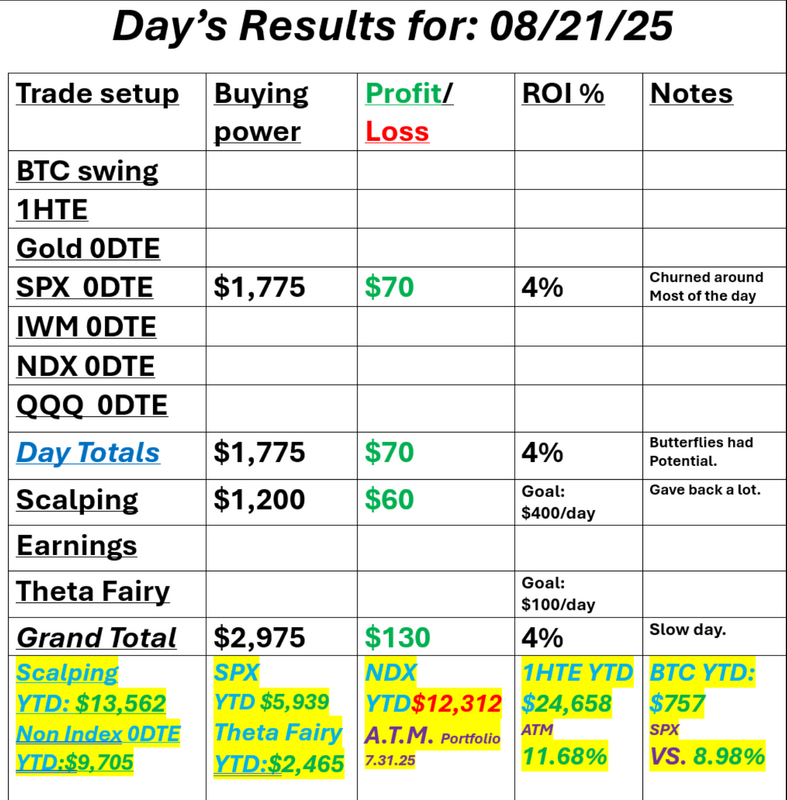

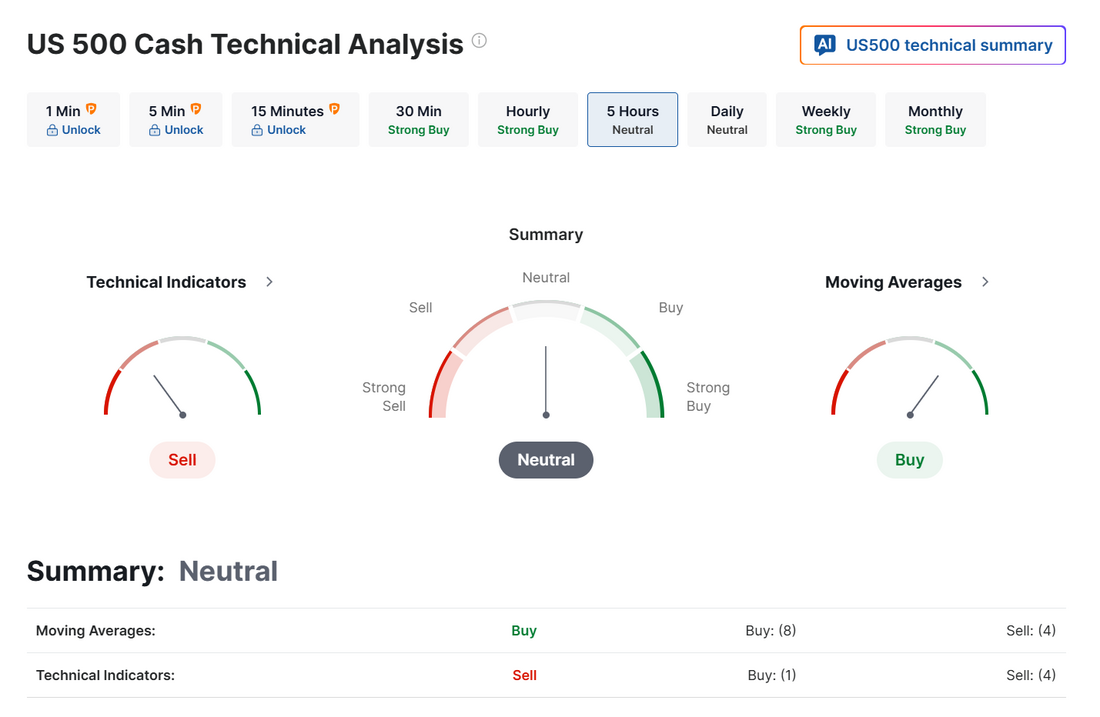

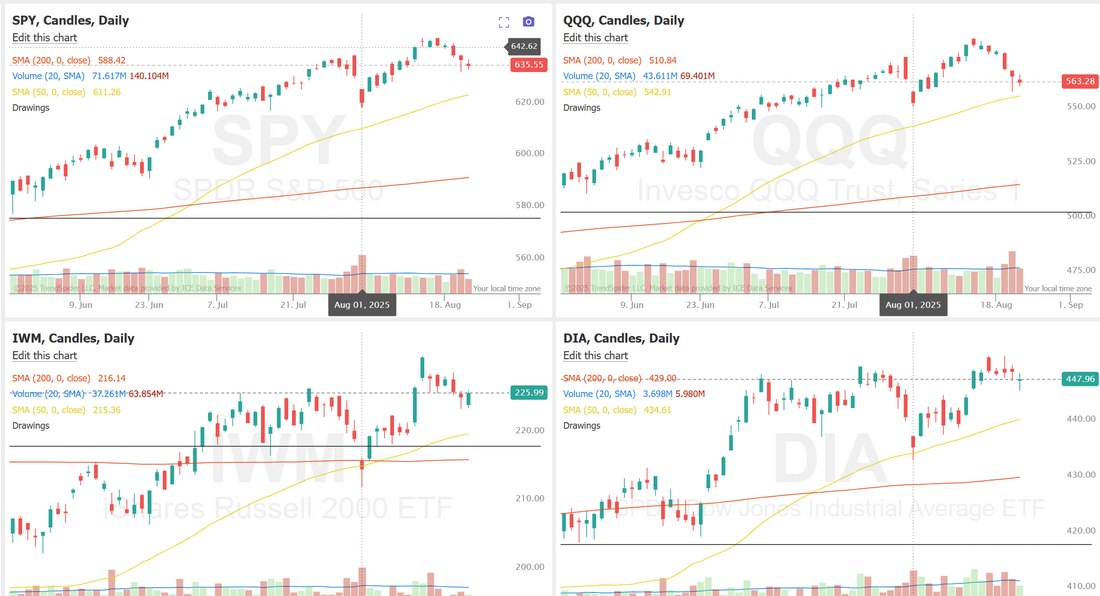

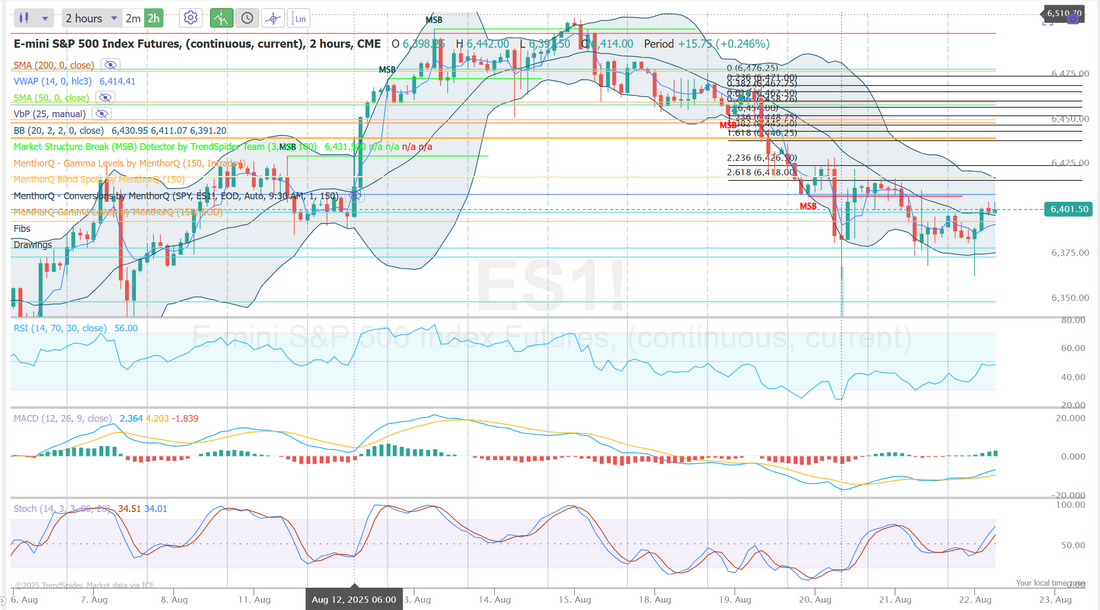

Jackson Hole timeWe don't have a lot to discuss this morning. Powell's speech this morning should set the tone for the day. It's a busy morning of speeches: We'll be patient this morning and wait to see if we get a trend to develop. Our day yesterday was slow. We had a nice opportunity late in the day with a couple of butterflies. We just caught the corner of one which helped us get some green on the day. We had a great start to scalping but I ended up giving most of it back. Here's a look at my day. September S&P 500 E-Mini futures (ESU25) are trending up +0.26% this morning, attempting to snap a five-session losing streak, with focus squarely on a highly anticipated speech from Federal Reserve Chair Jerome Powell. In yesterday’s trading session, Wall Street’s major indices ended in the red. Renewable energy stocks slumped after President Trump said in a social media post that the U.S. would not approve solar or wind power projects, with First Solar (FSLR) sinking about -7% to lead losers in the S&P 500 and Sunrun (RUN) sliding more than -4%. Also, Walmart (WMT) fell over -4% and was the top percentage loser on the Dow after the world’s largest retailer posted weaker-than-expected Q2 adjusted EPS. In addition, Coty (COTY) tumbled more than -21% after the cosmetics company posted an unexpected quarterly loss and projected that steep sales declines would continue in FQ1. On the bullish side, Nordson (NDSN) rose +3% after the manufacturing company reported better-than-expected FQ3 results and raised its full-year earnings guidance. Economic data released on Thursday showed that the U.S. S&P Global manufacturing PMI unexpectedly rose to a 3-year high of 53.3 in August, stronger than expectations of 49.7. Also, U.S. existing home sales unexpectedly rose +2.0% m/m to 4.01 million in July, stronger than expectations of 3.92 million. At the same time, the number of Americans filing for initial jobless claims in the past week rose by +11K to a 2-month high of 235K, compared with the 226K expected. “The great PMI numbers have made it more difficult for Powell to pivot to employment weakness... No fun in the equity space either,” said Andrew Brenner at NatAlliance Securities. Cleveland Fed President Beth Hammack said on Thursday that she would not support lowering interest rates if policymakers were making a decision tomorrow. “We have inflation that’s too high and has been trending upwards over the past year,” Hammack said. Also, Atlanta Fed President Raphael Bostic said he still views just one rate cut as appropriate for this year, but added that the labor market’s trajectory is “potentially troubling” and warrants close attention. In addition, Kansas City Fed President Jeffrey Schmid said that inflation risks still outweigh risks to the labor market. Finally, Chicago Fed President Austan Goolsbee said that although some recent inflation data have come in better than expected, he hopes one “dangerous” reading proves to be just a temporary blip. Meanwhile, U.S. rate futures have priced in a 69.3% chance of a 25 basis point rate cut and a 30.7% chance of no rate change at September’s policy meeting. Today, all eyes are focused on Fed Chair Jerome Powell’s speech at the central bank’s annual Economic Policy Symposium in Jackson Hole, Wyoming. Investors are watching to see whether Powell provides any signal about what the Fed might do at the September meeting. However, it may be difficult for him to give a clear signal, especially with some of his colleagues still not in a rush to cut rates. A survey conducted by 22V Research revealed that 43% of investors expect the market reaction to Jackson Hole to be “neutral,” 39% anticipate “risk-off,” and only 18% expect “risk-on.” “Key to the Jackson Hole symposium will be whether Fed Chair Powell updates his monetary policy reaction function. In our base case, Powell sticks to his reaction function laid out in July. We think this would surprise markets hawkishly,” said Calvin Tse at BNP Paribas. The U.S. economic data slate is empty on Friday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.340%, up +0.21%. Let's take a look at the market: With no idea how the market will react to Powell today it seems appropriate that we start the day technically at a neutral rating. With a five day downtrend developing it seems more and more likely that we get a downtrend continuation. There's no real benefit to starting the day with a pre-concieved lean or bias as Jackson Hole will likely direct the price action. We'll be patient and wait to see if a trend develops. Let's take a look at the main key, intra-day levels today which could dictate todays trend. 6410 is the first resistance level I'm watching with 6441 being the big one. Above that bulls could be back in charge. 6380 is the first support zone I'm watching with 6349 the big one. Below that the bears continue to build downside momentum. I'm routing for the bears. Today is a perfect day to focus on scalping futures and an SPX 0DTE. I don't think we need anything else to give us a good potential result...assuming we get some movement today. We had a good training session yesterday. I'm looking forward to Monday when we'll have part two! Make sure to tune in to the zoom then. I'll see you all in the live trading room shortly. Let's see is Powell can deliver for us today.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |