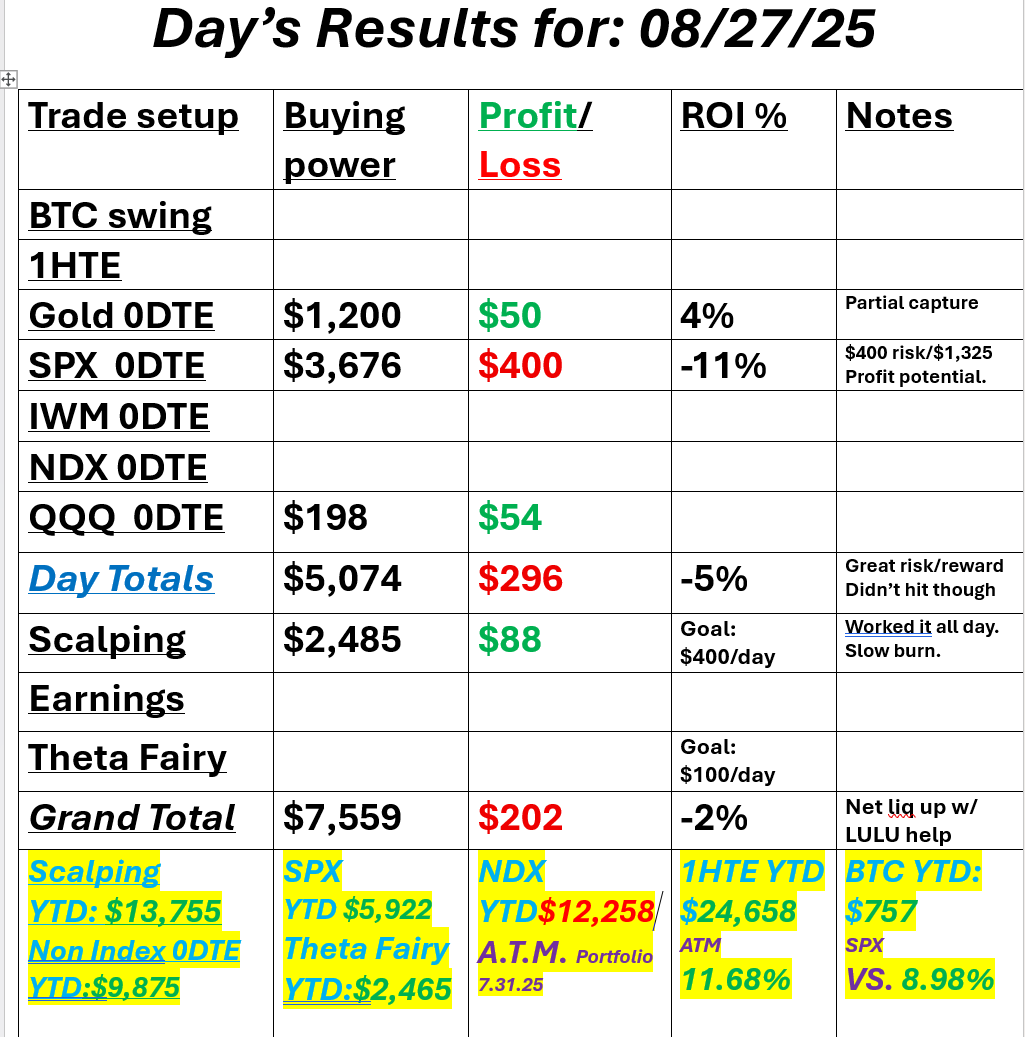

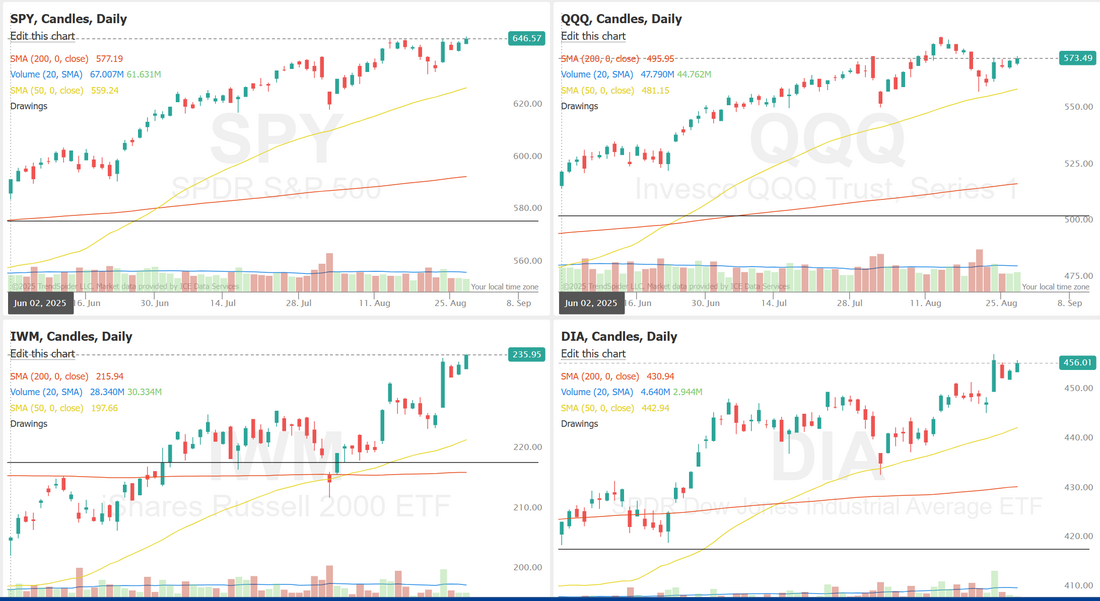

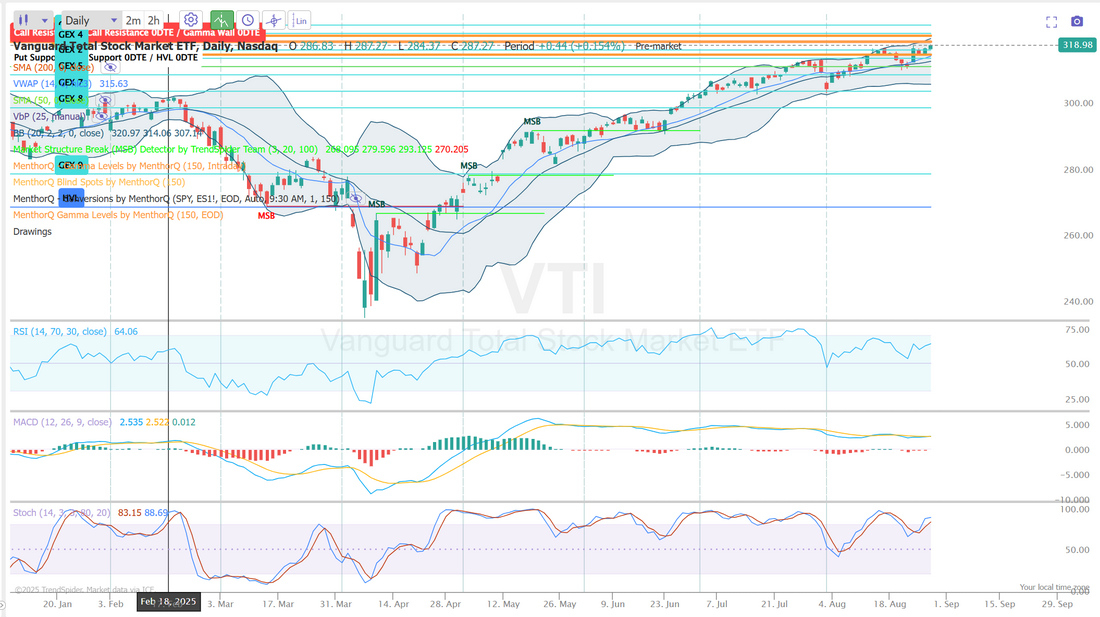

New ATH's on our ATM portfolioLet me start off with a little pump of our A.T.M. (Asymmetric Trade Management) asset allocation portfolio. We hit a new ATH yesterday on that portfolio and it continues to produce for us. Five years in we have tripled our investment and met our dual fold mandate of besting the SP500 and doing it with less risk/volatility. It's a somewhat passive approach that takes 5 min each morning to adjust and then you're done for the day. If you are either not out performing the SP500 and or you want a portfolio with downside hedges to protect you I'd encourage you to check it out. Click the link below. You can try it for free. I'll schedule a zoom call with you to answer any questions. The results speak for themselves. I'm excited for next weeks training module on H.E.A,T. approach to building your portfolio to beat the market. It should be a good one with about two hours of information. Make sure to mark your calendar for next Weds. zoom session. We had a good day yesterday net liq wise with our LULU position continuing to perform as it nears its earnings report but our SPX 0DTE didn't hit. It was still a good setup with $400 risk for $1,325 max profit potential but it didn't hit. Here's a look at our days results. Let's take a look at the markets. Small caps continue to rock higher with the other major indices hitting a wall or resistance. Looking at the VTI it paints the same picture. Bullish bias with some strong overhead resistance. September S&P 500 E-Mini futures (ESU25) are up +0.03%, and September Nasdaq 100 E-Mini futures (NQU25) are down -0.06% this morning, pointing to a muted open on Wall Street as investors digest Nvidia’s underwhelming earnings report. Nvidia (NVDA) fell nearly -2% in pre-market trading after the chipmaker reported slightly weaker-than-expected Q2 revenue from the important data center segment and gave Q3 revenue guidance that, while still strong in absolute terms, fell short of lofty expectations. Adding to investors’ disappointment, the company said its sales forecast does not factor in shipments of its H20 chip to China. Investor focus now turns to fresh U.S. economic data, including the second estimate of second-quarter GDP and jobless claims figures, earnings reports from several major companies, as well as remarks from a Federal Reserve official. In yesterday’s trading session, Wall Street’s three main equity benchmarks ended in the green. MongoDB (MDB) soared over +37% after the database software company posted upbeat Q2 results and raised its full-year guidance. Also, Kohl’s (KSS) surged +24% after the retailer reported better-than-expected Q2 adjusted EPS and lifted its full-year adjusted EPS guidance. In addition, nCino (NCNO) climbed over +13% after the company posted stronger-than-expected Q2 results and boosted its annual guidance. On the bearish side, Paramount Skydance (PSKY) slumped more than -6% and was the top percentage loser on the S&P 500 after Morgan Stanley lowered its price target on the stock to $10 from $12. New York Fed President John Williams said on Wednesday that the September FOMC meeting would be a “live” one. Williams said the current level of rates is “modestly restrictive,” meaning the Fed could “reduce interest rates and still be somewhat restrictive going forward, but again, we’re going to have to figure out exactly what’s happening in the economy.” Meanwhile, U.S. rate futures have priced in an 87.2% chance of a 25 basis point rate cut and a 12.8% chance of no rate change at September’s monetary policy meeting. Today, all eyes are focused on the U.S. Commerce Department’s second estimate of gross domestic product. Economists expect the U.S. economy to expand at an annual rate of 3.1% in the second quarter, slightly above the initial estimate of 3.0%. Investors will also focus on U.S. Initial Jobless Claims data. Economists expect this figure to be 231K, compared to last week’s number of 235K. U.S. Pending Home Sales data will be released today as well. Economists forecast the July figure at -0.4% m/m, compared to the previous figure of -0.8% m/m. In addition, market participants will be looking toward a speech from Fed Governor Christopher Waller. On the earnings front, notable companies like Dell Technologies (DELL), Marvell Technology (MRVL), Autodesk (ADSK), Affirm Holdings (AFRM), and Dollar General (DG) are slated to release their quarterly results today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.226%, down -0.26%. My lean or bias today is undecided. Futures got taken out to the wood shed last evening after the NVDA report and they have not only recovered from that swoon but are back in the green now as I type. Everything leans bullish with heavy overhead resistance. That makes it tough so I'll watch the ORB again and base off that. Trade docket for the day: We've already got our daily Gold 0DTE started with call side only. We've got a QQQ put scalp carry over from yesterday. We'll keep scalping with /MNQ. That seems to be working well for us. SPX 0DTE. AFRM earnings trade. Let's take a look at our intra-day levels on /ES. They have changed a bit. 6500, 6510, 6520 are near term resistance with 6494, 6490, 6485, 6475 are support. Today should have potential in both our scalping and 0DTE effort. I look forward to trading with you in the live trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |