|

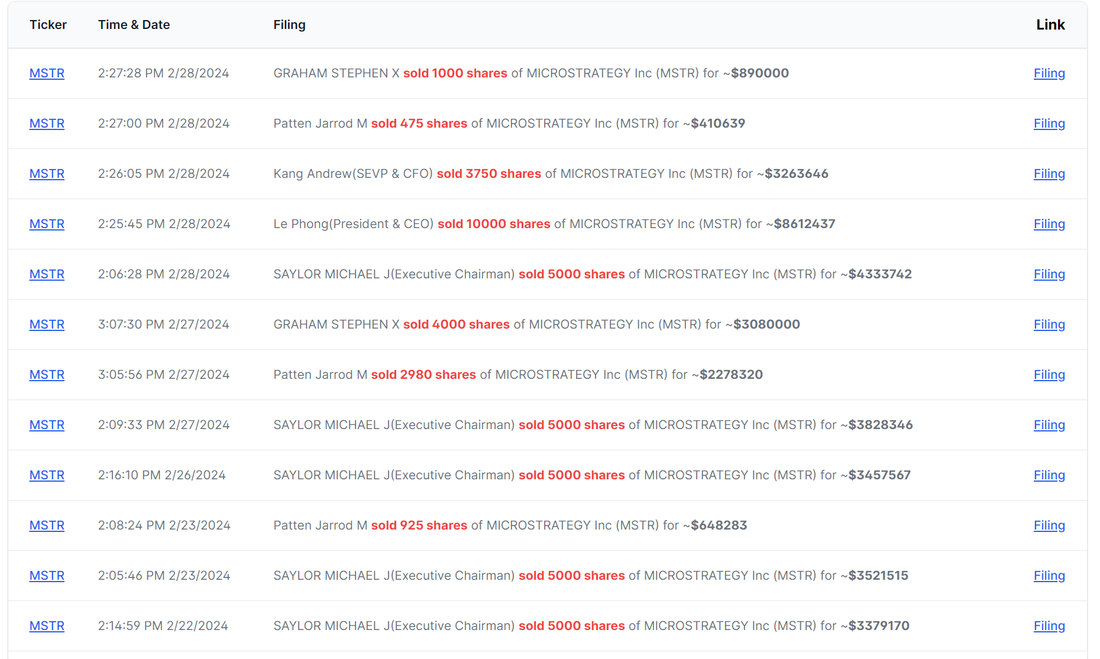

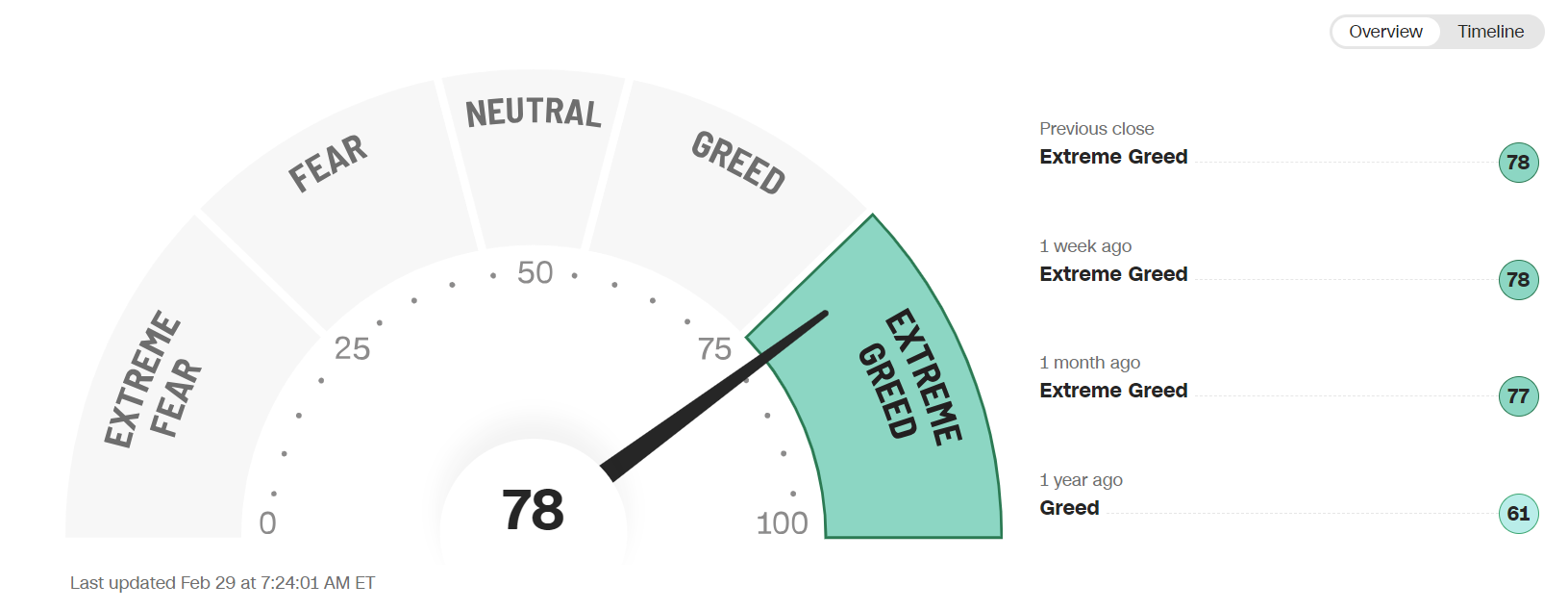

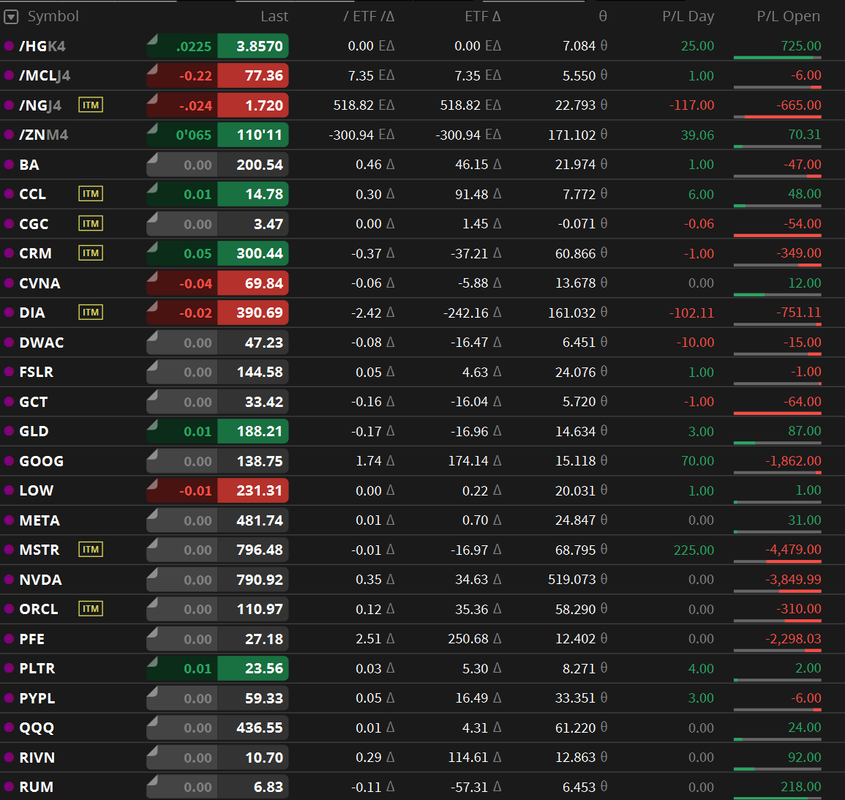

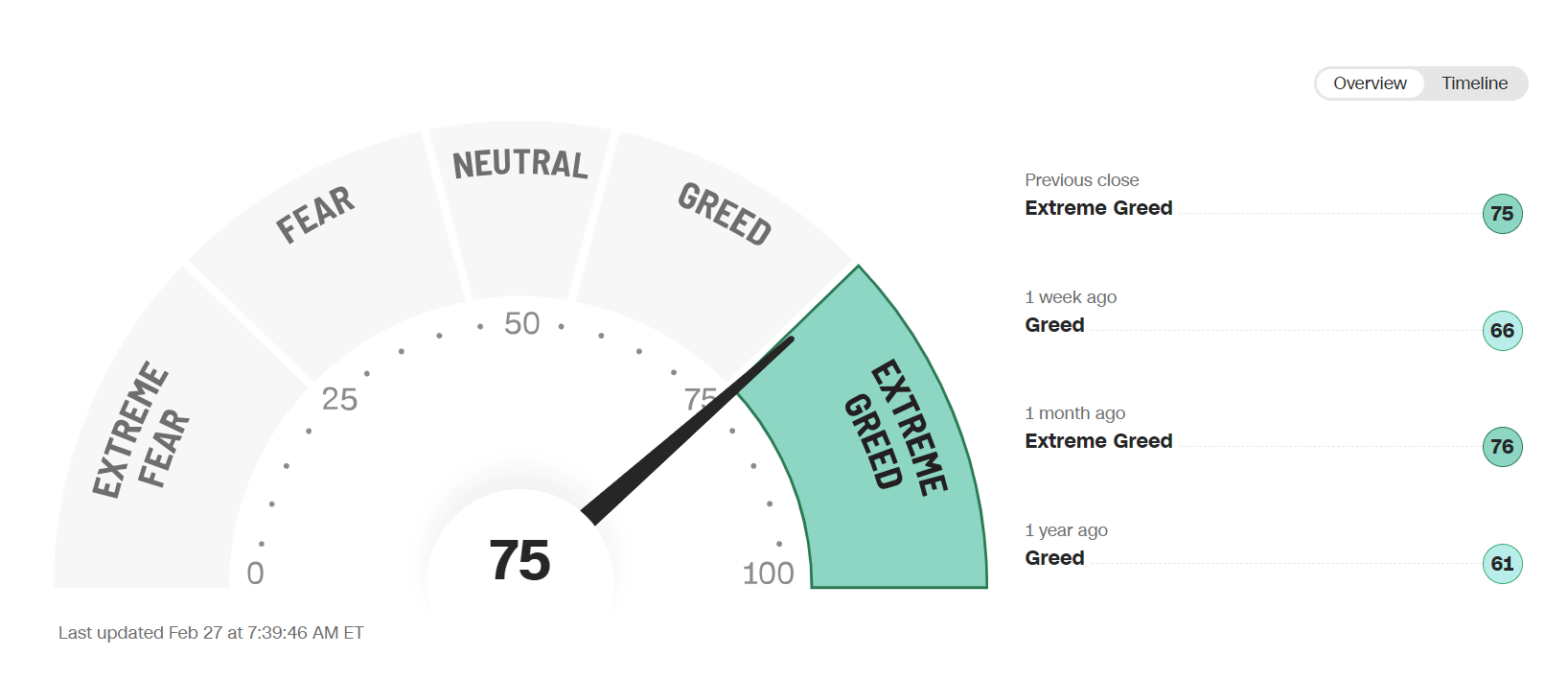

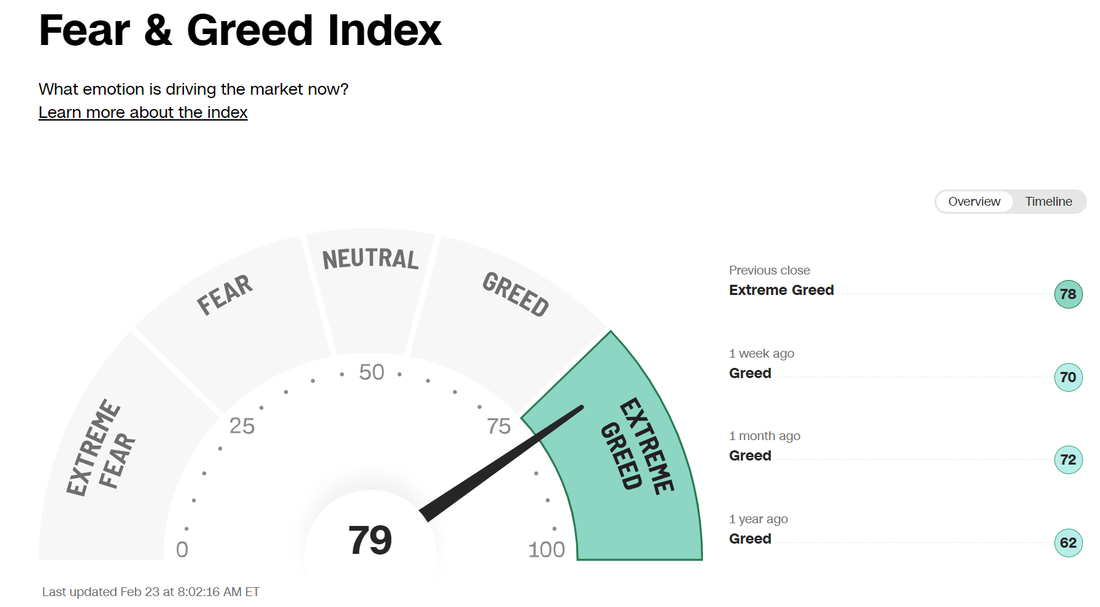

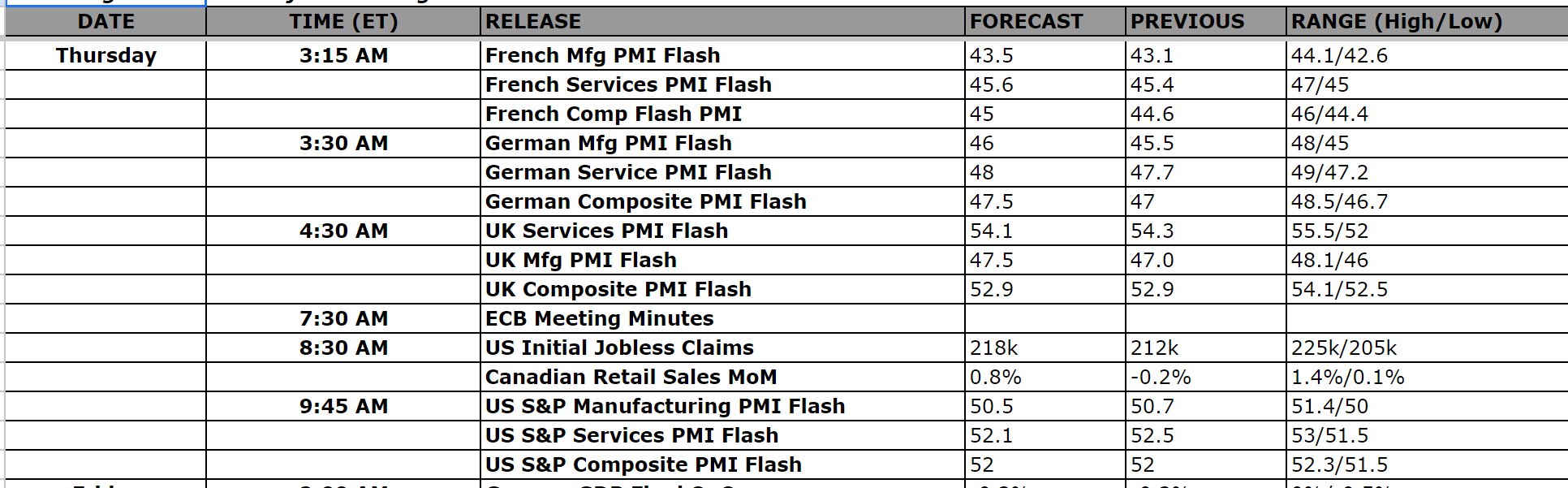

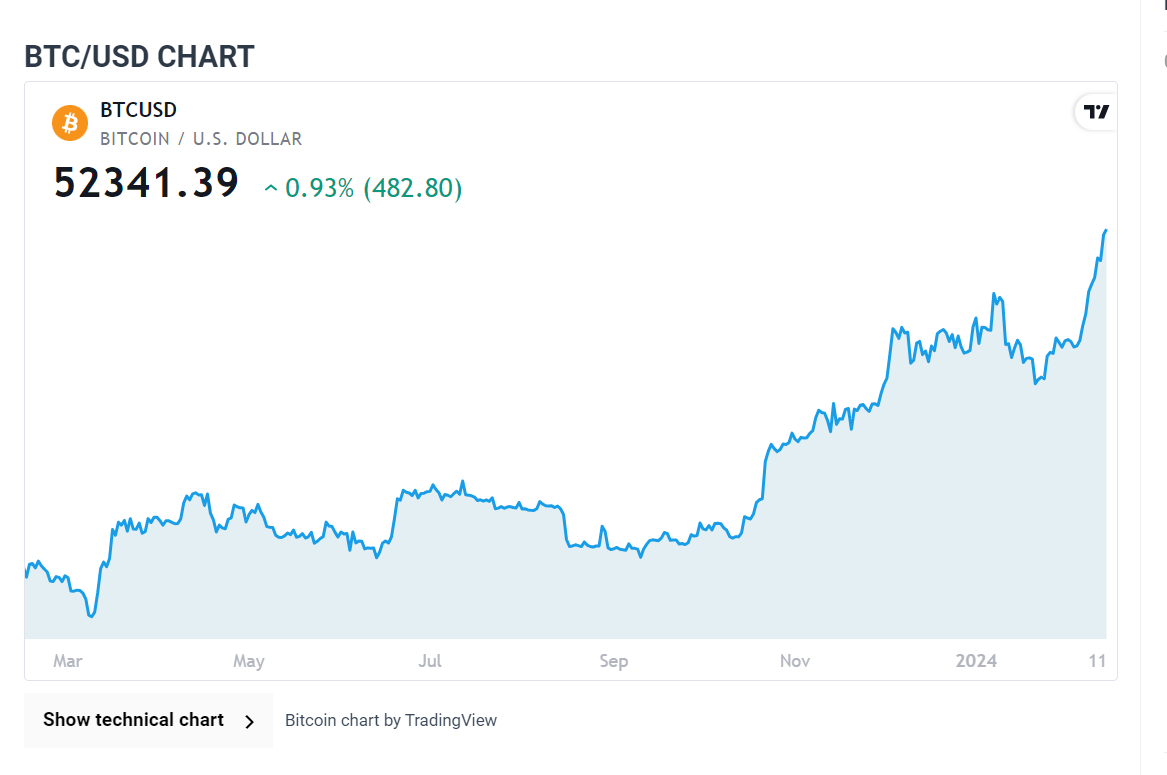

We had, what I'd call, a rock solid day yesterday. We try to have a broadly diversified model portfolio with varying strategies and underlyings as well as always carrying short positons regardless of market direction. This gives us a fighting chance each day for profits and it smoothes our the portfolio fluctuations. My net liq was up $2,162 yesterday. We had all three of our 0DTE's hit for profit. Between the three I had $10,312 capital commited and brought in $1,215 in profits. Our Event contract 0DTE was the biggest winner. If you are not trading event contract 0DTE's or are unfamiliar with them, I prepared a short tutorial of how they may help you up your "edge" in 0DTE trading. Earnings season has been hot and heavy for us and yesterday was no exception. CRM, SNOW, MARA, AI, AMC were our setups going into the close yesterday. They ALL look like nice wins for us this morning. Congrats on those wins. The Bitcoin charge continues: For me, one of the most intersting underlyings related to Bitcoin is MSTR. To say it's gone parabolic is an understatment. What you may not be aware of, is the fact that MSTR currently has the second most SEC form 4 insider sell numbers of any company on the U.S. exchanges. This is just a partial list of insiders who are dumping the stock Sell at the high...buy at the low, or so they say. That's the way to make money. We are in an MSTR trade now that we are chasing. I believe it will work out the same as our much scourned SMCI trade, which we exited yesterday at a massive profit. On to the market for today: PCE and Jobless claims should be our new catalyst for today. Thursday 29th February 08:30 ET US PCE Price Index for January The US Personal Consumption Expenditures Price Index is a measure of inflation that tracks changes in the prices of goods and services purchased by consumers throughout the US. It is released monthly by the Bureau of Economic Analysis and is considered a key indicator of inflationary trends. The PCE Price Index is closely watched by policymakers at the Federal Reserve, as it helps them assess whether inflation is rising or falling relative to their target. Unlike other measures of inflation, such as the Consumer Price Index (CPI), the PCE Price Index includes data on personal consumption expenditures, which covers a broader range of goods and services and is based on more comprehensive data sources. The basket of goods measured in the PCE report is also variable based on consumer spending habits, making it a better representation of how much more consumers are actually spending on their shopping and services. What to Expect Higher-than-expected inflation indicates that the Fed may need to keep rates higher for longer to bring inflation sustainably back to its 2% target, which would be likely to cause markets to pull back their bets on Fed rate cuts this year. This would cause strength in US stocks, and weakness in the dollar. Unicredit wrote in a note that they think the acceleration seen last month is mostly due to monthly volatility and one-offs. “We are expecting the PCE to be more elevated versus recent months as well. Not only were the CPI components that feed directly into the PCE up, but healthcare costs and financial costs available in the PPI were also up.” noted Societe Generale. US Weekly Initial & Continued Jobless Claims The US Initial Jobless Claims report provides data on the number of individuals who filed for unemployment benefits for the first time during the previous week. It serves as an indicator of the labor market’s health, with higher numbers indicating increased layoffs and economic instability, while lower numbers suggest a stronger job market. Continued Jobless Claims, on the other hand, represent the number of individuals who remain on unemployment benefits after their initial claim. What to Expect Employment is one of the Fed’s mandates, however, FOMC officials have mentioned that they do see a higher unemployment rate being in line with their goal back to 2% inflation. This means that Jobless Claims coming in higher than expected, suggesting higher unemployment, would be likely to be read by the Fed as good news for inflation’s return to target. This scenario could cause US stocks to strengthen and the dollar to weaken. Futures continue to be weak. Lets be clear, the market isn't rolling over here but its also stopped its recent forward progress. We continue to ask, is this just a consolidation pause to build energy for the next launch higher or, will the bears be able to rest control and definatively change the market bias? Futures are certainly trying to get this sell signal to develop into something substantive. The one thing I've learned doing this for 40 years is the saying, "Buy when others are fearful and sell when others are greedy" hold merit and works over the long haul. Guess where we are now? Our trade docket for today is busy:

CRM, SNOW, MARA, AI, AMC, DIA, GOOG, MSTR, ZM, SPX/NDX/Event contract 0DTE's, /MCL, NVDA, Three potential insider trade setups with WM, ORLY, EXAS and an interesting setup on VKTX and its counterpart ETF, XBI as well as three potential new earnings plays with DELL, ESTC, SOUN. WE'll also be in our live scalping room again today. I doubt will make $1,479 profit in 7.41 mins. like last time but...that's why we step up to the plate. You gotta be 'in it to win it". My intra-day levels are: /ES; 5073/5080/5086/5093* (key resistance level) to the upside. 5059* (key support)/5051/5039/5027 to the downside. /NQ; 17908/17958/17995/18042* (key resistance area) to the upside. 17853/17823* (key support)/17771/17759 to the downside.

0 Comments

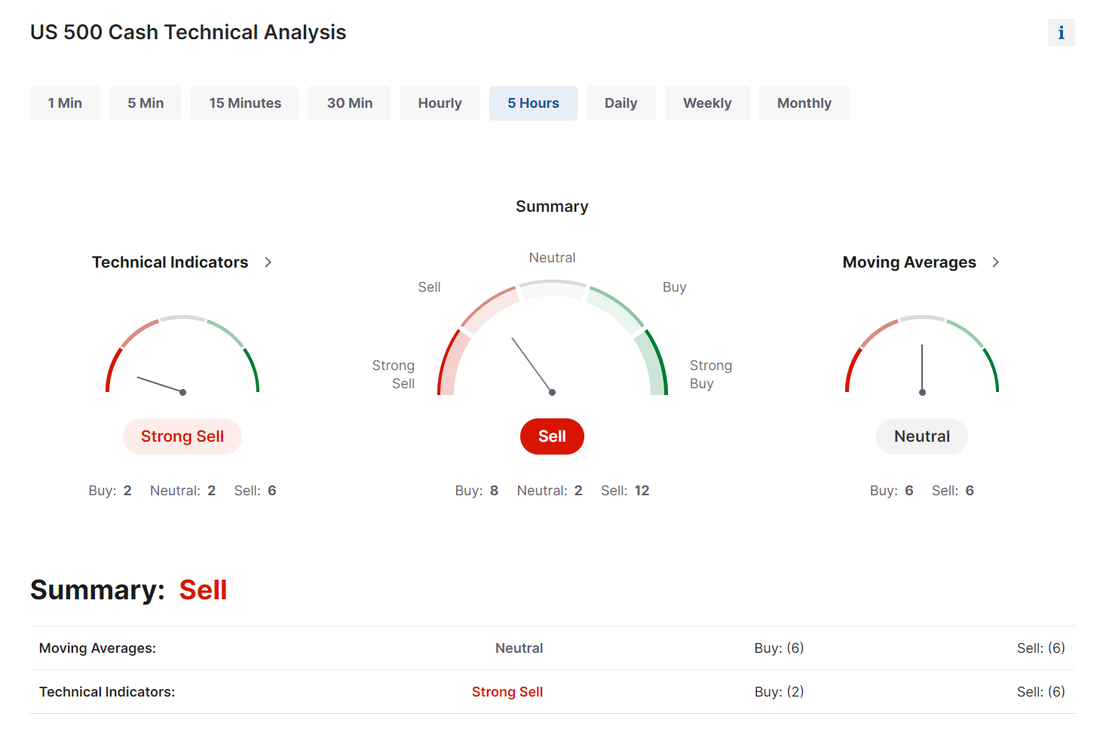

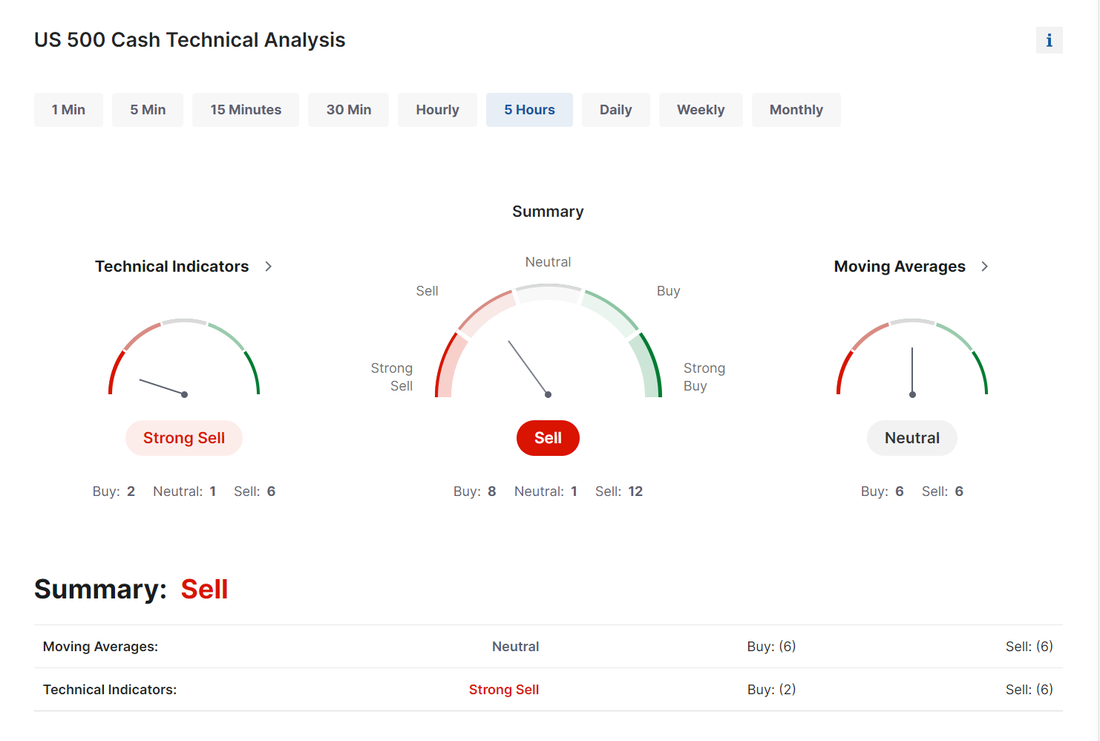

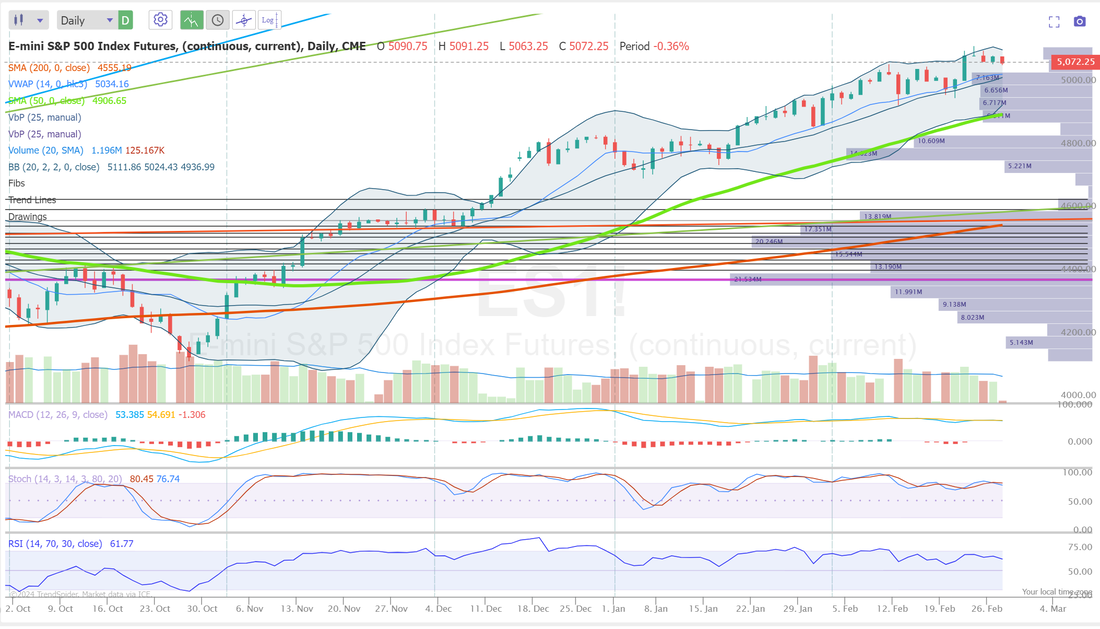

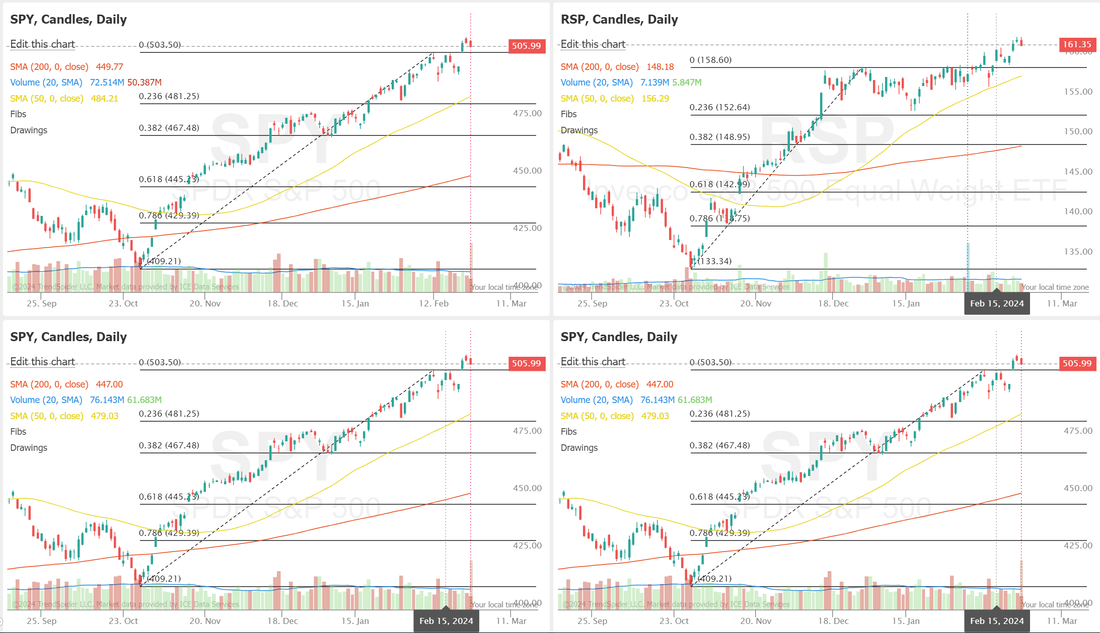

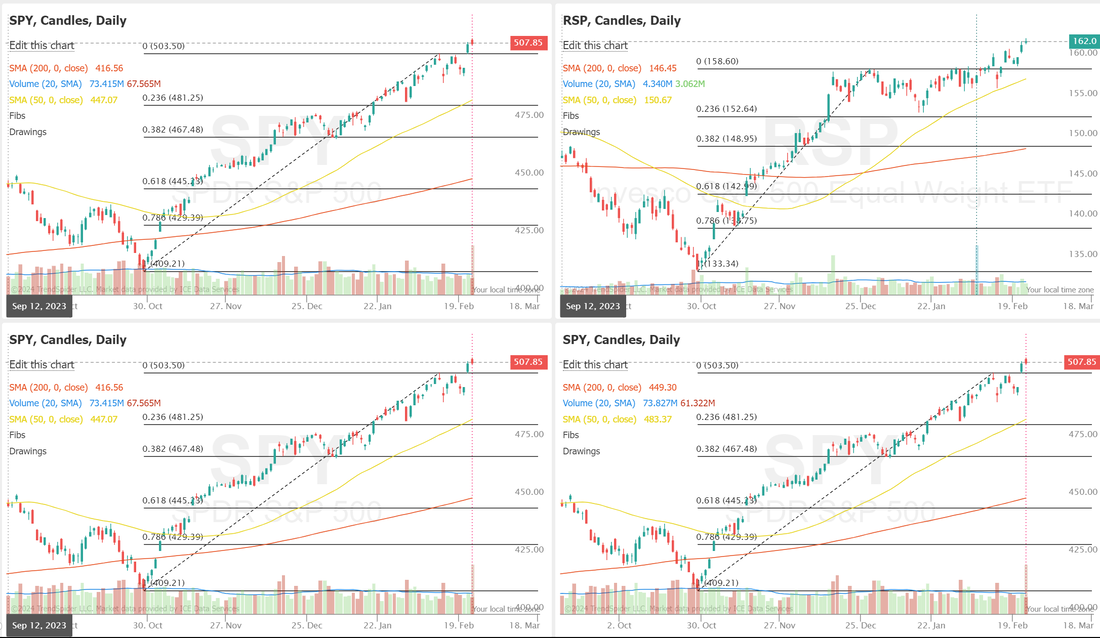

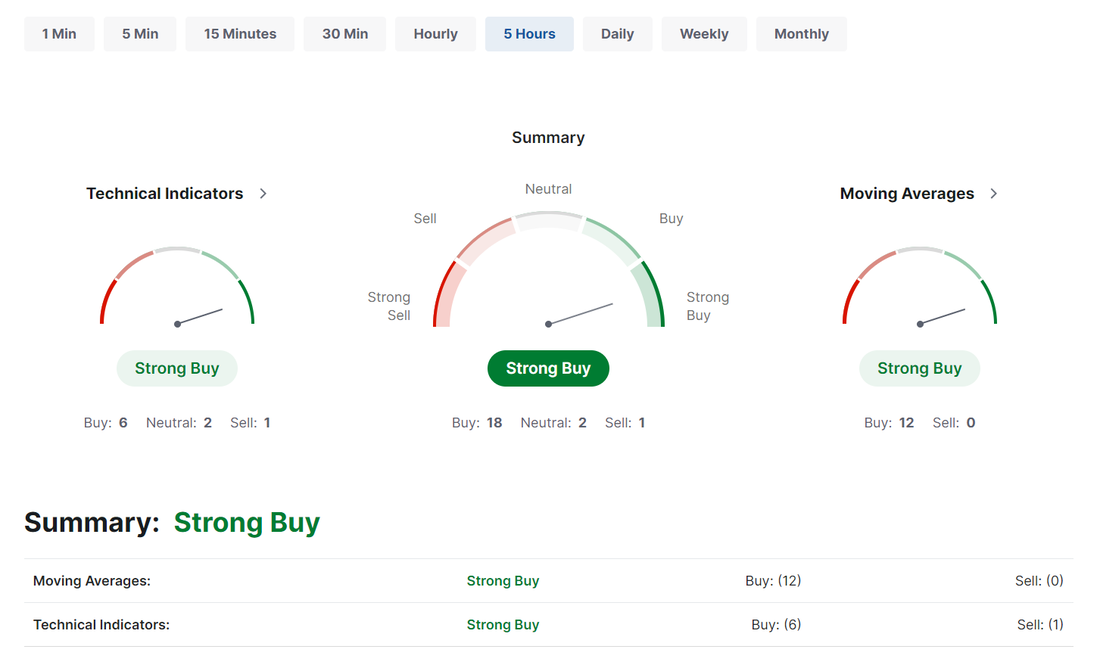

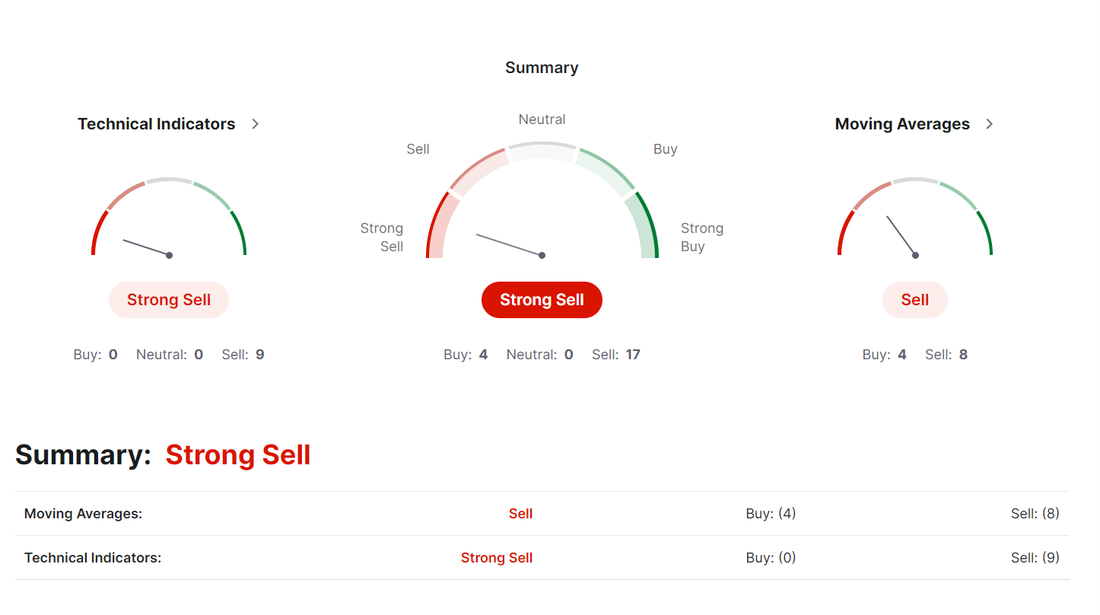

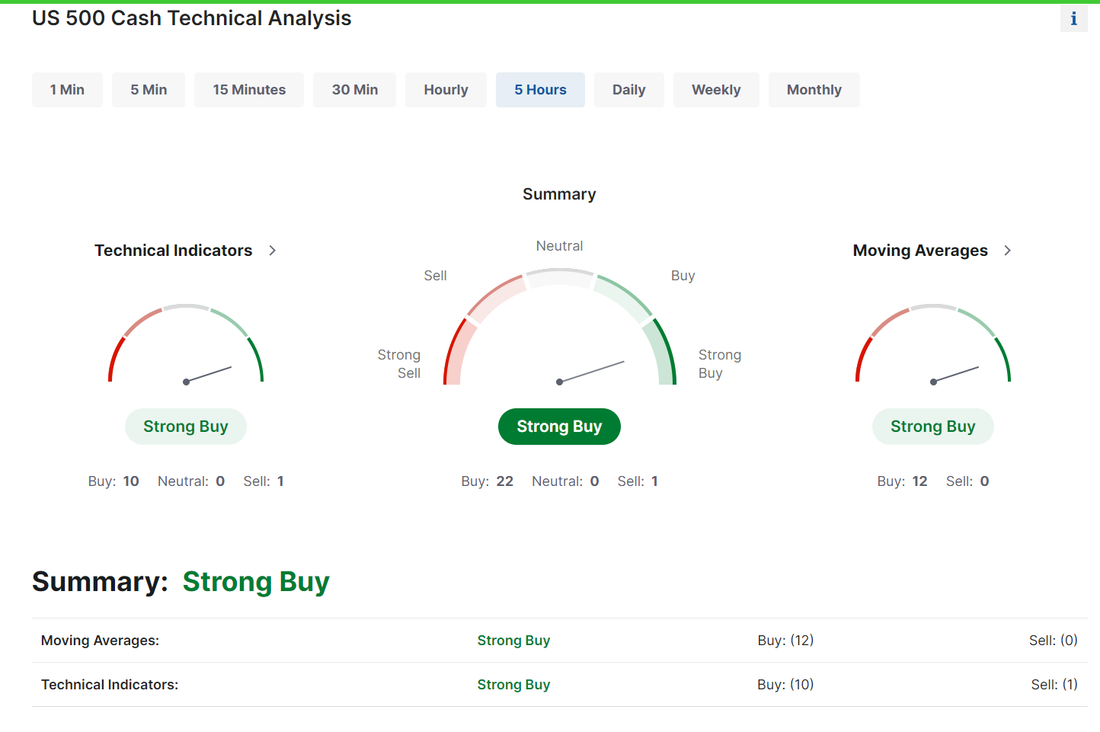

Welcome back traders. We had a really solid, overall day yesterday. My net liq was up $8,300. It certainly pointed to the importance of a well diversified portfolio. We had four 0DTE's once again. The more shots you take, the easier it will be to hit a target. Our standard SPX/NDX setups both went out with 10%+ returns on 80% capture rates. Our third NDX standard 0DTE made a whopping $36 dollar profit but...It had a crazy good insurance protective inner leg and could have hit for $1,100 profit IF we retraced going into the close. It didn't (obviously) but the risk/reward was fantastic. We will look to add another version of that setup today. Our non standard, event contract 0DTE also hit for a full profit of 3% ROI. All told is about $800 profit on 11K of buying power. We scalp QQQ 0DTE options every Tues/Thurs. and yesterday was no exception. We banked an impressive $1,479 gross profit on our first scalp. Our daily goal is $500-$1000 profit and when we get above $1,000 profit we stop so as not to give it back. Scalping yesterday lasted a whopping 7.41 minutes! Last Thurs. we scalped all day and didn't make any progress. Yesterday we grabbed a runner right out of the gate. You never know with scalping. You just need to commit to doing it consistently. We continue to be right on track to hit our $50,000 yearly scalping income goal, using 5K of capital and trading twice a week. If you are searching for ways to boost your income potential. Diversify your cash flow sources and gain a little more control over your results you might want to try our scalping program. We have a couple news catalysts today that could be market drivers. We are keen to add another ladder to our oil setup today so we'll be watching oil. Wednesday 28th February 08:30 ET US GDP Q4 Second Estimate US GDP refers to the Gross Domestic Product. GDP is a key indicator of the economic health and performance of a country and represents the total value of all goods and services produced within the country’s borders during a specific period. The fourth-quarter GDP figure provides insights into the growth rate or contraction of the economy during the final three months of the year. It’s an essential data point for policymakers, economists, and investors, offering information on overall economic activity, consumption, investment, government spending, and net exports. What to Expect Although a strong GDP figure will help cement a soft landing it could also have negative implications for monetary policy. Market participants will need to balance out these risks when assessing what this data means for US stocks and the dollar. “We expect real growth to be trimmed by 0.2 percentage points to a 3.1% annual rate. The slower pace reflects the downward revisions to November and December retail sales.” Morgan Stanley wrote in a note. 10:30 ET Weekly EIA Crude Oil Inventories The US Weekly Energy Information Administration Crude Oil Inventories report provides information on the total stockpile of crude oil in the United States. It includes data on the changes in crude oil inventories, indicating whether there has been an increase or decrease in the amount of oil held in storage. This report assesses supply and demand dynamics in the oil market and can influence oil prices. What to Expect A significant buildup in inventories may indicate oversupply, putting downward pressure on prices, while a decline may suggest increased demand, potentially impacting prices in the opposite direction. We've been trying to roll over for a few days now. With yesterdays price action we are back to, what has become rare...a sell signal technical rating. However, as much as I'd love to see us get bearish (we need the extra I.V.), let's not jump on the downside bandwagon just yet. We are still sitting right around the all time highs on most indices. We've spent the last three weeks banging our head on resistance with the /NQ. The /ES has spent the last three days clocking in weakness but maybe more important than the very slight move down is the absolute disappearing act of buying volume. Its drying up. I'm not a huge "bitcoin guy" but I am long ETH and Bitcoin. It's important to track this big upside push because even if you're not a big "bitcoin guy/gal", there are lots of equity underlyings that are being pulled up with this runup. Are they setting up for some nice shorting opportunities? I think so. Fed Governor Michelle Bowman on Tuesday repeated her anticipation that inflation will further decrease with interest rates held at current levels but emphasized that it’s too soon to initiate rate cuts. “Should the incoming data continue to indicate that inflation is moving sustainably toward our 2% goal, it will eventually become appropriate to gradually lower our policy rate to prevent monetary policy from becoming overly restrictive. In my view, we are not yet at that point,” Bowman said.

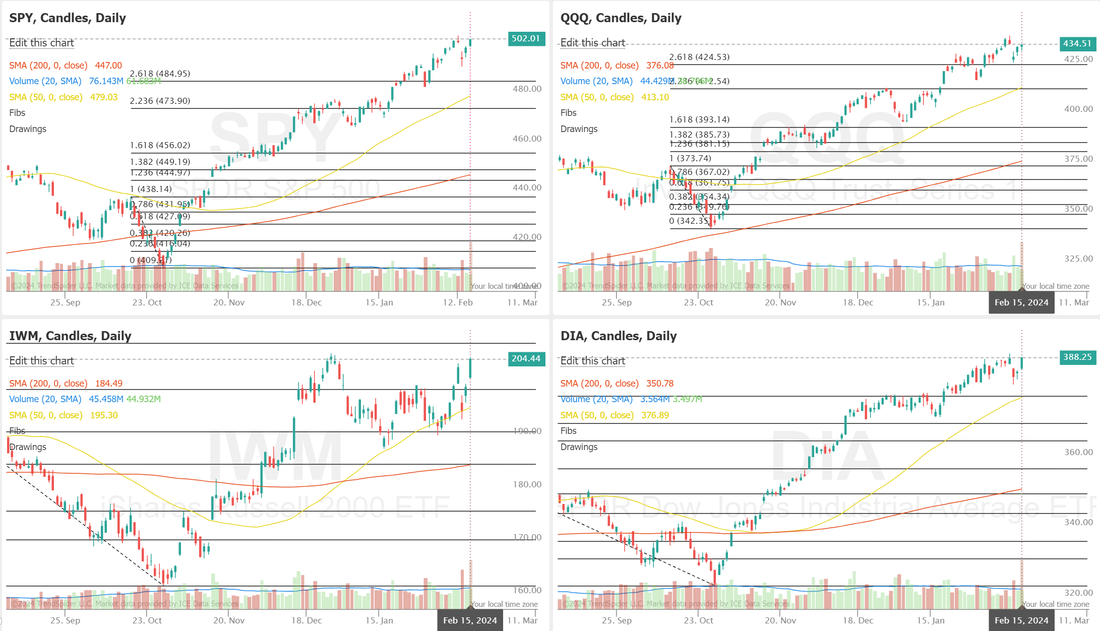

Meanwhile, U.S. rate futures have priced in a 0.5% chance of a 25 basis point rate cut at the March FOMC meeting and a 20.8% probability of a 25 basis point rate cut at May’s monetary policy meeting. Pre-Market U.S. Stock Movers Beyond Meat Inc (BYND) soared about +56% in pre-market trading after the company reported better-than-expected Q4 revenue, propelled by strong international sales. eBay Inc (EBAY) climbed over +3% in pre-market trading after the company topped Q4 revenue and gross merchandising volume expectations, gave a positive Q1 outlook, and authorized an additional $2 billion stock repurchase program. Coupang Inc (CPNG) gained more than +8% in pre-market trading after the company reported upbeat Q4 results. First Solar Inc (FSLR) rose over +4% in pre-market trading after reporting stronger-than-expected Q4 EPS and issuing in-line full-year guidance. Urban Outfitters Inc (URBN) plunged more than -9% in pre-market trading after the company posted weaker-than-expected Q4 results. Annovis Bio Inc (ANVS) slumped over -8% in pre-market trading after Brookline downgraded the stock to Hold from Buy with a $9 price target. We've got trades on EBAY and FSLR oh, and BYND! I told you yesterday to look for that BYND trade. If we open up today close to pre market pricing, that trade should hit for a 100%+ one day return. Our trade docket today is a tad lighter than yesterday: CRM, SNOW, MARA, AI, AMC (all earnings trades), /MCL, BYND, EBAY, SPX/NDX/Event contract 0DTE's. My intra-day levels: /ES; 5077/5082/5091/5103 to the upside. 5067/5061/5050/5039 to the downside. /NQ; 17990/18043/18073/18117 to the upside. 17906/17853/17793/17692 to the downside. Thanks for following! I'd love it if you could take a quick moment and shoot me a comment on anything in specific that you'd like to see added to the daily report. If there is some data set that you find valuable I'd love to add that to our overview. We had a solid day yesterday. All four of our 0DTE's went out at full profits. Two standard and two event contracts. The SPX event contract was a 25% ROI. MSTR and GOOG were the two sore spots for us. Most important is we got most of our freed up buying power back to work. We are loaded up with a full model portfolio. We have several earnings trades that should be profitable exits for us today. We'll replace those with EBAY and BYND setups for today. Rinse repeat on these earnings trades. The trade docket for today looks like this: /HG, /NG, BA, CRM, GOOG?, LOW, MSTR, NVDA?, SMCI?, U, ZM, SPY/NDX/Event contract 0DTE's, IWM and EBAY and BYND earnings setups, as I mentioned. We are now clinging to a buy signal in the market after yesterdays soft close. This market is still very much a "risk on" enviroment. The last two trading days have presented some weakness in this bull push. Can the sellers continue to push the market down today or will the bulls hold? The 2 hr. candle chart on /ES shows we've been trying (mostly unsuccessfully) to roll over since Feb. 23rd. We've got several earnings trades today but BYND is the most intersting to me. I think we've got a great initial entry setup for it today. Here's the data set on it. Intra-day levels for me: /ES: 5095/5100/5107/5121* (key level. ATH) to the upside. 5081/5072* (key level. low of yesterday)/5047. /NQ: 18059/18091/18110/18140* (key level. recent high) to the upside. 17999/17961/17927/17852* (key support area) to the downside. Today, all eyes are focused on U.S. CB Consumer Confidence data in a couple of hours. Economists, on average, forecast that February CB Consumer Confidence will stand at 114.8, compared to the previous figure of 114.8.

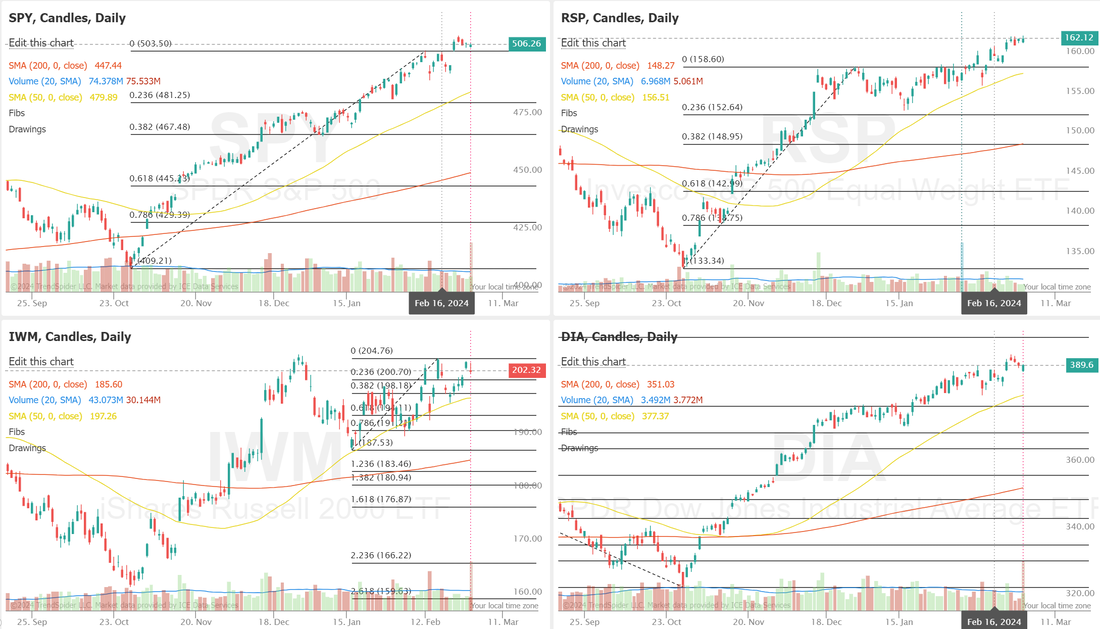

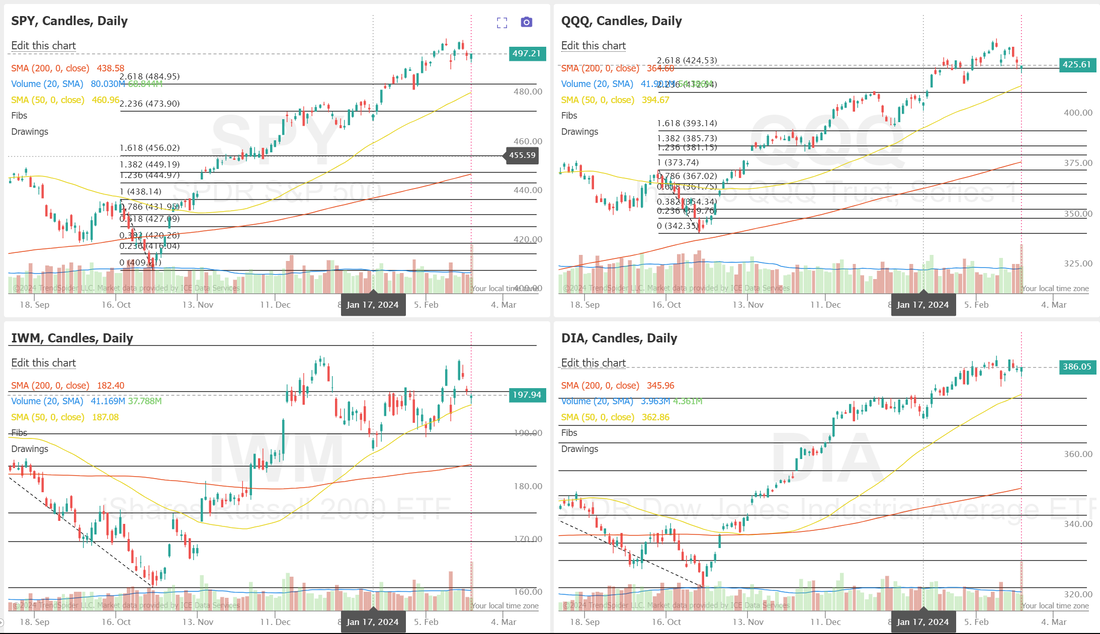

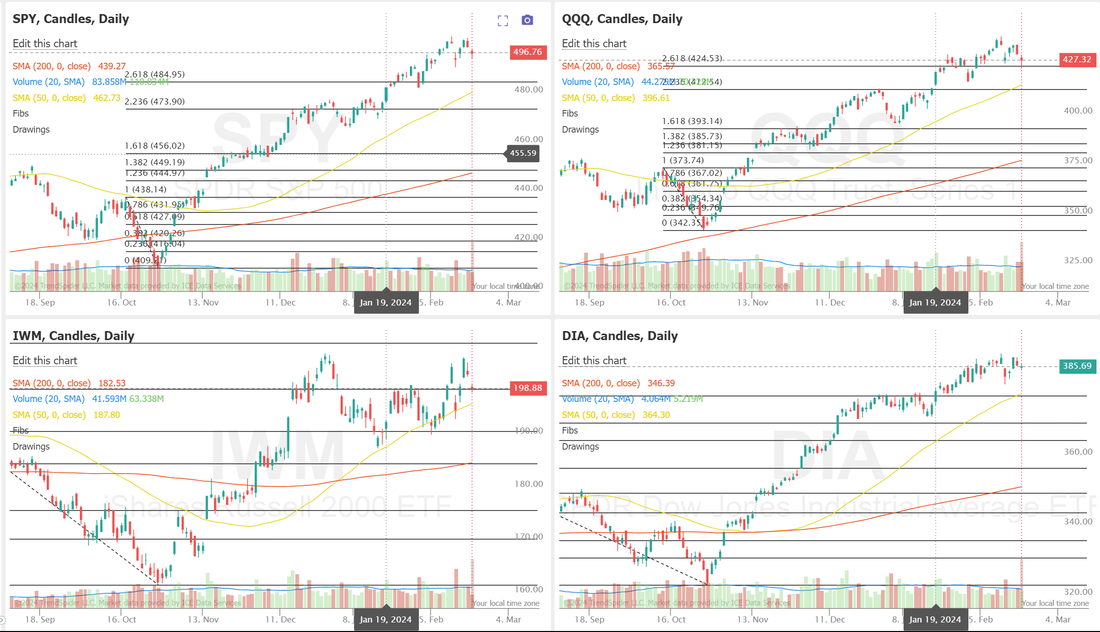

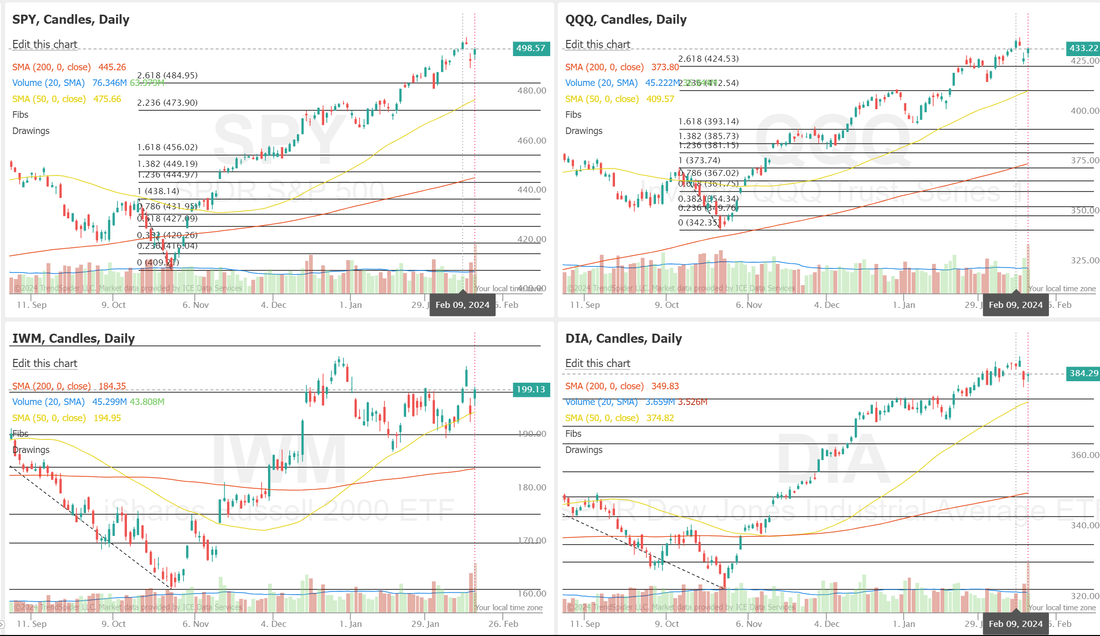

Also, investors will likely focus on U.S. Durable Goods Orders data, which stood at 0.0% m/m in December. Economists foresee the January figure to be -4.9% m/m. The U.S. S&P/CS HPI Composite - 20 n.s.a. will come in today. Economists expect December’s figure to be +6.0% y/y, compared to the previous number of +5.4% y/y. U.S. Core Durable Goods Orders data will also be closely watched today. Economists estimate this figure to come in at +0.2% m/m in January, compared to the previous value of +0.6% m/m. The U.S. Richmond Manufacturing Index will be reported today as well. Economists expect February’s figure to be -4, compared to the previous value of -15. Welcome back to a new week of trading! We finished strong on Friday with a solid, overall day. I needed to be careful with my buying power last week as we awaited the NVDA results so most of my normal positions were small. We have that buying power back this week so it should be business as usual. Mondays are busy for us regardless. The potential trade docket for today is long and we may not get them all done today. /NG, /HG, BA Dragonfly, /MCL, /ZN, PYPL, PLTR, RUT?, FSLR, WYNN, GLD, DIA, DWAC?, /ZC?, VTI, SPY/QQQ, NVDA?, IWM, MSTR, RIVN, Event contract 0DTE, SPX/NDX 0DTE's, CVNA and potential earnings trade setups on ZM, U, LOW. Here's a list of the major, pre-planned economic news catalysts that could be market movers. We had some inflation data and FED speak this week. Monday 26th February 10:00 ET US New Home Sales for January New home sales refer to the number of newly constructed homes that have been sold during a specific time period, typically reported monthly in the United States. This data insights into the overall health of the housing market and can indicate trends in consumer confidence and economic growth. What to Expect Although this data is unlikely to garner a market reaction, rising sales often stimulate job creation and economic expansion, while declines may indicate broader economic challenges or shifts in market conditions. Tuesday 27th February 08:30 ET US Durable Goods January Prelim US Durable Goods represents the change in the value of orders for durable goods from domestic manufacturers in the United States. This economic indicator, reported by the US Census Bureau, serves as a gauge of short-term fluctuations in business investment. Positive changes signify increasing orders, reflecting potential economic growth and heightened confidence among businesses, while negative changes may indicate declining demand or economic uncertainty. What to Expect Greater than expected US Durable Goods data could result in dollar strength and US stock weakness, as this suggests that demand for durable goods could be ignoring the effects of monetary policy from the Fed, and may have implications for other areas of the economy. However, if it comes in lower, that could mean, durable goods is reacting how policymakers desire. 10:00 ET US Conference Board Consumer Confidence for February US Consumer Confidence measures the optimism or pessimism among consumers about the overall economic conditions and their personal financial situations. Compiled and released by the Conference Board through consumer surveys, the index comprises two key components: the Present Situation Index, reflecting current perceptions of economic and employment conditions, and the Expectations Index, indicating consumers’ outlook for the short-term future. A higher index generally signals increased consumer optimism, potentially leading to higher spending, while a lower index may suggest heightened pessimism and potential decreases in consumer spending. What to Expect Considering the current position of the US economy, traders must weigh two scenarios when assessing this data. Lower-than-expected data could indicate consumers are spending less than they otherwise would, potentially helping inflation’s downward trend. Conversely, if sentiment turns out to be higher than expected, this may indicate that consumers are content about the financial climate, which could aid a soft landing. Wednesday 28th February 08:30 ET US GDP Q4 Second Estimate US GDP refers to the Gross Domestic Product. GDP is a key indicator of the economic health and performance of a country and represents the total value of all goods and services produced within the country’s borders during a specific period. The fourth-quarter GDP figure provides insights into the growth rate or contraction of the economy during the final three months of the year. It’s an essential data point for policymakers, economists, and investors, offering information on overall economic activity, consumption, investment, government spending, and net exports. What to Expect Although a strong GDP figure will help cement a soft landing it could also have negative implications for monetary policy. Market participants will need to balance out these risks when assessing what this data means for US stocks and the dollar. 10:30 ET Weekly EIA Crude Oil Inventories The US Weekly Energy Information Administration Crude Oil Inventories report provides information on the total stockpile of crude oil in the United States. It includes data on the changes in crude oil inventories, indicating whether there has been an increase or decrease in the amount of oil held in storage. This report assesses supply and demand dynamics in the oil market and can influence oil prices. What to Expect A significant buildup in inventories may indicate oversupply, putting downward pressure on prices, while a decline may suggest increased demand, potentially impacting prices in the opposite direction. Thursday 29th February 08:30 ET US PCE Price Index for January The US Personal Consumption Expenditures Price Index is a measure of inflation that tracks changes in the prices of goods and services purchased by consumers throughout the US. It is released monthly by the Bureau of Economic Analysis and is considered a key indicator of inflationary trends. The PCE Price Index is closely watched by policymakers at the Federal Reserve, as it helps them assess whether inflation is rising or falling relative to their target. Unlike other measures of inflation, such as the Consumer Price Index (CPI), the PCE Price Index includes data on personal consumption expenditures, which covers a broader range of goods and services and is based on more comprehensive data sources. The basket of goods measured in the PCE report is also variable based on consumer spending habits, making it a better representation of how much more consumers are actually spending on their shopping and services. What to Expect Higher-than-expected inflation indicates that the Fed may need to keep rates higher for longer to bring inflation sustainably back to its 2% target, which would be likely to cause markets to pull back their bets on Fed rate cuts this year. This would cause strength in US stocks, and weakness in the dollar. US Weekly Initial & Continued Jobless Claims The US Initial Jobless Claims report provides data on the number of individuals who filed for unemployment benefits for the first time during the previous week. It serves as an indicator of the labor market’s health, with higher numbers indicating increased layoffs and economic instability, while lower numbers suggest a stronger job market. Continued Jobless Claims, on the other hand, represent the number of individuals who remain on unemployment benefits after their initial claim. What to Expect Employment is one of the Fed’s mandates, however, FOMC officials have mentioned that they do see a higher unemployment rate being in line with their goal back to 2% inflation. This means that Jobless Claims coming in higher than expected, suggesting higher unemployment, would be likely to be read by the Fed as good news for inflation’s return to target. This scenario could cause US stocks to strengthen and the dollar to weaken. Friday 1st March 09:45 ET US S&P Manufacturing PMI February Final The US S&P Manufacturing Purchasing Managers’ Index is an economic indicator that measures the performance of the manufacturing sector. It provides insight into factors such as new orders, production levels, employment, supplier deliveries, and inventory levels. As a diffusion index, a reading above 50 indicates expansion in the sector, while a reading below 50 suggests contraction. The S&P Manufacturing PMI is based on a survey of purchasing managers in the manufacturing industry. What to Expect The markets still seem to think that ‘good news is bad news’ with this report, though it has less weight than its counterpart (The ISM Manufacturing PMI, detailed below) Nonetheless, this means that if the manufacturing PMI comes in above expectations, especially in expansionary territory (50+), then stocks are likely to weaken, and the dollar is likely to strengthen. This is because it is seen as an upside inflation risk, as it indicates there is still strong demand for manufactured goods, despite high interest rates. 10:00 ET US ISM Manufacturing PMI for February The US ISM Manufacturing Purchasing Managers’ Index measures the economic activity and sentiment of manufacturing sector managers. It assesses factors like new orders, production, employment, supplier deliveries, and inventories. The index is compiled from a survey of purchasing managers as a diffusion index, with a reading above 50 indicating expansion and below 50 indicating contraction. The US S&P Manufacturing PMI also measures manufacturing sector activity but uses a different methodology and survey structure. While both PMIs aim to gauge the health of the manufacturing sector, they may differ in their coverage, sample size, and methodology, leading to variations in the reported figures. What to Expect The markets still seem to think that ‘good news is bad news’ with this report. This means that if the manufacturing PMI comes in above expectations, especially in expansionary territory (50+), then stocks are likely to weaken, and the dollar is likely to strengthen. This is because it is seen as an upside inflation risk, as it indicates there is still strong demand for manufactured goods, despite high interest rates. University of Michigan Sentiment February Final The University of Michigan Consumer Sentiment Index, often referred to as the Consumer Sentiment Index or just Consumer Sentiment, is a widely followed economic indicator that measures the confidence of American consumers in the state of the economy. It is based on a survey conducted by the University of Michigan, which gathers data on consumers’ attitudes and expectations regarding their personal finances, business conditions, and overall economic outlook. The index is released monthly and is considered a leading indicator of consumer spending, as confident consumers are more likely to spend money on goods and services, driving economic growth. What to Expect Consumer sentiment is closely watched by markets to assess consumer resilience in a high-interest-rate environment. Elevated sentiment may suggest strong demand, potentially leading to inflationary pressures, but it could also signal consumer resilience, reducing recession fears. In this release, the market focus is on the 1 & 5-year inflation expectations accompanying the sentiment data. Higher inflation expectations may delay Fed rate cuts, affecting US stocks negatively and strengthening the dollar. The expected move on the SPX for the week is 1% and 12% I.V. Not very conducive to option sellers and certainly makes it difficult for us to get back on our daily Theta Fairy trades. This gives us roughly a 100 point trading range target for the week. We have a few earnings trade potential setups today. ZM, U, LOW and also FSLR may provide entries for us today. As you can see, most of the indices we trade and track are at or near all time highs. However, on the /ES futures we are stuck in a tight range around 5,100 and have been since the 22nd. On the /NQ we are lower than we were back on Feb. 12th. There's some decent overhang here. We'll have to see if the bulls can continue the push higher. The resistance levels here are real and it would be impressive if they could turn resistance into support. Intra-day levels for me:

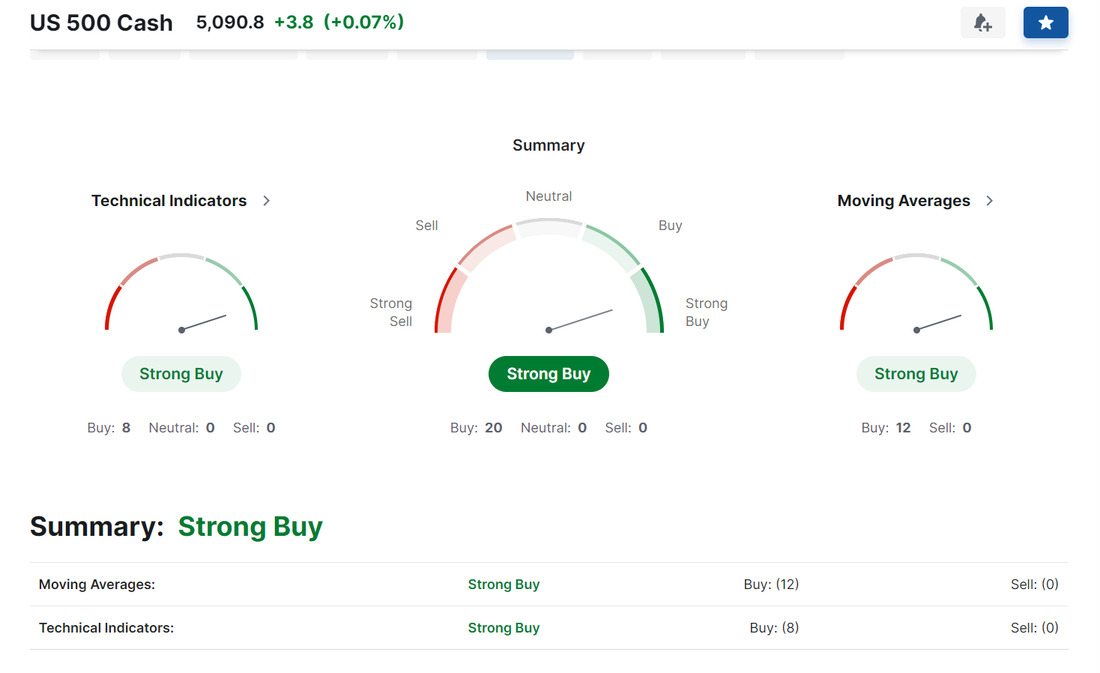

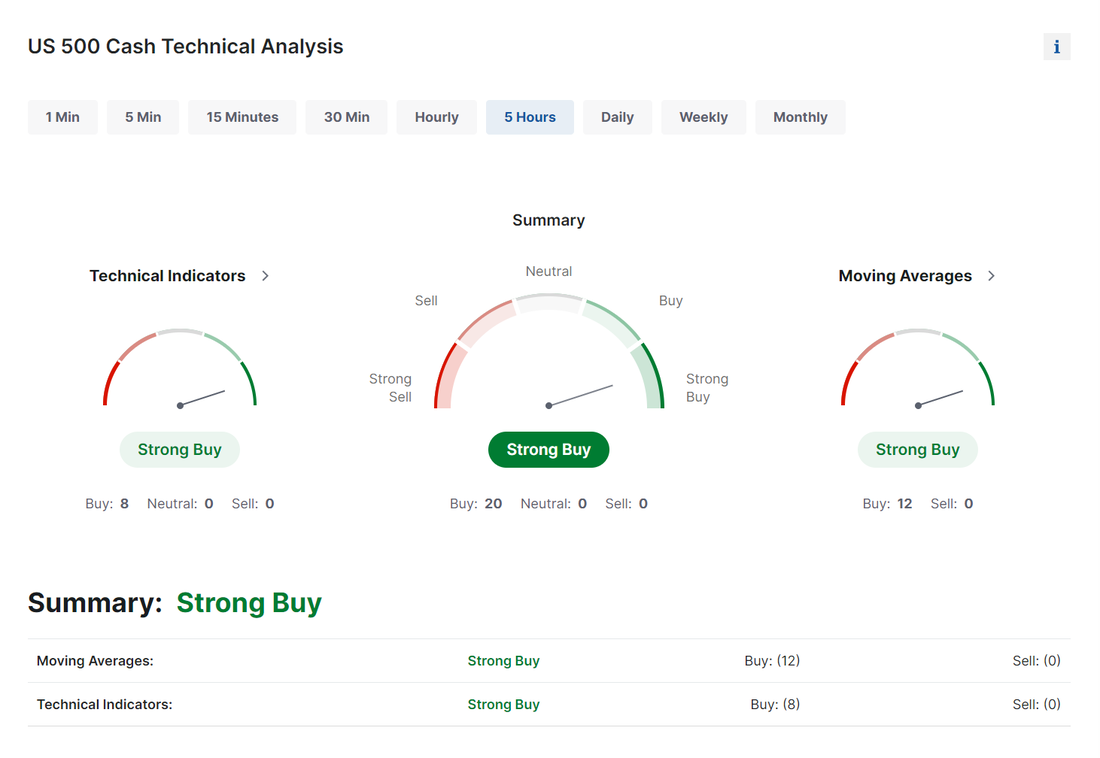

/ES: 5110/5115/5123/5132 to the upside. 5095/5087/5075/5065 to the downside. /NQ: 18111/18270/18380/18523 to the upside. 17920/17850/17699/17587 to the downside. Well, yesterday was an interesting day. We knew the NVDA earnings announcment was going to move things...one way or the other. It certainly did. We measure our success based on the movement of our Net liq (or account value) In theory, we could do 10 trades, 9 are losers and 1 is a winner but, If our net liq goes up, we call it a success. In this regard, yesterday was horrible for me. My net liq got hit pretty good with the NVDA move and yet, our trades, for the most part look solid. There's just a lot of extrinsic sitting out there that needs to move into our pockets. We'll continue to work them today and patiently wait for that theta decay. Markets are full on buy mode now: Oh, and also, congrats... we are back to full "risk on" mode: We don't have any major, planned news catalysts for the day.

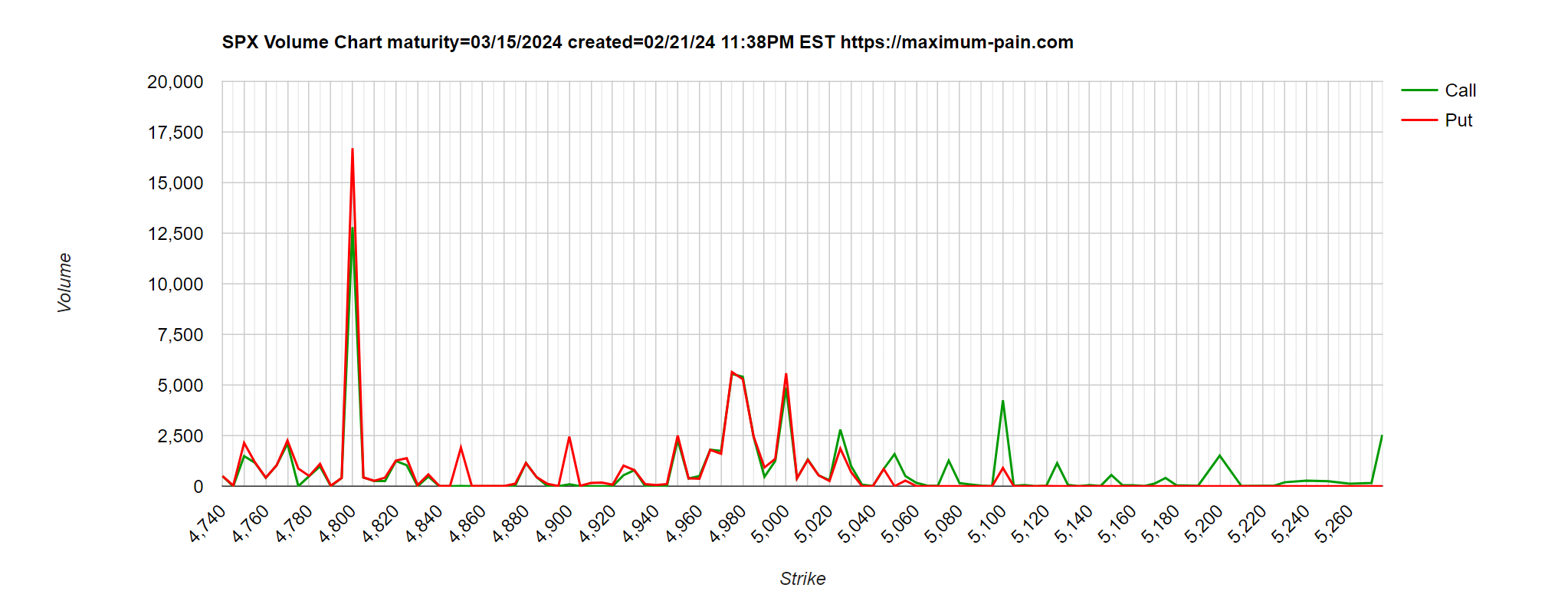

Our trade docket for the day consists of; SPX/NDX/Event contract 0DTE's, /ZN, DIA, GLD, MSTR, NVDA, RIVN, SMCI and some possible additions of our normal weekly credit strangles we took off earlier this week. The futures are slightly green. Maybe a little hangover from the NVDA party of yesterday, which was the biggest one day rally we've had this year. Levels for me today: /ES: 5108/5118/5128/5135 to the upside. 5095/5091/5072/5067 to the downside /NQ: 18101/18165/18327/18377 to the upside. 18067/18019/17951/17907 to the downside Welcome back! Yesterday was another picture perfect day for us. Two of our three 0DTE's hit for profit and even with letting our NDX go to loss I had an almost $10,000 bump in my net liq. The last two days have been stellar for us. We have a ton of earnings trades we put on with NVDA, RUN, LCID, ETSY, RIVN and they all look set to add to our profits. We also had some of our bigger trades come into line quite nicely as well. The DIA and Gold ladder trades both look great and Nat gas, GOOG and MSTR all improved as well. While the earnings results were somewhat mixed, the one that matters...NVDA, the one that moves the markets reported and moved higher. That was enough to move the futures higher and flipped our temporary "sell" mode right back to "buy". While the futures shift was big it wasn't enough to set in an "all clear" on the bullish technicals. While yesterdays reversal of fortune in the futures. coming off the NVDA high, was a solid move, it simply puts us back to where we were two weeks ago. We do have PMI and Jobless claims this morning. We also have oil inventory out today: 10:30 ET US Weekly EIA Crude Oil Inventories The US Weekly EIA Crude Oil Inventories report provides data on the stockpile of crude oil held by US commercial firms over a specific week. It is released every Wednesday by the Energy Information Administration and is monitored to gauge supply and demand dynamics in the oil market. This report helps market participants assess the balance between supply and demand, which can impact trading decisions and energy policy considerations. What to Expect Changes in crude oil inventories can influence oil prices, as a buildup suggests oversupply or weakening demand, while a drawdown indicates the opposite. We'll look to add to our oil ladder later today. Open interest walls have shifted a bit with the upside wall still around 5000 and smaller, multiple put side walls around 4800. It should be an interesting day with our 0DTE setups and Scalping.

Intraday levels for me: /ES: 5055/5067/5071/5089 to the upside. 5044/5029/5016/5001 to the downside. /NQ: 17908/17976/18029/18066 to the upside. 17810/ 17773/ 17720/ 17642 to the downside. Trades on the docket for today: CCL, DIA, ETSY, GCT, GOOG, IWM, LCID, META, NVDA, RIVN, RUN, SMCI, SPX/NDX/Event contract 0DTE's. We had a rock solid day yesterday. My net liq bumped by $5,000 dollars. Most everything we touched worked. We had four, yes FOUR successful 0DTE setups. Two traditional setups with NDX/SPX and two event contracts. Those are just exceptional products to trade and we are looking to expand those more. Scalping brought in another $850 dollars so it was just one of those perfect days. Today is an interesting day. We've got FOMC minutes from the Jan. meeting being released today as well as the much anticipated and awaited NVDA earnings after the close. We've pulled out bond ladders in anticipation of the FED release and will reapply them tomorrow. Wednesday 21st February 14:00 ET FOMC Meeting Minutes for the January 31st Meeting The FOMC (Federal Open Market Committee) Meeting minutes provide comprehensive records of the discussions and decisions undertaken during the committee’s meetings, which are pivotal in determining U.S. monetary policy. These minutes detail deliberations on economic indicators such as inflation, employment, and overall economic growth, guiding the FOMC’s decisions on interest rates and other monetary policy tools. Released approximately three weeks following each meeting, the minutes offer insights into the perspectives of committee participants, including governors and Federal Reserve Bank presidents, outlining their assessments of economic conditions and the rationale behind any policy adjustments. What to Expect If the deliberations have hawkish undertones, or mention holding rates for longer than anticipated, this could result in Dollar strength and US stock weakness. On the other hand, talks on rate cuts may result in the inverse occurring. Any comments from Fed officials that contradict the current projections held by members and published in the SEP could also affect the markets. Technicals are now becoming more intrenched with sell signals NVDA is looking for about a 10% Move after hours Pre-Market U.S. Stock Movers Palo Alto Networks Inc (PANW) tumbled about -23% in pre-market trading after the cybersecurity company cut its full-year revenue and billings guidance. SolarEdge Technologies Inc (SEDG) plunged over -15% in pre-market trading after the company issued lower-than-expected Q1 revenue guidance. Teladoc Inc (TDOC) slumped more than -20% in pre-market trading after the telehealth and telemedicine services provider reported mixed Q4 results and provided disappointing Q1 and FY24 guidance. Keysight Technologies Inc (KEYS) slid over -5% in pre-market trading after the company offered below-consensus Q2 guidance. Amazon.com Inc (AMZN) gained more than +1% in pre-market trading after S&P Dow Jones Indices said on Tuesday that the e-commerce giant will replace Walgreens Boots Alliance Inc. in the Dow Jones Industrial Average effective next week. The Wendy’s Co (WEN) fell over -1% in pre-market trading after JPMorgan downgraded the stock to Neutral from Overweight with a price target of $19. While markets continue to stall here, and most indices are flashing sell, they haven't really rolled over yet. I don't usually issue price levels on FOMC days or days like this in general, be it NFP or CPI etc. These days are driven by Algos and computerized high frequency trading. Today we have the added catalyst of NVDA which won't come until after the bell. The bias is clearly bearish. #1. I believe the FOMC minutes will reveal that we aren't ready for a rate cut yet but may confirm that we can still get three in this year. #2. I believe NVDA will continue on its recent path of "buy the rumor, sell the news" as it's done so often after earnings. Both of these could be bearish.

We only have LYFT, MSTR?, NVDA?, ORCL, Event Contract 0DTE on the trade docket today. After NVDA earnings the floodgates will open back up for most of our "normal" trade setups. Tomorrow we'll be looking at /MCL, /ZN, PYPL, PLTR, RUT, FSLR, WYNN, GLD, DWAC, SMCI, /ZC, VTI setups again. Welcome back traders! I hope everyone had a nice break. We are back at it once again! Last week was solid for us. My net liq was up $6,000 and a good portion of that was our scalping efforts. We'll be back in the live scalping room today if you want to join us. The last few trading days have flipped us back to bearish trends now: We are looking at about a 1.1% expected move in the SPX this week with the shortened holiday trading sessions. Potential news catalysts for this week: Tuesday 20th February 08:30 ET Canadian CPI for January The Canadian Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by consumers for a basket of goods and services. It is one of the most widely used indicators for tracking inflation in Canada. The CPI is released monthly by Statistics Canada, the country’s national statistical agency. It covers a wide range of goods and services, including food, housing, transportation, clothing, and recreation, among others. What to Expect The Bank of Canada want CPI to continue ticking down to the target, therefore, any data on inflation coming in hotter than expected will most likely cause a positive reaction in the Canadian Dollar send it higher while Canadian stocks may take a hit. Wednesday 21st February 14:00 ET FOMC Meeting Minutes for the January 31st Meeting The FOMC (Federal Open Market Committee) Meeting minutes provide comprehensive records of the discussions and decisions undertaken during the committee’s meetings, which are pivotal in determining U.S. monetary policy. These minutes detail deliberations on economic indicators such as inflation, employment, and overall economic growth, guiding the FOMC’s decisions on interest rates and other monetary policy tools. Released approximately three weeks following each meeting, the minutes offer insights into the perspectives of committee participants, including governors and Federal Reserve Bank presidents, outlining their assessments of economic conditions and the rationale behind any policy adjustments. What to Expect If the deliberations have hawkish undertones, or mention holding rates for longer than anticipated, this could result in Dollar strength and US stock weakness. On the other hand, talks on rate cuts may result in the inverse occurring. Any comments from Fed officials that contradict the current projections held by members and published in the SEP could also affect the markets. Thursday 22nd February 08:30 ET US Weekly Initial & Continued Jobless Claims The US weekly initial jobless claims refer to the number of individuals who file for unemployment benefits for the first time during a given week. These claims are reported by the US Department of Labor and are considered a key indicator of the health of the labor market. A higher number of initial jobless claims indicates increased layoffs and potential economic distress, while a lower number suggests a healthier job market. What to Expect If Jobless Claims comes in noticeably above forecast, you could see US stocks strengthen and Dollar weaken as market participants view a potential softening labor market despite it being one week of data. 09:45 ET US S&P Manufacturing & Services PMI February Prelim The US S&P Manufacturing and Services Purchasing Managers’ Index are monthly indicators of economic health for the manufacturing and services sectors, respectively. They are based on surveys of purchasing managers in these sectors and provide insights into business conditions, including new orders, production, employment, supplier deliveries, and inventories. As a diffusion index, a PMI above 50 indicates expansion, while below 50 suggests contraction. These indices are watched by economists, policymakers, and investors for gauging the overall health and direction of the US economy. What to Expect While manufacturing has been swinging between expansion and contraction for the last few months, market participants are looking to the Services sector, as Fed officials have noted that we need to see cooling in the services sector as it is acting as a potential headwind to disinflation. A higher-than-expected read in these PMI reads could point toward the ‘higher for longer’ narrative, which would be likely to cause strength in the dollar and weakness in US stocks. 10:00 ET US Existing Home Sales for January US Existing Home Sales is a monthly report released by the National Association of Realtors that provides data on the sales of previously owned homes, excluding newly constructed ones. It measures the number of completed transactions for single-family homes, townhomes, condominiums, and co-ops. This data is an indicator of the health of the housing market and the overall economy, as it reflects consumer confidence, affordability, and the availability of mortgage financing. What to Expect Changes in existing home sales can impact various sectors, including real estate, construction, banking, and consumer spending. Though unlikely to move the markets without a large deviation, it is a good measure of consumer sentiment, as a home is one of the largest investments that the average consumer will make. Nonetheless, a higher-than-expected Existing Home Sales number could indicate that consumers are not phased by rising interest rates, creating upside inflation risks, which in theory, would be bullish for the dollar and bearish for US stocks. 10:30 ET US Weekly EIA Crude Oil Inventories The US Weekly EIA Crude Oil Inventories report provides data on the stockpile of crude oil held by US commercial firms over a specific week. It is released every Wednesday by the Energy Information Administration and is monitored to gauge supply and demand dynamics in the oil market. This report helps market participants assess the balance between supply and demand, which can impact trading decisions and energy policy considerations. What to Expect Changes in crude oil inventories can influence oil prices, as a buildup suggests oversupply or weakening demand, while a drawdown indicates the opposite. The two big focuses for this shortened week will be FOMC mins. release on Weds. and NVDA's much anticipated earnings report, Weds. after the close. We are locked and loaded for both of those events. We have /MCL, /ZN, DIA, GLD, IWM, MSTR, ORCL, PFE, SPX/NDX/Event contract 0DTE's all on the trade docket for today. San Francisco Fed President Mary Daly said Friday that the Federal Reserve should take its time before implementing interest rate cuts, citing the risks associated with the possibility that certain factors currently pushing down inflation could peter out or reverse. At the same time, she said an expectation of three rate cuts was a “reasonable baseline” for the monetary policy outlook this year. Also, Atlanta Fed President Raphael Bostic said he supports initiating rate cuts at some point this summer, but he indicated that more positive inflation data could warrant an earlier start. “A year ago, six months ago, I was in the fourth quarter. So, we’ve seen tremendous progress, and I’m hopeful that that continues. If that continues, I’ll be willing to pull it forward even further,” Bostic said in an interview on CNBC. In addition, Richmond Fed President Thomas Barkin stated that the latest inflation figures highlight why policymakers want to see more data before cutting interest rates. Meanwhile, U.S. rate futures have priced in an 8.5% probability of a 25 basis point rate cut at the conclusion of the Fed’s March meeting and a 34.0% chance of a 25 basis point rate cut at the May FOMC meeting. Fourth-quarter earnings season winds down, but several notable companies are due to report this week, including NVIDIA (NVDA), Walmart (WMT), Home Depot (HD), Palo Alto Networks (PANW), Medtronic (MDT), Analog Devices (ADI), Intuit (INTU), and Booking (BKNG). It will be interesting to see if NVDA earnings and FOMC minutes can combine to acclerate this slight bearish action we are getting. The market is certainly trying to roll over here...if the bulls will let it. Intra day levels for me:

/ES: 5013/5023/5030/5041 to the upside. 4995/4982/4969/4962 to the downside. /NQ: 17715/17790/17833/17905 to the upside. 17627/17612/17549/17488 to the downside. We had another solid day yesterday. We made money on all three 0DTE setups including the event contract. We are still in the SPX call roll. NVDA (of all things!) was our biggest help yesterday. We are just three trading days away from NVDA earnings, which should bring some relief to that setup. We are still firmly in the bullish technical camp: We do have some potential news catalysts today: Friday 16th February 08:30 ET US PPI The US Producer Price Index measures the average change over time in the selling prices received by domestic producers for their output. It is an economic indicator that reflects the direction of inflationary pressures at the producer level. PPI is used to assess inflation trends in the early stages of the production process, providing insights into potential changes in consumer prices, making it a leading indicator. What to Expect Higher-than-expected producer prices can point to the potential for these price increases on the supply side to be passed down to the consumer side and become reflected in CPI, which would be a headwind for the Fed’s goal of returning inflation to target. This would be likely to cause weakness in US stocks and strength in the dollar, as traders would likely push back bets on when the Fed would start cutting interest rates this year. US Housing Starts US Housing Starts is an economic indicator that measures the number of new residential construction projects that have begun on a monthly basis. The data includes both single-family and multi-family housing units. Housing starts are considered a key indicator of economic health, as increased construction activity is associated with economic growth. Rising housing starts can signify a robust real estate market and increased consumer confidence. Conversely, a decline in housing starts may indicate economic challenges or a slowdown in the housing sector. What to Expect This data is unlikely to move the markets on its own unless there is a large deviation from expectations. However, it can still paint a picture of consumer confidence, as higher-than-expected housing starts would indicate high demand for homes, which is one of the largest investments the average American will make. 10:00 ET University of Michigan Sentiment The University of Michigan Consumer Sentiment Index measures the confidence of US consumers in the economy. It is based on a survey that assesses consumers’ perceptions and expectations regarding their personal finances, business conditions, and overall economic prospects. A higher sentiment index indicates increased confidence, which can positively impact consumer spending and economic activity, while a lower index may suggest reduced confidence and potential economic caution. What to Expect The last University of Michigan report was received as ‘Fed Friendly’ because it showed higher than expected consumer sentiment but also showed downward revisions to consumers’ 1- and 5-year inflation expectations. This outlined the case for a soft landing, with consumers having confidence in the economy, as well as the view that inflation was on track to reach the Fed’s target. A result like this again would be likely to cause strength in US stocks and weakness in the dollar, as it may cause traders to push forward their bets on Fed interest rate cuts this year. FED speak We also have two FED members speaking today. Price action is most decidedly bullish but it also puts us right back up to resistance. Can the indices push above this substantive level? The trade docket for today is the same as most Fridays. We will be looking to book profits where we can and clean up the portfolio for the week. CCL, COIN, DASH, DKNG, IWM, LYFT, MSTR, NDX/SPX/Event contract 0DTE's, QQQ, ROKU, DWAC, VTI all on the potential trade docket for today. All our earnings trades look solid going into the open. Intra-day levels for me: /ES: 5066/5089/5101/5124 to the upside. 5047/5029/5018/5008 to the downside. /NQ: 18071/18167/18254/18327 to the upside. 17969/17922/17852/17820 to the downside. We are headed into a three day trading weekend! Enjoy the time off!

Yesterday ended up being a solid green day for us but could have been so much better. We made money on all three of our 0DTE setups but all three could have yielded so much more. We may have gotten the answer to our question posed after the CPI dump. Is this a 'buy the dip" or "sell the rip" event? I said the way we traded yesterday and maybe more importantly, how we closed the day would be the tell. Well...it certainly looks like it was a "buy the dip" opportunity and we are back to full on bullish. That's important for us because we need to re-apply our VTI swing trade. The sell rating only lasted a few hours. The neutral rating only lasted a day. We are now firmly back to bullish price action. All our major indices continue to trudge higher: We have a fairly busy trade docket today: IWM, LYFT, META, ORCL, PFG, QQQ, SPX/NDX/Event contract 0DTE's, SPY, TWLO, WYNN?, /MCL?, /ZN?, DIA, GLD and multiple earnings potentials ROKU, DKNG, COIN, DASH, AMT, and last but not least, our VTI swing trade. Our two earnings trades from yesterday (TWLO and CSCO) both look good for profits today. We have jobless claims as well as earnings and retail sales numbers to drive todays market: Thursday 15th February 08:30 ET US Retail Sales US Retail Sales is a metric that quantifies the total revenue generated by retail establishments in the United States, encompassing various sectors like automotive, electronics, clothing, and general merchandise. Compiled and reported monthly by the US Census Bureau, this data serves as an indicator of consumer spending patterns, offering valuable insights into the health of the economy. What to Expect Rising retail sales are generally associated with economic expansion and increased consumer confidence, while a decline may signal an economic contraction. As this may have implications for the future of inflation, a weak reading may result in US stocks strengthening and the dollar weakening. US Weekly Initial & Continued Jobless Claims The US Weekly Initial Jobless Claims and Continued Jobless Claims are economic indicators that provide insights into the labor market’s health. Initial Jobless Claims represent the number of individuals who filed for unemployment benefits for the first time during a specific week. It serves as an indicator of the pace of layoffs and helps economists assess the overall health of the job market. A lower number of initial claims suggests a stronger job market. Continued Jobless Claims reflect the number of individuals who continue to receive unemployment benefits. It gives an indication of ongoing unemployment and the ability of workers to find new employment. A decreasing trend in continued claims may suggest improving employment conditions. What to Expect If jobless claims come in higher than expected, it could indicate weakness in the jobs market, which could be a potential downside inflation catalyst. In this case, stocks would likely strengthen and the dollar would weaken, as it could be an indicator that inflation will come down closer to the Fed’s target and push forward bets on rate cuts this year. However, traders are also attentive to the risk of recession, and if unemployment is too high, this could be an early sign of a potential hard landing if continued across multiple weeks. We also have some speakers today but that shouldn't be too much of a potential catalyst: Speakers 08:50 ET BoE’s Mann speaks as a panellist at the 40th Annual National Association for Business Economics (NABE) Economic Policy Conference in Washington on “Labor, investment and technology: assess the drivers of productivity growth”. 13:00 ET ECB’s Nagel gives a speech on Stability and prosperity in Europe at Munich Europe Conference. 13:15 ET Fed’s Waller gives remarks on the dollar’s international role at the Global Interdependence Center and University of the Bahamas Conference in Nassau, Bahamas. Both text and Q&A are expected. 13:40 ET RBNZ’s Orr will speak about “the changing drivers of inflation over the past couple of years and the shift from transitory to more stubborn underlying inflation” at NZ Economics Forum. Bitcoin continues to soar. Pulling a lot of the crypto space with it. On the subject of the never ending FED watch, we got the following statements yesterday: Chicago Fed President Austan Goolsbee stated on Wednesday that even if inflation data ticked slightly higher for a few months, it would still align with the trajectory toward the central bank’s 2% target, cautioning against delaying rate cuts for too long. “Rate cuts should be tied to confidence in being on a path toward the target. More data like we have seen in the past six months would indicate that path, but that’s probably too stringent,” Goolsbee said in a prepared speech at the Council on Foreign Relations in New York. At the same time, Fed Vice Chair for Supervision Michael Barr stated that U.S. policymakers need to see more data indicating inflation is returning to target levels before considering lowering interest rates. Meanwhile, U.S. rate futures have priced in a 10.5% chance of a 25 basis point rate cut at the conclusion of the Fed’s March meeting and a 36.9% chance of a 25 basis point rate cut at May’s monetary policy meeting. Intra-day levels for me:

/ES: 5038 on the upside and 5017 on the downside. This is a very tight "chop zone" for me today. Anything inside this range has no directional bias confirmation to me. 5038/5066* (yesterdays high) /5098/5116 to the upside. 5017/4986/4966/4937* (recent low) to the downside. /NQ: 17928/17965/18019/18069 to the upside. 17873/17837/17795/17743 to the downside. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |