|

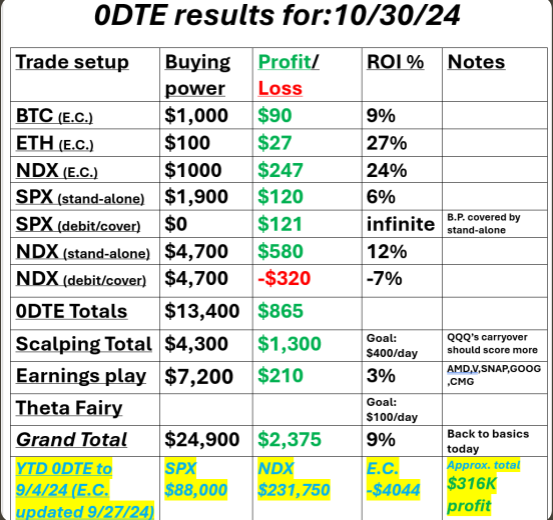

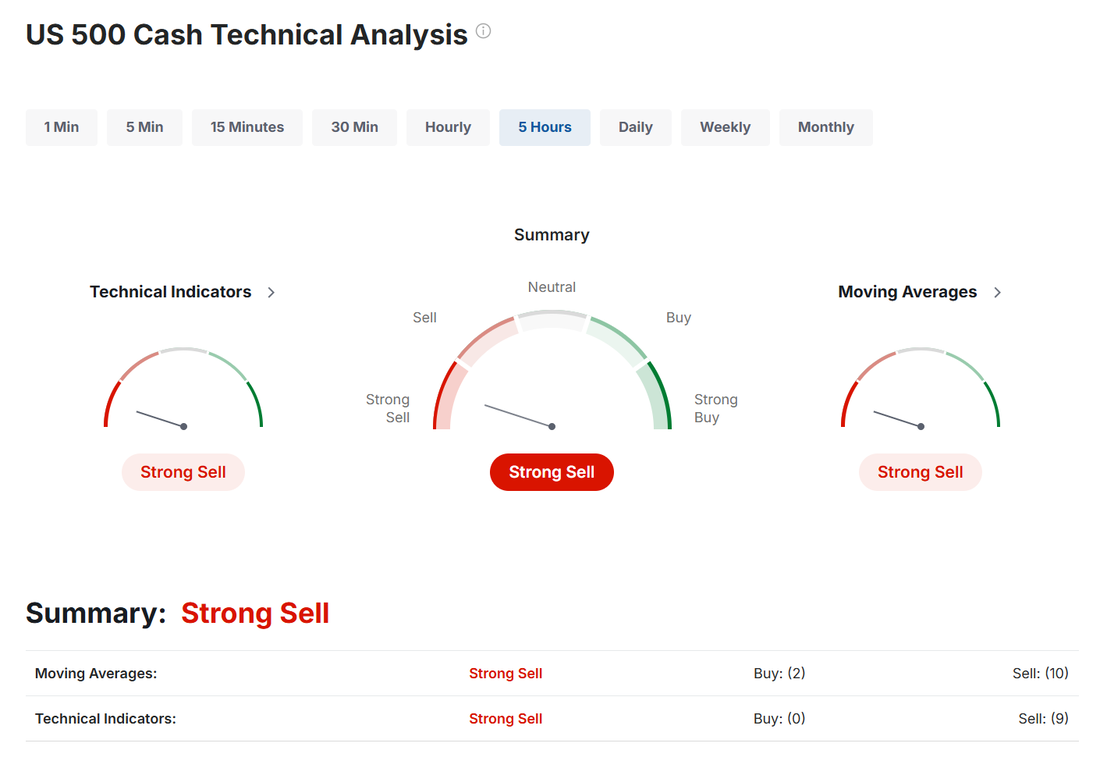

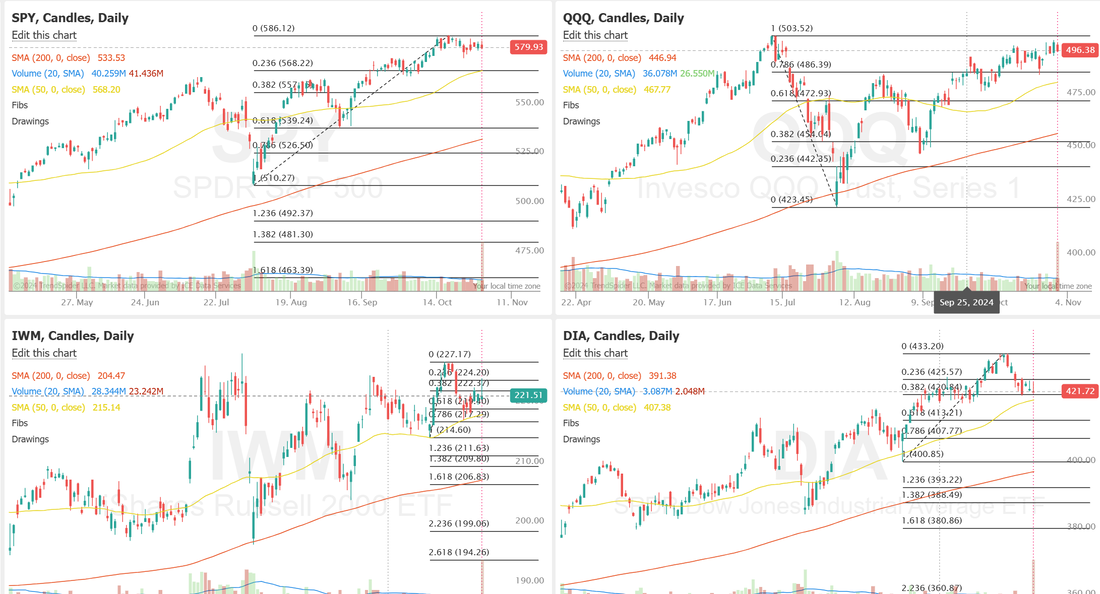

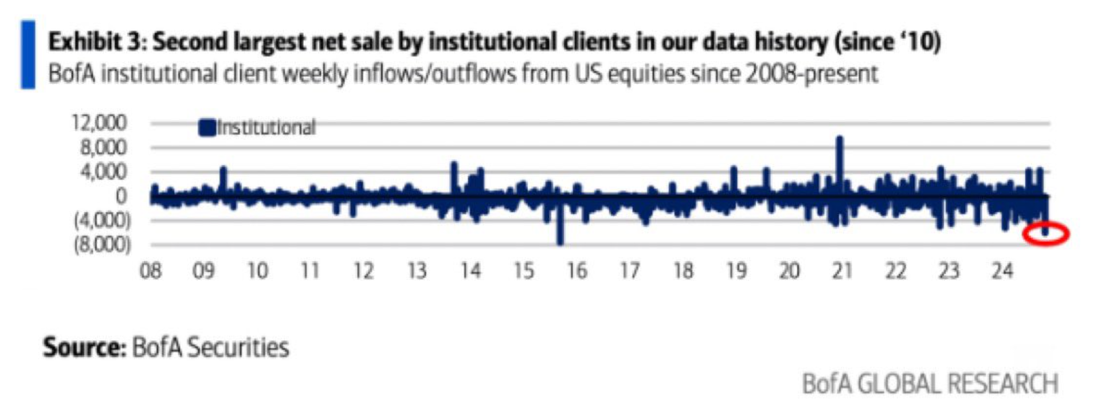

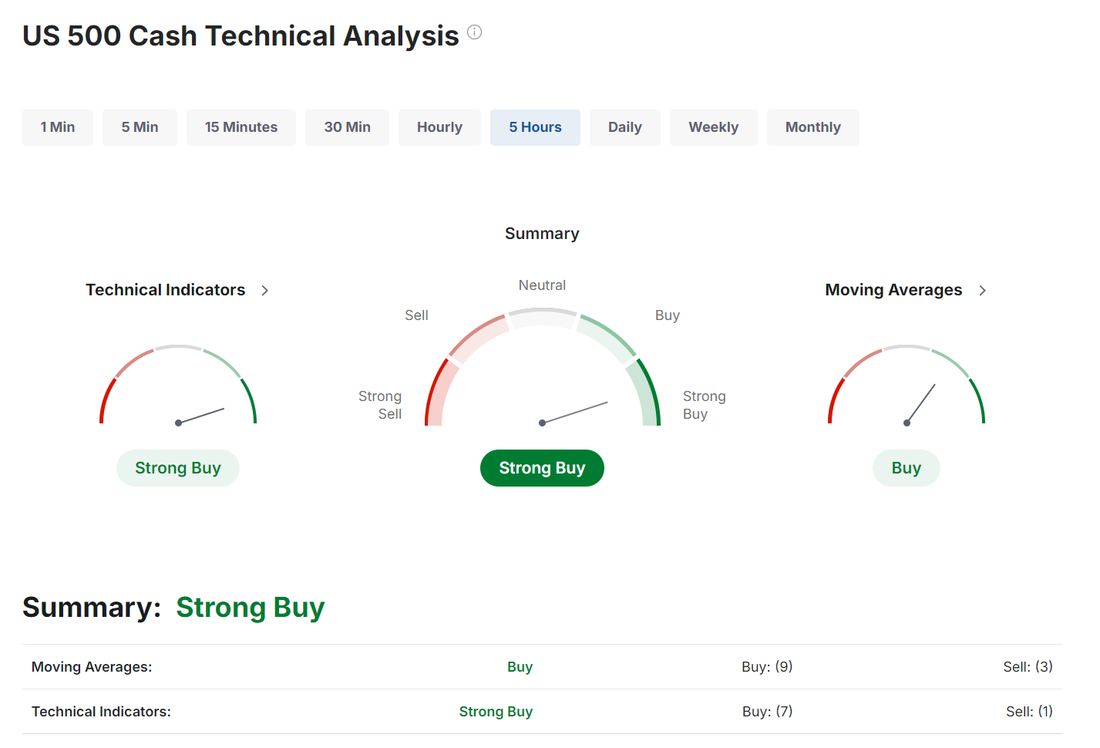

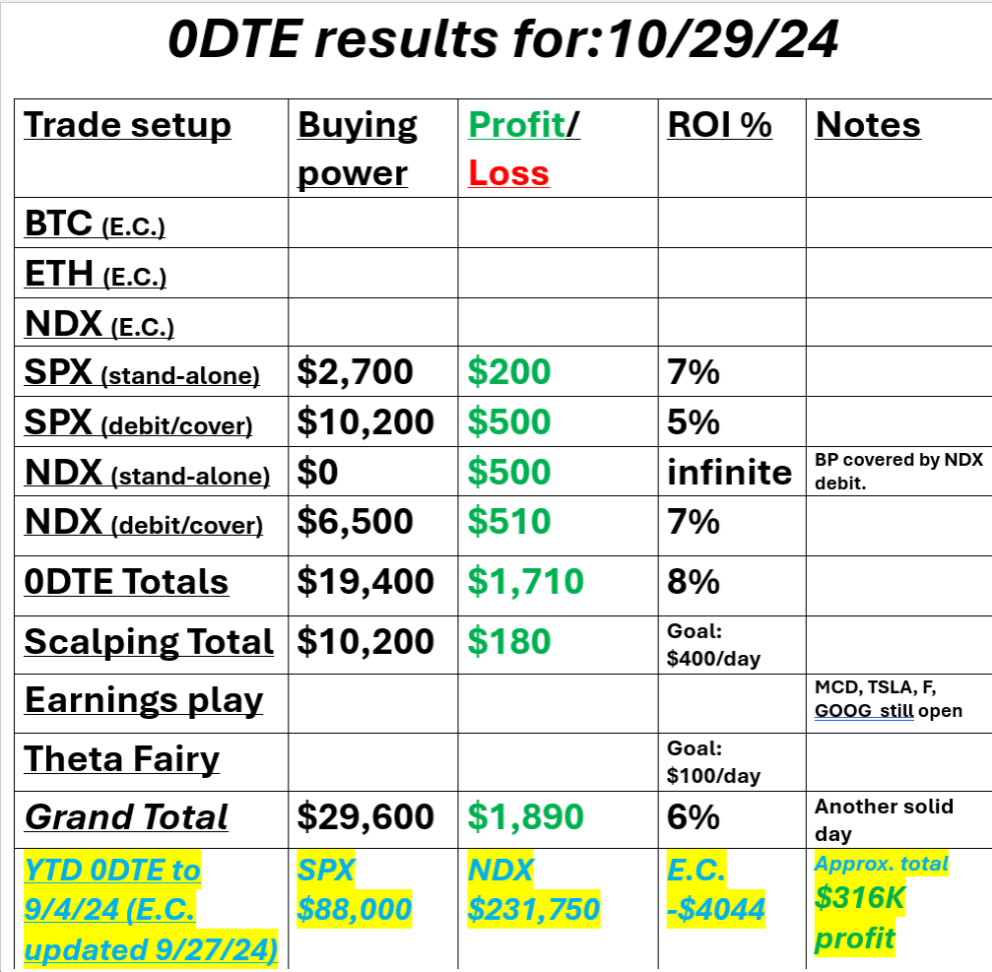

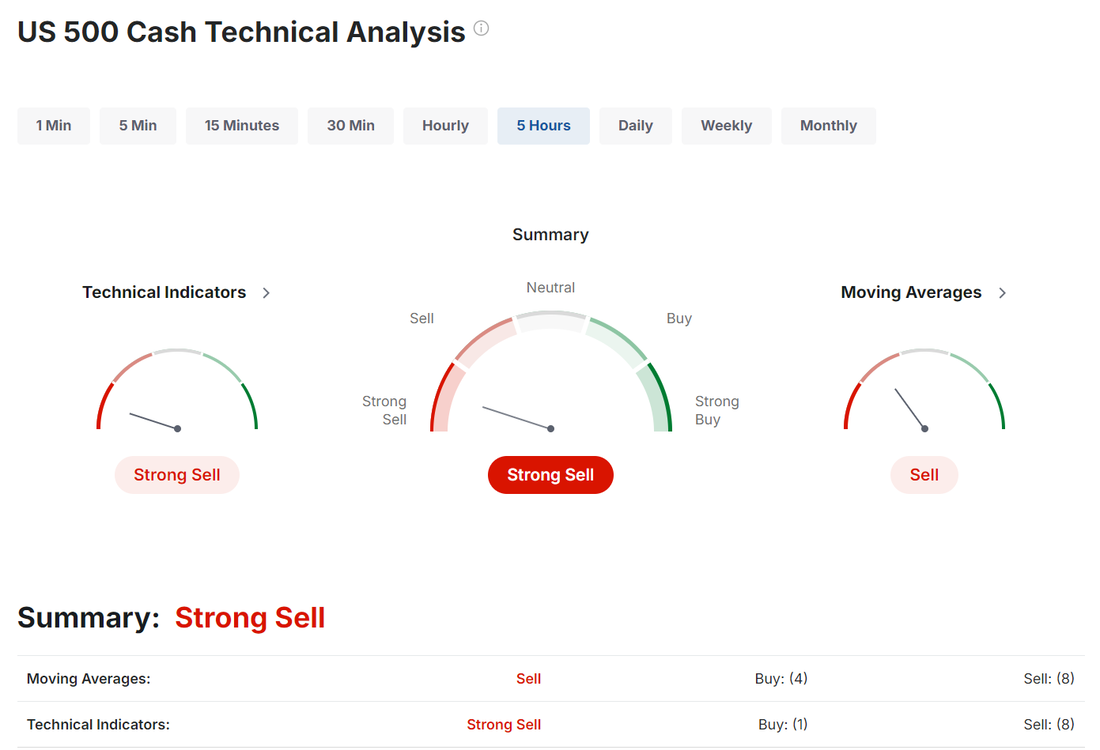

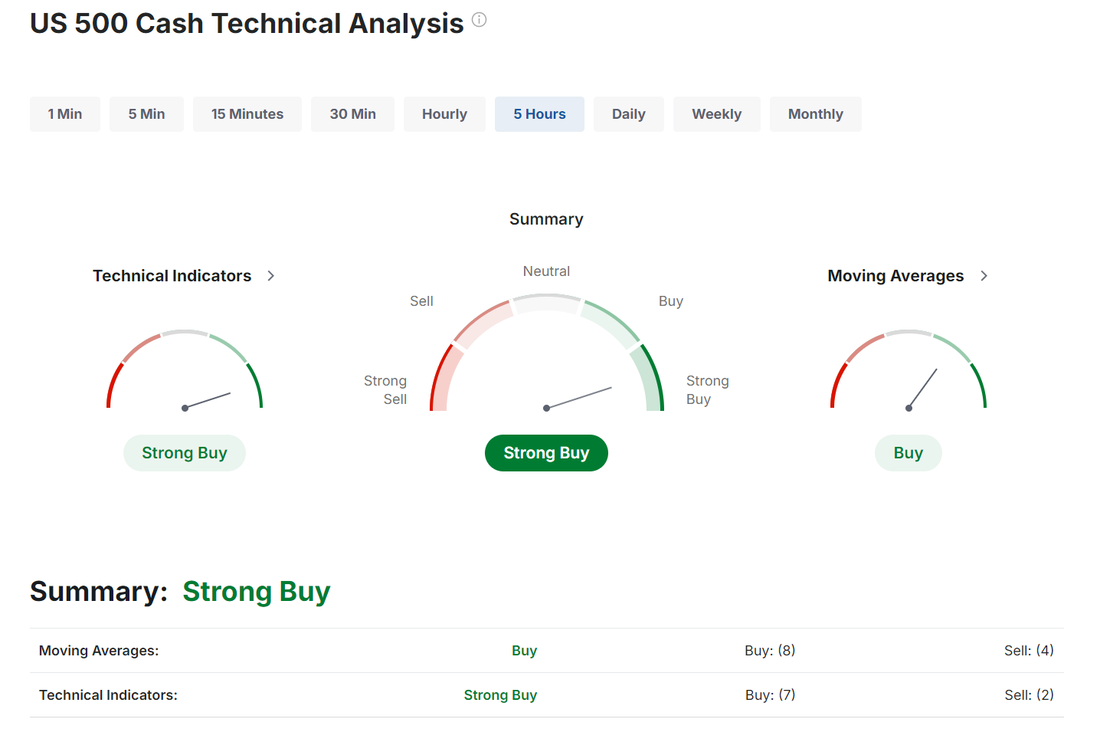

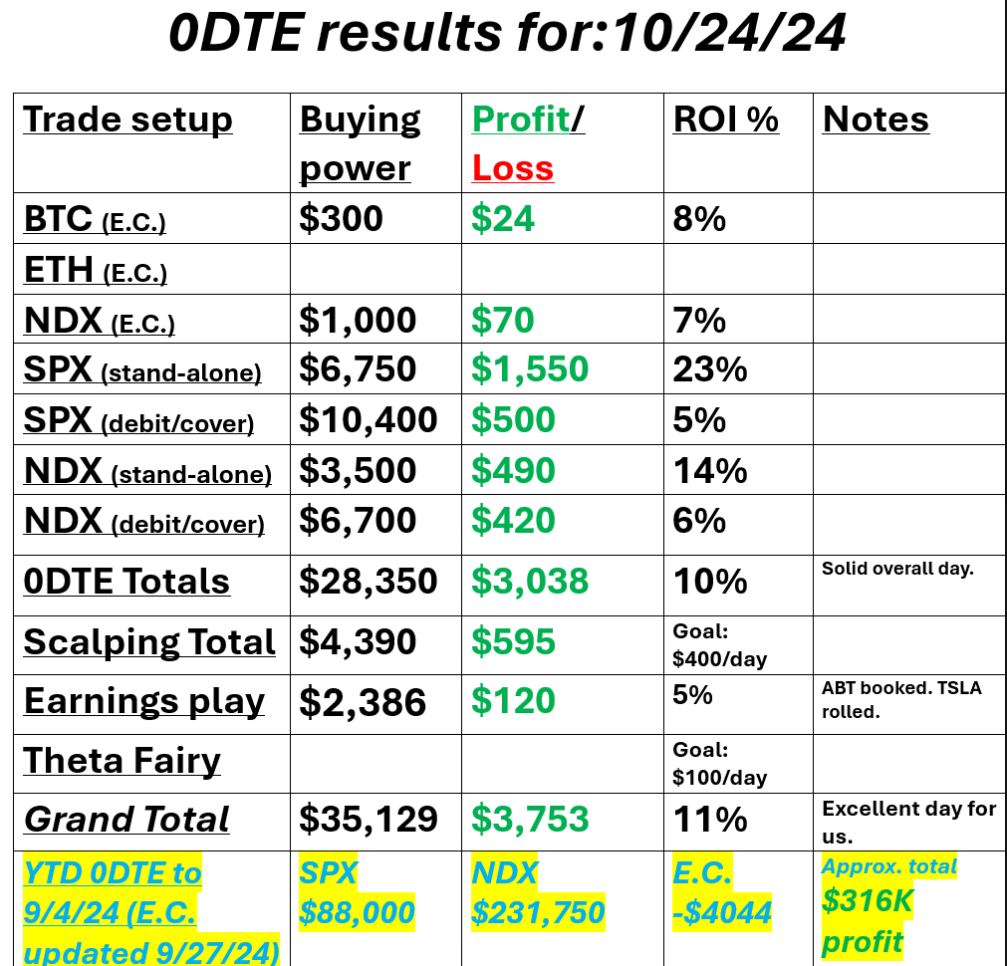

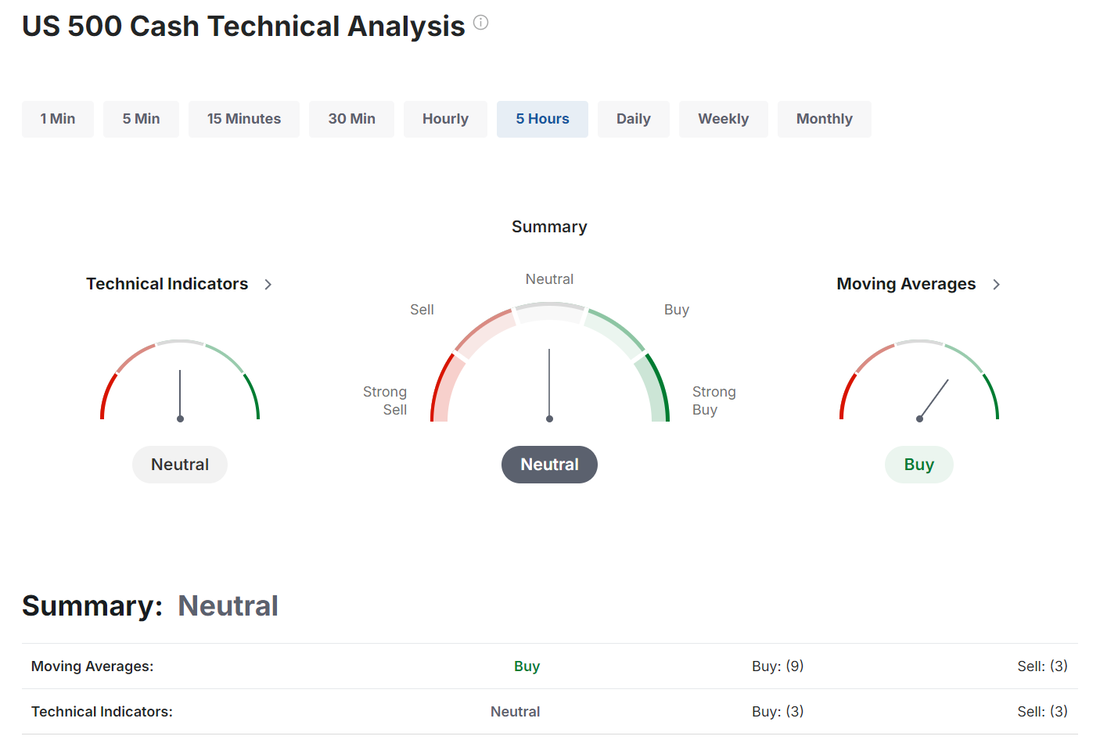

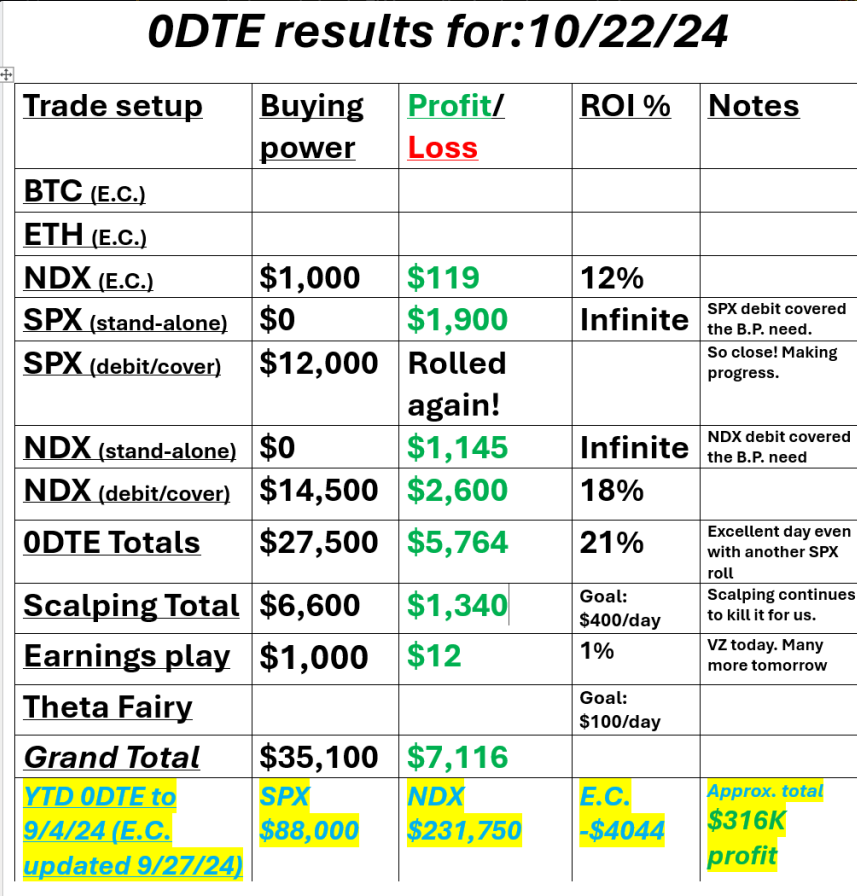

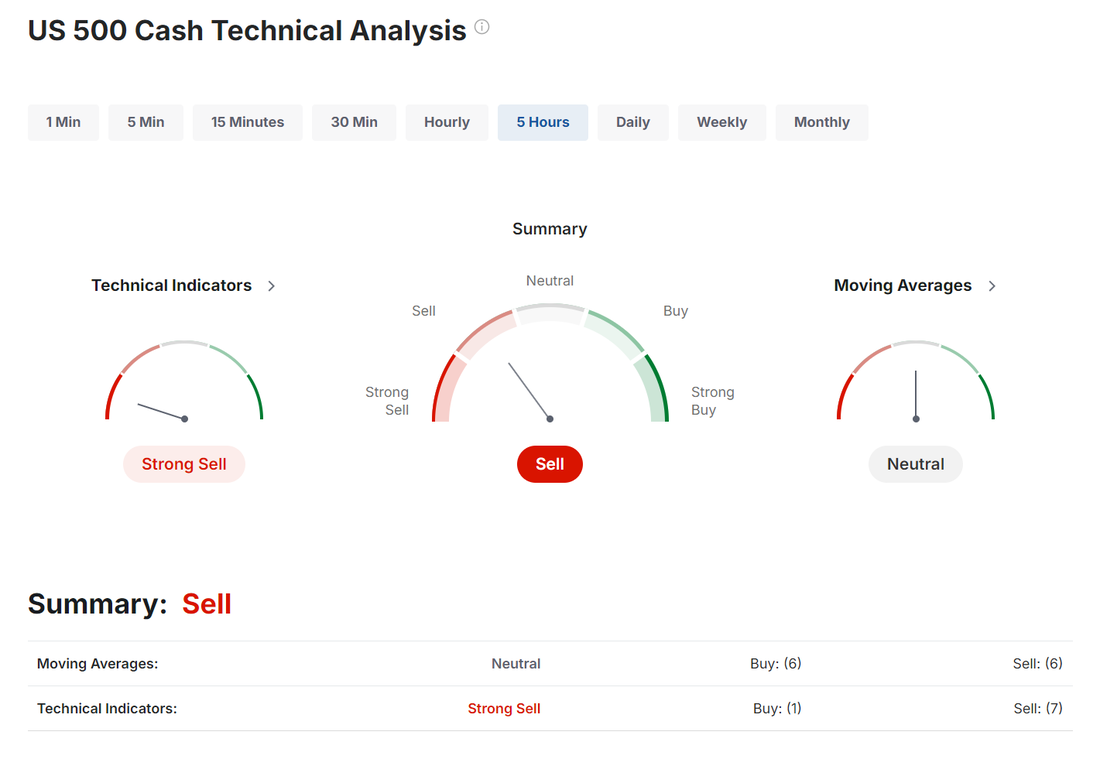

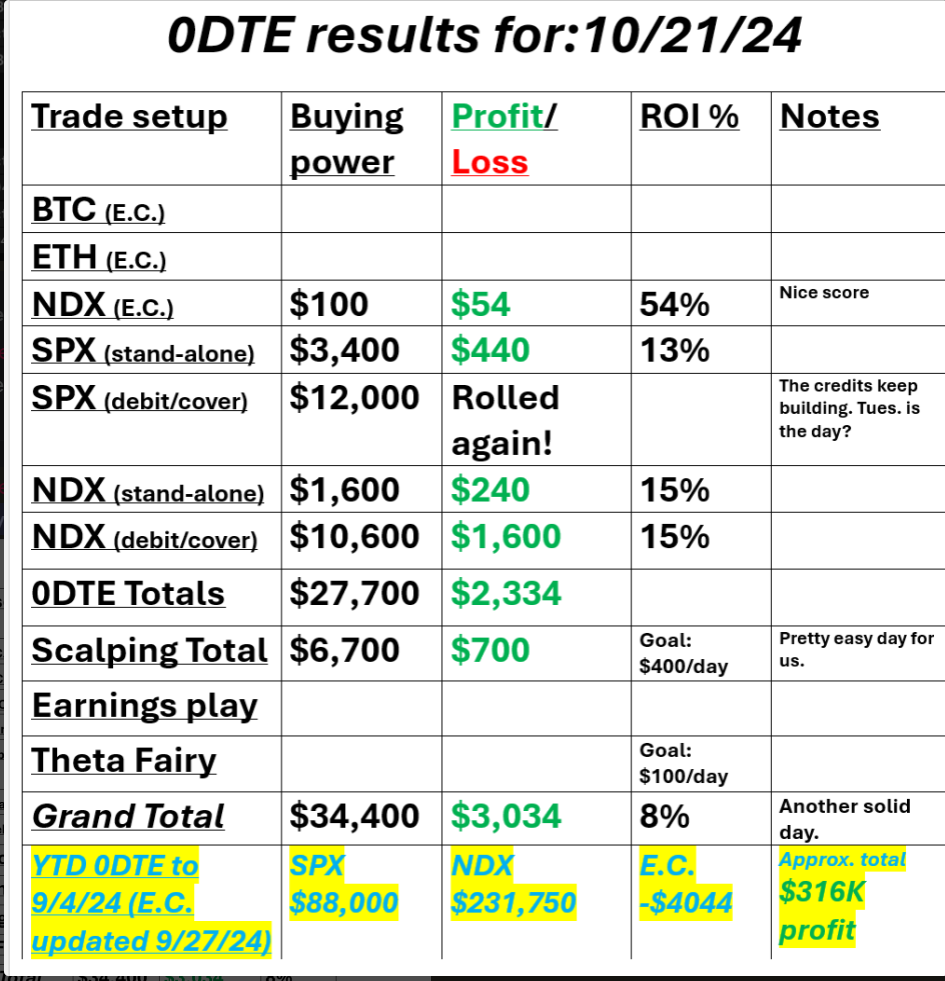

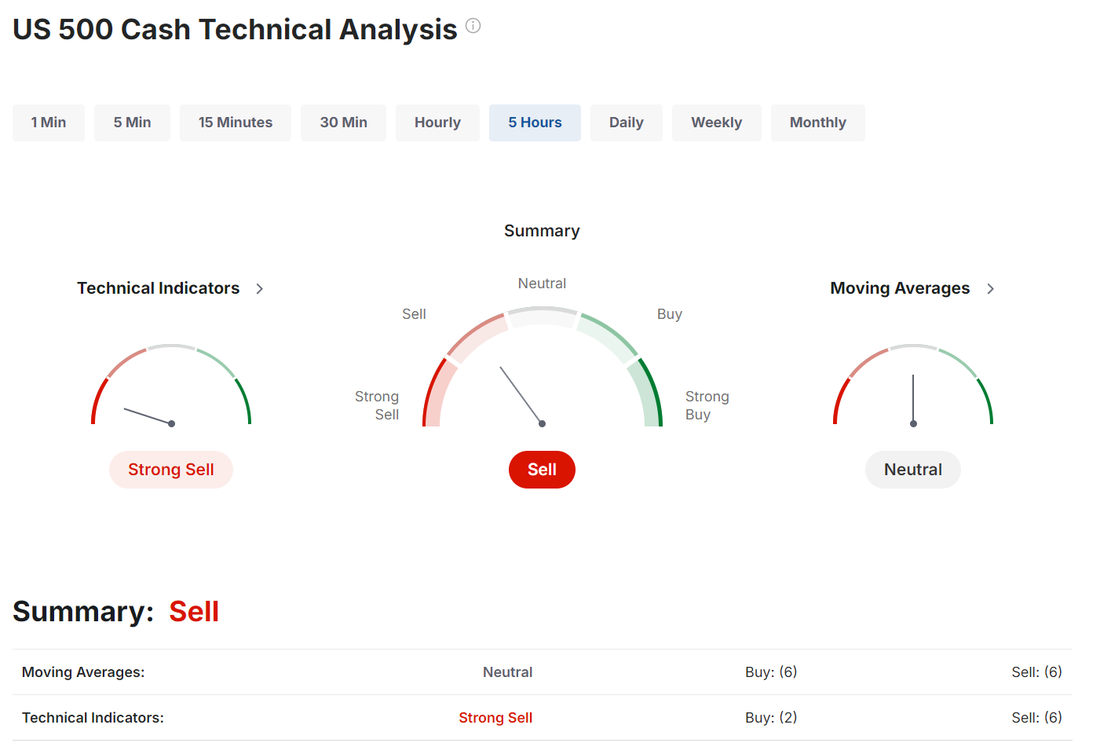

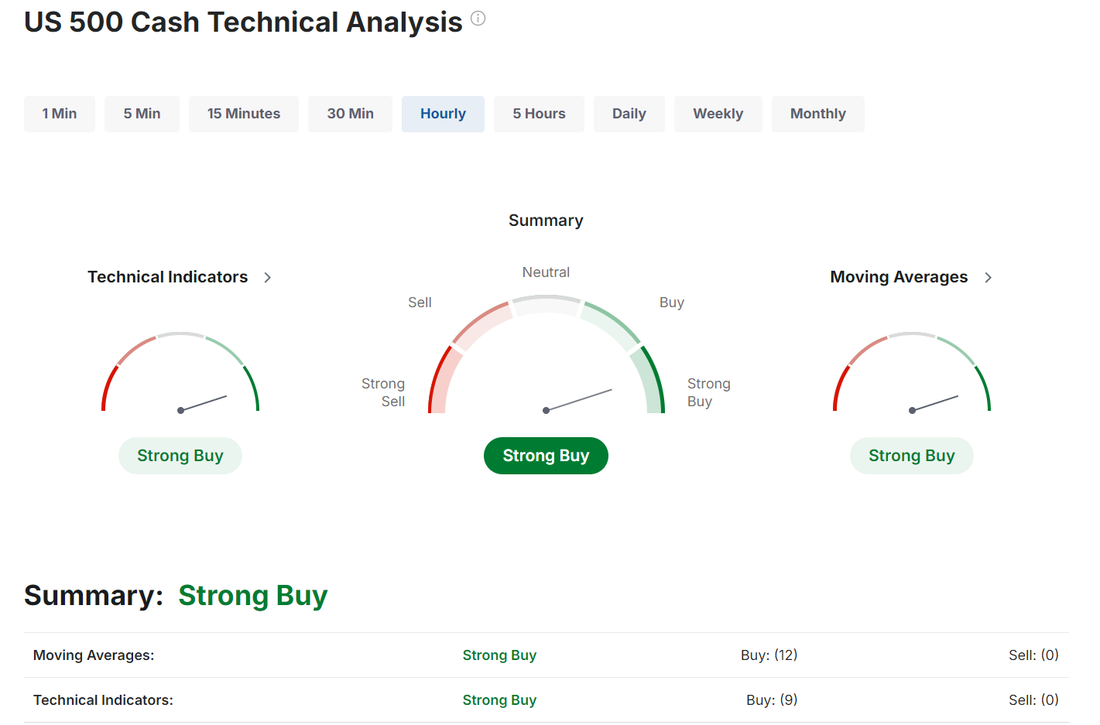

Good morning traders! After a nasty Tues. we went back to basics and scaled down. It's the best way to reduce stress. It ended up well for us and our QQQ puts we held from scalping yesterday should cash flow some additional profit for us at the open. I'll be getting my left eye worked on today so no zoom. Will move it to Friday. After this week we'll be on the Mon. Weds. Thurs. rotation. Also..happy Halloween! My wifes favorite holiday. Our results are below: Let's take a look at the markets this morning: Technicals have swung back to a sell rating after some earnings shortfalls. Once again, we get "some" movement but nothing that moves us out of the current chop zones or gives us any directional bias. December S&P 500 E-Mini futures (ESZ24) are down -0.77%, and December Nasdaq 100 E-Mini futures (NQZ24) are down -1.09% this morning as investors digested quarterly earnings reports from Microsoft and Meta as well as robust U.S. economic data that muddied the outlook for Federal Reserve rate cuts. Investors now look forward to the release of the Fed’s preferred inflation gauge and a new round of corporate earnings reports, with particular focus on results from “Magnificent Seven” companies Apple and Amazon. Microsoft (MSFT) slid over -3% in pre-market trading after the tech giant provided a disappointing FQ2 cloud revenue growth forecast. Also, Meta Platforms (META) fell more than -3% in pre-market trading after CEO Mark Zuckerberg cautioned investors that the company will keep investing heavily in AI and other futuristic technologies. In yesterday’s trading session, Wall Street’s major indices ended in the red. Super Micro Computer (SMCI) plummeted over -32% and was the top percentage loser on the S&P 500 and Nasdaq 100 after accounting firm Ernst & Young LLP resigned as the company’s auditor. Also, Advanced Micro Devices (AMD) plunged more than -10% after the semiconductor giant provided a weak Q4 revenue forecast. In addition, Eli Lilly (LLY) slumped over -6% after the drugmaker posted downbeat Q3 results and cut its full-year adjusted EPS forecast. On the bullish side, Garmin Ltd. (GRMN) soared more than +23% and was the top percentage gainer on the S&P 500 after posting upbeat Q3 results and raising its full-year guidance. Also, Alphabet (GOOGL) gained over +2% after the Google parent reported stronger-than-expected Q3 results. The U.S. Bureau of Economic Analysis in its first estimate of Q3 GDP growth said on Wednesday that the economy grew at a +2.8% annualized rate, slightly weaker than expectations of +3.0%. Also, the U.S. October ADP employment change jumped +233K, higher than the +110K consensus and the biggest increase in 15 months. In addition, U.S. pending home sales climbed +7.4% m/m in September, stronger than expectations of +1.9% m/m and the largest increase in 4-1/4 years. “Solid but not blistering growth fits nicely within the current economic backdrop,” said Bret Kenwell at eToro. “Too hot of a print and investors would likely question the Fed’s decision to cut rates by 50 basis points in September, while a weak print could reignite worries about a deteriorating economy.” Meanwhile, U.S. rate futures have priced in a 96.1% chance of a 25 basis point rate cut and a 3.9% chance of no rate change at the November meeting. Third-quarter corporate earnings season continues in full flow, with market participants awaiting new reports today from notable companies such as Apple (AAPL), Amazon (AMZN), Mastercard (MA), Intel (INTC), Merck & Co. (MRK), Altria (MO), and Uber Technologies (UBER). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +4.3% increase in quarterly earnings for Q3 compared to the previous year, down from +7.9% growth projected in mid-July. On the economic data front, all eyes are focused on the U.S. core personal consumption expenditures price index, the Fed’s preferred price gauge, which is set to be released in a couple of hours. Economists, on average, forecast that the core PCE price index will stand at +0.3% m/m and +2.6% y/y in September, compared to the previous figures of +0.1% m/m and +2.7% y/y. Also, investors will focus on the U.S. Chicago PMI, which arrived at 46.6 in September. Economists foresee the October figure to be 46.9. U.S. Personal Spending and Personal Income data will be closely monitored today. Economists forecast September Personal Spending to be +0.4% m/m and Personal Income to come in at +0.3% m/m, compared to the August numbers of +0.2% m/m and +0.2% m/m, respectively. The U.S. Employment Cost Index will come in today. Economists expect this figure to arrive at +0.9% q/q in the third quarter, matching the second quarter’s figure. U.S. Initial Jobless Claims data will be reported today as well. Economists estimate this figure to be 229K, compared to last week’s number of 227K. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.292%, up +0.59%. Lots of potential catalysts this morning. PCE, Jobless claims, Consumer spending data all hitting the wires 1hr. before the cash open. My bias today is back to Neutral. Look at the VTI for guidance as to what the total market picture looks like. We're just hanging around. At some point we'll get some directional bias but for now,..we wait. Some things I'm thinking about today: NSTITUTIONAL TRADERS JUST SOLD THE MOST AMOUNT OF STOCKS LAST WEEK IN MORE THAN 9 YEARS IN EVERY BUBBLE LIKE 1929, 1987, 2001, & 2008 THE LAST STAGES WERE WHEN INSTITUTIONS STARTED DUMPING ON THE BAG HOLDING RETAIL WHICH BUY IT UP At some point folks...we going to get a correction. It's just how it works. While the internet would go on to become ubiquitous and a source of tremendous wealth and innovation -- at the height of the dot com bubble it was pure Hype at that stage... certainly relative to the valuations prevailing at that time. The bond market continues screaming "policy error" Despite oil prices crashing below $70 and the latest employment data showing the weakest job openings in over 3 years, interest rates are spiking The 10-year US Treasury yield is breaking through 4.3% and now up 70 bps since the Fed's 50 bps rate cut This is the bond market making its best effort to take away Mr. Powell's printing press Meanwhile, gold prices are defying the typical gravitational pull imposed by higher rates and rallying to new all-time highs with each passing day Investors are dumping the former "safe haven" known as US government bonds in favor of real money Weak economy + sticky inflation + spiking bond yields and sky-rocketing gold prices = stagflation My bias for today is more neutral. Until we break the market out, one direction or the other we just continue to consolidate. Trade docket for today is pretty full. Mostly earnings plays. /MNQ,QQQ scalping, AMZN, JNPR, AAPL, INTC, X, TEAM, COIN, CVNA, DASH, HOOD, META?, MSFT, RIOT, ROKU, SBUX, TSLA? TWLO, 0DTE's Let's execute today and stick to our knitting and we should have another solid result.

0 Comments

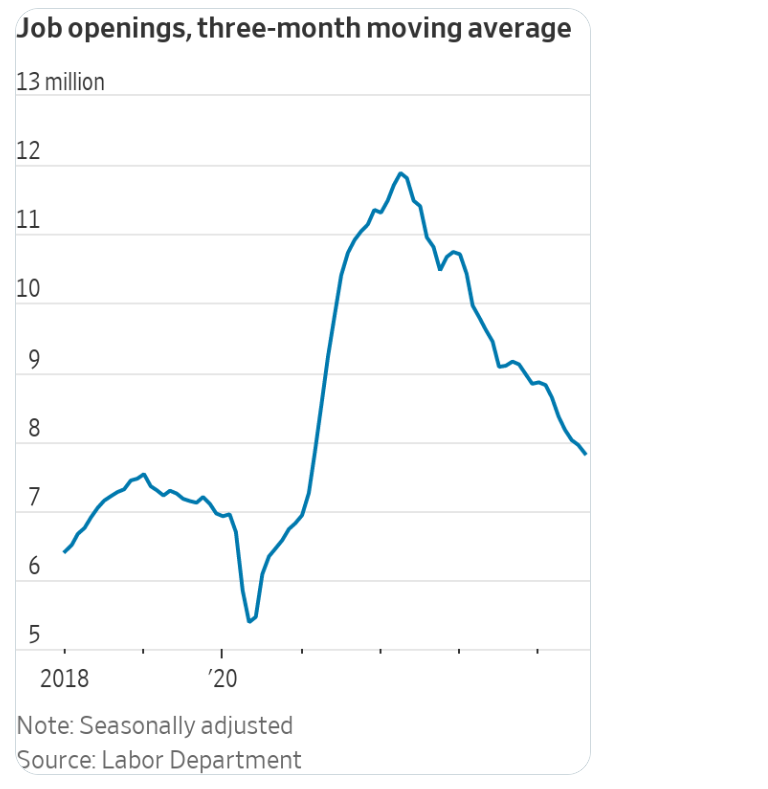

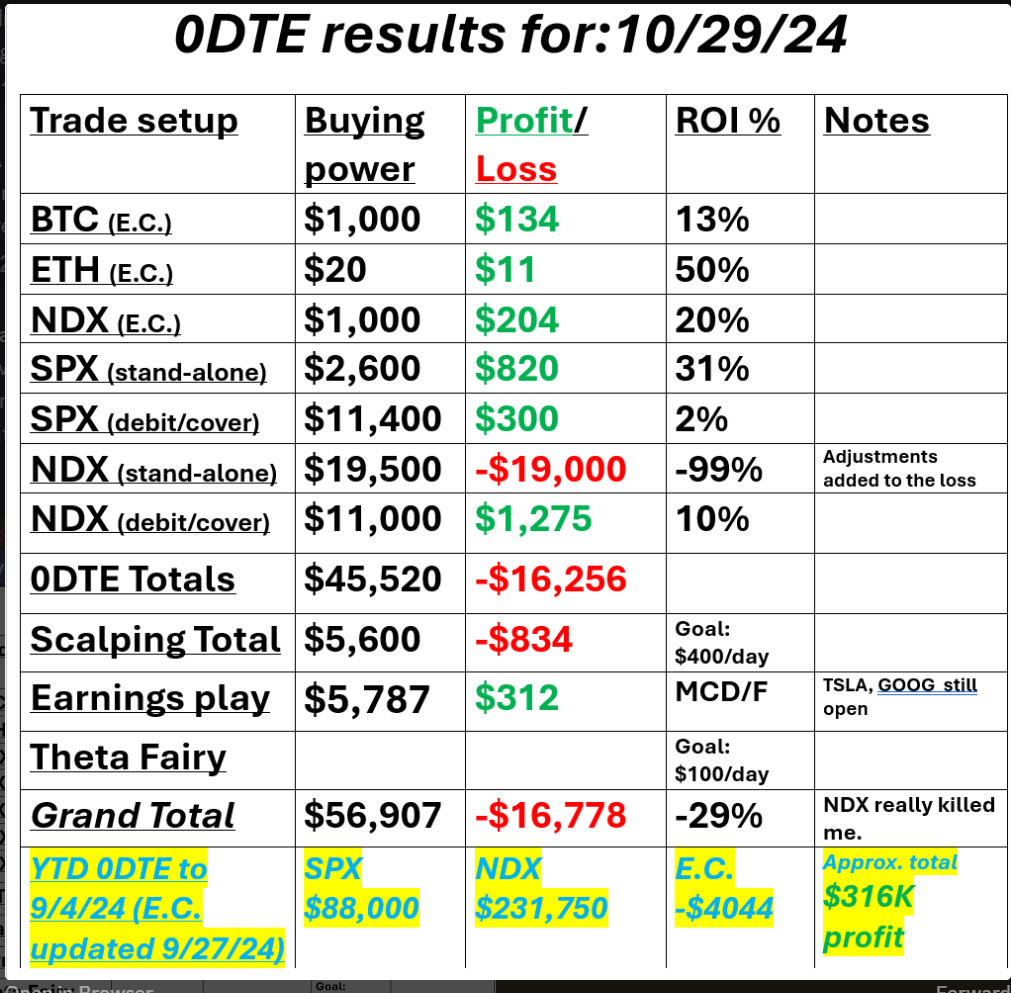

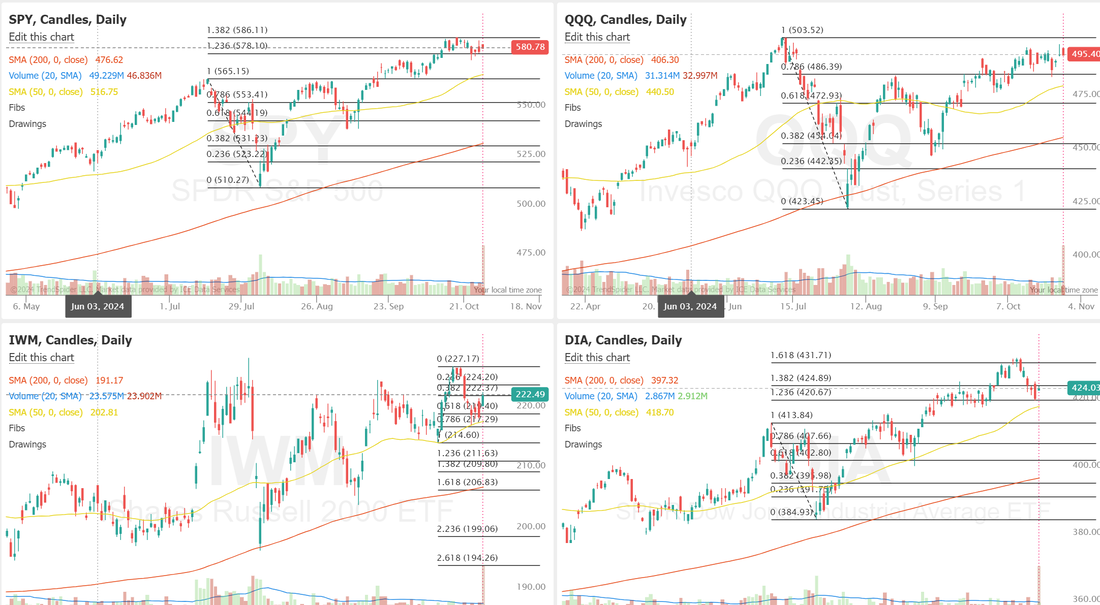

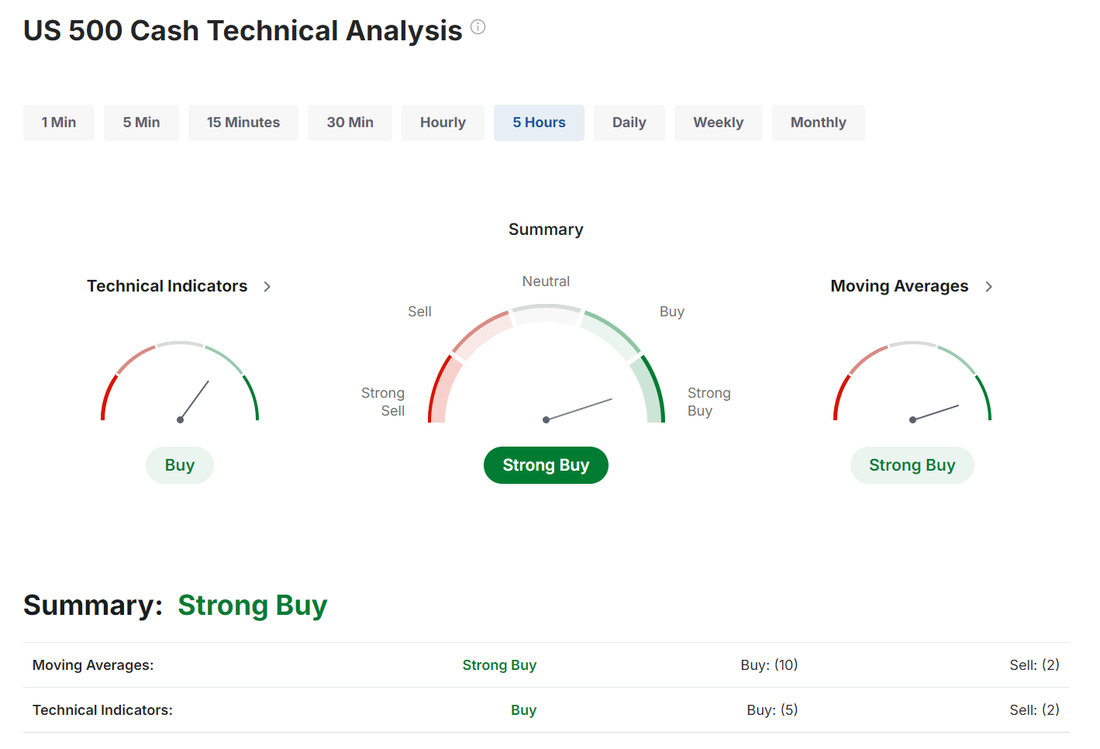

Welcome back! It's Weds. Yesterday was a bad one for me and it wasn't the markets fault. It was mine. I had a losing position on in the NDX and while it would have resulted in a loss it would have been managable however I adjusted it and the adjustment ALSO lost. It was a double whammy. I'll work to do better today. Here's our results below: One key thing I remind myself and our trading room after a bad day like this is to not revenge trade. It can just dig the hole deeper. Let's take a look at the markets; Buy mode is holding. It's interesting that even though the push up on the NDX yesterday caught me by surprise and killed my results, we are still just chopping around the same levels we have been for a while now. December Nasdaq 100 E-Mini futures (NQZ24) are trending up +0.28% this morning as strong quarterly results from Alphabet boosted sentiment, while investors also awaited a fresh batch of U.S. economic data and earnings reports from “Magnificent Seven” companies Microsoft and Meta. Alphabet (GOOGL) climbed over +5% in pre-market trading after the Google parent reported stronger-than-expected Q3 results. In yesterday’s trading session, Wall Street’s main stock indexes closed mixed. Cadence Design Systems (CDNS) surged over +12% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the company posted upbeat Q3 results and raised its full-year EPS guidance. Also, chip stocks gained ground, with Arm (ARM) and Broadcom (AVGO) climbing more than +4%. In addition, V.F. Corporation (VFC) soared over +27% after the company reported stronger-than-expected FQ2 results. On the bearish side, Ford (F) plunged more than -8% after the carmaker lowered its full-year adjusted EBIT guidance. Also, PayPal (PYPL) slid about -4% and was the top percentage loser on the Nasdaq 100 after the payment technology firm reported weaker-than-expected Q3 revenue and offered a soft Q4 revenue forecast. A Labor Department report released on Tuesday showed that the U.S. JOLTs job openings fell to a 3-3/4 year low of 7.443M in September, weaker than expectations of 7.980M. Also, the U.S. Conference Board’s consumer confidence index jumped to a 9-month high of 108.7 in October, easily beating the 99.5 consensus. In addition, the U.S. August S&P/CS HPI Composite - 20 n.s.a. eased to +5.2% y/y from +5.9% y/y in July, stronger than expectations of +4.9% y/y. “The labor market no longer poses a threat to the price stability side of the Fed’s dual mandate,” Wells Fargo economists said. Meanwhile, U.S. rate futures have priced in a 99.7% chance of a 25 basis point rate cut at the November FOMC meeting. Third-quarter corporate earnings season rolls on, with investors looking forward to fresh reports today from major companies such as Microsoft (MSFT), Meta Platforms (META), Eli Lilly (LLY), AbbVie (ABBV), Caterpillar (CAT), Booking (BKNG), KLA Corp. (KLAC), and Doordash (DASH). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +4.3% increase in quarterly earnings for Q3 compared to the previous year, down from +7.9% growth projected in mid-July. On the economic data front, all eyes are focused on the first estimate of U.S. third-quarter gross domestic product, due later in the day. Economists, on average, forecast that U.S. GDP will stand at +3.0% q/q, matching the second quarter’s figure. Also, investors will focus on the U.S. ADP Nonfarm Employment Change data, which came in at 143K in September. Economists foresee the October figure to be 110K. U.S. Pending Home Sales data will come in today. Economists expect the September figure to be +1.9% m/m, compared to the previous figure of +0.6% m/m. U.S. Crude Oil Inventories data will be reported today as well. Economists estimate this figure to be 1.500M, compared to last week’s value of 5.474M. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.235%, down -0.94%. Today the flood gates open for earnings. Our trade docket will be filled with them. Trade docket:CVNA, ROKU, TWLO, HOOD, RIOT, DASH, MSFT, SBUX, META, COIN, AMD, CMG, FSLR, GOOG, SNAP, V, /MNQ scalping 0DTE's. Levels havent really changed much from yesterrday for intra-day trades. I'll alter them a bit in the zoom feed today. My bias or lean today is Neutral to slightly bearish. GOOG earnings have pushed the futures higher which keeps us pinned at some big resistance levels. Let's get ourselves back on track today!

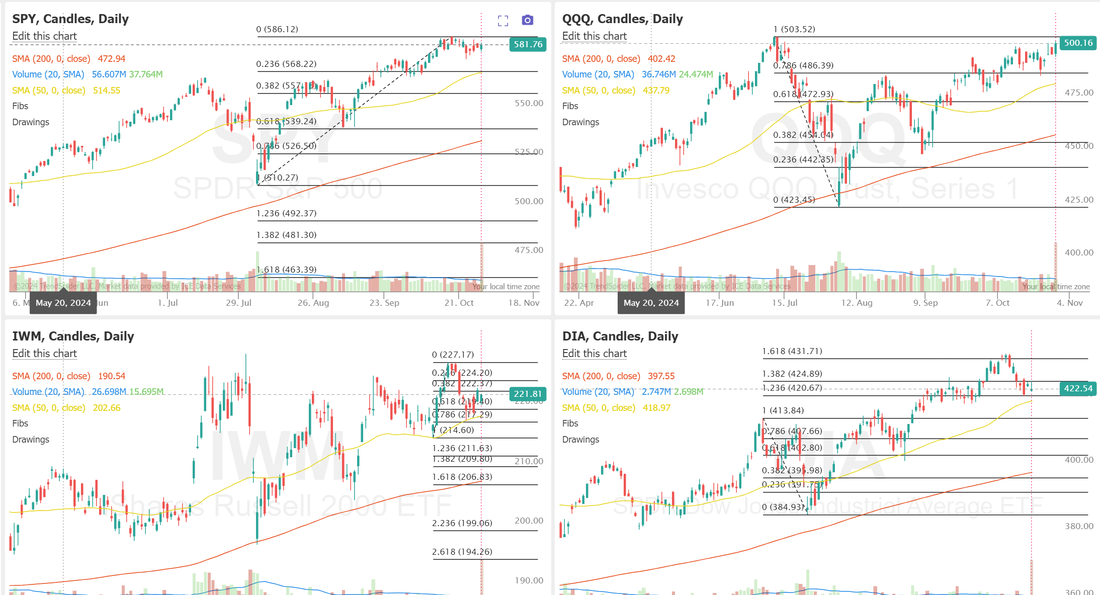

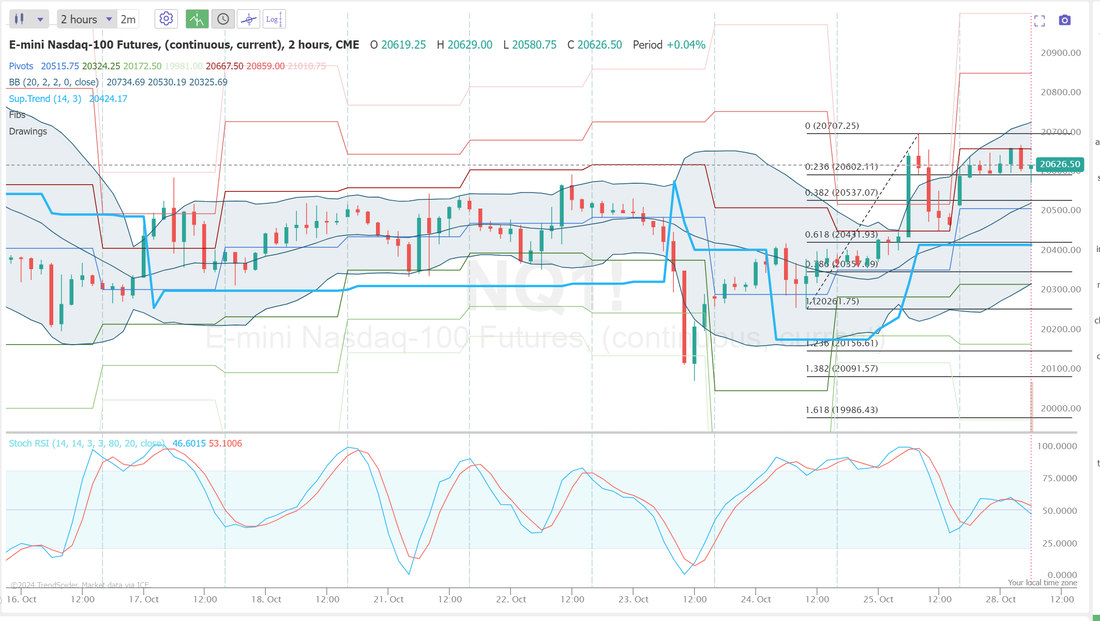

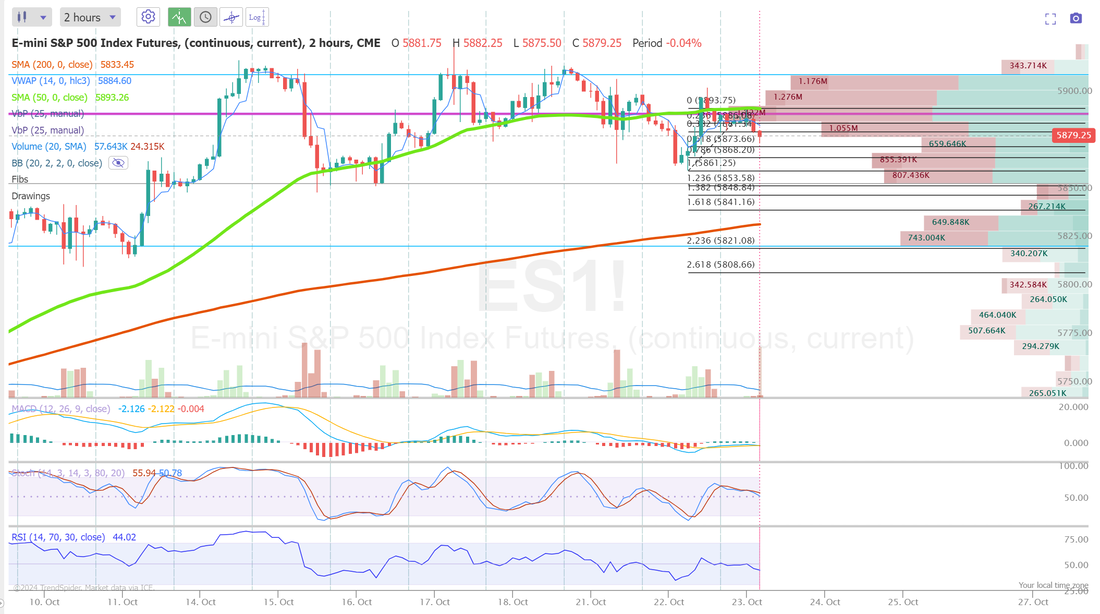

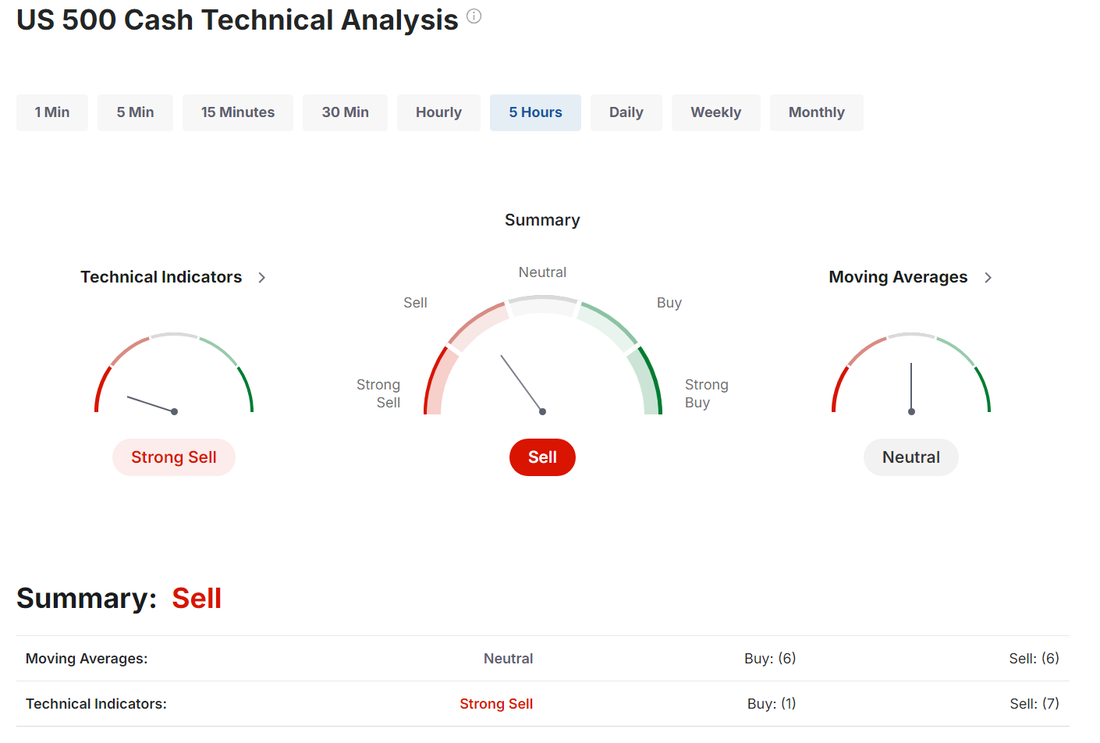

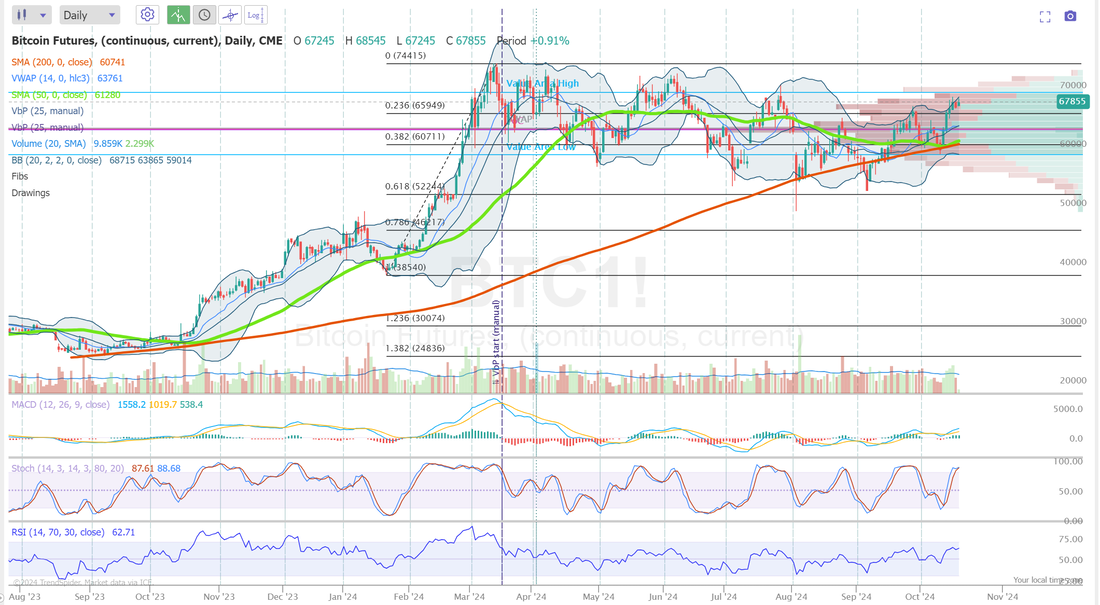

Welcome back traders! We had a clean and "excellent" day yesterday. Everything worked for us but scalping was a battle. See our results below. December S&P 500 E-Mini futures (ESZ24) are up +0.06%, and December Nasdaq 100 E-Mini futures (NQZ24) are up +0.08% this morning as market participants geared up for the latest reading on U.S. job openings while also awaiting a deluge of corporate earnings reports from heavyweight names. In yesterday’s trading session, Wall Street’s major indexes ended in the green. 3M Company (MMM) climbed over +4% and was the top percentage gainer on the Dow after JPMorgan raised its price target on the stock to $165 from $160. Also, airline and transportation stocks rallied as oil prices plunged, with Carnival (CCL) rising more than +4% and American Airlines Group (AAL) advancing over +3%. In addition, ON Semiconductor (ON) gained more than +1% after reporting better-than-expected Q3 results. On the bearish side, Boeing (BA) fell over -2% and was the top percentage loser on the Dow after the planemaker launched a $19 billion share sale. Meanwhile, markets are bracing for the possibility of Donald Trump returning to the White House, with most major polls indicating he is in a close race with Vice President Kamala Harris. A win for Trump could be more advantageous for stocks and Bitcoin compared to his Democratic opponent, whereas a Harris presidency might provide slightly more relief in housing costs, according to a Bloomberg Markets Live Pulse survey. Third-quarter corporate earnings season is in full swing, with investors awaiting new reports today from prominent companies such as Alphabet (GOOGL), Visa (V), Advanced Micro Devices (AMD), McDonald’s (MCD), Pfizer (PFE), and PayPal (PYPL). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +4.3% increase in quarterly earnings for Q3 compared to the previous year, down from +7.9% growth projected in mid-July. “Near-term focus is shifting to megacap earnings that kick off today with Google. There is still an expectation that AI spending will be maintained and that could continue to be a significant driver of broader equity momentum,” said Charu Chanana, chief investment strategist at Saxo Markets. On the economic data front, all eyes are focused on the U.S. JOLTs Job Openings data, which is set to be released in a couple of hours. Economists, on average, forecast that the September JOLTs Job Openings will stand at 7.980M, compared to the August figure of 8.040M. Also, investors will focus on the U.S. Conference Board’s Consumer Confidence Index, which arrived at 98.7 in September. Economists foresee the October figure to be 99.5. The U.S. S&P/CS HPI Composite - 20 n.s.a. will come in today. Economists expect August’s figure to be +4.9% y/y, compared to the previous number of +5.9% y/y. U.S. Wholesale Inventories preliminary data will be reported today as well. Economists estimate this figure to arrive at +0.2% m/m in September, compared to +0.1% m/m in August. U.S. rate futures have priced in a 96.4% chance of a 25 basis point rate cut and a 3.6% chance of no rate change at the conclusion of the Fed’s November meeting. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.314%, up +0.75%. Let's take a look at the markets: The best way to describe the market is "stalled". It's just hanging out, waiting for a directional bias to kick in. Technicals today start with a slight sell bias. Trade docket today: SNAP, AMD, CMG, /NG, V, /MNQ,QQQ scalping, /ZC, /ZN, F, FSLR, GOOG, LRN, MCD?, PYPL?, 0DTE's Let's take a look at intra-day levels: /ES; Still consolidating. 5865 then 5880 resistance with 5838 and 5818 support. /NQ; Two key levels for me today. 20624 resistance and 20422 support. Between is the chop zone. Bitcoin: BTC is picking up steam! Getting very close to new highs! Can it continue to push today? I'm looking for a retace to enter a bearish setup today. Let's have great day!

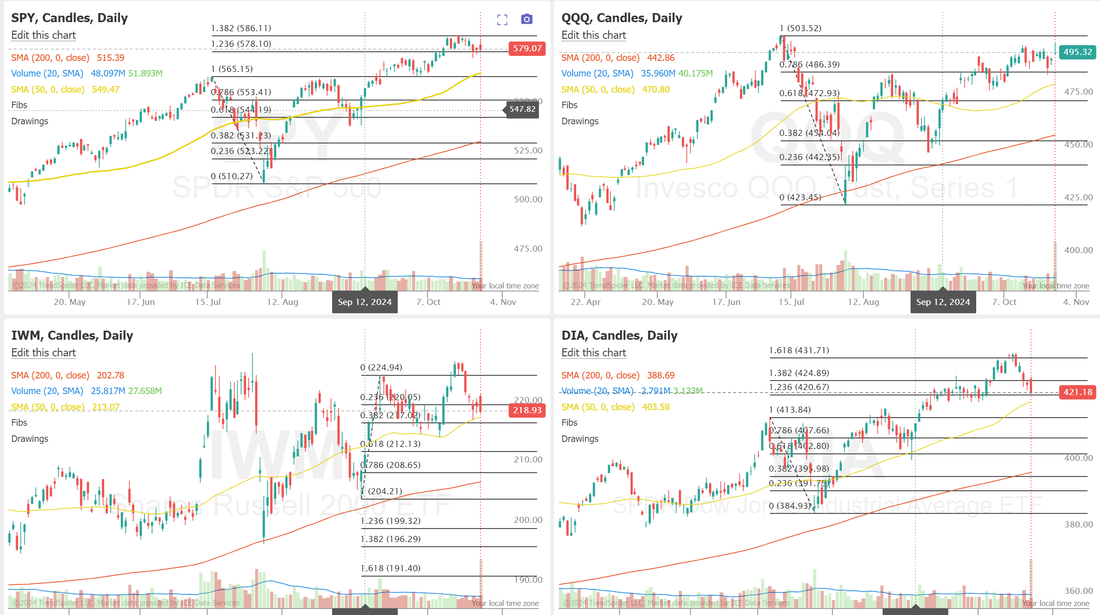

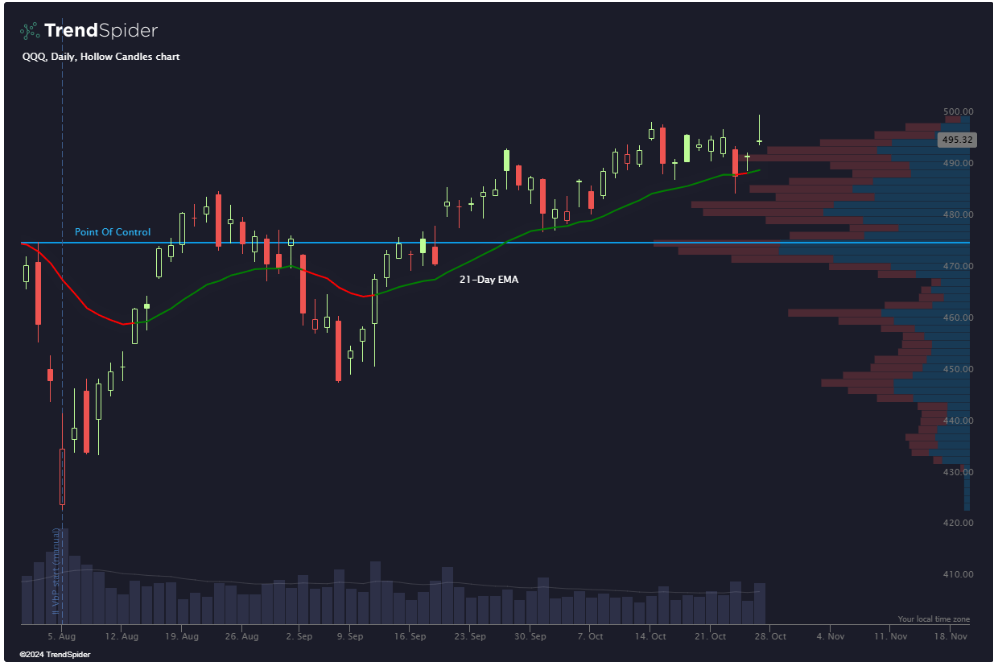

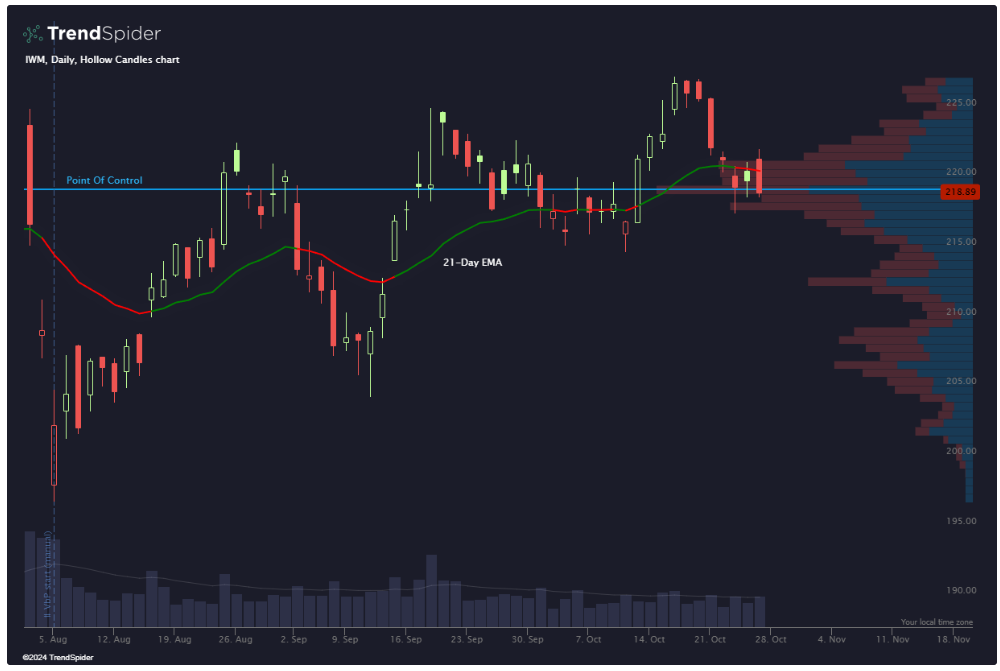

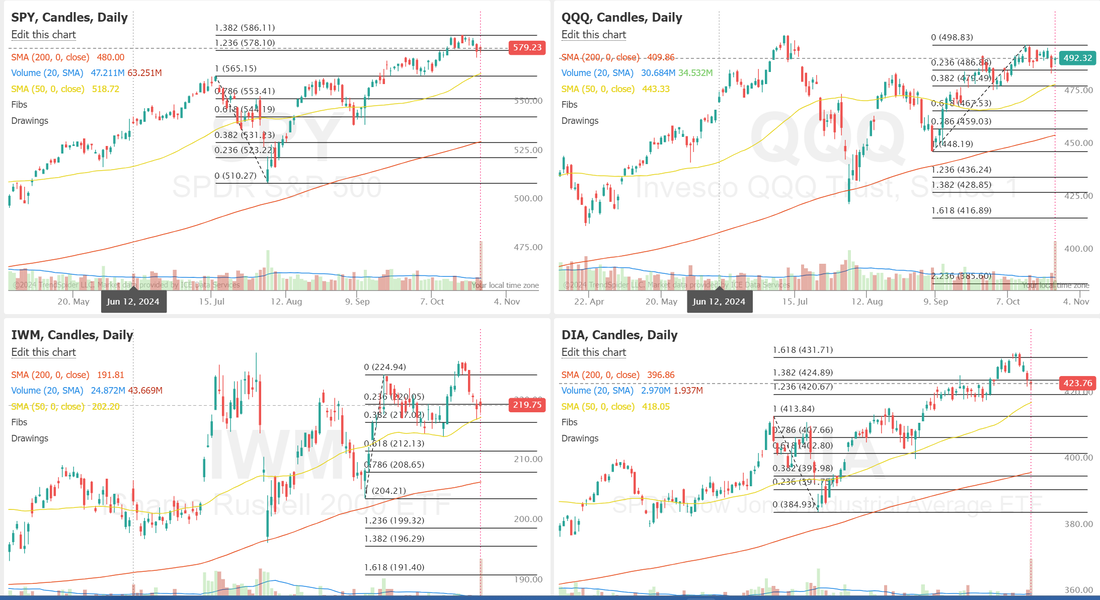

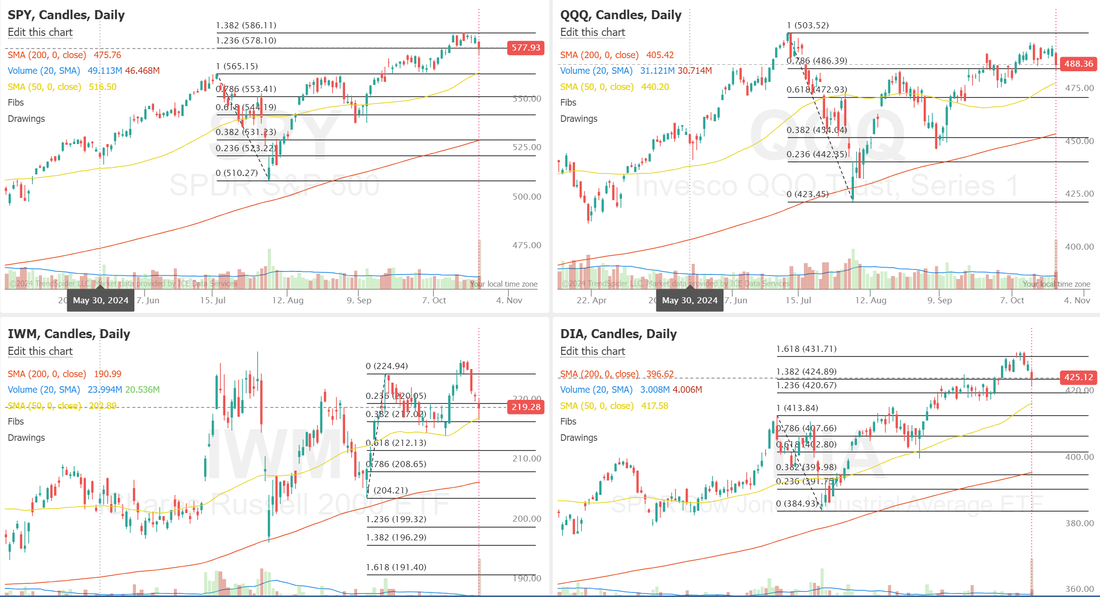

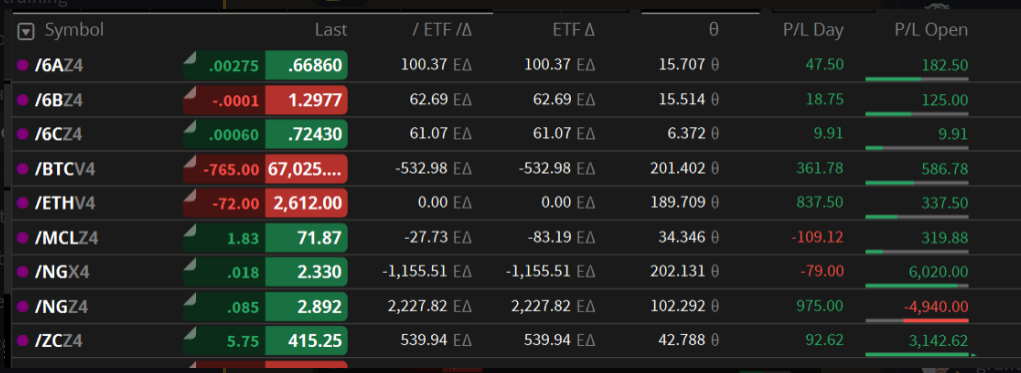

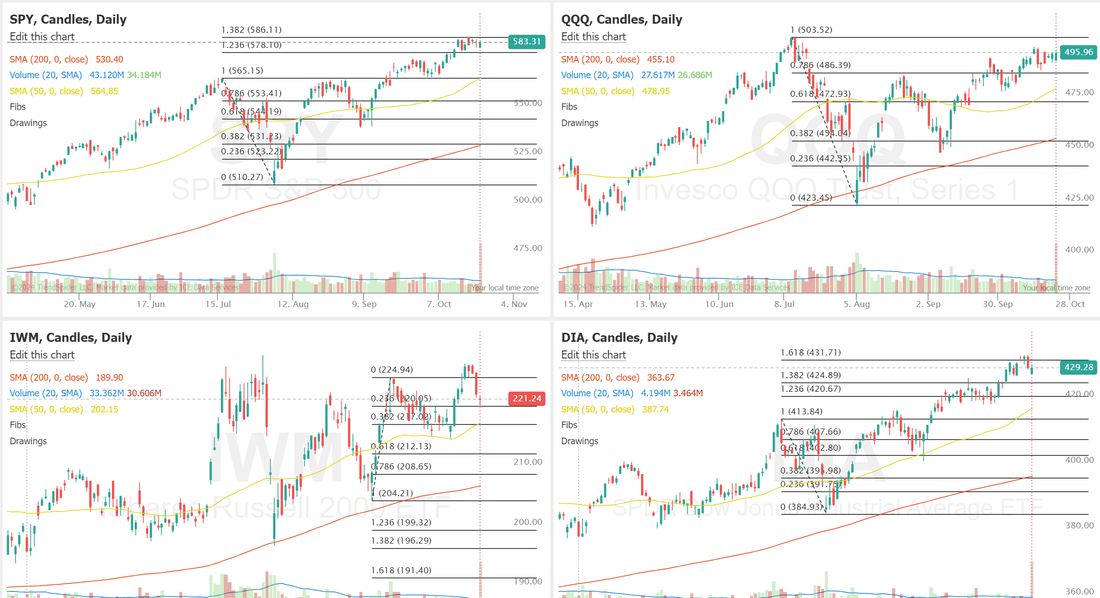

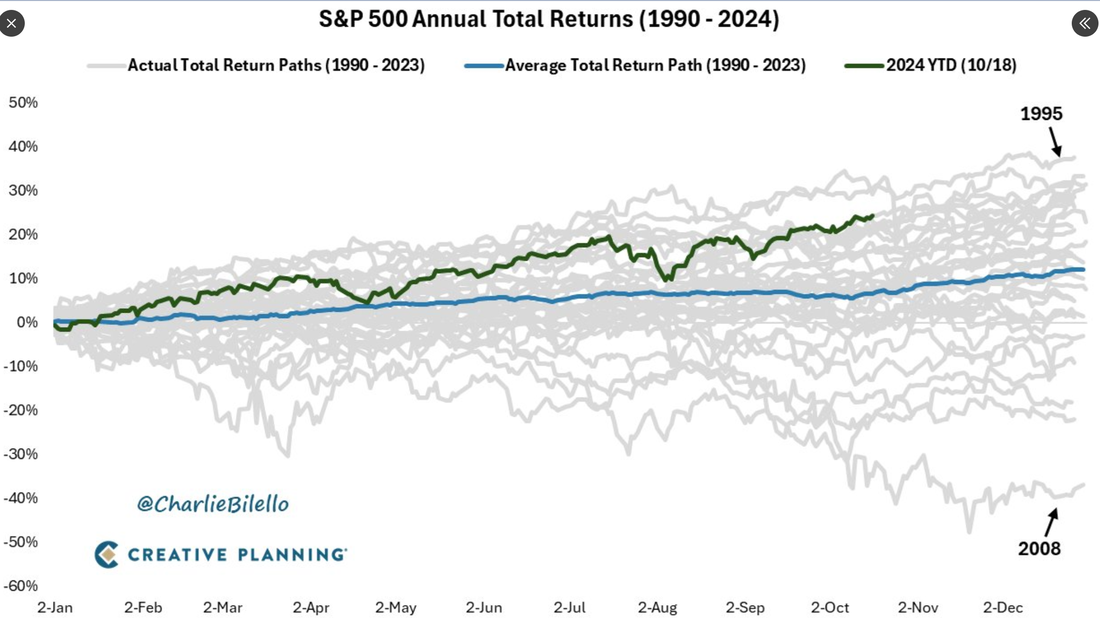

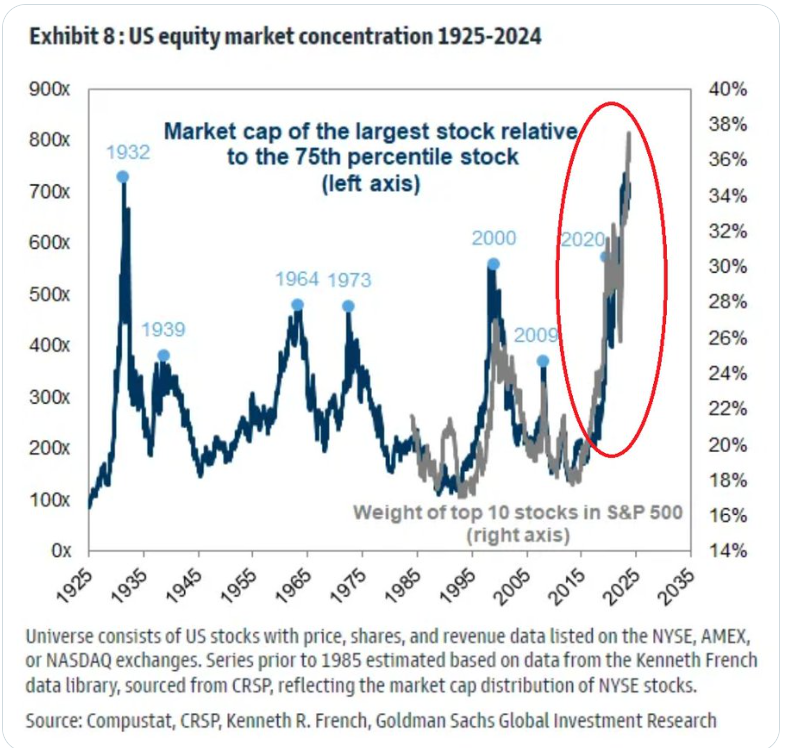

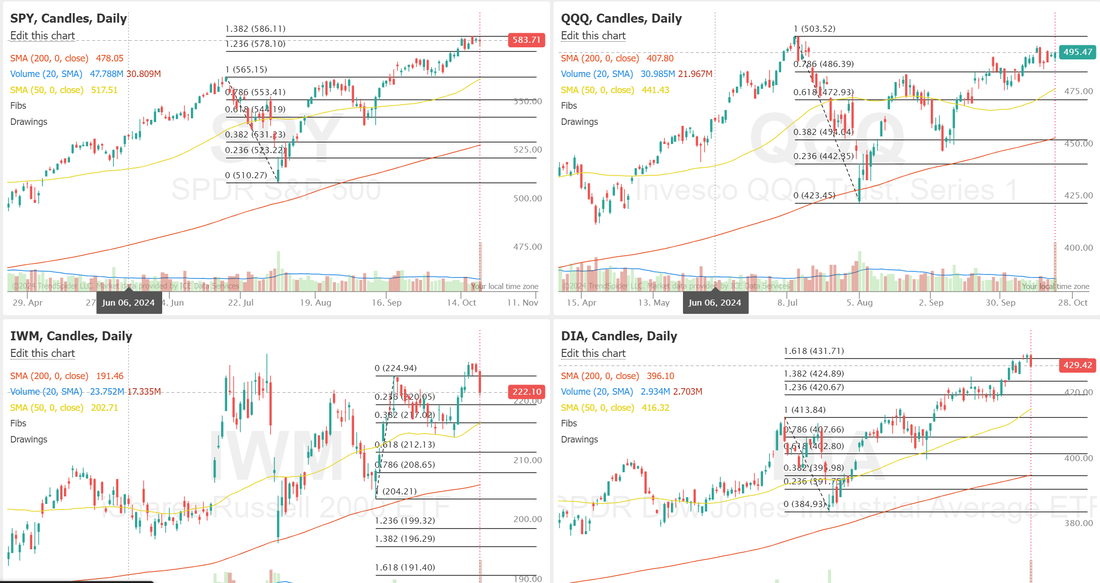

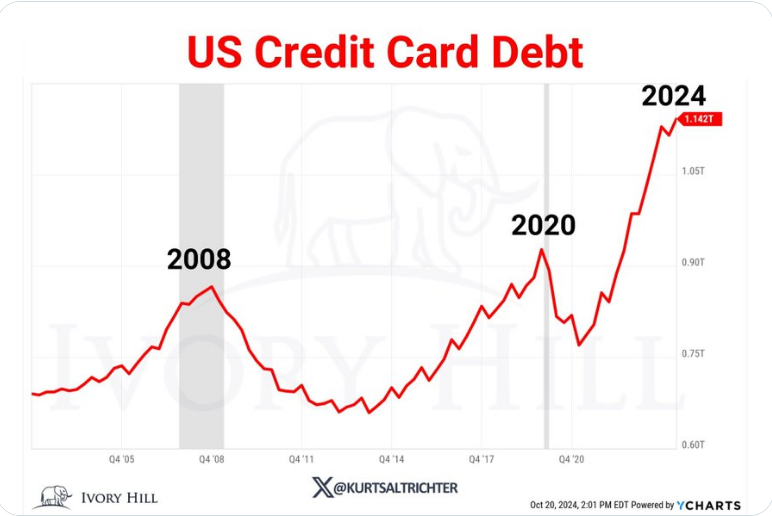

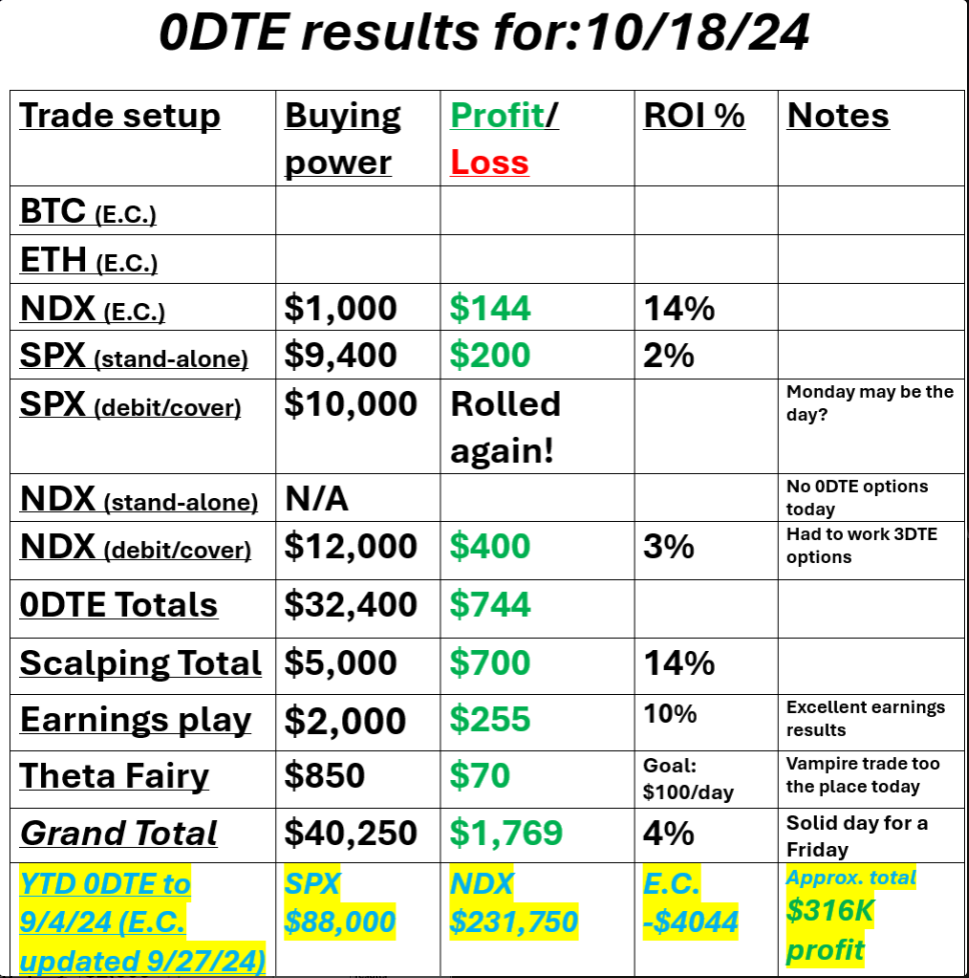

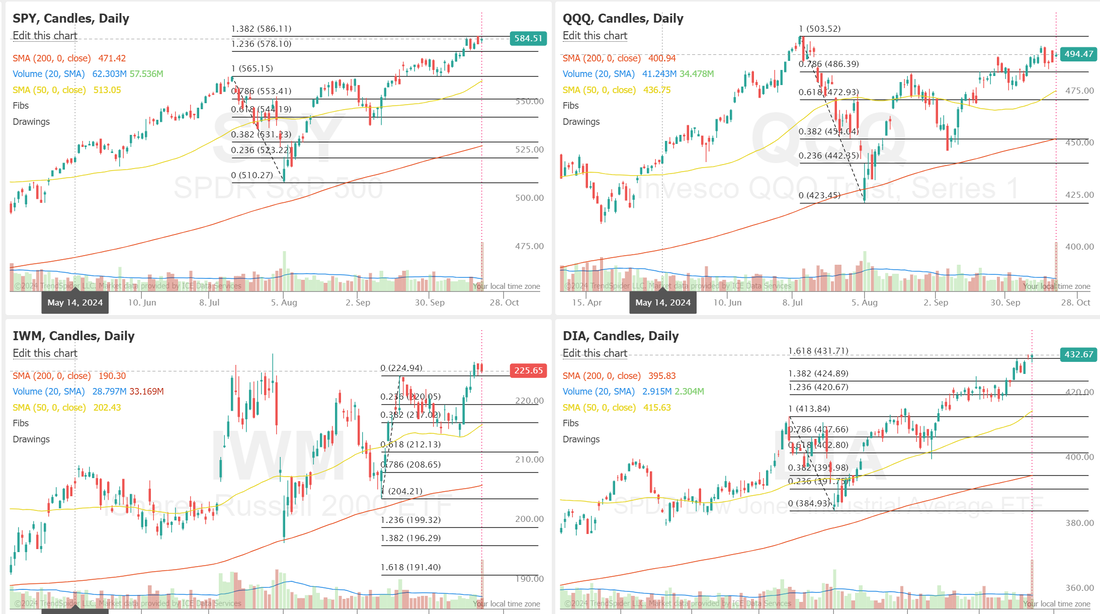

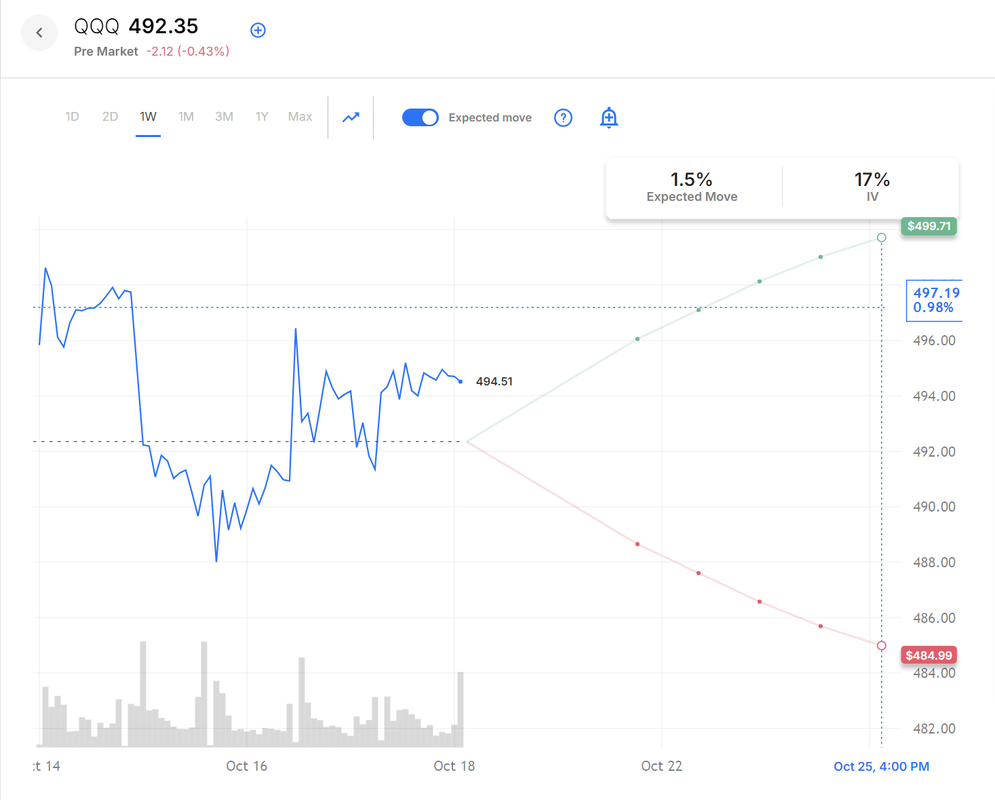

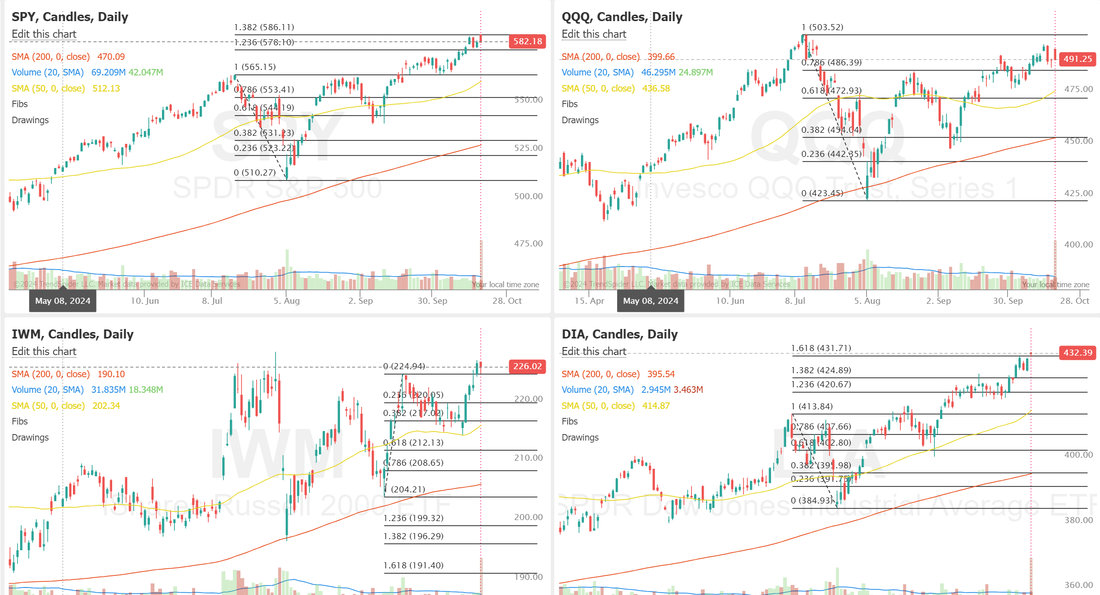

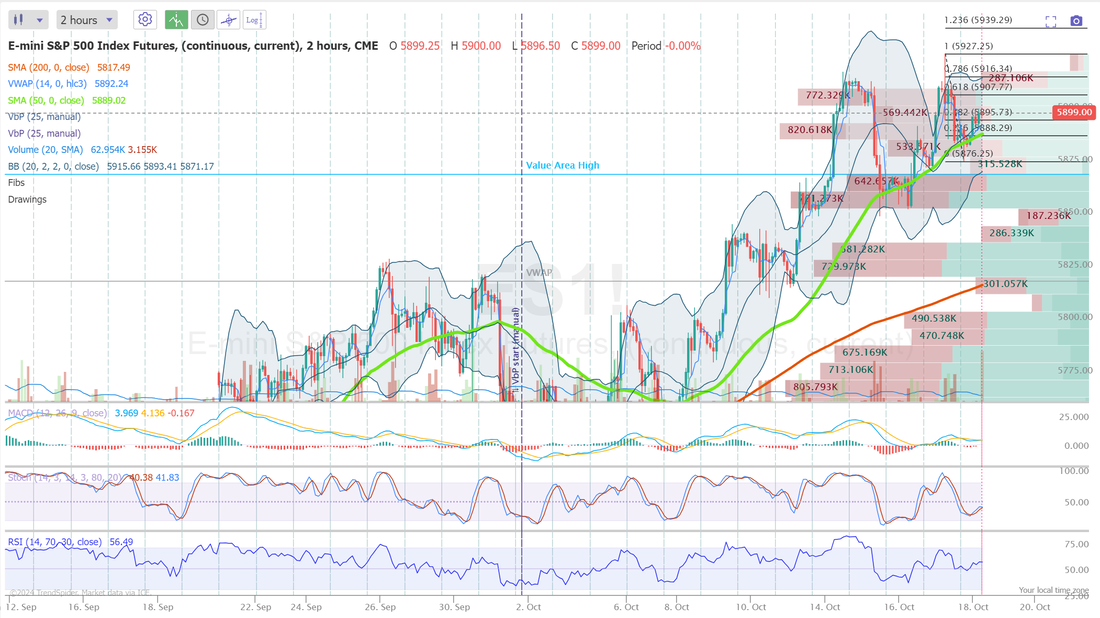

Welcome back traders. The last week of October and Snow is in the forecast for my town. Halloween parties means time to break out the Chewbaca outfit. It's a fun time of year. I hope you all get some time off to enjoy. We had a bang up finish to our week on Friday. We worked right up to the close and Scalping killed again. It all added up to a good day. See our results below. Let's take a look at the markets. Futures are pushing higher this morning and trying to keep the bullish bias in place. There's certainly been some weakness trying to creep in but all the major indices remain above their 50DMA. It was a challenging week for the SPY, breaking a six-week winning streak and failing to put in a new all-time high despite a solid attempt from the bulls on Friday. Key support came from the 21-day EMA, which provided a bounce that helped the index close only slightly lower at $580.21 (-0.94%). If this level is lost next week, all eyes will be on the Volume Point of Control from the September lows, at $570. Despite putting in a new weekly high and closing in the green at $495.32 (+0.17%), QQQ is still facing resistance just below its all-time high. Similar to the SPY, the 21-day EMA has provided solid support, but if that level is to fail, perhaps the Volume Point of Control could become a key target for the bears as we approach the election. IWM struggled the most this week, closing at $218.89 (-2.99%). The crucial 21-day EMA was lost on Wednesday, and attempts to regain it were thwarted by the bears. As they say, nothing good happens below the 21-day EMA, so bulls will be hoping that the Volume Point of Control holds despite Friday’s precarious close just below the level. Let's look at the expected moves this week: The ranges are not much different than what we've been getting as of late. That could change as we get closer to the election. December S&P 500 E-Mini futures (ESZ24) are up +0.37%, and December Nasdaq 100 E-Mini futures (NQZ24) are up +0.48% this morning as investors looked ahead to earnings reports from some of the biggest tech heavyweights as well as key economic data, including a payrolls report, the Fed’s favorite inflation gauge, and the first estimate of third-quarter GDP. Oil prices plunged on Monday after Iran said that its oil industry was functioning normally following Israel’s retaliatory strikes on military targets across the country over the weekend. That resulted in some easing of geopolitical tension as markets geared up for a week filled with event risks. In Friday’s trading session, Wall Street’s major averages closed mixed, with the blue-chip Dow falling to a 2-week low and the tech-heavy Nasdaq 100 rising to a 3-1/4 month high. Tapestry (TPR) surged over +13% and was the top percentage gainer on the S&P 500 after a federal judge blocked the company’s $8.5 billion acquisition of Capri Holdings. Also, Western Digital (WDC) gained more than +4% to lead chip stocks higher after reporting better-than-expected Q1 adjusted EPS. In addition, Deckers Outdoor (DECK) climbed over +10% after the company posted upbeat Q2 results and raised its full-year revenue growth forecast. On the bearish side, Mohawk Industries (MHK) plunged more than -13% and was the top percentage loser on the S&P 500 after providing below-consensus Q4 adjusted EPS guidance. Also, McDonald’s (MCD) fell about -3% and was the top percentage loser on the Dow after the CDC said that the E. coli outbreak linked to the fast-food chain’s burgers has now spread to 13 states and infected 75 people. Economic data released on Friday showed that the University of Michigan’s U.S. consumer sentiment index was revised upward to a 6-month high of 70.5 in October, stronger than expectations of 68.9. Also, U.S. September durable goods orders fell -0.8% m/m, a smaller drop than the -1.1% m/m expected, while core durable goods orders, which exclude transportation, rose +0.4% m/m, stronger than expectations of -0.1% m/m. “Certainly better news for Jerome Powell and Company,” said Jeff Roach at LPL Financial. “Consumers feel confident that inflation is easing. Investors are anticipating Friday’s employment release as the Fed attempts to stick the soft landing.” Meanwhile, U.S. rate futures have priced in a 96.8% chance of a 25 basis point rate cut and a 3.2% chance of no rate change at the Fed’s monetary policy committee meeting next week. Third-quarter earnings season continues in full force, and investors anticipate fresh reports from major companies this week, including Microsoft (MSFT), Alphabet (GOOGL), Meta Platforms (META), Amazon (AMZN), Apple (AAPL), Visa (V), AMD (AMD), McDonald’s (MCD), Pfizer (PFE), Ford Motor (F), Eli Lilly (LLY), Caterpillar (CAT), Starbucks (SBUX), Doordash (DASH), Mastercard (MA), Intel (INTC), Merck (MRK), Altria (MO), Uber Technologies (UBER), Exxon Mobil (XOM), and Chevron (CVX). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +4.3% increase in quarterly earnings for Q3 compared to the previous year, down from +7.9% growth projected in mid-July. On the economic data front, the September reading of the U.S. core personal consumption expenditures price index, the Fed’s preferred inflation measure, and the Nonfarm Payrolls report for October will be the main highlights. Also, market participants will be monitoring a spate of other economic data releases, including U.S. GDP (preliminary), the CB Consumer Confidence Index, JOLTS Job Openings, the S&P/CS HPI Composite - 20 n.s.a., Wholesale Inventories (preliminary), ADP Nonfarm Employment Change, Pending Home Sales, Crude Oil Inventories, the Employment Cost Index, Initial Jobless Claims, Personal Income, Personal Spending, Chicago PMI, Average Hourly Earnings, the Unemployment Rate, Construction Spending, the ISM Manufacturing PMI, and the S&P Global Manufacturing PMI. Federal Reserve officials are in a media blackout period before the November meeting, so they are prohibited from making public comments this week. The U.S. economic data slate is largely empty on Monday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.281%, up +1.09%. Trading docket for us is busy today: /MNQ, QQQ scalpiing. F, GOOG, /ZC, LRN, MCD, TSLA, FSLR, WYNN, UPST, CCL, PLTR, PYPL< SHOP, CRM?, SPY/QQQ 4DTE, 0DTE's. Let's take a look at some intra-day 0DTE levels of focus /ES: We start the day sitting smack dap on the PoC for a 2hr. chart. Even with futures up this morning it's hard to tell what direction we move today. That PoC is a magnet. 5886 and 5900 are the first two key resistance levels. 5859 and 5835 are key support. Below 5835 there is some substantial downside potential. /NQ; Two keys for me today. 20708 is resistance. 20531 support. Anything between is just chop. BTC: Bitcoin is back up to the high point it hit last week before the big reversal. 70,887 is current resistance wit 67,092 support. My lean or bias today is more neutral. Bulls are trying but reistance levels are strong and have been tested several times. We continue to look for a break with a directional move. Let's have a great day! Our Nat gas trade looks to yield some good results today with the calls expiring.

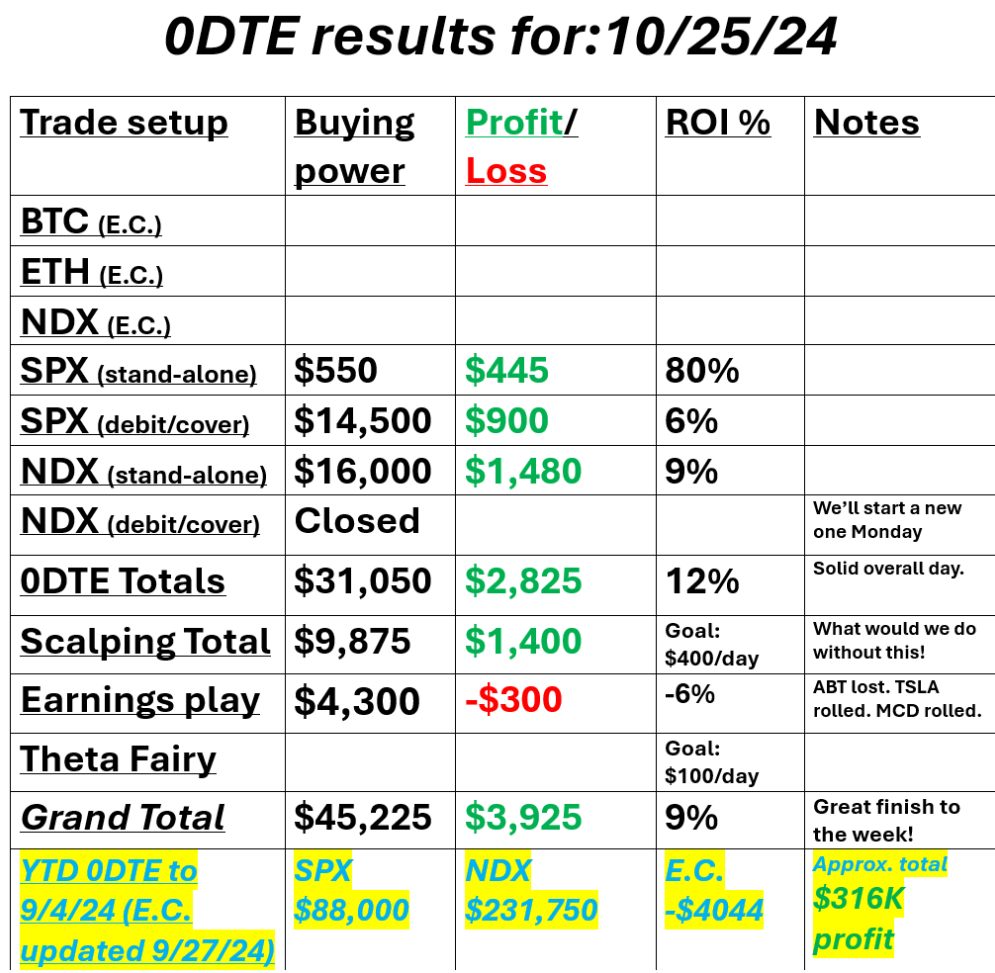

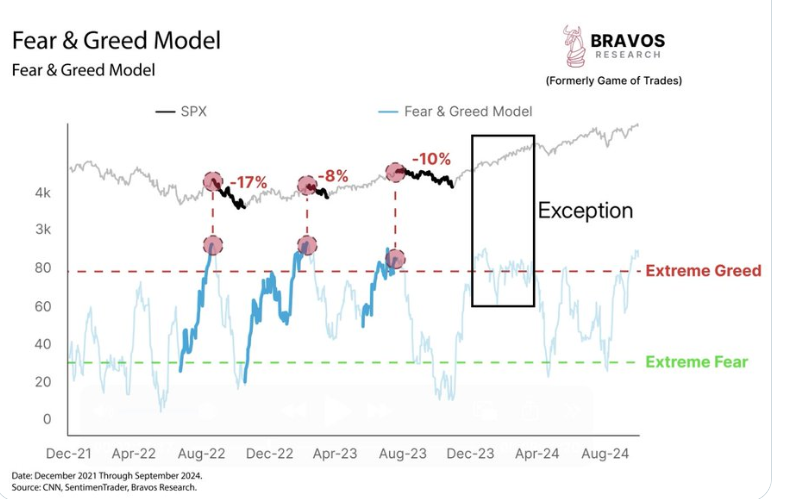

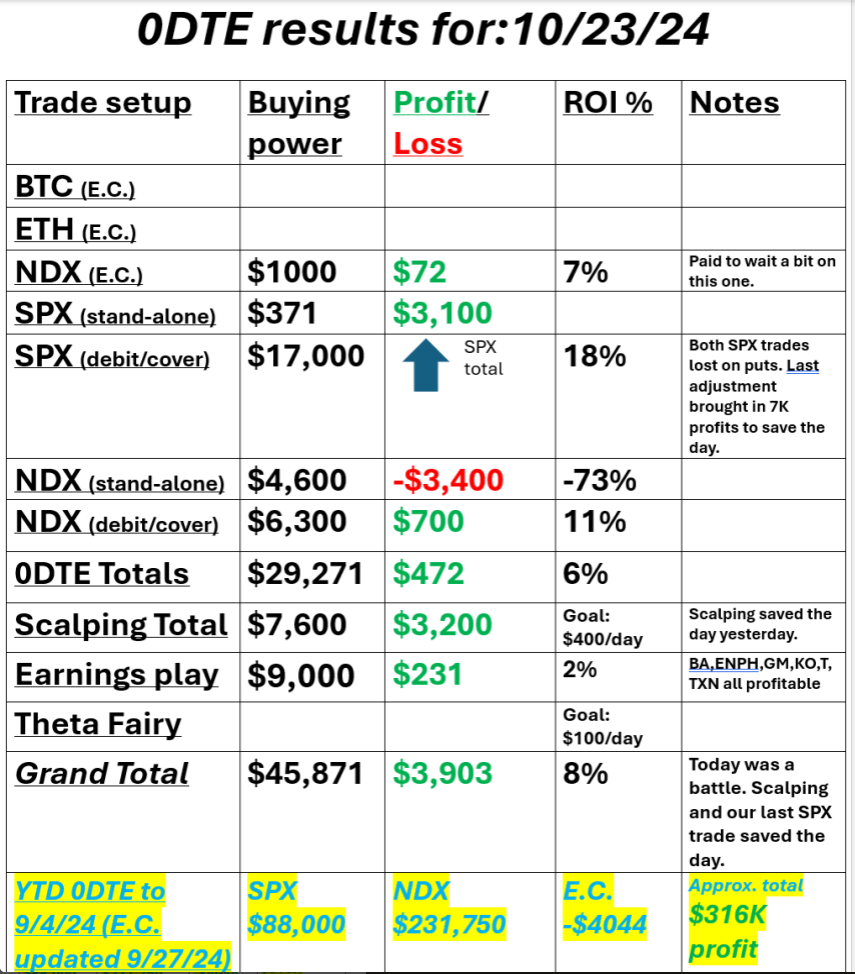

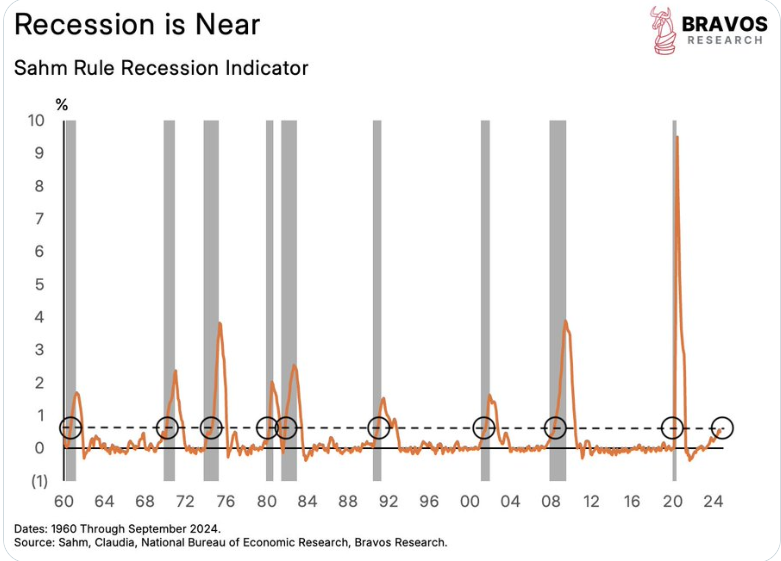

Welcome back to Friday traders! This week went by fast for me. I was out of pocket for half the day yesterday with eye surgery and monitoring our positions with one eye on a phone with a cracked screen! It went well and we had an excellent day. Check out our results below: It was a perfect day for us. Much smoother than Weds. We had another late day enhancement to the SPX stand alone trade that really boosted the ROI there and scalping just continues to pull more than its fair share of weight. Let's take a look at the markets: With yesterdays push and the futures being up this morning we are back to a bullish bias. While the IWM and DIAhave a bit more retrace going on, the SPY and QQQ continue to just channel. No real discernable trend as of yet. December S&P 500 E-Mini futures (ESZ24) are up +0.21%, and December Nasdaq 100 E-Mini futures (NQZ24) are up +0.22% this morning as Treasury yields fell for a second day, with investors looking ahead to a new batch of U.S. economic data and comments from a Federal Reserve official. In yesterday’s trading session, Wall Street’s major indexes ended mixed. Tesla (TSLA) soared nearly +22% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the electric vehicle maker reported stronger-than-expected Q3 adjusted EPS and said it expects “slight growth” in vehicle deliveries this year and a big jump in 2025. Also, United Parcel Service (UPS) gained more than +5% after the parcel delivery giant and economic bellwether posted upbeat Q3 results. In addition, Molina Healthcare (MOH) surged over +17% after reporting better-than-expected Q3 results. On the bearish side, Newmont (NEM) tumbled more than -14% and was the top percentage loser on the S&P 500 after the company reported downbeat Q3 results. Also, International Business Machines (IBM) slid over -6% and was the top percentage loser on the Dow after reporting weaker-than-expected Q3 revenue. Economic data released on Thursday showed that the U.S. S&P Global manufacturing PMI edged up to 47.8 in October, stronger than expectations of 47.5. Also, the U.S. October S&P Global services PMI unexpectedly rose to 55.3, better than expectations of 55.0. In addition, U.S. new home sales rose +4.1% m/m to a 16-month high of 738K in September, stronger than expectations of 719K. Finally, the number of Americans filing for initial jobless claims in the past week unexpectedly fell by -15K to 227K, compared with the 243K expected. “Goldilocks data that’s in-line with expectations (so not too good or too bad) is the best outcome for a continued rebound in stocks and bonds,” said Tom Essaye at The Sevens Report. Meanwhile, U.S. rate futures have priced in a 95.0% chance of a 25 basis point rate cut and a 5.0% chance of no rate change at November’s monetary policy meeting. On the earnings front, notable companies like Colgate-Palmolive (CL) and HCA Healthcare (HCA) are set to report their quarterly figures today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +4.3% increase in quarterly earnings for Q3 compared to the previous year, down from +7.9% growth projected in mid-July. On the economic data front, all eyes are focused on U.S. Durable Goods Orders data, which is set to be released in a couple of hours. Economists, on average, forecast that September durable goods orders will come in at -1.1% m/m, compared to 0.0% m/m in August. Also, investors will focus on U.S. Core Durable Goods Orders data, which stood at +0.5% m/m in August. Economists foresee the September figure to be -0.1% m/m. The University of Michigan’s U.S. Consumer Sentiment Index will be reported today as well. Economists estimate this figure to arrive at 68.9 in October, compared to 70.1 in September. In addition, market participants will be anticipating a speech from Boston Fed President Susan Collins. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.195%, down -0.14%. My lean or bias today is bullish. We have durable goods and consumer sentment coming out this morning that could change that but I believe that's a low likelyhood. A couple things I'm thinking about today: Number of times when both gold and the S&P 500 are up 25% in the same year? Zero. SPY up 24% or so this year with gold up 33%. Hum. Something seems fishy here to me. Fear and Greed model has just flashed a WARNING sign It has entered the "Extreme Greed" zone This typically occurs near local stock market tops Fasten your seatbelts Trade docket today: ABT, /MNQ scalping, DXCM, FDX, LRN, MCD, SPY/QQQ, UAL, TSLA, /SI, 0DTE's. Let's take a look at the intra-day levels for our 0DTE's today: /ES: Today should be an interesting one. The price action this morning looks bullish but we are below both the 50 period M.A. and the Poc on the 2 hr. chart. That could pose some overhang for the bulls today. 5970 is first resistance. It's the 50 period M.A. 5980 is next with 5990 being key. It's PoC. On the downside, 5860, 5852, 5843 are the support levels with 5843 being key. It's the 200 period M.A. /NQ is not as nuanced. 20536 is resistance. 20344 is support with 20455 is the PoC and most likely magnet for today. BTC has stabilized a bit. 68601 is resistance with 66471 support. Let's have a storng finish to the week! Welcome back traders! Well...I'm super conflicted about our trading day yesterday. We squeaked out a small green result on our 0DTE's. Scalping and our earnings trades absolutely killed it and last but certainly not least, my net liq was us $2,300 dollars. That all meets our critera for an "excellent" day but oh what could have been! We've been builidng our SPX debit trade for several weeks now looking for a 20K payoff. I messed that up yesterday and should have just sat on my hands all day. I'm super grateful and relieved that we got the result we did. At one point my net liq was down $5,500 so being able to swing to green was a relief. Our last SPX adjustment brought in $7,100 profit and made all the difference. Check out our results below. I talked about how important our scalping was Tues.. Little did I know we'd need it yesterday! A large part of our trades are credit trades. What hurts a credit trade? Big moves. What's the best enviroment for scalping? Big move days! It's critical if you're serious about trading to have as many tools as possible to give you an edge and be able to hedge your positions. Scalping has been invaluable to us. Let's take a look at the markets: We are back to a neutral rating this morning with futures rebounding from yesterdays sell day. Was the bull market damaged yesterday? Well, the slide didn't help but all the major indices we track and trade are still well above their respective 50DMA. Unless those break you're uptrend is still in play. My lean or bias today is bullish. Futures are rebounding strong and Tesla earnings are helping lift other underlyings. December S&P 500 E-Mini futures (ESZ24) are up +0.46%, and December Nasdaq 100 E-Mini futures (NQZ24) are up +0.72% this morning as risk sentiment got a boost after Tesla posted its biggest quarterly profit in over a year, while investors geared up for U.S. business activity data and the next round of corporate earnings reports. Tesla (TSLA) surged over +10% in pre-market trading after the electric vehicle maker reported stronger-than-expected Q3 adjusted EPS and said it expects “slight growth” in vehicle deliveries this year and a big jump in 2025. In yesterday’s trading session, Wall Street’s major indices closed in the red. Enphase Energy (ENPH) plunged about -15% and was the top percentage loser on the S&P 500 after the solar equipment maker posted downbeat Q3 results and provided below-consensus Q4 revenue guidance. Also, Arm (ARM) slumped more than -6% and was the top percentage loser on the Nasdaq 100 following a Bloomberg report that the company canceled a license that allowed Qualcomm to use its intellectual property to design chips. In addition, McDonald’s (MCD) slid over -5% and was the top percentage loser on the Dow after the U.S. Centers for Disease Control and Prevention said that a severe E. coli outbreak linked to the company’s Quarter Pounders sickened dozens of people in the U.S. On the bullish side, Northern Trust (NTRS) climbed more than +7% and was the top percentage gainer on the S&P 500 after posting upbeat Q3 results. Also, Texas Instruments (TXN) advanced over +4% and was the top percentage gainer on the Nasdaq 100 after the semiconductor company reported better-than-expected Q3 results. “This is about price exhaustion, this is about election exhaustion, it’s about campaign exhaustion, it’s about Fed exhaustion, it’s about policy exhaustion, it’s about geopolitical exhaustion,” said Kenny Polcari at SlateStone Wealth. “It’s about how stocks are stretched and it’s about the need for stocks to retreat, test lower, shake the branches, see who falls out, and then move on.” Economic data released on Wednesday showed that U.S. existing home sales unexpectedly fell -1.0% m/m to an almost 14-year low of 3.84M in September, weaker than expectations of 3.88M. Meanwhile, the Federal Reserve said Wednesday in its Beige Book survey of regional business contacts that economic activity was little changed in most parts of the U.S. since early September. Over half of the Fed’s 12 districts reported “slight or modest” growth in employment, while most districts said that prices increased at a “slight or modest pace.” Multiple districts also reported a slowdown in wage growth. “Reports on consumer spending were mixed, with some districts noting shifts in the composition of purchases, mostly toward less expensive alternatives,” according to the Beige Book. U.S. rate futures have priced in a 92.9% chance of a 25 basis point rate cut and a 7.1% chance of no rate change at the November FOMC meeting. On the earnings front, notable companies like United Parcel Service (UPS), Honeywell International (HON), Union Pacific (UNP), Keurig Dr Pepper (KDP), L3Harris Technologies (LHX), Tractor Supply (TSCO), Southwest Airlines (LUV), and American Airlines (AAL) are scheduled to release their quarterly results today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +4.3% increase in quarterly earnings for Q3 compared to the previous year, down from +7.9% growth projected in mid-July. On the economic data front, all eyes are focused on the U.S. S&P Global Manufacturing PMI preliminary reading, which is set to be released in a couple of hours. Economists, on average, forecast that the October Manufacturing PMI will come in at 47.5, compared to last month’s value of 47.3. Also, investors will focus on the U.S. S&P Global Services PMI, which arrived at 55.2 in September. Economists foresee the preliminary October figure to be 55.0. U.S. New Home Sales data will come in today. Economists foresee this figure to stand at 719K in September, compared to 716K in August. U.S. Initial Jobless Claims data will be reported today as well. Economists estimate this figure to be 243K, compared to last week’s number of 241K. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.197%, down -1.11%. Trade docket for today: /MNQ,/NQ scalping. DXCM, MCD, LRN, TSLA, UAL, /BTC, /SI, /ZN, 0DTE's Some things I'm thinking about today: 10-year Treasury yield has just spiked to 4.25% The last 3 times yields spiked, markets corrected: - Sept 2022 - Oct 2023 - April 2024. Those were NOT good times! The Sahm Rule has been triggered It's predicted the last 9 recessions With 0 false signals since 1960. If you aren't familar with this rule you can brush up here: Let's look at our intra-day 0DTE levels: /ES; As you can see, the futures have already repaired most of the damage from yesterdays sell off. Two key levels for me today. 5884 is key resistance its close to both PoC and the 50 period M.A. on the 2hr. chart. 5836 is key support and corresponds to the 200 period M.A. /NQ: Nasdaq futures, with the help of Tesla are popping this morning and have negated any downside momentum the bears wished to establish yesterday. I'm looking at a tight support/resistance range today. 20441 is key resistance for me. It's closely coorelated to both the PoC and 50 period M.A. A break above this zone is back to full bull mode. 20329 is key support. It corresponds to the 200 period M.A. /BTC: Bitcoin got hammered yesteday. We pulled our trade at a profit but just barely. I'm looking for a bullish setup today with 65,744 as support. I'll be out of the office for most of the day today with eye surgery and then next Thurs. for the other eye. Trade to trade well folks. I'll see you in our zoom feed tomorrow. Welcome back traders. It's the mid-week point. We had an "excellent" day yesterday, meaning our net liq was up and our day trades made money. This quote from the wise James Clear really rang home for me yesterday. We aren't neccessarily amazing traders but...we have a system. We have a process and that process is working. Let's take a look at our day yesterday. It was another "excellent" day. My net liq was only up about 4K because our SPX debit still hasn't hit but man, everything else was super strong. I want to talk about a couple of our programs that don't get highlighted much here on the blog. Our day trades get all the attention but we've got plenty more out there working. Our scalping effort is one. We set a big goal this year to bring in $100,000 in profits and I'm proud to say we are well ahead of our goal! We continuously crush our $400 dollar a day target. Who doesn't need an extra $100,000 a year? If you are already trading 0DTE's then you are cutting your potential way down if you're not scalping at the same time. It our easiest, most straight forward program we offer. Check it out: The other is our model portfolio. Not everyone has the time or inclination to day-trade. No worries. We've got plenty of trades that span weeks or months that require little supervision or monitoring. This month we had over 25 of these. With $31,000 of capital we generated over $9,000 in profit! You don't need to day trade to create good potential. An additional benefit is that a lot of these are non-equity correlated and offer nice diversification. If you're interested in seeing how we generated these returns you're welcome to join us for free for a week to check us out. As I said, we had another "excellent" day. My net liq was up 4K and our day trades just killed it. Let's take a look at the market. We start the day with a slight sell signal. Seven trading days...seven! That's how long we've been hanging out near the ATH's. I've been saying and seeing that we've been "toppy" for a while now. Can the bears really gain any momentum? We are only going to stay in this tight zone for so long before some movement shows up. Our biggest position, profit potential wise is our SPX call debit trade that's covered with a credit call spread. It's got a whopping $23,000 of potential profit sitting in it today if we can slide down below 5840 on the SPX. If we don't, I've got a simple little tweak today that will at least guarantee us $5,000 in profit. Yes, that's right. We WILL be banking some profit today on it. No matter what the market does. Want to see how we do it? Come join us in our live trading room. December Nasdaq 100 E-Mini futures (NQZ24) are trending down -0.23% this morning as Treasury yields continued to rise on the prospect of less aggressive Federal Reserve interest rate cuts, while investors awaited a slew of corporate earnings reports, with a particular focus on results from “Magnificent Seven” member Tesla. In yesterday’s trading session, Wall Street’s main stock indexes ended little changed. Philip Morris International (PM) surged over +10% and was the top percentage gainer on the S&P 500 after the company posted upbeat Q3 results and lifted its full-year EPS forecast. Also, General Motors (GM) climbed more than +9% after the legacy carmaker reported stronger-than-expected Q3 results and raised the lower end of its full-year adjusted EPS guidance. In addition, Zions Bancorporation (ZION) advanced over +6% after reporting better-than-expected Q3 adjusted net interest income. On the bearish side, Genuine Parts Co. (GPC) tumbled about -21% and was the top percentage loser on the S&P 500 after cutting its full-year adjusted EPS guidance. Also, Verizon Communications (VZ) slid over -5% and was the top percentage loser on the Dow after the telecom giant reported weaker-than-expected Q3 revenue. Economic data released on Tuesday showed that the U.S. Richmond Fed manufacturing survey rose to a 4-month high of -14 in October, stronger than expectations of -19. Meanwhile, the International Monetary Fund noted that the U.S. election is creating “high uncertainty” for markets and policymakers due to the starkly different trade priorities of the candidates. Investors continue to worry that, no matter who wins the presidential election, there will probably be a rise in both the government’s fiscal deficit and the issuance of bonds, some analysts say. Third-quarter corporate earnings season rolls on, with investors awaiting new reports from prominent companies today, including Tesla (TSLA), Coca-Cola (KO), T-Mobile US (TMUS), Thermo Fisher Scientific (TMO), International Business Machines (IBM), ServiceNow (NOW), AT&T (T), and Boeing (BA). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +4.3% increase in quarterly earnings for Q3 compared to the previous year, down from +7.9% growth projected in mid-July. On the economic data front, investors will focus on U.S. Existing Home Sales data, which is set to be released in a couple of hours. Economists, on average, forecast that September existing home sales will stand at 3.88M, compared to 3.86M in August. U.S. Crude Oil Inventories data will also be reported today. Economists estimate this figure to be 0.800M, compared to last week’s value of -2.191M. In addition, market participants will be looking toward speeches from Fed Governor Michelle Bowman and Richmond Fed President Thomas Barkin. Later today, the Federal Reserve will release its Beige Book survey of regional business contacts, which provides an update on economic conditions in each of the 12 Federal Reserve districts. The Beige Book is published two weeks before each meeting of the policy-setting Federal Open Market Committee. U.S. rate futures have priced in an 88.9% chance of a 25 basis point rate cut and an 11.1% chance of no rate change at the next central bank meeting in November. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.239%, up +0.74%. Just some things to note: 1. Bonds are falling like the Fed is raising rates again 2. Gold is rising like the Fed is aggressively cutting rates 3. Oil prices are falling like we are entering a recession 4. Stocks are rising like the bull market just started 5. Home prices are rising like inflation is rebounding 6. Mortgage rates are rising like the economy is strong If you can make sense of all that you're a better man than I Gunga Din. Returns in the market the last couple of years have been well above avg. Reversion to the mean is a real thing. $2.3 trillion of US excess savings have been spent over the last 3 years. As a result, cumulative excess savings are now NEGATIVE $216 billion, according to the Fed data. Meanwhile, US credit card debt is a record $1.1 trillion. Folks, something has to give here. Top 10 largest stocks of the S&P 500 account now for 36% of the index market value, near the most on record. At the same time, the biggest stock (Apple) is 750 TIMES LARGER than the 125th one. Truly unprecedented. My bias or lean today is slightly bearish. No big news catalysts planned. Earnings season marches on. Trade docket for today: TSLA, IBM, UPN, UPS, DXCM, ENPH, BA, GM, KO, LRN, STX, T, TXN, 0DTE's. Let's take a look at our intra-day levels for 0DTE's: /ES; 5890 is the first key resistance. It's PoC on the 2hr. chart 5911 is the big one. The markets had a 100% failure rate, so far, in trying to hold above this level. 5864 is the first support line then 5854. If the bears can push below that we may have some downside potential. /NQ: The Nasdaq continues to lag the SP500 in terms of strenght to the upside. 20543, 20586, 20658 are the closest resistance levels. 20448 and 20361 are support. Below 20361 we could see some substantive downside. BTC: We've got a couple large crypto trades on right now with BTC and ETH. This slight retrace has been very helpful to our positions. 69,172 is resistance and 65173 is support. Let's keep this winning streak going folks. Let's make some money today! See you in the trading room shortly.

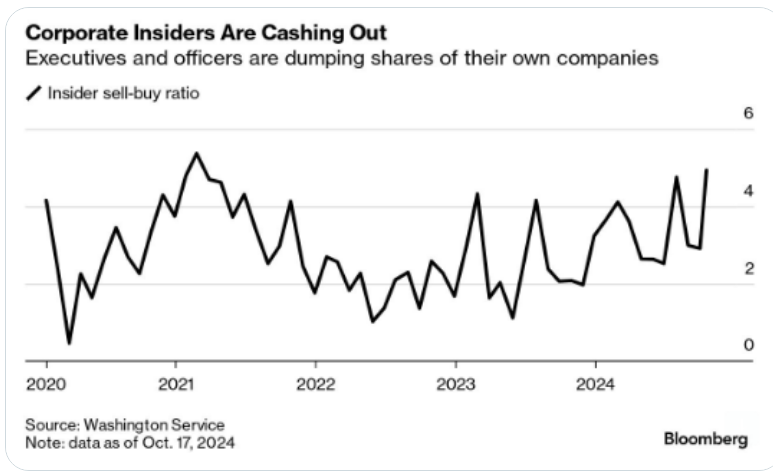

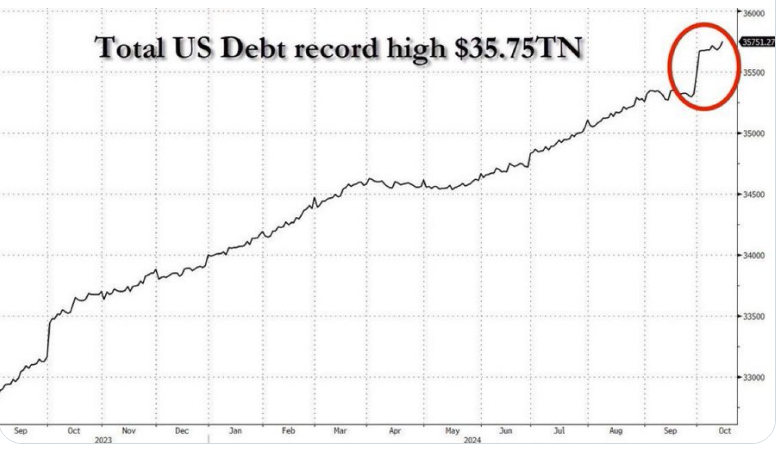

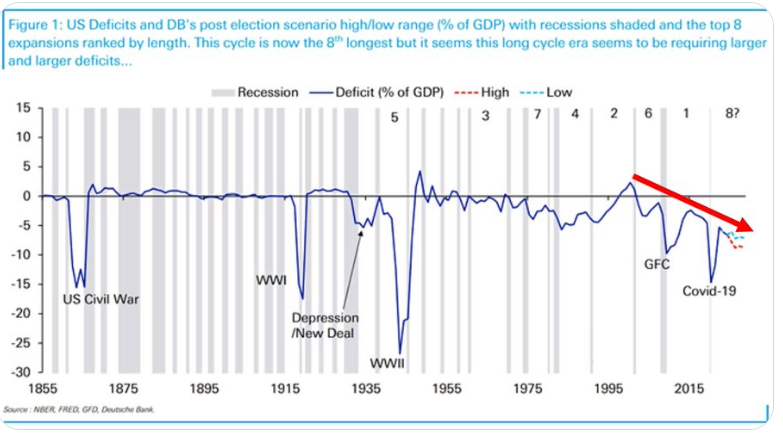

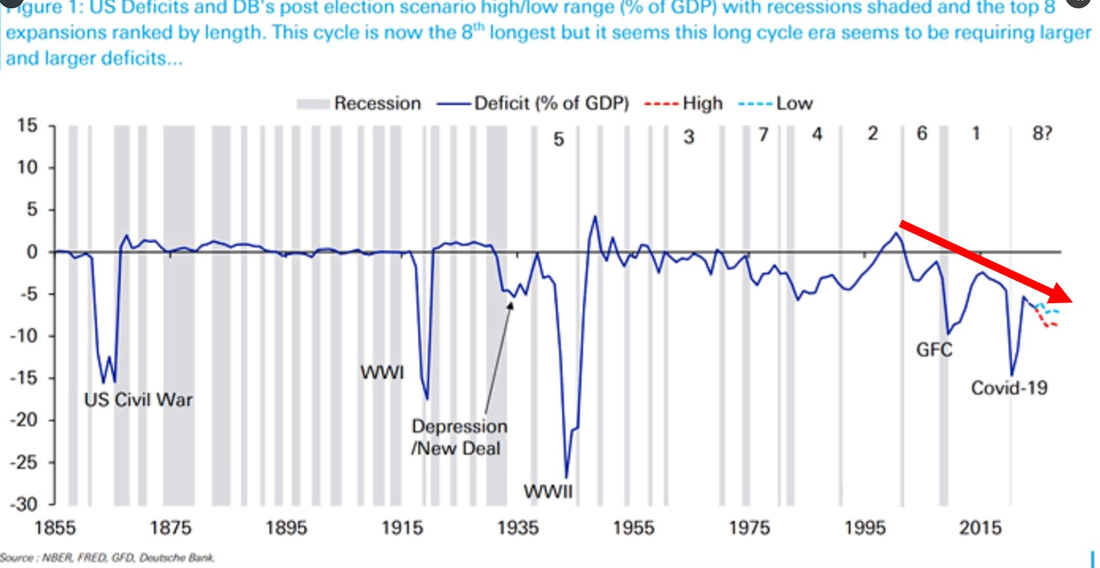

Welcome back traders! Today is Tuesday. We had a solid day yesterday. All our trades worked with the exception of the SPX debit. We rolled the cover on it again. This morning looks good with futures down a bit. Maybe today is our payoff day? The payoff continues to grow. This is what it looks like going into todays trading session. It could be almost a $15,000 dollar payday. Here's our results from yesterday. It was another "excellent" day. Our net liq was up and we made money on our day trades. Let's take a look at the markets: We've got an ever so slight sell signal forming this morning. We are due for a pullback and today may be that day. This is now six days in a row that the major indices can't break higher. A rollover looks more and more likely. My bias for the day: Bearish. It's time. We've been running out of gas for six days now. Buyers are getting tired. Without a major catalyst today I think we drift lower. Our SPX debit/cover trade would like that (and so would our bank accounts). December S&P 500 E-Mini futures (ESZ24) are down -0.46%, and December Nasdaq 100 E-Mini futures (NQZ24) are down -0.62% this morning as Treasury yields extended their rise amid speculation on the trajectory of U.S. interest rates, while investors geared up for the next round of corporate earnings. In yesterday’s trading session, Wall Street’s major indexes closed mixed. Cigna Group (CI) slumped over -4% after Bloomberg reported that the company was reviving efforts to merge with its smaller rival Humana. Also, homebuilder stocks lost ground after the benchmark 10-year Treasury yield rose to a 2-1/2 month high, with Builders FirstSource (BLDR) sliding more than -5% to lead losers in the S&P 500 and DR Horton (DHI) falling over -4%. In addition, United Parcel Service (UPS) dropped more than -3% after Barclays downgraded the stock to Underweight from Equal Weight with a price target of $120. On the bullish side, Kenvue (KVUE) advanced more than +5% and was the top percentage gainer on the S&P 500 after the Wall Street Journal reported that activist investor Starboard Value had taken a sizeable stake in the company. Also, Boeing (BA) rose over +3% and was the top percentage gainer on the Dow after the company and the leaders of its striking machinists union reached a new tentative agreement that could end a strike lasting over a month. Economic data released on Monday showed that the Conference Board’s leading economic index for the U.S. fell -0.5% m/m in September, weaker than expectations of -0.3% m/m. Dallas Fed President Lorie Logan reiterated her stance on Monday that the U.S. central bank should lower interest rates at a careful pace given the uncertain economic environment. “If the economy evolves as I currently expect, a strategy of gradually lowering the policy rate toward a more normal or neutral level can help manage the risks and achieve our goals,” Logan said. Also, Minneapolis Fed President Neel Kashkari reiterated that he supports reducing interest rates at a gradual pace in the coming quarters, though a sharp weakening of the labor market could prompt him to push for faster rate cuts. In addition, Kansas City Fed President Jeffrey Schmid stated he supports a slower pace of interest rate cuts due to uncertainty about the ultimate level to which the Fed should reduce rates. Meanwhile, U.S. rate futures have priced in an 88.9% probability of a 25 basis point rate cut and an 11.1% chance of no rate change at the next FOMC meeting in November. Third-quarter earnings season is gathering pace, with investors awaiting fresh reports from notable companies today, including General Electric (GE), Philip Morris (PM), Verizon (VZ), Texas Instruments (TXN), Lockheed Martin (LMT), General Motors (GM), and 3M (MMM). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +4.3% increase in quarterly earnings for Q3 compared to the previous year, down from +7.9% growth projected in mid-July. On the economic data front, investors will likely focus on the U.S. Richmond Manufacturing Index, which is set to be released in a couple of hours. Economists estimate this figure to come in at -19 in October, compared to the previous value of -21. Market participants will also be anticipating a speech from Philadelphia Fed President Patrick Harker. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.212%, up +0.60%. Here's a few things I'm thinking about. Gold hits new all time high despite surging dollar; the precious metal has now completely disconnected from the greenback amid relentless central bank buying Credit card debt is exploding way beyond 2008 and 2020 levels. If history’s taught us anything, it’s that this kind of spike usually screams incoming economic crash. Time will tell. Corporate Insiders are dumping shares at the fastest pace in more than 3 years Rates just keep moving higher! Either the bond market is wrong on this economy or the FED is. The Bond market is rarely wrong! Half a TRILLION dollars has been added to the National Debt in the in the past 3 weeks. Wasteful spending is out of control in this country. A Department of Government Efficiency is desperately needed. I don't get into politics here but a Trump presidency is important. Not for Trump (IMHO) rather to get Elon Musk in there to cut spending and Bobby Kennedy to clean up our horrible food sources. US public deficit hit $1.8 trillion in Fiscal Year 2024 or 6.4% of GDP, the largest since 2021. Over the last 200 years, it has been higher only during wars, the Great Financial Crisis, and the COVID Crisis. There will be a day of reckoning. I don't know when and I don't know how bad but it IS coming. Trade docket for today: T, STX, ENPH, KO, BA, GM, TXN, VZ, /MNQ,QQQ,/NQ scalping, 0DTE's. Let's go get em today folks! All eyes on the SPX debit trade!

Welcome back traders! It's a new week. Our Friday worked out o.k. It's always a little tougher on overnight Vampire trade days (third friday of each month) as we don't have the 0DTE NDX options to work. Our results are below: We've got a lot of accrued credits in the SPX debit setup. Will today be payoff day? We'll know by this afternoon. Let's take a look at the markets. We would benefit from a slight down day. Futures are dropping slightly at the open. We continue to sit, perched at the ATH's. This week, the SPY closed at another record high of $584.59 (+0.87%), as the price attempts to break free from the rising wedge it’s been trapped in since early August. The CHATS indicator shows a strong uptrend reading that has held steady for nearly a month, and the rising 5-day SMA serves as a key signal to stay the course with bullish positions. Despite a modest gain relative to last week’s close, QQQ ended the week in the red at $494.47 (+0.23%). This index remains the weakest of the bunch, with the price hovering just above a flat 5-day SMA and gravitating toward the bottom of the rising wedge. It’s also struggling to maintain the ‘strong uptrend’ signal from CHATS. IWM delivered the strongest performance this week, closing just below the top of its rising wedge at $225.65 (+1.97%). Historically, each test of this wedge’s upper boundary has coincided with a ‘strong uptrend’ reading on CHATS. However, the recent three-day consolidation is a more constructive pattern than we’ve seen before, suggesting the index could be gearing up for a potential breakout. December S&P 500 E-Mini futures (ESZ24) are down -0.36%, and December Nasdaq 100 E-Mini futures (NQZ24) are down -0.55% this morning as Treasury yields climbed at the start of a busy week, with investors looking ahead to a fresh batch of U.S. economic data, comments from Federal Reserve officials, and corporate earnings reports. In Friday’s trading session, Wall Street’s major averages ended higher, with the blue-chip Dow notching a new all-time high. Netflix (NFLX) surged over +11% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the streaming giant posted upbeat Q3 results. Also, Intuitive Surgical (ISRG) climbed more than +10% after the company reported stronger-than-expected Q3 results. In addition, Lamb Weston Holdings (LW) gained over +10% after activist investor Jana Partners disclosed a 5% stake in the company and said it plans to push the french-fry maker to explore a sale. On the bearish side, American Express (AXP) fell more than -3% and was the top percentage loser on the Dow after reporting weaker-than-expected Q3 revenue and lowering its full-year revenue growth guidance. Economic data released on Friday showed that U.S. housing starts fell -0.5% m/m to 1.354M in September, stronger than expectations of 1.350M. At the same time, U.S. September building permits, a proxy for future construction, fell -2.9% m/m to 1.428M, weaker than expectations of 1.450M. “Earnings season is off to the races, and despite some mixed signals, appears to be in good shape,” said Liz Young Thomas, head of investment strategy at SoFi. “We’re in the early innings though, and coming up on the final days before the election and the next Fed meeting. Never a dull moment.” Meanwhile, U.S. rate futures have priced in a 90.2% probability of a 25 basis point rate cut and a 9.8% chance of no rate change at the conclusion of the Fed’s November meeting. Third-quarter earnings season kicks into high gear this week, with investors looking forward to new reports from prominent companies including Tesla (TSLA), Coca-Cola (KO), T-Mobile (TMUS), Verizon (VZ), Texas Instruments (TXN), Lockheed Martin (LMT), General Motors (GM), 3M (MMM), IBM (IBM), AT&T (T), Boeing (BA), UPS (UPS), L3Harris Technologies (LHX), and Colgate-Palmolive (CL). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +4.3% increase in quarterly earnings for Q3 compared to the previous year, down from +7.9% growth projected in mid-July. Market participants will also be monitoring a spate of economic data releases this week, including the U.S. S&P Global Composite PMI (preliminary), the S&P Global Manufacturing PMI (preliminary), the S&P Global Services PMI (preliminary), the Richmond Manufacturing Index, Existing Home Sales, Crude Oil Inventories, Building Permits, Initial Jobless Claims, New Home Sales, Durable Goods Orders, Core Durable Goods Orders, and the University of Michigan’s Consumer Sentiment Index. In addition, the Federal Reserve will release its Beige Book survey of regional business contacts this week, which provides an update on economic conditions in each of the 12 Federal Reserve districts. The Beige Book is published two weeks before each meeting of the policy-setting Federal Open Market Committee. A host of Fed officials will be making appearances throughout the week, including Logan, Kashkari, Schmid, Daly, Harker, Bowman, and Barkin. In other news, Israel is in discussions regarding its response to Iran after a Hezbollah drone exploded near Prime Minister Benjamin Netanyahu’s private residence over the weekend. Today, investors will likely focus on the U.S. Conference Board’s Leading Index, which is set to be released in a couple of hours. Economists expect the September figure to be -0.3% m/m, compared to the previous number of -0.2% m/m. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.121%, up +1.11%. Let's take a look at the expected moves this week: Not much volatility to start the week. My bias or lean today is neutral. Time for a pause, I believe. Trade docket for today: /MNQ, QQQ scalping. VX, TXN, GM earnings trades, /NG, SPY$QQQ 4DTE and 0DTE's We don't have a bunch of economic new today. Maybe today it the payoff day for our SPX debit trade?

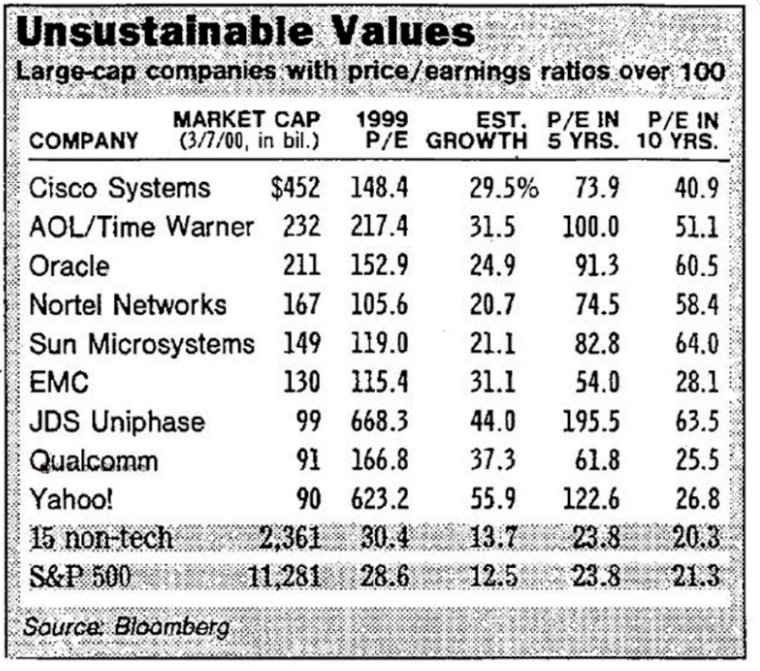

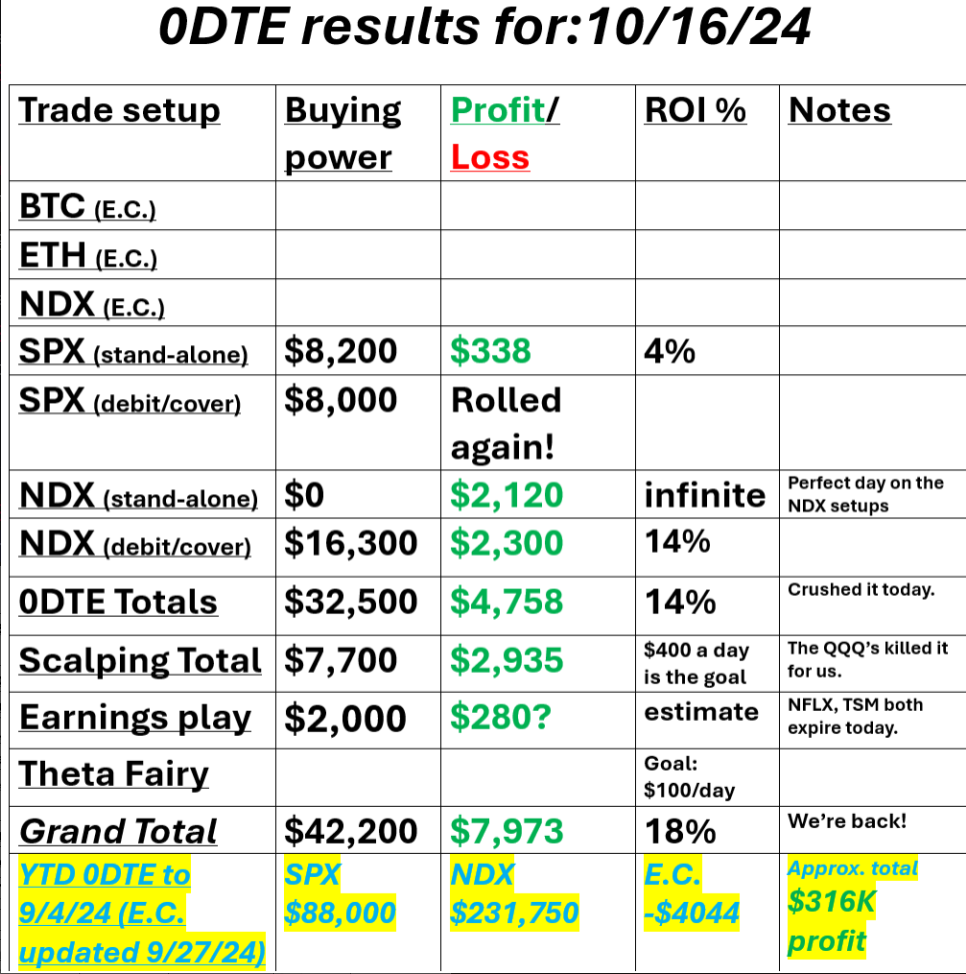

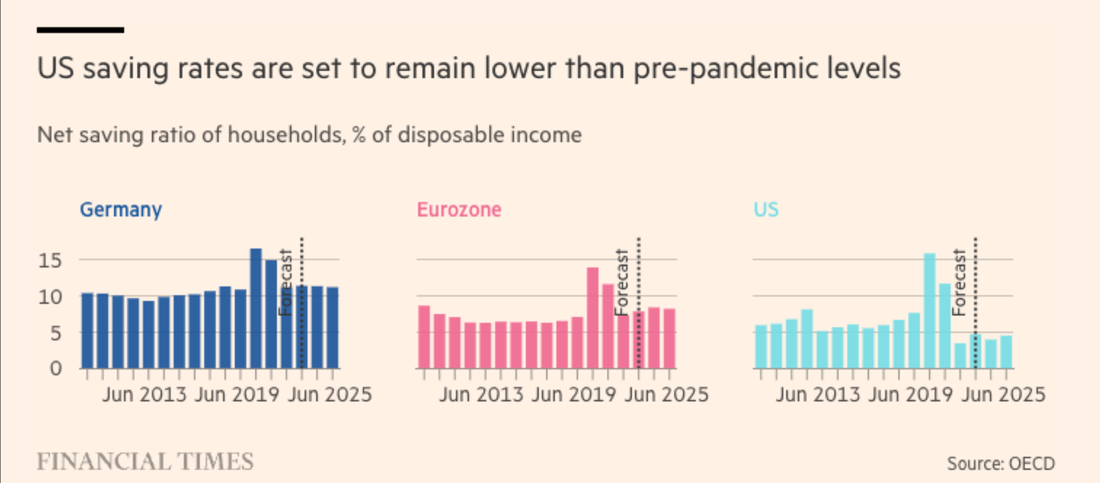

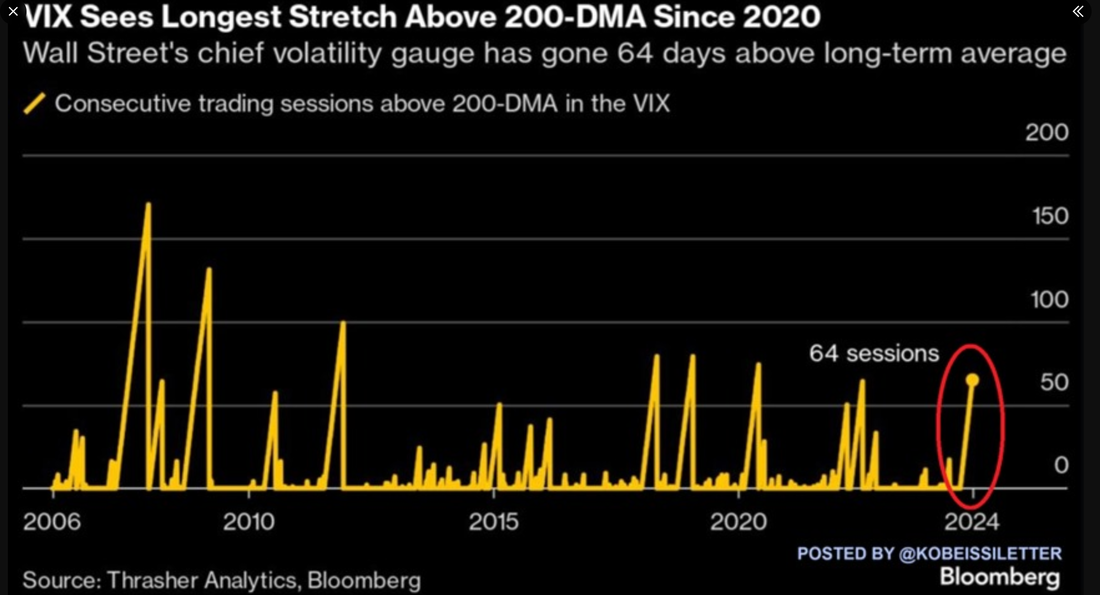

See you all in the trading rooms shortly. Welcome to a rainy, drizzly Friday, here in Utah. We went from 88 degrees to 45 overnight! Heading into winter I guess. Where has the year gone? Folks...we are back! In the imortal words of the great LL Cool J. Don't call it a comeback! We had an absolutely amazing day yesterday. We almost got our SPX debit to finish in the profit zone too! That was close but no cigar. Maybe today? Either way, that trade contiues to look better and better. Here's our results. Scalping, once again, killed it for us. Let's take a look at this crazy market and a couple things we should be keeping in mind. Buy mode is still in place. Do we look a little "toppy" here? Sure. We usually do when we are hovering around ATH's. That's not neccessarily a bearish indicator. There are a few things, however, I think we should keep in mind. In the cause of fairness and balanced viewing. Even as we push to new ATH's we are starting to see negative divergence with the RSI. US saving rates are in the toilet. Gold hits new all time high despite surging dollar; the precious metal has now completely disconnected from the greenback amid relentless central bank buying US public deficit hit $1.8 trillion in Fiscal Year 2024 or 6.4% of GDP, the largest since 2021. Over the last 200 years, it has been higher only during wars, the Great Financial Crisis, and the COVID Crisis. The Volatility index, $VIX, has been trading above its 200-day moving average for 64 trading sessions, the longest stretch since 2020. This streak is even longer than the one seen during the 2022 bear market. This is all despite the S&P 500 rallying 22.5% and hitting 45 all-time high this year. Meanwhile, bond market volatility has jumped 40% in October and hit its highest level since November 2023. Are volatility metrics trying to tell us something? AT THE PEAK OF THE DOTCOM BUBBLE, CISCO WAS WORTH 5.5% OF THE US GDP AND TODAY $NVDA IS WORTH OVER 11.7% WHICH IS 200% HIGHER WHEN THIS BUBBLE POPS, AND IT WILL, IT WILL LEAD TO A COLLAPSE BIGGER THAN 2008 Buffett valuation indicator of the #stockmarket has NEVER been this high. Higher than ever before, including Nov 2021 and the Dot-Com Bubble. All this isn't to imply we are due a crash but...you never know when the next one is coming. As my wife likes to joke, "Jesus is coming. Look busy everyone!" Best to be prepared so as not to be shocked. My lean or bias today is neutral. Low volume. Friday. Not a lot of news catalysts. We would need something to get us moving today IMHO save for a sell off like we had a few days ago. That could happen on its own with a little nudge. Let's take a look at the intra-day levels for /NQ, /ES and Bitcoin. /ES: It's always tough to pinpoint clear resistance levels when you are breaking ground into new ATH's but 5907 is the first level. 5915 the next. 5926 is the key. It's our ATH and a push above that would keep the bullish party going. 5888 is the first key support. This is the 50 period M.A. 5878 is next. Below that we have some room to move. The Nasdaq, once again, is having a bit more struggle to the upside than the other major indices. 20491 is first resistance with 20533 and 20594 the next two levels. 20426 is the first really key support. It's the PoC on the 2hr. chart. 20387 is the next. BTC: Bitcoin has been on a nice run lately. I've got a decent amount of long term investment capital in both BTC and ETH so I'd like to see those new ATH's everyone keeps talking about but, I've also got an event contract trade on that wins if we DON'T hit new ATH's before Dec. 31st. AND we also have some juicy Iron Condors on in the trading room that could use some stabilization for the next week. We do seem to be stalling here. 68,562 is resistance with 66798 support. Let's make it happen today folks! A strong finish to the week would be sweet! I need to get back to pulling a daily paycheck! Eye surgery is next week and they will want payment! LOL

|

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |