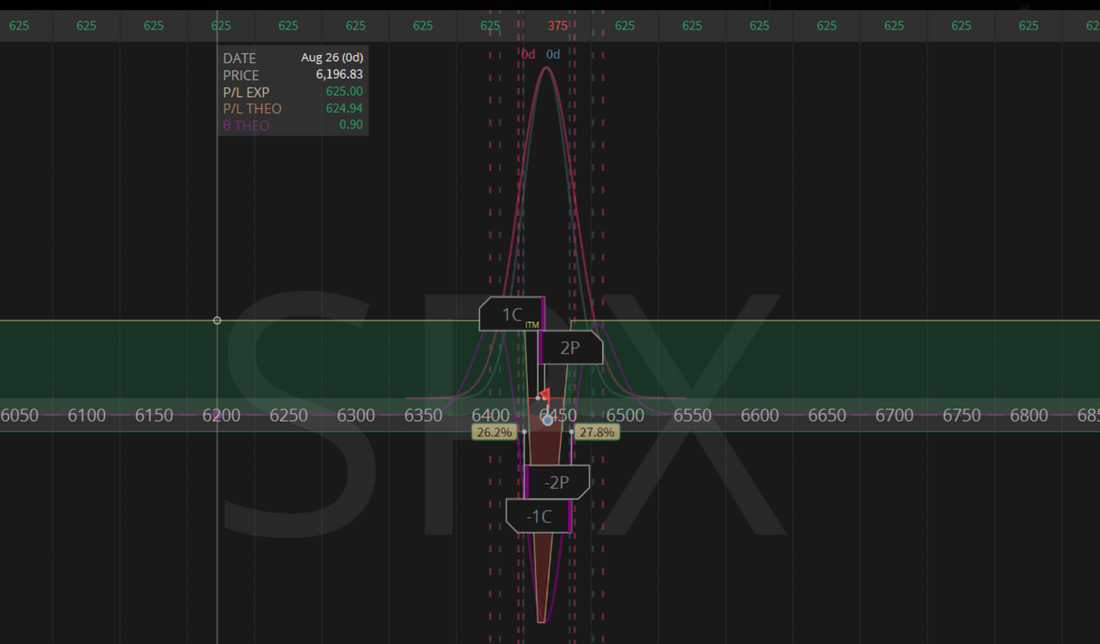

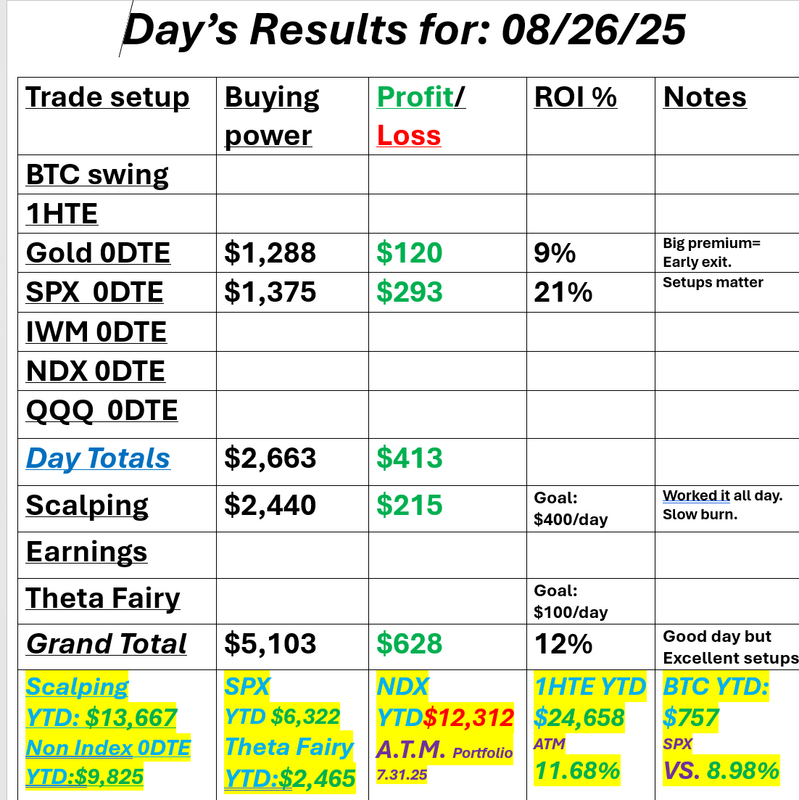

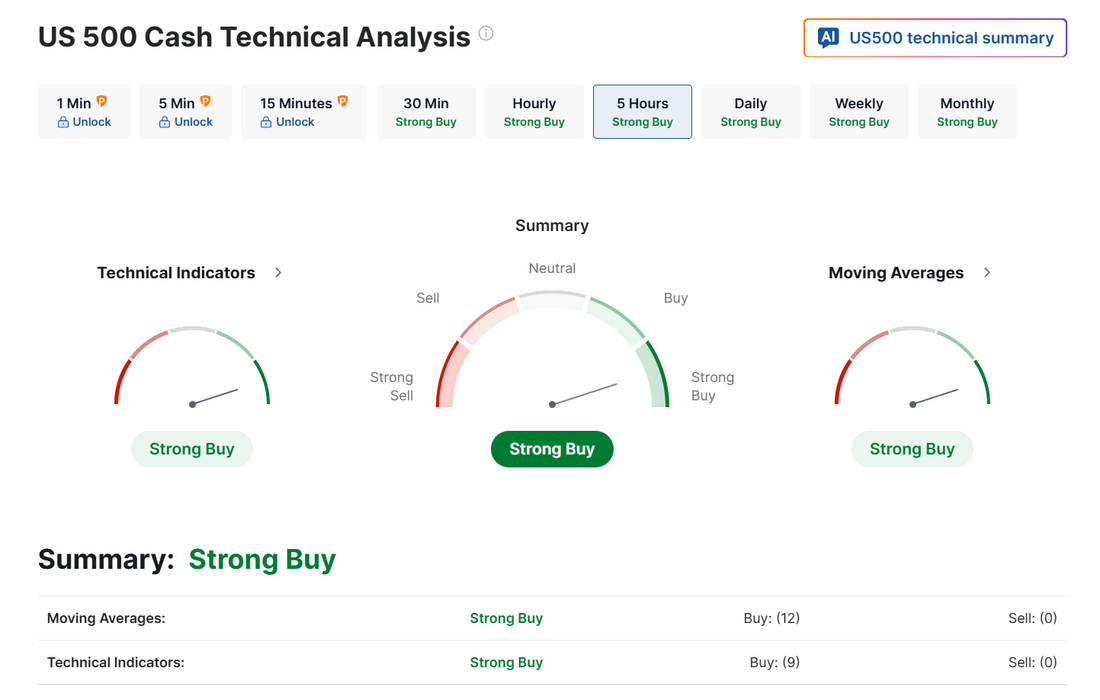

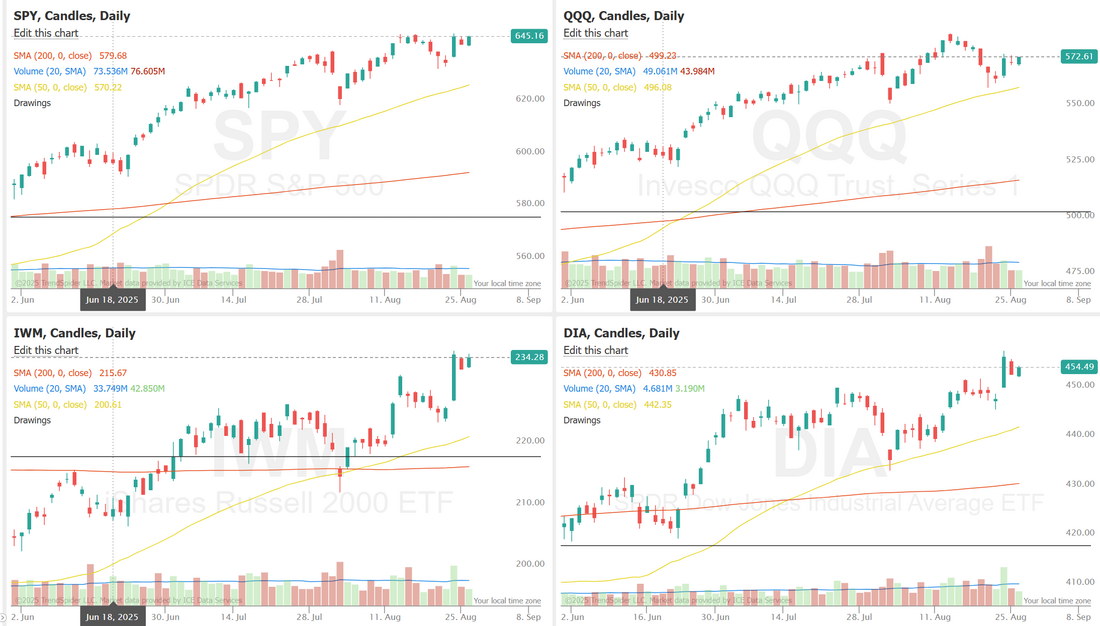

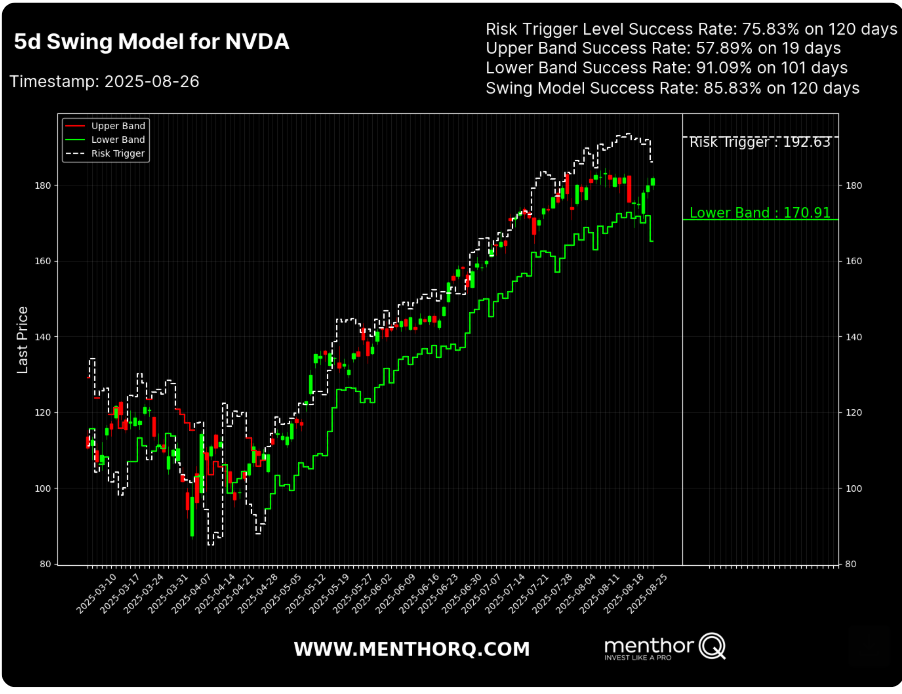

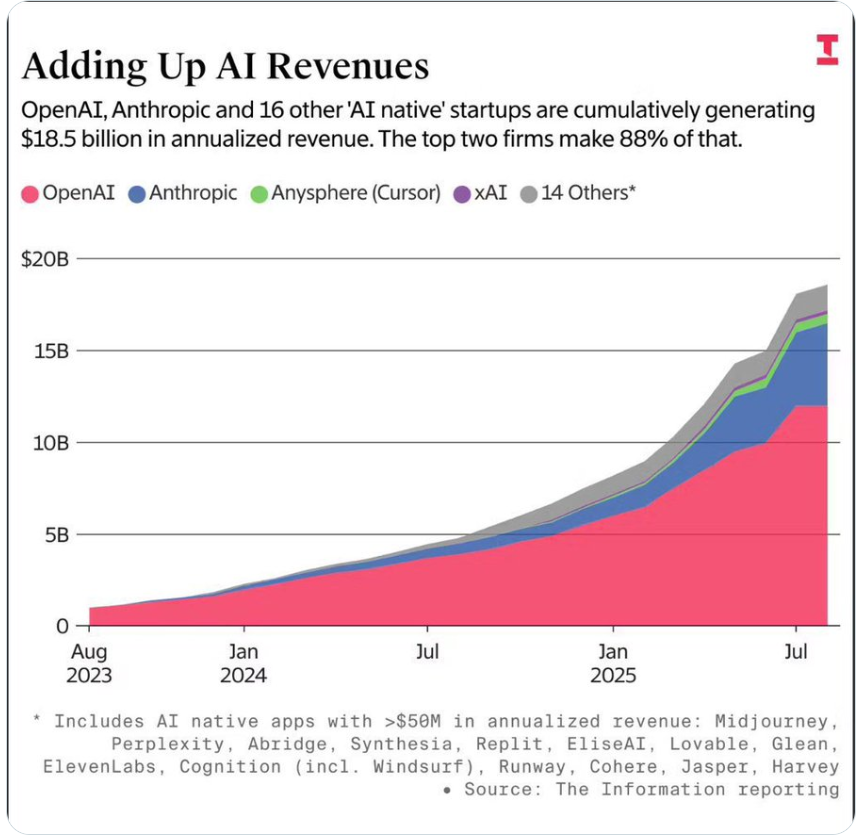

Good setups trump intelligenceI've never been one of those individuals that walks into a room and thinks, "hey I'm probably the smartest person here!" I've found that actually is good for trading. Super smart people get lots of "paralysis by analysis". It's not about being smart if you can utilize good setups. What a good setup? Something with low risk. great risk/reward ratio. Something that is scalable and adjustable. All three of our trades yesterday met that criteria. Let's start with our scalping. We scalp using the /MNQ futures. I try to keep my stop loss to about $50 each scalp. Four losing scalps in I was down $250 dollars. Scalping is all directional so you're only losing if you're wrong. I was wrong most of the day but we were able to scale and DCA and that made the difference. We made money when we were wrong because our approach overcame it. Next was our Gold 0DTE. I wasn't happy with our strikes but we got twice the premium we usually get. That allowed us get out early at a great profit when gold started to go crazy. Our last setup was our SPX 0DTE. We didn't have any movement at the open and that also meant we didn't have a directional bias. Most traders just wait or walk away but our setup once again came to the rescue. There's always a setup for every day and every market. Sometimes they are not initially apparent and it's easy to get in a rut with your "favorite" setup but setups trump everything. Get it right and you have a good chance of making money. Here's a look at my day yesterday. Let's take a look at the markets. Bullish bias is holding. Bulls are trying to get some new ATH's. September Nasdaq 100 E-Mini futures (NQU25) are trending up +0.02% this morning, with investors in wait-and-see mode ahead of a highly anticipated earnings report from AI darling Nvidia. In yesterday’s trading session, Wall Street’s major indexes closed higher. Eli Lilly (LLY) climbed over +5% and was the top percentage gainer on the S&P 500 after the drugmaker announced positive results from a late-stage trial of its experimental weight-loss pill. Also, chip stocks advanced, with Marvell Technology (MRVL) and Qualcomm (QCOM) rising more than +1%. In addition, Boeing (BA) rose more than +3% and was the top percentage gainer on the Dow after the planemaker announced that Korean Air ordered 103 planes. On the bearish side, Keurig Dr Pepper (KDP) slid over -6% and was the top percentage loser on the S&P 500 and Nasdaq 100 after HSBC downgraded the stock to Hold from Buy Economic data released on Tuesday showed that the U.S. Conference Board’s consumer confidence index fell to 97.4 in August, stronger than expectations of 96.4. Also, U.S. July durable goods orders fell -2.8% m/m, better than expectations of -3.8% m/m, while core durable goods orders, which exclude transportation, unexpectedly climbed +1.1% m/m, stronger than expectations of +0.2% m/m. In addition, the U.S. June S&P/CS HPI Composite - 20 n.s.a. eased to +2.1% y/y from +2.8% y/y in May, in line with expectations. Finally, the U.S. Richmond Fed manufacturing index unexpectedly rose to a 5-month high of -7 in August, stronger than expectations of -11. “Consumers don’t appear afraid, but perhaps restrained. Corporate conference calls reveal what appears to be a resilient consumer, while retail sales echo similar reassurances,” said Bret Kenwell at eToro. Richmond Fed President Tom Barkin said on Tuesday that he expects only a modest adjustment in interest rates, given his outlook for little variation in economic activity over the rest of the year. Meanwhile, U.S. rate futures have priced in an 87.3% probability of a 25 basis point rate cut and a 12.7% chance of no rate change at the September FOMC meeting. On the trade front, U.S. President Donald Trump imposed a hefty 50% tariff on certain Indian goods, the highest in Asia, to punish the country for purchasing Russian oil. The new tariffs, which double the existing 25% duty, took effect at 12:01 a.m. in Washington on Wednesday and will hit more than 55% of goods shipped to the U.S. Investors are eagerly awaiting Nvidia’s second-quarter earnings report, scheduled for release after the market close. The chipmaker’s earnings reports have been market-moving since May 2023, when it delivered the revenue growth forecast that reverberated globally. Analysts expect another record in sales, driven by the continued robust demand for the company’s GPU chips used in generative AI applications. Investors will be listening closely to what CEO Jensen Huang says about demand in the current AI market after AI stocks were hit last week amid fears of a bubble. “Today’s focus would be on Nvidia earnings, which is likely to set the tone for risky assets over the coming days,” said Mohit Kumar, chief European strategist at Jefferies International. Prominent companies like Snowflake (SNOW), Veeva Systems (VEEV), Agilent Technologies (A), and HP Inc. (HPQ) are also set to report their quarterly figures today. On the economic data front, investors will focus on U.S. Crude Oil Inventories data, which is set to be released later in the day. Economists expect this figure to be -2.000M, compared to last week’s value of -6.014M. In addition, market participants will parse comments today from Richmond Fed President Tom Barkin. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.257%, up +0.05%. Wonder how soon until markets remember the start of a Fed cutting cycle marked the top of both the Dot Com bubble and Great Recession? This time is different tho, obviously NVDA reports today after the close. It represents 8% of the market cap of the market! Keep an eye on not only how it reacts but how the futures flow after the announcement overnight. The NVDA 5-day swing model chart highlights short-term dynamics within defined trading bands. The lower band, currently near 170.91, has been a strong area of support, with the model showing a 91% success rate when tested over the past 120 days. On the upper end, the risk trigger sits around 192.63, with a more moderate success rate near 76%, suggesting this level has frequently capped moves in recent months. The swing model’s overall success rate of 85.8% underscores that price has generally respected these boundaries. In the short term, NVDA’s positioning near the middle of its range means traders will likely watch whether momentum builds toward retesting the risk trigger level or drifts back toward the lower support zone. Something to think about today as NVDA reports. $1 trillion of AI Capex spend. $20 billion of revenue. AI is a bubble. Let's take a look at the intra-day levels on /ES that I'll be focusing on today. 6491, 6500, 6510 are resistance levels. 6500 is the big one and will be my starting point for our SPX 0DTE today. 6475, 6461, 6455, 6450, 6436 are support. 6436 is the big one below that the flood gates open for downside potential. My lean or bias today is bearish. I don't think we get above the 6500 level today. Trade docket today: Gold 0DTE. We have a chicken I.C. working already with 7.10 credit received. We'll set a NVDA earnings play before the close. Scalping with /MNQ and SPX 0DTE as well.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |