|

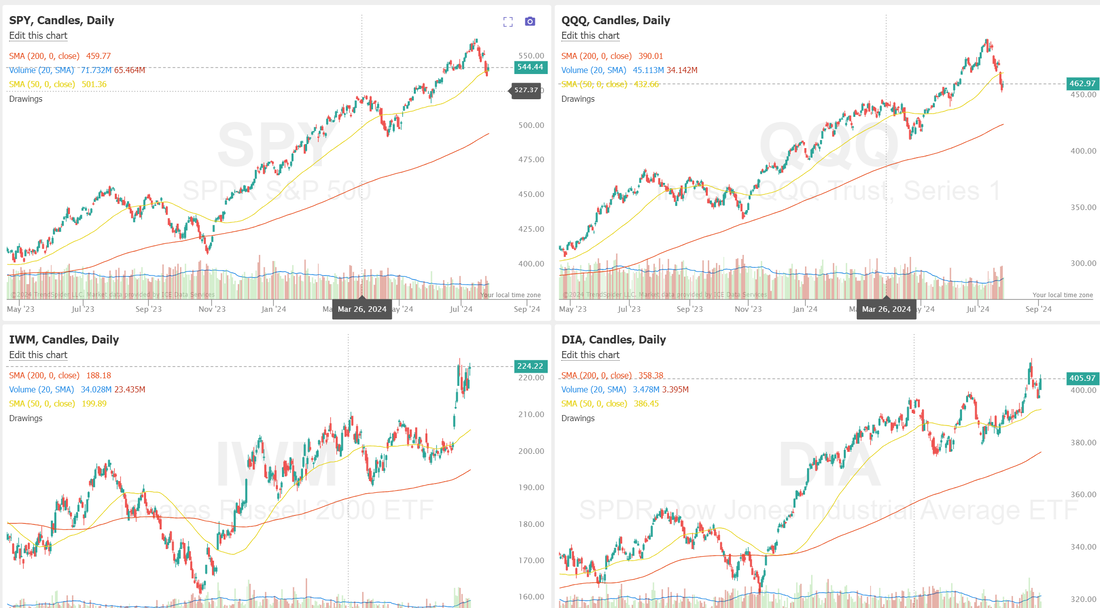

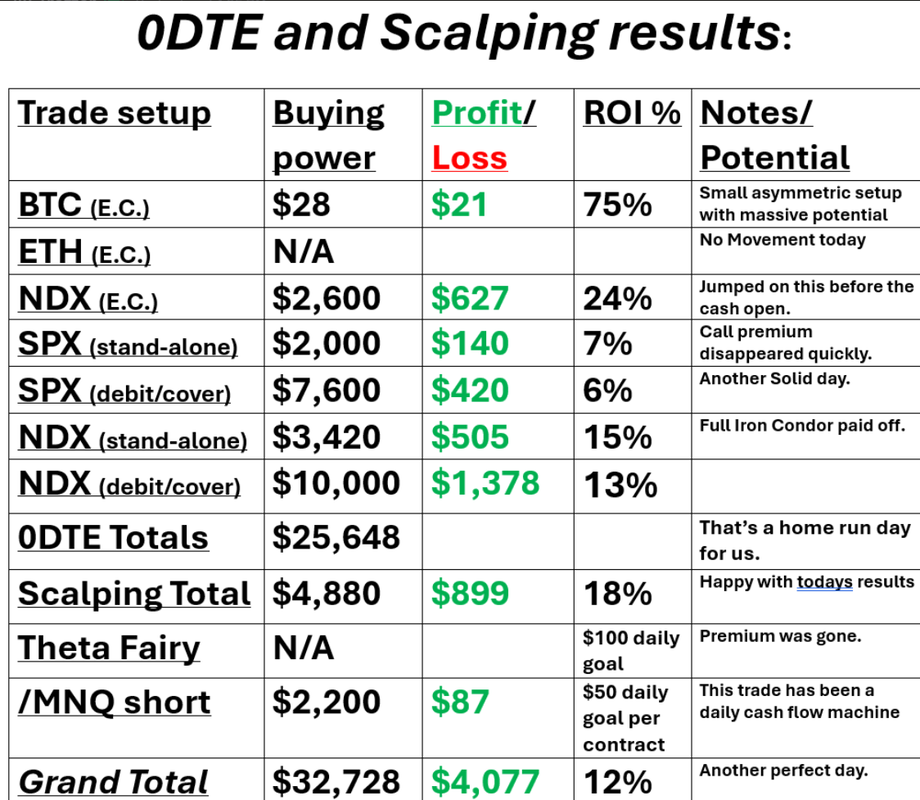

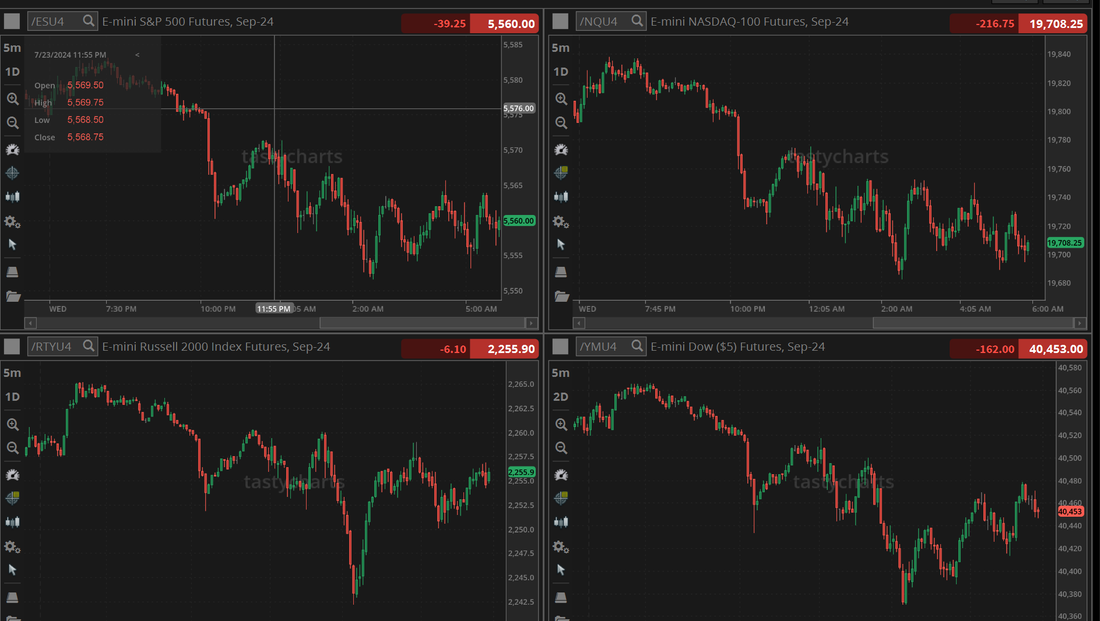

Welcome back to FOMC day! Lots of traders dread today and some simply take the day off. We love it! Mostly we just sit on our hands all day until the last 90 minutes. That's when things get exciting. I'm super happy with our trading results from yesterday. I was down 8-10K for a good part of the day. We worked and worked and worked our 0DTE's and all in all I have to say it was a good day. Let's take a look at our results. I'd like to say we are out of the woods and all our rolled trades but alas no. We've still got a rolled call side on NDX that we will need to deal with today. Let's take a look at the markets. Futures are up this morning. Retracing everything the market gave away yesterday. It's like yesterday never happened. Back to a bullish bias. There was some damage done yesterday with the QQQ's continuing to be the weakest, staying down below the 50DMA. The SPY however, found support there and held firm. The IWM and DIA seem impervious to anything negative. Their strength is impressive. Most of the internal metrics we look at continue to point to bullish price action. Our trade docket and plan of attack for today: /ES (theta fairy), /MNQ, QQQ, 0DTE's, Scalping all on the agenda today as well as a bunch of potential earnings plays in META, QCOM, ARM, EBAY, CVNA, ETSY, MGM, RIG, RIOT. As far as our 0DTE implementation today, we usually wait until the last 90 min. of the day to put them on. FOMC minutes come out and 30 min. later Powell speaks. About 15-20 min. into his speech is usually when the algos pick up on a word of phase he uses and the markets start to move. Unually the first intial move gets faded. That's when we like to pounce. The 1 day VIX is showing the I.V. we like to see. Premiums should be excellent today. NYSE Up volume is still positive vs. down volume. The RUT continues to have elements that keep hitting new highs. But I believe we are overstretched here on the IWM. Diminished buying vol. Price action stalled out the last three days and Stoch in over bought zone. No levels or bias lean for me today as is the case every FOMC day. We will just trade what we see. Here's your cheat sheet for Powell today. September S&P 500 E-Mini futures (ESU24) are up +0.98%, and September Nasdaq 100 E-Mini futures (NQU24) are up +1.57% this morning as expectations mounted that Fed Chair Jerome Powell might signal a potential rate cut for September, while investors also awaited a fresh batch of U.S. economic data and an earnings report from Meta Platforms. In yesterday’s trading session, Wall Street’s main stock indexes closed mixed. CrowdStrike Holdings (CRWD) slumped over -9% and was the top percentage loser on the Nasdaq 100 after CNBC reported that Delta Air Lines had hired lawyers to seek compensation from the cybersecurity firm and Microsoft over the operations meltdown experienced during the global IT outage. Also, Merck & Co. (MRK) slid more than -9% and was the top percentage loser on the S&P 500 and Dow after the pharma giant cut its full-year adjusted EPS forecast. In addition, Procter & Gamble (PG) fell over -4% after reporting weaker-than-expected Q4 sales. On the bullish side, Howmet Aerospace (HWM) surged more than +13% and was the top percentage gainer on the S&P 500 after the supplier to Boeing lifted its FY24 adjusted EPS guidance. Also, PayPal Holdings (PYPL) climbed over +8% and was the top percentage gainer on the Nasdaq 100 after posting upbeat Q2 results and boosting its annual earnings guidance. A Labor Department report on Tuesday showed that U.S. JOLTs job openings fell to 8.184M in June, compared to an expected figure of 8.020M. Also, the Conference Board’s U.S. July consumer confidence index inched up to 100.3, stronger than expectations of 99.7. In addition, the U.S. S&P/CS HPI Composite - 20 n.s.a. rose +6.8% y/y in May, stronger than expectations of +6.5% y/y. Today, all eyes are focused on the Federal Reserve’s monetary policy decision later in the day. While the Fed is anticipated to maintain benchmark rates at the highest level in more than two decades, market participants will be closely monitoring for any hints that the start of policy easing is near. “If the Fed does not signal a September rate cut, markets could get a bit ugly given recent tech weakness - especially if earnings underwhelm,” said Tom Essaye at The Sevens Report. Meanwhile, U.S. rate futures have priced in a 99.7% chance of at least a 25 basis point rate cut at September’s monetary policy meeting and a 60.6% probability of a 25 basis point rate cut at the November meeting. On the earnings front, notable companies like Meta Platforms (META), Qualcomm (QCOM), Western Digital Corporation (WDC), Arm Holdings (ARM), Boeing (BA), eBay (EBAY), Altria (MO), and Marriott International (MAR) are slated to release their quarterly results today. On the economic data front, investors will direct their attention to the U.S. ADP Nonfarm Employment Change data, set to be released in a couple of hours. Economists, on average, forecast that the July ADP Nonfarm Employment Change will stand at 147K, compared to the previous number of 150K. Also, investors will focus on the U.S. Chicago PMI, which stood at 47.4 in June. Economists foresee the July figure to be 44.8. The U.S. Employment Cost Index will be reported today. Economists foresee this figure to arrive at +1.0% q/q in the second quarter, compared to the first-quarter number of +1.2% q/q. U.S. Pending Home Sales data will come in today. Economists expect June’s figure to be +1.4% m/m, compared to last month’s figure of -2.1% m/m. U.S. Crude Oil Inventories data will be reported today as well. Economists estimate this figure to be -1.600M, compared to last week’s value of -3.741M. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.138%, down -0.07%. Let's have a great day folks. FOMC days always give us the potential we need. It's up to us to properly execute on that.

0 Comments

Welcome back traders. We had a solid day yesterday. It could have been much better. It could have been worse. Our net liq was up on the day and several of our 0DTE setups worked but my QQQ hedge in scalping to protect our NDX rolled puts lost money and our Event Contract 0DTE just missed out on profits on the NDX. Here's a look at our results from all our day trades. Our working order for a Theta fairy hit on both the entry and take profit so that result will post to todays P/L matrix. This is our big NDX roll we've been working since last week. I positve day here would help a bunch. There's almost 10K of profit sitting in it. September S&P 500 E-Mini futures (ESU24) are trending up +0.17% this morning as market participants braced for the start of the Federal Reserve’s two-day policy meeting while also awaiting the latest reading on U.S. job openings as well as an earnings report from tech giant Microsoft. In yesterday’s trading session, Wall Street’s major indexes ended mixed. ON Semiconductor (ON) surged over +11% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the semiconductor maker reported better-than-expected Q2 results. Also, Tesla (TSLA) advanced more than +5% after Morgan Stanley named the electric vehicle giant as its new “Top Pick” within the U.S. auto sector. In addition, McDonald’s (MCD) climbed over +3% and was the top percentage gainer on the Dow despite posting downbeat Q2 results, as executives pledged to launch new promotions. On the bearish side, Arm (ARM) slumped more than -5% and was the top percentage loser on the Nasdaq 100 after HSBC downgraded the stock to Reduce from Hold. The Federal Reserve begins its two-day meeting later in the day. Fed officials, who have maintained interest rates at a more than two-decade high for a full year, are widely anticipated to keep them unchanged again when their two-day meeting concludes on Wednesday. Instead, investors expect policymakers to lower their benchmark rate in September as the risk of jeopardizing a solid yet moderating job market increases. Second-quarter corporate earnings season is in full swing, with investors awaiting new reports today from notable companies such as Microsoft (MSFT), Procter & Gamble (PG), Merck (MRK), Advanced Micro Devices (AMD), Pfizer (PFE), and Starbucks (SBUX). On the economic data front, all eyes are focused on the U.S. JOLTs Job Openings data, set to be released in a couple of hours. Economists, on average, forecast that the June JOLTs Job Openings will come in at 8.020M, compared to the previous figure of 8.140M. Also, investors will focus on the U.S. CB Consumer Confidence Index, which arrived at 100.4 in June. Economists foresee the July figure to be 99.7. The U.S. S&P/CS HPI Composite - 20 n.s.a. will be reported today as well. Economists expect May’s figure to be +6.5% y/y, compared to the previous number of +7.2% y/y. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.185%, up +0.19%. Trade docket for today: Theta Fairy, /MNQ, CRWD, FSLR, MRK, PG, QQQ, MSFT, AMD, SBUX, 0DTE's, Scalping My bias today is bullish. If jobless claims don't rock the boat I think we go higher today. Market technicals as ever so slightly bullish We continue to be stuck in a consolidating pattern on most of the indices. Let's look at my intra-day levels for 0DTE trades: /ES; 5516/5523/5533*(key level. above it we could get some upside)/5552 to the upside. 5507*(key level. PoC)/5493/5480*(key level. below it we could build some downside)/5470 to the downside. /NQ; 19315/19369*(key level high of yesterday)/19448/19493 to the upside. 19191/19147/19080*(key level. below is a lot of downside pressure)/19004 to the downside. BTC: Bitcoin gave back some of its weekend gains on Monday. Its new support is 66,428 and resistance is 68,585. Good fortune today traders. Let's see if we can get our rolled NDX puts to the finish line.

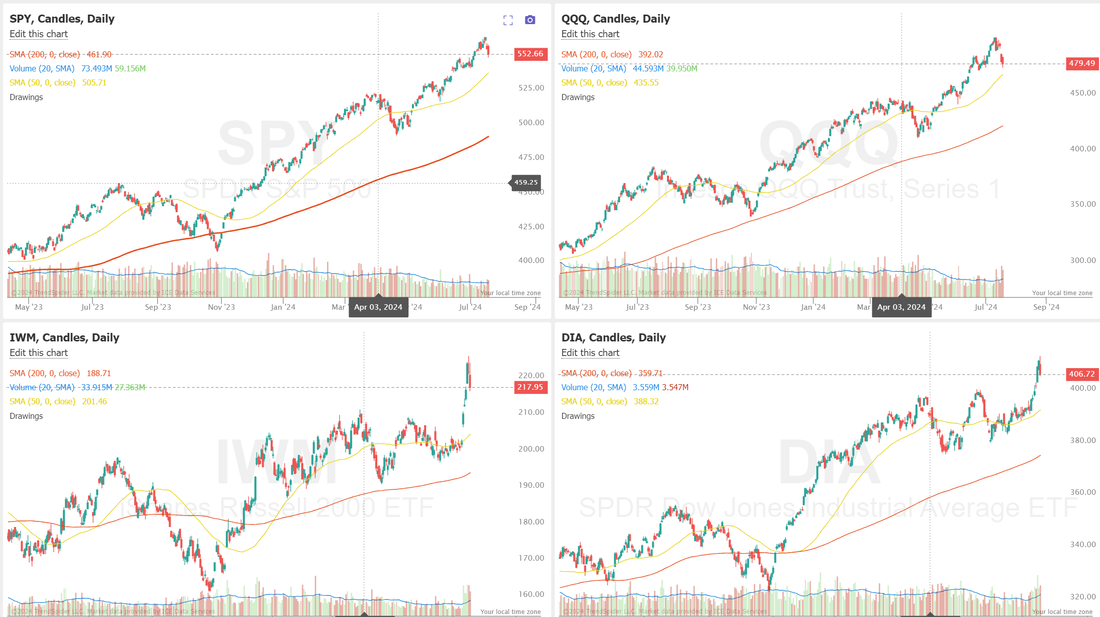

Welcome back to a new trading week! Last week was a tough one for a lot of traders. It did however bring back the I.V. we've been missing. We had a decent day on Friday with some of our rolled positions going out at a profit but our NDX rolls are still going. It looks like we can get a couple take profits on those today if the futures hold. Here's a look at our day last Friday. Let's take a look at the markets. Technicals are swinging back to buy mode this morning. It's really a tale of two different money flows. The SPY and QQQ are still stuck in a consolidation zone while the IWM and DIA continue to look to new bullish highs. After finding nearly perfect resistance at the 1.618 golden Fibonacci extension last week, the SPY reversed sharply lower to find itself at the bottom of the ascending channel, closing the week at $548.99 (-1.96%). A weekly bearish engulfing candle suggests the possibility of further downside, which is supported by the price closing below the daily 8/21 EMA cloud. The pain continued for the QQQ this week, which closed at $475.24 (-3.96%). With the price breaking down below the ascending channel and a seemingly imminent bearish 8/21 EMA cross on the horizon, the area of low volume looks primed for an eventual test. The rotation into small caps continued this week, gaining over 6% before a strong reversal on Wednesday. Despite this, the IWM closed higher for the second week in a row at $216.84 (+1.74%), but put in a concerning Shooting Star weekly candle as the price fell back into the ascending channel. Bulls will be looking for the 8/21 EMA cloud to act as support next week. Let's take a look at the expected moves for the week. I.V. looks solid for us. Let's see if it holds through the week. eptember S&P 500 E-Mini futures (ESU24) are up +0.29%, and September Nasdaq 100 E-Mini futures (NQU24) are up +0.38% this morning as market participants looked ahead to earnings reports from major tech names, the Federal Reserve’s policy meeting, as well as the release of the U.S. jobs report later in the week. In Friday’s trading session, Wall Street’s major averages ended in the green. 3M Company (MMM) soared about +23% and was the top percentage gainer on the S&P 500 and Dow after the company posted upbeat Q2 results and raised the lower end of its full-year adjusted EPS guidance. Also, Charter Communications (CHTR) surged more than +16% and was the top percentage gainer on the Nasdaq 100 after the cable and internet company reported better-than-expected Q2 results. In addition, Deckers Outdoor (DECK) climbed over +6% after the company reported stronger-than-expected Q1 results and raised its FY25 EPS guidance. On the bearish side, DexCom (DXCM) plummeted more than -40% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the diabetes device maker reported mixed Q2 results, issued below-consensus Q3 revenue guidance, and lowered its FY24 revenue outlook. Data from the U.S. Department of Commerce on Friday showed that the U.S. core PCE price index, a key inflation gauge monitored by the Federal Reserve, came in at +0.2% m/m and +2.6% y/y in June, compared to expectations of +0.2% m/m and +2.5% y/y. Also, U.S. June personal spending rose +0.3% m/m, in line with expectations, while U.S. June personal income rose +0.2% m/m, weaker than expectations of +0.4% m/m. In addition, the University of Michigan U.S. consumer sentiment index was revised upward to 66.4 in July, stronger than expectations of 66.0. The U.S. Federal Reserve’s interest rate decision and Fed Chair Jerome Powell’s post-policy meeting press conference will take center stage in the coming week. The Federal Open Market Committee is widely anticipated to maintain rates at the current range of 5.25% to 5.50%, with investors and economists believing that the central bank won’t adjust rates until its meeting in September. At the same time, economists surveyed by Bloomberg News expect the Fed to signal its intention to lower interest rates in September at the conclusion of its meeting on Wednesday. Meanwhile, U.S. rate futures have priced in a 99.6% chance of at least a 25 basis point rate cut at the September FOMC meeting and a 61.4% probability of a 25 basis point rate cut at the conclusion of the Fed’s November meeting. Second-quarter earnings season continues in full force, and investors anticipate fresh reports from major companies this week, including Microsoft (MSFT), Amazon (AMZN), Meta Platforms (META), Apple (AAPL), Starbucks (SBUX), McDonald’s (MCD), Boeing (BA), Mastercard (MA), Pfizer (PFE), Moderna (MRNA), Merck (MRK), Chevron (CVX), ExxonMobil (XOM), SoFi Technologies (SOFI), Advanced Micro Devices (AMD), Intel (INTC), and Qualcomm (QCOM). On the economic data front, the U.S. Nonfarm Payrolls report for July will be the main highlight. Also, market participants will be eyeing a spate of other economic data releases, including the U.S. CB Consumer Confidence Index, JOLTs Job Openings, S&P/CS HPI Composite - 20 n.s.a., ADP Nonfarm Employment Change, Employment Cost Index, Chicago PMI, Pending Home Sales, Crude Oil Inventories, Initial Jobless Claims, Nonfarm Productivity (preliminary), Unit Labor Costs (preliminary), S&P Global Manufacturing PMI, Construction Spending, ISM Manufacturing PMI, Average Hourly Earnings, Unemployment Rate, and Factory Orders. The U.S. economic data slate is mainly empty on Monday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.169%, down -0.77%. Our trade docket for today is fairly busy: /MNQ, /NG, /ZC, /ZN, DIA, DJT, F, IWM, NVDA, QQQ/SPY, UPST, ORCL, CCL, CRM, PLTR, PYPL, SHOP, MRK, PG, 0DTE's, Scalping. Intra-day levels for me: /ES; 5529/5536/5554* (key level bulls need to clear today)/5588 to the upside. 5507/5493/5478* (key level of support. If we lose this we have some downside potential)/5457. /NQ; 19329/19374* (key level of 50 period M.A.)/19396/19575/ to the upside. 19,266,19218,19153,19105 to the downside. BTC; Had a nice run up over the weekend. 73,000 is the new resistance and 68829 support. We needed this push up we are currently getting with the futures. If we could exit our SPY/QQQ trades and Some of our NDX puts today it would be a fantastic day for us. Let's go get some today traders!

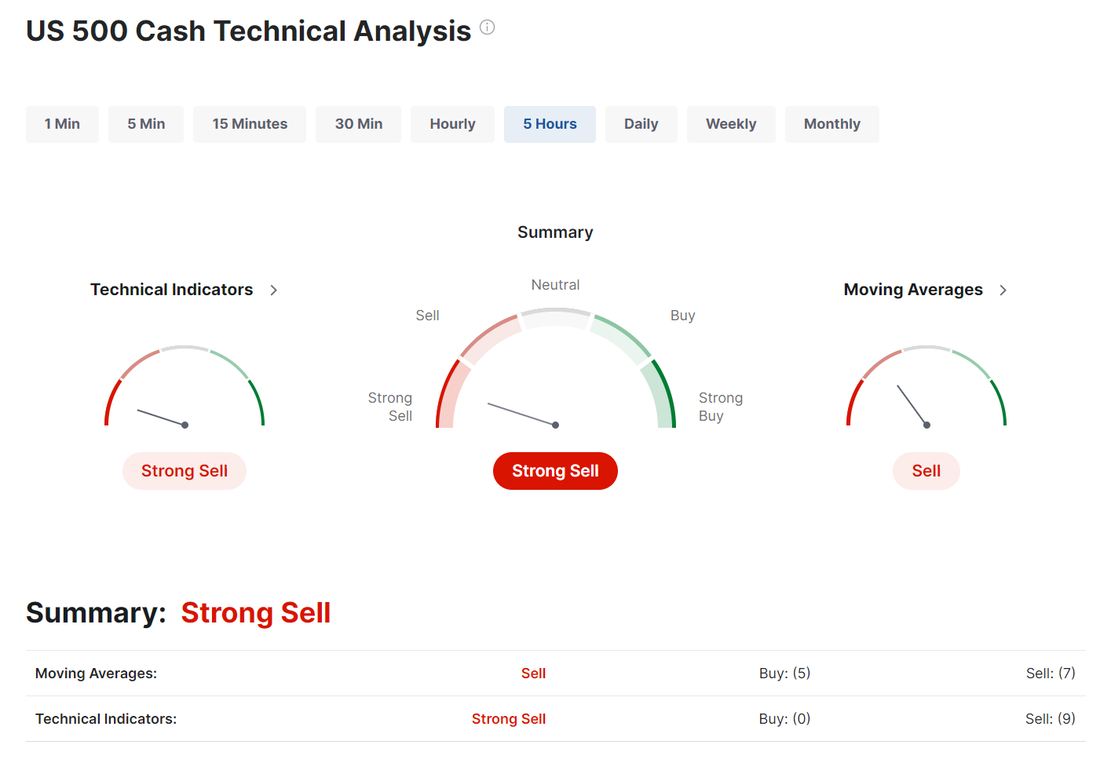

Welcome back traders and happy Friday! We didn't make much progress yesterday as I had to roll both put and call sides of some of our 0DTES. We did have some success with Scalping and our NDX event contract 0DTE. Both of these can provide some needed buffers when the market is crazy. If you'd like to trade these daily setups with us I'll provide the links below. Some of you have inquired about access prop funds to trade with. I love and endorse Apex. I think its a great training tool. You can check it out here. While our results from yesterday didn't look very good, our rolls into today look to hopefully yield some good results. Here's what we did achieve yesterday. Technicals are still in sell mode but it wouldn't take much to flip back to buy mode. We seem overstretched to the downside. Yesterdays price action didn't do much to change the directional landscape. A nice push up and then a finish at the days lows. With the exception of the Russell, which is on a parabolic rip, all the indices we trade are still stuck around the new support/resistance area that was established about one month ago. The fear and greed index is starting to flash a buy signal Tech was ugly yesterday but the overall market actually looked pretty healthy. In yesterday’s trading session, Wall Street’s major indexes closed mixed. Edwards Lifesciences (EW) plummeted over -31% and was the top percentage loser on the S&P 500 after the company reported weaker-than-anticipated Q2 revenue, issued lackluster Q3 guidance, and cut its annual guidance for sales of some heart valve replacements. Also, Lululemon Athletica (LULU) slumped more than -9% and was the top percentage loser on the Nasdaq 100 after Citi downgraded the stock to Neutral from Buy. In addition, Ford Motor (F) tumbled over -18% after the carmaker reported downbeat Q2 results. On the bullish side, ServiceNow (NOW) surged more than +13% and was the top percentage gainer on the S&P 500 after the company posted upbeat Q2 results and raised its FY24 subscription revenue guidance. Also, International Business Machines (IBM) climbed over +4% and was the top percentage gainer on the Dow after the IT giant reported better-than-expected Q2 results and raised its full-year free cash flow forecast. The U.S. Department of Commerce’s preliminary reading on Thursday showed that the U.S. economy grew at a +2.8% annualized rate in the second quarter, surpassing the +2.0% consensus estimate and accelerating from +1.4% in the prior quarter. Also, the U.S. Q2 core personal consumption expenditures price index rose +2.90%, slowing from +3.70% in Q1. In addition, U.S. June durable goods orders unexpectedly plunged -6.6% m/m, weaker than expectations of +0.3% m/m, while U.S. June core durable goods orders rose +0.5% m/m, stronger than expectations of +0.2% m/m. Finally, the number of Americans filing for initial jobless claims in the past week fell -10K to 235K, compared with the 237K expected. “Goldilocks is getting stronger and the risk of stagflation is fading,” said David Russell at TradeStation. “There’s not much ‘stag; and not much ‘flation’. This kind of GDP report is a potential tailwind for corporate earnings that keeps us on pace for lower rates going forward.” Meanwhile, U.S. rate futures have priced in a 6.7% chance of a 25 basis point rate cut at next week’s monetary policy meeting and a 99.8% probability of at least a 25 basis point rate cut at the conclusion of the Fed’s September meeting. On the earnings front, notable companies like Bristol-Myers Squibb (BMY), Colgate-Palmolive (CL), Charter Communications (CHTR), and 3M (MMM) are set to report their quarterly figures today. Today, all eyes are focused on the U.S. core personal consumption expenditures price index, the Fed’s preferred price gauge, set to be released in a couple of hours. Economists, on average, forecast that the core PCE price index will stand at +0.2% m/m and +2.5% y/y in June, compared to last month’s figures of +0.1% m/m and +2.6% y/y. U.S. Personal Spending and Personal Income data will also be closely monitored today. Economists forecast June Personal Spending to be at +0.3% m/m and June Personal Income to come in at +0.4% m/m, compared to the May numbers of +0.2% m/m and +0.5% m/m, respectively. The U.S. Michigan Consumer Sentiment Index will be reported today as well. Economists estimate this figure to arrive at 66.0 in July, compared to 68.2 in June. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.252%, down -0.17%. PCE numbers out shortly, should be the news catalyst for the day. My bias for today is bullish. Our trade docket for today: DELL, DIA, BMY, DLR, IWM, NVDA, QQQ/SPY, LULU, DXCM, SNOW, 0DTE's. Intra-day levels for me: /ES; 5494/5509/5533*(50 period M.A. on 2hr. chart)/5572 to the upside. 5472/5454/5432 to the downside. /NQ; 19346/19525/19619/19721 to the upside. 19057/18971/18882/18716 to the downside. Bitcoin; BTC had a strong upward push overnight. 68,588 is the new resistance. 66,484 is support. Let's bring some of that rolled premium in today! Have a great weekend.

Welcome back traders! Well...how was your day yesterday? Those were some big, substantivie moves. It's been a long time since the SP500 took a 2%+ move. The SPY is also having a rotation problem. The largest fund to track the key stock market benchmark, the SPDR S&P 500 Trust ETF (SPY), is losing to 10 major market segments over the past month. What do all the recent market leaders have in common? They have little to zero exposure to the mega-cap tech stocks known as the Magnificent 7. Since July 1, the Mag 7 have collectively declined by more than 12%, as measured by the Roundhill Magnificent Seven ETF (MAGS). The Mag 7 stocks comprise roughly one-third of the cap-weighted S&P 500 index, which until this month had outperformed most of the market segments that are now beating it. The greatest example of the turn in market performance is the iShares Russell 2000 ETF (IWM), which is up nearly 8% in the past month, compared to SPY’s 0.8% decline. Other market segments that are outperforming the S&P 500 include midcap and value stocks, a range of sectors including real estate, consumer discretionary, and financials, as well as commodities and alternative assets like gold and bitcoin. Let's take a look at my results from yesterday. We had to roll so many of our puts yesterday that we won't really see the true results of our day until the close of todays market. There are a lot of warning signs out there. No surprise. Technicals are in full sell mode. Futures are down again this morning as I type. And volatility is spiking. I.V. is certainly not a problem now for option sellers. The motto may be, "Be careful what you wish for." We've (I) have been complaining about low I.V. for what seems like ages. That's not a problem today! The real impact of yestedays selloff is still unkown. If you look at the four major indices we trade all it's done is bring us back to previous resistance levels that are now, of course, support. The question that needs to be answered is, does it hold? If we lose these new support levels it certainly looks like we not only have downside ahead but plenty of it! The NDX looks to have approx. 1,000 points of downside to it's PoC (Point of control purple line) The SPX has close to 400 points of potential downside before we hit PoC. It's a big day for economic news. Jobless claims, Durable goods and GDP all hit this morning. In yesterday’s trading session, Wall Street’s major indices ended lower, with the tech-heavy Nasdaq 100 suffering its largest single-day percentage drop since October 2022. Tesla (TSLA) plunged over -12% and was the top percentage loser on the Nasdaq 100 after the electric vehicle giant reported weaker-than-expected Q2 adjusted EPS and postponed its Robotaxi event to October. Also, Alphabet (GOOGL) slumped more than -5% after the Google parent reported higher-than-expected Q2 capital spending, and its chief indicated that patience would be required to see concrete results from artificial intelligence investments. In addition, Lamb Weston (LW) plummeted over -28% and was the top percentage loser on the S&P 500 after reporting downbeat Q4 results and providing below-consensus FY25 guidance. On the bullish side, Enphase Energy (ENPH) surged more than +12% and was the top percentage gainer on the S&P 500 after the company reported strong Q3 bookings. Also, AT&T (T) rose over +5% after the telecommunications company reported better-than-expected wireless subscriber additions in Q2. “The market is not impressed with the start of earnings season for the mega tech stocks,” said Kathleen Brooks, research director at XTB. “There was a lot resting on these results and we don’t think that they give clear answers to questions about the effectiveness and profit potential for AI right now.” Economic data on Wednesday showed that the U.S. S&P Global manufacturing PMI unexpectedly fell to 49.5 in July, weaker than expectations of 51.7. Also, U.S. June new home sales unexpectedly fell -0.6% m/m to 617K, weaker than expectations of 639K. At the same time, the U.S. S&P Global services PMI rose to 56.0 in July, stronger than expectations of 54.7. Meanwhile, U.S. rate futures have priced in a 10.9% chance of a 25 basis point rate cut at next week’s monetary policy meeting and a 98.7% probability of at least a 25 basis point rate cut at September’s policy meeting. On the earnings front, notable companies such as AbbVie (ABBV), Union Pacific (UNP), Northrop Grumman (NOC), Rtx Corp. (RTX), Honeywell (HON), Keurig Dr Pepper (KDP), Deckers Outdoor (DECK), and Southwest Airlines (LUV) are slated to release their quarterly results today. On the economic data front, all eyes are focused on the first estimate of U.S. second-quarter gross domestic product, due later in the day. Economists, on average, forecast that U.S. GDP will stand at +2.0% q/q in the second quarter, compared to the first-quarter figure of +1.4% q/q. Also, investors will focus on U.S. Durable Goods Orders data, which came in at +0.1% m/m in May. Economists foresee the June figure to be +0.3% m/m. U.S. Core Durable Goods Orders data will be reported today. Economists foresee this figure to come in at +0.2% m/m in June, compared to the previous number of -0.1% m/m. U.S. Initial Jobless Claims data will come in today as well. Economists estimate this figure to be 237K, compared to last week’s value of 243K. My bias or lean today is nothing! I was clearly wrong yesterday. I thought we would get a little bounce. It was nothing but straight down all day. With yesterdays move and all the news catalysts coming this morning I'm just going to react to what the market gives us. No intra-day levels for me. Let's just let the day play out and be patient with our entries. Trade docket for today: /MCL, /MNQ, /ZN, /NG, CMG, CRWD, DELL, DIA, DJT, F, IWM, LUV, LVS, NVDA, QQQ/SPY, UPST, CMG? DLR, JNPR, BMY. Be patient today and trade small. Stay safe. Nothing wrong with simple preservaton in times like this and remember...cash is a position.

Welcome back my fellow traders! We had another stellar day yesterday. We generate enough trades, daily and weekly that our diversification is pretty strong but that can also eliminate "home run" type days as it's statistically difficult to have all your trades end up winners every day. Yesterday was another exception for us with everything working well. Not shown in our results is a last scalp we took going into the close. That resulted in a $600 profit so we are starting today off on the right foot. Take a look at our results for the day. Let's take a look at the markets. Technicals are back to sell mode after horrible Tesla earnings and poor reception to GOOG results. Futures are hammered down, as I said, based on poor tech earnings. I wouldn't be surprised to see a rebound today. September Nasdaq 100 E-Mini futures (NQU24) are trending down -1.04% this morning as Alphabet’s cautious outlook on AI progress and Tesla’s profit miss, coupled with a delay in its Robotaxi event, weighed on sentiment, while investors awaited U.S. business activity data and the next round of corporate earnings reports. Tesla (TSLA) slumped over -7% in pre-market trading after the electric vehicle giant reported weaker-than-expected Q2 adjusted EPS and postponed its Robotaxi event to October. Also, Alphabet (GOOGL) fell more than -3% in pre-market trading after the tech giant reported higher-than-expected Q2 capital spending, and its chief indicated that patience will be required to see concrete results from artificial intelligence investments. In yesterday’s trading session, Wall Street’s main stock indexes closed in the red. UPS (UPS) tumbled over -12% and was the top percentage loser on the S&P 500 after reporting weaker-than-expected Q2 results. Also, NXP Semiconductors (NXPI) slid more than -7% after the company provided disappointing Q3 guidance. On the bullish side, Pentair (PNR) climbed +9% and was the top percentage gainer on the S&P 500 after the company posted upbeat Q2 results and updated its full-year adjusted EPS guidance to around $4.25 from $4.15-$4.25. In addition, Arm (ARM) rose about +5% and was the top percentage gainer on the Nasdaq 100 following a note from M Science stating that all new Arm deployments in the first half of July were powered by Amazon Graviton GPUs. Economic data on Tuesday showed that U.S. existing home sales fell -5.4% m/m to 3.89M in June, weaker than expectations of 3.99M. Also, the July Richmond Fed manufacturing index came in at -17, weaker than expectations of -7. Second-quarter corporate earnings season rolls on, with investors awaiting fresh reports from notable companies today, including IBM (IBM), AT&T (T), Chipotle Mexican Grill (CMG), Thermo Fisher Scientific (TMO), General Dynamics (GD), Ford Motor (F), and Las Vegas Sands (LVS). On the economic data front, all eyes are focused on the U.S. S&P Global Manufacturing PMI preliminary reading, set to be released in a couple of hours. Economists, on average, forecast that the July Manufacturing PMI will come in at 51.7, compared to last month’s value of 51.6. Also, investors will focus on the U.S. S&P Global Services PMI, which stood at 55.3 in June. Economists foresee the preliminary July figure to be 54.7. U.S. New Home Sales data will be reported today. Economists foresee this figure to stand at 639K in June, compared to the previous number of 619K. The U.S. Building Permits data will come in today. Economists expect June’s figure to be 1.446M, compared to 1.399M in May. U.S. Crude Oil Inventories data will be reported today as well. Economists estimate this figure to be -2.600M, compared to last week’s value of -4.870M. Meanwhile, investor focus also rests on the U.S. core personal consumption expenditures price index for June, the Fed’s first-line inflation gauge, which is set for release on Friday. The reading could provide insights into whether policymakers might lower interest rates in September. U.S. rate futures have priced in a 4.7% chance of a 25 basis point rate cut at next week’s monetary policy meeting and a 91.7% probability of a 25 basis point rate cut at the September meeting. My bias today is bullish! As I mentioned, I think we take some time this morning to absorb the poor TSLA/GOOG results and then work back higher. By bullish, I don't mean we neccessarily finish green. Just that we work our way back up from the NDX being down 220 points as the futures indicate right now. Trade docket for today: /MNQ, DJT, ENPH, GOOG, TSLA, V?, F, LUV,AAL, CMG, LVS, WM, 0DTE's, Scalping, We continue to be stuck around our currrent levels. We need a break out, either up or down, at this point, to establish a new trend. Price action from yesterday was more neutral in nature. Key economic indicator for us today is the PMI. With PMI out this morning I don't usually publish levels as day's like today are more Algo driven. Of note is the fact the the Ether ETF started trading. This isn't having the same impact as the BTC ETF's but should be overall positive for crypto. We should have a better chance today of getting all seven of our daily 0DTE's working.

Let's have a great day folks. If we can make half as much as we did yesterday I'll call that a success. Welcome back! We had a solid day yesteray to start the week off. Crypto didn't have much directional bias and we waited too long on the NDX to get any decent event contract 0DTES but everything else clicked for us. Here are our results. The market held its ground yesterday as we continue to wait for the next big directional move. We've moved back to a slightly bullish technical bias. My lean today is neutral. The "Magnificent seven" are due for earnings and I'm sure that will give us some directional push. September S&P 500 E-Mini futures (ESU24) are up +0.02%, and September Nasdaq 100 E-Mini futures (NQU24) are down -0.11% this morning as investor attention shifted from U.S. politics to a deluge of corporate earnings reports, with particular emphasis on results from “Magnificent Seven” companies Tesla and Alphabet. In yesterday’s trading session, Wall Street’s major indexes ended higher. IQVIA Holdings (IQV) surged over +9% and was the top percentage gainer on the S&P 500 after the company posted upbeat Q2 results and raised its FY24 guidance. Also, ON Semiconductor (ON) advanced more than +6% and was the top percentage gainer on the Nasdaq 100 after the company announced it had signed a multi-year deal with Volkswagen to be the main supplier of a complete power box solution for its next-generation electric vehicles. In addition, Nvidia (NVDA) rose over +4% after Reuters reported that the company is developing a version of its new flagship AI chips for the China market that will comply with existing U.S. export controls. On the bearish side, CrowdStrike Holdings (CRWD) tumbled more than -13% and was the top percentage loser on the S&P 500 and Nasdaq 100 after several brokerages downgraded their ratings and reduced their price targets on the stock following a software update from the company that triggered a global IT outage last Friday. Also, Verizon (VZ) slid over -6% and was the top percentage loser on the Dow after reporting weaker-than-expected Q2 revenue. Second-quarter earnings season is gathering pace, with investors awaiting new reports from big-name companies such as Alphabet (GOOGL), Tesla (TSLA), Visa (V), Coca-Cola (KO), Philip Morris International (PM), UPS (UPS), Lockheed Martin (LMT), and General Motors (GM). On the economic data front, investors will focus on U.S. Existing Home Sales data, set to be released in a couple of hours. Economists, on average, forecast that June Existing Home Sales will stand at 3.99M, compared to last month’s figure of 4.11M. The U.S. Richmond Manufacturing Index will be reported today as well. Economists estimate July’s figure to be -7, compared to the previous number of -10. Meanwhile, investor focus also rests on the U.S. core personal consumption expenditures price index for June, the Fed’s first-line inflation gauge, which is set for release on Friday. The reading could provide insights into whether policymakers might lower interest rates in September. U.S. rate futures have priced in a 2.6% chance of a 25 basis point rate cut at the Fed’s monetary policy committee meeting later this month and a 91.7% probability of a 25 basis point rate cut at the September FOMC meeting. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.241%, down -0.47%. Our trade docket for today is fairly busy. CRWD, /ZN, /MCL, WYNN, NVDA, GOOG, TSLA, V, ENPH, T, SPY/QQQ adn all our 0DTE's. Intra-day levels for me: /ES; 5629/5639/5650/5659 to the upside. 5598/5587/5577/5569 to the downside. /NQ; 20046/20101/20160/20229 to the upside. 19951/19896/19802/19740 to the downside. Bitcoin; 68,700 is resistance. 65,941 is support. Let's have another great day folks! I.V. is still pretty strong!

Welcome back to a new week of trading folks! We start this week with a little better I.V. than we've had lately. That's a hopeful sign! We've got our daily /MNQ trade working and we were finally able to get some good premium on the Thetafairy last week. We have a working order on a new one going as I type. Last Fridays results were a mixed bag for me. I took a big swing on Bitcoin that missed and scalping was a loss. I did carry over a small long scalp from Friday that looks to print profits at the open today. Here's a look at my results from Friday. Let's take a look at the market technicals. Futures are up smartly, as I type but technicals are still bearish. That makes sense as we've had over a week of nothing but down. SPY and QQQ are back to kety support levels and the parabolic upward moves on IWM and DIA have taken a breather. This week, the retreat from high-flying tech names into more rate-sensitive ones began to take hold, with both the Nasdaq and the S&P 500 posting their second-largest weekly losses of the year. This shift is driven by growing optimism among traders about potential interest rate cuts, which would favor small-cap stocks and companies facing higher financing costs. Notably, the CME FedWatch tool indicates a 95% probability that the Federal Reserve will reduce rates in September. In other news;

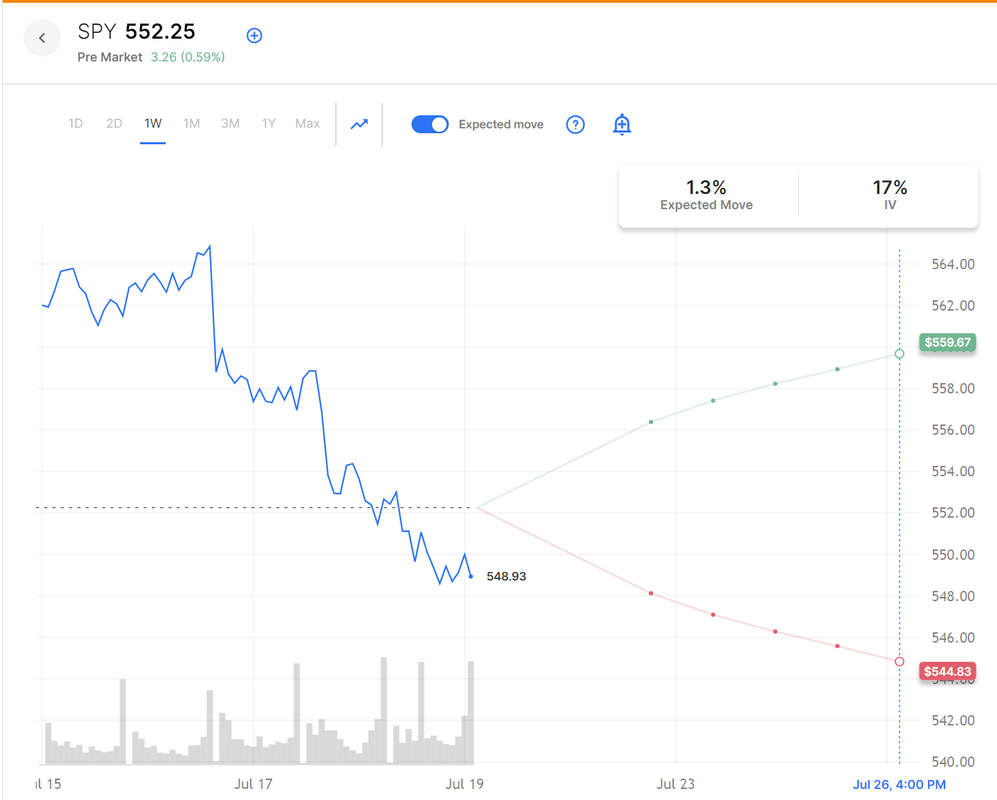

We’re now seven sessions into this rotation. Will small caps dig in and continue higher or was this just a flash in the pan? Let’s get into the charts and see how things are looking. After finding nearly perfect resistance at the 1.618 golden Fibonacci extension last week, the SPY reversed sharply lower to find itself at the bottom of the ascending channel, closing the week at $548.99 (-1.96%). A weekly bearish engulfing candle suggests the possibility of further downside, which is supported by the price closing below the daily 8/21 EMA cloud. The pain continued for the QQQ this week, which closed at $475.24 (-3.96%). With the price breaking down below the ascending channel and a seemingly imminent bearish 8/21 EMA cross on the horizon, the area of low volume looks primed for an eventual test. The rotation into small caps continued this week, gaining over 6% before a strong reversal on Wednesday. Despite this, the IWM closed higher for the second week in a row at $216.84 (+1.74%), but put in a concerning Shooting Star weekly candle as the price fell back into the ascending channel. Bulls will be looking for the 8/21 EMA cloud to act as support next week. A lot of the weakness in the overall indices can be traced to the semi's which just plain got beat up last week Here's a snapshot of the economic calendar for this week. Thurs. and Fri. are the days I'm targeting for this weeks biggest trade docket. September S&P 500 E-Mini futures (ESU24) are up +0.47%, and September Nasdaq 100 E-Mini futures (NQU24) are up +0.59% this morning as investors looked past Joe Biden’s exit from his presidential reelection campaign and awaited a slew of corporate earnings reports, with a particular focus on results from “Magnificent Seven” companies Tesla and Alphabet, as well as the release of the Fed’s preferred inflation gauge later in the week. U.S. President Joe Biden ended his reelection campaign on Sunday and endorsed Vice President Kamala Harris as the Democratic nominee. In a post on X, Biden said that he will stay in his role as President and Commander in Chief until his term ends in January 2025 and will address the nation later this week. “It has been the greatest honor of my life to serve as your President. And while it has been my intention to seek reelection, I believe it is in the best interest of my party and the country for me to stand down and to focus solely on fulfilling my duties as President for the remainder of my term,” Biden wrote. The move was widely anticipated following Biden’s poor debate performance in June and amid polls indicating a growing likelihood of an election win by former President Donald Trump in November. In Friday’s trading session, Wall Street’s major averages closed in the red, with the benchmark S&P 500 dropping to a 2-1/2 week low and the tech-heavy Nasdaq 100 falling to a 3-1/2 week low. CrowdStrike Holdings (CRWD) plunged over -11% and was the top percentage loser on the S&P 500 and Nasdaq 100 after a botched upgrade of its cybersecurity software brought down Microsoft’s systems and triggered a global IT outage. Also, chip stocks lost ground, with Intel (INTC) sliding more than -5%, ON Semiconductor (ON) dropping over -3%, and Nvidia (NVDA) falling more than -2%. In addition, Travelers Cos. (TRV) slumped over -7% and was the top percentage loser on the Dow after reporting weaker-than-expected Q2 revenue. On the bullish side, Intuitive Surgical (ISRG) surged more than +9% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the company reported better-than-expected Q2 results. Also, Starbucks (SBUX) climbed over +6% following a report from the Wall Street Journal that activist investor Elliott Management has built a “sizeable” stake in the coffee chain. Second-quarter earnings season kicks into high gear this week, with investors awaiting fresh reports from major companies such as Tesla (TSLA), Alphabet (GOOGL), IBM (IBM), AT&T (T), Verizon (VZ), Comcast (CMCSA), ServiceNow (NOW), Texas Instruments (TXN), NXP Semiconductors N.V. (NXPI), Spotify Technology S.A. (SPOT), General Motors (GM), Ford (F), AbbVie (ABBV), Bristol-Myers Squibb Company (BMY), Visa (V), 3M Company (MMM), Coca-Cola (KO), Lockheed Martin (LMT), American Airlines Group (AAL), and United Parcel Service (UPS). On the economic data front, the June reading of the U.S. core personal consumption expenditures price index, the Fed’s preferred inflation gauge, will be the main highlight in the coming week. Also, market participants will be monitoring a spate of other economic data releases, including the U.S. GDP (preliminary), S&P Global Composite PMI (preliminary), S&P Global Manufacturing PMI (preliminary), S&P Global Services PMI (preliminary), Existing Home Sales, Richmond Manufacturing Index, Building Permits, Goods Trade Balance, New Home Sales, Crude Oil Inventories, Durable Goods Orders, Core Durable Goods Orders, Initial Jobless Claims, Personal Income, Personal Spending, and Michigan Consumer Sentiment. Federal Reserve officials are in a blackout period before the Federal Open Market Committee meeting at the end of July, so they are prohibited from making public comments this week. Meanwhile, U.S. rate futures have priced in a 4.7% chance of a 25 basis point rate cut at July’s monetary policy meeting and a 91.7% probability of a 25 basis point rate cut at the conclusion of the Fed’s September meeting. The U.S. economic data slate is mainly empty on Monday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.236%, down -0.07% Let's take a look at I.V. and expected moves this week. We have a 1.3% expected move on the SPY with 17% I.V. Guess what? That's plenty to work with!!!! We've been waiting for this. With about 30% more IV we are finally back to a decent risk/reward ratio on credit trades. The QQQ's are even better. My bias today is back to bullish. Futures are up strong. We don't have any large economic or earnings results to drive us today. The market seems to like the Biden news. Trade docket for today: /ES, /MNQ, /NG, CRWD, GLD, IWM, LEVI, NVDA, SPY/QQQ 4DTE, All seven 0DTE's. I'm looking to get back to our normal weekly schedule of credit strangles and ladder setups Weds. or Thurs. of this week. Scalping should hold some better potential for us Thurs and Friday as well. Intra-day levels for me: /ES; 5594/5605/5615* (200 period M.A.)/5638*(PoC on 2hr. chart) to the upside. 5568/5557/5540/5522 to the downside. /NQ; 19976/20103*(big resistance area)/20183 to the upside. 19853/19783/19650*(large drop space below this) to the downside. Bitcoin. I swung big on the bitcoin 0DTE on Friday with a 38% ROI trade. It was close but close doesn't count. After a nice run late Friday and over the weekend Bitcoin looks stalled here to start the week. Resistance is now 68,717. We are slowly working our way back to the ATH's. Support is 66,666. Yes I know. I don't like the number either! Let's have a great day today and a great week. I think the market has given us all the tools we need for us to have a successful result.

Welcome to Friday traders! The gateway to the weekend! We had a pretty good day yesterday and our Event Contract 0DTE's contributed a bunch. Here's our results. A couple on notes on our trades: We had a very quick, post-earnings take profit on TSM. We also have NFLX and ISRG earnings trades that we should get a profitable exit this morning at the open. We restarted our /MNQ ratio setup last night. I anticipate this to be a near daily setup now with the goal of bringing in $100 a day per contract traded. We'll go into more detail on that setup in todays zoom. We also got a Theta Fairy working and I want to discuss how we can get that back to a more full time trade today. We had two 0DTE's on BTC and two on ETH yesterday. As you know, we strive to make at least $1,000 a day on our 0DTE's and with just $3,200 of buying power the crypto 0DTE's brought in almost $400 of that goal. If you're not trading event contracts you're missing out on some opportunites to create edge and its the best way I know of to day trade crypto. You can get the platfrom setup for free and trade with as little as $20 dollars. Check it out. Let's take a look at the markets. With yesterdays sell off we flip back to a more decisive sell rating on the technicals. A couple of interesting notes; S&P 500 was down more than 1%. What was telling was the breadth. Is this the strongest market ever? The S&P 500 has hit 37 all-time highs this year, the most since 2021. The index has already seen more new records than in every year since 2016, except for 2017 and 2021. It is on pace to hit the 3rd most all-time highs in history, only behind 2021 and 1995 which saw 70 and 77 records. Overall, the S&P 500 is up ~17% year-to-date which marks the 12th best start to a year in the entire stock market history. Will the market hit over 70 new highs this year? $VIX overbought on daily RSI. VIX rarely stays overbought long... The past four times this has happened, it's marked multi-month tops for the VIX. Here's a snapshot of the major indices we trade. Of note yesterday was the fact that the parabolicly bullish IWM and DIA also joined in on the sell off. Futures are slightly up to mixed as I type. I've got a long QQQ scalp on that I carried over from yesterday that could use some more bullishness. Computer systems failed worldwide on Friday, disrupting services at airlines, banks, and the London Stock Exchange after a widely used cybersecurity program crashed and Microsoft separately reported issues with its cloud services. CrowdStrike Holdings alerted customers on Friday that its Falcon Sensor threat-monitoring product was causing crashes in Microsoft’s Windows operating system. At the same time, it was unclear what caused the issues, which coincided with disruptions in Microsoft’s Azure cloud and 365 services. In yesterday’s trading session, Wall Street’s major indexes ended lower. Domino’s Pizza (DPZ) tumbled over -13% and was the top percentage loser on the S&P 500 after the world’s largest pizza company reported weaker-than-expected Q2 total domestic comparable sales growth and suspended its target of opening more than 1,100 global net stores. Also, mega-cap technology stocks lost ground, with Amazon.com (AMZN) and Apple (AAPL) falling more than -2%. In addition, Elevance Health (ELV) slid over -3% after Bank of America Global Research downgraded the stock to Neutral from Buy. On the bullish side, D.R. Horton (DHI) surged more than +10% and was the top percentage gainer on the S&P 500 after the homebuilder reported upbeat Q3 results and announced a new $4.0 billion stock buyback program. The Labor Department’s report on Thursday showed that the number of Americans filing for initial jobless claims in the past week rose +20K to 243K, compared with the 229K expected. Also, the U.S. July Philadelphia Fed manufacturing index rose to 13.9, stronger than expectations of 2.7. In addition, the Conference Board’s leading economic index for the U.S. fell -0.2% m/m in June, better than expectations of -0.3% m/m. “The Fed asked to see more evidence of a cooling economy, and for the most part, they’ve gotten it,” said Chris Larkin at E*Trade from Morgan Stanley. “Add [Thursday’s] weekly jobless claims to the list of rate-cut-friendly data points. The path to September remains open.” Chicago Fed President Austan Goolsbee said on Thursday that the Fed may need to cut interest rates soon to prevent a sharper deterioration in the labor market, which has cooled in recent months. While the Fed’s battle against inflation continues, several months of improving data have reassured him that officials are on course to reduce inflation to their 2% target, Goolsbee said. Also, San Francisco Fed President Mary Daly stated that some recent inflation data has been “really good,” but the Fed has not yet attained price stability. “We’re not there yet,” Daly said. “We don’t have price stability right now and we need to be very confident that we’re on a sustainable path to achieve it.” Meanwhile, U.S. rate futures have priced in a 4.7% chance of a 25 basis point rate cut at the July FOMC meeting and a 95.3% chance of a 25 basis point rate cut at September’s policy meeting. On the earnings front, notable companies like American Express (AXP), Schlumberger (SLB), Travelers (TRV), Halliburton (HAL), and Regions Financial (RF) are set to report their quarterly figures today. The U.S. economic data slate is empty on Friday. However, investors will likely focus on speeches from New York Fed President John Williams and Atlanta Fed President Raphael Bostic. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.192%, up +0.12%. My bias today is slightly bullish IF, and it's a big if, the markets can shake off the big computer snafu from overnight. One of the trades we are looking at today is CRWD. Our trade docket today: DELL, DJT, FSLR, ISRG, Theta fairy, /MNQ, IWM, LEVI, NFLX, NVDA, CRWD, 0DTE's. Intra-day levels for me: /ES; 5605/5613*(200 period M.A.)/5628/5642*(PoC) to the upside. 5592/5579/5570 to the downside. Below 5570 we could get some heavy bearish action. /NQ; 19968/20000*(PoC)/20082/20173 to the upside. 19888/19846/19805/19754 to the downside. Below 19754 could be very bearish. Bitcoin; 65,373 resistance. 63,623 support. Unless we get some movement today it may be tough to get a setup on the cryptos. Let's have another profitable day and I hope you all have a safe and enjoyable weekend!

|

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |