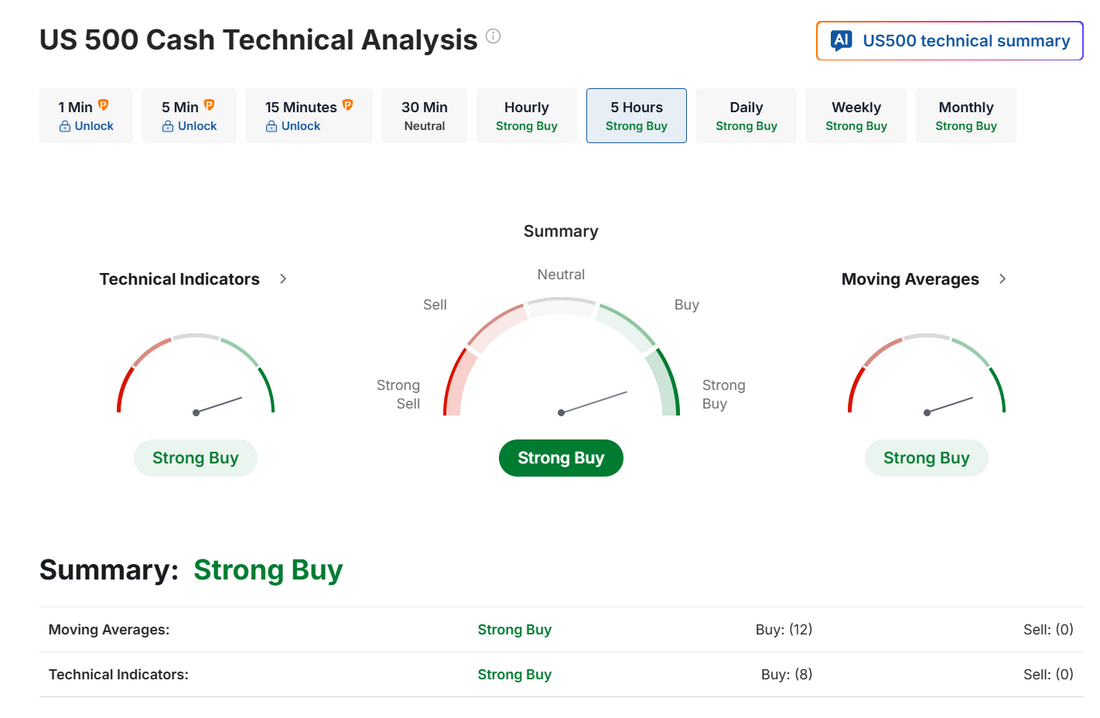

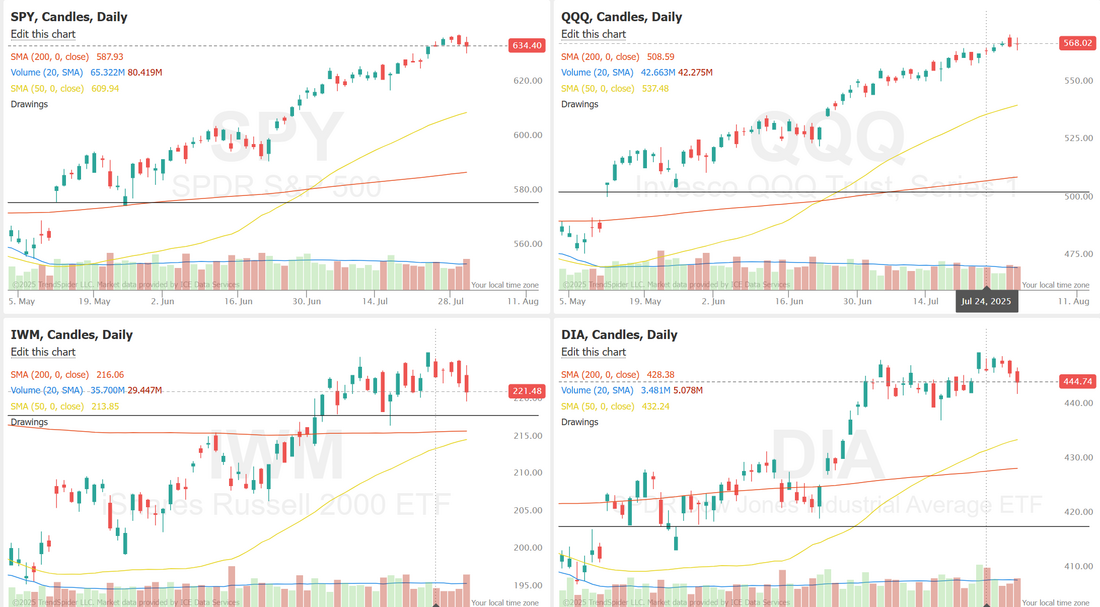

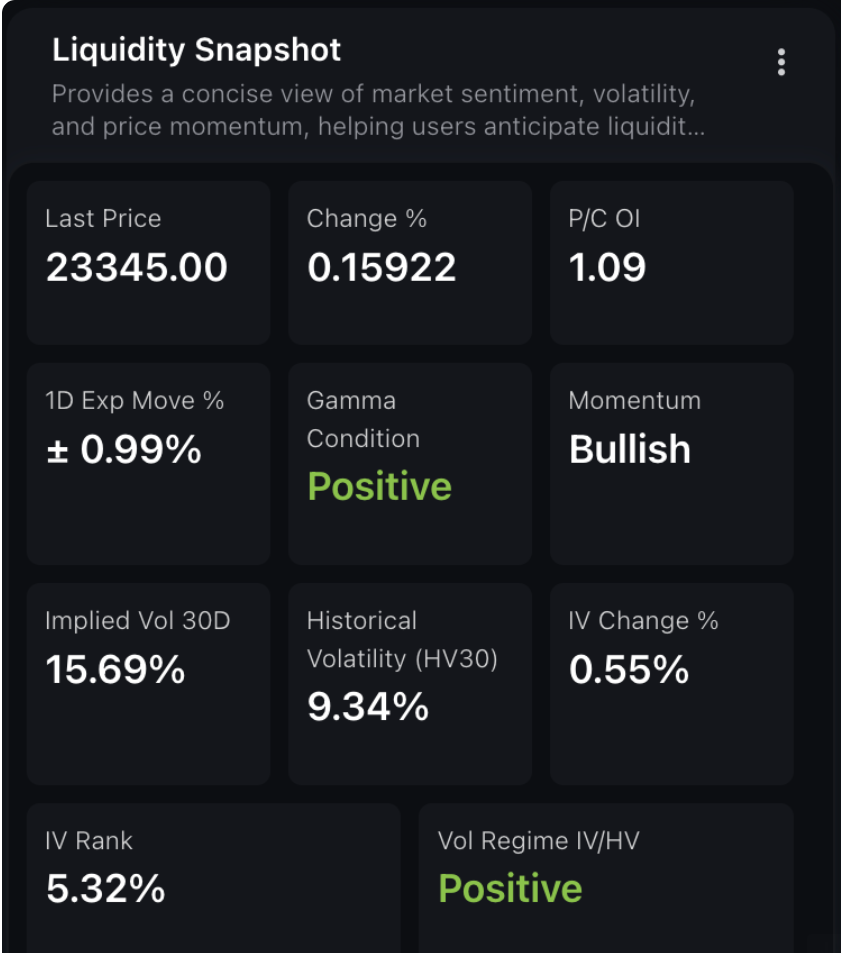

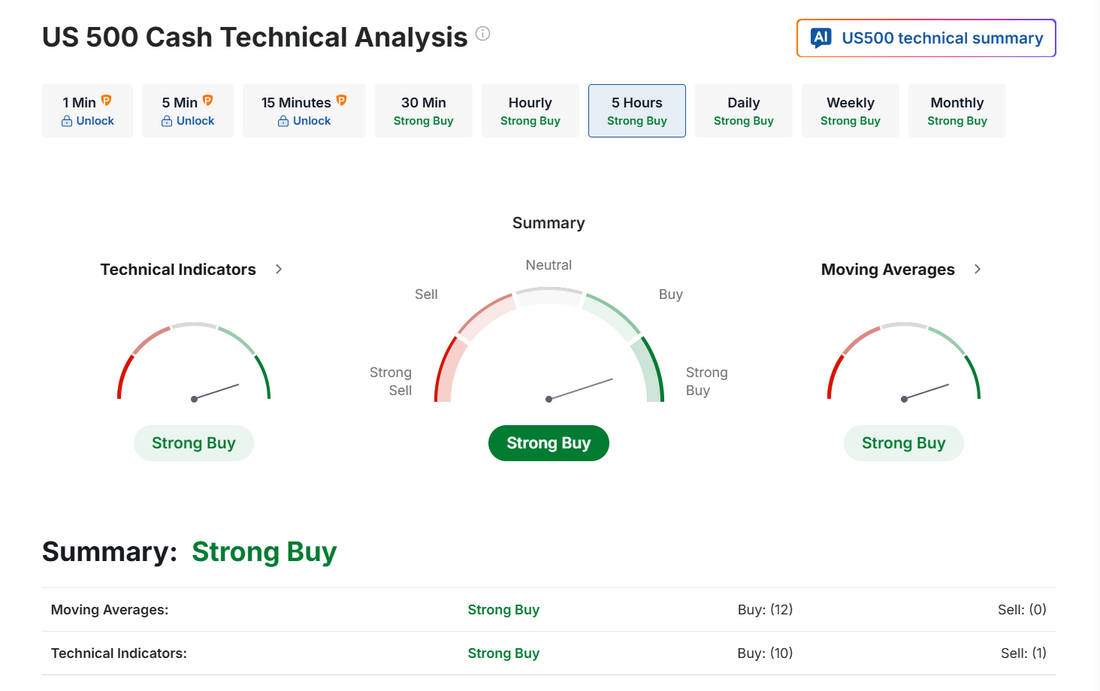

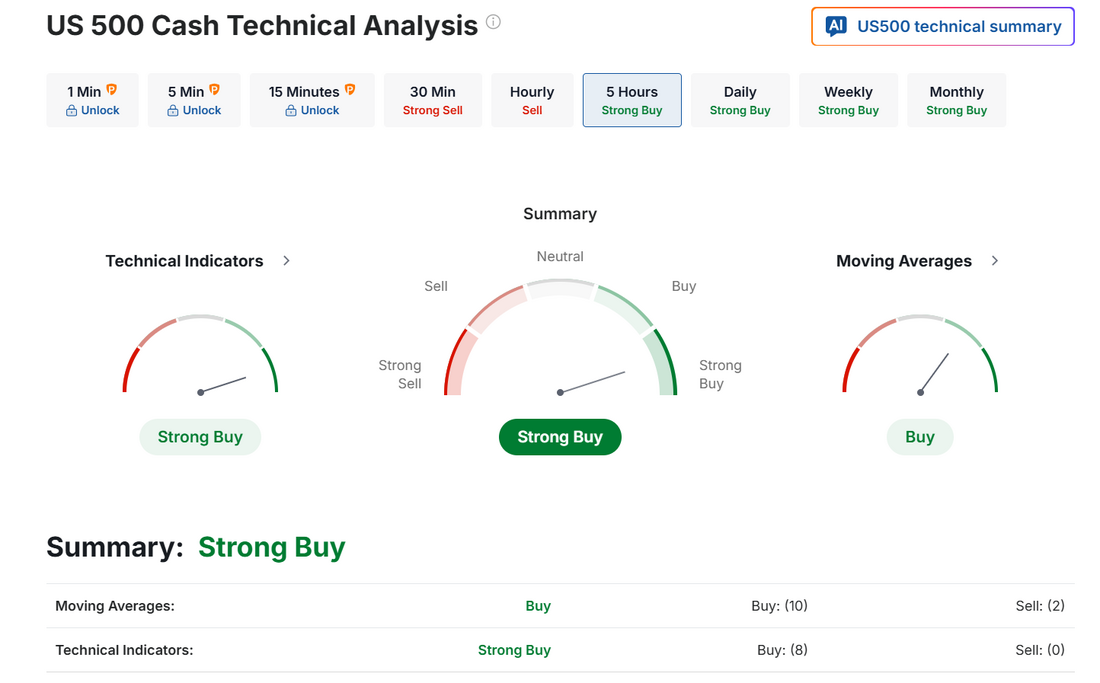

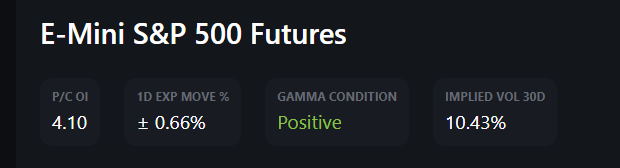

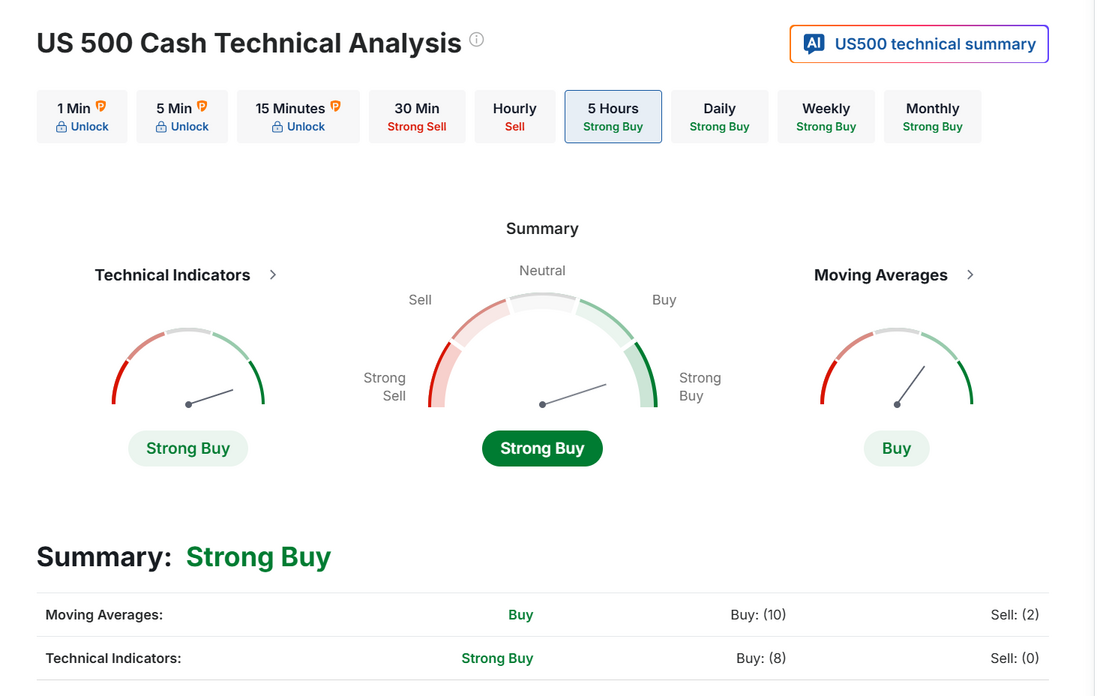

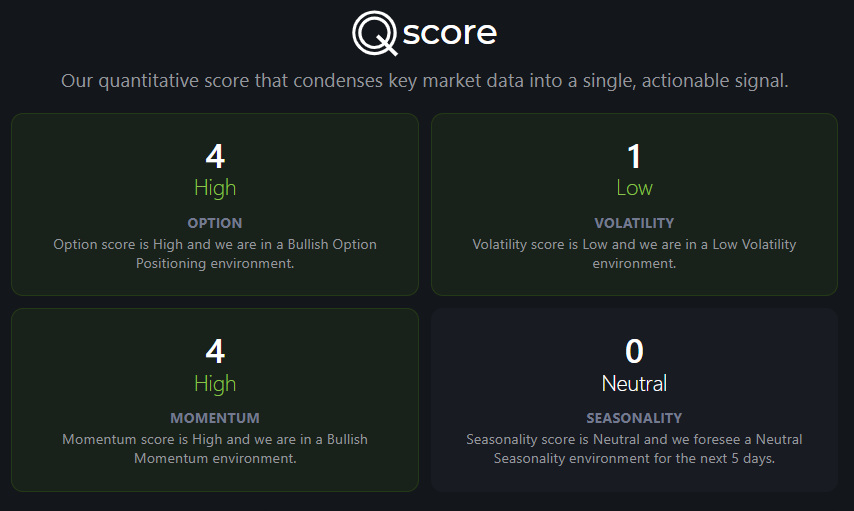

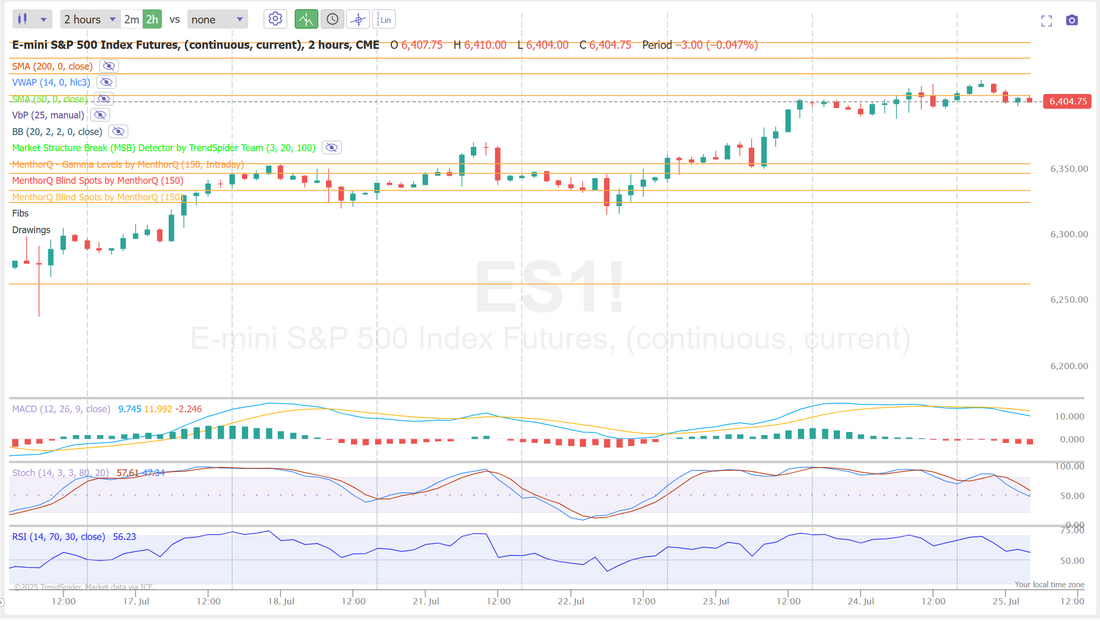

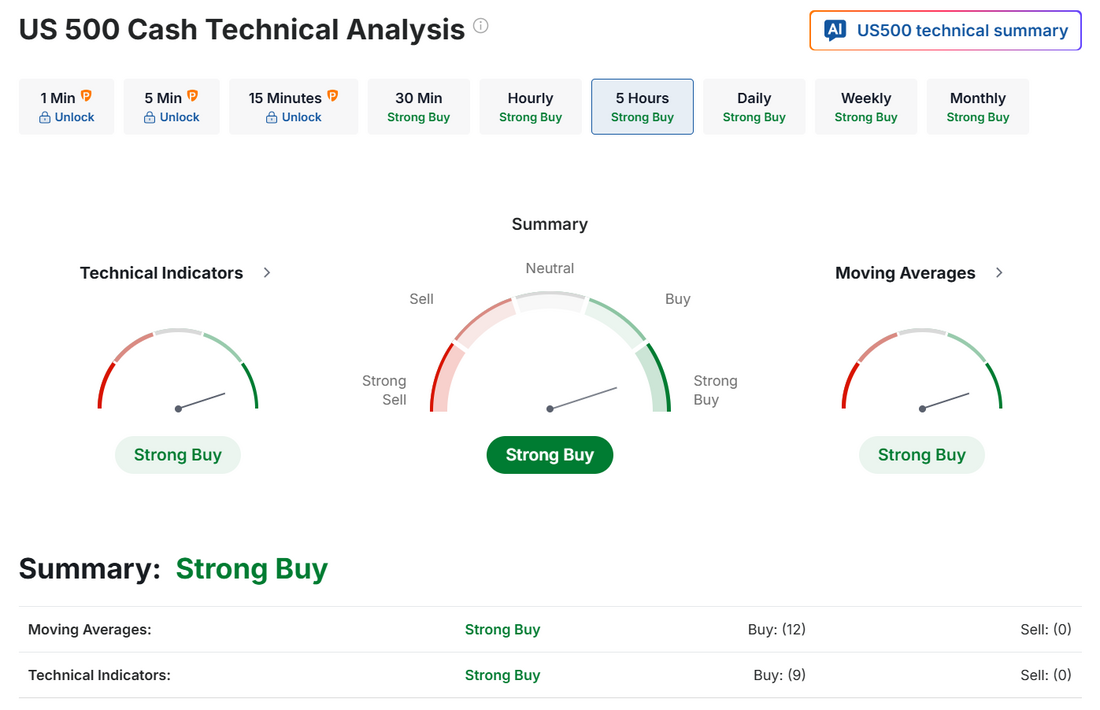

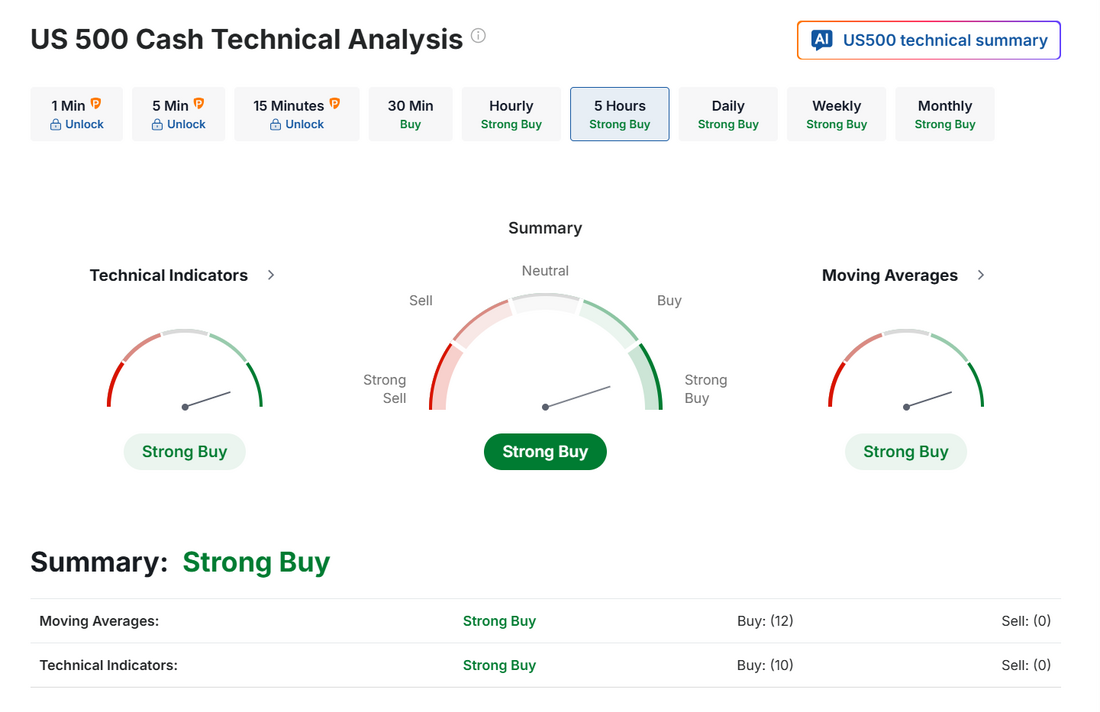

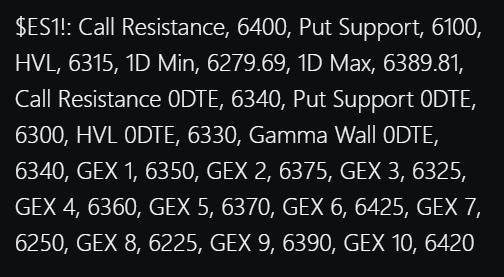

Do we get a 1%+ day today?It's been a very, very long time since we've had a 1% or greater move in the SPX in a single day. Is today the day? Futures are up almost 1% as I type. Blowout earnings from a couple tech stocks and more talk of trade deals getting done are pushing the futures this morning after an interesting session yesterday with Powell not wanting to commit to rate cuts...again. We had an exceptional day yesterday. FOMC days usually present some great movement and that's all we are looking for, as traders. We certainly got it yesterday and we did a nice job of being patient and timing the moves. Take a look at our results below: FOMC is usually a day that delivers for us. With MSFT and META reporting blowout numbers on AI benefits the futures are pushing us to new heights this morning. We've got PCE, Jobless claims and consumer spending coming out shortly which could also affect the days trajectory. The question at hand is, can the market hold these futures gains and build or do we give it back? Let's take a look at the markets: Markets continue to be bullish but waning is starting to show. The bull appears to be getting tired. Federal Reserve Chair Jerome Powell held firm on interest rates, signaling no immediate cuts despite mounting pressure from the White House and dissent from two Fed governors. The FOMC’s decision to keep rates steady for the fifth consecutive meeting marks a cautious approach, as Powell emphasized the need for more data on inflation and employment before taking action. While market participants had hoped for clearer signals on potential easing in September, Powell’s neutral tone cooled those expectations, with rate-cut odds dropping to around 40%. With uncertainty lingering around Trump’s tariff policy and its inflationary impact, the Fed appears focused on managing inflation risk efficiently rather than responding preemptively. Markets responded with a dip in equities and a stronger dollar, reflecting investor recalibration. Now let's look at positioning. The SPX Option Score chart as of July 30, 2025, suggests that while the spot price continues its steady climb near recent highs, the Option Score has begun to drift lower from its previously elevated range. After maintaining consistent readings near the 4–5 level throughout the rally, the recent dip toward 3 could indicate a cooling in options market conviction. In the short term, this shift may reflect some hesitation or reduced bullish sentiment among option traders despite the index's resilience. Market participants may want to monitor whether this divergence widens further, especially as the SPX approaches potential resistance around 6400. The NDX liquidity snapshot paints a constructive short-term picture, with bullish momentum and a positive gamma condition suggesting a supportive backdrop for price stability or further upside. Implied volatility at 15.69% remains elevated relative to 30-day historical volatility at 9.34%, indicating a rich premium environment, although the low IV rank of 5.32% signals implied vol is still low compared to its past range. The put/call open interest ratio at 1.09 shows a slight defensive bias, but with the volatility regime also flagged as positive, overall market structure appears conducive to continued resilience, barring a sharp volatility shock. September S&P 500 E-Mini futures (ESU25) are up +0.97%, and September Nasdaq 100 E-Mini futures (NQU25) are up +1.30% this morning as forecast-beating quarterly results from Meta and Microsoft boosted sentiment. Meta Platforms (META) surged over +11% in pre-market trading after the maker of Facebook and Instagram posted upbeat Q2 results and issued strong Q3 revenue guidance. Also, Microsoft (MSFT) climbed more than +8% in pre-market trading after the technology behemoth reported stronger-than-expected FQ4 results and provided an upbeat FQ1 revenue growth forecast for the Azure cloud unit. In addition, both companies vowed to spend heavily on artificial intelligence. On the trade front, U.S. President Donald Trump said on Wednesday he reached an agreement with South Korea that would set a 15% tariff on its exports to the U.S. and include a commitment from Seoul to invest $350 billion in the U.S. Also, President Trump said he would impose a 25% tariff on India’s exports to the U.S. beginning Friday and threatened a further penalty related to the country’s energy imports from Russia. In addition, U.S. Commerce Secretary Howard Lutnick said on Wednesday that the U.S. reached trade agreements with Cambodia and Thailand. Investors now await the release of the Federal Reserve’s first-line inflation gauge and earnings reports from “Magnificent Seven” companies Apple and Amazon. As widely expected, the Federal Reserve left interest rates unchanged yesterday. The Federal Open Market Committee voted 9-2 to keep the federal funds rate in a range of 4.25%-4.50%. Governors Christopher Waller and Michelle Bowman voted against the decision, favoring a quarter-point rate cut instead. In a post-meeting statement, officials lowered their assessment of the U.S. economy, saying that “although swings in net exports continue to affect the data, recent indicators suggest that growth of economic activity moderated in the first half of the year.” The Fed had earlier described growth as expanding “at a solid pace.” At a press conference, Fed Chair Jerome Powell said that the slowdown in growth highlighted in the Fed’s statement “largely reflects a slowdown in consumer spending.” However, Mr. Powell refrained from signaling that a rate cut is likely in September. “It seems to me, and to almost the whole committee, that the economy is not performing as though a restrictive policy is holding it back inappropriately,” he said, adding, “We have made no decisions about September.” “The next two months of data will be pivotal, and we see a path to a resumption of the Fed’s easing cycle in the autumn should tariff inflation prove more modest than expected or the labor market show signs of weakness,” said Ashish Shah at Goldman Sachs Asset Management. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed mixed. IDEX Corp. (IEX) plunged over -11% and was the top percentage loser on the S&P 500 after the company cut its full-year adjusted EPS guidance. Also, Old Dominion Freight Line (ODFL) slumped more than -9% and was the top percentage loser on the Nasdaq 100 after the company posted downbeat Q2 results. In addition, Seagate Technology (STX) slid over -3% after the data storage company issued soft FQ1 guidance. On the bullish side, Teradyne (TER) surged more than +18% after the maker of testing equipment for semiconductors and robotics posted better-than-expected Q2 adjusted EPS. The U.S. Bureau of Economic Analysis, in its initial estimate of Q2 GDP growth, said on Wednesday that the economy grew at a +3.0% annualized rate, stronger than expectations of +2.5%. Also, the U.S. ADP employment change rose by 104K in July, stronger than expectations of 77K. At the same time, U.S. June pending home sales unexpectedly fell -0.8% m/m, weaker than expectations of +0.2% m/m. “The significant beat in Q2 GDP is just a rebound from the drop in Q1. Don’t get me wrong, these GDP data are great, just not that great. The economy remains resilient and growing, and that’s the most important takeaway from this report,” said Jamie Cox at Harris Financial Group. Meanwhile, U.S. rate futures have priced in a 59.0% chance of no rate change and a 41.0% chance of a 25 basis point rate cut at the next central bank meeting in September. Second-quarter corporate earnings season rolls on, and market participants await reports today from high-profile companies such as Apple (AAPL), Amazon.com (AMZN), Mastercard (MA), AbbVie (ABBV), and KLA Corp. (KLAC). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +4.5% increase in quarterly earnings for Q2 compared to the previous year, exceeding the pre-season estimate of +2.8%. On the economic data front, all eyes are focused on the U.S. core personal consumption expenditures price index, the Fed’s preferred price gauge, which is set to be released in a couple of hours. Economists, on average, forecast that the core PCE price index will stand at +0.3% m/m and +2.7% y/y in June, compared to the previous figures of +0.2% m/m and +2.7% y/y. U.S. Personal Spending and Personal Income data will also be closely monitored today. Economists anticipate June Personal Spending to rise +0.4% m/m and Personal Income to grow +0.2% m/m, compared to the May figures of -0.1% m/m and -0.4% m/m, respectively. The U.S. Employment Cost Index will be reported today. Economists expect this figure to come in at +0.8% q/q in the second quarter, compared to +0.9% q/q in the first quarter. The U.S. Chicago PMI will come in today. Economists forecast the July figure at 41.9, compared to the previous value of 40.4. U.S. Initial Jobless Claims data will be released today as well. Economists expect this figure to be 222K, compared to last week’s number of 217K. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.358%, down -0.43%. Trade docket for today: Busy. /GC 0DTE, /MNQ scalping again. ABBV, ARM, CVS, HOOD, META, MSFT, QCOM, AAPL, AMZN, XOM earnings trades. QQQ 0DTE, SPX and NDX 0DTE's. My lean or bias today is bearish. By bearish I mean we retrace from this highs we are seeing in the futures, as I type. /NQ is up +320 and /ES is up 60+ Let's take a look at our intra-day levels: 6460, 6470, 6475, 6480 are resistance levels. 6448, 6443, 6433 are support. Today should be a good opportunity day with futures already soaring. I'll see you all in the live trading room shortly.

0 Comments

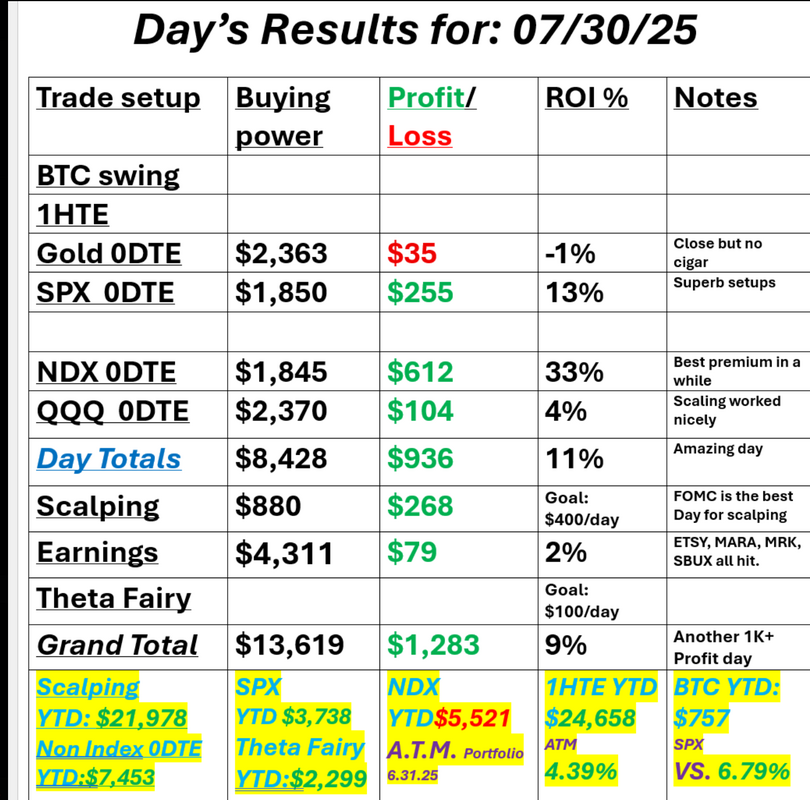

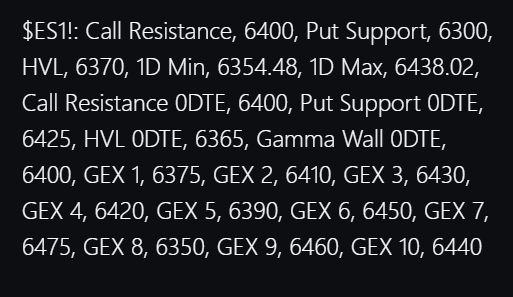

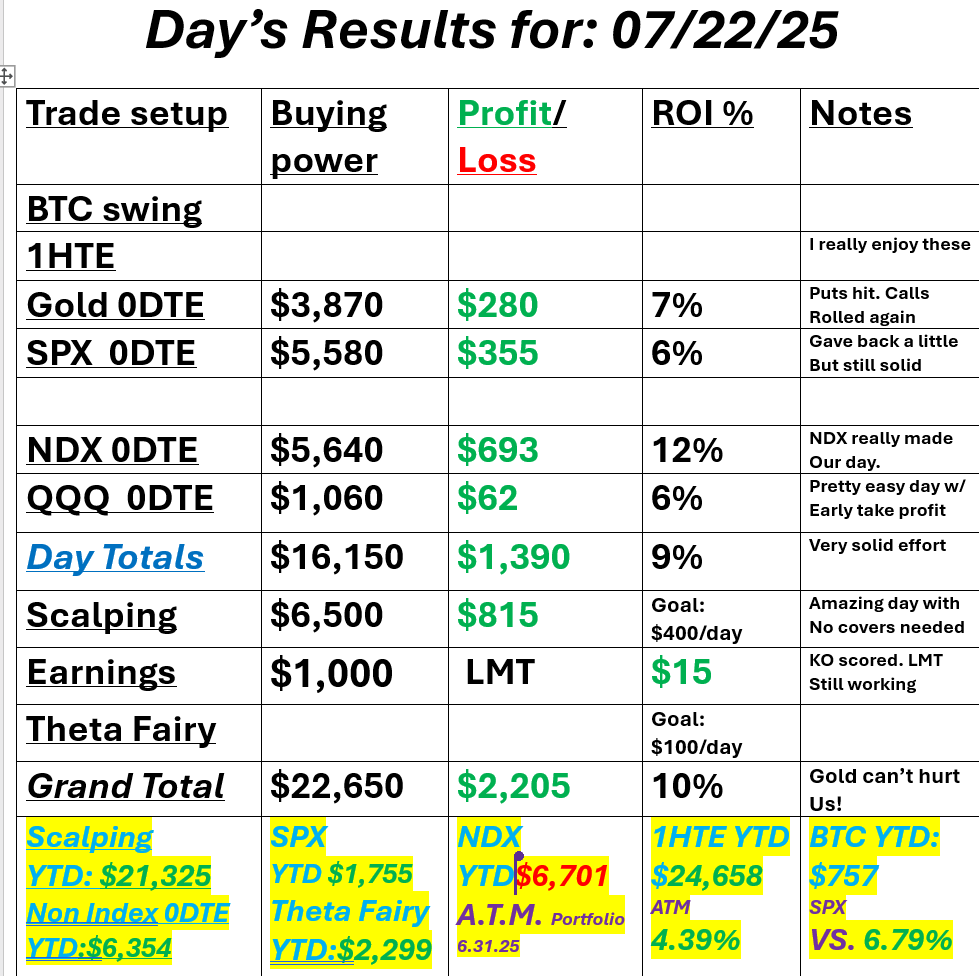

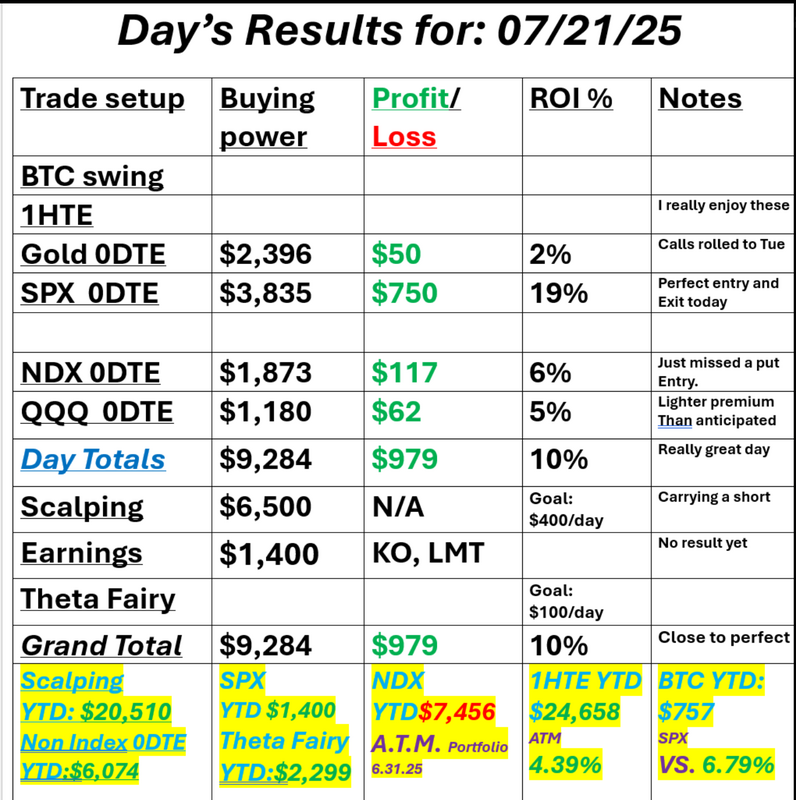

FOMC dayIt's FOMC day and you know what that means for us. We have a very specific way we trade today, which we'll go over again in our live zoom. We had a barn burner of a day yesterday September S&P 500 E-Mini futures (ESU25) are up +0.12%, and September Nasdaq 100 E-Mini futures (NQU25) are up +0.21% this morning, pointing to a slightly higher open on Wall Street, while investors await the Federal Reserve’s policy decision, a fresh batch of U.S. economic data, including the ADP employment report and the first estimate of second-quarter GDP, as well as earnings reports from “Magnificent Seven” companies Microsoft and Meta. In yesterday’s trading session, Wall Street’s major indexes ended in the red. United Parcel Service (UPS) slumped over -10% and was among the top percentage losers on the S&P 500 after the delivery company reported weaker-than-expected Q2 adjusted EPS and said it would not provide full-year revenue or operating profit guidance due to macroeconomic uncertainty. Also, Brown & Brown (BRO) plunged more than -10% after the company posted weaker-than-expected Q2 organic revenue growth. In addition, UnitedHealth Group (UNH) fell over -7% and was the top percentage loser on the Dow after the company reported weaker-than-expected Q2 adjusted EPS and provided below-consensus FY25 guidance. On the bullish side, Corning (GLW) surged more than +11% and was the top percentage gainer on the S&P 500 after the maker of specialty glass and ceramics reported better-than-expected Q2 results and issued above-consensus Q3 core EPS guidance. A Labor Department report released on Tuesday showed that U.S. JOLTs job openings fell to 7.437 million in June, weaker than expectations of 7.510 million. At the same time, the U.S. Conference Board’s consumer confidence index rose to 97.2 in July, stronger than expectations of 95.9. In addition, the U.S. May S&P/CS HPI Composite - 20 n.s.a. eased to +2.8% y/y from +3.4% y/y in April, weaker than expectations of +2.9% y/y. “Overall, it was a mixed round of data that has done little to materially challenge the price action or macro narrative,” said Ian Lyngen at BMO Capital Markets. Today, all eyes are focused on the Federal Reserve’s monetary policy decision. The Federal Open Market Committee is widely expected to keep the Fed funds rate unchanged in a range of 4.25% to 4.50%. The decision comes amid intense political pressure, evolving trade policy, and economic cross-currents. Market watchers will follow Chair Jerome Powell’s post-policy meeting press conference for any indication of a greater openness from the central bank to ease policy when it next meets in September. Second-quarter corporate earnings season continues in full force. Investors will be closely monitoring earnings reports today from “Magnificent Seven” companies Microsoft (MSFT) and Meta Platforms (META). Prominent companies like Qualcomm (QCOM), Arm (ARM), Lam Research (LRCX), and Altria (MO) are also scheduled to release their quarterly results today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +4.5% increase in quarterly earnings for Q2 compared to the previous year, exceeding the pre-season estimate of +2.8%. On the economic data front, investors will focus on the Commerce Department’s first estimate of gross domestic product, set to be released in a couple of hours. Economists, on average, forecast that U.S. GDP growth will stand at +2.5% q/q in the second quarter, compared to the first-quarter figure of -0.5% q/q. The U.S. ADP Nonfarm Employment Change data will also be closely monitored today. Economists expect the July figure to come in at 77K, compared to the June figure of -33K. U.S. Pending Home Sales data will be reported today. Economists forecast the June figure at +0.2% m/m, compared to the previous figure of +1.8% m/m. U.S. Crude Oil Inventories data will be released today as well. Economists expect this figure to be -2.300M, compared to last week’s value of -3.169M. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.326%, down -0.21%. No levels or bias on FOMC day. We usually start the day with a high theta, low risk setup. Take that off before FOMC then re-apply once Powell starts speaking. Trade docket: Busy with earnings today. MARA, MRK, SBUX, ETSY, MSFT, META, QCOM, ARM, ABBV, CVS. We missed an entry on Gold 0DTE so we'll try a 1DTE today. QQQ 0DTE, SPX and NDX 0DTE. I'll see you all in the live trading room shortly.

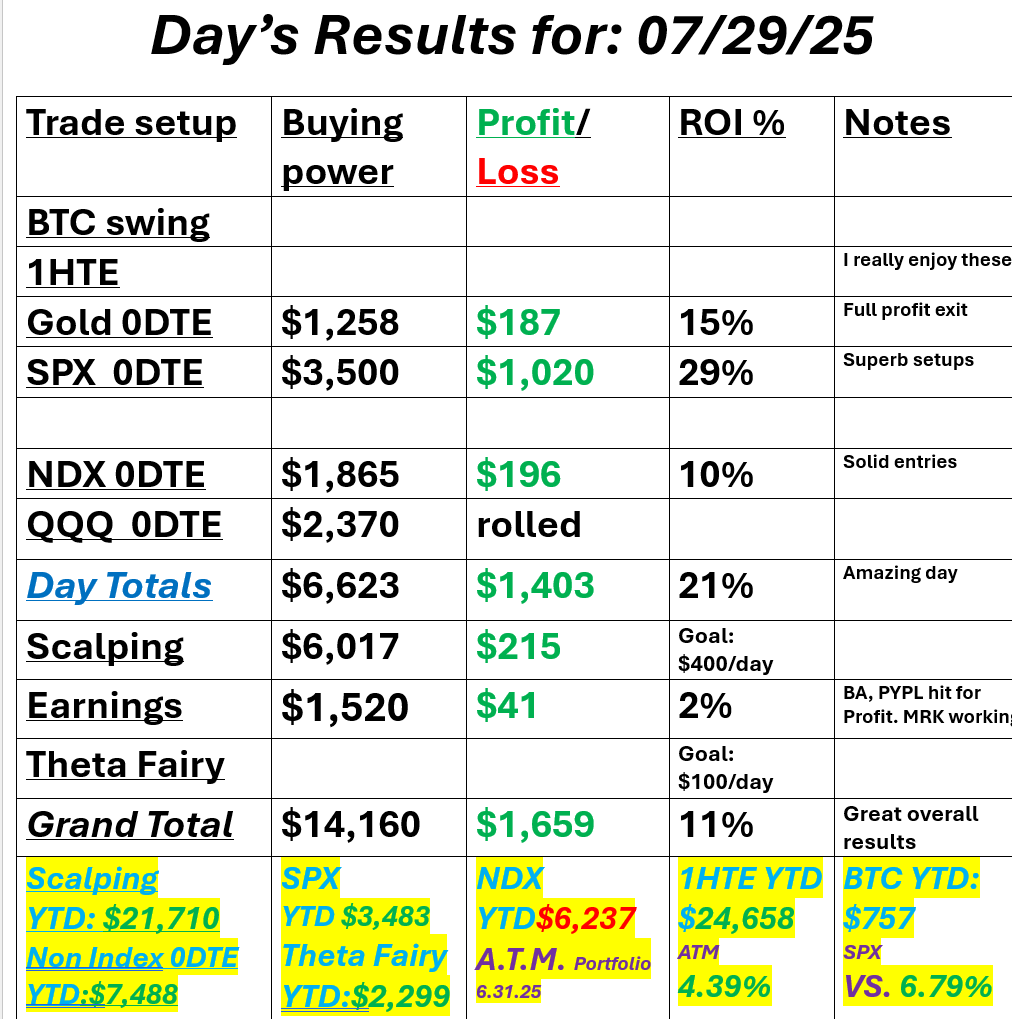

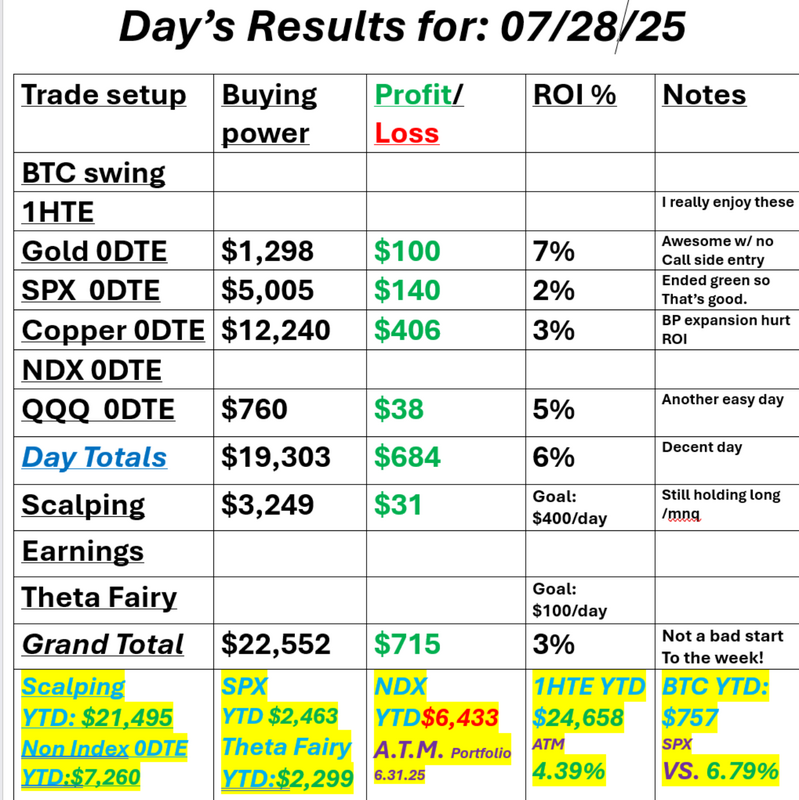

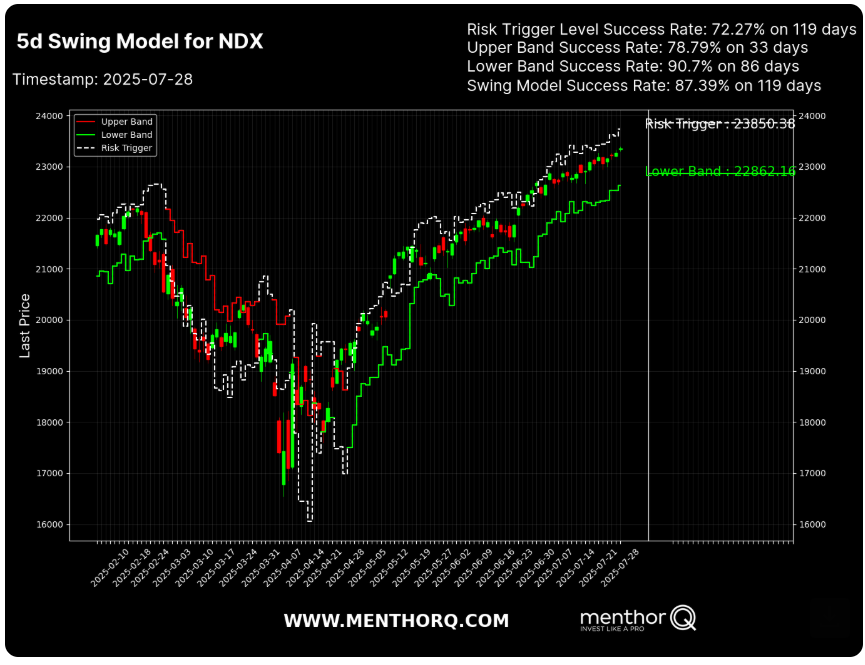

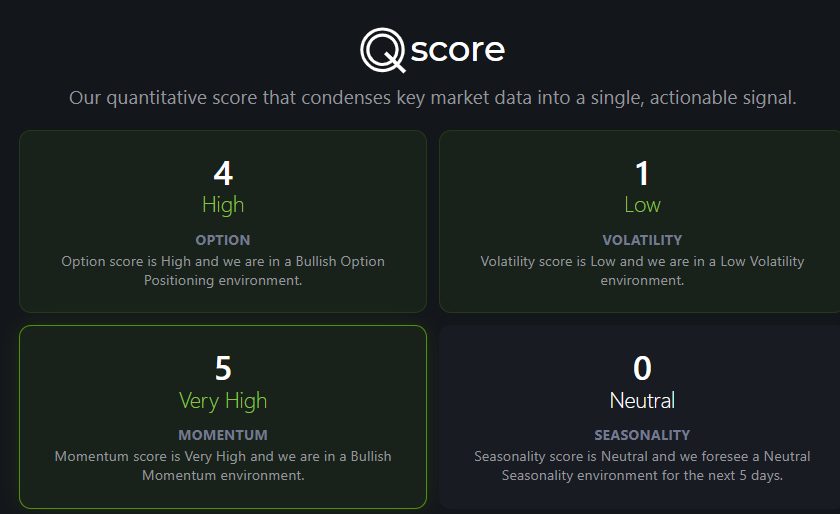

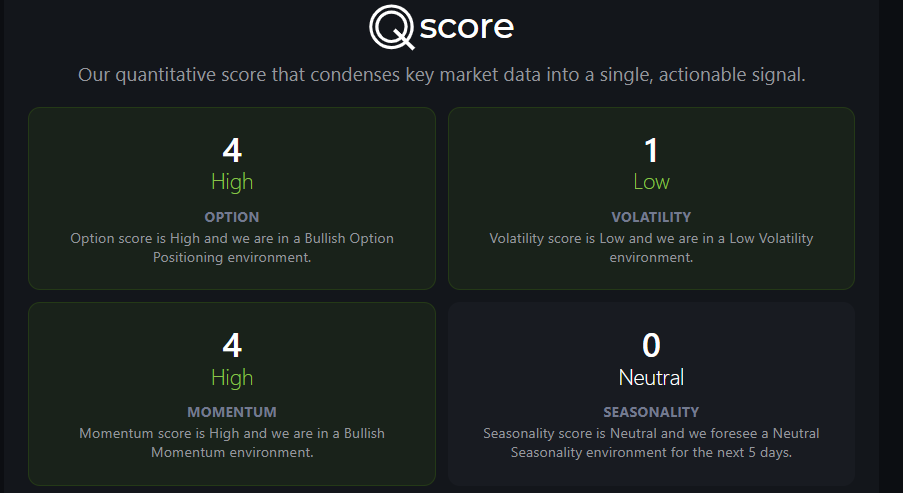

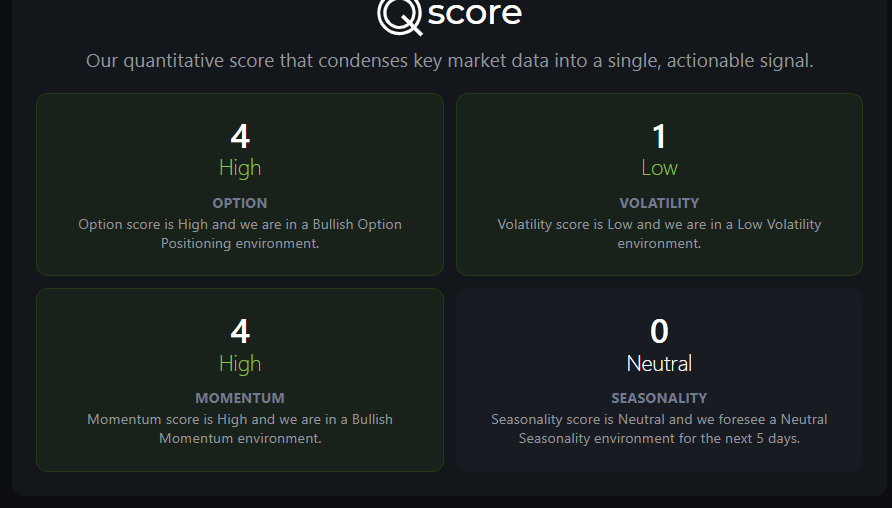

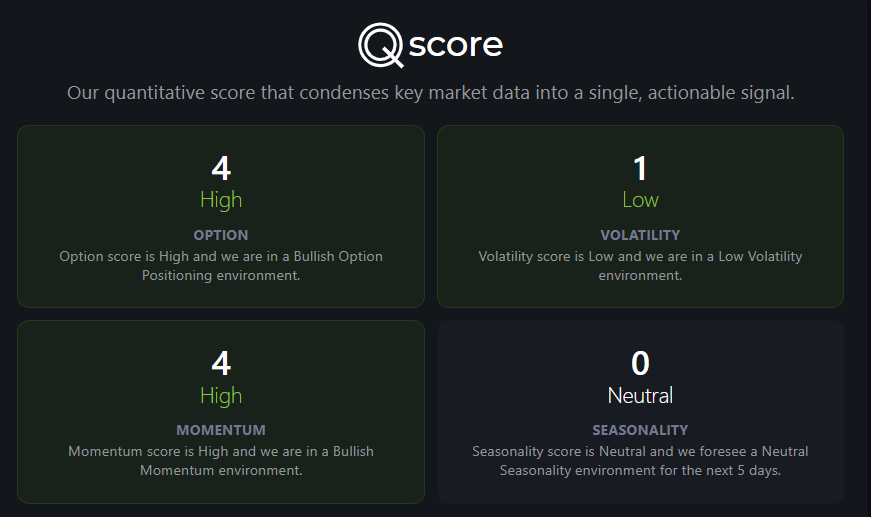

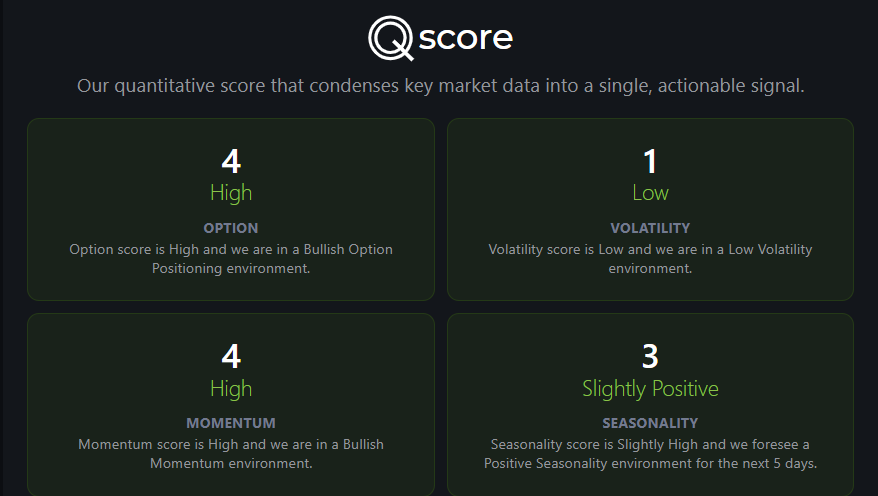

The market likes the trade dealsThe market continues to like the leverage Pres. Trump has created in the latest round of trade deals. They do clearly favor the U.S. and the market is responding with risk on trading. We had a solid day yesterday but that was largely helped by our Copper trade profits. We won't have those to depend on today so our 0DTE's will need to carry the load. Here's a look at our day. Let's take a look at the markets. Not much has changed from yesterday, except some intra-day levels. Bullish bias is holding firm. The SPX momentum chart as of July 28, 2025, reflects a strong short-term upward trajectory. The price action continues to form higher highs, with the SPX spot pushing near 6400, marking sustained bullish behavior since early May. Importantly, the momentum score has climbed back to the maximum level of 5 after briefly dipping to 4, suggesting that trend strength has re-accelerated. This recovery in momentum aligns with the consistent green candles seen recently, highlighting persistent buying pressure. Gamma still incredibly positive Here's what's crazy. 23 straight sessions without a 1% move. It's coming folks! I don't know when but it's coming. The 5-day Swing Model for the NDX as of July 28, 2025, shows the index continuing its climb toward the upper band, approaching the risk trigger level of 23,850.38. With recent price action hugging the higher end of the band, this suggests short-term bullish sentiment. The model's historical performance is notable, with a swing model success rate of 87.39% and particularly strong reliability at the lower band (90.7% success). This elevated positioning, near resistance levels, could imply a zone of caution for mean-reversion strategies, while still favoring momentum-based setups until a reversal signal or failure at the upper band emerges. Margin debt just hit $1.008 trillion, the highest level in history. That’s more leverage than at the peak of the dot-com bubble or the 2008 crash. This is the most dangerous signal in markets right now. The Quant score has turned even more bullish...if possible. September S&P 500 E-Mini futures (ESU25) are trending up +0.24% this morning, extending yesterday’s gains, while investors shift their focus from recent U.S. trade deals to economic data, a new round of corporate earnings reports, and the start of the Federal Reserve’s two-day policy meeting. In yesterday’s trading session, Wall Street’s main stock indexes closed mixed, with the S&P 500 and Nasdaq 100 notching new all-time highs. Super Micro Computer (SMCI) surged over +10% and was the top percentage gainer on the S&P 500 amid optimism that demand for its AI servers will remain strong. Also, Advanced Micro Devices (AMD) climbed more than +4% and was the top percentage gainer on the Nasdaq 100 following reports that the chipmaker plans to raise the price of its Instinct MI350 AI accelerator from $15,000 to $25,000. In addition, Nike (NKE) rose over +3% and was the top percentage gainer on the Dow after JPMorgan upgraded the stock to Overweight from Neutral with a price target of $93. On the bearish side, Revvity (RVTY) slumped more than -8% and was among the top percentage losers on the S&P 500 after the health sciences company cut its full-year adjusted EPS guidance. Chris Larkin at E*Trade from Morgan Stanley. “This week could make or break that momentum in the near term.” Meanwhile, U.S. President Donald Trump said on Monday that a blanket 15% to 20% “world tariff” rate would apply to trading partners that fail to strike separate trade deals with the U.S. before August 1st. The Federal Reserve kicks off its two-day meeting later in the day. The central bank is widely expected to leave the Fed funds rate unchanged in a range of 4.25% to 4.50% on Wednesday. The decision comes amid intense political pressure, evolving trade policy, and economic cross-currents. Investors will closely monitor Chair Jerome Powell’s post-policy meeting press conference for clues on a potential September rate cut. Second-quarter corporate earnings season is in full swing, with investors looking ahead to new reports from prominent companies today, including Visa (V), Procter & Gamble (PG), UnitedHealth (UNH), Merck & Co. (MRK), Booking (BKNG), Boeing (BA), Starbucks (SBUX), and PayPal (PYPL). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +4.5% increase in quarterly earnings for Q2 compared to the previous year, above the pre-season forecast of +2.8%. On the economic data front, all eyes are on the U.S. JOLTs Job Openings figures, set to be released in a couple of hours. Economists, on average, forecast that the June JOLTs Job Openings will arrive at 7.510 million, compared to the May figure of 7.769 million. Investors will also focus on the U.S. Conference Board’s Consumer Confidence Index, which came in at 93.0 in June. Economists expect the July figure to be 95.9. The U.S. S&P/CS HPI Composite - 20 n.s.a. will be reported today. Economists expect the May figure to ease to +2.9% y/y from +3.4% y/y in April. U.S. Wholesale Inventories data will be released today as well. Economists forecast the preliminary June figure at -0.1% m/m, compared to -0.3% m/m in May. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.410%, down -0.72%. Trade docket for today: Gold 0DTE, SPX 0DTE, a good shot at a NDX 0DTE later in the day. QQQ 0DTE. BA, MRK, PYPL earnings trades with new earnings trades on SBUX. I'll continue to use the /MNQ for scalping. The profits haven't been big but they've been consistent. Let's take a look at the intra-day levels: 6446 is first resistance with 6453 next. Then comes 6458 that the current session high. Support comes in at 6427, 6420, 6408. My bias or lean today continues to be bullish. Until something changes that what I'm sticking with. See you all in the live trading room shortly!

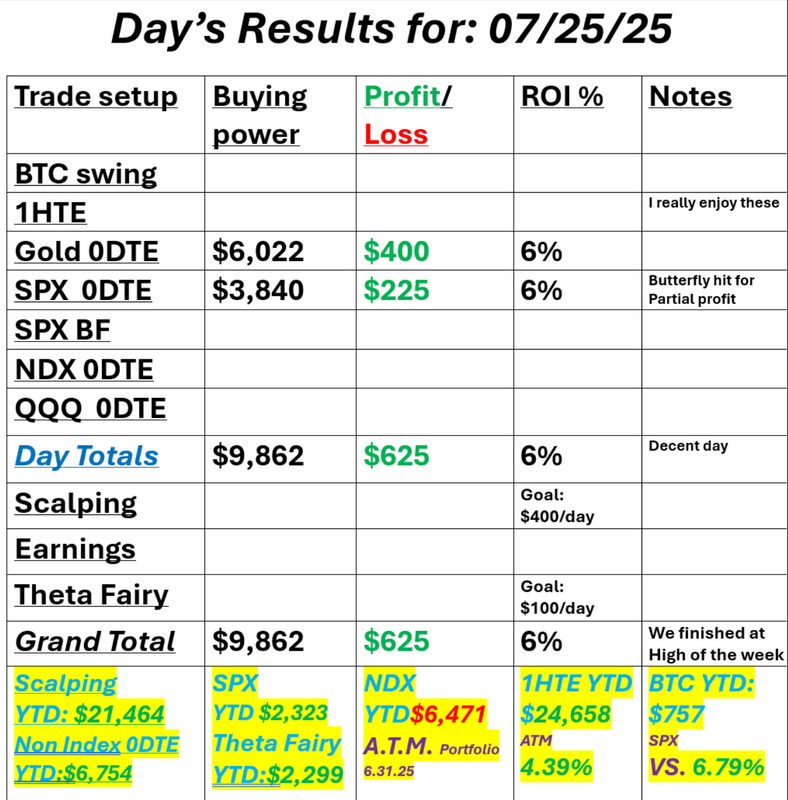

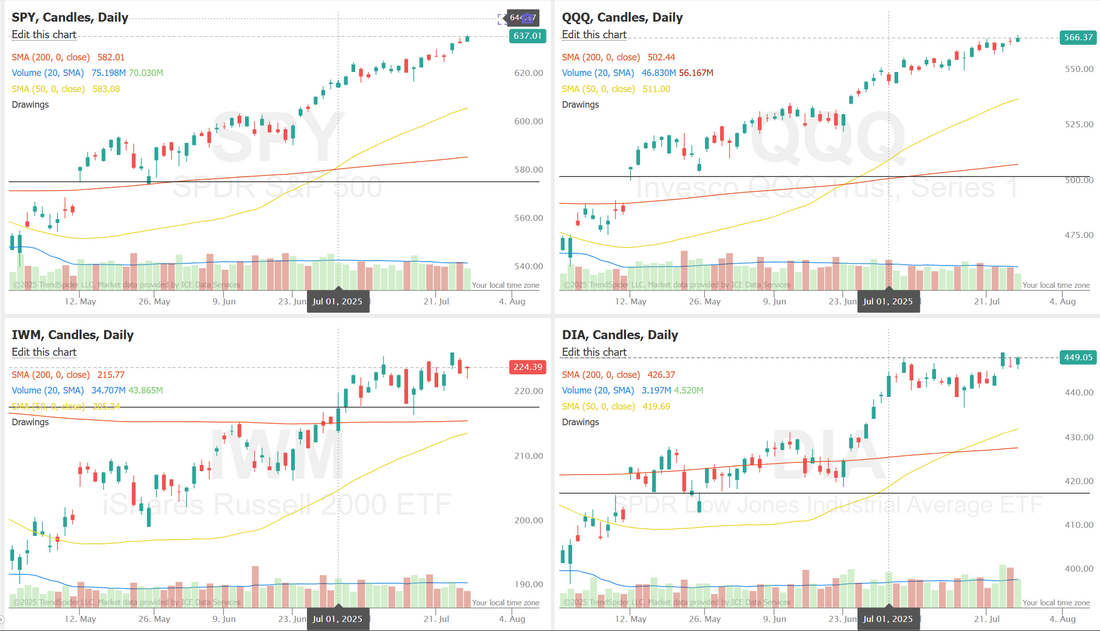

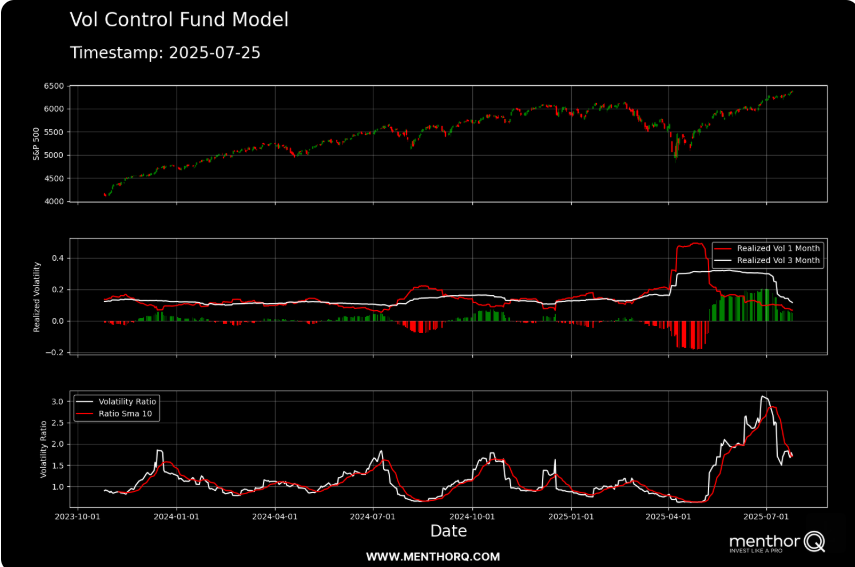

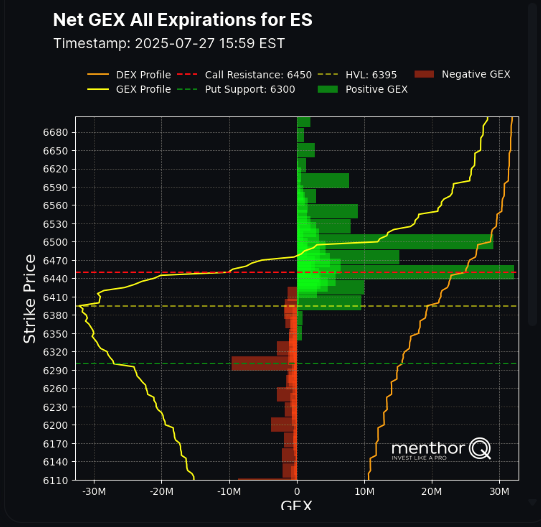

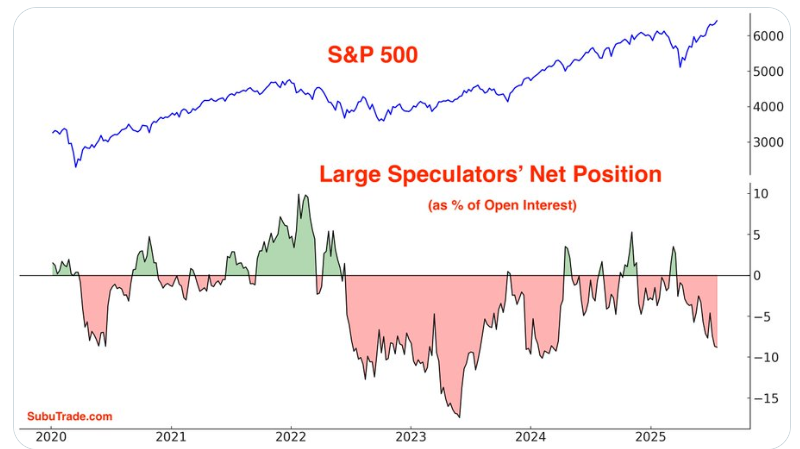

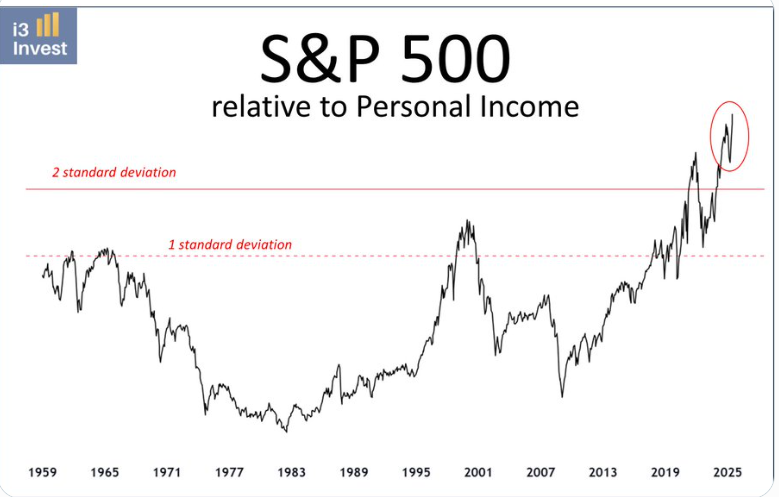

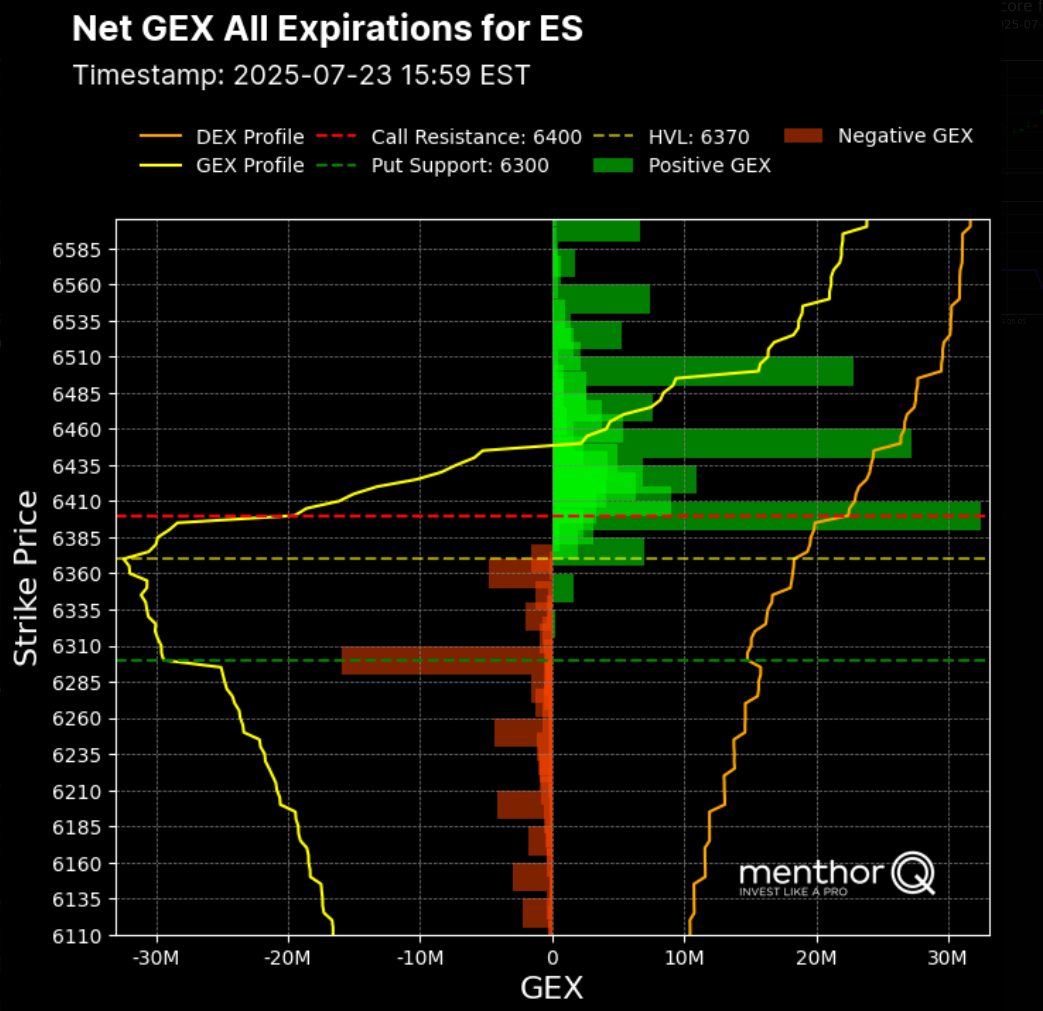

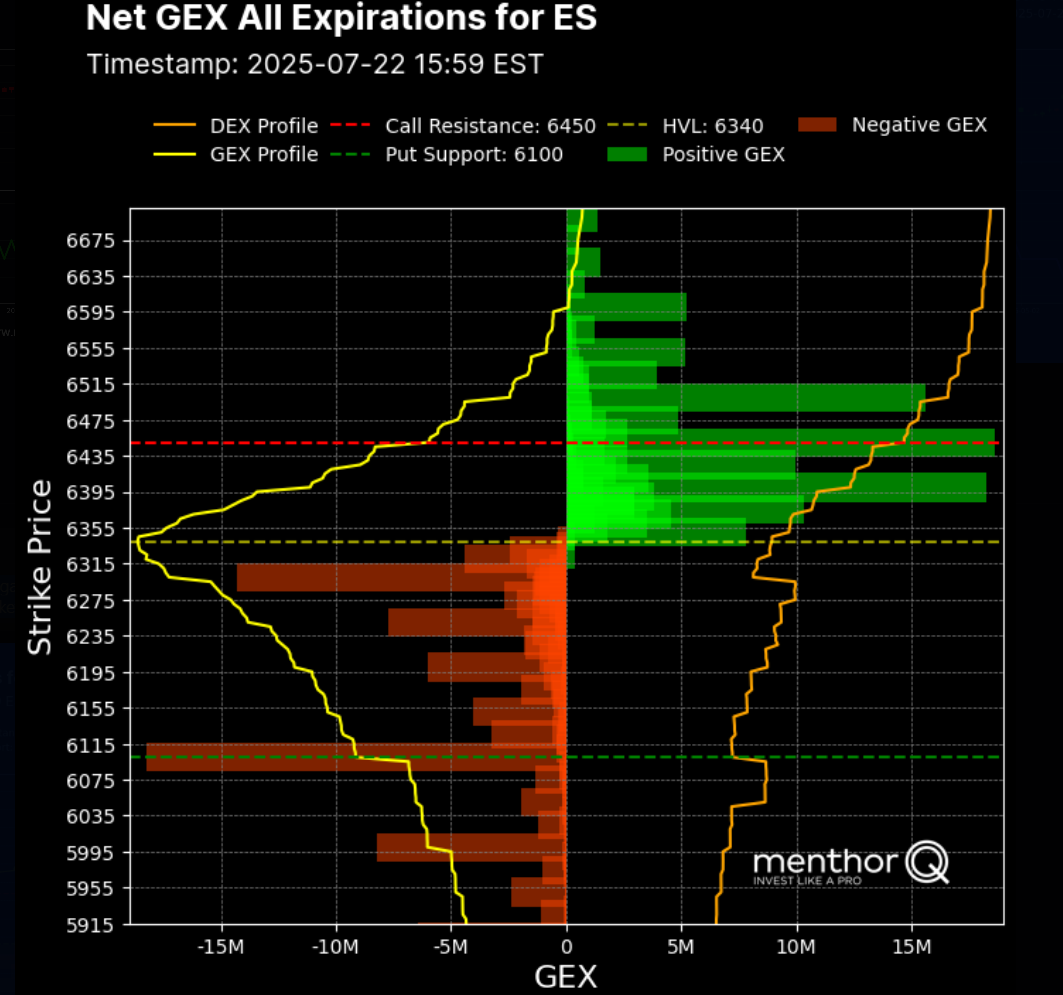

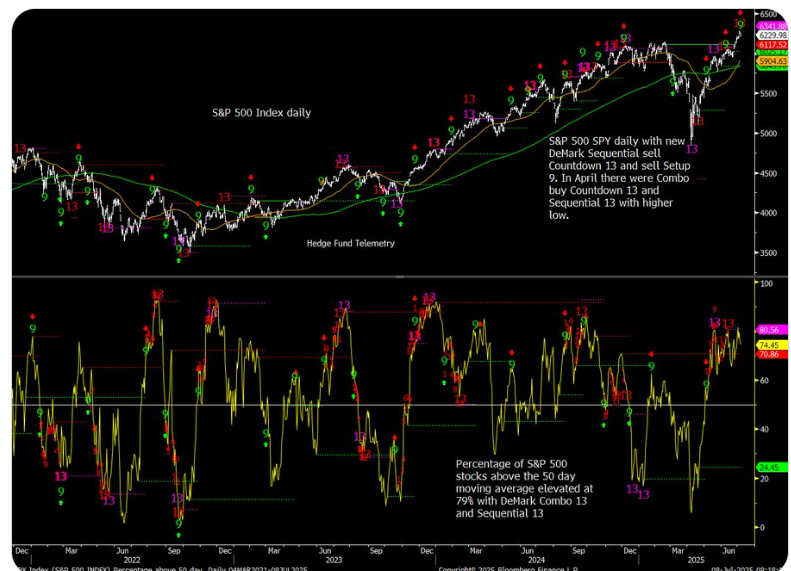

Trade deals, FOMC and EarningsWelcome back traders. We had another great week last week. Our net liq went up nearly every day and we ended Friday at our weekly high. Nearly a repeat of the previous week.. I had a nice week up in the mountains the family. I'm sunburned and glad to be back but what a great week. In trade news this week we got a big bump in futures Sunday night with news of the EU trade deal. We've got FOMC Weds. and lots and lots of earnings this week. Our results Friday weren't amazing, off the charts but our net liq was up $1,400 with the help of our copper trade. Take a look below: Let's take a look at some of the market metrics: Technicals are still bullish. We continue to still up at these ATH's. When will the push end? The Vol Control Fund Model for SPX as of July 25, 2025, highlights a recent decline in both 1-month and 3-month realized volatility after a notable spike earlier this quarter. The top panel shows continued strength in the S&P 500 price action, with the index trending higher and approaching new highs. Meanwhile, the lower panel indicates that the volatility ratio (1-month vs. 3-month realized vol) has dropped from elevated levels but remains above the long-term average, suggesting a cooling period following a burst of market movement. In the short term, this easing in realized volatility could imply reduced pressure on volatility-targeting strategies, potentially allowing for more stability or even incremental re-risking behavior. However, market participants may want to stay alert to any reversal in this ratio trend, which could signal shifting dynamics in risk-adjusted exposures. Gamma structure is still bullish The Quant score is still very bullish Net GEX levels haven't changed much from Fridays levels. With all this bullishness there are some things I'd like you to keep in the back of your mind. Asset managers are selling into the rally. Everyone is trying to anticipate a pullback and no one believes the breakout over all time highs. Large Speculators / Hedge Funds are the most net short S&P 500 futures in over a year. This is a blow off top now. The TSI closed above 42. This is the 3rd time that happened in the last 5 years. The other cases topped at 51 in Sep 2020, 51 in Dec 2023 and 49 in Jul 2024. Dec 2023 isn't comparable. The 2020 and 2024 cases were followed by 10% corrections. Nasdaq 100 now priced at a critical juncture relative to M2 (Money Supply). As history suggest, a crash is imminent Just some things to think about. I don't know when or by how much markets will fall but they will...they always do. September S&P 500 E-Mini futures (ESU25) are up +0.28%, and September Nasdaq 100 E-Mini futures (NQU25) are up +0.46% this morning, pointing to a higher open on Wall Street after U.S. President Donald Trump reached a trade deal with the European Union. President Trump and European Commission President Ursula von der Leyen announced the EU agreement on Sunday at his golf club in Turnberry, Scotland. The U.S. would impose a baseline tariff of 15% on European goods, including automobiles. The new tariff rate will take effect on August 1st, according to a U.S. official. Mr. Trump said tariffs on steel and aluminum, which are currently at 50%, would remain unchanged. He also said the EU had agreed as part of the deal to purchase $750 billion worth of American energy products, invest an additional $600 billion in the U.S., and buy “vast amounts” of military equipment. In addition, U.S. goods shipped to Europe won’t be charged tariffs. This week, market participants look ahead to earnings reports from major tech names, the Federal Reserve’s interest rate decision, as well as key economic data, including the jobs report, the Fed’s favorite inflation gauge, and the first estimate of second-quarter GDP. In Friday’s trading session, Wall Street’s major equity averages ended higher, with the S&P 500 and Nasdaq 100 notching new all-time highs. Deckers Outdoor (DECK) surged over +11% and was the top percentage gainer on the S&P 500 after the company posted upbeat FQ1 results and provided solid FQ2 EPS guidance. Also, Newmont (NEM) climbed more than +6% after the gold miner reported stronger-than-expected Q2 results. In addition, Centene (CNC) rose over +6% after the health insurer unveiled a plan to address issues in its Affordable Care Act business to ensure profitability in 2026. On the bearish side, Charter Communications (CHTR) tumbled more than -18% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the company posted weaker-than-expected Q2 EPS. Economic data released on Friday showed that U.S. durable goods orders slumped -9.3% m/m in June, better than expectations of -10.4% m/m, while core durable goods orders, which exclude transportation, rose +0.2% m/m, stronger than expectations of +0.1% m/m. “The pace of earnings so far this month has been positive, economic data has been hanging in there, and we’re even starting to get some sense of clarity on tariffs. You can’t fault investors for being optimistic,” said Bespoke Investment Group. Second-quarter corporate earnings season continues in full force, and investors await fresh reports from high-profile companies this week, including Microsoft (MSFT), Meta Platforms (META), Apple (AAPL), Amazon.com (AMZN), Mastercard (MA), Visa (V), Arm (ARM), Qualcomm (QCOM), KLA Corp. (KLAC), Procter & Gamble (PG), United Parcel Service (UPS), Exxon Mobil (XOM), and Chevron (CVX). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +3.2% increase in quarterly earnings for Q2 compared to the previous year, slightly above the pre-season forecast of +2.8%. Market watchers will also focus on the Federal Reserve’s interest rate decision and Chair Jerome Powell’s post-policy meeting press conference. The central bank is widely expected to leave the Fed funds rate unchanged in a range of 4.25% to 4.50%. The decision comes amid criticism of Mr. Powell by President Trump and repeated calls for the central bank to lower interest rates. Powell and other Fed officials have emphasized the importance of patience as the Trump administration’s tariffs pose a risk of reigniting inflation. “We believe this [Fed] meeting will be a non-event with rates left on hold and quantitative tightening likely left unchanged,” ING analysts said in a note. This week’s top-tier U.S. economic data will offer insight into whether the Fed may be justified in lowering interest rates in the coming months. The advance estimate of second-quarter U.S. gross domestic product, the July Nonfarm Payrolls report, and the latest reading of the core personal consumption expenditures price index will be the main highlights. Any indications of a cooling labor market or slowing economy could boost the likelihood of rate cuts resuming in September or October. Other noteworthy data releases include the U.S. JOLTs Job Openings, the Conference Board’s Consumer Confidence Index, the S&P/CS HPI Composite - 20 n.s.a., ADP Nonfarm Employment Change, Pending Home Sales, the Employment Cost Index, Initial Jobless Claims, Personal Income, Personal Spending, the Chicago PMI, Average Hourly Earnings, the Unemployment Rate, the S&P Global Manufacturing PMI, Construction Spending, the ISM Manufacturing PMI, and the University of Michigan’s Consumer Sentiment Index. Meanwhile, the August 1st deadline for the U.S. to impose reciprocal tariffs also takes center stage. Optimism has been building that the U.S. will reach trade agreements with multiple countries before the deadline. The U.S. economic data slate is largely empty on Monday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.373%, down -0.30%. Trade docket today is busy: We'll be working our Gold 0DTE. Our Copper trade expires today and should result in an O.K. return. The profit projection is the same but BP has increased and cut down ROI. /MNQ scalping again today. LULU covered call. QQQ 0DTE. SPX 0DTE. Possible NDX 0DTE later in the day. UNH, MRK, BA, PYPL earnings trades. My lean or bias today is bullish. Once again, at some point we'll get a change of direction but for now, everything continues to look bullish. Futures have retraced a bit from Sunday's high but we are still looking to open up. Let's take a look at the intra-day /ES levels: 6442, 6456, 6474 are todays resistance levels. 6435, 6423, 6412, 6402 are support levels. Gamma levels for 0DTE: Today should be a good day with our Gold 0DTE already cash flowing and our Copper trade take profit coming shortly. I'll see you all back on Zoom this morning! Looking forward to it.

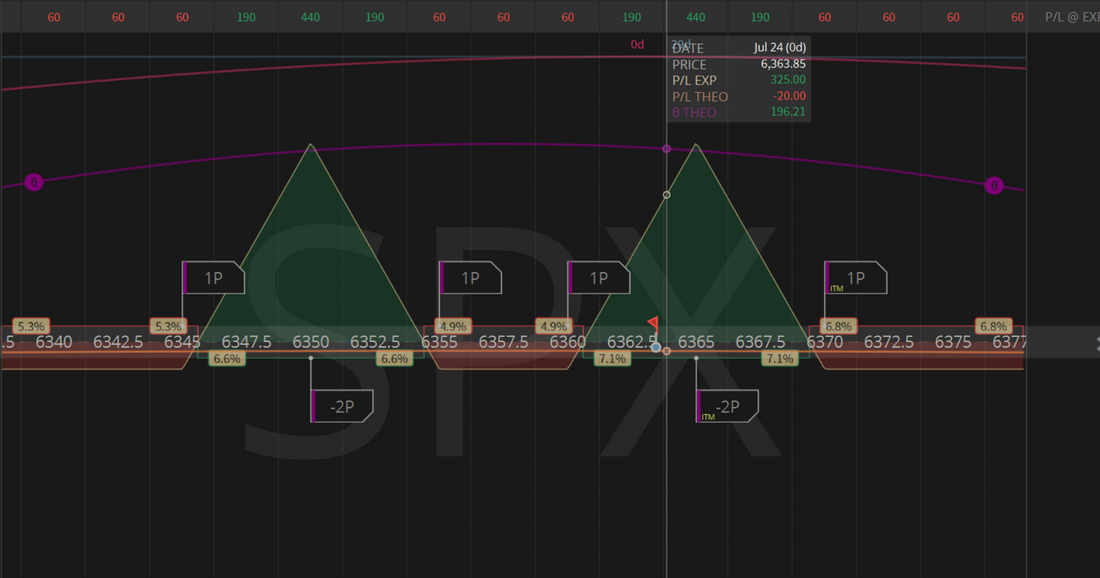

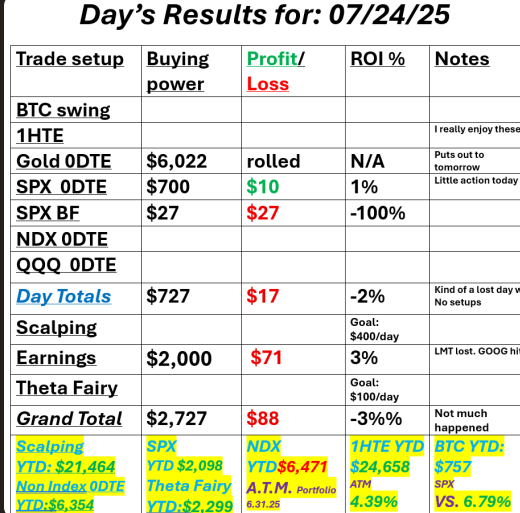

What's the best part of trading for you?I love trading and I'm super grateful to be able to make a living from it. Some days are up and some are down but one thing I love about it is that every day is a new day with new opportunities. If you didn't like today, tomorrow will most likely serve something else up that you very well may like! Yesterday was one of those rare days where I felt like we were just wasting our time. We never really got any substantive setups working. That's not totally true. We repositioned out Gold puts to todays expiration and they look to provide some good cash flow today but as far as booking results from yesterday it was a bust. I did add another butterfly late yesterday that cost me $47 dollars and hit for a $325 profit but...I didn't add it as an official trade to the group and so it doesn't get counted in our P/L matrix. It was a nice hit though and we very well may be back using butterflies today. As I said, not much to report from yesterday. Let's take a look at the markets. Surprise, surprise. The bullish bias continues to hold. The SPX chart as of July 24, 2025, shows a strong upward trend in spot prices, with a steady sequence of higher highs and higher lows. The momentum score remains elevated at level 4, just below its recent peak of 5, indicating continued strength but slightly less acceleration in recent sessions. This persistent high momentum may reflect broad market confidence, although some moderation suggests short-term consolidation could be underway. In the near term, watching for any drop in momentum score or a reversal in price pattern could be useful for gauging shifts in market behavior. Positive gamma continues. Quant score continues to be bullish. Looking at intra-day levels: /ES futures are flat, as I type. One thing I would take note of is the placement of the different gamma walls. As you can see (orange lines) there are more resistance areas, cloistered close together creating multiple resistance zones, close to current levels. On the downside they are farther away. This implies that we are stretched to the upside. We will get a downturn today? No one knows but with each passive day of bullish price action, the potential for a retrace grows. Resistance levels today are 6411, 6425, 6438. Support is all the way down at 6357. My bias or lean today is neutral. Yes, everything still points bullish but I'm looking for a bit of a pause today. Extremes almost always result in a reversion to the mean. If you aren't seriously preparing for something like this or say it can't happen, I'd take a hard look at your risk managment. Here's something else to consider. Wall Street’s AI bubble now eclipses the dotcom bubble. Tech now makes up 34% of the S&P 500 — surpassing the 33% peak in 2000. Top 10 stocks control 40% of the index vs. 25% in ’99. Concentration risk is real. Trade docket for today is very simple. We don't need much to bump our net liq's $1,000+ dollars today. Our Gold puts are expiring today. That should be $500 profit. Our Copper trade for today has already executed and that whole trade expires Monday. It's up $400+ as I type. We'll also focus on SPX today and I believe more butterflies may be on the agenda. I look forward to finishing the week strong with you all! Our net liq should have a good shot today at doing the same thing it did last week...finishing at the high of the week. That's what it's all about at the end of the day.

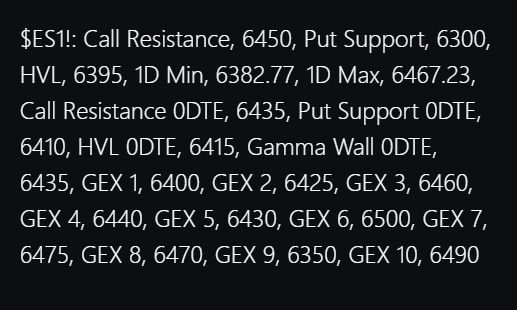

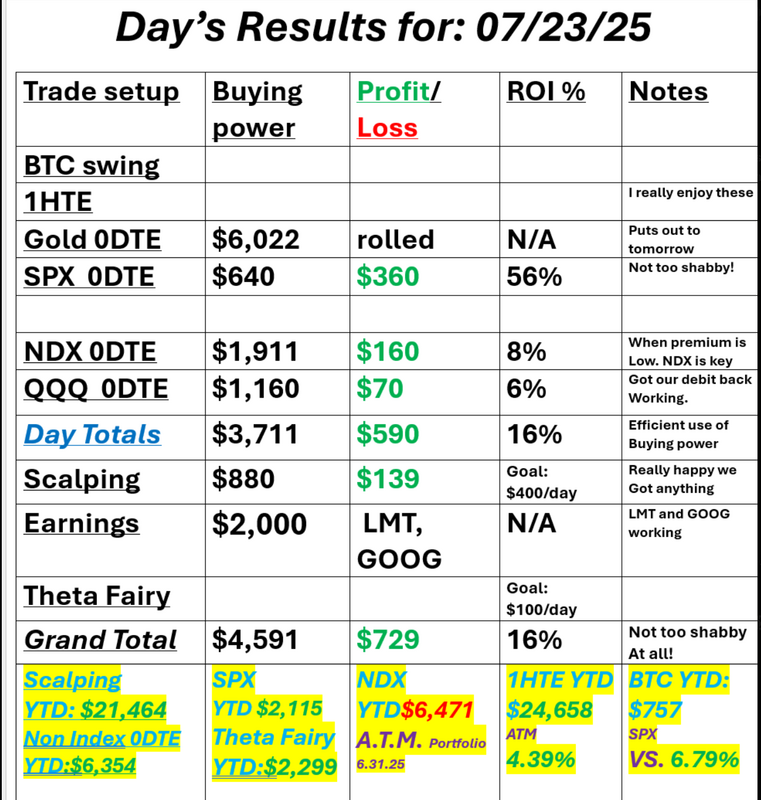

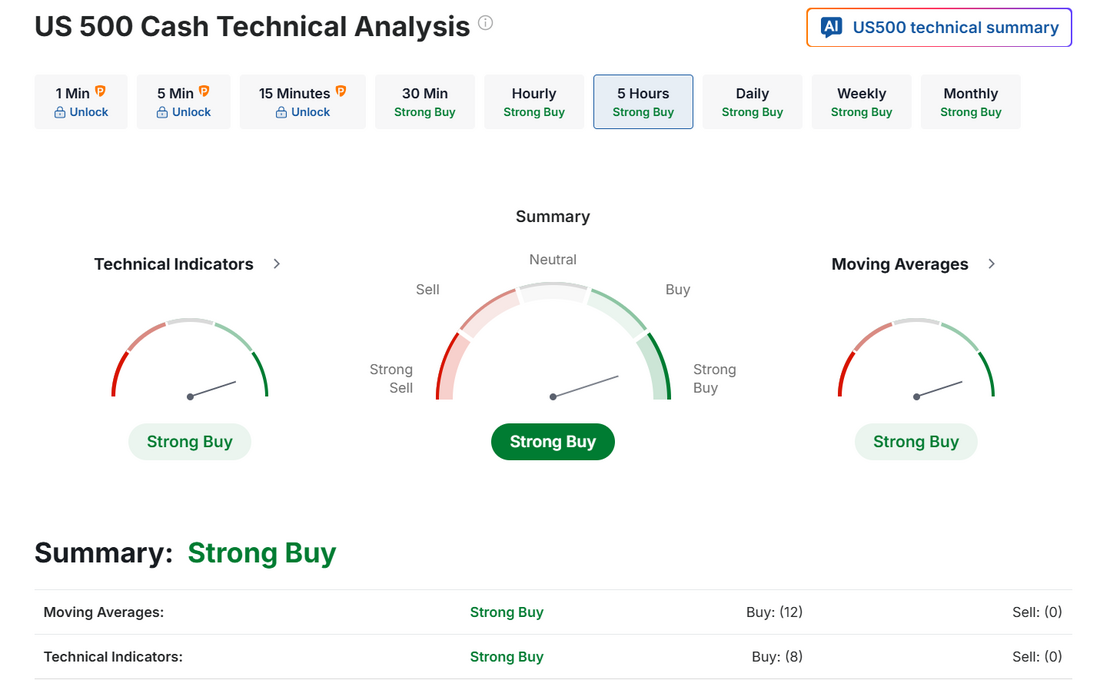

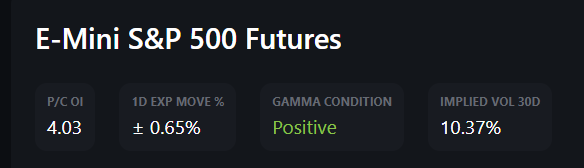

See you all in the live trading room! How good is your critical thinking?Happy 24th of July holiday! It's not a holiday for you? Well, for us Utahn's it is. It commemorates the first pioneers entering the Salt Lake valley and it's just as big as the 4th for us. I'm up in the mountains with the family for a much needed break. No. We are still trading every day! Just a break from home. Tesla reported earnings yesterday after the close and they were spot on, exactly...to a tee, what I thought they would be. We know sales are crashing. We know profit margins are shrinking. We know competitors are killing their market share. We know that robo taxis, AI and robots are not only not making a dime...yet, but they are actually a cash drain. None of this was conjecture or opinion before the earnings release. We already knew all this yet, everything , and I mean everything I could see online was bullish. People asking if we would see $400 a share today. Clearly all this was wishful thinking. Let me be clear. I'm not a hater. I have solar that powers my house. I own three Teslas. A model 3 and two powerwall back up battery stations. I'm also a critical thinker and so, we positioned for a slide in Tesla stock. What's the lesson here? Don't let personal bias entry the equation. Employee some critical thinking. Also...as I always say, it's way easier to make money to the downside than the upside. Let's take a look at our day yesterday: Let's take a look at the market today: Technicals continue to lean bullish. Trade deals and GOOG strong results are supporting the futures this morning. We come into the day still holding lots of positive Gamma, which is bullish. The Quant score is still very bullish. Positive GEX continues to build September Nasdaq 100 E-Mini futures (NQU25) are trending up +0.36% this morning as investors cheer forecast-beating quarterly results from Alphabet and remain optimistic that the U.S. may strike more trade deals soon. Alphabet (GOOGL) rose over +3% in pre-market trading after the Google parent reported stronger-than-expected Q2 results, boosted by demand for AI products. The company also projected a $10 billion increase in its capital spending for the year, with CEO Sundar Pichai attributing the move to the “strong and growing demand for our cloud products and services.” Also aiding sentiment, reports emerged that the European Union and the U.S. are making headway on a deal that would impose a 15% tariff on most EU imports. In addition, Bloomberg reported that the U.S. and South Korea have discussed creating a fund to invest in American projects as part of a trade agreement. Investors now look ahead to U.S. business activity data and the next round of corporate earnings reports. In yesterday’s trading session, Wall Street’s three main equity benchmarks ended higher. Lamb Weston Holdings (LW) surged over +16% and was the top percentage gainer on the S&P 500 after the producer of frozen potato products posted upbeat FQ4 results and introduced a new cost savings program. Also, Baker Hughes (BKR) climbed more than +11% and was the top percentage gainer on the Nasdaq 100 after the company reported better-than-expected Q2 results. In addition, GE Vernova (GEV) advanced over +14% after the company reported stronger-than-expected Q2 results and said it expects full-year revenue to trend toward the “higher end” of its $36B-$37B guidance. On the bearish side, Texas Instruments (TXN) plunged more than -13% and was the top percentage loser on the Nasdaq 100 after the semiconductor company issued disappointing Q3 earnings guidance. Economic data released on Wednesday showed that U.S. June existing home sales fell -2.7% m/m to a 9-month low of 3.93M, weaker than expectations of 4.00M. “With the Aug. 1 deadline looming, investors have been encouraged by the recent trade-deal announcements,” said Ian Lyngen and Vail Hartman at BMO Capital Markets. “The progress on the trade war will provide clarity and help the market move forward to incorporate the new global trade environment.” Second-quarter corporate earnings season continues in full flow, and investors look forward to fresh reports from notable companies today, including Blackstone (BX), Honeywell (HON), Union Pacific (UNP), Intel (INTC), and L3Harris Technologies (LHX). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +3.2% increase in quarterly earnings for Q2 compared to the previous year, slightly above the pre-season forecast of +2.8%. On the economic data front, all eyes are focused on S&P Global’s flash U.S. purchasing managers’ surveys, set to be released in a couple of hours. Economists, on average, forecast that the July Manufacturing PMI will come in at 52.7, compared to last month’s value of 52.9. Also, economists expect the July Services PMI to be 53.0, compared to 52.9 in June. Investors will also focus on U.S. New Home Sales data. Economists foresee this figure coming in at 649K in June, compared to 623K in May. U.S. Initial Jobless Claims data will be released today as well. Economists estimate this figure will come in at 227K, compared to last week’s number of 221K. Meanwhile, U.S. President Donald Trump is set to visit the Federal Reserve’s headquarters later today. President Trump has repeatedly criticized Fed Chair Jerome Powell for his reluctance to cut interest rates. U.S. rate futures have priced in a 97.4% probability of no rate change and a 2.6% chance of a 25 basis point rate cut at next week’s policy meeting. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.396%, up +0.16%. We've got PMI, home sales and Jobless claims all coming in this morning which could move markets. There's also the chance we get more good trade news dropping. All these things could be market movers today. My bias or lean is still bullish. Again...you just kind of have to be here. Ladies and Gentleman, I present to you the Shiller PE ratio. Currently only the tech bubble of 2000 has us at higher valuations. What could go wrong? We'll keep stacking bearish plays in our ATM portfolio. Trade docket for today: Very simple day today. Gold: still working our rolls. SPX 0DTE: This could be our main focus today. GOOG: book profit. LMT: Possible take profit today but we may need to work it into tomorrow. QQQ 0DTE: continue to bring in credit against the debit portion. Let's take a look at the intra-day numbers for /ES. As you can see, there are multiple (and tightly grouped) resistance levels with only one substantive support level which is much further down. 6410, 6419, 6437 are my resistance levels with 6366 working as the major support level. Very focused day today. We had another nice day yesterday. Let's see if we can repeat it today! As always, I look forward to seeing you all in the live trading room. Let's see if we can get another green day on our net liq.!

Trade deals incomingSeveral big trade deals announced with Japan leading the way. People like to derisively use the TACO acronym but not today. With 100+ billion having been poured into the U.S. treasury and looking like half a trillion a year coming in overall Trump is accomplishing what he set out to do. You can say the bulk of that cost is carried by the U.S. consumer but what I think is more interesting are the concessions he's getting out of these deals. While it's debatable about whether the tariffs are a good/bad deal for consumers, there's no debate he's strengthened the U.S. position in global trade. Markets like the news and futures are up. We had an absolutely stellar day yesterday. I say stellar because we continue to chase our Gold call side 0DTE with another roll higher and our LMT earnings trade also drug our net liq down. It was a battle all day but our traders who stuck it out ended the day up! Net liq was once again green. It was an all day effort but it paid off. Here's a look at our days results. Let's take a look at the market: With trade deals starting off the day everything continues to look bullish. Gamma continues to be positive and bullish Quant score is bullish Gamma walls continue to be skewed to more downside than upside percentage wise. Intra-day /ES levels: 6376 is first resistance with 6408 next. 6365 is first support with 6350 and 6322 next. Maybe this isn't the place you want to be adding longs? We continue to add bearish positions to our ATM portfolio, which is performing right in line with expectations. September S&P 500 E-Mini futures (ESU25) are up +0.39%, and September Nasdaq 100 E-Mini futures (NQU25) are up +0.19% this morning as sentiment got a boost after the U.S. announced a trade deal with Japan. U.S. President Donald Trump said in a post on Truth Social late Tuesday that the U.S. will impose a 15% tariff on Japanese goods, including autos, which is lower than the 25% rate he had previously threatened in a letter to the Japanese government. The deal will also see Japan invest $550 billion into the U.S. The U.S. also struck a deal with the Philippines, setting a 19% tariff on the nation’s exports. In addition, President Trump unveiled further details about a pact with Indonesia. However, gains in U.S. equity futures are limited amid investor caution ahead of earnings from “Magnificent Seven” companies Tesla and Alphabet. Higher bond yields today are also weighing on stock index futures. In yesterday’s trading session, Wall Street’s major indexes closed mixed. IQVIA Holdings (IQV) surged over +17% and was the top percentage gainer on the S&P 500 after the company reported stronger-than-expected Q2 results. Also, Paccar (PCAR) climbed more than +6% and was the top percentage gainer on the Nasdaq 100 after the company posted better-than-expected Q2 results. In addition, D.R. Horton (DHI) jumped over +16% after the homebuilder reported upbeat FQ3 results. On the bearish side, Lockheed Martin (LMT) slumped over -10% and was the top percentage loser on the S&P 500 after the defense contractor posted weaker-than-expected Q2 revenue and cut its full-year EPS guidance. Economic data released on Tuesday showed that the U.S. Richmond Fed manufacturing index unexpectedly fell to an 11-month low of -20 in July, weaker than expectations of -2. Second-quarter corporate earnings season is in full swing, with all eyes today on reports from two of this year’s laggards among the Magnificent Seven — Tesla (TSLA) and Alphabet (GOOGL). Investors will also monitor earnings reports from other prominent companies such as T-Mobile US (TMUS), International Business Machines (IBM), ServiceNow (NOW), AT&T (T), Thermo Fisher Scientific (TMO), and Chipotle Mexican Grill (CMG). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +3.2% increase in quarterly earnings for Q2 compared to the previous year, slightly above the pre-season forecast of +2.8%. On the economic data front, investors will focus on U.S. Existing Home Sales data, which is set to be released in a couple of hours. Economists, on average, forecast that June Existing Home Sales will stand at 4.00M, compared to 4.03M in May. U.S. Crude Oil Inventories data will be released today as well. Economists expect this figure to be -1.400M, compared to last week’s value of -3.859M. U.S. rate futures have priced in a 95.3% chance of no rate change and a 4.7% chance of a 25 basis point rate cut at next week’s policy meeting. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.381%, up +1.04%. Trade docket for today: /GC 0DTE, /HG next tranche addition, LMT continued work, GOOG earnings trade, QQQ 0DTE, SPX 0DTE, Possible NDX 0DTE again. These have been some of our biggest gainers lately. Possible /MNQ scalp again. Our scalping results yesterday were amazing considering we used /MNQ vs. QQQ options and never covered. No 1HTE's the rest of this week. I'm working remote on my laptop and don't have my screens to watch it. My bias or lean today is slightly bullish....hard not to be. Yesterday was amazing effort folks. I look forward to seeing what we can accomplish today. See you soon in the trading room.

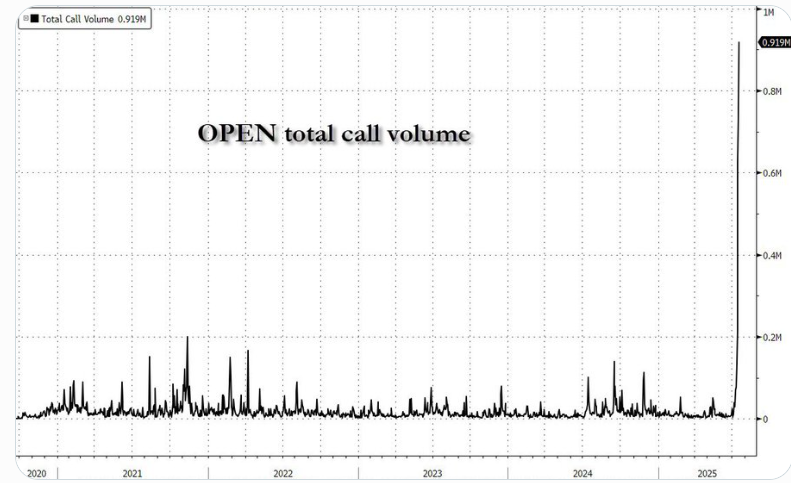

Heavy resistance remainsWe had another great day yesterday. Our levels were spot on all day and that helped us control our entries and exits. Gold gave us something to work on but other than that we came really close to a $1,000+ dollar profit day. Some of our members got a fill on our NDX put order (I didn't) and that pushed them over the top. Here's a look at my day: I'm traveling today so I'll be giving our levels inside our trading room. September S&P 500 E-Mini futures (ESU25) are trending down -0.04% this morning as investors brace for a raft of corporate earnings reports and continue to keep a close eye on any trade developments between the U.S. and key trading partners as the August 1st deadline approaches. White House Press Secretary Karoline Leavitt said that U.S. President Donald Trump could issue additional unilateral tariff letters before August 1st. She added that more trade deals could also be reached before the deadline. Meanwhile, Philippine President Ferdinand Marcos Jr. will become the latest foreign leader eager to strike a deal before the deadline as he meets with Trump in the Oval Office later today. In yesterday’s trading session, Wall Street’s main stock indexes ended mixed, with the S&P 500 and Nasdaq 100 notching new all-time highs. Verizon Communications (VZ) climbed over +4% and was the top percentage gainer on the S&P 500 and Dow after the carrier posted upbeat Q2 results and raised the lower end of its full-year adjusted EPS growth forecast. Also, chip stocks gained ground, with Arm Holdings (ARM) rising more than +3% to lead gainers in the Nasdaq 100 and Qualcomm (QCOM) advancing over +2%. In addition, Block (XYZ) surged more than +7% after S&P Dow Jones Indices announced that the stock would be added to the S&P 500 index on Wednesday, July 23rd. On the bearish side, Bruker (BRKR) plunged over -12% after the maker of scientific instruments posted weaker-than-expected preliminary Q2 results. Economic data released on Monday showed that the Conference Board’s leading economic index for the U.S. fell -0.3% m/m in June, weaker than expectations of -0.2% m/m. “While stocks may be due for a breather, we believe the bull market remains intact. We maintain our June 2026 S&P 500 price target of 6,500, and recommend using volatility as an opportunity to phase into markets,” said Ulrike Hoffmann-Burchardi at UBS Global Wealth Management. Second-quarter corporate earnings season is ramping up. Investors will be closely monitoring earnings reports today from notable companies like Coca-Cola (KO), Philip Morris International (PM), RTX Corp. (RTX), Texas Instruments (TXN), Intuitive Surgical (ISRG), Danaher (DHR), Lockheed Martin (LMT), and General Motors (GM). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +3.2% increase in quarterly earnings for Q2 compared to the previous year, slightly above the pre-season forecast of +2.8%. On the economic data front, investors will focus on the U.S. Richmond Fed Manufacturing Index, which is set to be released in a couple of hours. Economists foresee this figure coming in at -2 in July, compared to the previous value of -7. Meanwhile, Fed Chair Jerome Powell is scheduled to deliver opening remarks later today at a conference focused on capital frameworks for large banks. With Fed officials in a blackout period before the July 29-30 policy meeting, Mr. Powell is likely to avoid commenting on interest rates. U.S. rate futures have priced in a 97.4% probability of no rate change and a 2.6% chance of a 25 basis point rate cut at the upcoming monetary policy meeting. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.389%, up +0.23%. Trade docket today: Gold 0DTE, Copper next tranche, /MNQ short scalp, KO, LMT, ENPH earnings, QQQ 0DTE, SPX and NDX 0DTE. Ladies and Gentlemens, the Warren Buffett indicator has now officially entered the exosphere. 208% Guess what happens next? Looks like the biggest gamma squeeze in history Be prepared folks. If you aren't hedging for a downside move you may be taking on too much risk. My lean or bias today is Neutral. We need a catalyst to move us. Looking at Gamma levels (orange lines) it seems to indicate more downside than upside. I'll see you all in the live trading room shortly!

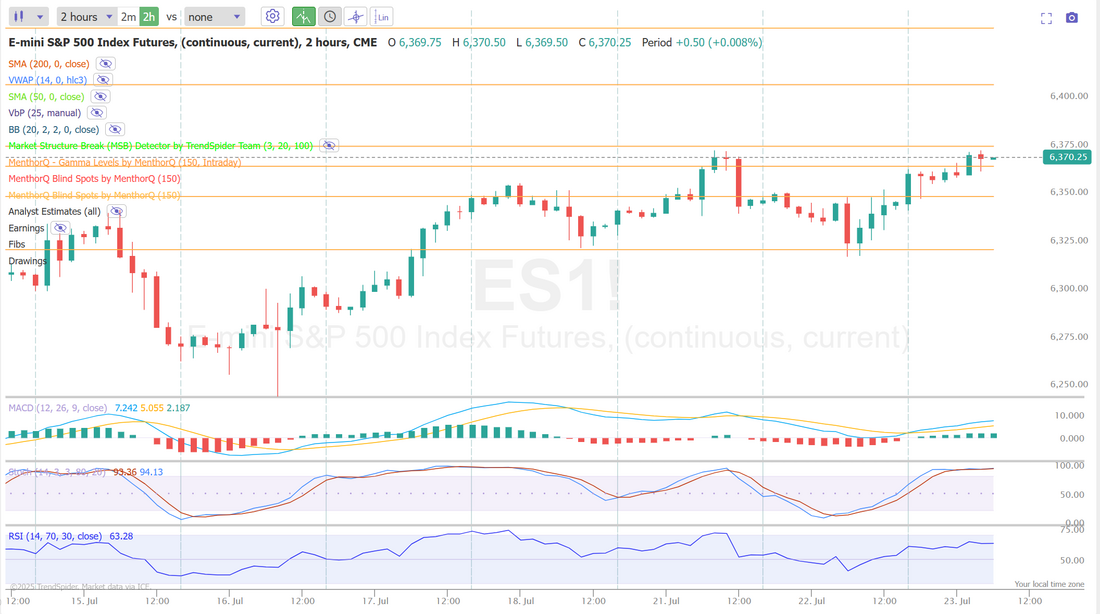

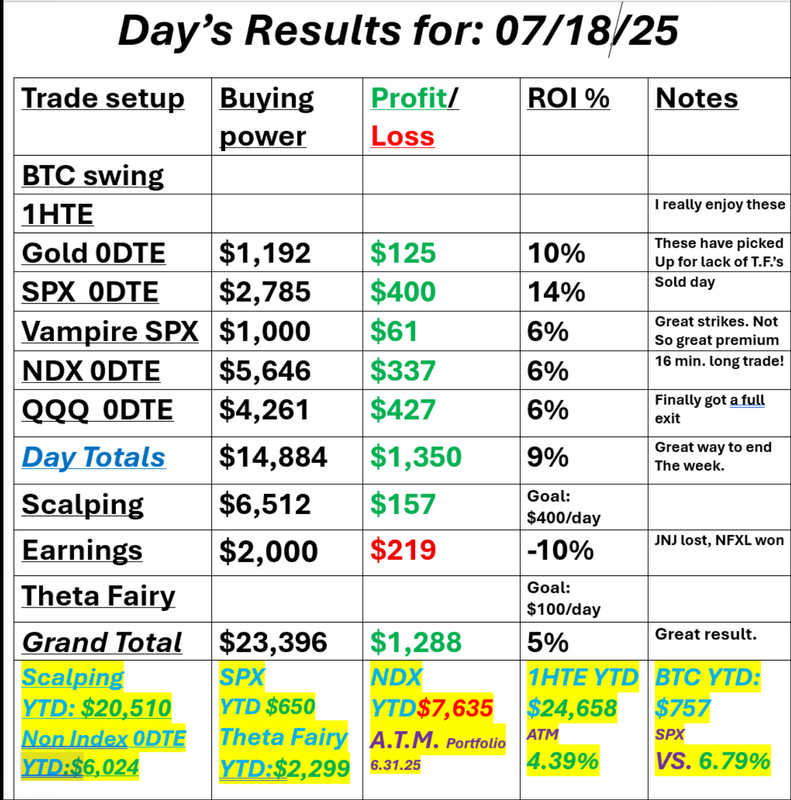

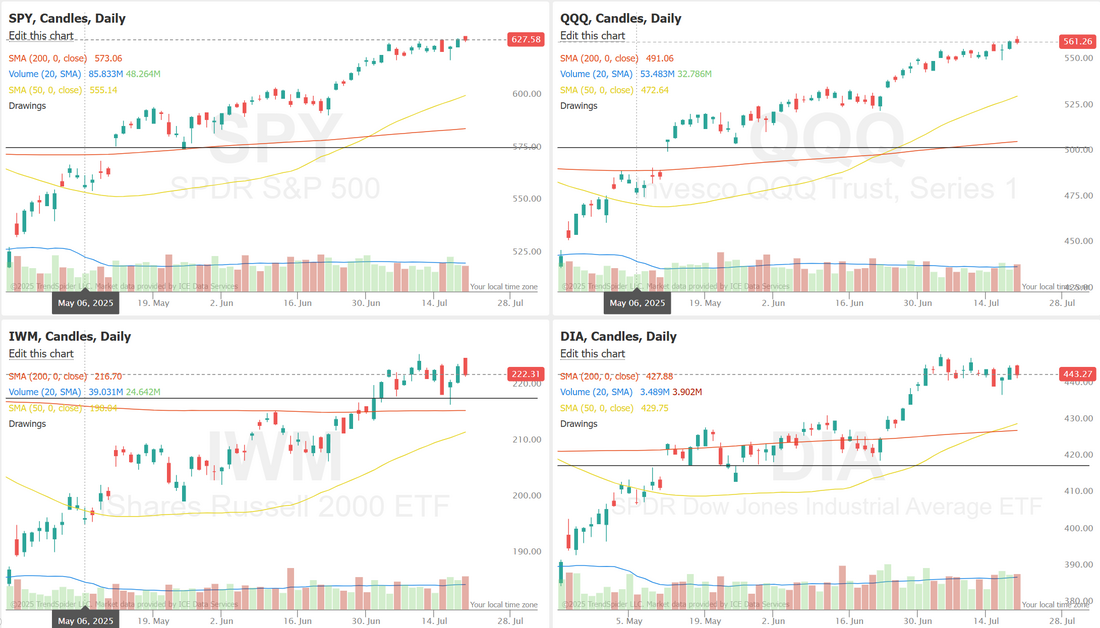

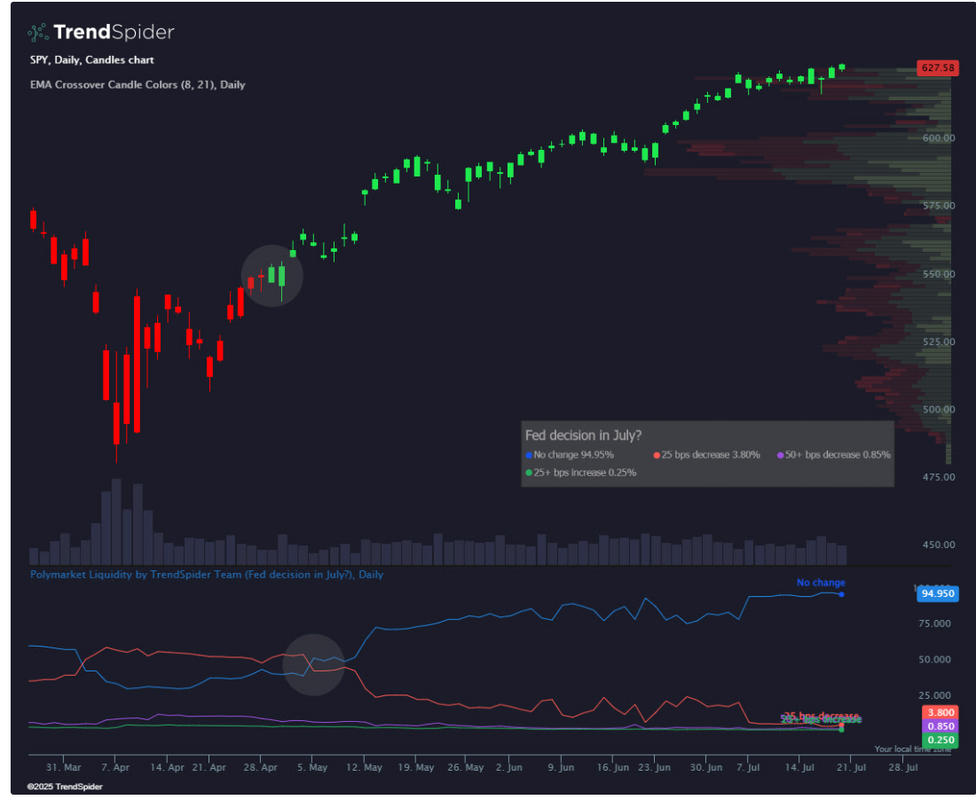

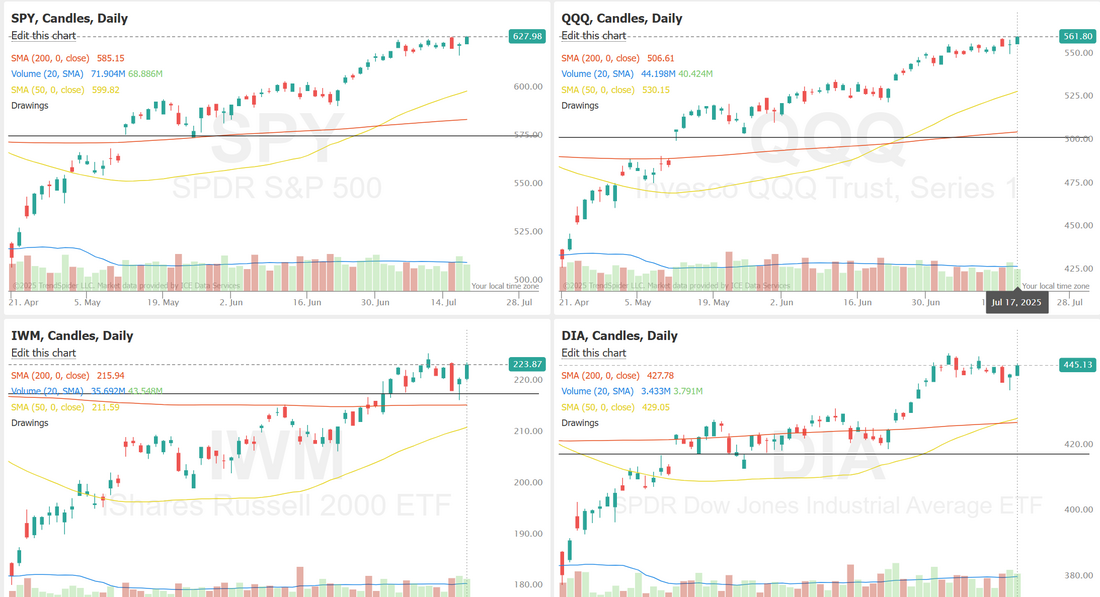

Can the bulls breakout?After two weeks of going no where the bulls were able to break out to the upside on Thurs. Fri. came and gave it all back! Never the less, the bulls are trying. We had a solid day Friday and really, a very solid week. It seemed like we had a loser every day but our net liq went up every single day! Take a look at our last Friday. Let's take a look at the markets. Technicals are bullish. Friday gave back a good portion of Thursdays gains. We continue to sit near the ATH's. The SPY edged higher last week, closing at $627.58 (+0.64%), maintaining its bullish posture. The bullish 8/21 EMA crossover indicator initiated in April remains strong, with price consistently finding support during pullbacks. Alongside the bullish EMA crossover, the decrease in rate cut expectations on the Polymarket Indicator helped fuel the ongoing rally, showing markets shrugged off the need for lower rates. The QQQ finished in the green last week, closing at $561.26 (+1.27%), as tech earnings season kicked off with Netflix’s report. Interestingly, the index started its bullish run in May even as the prediction market flashed declining odds of a Fed rate cut, defying the typical relationship between lower rates and tech strength. This divergence suggests that expectations are already priced in, raising the risk of a “sell-the-news” reaction when rate cuts eventually happen. Small caps underperformed last week with the IWM closing at $222.33 (+0.29%). With at least one rate cut expected later this year, small caps could have more upside potential than their large-cap peers, provided the ETF continues to hold support above the 8/21 EMA crossover. The key question for traders is whether the market has already priced in the coming policy shift or if there’s still meaningful upside once cuts are delivered. Gamma continues to be positive coming into today. Quant score is about as bullish as can be. Key intra-day levels: Intra-day chart: For bulls, they need to break above 6373. Support levels are 6339, 6319, 6300. September S&P 500 E-Mini futures (ESU25) are up +0.27%, and September Nasdaq 100 E-Mini futures (NQU25) are up +0.28% this morning, pointing to a higher open on Wall Street, while investors await more news on trade talks, a fresh batch of U.S. economic data, and a slew of corporate earnings reports, with a particular focus on results from “Magnificent Seven” stalwarts Tesla and Alphabet. U.S. equity futures drew support from falling Treasury yields, which extended their drop to a fourth day. In Friday’s trading session, Wall Street’s major equity averages closed mixed. Health insurance stocks retreated, with Molina Healthcare (MOH) plunging over -10% to lead losers in the S&P 500 and Elevance Health (ELV) sliding more than -8%. Also, Netflix (NFLX) slumped over -5% even after the streaming giant reported stronger-than-expected Q2 results and raised its full-year revenue guidance. In addition, Sarepta Therapeutics (SRPT) plummeted more than -35% after the company said another patient had died from acute liver failure following treatment with one of its experimental gene therapies for a muscle disease. On the bullish side, Invesco Ltd. (IVZ) surged over +15% and was the top percentage gainer on the S&P 500 after the investment management firm proposed changing the structure of its QQQ exchange-traded fund. Economic data released on Friday showed that the University of Michigan’s preliminary U.S. consumer sentiment index rose to a 5-month high of 61.8 in July, stronger than expectations of 61.4. Also, the University of Michigan’s U.S. July year-ahead inflation expectations fell to a 5-month low of 4.4%, better than expectations of no change at 5.0%, while 5-year implied inflation expectations fell to a 5-month low of 3.6%, better than expectations of 3.9%. In addition, U.S. June housing starts rose +4.6% m/m to 1.321M, stronger than expectations of 1.290M, while building permits, a proxy for future construction, unexpectedly rose +0.2% m/m to 1.397M, stronger than expectations of 1.390M. Fed Governor Christopher Waller said in a Bloomberg TV interview on Friday that he sees no evidence of rising inflation expectations, which gives the Fed room to proceed with rate cuts. He also reiterated that the central bank should lower rates when policymakers meet later this month, citing data indicating the U.S. labor market is “on the edge.” Meanwhile, U.S. rate futures have priced in a 95.3% chance of no rate change and a 4.7% chance of a 25 basis point rate cut at next week’s monetary policy meeting. Second-quarter corporate earnings season kicks into high gear this week, with investors awaiting fresh reports from major companies such as Tesla (TSLA), Alphabet (GOOGL), Intel (INTC), ServiceNow (NOW), International Business Machines (IBM), NXP Semiconductors N.V. (NXPI), Coca-Cola (KO), AT&T (T), Verizon (VZ), General Motors (GM), Blackstone (BX), American Airlines (AAL), Southwest Airlines (LUV), Philip Morris International (PM), Chipotle (CMG), Union Pacific (UNP), Honeywell (HON), and Phillips 66 (PSX). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +3.2% increase in quarterly earnings for Q2 compared to the previous year, slightly above the pre-season forecast of +2.8%. Market watchers will also closely monitor preliminary purchasing managers’ surveys on U.S. manufacturing and services sector activity for July for any signs of how President Trump’s tariff policies are affecting the economy. Other noteworthy data releases include U.S. Existing Home Sales, Initial Jobless Claims, the Richmond Fed Manufacturing Index, New Home Sales, Durable Goods Orders, and Core Durable Goods Orders. “As the final shape of the U.S. tariff regime is still up in the air, the recent moderate inflation trend has apparently not helped to reduce uncertainty about the ultimate impact of Trump’s trade policy on inflation,” said ABN Amro analysts. In addition, investors will continue to await any updates on U.S. tariff agreements with other countries ahead of the August 1st deadline, when reciprocal tariffs are set to take effect. U.S. President Donald Trump said he’s close to announcing a couple of “big” trade deals. U.S. central bankers are in a media blackout period before the July 29-30 policy meeting, though Fed Chair Jerome Powell is scheduled to deliver opening remarks on Tuesday at a conference focused on capital frameworks for large banks. Today, investors will focus on the Conference Board’s Leading Economic Index for the U.S., which is set to be released in a couple of hours. Economists expect the June figure to be -0.2% m/m, compared to the previous number of -0.1% m/m. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.381%, down -1.13%. My bias or lean today is slightly bullish. You really have to be right now but I'm not expecting too much upside. Similar to the last few weeks. Trade docket today: We got a compromised fill on our Gold 0DTE after exchange issues last night. We'll continue to work that today. Our copper trade is finally in a place that we can add the next scale in. I'll continue to work the /MNQ futures for scalping today and we'll go over the cover we used on Friday. LULU cash flow. QQQ 0DTE, SPX 0DTE. Possible NDX 0DTE. KO, LMT earnings. A quick note. We'll be headed up to the cabin in East canyon tomorrow for our annual boating, rock crawling, mountain biking week with limited space and bandwidth to zoom. We'll be trading every day, of course, but today will be the only zoom session this week.

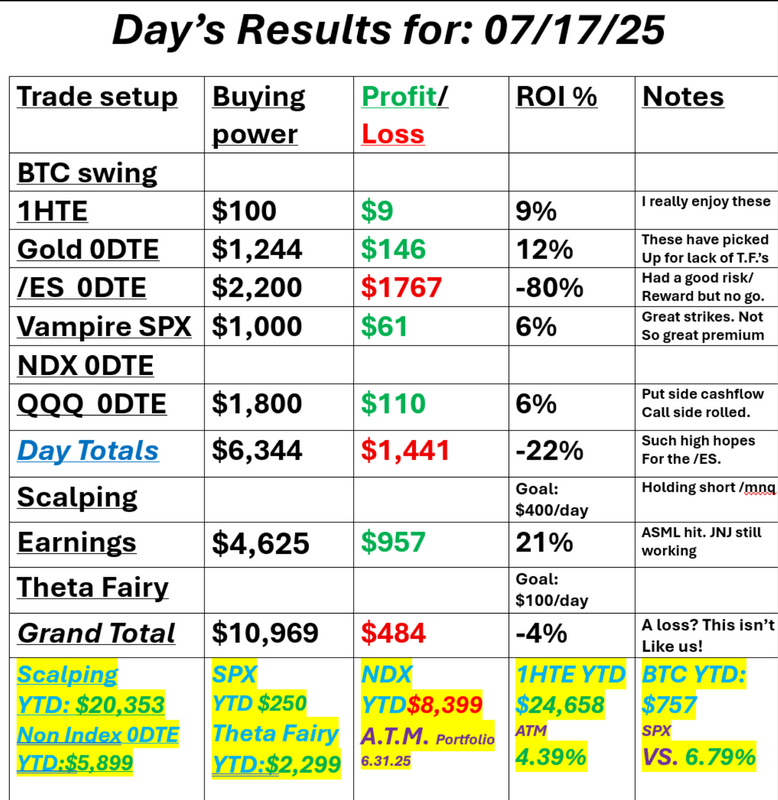

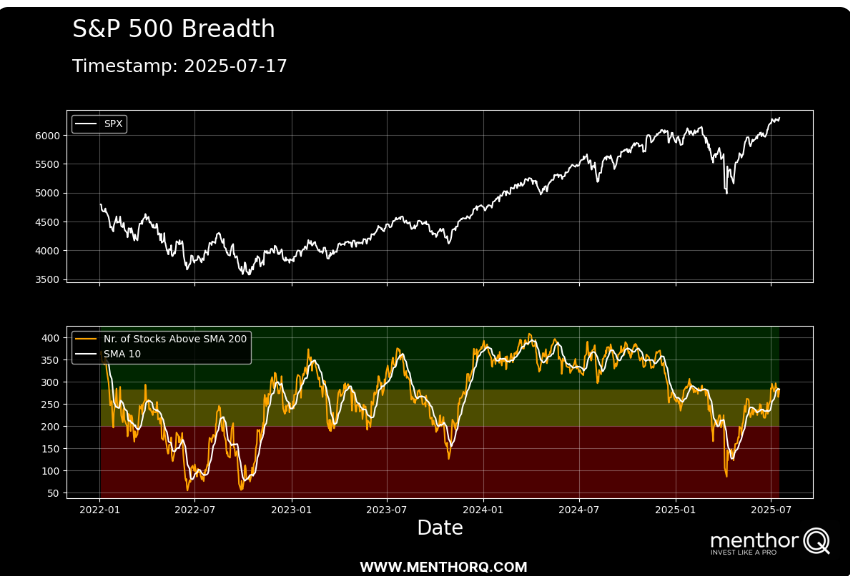

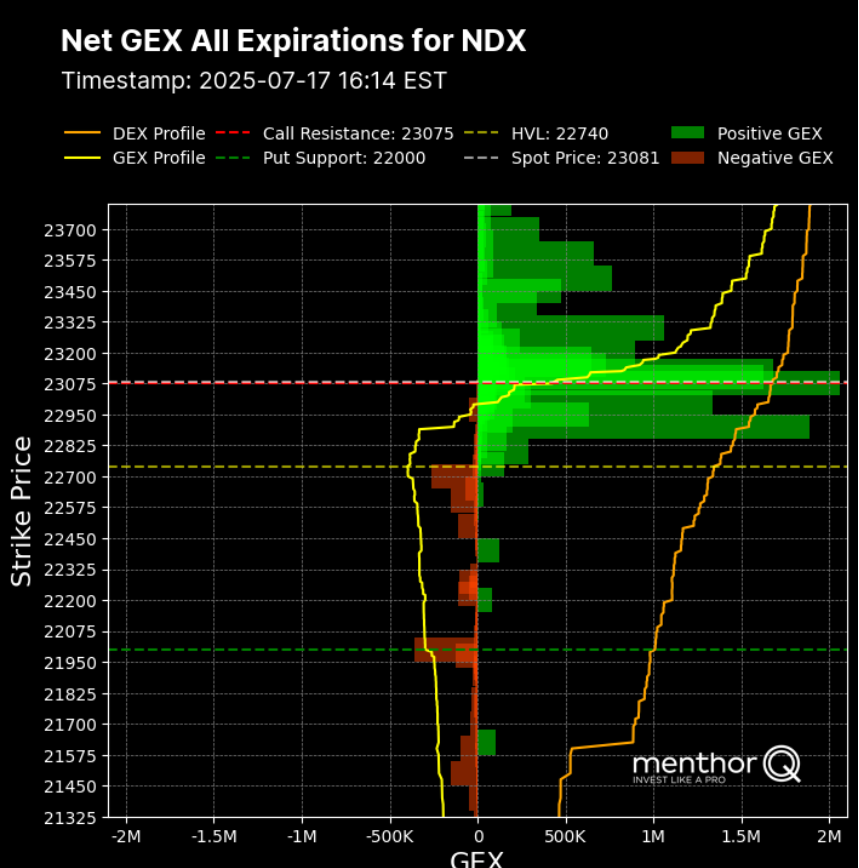

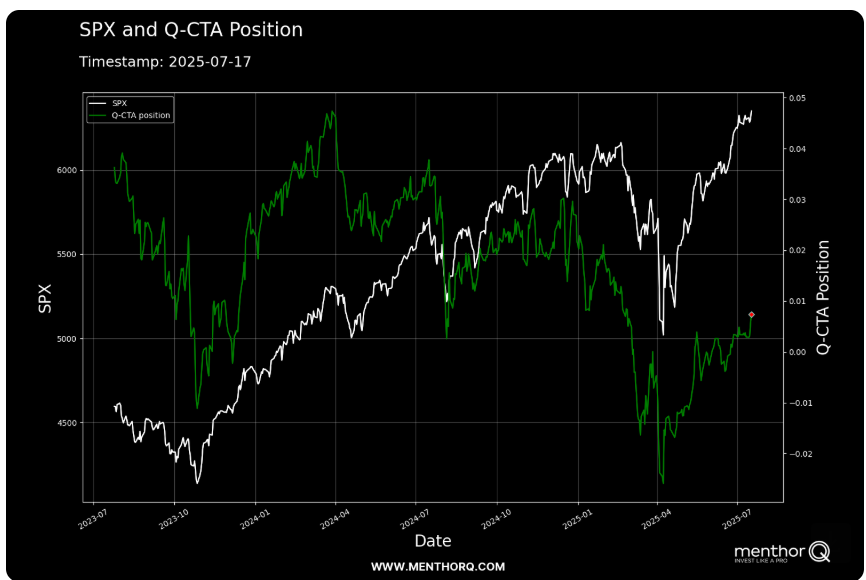

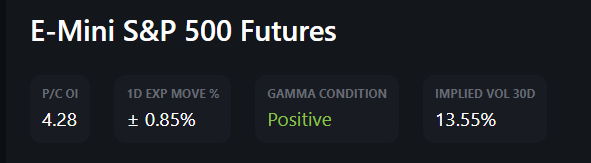

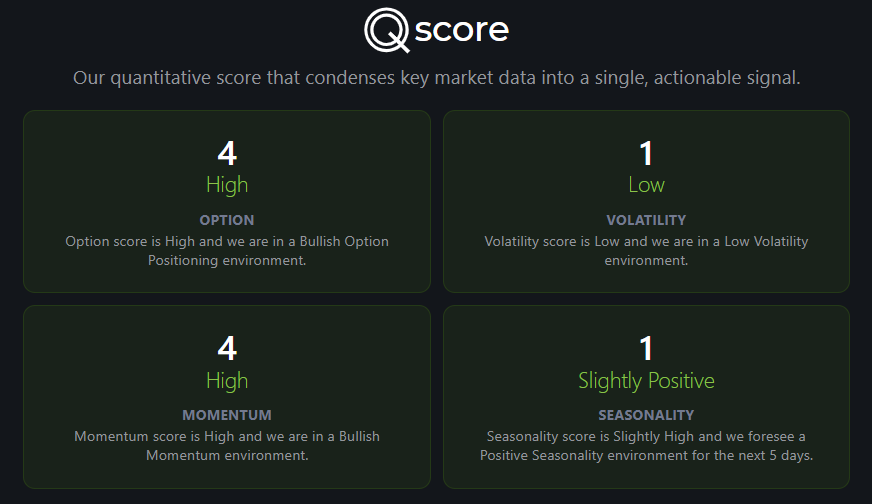

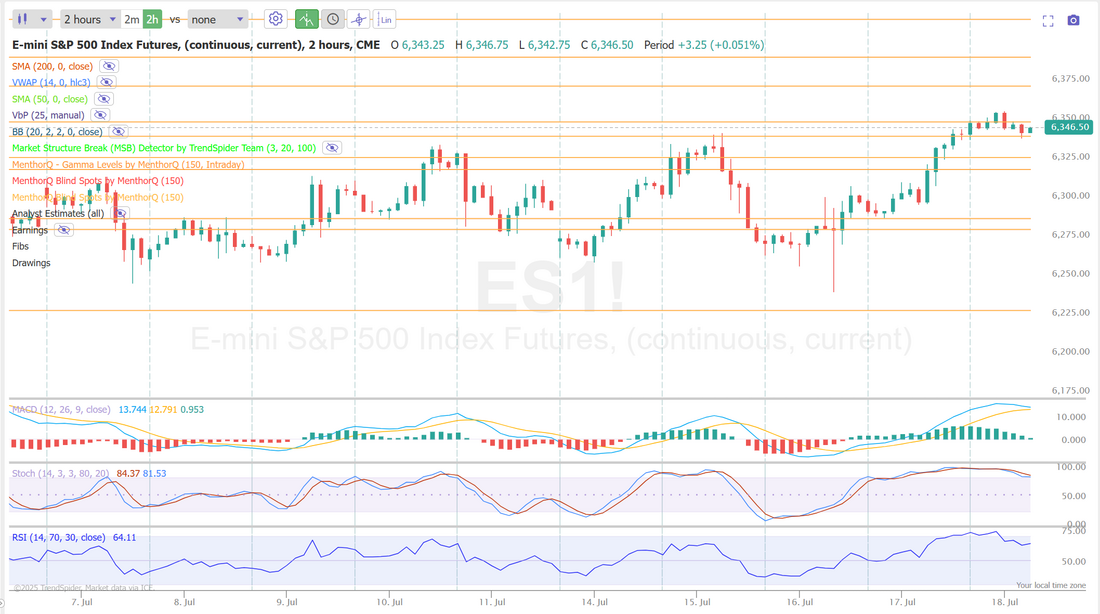

I'll see you all in the zoom session shortly! Are the bulls back?After several weeks of treading water the bulls had a slight breakout yesterday. It puts us right back up to those ATH's and what looks like some serious resistance. We had an "O.K." day yesterday. There are two facets to our day. #1. What did we generate cash flow wise on the day and #2. What did our net liq do? The cash flow is in our control. The net liq, not so much. What we hold will go up and down as it pleases so until that is realized we don't count it. Our net liq was good yesterday but our cash flow was negative. Our much vaulted /ES trade lost. Even up to the end it still had decent risk/reward of about 1to1 but in hindsight we should have just booked a profit when it was up $300 dollars. Lesson learned. Here's a look at our day: The S&P 500 breadth chart as of July 17, 2025, shows a noteworthy rebound in participation, with the number of stocks above their 200-day moving average rising steadily toward the mid-range zone. This uptick in breadth suggests improving internal market strength after a prolonged period of weakness earlier this year. The short-term 10-day moving average of breadth has also turned upward, reinforcing near-term momentum. While SPX itself remains near all-time highs, broader participation may lend support to the trend if sustained, indicating healthier market undercurrents in the immediate term. The Net GEX chart for NDX as of July 17, 2025, indicates a concentrated zone of positive gamma exposure just above the current spot price of 23,081, with notable resistance around the 23,075 strike reinforced by high call open interest. This suggests the index may be approaching a region of hedging-driven dampened volatility. Meanwhile, strong put support near 22,000 adds a potential downside buffer. With HVL marked at 22,740 and most gamma concentrated between this level and current price, the short-term range appears technically well-defined, offering insight into potential market stabilization or congestion zones near these strikes. The SPX and Q-CTA Position chart as of July 17, 2025, highlights a continued climb in SPX prices, reaching new highs, while Q-CTA positioning has recently turned positive after a prolonged period of neutrality to slight bearishness. The recent shift in systematic positioning suggests that trend-following models may be slowly re-engaging with the rally after previously staying defensive. September S&P 500 E-Mini futures (ESU25) are trending up +0.19% this morning, extending yesterday’s gains as rising confidence in the strength of the U.S. economy and positive earnings reports bolstered investors’ risk appetite. In yesterday’s trading session, Wall Street’s major indices closed higher, with the S&P 500 and Nasdaq 100 notching new record highs. Snap-On (SNA) surged nearly +8% and was the top percentage gainer on the S&P 500 after the company reported stronger-than-expected Q2 results. Also, PepsiCo (PEP) climbed more than +7% and was the top percentage gainer on the Nasdaq 100 after the beverages and snacks company posted better-than-expected Q2 results and maintained its full-year outlook. In addition, Lucid Group (LCID) jumped over +36% after the company announced a self-driving partnership with Uber and Nuro. On the bearish side, Elevance Health (ELV) plunged more than -12% and was the top percentage loser on the S&P 500 after the health insurer cut its full-year earnings guidance. Economic data released on Thursday showed that U.S. retail sales grew +0.6% m/m in June, stronger than expectations of +0.1% m/m, while core retail sales, which exclude motor vehicles and parts, increased +0.5% m/m, stronger than expectations of +0.3% m/m. Also, the U.S. Philly Fed manufacturing index rose to a 5-month high of 15.9 in July, stronger than expectations of -1.2. In addition, the number of Americans filing for initial jobless claims in the past week unexpectedly fell -7K to a 3-month low of 221K, compared with the 233K expected. Finally, the U.S. import price index rose +0.1% m/m in June, weaker than expectations of +0.3% m/m. “The consumer came back to life in June. Other data like initial jobless claims and Philly Fed also painted the picture of a strong economy,” said David Russell at TradeStation. “While it’s good for growth overall, it makes it harder to justify rate cuts.” Fed Governor Adriana Kugler said on Thursday that the central bank should continue to hold interest rates steady “for some time,” citing accelerating inflation as tariffs begin to drive up prices. At the same time, Fed Governor Christopher Waller stated that policymakers should lower interest rates this month to support a weakening labor market. Also, San Francisco Fed President Mary Daly stated that the inflationary impact of tariffs may be more muted than previously anticipated, reiterating that two interest rate cuts this year remain a “reasonable” expectation. Meanwhile, U.S. rate futures have priced in a 97.4% probability of no rate change and a 2.6% chance of a 25 basis point rate cut at the July FOMC meeting. Today, investors will focus on the University of Michigan’s U.S. Consumer Sentiment Index, which is set to be released in a couple of hours. Economists, on average, forecast that the preliminary July figure will stand at 61.4, compared to 60.7 in June. U.S. Building Permits (preliminary) and Housing Starts data will also be reported today. Economists expect June Building Permits to be 1.390M and Housing Starts to be 1.290M, compared to the prior figures of 1.394M and 1.256M, respectively. On the earnings front, notable companies like American Express (AXP), Charles Schwab (SCHW), 3M (MMM), Truist Financial (TFC), and Schlumberger (SLB) are slated to release their quarterly results today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average 3.2% increase in quarterly earnings for Q2 compared to the previous year, slightly ahead of pre-season expectations of 2.8%. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.443%, down -0.47%. We are starting the day off once again with positive Gamma. Quant score is still decidedly bullish Key intra-day /ES levels: Looking at in on a 2hr. chart. 6372 is nearest resistance with 6340 nearest support. If we lose 6340, 6327 is next. Trade docket for today: We've got a Gold 0DTE working order right now. I'm not sure if it will hit or not. Slim pickings today on one of our favorite trades. I'm continuing to work a scalp with short /mnq and one of my favorite covers. We'll look to exit our JNJ earnings trade. A possible cash flow on our LULU position. We should be booking a nice profit on our NFLX earnings trade right at the open. A big focus today will be to see if we can get a full profit on our QQQ 0DTE. We've been rolling the call side since last week! Our overnight Vampire trade on SPX looks to finish our this morning with a full profit so no futures hedging will be required. I look forward to a strong finish to the week and seeing you all in the live trading room shortly. Let's see if we can get our QQQ trade to the finish line!

|

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |