun Dallas Fed manufacturing outlook survey rose +4.3 to -15.1, slightly weaker than expectations of -15.0. The markets are awaiting Friday’s release of the US May core PCE deflator, the Fed’s preferred inflation gauge, to see if price pressures are abating, which could pave the way for the Fed to begin cutting interest rates. The consensus is that the May core PCE deflator eased to +2.6% y/y from +2.8% y/y in April. The markets are discounting the chances for a -25 bp rate cut at 10% for the next FOMC meeting on July 30-31 and 65% for the following meeting on September 17-18. Generally positive Q1 earnings results are supportive of stocks. Q1 earnings are expected to climb +7.1% y/y, well above the pre-earnings season estimate of +3.8%. According to data compiled by Bloomberg Intelligence, about 81% of reporting S&P 500 companies have beaten Q1 earnings estimates. Overseas stock markets Monday settled mixed. The Euro Stoxx 50 rose to a 1-week high and closed up +0.89%. China's Shanghai Composite fell to a 3-3/4 month low and closed down -1.17%. Japan's Nikkei Stock 225 Index climbed to a 1-week high and closed up +0.54%. My intra-day levels: /ES; 5540/5558/5570/5581 to the upside. 5522/5510/5490/5474 to the downside. /NQ; 19861/19949/20009/20085 to the upside. 19809/19724/19685/19638 to the downside. Bitcoin; The weakness continues with support levels tenuous. We are working on a 13 day slide at this point. 65,888 is resistance and 56,782 is new support. Let's see if I can snag some green today after yesterdays red!

Welcome back to a new week of trading! Friday ended up a pretty solid week for us. All told we brought in over $13,000 of profits from our 0DTE's with our event contracts contributing $1,400 and our standard SPX/NDX combos bringing in the rest. We also had some nice success with our SPY/QQQ combo even though it was put on much later in the week than normal. Today is a big day for our NDX as we have $5,000 of extrinsic set for expiration today. Let's take a look at the markets. The SPY made little headway this week, giving back much of its early-week gains and closing at $544.51 (+0.32%). Cautious traders are pointing to a clear overextension away from the 200-day SMA and an overbought RSI reading as reasons to tread lightly. In fact, the last time this index was this far above its 200-day SMA was in May of 2021! This week, QQQ made history, with a daily close above an 80 RSI level for only the 13th time ever. Despite this strength, the week ended on a down note, closing at $480.18 (+0.19%). This index has been running hot and is currently farther away from its 200-day moving average than it’s been in nearly a year, suggesting the possibility for some cooling in the weeks to come. It’s hard to believe, but the small caps were the top gainer this week, closing at $200.35 (+0.82%). That said, is history about to repeat itself? In August of last year, a clear head and shoulders pattern led the way to a break below the 100-day SMA, and a very similar-looking setup appears to be forming now. NVDA, which is a big weekly trade for us, turned lower this week following a large bearish engulfing candle, resembling the March market top that front ran a 22% correction. With weak S&P seasonality on the horizon, prices may stay suppressed. At the same time, CEO Jensen Huang has cashed out over $90M worth of shares since June 15th. Let's take a look at I.V. and potential moves for the week. The 1 day VIX is still dreadfully low in the 8 dollar range. A reading above 15 is the sweet spot for getting Theta fairy setups and also gives us the best risk/reward ratio for our 0DTE's. Expected moves in the market this week: In other words...nothing new or exciting happening on the I.V. front. Not much to work with...again. Economic data on Friday showed that the U.S. S&P Global manufacturing PMI unexpectedly rose to 51.7 in June, stronger than expectations of 51.0. Also, the U.S. June S&P Global services PMI unexpectedly rose to a 2-year high of 55.1, stronger than expectations of 53.4. At the same time, U.S. existing home sales fell -0.7% m/m to a 4-month low of 4.11M in May, compared with the 4.08M consensus. In addition, the Conference Board’s leading economic index for the U.S. fell -0.5% m/m in May, weaker than the expected -0.4% m/m. “Investors should brace for drama. The second half of 2024 is shaping up to be a time of transition and volatility. The decisions that investors make now will be key to navigating this period effectively,” said Solita Marcelli at UBS Global Wealth Management. U.S. rate futures have priced in a 10.3% chance of a 25 basis point rate cut at the next central bank meeting in July and a 60.3% probability of a 25 basis point rate cut at the conclusion of the Fed’s September meeting. In the coming week, the May reading of the U.S. core personal consumption expenditures price index, the Fed’s preferred measure of inflation, will be the main highlight. Also, market participants will be eyeing a spate of other economic data releases, including the U.S. GDP (third estimate), CB Consumer Confidence Index, S&P/CS HPI Composite - 20 n.s.a., Richmond Manufacturing Index, Building Permits, New Home Sales, Crude Oil Inventories, Durable Goods Orders, Core Durable Goods Orders, Goods Trade Balance, Initial Jobless Claims, Wholesale Inventories (preliminary), Pending Home Sales, Personal Income, Personal Spending, Chicago PMI, and Michigan Consumer Sentiment Index. Several notable companies like Nike (NKE), FedEx (FDX), Micron Technology (MU), Walgreens Boots Alliance (WBA), General Mills (GIS), and Carnival (CCL) are slated to release their quarterly results this week. Investors will also gain further insights into the artificial intelligence landscape this week as investor favorite Nvidia hosts its annual shareholder meeting on Wednesday. In addition, several Fed officials will be making appearances throughout the week, including Daly, Cook, Bowman, and Barkin. Meanwhile, investors will be closely watching the first U.K. prime ministerial and U.S. presidential debates scheduled for this week, alongside the first round of voting in the French legislative election scheduled for this weekend. The U.S. economic data slate is mainly empty on Monday. With the pause in the markets Friday we are closer to sell signals than buys as we start the week. One ominous sign that I don't think is getting enough airplay is the huge divergence in the markets. With the SPY and QQQ bouncing around ATH's the overall market is seeing more and more selling. Take a look at the SPY vs. the equal weighted RSP. It's largely been tech and semi's and A.I. driven stocks holding this market up. The rest of the market is struggling. If TSLA and NVDA continue to be weak it could be the catalyst to pull the broader markets down. Our VTI swing trade is flashing a short signal. Add to that the fact that the technicals have swung back to the dreaded neutral rating today. Today could be key for the bulls if they want to hold on to any momentum. We are back to a full week of potential earnings trades with FDX, CCL, MU, PAYX, GIS, LEVI, NKE, WBA all on our potentals list. Our trade docket for today: /NG, /HG, /ZN, CCL, DELL, DIA, ODTE's, GLD, PLTR, IWM, CRM, NVDA, PYPL, SHOP, WYNN, UPST, SPY/QQQ 4DTE, VTI, NVDA. My lean today is bearish. With finishing last week with a week close and the neutral rating technically today as well as the VTI flashing sell I'm leaning to the downside today. Intra-day levels for me: /ES; 5539/5545/5550/5556 to the upside. 5529/5519/5513/5509 to the downside. As you can see, the range is very tight today as is normal on a neutral rated day but there is an open air pocket below support if we start to drop. /NQ; 20009/20091/20188/20248 to the upside. 19990* (key support) 19849/19787/19694 to the downside. Bitcoin: Is back to a critical support level it established in early May. 65,908 is now resistance and 60,694 is critical support. A break below that and there could be some downside potential. Let's have a great day!

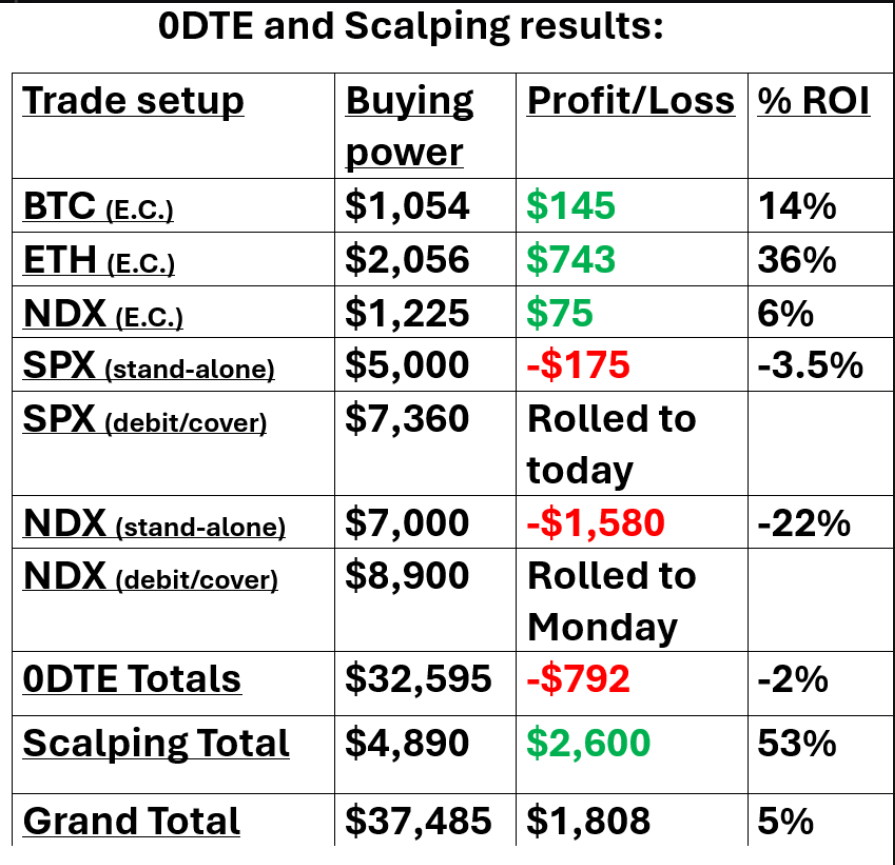

Yesterday was a mixed bag for me with most of our expiring trades working well but we needed to roll a couple of our 0DTE's. I finally had a good day scalping which was nice. It seems like its been forever that we got some good price action and we caught some good reversals throughout the day. Our Event contract 0DTES were a big help with ETH bringing in a 36% return. Our SPX stand alone was so close to profits but just couldn't hold it into the close. Our SPX debit roll could be a huge payoff today with approx. $4,500 of profit but it didn't cash flow for us yesterday. The NDX got run over and we booked a loss on the stand alone and are continuing to work the debit cover. Let's look at the markets: Going into yesterday we were on a seven day winning streak. That usually doesn't last and as expected, we got a reversal yesterday. The DOW however had one of its strongest days in a while. It now joins the SPY an QQQ above their 50DMA. The lowly IWM is the remaining laggard. We didn't get an overnight Vampire trade on yesterday and that was primarily because the premium was lacking. That particular trade setup is very similar in nature to our Theta fairy which also has been scarce lately. One of our trading room members mentioned the one day VIX which is a good indication of where we are at volatility wise. While you can see it spiked yesterday, it really needs to be closer to 17 to get the premium we need for both of those trades. Lately it's been closer to 10! In yesterday’s trading session, Wall Street’s major indices ended mixed. Jabil (JBL) slumped over -11% and was the top percentage loser on the S&P 500 after the company cut its full-year revenue guidance. Also, Qualcomm (QCOM) slid more than -5% after the Wall Street Journal reported that Samsung’s new AI laptops faced operational issues with Windows 11 and the Qualcomm processor. In addition, Trump Media & Technology Group Corp. (DJT) tumbled over -14% following the SEC’s declaration that the company’s April S-1 registration statement had become effective. On the bullish side, Gilead Sciences (GILD) climbed more than +8% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after announcing that a Phase 3 PURPOSE 1 trial of its experimental therapy, lenacapavir, demonstrated 100% efficacy in the prevention of HIV in cisgender women. The Labor Department’s report on Thursday showed that the number of Americans filing for initial jobless claims in the past week fell -5K to 238K, compared with the 235K expected. Also, U.S. May housing starts unexpectedly fell -5.5% m/m to a 4-year low of 1.277M, well below the 1.370M consensus, while U.S. building permits unexpectedly fell -3.8% m/m to an almost 4-year low of 1.386M in May, weaker than expectations of 1.450M. In addition, the U.S. June Philadelphia Fed manufacturing index unexpectedly fell to a 5-month low of 1.3, weaker than expectations of 4.8. Minneapolis Fed President Neel Kashkari said Thursday that it would take a year or two to bring inflation back to 2%, given that wage growth might still be too high, suggesting interest rates could remain higher for longer. Also, Richmond Fed President Thomas Barkin stated that he requires additional clarity on the trajectory of inflation before cutting interest rates. “My personal view is let’s get more conviction before moving,” Barkin said. U.S. rate futures have priced in a 10.3% chance of a 25 basis point rate cut at July’s monetary policy meeting and a 59.5% probability of a 25 basis point rate cut at the September meeting. Meanwhile, Wall Street is preparing for a quarterly event known as triple witching, during which derivatives contracts linked to equities, index options, and futures expire, prompting traders collectively to either roll over their current positions or initiate new ones. About $5.5 trillion of options are set to expire today. Today, all eyes are focused on the U.S. S&P Global Manufacturing PMI preliminary reading, set to be released in a couple of hours. Economists, on average, forecast that the June Manufacturing PMI will come in at 51.0, compared to the previous value of 51.3. Also, investors will focus on the U.S. S&P Global Services PMI, which stood at 54.8 in May. Economists foresee the preliminary June figure to be 53.4. U.S. Existing Home Sales data will come in today. Economists foresee this figure to stand at 4.08M in May, compared to the previous number of 4.14M. The U.S. Conference Board Leading Index will be reported today as well. Economists expect May’s figure to be -0.4% m/m, compared to the previous figure of -0.6% m/m. Our trade docket today is full of expirations so some of these with a question mark may expire fully profitable on their own. /MCL?, /ZC, /ZN?, CCL?, DIA?, GLD?, IWM?, LULU, MSTR, ODTE's, NVDA, ORCL?, PYPL?, QQQ?, SHOP, SMCI?, SPY?, TSLA?, UPST?, VTI?, WYNN. Intra-day levels for me: /ES; 5540/5548/5555/5566 to the upside. 5518/5506/5495/5481 to the downside. /NQ; 20094/20181/20250/20337 to the upside. 19940/19853/19787/19694 to the downside. Bitcoin; Continues to weaken. 65,934 is resistance. 62,409 is new support. My bias for today is slightly bullish. Futures are still down and PMI is still to come so that may all change but I think we get a slight rebound from yesterday. Have a great weekend folks. See you all Monday.

Welcome back traders! I hope everyone had a nice break yesterday. It feels a little strange to have a mid-week break but I got some stuff done so it was useful. Our trading on Tues. went well. Although I continue to lag in my scalping results. Let's take a look at the markets: In Tuesday’s trading session, Wall Street’s main stock indexes closed higher, with the benchmark S&P 500 posting a new all-time high. Nvidia (NVDA) gained over +3% after Rosenblatt Securities raised its price target on the stock to $200 from $140. Also, Micron Technology (MU) advanced more than +3% after Bank of America added the stock to its “U.S. 1 List.” In addition, Silk Road Medical (SILK) surged over +24% after Boston Scientific entered into a definitive agreement to acquire the company for about $1.16 billion, or $27.50 a share. On the bearish side, Lennar Corporation (LEN) slumped about -5% after the homebuilder provided weaker-than-expected Q3 new orders and home deliveries guidance. Economic data on Tuesday showed that U.S. retail sales edged up +0.1% m/m in May, weaker than expectations of +0.3% m/m, while April’s reading of unchanged m/m was revised downward to -0.2% m/m. Also, U.S. May core retail sales unexpectedly fell -0.1% m/m, weaker than expectations of +0.2% m/m. At the same time, U.S. industrial production climbed +0.9% m/m in May, stronger than expectations of +0.3% m/m. In addition, U.S. May manufacturing production advanced +0.9% m/m, stronger than expectations of +0.3% m/m. New York Fed President John Williams stated on Tuesday that the U.S. economy is “moving in the right direction” but stressed that decisions on the timing or extent of policy easing this year would hinge on incoming economic data. Also, Fed Governor Adriana Kugler indicated it would likely be suitable for the central bank to reduce rates “sometime later this year” if economic conditions evolve as she expects. In addition, Dallas Fed President Lorie Logan said, “From a monetary policy perspective, we’re in a good position; we’re in a flexible position to watch the data and be patient. We’re going to need to see several months of that data to really have confidence in our outlook that we’re headed to 2% on inflation.” At the same time, St. Louis Fed President Alberto Musalem said U.S. interest rate cuts could be delayed for some time, indicating it’s more likely to take “quarters” rather than months to see data supporting a reduction. Also, Boston Fed President Susan Collins said, “It is too soon to determine whether inflation is durably on a path back to the 2% target, and this process may just take more time than previously thought.” Finally, Richmond Fed President Thomas Barkin described recent U.S. inflation figures as “very encouraging,” but emphasized the need for continued progress toward the Fed’s 2% goal. Meanwhile, U.S. rate futures have priced in a 10.3% chance of a 25 basis point rate cut at the next FOMC meeting in July and a 57.9% chance of a 25 basis point rate cut at September’s policy meeting. On the earnings front, notable companies like Accenture (ACN), Kroger (KR), Darden Restaurants (DRI), Jabil (JBL), and Winnebago (WGO) are slated to release their quarterly results today. On the economic data front, all eyes are focused on the U.S. Philadelphia Fed manufacturing index, set to be released in a couple of hours. Economists, on average, forecast that the June Philadelphia Fed manufacturing index will stand at 4.8, compared to the previous value of 4.5. Also, investors will focus on U.S. Initial Jobless Claims data. Economists estimate this figure to arrive at 235K, compared to last week’s number of 242K. The U.S. Building Permits (preliminary) and Housing Starts data for May will be reported today. Economists forecast Building Permits to be 1.450M and Housing Starts to be 1.370M, compared to the previous numbers of 1.440M and 1.360M, respectively. Technically we are still holding onto the bullish bias. With the SPY and QQQ holding at these ATH's and the DIA and IWM still trying to get back above their respective 50DMA levels. My market bias for today is neutral. Technicals are all bullish but we've been on a very long, seven day, sustained run to the upside in the SPX. We are due for a pause. Trade docket for today: /ZC, KBH, All 0DTE's, NVDA, ORCL, PLTR, SMCI, SPCE, LULU, VTI, SPY/QQQ Intra-day levels for me: /ES; 5513/5518/5528/5532 to the upside. 5501/5491/5482/5473 to the downside. /NQ; 20040/20094/20153/20209 to the upside. 19946/19903/19849/19795 to the downside. Bitcoin; Resistance 67495. Support 64771. Let's have a great day!

Good morning traders. The market is closed tomorrow so with a shortened week already ahead of us, I didn't get the best of starts yesterday. Let's see if I can get a better result today. My bias lean yesterday of neutral couldn't have been more off. We had a bullish trending day pretty much all day. Pushing the SPY and QQQ to new highs and even the lowly IWM and DIA are trying to push above their 50DMA's. Economic data on Monday showed that the U.S. Empire State manufacturing index rose to a 4-month high of -6.00 in June, stronger than expectations of -12.50. Philadelphia Fed President Patrick Harker said on Monday that he views one interest-rate cut as appropriate for this year according to his current forecast. Harker noted that a recent report showing a cooling of consumer prices in May was “very welcome,” yet emphasized that policymakers require more evidence to be assured that inflation is moving toward the central bank’s 2% goal. “If all of it happens to be as forecasted, I think one rate cut would be appropriate by year’s end,” Harker said. “Indeed, I see two cuts, or none, for this year as quite possible if the data break one way or another. So, again, we will remain data dependent.” Meanwhile, U.S. rate futures have priced in an 8.3% chance of a 25 basis point rate cut at the July FOMC meeting and a 55.0% chance of a 25 basis point rate cut at the conclusion of the Fed’s September meeting. Today, all eyes are focused on U.S. Retail Sales data, set to be released in a couple of hours. Economists, on average, forecast that May Retail Sales will stand at +0.3% m/m, compared to the previous number of 0.0% m/m. Also, investors will focus on U.S. Core Retail Sales data, which came in at +0.2% m/m in April. Economists foresee the May figure to be +0.2% m/m. U.S. Industrial Production data will be reported today. Economists expect May’s figure to be +0.3% m/m, compared to the previous number of 0.0% m/m. U.S. Manufacturing Production data will come in today. Economists forecast this figure to stand at +0.3% m/m in May, compared to the previous figure of -0.3% m/m. U.S. Business Inventories data will be reported today as well. Economists foresee this figure to come in at +0.3% m/m in April, compared to the previous number of -0.1% m/m. In addition, market participants will be looking toward a batch of speeches from Fed officials Barkin, Collins, Logan, Kugler, Musalem, and Goolsbee. The U.S. stock markets will be closed on Wednesday for observance of the Juneteenth National Independence Day federal holiday. Trade docket for today: /MCL?, /ZN, DELL, DIA, DJT, FSLR, 0DTE's, NVDA, ORCL, PLTR SPY/QQQ. My lean today is neutral to slightly bullish : Intra-day levels for me: /ES; 5494/5502/5520/5528 to the upside. 5467/5452/5439/5424 to the downside. /NQ; 19978/20044/20119/20180 to the upside. 19899/19855/19771/19709 to the downside. Bitcoin; Weakness continues with 67504 resistance and 64690 the new support. Let's see if we can get some better results today folks!

Good morning traders! Welcome back to a shortened trading week with June19th off. We finished off the week strong with solid 0DTE results once again. Let's look at the markets as we start off the trading today: Buy signals are still holding: We start the week with the same divergence as last with the IWM and DIA still down below their 50DMA and the SPY and QQQ sitting near ATH's. After a powerful gap-up on Wednesday, the SPY stayed strong into the weekend, holding the gap and closing at $542.78 (+1.64%). The price now sits right below the 1.618 golden Fibonacci extension from the March highs, a key level to gain for a continuation move in the weeks to come. The QQQ was in a league of its own this week, closing well above the 1.618 golden Fibonacci extension at $479.19 (+3.51%). With AAPL leading the charge off the heels of its blockbuster WWDC event, this index is now showing its highest RSI reading since December 2023. IWM continued their doldrums this week, filling Wednesday’s gap up and closing nearly at the lows of the week at $198.73 (-1.22%). On Friday, the price also failed below the year-to-date anchored VWAP, which means the average buyer in 2024 is now underwater. If previous losses of this level are any indication, we could be stuck below it for a few weeks. Expected moves for the week: Trade docket for today: /ZN, CCL, DELL< DIA, NVDA, PFE, 0DTE's, SPY/QQQ 4DTE Economic data on Friday showed that the University of Michigan’s U.S. consumer sentiment index unexpectedly fell to a 7-month low of 65.6 in June, weaker than expectations of 72.1. Also, the University of Michigan’s June year-ahead inflation expectations were unchanged from May at 3.3%, above expectations of a decline to 3.2%, while 5-year implied inflation expectations rose to a 7-month high of 3.1%, higher than expectations of no change at 3.0%. At the same time, the U.S. import and export price indexes for May unexpectedly fell to -0.4% m/m and -0.6% m/m, respectively. “[Friday’s] softer-than-expected reading puts consumer sentiment at roughly the midpoint of where it has been over the past two years. The growth in prices may be coming down, but prices are not and that is weighing on households, particularly those in the middle most apt to feel the squeeze,” Wells Fargo’s Tim Quinlan said. Cleveland Fed President Loretta Mester stated Friday that she continues to view inflation risks as tilted to the upside despite the latest softer-than-expected inflation figures. The Cleveland Fed chief also said that the median projection of policymakers’ latest forecasts, which indicated only one interest-rate cut this year, aligns closely with her own outlook for the economy. Also, Minneapolis Fed President Neel Kashkari said Sunday that the central bank can take its time and monitor incoming data before initiating interest rate cuts. “We need to see more evidence to convince us that inflation is well on our way back down to 2%,” Kashkari said on CBS’s Face the Nation. U.S. rate futures have priced in an 11.4% chance of a 25 basis point rate cut at the next central bank meeting in July and a 60.0% chance of a 25 basis point rate cut at the September FOMC meeting. In other news, Goldman Sachs strategists raised their year-end target for the S&P 500 index to 5,600 from 5,200 on Friday, citing “milder-than-average negative earnings revisions and a higher fair value P/E multiple.” In the coming week, investors will be monitoring a spate of economic data releases, including U.S. Retail Sales, Core Retail Sales, Industrial Production, Manufacturing Production, Business Inventories, Philadelphia Fed Manufacturing Index, Building Permits (preliminary), Housing Starts, Current Account, Initial Jobless Claims, Crude Oil Inventories, S&P Global Composite PMI (preliminary), S&P Global Manufacturing PMI (preliminary), S&P Global Services PMI (preliminary), Existing Home Sales, and Leading Index. In addition, a slew of Fed officials will be making appearances throughout the week, including Williams, Harker, Cook, Barkin, Logan, Kugler, Kashkari, Daly, and Goolsbee. Meanwhile, the U.S. stock markets will be closed on Wednesday for observance of the Juneteenth National Independence Day federal holiday. My market bias for today is neutral. With the SPY/QQQ sitting at ATH's and the IWM/DIA lagging below their 50DMA we'll need a catalyst of some sort to get more movement. Intra0day levels: /ES; 5444/5449/5459/5466 to the upside. 5432/5426/5416/5407 to the downside. /NQ; 19749/19789/19857/20000 to the upside. 19689/19654/19595/19504 to the downside. Bitcoin: 67213 resistance. 65143 support. Let's have another great week!

Welcome to Friday folks! Yesterday ended up being just o.k. for me. We had the BTC 0DTE that couldn't have been closer to profits but just missed. That plus a poor scalping result and not getting enough capital into the other 0DTE's hurt my overall result. Still...green in green and not every every is a home run day. The markets are still flashing buy. But, there's a widening cavern bettween the NDX and SPX which are holding at ATH's and the IWM and DIA which are still lagging below their 50DMA. Futures are weak in the pre-market. Our trade docket for today is heavy and a little different from most Fridays where we are normally just de-risking positions and getting buying power in place for next week. We finally have some premium to work with and so it's important to get back to our normal business plan: /MCL, /HG, /ZN, GLD, DIA, ORCL, IWM, CRM, PYPL, SHOP, WYNN, ADBE, RH, BA, DELL, 0DTE's, NVDA, SMCI, XBI, PLTR. My bias today is neutral. We've got bullish technicals with lower futures and the IWM/DIA continue to drag on the SPY/QQQ. Intra-day levels for me: /ES; 5425/5433/5442/5451 to the upside. 5406/5398/5384/5377 to the downside. /NQ; 19620/19655/19693/19783 to the upside. 19525/19469/19420/19352 to the downside. Bitcoin; 69770 resistance/ 66379 support Let's have a good day folks and have a great weekend!

Welcome back traders! Yesterday was an interesting one for sure. My results ended up being just fine but still less than I had hoped for, to be frank. We always look forward to FOMC days when Powell gives testimony. While some traders just take the day off, we love the opportunity the expected volatility brings but yesterdays session was different. We had the added catalyst of CPI numbers and while the market loved the cooling print we got, that pretty much made up the whole days move, with Powell having very little impact. This took away the great scalping opportunity I thought we might get and also didn't allow us to commit as much capital to our 0DTE's as usual. Still a good day. Just below expectations. Markets are back to bullish! This likely means I'll need to stop loss my short VTI swing trade. Not much bearishness here. The big, last remaining bearish warning I can see is the (fairly large) divergence in the market that I noted in yesterdays blog. Today's trade docket is focused on generating some income with Scalping and our 0DTE's (possibly seven) and de-risking a couple other trades as well as creating some more efficent use of BP in our PM NVDA trade.: /HQ, VTI, /MNQ, BA, DIA, FSLR, NVDA, SMCI, 0DTE's. My lean today is bullish. I may or may not cover our bullish SPX debit 0DTE, depending on how much strength we get today. The Labor Department’s report on Wednesday showed consumer prices were unchanged on a monthly basis in May, marking the first flat reading since October 2023. On an annual basis, headline inflation unexpectedly eased to +3.3% in May from +3.4% in April, against expectations of no change at +3.4%. In addition, the core CPI, which excludes volatile food and fuel prices, eased to a 3-year low of +3.4% y/y in May, compared with +3.5% y/y expected and +3.6% y/y in April. Meanwhile, U.S. rate futures have priced in an 8.3% chance of a 25 basis point rate cut at the next central bank meeting in July and a 56.7% chance of a 25 basis point rate cut at the September FOMC meeting. On the earnings front, Photoshop maker Adobe (ADBE) is set to report its Q2 earnings results today. Today, all eyes are focused on the U.S. Producer Price Index in a couple of hours. Economists, on average, forecast that the U.S. May PPI will stand at +0.1% m/m and +2.5% y/y, compared to the previous figures of +0.5% m/m and +2.2% y/y. The U.S. Core PPI will also be closely watched today. Economists expect May’s figures to be +0.3% m/m and +2.4% y/y, compared to the previous numbers of +0.5% m/m and +2.4% y/y. U.S. Initial Jobless Claims data will be reported today as well. Economists estimate this figure to be 225K, compared to last week’s number of 229K. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.316%, up +0.54%. Intra-day levels: /ES; 5440/5447/5455/5466 to the upside and 5426/5418/5402/5386 to the downside. /NQ; 19669/19734/19783/20000 to the upside. 19576/19516/19459/19409 to the downside. Bitcoin; Still having trouble gaining traction. 69,225 resistance. 67,100 support. Have a great day today. Thanks to all our members who traded FOMC with me yesterday. It was a fun, interesting day.

|

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |