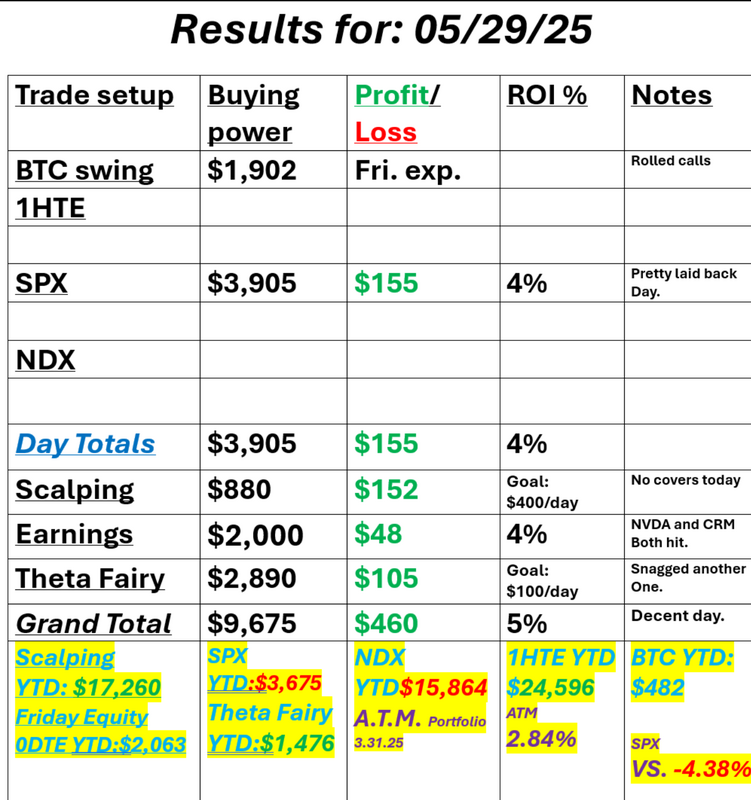

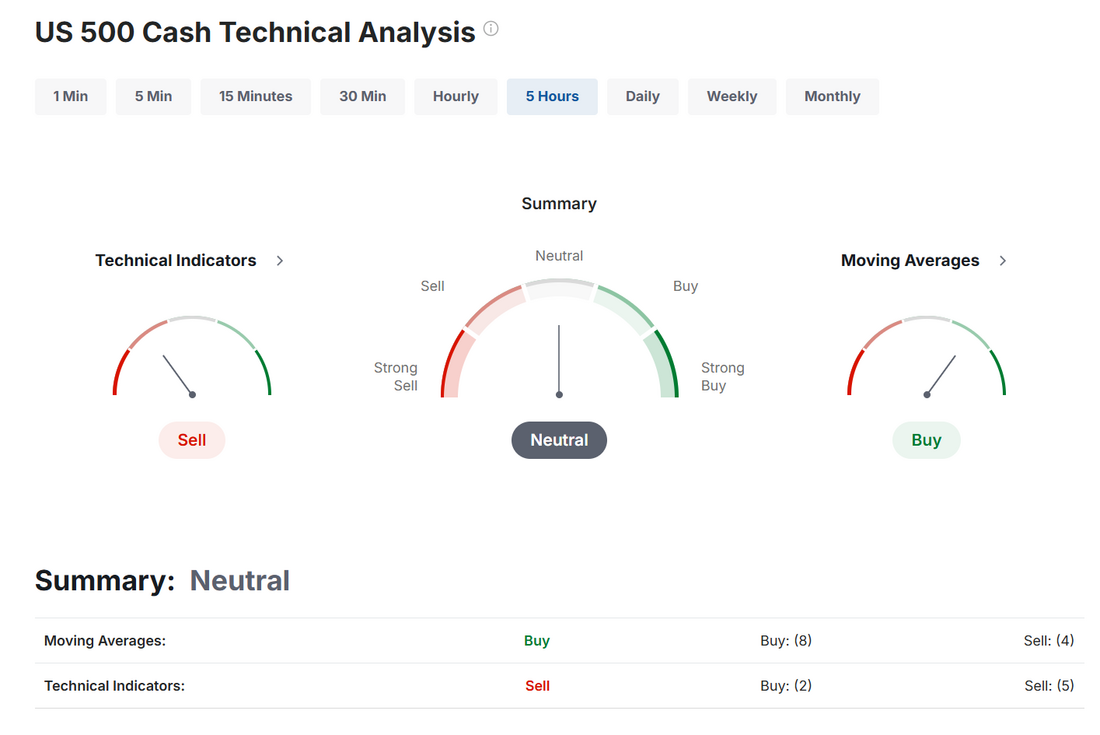

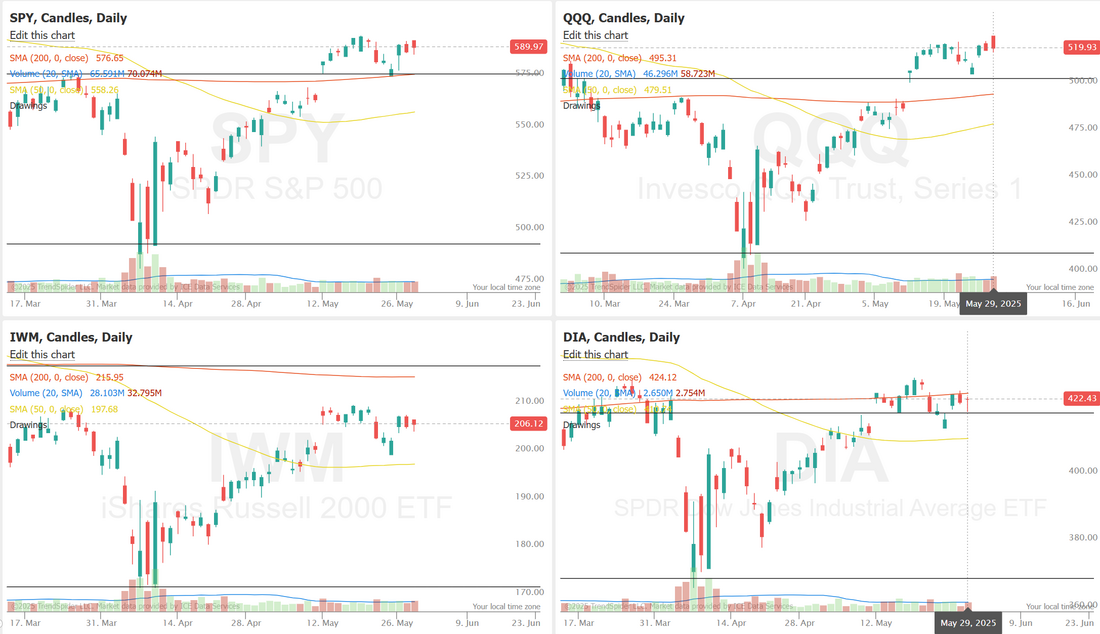

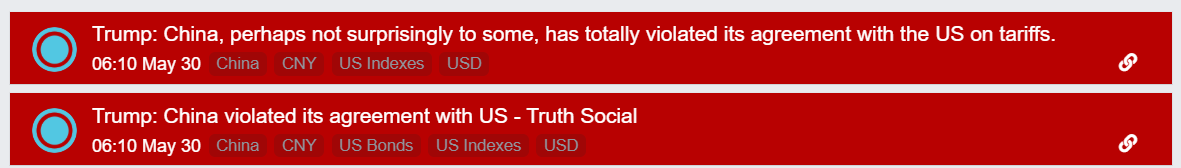

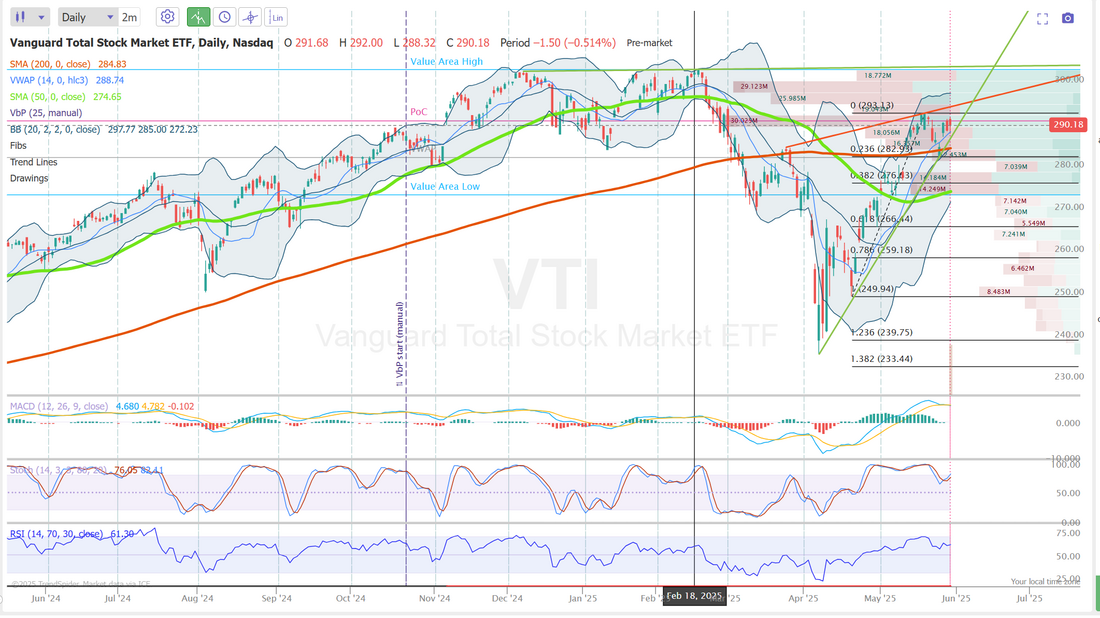

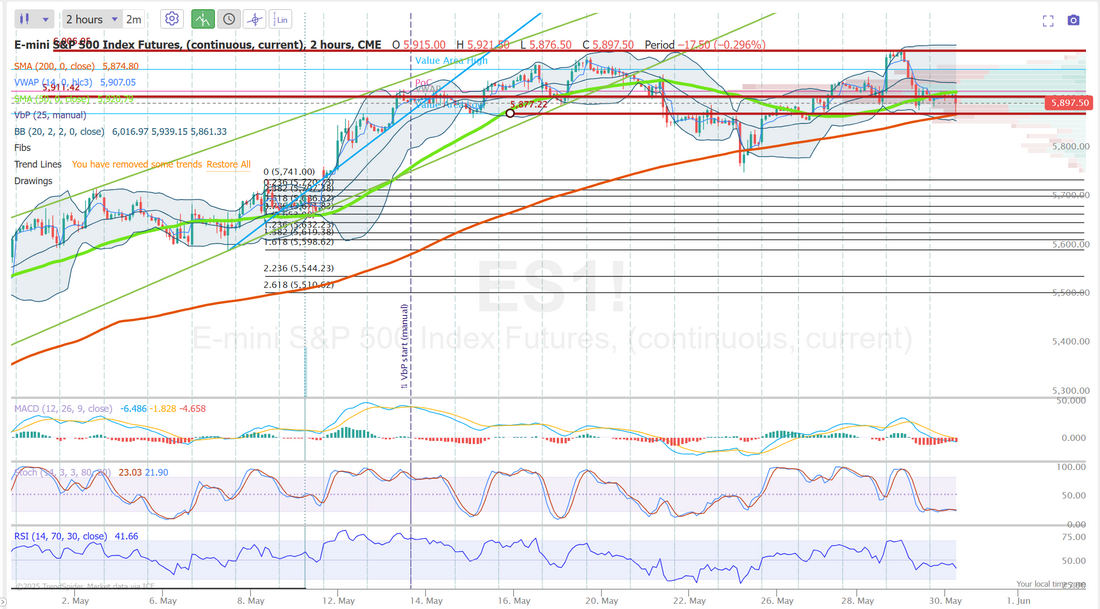

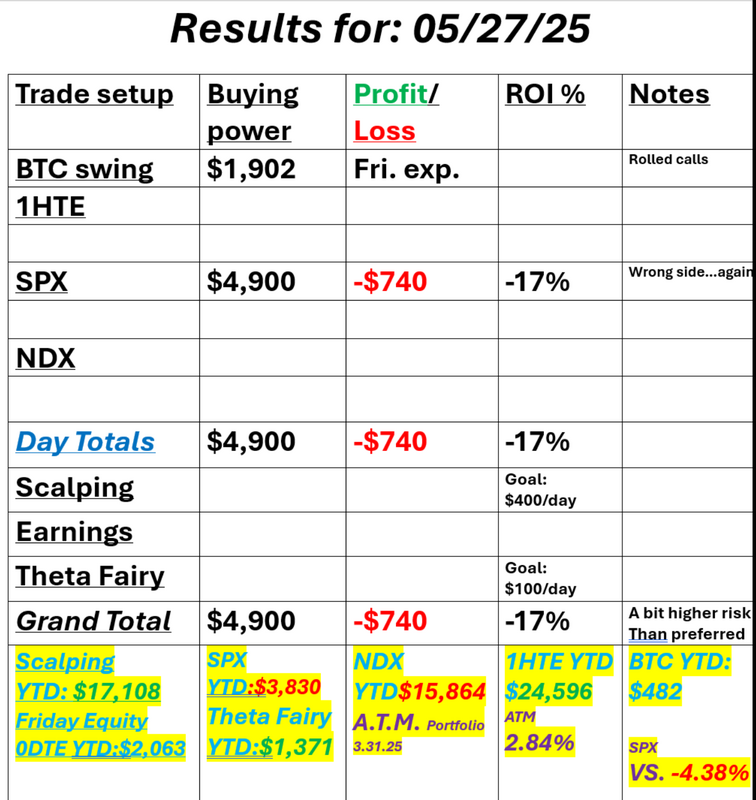

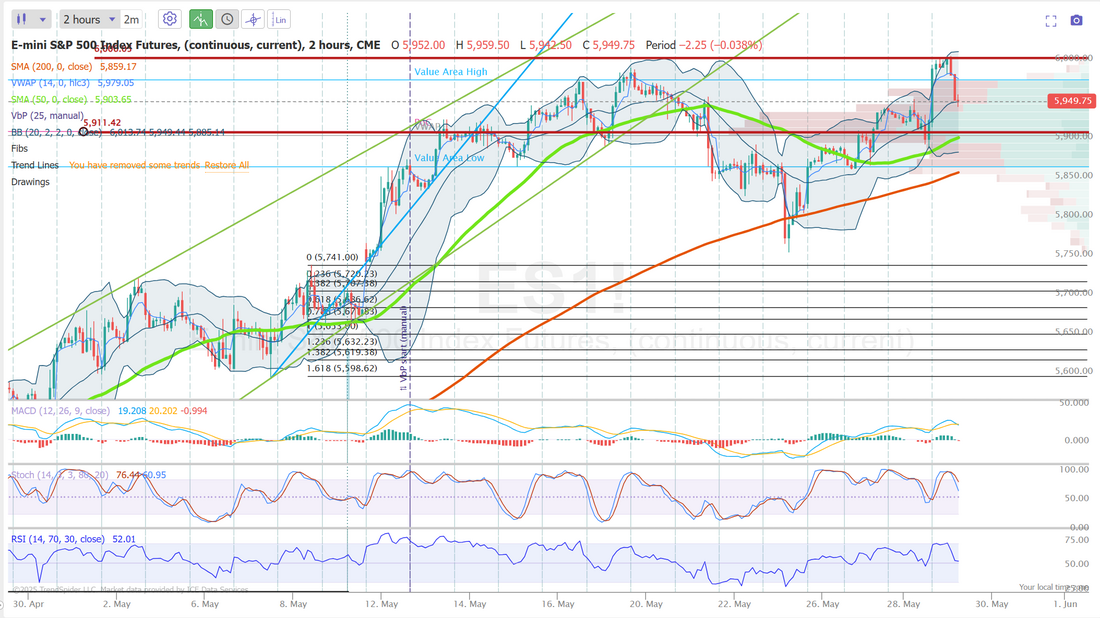

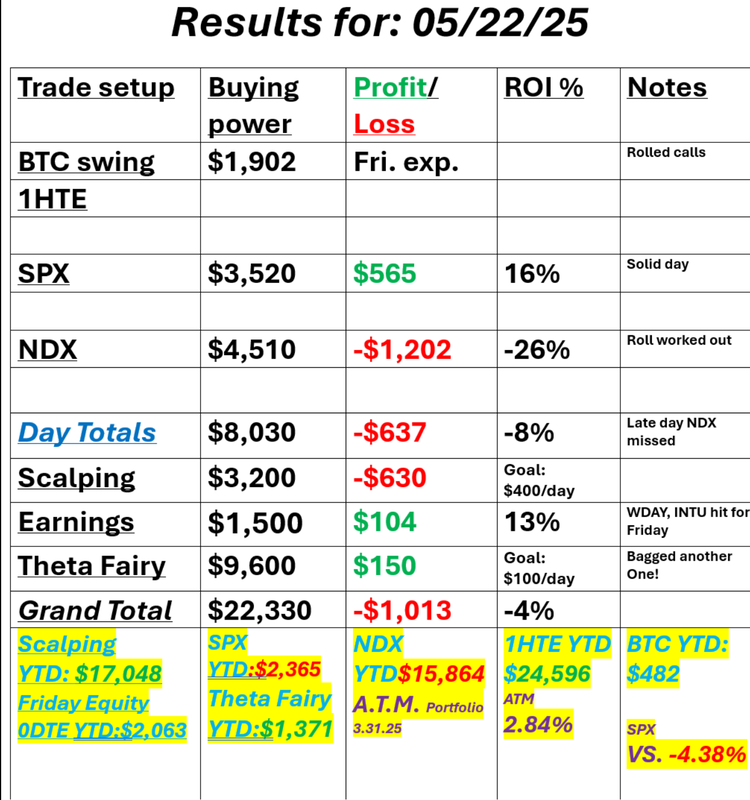

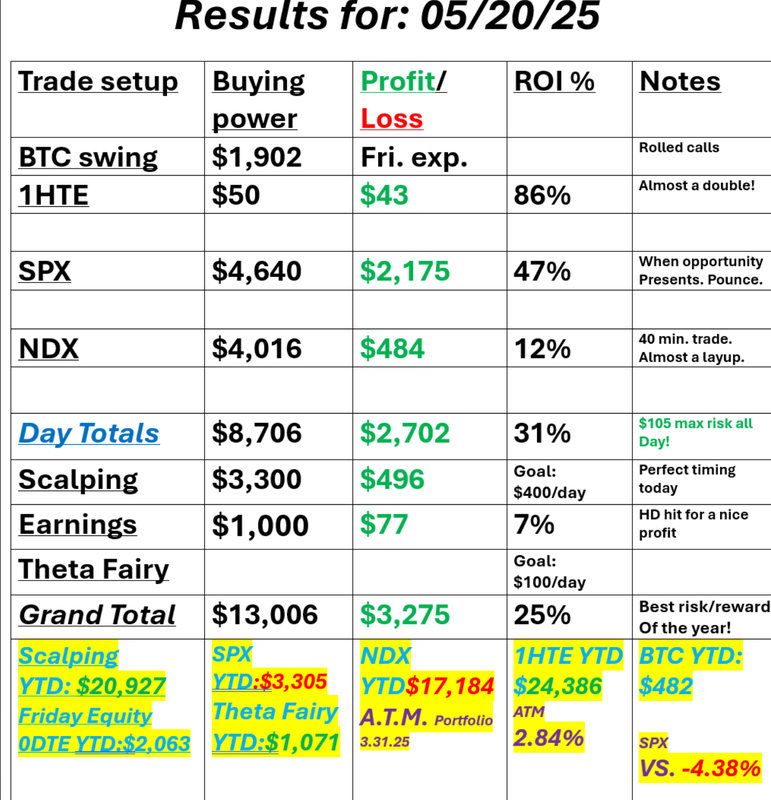

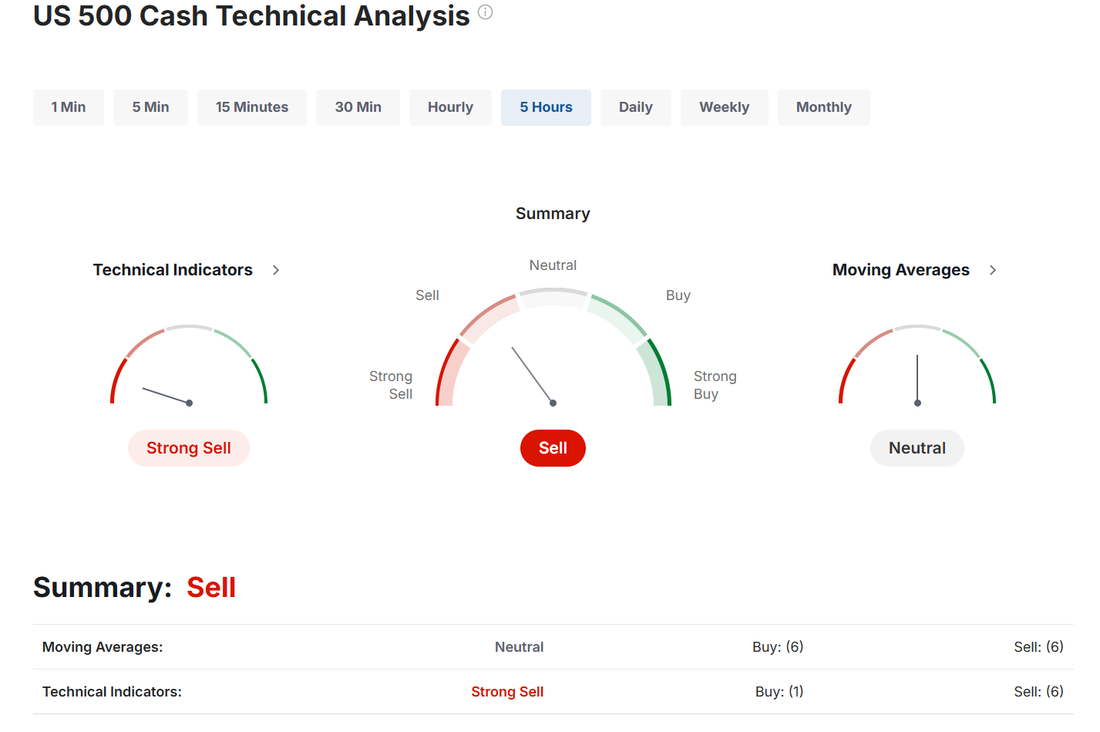

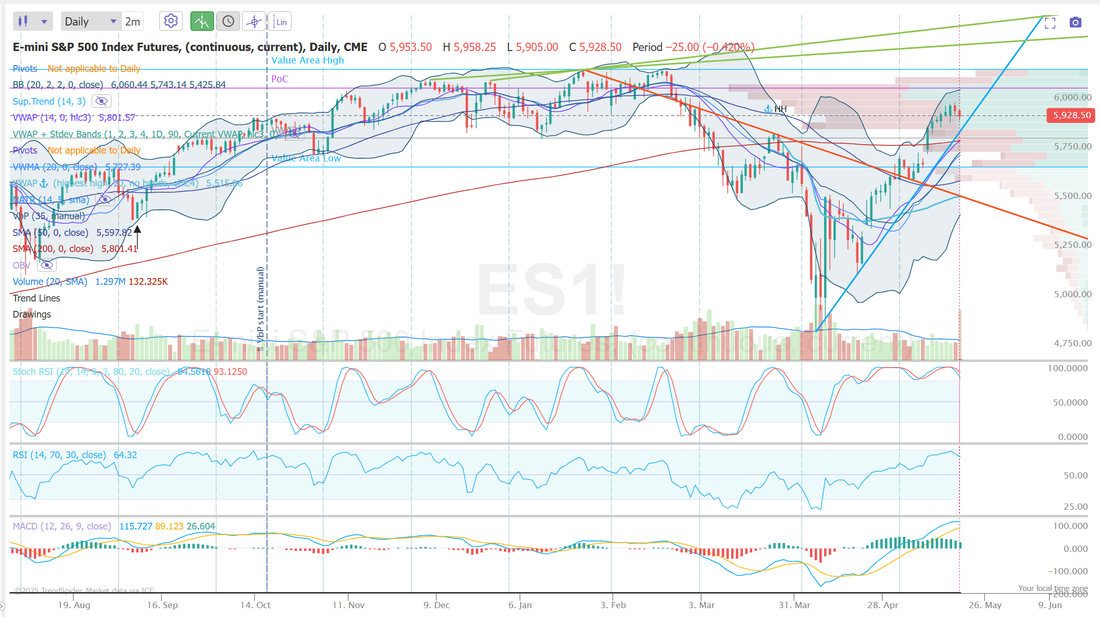

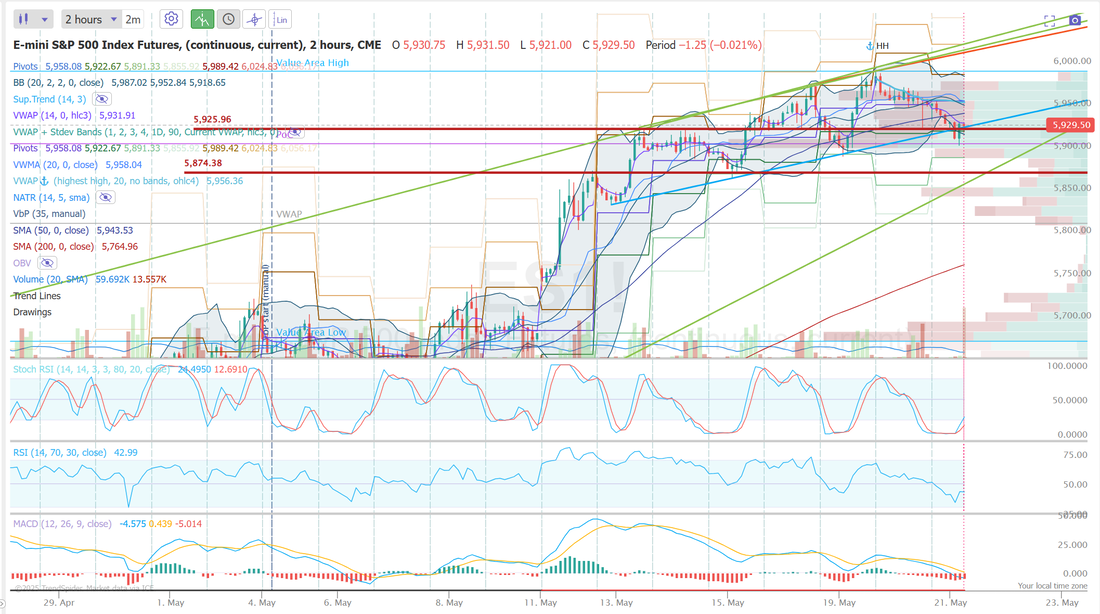

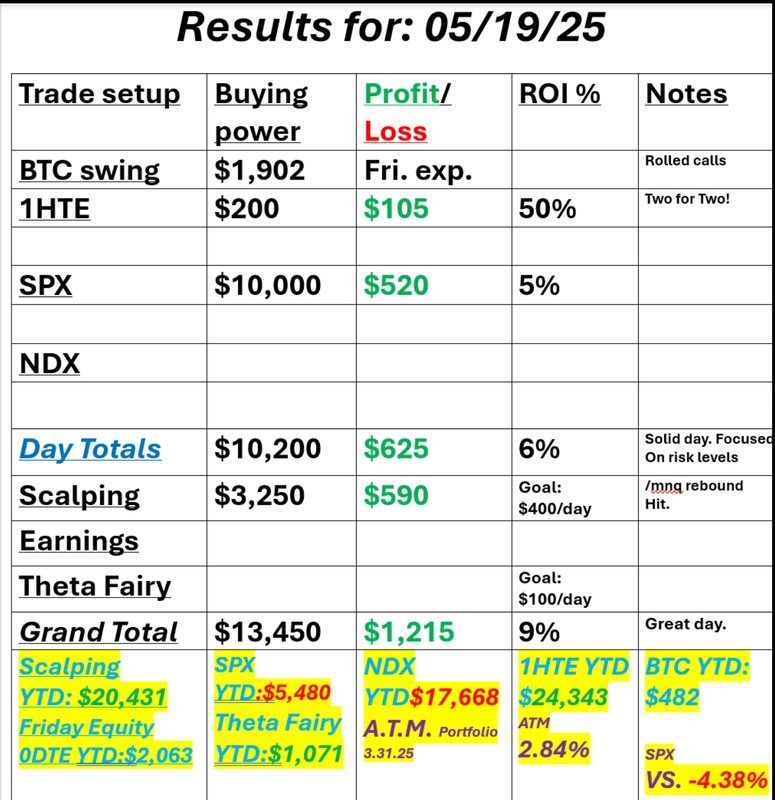

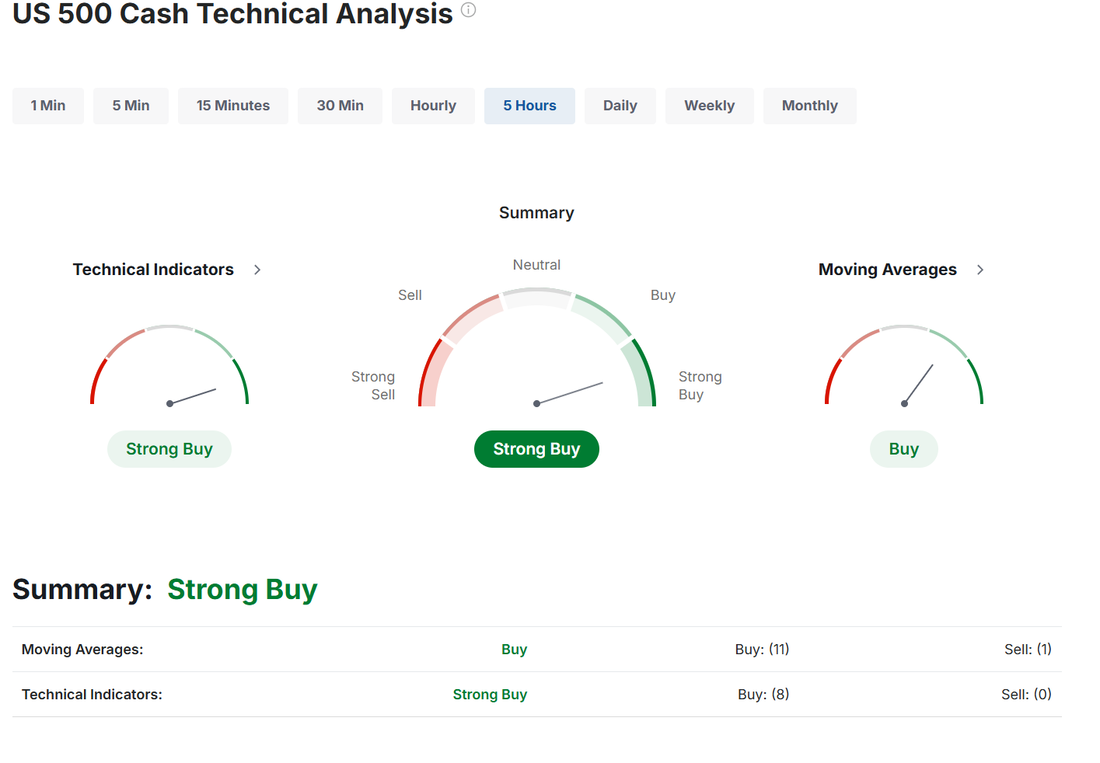

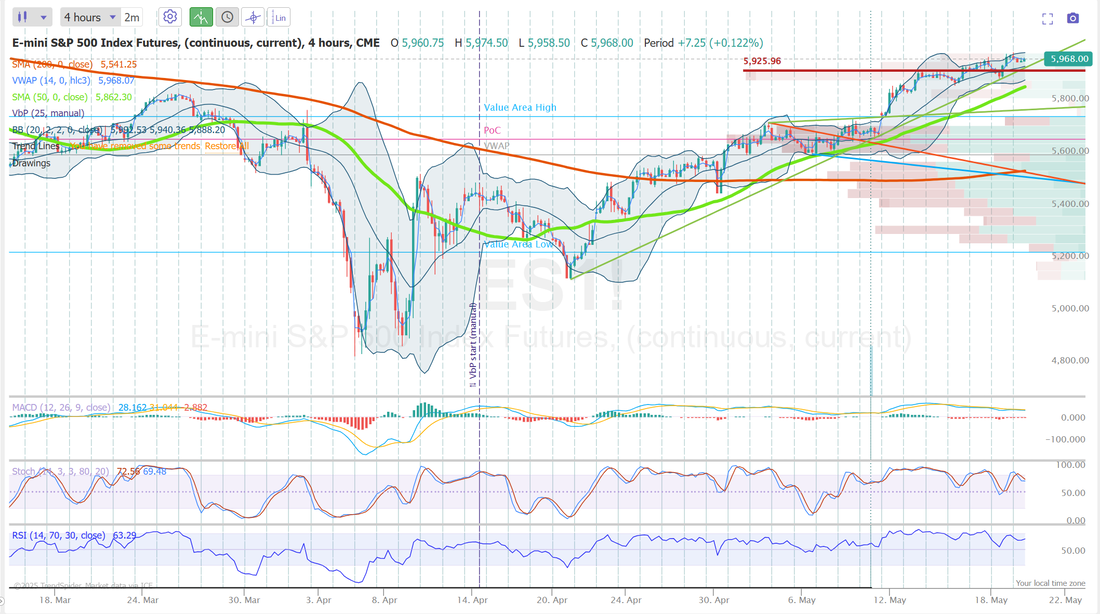

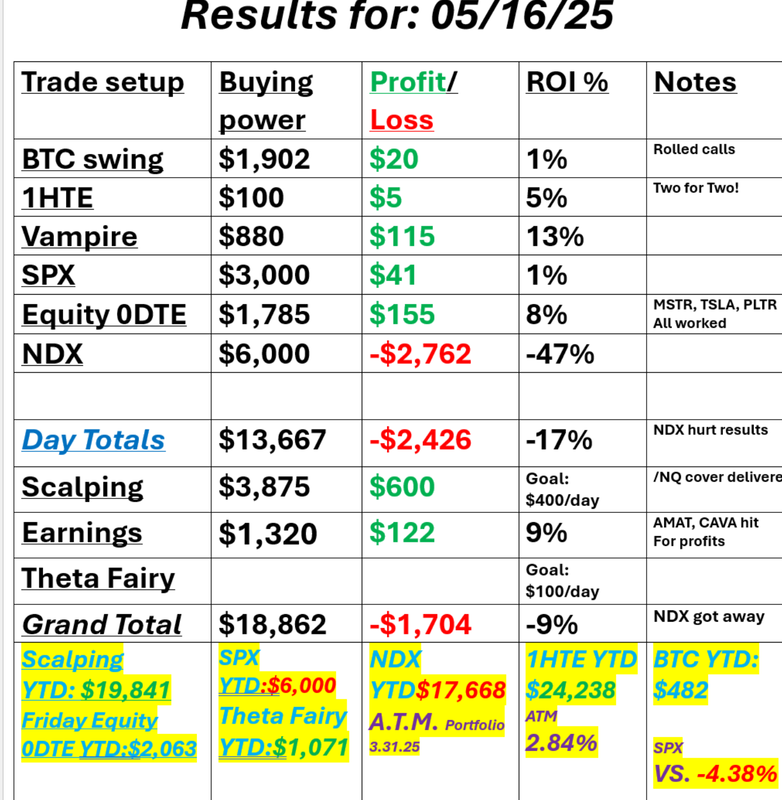

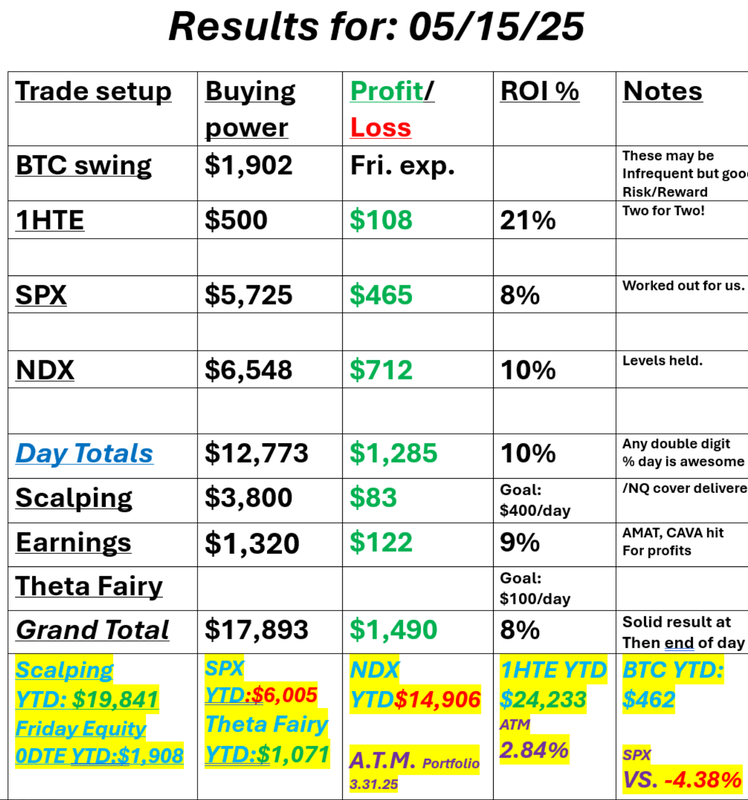

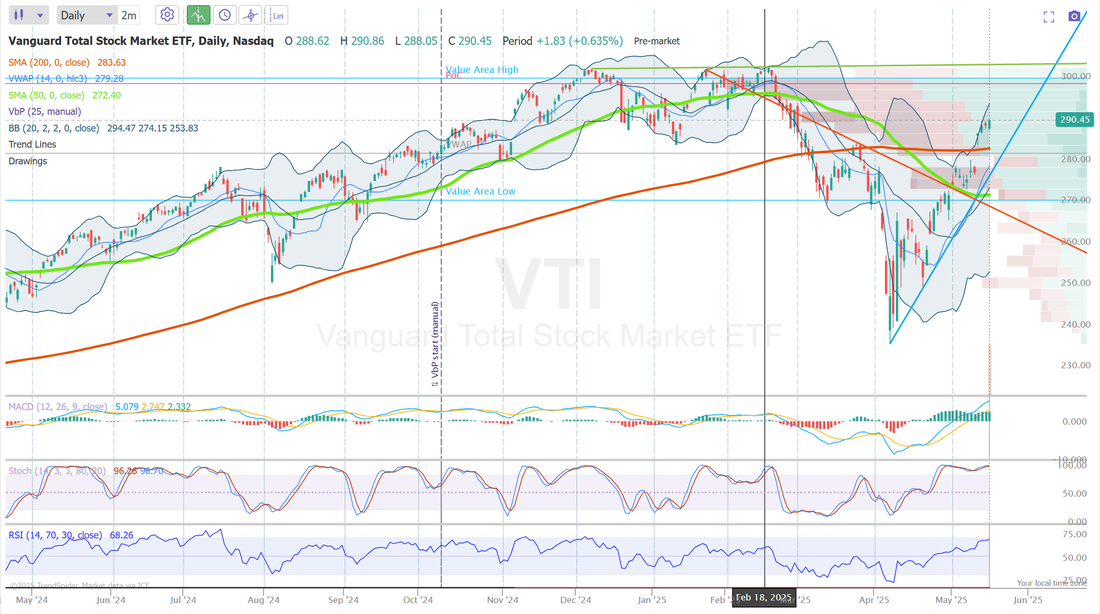

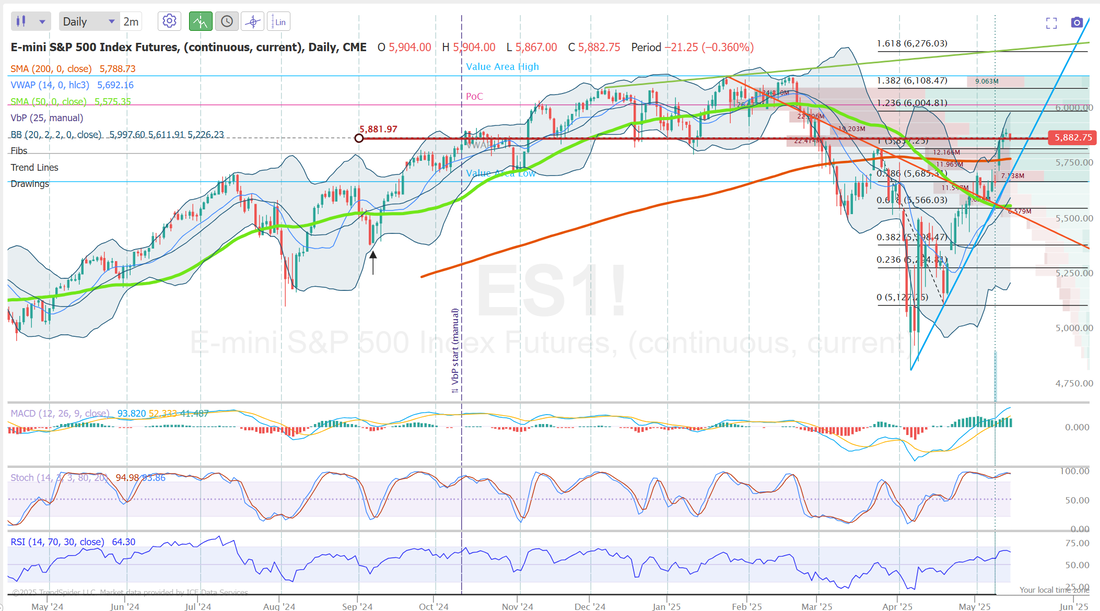

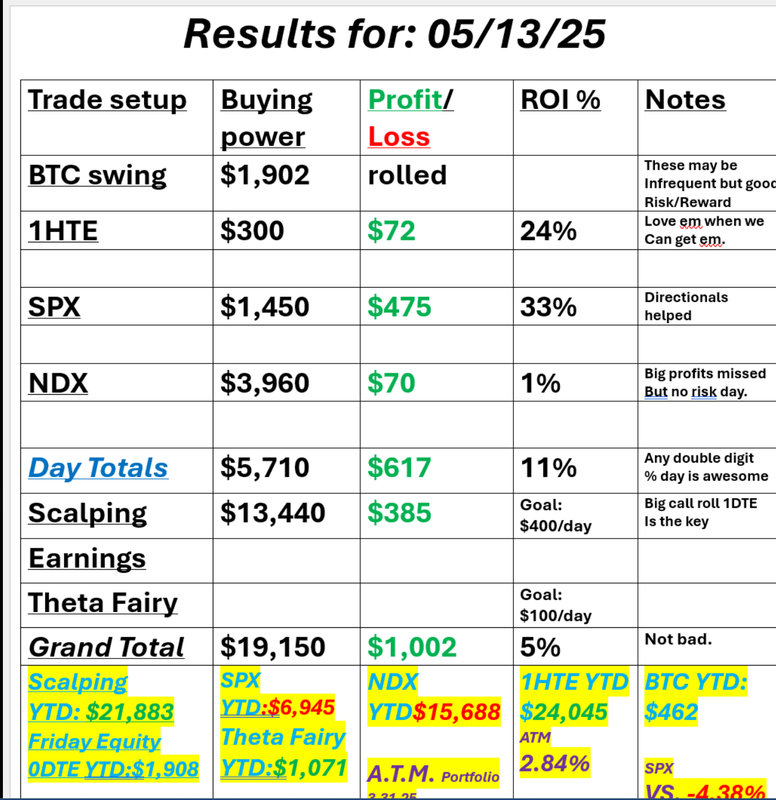

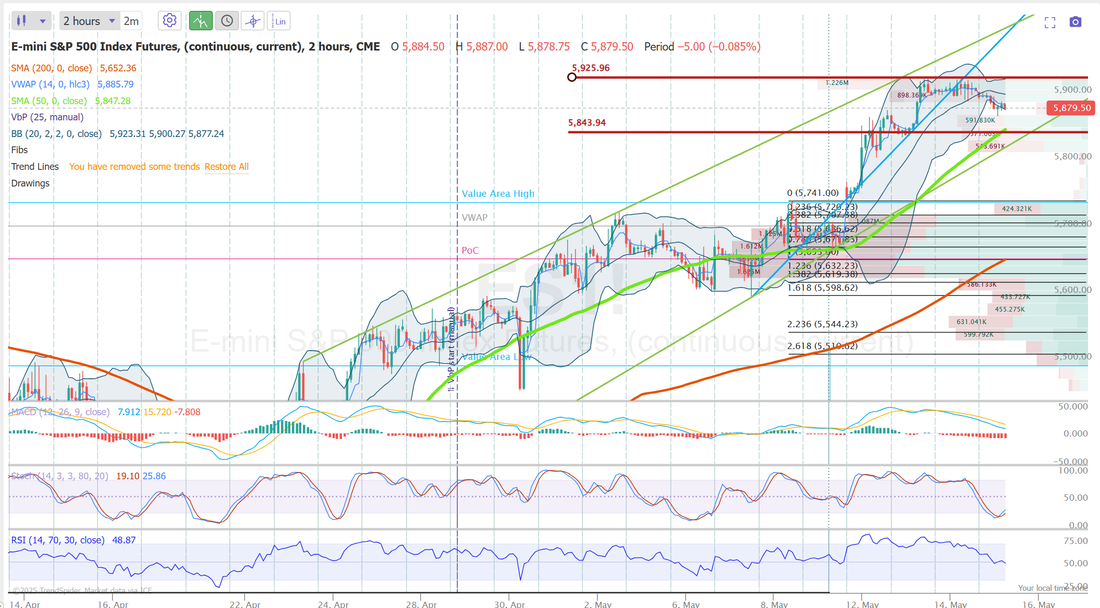

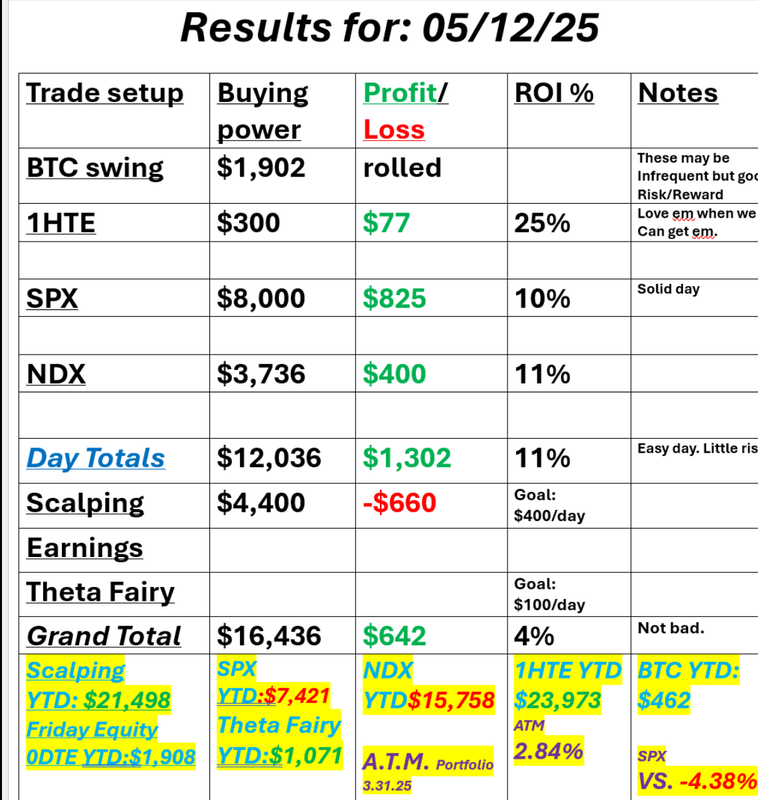

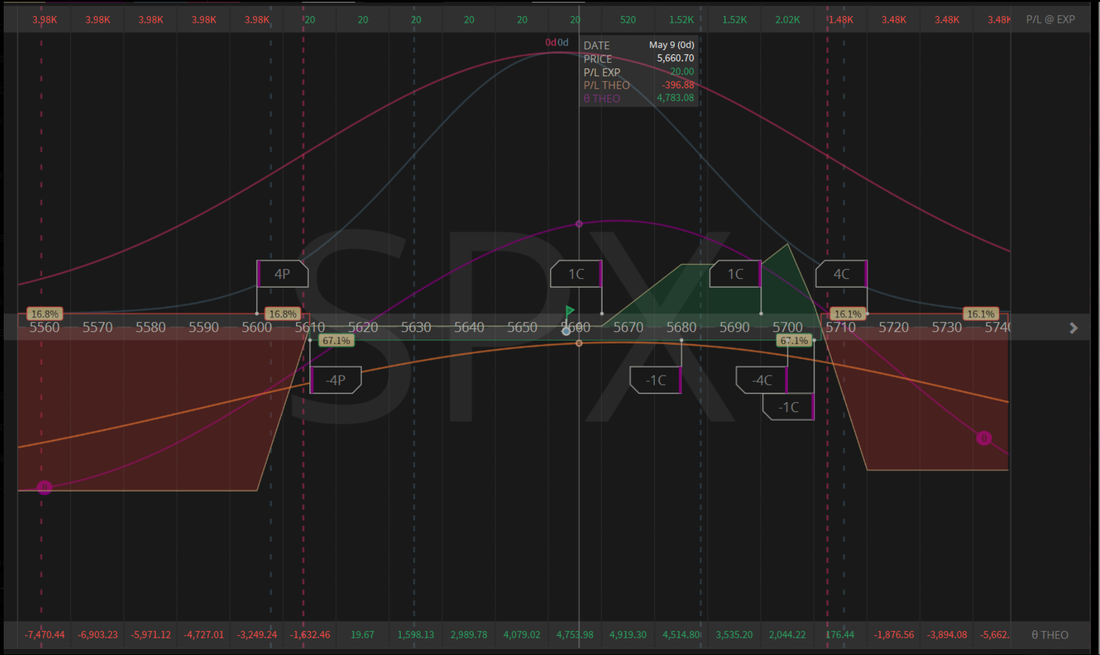

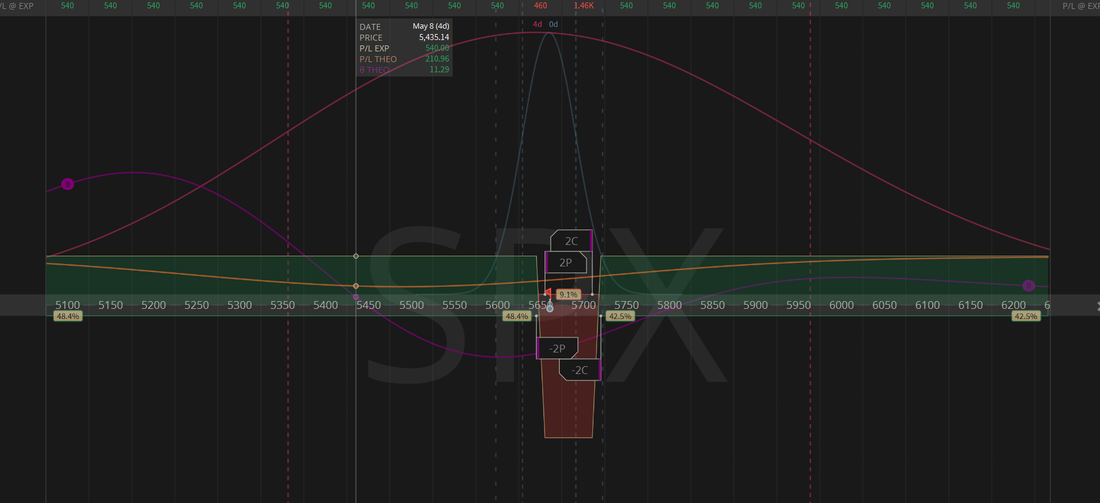

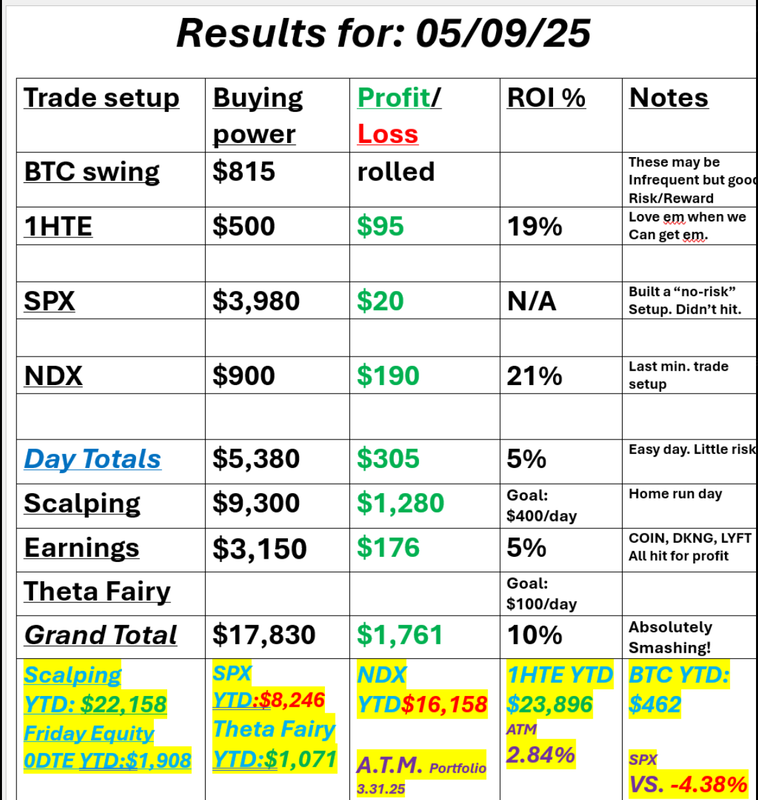

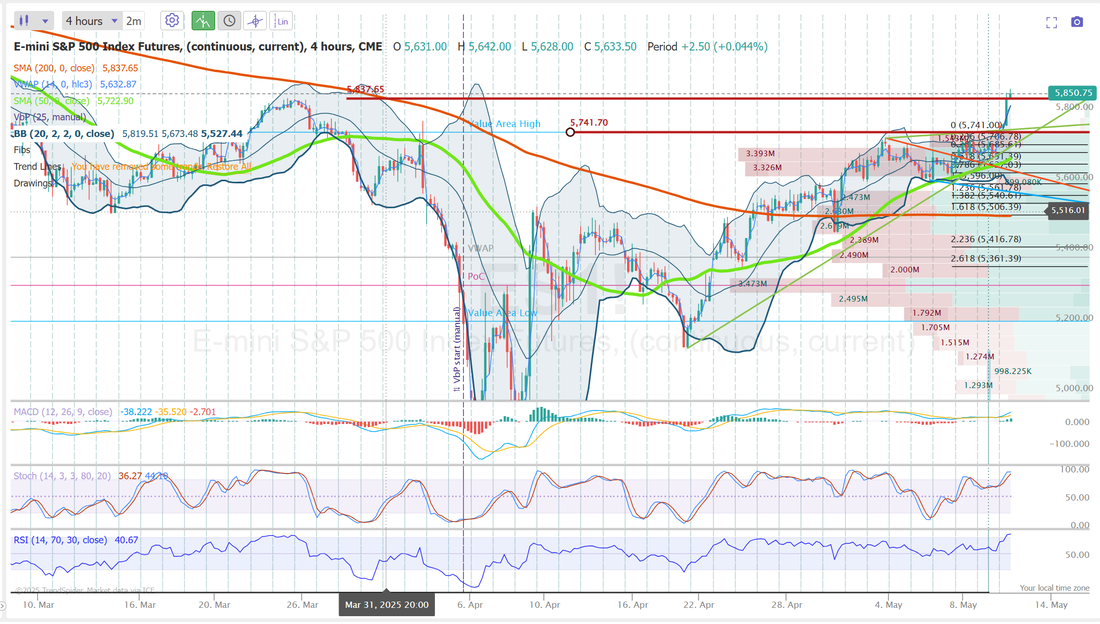

Not so fast...The market euphoria over tariffs going away "permanently" quickly dissipated as the White house got an appeal and through certain aspects that I don't care to delve into here, nor do I fully understand, Trumps ability to use tariffs may have actually increased! Oh, these markets...you've got to love them. We had a great day yesterday. It wasn't a $1,000+ profit day like we shoot for but it was easy and stress free and all our trades combined for a decent result, plus...we got another Theta fairy on! It's always nice to make money while you sleep. Here's a look at our results. June S&P 500 E-Mini futures (ESM25) are trending down -0.07% this morning as investors grappled with fresh uncertainty surrounding U.S. President Donald Trump’s tariff policies and looked ahead to the release of the Federal Reserve’s first-line inflation gauge. A U.S. federal appeals court on Thursday allowed President Trump’s tariffs to remain in place while the administration’s appeal proceeds. The Trump administration could still win the appeal, but may also pursue alternative measures to implement or maintain tariffs. The Wall Street Journal reported on Thursday that the administration is weighing a temporary measure to impose tariffs on large parts of the global economy using an existing law that permits duties of up to 15% for a duration of 150 days. In yesterday’s trading session, Wall Street’s major indexes ended in the green. Nvidia (NVDA) rose over +3% after the world’s most valuable chipmaker posted better-than-expected Q1 results and gave a solid Q2 revenue forecast. Also, Nordson (NDSN) climbed more than +6% and was the top percentage gainer on the S&P 500 after the industrial technology manufacturer reported upbeat FQ2 results and issued above-consensus FQ3 guidance. In addition, e.l.f. Beauty (ELF) soared over +23% after the cosmetics company reported stronger-than-expected FQ4 results and announced the acquisition of Hailey Bieber’s Rhode beauty brand for $1 billion. On the bearish side, HP Inc. (HPQ) slumped more than -8% and was the top percentage loser on the S&P 500 after the personal computer company posted weaker-than-expected FQ2 adjusted EPS and cut its full-year adjusted EPS guidance. The U.S. Bureau of Economic Analysis’ second estimate showed on Thursday that the economy contracted at a 0.2% annualized pace in the first quarter, compared with an initially reported 0.3% decline. Also, U.S. April pending home sales fell -6.3% m/m, weaker than expectations of -0.9% m/m and the largest decline in more than 2-1/2 years. In addition, the number of Americans filing for initial jobless claims in the past week rose +14K to 240K, compared with the 229K expected. “Historic and more current data brought no surprises. Even if that had been the case, the focus would have remained firmly on the here and now — tariffs, courts, China, Nvidia, yields, and equity markets,” said Neil Birrell at Premier Miton Investors. Meanwhile, Fed Chair Jerome Powell met with President Trump at the White House on Thursday. Trump pushed the Fed chief to cut interest rates during their first in-person meeting since the president’s inauguration, the White House said. The Fed said policy “depends entirely on incoming economic information and what that means for the outlook.” Chicago Fed President Austan Goolsbee said on Thursday that a resolution in trade policy could steer the U.S. economy back to its pre-tariff path, paving the way for officials to cut interest rates. “If you have stable full employment and inflation going to target, rates can come down to where they would eventually settle,” Goolsbee said. Also, San Francisco Fed President Mary Daly said that monetary policy is currently in a “good place” to keep driving inflation lower. In addition, Dallas Fed President Lorie Logan indicated it could be some time before policymakers understand how the economy will respond to tariffs and other policy shifts and, in turn, how interest rates should be adjusted. U.S. rate futures have priced in a 97.9% chance of no rate change and a 2.1% chance of a 25 basis point rate cut at June’s monetary policy meeting. Today, all eyes are focused on the U.S. core personal consumption expenditures price index, the Fed’s preferred price gauge, which is set to be released in a couple of hours. Economists, on average, forecast that the core PCE price index will stand at +0.1% m/m and +2.5% y/y in April, compared to the previous figures of unchanged m/m and +2.6% y/y. U.S. Personal Spending and Personal Income data will also be closely monitored today. Economists anticipate April Personal Spending to be +0.2% m/m and Personal Income to be +0.3% m/m, compared to the March figures of +0.7% m/m and +0.5% m/m, respectively. The University of Michigan’s U.S. Consumer Sentiment Index will be reported today. Economists expect the final May figure to be revised higher to 51.1 from the preliminary reading of 50.8. U.S. Wholesale Inventories data will come in today. Economists forecast the preliminary April figure at +0.4% m/m, the same as in March. The U.S. Chicago PMI will be released today as well. Economists expect this figure to come in at 45.1 in May, compared to the previous value of 44.6. In addition, market participants will hear perspectives from Atlanta Fed President Raphael Bostic and Chicago Fed President Austan Goolsbee throughout the day. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.434%, up +0.23%. PCE data as well as a few FED members speaking today should be our main news catalysts. Take a look at the market trends and tell me what you see. Technicals are stuck in a vacuum this morning. Markets are having up and down days but not really going anywhere. Futures just got hit as I type with this headline. The VTI is very neutral as well. I think its just a pure guess and speculation to try to divine a directional bias in these conditions. We have a fairly busy day for a Friday. Scalping again today with the /MNQ. We should be booking profits on our COST, MRVL, PATH, ULTA earnings trades. Possibly a TSLA equity 0DTE. We already booked our profit on our Theta fairy. BITO roll again today. SPX and possibly NDX 0DTE's and another shot at the 1HTE BTC trades this morning. Let's look at the intra-day levels on /ES. There are three main levels I'm interested in today with two being key. 5911 is a must retake for the bulls. We were above it before the China tweet. A recapture of that would be the first order of business for bulls. Then, a lesser level that is a bit far away is the 6004 area. For us to push out of this consolidation zone we've been in for a while, the bulls need to clear that level. On the downside I'm very focused on 5877. If bears can push below that I think we could easily see a 100+ point down move. Next week's training will be on pairs trades and our approach to them. How they work and why they may be a good fit for our ATM program. I look forward to seeing you all in the live trading room. I thought it might be a boring day but Pres. Trump came to the rescue...again!

0 Comments

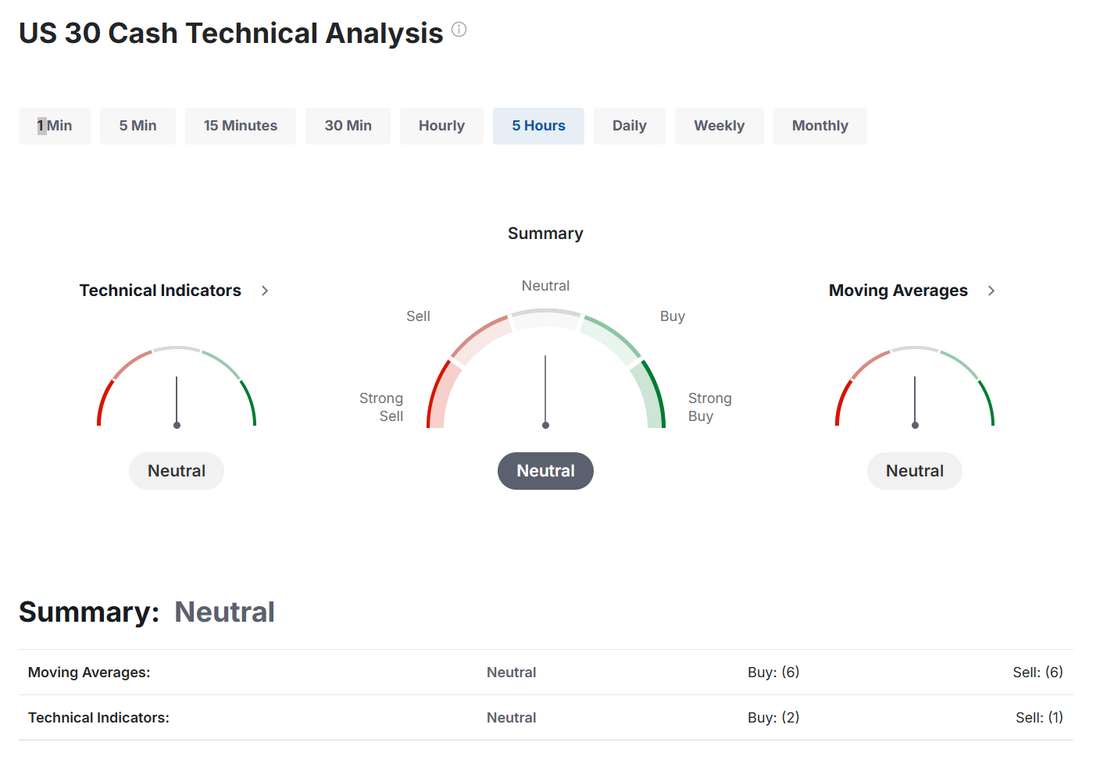

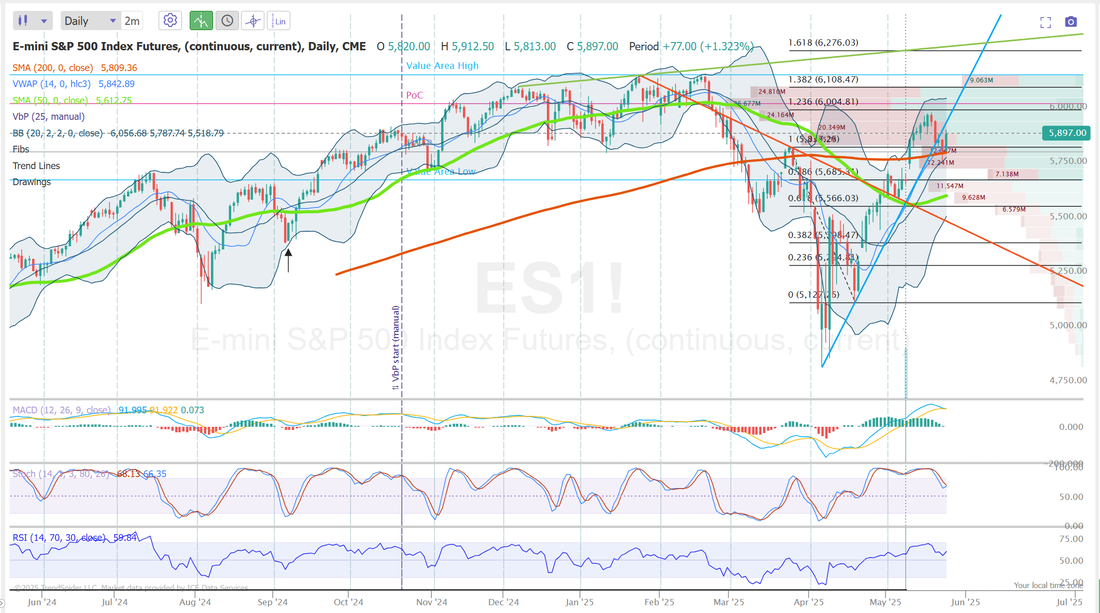

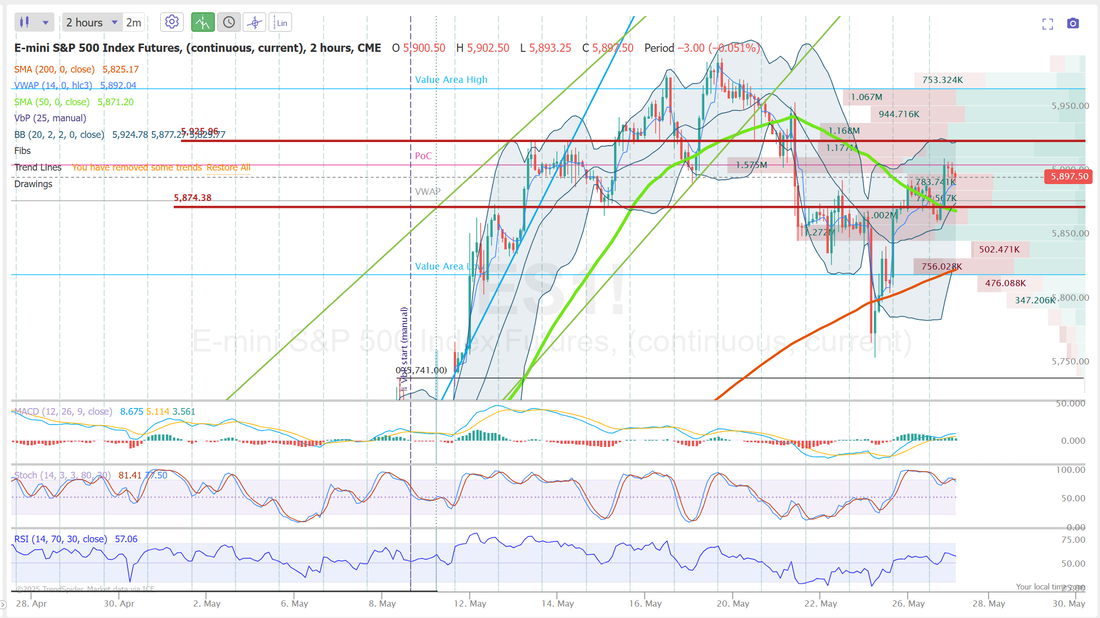

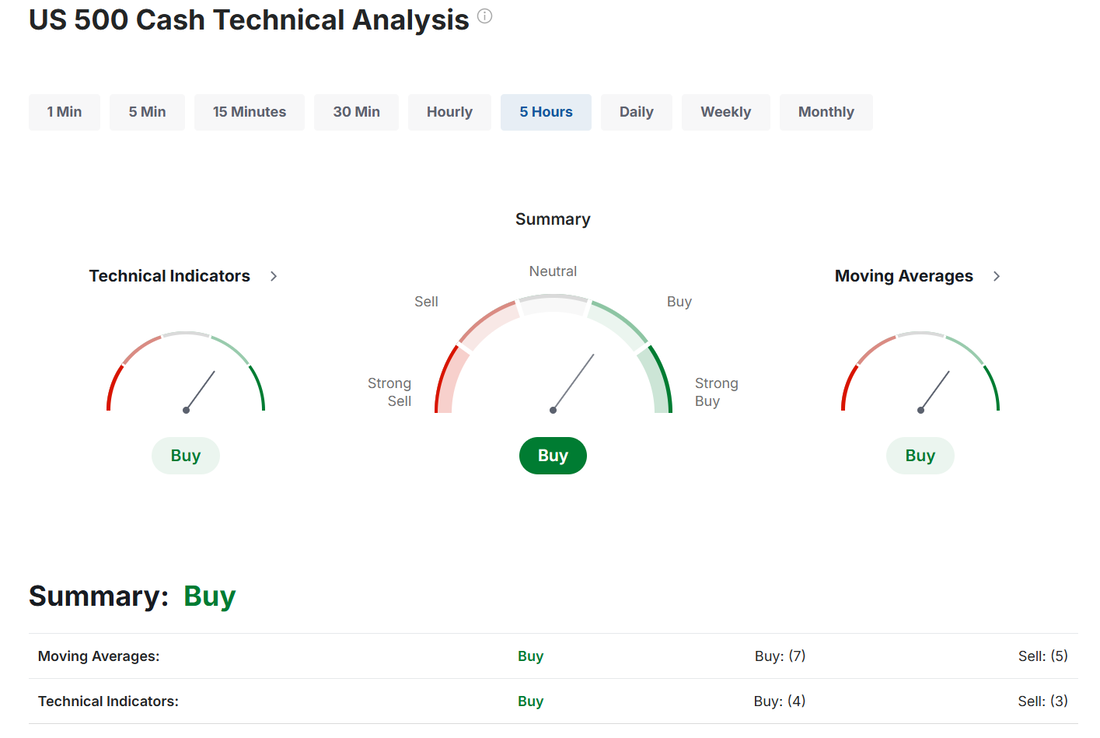

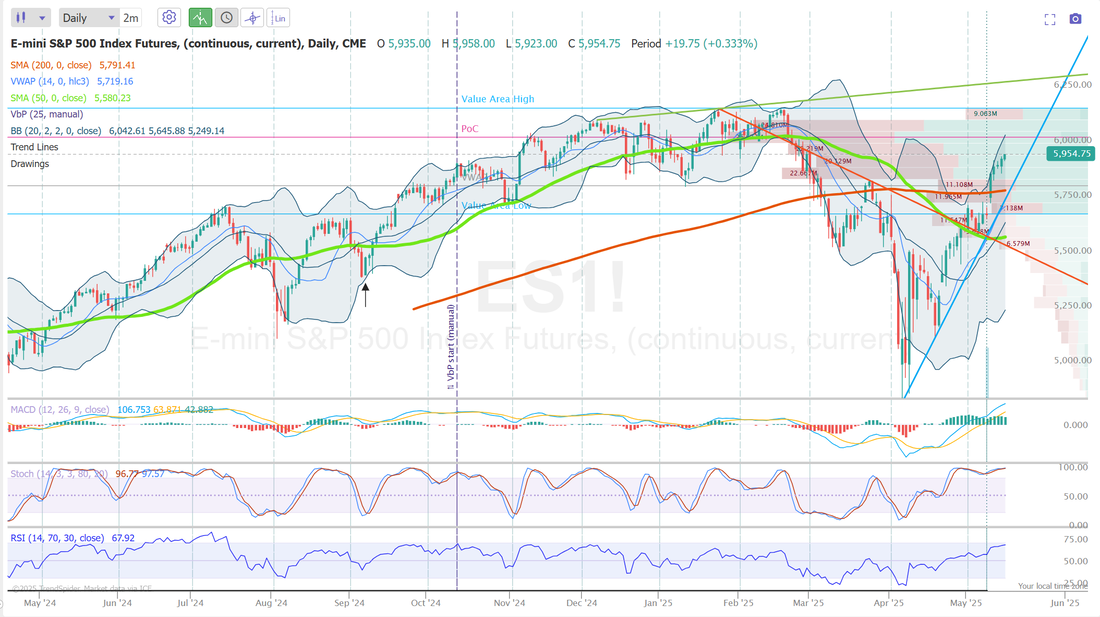

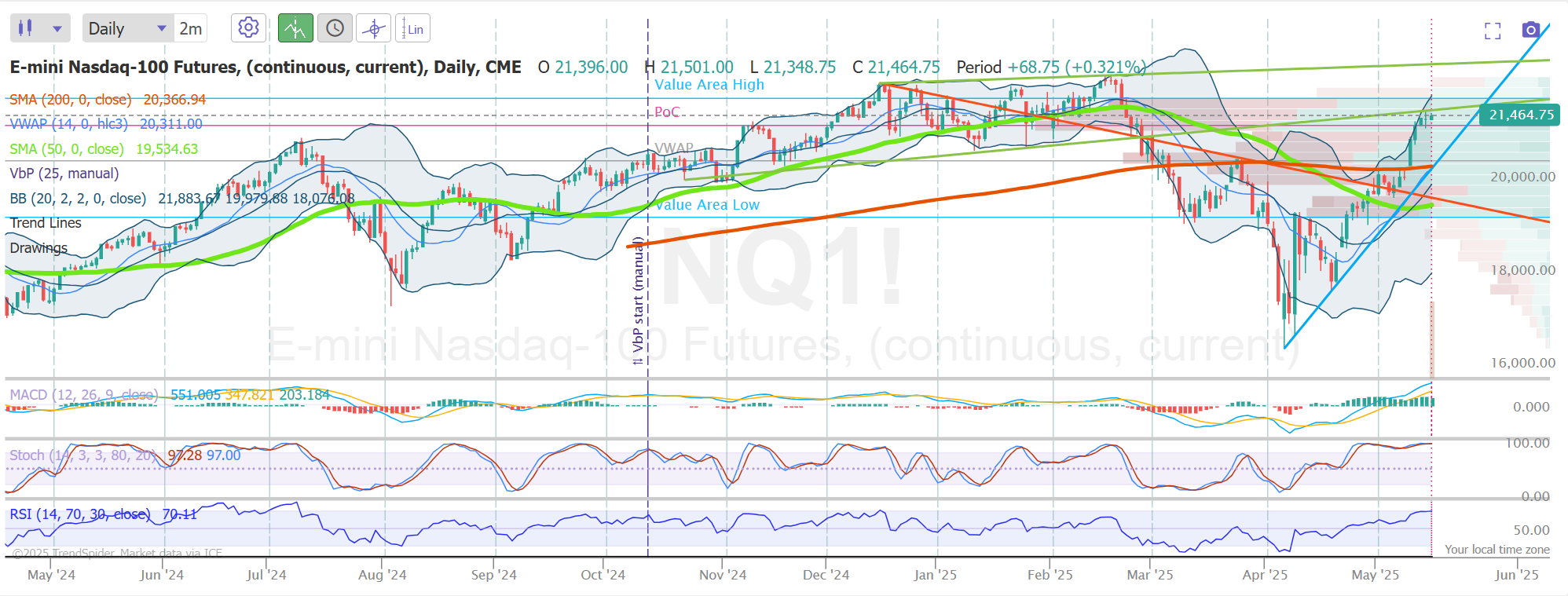

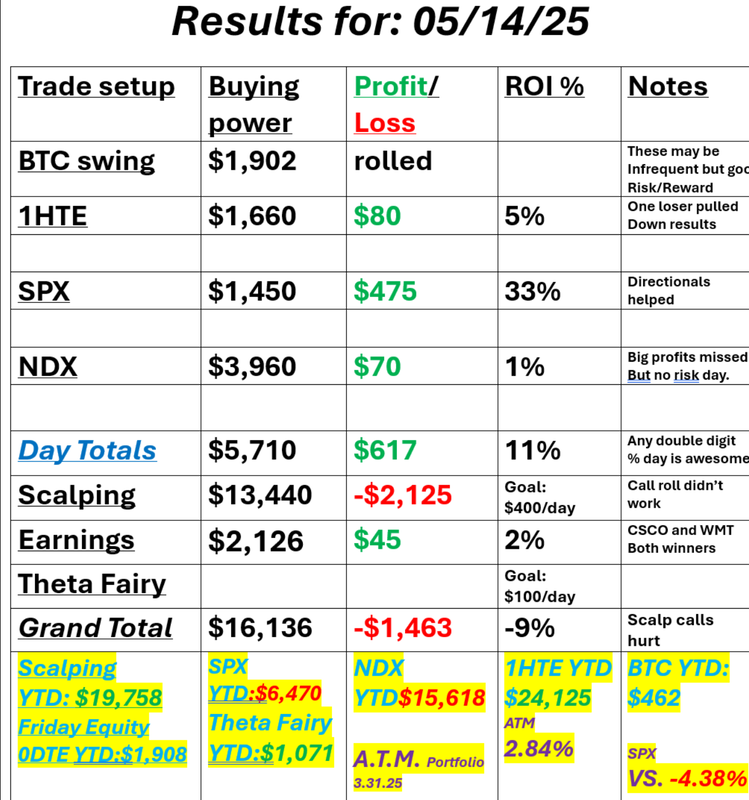

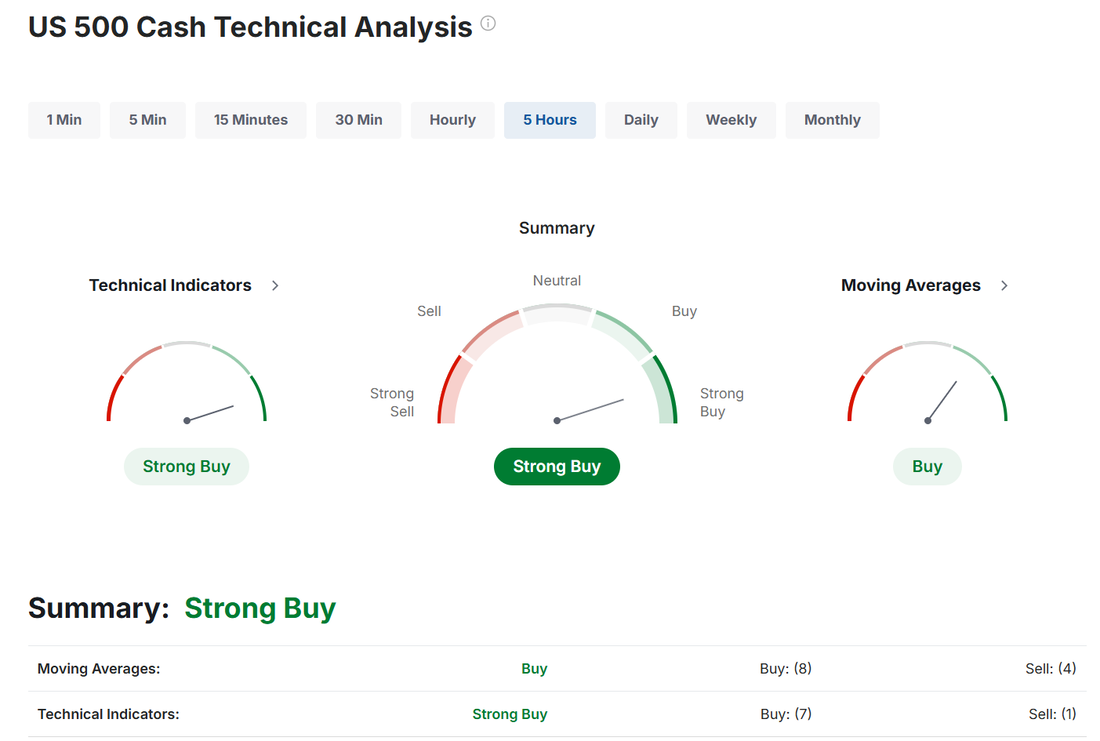

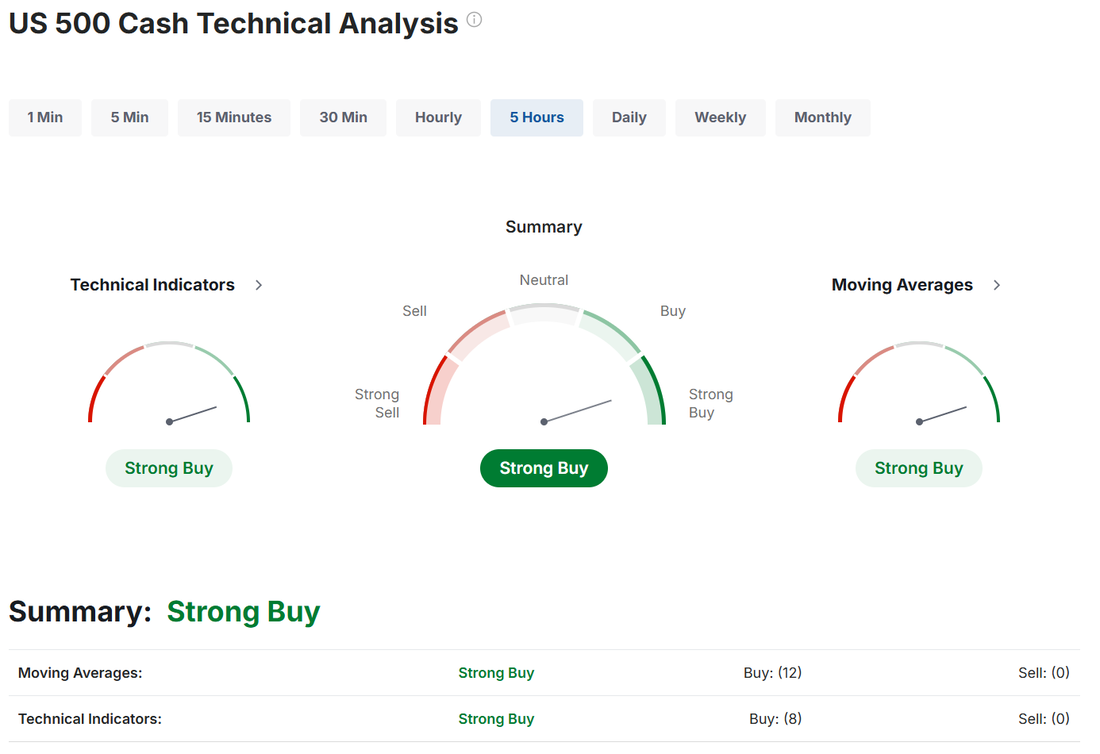

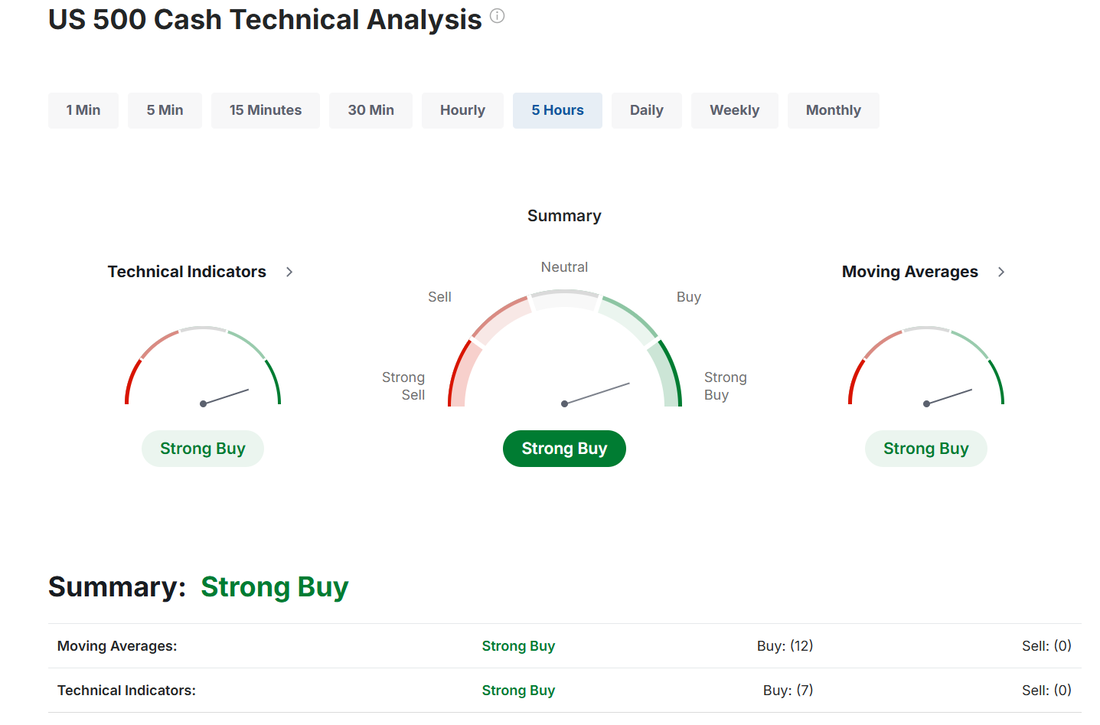

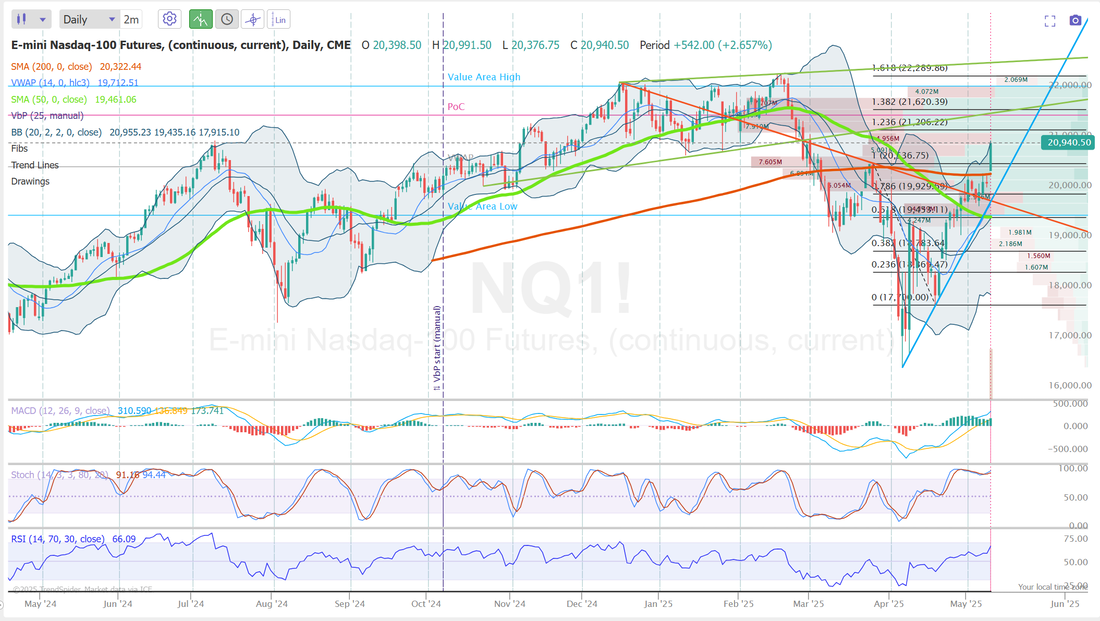

Tariffs are done? Not so fast.A Federal court kicked the reciprocal tariffs to the curb. That, combined with NVDA (the 800 pound gorilla) earnings have pushed the futures higher this morning. Does that mean we won't see or need to deal with tariffs anymore? Not so fast! The White house has appealed the verdict and as Adam Crisafulli said, " The tariff drama isn't over. Trump has other legal avenues to pursue." I'm running a two day losing streak. Two days ago I was bearish and we were up. Yesterday I was bullish and we were down. I had good risk/reward but it still stings. I'll try hard to reverse that today. Here was my trade yesterday. We do have CRM and NVDA earnings trades from yesterday that both look to cash flow for us today. Let's look at the market. We are back to the neutral rating. It's just impossible to judge these days and what we get. It's an "inflection" day. My bias or lean today: Two days ago we had a start to the day much like we should have today. Futures were up sharply and I looked for a retracement back down. That didn't happen. The market continued higher all day. We've had /ES futures up over 100+ points this morning and they've already given 60% of that gain back, as I type. I'm going to lean a bit bearish today...looking for that elusive retrace. June S&P 500 E-Mini futures (ESM25) are up +1.57%, and June Nasdaq 100 E-Mini futures (NQM25) are up +1.96% this morning as risk sentiment improved following upbeat earnings from Nvidia and after a federal trade court struck down U.S. President Donald Trump’s sweeping tariffs. A panel of three judges at the U.S. Court of International Trade in Manhattan ruled that President Trump didn’t have the authority to impose sweeping tariffs on nearly every nation. Trump was granted 10 days to suspend the tariffs. The court’s order covers Trump’s global flat tariff, increased duties on China and others, and his fentanyl-related tariffs on China, Canada, and Mexico. Still, other tariffs imposed under separate powers, such as the Section 232 and Section 301 levies, are unaffected and cover items like steel, aluminum, and automobiles. In a swift response, the Trump administration lodged an appeal and questioned the court’s authority. The final ruling in the high-stakes case could ultimately lie with higher courts, including the U.S. Supreme Court. Investors also digested Nvidia’s (NVDA) upbeat earnings. Shares of the world’s most valuable chipmaker climbed over +5% in pre-market trading after the company posted better-than-expected Q1 results and gave a solid Q2 revenue forecast. Investor focus now shifts to fresh U.S. economic data, including the second estimate of first-quarter GDP and jobless claims figures, as well as remarks from Federal Reserve officials. The minutes of the Federal Open Market Committee’s May 6-7 meeting, released Wednesday, revealed that officials broadly agreed that heightened economic uncertainty warranted their patient stance on interest-rate adjustments. Policymakers judged that the risks of both higher unemployment and inflation had increased since their prior meeting in March, largely due to the potential effects of tariffs. “Participants agreed that with economic growth and the labor market still solid and current monetary policy moderately restrictive, the committee was well positioned to wait for more clarity on the outlooks for inflation and economic activity,” according to the FOMC minutes. In addition, the minutes said, “Participants agreed that uncertainty about the economic outlook had increased further, making it appropriate to take a cautious approach until the net economic effects of the array of changes to government policies become clearer.” In yesterday’s trading session, Wall Street’s main stock indexes closed lower. U.S. chip software designers slumped after the Financial Times reported that the Trump administration told U.S. firms providing software for semiconductor design to stop selling their services to China, with Cadence Design Systems (CDNS) plunging over -10% to lead losers in the S&P 500 and Nasdaq 100 and Synopsys (SNPS) falling more than -9%. Also, PDD Holdings (PDD) slid over -4% after three brokerages downgraded the ADRs. In addition, Okta (OKTA) tumbled more than -16% after the identity access management company maintained its full-year revenue guidance, disappointing investors. On the bullish side, Fair Isaac (FICO) climbed over +7% and was the top percentage gainer on the S&P 500 after Baird upgraded the stock to Outperform from Neutral with a price target of $1,900. Economic data released on Wednesday showed that the U.S. Richmond Fed manufacturing index rose to -9 in May, in line with expectations. Today, all eyes are focused on the U.S. Commerce Department’s second estimate of gross domestic product. Economists expect the U.S. economy to contract at an annual rate of 0.3% in the first quarter, in line with initial estimates. Investors will also focus on U.S. Initial Jobless Claims data. Economists expect this figure to be 229K, compared to last week’s number of 227K. U.S. Pending Home Sales data will be reported today. Economists foresee the April figure standing at -0.9% m/m, compared to the previous figure of +6.1% m/m. U.S. Crude Oil Inventories data will be released today as well. Economists expect this figure to be 1.000M, compared to last week’s value of 1.328M. On the earnings front, notable companies like Dell Technologies (DELL), Marvell Technology (MRVL), Zscaler (ZS), Ulta Beauty (ULTA), and Best Buy (BBY) are slated to release their quarterly results today. In addition, market participants will be looking toward speeches from Fed officials Barkin, Goolsbee, Kugler, Daly, and Logan. U.S. rate futures have priced in a 97.7% probability of no rate change and a 2.3% chance of a 25 basis point rate cut at the Fed’s monetary policy committee meeting next month. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.522%, up +0.96%. Yesterdays bearish day did nothing to help the indices break out of this consolidation zone we've been in for a while now. Trade docket today. I think we can get a 1HTE on today with BTC. We have NVDA and CRM earnings plays that should go out at a profit for us today. COSt MRVL DELL, ULTA, PATH are new potential earnings setups. SPX 0DTE focus as well. Scalping I'll look at the /MNQ today. Let's look at the intra-day level on /ES for today: The 2hr. chart is bearish. The market pushed up overnight and early this morning to 6004. 6000 is a big psychological level as well as being a break above the May 19th high so it is important. That is our new target for bulls. Get back above that 6000 level. For bears they need to get back down below 5911. It's a neutral rated technical day, as I mentioned above so it's anybody's guess right now on how the day pans out. We had a good training yesterday on Richard Dennis' top 10 trading tips. Next week I'm planning on doing a training on pairs trades. It should be a good one also! See you all in the live trading room shortly!

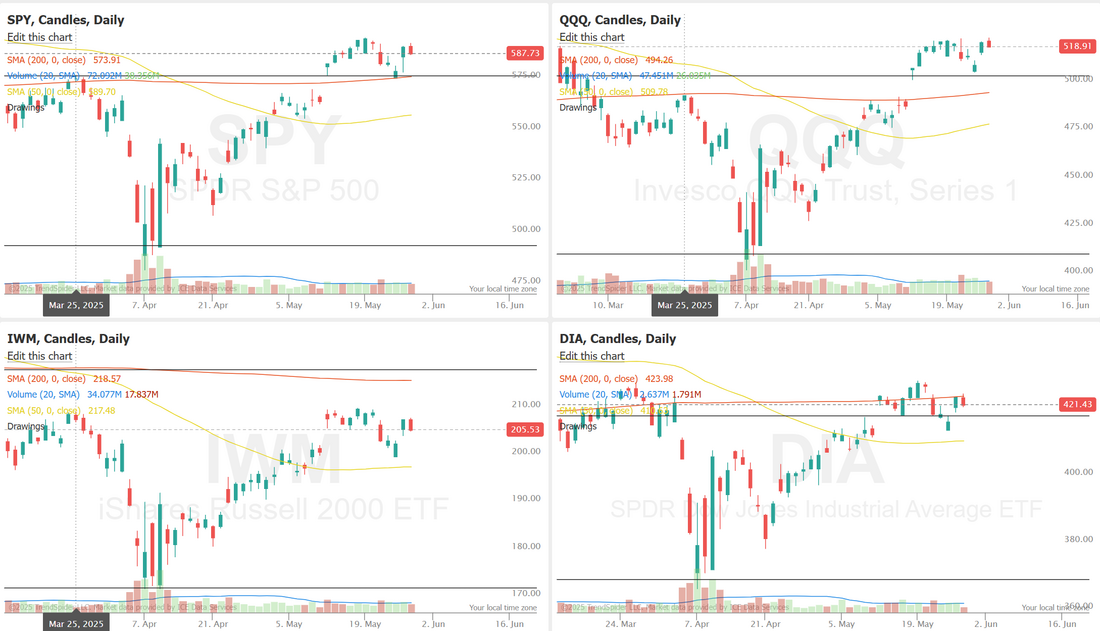

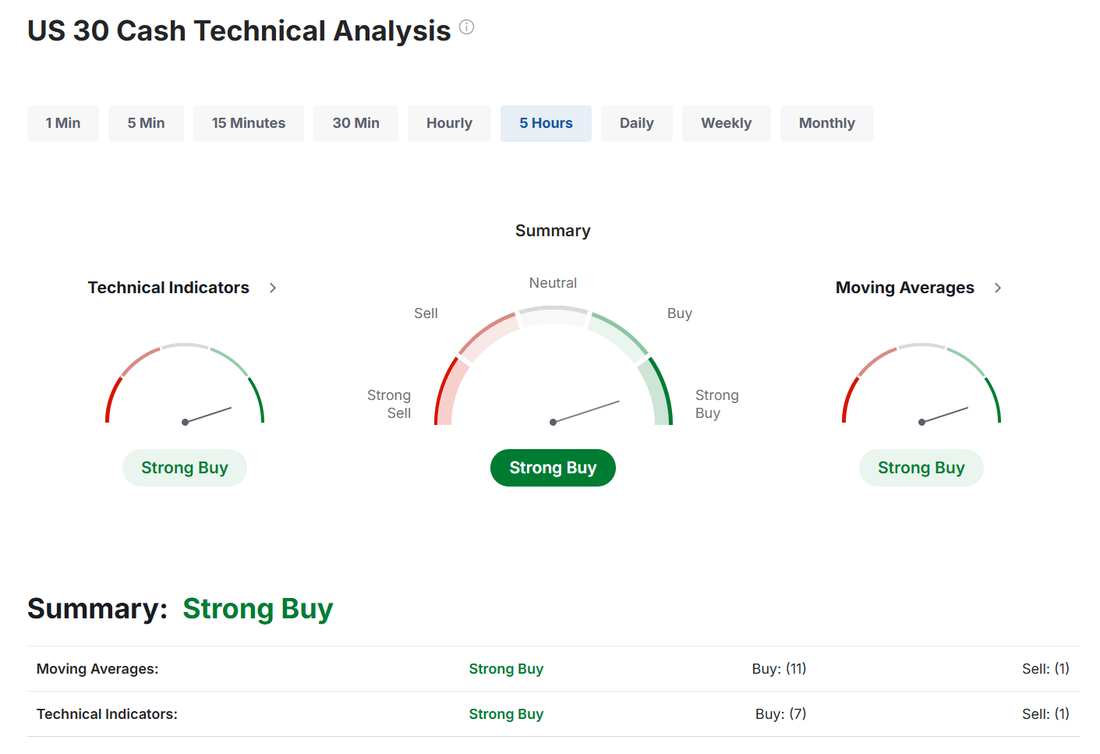

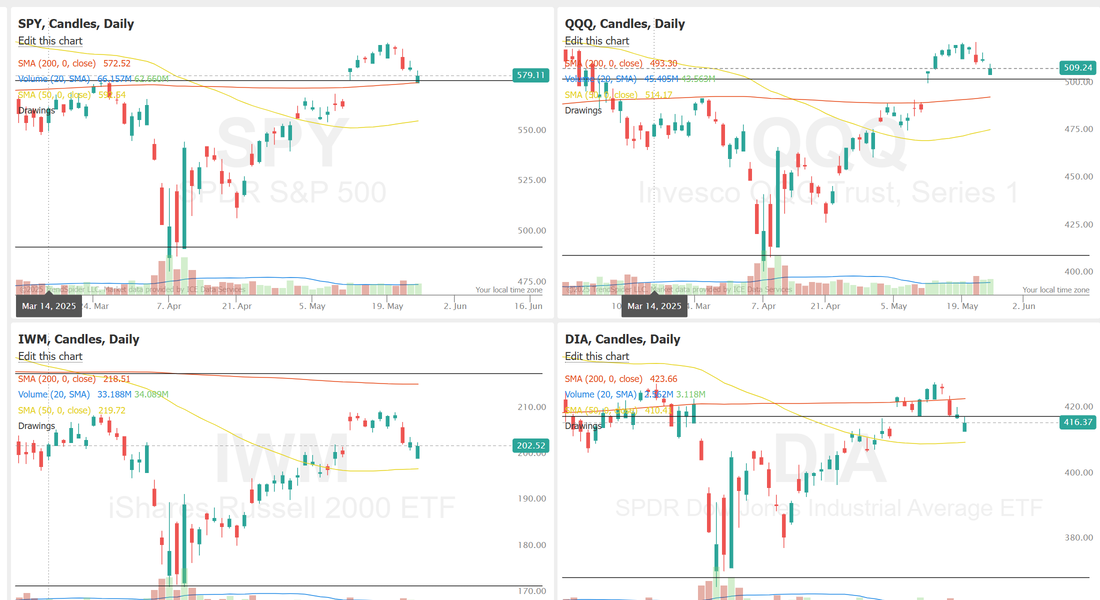

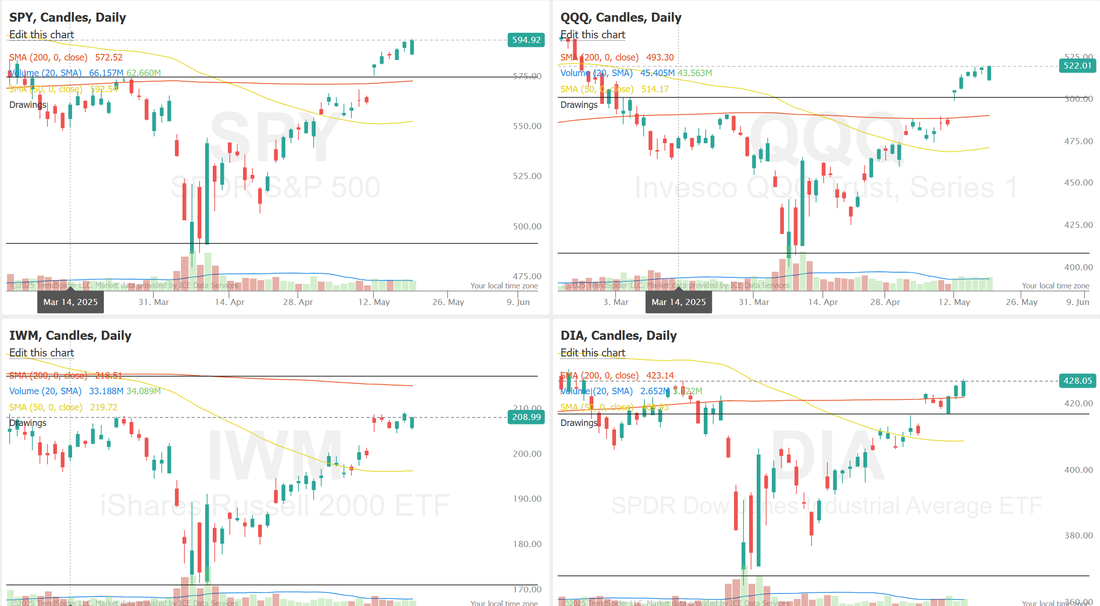

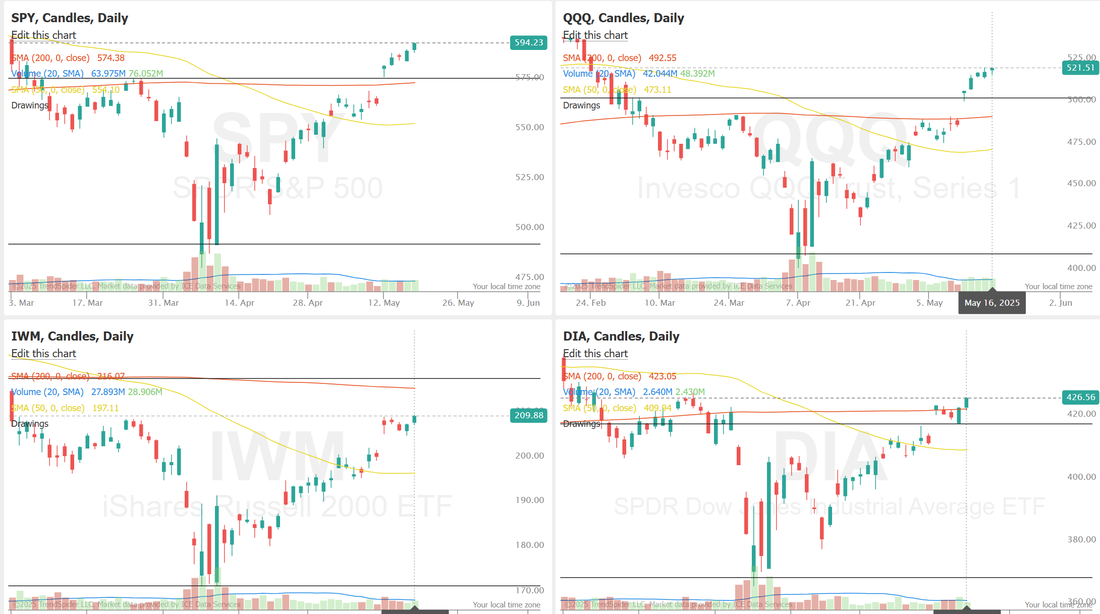

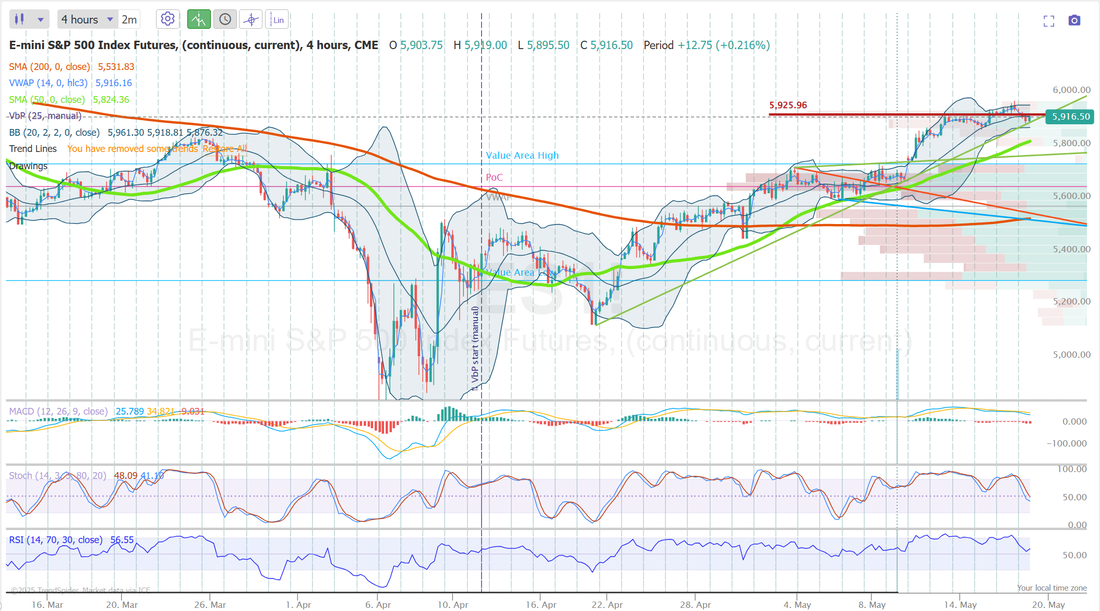

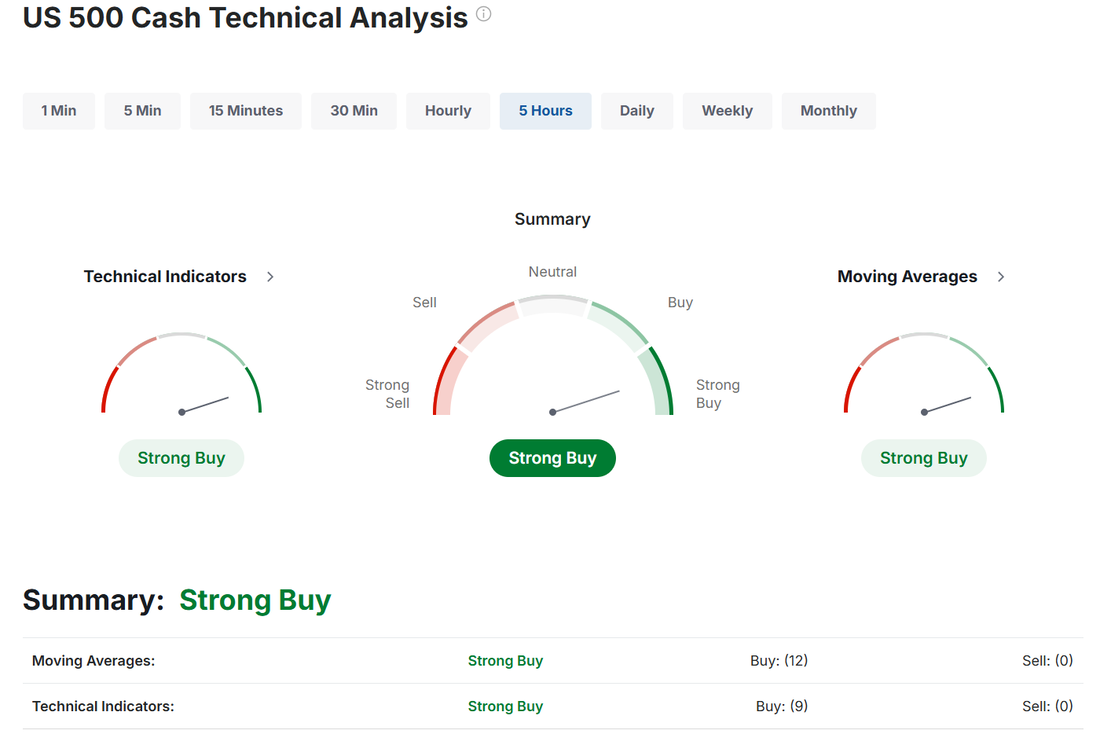

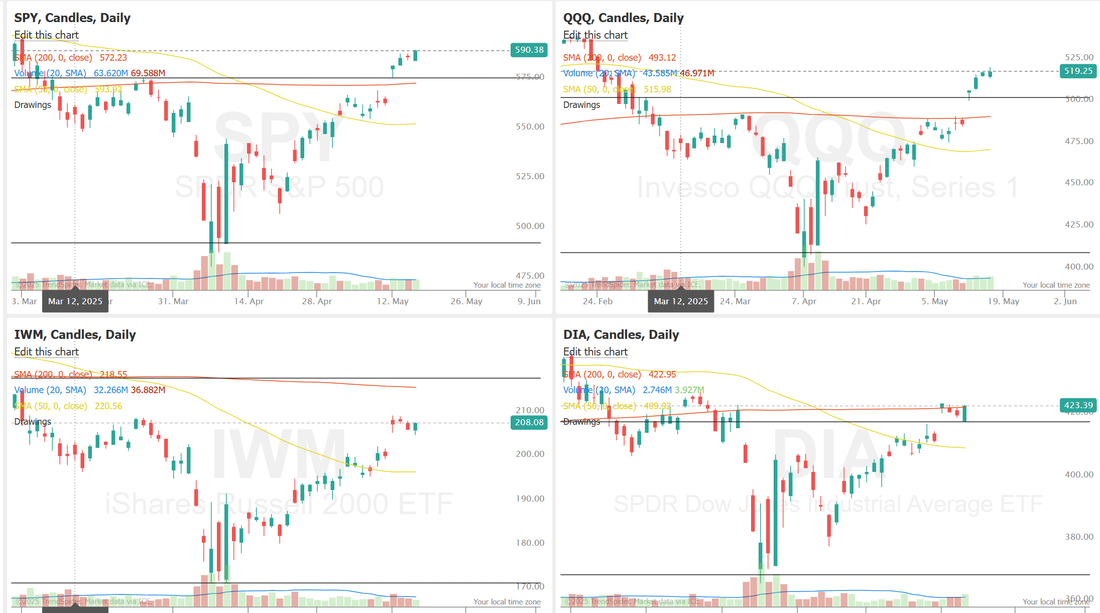

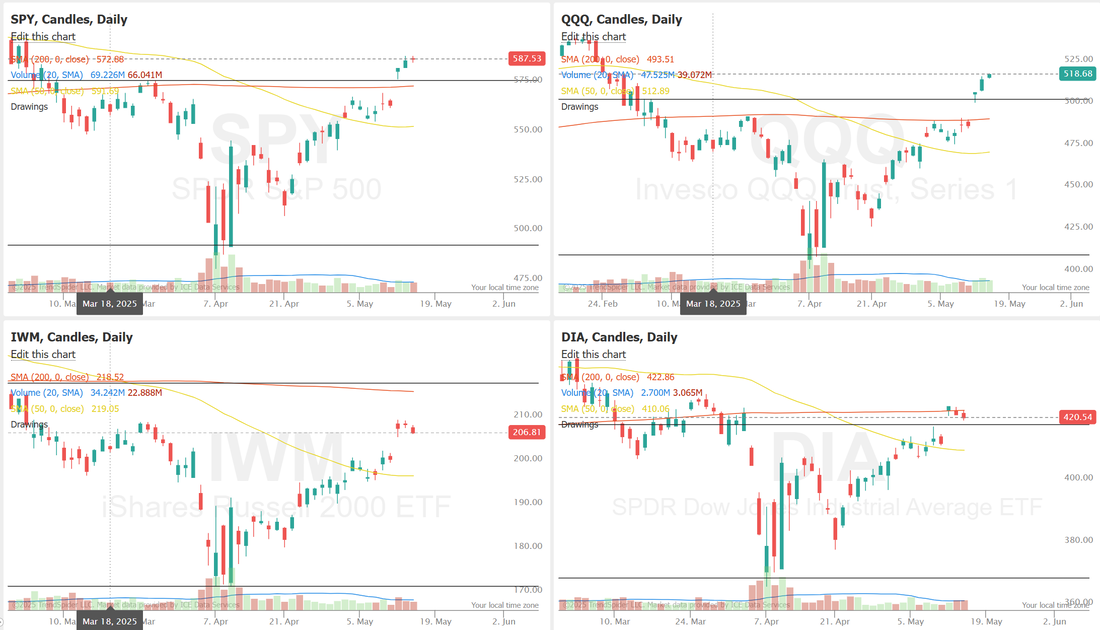

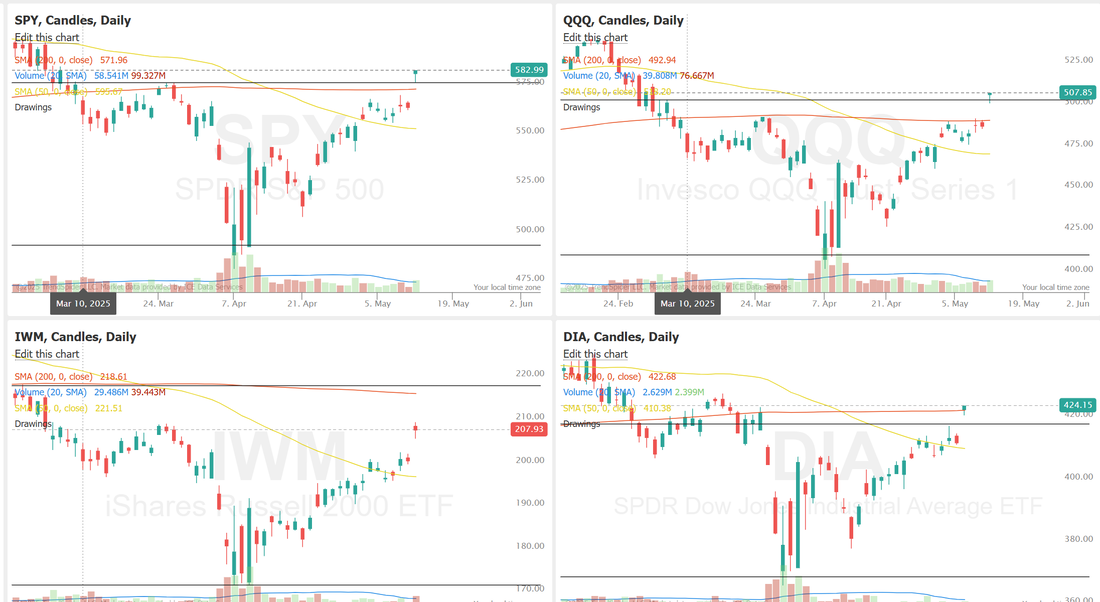

I hope you all had a wonderful Memorial day. I'm grateful for all who have served and will serve. On or off? Depends on the day.Markets were rocked last week with new Tariff news and futures are up a solid 1.5% this morning on news of a repreve. It's hard to say where this all ends up but it does illustrate the challenge of putting longer term trades together. Not many traders want duration risk in this market. My Friday was a mixed bag. Our SPX worked well but my late day NDX lost. Let's take a look at the markets for this shortened trading week. New's of the EU tariff delay have pushed us back into a buy signal. Yes, futures are popping this morning but the current trend has been down. That poses the question today. Do we continue higher once the cash market opens or do we retrace? My overall feeling is that this news of an E.U. delay will NOT be enough to carry up back to an overall bullish trend. I'd favor a bit of a retracement today. That puts my bias or lean slightly bearish from the highs of the futures this morning. June S&P 500 E-Mini futures (ESM25) are up +1.56%, and June Nasdaq 100 E-Mini futures (NQM25) are up +1.63% this morning, pointing to a sharply higher open on Wall Street after a long weekend, as sentiment got a boost from U.S. President Donald Trump’s decision to extend the deadline on sweeping euro area tariffs. President Trump said he would push back the deadline for the European Union to face 50% tariffs to July 9th from June 1st following a phone call with Commission President Ursula von der Leyen. “We had a very nice call and I agreed to move it,” Trump told reporters Sunday. Von der Leyen said Sunday in a post on X that “Europe is ready to advance talks swiftly and decisively,” but that “a good deal” will need “time until July 9.” That’s the date when Trump’s 90-day pause on his reciprocal tariffs was initially scheduled to expire. Also aiding sentiment, bond yields slumped worldwide after reports emerged that Japan is looking to stabilize its debt market following weeks of selloff. Investor focus this week is on an earnings report from semiconductor stalwart Nvidia, the minutes of the Federal Reserve’s latest policy meeting, and the release of the Fed’s preferred inflation gauge. In Friday’s trading session, Wall Street’s major equity averages closed lower after President Trump threatened to impose sweeping tariffs on the EU and Apple. Deckers Outdoor (DECK) plunged over -19% and was the top percentage loser on the S&P 500 after the maker of Hoka running shoes and UGG boots issued below-consensus FQ1 guidance. Also, chip stocks lost ground, with Microchip Technology (MCHP) sliding more than -3% and ON Semiconductor (ON) falling over -2%. In addition, Apple (AAPL) dropped more than -3% after President Trump stated that the company would face “at least” a 25% tariff if iPhones sold in the U.S. are not manufactured domestically. On the bullish side, Intuit (INTU) climbed over +8% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the financial software company posted upbeat FQ3 results and raised its full-year guidance. Economic data released on Friday showed that U.S. new home sales unexpectedly rose +10.9% m/m to a 3-year high of 743K in April, stronger than expectations of 694K. Minneapolis Fed President Neel Kashkari said on Monday that significant shifts in U.S. trade and immigration policy are creating uncertainty, making it difficult for Fed officials to move on interest rates before September. “Will the picture be clear enough by September? I am not sure right now. We will have to see what the data says, but also how the negotiations are going,” Kashkari said in an interview on Bloomberg Television. He noted that if the U.S. secures trade deals with other countries in the coming months, “that should provide a lot of the clarity we are looking for.” Meanwhile, U.S. rate futures have priced in a 97.9% probability of no rate change and a 2.1% chance of a 25 basis point rate cut at the conclusion of the Fed’s June meeting. In this holiday-shortened week, market participants will focus on earnings reports from several major companies, with semiconductor giant Nvidia’s (NVDA) report on Wednesday attracting the most attention. Wedbush analysts stated that the company is poised to remain a key beneficiary of massive AI infrastructure investments by hyperscalers. Retailers such as Costco Wholesale (COST), AutoZone (AZO), and Dick’s Sporting Goods (DKS), along with notable companies like Salesforce (CRM), Marvell Technology (MRVL), Dell Technologies (DELL), and HP Inc. (HPQ), are also set to release their quarterly results this week. On the economic data front, the April reading of the U.S. core personal consumption expenditures price index, the Fed’s preferred inflation gauge, will be the main highlight. Other noteworthy data releases include U.S. GDP (second estimate), the Richmond Fed Manufacturing Index, Initial Jobless Claims, Pending Home Sales, Crude Oil Inventories, Goods Trade Balance, Personal Income, Personal Spending, Wholesale Inventories (preliminary), the Chicago PMI, and the University of Michigan’s Consumer Sentiment Index. Market watchers will also closely monitor the Fed’s minutes from the May 6-7 meeting, set for release on Wednesday, for further insights into policymakers’ discussions on interest rates and the economy. The Fed signaled that rate cuts are unlikely for now due to inflation risks, though officials remain concerned about the potential economic damage from tariffs. In addition, several central bankers are scheduled to deliver remarks this week, including Kashkari, Williams, Waller, Barkin, Goolsbee, Kugler, Daly, Logan, and Bostic. Today, all eyes are focused on the U.S. Conference Board’s Consumer Confidence Index, which is set to be released in a couple of hours. Economists, on average, forecast that the May CB Consumer Confidence index will stand at 87.1, compared to last month’s figure of 86.0. Investors will also focus on U.S. Durable Goods Orders and Core Durable Goods Orders data. Economists expect April Durable Goods Orders to be -7.6% m/m and Core Durable Goods Orders to be -0.1% m/m, compared to the prior figures of +9.2% m/m and 0.0% m/m, respectively. The U.S. S&P/CS HPI Composite - 20 n.s.a. will be released today as well. Economists foresee the March figure coming in at +4.5% y/y, the same as in February. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.473%, down -0.84%. NVDA earnings this week will be closely watched. With a shortened week, the expected move is down. VXX is back to a more "normal" level. SPY closed the week strong at $594.20 (+5.31%), gapping above the 200-day moving average, a key level many trend followers watch as a potential signal of bullish continuation. Bulls remained firmly in control, with price action skipping the Weak Go phase and triggering a Strong Go signal on the GoNoGo Trend® Indicator. However, with RSI approaching overbought territory, traders may want to watch for signs of exhaustion heading into next week. QQQ closed even stronger at $521.51 (+6.87%), landing near its year-to-date volume point of control, a key zone of potential overhead supply. With RSI pushing into overbought territory, the stage is set for a tug-of-war between trend-followers riding momentum above the 200-day moving average and bears looking for signs of a reversal. The IWM small-cap ETF lagged behind last week, closing at $209.85 (+4.49%). A Strong Go signal has triggered, and with the index still trading roughly 3% below its 200-day moving average, bulls may have room to push higher before encountering resistance. Unlike its large-cap peers, IWM’s RSI remains below overbought territory, offering more room for near-term follow-through. Trade docket for today is very simple. Today my focus is on our BITO trade and SPX 0DTE. Tomorrow we get a slew of earnings setups with NVDA , CRM, SNPS, Thurs. will bring ULTA, BBY, PATH, DELL. With our day trade focus today on SPX, let's look at the /ES to divine intra-day levels. Looking at the daily chart I see a couple items that stick out to me. #1. The 200DMA is holding firm, for now, as a support level. #2. The Trend is still down, even with the futures bump this morning. On the 2hr. chart I have two key levels that, incidentally, were big levels for us from last week. 5925 as resistance. A break above here and it really looks to me that the bulls are back in business. 5874 as support. Below here I think we give back the gains from the futures this morning and the bearish trend continues. Tomorrow we'll have the training on Richard Dennis and the Turtle traders so don't miss that. I'll see you all in the live trading room shortly!

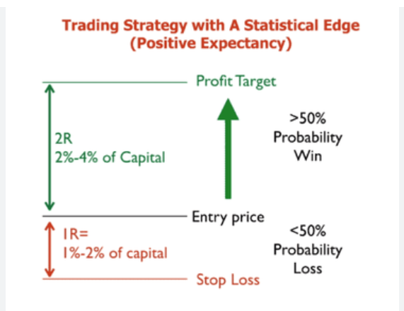

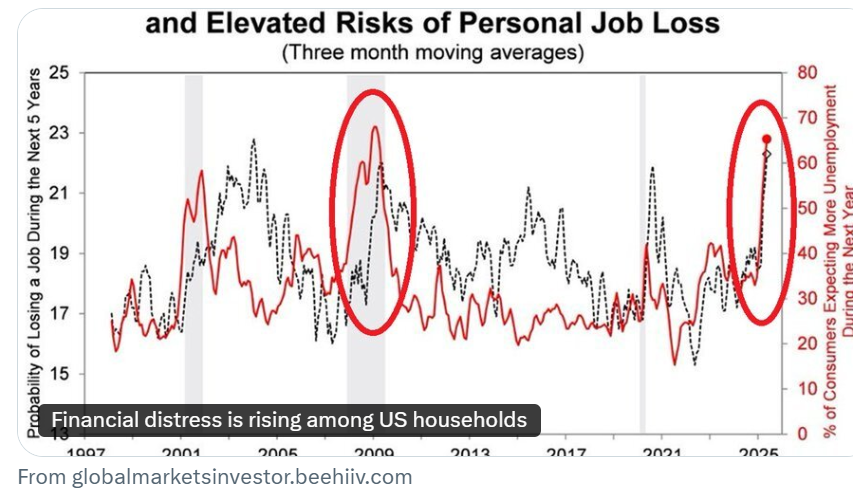

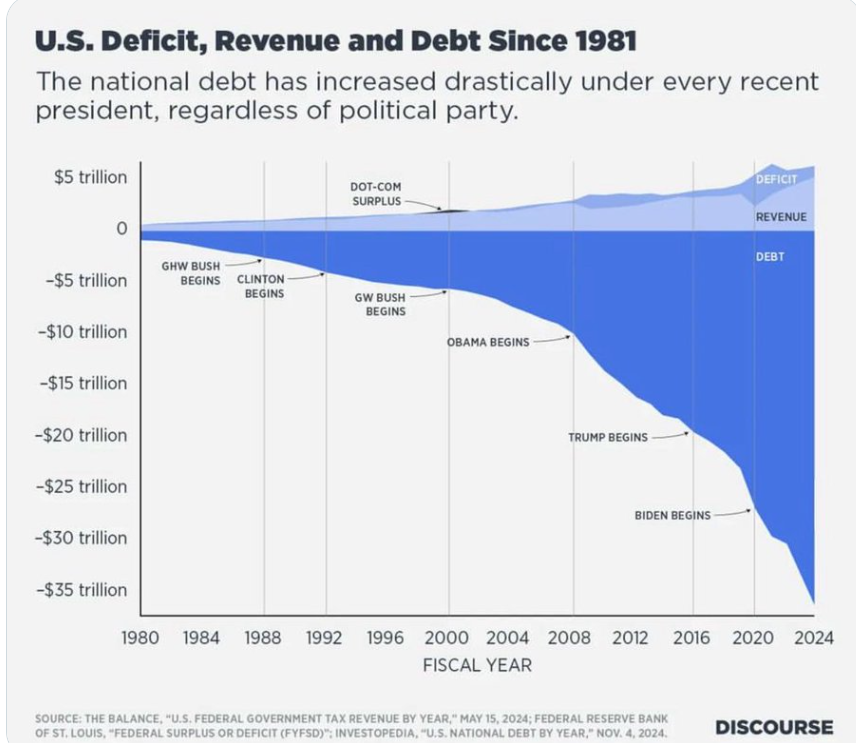

Does positive expectancy guarantee profits?If you can build and trade a system that has "positive expectancy" then you have "edge" If you have edge then you are a theoretical money printing machine. Is it really that simple? Of course not. Nothing in life is ever really as simple as it seems. Let's talk first about positive expectancy. The idea is simply that more profits come in than losses going out. It is NOT about avoiding or removing losses. It's simply about having a bigger green number than red at the end of the accounting period. If your system does that over time then you have what traders call edge. Edge is what the casinos have. Playing roulette and betting on either red or black is NOT a 50/50 shot. You've got a double zero on the wheel. That gives the house an edge of 5.2%. Could you win playing red or black 10 times in a row? Of course! Eventually though, the house will get that money back. Trying to maintain an edge in trading can be challenging at times but yesterday was our best day of the year. We've never risked so little to make so much. Our biggest risk or unrealized loss amount of the day was $105 dollars. We made over $3,200 in profit. We've made more and heavens knows we've risked more but we've rarely, if ever, had a risk/reward ratio like we had yesterday. Here's a look at our day. We got an early start on today's trading with our modified Theta fairy, a short /MNQ scalp with an ATM cover and a /NQ trade that looks amazing! Yeah, we have trades all day long because.... I didn't come into yesterday with a lean or bias, even though futures were down a bit. Once we started trading my signals kicked over to bearish and we took a larger bearish position than we normally start with. It paid off in spades for us yesterday. Today I'm sticking with a bearish bias. Let's all pray for another significant selloff! There's nothing better for a trader than a bear market. Job loss concern is exploding. National debt is exploding. Japan's bond market is imploding: Japan's 30Y Government Bond Yield has officially surged to its highest level in history, at 3.15%. For decades, Japan was known for low long-term interest rates. Now, they are dealing with high inflation, shifting policy outlook, and a whopping 260% Debt-to-GDP ratio. On top of this, Japan holds $1.1 TRILLION worth of US debt, making it the largest foreign holder of US debt. Yesterday, Japan’s Prime Minister Ishiba called the situation “worse than Greece.” There are some real ugly things developing in the macro economic picture. Let's take a look at the market. It sure looks like we are wanting to roll over. Is it too early to tell? Sure. We've been flat to slightly down for three days now. That doesn't make a trend change but it does look like the market is taking a pause here. With the selling yesterday and futures being down this morning we are still holding up fairly well technically speaking. We are getting a slight sell order this morning. Trade docket for today: ASML, MDB, aBNB, AAPL, "6 day candle rollover" trades. SNOW and ZM earnings, 1HTE, SPX, NDX 0DTE's TJX, LOW, PANW earnings take profits. Let's take a look at our intra-day level on /ES: On the daily chart is certainly looks like a rollover is being attempted. Price action, RSI and Stochastics are all rolling over with MACD almost there. On an intra-day chart: My key level is still the same. 5925. Bulls need to hold this level. If they can not the bears could easily take us down to 5874. As I type we sit down -31 points and at 5928. Just above that key 5925 level. We've got another great training coming up next week with the top trading keys from the infamous Richard Dennis. I look forward to having a good discussion with you all on that day. See you all in zoom shortly!

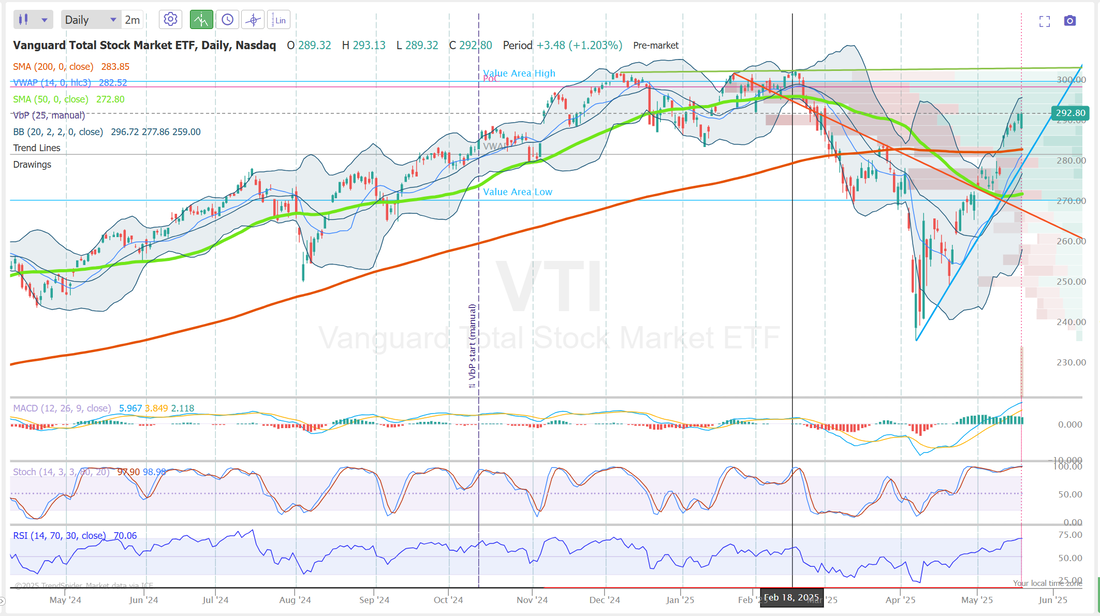

Just don't lose?With the credit downgrade yesterday the futures tanked. I knew that meant we had a bigger than normal opportunity so I used all my buying power right up front and managed it via stop losses. This is a bit different than a normal day for us where we start small and build, mold and shape the trade as the day progresses. I had to stop loss out four times before I finally got on the right side of the market! Ultimately it was a very successful day for us and it continued to remind us that really our main job, as traders is to just focus on the risk and let everything else fall where it may. Here's a look at our day: With futures buried early yesterday morning I was looking for a bullish day and that's what we got. The market retraced all of the selloff but I don't think that means the bulls are fully back in charge. I don't really have a lean or bias today. Futures are down every so slightly as I type. Based on the previous two credit downgrades, it may take a few days to see it's full effect. I'm going to try to be patient this morning and let the market sort out its directional bias. Let's take a look at the markets: That was quite the rebound yesterday and it puts most indices back up to it's near term high. Technicals were still flashing bullish yesterday morning, even with the early selloff. They continue to flash a buy signal. Our trade docket today is full. HD, TJX, LOW, PANW, MDT earnings trades. /MNQ scalp. SPX and possible NDX 0DTE's. 1HTE with BTC. QTTB, BITO. une S&P 500 E-Mini futures (ESM25) are down -0.33%, and June Nasdaq 100 E-Mini futures (NQM25) are down -0.49% this morning, pointing to a pause in the recent rally on Wall Street, while investors await further comments from Federal Reserve officials and an earnings report from home improvement chain Home Depot. In yesterday’s trading session, Wall Street’s main stock indexes ended slightly higher. UnitedHealth Group (UNH) surged over +8% and was the top percentage gainer on the S&P 500 and Dow on signs of insider buying after an SEC filing revealed that CEO Stephen Hemsley and CFO John Rex purchased about $30 million worth of shares last Friday. Also, recently beaten-down pharmaceutical stocks advanced, with Moderna (MRNA) climbing more than +6% and Gilead Sciences (GILD) rising over +3% to lead gainers in the Nasdaq 100. In addition, Take-Two Interactive Software (TTWO) gained more than +3% after Morgan Stanley raised its price target on the stock to $265 from $210. On the bearish side, chip stocks lost ground, with Arm Holdings (ARM) sliding over -2% to lead losers in the Nasdaq 100 and Advanced Micro Devices (AMD) falling more than -2%. Economic data released on Monday showed that the Conference Board’s leading economic index for the U.S. slid -1.0% m/m in April, weaker than expectations of -0.7% m/m and the largest decline in over two years. Fed Vice Chair Philip Jefferson said on Monday that the central bank must make sure any price increases stemming from policy changes in Washington don’t trigger a persistent rise in inflation, adding that monetary policy is in a “very good place.” Also, New York Fed President John Williams suggested that policymakers may hold off on cutting interest rates until at least September as they navigate an uncertain economic outlook. “It’s not going to be that in June we’re going to understand what’s happening here, or in July. It’s going to be a process of collecting data, getting a better picture, and watching things as they develop,” Williams said. In addition, Atlanta Fed President Raphael Bostic said, “Given the trajectory of our two mandates, our two charges, I worry a lot about the inflation side, and mainly because we’re seeing expectations move in a troublesome way,” repeating his expectation for one interest rate cut this year. Finally, Minneapolis Fed President Neel Kashkari stated that there is currently significant uncertainty in the economy. U.S. rate futures have priced in a 91.4% probability of no rate change and an 8.6% chance of a 25 basis point rate cut at the conclusion of the Fed’s June meeting. Meanwhile, JPMorgan CEO Jamie Dimon said Monday that he doesn’t believe the full impact of tariffs has yet passed through to the broader economy. He cautioned that the stock market could plunge as companies contend with added costs for supplies. Today, investors will focus on speeches from Fed officials Barkin, Bostic, Collins, Kugler, Daly, and Musalem. Market participants will also look forward to earnings reports from home improvement chain Home Depot (HD) and cybersecurity firm Palo Alto Networks (PANW). The U.S. economic data slate is empty on Tuesday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.436%, down -0.87%. Our training yesterday on a traders checklist was well received. I'll work on putting another training together for us for next week. These have been good additions to the trading room. Let's take a look at the intra-day levels we have on tap for today in /ES. Unfortunately, yesterdays amazing recovery for a big futures selloff early in the morning didn't really help us with divining any new or substantive levels. I believe I'll start today the same as yesterday with most of my capital invested upfront and manage through stop loss protection. I'm going to start with a bearish setup initially. 5925 is still my key level. I'm looking for a break back down below that. I think that could open up the flood gates to more downside, which we love! Taking a look at the VTI two things become apparent to me. #1. The trend is bullish. #2. Indicators are really overstretched to the upside here. No, there's no real sell signal...yet. Keep your head on a swivel. I look forward to seeing you all in the live trading room. We've got a lot of trades to focus on today.

Also, feel free to offer up any suggestions for next weeks training topic! Deciphering real vs. potential.The markets have been moving a lot lately! That's probably not news to you. It's the "what" that has been moving it that is important. Tariff news has been the catalyst. Tariffs are announced and markets drop. Tariffs get a reprieve and markets pop. The reality however is tariffs, in the real world, have had little to no effect. Most companies have 3 month inventory on hand so prices haven't risen. Consumers are still buying at the same rate as before. Inflation is still coming down. Rating agencies say that the potential tariffs will NOT have an effect on GDP or growth. May this all change in the future? Of course! Today, however, we get "Real" news. Moody's dropping their rating on the U.S. due to the ballooning debt. This is real. This is actually happening. The U.S. debt is out of control and the markets are reacting today. Our ATM portfolio continues to carry a negative delta as these continue to be trying times. As I type, the market isn't open yet but futures are tanking. It's nice to know we should have a nice green number in our portfolio to start the day. Our trading on Friday was largely good with the exception of the NDX which put a damper on the day. See my results below: June S&P 500 E-Mini futures (ESM25) are down -1.22%, and June Nasdaq 100 E-Mini futures (NQM25) are down -1.59% this morning as sentiment took a hit after rating agency Moody’s downgraded the United States’ credit rating. Late Friday, Moody’s Ratings lowered the U.S. credit score by one notch to Aa1, aligning with Fitch Ratings and S&P Global Ratings in grading the world’s largest economy below the top, triple-A position. Moody’s said the downgrade “reflects the increase over more than a decade in government debt and interest payment ratios to levels that are significantly higher than similarly rated sovereigns.” Speaking on NBC’s Meet the Press with Kristen Welker on Sunday, U.S. Treasury Secretary Scott Bessent dismissed concerns about the government’s debt, calling Moody’s a “lagging indicator.” This week, investor focus is on a fresh batch of U.S. economic data, remarks from Federal Reserve officials, and earnings reports from retail heavyweights. In Friday’s trading session, Wall Street’s major equity averages closed higher. CoreWeave (CRWV) soared over +22% after a 13G filing revealed that Nvidia raised its stake in the cloud-computing provider to 7% from 5.2%. Also, recently beaten-down healthcare stocks rallied, with UnitedHealth Group (UNH) climbing more than +6% to lead gainers in the S&P 500 and Dow and Moderna (MRNA) rising over +5%. In addition, Archer Aviation (ACHR) surged more than +9% after being selected as the Official Air Taxi Provider for the 2028 Los Angeles Olympic and Paralympic Games. On the bearish side, Applied Materials (AMAT) slumped over -5% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the semiconductor equipment maker provided a tepid FQ3 revenue forecast. Economic data released on Friday showed that the University of Michigan’s U.S. consumer sentiment index unexpectedly fell to a nearly 3-year low of 50.8 in May, weaker than expectations of 53.1. Also, U.S. April housing starts rose +1.6% m/m to 1.361M, stronger than expectations of 1.360M, while building permits, a proxy for future construction, fell -4.7% m/m to 1.412M, weaker than expectations of 1.450M. In addition, the U.S. import price index unexpectedly rose +0.1% m/m in April, stronger than expectations of -0.4% m/m. Atlanta Fed President Raphael Bostic said on Friday that he anticipates the U.S. economy will slow this year but avoid a recession, and reaffirmed his expectation for one interest rate cut in 2025. U.S. rate futures have priced in a 91.7% chance of no rate change and an 8.3% chance of a 25 basis point rate cut at the Fed’s monetary policy committee meeting next month. Meanwhile, a key House committee advanced U.S. President Donald Trump’s massive tax and spending package after Republican hardliners secured a deal with party leaders to accelerate cuts to Medicaid health coverage. This week, market participants will keep a close eye on U.S. economic data releases for clues on how tariffs and the uncertainty surrounding them are affecting the economy. Preliminary purchasing managers’ surveys for May will provide a timely snapshot of the health of the U.S. manufacturing and services sectors as tariffs begin to take a greater toll on businesses. Other noteworthy data releases include U.S. Existing Home Sales, Initial Jobless Claims, and New Home Sales. “Global activity is still showing resilience, including in the U.S., where continued frontloading is supporting the ‘hard data,’” Citi analysts said in a recent note. However, they noted that ‘soft data,’ including activity and confidence surveys, “paint a potentially grimmer picture, particularly in the U.S., where consumer and business confidence are still deteriorating.” Investors will also monitor speeches from Fed officials as they look for signals on whether policymakers are moving closer to cutting interest rates following the latest soft inflation data. Bostic, Williams, Jefferson, Logan, Musalem, Daly, and Hammack are scheduled to speak this week. In addition, retailers such as Home Depot (HD), TJX Companies (TJX), Lowe’s (LOW), Target (TGT), and Ross Stores (ROST), along with notable companies like Palo Alto Networks (PANW), Medtronic (MDT), Snowflake (SNOW), Intuit (INTU), and Analog Devices (ADI), are slated to release their quarterly results this week. Investors will closely watch retail earnings for indications of consumer weakening amid reports of waning sentiment and worries that tariffs could push prices higher. Today, investors will focus on the Conference Board’s Leading Economic Index for the U.S., which is set to be released in a couple of hours. Economists expect the April figure to be -0.7% m/m, the same as in March. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.544%, up +2.37%. Let's take a look at the markets. In spite of the futures sell off with the credit downgrade, technicals are still holding to a slight buy signal. We were looking for a bullish day on Friday and that's what we got. All the indices are now solidly above their 200DMA. Futures being down today change the look a bit but we are still in a near term bullish trend. What the market does with today's news catalyst will be the tell. Does it shake it off today or use it to turn us to a bearish stance? SPY closed the week strong at $594.20 (+5.31%), gapping above the 200-day moving average, a key level many trend followers watch as a potential signal of bullish continuation. Bulls remained firmly in control, with price action skipping the Weak Go phase and triggering a Strong Go signal on the GoNoGo Trend® Indicator. However, with RSI approaching overbought territory, traders may want to watch for signs of exhaustion heading into next week. QQQ closed even stronger at $521.51 (+6.87%), landing near its year-to-date volume point of control, a key zone of potential overhead supply. With RSI pushing into overbought territory, the stage is set for a tug-of-war between trend-followers riding momentum above the 200-day moving average and bears looking for signs of a reversal. The IWM small-cap ETF lagged behind last week, closing at $209.85 (+4.49%). A Strong Go signal has triggered, and with the index still trading roughly 3% below its 200-day moving average, bulls may have room to push higher before encountering resistance. Unlike its large-cap peers, IWM’s RSI remains below overbought territory, offering more room for near-term follow-through. Taking a look at the weekly expected moves. In spite of this mornings futures selloff, the expected moves and I.V. for the week are back to "normal" levels. My bias or lean today is slightly bullish off the lows of the futures. As I type this the /ES is down -65 and the /NQ is down -340. I think we recoup some of that today. Maybe we don't finish green but I think we rise from here. Earnings season is winding down but we still have HD, TJX, LOW, TGT, PANW, MDT SNOW and INTU potentials this week. We'll work HD today. Our QTTB cover needs replacing. We are already scalping with a long /MNQ with a ratio cover. BITO needs the put side entry. SPX 0DTE with a low probability of a NDX entry today. Lastly, our 1HTE BTC should kick off shortly today. Let's take a look at the /ES as our main focus for today's intra-day levels. 5925 has been a key level for me for a while now on the 4hr. chart. We are back to being slightly below it this morning, as I type. The bulls first order of business today is to get back above that level. On a tighter, 2hr. chart that 5925 still holds key for the bulls. Above that and it's like the down grade never even happened. Support is down at 5874. Below that and well...you can see. There's plenty of downside for a potential retracement. Today we'll be doing another training on a traders checklist that will help all traders focus on what's most important! Either tune into the live zoom feed or watch the replay! See you all in the live trading room shortly!

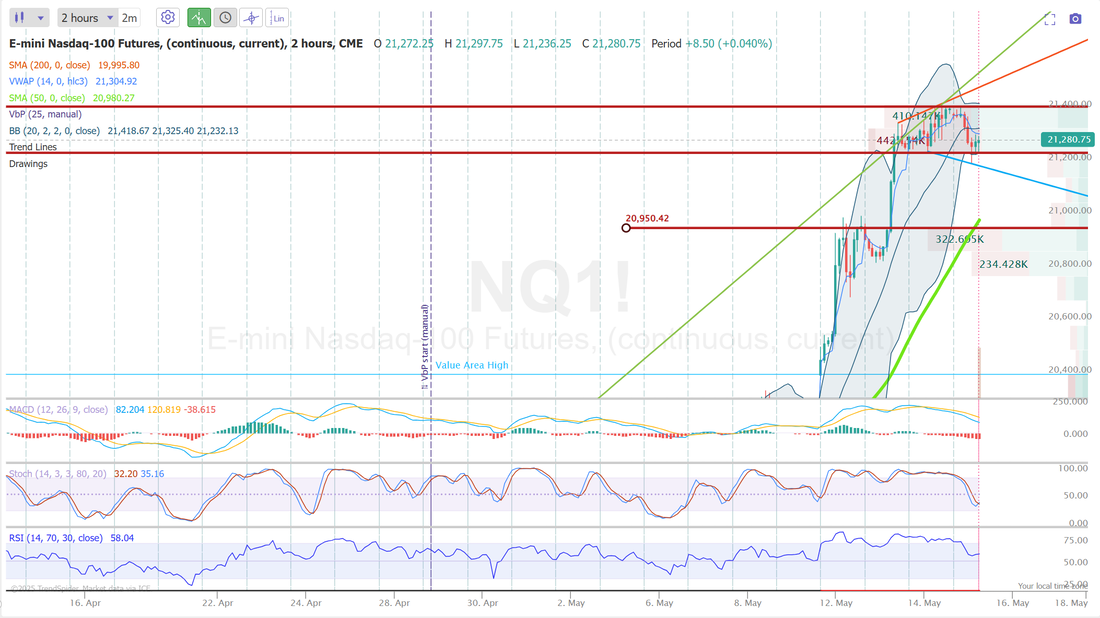

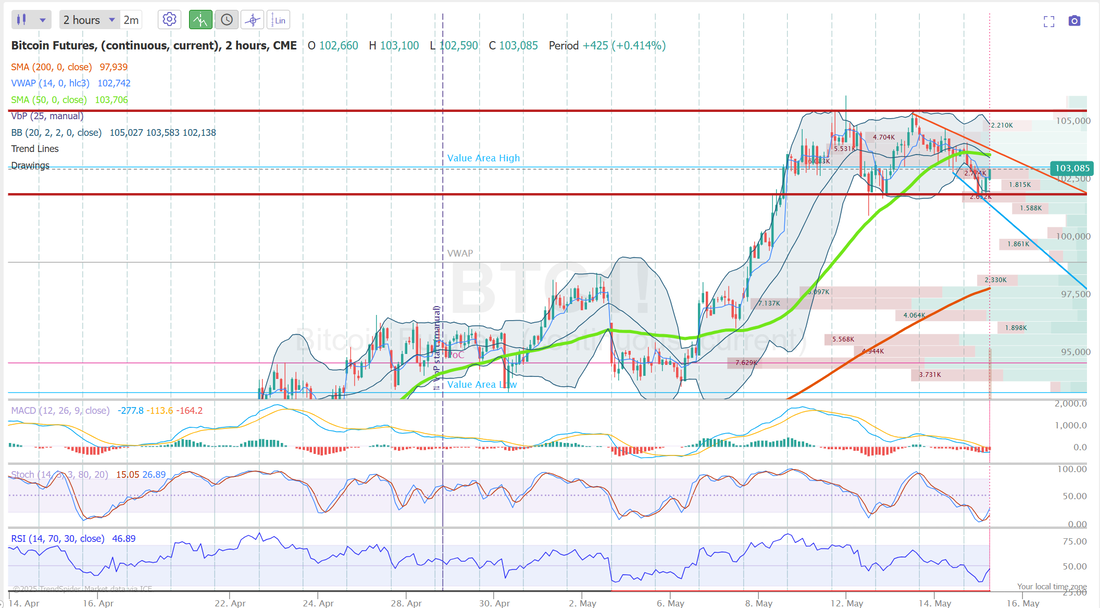

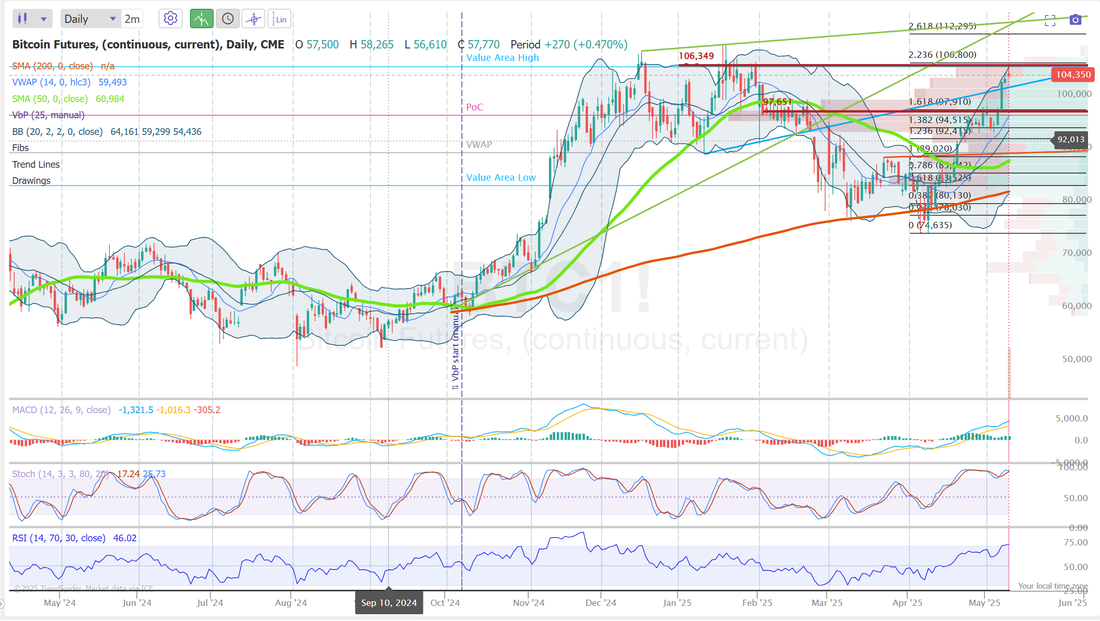

Can you make money being wrong?I love the study of great traders. Whether it's the book Market wizards or a documentary on Youtube, it's insightful to delve into the story of those that are successful in this game of trading. Not surprisingly, a lot of them are unique. They have high IQ's. They are math quants. They play bridge and poker at a high level, etc. In other words they are "special". Does that mean the average person can't succeed at this zero-sum game? Absolutely not! I'm a great example of that! I took a bearish stance yesterday. I thought we were due a retrace after a solid five day rally. Guess what? I was wrong. Markets went up. Not a lot, but they did move in exactly the opposite direction that I planned. I started the day with a short scalp on /MNQ and a bearish SPX 0DTE and then later with a bearish NDX 0DTE. Admittedly, my risk on the day rose above the $500/per trade goal that I have but ultimately EVERY SINGE TRADE I did made money. That's the power of dynamic trading and scaling into trades as the day progresses. Take a look at our day: Let's take a look at the market. Bullish technicals continue to look a tad overstretched and yet we continue higher. The charts certainly look impressive if you are bullish. Taking a look at VTI, which I think gives the best "clear" sign of where the overall market is at, I see a couple divergent signals. #1. Clearly the action is bullish. We are back above the 200DMA. We are gapping up. That's all bullish, however, this is a long bullish run. Indicators, particularly the RSI and Stochastics are really over stretched to the upside. Can they get even more over stretched? Of course however, markets NEVER move in a straight line forever and we have a straight line up right now. June S&P 500 E-Mini futures (ESM25) are trending up +0.19% this morning, with the benchmark index set for one of its strongest weeks this year, as the U.S.-China trade truce continues to bolster sentiment, while investors await a new batch of U.S. economic data and remarks from Federal Reserve officials. U.S. equity futures also drew support from falling Treasury yields, which continued their slide from Thursday after the latest economic data fueled speculation that the Fed may cut rates earlier than expected to avoid a recession. In yesterday’s trading session, Wall Street’s major indices ended mixed. Steris Plc (STE) climbed over +8% and was the top percentage gainer on the S&P 500 after the company reported better-than-expected FQ4 life sciences revenue. Also, Cisco Systems (CSCO) rose more than +4% and was the top percentage gainer on the Dow and Nasdaq 100 after the company posted upbeat FQ3 results and raised its full-year guidance. In addition, Foot Locker (FL) jumped over +85% after Dick’s Sporting Goods agreed to buy the company for about $2.4 billion. On the bearish side, UnitedHealth Group (UNH) plunged more than -10% and was the top percentage loser on the Dow after the Wall Street Journal reported that the U.S. Department of Justice was investigating the company for possible Medicare fraud. Economic data released on Thursday showed that U.S. retail sales rose +0.1% m/m in April, stronger than expectations of no change m/m. Also, the U.S. producer price index for final demand came in at -0.5% m/m and +2.4% y/y in April, weaker than expectations of +0.2% m/m and +2.5% y/y. In addition, U.S. industrial production was unchanged m/m in April, weaker than expectations of +0.2% m/m, while manufacturing production fell -0.4% m/m, weaker than expectations of -0.2% m/m. Finally, the number of Americans filing for initial jobless claims stood at 229K last week, in line with expectations. “[Yesterday’s] data doesn’t change the narrative. Retail sales suggest consumers are becoming pickier, while there remains no sign of broad-based layoffs. The slowdown in inflation in April provides little comfort as the impact from tariffs is yet to come,” said Ellen Zentner at Morgan Stanley Wealth Management. Fed Chair Jerome Powell said on Thursday that policymakers are considering adjustments to key elements of the framework that guides their monetary policy decisions, including their perspective on U.S. employment shortfalls and their strategy for achieving the inflation target. He added, “Anchored inflation expectations are critical to everything we do, and we remain fully committed to the 2% target today.” Also, Fed Governor Michael Barr stated that the economy remains on solid footing, but cautioned that tariff-related supply-chain disruptions could lead to slower growth and higher inflation. Meanwhile, U.S. rate futures have priced in a 91.8% probability of no rate change and an 8.2% chance of a 25 basis point rate cut at June’s policy meeting. Today, investors will focus on the University of Michigan’s U.S. Consumer Sentiment Index, which is set to be released in a couple of hours. Economists, on average, forecast that the preliminary May figure will stand at 53.1, compared to 52.2 in April. U.S. Building Permits (preliminary) and Housing Starts data will also be reported today. Economists expect April Building Permits to be 1.450M and Housing Starts to be 1.360M, compared to the prior figures of 1.467M and 1.324M, respectively. U.S. Export and Import Price Indexes will be released today as well. Economists anticipate the export price index to be -0.5% m/m and the import price index to be -0.4% m/m in April, compared to the previous figures of unchanged m/m and -0.1% m/m, respectively. In addition, market participants will be anticipating speeches from Richmond Fed President Tom Barkin and San Francisco Fed President Mary Daly. Later today, investors will also be monitoring negotiations surrounding the U.S. budget, with its proposed substantial tax cuts and the potential impact these could have on the fiscal deficit. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.415%, down -0.90%. My lean or bias today is bullish. If the "trend is your friend" then you kind of need to be bullish today. Trade docket today is a bit busy for a Friday. AMAT and CAVA earnings take profits. BITO partial take profit and call side roll. QTTB. SPX overnight Vampire trade. It looks like is should expire fully profitable at the open and not require hedging. We've got a 1HTE BTC trade working right now and will continue to trade these as long as the setup allows. This have been so good for us. SPX and NDX 0DTE's. Possibly a share trade on UNH. TESLA, MSTR, PLTR potential 0DTE's. We are working a long /MNQ scalp to start the day and looking to add an /NQ cover. Let's take a look at our intra-day levels for our 0DTE's today. /ES: I have two BIG levels. 6038 is the PoC on the daily chart. That's where the bulls want to take us. It's also the level that I would look for a reversal IF we get there. 5810 is the low volume level and works as support. These are admittedly wide zones so I'll once again use intra-day pivot points to guide our levels today. Those have been really solid lately. /NQ: 21,833 is the High value area and works as resistance with 21,286 being PoC and the immediate downside target. Again, pivot points will be what I queue off of today. BTC: We are headed to our first profit of the day on our first 1HTE. Levels for BTC haven't changed since yesterday. 105,633 is resistance with 102,012 support. I look forward to seeing you all in the live trading room shortly! Let's work hard and see if we can end the week putting another $1,000+ dollars in our pockets today! I'm also excited to do another training session with you all on Monday. I'm going to give you a definitive check list for planning your trading day. Pre-trade. During the trade. Post trade.

Headwinds now?I called for a neutral day yesterday and boy, that was spot on! We came back to a previous consolidation level that goes back to Oct. of last year. Can we go higher from here? Sure. Of course we can. And most assuredly we will, over the long term but short term I think we are stalling here. Stochastics and RSI are very overbought and looking to send us a sell signal. The blog was down yesterday. Here's a look at Tuesdays results: Here's our results from yesterday. We had a big scalp on with the /NQ and we just didn't get the retrace we needed but everything else hit for a profit. Let's take a look at the markets: Technicals are still bullish but very stretched to the upside. I wouldn't be surprised to see a pause or slight rollover soon. SPY stalled out. IWM and DIA are rolling over to the downside. QQQ is the strongest and holding tight. We've had a nice, multi-day run. It may be time for a retrace. June S&P 500 E-Mini futures (ESM25) are down -0.59%, and June Nasdaq 100 E-Mini futures (NQM25) are down -0.77% this morning, pointing to a lower open on Wall Street as a rally sparked by the U.S.-China tariff deal cooled, while investors look ahead to a raft of U.S. economic data, remarks from Federal Reserve Chair Jerome Powell, and an earnings report from retail giant Walmart. In yesterday’s trading session, Wall Street’s major indexes closed mixed. Super Micro Computer (SMCI) surged over +15% and was the top percentage gainer on the S&P 500, extending Tuesday’s gains after Saudi Arabia-based data center company DataVolt signed a multi-year partnership agreement with the company. Also, chip stocks advanced, with Arm Holdings (ARM) climbing more than +5% to lead gainers in the Nasdaq 100 and Advanced Micro Devices (AMD) rising over +4%. In addition, Exelixis (EXEL) soared more than +20% after the biotechnology firm posted upbeat Q1 results and raised its full-year revenue guidance. On the bearish side, American Eagle Outfitters (AEO) slumped over -6% after the apparel chain withdrew its full-year guidance due to macro uncertainty. “As trade tensions ease, investors are pivoting back to fundamentals, but they may not like what they see. The market has raced from oversold to overbought in record time. That limits near-term upside unless we see a clear re-acceleration in growth,” said Mark Hackett at Nationwide. Meanwhile, U.S. President Donald Trump stated on Thursday that India has proposed eliminating tariffs on U.S. goods, even as bilateral trade negotiations between the two nations continue. “They’ve offered us a deal where basically they’re willing to literally charge us no tariff,” Trump said. Fed Vice Chair Philip Jefferson stated on Wednesday that tariffs and the associated uncertainty could dampen growth and boost inflation this year, but monetary policy remains well-positioned to respond as needed. “If the increases in tariffs announced so far are sustained, they are likely to interrupt progress on disinflation and generate at least a temporary rise in inflation,” Jefferson said. Also, Chicago Fed President Austan Goolsbee emphasized that policymakers should avoid reacting to daily fluctuations in equities and policy announcements, noting that current economic data remain steady. U.S. rate futures have priced in a 91.7% chance of no rate change and an 8.3% chance of a 25 basis point rate cut at June’s monetary policy meeting. Fed Chair Jerome Powell is set to deliver remarks on the central bank’s monetary policy review at the Thomas Laubach Research Conference later today. Also, Fed Vice Chair for Supervision Michael Barr will speak today. On the earnings front, notable companies like Walmart (WMT), Applied Materials (AMAT), Deere & Company (DE), and Take-Two (TTWO) are scheduled to report their quarterly figures today. On the economic data front, all eyes are focused on U.S. Retail Sales data, which is set to be released in a couple of hours. Economists, on average, forecast that April Retail Sales will be unchanged m/m following a +1.4% m/m jump in March. Investors will also focus on U.S. Core Retail Sales data, which came in at +0.5% m/m in March. Economists expect the April figure to be +0.3% m/m. The U.S. Producer Price Index will be closely monitored today. Economists foresee the U.S. April PPI coming in at +0.2% m/m and +2.5% y/y, compared to the previous figures of -0.4% m/m and +2.7% y/y. The U.S. Core PPI will be released today. Economists expect April figures to be +0.3% m/m and +3.1% y/y, compared to the March numbers of -0.1% m/m and +3.3% y/y. U.S. Industrial Production and Manufacturing Production data will be reported today. Economists forecast April Industrial Production at +0.2% m/m and Manufacturing Production at -0.2% m/m, compared to the March figures of -0.3% m/m and +0.3% m/m, respectively. The U.S. Philadelphia Fed Manufacturing Index and the Empire State Manufacturing Index will come in today. Economists anticipate the Philly Fed manufacturing index to be -11.3 and the Empire State manufacturing index to be -8.20 in May, compared to last month’s values of -26.4 and -8.10, respectively. U.S. Initial Jobless Claims data will be released today as well. Economists estimate this figure will come in at 229K, compared to 228K last week. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.507%, down -0.46%. PPI could be the main news driver this morning. Trade docket for today. We'll be cashing in our profits on CSCO and WMT this morning. Adding AMAT and CAVA earnings trades later in the day. SPX and NDX 0DTE's. 1HTE on BTC. We've already got one working for you early risers. Let's take a look at our intra-day levels: /ES: 5925 is resistance with 5834 support. /NQ: 21,408 is resistance with 21,237 support. If we lose 21,237 support we could drop to 20,950. BTC: Bitcoin resistance is 105,590 with support at 102,050 My bias or lean today is bearish. I was looking for a stall or neutral day yesterday and that's what we got. Today seems like a good day for a retrace. Futures are down and PPI, Retail sales and Jobless claims are all out and not really pushing future higher. I'll see you all in the live trading room shortly!

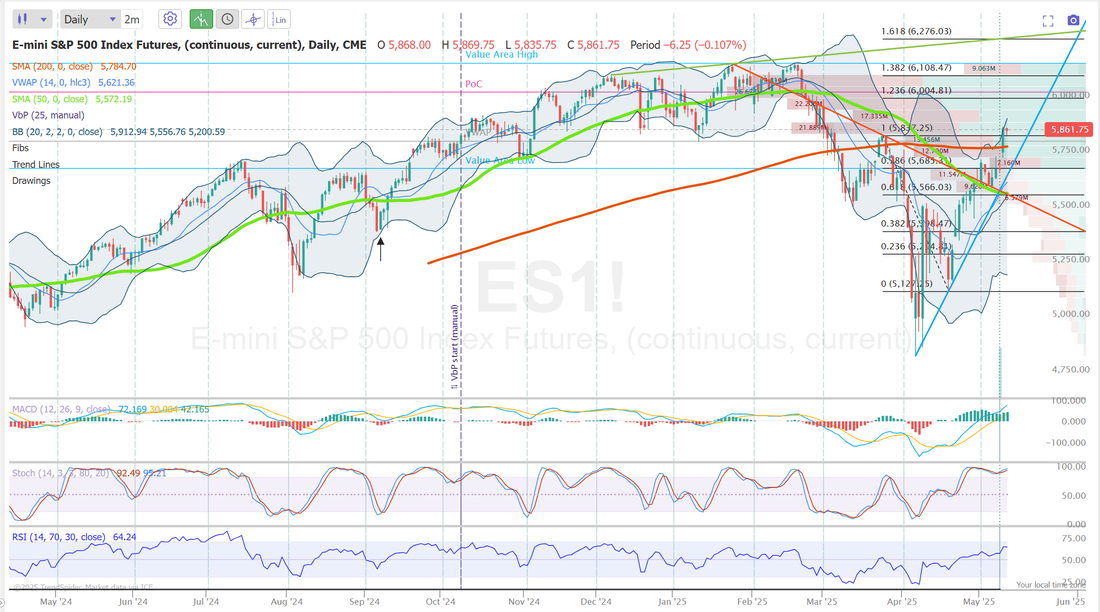

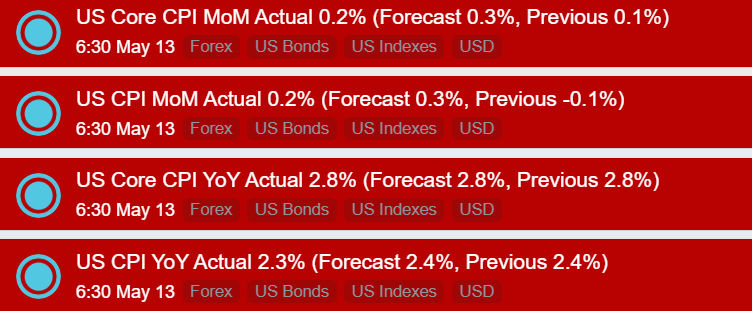

Did we get the "all clear" signal?Markets are back above their 200DMA. Recessionary fears that were strong just a few days ago have wilted. Tariff news seems to be about reductions now. Is this the signal bulls have been looking for to take the market to new all time highs? Well...that may be a bit too big of an ask right now but moving back above the 200DMA is significant and can't be ignored. Inflation numbers will be key this week. Today we get CPI. Let's take a look at the news of the day: June S&P 500 E-Mini futures (ESM25) are down -0.26%, and June Nasdaq 100 E-Mini futures (NQM25) are down -0.41% this morning, taking a breather after yesterday’s rally, while investors gear up for the release of key U.S. inflation data. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed sharply higher after the U.S. and China agreed to temporarily suspend most tariffs on each other’s products. The Magnificent Seven stocks rallied, with Amazon.com (AMZN) surging over +8% and Meta Platforms (META) rising more than +7%. Also, chip stocks jumped, with Microchip Technology (MCHP) climbing more than +10% and ON Semiconductor (ON) gaining over +8%. In addition, NRG Energy (NRG) soared more than +26% and was the top percentage gainer on the S&P 500 after the company posted upbeat Q1 results and acquired a fleet of natural gas-fired power plants from LS Power Equity Advisors for about $12 billion, including debt. On the bearish side, Cigna Group (CI) slid over -5% after President Trump proposed a plan to “cut out” drug industry middlemen in an effort to lower healthcare costs. “With good news on the trade front poised to give stocks a boost at the start of the week, it will be up to inflation data, retail sales, and earnings to sustain the momentum,” wrote Chris Larkin at E*Trade from Morgan Stanley. Meanwhile, a White House executive order overnight said the U.S. will reduce the so-called de minimis tariff on low-value packages from China, including Hong Kong, from 120% to 54% starting May 14th. However, a flat fee of $100 will still apply. Goldman Sachs lowered its estimated risk of a recession in the U.S. to 35% from 45% following a temporary tariff truce with China that raised hopes for a potential de-escalation in the global trade war. Fed Governor Adriana Kugler stated on Monday that despite the recently announced tariff reductions on China, U.S. tariff policies are likely to boost inflation and dampen economic growth. “Trade policies are evolving and are likely to continue shifting, even as recently as this morning. Still, they appear likely to generate significant economic effects even if tariffs stay close to the currently announced levels,” Kugler said. U.S. rate futures have priced in a 91.8% chance of no rate change and an 8.2% chance of a 25 basis point rate cut at the next central bank meeting in June. Today, all eyes are focused on the U.S. consumer inflation report, which is set to be released in a couple of hours. The report is expected to confirm that inflationary pressures are still too elevated to warrant a rate cut at this time. Economists, on average, forecast that the U.S. April CPI will come in at +0.3% m/m and +2.4% y/y, compared to the previous numbers of -0.1% m/m and +2.4% y/y. Also, the U.S. core CPI is expected to be +0.3% m/m and +2.8% y/y in April, compared to the March figures of +0.1% m/m and +2.8% y/y. “April inflation numbers are likely to show elevated inflation pressures persist with some evidence of pre-emptive price hikes as the influence of tariffs starts to show,” said James Knightley, economist at ING. He added that June is likely to be the point when price increases become more apparent. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.455%, down -0.04%. We had a good day yesterday. My scalps lost money but everything else we touched worked. See our results below: Trade docket today is simple: No earnings trades today but we'll get some later this week. We have a big scalp on with /NQ that I'll try to work towards our take profit goal of $400. SPX will be my main 0DTE focus with NDX a smaller goal. We should be able to get some 1HTE's working on BTC as well. Let's take a look at the markets: The only index not fully participating in this rally is the IWM and it still looks good. All the other indices are above my buy zones. Technicals are bullish My bias or lean today is bullish. We have CPI out shortly and that should drive the initial market but the uptrend right now is pretty strong. Let's take a look at the intra-day levels on /ES. Today could be a wide chop zone. 5903 is resistance. That's a ways up and 5786 is the 200DMA and acting as support. It's a wide zone. We'll use pivot points to guide us today. CPI was just released. A little softer than expected. Futures are a bit higher off the news. I'll see you all in the live trading room shortly!

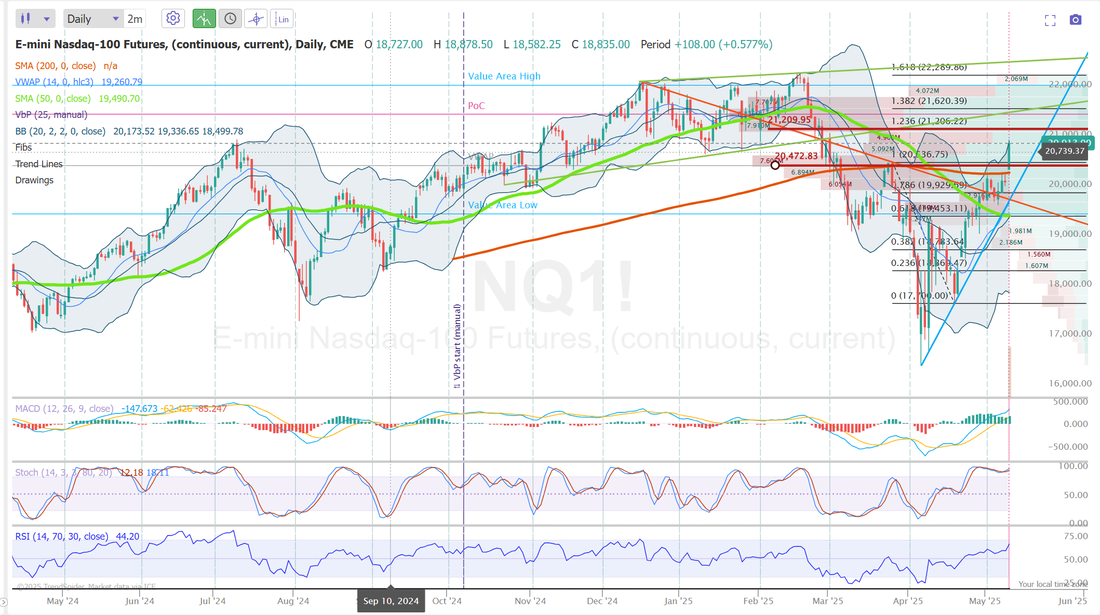

What is a perfect trade?That's so hard to define. Every trader is looking for different things. For me, it's a trade that has a potential profit that is big enough that I'd be thrilled with, should it hit but risk that is low enough that I don't feel stressed or worried. Our SPX 0DTE from last Friday was a perfect example. It was, oh-so-close to hitting a nice big juicy profit but...it didn't. That's always a bummer but the fact that is had no risk in the zone that is was trading in going into the close sure gave me comfort. Here's a look at it. We'll continue to build "forward thinking" setups. We have one already working for today that we started on Friday. Knowing the news catalysts is important. We know over the weekend that negotiations with China would happen and it was pretty clear that we would either get great news, or no news (which would be interpreted as bad new) buy Monday morning. We put on a long Iron condor (see below) This looks set to cash flow for us right out of the gate this morning! We also had a great day Friday, even with our SPX not hitting for max profit. Take a look below: You never know where the profit will come from. That's why we have so many diversified strategies. Let's take a look at this new week. Technicals are bullish. No surprise there with the China news. Maybe most important; The /NQ and /ES are breaking back up above their 200DMA. That's bullish, my friends. We've been looking for this signal for a while now. Will it be all lolly pop and rainbows going forward? Probably not...it never is but, this is a big accomplishment for the bulls. My lean or bias today is bullish. You kind of have to be. My question is, do we retrace this massive futures spike (/ES is currently up a massive 182 points as I type) or is there even more upside once the cash market opens up? Volatility is still with us. We've got over a 2% expected move in the SPY this week and it's already looking to open up 3.2% higher! June S&P 500 E-Mini futures (ESM25) are up +2.78%, and June Nasdaq 100 E-Mini futures (NQM25) are up +3.82% this morning after China and the U.S. agreed to reduce tariffs for 90 days following weekend trade talks in Geneva aimed at easing tensions. The U.S. announced it would reduce its “reciprocal” tariff on Chinese goods from 125% to 10%. Still, U.S. President Donald Trump’s 20% fentanyl-related tariffs on China will remain. At the same time, China said it would lower its tariff on U.S. goods to 10% from 125%. The mutual tariff adjustments will take effect by May 14th. “We are in agreement that neither side wants to decouple,” U.S. Treasury Secretary Scott Bessent said, adding that “we had a very robust and productive discussion on steps forward on fentanyl” and that the talks could result in “purchasing agreements” by China. This week, investors look ahead to the release of key U.S. inflation data, remarks from Federal Reserve Chair Jerome Powell and other Fed officials, and earnings reports from several high-profile companies. In Friday’s trading session, Wall Street’s major equity averages ended mixed. Insulet (PODD) soared over +20% and was the top percentage gainer on the S&P 500 after the company posted upbeat Q1 results and raised its full-year revenue growth guidance. Also, The Trade Desk (TTD) surged more than +18% and was the top percentage gainer on the Nasdaq 100 after the advertising-technology company reported stronger-than-expected Q1 results and gave solid Q2 revenue guidance. In addition, Microchip Technology (MCHP) climbed over +12% after the maker of chips and circuits for electronics reported better-than-expected FQ4 results and issued above-consensus FQ1 revenue guidance. On the bearish side, Akamai Technologies (AKAM) plunged more than -10% and was the top percentage loser on the S&P 500 after the cybersecurity company provided a soft full-year adjusted EPS forecast. Fed officials, speaking Friday at the Hoover Monetary Policy Conference at Stanford University, supported Chair Jerome Powell’s “wait-and-see” stance, stating that the central bank requires greater clarity on how the tariffs will affect the economy before making any changes to interest rates. Meanwhile, U.S. rate futures have priced in a 92.0% probability of no rate change and an 8.0% chance of a 25 basis point rate cut at the conclusion of the Fed’s June meeting. The U.S. consumer inflation report for April will be the main highlight this week. The report is expected to confirm that inflationary pressures are still too elevated to warrant a rate cut at this time. Retail sales data for April and the University of Michigan’s preliminary consumer sentiment index for May will also be closely monitored for indications of how the prospect of tariffs is affecting consumer sentiment and spending. Other noteworthy data releases include the U.S. PPI, the Core PPI, Initial Jobless Claims, the Empire State Manufacturing Index, the Philadelphia Fed Manufacturing Index, Industrial Production, Manufacturing Production, Business Inventories, Building Permits (preliminary), Housing Starts, the Export Price Index, and the Import Price Index. Fed Chair Jerome Powell is set to deliver remarks on the central bank’s monetary policy review at the Thomas Laubach Research Conference on Thursday. Several other Fed officials will also be making appearances throughout the week, including Kugler, Waller, Jefferson, and Daly. First-quarter corporate earnings season is winding down, but several notable companies are due to report this week, including Walmart (WMT), Deere & Company (DE), Applied Materials (AMAT), Cisco Systems (CSCO), and Take-Two Interactive (TTWO). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +6.7% increase in quarterly earnings for Q1 compared to the previous year. The U.S. economic data slate is mainly empty on Monday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.438%, up +1.44%. Trade docket for today: Scalping. It's hard to tell with the /NQ up 800+ points what will give us the best setups for today. QQQ's may work IF we get more movement. /NQ credit spreads could work as well. I'm leaning to an /NQ Credit call spread. 0DTE will focus again on SPX and look for a late day entry in NDX. 1HTE should be viable this morning and we've got more earnings trades this week. Today we'll start with ZI. We'll start our weekly oil trade back up with /MCL and may scale in on our GLD/SLV pairs trade. Let's look at our intra-day levels: /ES: I've got to go out to the 4hr. chart with todays massive upswing. There are two key levels for me today. 5837 is resistance. We are already above that now. This was the March 25th high. Above this is all blue sky so this is the bulls first order of business. Hold this line! Support is down at 5741. That will likely be many pivot points in between these so stay tuned to our zoom feed for those as the day progresses. /NQ: Nasdaq is a bit stronger and already well above the March highs. 21,209 is resistance with 20,472 support. This is again a wide range so look for the pivot points we'll give you in the zoom feed today. BTC: Bitcoin is now well above the 100K mark. $106,349 is the key resistance and that will likely be the area I play today with our 1HTE setups. Today should be another interesting day folks. Our SPX looks set to cash flow right out of the gate. I look forward to seeing you all in the live trading room. Remember today we have another training session. Today our focus is on retraining your brain and managing fear.

|

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |