|

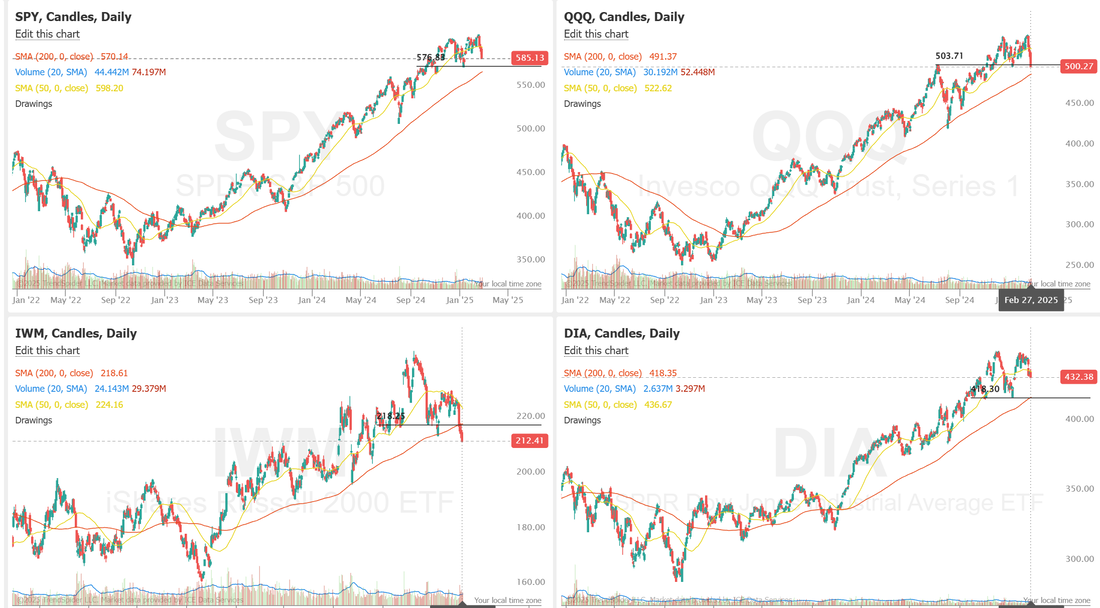

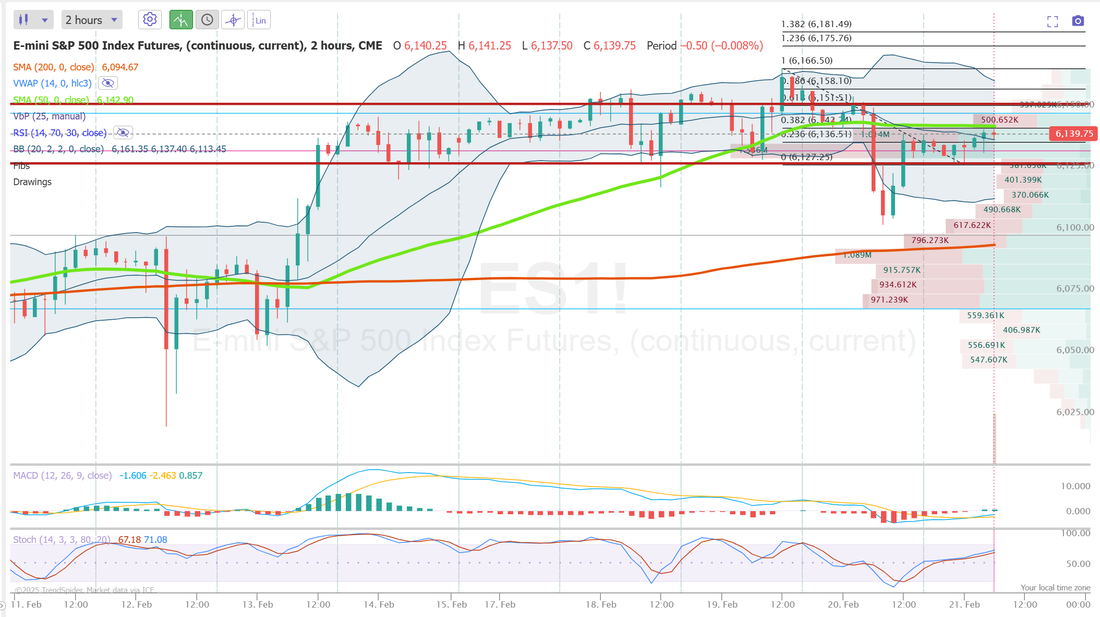

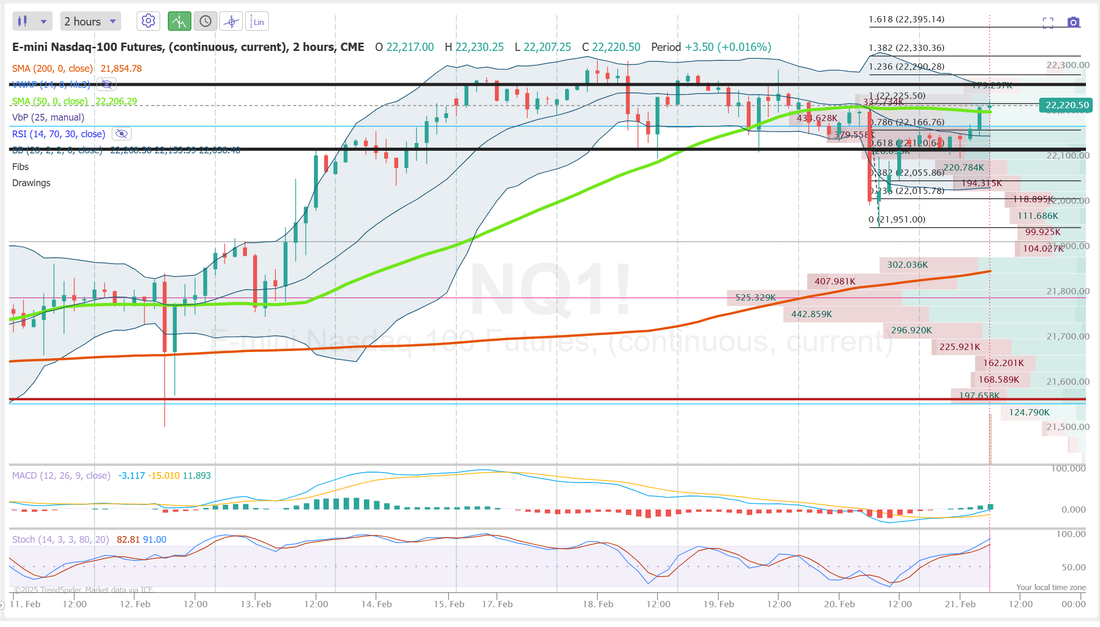

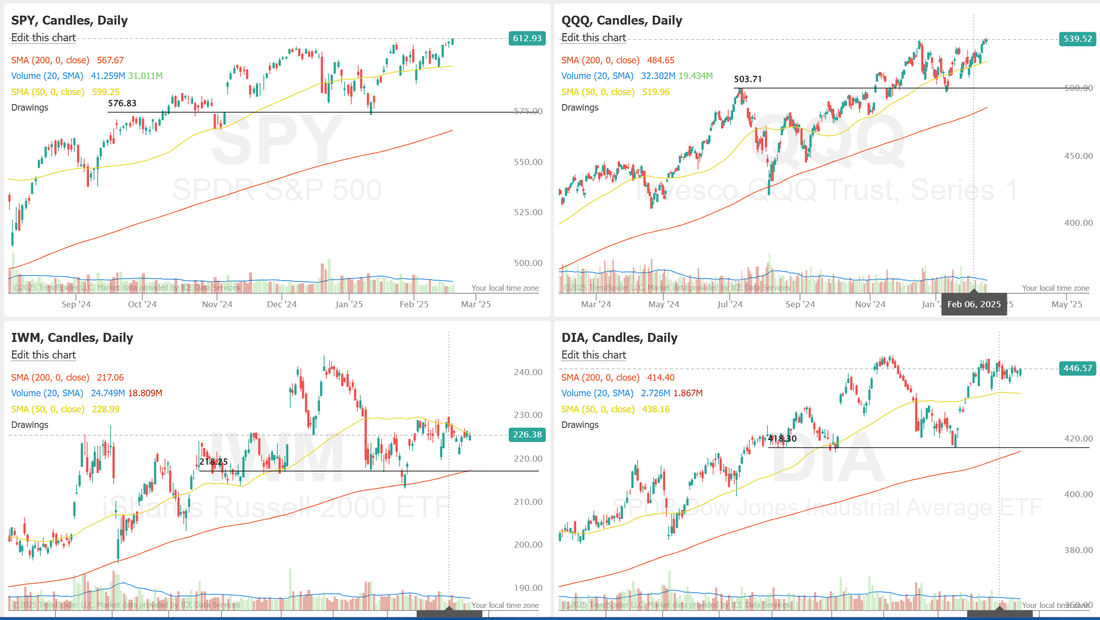

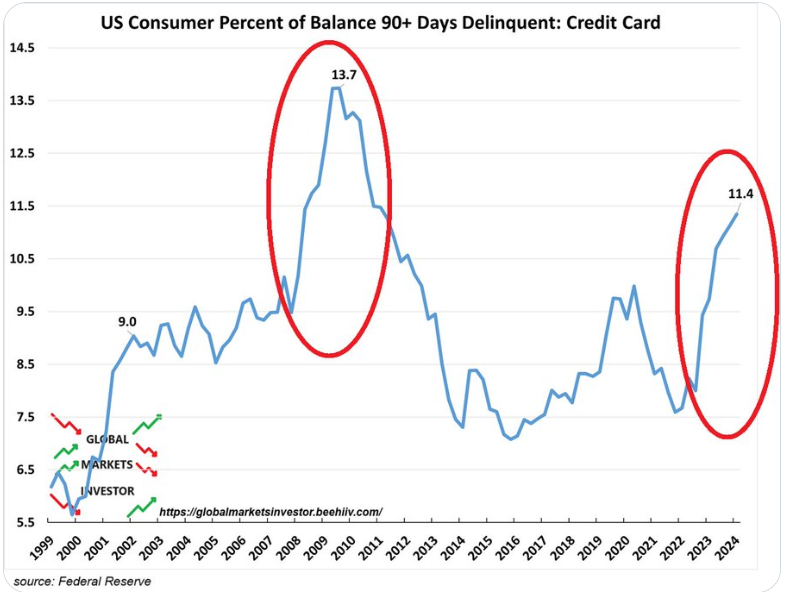

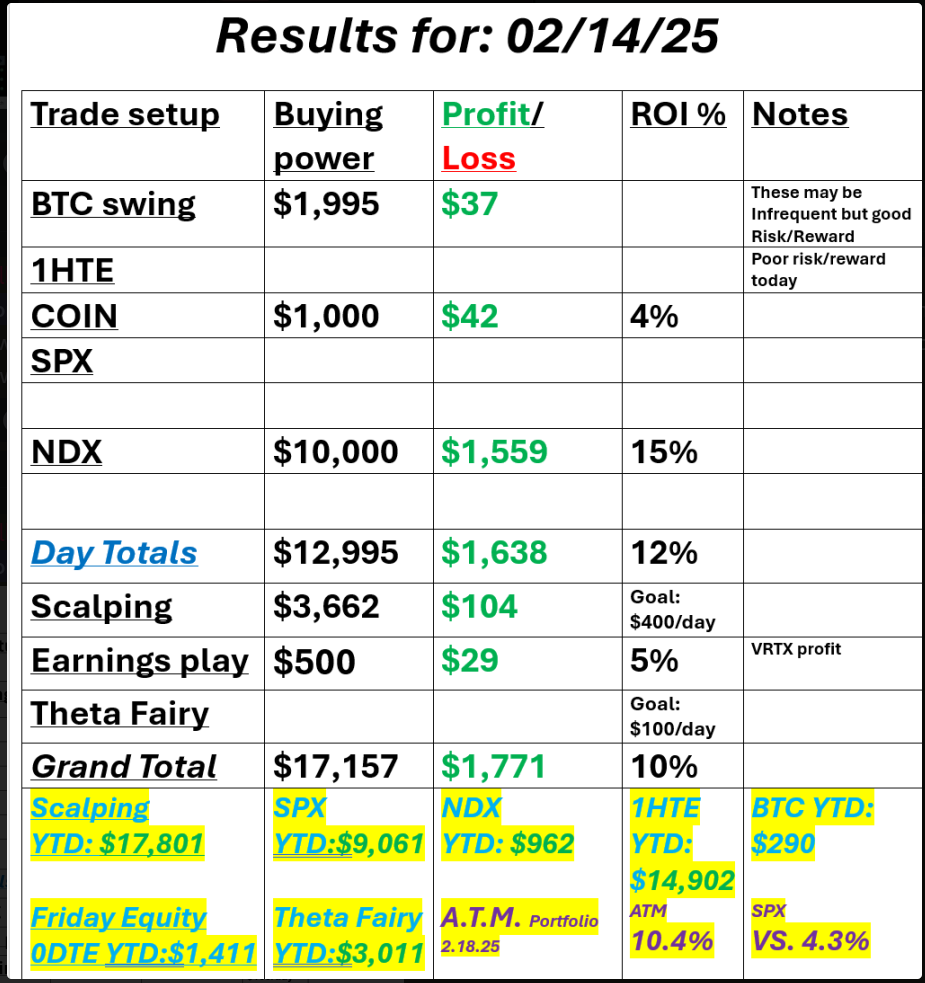

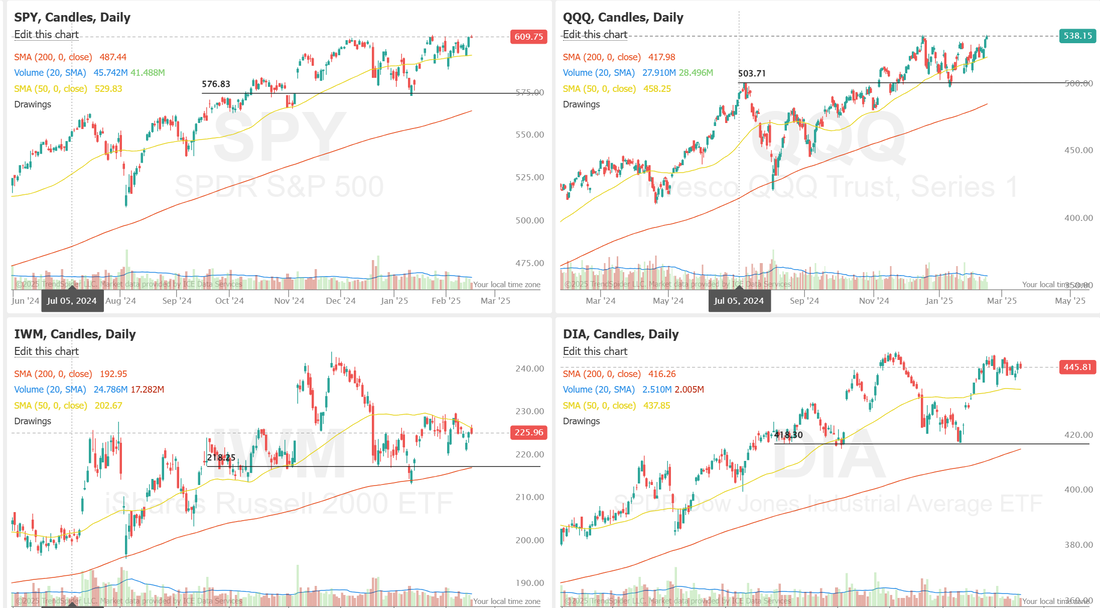

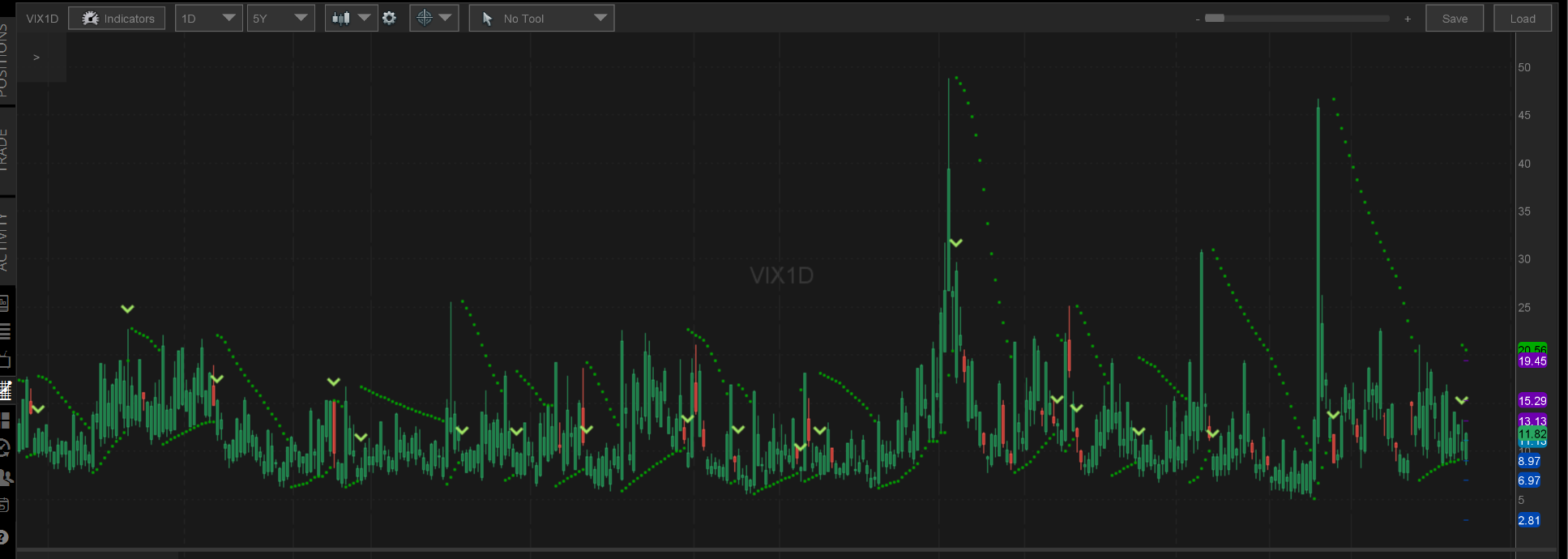

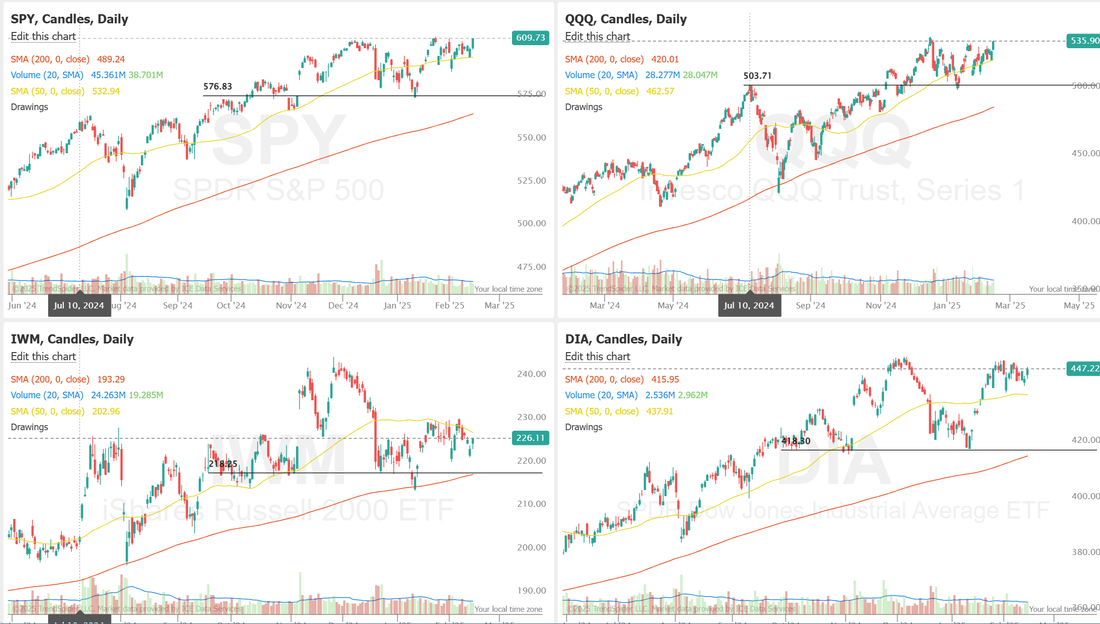

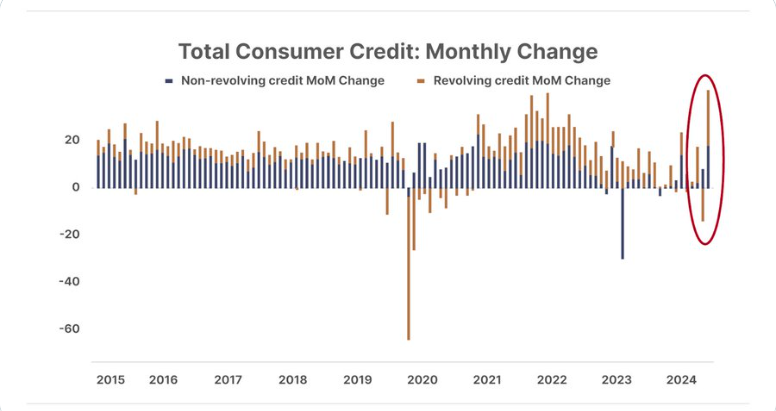

Welcome to Friday! The "Gateway to the weekend" LOL. It's been an o.k. week for us but I really let a golden opportunty slip through my fingers yesterday. We were sitting on a nice profit on both our NDX and SPX 0DTE's and then came "Tariff talk", which seems to be the main boogey man right now (along with inflation) in the market. While some of our trading members had already locked in their gains, I was caught flat footed and needed to roll. PCE is out shortly and I'm sure that will be the main catalyst today allthough we do have Trump meeting with Zelenskiy today. They will hold a joint press conference at 13:00 ET. That could be a market mover as well. Here's a look at what we did get logged yesterday. One nice enhancement we've worked on over the last two weeks are our earnings trades. Instead of exiting them the next day we hold for a few more days and work them. We are only two weeks in so data is light but so far it's been a very positive expierience. Moving from 1-3% returns to closer to 8-10% profits. Let's take a look at this crazy market. We came into yesterdays session with a neutral technical rating. This have proven to be very difficult days to trade. It's a sign the market is searching. Then came the "tariff talk" and down we went. We are opening today with a bearish lean. For the last three days I've been looking for a bounce. It's not been pure "hopeium". The bulls have given it a go each day but simply didn't have enough strength to keep the push higher going. It's pretty clear, if you look at the charts that the bearishness is starting to take hold. All the major indices are now below their 50DMA and the IWM looks particularly ugly, down below its 200DMA. Bitcoin has been ugly as well. One of the best "big picture" tools I use to judge market health is the VTI. Its the "whole" market. Every technical you can look at is bearish but... we are back to a long term trend support line. Today should be critical. March S&P 500 E-Mini futures (ESH25) are trending up +0.38% this morning, staging a partial rebound from the prior session’s losses, while investors brace for the release of the Federal Reserve’s first-line inflation gauge. In yesterday’s trading session, Wall Street’s major indices closed in the red. Teleflex (TFX) plummeted over -21% and was the top percentage loser on the S&P 500 after the company provided a downbeat full-year adjusted EPS forecast. Also, Nvidia (NVDA) slumped more than -8% and was the top percentage loser on the Dow after the chipmaker’s good-but-not-great quarterly results disappointed investors. In addition, Salesforce (CRM) fell over -4% after reporting weaker-than-expected Q4 revenue and issuing below-consensus FY26 revenue guidance. On the bullish side, Invitation Homes (INVH) climbed more than +5% and was the top percentage gainer on the S&P 500 after reporting better-than-expected Q4 revenue. The U.S. Bureau of Economic Analysis, in its second estimate of Q4 GDP growth, said on Thursday that the economy grew at an unrevised +2.3% annualized rate. Also, U.S. January durable goods orders advanced +3.1% m/m, stronger than expectations of +2.0% m/m, while core durable goods orders, which exclude transportation, were unchanged m/m, weaker than expectations of +0.2% m/m. In addition, U.S. pending home sales fell -4.6% m/m in January, weaker than expectations of -0.9% m/m and the biggest decline in 9 months. Finally, the number of Americans filing for initial jobless claims in the past week rose +22K to a 2-1/2 month high of 242K, compared with the 222K expected. “Investors want lower rates from the Fed, but they don’t want to get there by seeing a notable deterioration in the underlying economy,” said Bret Kenwell at eToro. “At the very least, if the economy is going to slow, investors will want to see inflation slow down too.” Cleveland Fed President Beth Hammack stated on Thursday that interest rates are not “meaningfully restrictive” and should remain unchanged for some time as policymakers await clear evidence that inflation is moving toward their 2% target. “A patient approach will allow us time to monitor the trajectories for the labor market and inflation and how the economy in general is performing in the current rate environment,” Hammack said. Also, Philadelphia Fed President Patrick Harker said, “The policy rate remains restrictive enough to continue putting downward pressure on inflation over the longer term, as we need it to, while not negatively impacting the rest of the economy.” In addition, Kansas City Fed President Jeffrey Schmid said that the central bank could have to balance inflation risks against growth concerns. “While the risks to inflation appear to be to the upside, discussions with contacts in my district, as well as some recent data, suggest that elevated uncertainty might weigh on growth,” he noted. Meanwhile, U.S. rate futures have priced in a 94.5% chance of no rate change and a 5.5% chance of a 25 basis point rate cut at the March meeting. Today, all eyes are focused on the U.S. core personal consumption expenditures price index, the Fed’s preferred price gauge, which is set to be released in a couple of hours. Economists, on average, forecast that the core PCE price index will stand at +0.3% m/m and +2.6% y/y in January, compared to the previous figures of +0.2% m/m and +2.8% y/y. U.S. Personal Spending and Personal Income data will also be closely monitored today. Economists anticipate January Personal Spending to be +0.2% m/m and Personal Income to be +0.4% m/m, compared to December’s figures of +0.7% m/m and +0.4% m/m, respectively. The U.S. Chicago PMI will be reported today. Economists expect this figure to come in at 40.5 in February, compared to the previous value of 39.5. U.S. Wholesale Inventories data will be released today as well. Economists foresee the preliminary January figure standing at +0.1% m/m, compared to the previous figure of -0.5% m/m. In addition, market participants will be anticipating a speech from Chicago Fed President Austan Goolsbee. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.249%, down -0.89%. U.S. credit card debit hit's a record. This is "No bueno" for future economic outlook. Freddie Mac (Housing) delinquency rates are now HIGHER THAN 2008 and 2008 was UGLY! Housing is the #1 driver of our economy. As housing goes, so goes the economy. My bias or lean today is...slightly bullish...again. I've been beating this drum (wrongly) for three days now. Yes, the economic data I'm looking at doesn't look great but...we are working on seven straight days down. RSI and Stocastic are looking very stretched to the oversold downside. The two variables are PCE data and the press conference. If those go smoothly I think we trade higher. /MNQ (/NQ) scalping. /NG?, BITO, DIA, FSLR, SPY/QQQ, 0DTE's, RIOT, /GC? Let's take a look at our intra-day levels for trading today. Our levels were pretty spot on yesterday. /ES: 6017 is now resistance with 5859 the new support. If we lose this support level today I think we get some decent downside potential. /NQ: Same situation closer to support than resistance. 21,071 is resistance with 20,538 working as support. If we break this support level it could be "look out below". BTC: Bitcoin's weakness continues. 87,121 is now resistance with support at 78,498. We may be able to work a couple smaller 1HTE's today. Last weeks Friday left a sour taste in our mouths. Let's see if we can go into the weekend a bit happier today!

See you all in the live trading room shortly

0 Comments

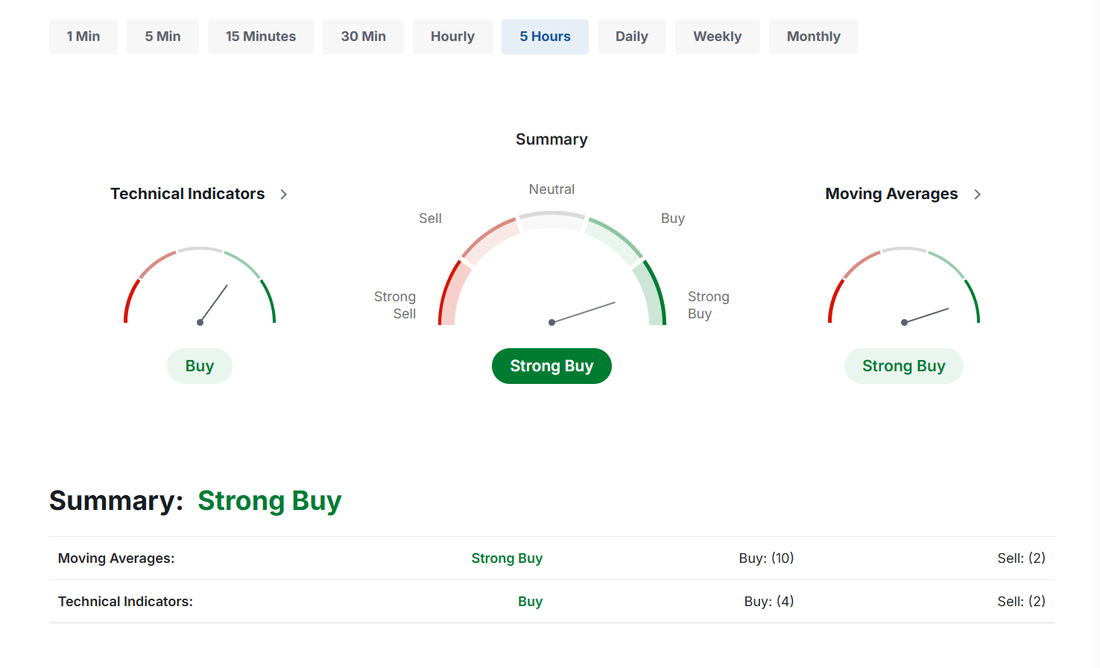

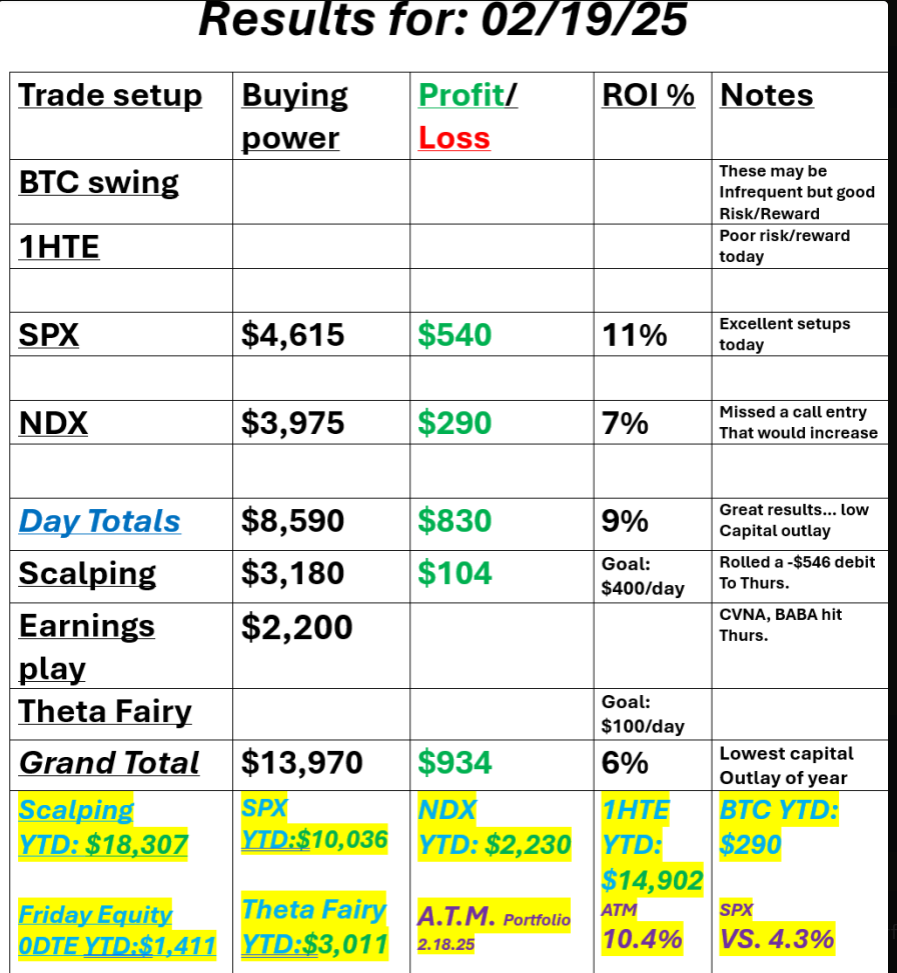

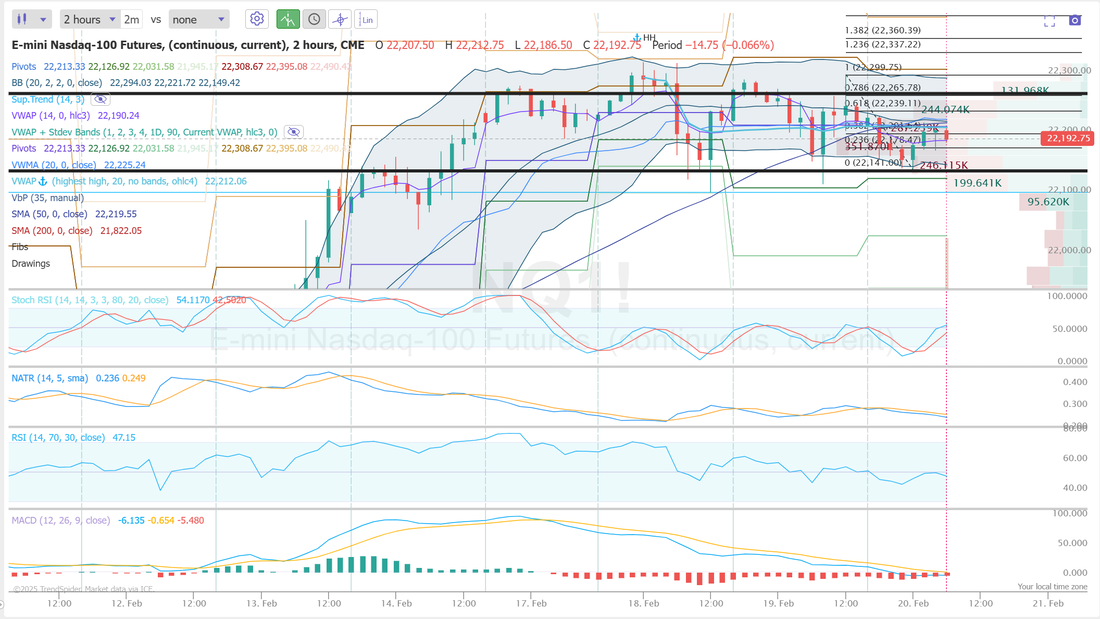

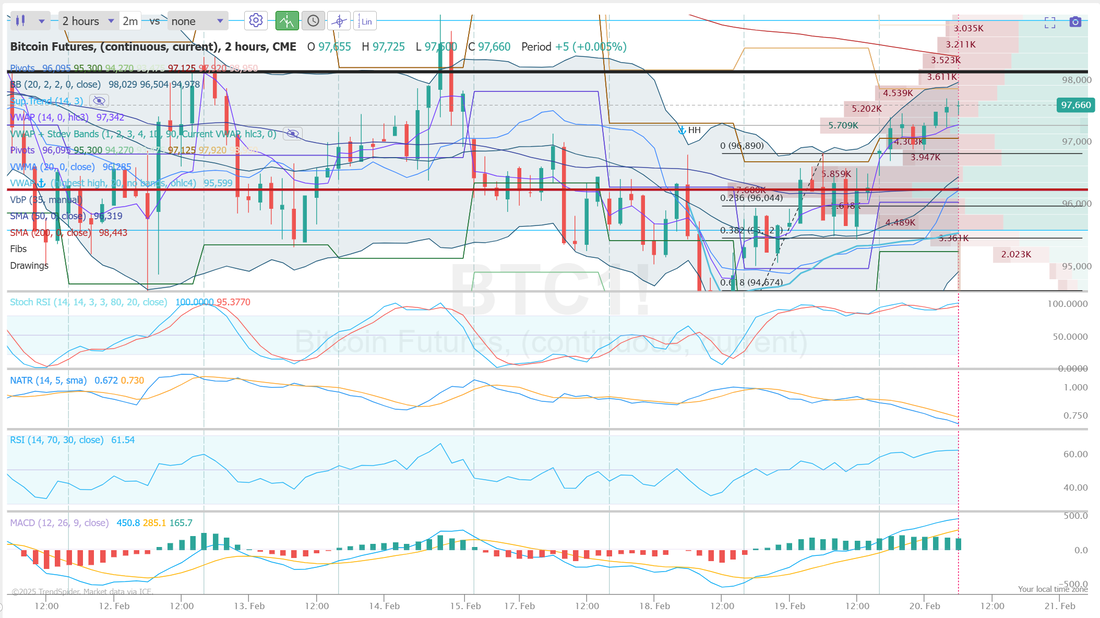

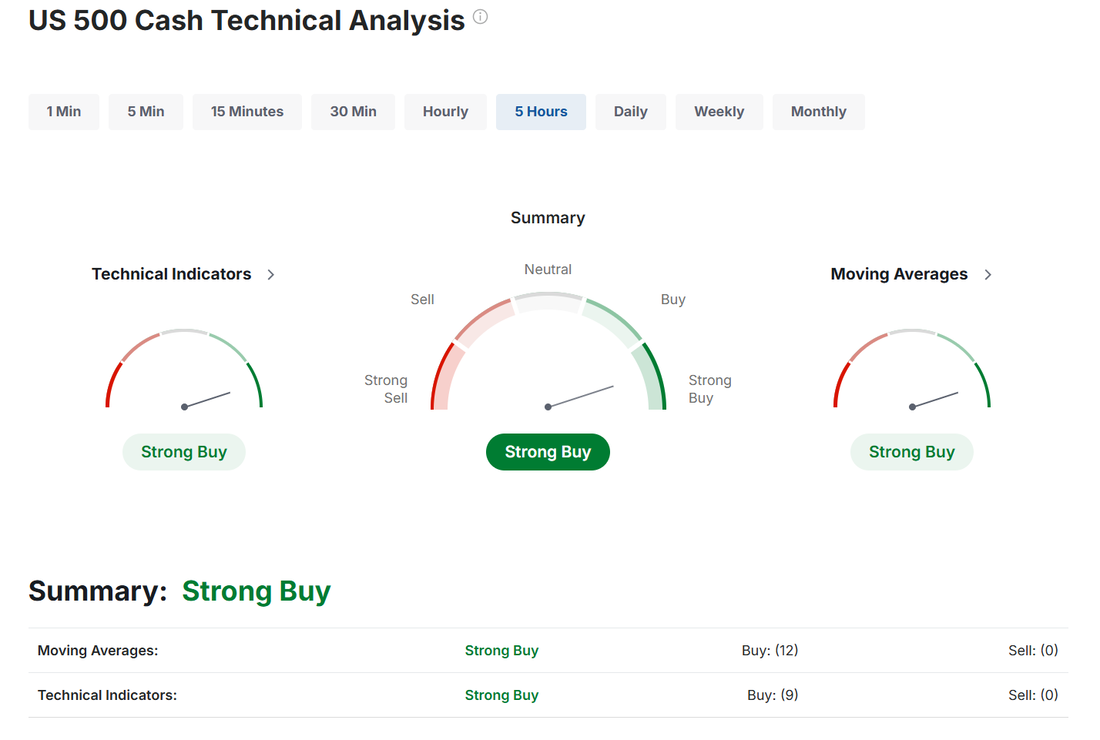

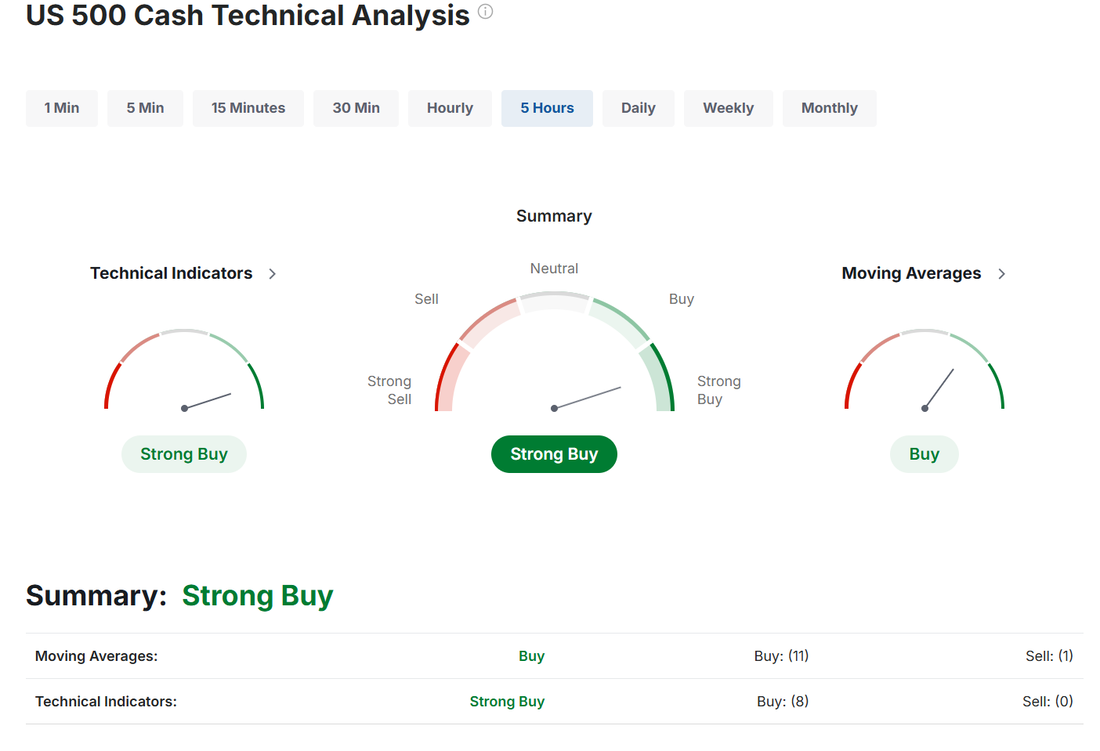

Welcome back traders! Yesterday was an interesting day. I had an eye appt. in the middle of the day so we got a lot of earnings trades, Nat gat and DIA trades going in the morning but because I'm out of pocket most of the day we started our 0DTE's with 1DTE's that expire today. I was able to get back before the power hour and got a couple small 0DTE's working, which is shown below. It was an easy day with a lot of delayed gratification. Today we should see the results of yesterdays efforts. Let's take a look at the markets. The market really tried to go higher yesterday. It just couldn't hang on. We are back to a neutral rating to start the day. Futures are up. Today may be the day folks! Can the bulls finally take control? Taking a look at the four major indices we trade, yes, it still looks ugly. All four indices are still stuck below their 50DMA which is not great. The IWM is actually still below the 200DMA. Bulls really are trying this week. They just haven't had the firepower. It looks like from the futures this morning that they will be giving it another go today. Will it hold? That's the $64,000 dollar question. March S&P 500 E-Mini futures (ESH25) are up +0.70%, and March Nasdaq 100 E-Mini futures (NQH25) are up +0.72% this morning, pointing to a strong open on Wall Street as earnings from AI darling Nvidia reassured investors about the outlook for AI chip demand. Nvidia (NVDA) rose about +1% in pre-market trading after the chipmaker posted better-than-expected Q4 results and issued largely in-line Q1 revenue guidance. Other megacap technology stocks also advanced in pre-market trading. Investors also digested the latest tariff announcements from U.S. President Donald Trump. Trump said he would impose tariffs of 25% on the European Union. A White House official stated that the European tariffs could target all exports from the bloc or be limited to specific sectors. Also, the Trump administration is set to impose tariffs on Mexico and Canada, though it remains uncertain whether they will be enacted in March. Investors now look ahead to fresh U.S. economic data, including the second estimate of fourth-quarter GDP and jobless claims figures, as well as remarks from Federal Reserve officials. In yesterday’s trading session, Wall Street’s three main equity benchmarks ended mixed. Axon Enterprise (AXON) surged over +15% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the company posted upbeat Q4 results and issued strong FY25 revenue guidance. Also, Super Micro Computer (SMCI) climbed more than +12% after the company filed its “delinquent” financial reports with the U.S. Securities and Exchange Commission just before the deadline. In addition, Intuit (INTU) gained over +12% after the tax and accounting software company reported better-than-expected FQ2 results. On the bearish side, health insurance stocks slumped after the Wall Street Journal reported that Republican Senator Chuck Grassley is advocating for greater oversight of Medicare Advantage plans, with Centene (CNC) sliding more than -7% to lead losers in the S&P 500 and Molina Healthcare (MOH) falling over -6%. Also, AppLovin (APP) plunged more than -12% and was the top percentage loser on the Nasdaq 100 after Fuzzy Panda and Culper Research published short reports against the company. Economic data released on Wednesday showed that U.S. new home sales slumped -10.5% m/m to 657K in January, weaker than expectations of 679K. Atlanta Fed President Raphael Bostic stated on Wednesday that the central bank should keep interest rates unchanged, at a level that continues to exert downward pressure on inflation. “We need to stay where we are,” he said. Meanwhile, U.S. rate futures have priced in a 97.5% probability of no rate change and a 2.5% chance of a 25 basis point rate cut at the next central bank meeting in March. Today, all eyes are focused on the U.S. Commerce Department’s second estimate of gross domestic product. Economists expect the U.S. economy to expand at an annual rate of 2.3% in the fourth quarter, in line with initial estimates. Investors will also focus on U.S. Durable Goods Orders and Core Durable Goods Orders data. Economists forecast January Durable Goods Orders at +2.0% m/m and Core Durable Goods Orders at +0.2% m/m, compared to the prior figures of -2.2% m/m and +0.3% m/m, respectively. U.S. Pending Home Sales data will be reported today. Economists foresee the January figure standing at -0.9% m/m, compared to the previous figure of -5.5% m/m. U.S. Initial Jobless Claims data will be released today as well. Economists expect this figure to be 222K, compared to last week’s number of 219K. In addition, market participants will be looking toward a batch of speeches from Fed officials Barkin, Schmid, Barr, Bowman, Hammack, and Harker. On the earnings front, notable companies like Dell Technologies (DELL), Autodesk (ADSK), Vistra Corp. (VST), Monster Beverage (MNST), and HP Inc. (HPQ) are slated to release their quarterly results today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.313%, up +1.51%. /MNQ, /NQ scalping continuation today. CAVA, CRM, EBAY, FSLR, HIMS?, INTU, NVDA, SNOW, WDAY, DELL, 0DTE's. My bias or lean today is bullish. I think the bulls may finally have the staying power to turn in a green day. Futures are up nicely but that's been the case most days this week. Yesterday looked like the NDX could finish up 200+ points and by the end of the day it gave it all back. I think today they have a better shot at holding green. Let's take a look at the intra-day, key levels for us. /ES: Levels haven't really changed. 6052 is resistance with 5940 working as support. /NQ: Levels have altered a bit for Nasdaq. 21,503 resistance with 21,039 support BTC: We had a good day yesterday deploying a small amount of capital and we'll likely do the same today. Bitcoin weakness continues. 92,822 is current resistance with 82,283 working as support. We've got a lot of potential built into our trades today. Let's see how much of it we can capture. See you all in the live trading room shortly.

Welcome to the midweek point! We had a pretty darn good day yesterday. Everything we touched worked. We had about a $600 dollar profit on the SPX but the 4DTE puts that we had rolled expired worthless and that puts our result at a loss for the day overall but, we've brought in some good income on that position over the last four days. Here's a look at our results. Net liq ended up about 2K for me by the end of the day. We've been proiftable on both of our Nat gas trades for the last two months but controlling buying power is still an issue with this underlying. Our new trade for this next month looks amazing (If I do say so myself!) Cash flowing approx. $120/day with the potential for a $3,500 profit on a $5,500 investment. I love it! Technicals are still slightly in the sell zone but I think the bulls may finally grab a hand hold today. They've been trying for the last week to push higher but just haven't had the strength to overpower the selling. Is today the day? Futures are up solidy right now, as I type but that's happened several times since retracing from ATH's. I think they hold today. We've got a long /MNQ scalp working this morning. I apologize but no charting or levels today. This is all I'm getting out of my Trendspider software, at the moment. NOTE: We've got a little different schedule today. I've got another eye appt. right in the middle of the trading day so we'll get as much working this morning as possible. I'll start our 0DTE's off with 1DTE's that we'll finish off tomorrow. Zoom session will be live in the A.M. for the portfolio/results review and then I should be back before the close. /MCL ladder, /NG, CAVA, DIA, FSLR, INTU, WDAY, NVDA, CRM, SNOW, EBAY, 0DTE's (started as 1DTE's). March Nasdaq 100 E-Mini futures (NQH25) are trending up +0.77% this morning, rebounding from yesterday’s losses, while investors turn their attention to a highly anticipated earnings report from AI darling Nvidia. In yesterday’s trading session, Wall Street’s major indexes closed mixed. Sempra (SRE) plunged over -18% and was the top percentage loser on the S&P 500 after the company posted downbeat Q4 results and cut its FY25 EPS guidance. Also, Nvidia (NVDA) dropped more than -2% and was the top percentage loser on the Dow after a Bloomberg report stated that some officials in the Trump administration are seeking to impose additional restrictions on the type of Nvidia chips that can be exported to China without a license. In addition, Tesla (TSLA) slumped over -8% after data from the European Automobile Manufacturers’ Association showed that the company’s sales in Europe tumbled 45% in January from a year ago. On the bullish side, Solventum Corp. (SOLV) surged more than +9% and was the top percentage gainer on the S&P 500 after Thermo Fisher agreed to buy the company’s purification and filtration unit for about $4.1 billion. Economic data released on Tuesday showed that the U.S. Conference Board’s consumer confidence index fell to an 8-month low of 98.3 in February, weaker than expectations of 102.7 and marking the biggest monthly drop since August 2021. Also, the U.S. December S&P/CS HPI Composite - 20 n.s.a. increased to +4.5% y/y from +4.3% y/y in November, stronger than expectations of +4.4% y/y. In addition, the U.S. Richmond Fed manufacturing index unexpectedly rose to +6 in February, stronger than expectations of -3. “Consumer confidence continues to come off its election-fueled sugar high from November. Economic uncertainty remains elevated, whether that’s around tariffs or more US-centric data like inflation or retail sales,” said Bret Kenwell at eToro. Richmond Fed President Thomas Barkin said on Tuesday that the central bank must stay resolute in its fight against inflation and highlighted the risk of longer-term inflationary headwinds. “It makes sense to stay modestly restrictive until we are more confident inflation is returning to our 2% target,” Barkin said. U.S. rate futures have priced in a 97.5% probability of no rate change and a 2.5% chance of a 25 basis point rate cut at the next FOMC meeting in March. Meanwhile, prospects for early action on U.S. President Donald Trump’s tax cut plans improved as the Republican-controlled U.S. House of Representatives passed a budget blueprint late on Tuesday that includes deep reductions in safety-net programs like Medicaid. Investors are eagerly awaiting Nvidia’s fourth-quarter earnings report, scheduled for release after the market close. Sales of the company’s AI chip, Blackwell, will be in focus, with analysts eyeing future demand, especially after China’s DeepSeek claimed it could train competitive AI models with significantly fewer resources. “Nvidia’s numbers could well be a make-or-break event for the market, at least in the short term,” said Tim Waterer, chief market analyst at KCM Trade. Prominent companies like Salesforce (CRM), TJX (TJX), Lowe’s (LOW), and Snowflake (SNOW) are also set to report their quarterly figures today. On the economic data front, investors will focus on U.S. New Home Sales data, which is set to be released in a couple of hours. Economists foresee this figure standing at 679K in January, compared to 698K in December. U.S. Crude Oil Inventories data will be released today as well. Economists expect this figure to be 2.500M, compared to last week’s value of 4.633M. In addition, market participants will hear perspectives from Richmond Fed President Thomas Barkin and Atlanta Fed President Raphael Bostic throughout the day. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.304%, up +0.14%. I'll see you all in the zoom shortly!

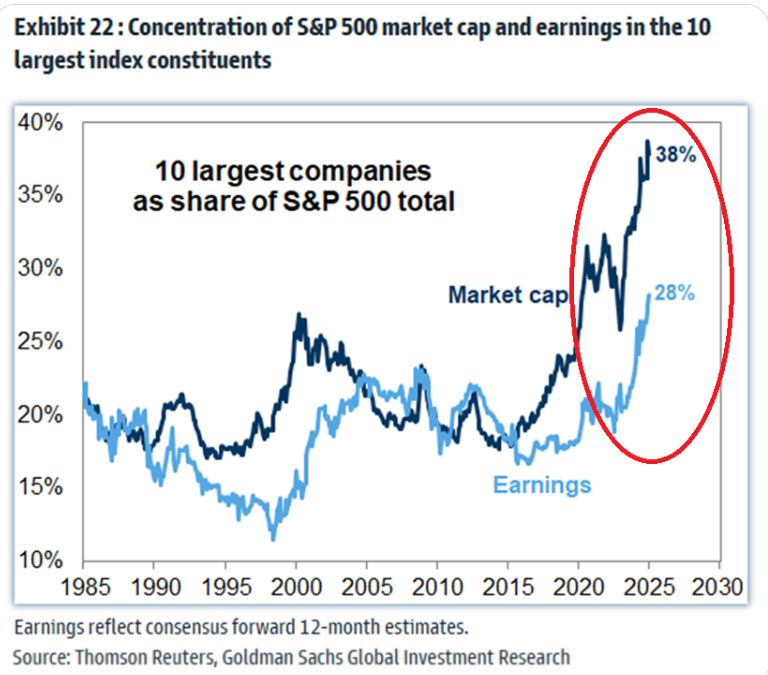

Welcome back traders! We had a solid day, all around yesterday. Here's our results. Let's take a look at the markets: Sell mode is still holding on. We've got all four of our indices now under their 50DMA and the IWM is under our critical support line. We'll be starting a new DIA ladder today. This price action is starting to look like it could build some downside. March S&P 500 E-Mini futures (ESH25) are down -0.21%, and March Nasdaq 100 E-Mini futures (NQH25) are down -0.39% this morning, while Treasury yields also slipped amid worries that U.S. President Donald Trump’s policies could hurt global economic growth. President Trump signaled on Monday that tariffs set to hit Canada and Mexico next month were “on time” and “moving along very rapidly” after an initial delay. His administration is also outlining stricter versions of U.S. semiconductor curbs and urging key allies to tighten their restrictions on China’s chip industry. Bloomberg News reported that Trump officials recently met with their Japanese and Dutch counterparts to discuss restricting Tokyo Electron and ASML Holding engineers from servicing semiconductor equipment in China. Investors now await a new batch of U.S. economic data, remarks from Federal Reserve officials, and an earnings report from home improvement chain Home Depot. In yesterday’s trading session, Wall Street’s main stock indexes ended mixed. Palantir Technologies (PLTR) slumped over -10% and was the top percentage loser on the S&P 500 and Nasdaq 100 on continued worries about potential budget cuts by the Department of Defense. Also, chip stocks lost ground, with Marvell Technology (MRVL) sliding more than -5% and Broadcom (AVGO) dropping over -4%. In addition, Microsoft (MSFT) fell about -1% after TD Cowen analysts said in a note that the software giant canceled several AI data center leases. On the bullish side, Nike (NKE) climbed more than +4% and was the top percentage gainer on the Dow after Jefferies upgraded the stock to Buy from Hold with a price target of $115. Meanwhile, market watchers are looking ahead to an earnings report from AI darling Nvidia (NVDA) on Wednesday, as well as the January reading of the U.S. core personal consumption expenditures price index, the Fed’s preferred inflation gauge, on Friday. “If we see blowout earnings from Nvidia and softer-than-expected inflation data, that could add upward momentum to stocks,” said Clark Bellin at Bellwether Wealth. Today, home improvement chain Home Depot (HD), as well as notable companies like Intuit (INTU), Workday (WDAY), Keurig Dr Pepper (KDP), and Keysight Technologies (KEYS), are slated to release their quarterly results. On the economic data front, all eyes are focused on the U.S. Conference Board’s Consumer Confidence Index, which is set to be released in a couple of hours. Economists, on average, forecast that the February CB Consumer Confidence index will stand at 102.7, compared to last month’s figure of 104.1. Investors will also focus on the U.S. S&P/CS HPI Composite - 20 n.s.a. Economists expect the December figure to be +4.4% y/y, compared to +4.3% y/y in November. The U.S. Richmond Fed Manufacturing Index will be released today as well. Economists estimate this figure to come in at -3 in February, compared to the previous value of -4. In addition, market participants will be anticipating speeches from Richmond Fed President Tom Barkin and Fed Vice Chair for Supervision Michael Barr. U.S. rate futures have priced in a 95.5% chance of no rate change and a 4.5% chance of a 25 basis point rate cut at the conclusion of the Fed’s March meeting. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.340%, down -1.21%. Berkshire Hathaway's Cash Pile soars to a new all-time high of $334.2 Billion. Buffett can’t find any value plays to put it in. You can say he's out of touch of past his prime but this guy usually has pretty good timing! Top 10 US stocks' market cap and earnings GAP is INSANE: The largest 10 firms as a share of the S&P 500 hit 38%, near an all-time high. Their earnings account for 28% of the S&P 500 profits and have not kept up with the market cap expansion. The gap will eventually close. Trade docket: 0, FANG, INTU, WDAY, FSLR, CAVA, DIA, 1HTE, 0DTE, Theta fairy, Scalping. My lean or bias today is bearish. It's starting to look a bit ugly here. The bulls may decide to step in but if you have even a rudimentary understanding of technical analysis, you are seeing some worrysome signs. Let's take a look at our intra-day levels. They were key for us yesterday. /ES: We are getting some range expansion, finally. 6054 is resistance with 5941 support. It's a wide range. Be ready for some big swings. /NQ: Large range as well. 21,605 is resistance with 21,047 support. I would give the day some time to develop before jumping in. BTC: Bitcoin gave us a nice 6% return yesterday. It's hard to tell at this point if we'll get a setup for today. Resistance is 95,030 with support at 86,633. I'll see you all in the live trading room shortly!

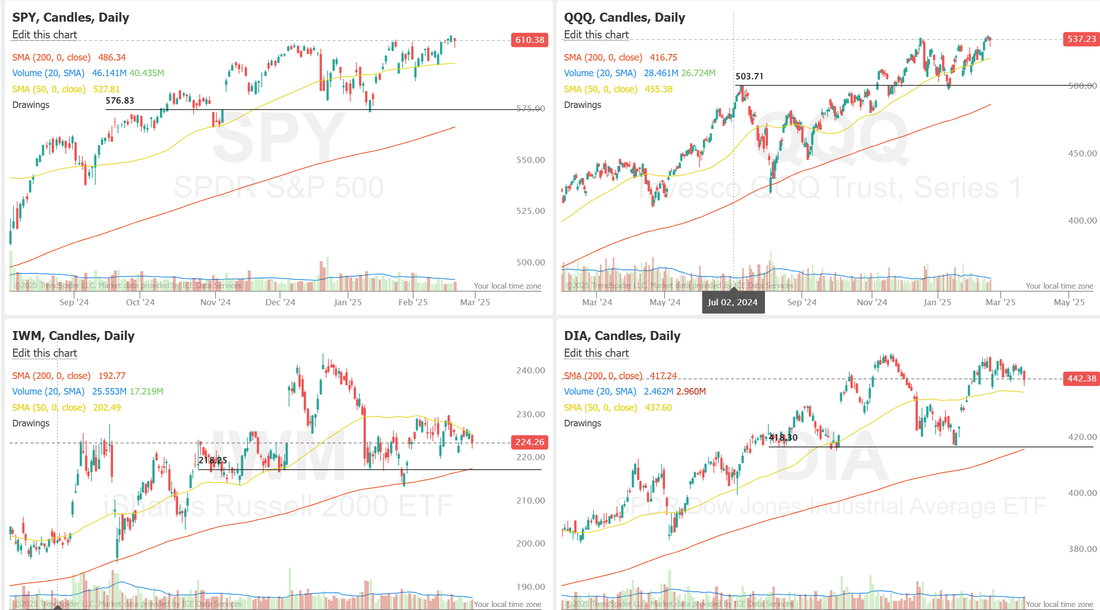

Welcome back traders! Friday was a day to forget for me. Just horrible. I was on wrong side of the market for both our SPX and our scalping and it bite me. We got a nice bounce back this morning with our Nat gas position adding 10K of profits right before expiration tomorrow and you know what? That's great. It certainly lifts spirits and makes today a little brighter but.... you can't and shouldn't depend on stuff like that to bail us out. I need to get back to solid risk management. It's a shame but sometimes it takes a day like Friday to reintroduce that concept to your brain. Here's a snapshot of our day Friday. Again...it's nice Nat gas helped us out today but we can't always depend on that. Let's take a look at the markets: Fridays selloff flipped the technicals to a bearish slant. Taking a closer look at the major indices we trade: There are a couple things that jump out at me. #1. The SPY and QQQ are now sitting right ontop of their 50DMA. This is a big demarcation point. Futures are up today. Does this level hold? It looks like it wants to. As far as IWM and DIA. Both are well below their 50DMA and IWM is actually looking to break below its 200DMA. Very bearish on both these indices. We have bearish setups on both of these in our ATM portfolio and will continue to hold and work those for the forseeable future. Let's look at the expected moves this week: I.V. is not horrible. Sort of middle of the road. The SPY hit all-time highs earlier in the week but then reversed, closing at $599.98 (-1.60%). What initially looked like a decisive move out of the range was all given back by the end of the week. The reversal came with a notable surge in volume, as shown in our RVOL color-coded volume indicator, signaling that selling pressure intensified as SPY gave back its breakout gains. Traders will be watching closely to see if this pullback finds support or if a deeper retracement is in play. While the QQQ briefly notched a new all-time high this week, it ended up closing down at $526.08 (-2.24%). It has remained trapped in the same daily range since November, struggling to establish a clear trend. Friday’s sell-off came on elevated RVOL, highlighting increased participation in the move lower. With no clear breakout in either direction, traders will be watching to see if QQQ finally picks a path—or if the chop continues. Since December, IWM has been stuck in a range and trailing behind its peers, closing at $217.80 (-3.61%). Unlike SPY and QQQ, which briefly hit new highs before reversing, IWM struggled to gain any real momentum. Its early February breakout attempt failed almost immediately, showing a lack of momentum. With the highest daily volume bar since December, selling pressure is accelerating, pushing small caps toward their year-to-date lows. March S&P 500 E-Mini futures (ESH25) are up +0.53%, and March Nasdaq 100 E-Mini futures (NQH25) are up +0.42% this morning, pointing to a partial rebound from Friday’s selloff on Wall Street. This week, investors look ahead to an earnings report from semiconductor stalwart Nvidia, comments from Federal Reserve officials, and the release of the Fed’s preferred inflation gauge along with other key economic data. In Friday’s trading session, Wall Street’s major equity averages closed sharply lower. Akamai Technologies (AKAM) tumbled over -21% and was the top percentage loser on the S&P 500 after the content delivery networking company issued below-consensus 2025 guidance. Also, UnitedHealth Group (UNH) slumped more than -7% and was the top percentage loser on the Dow after the Wall Street Journal reported that the U.S. Justice Department had launched an investigation into the health insurer’s Medicare billing practices. In addition, Block (XYZ) plunged over -17% after the company posted downbeat Q4 results and provided weak FY25 gross profit guidance. On the bullish side, MercadoLibre (MELI) climbed more than +7% and was the top percentage gainer on the Nasdaq 100 after reporting better-than-expected Q4 results. Economic data released on Friday showed that the University of Michigan’s U.S. consumer sentiment index was revised lower to a 15-month low of 64.7 in February, weaker than expectations of no change at 67.8. Also, the U.S. February S&P Global services PMI unexpectedly fell to 49.7, weaker than expectations of 53.0. In addition, U.S. existing home sales fell -4.9% m/m to 4.08M in January, weaker than expectations of 4.13M. At the same time, the U.S. February S&P Global manufacturing PMI rose to an 8-month high of 51.6, stronger than expectations of 51.3. “With policy uncertainty and weaker retail sales guidance [last Thursday] from consumer spending bellwether Walmart, we may have the catalyst we need for a healthy correction. However, there’s still a strong foundation in place for the bull market to continue,” said Gina Bolvin at Bolvin Wealth Management Group. Meanwhile, U.S. rate futures have priced in a 97.5% probability of no rate change and a 2.5% chance of a 25 basis point rate cut at the March FOMC meeting. Market participants will focus on earnings reports from several major companies this week, with semiconductor giant Nvidia’s (NVDA) report on Wednesday attracting the most attention. BofA analysts noted recently that the results will serve as the “next important test for AI bulls.” Retailers such as Home Depot (HD), Lowe’s (LOW), and TJX Companies (TJX), along with notable companies like Salesforce (CRM), Snowflake (SNOW), Zoom (ZM), C3.ai (AI), Dell Technologies (DELL), and HP Inc. (HPQ), are also set to release their quarterly results this week. On the economic data front, the January reading of the U.S. core personal consumption expenditures price index, the Fed’s preferred inflation gauge, will be the main highlight this week. Market watchers will also be monitoring a spate of other economic data releases, including U.S. GDP (second estimate), the Conference Board’s Consumer Confidence Index, the S&P/CS HPI Composite - 20 n.s.a., the Richmond Fed Manufacturing Index, New Home Sales, Crude Oil Inventories, Durable Goods Orders, Core Durable Goods Orders, Initial Jobless Claims, Pending Home Sales, Goods Trade Balance, Personal Income, Personal Spending, Wholesale Inventories (preliminary), and the Chicago PMI. Investors will also await further announcements from U.S. President Donald Trump regarding his plans to impose hefty trade tariffs. In addition, several central bankers are scheduled to deliver remarks this week, including Logan, Barr, Barkin, Bostic, Schmid, Bowman, Harker, and Goolsbee. The U.S. economic data slate is mainly empty on Monday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.437%, up +0.38%. Busy day today as we are loading back up on our pairs trades: /NG,HIMS, ZM, RIOT, HD, SPY/QQQ, Bitcoin, 0DTE's, AALD, BXMT, CADL, LUNG, CTLP, INOD, NTH, SWTX, ADVS, ASGN, CECO, BKE, BPMC, CBRL, CMPR, WWW. My lean or bias on Friday was neutral. That was clearly off. I had been saying we had a big move incoming but clearly was caught off guard with Fridays move. Futures are up this morning. The 50DMA is key on the SPY/QQQ. If that holds I think bulls are fine. If we lose them? Certainly possible we get a down trend move. I'm slightly bullish today. The 50DMA's look like good support here and futures are rebounding. Let's take a look at our intra-day levels: /ES: With as much movement as we've gotten the last few days I'm pulling back to look at the 1DTE candles. 6077 is resistance and a move above that would get us back to bullish bias. 6022 is support and if we break that, I believe there is a lot more downside potential. /NQ: The Nasdaq looks a little more worrysome. On the daily we've got 21,951 as resistance with 21,722 as support. That support level is close. If we break that we could see a move all the way down to 21,565. BTC: Bitcoin continues to hold in a range. 96,545 is resistance with 94,576 acting as support. We've got a full day (0DTE) BTC trade on today vs. a 1HTE. 6% ROI potential if BTC stays below 97,750 today. I look forward to seeing you all in the live trading room shortly! I will be a busy day with all the new pairs trades.

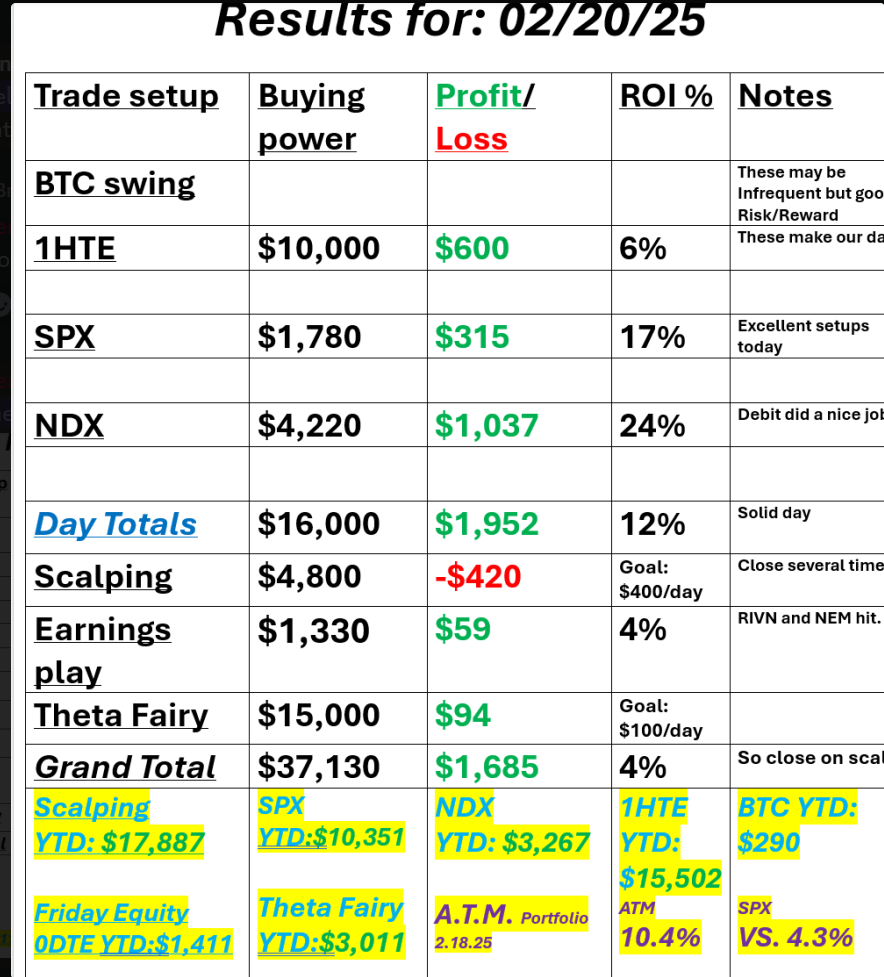

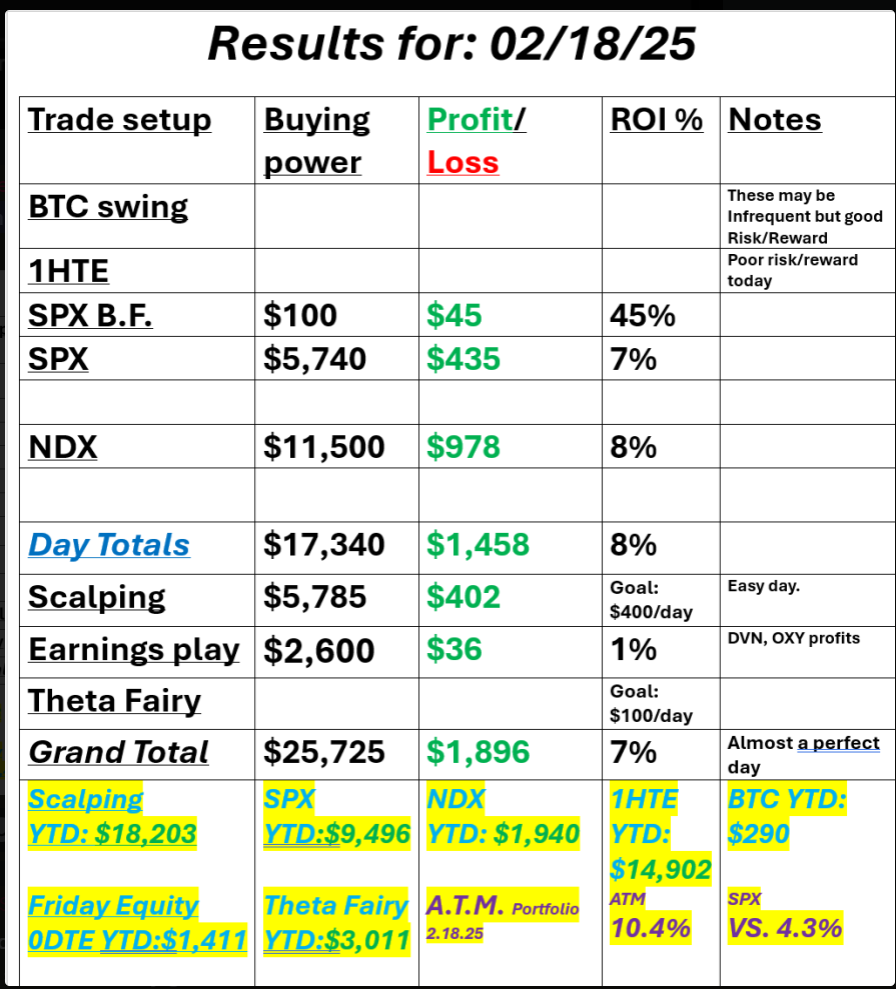

It's Friday! I've got Four vehicles that need registering today. That's my life after the close today! We had a pretty decent week. Here's our results from yesterday. We called the pullback perfectly yesterday so that gave us some good setups to work with. I was close three times to pulling a small profit on scalping and should have done so. We'll see what we can do today. Let's take a look at the markets as we finish out the week. The story for most of the week continued yesterday. The SPY/QQQ are stuck trying to get to new ATH's and the IWM and DIA continue to weaken. Our bearish setups on both of them have performed well for us this week in our ATM portfolio. The market continues to cling to a slight bullish technical outlook. I wouldn't read too much into that unless we can break out of this current range. March S&P 500 E-Mini futures (ESH25) are up +0.11%, and March Nasdaq 100 E-Mini futures (NQH25) are up +0.28% this morning, partially rebounding from yesterday’s slump on Wall Street, while investors brace for U.S. business activity data. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed in the red. Walmart (WMT) slid over -6% and was the top percentage loser on the Dow after the world’s largest retailer issued below-consensus FY26 guidance. Also, EPAM Systems (EPAM) tumbled more than -12% and was the top percentage loser on the S&P 500 after the company provided a disappointing full-year EPS forecast. In addition, Carvana (CVNA) plunged over -12% after the company reported a decline in gross profit per vehicle and lower wholesale volumes for the fourth quarter. On the bullish side, Hasbro (HAS) climbed nearly +13% and was the top percentage gainer on the S&P 500 after the toymaker posted better-than-expected Q4 results. “This news out of Walmart raises even more concerns about the state of the consumer. We have already seen some very disappointing numbers on consumer confidence and last week’s retail sales data was much lower than expected. It raises some questions about how strong growth will be over the rest of this year,” said Matt Maley at Miller Tabak + Co. Economic data released on Thursday showed that the U.S. Philly Fed manufacturing index fell to 18.1 in February, weaker than expectations of 19.4. Also, the number of Americans filing for initial jobless claims in the past week rose +5K to 219K, compared with the 215K expected. In addition, the Conference Board’s leading economic index for the U.S. fell -0.3% m/m in January, weaker than expectations of -0.1% m/m. St. Louis Fed President Alberto Musalem said on Thursday that policy should stay “modestly restrictive” until there is clear evidence that inflation is moving toward the central bank’s 2% target, adding that he sees increased risks that progress could stall or even reverse. Also, Fed Governor Adriana Kugler stated that upside risks to inflation persist, indicating support for the central bank to keep its key policy rate unchanged for now. Meanwhile, U.S. rate futures have priced in a 97.5% chance of no rate change and a 2.5% chance of a 25 basis point rate cut at the next central bank meeting in March. Today, all eyes are focused on the U.S. S&P Global Manufacturing PMI preliminary reading, which is set to be released in a couple of hours. Economists, on average, forecast that the February Manufacturing PMI will come in at 51.3, compared to last month’s value of 51.2. Investors will also focus on the U.S. S&P Global Services PMI, which stood at 52.9 in January. Economists expect the preliminary February figure to be 53.0. U.S. Existing Home Sales data will be reported today. Economists foresee this figure standing at 4.13M in January, compared to the previous number of 4.24M. The University of Michigan’s U.S. Consumer Sentiment Index will be released today as well. Economists estimate this figure at 67.8 in February, compared to 71.1 in January. In addition, market participants will be looking toward a speech from Fed Vice Chair Philip Jefferson. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.489%, down -0.22%. My bias or lean today is neutral. Look...we need a catalyst of some kind to come along and shake us out of this range we are stuck in. Will the weak IWM and DIA be able to drag the SPY and QQQ down or will the broader indices pull the weak ones up? Either way, a big directional move is incoming. When and what direction? Your guess is as good as mine but we do have a couple bearish setups we are trading around. I'd really rather be short here vs. long. Well...I missed getting our overnight Vampire trade on! My bad. That looks like it would have cash flowed. We did, however, get a modified Theta fairy on that hit our profit target. For today: PLTR, /NG, BABA, CRNX, CVNA, F, META, NEM, QQQ/SPY, RIVN, 1HTE, 0DTE's. Let's take a look at our intra-day levels...for what it's worth. Not much change happening. /ES: We seem to want to continue channeling in an incredibly tight range. 6152 is resistance with 6127 support. Anything in this range is meaningless chop to me. Above I'm bullish. Below I'm bearish. /NQ: Same story...different index. 22,272 is resistance with 22,124 support. Anything in between is chop. We need a break out move to get a real directional bias working again. BTC: We are getting some movement in Bitcoin. We were finally able to get a 1HTE on yesterday and that $600 profit really helped out the totals for the day. I'd only be interested in playing the support side today. Resistance is 100,795 with support at 98,235. See you all in the trading room shortly! Let's finish the week strong!

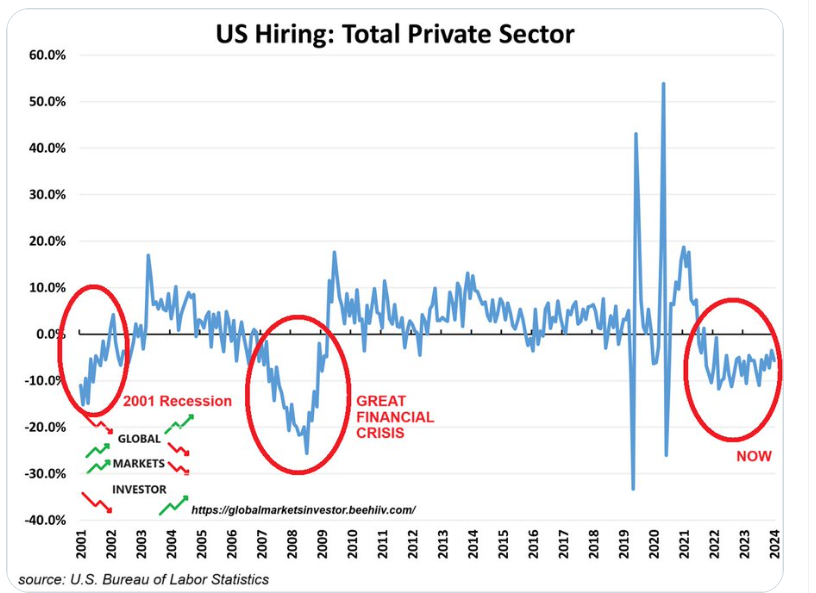

Welcome to Thursday traders! Sorry the blog software was giving me fits yesterday. Here's our results from Tues. Our results from yesterday were solid as well. Impressive even if you consider the low premium and poor price action for the day but it was also our lowest captial outlay of the year. Just not a lot to get behind. Let's take a look at the markets: SPY and QQQ are back to ATH's with the IWM and DIA stuck in a seemingly locked in, tight consolidation zone. March S&P 500 E-Mini futures (ESH25) are down -0.15%, and March Nasdaq 100 E-Mini futures (NQH25) are down -0.17% this morning as investors assess tariff and geopolitical risks, while also awaiting a raft of U.S. economic data, remarks from Federal Reserve officials, and an earnings report from retail giant Walmart. Market jitters have been fueled in recent days by U.S. President Donald Trump’s apparent shift away from supporting Ukraine and its European allies, along with his threats to expand tariff plans across multiple sectors. Trump told reporters on Wednesday that he is considering a 25% tariff on lumber, with the import levy potentially coming around April 2nd. Trump also said he would announce tariffs on cars, semiconductors, and pharmaceuticals “over the next month or sooner.” The minutes of the Federal Open Market Committee’s January 28-29 meeting, released Wednesday, showed that officials are in no hurry to cut interest rates amid stubborn inflation and economic policy uncertainty. “Participants indicated that, provided the economy remained near maximum employment, they would want to see further progress on inflation before making additional adjustments to the target range for the federal funds rate,” according to the FOMC minutes. Policymakers are also monitoring the implementation of Trump’s economic policy plans and their potential impact on the economy. “Participants cited the possible effects of potential changes in trade and immigration policy, the potential for geopolitical developments to disrupt supply chains, or stronger-than-expected household spending,” the minutes said. Still, officials anticipated that “under appropriate monetary policy” inflation would continue to move toward their 2% target. “Another ‘nothing burger’ from the Fed. After making a big adjustment in December there is no rush to make other changes. It’s uncharted territory but not necessarily bad for stocks,” said David Russell at TradeStation. In yesterday’s trading session, Wall Street’s major indexes ended higher. Garmin (GRMN) surged over +12% and was the top percentage gainer on the S&P 500 after the company reported better-than-expected Q4 results and provided solid FY25 guidance. Also, quantum computing stocks soared on Microsoft’s new chip, with D-Wave Quantum (QBTS) jumping more than +8% and Quantum Computing (QUBT) climbing over +7%. In addition, Analog Devices (ADI) rose more than +9% after the chipmaker posted upbeat FQ1 results and issued above-consensus FQ2 guidance. On the bearish side, Celanese (CE) plummeted over -21% and was the top percentage loser on the S&P 500 after the specialty chemicals company swung to a quarterly loss. Economic data released on Wednesday showed that U.S. housing starts fell -9.8% m/m to 1.366M in January, weaker than expectations of 1.390M. At the same time, U.S. building permits, a proxy for future construction, rose +0.1% m/m to 1.483M in January, stronger than expectations of 1.460M. Fed Vice Chair Philip Jefferson said on Wednesday that a strong U.S. economy gives policymakers the flexibility to wait before considering further interest rate cuts. Also, Atlanta Fed President Raphael Bostic said, “I’ve been really comfortable with the idea that we would take a pause and wait and see how the economy’s evolving and then use that information to guide what our policy should look like over the next several months.” Meanwhile, U.S. rate futures have priced in a 97.5% probability of no rate change and a 2.5% chance of a 25 basis point rate cut at the March FOMC meeting. Today, retail giant Walmart (WMT) and notable companies like Booking (BKNG), Copart (CPRT), Block (XYZ), and Rivian Automotive (RIVN) are slated to release their quarterly results. On the economic data front, all eyes are on the U.S. Philadelphia Fed Manufacturing Index, which is set to be released in a couple of hours. Economists, on average, forecast that the February Philly Fed manufacturing index will stand at 19.4, compared to last month’s value of 44.3. Investors will also focus on U.S. Initial Jobless Claims data. Economists expect this figure to be 215K, compared to last week’s number of 213K. The Conference Board’s Leading Economic Index for the U.S. will be reported today. Economists forecast the January figure at -0.1% m/m, the same as the previous reading. U.S. Crude Oil Inventories data will be released today as well. Economists estimate this figure to be 3.200M, compared to last week’s value of 4.070M. In addition, market participants will be anticipating speeches from Fed officials Goolsbee, Jefferson, Musalem, Barr, and Kugler. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.524%, down -0.24%. CVNA, BABA, META, QQQ's, /MNQ scalping, VALU?, RIVN, NEM, 1HTE, 0DTE's. Top 10 US stocks' market cap and earnings GAP is INSANE: The largest 10 firms as a share of the S&P 500 hit 38%, near an all-time high. Their earnings account for 28% of the S&P 500 profits and have not kept up with the market cap expansion. The gap will eventually close. US private sector hiring is in a RECESSION: US hiring in the private sector has declined for 29 months STRAIGHT, the longest streak since the Great Financial Crisis. Hiring rate dropped to 3.6% in December, the second-lowest in 10 YEARS, nearly in line with the 2020 low. Americans are MISSING debt payments as if there is a RECESSION: US consumer serious delinquency rates (90+ days) in credit card debt have jumped to 11.4%, the highest in 13 YEARS. They have risen at the pace recently seen in the Great Financial Crisis of 2007-2009. Serious delinquencies have also exceeded the 2001 recession levels. US consumers are struggling. My bias or lean today is neutral to bearish. I'm not seeing the catalyst that can push the SPY/QQQ's to new ATH's and the IWM/DIA are stuck. We've had a nice run. The tecnicals are still bullish but I think we are due a pause. Let's take a look at our levels today: /ES: Another day of very low expected moves. 6157 is resistance with 6132 support. Very tight range today. /NQ: Same situation. The zone is incredibly tight. It's almost like the market shut down on Feb. 13th and hasn't moved since. We'll get a break out at some point. Resistance is 22,270 with support at 22,140. BTC: Bitcoin is finally getting a bit of movement. $98,171 is now resistance with $96,318 support. I'm not sure what premium will look like this morning with 1HTE's but we may be able to get one working. See you all in the live trading room shortly!

Good morning traders! Welcome back to a shortened holiday trading week. I hope you all had a great break from trading. My wife and I were able to spend some time with some good friends up in the mountains and it was nice to have a break. We had a solid day Friday using very little capital, comparitively speaking. We'll have a very short zoom session this morning to talk strategy and go over our results YTD. Here's a look at how our Friday went. Markets are starting off the week with a slight bullish lean. The SPY and QQQ's are pressing on the ATH's. The IWM and DIA look a tad weaker. We are initiating some bearish cash flow setups today in our ATM portfolio on both of those. March S&P 500 E-Mini futures (ESH25) are up +0.32%, and March Nasdaq 100 E-Mini futures (NQH25) are up +0.36% this morning as U.S. and Russian representatives met to negotiate an end to the three-year war in Ukraine. Limiting gains in U.S. stock futures, Treasury yields surged as cash trading resumed following the Presidents’ Day holiday. A rise in bond yields followed hawkish comments from Fed officials. Fed Governor Christopher Waller stated on Tuesday that recent economic data supported maintaining interest rates at current levels until further progress on inflation was observed. Also, Fed Governor Michelle Bowman said on Monday that while monetary policy “is now in a good place,” she wants to “gain greater confidence that progress in lowering inflation will continue as we consider making further adjustments to the target range.” In addition, Philadelphia Fed President Patrick Harker advocated for keeping rates unchanged amid a strong economy but said he anticipates interest rates will gradually decline in the long run. See Next: Meet the Disruptor Shaking Up the $500 Billion Smartphone Industry The Barchart Brief: Your FREE insider update on the biggest news stories and investing trends, delivered middayInvestors’ focus this week is also on the publication of the minutes of the Federal Reserve’s latest policy meeting, remarks from other Fed officials, and a fresh batch of U.S. economic data. In Friday’s trading session, Wall Street’s major equity averages ended mixed. Airbnb (ABNB) surged over +14% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the vacation home rental company reported upbeat Q4 results. Also, chip stocks gained ground after Treasury yields extended declines, with Micron Technology (MU) rising more than +4% and Nvidia (NVDA) advancing over +2%. In addition, Roku (ROKU) climbed more than +14% after the company posted better-than-expected Q4 results and said it aims to be profitable in FY26. On the bearish side, GoDaddy (GDDY) tumbled over -14% and was the top percentage loser on the S&P 500 after reporting weaker-than-expected Q4 EPS. Also, Applied Materials (AMAT) slid more than -8% and was the top percentage loser on the Nasdaq 100 after the chipmaking equipment maker provided a weak FQ2 revenue forecast. Economic data released on Friday showed that U.S. retail sales slipped -0.9% m/m in January, missing the -0.2% m/m consensus, while core retail sales, which exclude motor vehicles and parts, dropped -0.4% m/m, weaker than expectations of +0.3% m/m. Also, U.S. industrial production climbed +0.5% m/m in January, stronger than expectations of +0.3% m/m, while manufacturing production unexpectedly fell -0.1% m/m, weaker than expectations of +0.1% m/m. In addition, the U.S. import price index rose +0.3% m/m in January, weaker than expectations of +0.4% m/m. “The consumer sentiment report showed people were getting nervous and [Friday’s] weak retail sales number confirmed it. However, the resulting slack is good news for the Fed and tilts the balance a little bit more toward rate cuts,” said David Russell at TradeStation. In this holiday-shortened week, investors will be closely watching the Federal Reserve’s minutes from the January 28-29 meeting, scheduled for release on Wednesday, for further indications that rate cuts remain unlikely in the foreseeable future amid expectations that inflation may remain elevated for longer. Market participants will pay particular attention to any comments on the potential inflationary impact of President Trump’s proposed policies, including trade tariffs. Meanwhile, U.S. rate futures have priced in a 97.5% probability of no rate change and a 2.5% chance of a 25 basis point rate cut at the conclusion of the Fed’s March meeting. Market watchers will also focus on several economic data releases this week, including the U.S. S&P Global Manufacturing PMI (preliminary), the S&P Global Services PMI (preliminary), Building Permits (preliminary), Housing Starts, the Philadelphia Fed Manufacturing Index, Initial Jobless Claims, Crude Oil Inventories, Existing Home Sales, and the University of Michigan’s Consumer Sentiment Index. In addition, San Francisco Fed President Mary Daly, Fed Vice Chair for Supervision Michael Barr, Fed Vice Chair Philip Jefferson, Chicago Fed President Austan Goolsbee, Fed Governor Adriana Kugler, and St. Louis Fed President Alberto Musalem will be making appearances this week. Fourth-quarter corporate earnings season is winding down, but several notable companies are due to report this week, including Walmart (WMT), Arista Networks (ANET), Medtronic (MDT), Analog Devices (ADI), Booking (BKNG), Rivian Automotive (RIVN), and Occidental Petroleum (OXY). Today, investors will focus on the Empire State Manufacturing Index, which is set to be released in a couple of hours. Economists, on average, forecast that the February Empire State manufacturing index will come in at -1.90, compared to -12.60 in January. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.506%, up +0.67%. My lean or bias today is a bit of a mixed bag. I'm still slightly bullish on SPY/QQQ however they are hitting up against ATH's so watch that. I'm also initiating a bearish setup on IWM/DIA today. Let's take a look at volatility and expected moves this shortened week: Nothing impressive I.V. wise. VIX1D is buried. MRK, /MNQ,/NQ scalping, SPY/QQQ 3DTE, IWM, /BTC, OXY, DVN, 1HTE, 0DTE's. Let's take a look at our intra-day levels: /ES: Bullish price action with 6157 being the overhand and nearest resistance. A break above this would take us into unchartered territory. 6139 is support. /NQ: Similar pattern as /ES. 22,317 is resistance with 22,214 working as support. BTC: Bitcoin continues to be range bound. We'll be putting on a 10DTE today with a neutral slant and almost a 11% ROI potential. 97,230 is resistance with 95,574 working as support. I'll see you all in the special zoom session shortly!

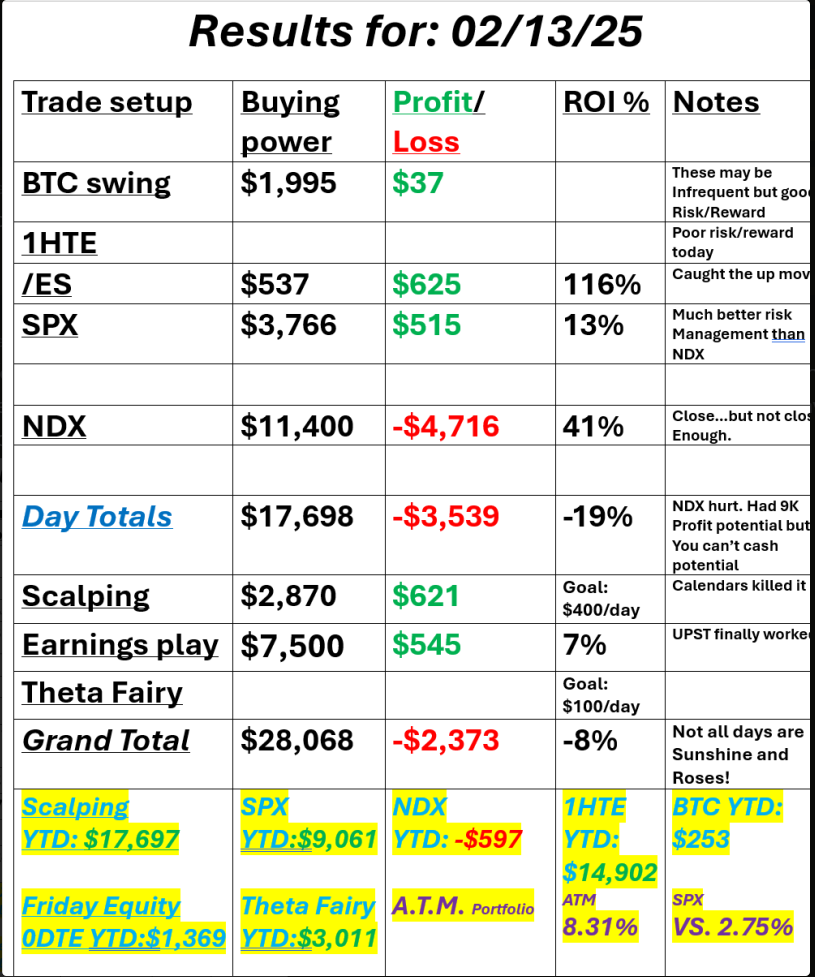

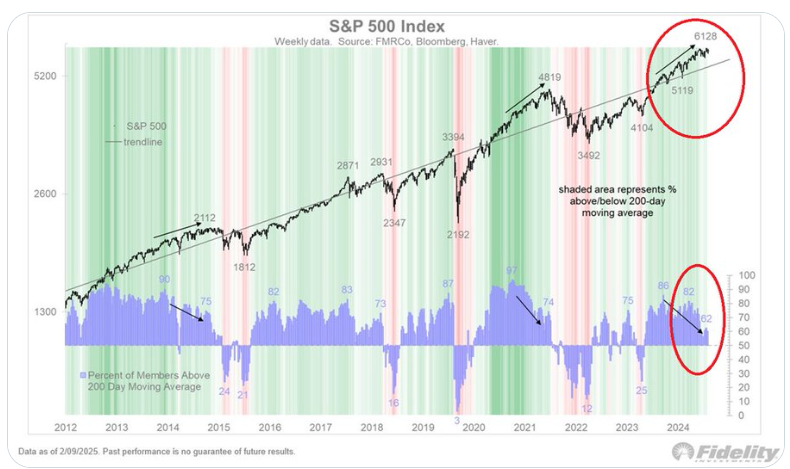

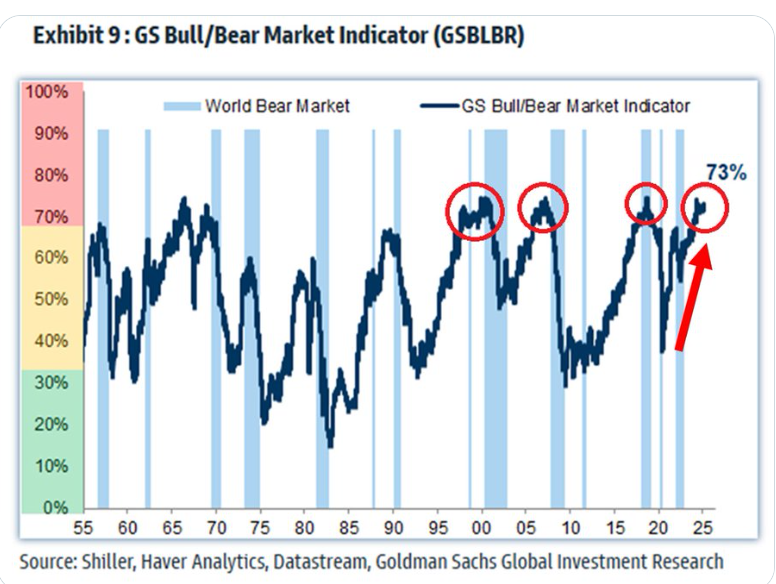

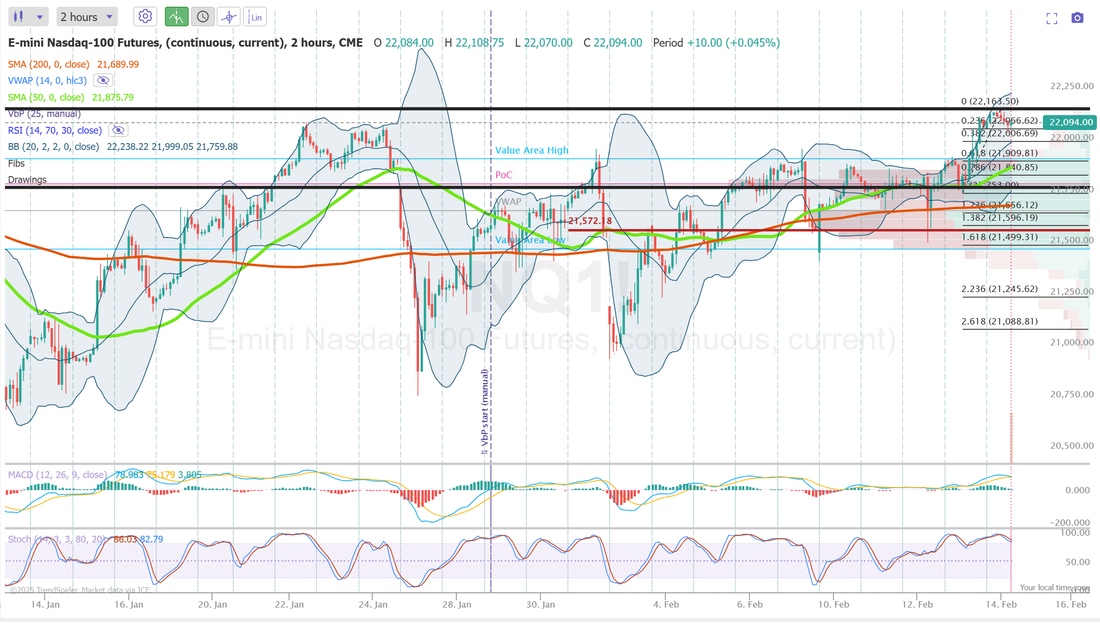

Good morning traders and Happy Valentines (if that's something you celebrate). I'm a lucky man. My wife agrees with me that it's a manufactured holiday and we don't do gifts. Makes it easy if you're a man! I had a losing day yesterday. It's been a while. We've had a nice run but they can't all be winners. Most of our trades did well but the NDX ended up being a loser for me. I was asked by one of our trading members, "in retrospect, would you still do the trade?" My response was, "In retrospect I would NOT do any trade at any time that loses money!" LOL. It seemed pretty obvious to me but thinking deeper it's not that easy. It was a good risk/reward. I was risking about $4,500 for a potential $9,000 profit. It just didn't hit. If you look at our YTD results so far everything has been going well...except the NDX. What are my take aways with regards to that? #1. We just have to, have to, have to be out of these setups before the close. Trying to take the NDX all the way to expiration is like a kamakazi mission #2. I try to constantly remind myself that every trade is a winning trade...of one of the trade participants. That means if you are in a setup that is constantly losing, it may be a great trade! You're just on the wrong side of it. If wild unexpected moves are hurting us in the NDX I'm going to go with the flow today and put on a long vol NDX trade. Let the market do what it will! Here's our results below: Let's take a look at the markets: Technicals are slightly bullish. For the first time in nearly three weeks it looks like the markets are wanting to trend again. We are getting close to pressing on the ATH's on several major indices. My bias or lean today is slightly bullish. That seems to be the push that started yesterday. Yes, we are going to be running into resistance soon but the buyers seem stronger than the sellers right now. March S&P 500 E-Mini futures (ESH25) are trending down -0.15% this morning, taking a breather at the end of a turbulent week, while investors await a raft of U.S. economic data, with a particular focus on the retail sales report. In yesterday’s trading session, Wall Street’s major indices closed in the green, with the benchmark S&P 500 posting a 1-1/2 week high and the tech-heavy Nasdaq 100 notching an 8-week high. MGM Resorts International (MGM) surged over +17% and was the top percentage gainer on the S&P 500 after the casino operator reported stronger-than-expected Q4 results. Also, chip stocks advanced after Treasury yields retreated, with Intel (INTC) climbing more than +7% and Micron Technology (MU) rising over +4%. In addition, AppLovin (APP) jumped more than +24% and was the top percentage gainer on the Nasdaq 100 after the mobile software company posted upbeat Q4 results and issued above-consensus Q1 revenue guidance. On the bearish side, West Pharmaceutical Services (WST) cratered over -38% and was the top percentage loser on the S&P 500 after issuing below-consensus FY25 guidance. Also, The Trade Desk (TTD) tumbled more than -32% after the ad tech firm posted weaker-than-expected Q4 revenue and provided disappointing Q1 revenue guidance. Economic data released on Thursday showed that the U.S. producer price index for final demand rose +0.4% m/m and +3.5% y/y in January, stronger than expectations of +0.3% m/m and +3.2% y/y. Also, the core PPI, which excludes volatile food and energy costs, rose +0.3% m/m and +3.6% y/y in January, compared to expectations of +0.3% m/m and +3.3% y/y. In addition, the number of Americans filing for initial jobless claims in the past week fell -7K to 213K, compared with the 217K expected. “While PPI was much higher than expected, with even higher revisions, the real data that goes into PCE was weaker. And PCE is the one that Jerome Powell and the Fed look at. So in reality, the numbers are better,” said Andrew Brenner at NatAlliance Securities. U.S. rate futures have priced in a 97.5% chance of no rate change and a 2.5% chance of a 25 basis point rate cut at the next central bank meeting in March. Meanwhile, U.S. President Donald Trump on Thursday ordered his administration to explore the implementation of reciprocal tariffs on multiple trading partners. Trump signed a measure directing the U.S. Trade Representative and Commerce Secretary to propose new tariffs on a country-by-country basis to rebalance trade relations, a comprehensive process that could span weeks or months to complete. Howard Lutnick, Trump’s nominee for Commerce Secretary, stated that all studies should be finalized by April 1st, allowing Trump to take action immediately thereafter. “The fact this is a slow burn approach from Trump, with the chance many of the tariffs will be extinguished, is supporting market sentiment,” said Kyle Rodda, senior market analyst at Capital.com. Today, all eyes are focused on U.S. Retail Sales data, which is set to be released in a couple of hours. Economists, on average, forecast that January Retail Sales will stand at -0.2% m/m, compared to the December figure of +0.4% m/m. Investors will also focus on U.S. Core Retail Sales data, which came in at +0.4% m/m in December. Economists expect the January figure to be +0.3% m/m. U.S. Industrial Production and Manufacturing Production data will be reported today. Economists forecast January Industrial Production at +0.3% m/m and Manufacturing Production at +0.1% m/m, compared to December’s figures of +0.9% m/m and +0.6% m/m, respectively. U.S. Export and Import Price Indexes will be released today as well. Economists anticipate the export price index to be +0.3% m/m and the import price index to be +0.4% m/m in January, compared to the previous figures of +0.3% m/m and +0.1% m/m, respectively. In addition, market participants will be anticipating a speech from Dallas Fed President Lorie Logan. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.528%, up +0.07%. /MCL, /ZN, /ZW?, IBIT, MRK, TSLA, VRTX. ABNB, TWLO and COIN as possible equity 0DTE's. NDX 0DTE. I'll focus our 0DTE efforts today on NDX. As I mentioned, markets are finally back to pressing on ATH's. Can the bulls breakthrough and establish a new uptrend? As inflation runs hot, more Americans are relying on debt to get through life. Total consumer debt surged by a record $40.8 billion in December, contributing to a $950 billion increase over the past five years. This brought total consumer debt to over $5 trillion. Financial pressure on households continues to escalate (and meanwhile, job openings are falling… and rents are falling …)... when will they finally reach their limit? $META has now traded green for 19 consecutive days, the longest winning streak in history for any Magnificent 7 stock and one of the greatest runs in history! Is the S&P 500 bull market near an end? ~61% of S&P 500 stocks trade above their 200-day moving average, down from 86% at the peak. According to Jurrien Timmer, Director of Global Macro at Fidelity, this trend shows a negative divergence, feeling like "late innings" to him. The Goldman Sachs Bull/Bear Market Indicator measuring market and economic sentiment hit 73%, one of the largest readings in history. The index uses valuations, yield curve, unemployment, inflation and other metrics. The sentiment has rarely been greater. Let's take a look at our intra-day level on /NQ as that will be our focus for 0DTE today. On a daily chart we are back to ATH! On the 2hr. chart however, we start to see some divergence. Resistance is close and obviously correlates with the ATH. It would be a big feat for the bulls if they could break above 22,161 and hold. There are multiple support levels on the way down. 22,066, 22,008, 21,912, 21,840, 21,782. There's a lot more support levels than resistance. It should be easier for the bears to push down through these levels than for the bulls to push up above the ATH. I'll see you all in the trading room shortly! Let's get a nice finish today to end the week.

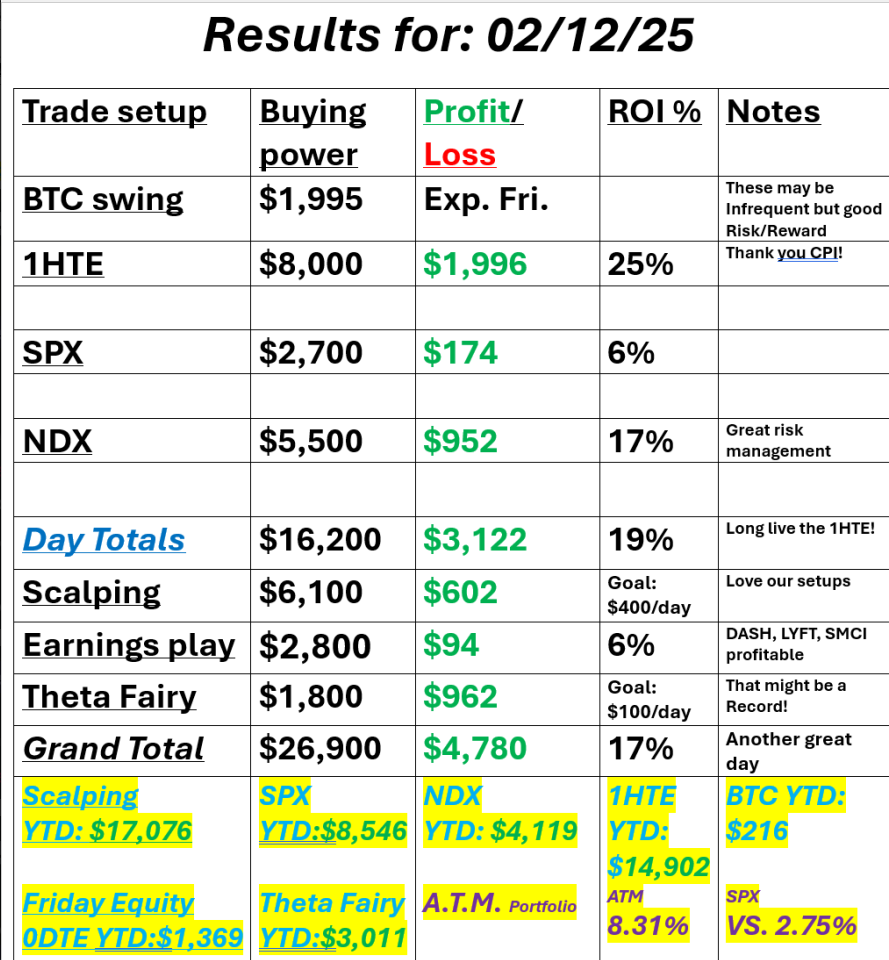

Welcome back traders. CPI was good for us. It offered up great scalping opportunities. We had to work our NDX most of the day. It caused me to miss some good earnings setups but that's o.k. I'm proud of our risk management again with our NDX. One of the most powerful quotes in trading is: "All large losses start as small losses". Be willing to take lots of small losses in order to avoid that big one. CPI offered us an amazing opportunity in the 1HTE bitcoin trade. It contributed a bunch to our excellent overall results. Here's a look at our results. PPI incoming today so no bias or levels. March S&P 500 E-Mini futures (ESH25) are down -0.02%, and March Nasdaq 100 E-Mini futures (NQH25) are up +0.06% this morning as market participants awaited crucial producer inflation data and a new round of corporate earnings reports. In yesterday’s trading session, Wall Street’s major indexes ended mixed. Westinghouse Air Brake Technologies (WAB) slumped over -9% and was the top percentage loser on the S&P 500 after the company posted downbeat Q4 results and provided soft FY25 guidance. Also, Biogen (BIIB) fell more than -4% and was the top percentage loser on the Nasdaq 100 after the drug developer issued weaker-than-expected FY25 adjusted EPS guidance. In addition, Lyft (LYFT) slid over -7% after the ride-hailing company gave disappointing guidance for Q1 gross bookings. On the bullish side, CVS Health (CVS) surged nearly +15% and was the top percentage gainer on the S&P 500 after the healthcare conglomerate reported better-than-expected Q4 results. The U.S. Bureau of Labor Statistics report released on Wednesday showed that consumer prices jumped +0.5% m/m in January, stronger than expectations of +0.3% m/m. On an annual basis, headline inflation unexpectedly accelerated to +3.0% in January from +2.9% in December, stronger than expectations of no change at +2.9% and the fastest pace of increase in 7 months. Also, the January core CPI, which excludes volatile food and fuel prices, unexpectedly accelerated to +3.3% y/y from +3.2% y/y in December, stronger than expectations of +3.1% y/y. “Higher-for-longer may have just gotten a little longer,” said Ellen Zentner at Morgan Stanley Wealth Management. “The Fed has been waiting for clear signs that inflation is trending lower again, and [yesterday] they got the opposite. Until that changes, the markets are going to have to remain patient about additional rate cuts.” Federal Reserve Chair Jerome Powell stated on Wednesday that the latest CPI report indicates that although the central bank has made substantial progress toward taming inflation, there is still more work to do. “I would say we’re close, but not there on inflation. Last year, inflation was 2.6% - so great progress - but we’re not quite there yet,” Powell told House lawmakers in response to a question on the second day of his semi-annual testimony to Congress. The Fed chief added that policymakers “want to keep policy restrictive for now,” suggesting that interest rates will stay elevated for the foreseeable future. Also, Atlanta Fed President Raphael Bostic said that the timing of the next interest rate cut remains uncertain due to the unclear trajectory of inflation and potential policy changes, including tariffs, from the Trump administration. “It’s going to take a while to just figure out what is going on,” Bostic noted. Meanwhile, U.S. rate futures have priced in a 97.5% chance of no rate change and a 2.5% chance of a 25 basis point rate cut at the March meeting. On the earnings front, notable companies like Applied Materials (AMAT), Deere & Company (DE), Palo Alto Networks (PANW), Duke Energy (DUK), Airbnb (ABNB), and Datadog (DDOG) are set to report their quarterly figures today. Today, all eyes are focused on the U.S. Producer Price Index, which is set to be released in a couple of hours. Economists, on average, forecast that the U.S. January PPI will come in at +0.3% m/m and +3.2% y/y, compared to the previous figures of +0.2% m/m and +3.3% y/y. The U.S. Core PPI will also be closely monitored today. Economists expect January figures to be +0.3% m/m and +3.3% y/y, compared to December’s numbers of 0.0% m/m and +3.5% y/y. U.S. Initial Jobless Claims data will be released today as well. Economists estimate this figure will come in at 217K, compared to 219K last week. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.601%, down -0.71%. AMT, PANW, ABNB, TWLO, WYNN, COIN, DDOG, /ES, /NG, UPST, 0DTE's. See you in our live zoom shortly!

|

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |