|

Another solid day for us yesterday. Multiple 0DTE's that all hit for big profits. Our SPX with 3k of buying power hit for $1,334 profit. The butterfly part was key. Our NDX with 3k buying power hit for $525 profit and our Event contract only got $800 buying power filled but hit for a 23% ROI and $190 profit. All told our 7k of buying power generated $2,049 of profit. NVDA was also a contributor to our day. It's been a very tough week to find good credit setups with I.V. being so low. I honestly didn't expect much out of our 0DTE's this week but they've been amazing. Setup is the key...as always. We do have some potential news catalysts today that may get the market moving: Thursday 28th March 08:30 ET US Weekly Initial & Continued Jobless Claims The US Weekly Initial Jobless Claims report provides the number of people who filed for unemployment benefits for the first time during the past week, serving as a measure of new layoffs. This indicator is a key gauge of the labor market’s health and economic activity, with lower numbers suggesting fewer layoffs and a stronger job market. Continued Jobless Claims, on the other hand, represent the number of people already receiving unemployment benefits. This figure helps gauge the longer-term employment situation and provides insight into how easily displaced workers are finding new employment. Both metrics are monitored by investors, policymakers, and economists because they offer real-time insights into labor market conditions and, by extension, the overall health of the economy. What to Expect Higher jobless claims indicate a higher unemployment rate. The FOMC have noted that they see a higher unemployment rate to be in line with inflation’s descent back to the 2% target. This means if Jobless Claims came in higher than expected, it could cause strength in US stocks and weakness in the dollar, as traders increase the chances of rate cuts this year. US GDP US Gross Domestic Product measures the total value of all goods and services produced within the United States. It serves as a comprehensive gauge of the country’s economic performance and is published by the Bureau of Economic Analysis (BEA) on a quarterly basis. GDP includes consumer spending, business investments, government expenditures, and net exports (exports minus imports). What to Expect Changes in GDP growth rates reflect the overall health and direction of the US economy, influencing policy decisions and providing insights into economic trends. In terms of the market’s potential reaction to this data point, this is tricky to gauge at the current stage of the economic cycle. On one hand, a higher-than-expected GDP can be seen as an upside inflation risk, as it can indicate increased demand through increased consumer and government expenditures. On the other hand, inflation is coming down towards the target despite resilient consumer demand, so a higher GDP number could also reinforce the chances for a soft landing, with inflation still returning to the target. Buy mode continues to hang in there: The SPX and the DOW rebounded with the SPX hitting a new ATH. The NDX eked out a small gain. The DOW jump was largely attributable to Merck which jumped 5% on the day. GME plunged 15% and our earnings trade on that hit for a nice, one day gain. Our trade docket for today resembles a Friday, with the shortened trading week. Most Fridays are set for booking profits. De-risking the acct. and freeing up buying power for the next week. That will happen for us today. Lots of tentative trades that may or may not expire fully profitable on their own: AAPL?, BA?, CRM?, DIA?, HUT, IWM?, MSTR, NVDA, PYPL?, RUM, SMCI?, VKTX, WBA, WYNN?, SPX/NDX/Event contract 0DTE's. Intra-day levels for me: /ES; 5314/5322/5329/5341 to the upside. 5297/5287/5280/5270 to the downside /NQ; 18497/18530/18572/18605 to the upside. 18480/18424/18376/18331 to the downside. My lean for today is slightly bearish:

0 Comments

Yesterday was a most pleasant surprise. It might have been the day of the year so far that I expected the least. At one point I thought of just skipping the 0DTE's for the day. I.V. was in the tanks and it looked like the day was going to be a big nothing burger. Both those predictions came true however we were able to use some very unique setups to garner some amazing results. 6k in the SPX yielded $998 profit. 4K in NDX hit for $550 profit and the Event contract 0DTE hit for 11% ROI and $100 profit. We made $1,650 dollars on 13K of capital. It really makes the saying true. $1,000 dollars a day keeps the day job away. Overall it was a great day. My net liq was up $11,700 dollars on the day. A good portion of that was NVDA helping out. Markets have now booked three consecutive days of downward movement. The next real market catalyst should come tomorrow with the PCE data. It's always interesting to see how the market participants are leaning. Kalshi, our Event contract broker puts up all these stats. Markets are back to a slight bullish bias after slipping for three days. But the struggle to clear our recent highs continues on all the major indices Donals Trumps Truth social completed their merger yesterday. New ticker is DJT. The same ticker he rode to bankrupcy previously with his casinos. It popped 50% yesterday and settled up 17%. This is a company now that has an eight billion (BILLION) dollar valuation with a whopping 3.5 million dollars in annual revenue. Its also sporting 49 million in annual losses. We've had great success in shorting DWAC. We'll continue that process today on DJT. It also appears the the "meme" has been taken out of the grand daddy of meme stocks, GME. We placed an earnings trade on it yesterday that looks like a nice profit for us today. In terms of meme stocks, GME doesn't have the juice anymore. In fact, our BA trade has more meme interest. My feeling on the market today is more of the same from yesterday. Futures are up as I type and with three consecutive down days and no substantive, pre-planned news items I would expect an upswing today but markets are really just biding time until PCE is released. We do have oil inventory out today. Normally we use Thurdays as the day to adjust our ladder trades but with the shortened holiday week, that will come today and oil is on that list. 10:30 ET Weekly EIA Crude Oil Inventories The US Weekly Energy Information Administration Crude Oil Inventories report provides information on the total stockpile of crude oil in the United States. It includes data on the changes in crude oil inventories, indicating whether there has been an increase or decrease in the amount of oil held in storage. This report is crucial for assessing supply and demand dynamics in the oil market and can influence oil prices. What to Expect A significant build-up in inventories may indicate oversupply, putting downward pressure on prices, while a decline may suggest increased demand, potentially impacting prices in the opposite direction. My lean today is neutral: Trade docket for today: DJT, GME, RUM, CCL, WBA, HUT, GLD, GOOG, IWM, MSTR, QQQ?, SPX/NDX/Event contract 0DTE's. My intra-day levels:

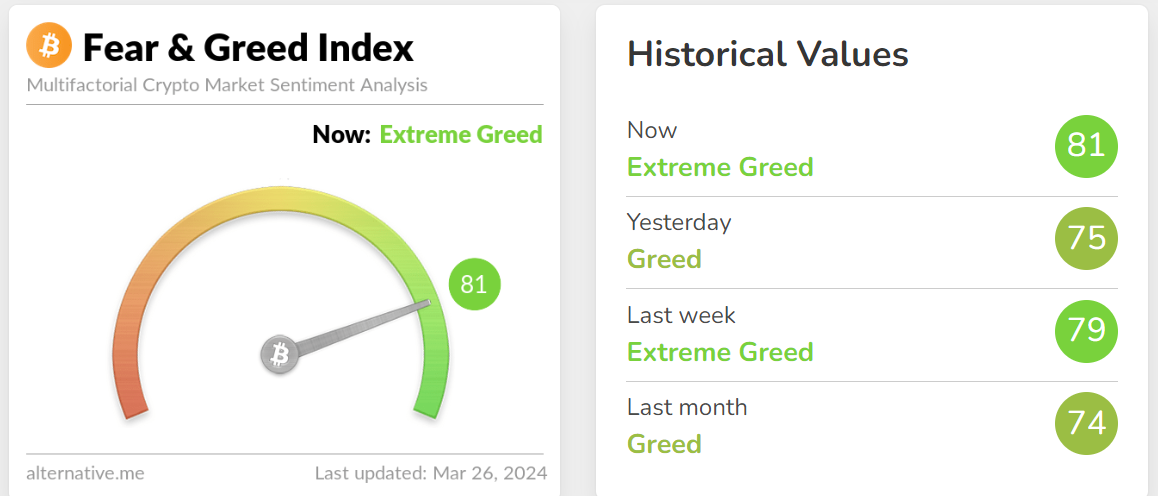

/ES; 5285/5290 (PoC)/5300/5310 to the upside. 5227/5271/5263/5248 to the downside /NQ: 18550/18561 (PoC)/18606/18658 to the upside. 18507/18481/18447/18365 to the downside. The purple line on both the /ES and /NQ is the PoC (point of control) The PoC represents the price level at which most trading activity has occurred, indicating the highest liquidity and traded volume. I would not be surprised one bit if we finished the day close to this level. Good morning traders! I missed Mondays update with some technical issues but I'm back today. Friday was another solid day for us and I finished the week up 9k total on net liq. We went 15 for 15 with wins on our 0DTE's last week. Thats a tough goal to repeat but yesterday we went 4 for 4 for $1,300 proft on about 12k of buying power. As we talked about in our live zoom yesterday, I.V. is incredibly low this week with the absence of major pre-planned news items and the short holiday trading schedule. Our trade docket for today is as follows: BA, IWM?, MKC, MSTR, PFE, SBUX, SMCI, SPX/NDX/Event contract 0DTE, XBI, GME, CCL?, PAYX, /ZW, /HE, 2DTE butterfly on SPX. Markets are back to buy signal again. However, its not that strong. Most of the major indices we trade look a little tired here. Point in fact. We re-initiated our monthly VTI swing trade (which is one of my favorites and on track this year for our 36%-50% ROI target) with a bearish slant for the first time this year. We look for three indicators to cross and give us a directional bias. Its bearish right now. If you look at the expected move for SPY, even taking into account the shortened trading week, its pretty pitiful. Hence the 2DTE Butterfly we'll put on today. Fear and Greed index is still stuck in the Greed area. What's possibly more interesting is the fear and greed index on crypto. Bitcoin is pushing back to ATH and it doesn't look like it wants to stop. As I've said before. I've never been a big "Crypto guy" but I have thrown $400-$500 dollars a month into crypto over the last few years. I stopped when my balance reached $4,000 dollars. Its spread across BTC, ETH, DOT. Its now at $17,000 value. Who knows where crypo will end up but its certainly been bullish lately. All one has to do it look at the fear and greed index on crypto to know what people are thinking. 5300 seems to be the volume profile target for today on /ES My lean for today, and probably for the rest of this week (unless we get some sort of catalyst) is neutral to slightly bullish. My intra day levels:

/ES; 5303/5312/5325/5339 to the upside. 5292/5281/5263/5249 to the downside. /NQ; 18704/18792/18868/18911 to the upside. 18570/18505/18445/18417 to the downside. Good morning traders! Welcome to the "gateway to the weekend". We've had a great week so far so it was probably expected that yesterday I would struggle. My net liq was down $7,900 at the close. We have a couple trades that have pretty large leverage in them. MSTR, DIA, NVDA. MSTR continues to work for us and while its volatile we continue to bring in a nice cash flow. DIA just continues to push. We've added a couple long calls and thats helped a bunch but we are back to chasing it again. NVDA gave us a great week but yesterday it was $5,600 of my $7,900 drawdown on net liq. We have been successful in booking profits on the Iron Condor portion of that trade so our buying power continues to drop, which is helpful. 0DTE's were also a mixed bag. NDX scored a $790 profit on $4,200 of capital. Event contract 0DTE scored a 4% ROI but again, I was only filled on $1,000 worth. We have found a ton of value in these contracts. Our SPX was close to a big score. How close? Pretty close. We rolled a small put side to today so we have a decent chance of redeeming ourselves today. These 0DTE's have been built with lower risk but also lower probability. Our NVDA continues to hold the most extrinsic. That trade looks wonderful where its at but as I.V. increases, it affects both side of the trade. We have three earnings trades to exit this morning. NKE, FDX, LULU. That should give us some nice buying power back headed into the weekend. Markets continue their bullish push DIA is the big break out story. Market concentration hasn't been this grouped up since the 1930's. The saying now is, "its different. It's A.I." Maybe, but we continue to see a few big cap companies shouldering most of the work to push us higher. A big part of the 2000 tech bubble crash was the large concentration to tech. When that let loose so did everything else. I don't think A.I. is a fad or going away but valuation may come down and the implication is bearish for the overall market. One interesting new ETF that we've incorporated into our ATM asset allocation model is ticker XDTE. This is the SPY with 0DTE covered calls written on it. Pretty inovative. You can see the white paper here. www.roundhillinvestments.com/assets/pdfs/xdte_etf_fact_sheet.pdf Tim Maloney, the founder of Roundhill Investments is a great guy. They have a bunch of inovative ETF's. Check them out when you have time. My bias is bearish today. I belive we are due a retrace. Intra-day levels for me:

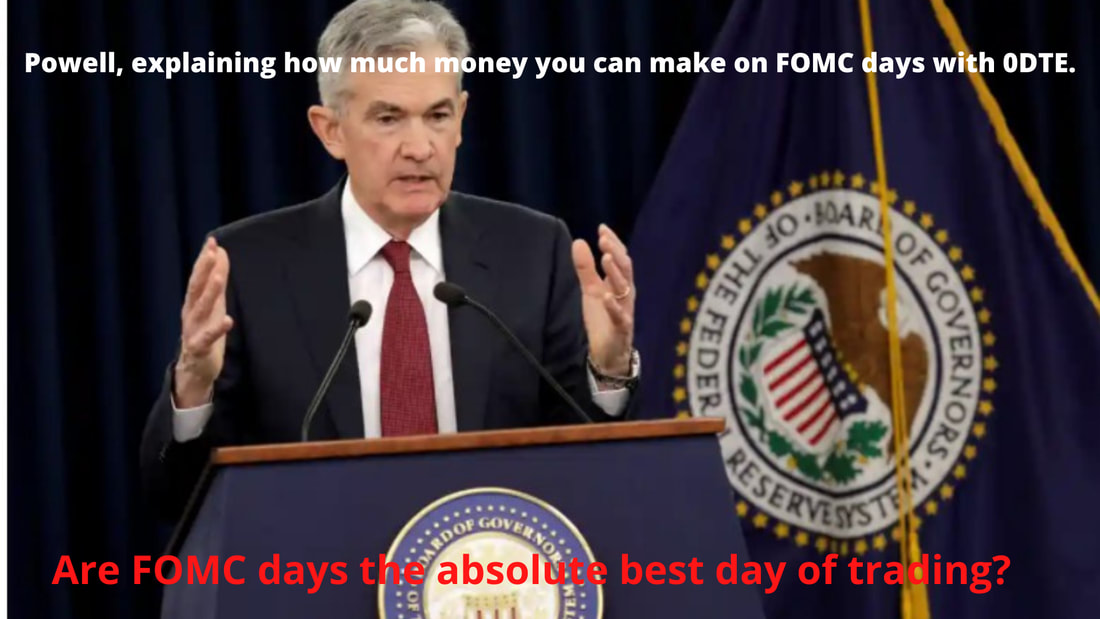

/ES; 5301/5322/5343/5352 to the upside. 5288/5267/5251/5233 to the downside. /NQ; 18610/18705/18800/18869 to the upside. 18445/18397/18333/18265 to the downside. Trade docket for today is a usual Friday. Primarily we look to lock in profits and derisk the portfolio. Free up our buying power in preparation for Monday when we all start it over. BA, FDX, LULU, NVDA, QQQ, SMCI, SPX/NDX/Event contract 0DTE's, AAPL We had another absolutely stellar day yesterday. FOMC always gives us opportunity and its up to us as traders to maximize what it gives us. We had all three of our 0DTE trades work. 10% ROI on our Event contract 0DTE. 12% on our NDX and 5% on our SPX. MSTR and NVDA added 4k to the the net liq alone. All told my net liq was up almost 6K. MSTR itself is on track to yield over 10K in profits on a 14K investment and we should bring in another 1K today on NVDA. Additionally, we scored 20%+ returns on our 4DTE SPY/QQQ setup with the zebra components really kicking in yesterday. The market liked what it heard from Powell yesterday. June Nasdaq 100 E-Mini futures (NQM24) are trending up +0.66% this morning as investors cheered forecast-beating quarterly results and guidance from Micron as well as the Fed’s unchanged projection for three rate cuts this year while also awaiting U.S. business activity data and earnings reports from Nike and FedEx. We'll be trading both of those earnings plays as well as LULU. Technicals continue to show strength. Here's some interesting data complied by Charlie Bilello. The S&P 500 just crossed above 5,200 for the first time. It took 757 days to go from 4,800 to 4,900 and just 56 days to go from 4,900 to 5,200. $SPX If you trade commodities, which I believe every trader should. It gives you non-equity correlation in your portfolio. You'll see why we like Corn, Wheat and Nat gas at these levels. The S&P 500 closed at an all-time for the 19th time this year after the Fed maintained its projection of 3 rate cuts before year-end. $SPX Most of the indices we trade are pushing for new ATH's. My lean today is bullish: Trade docket for today is: /MCL, CHWY, /ZN, DIA, GLD, IWM, MU, NVDA?, PFE, SBUX, DWAC, SPX/NDX/Event contract 0DTE's, BA. NKE, FDX, LULU earnings trades. Intra-day levels for me: levels have expanded quite a bit after yesterday.

/ES; 5325/5377//5426/5502 to the upside. 5249/5214/5180/5159 to the downside. /NQ; 18664/18706/18787/18868 to the upside. 18484/18439/18325/18185 to the downside. Yesterday was a stellar day for us. Everything we touched worked well and a couple of trades we've been working really delivered. MSTR could end up giving us $10,000 of profit on a $13,000 trade. It now looks fantastic. NVDA helped our net liq yesterday to the tune of $7,000. Both these trades look like they have a lot more profit potential. My net liq was up over $12,000 yesterday. Our three 0DTE's combined for $2,316 profit but I was down $709 on scalping. Today is all about FOMC. There's not a big edge in trying to put up support/resistance levels on a day like today: Today, all eyes are focused on the Federal Reserve’s monetary policy decision later in the day. With the Fed anticipated to keep rates on hold for a fifth straight meeting, the focus will turn to the central bank’s quarterly “dot plot” and Chair Jerome Powell’s post-decision press conference. The summary of economic projections will unveil whether the recent strong economic data are prompting officials to reconsider their plans to reduce rates or if their outlook for three rate cuts this year remains unchanged. “We don’t think the Fed will fundamentally change its outlook for inflation based on two hotter-than-desired prints to start the year. However, we do expect a slightly more hawkish tone in the hopes of keeping a leash on financial conditions,” said Christopher Hodge, chief economist at Natixis CIB Americas. If you are new to our trading room, our approach is to adjust our model portfolio early in the day. We don't have much of anything that needs attention right now. We will start an SPX 0DTE with low risk/high reward/low probability/high theta 0DTE like a chicken iron condor or Iron fly. We look to pull this trade as soon as it gets green. We then work our oil ladder after oil inventory numbers come out. Then we wait...and sit. FOMC minutes come out at 2:00 pm EST and Powell speaks a half hour later. We usually wait 20-30 minutes into his speech to enter our next 0DTE's. We'll try to get another SPX on as well as NDX and Event contract 0DTE's. These are usually good trading days for us, using this setup. Trade docket for today: SMCI, /MCL, MU and CHWY earnings trades, MSTR, Possible adds to our SPY/QQQ 4DTE, SPX/NDX,Event contract 0DTE's.

Good morning traders. We had a great start to the week yesterday. Pretty much everything we did resulted in nice profits. Our model portfolio performed well with the exception of BA continuing to slide but everything else was green MSTR and NVDA helped out but our 0DTE's were the stars of the day. Our SPX made $870 profit. Our NDX made $1,600 profit and our Event contract 0DTE made $500 profit. All told I had about $26,500 in 0DTE positions that yielded us $3,970 profit. My net liq was up about $6,000 for the day. Markets continue to look choppy here. We've flipped back to sell mode. This hasn't happened much this year and every time it has its been a "buy the dip" opportunity. At some point "buy the dip" will stop working. QQQ's and IWM are in a pretty defined down trend now. SPY is hanging on and the ever resilent DIA seems to be floating. Of the four major indices we trade, its the strongest. The last weeks price action has been mixed at best. Futures are down this morning as the market prepares to receive FOMC data later tomorrow. Housing data is front and center today. Bitcoin continues to retrace. The one interesting fact I find with Bitcoin is the same thing I like about trading commodities. Its simply a supply/demand equation. Right now there is more demand than supply. I continue to be bullish on BTC, ETH, DOT (bold call, I know). The bond market continues to be THE place to watch (IMHO) as the FED minutes get released tomorrow. 10-year yields may be down slightly on the day but at 4.31%, they are over 25 bps higher from the lows seen on Monday last week. Traders are more wary amid the slew of US data in the week before, as the rates market also no longer prices in a full Fed rate cut for June. The odds of that have dropped to ~63% currently. We should finally get an entry on on of my favorite set ups today; Wheat. 3% ROI potential in three days. My market lean today is Neutral while we await the FED. Intra-day levels for me:

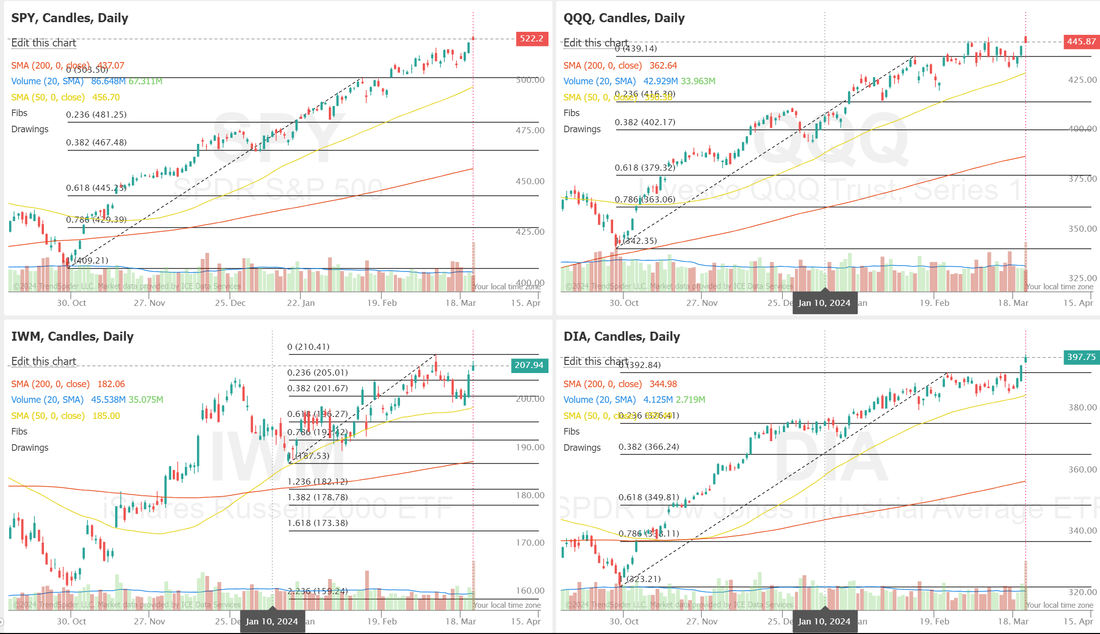

/ES; 5199/5206/5215/5226 to the upside. 5187/5178/5168/5159 to the downside. /NQ; 18185/18206/18238/18292 to the upside. 18058/18022/17989/17928 to the downside. Trade docket today: BA, XBI, SPX/NDX/Event contract 0DTE's, HQY earnings trade, ADM, BMY, /ZW. Welcome back traders! Another new week. We had pretty solid results overall last week. It certainly helped to have multiple trades working at at the same time. Mondays are usually our busiest day of the week so I'll get right into our trade docket: /ES, /MCL, /ZN, ADBE?, BA, CCL?, DELL, DIA, GLD, GOOG, MSTR, SPX/NDX/Event contract 0DTE's, NVDA, PYPL, WYNN, FSLR, IWM, SBUX, VTI?, SPY/QQQ, VKTX Things are starting to look interesting in the market. We are starting off the day with a rare neutral technical rating. All three major indexes putting in their second straight week of red candles. The small caps led the charge lower while the SPY managed to contain its losses, but the move off the October lows has been undeniably powerful, and perhaps some rest is needed in the markets in the weeks to move higher. This week, the SPY put in a second red reversal candle in a row and closed at $509.83 (-0.37%). This is the first time this index has seen two red weeks in a row since the October lows, suggesting that perhaps a pullback is in store in the weeks to come. Much like the SPY, QQQ has also put in its second red candle in a row and closed the week at $433.92 (-1.16%). Also like the SPY, a pullback similar to last July would put this index back at the 2021 high. After last week’s Doji reversal candle, the IWM continued its push lower to close the week at $202.41 (-2.14%). Of particular concern is the rounding top visualized on the Momentum indicator, a correlation seen on the past three swing highs since June 2022. The U.S. Federal Reserve interest rate decision and Fed Chair Jerome Powell’s post-policy meeting press conference will take center stage in the coming week. The Federal Open Market Committee is expected to hold interest rates steady for the fifth straight meeting on Wednesday, with the primary attention directed towards the central bank’s quarterly “dot plot” in its Summary of Economic Projections. U.S. rate futures have priced in an 8.1% chance of a 25 basis point rate cut at the May meeting and a 52.7% probability of a 25 basis point rate cut at the conclusion of the Fed’s June meeting. FOMC always presents a nice opportunity for us in our live trading room: With FOMC this week we have adequate I.V. to make our trades work. I.V. is up on all the indicies we trade. My lean today, after two weeks a bearish action is bullish. Intra-day levels for me: /ES; 5230/5245/5255/5269 to the upside. 5206/5191/5182/5168 to the downside. /NQ; 18254/18396/18442/18518 to the upside. 18202/18126/18081/18025 to the downside.  Welcome back to the weekend (almost) and Quad witching day! We had a very nice day yesterday. NVDA and MSTR gave us some love. BA continued its march down so we'll need to work that position today. Scalping was a success with about $1,300 of profit on a bunch of small wins. We didn't really catch a single runner all day but the wins added up. We weren't able to get a setup I felt good about with our event contract 0DTE's but our two standard NDX/SPX setups scored well for us. Our SPX 0DTE was a unique setup that gave us a potentially greater profit, the worse it did. We'll explore this setup more today in our live zoom session. With NVDA helping along with scalping and the successful 0DTE's my net liq was up almost 12K on the day. PPI came in just as hot (if not hotter) than CPI. Both of these catalysts pushed our 10 yr. Bond ladder down. We're looking to take a potential long assignment on one contract today and cash flow with covered calls next week. We were close to getting another Theta Fairy on last night but it never hit. We did get an overnight Vampire trade working right before the close and that looks to expire fully profitable at the open this morning. Vampire trades, Shorts and well as longs, Scalps, 0DTE's, Event contracts, etc. It certainly helps to have a very diversified approach as you never know what will be working, day to day. Our expected trading range for the week held and we were also able to pull our SPY/QQQ 4DTE's for a nice profit. Bitcoin seems to be taking a breather here: The markets continue to bounce up against these ATH's. We are actually starting to develop a slight downtrend in the IWM and QQQ's. Our trade docket for today should be fairly light. Fridays are usually meant for booking profits and de-risking our model portfolio, in preparation for starting next week fresh. We have a potential long assignment on /ZN. Booking profits on our ADBE and ULTA earnings setups. More cash flow on GOOG and a potential flip on BA to a long position using a L.E.A.P.. No NDX 0DTE today with Quad witching so we'll focus our 0DTE effort on SPX Intra-day levels for me: (flipping to /ESM4. June contract) /ES 5229/5241/5246/5269 to the upside. 5205/5189/5183/5175 to the downside No /NQ levels today as we aren't trading NDX. My lean for today: Neutral to bearish

We had a pretty solid day yesterday. All Three of our earnings trades scored profits. All three of our 0DTE's hit for large gains with our event contract 0DTE scoring a 22% ROI. Unfortunately, once again, I didn't get a full fill on my entry but waiting a bit into the day and placing a limit order a bit away from the market price seems to be the best approach with these event contracts. That means sometimes they don't get a full fill or don't hit at all. We've already got a nice start today with our NDX debit call spread coming into this morning. The market liked the CPI numbers. Today we get PPI and Jobless claims: Thursday 14th March 08:30 ET US PPI for February The US Producer Price Index measures the average change over time in the selling prices received by domestic producers for their output. It tracks price movements from the perspective of the seller and is an important indicator of inflationary pressures in the economy. The PPI is calculated for various stages of production, including finished goods, intermediate goods, and crude goods, providing insights into price trends at different levels of the supply chain. Changes in the PPI can influence the decisions of businesses regarding pricing strategies, production levels, and investment, and can also impact consumer prices (CPI), wages, and monetary policy decisions, making it, in some ways, a leading indicator of inflation. What to Expect Inflation is closely watched by the markets. Higher than expected inflation could prompt the markets to push back on bets for rate cuts this year, which would cause weakness in US stocks, and strength in the dollar. The inverse is also true. If inflation comes in lower, this could mean that the Fed is getting closer to their inflation target, which could cause markets to ramp up bets for rate cuts this year, which would cause strength in US stocks, and weakness in the dollar. US Retail Sales US Retail Sales is a key economic indicator that measures the total sales at retail establishments within the United States. It includes sales of goods and services from a wide range of retail stores, such as clothing stores, grocery stores, restaurants, and online retailers. Retail sales data provides insights into consumer spending patterns, which is a crucial component of overall economic activity. Rising retail sales typically indicate a healthy economy, while declining sales may signal economic weakness. What to Expect As this release is at the same time as the PPI data, it is likely to be overshadowed by this. However, if a large deviation is seen here, and not in the PPI data, attention could turn to this. If it comes out higher than expected, markets will balance the risks between the potential upside inflation risk that increased retail sales could cause, as well as the lower likelihood of a recession in the US. Typically, markets still see this release as ‘good news is bad news’, which would mean that higher than expected retail sales could cause weakness in US stocks, and strength in the dollar. Unicredit notes that Retail sales likely rebounded in February after contracting 0.8% in January, which was primarily driven by one-off factors such as bad weather and an overhang from a strong holiday shopping season. Weekly US Initial & Continued Jobless Claims Weekly US Initial Jobless Claims and Continued Jobless Claims are key economic indicators that provide insights into the labor market’s health. Initial Jobless Claims refer to the number of individuals who file for unemployment benefits for the first time during a given week. This metric helps gauge the rate of layoffs and indicates the labor market’s immediate health. A lower number of initial claims suggests a stronger job market, while a higher number may indicate economic weakness. Continued Jobless Claims, on the other hand, represent the number of individuals who continue to receive unemployment benefits after their initial claim. This figure reflects the ongoing level of unemployment and can indicate the persistence of joblessness in the economy. What to Expect As this release is coming out at the same time as the US PPI, it is likely to be overshadowed by this. Nonetheless, higher-than-expected Jobless Claims indicate higher unemployment, which is often seen by the markets as a downside risk to inflation. This could cause strength in US stocks and weakness in the dollar, as it could cause traders to push forward their bets for Fed rate cuts. We have quad witching coming up tomorrow: The quad witching dates in 2024 happen on these days:

The market continues to hold its bullish bias. As bullish as we remain, we continue to just bounce along these ATH's and continue to form resistance. PPI today could be the catalyst to break us into a more trending market Intra-day levels for me:

/ES; 5192/5206/5221/5240 to the upside. 5166/5156/5150/5139 to the downside. /NQ; 18188/18208/18256/18308 to the upside. 18117/18083/18035/17923 to the downside. Trade docket for today: BA, DIA, GLD, GOOG, META, MSTR, NDX/SPX/Event contract 0DTE's, NVDA, QQQ, SPY, WOOF, Vampire overnight trade, ADBE and ULTA earnings trades. My bias for today is bullish. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |