|

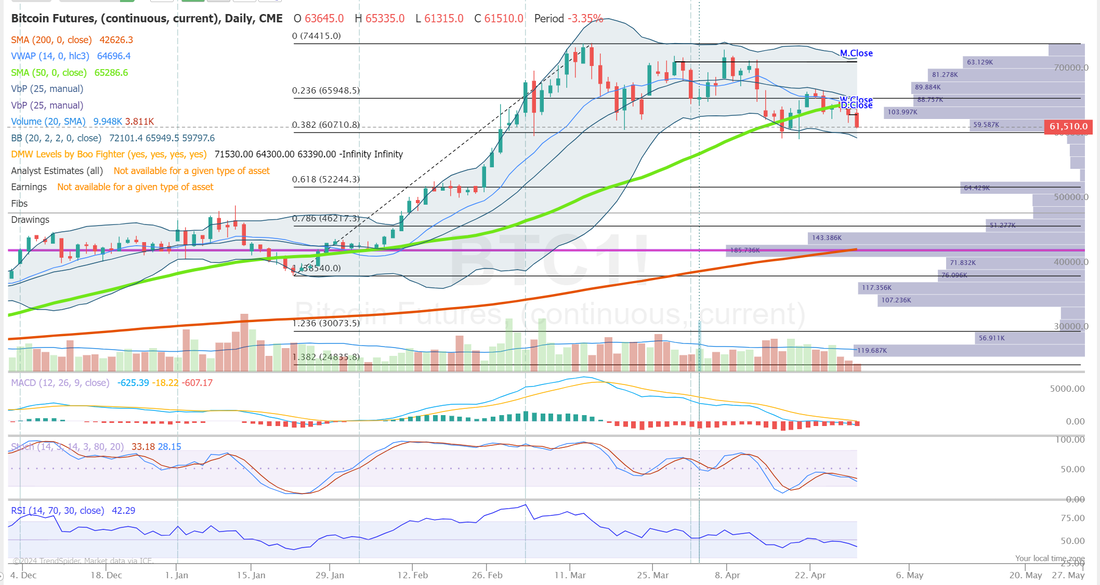

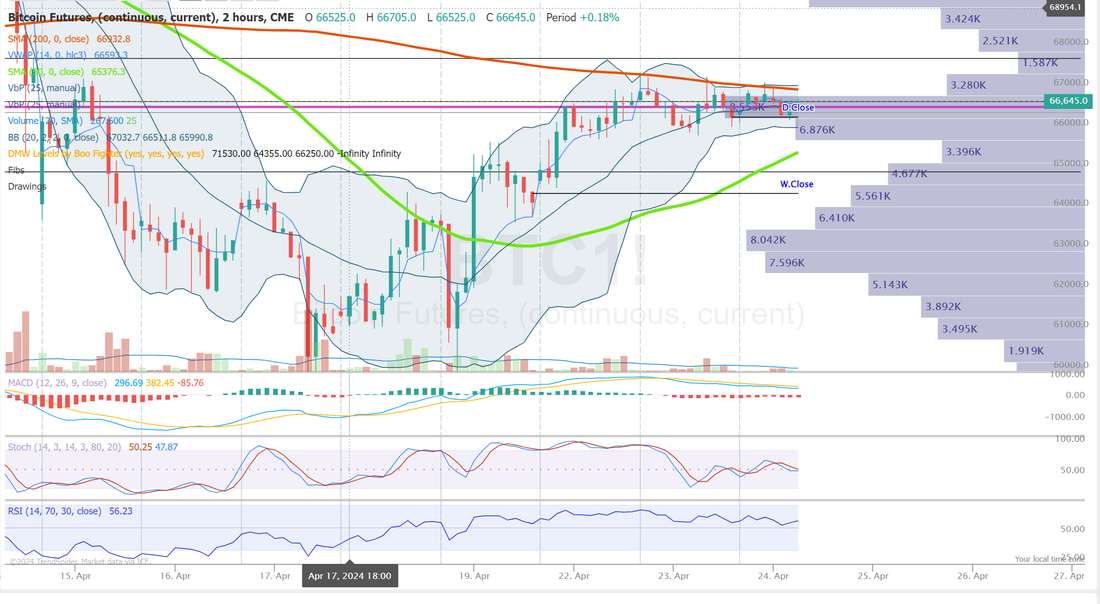

Every once in a while, I find so much gratitude for what trading has provided me in my life. Yesterday I had a friend need some help so I was away from my computer most of the day but I took my laptop and after a few stops by the side of the road, we were still able to get most of our trades done and all four 0DTE's. They all made money. SPX 4%. NDX 12% Bitcoin 11% and Event contract NDX 4%. All told, we deployed about 11k of capital for $1,090 of total profit. Lets look at the market: Buy mode is still in place. All four of the indices we trade are trying to continue this push higher. The news catalysts for the day: Sentiment Stock markets fell and the dollar rose on the last day of the month amid concerns that the Federal Reserve would maintain its hawkish messaging at its meeting on Wednesday. The euro outperformed, and the region’s government bonds fell, after data showed that the Bloc’s largest economies performed better than expected in Q1. The yen fell in line with its peers. Docket 08:30 ET Canadian GDP MoM for February Median Forecast: 0.3% | Prior: 0.6% | Range: 0.6% / 0.2% 10:00 ET US CB Consumer Confidence for April Median Forecast: 104 | Prior: 104.7 | Range: 108.5 / 101 Earnings 16:00 ET Amazon Q1 2024 Earnings Est Rev: $142.57B Est EPS: $0.82 16:05 ET Starbucks Q1 2024 Earnings Est Rev: $9.13B Est EPS: $0.80 16:15 ET AMD Q1 2024 Earnings Est Rev: $5.44B Est EPS: $0.61 Our trade docket for today: PYPL, MSTR, AMZN, AMD, /MCL?, PARA, SBUX? SPX/NDX/Event contract NDX/Bitcoin 0DTE's. Right now all signs point bullish but we do have FOMC and NFP coming up this week. I belive those will both be potential catalysts to the downside. I'm leaning bearish for the rest of the week. Intra-day levels for me: /ES; 5155/5171/5194/5230 to the downside. 5131/5122/5104/5072 to the downside. /NQ; 17927/17948/18028/18185 to the upside. 17865/17841/17774/17729 to the downside. Bitcoin; 64,050 is consolidation. 71383 is resistance. 60564 is a cliff of support. If that breaks the next support is all the way down at 52,029. We'll be in our scalping room today. Lets see if we can get another profitable session under our belt. Have a great day folks!

0 Comments

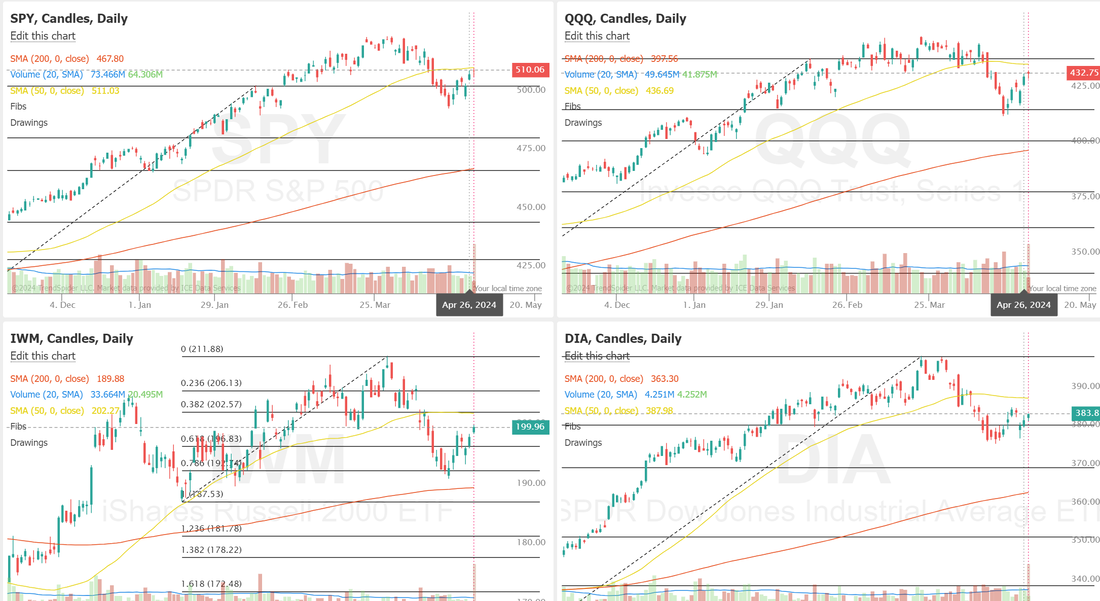

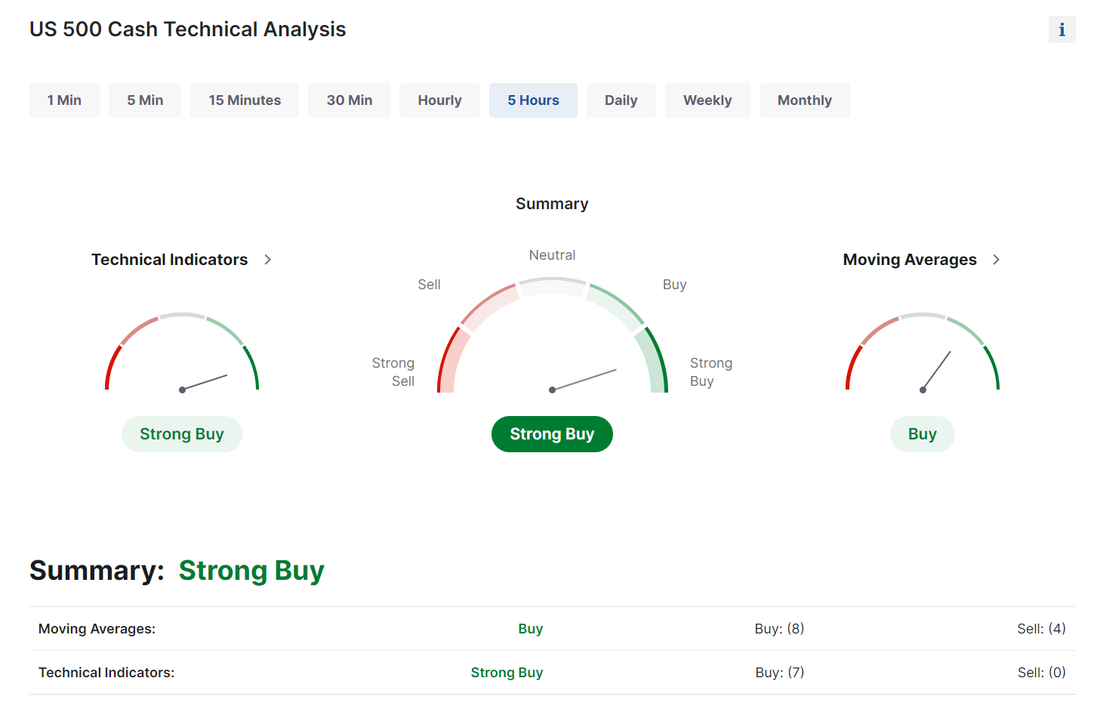

Good Monday to you all! Welcome back to a new week of trading. Markets are working a bullish retrace right now. The next target for the indices is their respective 50DMA (yellow line) This will be the next big test for this rebound attempt. We've got some decent I.V. to start the week. We've had limited ability to get our daily Theta fairy trades on. We may get some more opportunities this week. Our 1DTE /NQ trade has continued to work well. We start the day off today already booking our profit there. There's not too much on the new docket today: Stocks rose on earnings optimism as traders anticipated a busy week for business reporting. The yen rallied after reaching its lowest level in 34 years. With Apple and Amazon set to report in the coming days, investors will be looking for further proof that large technology earnings will keep equities rising. S&P 500 futures rose 0.1% on Monday. Tesla’s stock rose 8% in premarket trade after passing regulatory barriers to launch its driver-assistance technology in China. Docket 11:30 ET US sells $70 bln 3-Month Bills US sells $70 bln 6-Month Bills Speakers 11:00 ET ECB’s Muller Speaks 15:20 ET ECB’s Vice President de Guindos gives remarks at a dinner at the Royal Automobile Club organised by Euro50 Group in London, UK If you'd like access to a spread sheet that lists all the actionable news items for this week, copy and past here: https://docs.google.com/spreadsheets/d/1ISkEMJc_4CjPyC_jYSDHBTrpxmE1oGErFR_qoaDN2Ek/edit#gid=938335859 My lean today is bullish: Trade docket for today: /MCL?, DIA, GOOG, SPY/NDX/Event contract NDX/Bitcoin 0DTE's, NVDA, ORCL, PFE, PLTR, FSLR, WYNN, IWM, CRM, PYPL, SHOP, SOFI? Intra-day levels for me: /ES; 5146/5161/5176/5194 (200 period MA on 4 hr. chart) to the upside. 5137/5130/5120/5114 to the downside. /NQ; 18028/18176/18325/18449 to the upside. 17828/17762/17707/17631 to teh downside Bitcoin: 65833 is consolidation area. 71612 is first resistance. 74382 is the big resistance level. 60776 is key support. If that breaks the next support is all the way down at 52107. We have one potential earnings play for today: PARA. Have a great week folks!

Welcome to Friday traders! We had a decent week this week. We've had a few trades we needed to chase, which is pretty much every week but overall, we brought in some good cash flow. Yesterday was another stellar day for our scalping program. We scalped for 46 min. and did seven trades for a total of $1,035 profit on $4,794 of capital. If you're looking for an extra $50,000-$100,000 a year of income (depending on if you use 5k or 10k of capital), working part-time, a couple hours a week, scalping may be for you. Thats what we are on pace for over the last year. All four of our 0DTE's hit for us yesterday. The Bitcoin 11% return wasn't the biggest dollar amount but we are still finding that particular 0DTE setup to be one of the best risk/reward opportunites out there. On our four 0DTE setups we used about 16k of capital for a $2,350 overall profit. Unfortunately our NDX debit call spread cover didn't hit and we rolled it to Monday. We also have our MSTR trade today that will need some work. Our NVDA trade hurt us Weds. but came roaring back yesterday. That particular trade has a lot of leverage in it so the daily swings tend to be large. June S&P 500 E-Mini futures (ESM24) are up +0.63%, and June Nasdaq 100 E-Mini futures (NQM24) are up +0.86% this morning as upbeat quarterly results from tech titans Alphabet and Microsoft boosted sentiment, while investors geared up for the release of the Fed’s preferred inflation gauge. Alphabet (GOOGL) surged over +11% in pre-market trading after the Google parent reported Q1 results that easily topped analysts’ expectations, declared its first-ever dividend of $0.20 per share, and announced an additional $70 billion buyback. Also, Microsoft (MSFT) climbed more than +3% in pre-market trading after the tech giant reported stronger-than-expected Q3 results. We put a new pairs trade on with TSLA short/ META long. We have found these pairs trades to be some of the very best risk/reward setups you can find. It's difficult to find pure arbitrage trades. Trades that aren't effected if the market crashes or soars. It doesn't matter what the market does. It's simply a convergence/divergence arbitrage play. The U.S. Department of Commerce’s preliminary reading on Thursday showed that the U.S. economy grew at a +1.6% annualized rate in the first quarter, weaker than expectations of +2.5%. At the same time, the U.S. Q1 core personal consumption expenditures price index picked up +3.7%, stronger than expectations of +3.4%. Also, U.S. pending home sales climbed +3.4% m/m in March, stronger than expectations of +0.3% m/m. Finally, the number of Americans filing for initial jobless claims in the past week fell -5K to a 2-month low of 207K, stronger than expectations of 214K. “[The GDP] report was the worst of both worlds: economic growth is slowing, and inflationary pressures are persisting. The Fed wants to see inflation start coming down in a persistent manner, but the market wants to see economic growth and corporate profits increasing,” said Chris Zaccarelli at Independent Advisor Alliance. Meanwhile, U.S. rate futures have priced in a 2.9% chance of a 25 basis point rate cut at May’s policy meeting and an 11.3% chance of a 25 basis point rate cut at the June FOMC meeting. Our trade docket for today is the same as every Friday. We look to de-risk. Book profits. Get our buying power back so we can do it all again next week. GOOG, INTC, MSFT, SPX/NDX/Event contract NDX/Bitcoin 0DTE's, NVDA, SNAP, XBI My lean today is bullish: Intra-day levels for me: /ES; 5133/5165/5184/5210 to the upside. 5107/5098/5065/5045 to the downside. /NQ; 17825/17919/18026/18191 to the upside. 17709/17630/17505/17419 to the downside. Bitcoin; 65935 consolidation zone. 71487 resistance. 60506 support. Have a great weekend folks. I'll see you back in the trading room Sunday evening. Our premium for more Theta fairys seems to be gone for now but the 1DTE /NQ trade seems to be back with the proper safety net. We made a whopping $40 dollars on todays but the opportunity is still there.

Good morning traders! Yesterday was a mixed bag for me. My net liq got dragged down because of our MSTR an NVDA positions but our 0DTE's continue to rake in the cash. Our NDX brought in a whopping $3,900 profit on 8k of capital. Our SPX hit for $870 profit on $4,300 of capital. Our event contract NDX hit for a 5% ROI or $50 dollars profit and our BTC trade narrowly hit the profit zone of 5% or $48 dollars. Just shy of a $5,000 profit day with all four combined. Our NDX today looks poised for more profits. We could easily be over $110,000 of documented profits YTD today on NDX. Our SPX has added over $35,000 of documented profits and could be over $40,000 by the end of the month. Add in our daily Event contract NDX and Bitcoin 0DTE's, which we put about $1,000 of capital into each and we are close to $155,000 dollars of profit YTD on our 0DTE setups. We use, on average, about $15,000-$20,000 a day to generate this. Add to this our scalping twice a week, which is tracking for over $50,000 of documented profits using $5,000 of capital. Next year I'll be going to $10,000 of capital scalping and shooting for $100,000 of profits. With just these two strategies we are annualizing out to close to a half million dollars of profit this year. Its always foolish to extrapolate out into the future that far as we never know what it holds but our results speak for themselves. Are we just amazing traders? Do we have better research then everyone else? I doubt it. I truly believe its all about the setups you use. What's happening in the market today? Sentiment Technology companies led falls in US market futures this morning, as Meta’s poor forecast highlighted the danger of volatility during a high-stakes earnings week. The stakes for tech titan profits are high following Wall Street’s record-breaking run fueled by the mania surrounding artificial intelligence. The market’s reaction demonstrates how expectations of the boost from AI to profitability at firms developing the technology may have run ahead of expectations. Docket 08:30 ET US GDP QoQ Q1 Advance Median Forecast: 2.5% | Prior: 3.4% | Range: 3.1% / 1.7% US Initial Jobless Claims Median Forecast: 215K | Prior: 212K | Range: 220K / 205K 11:30 ET US sells $70 Bln 4-Week Bills 13:00 ET US sells $44 bln 7-Year Notes Speakers 11:15 ET ECB’s Nagel Speaks About Climate Change Event details here 13:00 ET ECB’s Panetta Speaks in Frankfurt Earnings 16:00 ET Alphabet Q1 2024 Earnings Est EPS: $1.52 Est Rev: $66.06B Intel Q1 2024 Earnings Est EPS: $0.13 Est Rev: $12.70B 16:05 ET Microsoft Q3 2024 Earnings Est EPS: $2.83 Est. Rev: $60.87B Our trade docket for today: /MCL, /NG, BA, F, GLD, GOOG, IBM, IWM, MSTR, SPX/NDX/Event contract NDX/Bitcoin 0DTE's, ORCL, SBUX, SHOP, WYNN, XBI, MSFT, INTC, SNAP. My intra-day levels for 0DTE setups: /ES; 5090/5098 (PoC)/5115/5128 to the upside. 5067/5051/5032/5016 to the downside. /NQ: 17550/17644/17707/17764 to the upside. 17411/17348/17292/17182 to the downside. Bitcoin; Bitcoin got hammered yesterday. Our 0DTE just squeeked by for a full profit. 71751 is resistance and 60597 is support. If 60597 doesn't hold as support today, there is plenty of downside potential. My lean today is bearish. META's poor showing is dragging all the futures lower. I'll see you all in the scalping room today. Let's see what we can get done there.

Good morning traders! Yesterday was o,k. for me. My net liq ended down -$1,700 dollars but we had success with scalping which brought in $1,054 profit in 26 min. and all four of our 0DTE's made money. 7% ROI on Bitcoin. 10% On Event contract NDX. 14% on SPX. 35% on NDX. On approx. 14K of captial we generated amlost $3,300 of profits. We also booked another profit on a Theta fairy. Markets continue to try to build a bullish base here. All four of the major indices we trade are turning around. It was enough bullishness that we initiated a new VTI swing trade with a bullish setup. This is one of my favorite setups. It can be scaled to as large a buying power as you like and has consistently generated 36%-50% annualized returns for us. Critical news for today: 08:30 ET US Durable Goods Orders For March Median Forecast: 2.5% | Prior: 1.3% | Range: 5% / 0.3% Canadian Retail Sales MoM For February Median Forecast: 0.1% | Prior: -0.3% | Range 0.8% / 0% 10:30 ET Weekly EIA Crude Oil Inventories Median Forecast: 2M | Prior: 2.735M | Range: 2.254M / -1M 13:00 ET US sells $70 bln 5-Year Notes 13:30 ET BoC Meeting Minutes Speakers 08:16 ET German Economy Minister Habeck holds a news conference about the spring economic forecasts in Berlin. 09:15 ET ECB’s McCaul chairing plenary session and delivering concluding remarks at high- level seminar on “Governance and risk culture: going forward by looking back” jointly organised by the ECB and the Florence School of Banking and Finance. 10:00 ET ECB’s Schnabel gives opening remarks at “Frankfurt liest ein Buch”. Event details here Earnings 16:05 ET Meta Q1 2024 Earnings Est EPS: $4.30 Est Rev: $30.52B 16:10 ET IBM Q1 2024 Earnings Est EPS: $1.59 Est Rev: $14.56B Trade docket for today: /HE, /NG?, /MCL?, CRM?, DIA, DJT, IWM?, META?, SPX/NDX/Event contract NDX/Bitcoin 0DTE's, NVDA, IBM, F. My lean today is bullish: Intra-day levels for me: /ES; 5128/5161/5183/5199 to the upside. 5106/5099/5082/5068 to the downside. /NQ; 17762/17894/17924/18030 to the upside. 17654/17608/17524/17373 to the downside. Bitcoin; 66491 PoC. 67751 resistance. 65618 first support. 64901 second support. Trade well folks. Let's have a great day.

We had a strong start to the week yesterday with my net liq ending up $12,965 dollars. Most everything clicked for us. NVDA, which hurt me last Friday came roaring back to help. All four of our 0DTE's make money. 6% on Bitcoin. 36% on Event contract NDX. 7.5% on SPX and 77% on NDX. All told I worked $8,800 of capital to a $6,000+ dollar gain. We also have another Theta Fairy that is close to a full profit as I type. I was looking for a bullish day yesterday and that's what we got. Technicals are starting to swing back to slight buy mode: After nearly three weeks of weakness, the indices are trying to flash some green. My lean today is more neutral than bullish Trading catalysts for today: Sentiment US market futures rose slightly as the busiest week of the earnings season began, with prospects for a prolonged surge hinged on whether big tech can justify expensive valuations fueled by the artificial intelligence boom. The “Magnificent Seven” cohort of tech megacaps, led by Tesla, will report first after today’s market closure. Meta is next on Wednesday, then Microsoft and Alphabet on Thursday. Docket 09:45 ET US S&P April Flash PMIs for April Manufacturing – Median Forecast: 52 | Prior: 51.9 | Range: 53 / 50 Services – Median Forecast: 52 | Prior: 51.7 | Range: 52.2 / 50.8 10:00 ET US New Home Sales – Units for March Median Forecast: 0.67M | Prior: 0.662M | Range: 0.7M / 0.625M 13:00 ET US sells $69 bln 2-Year Notes Speakers 08:30 ET ECB’s Nagel Speaks in Berlin Event details Earnings 16:05 ET Tesla Q1 2024 Earnings Est EPS: 53c Est Rev: $22.42B Our Trade docket for today: /ES (theta fairy), VTI, TSLA, GL, META, MSTR, SPX/NDX/Event contract NDX/Bitcoin 0DTE's, SBUX, TXN. Intra-day levels for me: /ES; 5059/5077/5092/5110 to the upside. 5049/5033/5021/5005 to the downside. /NQ; 17438/17541/17633/17767 to the upside. 17338/17269/17208/17143 to the downside. Bitcoin: 65804 is consolidation zone. 74533 resistance. 60513 support Have a great Tuesday!

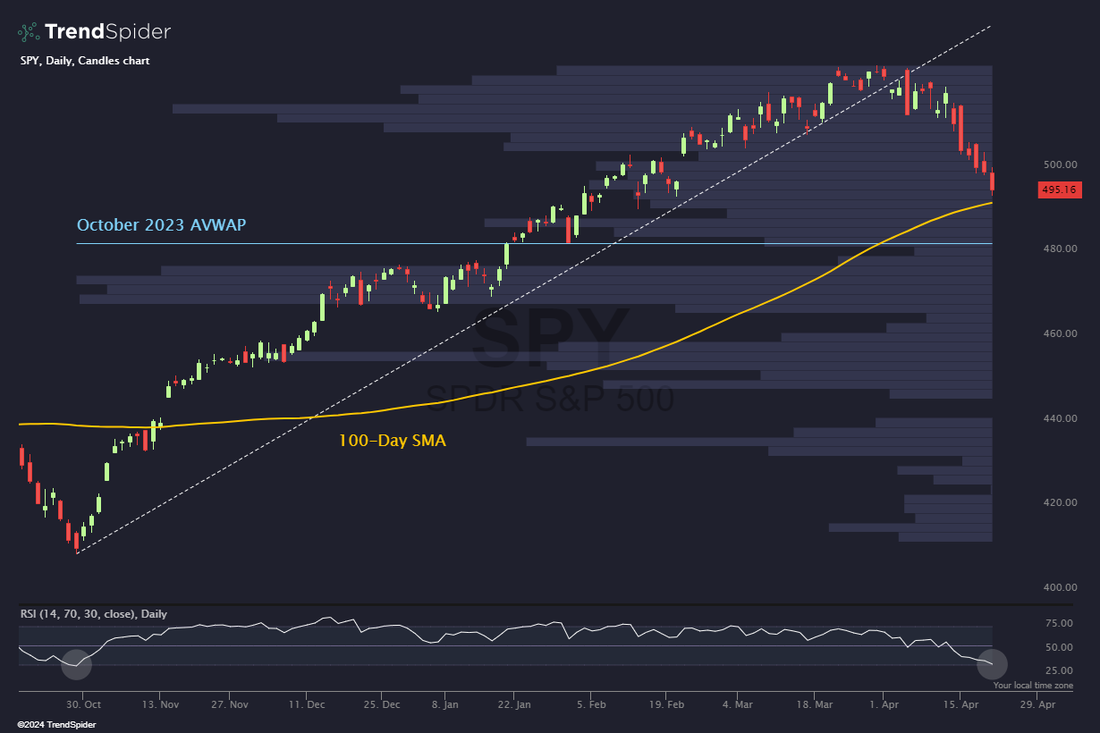

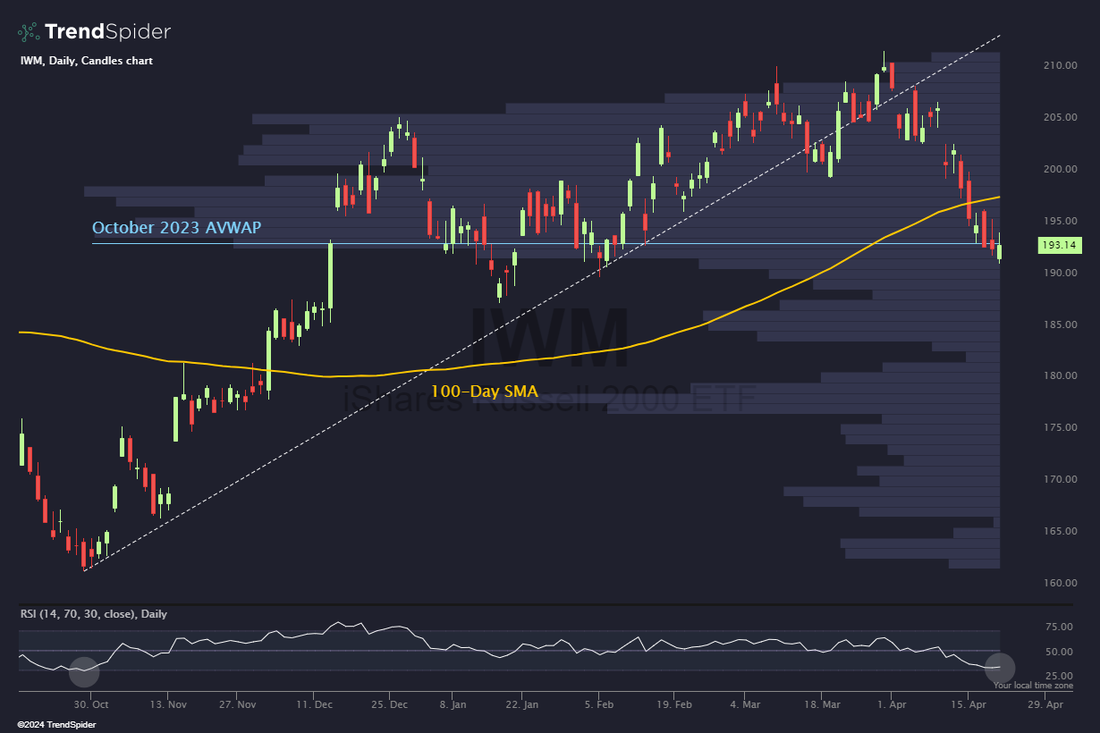

Welcome back traders! We had a pretty solid finish to our week last Friday with NVDA being the main pain point. We skipped our planned Theta fairy setup for the overnight Vampire trade. That worked well with the hedge portion adding $600 profit to the $200 original credit. It was nice to wake up to $800 bucks in our pocket before the day even gets started. All four of our 0DTE setups, including Bitcoin hit for profits. Almost $1,900 profit with 12k of buying power used. Lets look at the market: There's been a lot of talk about the "magnificent seven" holding the market up and when they give out, look out below. That's happening now and you can see, "The market" is really just a proxy for a few, very large cap stocks If you believe, "the trend is your friend" then you are currently bearish. All the major indices are pointed down with the IWM quickly approaching the 200DMA. The DIA is showing some bottoming. After blowing through the February gap, the SPY ETF closed the week at $495.16 (-3.07%). Just below lies the 100-day SMA and the October 2023 AVWAP, which could act as a powerful area of support in the weeks to come. RSI is also nearly oversold for the first time in half a year. Much like the SPY ETF, the QQQ ETF sliced through the February gap and closed at $414.65 (-5.39%). Meanwhile, the RSI is flashing its first oversold reading since those same lows, suggesting this move could be overdone in the near term. Despite failing below the 100-day SMA and the October 2023 AVWAP, the small caps IWM held up fairly well this week and closed at $193.14 (-2.79%). With RSI flattening out just above an oversold reading, could this index see a short-term bounce next week? We still have some pretty decent I.V. heading into this new week of trading. As is the case every Monday, our trading docket is full today: /ES (theta fairy), /MCL, /ZN, BA, CCL, DIA, GLD, GOOG, LULU, MSTR, SPX/NDX/Event contract/Bitcoin 0DTE's, NVDA, ORCL, PFE?, SPY/QQQ, XBI, CRM, SHOP, META?, PYPL, PLTR, VTI? My lean today is bullish: My intra-day levels: /ES; 5043/5056/5072/5083 to the upside. 5015/5008/4990/4965 to the downside. /NQ: 17350/17379/17462/17561 to the upside. 17213/17122/17103/16994 to the downside. Bitcoin: 66066 is consolidation zone. 74515 is resistance. 60624 is support. In Friday’s trading session, Wall Street’s major averages closed mixed, with the benchmark S&P 500 dropping to a 1-3/4 month low and the tech-heavy Nasdaq 100 falling to a 3-month low. Netflix (NFLX) plunged over -9% after the streaming giant provided weaker-than-expected Q2 revenue guidance and said it would stop reporting quarterly subscriber data. Also, chip stocks retreated after Taiwan Semiconductor Manufacturing Co. lowered its 2024 revenue growth outlook for the chip industry, with Advanced Micro Devices (AMD) falling more than -5% and Micron Technology (MU) sliding over -4%. In addition, Ulta Beauty (ULTA) dropped more than -2% after Jefferies downgraded the stock to Hold from Buy with a price target of $438. On the bullish side, Paramount Global (PARA) climbed more than +13% and was the top percentage gainer on the S&P 500 following a New York Times report indicating that Sony’s movie studio division is in discussions with Apollo Global Management about making a joint takeover bid for the company. Also, American Express (AXP) rose over +6% and was the top percentage gainer on the Dow after the credit card issuer topped quarterly profit estimates.

Chicago Fed President Austan Goolsbee remarked on Friday that progress on inflation has stalled, meriting a pause to permit incoming data to offer further clarity on how the economy evolves. “You never want to make too much of any one month’s data, especially inflation, which is a noisy series, but after three months of this, it can’t be dismissed. Right now, it makes sense to wait and get more clarity before moving,” Goolsbee said. Meanwhile, U.S. rate futures have priced in a 1.9% chance of a 25 basis point rate cut at May’s monetary policy meeting and a 15.0% probability of a 25 basis point rate cut at the conclusion of the Fed’s June meeting. In other news, market participants and observers perceive higher-than-expected interest rates in the face of persistent inflation as the most significant threat to financial stability, the Fed said in its semiannual Financial Stability Report published Friday. First-quarter earnings season kicks into full gear, and investors await fresh reports from major global companies this week, including Tesla (TSLA), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOGL), Boeing (BA), PepsiCo (PEP), Visa (V), Intel (INTC), Texas Instruments (TXN), IBM (IBM), UPS (UPS), General Motors (GM), Ford Motor (F), Caterpillar (CAT), Exxon Mobil (XOM), and Abbvie (ABBV). According to LSEG data, analysts estimate aggregate S&P 500 earnings to grow 2.9% year-over-year in Q1, compared with an expected rise of 5.1% on April 1st. On the economic data front, the March reading of the U.S. core personal consumption expenditures price index, the Fed’s preferred inflation gauge, will be the main highlight in the coming week. Also, market participants will be eyeing a spate of other economic data releases, including the U.S. GDP (preliminary), S&P Global Manufacturing PMI (preliminary), S&P Global Services PMI (preliminary), Building Permits, New Home Sales, Richmond Manufacturing Index, Durable Goods Orders, Core Durable Goods Orders, Crude Oil Inventories, Initial Jobless Claims, Wholesale Inventories (preliminary), Pending Home Sales, Personal Spending, Personal Income, and Michigan Consumer Sentiment. Welcome to the weekend folks! Yesterday was just a solid day for me. After the dust settled I was up $4,065 on my net liq. Most everything we touched worked. We logged $1,400 of profits in 20 mins. in the scalping program and are still on track for $50,000 of yearly income scalping twice a week with 5k of capital. Could you make $100,000 a year scalping with 10K? Well...that's what we are currently on track for. Our 0DTE's are just killing it. We are now approaching $130,000 of profits from our first quarters 0DTE's. We average $15,000 of capital a day. Could you really make a half million a year with our 0DTE setups? No guarantees but thats our current run rate. Yesterday all four of our 0DTE's worked and with $14,800 of capital we generated almost $2,900 of profit. Our Theta fairy hit for another full profit as well. We also have four earnings trades that look to expire today fully profitable. In addition to all that, we skipped the new Theta fairy setup in lieu of the overnight Vampire trade. That looks like its set to yield over $1,000 of profit for us at the open today. It would be nice to make $1,000 a night every night but alas, the Vampire trade is a, once a month trade. Two of my goals are to provide a trading setup for anyone, regardless of what you are looking for. I also stive for setups you are not getting anywhere else. Our unique scalping, 0DTE's, Theta fairy and Vampire trades meet both of those criteria. Lets Take a look at the markets: Middle Eastern tensions ramped again overnight.

Trading docket for today; Vampire /ES hedge, /MCL, AXP, CCL?, CGC, ISRG, IWM, M, MSTR?, SPX/NDX/Event contract NDX/Bitcoin 0DTE's, NFLX, NVDA?, PYPL, SPY/QQQ, TSM. Intra-day levels for me: /ES; 5066/5094/5118/5126 to the upside. 5016/4994/4984/4963 to the downside. /NQ; 17546/17644/17762/17908 to the upside. 17410/17344/17174/17097 to the downside. Bitcoin: 64947 key consolidation area. 66041 resistance. 63000 support. Let's have a great finish to the week. I hope you all have a nice weekend!

Welcome back traders! We are already half way through the week. It's been good so far. Yesterday was "adequate" for me. My net liq barely budged but it did finish in the green, by a whopping $249 dollars. Some of our trades worked and some did not. The markets continue to show weakness. Using the VTI as reference, we are now 13 trading days into the current downtrend which started April 1st with the IWM the most beat up and quickly approaching its 200DMA. It's also the most interest rate sensitive. We do have some news catalysts today that could be market moving. We have jobless claims out as well as Nat gas inventory and several Fed members talking throughout the day. My lean today in neutral, once again. Our trade docket for today: /ES (Theta fairy), /MCL, AA, DIA, GLD, GOOG, MSTR, NFLX, ISRG, AXP, TSM, Overnight Vampire trade, SPX/NDX/Event contract NDX/Bitcoin 0DTE setups. Intra-day levels for me: /ES; 5084/5090/5106/5118 to the upside. 5070/5061/5055/5046 to the downside. /NQ; 17830/17892/17968/18022 to the upside. 17615/17557/17404/17262 to the downside. Bitcoin; 60640 continues to be key support. Dowside is 52212 and upside is 65836. Have a good day folks. Lets see if we can make some money.

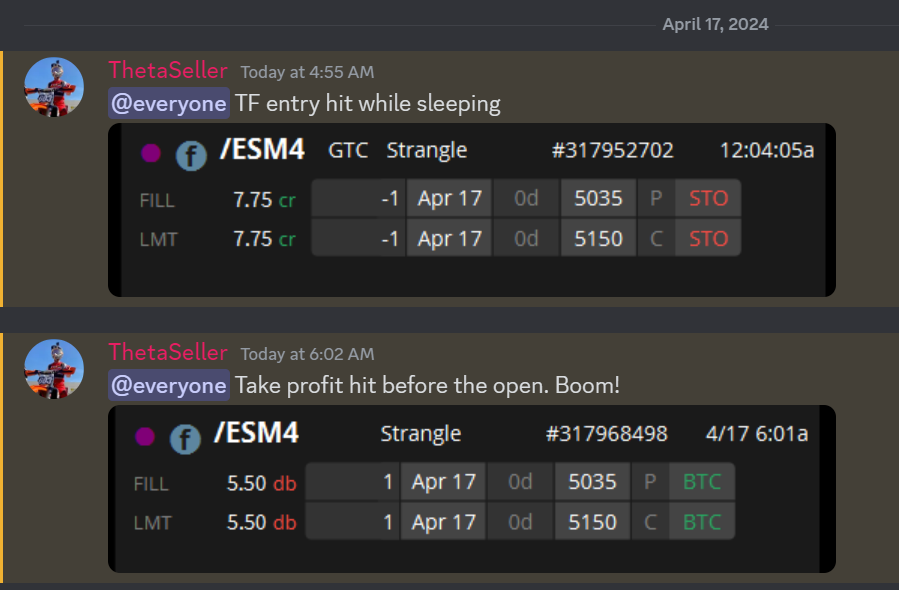

It's been a volatile few days of trading for me. Up 14k on Friday. Down 12k on Monday and yesterday we popped for over 17K! $17,408 bump in my net liq to be exact. We are now offically, on our documented trades, over $100,000 dollars in profits from our FOUR daily 0DTE setups. We deploy an average of 15K a day to generate that. Our scalping program is still on track for $50,000 of income this year with 5K of capital deployed. There are no guarantees in the market but I'd like to think our results speak for themselves...Just ask our members. Yesterday was big for our NDX 0DTE. $12,000 of profit on $10,000 of capital. Our SPX yielded $350 profit on $2,000 of capital and our Event contract NDX hit for $300 profit on $940 of capital...an 18% ROI. Agian, no guarantees in the market but we try really hard to find opportunities to yield us $1,000+ a day of potential gains. NVDA helped out as well with a nice $1,900 improvement to the net liq. We doubled our money in our NDX butterfly. I was so focused on it, I forgot our UAL earnings trade! We'll make up for it today with three new earnings setups. We were able to get another Theta Fairy trade working last night. The entry hit while I was asleep and, as I type this, our take profit just hit. The I.V. is there, at least for this week to keep generating setups. Our trade docket for today is fairly light: CCI, AA, SLG potential earnings setups. /HE, /MCL, DJT, IWM, SPX/NDX/Event contracts on NDX and Bitcoin 0DTE's. LULU, TSLA. Lets take a look at the markets: It's been a while since we've not been in full "risk on" mode. Technicals are still bearish. Indices are now decidedly in a bearish pattern. Having all broken down below their respective 50DMA and headed, it looks like, to the 200DMA. The index that might be the most telling, and also possibly the best "overall" indicators of market health is the VTI. Our bearish swing trade on it this month turned out well. We'll need to reset this trade next week. Will next months setup be bullish or bearish? Hard to tell right now but the bears now seem to be in charge. The only pre-planned news catalyst we have today that should effect us is oil inventory numbers. 10:30 ET US Weekly EIA Crude Oil Inventories The EIA Crude Oil Inventories report provides information on the change in the number of barrels of crude oil held in inventory by commercial firms in the United States over the past week. It is released by the Energy Information Administration and serves as a crucial indicator of supply and demand dynamics in the oil market. Traders and investors monitor this report as it can influence crude oil prices and impact various sectors of the economy, including energy companies, transportation, and manufacturing. What to Expect Increases in crude oil inventories may indicate oversupply conditions, which could put downward pressure on oil prices. Conversely, decreases in inventories may suggest tightening supply conditions and potentially support higher oil prices. We started the week off with a short oil posiiton with a covered put, which looks like its producing results. My market lean today is neutral. Intra-day levels for me: /ES; 5109/5130/5161/5183 to the upside. 5091/5079/5068/5042 to the downside. /NQ; 17930/18008/18030/18140 to the upside. 17882/17837/17787/17758 to the downside. Bitcoin; BTC is now sitting on a cliff. It wouldn't take much to send it crashing. 64807 and 66620 are the two closest upside targets. 61944 is current support. A break below that and it could be, "look out below". Have a great day folks!

|

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |