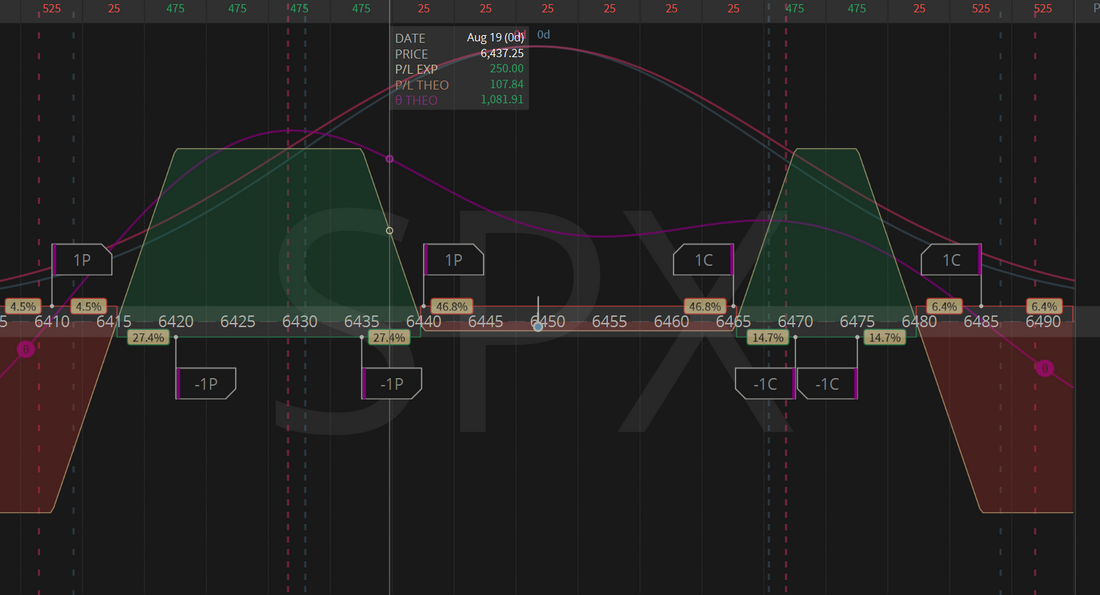

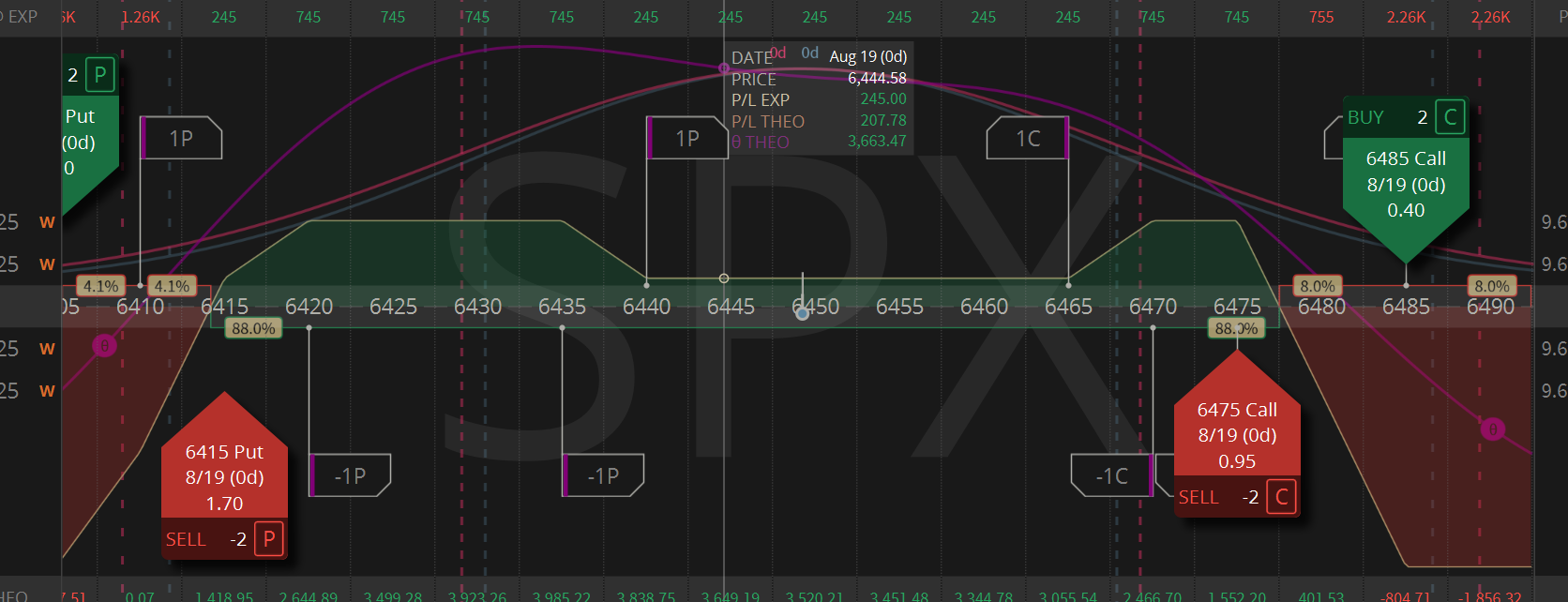

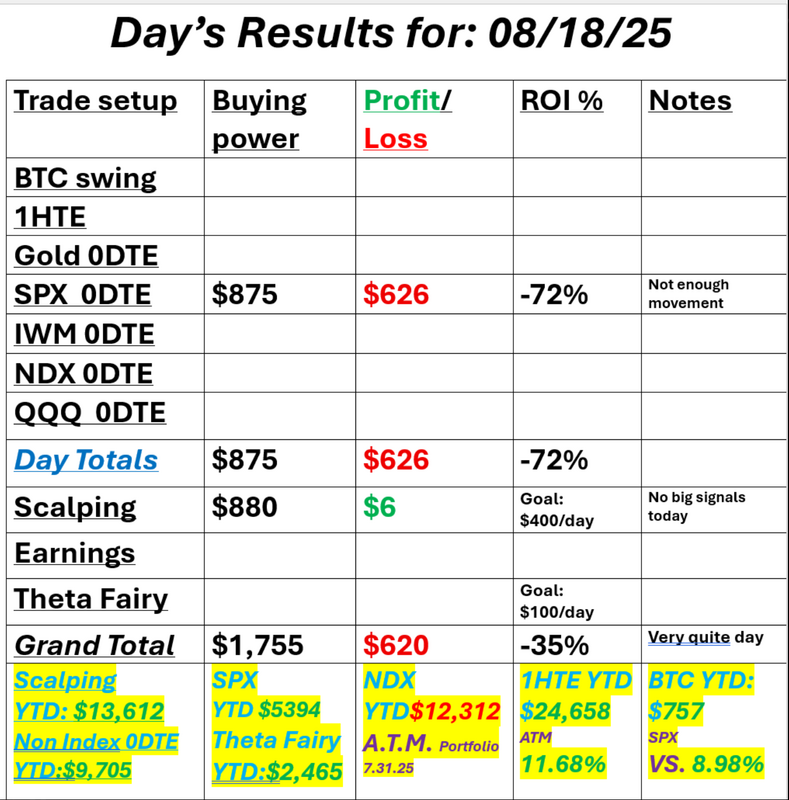

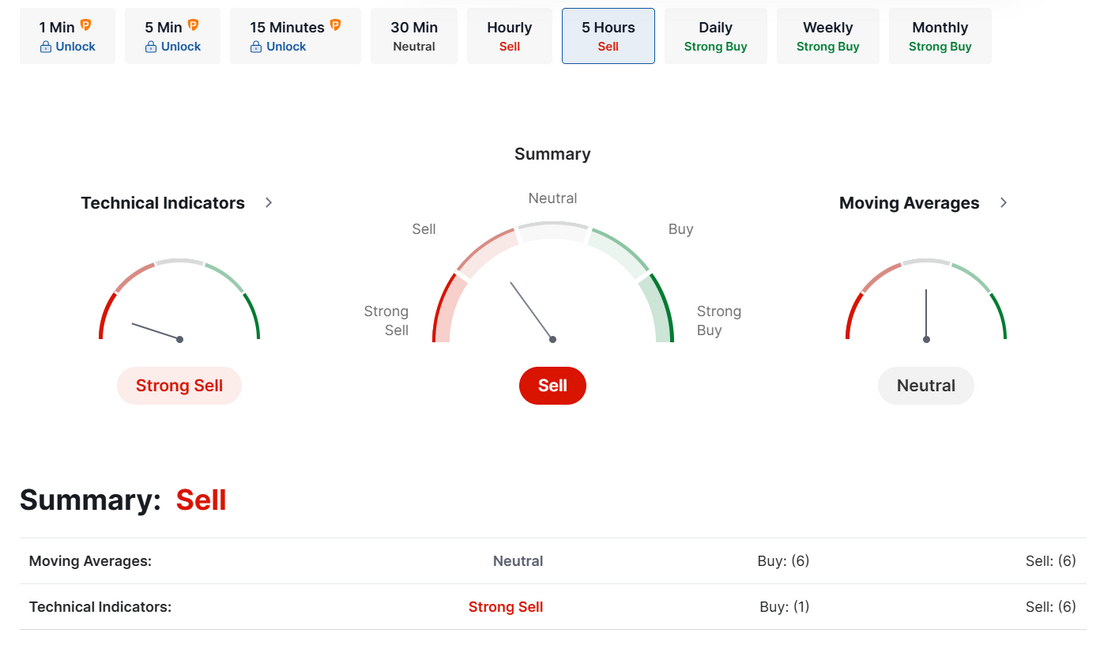

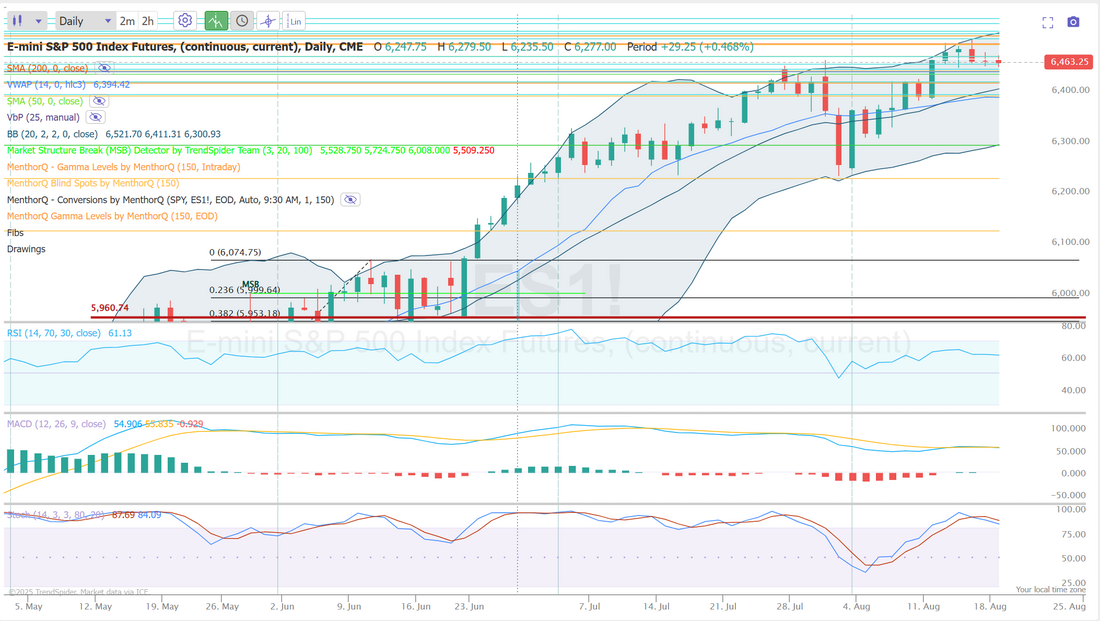

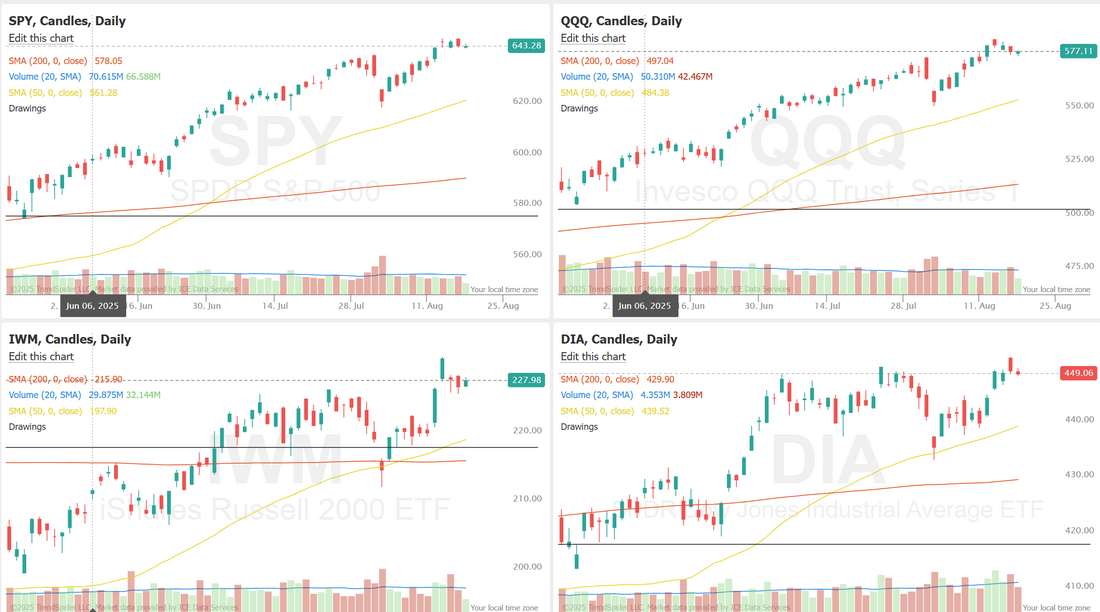

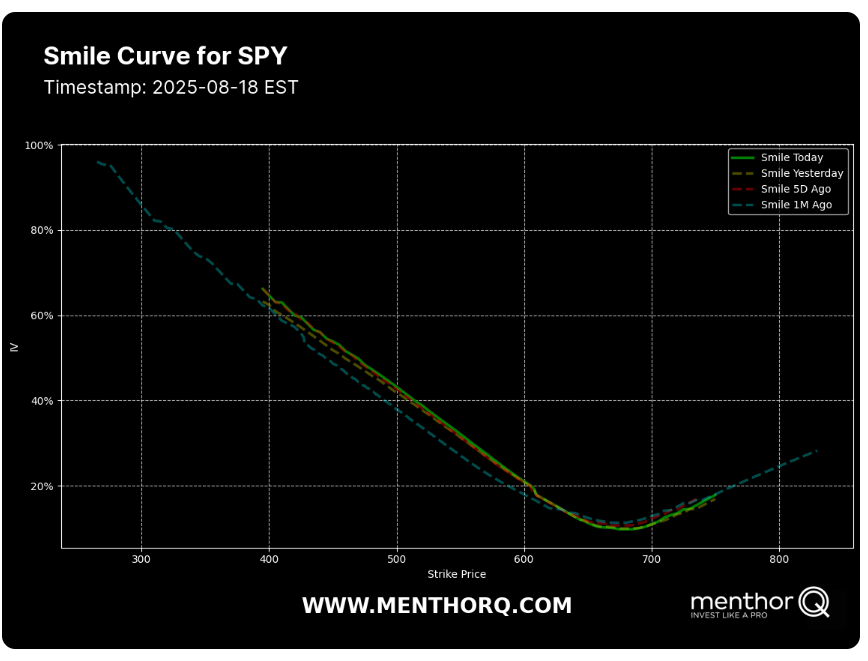

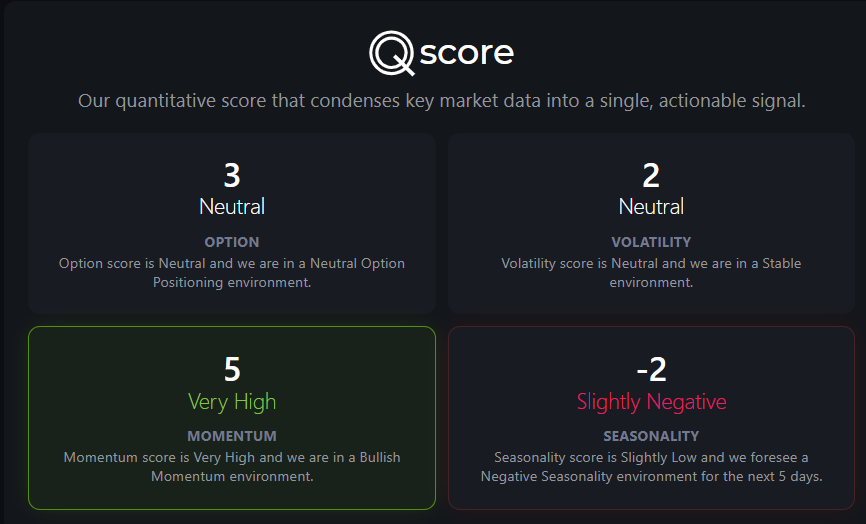

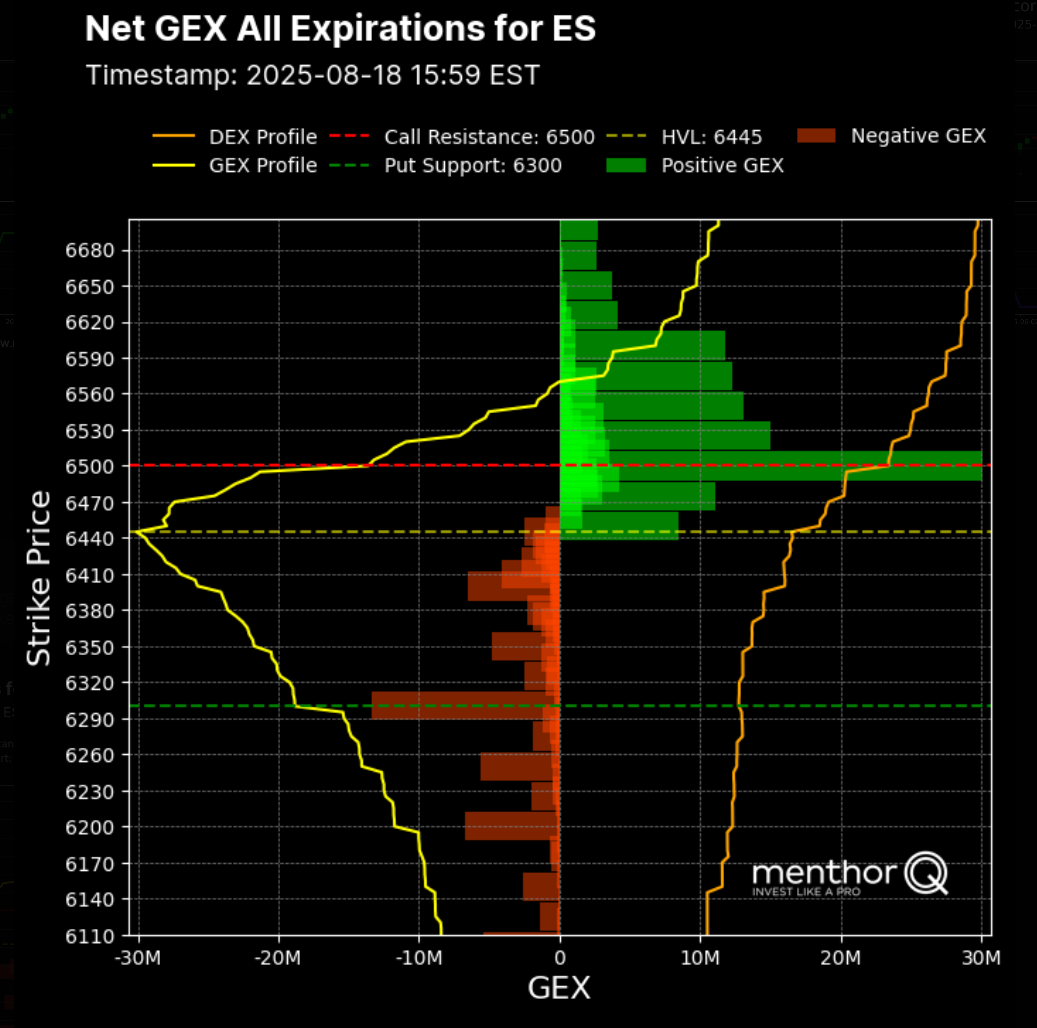

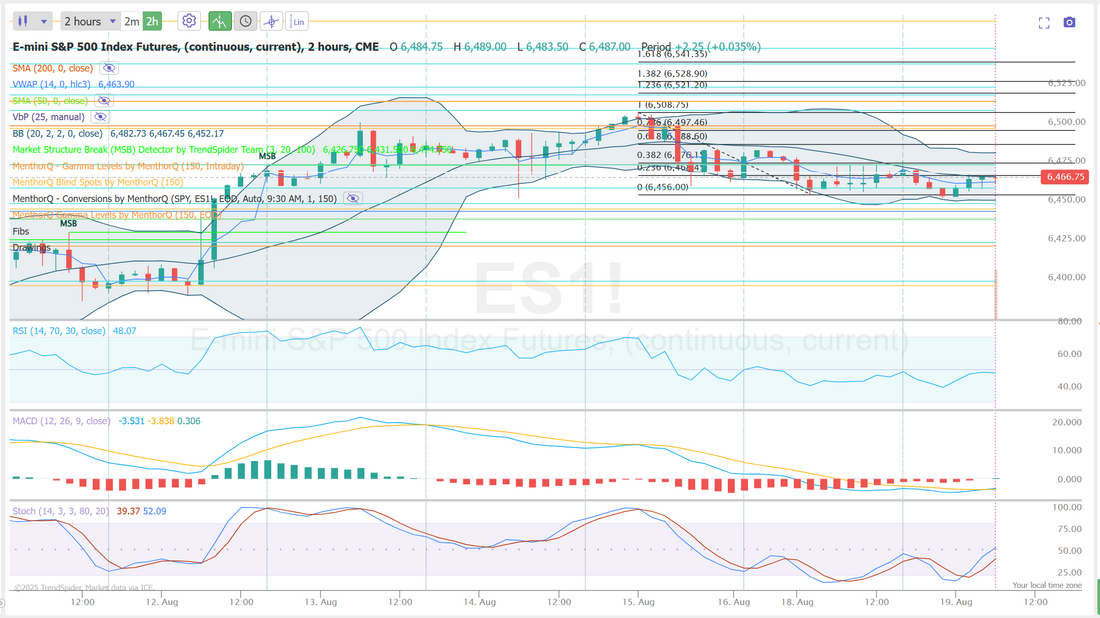

How long do we coil?The last five trading days have been a big nothing burger. We know that consolidation flows into expansion. When and how much and what direction? Who knows but we do know it's coming. We put on a 1DTE setup late afternoon yesterday with a debit (long) Iron condor. Which we will wrap this morning, with a credit (short) Iron condor...something like this. We have tried credit trades, debit trades, directional, non-directional, you name it. This seems to be the best way to play this "dead" market. As some point we'll get some movement. We just don't know when. Yesterday I focused solely on the SPX that we put on last Fri. It didn't hit...again. This low vol environment with no movement it tough to trade. We took a stab as several scalps but yesterday wasn't really a day for scalping. Here's a look at my day. Let's take a look at the markets: We start the day with slightly weak technicals. Five days now of a soft market. Not really rolling over yet but a downturn could be promising for those of us who would benefit from higher premiums. The markets are definitely in "pause" mode. The question is, are we resting before the next push up or forming the basis to roll over? One thing is certain. Volatility...and premiums couldn't be worse. Prepare for a spike up...that's my advice. September S&P 500 E-Mini futures (ESU25) are down -0.09%, and September Nasdaq 100 E-Mini futures (NQU25) are down -0.08% this morning as earnings from the nation’s retail heavyweights kicked off, shifting the focus to the strength of the American consumer. Home Depot (HD) rose over +1% in pre-market trading after the giant home-improvement retailer reiterated its full-year guidance. However, the company reported slightly weaker-than-expected Q2 results. Investors also assess the latest efforts to end the Russia-Ukraine war. U.S. President Donald Trump’s meeting with Ukrainian President Volodymyr Zelenskyy and European leaders concluded with a call for a summit with Russia. President Trump said he had spoken with Russian President Vladimir Putin and was working to set up a direct meeting between Putin and Zelenskyy, followed by a potential trilateral summit involving all three leaders. Zelenskyy said talks were positive and covered sensitive issues such as security guarantees, adding that he was prepared to meet with Putin bilaterally. NATO Secretary-General Mark Rutte said that Putin has agreed to meet with Zelenskyy. In yesterday’s trading session, Wall Street’s main stock indexes closed mixed. EQT Corp. (EQT) slid more than -4% and was the top percentage loser on the S&P 500 after Roth Capital downgraded the stock to Neutral from Buy. Also, Intel (INTC) fell more than -3% and was the top percentage loser on the Nasdaq 100 after Bloomberg reported that the Trump administration was in discussions to take a 10% stake in the company. In addition, Meta Platforms (META) dropped over -2% after the Information newsletter reported that the company is undertaking its fourth restructuring of its AI organization in the past six months. On the bullish side, Dayforce (DAY) soared over +25% and was the top percentage gainer on the S&P 500 after Bloomberg reported that private-equity firm Thoma Bravo was in talks to acquire the human resources management software provider. Meanwhile, S&P Global Ratings reaffirmed its AA+ long-term rating for the U.S. and its A-1+ short-term rating, while maintaining a stable outlook. “The stable outlook indicates our expectation that although fiscal deficit outcomes won’t meaningfully improve, we don’t project a persistent deterioration over the next several years,” it said in a statement. The ratings agency noted it expects strong revenues from the Trump administration’s newly implemented tariff regime to help offset the anticipated fiscal deterioration stemming from recent legislative changes. Investors face a crucial week as the Kansas City Fed’s annual Economic Policy Symposium kicks off Thursday evening in Jackson Hole, Wyoming, potentially providing signals on the direction of interest rates. Chair Jerome Powell, in remarks on Friday, is expected to outline the central bank’s new policy framework. Mr. Powell may also provide a fresh update on how much support exists for a September rate cut, at a time when the Trump administration is intensifying pressure to begin easing. “If the Fed is going to cut next month, expect hints out of this week’s Jackson Hole Symposium,” said Scott Wren at Wells Fargo Investment Institute. U.S. rate futures have priced in an 83.1% probability of a 25 basis point rate cut and a 16.9% chance of no rate change at September’s monetary policy meeting. Today, market watchers will focus on U.S. Building Permits (preliminary) and Housing Starts data, set to be released in a couple of hours. Economists expect July Building Permits to be 1.390 million and Housing Starts to be 1.290 million, compared to the prior figures of 1.393 million and 1.321 million, respectively. Investors will also look forward to earnings reports from home improvement chain Home Depot (HD), medical device firm Medtronic (MDT), and semiconductor electronics manufacturing firm Keysight Technologies (KEYS). In addition, market participants will parse comments today from Fed Governor Michelle Bowman. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.329%, down -0.25%. The SPX chart with momentum scoring highlights a steady uptrend over the past few months, with prices moving from below 5,900 to consolidating near 6,450. The momentum score has remained consistently elevated, holding around 4–5 for much of July and August after recovering from a brief dip in late July. This sustained strength suggests that near-term momentum continues to support the trend, even as price action has flattened slightly in recent sessions. From a short-term lens, the key observation is whether momentum can stay above 4 as dips in this score have historically aligned with brief pauses or retracements. In the immediate term, the consolidation phase may signal a build-up for the next directional move, with momentum levels providing a useful gauge for potential follow-through. The SPY smile curve chart highlights how implied volatility is distributed across strike prices, offering insight into current option market dynamics. Today’s curve (green) sits slightly above yesterday’s and the 5-day profile, showing a marginal uptick in implied volatility across strikes, especially in the wings. Compared with one month ago (blue), volatility is still elevated at deep out-of-the-money puts, but the overall curve is tighter, suggesting less extreme downside hedging pressure than previously. The at-the-money zone around the 640–660 strikes remains anchored near the trough of the curve, while skew toward both ends indicates traders are paying more for protection in tails. Short-term, the incremental steepening signals a modest shift in sentiment toward hedging activity rather than complacency. Gamma is low and positive. Quant score is turning more neutral. 6500 on /ES remains a huge gamma wall resistance area. Today looks to be starting our much like yesterday and the previous five days. Slow moving. Futures are slightly down but no real indication of directional movement today. We are set up for a neutral day and that's what I'm looking for. Trade docket today is fairly simple. I'll focus on scalping the /MNQ futures contracts and getting our SPX 0DTE to the finish line. We'll likely initiate another 1DTE SPX for tomorrow, much like we did yesterday. This seems to be the best approach for a market like this. There is no premium in Gold right now so we'll look at that again later today. Let's take a look at the intra-day levels. They haven't changed much in the last five trading days. With price action subdued, the levels are close and many. 6477, 6487, 6495, and 6500 are the closest resistance levels. 6460, 6455, 6450, 6444 are support. It seems like a big goal, lately but let's see if we can get our SPX to a green finish today! I'll see you all in the live trading room shortly.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |