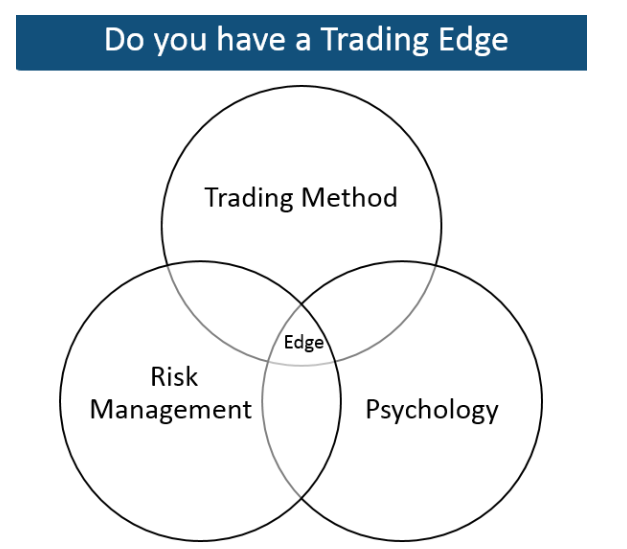

The desire of every trader is to find an approach that provides the opportunity for "edge".

Having a trading edge means having a systematic or strategic advantage in the financial markets that allows a trader to consistently outperform the market or achieve positive returns over time.

Here are ways a trader can develop a trading edge:

1. **Research and Analysis:**

- Conduct thorough research and analysis of financial instruments and markets.

- Use fundamental analysis to identify undervalued or overvalued assets.

- Employ technical analysis to identify trends, patterns, and trading opportunities.

2. **Risk Management:**

- Implement effective risk management strategies to protect capital.

- Set appropriate stop-loss orders to limit potential losses.

- Diversify the portfolio to spread risk across different assets or sectors.

3. **Quantitative Modeling:**

- Develop quantitative models to analyze market data and identify profitable trading opportunities.

- Utilize algorithmic trading strategies based on statistical analysis and machine learning techniques.

4. **Behavioral Finance:**

- Understand market psychology and investor behavior.

- Capitalize on market inefficiencies resulting from emotional biases or herd mentality.

5. **Information Advantage:**

- Utilize proprietary information or sources not readily available to the public.

- Stay informed about macroeconomic factors, geopolitical events, and news that may impact the markets.

6. **Execution Skills:**

- Develop efficient execution strategies to enter and exit trades at optimal prices.

- Utilize advanced trading platforms and technologies to minimize slippage and transaction costs.

7. **Adaptability and Continuous Learning:**

- Stay updated with the latest market trends, developments, and trading strategies.

- Adapt trading strategies based on changing market conditions and evolving trading environments.

8. **Backtesting and Optimization:**

- Backtest trading strategies using historical data to assess their performance under various market conditions.

- Continuously optimize trading strategies based on backtesting results to improve their effectiveness.

9. **Network and Collaboration:**

- Network with other traders, analysts, and professionals to gain insights and access to valuable resources.

- Collaborate with mentors or join trading communities to exchange ideas and strategies.

10. **Discipline and Emotional Control:**

- Maintain discipline in following trading rules and strategies.

- Control emotions such as fear and greed to avoid impulsive decision-making.

- Stick to a trading plan and avoid overtrading or revenge trading.

My Level to level trading approach:

#1. Its not a crystal ball. Levels are starting points. They are tools we can use to build a trading approach with edge. They are not the "end all be all". Use them for what they are. A tool that gives us some clarity on what the market might do.

#2. Recognize and respect. The market will recognize my levels with a fairly high degree of accuracy, meaning, when it hits a level you will usually see it studder step, pause or even retrace. However true that is, it does not mean ir will respect those levels. Often it will continue on through them. These levels offer a jumping off point for some trades or an adjustment window for others. It usually a "take action" point in the trade where something needs to happen on our end.

#3. Sitting on your hands. Whatever trade you find yourself in, its either working or its not. When a trade is working we need to just sit on our hands. It's harder to do than it sounds. Don't mess with trades that are working. It it's not working we need to take action. Stop loss out. Adjust etc.

#4. It’s not your entry but your management of the entry that matters. We rarely catch the top of a short or the bottom of a long. That's why we always keep dry powder to adjust and dollar cost average as the trade progresses. Entering a trade with the idea that we will always be wrong on our entry is a good mental state of mind to maintain.

#5. Respond, don’t predict. We are strategy and directionally bias Agnostics. We have no opinion. We form no bias on what may potentially happen since we can't predict the future. We simply trade what we see.

#6. What capture rate is optimal? You will find that statistically you will make more money, more consitently if you set your take profit levels at 50-75% capture rates. Don't swing for the fence. Only take 100% profit capture when the market serves it up to you on a silver platter.

#7. Why do I use futures to set levels? Futures don't have "gaps". They essentially trade 24/7. They give us a clearer picture of market price action and movement. Its pretty straight forward to calculate the differential between the Cash index (NDX/SPX/RUT/DIA etc.) by simply looking at the futures price and subtracting the difference with the cash market index. You can also use delta to transfer levels from futures to cash markets.

#8. FOMO vs. waiting. When in doubt wait. Sitting on your hands is a skill. There is always another trade opportunity coming. There's rarely a benefit to forcing trades.

#9. Entry point based on the “strong side”.

An object in motion tends to stay in motion (in the direction of the motion). No saying is more true in trading than "The trend is your friend". We work to keep momentum working for us. We do that by entering trades on the "strong side". This means if the market is trending up we sell puts. If the market is trending down we sell calls. It a higher probability setup.

#10. My trading mantras:

#1. Its not a crystal ball. Levels are starting points. They are tools we can use to build a trading approach with edge. They are not the "end all be all". Use them for what they are. A tool that gives us some clarity on what the market might do.

#2. Recognize and respect. The market will recognize my levels with a fairly high degree of accuracy, meaning, when it hits a level you will usually see it studder step, pause or even retrace. However true that is, it does not mean ir will respect those levels. Often it will continue on through them. These levels offer a jumping off point for some trades or an adjustment window for others. It usually a "take action" point in the trade where something needs to happen on our end.

#3. Sitting on your hands. Whatever trade you find yourself in, its either working or its not. When a trade is working we need to just sit on our hands. It's harder to do than it sounds. Don't mess with trades that are working. It it's not working we need to take action. Stop loss out. Adjust etc.

#4. It’s not your entry but your management of the entry that matters. We rarely catch the top of a short or the bottom of a long. That's why we always keep dry powder to adjust and dollar cost average as the trade progresses. Entering a trade with the idea that we will always be wrong on our entry is a good mental state of mind to maintain.

#5. Respond, don’t predict. We are strategy and directionally bias Agnostics. We have no opinion. We form no bias on what may potentially happen since we can't predict the future. We simply trade what we see.

#6. What capture rate is optimal? You will find that statistically you will make more money, more consitently if you set your take profit levels at 50-75% capture rates. Don't swing for the fence. Only take 100% profit capture when the market serves it up to you on a silver platter.

#7. Why do I use futures to set levels? Futures don't have "gaps". They essentially trade 24/7. They give us a clearer picture of market price action and movement. Its pretty straight forward to calculate the differential between the Cash index (NDX/SPX/RUT/DIA etc.) by simply looking at the futures price and subtracting the difference with the cash market index. You can also use delta to transfer levels from futures to cash markets.

#8. FOMO vs. waiting. When in doubt wait. Sitting on your hands is a skill. There is always another trade opportunity coming. There's rarely a benefit to forcing trades.

#9. Entry point based on the “strong side”.

An object in motion tends to stay in motion (in the direction of the motion). No saying is more true in trading than "The trend is your friend". We work to keep momentum working for us. We do that by entering trades on the "strong side". This means if the market is trending up we sell puts. If the market is trending down we sell calls. It a higher probability setup.

#10. My trading mantras:

I use the futures indices to establish my support and resistance levels. To convert them to the equity index you can use this site.