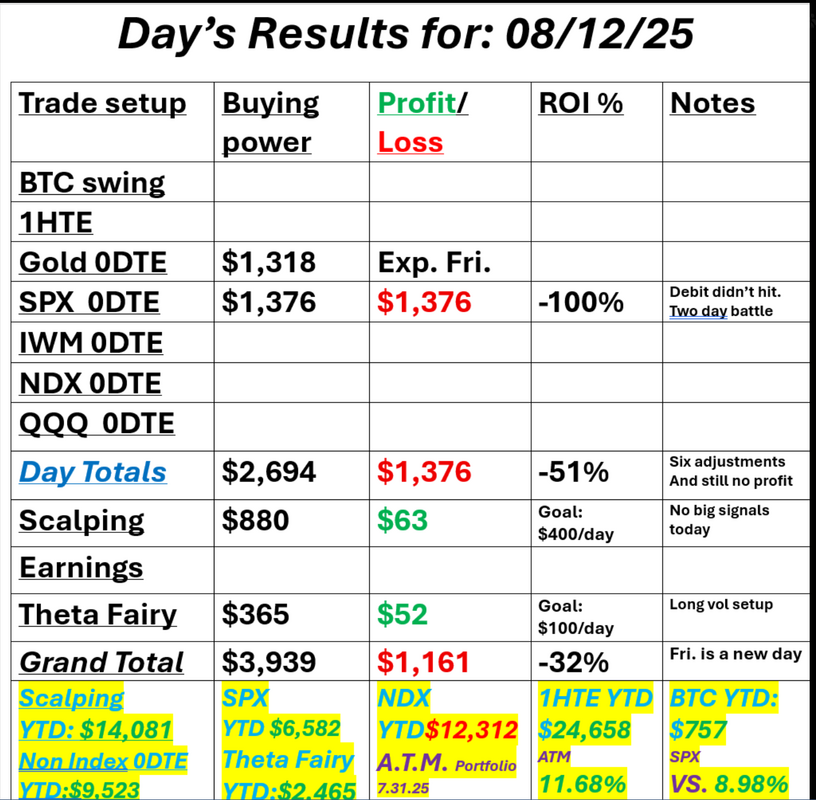

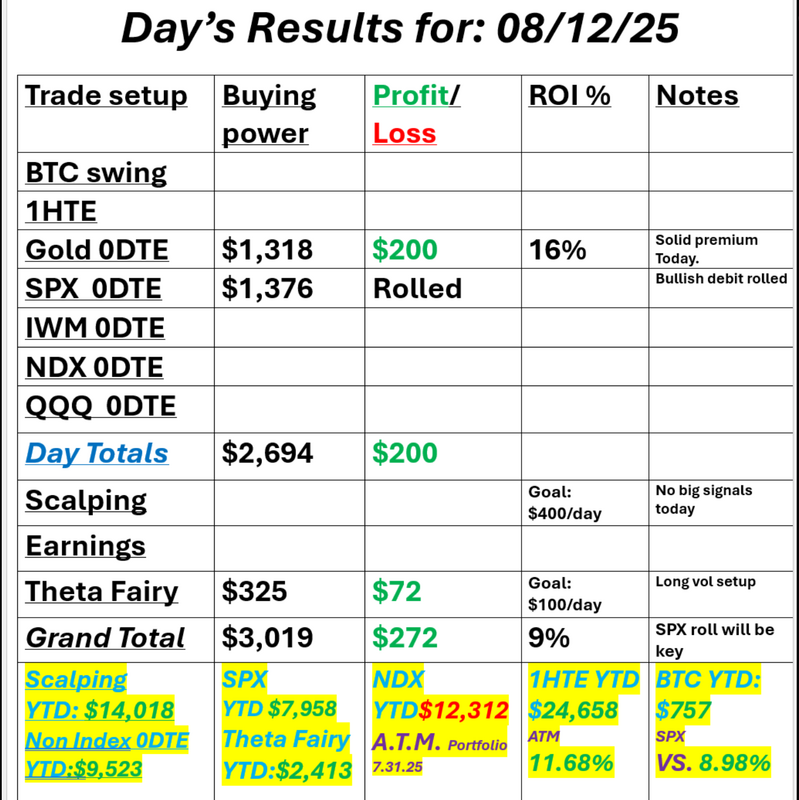

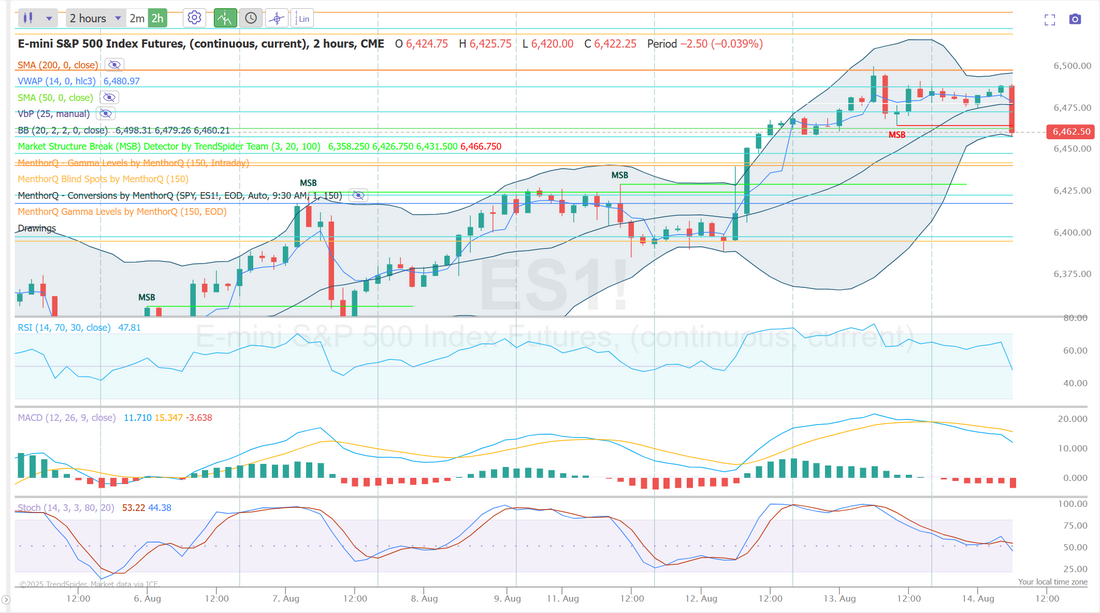

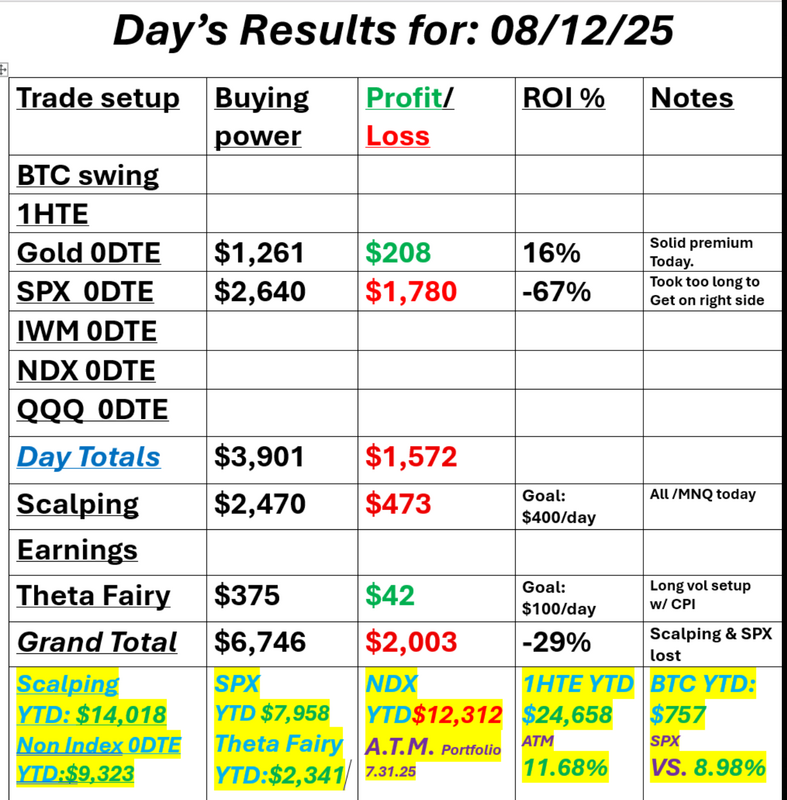

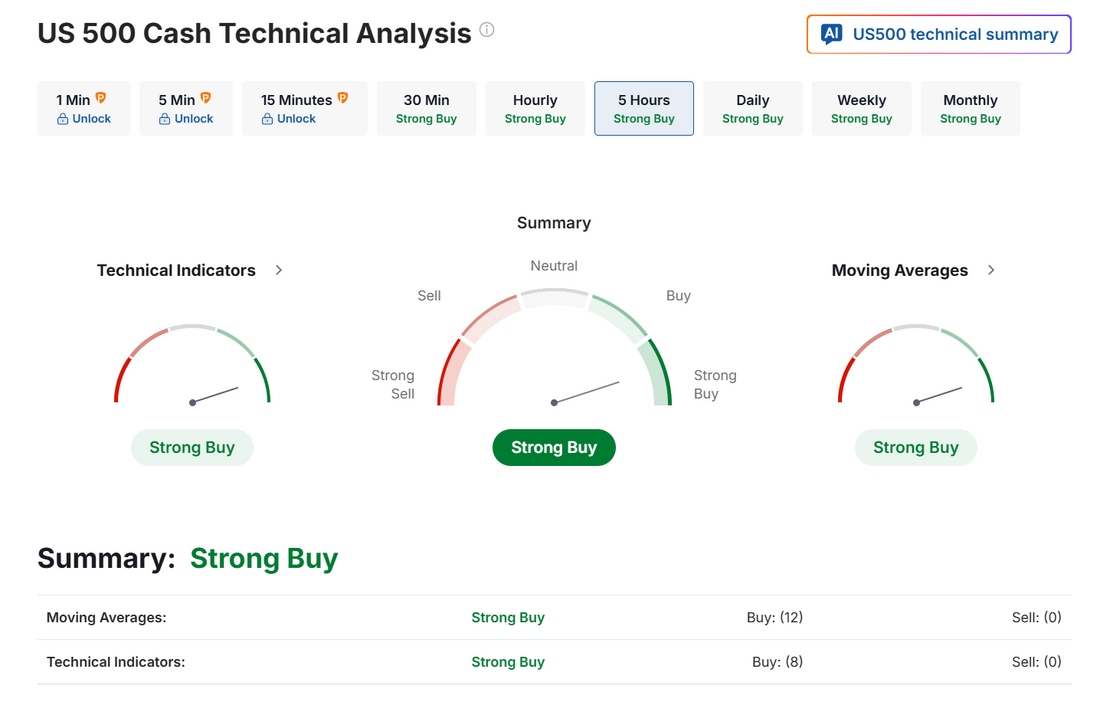

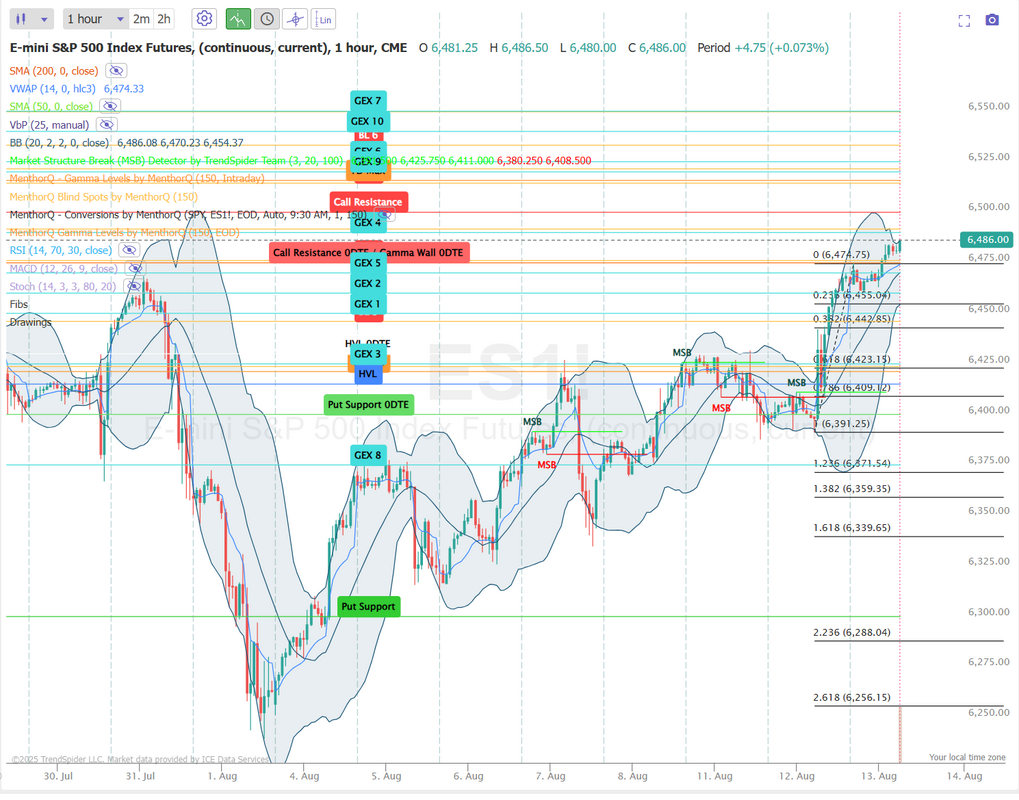

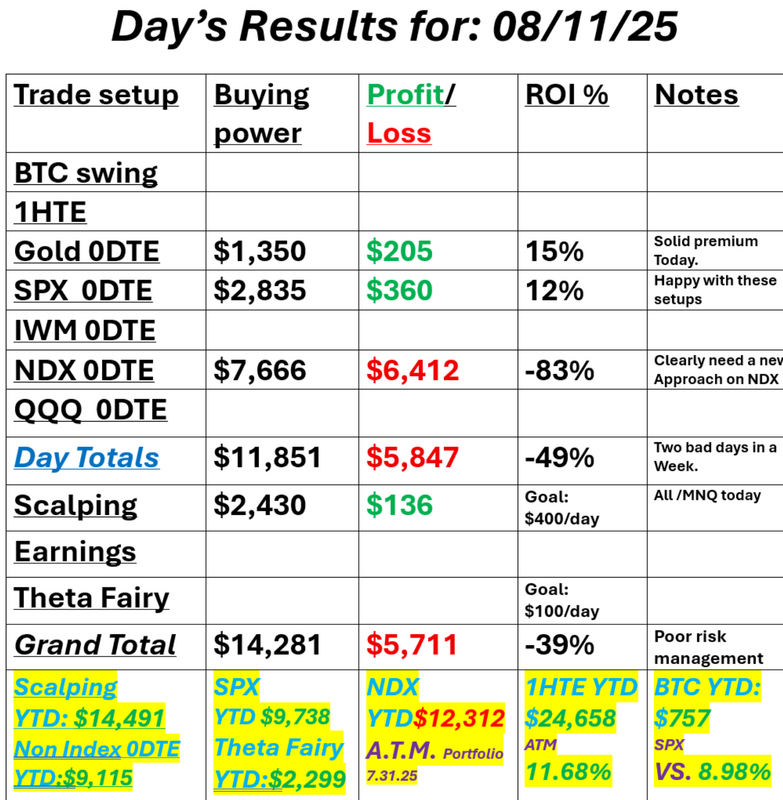

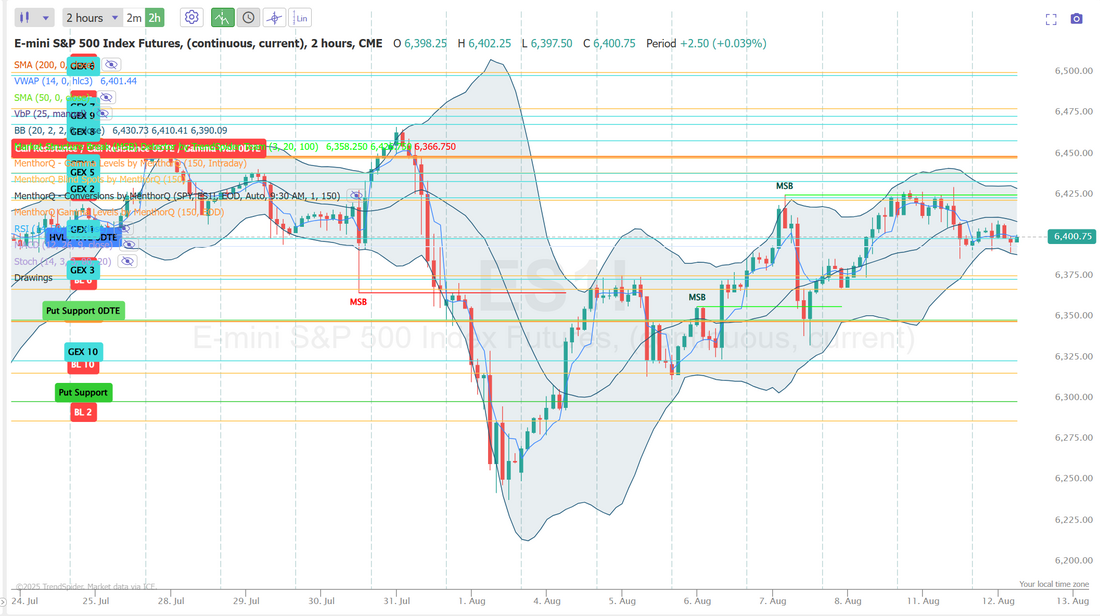

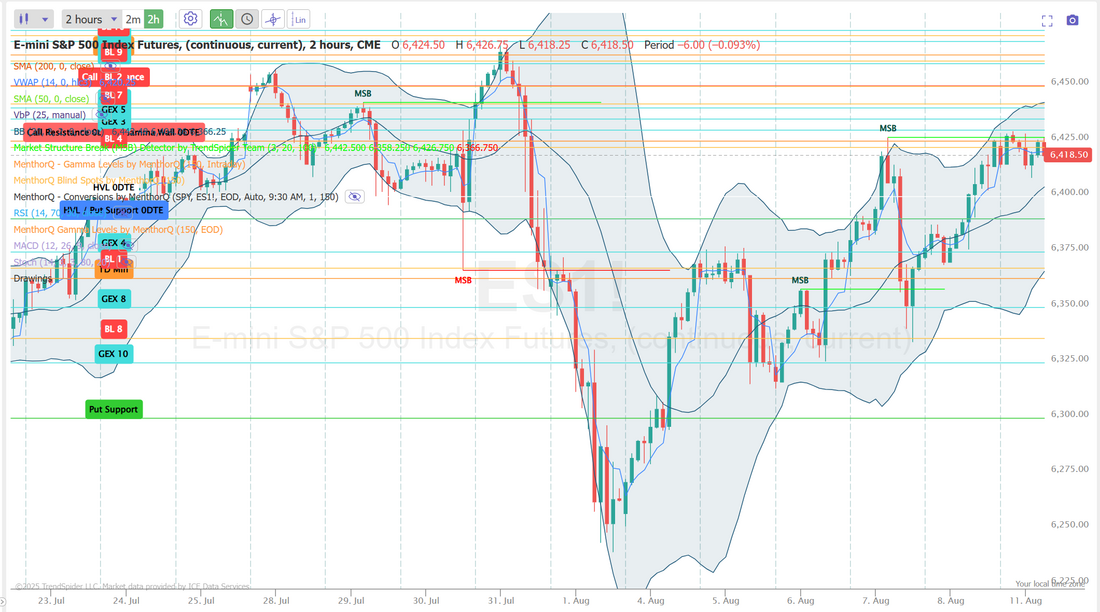

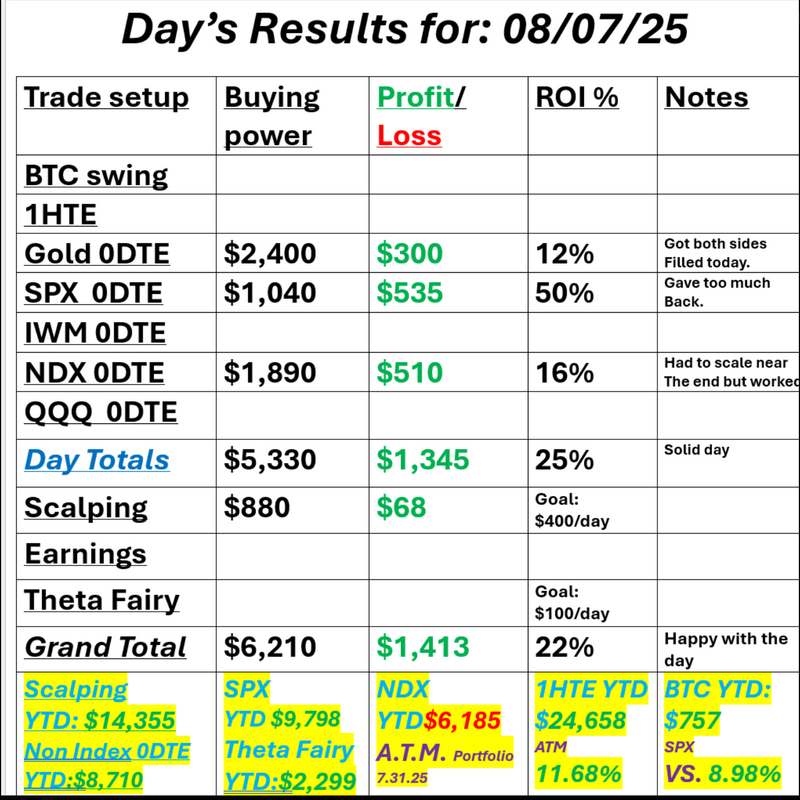

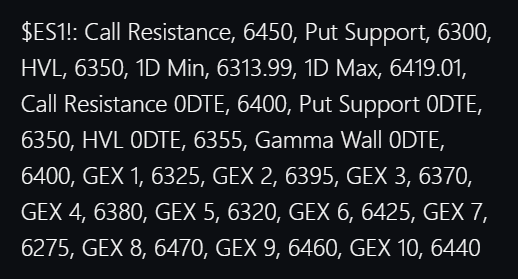

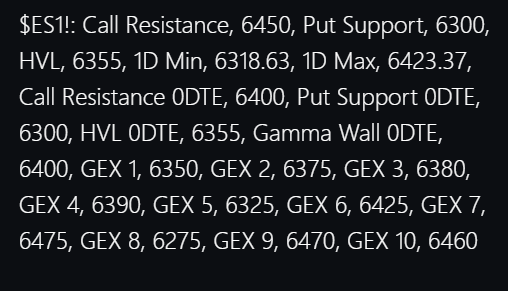

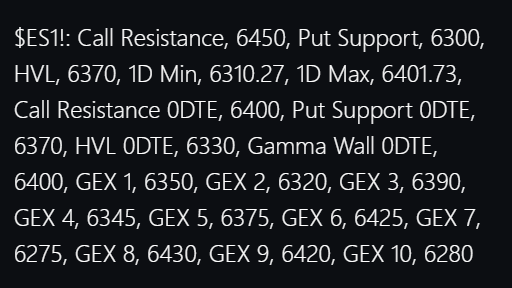

The battle of 6500The /ES is coiled tightly around the 6500 level. I battled it for two days with SPX 0DTE's and didn't get a directional move either days. Futures have been a bit higher and lower this morning but I believe this is the battle zone today. Below is bearish. Above is bullish. The real question I have is when will we get a move? You have to pick a directional bias to place trades and sometimes you're right...sometimes you're wrong. That's how it goes but what is really confusing to me is the tight range we are stuck in. A move will be incoming at some point so let's be patient and wait our turn. Here's my results from yesterday. I won't go over all the intra-day levels this morning as they are EXACTLY the same as yesterday but I do want to detail the 6500 level. This is the line in the sand. Will we get a substantive move today? That's really my only question. September S&P 500 E-Mini futures (ESU25) are trending up +0.17% this morning, bolstered by continued hopes for a Federal Reserve rate cut next month, while investors await U.S. retail sales data and high-stakes talks between U.S. President Donald Trump and Russia’s Vladimir Putin. In yesterday’s trading session, Wall Street’s major indices closed mixed. Tapestry (TPR) plunged over -15% and was the top percentage loser on the S&P 500 after the fashion-brand company issued below-consensus FY26 EPS guidance. Also, Deere & Company (DE) slumped more than -6% after the agricultural and construction equipment maker cut the upper end of its full-year net income guidance. In addition, Cisco Systems (CSCO) fell over -1% after the computer networking company gave a cautious full-year forecast. On the bullish side, Eli Lilly (LLY) rose over +3% after the drugmaker announced it would raise the list price of its Mounjaro weight-loss treatment in the U.K. by as much as 170%. Economic data released on Thursday showed that the U.S. producer price index for final demand rose +0.9% m/m and +3.3% y/y in July, much stronger than expectations of +0.2% m/m and +2.5% y/y. Also, the core PPI, which excludes volatile food and energy costs, rose +0.9% m/m and +3.7% y/y in July, stronger than expectations of +0.2% m/m and +2.9% y/y. In addition, the number of Americans filing for initial jobless claims in the past week fell by -3K to 224K, compared with the 225K expected. “This doesn’t slam the door on a September rate cut, but based on the market’s initial reaction, the opening may be a little smaller than it was a couple of days ago,” said Chris Larkin at E*Trade from Morgan Stanley. St. Louis Fed President Alberto Musalem said on Thursday that it is still too soon for him to determine whether to support an interest rate cut at next month’s meeting. Asked whether a 50 basis point cut could be warranted next month, Musalem said that, in his view, such a move would be “unsupported by the current state of the economy and the outlook for the economy.” Also, San Francisco Fed President Mary Daly said in an interview with the Wall Street Journal that she is not in favor of a 50 basis point rate cut at the September meeting, saying that “would send off an urgency signal that I don’t feel about the strength of the labor market.” U.S. rate futures have priced in a 92.6% probability of a 25 basis point rate cut and a 7.4% chance of no rate change at the next FOMC meeting in September. Investors await a meeting later today in Alaska between U.S. President Donald Trump and Russian President Vladimir Putin over the war in Ukraine. Trump cautioned there would be “very harsh consequences” if Putin failed to agree to a ceasefire with Ukraine, while suggesting the possibility of a follow-up meeting that could include Ukraine’s President Volodymyr Zelenskyy and some European leaders. Meanwhile, Putin looked to strengthen his relationship with Trump ahead of their summit, commending the U.S. leader’s attempts to mediate an end to the war in Ukraine and offering the prospect of economic cooperation along with a new arms control agreement. On the economic data front, all eyes are focused on U.S. Retail Sales data, which is set to be released in a couple of hours. Economists, on average, forecast that Retail Sales will show a +0.6% m/m rise in July, the same as the previous month. Investors will also focus on U.S. Core Retail Sales data, which rose +0.5% m/m in June. Economists expect the July figure to be +0.3% m/m. The University of Michigan’s U.S. Consumer Sentiment Index will be closely monitored today. Economists forecast that the preliminary August figure will stand at 61.9, compared to 61.7 in July. U.S. Industrial Production and Manufacturing Production data will be released today. Economists expect Industrial Production to be unchanged m/m and Manufacturing Production to drop -0.1% m/m in July, compared to the June figures of +0.3% m/m and +0.1% m/m, respectively. The Empire State Manufacturing Index will be reported today. Economists foresee the Empire State manufacturing index standing at -1.20 in August, compared to last month’s value of 5.50. U.S. Export and Import Price Indexes will be released today as well. Economists anticipate the export price index to rise +0.1% m/m and the import price index to rise +0.1% m/m in July, compared to the previous figures of +0.5% m/m and +0.1% m/m, respectively. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.289%, down -0.09%. Trade docket: I'm going to stick with the /MNQ futures today for scalping. We were able to squeeze a little profit out of that yesterday even without a lot of movement. We couldn't get a 0DTE Gold trade working yesterday so we went with a 1DTE which expires today. It's got $200 of potential profit in it so we'll continue to nurse that to the finish line today. I'll focus our other 0DTE effort on the SPX and patiently wait for a move off the 6500 area. We missed our entry on the Vampire trade yesterday. I apologize on that. It looks like it would be a solid result. New pairs trade will be pushed to Monday. I look forward to trading with you all today! We've got a good start today with our Gold 0DTE. Let's see what else we can produce!

0 Comments

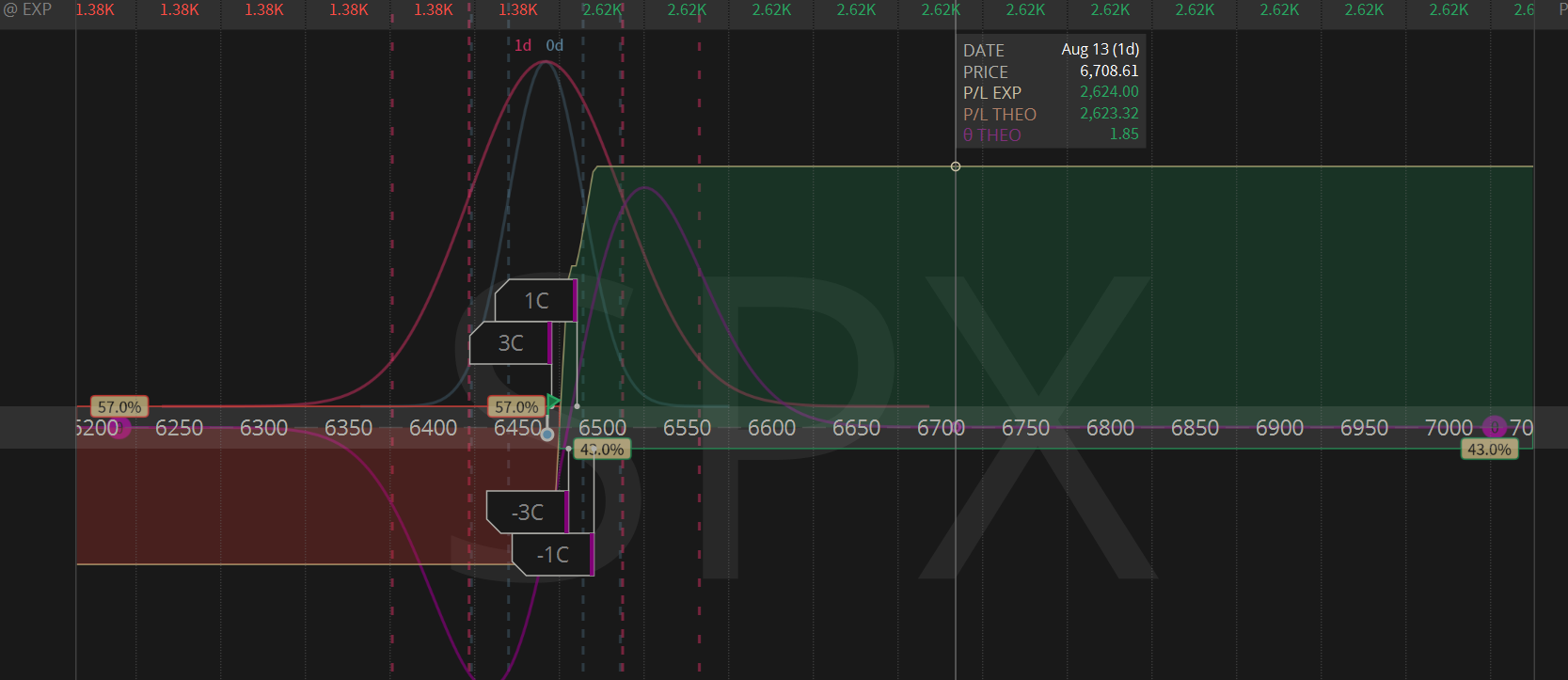

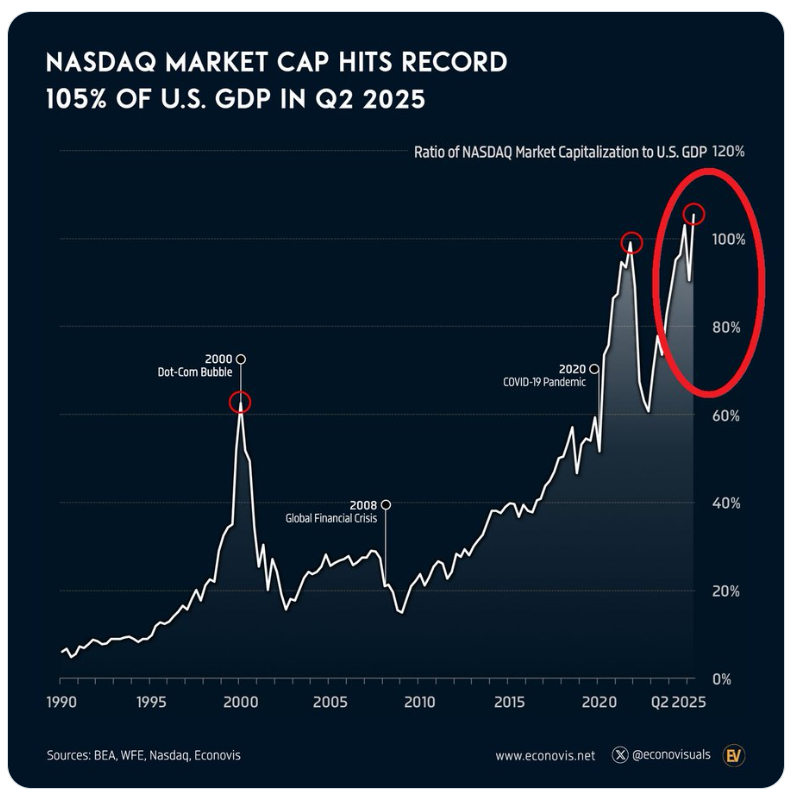

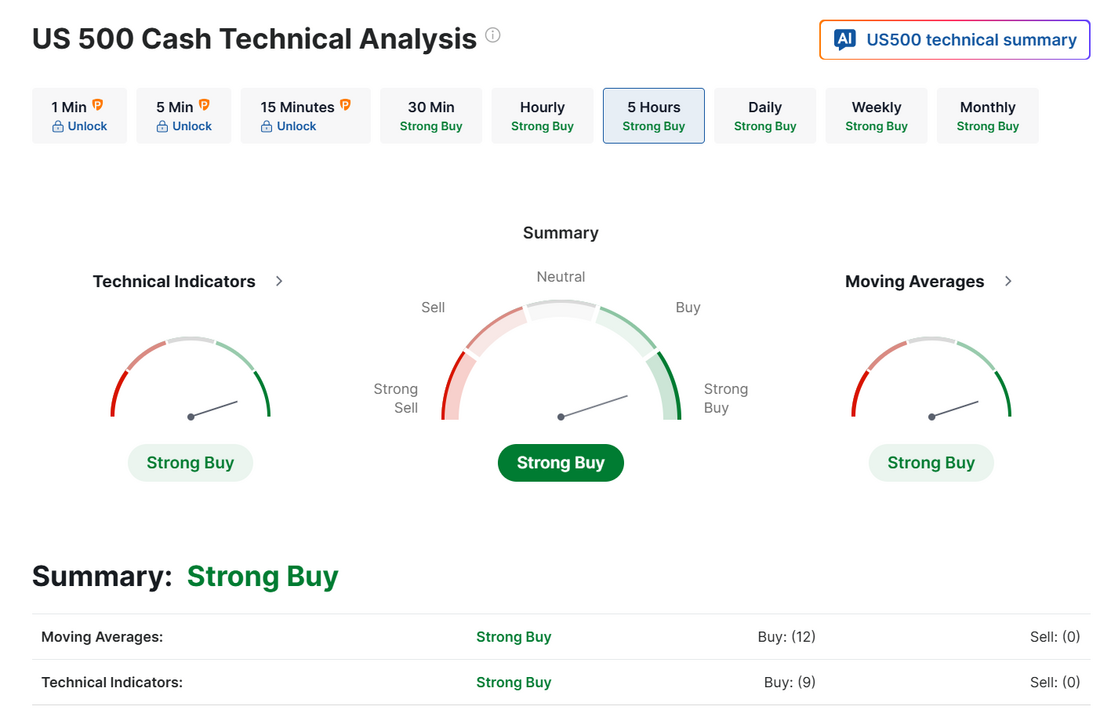

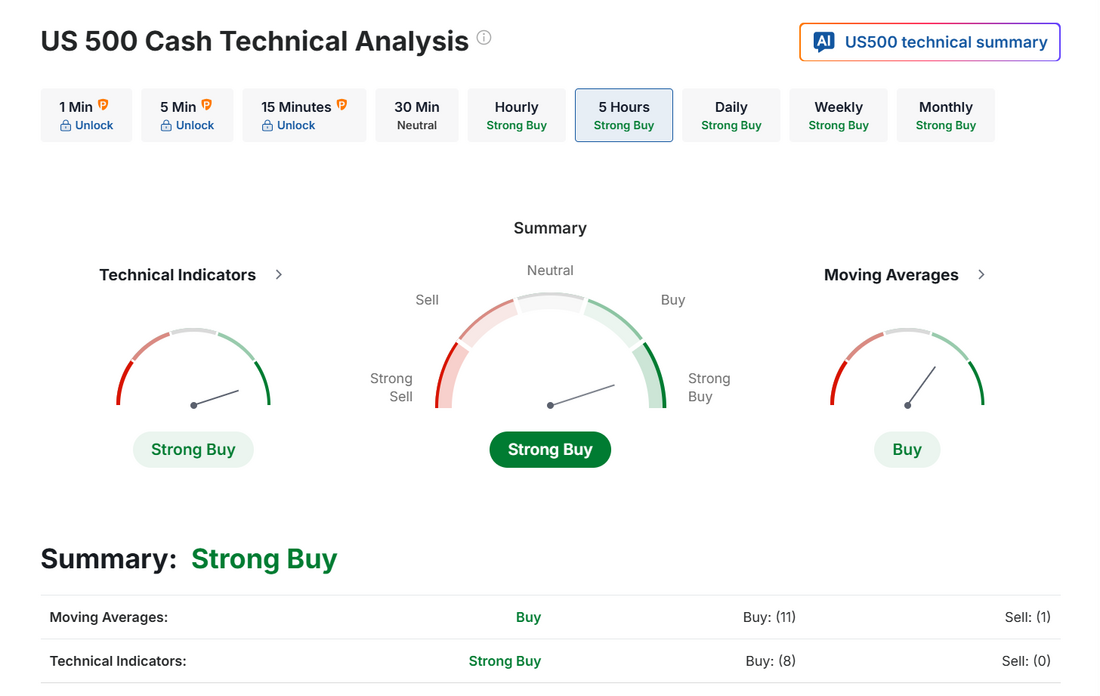

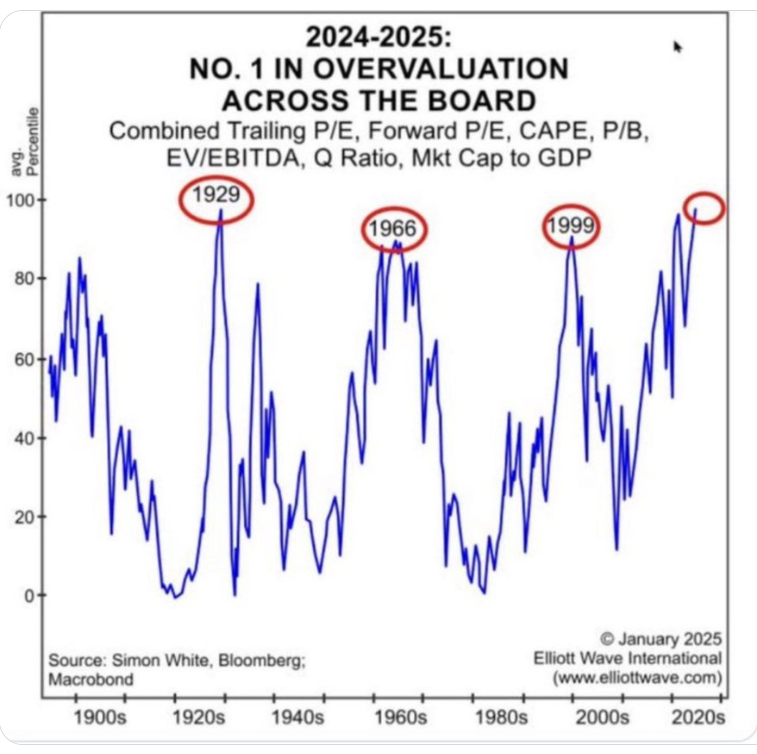

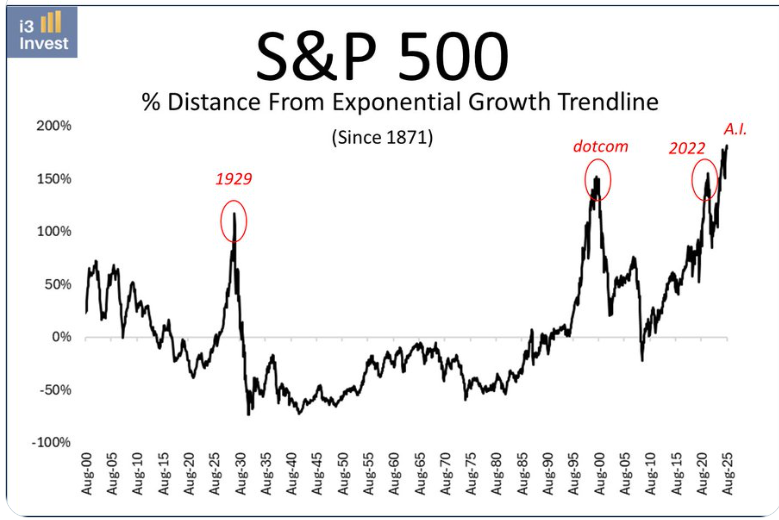

CPI down...PPI incomingMarket prognosticators are betting on a near certain rate cut come Sept. after a mild CPI. PPI will either confirm or deny that today but most market watchers think this should be enough data for the FED to take action. We didn't get any scalps working yesterday and our SPX was rolled to today so we only had our Theta fairy and Gold 0DTE to show for our efforts. Still...all in all, not a bad day. See our results below. Our SPX debit will be our key starting point today. It a bullish debit with two different tranches. It's got plenty of profit potential if we push higher. That would make for an easy day. If we drop we'll need to do some hedging. September S&P 500 E-Mini futures (ESU25) are down -0.02%, and September Nasdaq 100 E-Mini futures (NQU25) are down -0.08% this morning, taking a breather after recent gains, while investors look ahead to crucial U.S. producer inflation data for insight into how aggressively the Federal Reserve may cut interest rates. Today’s PPI data “could be make or break to cement a 25 basis-point rate cut from the Fed, or even to encourage the possibility of a jumbo cut,” said Andrea Gabellone, head of global equities at KBC Securities. In yesterday’s trading session, Wall Street’s major indexes ended in the green, with the S&P 500 and Nasdaq 100 posting new record highs. Chip stocks climbed amid growing expectations for Fed rate cuts, with Advanced Micro Devices (AMD) rising over +5% and NXP Semiconductors N.V. (NXPI) gaining more than +4%. Also, Amazon.com (AMZN) advanced over +1% after announcing plans to expand its same-day grocery delivery service to 2,300 cities by the end of the year. In addition, Intapp (INTA) surged more than +15% after the AI cloud company posted upbeat FQ4 results and announced a $150 million stock buyback. On the bearish side, CoreWeave (CRWV) tumbled more than -20% after the AI cloud vendor reported a wider-than-expected Q2 loss. Chicago Fed President Austan Goolsbee said on Wednesday that the central bank’s meetings this fall will be “live,” as he and his colleagues work to interpret mixed economic data and determine how best to adjust interest rates in response. “As we go into the fall, these are going to be some live meetings and we’re going to have to figure it out,” Goolsbee said. At the same time, Atlanta Fed President Raphael Bostic said he still considers one interest rate cut appropriate in 2025 if the labor market remains solid. Meanwhile, U.S. rate futures have priced in a 100% chance of a 25 basis point rate cut at September’s monetary policy meeting. Today, all eyes are focused on the U.S. Producer Price Index, which is set to be released in a couple of hours. Economists, on average, forecast that the U.S. July PPI will stand at +0.2% m/m and +2.5% y/y, compared to the previous figures of unchanged m/m and +2.3% y/y. The U.S. Core PPI will also be closely monitored today. Economists expect July figures to be +0.2% m/m and +2.9% y/y, compared to June’s numbers of unchanged m/m and +2.6% y/y. U.S. Initial Jobless Claims data will be released today as well. Economists estimate this figure will come in at 225K, compared to last week’s number of 226K. In addition, market participants will be looking toward a speech from Richmond Fed President Tom Barkin. On the earnings front, notable companies like Applied Materials (AMAT) and Deere & Company (DE) are scheduled to report their quarterly figures today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.209%, down -0.68%. I will present this without comment. There's not a lot to find out there that makes this market look cheap. Technicals still look bullish. Markets continue to hold these nose bleed levels. Trade docket for today: We've got a long Theta fairy working going into PPI this morning. We've got a 1DTE Gold trade working now. We couldn't get enough premium from a 0DTE. We've got the SPX 0DTE that was rolled from yesterday. PPI should be the driver. Our SPX will likely be our main focus today. Let's take a look at intra-day levels on /ES: PPI came in worse than expected creating a bearish open. 6490 and 6500 are still the resistance areas. 6466, 6450, 6443, 6431 are support levels. I look forward to seeing you all in the live trading room shortly!

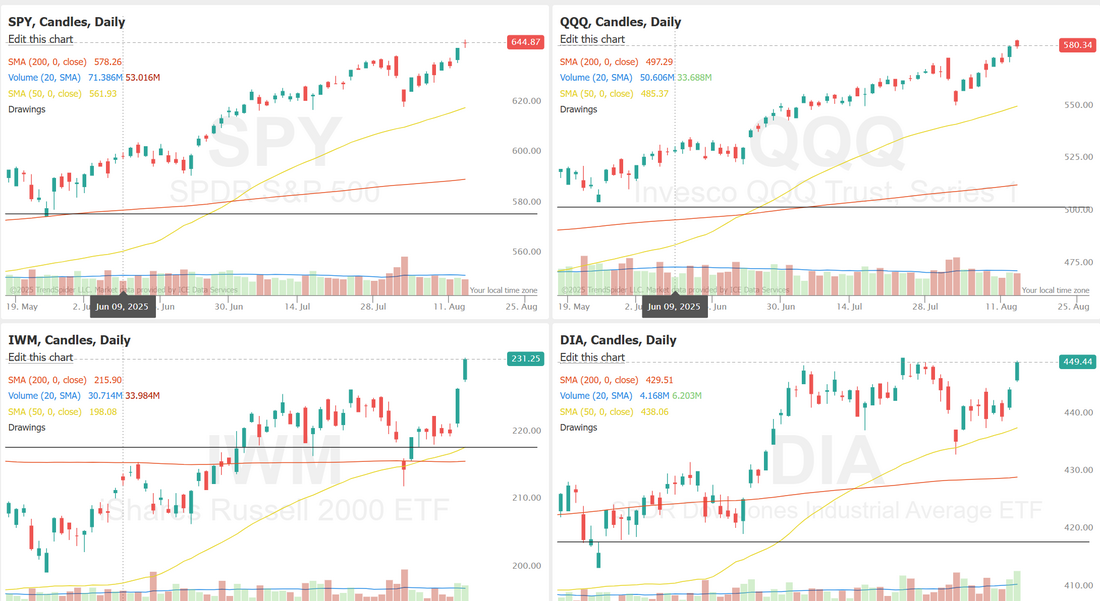

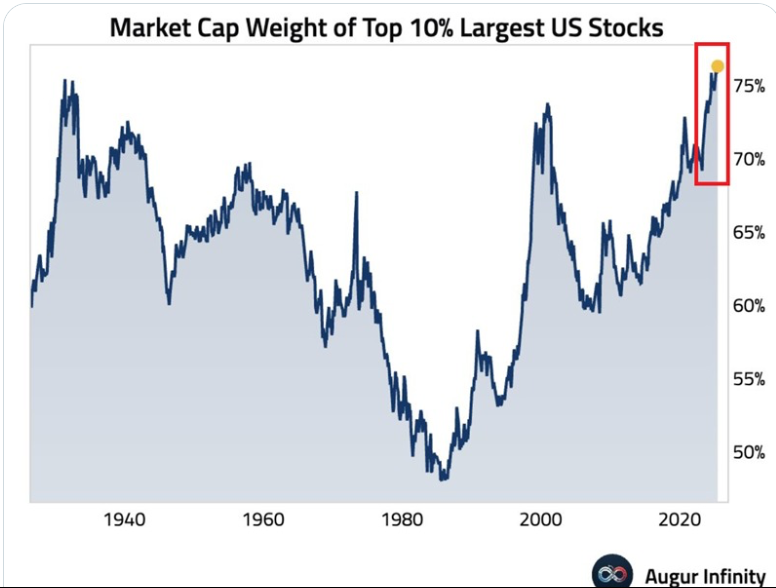

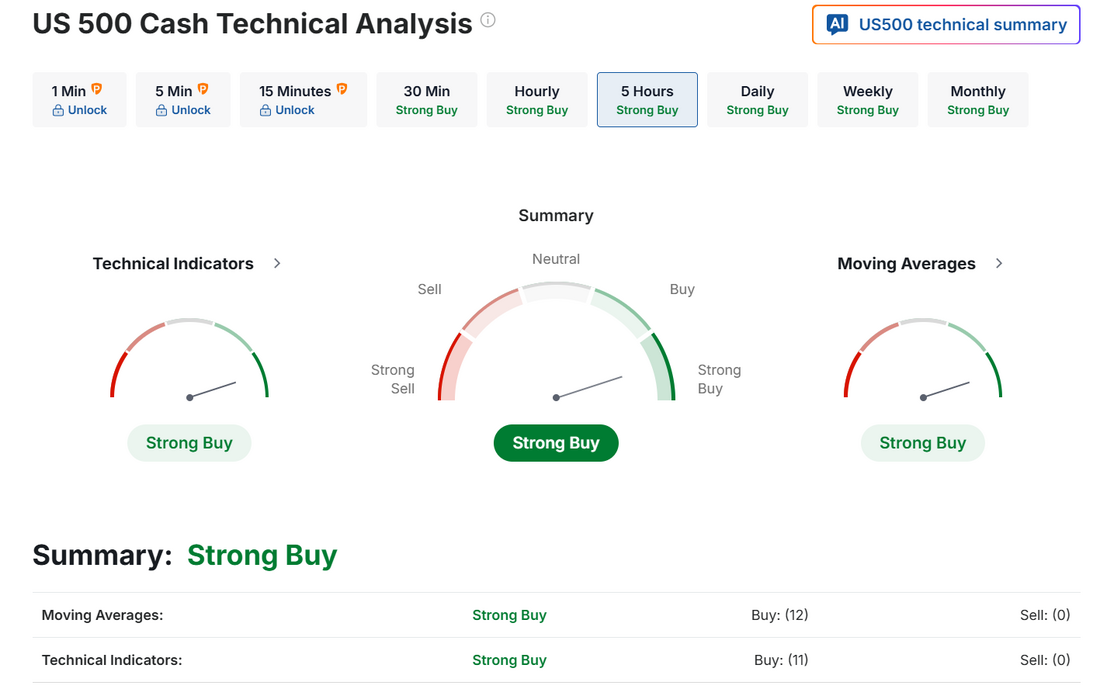

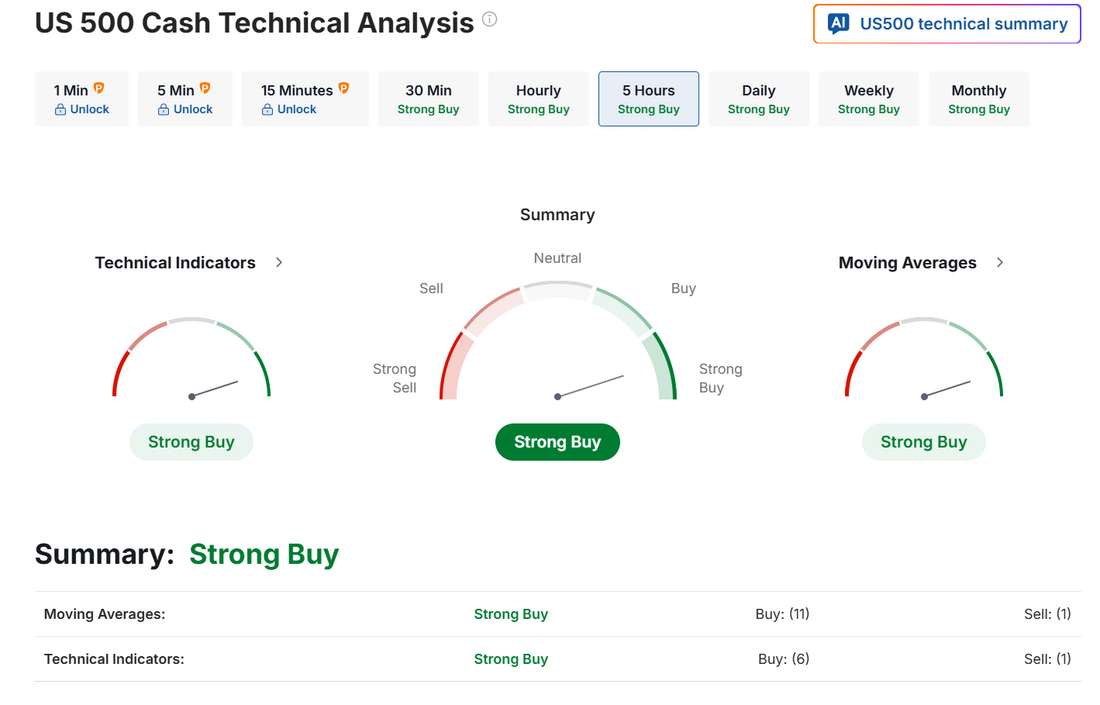

All clear for a rate cut?CPI came in below expectations and all bets are on now for a Sept. rate cut. PPI comes in tomorrow so there's still a bit of a potential overhang but it's looking clearer and clearer. Markets like it and the bullish bias is building. I had a losing day yesterday. I worked debits all day which means you have to be "right" and while I was right in the afternoon I wasn't right in the morning and the gains didn't cancel out the losses. Debits still seem the best approach for today. Here's a look at my day: We've got some FED speak today but most traders are looking towards tomorrows PPI. September S&P 500 E-Mini futures (ESU25) are trending up +0.24% this morning, extending yesterday’s gains as growing expectations for Federal Reserve interest rate cuts fueled risk-on sentiment. U.S. inflation data for July showed a modest increase in goods prices, reinforcing expectations that the Fed will resume rate cuts next month and move more aggressively to protect a labor market showing signs of strain. The data was accompanied by remarks from U.S. Treasury Secretary Scott Bessent, who suggested that the U.S. central bank should be open to a 50 basis-point rate cut in September. Optimism over a softer rate stance is further supported by easing global trade tensions and a much stronger-than-expected second-quarter earnings season in the U.S. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed sharply higher. The Magnificent Seven stocks advanced, with Meta Platforms (META) rising over +3% and Microsoft (MSFT) gaining more than +1%. Also, chip stocks gained ground, with NXP Semiconductors N.V. (NXPI) climbing over +7% to lead gainers in the Nasdaq 100 and ON Semiconductor (ON) rising more than +6%. In addition, airline stocks surged after oil prices declined, with United Airlines (UAL) jumping over +10% to lead gainers in the S&P 500. On the bearish side, Cardinal Health (CAH) slumped more than -7% and was the top percentage loser on the S&P 500 after the drug distributor posted weaker-than-expected FQ4 revenue and announced it had agreed to acquire Solaris Health for $1.9 billion in cash. The U.S. Bureau of Labor Statistics report released on Tuesday showed that consumer prices rose +0.2% m/m in July, in line with expectations. On an annual basis, headline inflation rose +2.7% in July, the same as the previous month and slightly weaker than expectations of +2.8%. Also, the core CPI, which excludes volatile food and fuel prices, rose +0.3% m/m and +3.1% y/y in July, compared to expectations of +0.3% m/m and +3.0% y/y. “Inflation is on the rise, but it didn’t increase as much as some people feared. In the short term, markets will likely embrace these numbers because they should allow the Fed to focus on labor-market weakness and keep a September rate cut on the table,” said Ellen Zentner at Morgan Stanley Wealth Management. Richmond Fed President Tom Barkin said on Tuesday that uncertainty about the U.S. economy’s trajectory is easing, but it remains unclear whether the central bank should place greater focus on curbing inflation or supporting the labor market. “We may well see pressure on inflation, and we may also see pressure on unemployment, but the balance between the two is still unclear. As the visibility continues to improve, we are well-positioned to adjust our policy stance as needed,” Barkin said. At the same time, Kansas City Fed President Jeff Schmid said he supports holding interest rates steady for now to prevent strong economic activity from adding to inflation pressures. “With the economy still showing momentum, growing business optimism, and inflation still stuck above our objective, retaining a modestly restrictive monetary policy stance remains appropriate for the time being,” Schmid said. He added that he is prepared to shift his stance if demand growth begins “weakening significantly.” Meanwhile, U.S. rate futures have priced in a 96.2% chance of a 25 basis point rate cut and a 3.8% chance of no rate change at the conclusion of the Fed’s September meeting. Today, investors will hear perspectives from Richmond Fed President Tom Barkin, Chicago Fed President Austan Goolsbee, and Atlanta Fed President Raphael Bostic. On the earnings front, network infrastructure provider Cisco Systems (CSCO) is set to report its FQ4 earnings results today. On the economic data front, investors will focus on U.S. Crude Oil Inventories data, which is set to be released later in the day. Economists expect this figure to be -0.900M, compared to last week’s value of -3.029M. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.256%, down -1.21%. My lean or bias today is bullish. We've got new ATH's across the board! The Equal-Weighted Indexes are firing warning signals a major top is forming, which will likely commence the severest bear market since the 2008 GFC. It's official: The top 10% largest US stocks now reflect a record 76% of the US equity market. This has officially surpassed the previous record set before the Great Depression in the 1930s. By comparison, at the 2000 Dot-Com Bubble peak, the top 10%'s share was at ~73%. In the 1980s, this figure was below 50%. Meanwhile, the top 10 stocks in the S&P 500 now represent a record 40% of the index’s market cap. We are witnessing history. Is the market about to correct? My official stance is "who knows?" but... I can say, at these levels its probably a good idea to have a downside hedge. Trade docket for today: We've got out long vol Theta fairy again and I may let that run today to maximize potential. Our Gold 0DTE put side entry already filled and the call side is still working. SPX 0DTE again, focused on debit entries. Back on /MNQ futures for scalping. CENT is in a take profit zone. Let's take a look at our new intra-day zones on /ES after reaching a new ATH. 6500 is the new resistance target with 6514 above that. 6475 is support with 6455 below that. I look forward to seeing you all in the live trading room shortly. Let's get a win today!

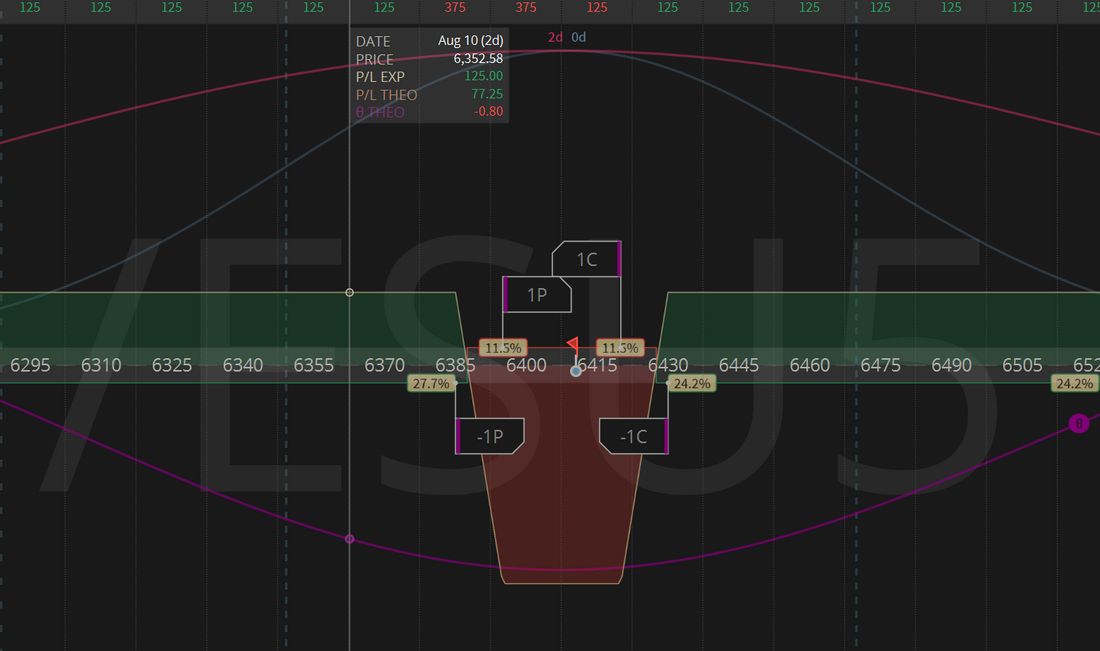

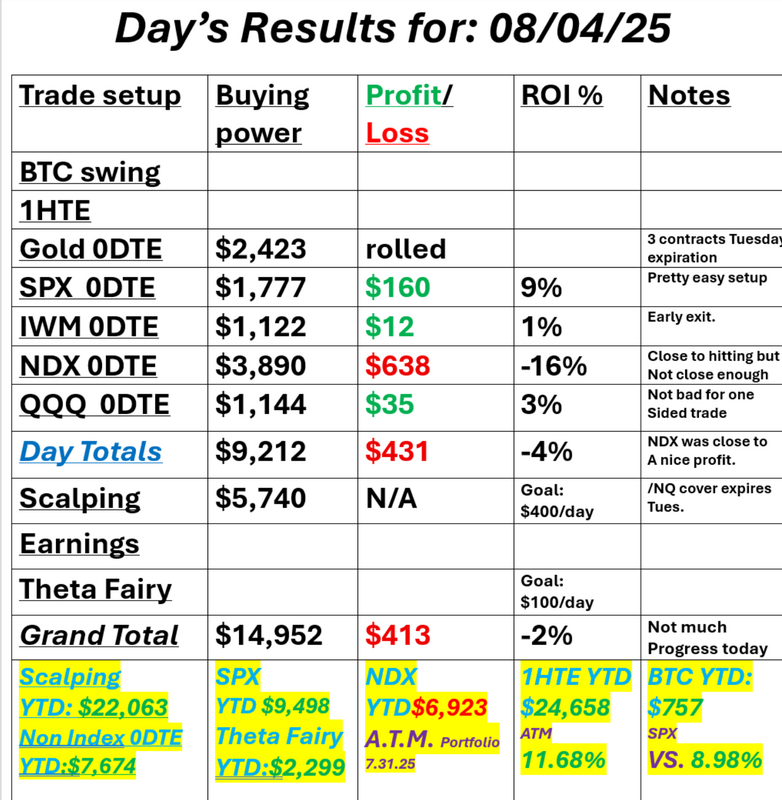

CPI day"Inflation watch" week is always big with CPI then PPI but this week seems bigger. The FED is closer than they've been all year to a possible rate cut and this weeks numbers could be key to either making that a reality or pushing it off for another time. We'll have the numbers shortly. We are working a long vol Theta fairy going into the open. Our day yesterday was lovely....with the exception (again) of the NDX. I clearly need a different approach with the NDX vs. the SPX. It's the one category that is dragging down our otherwise good year. Every other strategy we work is producing results. September S&P 500 E-Mini futures (ESU25) are up +0.06%, and September Nasdaq 100 E-Mini futures (NQU25) are up +0.02% this morning as investors refrained from making big bets ahead of key U.S. inflation data that could reshape expectations for Federal Reserve rate cuts. On Monday, U.S. President Donald Trump signed an executive order delaying hefty tariffs on Chinese imports through November 10th, stabilizing trade relations between the world’s two largest economies. China’s commerce ministry confirmed the move hours after Trump’s announcement, stating that the truce would be extended until mid-November. Still, some investors and analysts cautioned that the extension of the trade truce could prolong uncertainty and create a more persistent risk to inflation, complicating the outlook for Fed policymakers. In yesterday’s trading session, Wall Street’s main stock indexes ended in the red. Monday.com (MNDY) plummeted over -29% after the software company issued weak Q3 revenue guidance. Also, C3.ai (AI) tumbled more than -25% after the AI software company posted downbeat preliminary FQ1 results. In addition, Adobe (ADBE) fell over -2% after Melius Research downgraded the stock to Sell from Hold with a $310 price target. On the bullish side, TKO Group Holdings (TKO) surged more than +10% and was the top percentage gainer on the S&P 500 after Paramount Skydance agreed to pay more than $7 billion to make the newly formed media giant the exclusive distributor of the UFC. Meanwhile, President Trump named EJ Antoni, chief economist at the conservative Heritage Foundation, to lead the Bureau of Labor Statistics after firing the agency’s former head earlier this month. Today, all eyes are focused on the U.S. consumer inflation report, which is set to be released in a couple of hours. The report will provide an opportunity to assess the impact of tariffs on inflation amid a cooling labor market. The recent U.S. ISM services PMI showed an unexpected increase in the prices paid sub-index, serving as a reminder that “inflation is still a force to be reckoned with,” according to Chris Beauchamp, chief market analyst at IG. Economists, on average, forecast that the U.S. July CPI will come in at +0.2% m/m and +2.8% y/y, compared to the previous numbers of +0.3% m/m and +2.7% y/y. Also, the U.S. core CPI is expected to be +0.3% m/m and +3.0% y/y in July, compared to the June figures of +0.2% m/m and +2.9% y/y. A survey conducted by 22V Research revealed that only 18% of investors expect a “risk-on” market reaction to the CPI report, while 43% anticipate a “mixed” response and 39% foresee a “risk-off” reaction. “The market’s reaction to any surprises in the numbers could be exaggerated — especially if a significantly hotter-than-expected CPI print leads traders to believe the Fed may not cut rates at its next meeting,” said Chris Larkin at E*Trade from Morgan Stanley. U.S. rate futures have priced in an 84.5% probability of a 25 basis point rate cut and a 15.5% chance of no rate change at the September FOMC meeting. Market participants will also parse comments today from Richmond Fed President Tom Barkin and Kansas City Fed President Jeff Schmid. On the earnings front, notable companies like Sea Limited (SE), CoreWeave (CRWV), Cardinal Health (CAH), and Circle (CRCL) are scheduled to report their quarterly figures today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.276%, down -0.21%. With CPI today I won't start with a bias or lean. I'll just focus on price action. Trade docket today: We've got the long vol /ES trade that we'll work until it shows profit. Our Gold 0DTE has both sides filled. We'll continue to work that, if necessary. I'll focus on SPX 0DTE today. We scaled our scalping efforts yesterday using the /mnq and that worked quite well. I'll continue that approach today. Let's take a look at the intra-day levels that may come into play today. 6450 and 6350 continue to be the big demarcation zones with 6423/6378 the closest levels to watch today. I look forward to seeing you all in the live trading room. CPI days are usually pretty good to us!

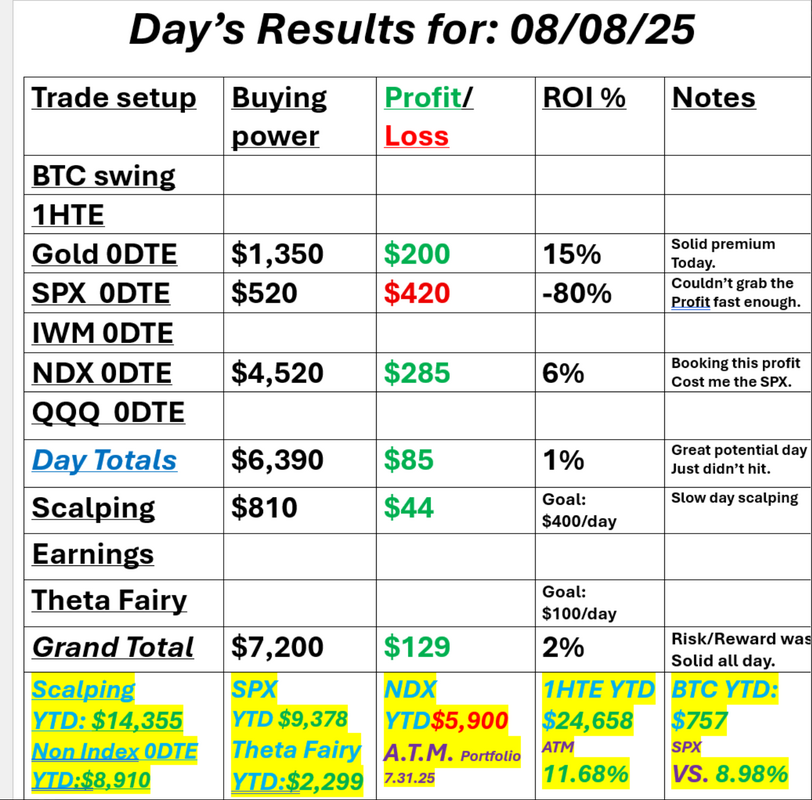

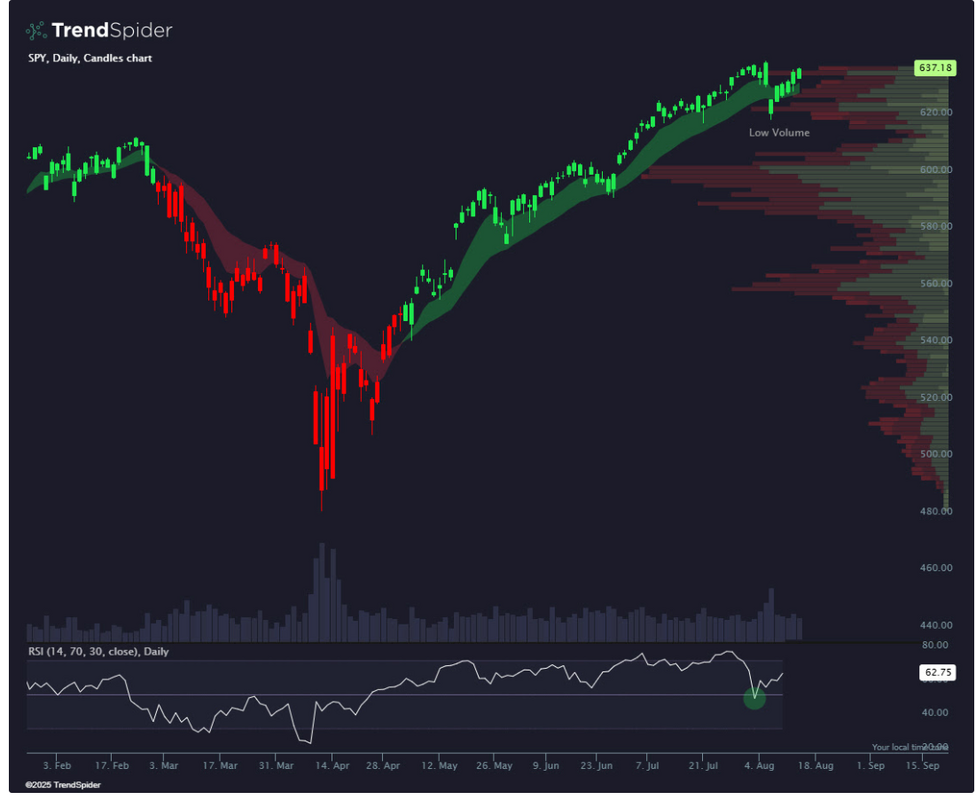

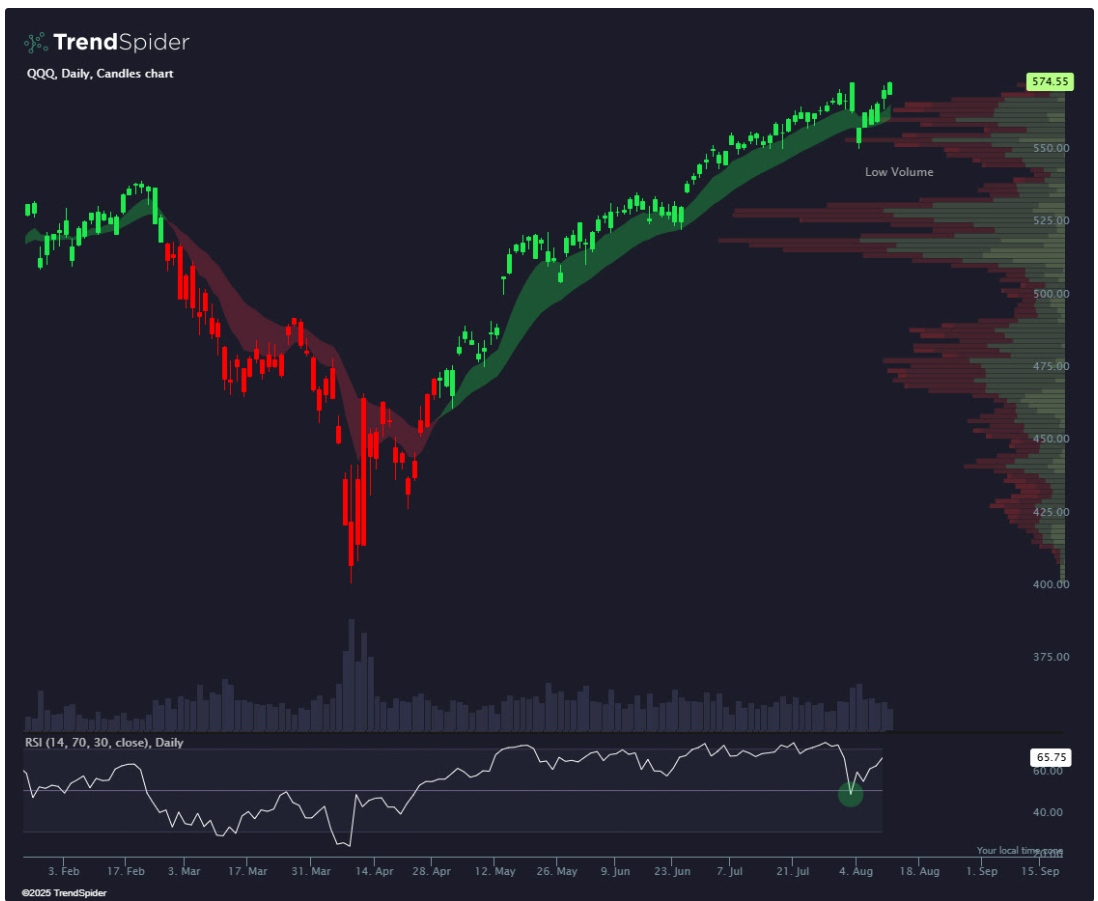

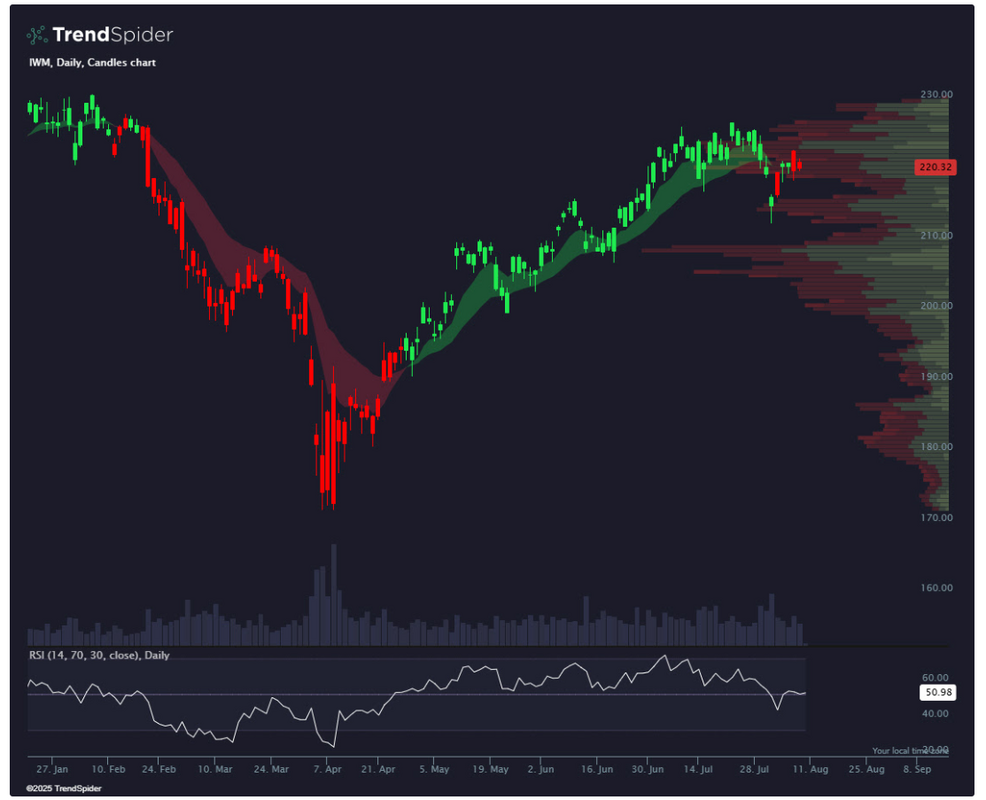

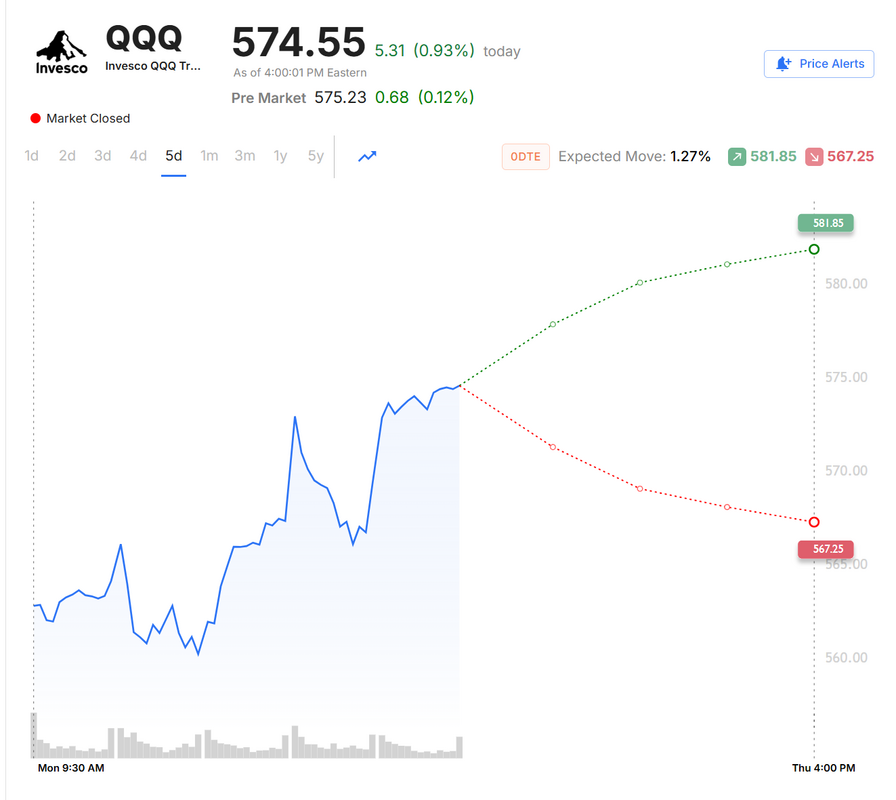

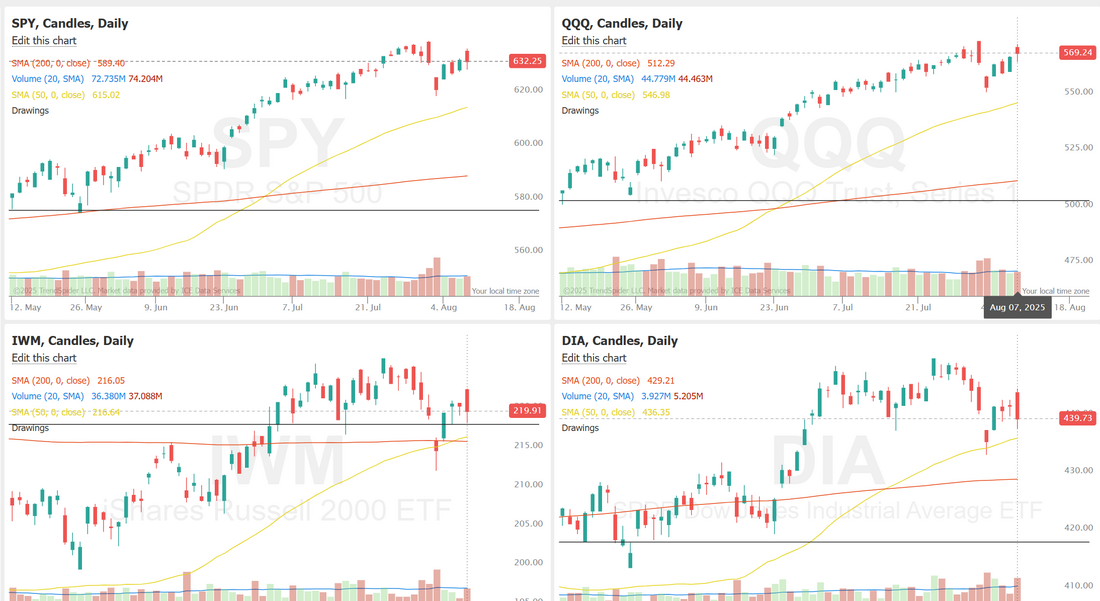

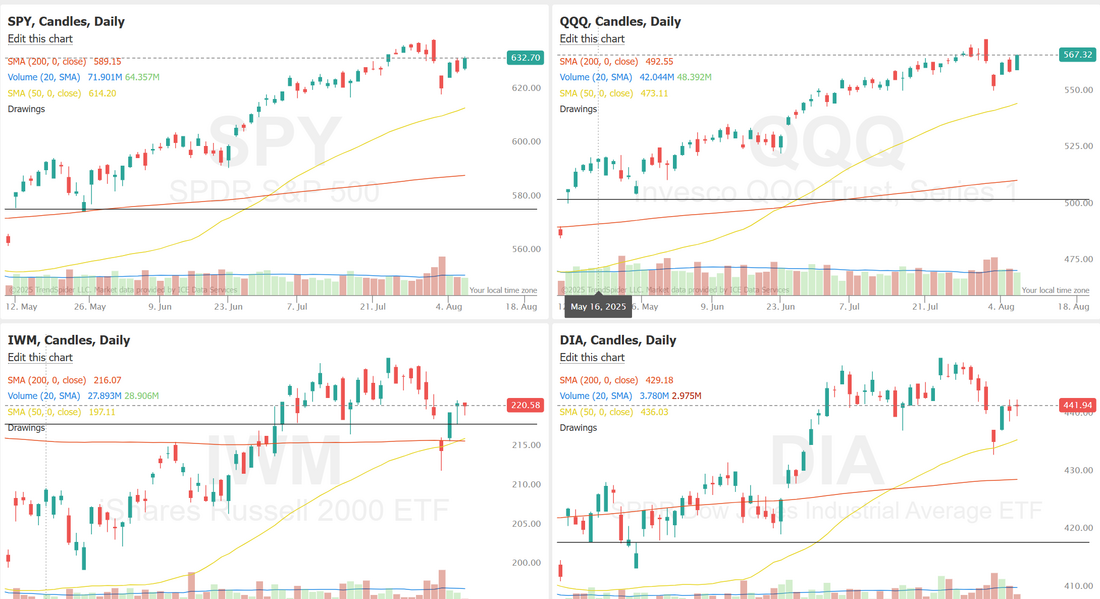

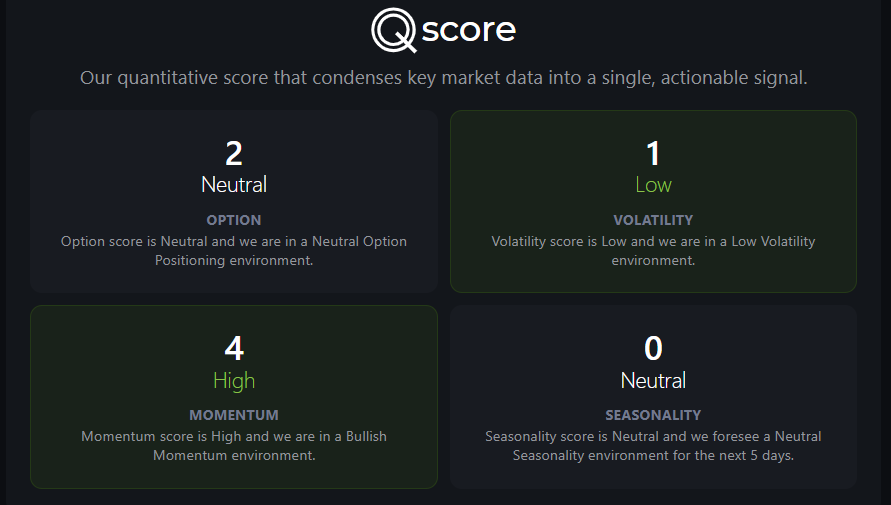

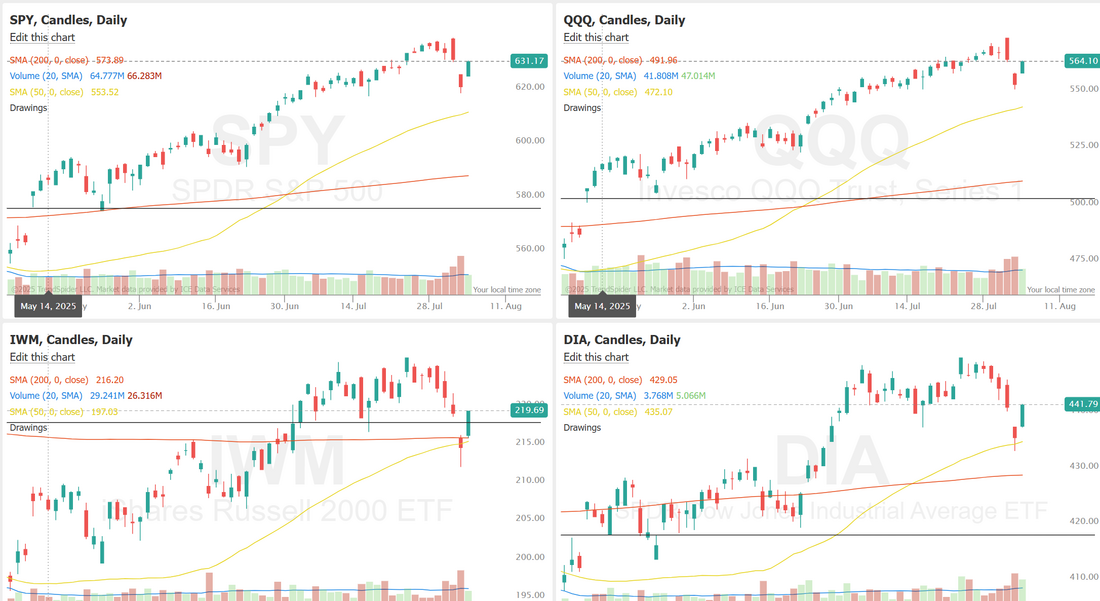

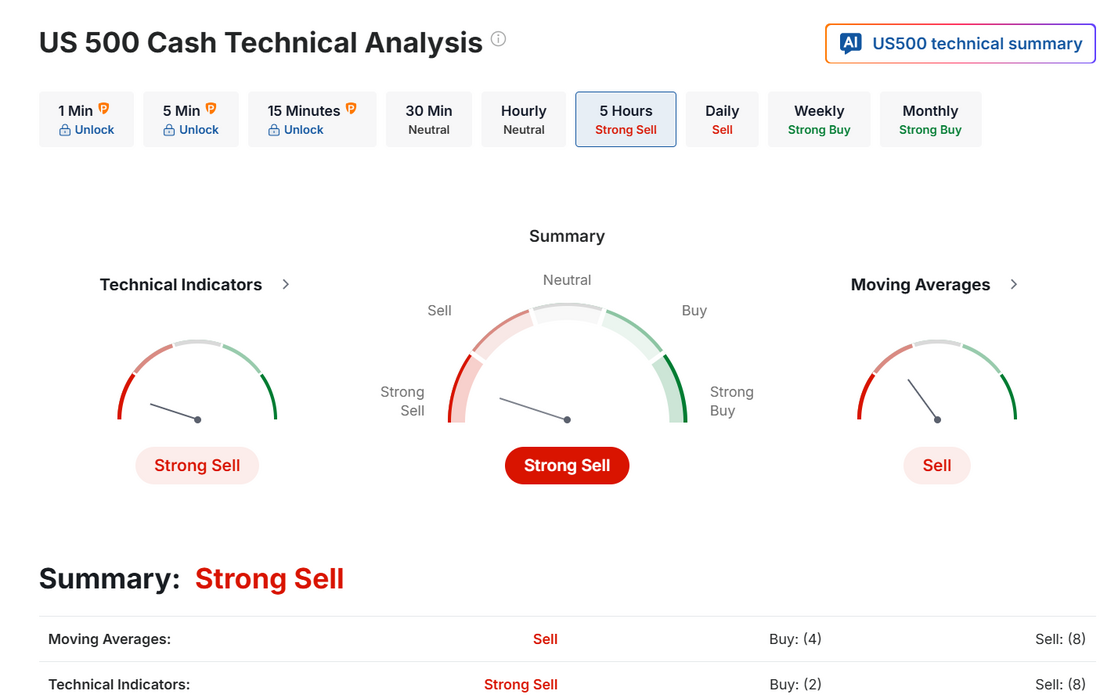

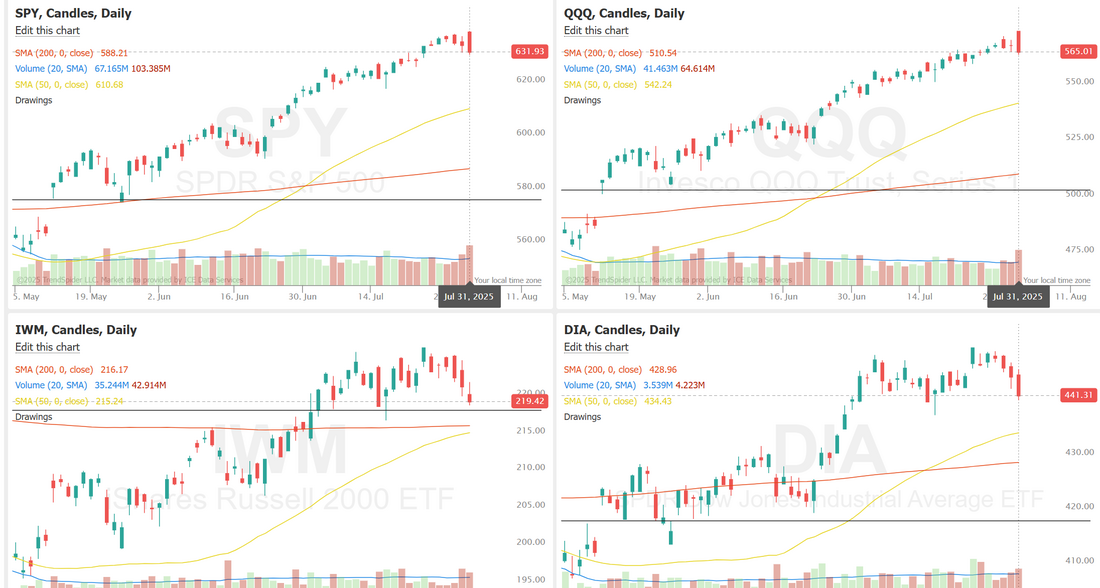

Higher highs...lower volumeThe market had a solid result last week, pushing higher. One of the concerning aspects of this recent push up is the lower volume we're getting. There's not much enthusiasm in the move but a move higher is still, a move higher. We weren't able to generate much success Friday. I had both the SPX and NDX in the profit zone but by the time I could log a profit on NDX the SPX slipped away. It was still a good setup day. We have over $2,000 in potential profits and risk was in check most of the day. With low I.V. the debit trades seem to be the best focus. Even when we get little movement. Here's a look at our day. Let's take a look at the markets: The bullish bias continues. The upcoming Alaska meeting between Presidents Vladimir Putin and Donald Trump is already being framed as a strategic win for Moscow, even before discussions begin. It marks Putin’s first invitation to meet a U.S. president on American soil since 2007, without conditions or Ukrainian and European participation a setup that Kyiv views warily. The talks come as Russia advances militarily in Ukraine’s south and east, with economic pressures mounting at home from sanctions, falling energy revenues, and persistent inflation. Moscow is expected to push for immediate sanctions relief and territorial concessions in exchange for a ceasefire, while signaling interest in joint economic ventures in Alaska and the Arctic. Markets have reacted positively to the prospect of negotiations, with European and U.S. equities gaining, though defense stocks dipped on speculation that peace could slow NATO-related spending. However, analysts note that defense names could benefit regardless of the outcome either from continued arms replenishment if talks fail or from sustained procurement needs even in a post-agreement environment. Gold prices slipped about 1% as geopolitical risk perceptions eased slightly. The outcome of Friday’s meeting remains uncertain, with Trump balancing pressure over sanctions against his stated interest in brokering a peace deal. The SPX chart for August 8 shows prices higher than levels seen in early August, moving toward the upper range observed in recent weeks near 6,400. The option score, which had declined sharply earlier in the month, is now recorded at 4 after reaching recent lows. This score change is concurrent with price movement during the same period and represents a difference from the quieter readings noted in late July and early August. The SPY snapped back from its gap down and closed at $637.12 (+2.47%). Once again, its dip into the 8/21 EMA cloud was quickly bought, with candles remaining green on the EMA Crossover Candle Colors Indicator, showing the bullish trend is still intact. However, with lower-than-average volume all week, bulls may remain cautious. A push back to all-time highs on stronger volume could help confirm continuation of the uptrend. Despite weak earnings from $AMD, the QQQ led the major indexes, pushing to all-time highs and closing the week at $574.55 (+3.73%). It fell below the 8/21 EMA cloud on Monday’s gap down, but found support at the RSI midpoint and quickly reclaimed the cloud, keeping bullish momentum intact. With names like $PLTR and $MSFT flashing on the power gap scan, tech stocks remain king in this market. IWM posted a solid week, closing at $220.62 (+2.50%), but unlike its large-cap peers, it remains well below all-time highs. Even with the Polymarket Indicator showing a 75% chance of a September rate cut, the EMA Crossover Candle Colors Indicator has begun flashing red, hinting at a potential bearish trend reversal. This week’s CPI and PPI releases could be key in shaping sentiment for the index going forward. Let's take a look at this weeks expected moves with CPI and PPI coming out. You can see, it's not much better than last week and we blew through last weeks expected move by more than 100%. Debits seem to be the way to go here. September S&P 500 E-Mini futures (ESU25) are up +0.09%, and September Nasdaq 100 E-Mini futures (NQU25) are up +0.05% this morning, pointing to a muted open on Wall Street as investors await key U.S. economic data, especially the inflation report, and a summit between U.S. President Donald Trump and Russia’s Vladimir Putin. Financial markets found some reassurance in renewed diplomatic efforts to end the Russia-Ukraine war, with Trump and Putin preparing to meet in Alaska on Friday. The weekend saw intense diplomacy between U.S., Ukrainian, and European officials, including meetings in the U.K. with U.S. Vice President JD Vance and British Foreign Secretary David Lammy. Still, Ukrainian President Volodymyr Zelenskiy has maintained his refusal to cede territory occupied by Russia. In Friday’s trading session, Wall Street’s major equity averages closed higher, with the S&P 500 posting a 1-week high and the Nasdaq 100 notching a new record high. Gilead Sciences (GILD) climbed over +8% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the biopharmaceutical giant posted upbeat Q2 results and raised its full-year guidance. Also, Monster Beverage (MNST) gained more than +6% after the company reported better-than-expected Q2 adjusted EPS. In addition, Expedia (EXPE) rose over +4% after the travel booking company posted stronger-than-expected Q2 results and raised its full-year gross bookings guidance. On the bearish side, Trade Desk (TTD) plummeted more than -38% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the ad-tech company issued weak Q3 revenue guidance and announced that CFO Laura Schenkein will be replaced by Alex Kayyal. St. Louis Fed President Alberto Musalem said on Friday that he backed policymakers’ recent decision to keep interest rates unchanged, adding that the central bank remains further from meeting the inflation side of its mandate. “Given the economy where it stands today, it seemed appropriate to maintain the policy rate at a constant for now,” Musalem said. He also said the most likely outcome is that the price effects from tariffs will be temporary, but added there is a “reasonable probability” they could prove more persistent. At the same time, Fed Governor Michelle Bowman said on Saturday that she favors three interest rate cuts this year. “With economic growth slowing this year and signs of a less dynamic labor market becoming clear, I see it as appropriate to begin gradually moving our moderately restrictive policy stance toward a neutral setting,” Bowman said. Meanwhile, U.S. rate futures have priced in an 88.4% chance of a 25 basis point rate cut and an 11.6% chance of no rate change at the Fed’s monetary policy committee meeting next month. The U.S. consumer inflation report for July will be the main highlight this week. The recent U.S. ISM services PMI showed an unexpected increase in the prices paid sub-index, serving as a reminder that “inflation is still a force to be reckoned with,” according to Chris Beauchamp, chief market analyst at IG. Citi economists said investors will be watching to gauge the extent to which tariffs are impacting prices after June’s report showed “early signs of larger increases in goods prices.” Investors will also monitor July retail sales data for clues on how tariffs are impacting consumers. Other noteworthy data releases include the U.S. PPI, the Core PPI, Initial Jobless Claims, the Export Price Index, the Import Price Index, the Empire State Manufacturing Index, Industrial Production, Manufacturing Production, and the University of Michigan’s Consumer Sentiment Index (preliminary). Second-quarter corporate earnings season is winding down, but several notable companies are due to report this week, including Cisco (CSCO), Applied Materials (AMAT), Deere & Company (DE), CoreWeave (CRWV), and Circle (CRCL). According to Bloomberg Intelligence, S&P 500 companies are on track to post a 9.1% increase in Q2 profits from a year earlier, well above analysts’ forecast of 2.8%. Market participants will also hear perspectives from several Fed officials, including Barkin, Schmid, Goolsbee, and Bostic, throughout the week. In addition, investors will closely watch for any further updates on U.S. tariff plans for specific sectors. Last week, President Trump said that U.S. tariffs on semiconductor and pharmaceutical imports would be announced “within the next week or so.” While some clarity was provided on chip tariffs last week, investors will be particularly eager for further updates on tariffs targeting the pharmaceutical sector. The U.S. economic data slate is empty on Monday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.258%, down -0.58%. My bias or lean today is more neutral. Futures are slightly green, as I type. We've got CPI and PPI later this week, which will likely be the main drivers for the market. We'll look at levels in a moment. If we can break either level we could get some movement. Trade docket today: We've booked profits on almost all our pairs trades so today we'll start a new batch. BELFP, SXI, IRMD, GRC all short. CRMT, OBT, CENT, KALU all long. We are already working our Gold 0DTE this morning. We've got a big retrace going off the gold tariff pump so we'll keep an eye on this one with possible enhancements as the day progresses. LULU covered call again. SPX 0DTE. I think I'll focus on the SPX today and wait for a potential later entry on NDX. Let's take a look at the key intra-day levels for me today on /ES: I've got two big levels I'm watching today 6450 on the upside and 6340 on the downside. A break above or below these areas could signify the next directional move. I look forward to seeing you all in the live trading room shortly!

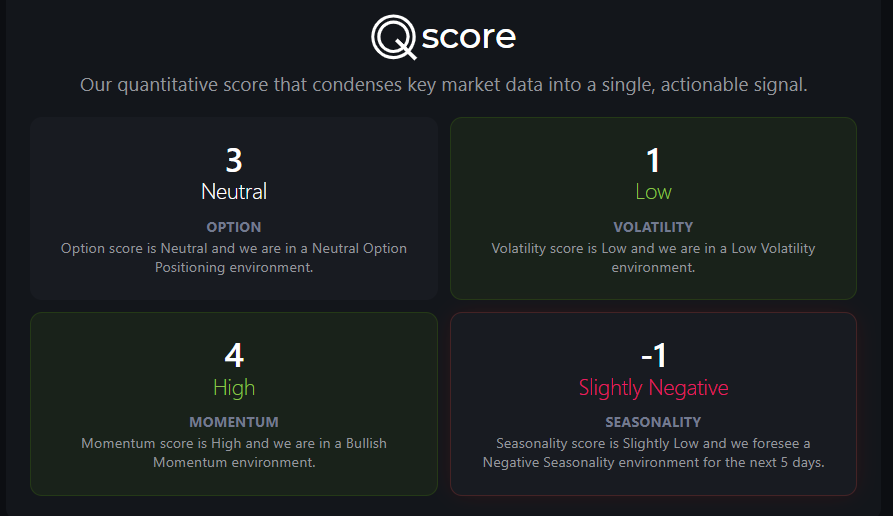

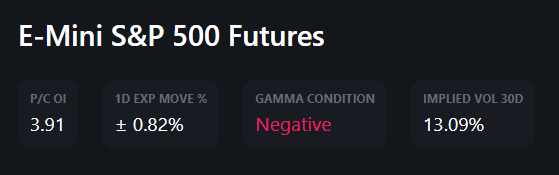

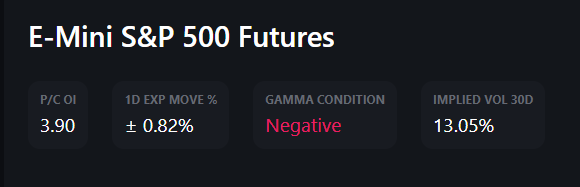

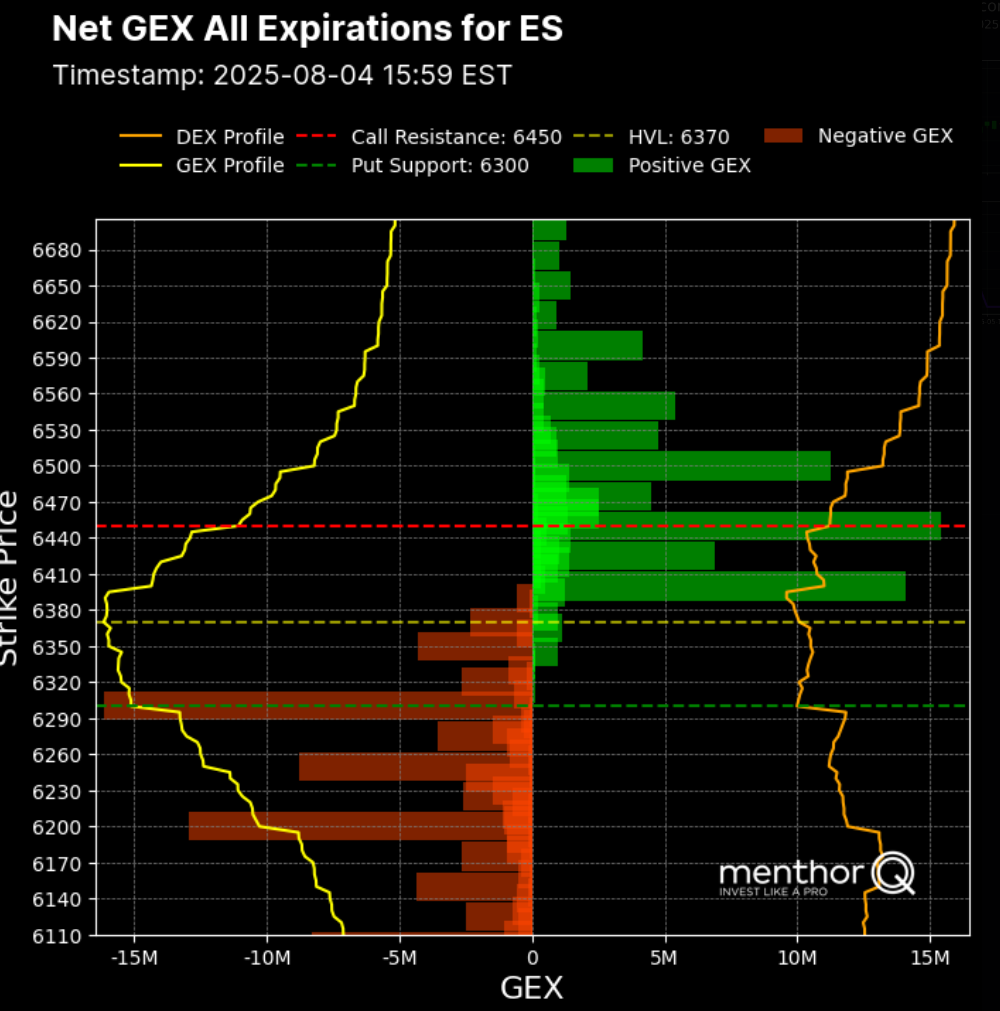

Now gold is tariffed?Most of you who trade with us know that we have a daily income goal of $1,000 dollars and our Gold 0DTE's generally can bring in 10-20% of that so it's frustrating when we can't get a setup working. Last night was NOT that! We got plenty of premium out of todays setup. Yesterday was a solid day for us. Debits all day long. I gave back a lot on the SPX setup but it still ended up well. Let's take a look at the markets: We start the day with a bullish lean but the price action doesn't look that impressive. My lean or bias today is bearish. I think we get a drawdown. Futures are up as I type. Trade docket for today: Gold 0DTE, ADMA, EHAB, FANG, KFS, PLTR, VRTX flip to a bullish zebra. SPX/NDX 0DTE September S&P 500 E-Mini futures (ESU25) are trending up +0.32% this morning, capping a week dominated by tariff and geopolitical developments, as well as a wave of earnings, with investors weighing U.S. President Donald Trump’s efforts to tighten his grip on the Federal Reserve. Gold futures in New York jumped after a Financial Times report said that U.S. imports of one-kilogram bullion bars are now subject to tariffs, posing a threat to trade flows from Switzerland and other major refining hubs. The most-active contract rose to a record intraday high above $3,534 an ounce. Late Thursday, President Trump said he had selected Council of Economic Advisers Chairman Stephen Miran to serve as a Fed governor. Mr. Trump said that Miran, who must be confirmed by the Senate, would serve only the remainder of Adriana Kugler’s term, which ends in January. In yesterday’s trading session, Wall Street’s major indices ended mixed. Fortinet (FTNT) plummeted over -22% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the cybersecurity firm was hit with multiple downgrades and price target cuts following the release of its Q2 results and guidance. Also, Eli Lilly (LLY) plunged more than -14% after the drugmaker reported disappointing data on its new weight-loss pill. In addition, Caterpillar (CAT) fell over -2% after Morgan Stanley downgraded the stock to Underweight from Equal Weight with a price target of $350. On the bullish side, chip stocks climbed after President Trump said firms that relocate production to the U.S. will be exempt from the proposed 100% tariff on chip imports, with Advanced Micro Devices (AMD) rising more than +5% and Lam Research (LRCX) gaining over +3%. The Labor Department’s report on Thursday showed that the number of Americans filing for initial jobless claims in the past week rose by 7K to 226K, compared with the 221K expected. Also, U.S. Q2 nonfarm productivity rose +2.4% q/q, stronger than expectations of +1.9% q/q, and unit labor costs rose +1.6% q/q, in line with expectations. In addition, U.S. consumer credit rose by $7.37 billion in June, weaker than expectations of $7.40 billion. “With the jobless claims beginning to rise again, this adds to concerns about the employment picture that were raised last week,” said Matt Maley, chief market strategist at Miller Tabak + Co. Atlanta Fed President Raphael Bostic said on Thursday that he still sees one rate cut as likely this year, and reiterated that there are reasons to doubt that the inflationary effects from tariffs will be short-lived. “This question about whether tariffs are a one-time thing, or whether they’re going to be more persistent in their effects and might even cause structural changes, I think is perhaps the most important question that we have today,” Bostic said. In other news, Bloomberg reported that Fed Governor Christopher Waller is emerging as a top candidate to become the central bank’s chair among President Trump’s advisers as they seek a successor to Jerome Powell. Meanwhile, U.S. rate futures have priced in an 89.4% probability of a 25 basis point rate cut and a 10.6% chance of no rate change at the September FOMC meeting. The U.S. economic data slate is empty on Friday. However, investors will focus on a speech from St. Louis Fed President Alberto Musalem. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.249%, down -0.16%. Let's take a look at the intra-day levels in /ES. Quant score is more neutral. Negative gamma. We could get some movement. 6399 and 6418 are resistance with 6370, 6358, 6348 working as support. Let's finish strong today folks. See you all in the live trading room!

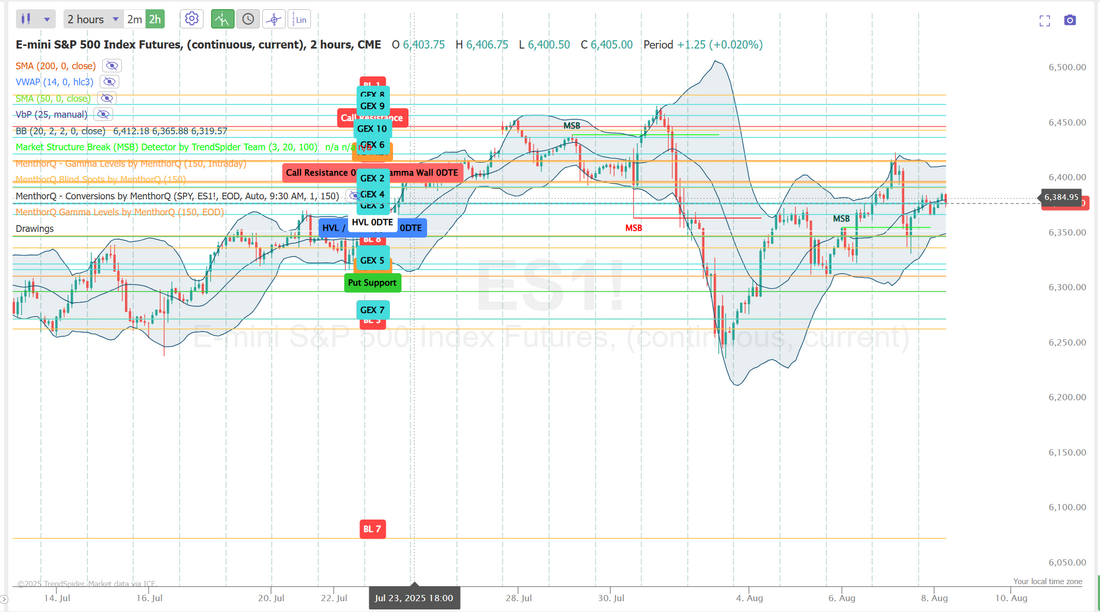

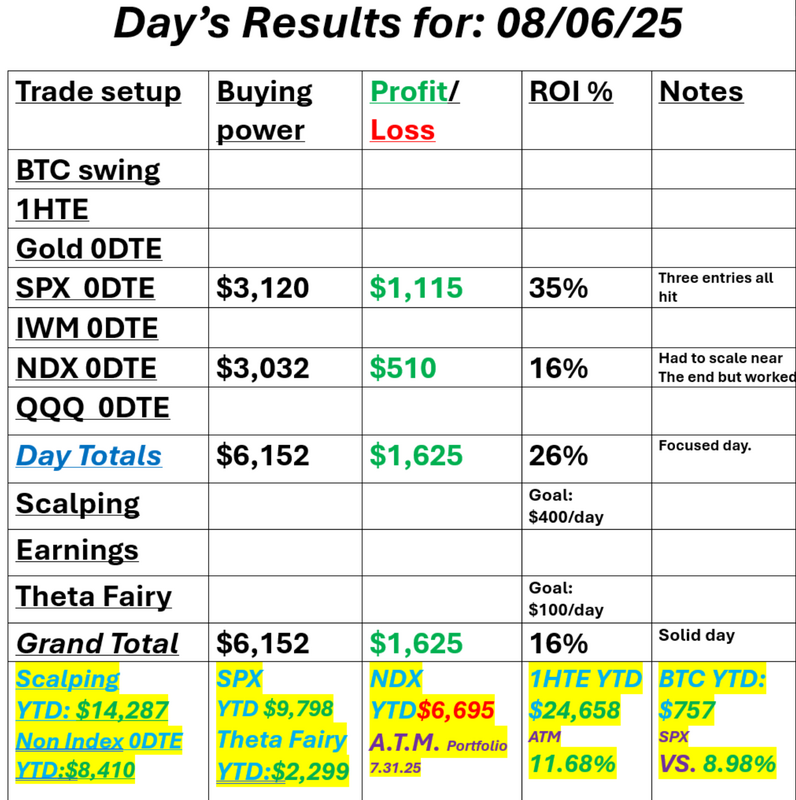

Fundamentals matter...eventually.Not to beat a dead horse but valuations are up there. We continue to look for opportunities to build bearish setups in our ATM portfolio. Yesterday was a focused effort for us on SPX and NDX 0DTE's and that paid off. See our results below: Let's take a look at the market. Yesterday was a largely bullish day for the indices. Negative gamma to start the day: Quant score is improving. September S&P 500 E-Mini futures (ESU25) are up +0.81%, and September Nasdaq 100 E-Mini futures (NQU25) are up +0.78% this morning as U.S. President Donald Trump’s 100% tariff threat on chip exporters included exemptions for firms investing in the U.S., while hopes for a truce in Russia’s war with Ukraine further boosted sentiment. President Trump announced late Wednesday a roughly 100% tariff on semiconductors entering the U.S., but noted that tech firms like Apple investing in domestic manufacturing would be exempt from the duties. Mr. Trump said that “if you’re building in the United States of America, there’s no charge.” Also aiding sentiment, the Kremlin confirmed that Presidents Donald Trump and Vladimir Putin are set to hold summit talks in the coming days, fueling hopes for a potential truce in Russia’s war with Ukraine. Increasing speculation that the Federal Reserve will resume rate cuts in September is also buoying sentiment as U.S. reciprocal tariffs took effect against dozens of countries a minute past midnight Washington time on Thursday. In a social-media post, Mr. Trump said, “Billions of dollars in tariffs are now flowing into the United States of America.” Investors now look ahead to U.S. jobless claims data for further insight into the health of the labor market. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed higher. Apple (AAPL) climbed over +5% and was the top percentage gainer on the Dow following reports that the tech titan is set to announce a fresh $100 billion investment in the U.S. in an effort to avoid steep tariffs on iPhones. Also, Arista Networks (ANET) surged more than +17% and was the top percentage gainer on the S&P 500 after the company reported stronger-than-expected Q2 results and issued solid Q3 revenue guidance. In addition, Shopify (SHOP) soared over +21% and was the top percentage gainer on the Nasdaq 100 after the company posted upbeat Q2 results. On the bearish side, Super Micro Computer (SMCI) plummeted more than -18% and was the top percentage loser on the S&P 500 after the AI server maker reported downbeat FQ4 results and provided disappointing FQ1 guidance. “There are a lot of narratives to keep track of in today’s investing environment, but earnings remain the main catalyst for stocks. While pullbacks are possible — particularly due to macro-related influences and poor seasonality trends — those pullbacks will likely prove to be buying opportunities,” said Bret Kenwell at eToro. Minneapolis Fed President Neel Kashkari said on Wednesday that a slowing of the U.S. economy could warrant an interest rate cut in the near term, and he still sees two cuts by the end of the year. Also, Fed Governor Lisa Cook described the July jobs report as “concerning” and suggested it may mark a turning point for the U.S. economy. “These revisions are somewhat typical of turning points,” Cook said. In addition, San Francisco Fed President Mary Daly said that policymakers will likely need to adjust interest rates in the coming months to prevent further labor market weakness. Meanwhile, U.S. rate futures have priced in a 93.2% chance of a 25 basis point rate cut and a 6.8% chance of no rate change at September’s monetary policy meeting. Today, investors will focus on U.S. Initial Jobless Claims data, which is set to be released in a couple of hours. Economists expect this figure to be 221K, compared to last week’s number of 218K. U.S. Unit Labor Costs and Nonfarm Productivity preliminary data will also be closely watched today. Economists forecast Q2 Unit Labor Costs to be +1.6% q/q and Nonfarm Productivity to be +1.9% q/q, compared to the first-quarter numbers of +6.6% q/q and -1.5% q/q, respectively. U.S. Wholesale Inventories data will be released today. Economists expect the final June figure to be +0.2% m/m, compared to -0.3% m/m in May. U.S. Consumer Credit data will be released today as well. Economists expect this figure to be $7.40 billion in June, compared to the previous figure of $5.10 billion. In addition, market participants will parse comments today from Atlanta Fed President Raphael Bostic. On the earnings front, notable companies like Eli Lilly (LLY), Gilead (GILD), ConocoPhillips (COP), Constellation Energy (CEG), Vistra Energy (VST), and Monster Beverage (MNST) are set to report their quarterly figures today. According to Bloomberg Intelligence, S&P 500 companies are on track to post a 9.1% increase in Q2 profits from a year earlier, well above analysts’ forecast of 2.8%. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.215%, down -0.35%. My bias or lean today is neutral to bearish. Futures are up a healthy .70% I don't think we hold these levels today. Trade docket: Gold 0DTE, ADMA, EHAB, FANG, GOGO, SPX/NDX 0DTE. Let's take a look at our intra-day /ES levels: 6424 is resistance with 6399, 6392, 6381, 6365 working as support levels. Let's have a great day folks. See you in the live trading room shortly.

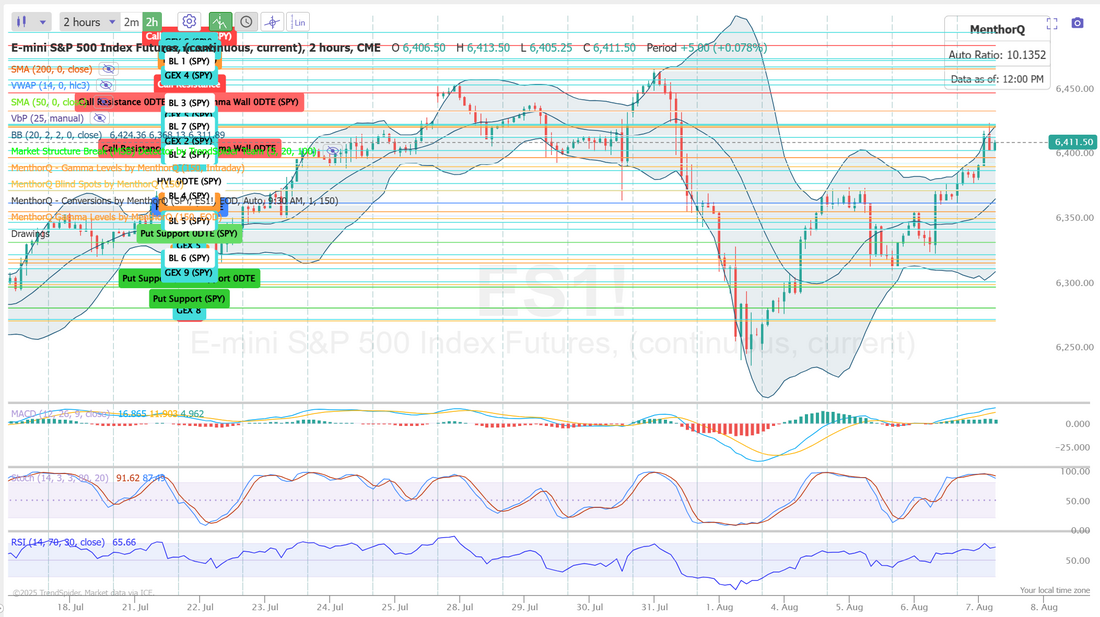

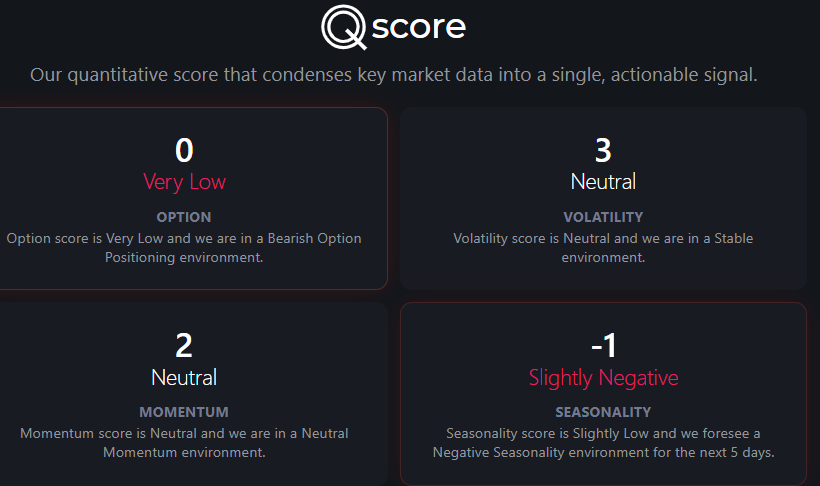

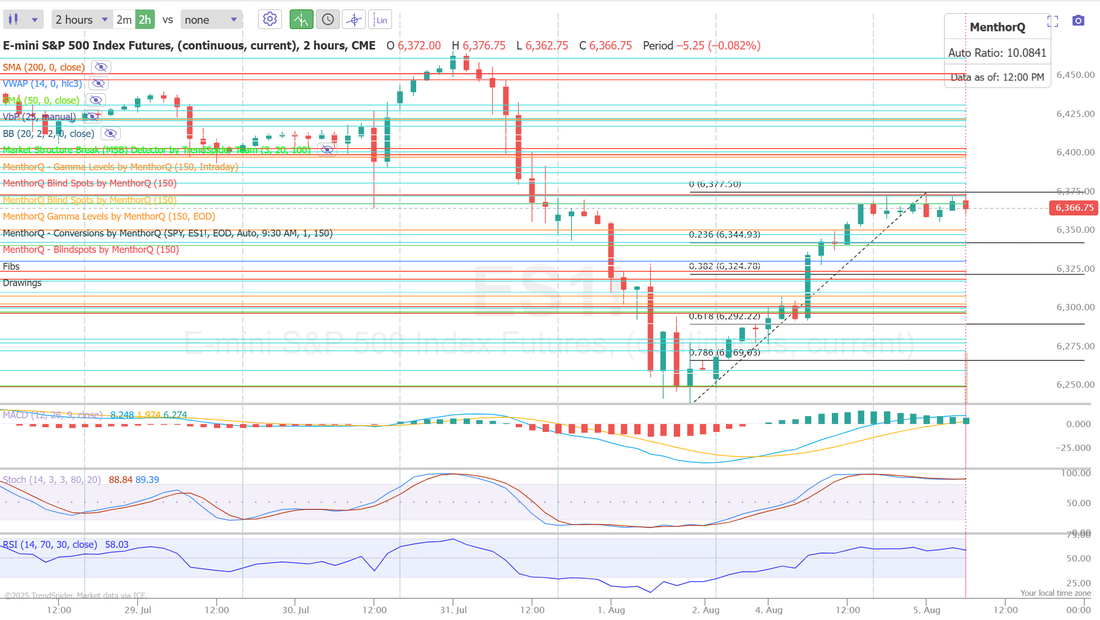

Palantir lifts all boatsPLTR earnings were a bigger blowout than the expected blowout and the stock is pushing up this morning carrying futures up with it. We have a long strangle on. It will be interesting to see what profit we can get out of it today. I didn't have much success in yesterday's trading session but that's o.k. I needed to roll my gold 0DTE to today. I was scalping short looking for a retrace that never came. I've covered it now for $1,000 of potential cash flow but that will go on todays results. The NDX had a $900 profit potential and was close but not close enough. Just too many things working against me. The bright spot yesterday was our ATM portfolio, once again, hitting a new ATH. Here's a look at my day yesterday: Let's take a look at the market. After a brief swoon the last part of last week we are back to bullish bias. The bulls still have some work to get the rally back on track but yesterday was a strong snap back and futures are up this morning. September S&P 500 E-Mini futures (ESU25) are up +0.24%, and September Nasdaq 100 E-Mini futures (NQU25) are up +0.30% this morning, extending a rebound driven by bets on Federal Reserve interest rate cuts and solid corporate earnings. Palantir Technologies (PLTR) was the latest company to impress Wall Street with its quarterly results. Shares of the data analysis software firm climbed over +5% in pre-market trading after it posted upbeat Q2 results and raised its full-year guidance. In yesterday’s trading session, Wall Street’s main stock indexes closed sharply higher. The Magnificent Seven stocks advanced, with Nvidia (NVDA) climbing over +3% to lead gainers in the Dow and Alphabet (GOOGL) rising more than +3%. Also, chip stocks gained ground, with Broadcom (AVGO) and KLA Corp. (KLAC) rising over +3%. In addition, IDEXX Laboratories (IDXX) soared more than +27% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the company posted upbeat Q2 results and raised its full-year guidance. On the bearish side, ON Semiconductor (ON) plunged over -15% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the chipmaker provided a weaker-than-expected Q3 adjusted gross margin forecast. Economic data released on Monday showed that U.S. factory orders fell -4.8% m/m in June, slightly better than expectations of a -4.9% m/m decline. Still, that marked the largest decline in more than 5 years. “This week is a quiet one on the economic calendar, so traders may be taking their cues from earnings, along with any new tariff and trade developments,” said Chris Larkin at E*Trade from Morgan Stanley. Larkin also noted that a key question now is whether traders will interpret any signs of economic weakness as a bearish signal for markets, or as a catalyst for the Fed to resume interest rate cuts. San Francisco Fed President Mary Daly said on Monday that the time for rate cuts is approaching amid growing signs of labor market weakness and the absence of persistent tariff-driven inflation, according to Reuters. Meanwhile, U.S. rate futures have priced in an 88.1% chance of a 25 basis point rate cut and an 11.9% chance of no rate change at the conclusion of the Fed’s September meeting. Second-quarter corporate earnings season rolls on, with investors awaiting fresh reports from high-profile companies today, including Advanced Micro Devices (AMD), Caterpillar (CAT), Amgen (AMGN), Arista Networks (ANET), Pfizer (PFE), and Duke Energy (DUK). According to Bloomberg Intelligence, S&P 500 companies are on track to post a 9.1% increase in Q2 profits from a year earlier, well above analysts’ forecast of 2.8%. On the economic data front, investors will closely monitor the U.S. ISM Non-Manufacturing PMI and S&P Global Services PMI, set to be released in a couple of hours. Economists expect the July ISM services index to be 51.5 and the S&P Global services PMI to be 55.2, compared to the previous values of 50.8 and 52.9, respectively. U.S. Trade Balance data will also be released today. Economists anticipate the trade deficit will narrow to -$62.60 billion in June from -$71.50 billion in May. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.212%, up +0.05%. Let's take a look at some of the internals: Quant score shows continued bearish option positioning. The big gamma walls sit at 6450 on the upside and 6300 on the downside. The SPX chart as of August 4, 2025, shows a recent short-term recovery following a brief but sharp pullback in spot price, with a notable rebound in the Momentum Score from 2 back up to 4. This bounce suggests buying interest has returned quickly after the dip, helping the index hold above prior consolidation levels. However, the score remains below peak levels seen in July, indicating that momentum, while positive, isn't at full strength. In the short term, traders may monitor whether the index can sustain this rebound or if momentum fades again potentially signaling continued choppiness or a need for stronger catalysts. My lean or bias today is neutral. We have PMI and Trade balance numbers this morning as well as Trump speaking on CNBC about tariffs as our main, planned news catalysts. With more tariffs coming between today and Thurs. I think we stall out here. Trade docket for today: Gold 0TE, QQQ 0DTE, IWM 0DTE, SPX 0DTE, NDX 0DTE. I'll continue working the /MNQ short scalp with the /NQ cover. CAT, FANG, PLTR, VRTX? earnings. New earnings trades in AMD, AMGN. Let's take a look at our intra-day levels on /ES: 6377, 6389, 6401 are my key resistance levels for today. 6354, 6344, 6325 are support. No revenge trading but....let's try to get a bit or redemption from yesterday! I look forward to chatting with you all in the live trading room shortly!

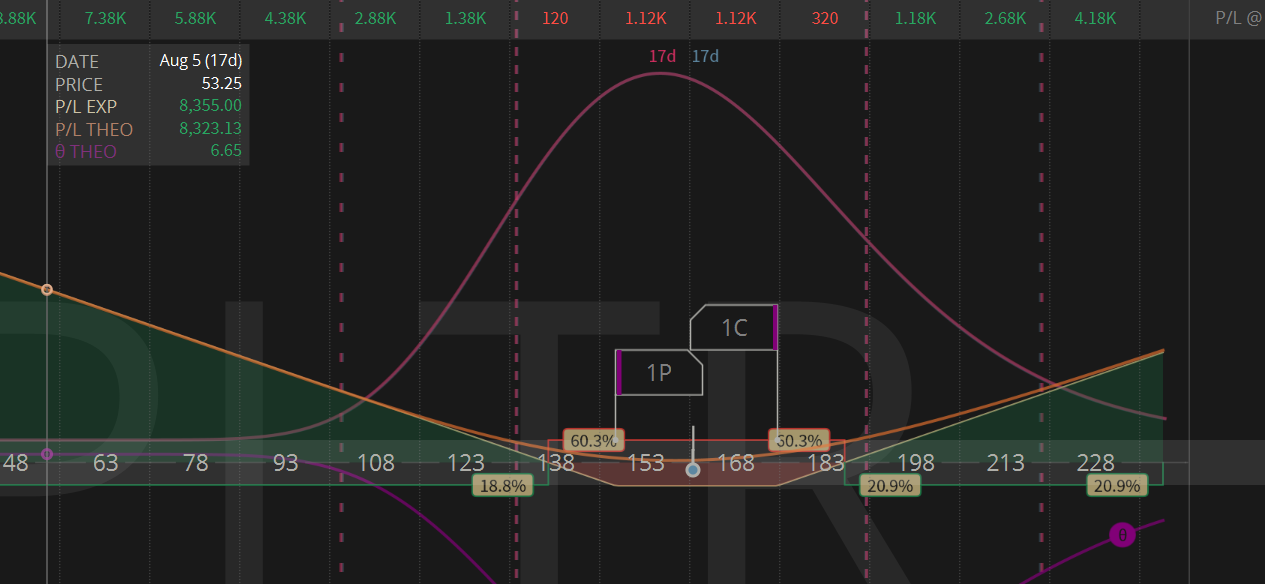

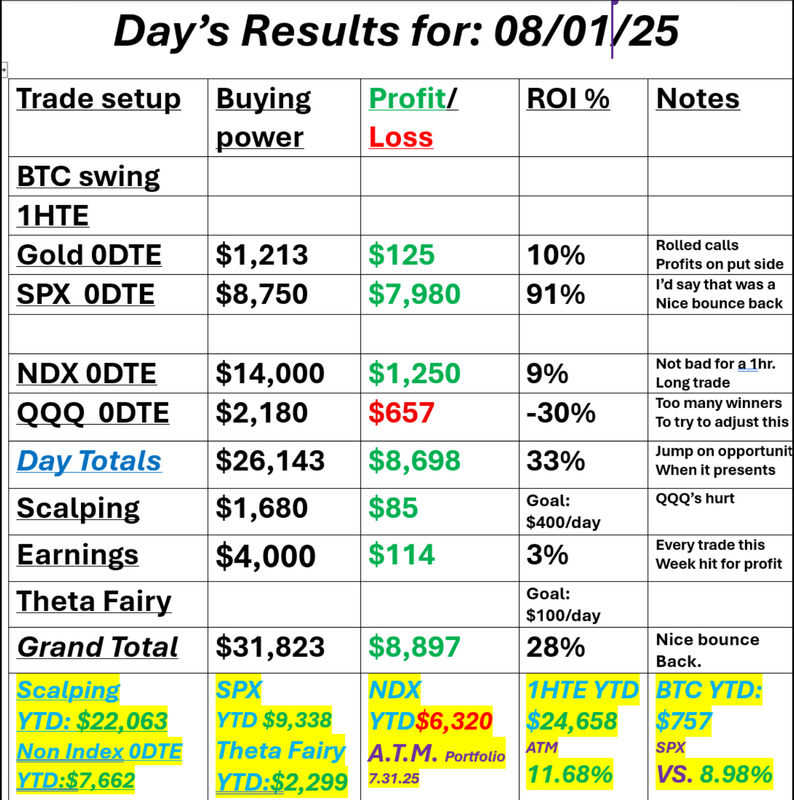

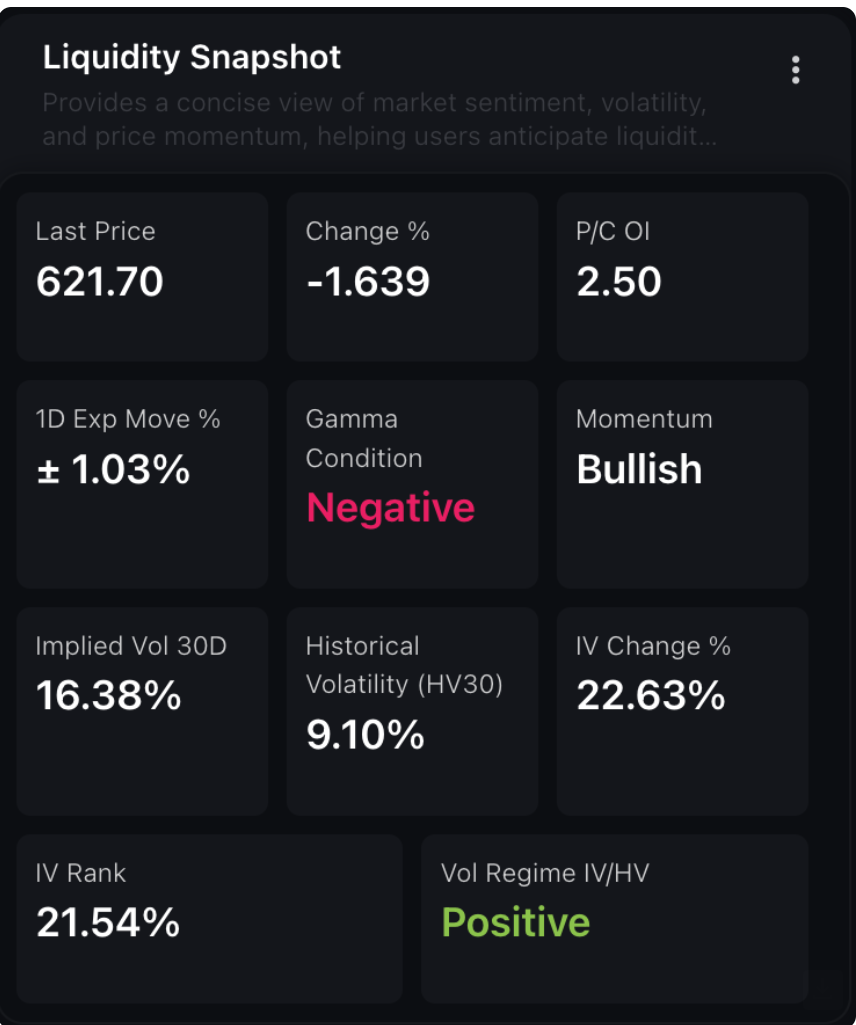

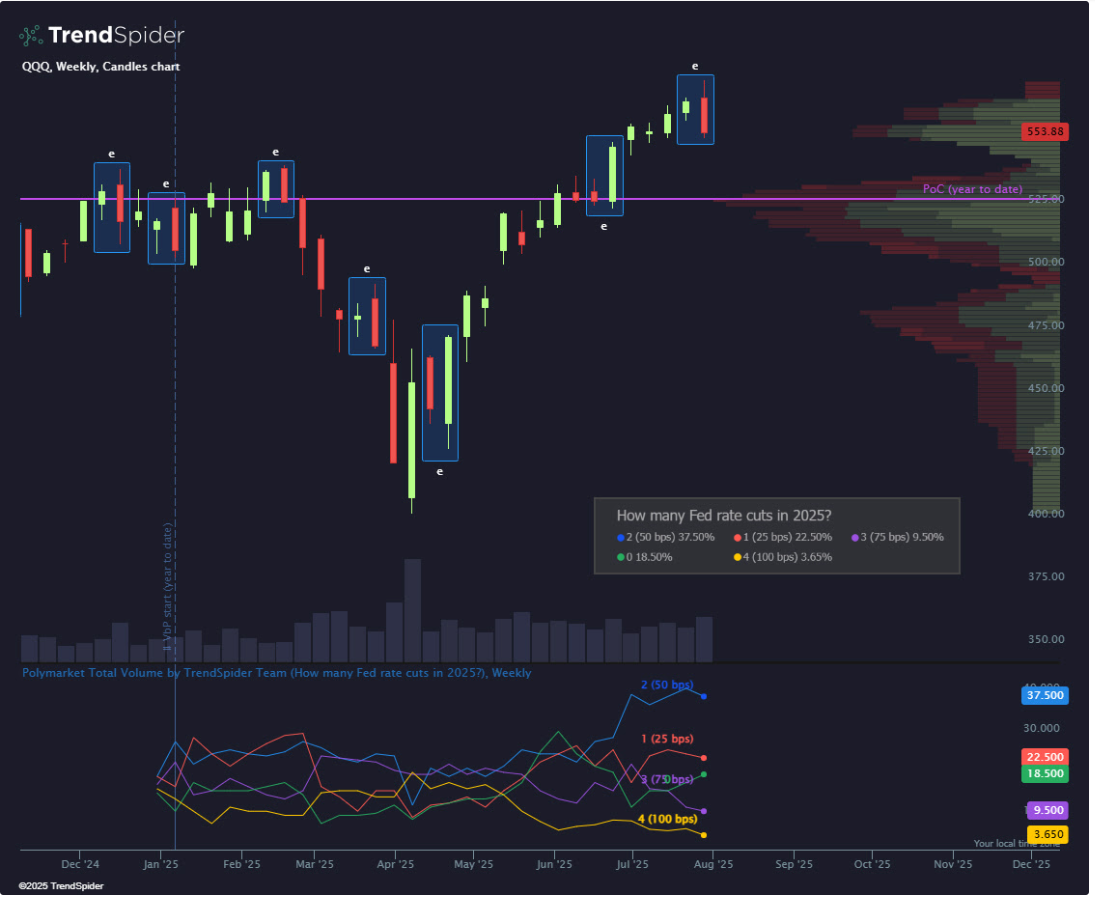

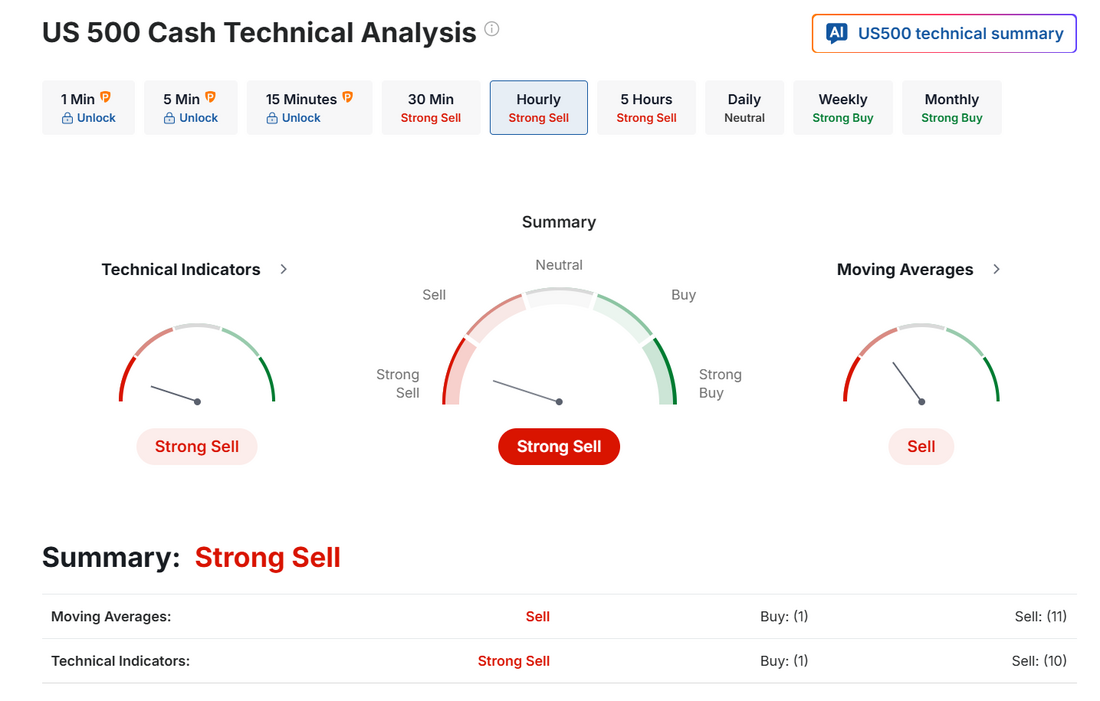

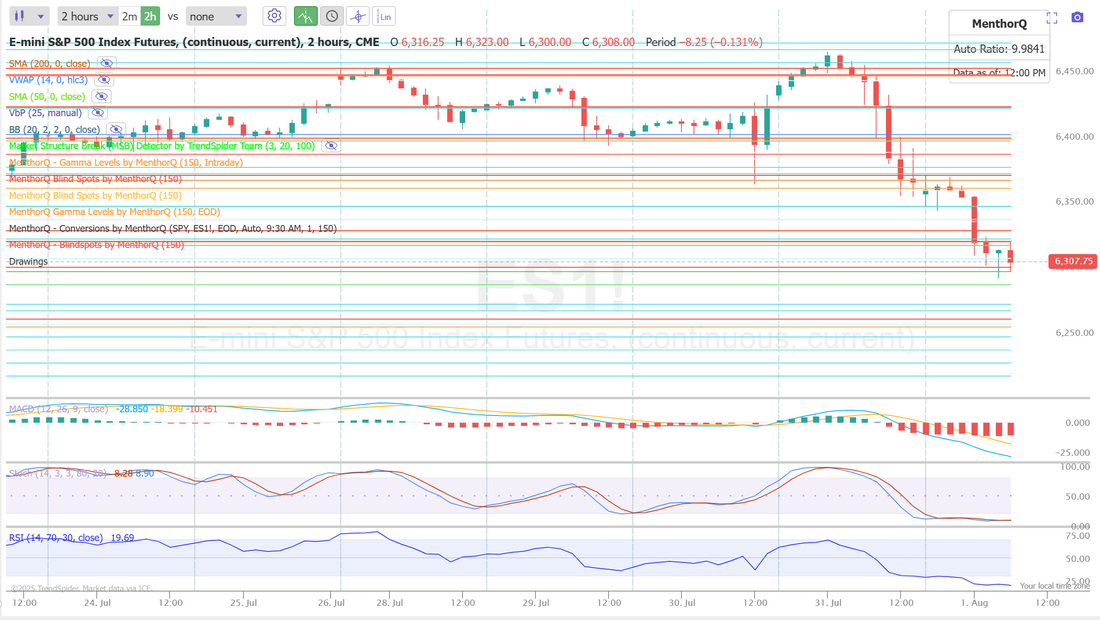

Finding OpportunityWe trade everyday the market is open. In fact, We start Sunday evening with the Futures. As you can imagine, some days offer up better opportunities than others. I always like to say, it's a bit like fishing. Some days you catch nothing. Some days you catch a few and every once in a while you catch a whopper. Regardless of result, everyday you are casting your line. Such is trading. There are days I look at the potential news catalysts and futures movement and think, "there's no opportunity today. We are wasting our time". Friday was not that day. /ES futures were down over 100+ points before the open and we knew it had all the makings of a great opportunity. We had one of our trading members who told me he cancelled a dentist appointment that day because the opportunity was so great. He was right. We had a blow out day. All we want is opportunity. Generally that means movement. Big movement. Preferably downward movement. We got it and fortunately were able to capitalize. See our results below: Fridays selloff also pushed our ATM asset allocation portfolio, briefly to a new ATH. It's still a thrill to me, after all these years, to see the market crashing and your portfolio rising. If you want a simple, passive portfolio that takes just 5 min. each morning to adjust, check out the ATM allocation. Let's take a look at the markets. With futures up this morning, it's not enough to swing us back to bullish sentiment. The SPX chart as of August 1, 2025, shows a sharp pullback in price following a steady upward trend through July. Notably, the Option Score has declined rapidly, dropping from a stable level of 4 to 0 in just a few sessions. This steep drop in the score may indicate rising uncertainty or a shift in sentiment within the options market, often associated with increased hedging or reduced directional conviction. In the short term, this could suggest caution around the recent price weakness, especially if follow-through selling continues. Monitoring whether the Option Score rebounds or remains suppressed could offer insight into whether this pullback is temporary or part of a broader change in trend. The SPY liquidity snapshot reveals a complex short-term picture. Despite a notable -1.64% price decline, momentum remains labeled as bullish, suggesting underlying strength or resilience. However, a negative gamma condition points to potential instability, where market makers may exacerbate volatility rather than dampen it. The put/call open interest ratio stands at a high 2.50, indicating elevated downside hedging or bearish sentiment in the options market. Implied volatility has spiked to 16.38%, up 22.63%, significantly above the historical 30-day volatility of 9.10%. With an IV Rank of 21.54% and a positive IV/HV volatility regime, the current environment reflects heightened caution and elevated premium pricing, which could impact short-term option dynamics. The SPY snapped its five-week winning streak, closing at $621.72 (-2.40%) and printing a weekly bearish engulfing candle, which TrendSpider automatically detected. Following the FOMC rate decision, the Polymarket Indicator showed declining odds of a rate cut, adding pressure to the tape. With a lighter catalyst calendar ahead, the YTD volume point of control now stands out as the next potential support level if bearish momentum persists. The QQQ closed at $553.88 (-2.21%) after a heavy week of tech earnings. Even as major holdings like $MSFT and $META posted strong power earnings gaps, macro pressures and fading rate cut odds weighed heavily on the ETF. After a five-week rally, the shift in sentiment may be opening the door for bears to take control and target the YTD volume point of control support below. Small caps took the hardest hit last week, with IWM closing at $214.92 (-4.22%). It’s no surprise that diminishing rate cut odds are hitting small-cap companies hardest, especially as the ETF decisively rejected the YTD volume point of control. Now sitting between two high-volume nodes, with the larger one overhead, bears appear to have the near-term leverage. September S&P 500 E-Mini futures (ESU25) are up +0.64%, and September Nasdaq 100 E-Mini futures (NQU25) are up +0.77% this morning, pointing to a higher open on Wall Street as investors placed their hopes on the Federal Reserve to step in with interest rate cuts following Friday’s weak U.S. payrolls data. This week, market participants look ahead to a new round of corporate earnings reports and U.S. economic data, as well as remarks from Fed officials. In Friday’s trading session, Wall Street’s major equity averages ended in the red. Amazon.com (AMZN) slumped over -8% and was the top percentage loser on the Dow after the tech and online retailing giant projected weaker-than-expected Q3 operating income. Also, chip stocks lost ground, with Marvell Technology (MRVL) sliding more than -7% and Micron Technology (MU) dropping over -3%. In addition, Eastman Chemical (EMN) plunged more than -19% and was the top percentage loser on the S&P 500 after the company posted downbeat Q2 results and issued below-consensus Q3 adjusted EPS guidance. On the bullish side, Reddit (RDDT) surged over +17% after the social media company posted better-than-expected Q2 results and issued upbeat Q3 revenue guidance. The U.S. Labor Department’s report on Friday showed that nonfarm payrolls rose 73K in July, weaker than expectations of 106K. Also, the U.S. unemployment rate ticked up to 4.2% in July, in line with expectations. In addition, U.S. July average hourly earnings rose +0.3% m/m and +3.9% y/y, compared to expectations of +0.3% m/m and +3.8% y/y. Finally, the U.S. ISM manufacturing index unexpectedly fell to 48.0 in July, weaker than expectations of 49.5. “What had looked like a Teflon labor market showed some scratches... A Fed that still appeared hesitant to lower rates may see a clearer path to a September cut, especially if data over the next month confirms the trend,” said Ellen Zentner at Morgan Stanley Wealth Management. Ahead of the jobs data, Fed Governors Christopher Waller and Michelle Bowman released statements explaining their dissent from Wednesday’s decision to hold rates steady, citing concerns that delaying rate cuts could cause unnecessary damage to the labor market. Cleveland Fed President Beth Hammack, speaking on Bloomberg Television following the release of the numbers, said the labor market still appeared healthy, though she acknowledged it was a “disappointing report to be sure.” U.S. rate futures have priced in a 79.7% chance of a 25 basis point rate cut and a 20.3% chance of no rate change at the September FOMC meeting. Second-quarter corporate earnings season continues, and investors await new reports from notable companies this week, including Advanced Micro Devices (AMD), Palantir (PLTR), McDonald’s (MCD), Walt Disney (DIS), Uber Technologies (UBER), Caterpillar (CAT), Amgen (AMGN), Eli Lilly (LLY), Pfizer (PFE), Gilead (GILD), and Shopify (SHOP). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +4.5% increase in quarterly earnings for Q2 compared to the previous year, exceeding the pre-season estimate of +2.8%. The U.S. economic calendar lightens up considerably following last week’s flurry of economic data releases. Investors will closely monitor the key ISM survey on U.S. services sector activity to assess the likelihood of interest rate cuts in the coming weeks. This data comes on the heels of the weaker-than-expected ISM manufacturing PMI, which, along with the soft jobs report, “amplifies concerns about economic slowdown,” according to FP Markets analyst Aaron Hill. Weakness in the services ISM could strengthen the case for a rate cut in September. Other noteworthy data releases include U.S. Trade Balance, the S&P Global Composite PMI, the S&P Global Services PMI, Initial Jobless Claims, Nonfarm Productivity (preliminary), Unit Labor Costs (preliminary), and Consumer Credit. Market participants will also parse comments from several Fed officials following the disappointing jobs report and the central bank’s decision to leave rates unchanged. San Francisco Fed President Mary Daly, Boston Fed President Susan Collins, Fed Governor Lisa Cook, Atlanta Fed President Raphael Bostic, and St. Louis Fed President Alberto Musalem are scheduled to speak this week. Meanwhile, investors will look for any signals from the White House on a potential nominee to replace Adriana Kugler, after the Fed board member announced her resignation on Friday. President Trump told reporters on Sunday that he plans to announce a new Fed governor in the coming days. In addition, investors will await further news on tariff agreements after President Trump announced steeper levies for dozens of trading partners last week, though the majority are set to take effect from August 7th. U.S. Trade Representative Jamieson Greer said that those tariffs are likely to remain in place rather than be reduced as part of continuing negotiations. Today, investors will focus on U.S. Factory Orders data, which is set to be released in a couple of hours. Economists expect this figure to drop -4.9% m/m in June following a +8.2% m/m jump in May. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.244%, up +0.33%. In terms of a bias of lean today that's a bit tricky for me. Futures are up this morning, as I type and that makes sense after a big retrace like we had Friday however, I think there was some real structural damage done to the bull market last week. Will it really shake it all off today, as if it never happened? My lean is that today's pump in the futures is a natural reaction to Fridays selloff and as we settle a bit today we'll continue to see weakness prevail. Today may be a neutral day but the bearishness is still trying to take control. I'll give you a bit of insight into our potential earnings plays this week: PLTR: 2025-08-04 AMC - Palantir Technologies IncAvg Move: ±24.66% | Last: -14.9% | Implied: ±12.01% AMD: 2025-08-05 AMC - Advanced Micro Devices IncAvg Move: ±11.62% | Last: 4.9% | Implied: ±9.3% PFE: 2025-08-05 BMO - Pfizer IncAvg Move: ±3.64% | Last: 4.6% | Implied: ±4.82% BP: 2025-08-05 BMO - British PetroleumAvg Move: ±4.19% | Last: 1.6% | Implied: ±4.23% SMCI: 2025-08-05 AMC - Super Micro Computer IncAvg Move: ±15.18% | Last: 23.4% | Implied: ±13.12% MCD: 2025-08-06 BMO - McDonalds CorpAvg Move: ±3.26% | Last: 5.4% | Implied: ±3.78% DIS: 2025-08-06 BMO - Walt Disney CoAvg Move: ±5.54% | Last: 12.1% | Implied: ±6.39% UBER: 2025-08-06 BMO - Uber Technologies IncAvg Move: ±9.41% | Last: -6.7% | Implied: ±8.12% SHOP: 2025-08-06 BMO - Shopify IncAvg Move: ±13.12% | Last: -6.7% | Implied: ±11.91% ABNB: 2025-08-06 AMC - Airbnb IncAvg Move: ±10.04% | Last: 16.2% | Implied: ±8.15% Taking a look at the weekly expected move. It's a bit better than we've had but not much. Trade docket for today: /GC 0DTE , SPX 0DTE, NDX 0DTE, QQQ 0DTE, IWM 0DTE, VRTX, PLTR, FANG, PFE, CAT, YUM, LULU. Another big earnings week for us. Still not enough premium for 1HTE's on BTC. Let's look at intra-day levels on /ES: 6326, 6333, 6346 are nearest resistance levels with 6289 acting as first support. 6275 is the most interesting support for me. If we can break below that 6251 is next and that could continue to open up downside potential. I look forward to seeing you all back in the live trading room shortly!

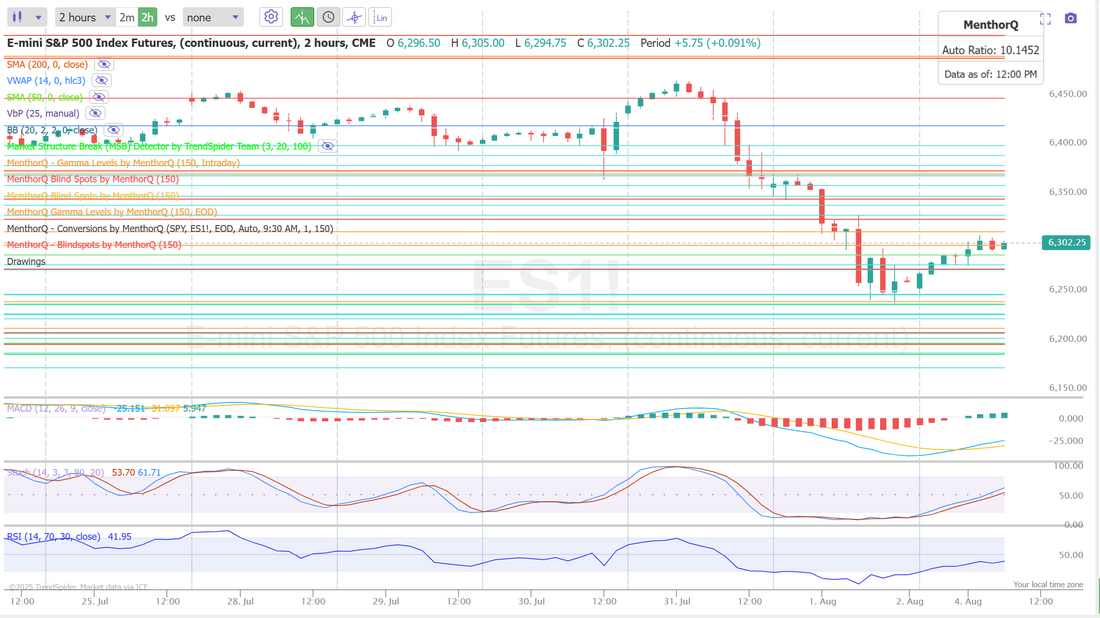

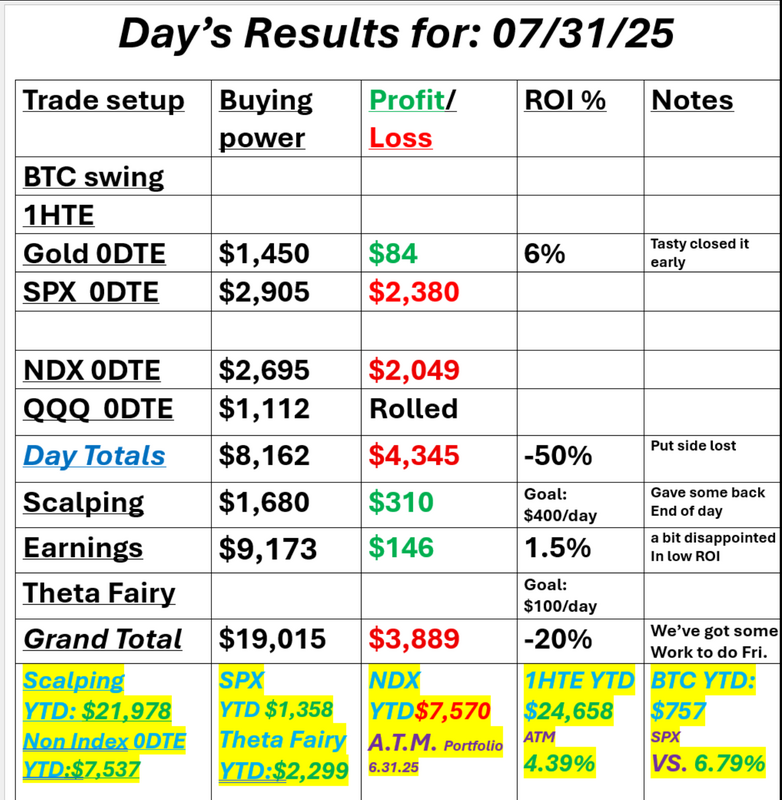

Is this it?Is this the crack in the markets we've been looking for? Waiting for? Wanting? Maybe! We are initiating our bearish anchor position in our ATM portfolio today. As that portfolio continues to outpace the SP500 I'll say it again. If you don't have something that hedges downside risk you are leaving yourself open to unnecessary potential losses. I got cooked yesterday on the downside. Yes, I called for a down day and that's what we got but it was way more downside than I thought we'd get. It buried my puts on SPX and NDX. Today looks like a great day for opportunity. Futures are buried today. We got a bearish engulfing candle yesterday. Here's hoping this is the correction we've been waiting for. We get better opportunities, I.V. etc. in down markets. We may even be able to get back on our Theta fairy's! Here's a look at my poor results yesterday. Let's see if I can redeem myself today! The opportunity should be there. It's just up to me to capitalize. Let's take a look at this "new" market. It's been the same for a while. Sell signals are finally kicking in. All four of the major indices are rolling over nicely. VTI is flashing "sell" Let's look at a downside target on /ES. 5960 is my downside target IF....the bears can take control, This is the first time in months that they've got a real shot. September S&P 500 E-Mini futures (ESU25) are down -0.93%, and September Nasdaq 100 E-Mini futures (NQU25) are down -1.03% this morning as U.S. President Donald Trump’s sweeping import tariffs fueled concerns about the outlook for economic growth. Late on Thursday, President Trump signed an executive order imposing tariffs between 10% and 41% on U.S. imports from foreign nations. Those hardest hit include Switzerland with a 39% tariff, Taiwan with a 20% tariff, and Canada, which is subject to a 35% levy on goods that do not comply with the U.S.-Mexico-Canada Agreement. Meanwhile, the U.S. president granted a one-week delay to trading partners that had received letters, with the exception of Canada. The average U.S. tariff would increase to 15.2% if the announced rates are implemented, according to Bloomberg Economics, up from 13.3% previously and well above the 2.3% level in 2024 before Trump took office. Also weighing on stock index futures, shares of Amazon.com (AMZN) slumped over -7% in pre-market trading after the tech and online retailing giant projected weaker-than-expected Q3 operating income. U.S. equity futures are also under pressure from rising Treasury yields after Trump said in a social-media post that the Fed’s board should “assume control” if Chair Jerome Powell doesn’t cut interest rates. Investor focus now turns to the key U.S. payrolls report. In yesterday’s trading session, Wall Street’s major indices closed lower. Align Technology (ALGN) plummeted over -36% and was the top percentage loser on the S&P 500 after the company posted downbeat Q2 results and issued below-consensus Q3 revenue guidance. Also, Arm Holdings (ARM) plunged more than -13% and was the top percentage loser on the Nasdaq 100 after the chip designer provided soft FQ2 adjusted EPS guidance. In addition, pharmaceutical stocks slumped after President Trump demanded that drugmakers slash U.S. prices, with Bristol-Myers Squibb (BMY) sliding over -5% and Merck & Co. (MRK) falling more than -4%. On the bullish side, Meta Platforms (META) surged over +11% and was the top percentage gainer on the Nasdaq 100 after the maker of Facebook and Instagram posted upbeat Q2 results and issued strong Q3 revenue guidance. Data from the U.S. Department of Commerce released on Thursday showed that the core PCE price index, a key inflation gauge monitored by the Fed, came in at +0.3% m/m and +2.8% y/y in June, compared to expectations of +0.3% m/m and +2.7% y/y. Also, U.S. June personal spending rose +0.3% m/m, weaker than expectations of +0.4% m/m, and personal income rose +0.3% m/m, stronger than expectations of +0.2% m/m. In addition, the U.S. employment cost index rose +0.9% q/q in the second quarter, stronger than expectations of +0.8% q/q. Finally, the number of Americans filing for initial jobless claims in the past week rose +1K to 218K, compared with the 222K expected. “Inflation remains sticky and justifies the Fed’s decision to keep interest rates unchanged at Wednesday’s meeting,” said Clark Bellin at Bellwether Wealth. “The stock market doesn’t need rate cuts in order to move higher and has already posted strong gains so far this year without any rate cuts.” Meanwhile, U.S. rate futures have priced in a 61.0% probability of no rate change and a 39.0% chance of a 25 basis point rate cut at the next FOMC meeting in September. Today, all eyes are focused on the U.S. monthly payroll report, which is set to be released in a couple of hours. Economists, on average, forecast that July Nonfarm Payrolls will come in at 106K, compared to the June figure of 147K. Investors will also focus on U.S. Average Hourly Earnings data. Economists expect July figures to be +0.3% m/m and +3.8% y/y, compared to the previous numbers of +0.2% m/m and +3.7% y/y. The U.S. Unemployment Rate will be reported today. Economists forecast that this figure will creep up a tick to 4.2% in July from 4.1% in the prior month. The U.S. ISM Manufacturing PMI and the S&P Global Manufacturing PMI will be closely watched today. Economists expect the July ISM Manufacturing PMI to be 49.5 and the S&P Global Manufacturing PMI to be 49.7, compared to the previous values of 49.0 and 52.9, respectively. U.S. Construction Spending data will be released today. Economists estimate this figure will be unchanged m/m in June, compared to -0.3% m/m in May. The University of Michigan’s U.S. Consumer Sentiment Index will be released today as well. Economists expect the final July figure to be revised slightly higher to 62.0 from the preliminary reading of 61.8. On the earnings front, notable companies like Exxon Mobil (XOM), Chevron (CVX), Enbridge (ENB), and Colgate-Palmolive (CL) are slated to release their quarterly results today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +4.5% increase in quarterly earnings for Q2 compared to the previous year, exceeding the pre-season estimate of +2.8%. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.391%, up +0.71%. Trade docket today: We got a fill on both sides of our Gold 0DTE for today so that should give us some good potential. We have AAPL, AMZN, META, MSFT earnings trades all expiring today and they all look great going into the open. We'll work our QQQ 0DTE as well as our main 0DTE focus, SPX. /MNQ has been very good to us lately with scalping so we'll stick with that today. Our big trade today should be SPX. I'll start with about 50% of my allocated BP, up from the usual 10%. As far as my lean or bias today it's just too early to tell. Futures are buried and we are seeing sell signals across the board but this market has been very resilient. Either way today I think we have a great chance for an outsized move. This selloff either continues or we get a retace but I doubt we finish close to where we will open. Let's pray it's to the downside! Don't fear down markets! Our traders have access to our ATM model portfolio that not only hedges downside but profits from it so if you have a retirement account of investment portfolio there's no concern and as far as trading goes, it's just easier in down markets. Way better opportunities. Let's all pray together that this is the turn we've been looking for! Intra-day levels on /ES. 6331, 6351, 6363, 6374 are resistance. 6303 is the first big support. A break below that would be a great start for the bears. 6289 and 6263 are next. I'll see you all in the live trading room shortly. Let's see if we can cap off this week with a big win today.

|

Archives

August 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |