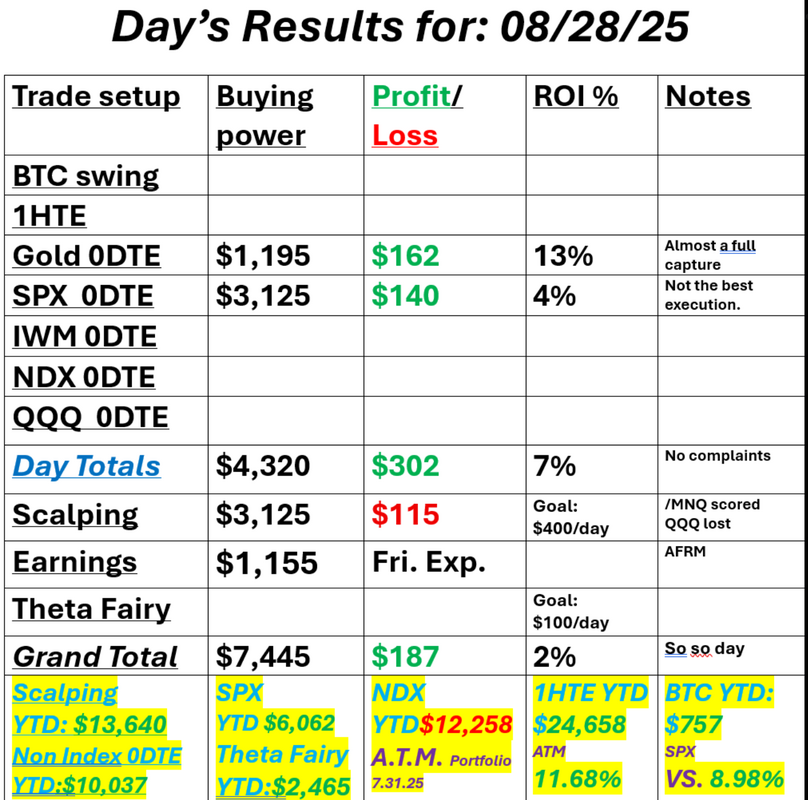

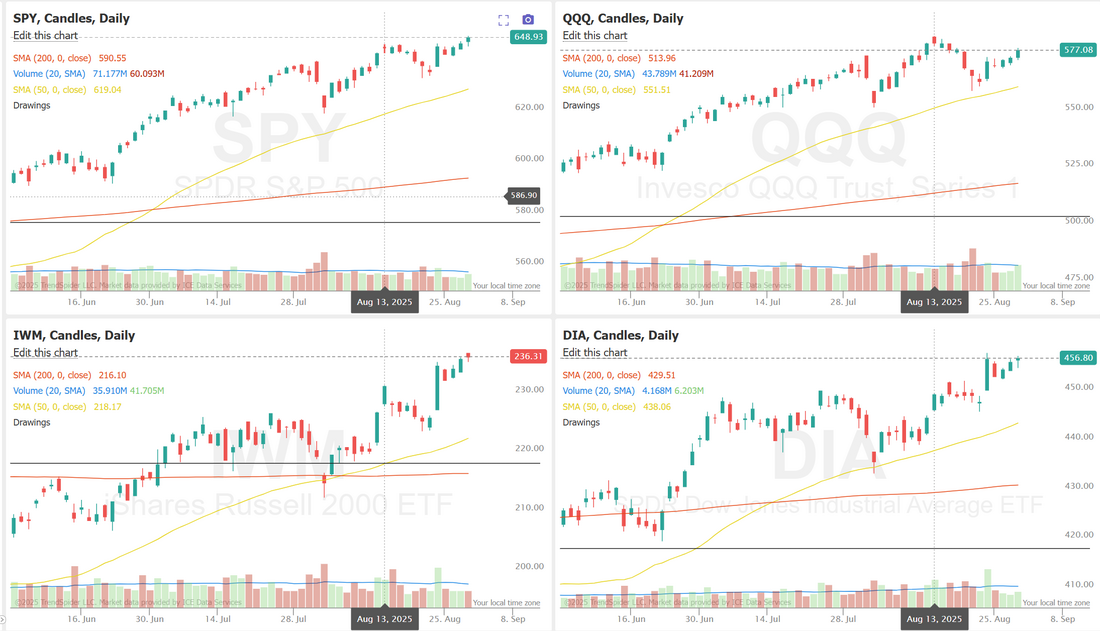

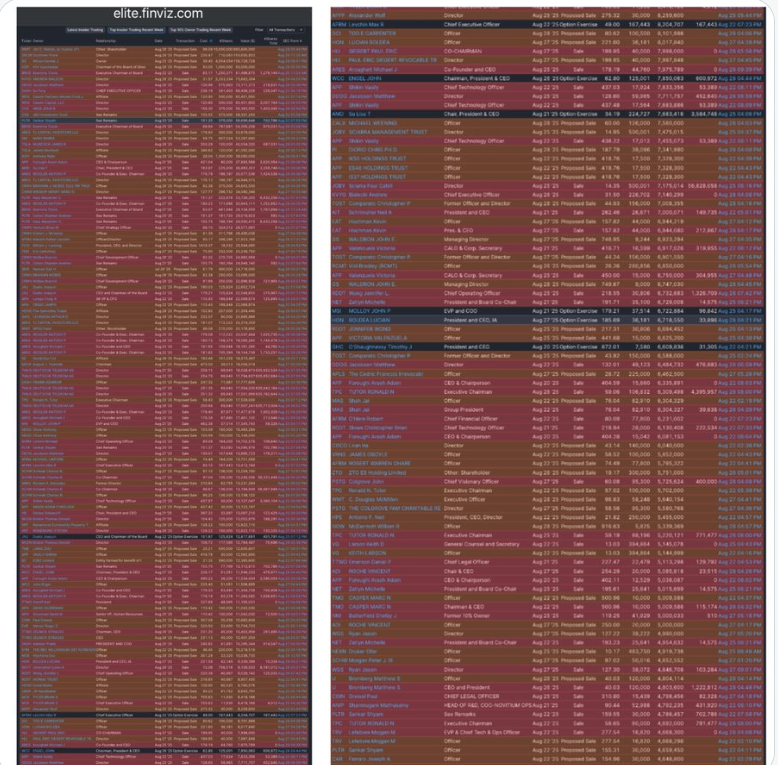

PCE dayI'm very interested to see the PCE numbers today. We've got more and more FED members leaning towards a Sept. rate cut. PCE is a much better inflation indicator over CPI. It could be a market catalyst today. Futures are dersking as I type. with the long weekend most traders are looking to pull back some risk. We had a good day yesterday. We got stuck in a QQQ that we couldn't exit the day before and that cost us but overall it was a pretty clean day of profits. Let's take a look at the markets. I didn't think we'd get such bullish price action but the market wants what it wants and it wanted to go higher yesterday. New ATH's incoming again? September S&P 500 E-Mini futures (ESU25) are down -0.27%, and September Nasdaq 100 E-Mini futures (NQU25) are down -0.47% this morning as investors trimmed risk ahead of the release of the Federal Reserve’s first-line inflation gauge, which could offer more insight into the interest-rate outlook. Some negative corporate news is weighing on stock index futures, with Marvell Technology (MRVL) tumbling over -14% in pre-market trading after the chip designer posted in-line Q2 results and provided tepid Q3 revenue guidance. Also, Dell Technologies (DELL) slumped more than -6% in pre-market trading after reporting a slowdown in AI server orders in Q2 and a weaker-than-expected operating margin in its infrastructure unit. Higher bond yields today are also weighing on stock index futures. In yesterday’s trading session, Wall Street’s major indices closed higher, with the S&P 500 notching a new all-time high. Snowflake (SNOW) jumped over +20% after the provider of cloud-based data-warehouse software posted upbeat Q2 results and raised its full-year product revenue guidance. Also, chip stocks gained ground, with Micron Technology (MU) and Marvell Technology (MRVL) rising more than +3%. In addition, Pure Storage (PSTG) soared over +32% after the company reported stronger-than-expected Q2 results and boosted its annual guidance. On the bearish side, Hormel Foods (HRL) plunged more than -13% and was the top percentage loser on the S&P 500 after the company posted weaker-than-expected FQ3 adjusted EPS and gave disappointing FQ4 guidance. The U.S. Bureau of Economic Analysis said on Thursday that Q2 GDP growth was revised higher to +3.3% (q/q annualized) from the initial estimate of +3.0%, stronger than expectations of +3.1%. Also, the number of Americans filing for initial jobless claims in the past week fell -5K to 229K, compared with the 231K expected. In addition, U.S. pending home sales fell -0.4% m/m in July, in line with expectations. “Slowing job growth indicates the economy will not keep up with the above-trend growth from the previous quarter. Economic growth will likely flatline in the third quarter. Softer growth in the third quarter will add fuel to those calling for rate cuts,” said Jeff Roach at LPL Financial. Fed Governor Christopher Waller reiterated his call for lower interest rates on Thursday, saying he would back a quarter-point cut in September and expects further reductions over the next three to six months. “With underlying inflation close to 2%, market-based measures of longer-term inflation expectations firmly anchored, and the chances of an undesirable weakening in the labor market increased, proper risk management means the FOMC should be cutting the policy rate now,” Waller said. Meanwhile, U.S. rate futures have priced in an 85.2% probability of a 25 basis point rate cut and a 14.8% chance of no rate change at the Fed’s monetary policy committee meeting next month. Today, all eyes are focused on the U.S. core personal consumption expenditures price index, the Fed’s preferred price gauge, which is set to be released in a couple of hours. Economists, on average, forecast that the core PCE price index will stand at +0.3% m/m and +2.9% y/y in July, compared to the previous figures of +0.3% m/m and +2.8% y/y. “In-line or lower results will likely cement investors’ confidence in a September rate cut. While a higher-than-expected print may not take a rate cut off the table next month, it could sour Wall Street’s mood as inflation concerns grow,” said Bret Kenwell at eToro. U.S. Personal Spending and Personal Income data will also be closely monitored today. Economists anticipate July Personal Spending to rise +0.5% m/m and Personal Income to grow +0.4% m/m, compared to the June figures of +0.3% m/m and +0.3% m/m, respectively. The University of Michigan’s U.S. Consumer Sentiment Index will be released today. Economists expect the final August figure to be revised slightly higher to 58.7 from the preliminary reading of 58.6. The U.S. Chicago PMI will come in today. Economists forecast the August figure at 46.6, compared to the previous value of 47.1. U.S. Wholesale Inventories data will be released today as well. Economists expect the preliminary July figure to rise +0.1% m/m, the same as in June. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.221%, up +0.33%. Trade docket today: We've got the AFRM earnings trade to unwind. /MNQ scalping. SPX 0DTE and Gold 0DTE Out of the top 200 insider trades over the last week (by value). 0/200 were buy orders. I have never seen anything like this in my life. Let's take a look at the intra-day levels on /ES. 6510, 6519, 6525 are resistance with 6525 being the big one. 6488, 6485, 6479, 6474 working as support with 6474 being the big one. Let's finish off the week strong! See you all in the live trading room!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |