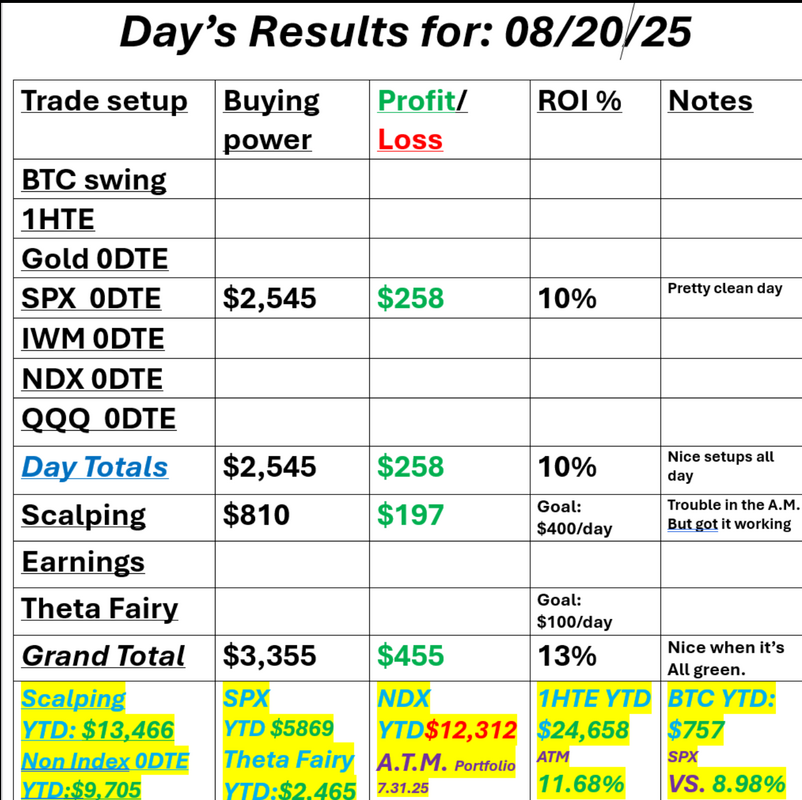

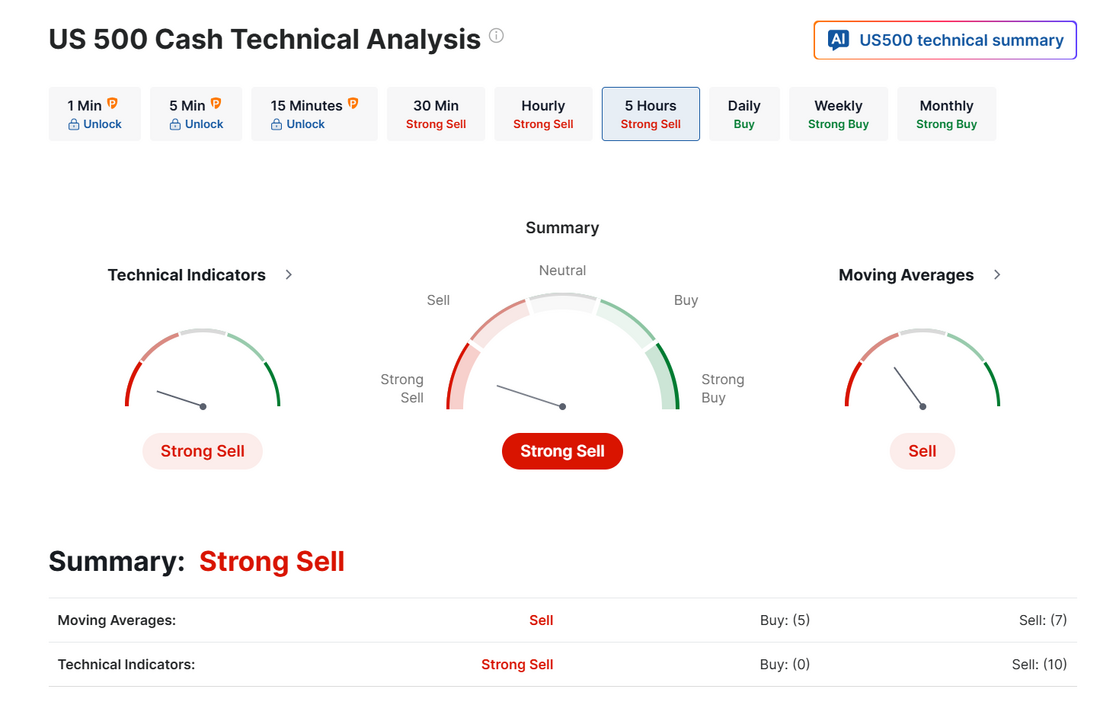

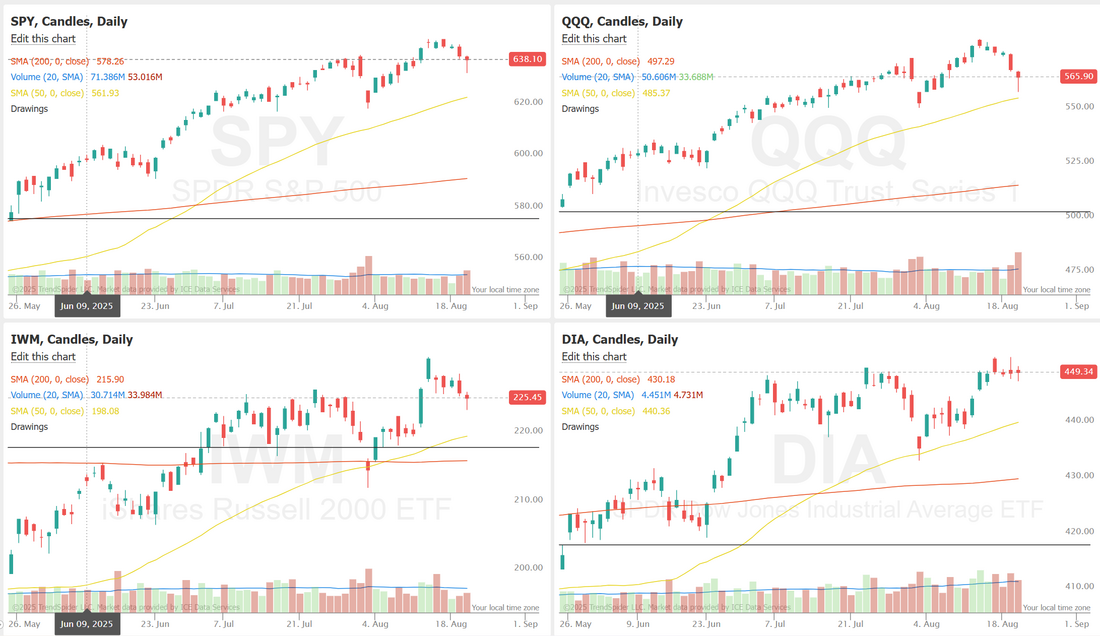

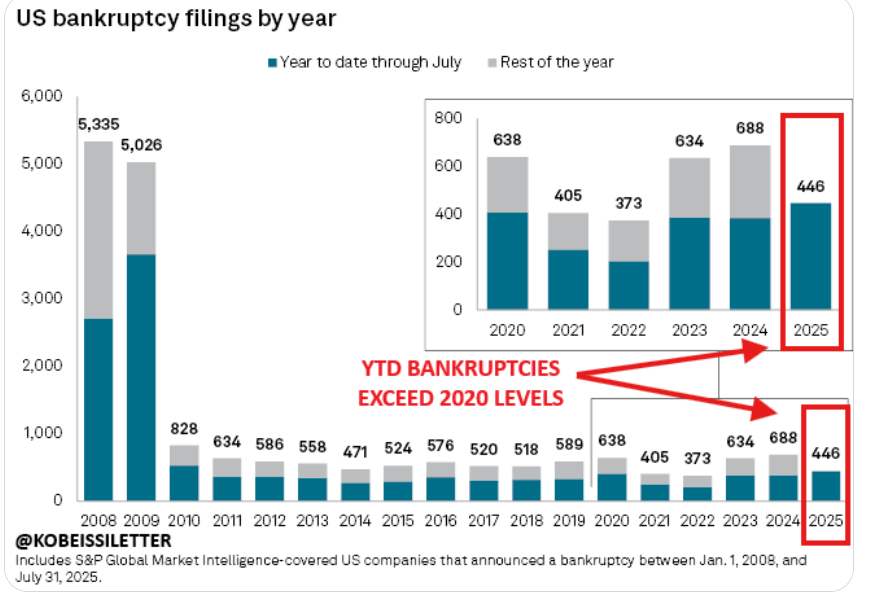

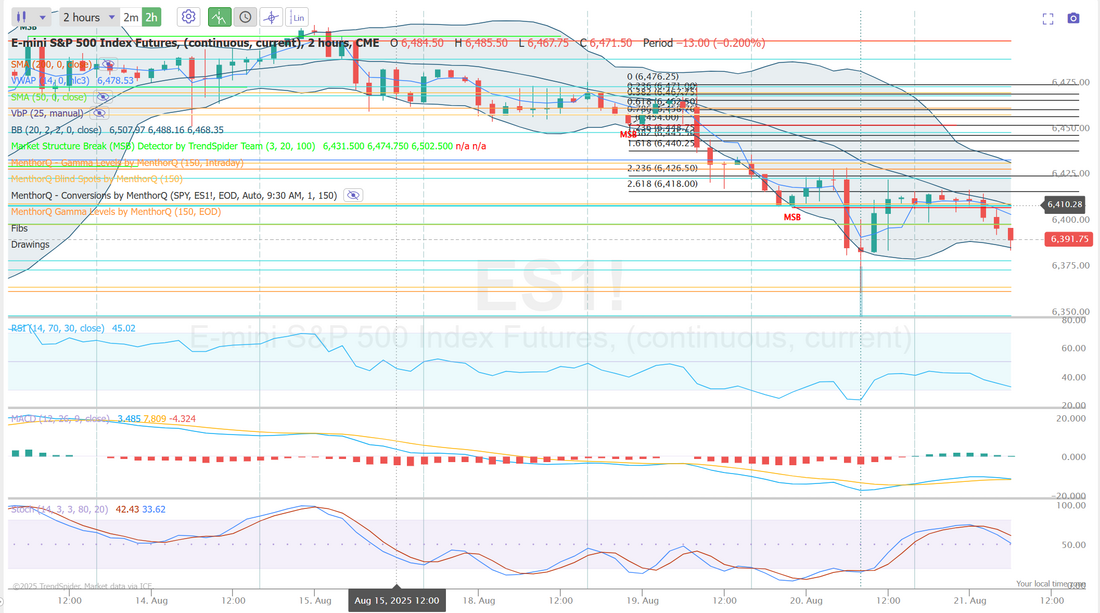

Market movement = Happy tradersThank you, thank you, thank you. As traders we just want movement. We don't even care what direction! We haven't had any for a while so the last couple of days have been heaven sent. Powell and Jackson Hole are in focus for Friday so I'm not sure how much action we'll get today but I am excited about the market potentially positioning, over the last few days for a roll over. We had a solid day yesterday. Not just that we made money but primarily that we were done well before the power hour. The first two hours of the day are really where we need to work our scalping. After that it's just too easy to get chopped up. Here's a look at my day yesterday: Let's take a look at the markets: Sell signals continue to hold. The roll over is looking more and more solid. September S&P 500 E-Mini futures (ESU25) are down -0.22%, and September Nasdaq 100 E-Mini futures (NQU25) are down -0.10% this morning, pointing to further losses on Wall Street, while investors await the Federal Reserve’s gathering at Jackson Hole, U.S. business activity data, and an earnings report from retail giant Walmart. The minutes of the Federal Open Market Committee’s July 29-30 meeting, released Wednesday, showed that most officials emphasized the risk of inflation as outweighing concerns about the labor market. Policymakers acknowledged concerns about higher inflation and weaker employment, but “a majority of participants judged the upside risk to inflation as the greater of these two risks,” according to the FOMC minutes. Also, officials debated whether tariffs would cause a one-time price increase or a more lasting inflation shock. “Several participants emphasized that inflation had exceeded 2% for an extended period and that this experience increased the risk of longer-term inflation expectations becoming unanchored in the event of drawn-out effects of higher tariffs on inflation,” the minutes said. In addition, many officials noted that it might take some time before the full impact of tariffs is reflected in consumer goods and services prices. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed mixed, with the S&P 500 dropping to a 1-1/2-week low and the Nasdaq 100 falling to a 2-week low. The Magnificent Seven stocks fell, with Tesla (TSLA) and Amazon (AMZN) sliding over -1%. Also, chip stocks slumped, with Intel (INTC) sinking about -7% to lead losers in the S&P 500 and Nasdaq 100, and Micron Technology (MU) slipping nearly -4%. In addition, Target (TGT) dropped more than -6% after the retailer appointed veteran Michael Fiddelke as its next chief executive officer, disappointing investors who had been hoping for an external hire to provide a fresh perspective. On the bullish side, Analog Devices (ADI) climbed over +6% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the semiconductor company posted upbeat FQ3 results and issued above-consensus FQ4 guidance. “Today feels like a test for the dip-buyers with data on PMIs on Thursday and Federal Reserve Chair Jerome Powell at Jackson Hole may prove to be market movers/narrative changers,” Andrew Tyler, head of global market intelligence at JPMorgan, wrote in a note to clients on Wednesday. The Kansas City Fed’s annual Economic Policy Symposium kicks off today in Jackson Hole, Wyoming. Chair Jerome Powell, in remarks on Friday, is expected to outline the central bank’s new policy framework. Investors are watching to see whether Powell confirms the market’s pricing for a September rate cut or pushes back by stressing that incoming data before the next policy meeting could change the outlook. They’re also seeking signals about the longer-term path of Fed cuts heading into next year. U.S. rate futures have priced in an 81.2% probability of a 25 basis point rate cut and an 18.8% chance of no rate change at the next FOMC meeting in September. On the economic data front, all eyes are focused on S&P Global’s flash U.S. purchasing managers’ surveys, set to be released in a couple of hours. They will give an up-to-date snapshot of how tariffs have impacted both activity and prices. Economists, on average, forecast that the August Manufacturing PMI will come in at 49.7, compared to last month’s value of 49.8. Also, economists expect the August Services PMI to be 54.2, compared to 55.7 in July. Investors will also focus on U.S. Existing Home Sales data. Economists foresee this figure coming in at 3.92 million in July, compared to 3.93 million in June. The U.S. Philadelphia Fed Manufacturing Index will be reported today. Economists anticipate the Philly Fed manufacturing index to stand at 6.8 in August, compared to last month’s value of 15.9. U.S. Initial Jobless Claims data will be released today. Economists estimate this figure will come in at 226K, compared to last week’s number of 224K. The Conference Board’s Leading Economic Index for the U.S. will be released today as well. Economists expect the July figure to drop -0.1% m/m, compared to the previous number of -0.3% m/m. On the earnings front, retail giant Walmart (WMT), along with notable tech players such as Intuit (INTU), Workday (WDAY), and Zoom Video (ZM), are set to report their quarterly figures today. Investors will keep a close eye on Walmart’s earnings following a mixed bag of results from retailers earlier this week. In addition, market participants will be anticipating a speech from Atlanta Fed President Raphael Bostic. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.309%, up +0.26%. The US has now seen 446 LARGE bankruptcy filings in 2025, officially +12% ABOVE pandemic levels in 2020. In July alone, the US saw 71 bankruptcies, marking the highest single-month total since July 2020. The gap between retail and professional investors have rarely been greater: Mom-and-pop investors have purchased ~$190 billion in US equity ETFs so far in 2025. At the same time, institutional investors have sold ~$40 billion. Remarkable divergence.  My lean or bias today is bearish. This rollover is starting to take hold (hopefully) and I don't think too many traders are wanting to take big positions before Powell's statement tomorrow. Trade docket for today: We've got another day where Gold and BTC (1HTE) are not in the premium range we want. That's o.k. Scalping and the SPX have offered enough potential for us to shoot for our $1,000 profit target. We are already off to a good start with an early morning /NQ scalp putting us up $360 dollars. I'll continue to look for scalping opportunities today with /MNQ and make SPX the main 0DTE focus. Let's take a look at the new intra-day /ES levels: 6400 is the big demarcation point. Above looks bullish. Below is bearish. 6409, 6417, 6426, 6435 are resistance levels. 6380, 6375, 6364, 6350 are support levels. I've got another great training module today on building your mental side of trading plus a couple cool (free) tools to help you be your best so make sure and tune in today. I look forward to seeing you all in the live trading room shortly. We've got some good stuff today!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |