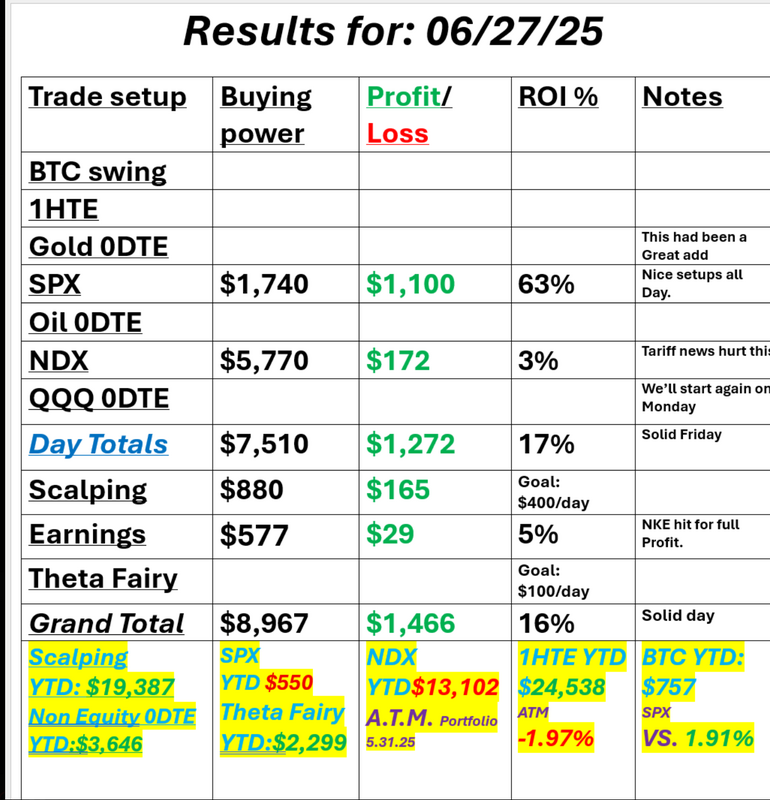

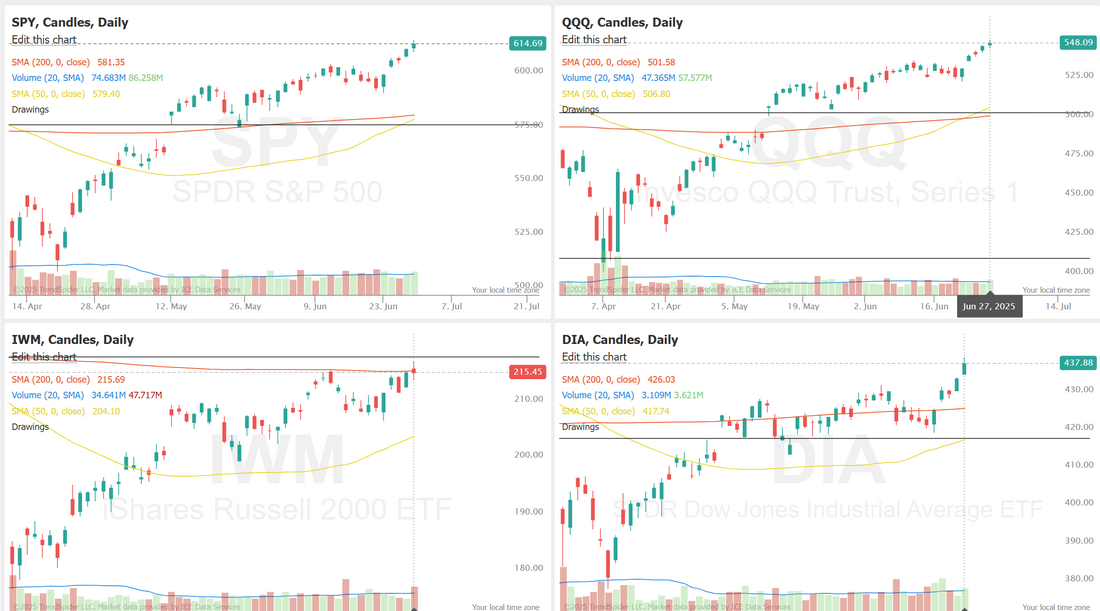

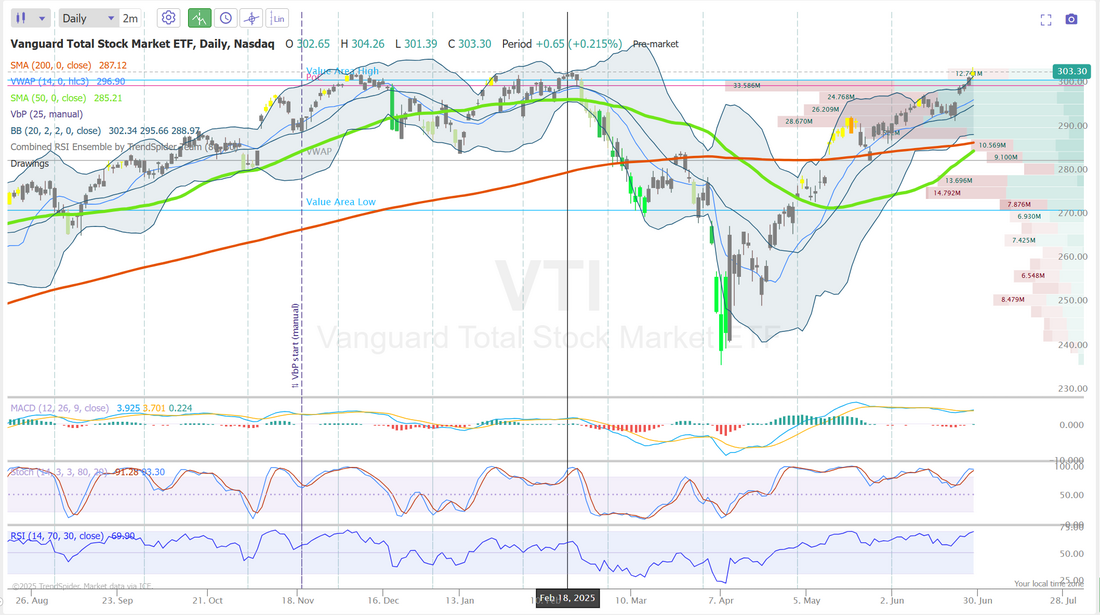

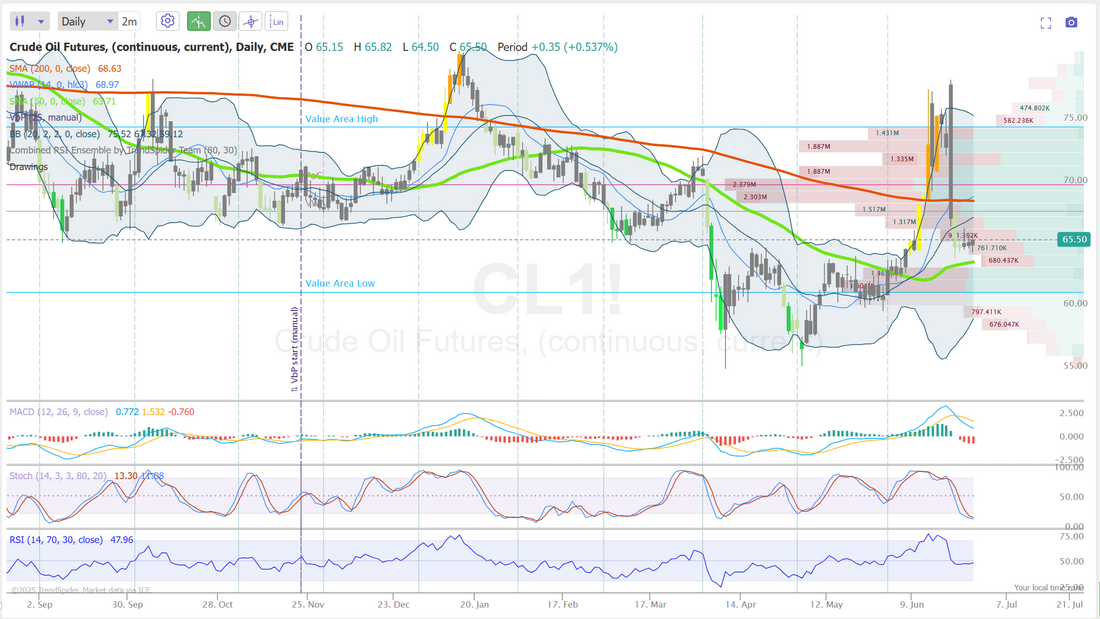

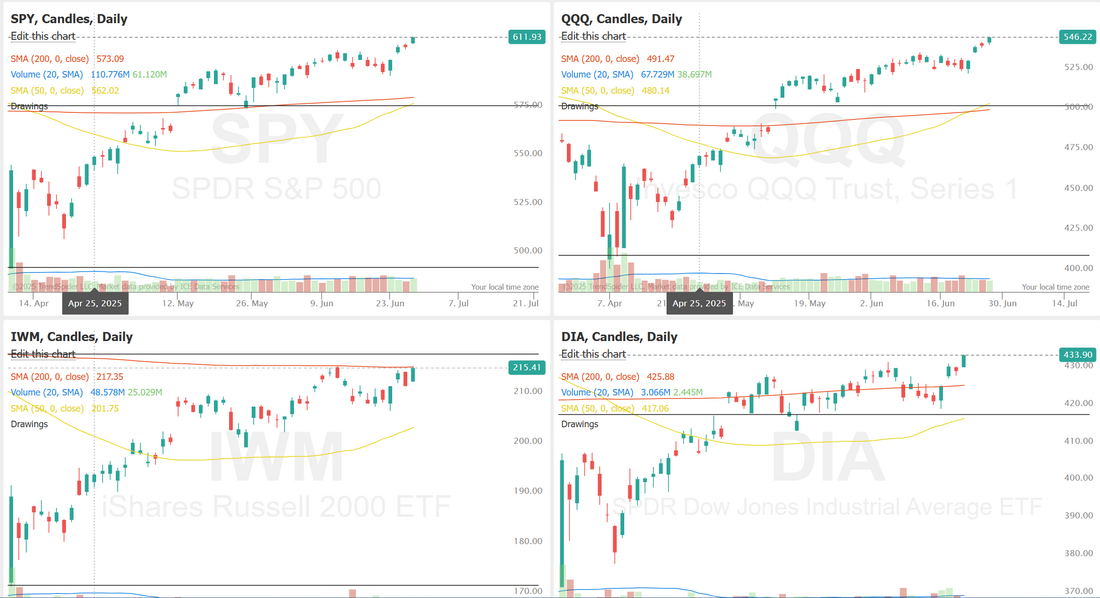

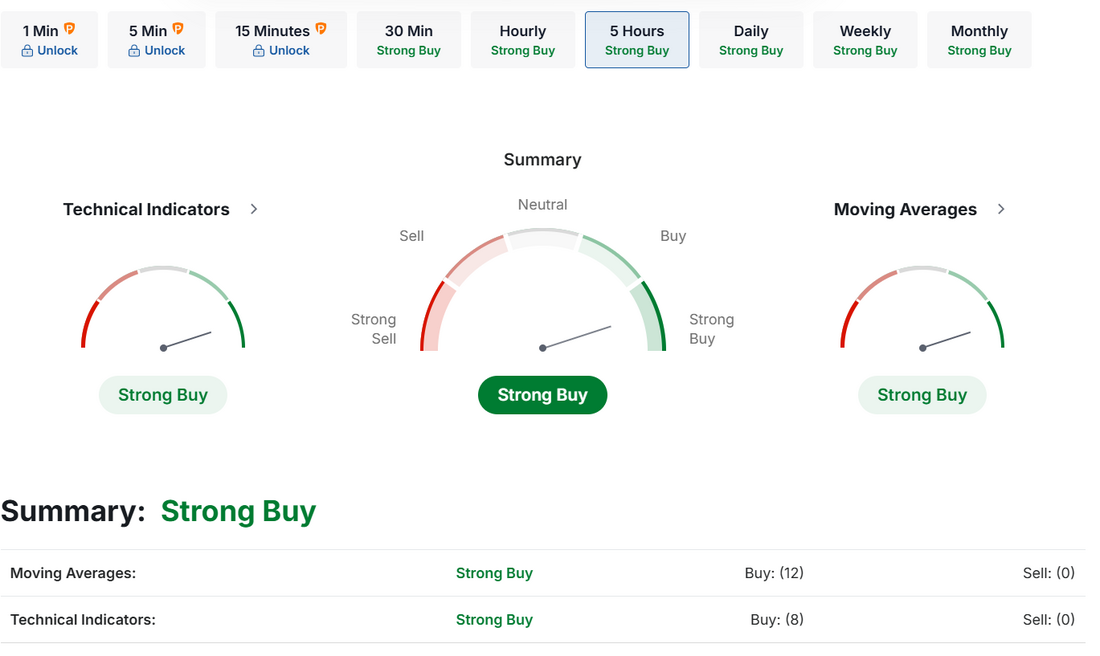

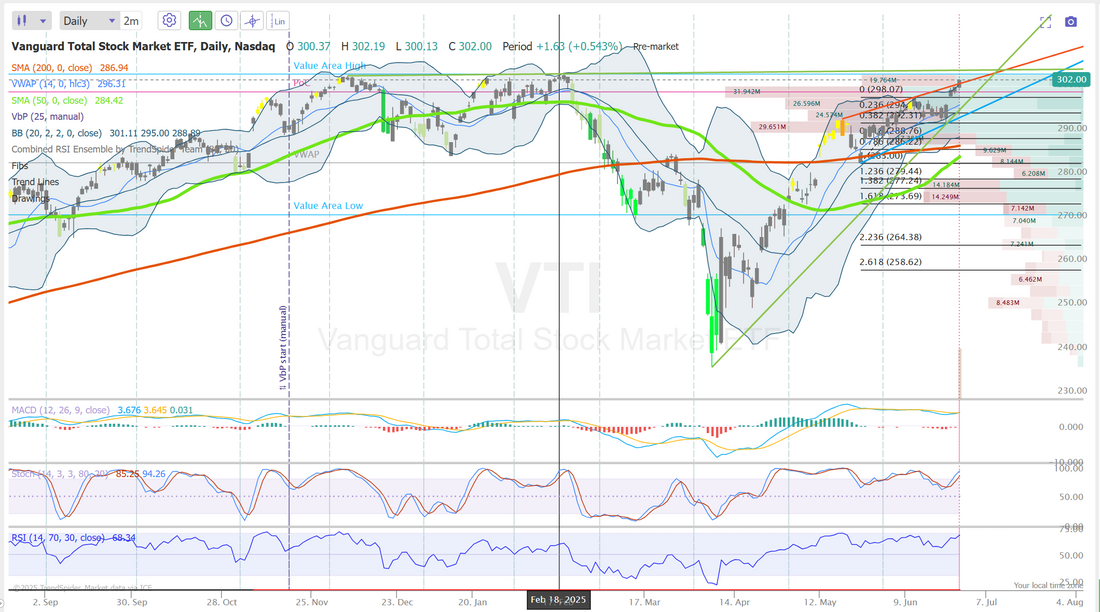

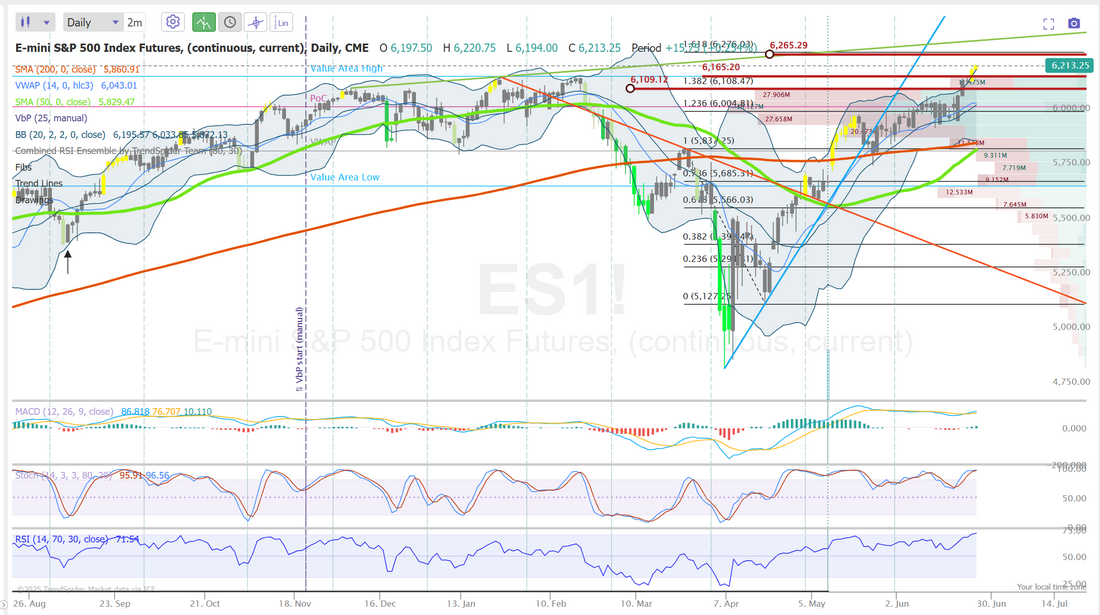

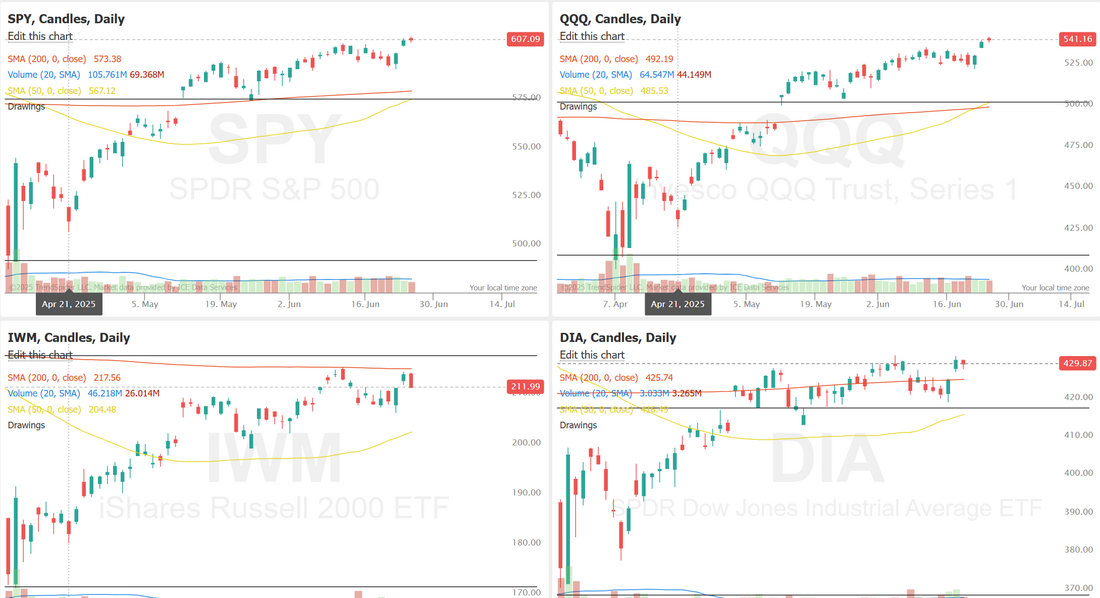

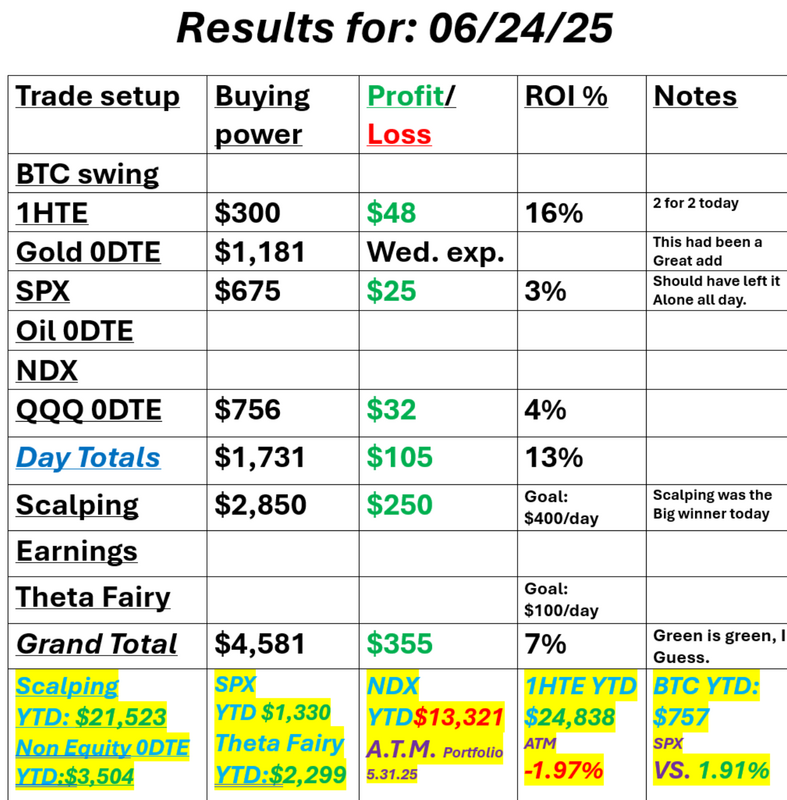

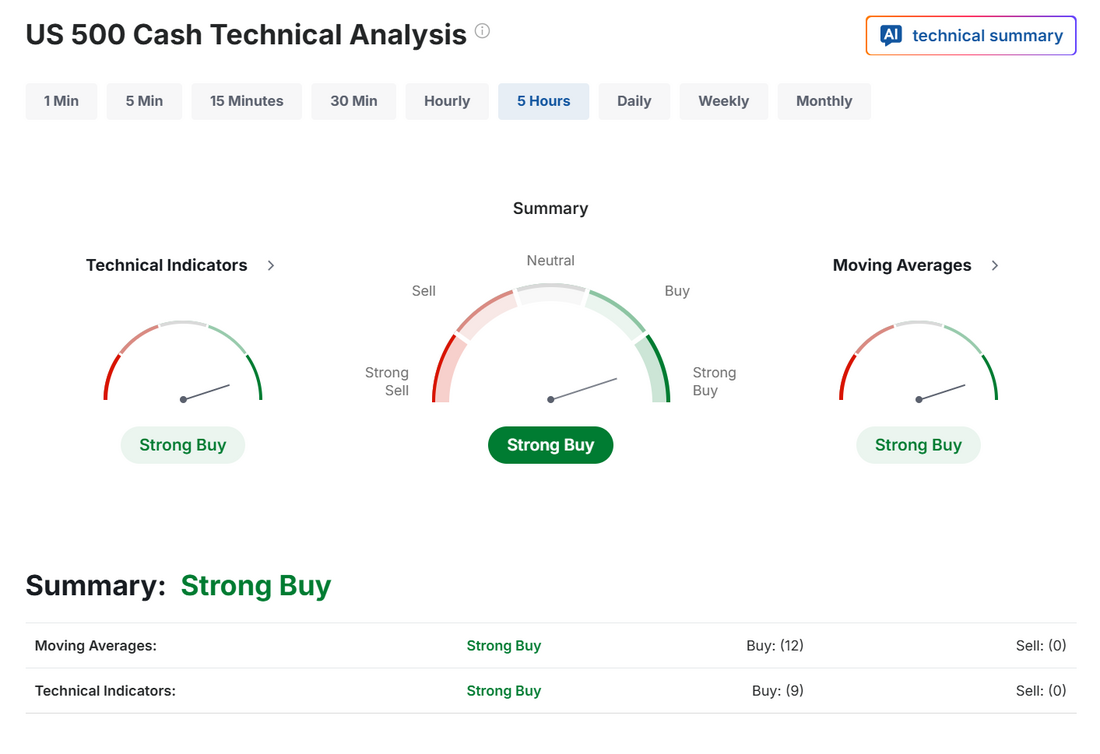

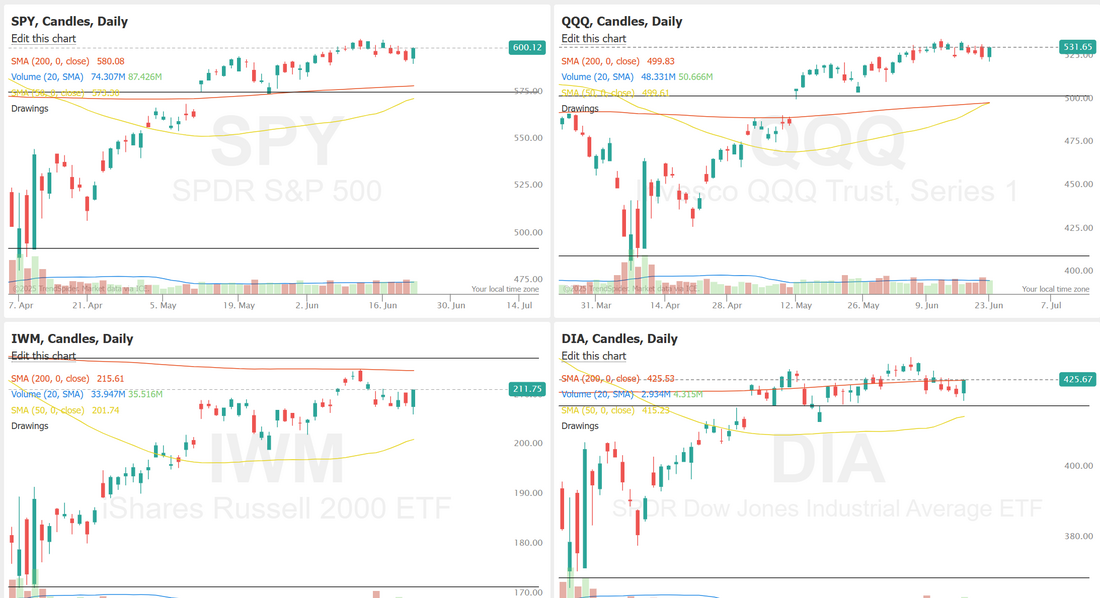

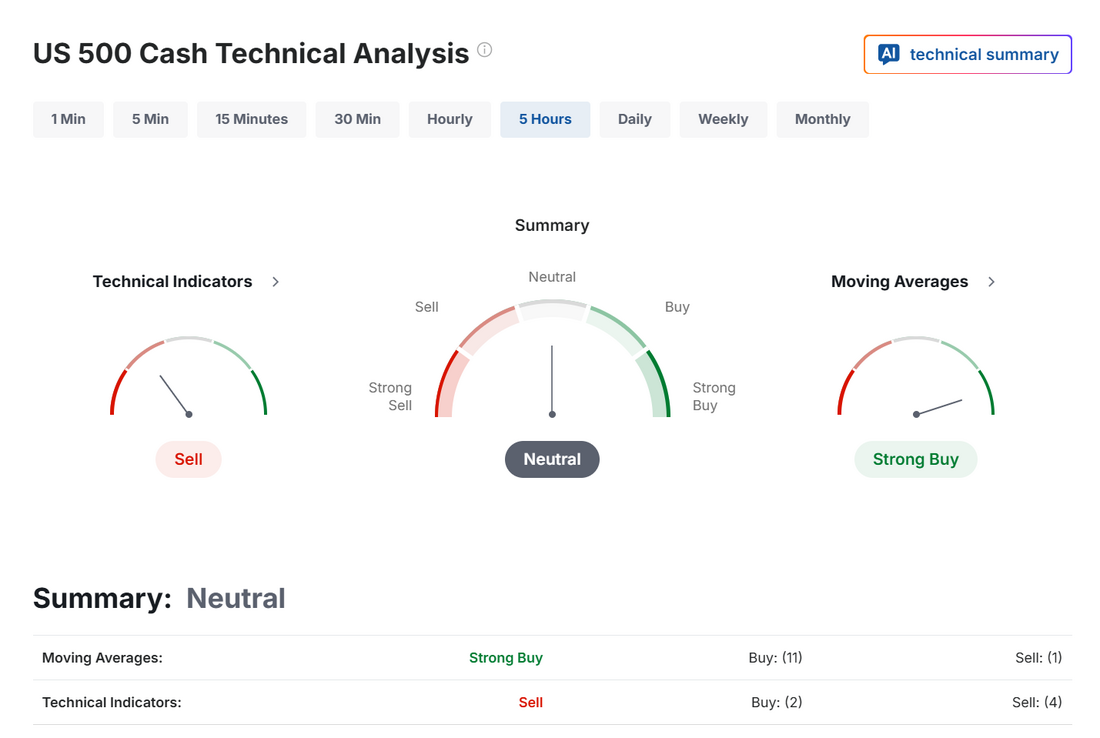

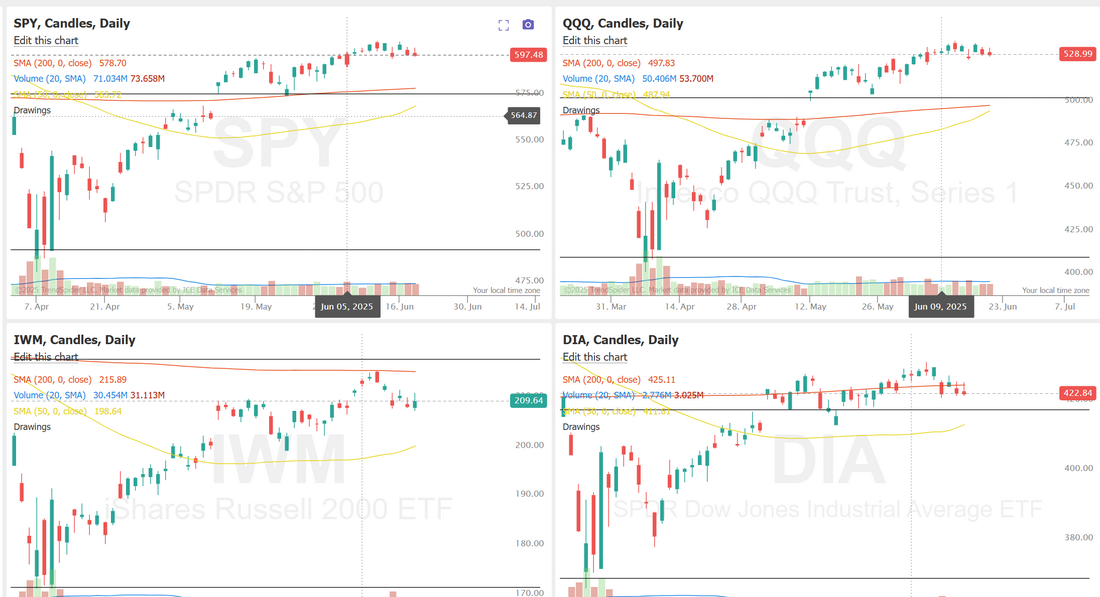

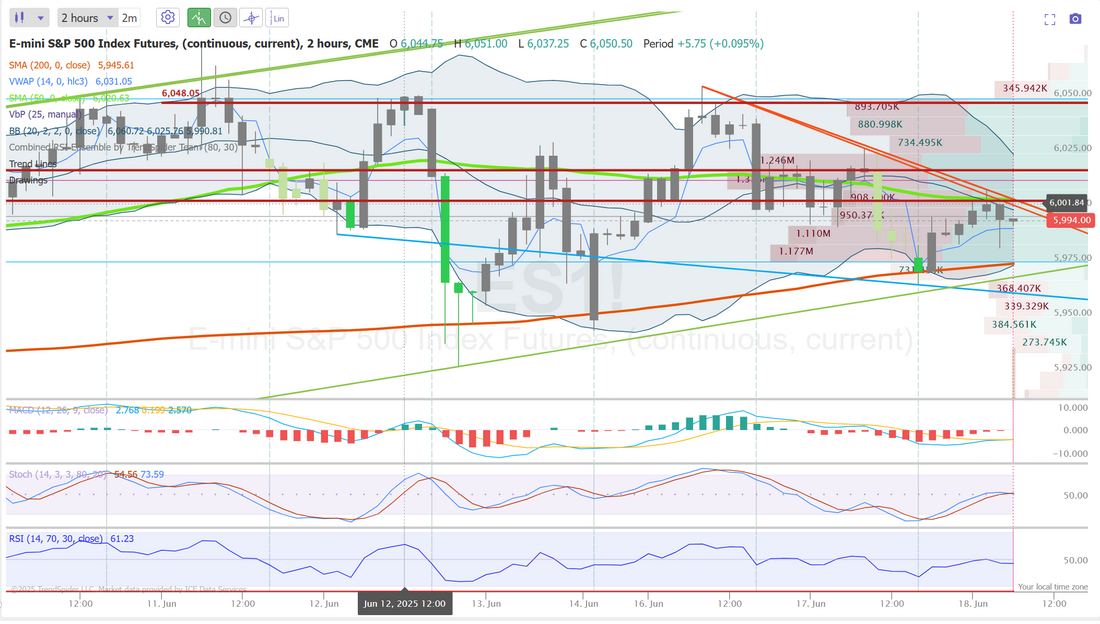

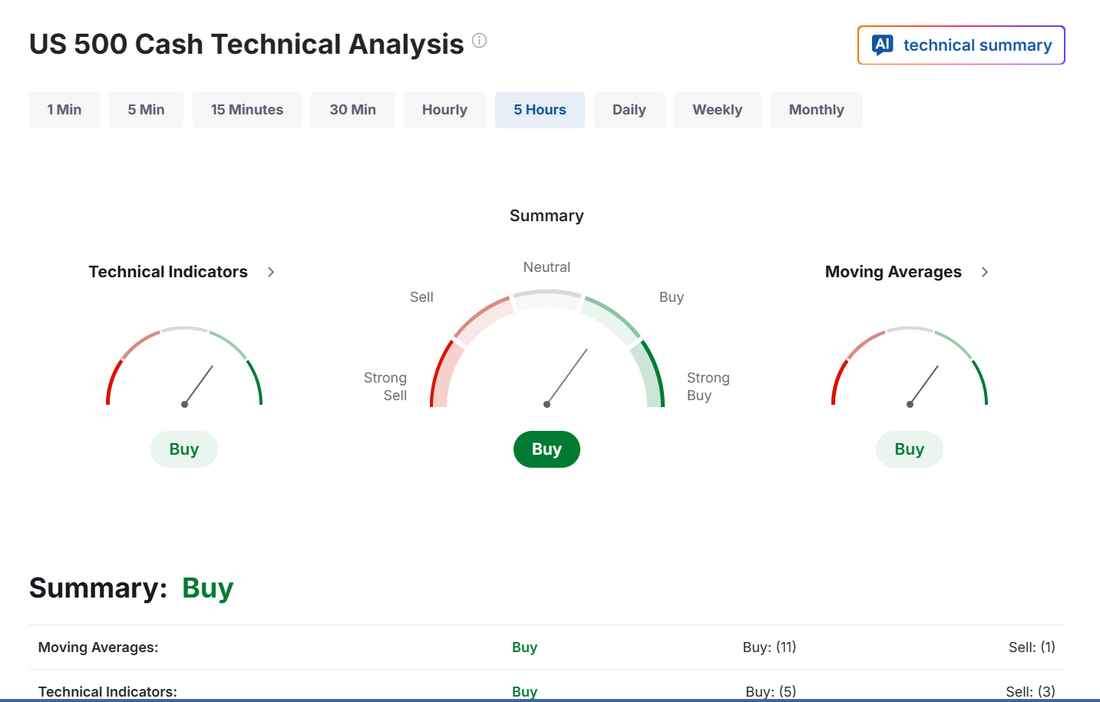

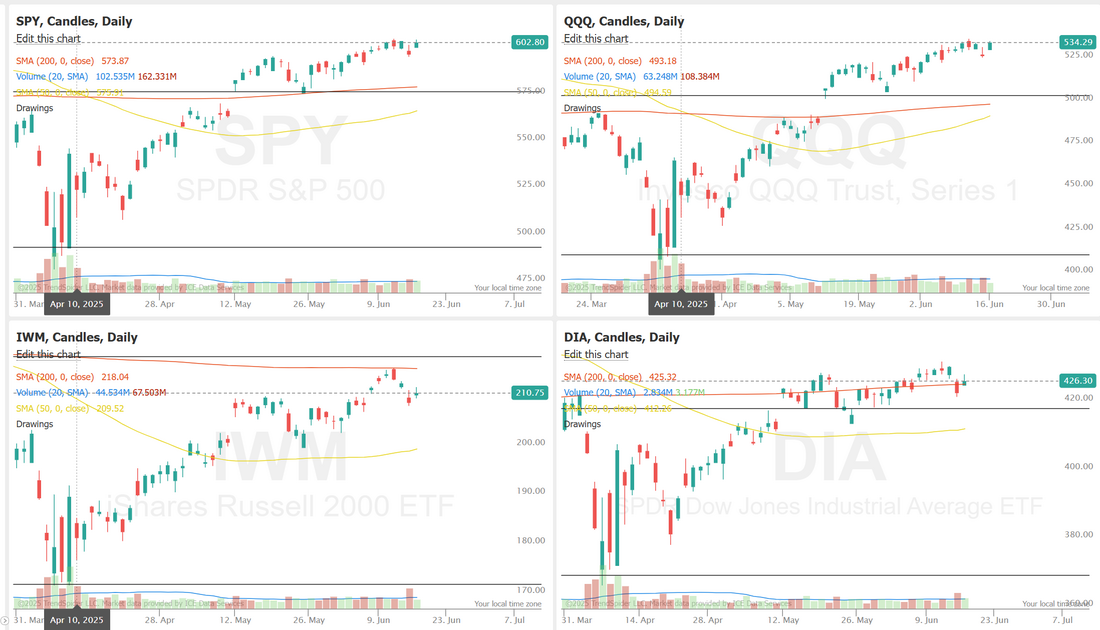

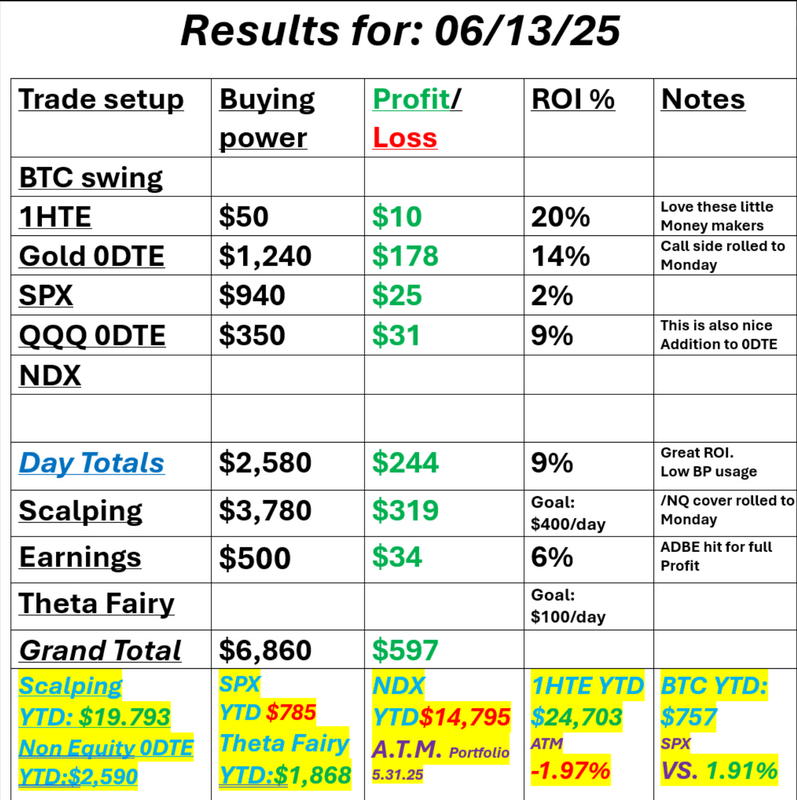

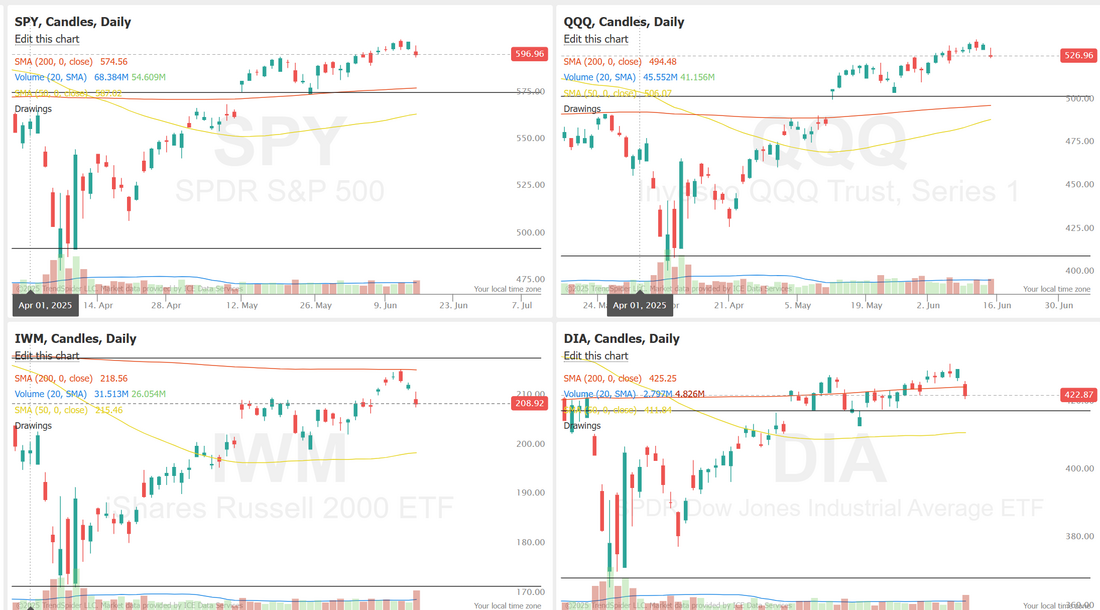

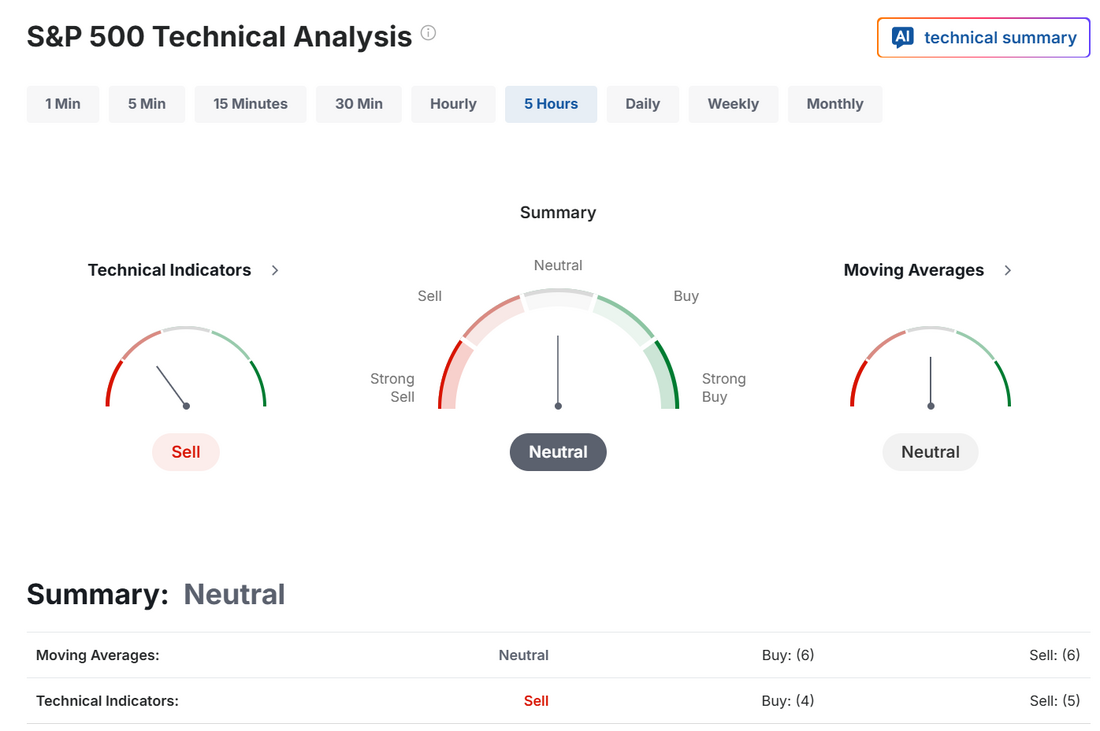

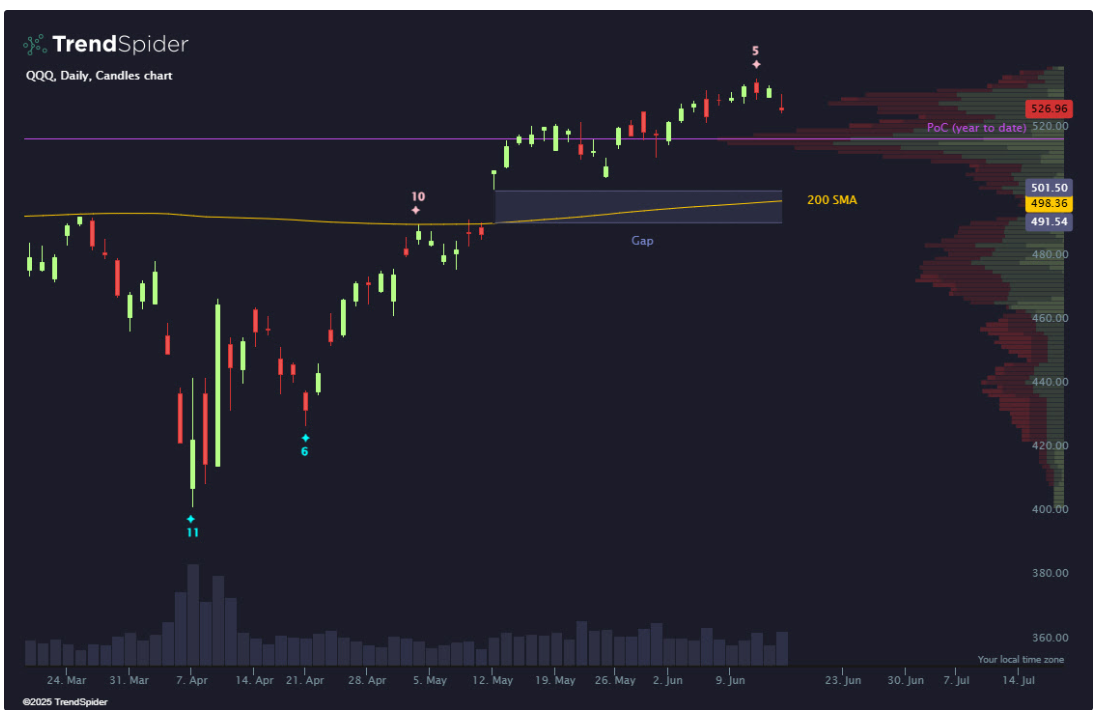

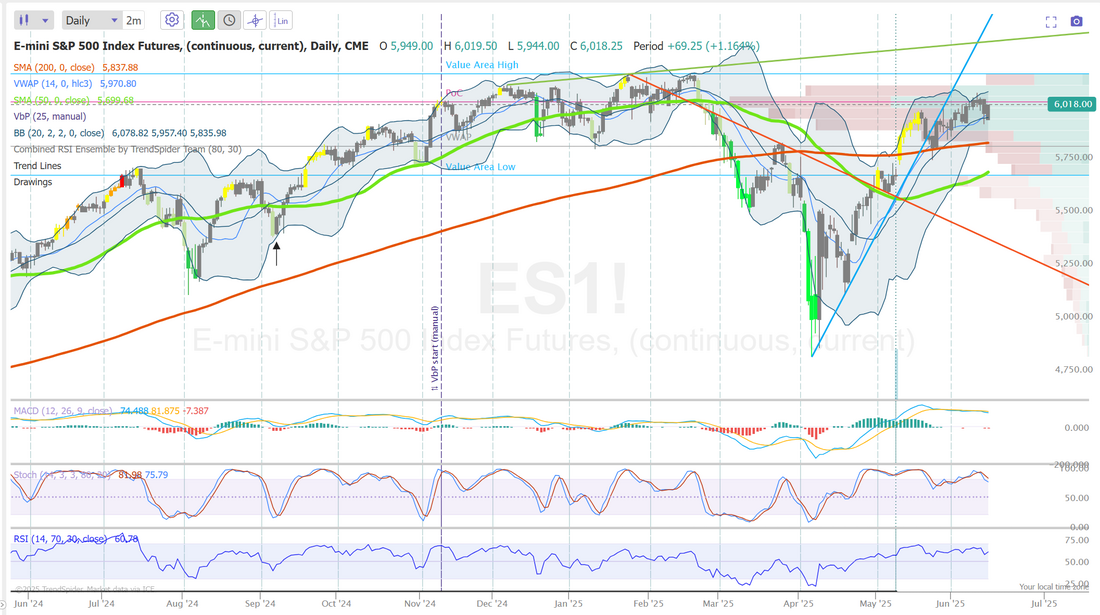

Golden Cross for QQQFriday not only got the markets pushing to new ATH's but in put in a strong golden cross for the QQQ's. It's an interesting chart right now. All the price action is bullish but CAPE ratio is back to overstretched. Stoch and RSI are flashing overbought. Futures are up strong this morning but as some point you'd think we are due for a pause. We had a good day Friday. Our NDX needed some work after the Canada tariff news dropped but it all ended well. Here's a look at our day. Let's take a look at the markets. ATH's across the board with IWM being the only index showing a bit of weakness. If we look at the VTI, our technicals are showing how overstretched it's looking. A retrace would be healthy at this point. Will it happen today? Way too early to tell. We had a bullish SPX and /MNQ scalp on. We've already taken our /MNQ profit off the table. September S&P 500 E-Mini futures (ESU25) are up +0.47%, and September Nasdaq 100 E-Mini futures (NQU25) are up +0.70% this morning, pointing to a higher open on Wall Street amid optimism over progress in trade negotiations between the U.S. and key partners. Japan’s top trade negotiator, Ryosei Akazawa, extended his stay in the U.S. for further talks, stating that negotiations have reached “a critical juncture.” Also, Bloomberg reported that India’s trade delegation prolonged its stay in Washington to iron out differences as both sides aim to finalize a deal ahead of the July 9th deadline. In addition, Canada withdrew its digital services tax on tech firms in an effort to restart trade negotiations with the U.S. Taiwan also said it has made “constructive progress” during a second round of trade negotiations with the U.S. Finally, French Finance Minister Eric Lombard stated that the European Union could reach some type of trade deal with the U.S. ahead of the July 9th deadline. This week, investors look ahead to remarks from Federal Reserve Chair Jerome Powell and a raft of U.S. economic data, with a particular focus on the nonfarm payrolls report. In Friday’s trading session, Wall Street’s major equity averages ended in the green, with the S&P 500 and Nasdaq 100 notching new all-time highs. Nike (NKE) surged over +15% and was the top percentage gainer on the S&P 500 and Dow after the sportswear company posted better-than-expected FQ4 results and said it expects the decline in sales and margins to ease in the current quarter. Also, Boeing (BA) climbed more than +5% after Redburn upgraded the stock to Buy from Neutral with a price target of $275. In addition, Alphabet (GOOGL) rose over +2% after Citizens JMP upgraded the stock to Outperform from Market Perform with a price target of $220. On the bearish side, Palantir Technologies (PLTR) slumped more than -9% and was the top percentage loser on the S&P 500 and Nasdaq 100 after Canada announced a tax on digital business from the U.S. Data from the U.S. Department of Commerce released on Friday showed that the core PCE price index, a key inflation gauge monitored by the Fed, came in at +0.2% m/m and +2.7% y/y in May, stronger than expectations of +0.1% m/m and +2.6% y/y. Also, U.S. May personal spending unexpectedly fell -0.1% m/m, weaker than expectations of +0.1% m/m, and personal income unexpectedly fell -0.4% m/m, weaker than expectations of +0.3% m/m. At the same time, the University of Michigan’s U.S. June consumer sentiment index was unexpectedly revised higher to 60.7, stronger than expectations of 60.4. Minneapolis Fed President Neel Kashkari said on Friday that he expects two 25-basis-point rate cuts to be likely this year, with the first possibly coming in September, but cautioned that tariffs could have a lagging effect on inflation and that officials should remain flexible. U.S. rate futures have priced in a 78.8% probability of no rate change and a 21.2% chance of a 25 basis point rate cut at the next FOMC meeting in July. In this holiday-shortened week, the U.S. June Nonfarm Payrolls report will be the main highlight, as signs of a weak labor market could bolster expectations that the Federal Reserve could lower interest rates sooner. The report is released on Thursday this month due to the U.S. Independence Day holiday falling on Friday. Ahead of the key jobs report, investors will monitor JOLTs job openings data for May on Tuesday and ADP private payrolls figures for June on Wednesday for further insights into the health of the U.S. job market. Other noteworthy data releases include the U.S. ISM Manufacturing PMI, the S&P Global Manufacturing PMI, Construction Spending, Average Hourly Earnings, Initial Jobless Claims, Trade Balance, the Unemployment Rate, the S&P Global Composite PMI, the S&P Global Services PMI, Factory Orders, and the ISM Non-Manufacturing PMI. “The Fed would likely need to see clearer evidence of softness in the form of subdued payrolls growth and a rising unemployment rate to trigger an early move,” ING chief international economist James Knightley said in a note. Market watchers will also be focused on remarks from Fed Chair Jerome Powell, who is set to participate in the European Central Bank’s annual forum in Sintra, Portugal, this week. Mr. Powell will speak on a panel alongside his counterparts from the Eurozone, Japan, South Korea, and the U.K. In addition, President Trump’s “One Big Beautiful Bill” will be in the spotlight. Negotiations over Trump’s tax-cut bill are ongoing as Republicans work to persuade remaining holdouts to back it for final passage. The president has demanded that Congress send him the bill by July 4th. The House also needs to vote on the latest version of the legislation before it can be sent to the White House for Trump’s signature. Meanwhile, the U.S. stock markets will close early at 1 p.m. Eastern Time on Thursday and remain closed on Friday for the Independence Day holiday. Today, investors will focus on the U.S. Chicago PMI, which is set to be released in a couple of hours. Economists, on average, forecast that the Chicago PMI will stand at 42.7 in June, compared to the previous value of 40.5. Also, market participants will be anticipating speeches from Atlanta Fed President Raphael Bostic and Chicago Fed President Austan Goolsbee. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.254%, down -0.09%. We've got a much shortened, holiday trading week with the markets closing early on Thurs and closed on Friday. My lean or bias is to flat to down today. Futures are up a solid 22+ on /ES and 125+ on /NQ. I think today is a day for a pause or slight retrace. I'll look to book our profit on our bullish SPX at the open and work a potential retrace later today. The SPY climbed sharply this week, closing at a record $614.91 (+3.48%) and entering price discovery mode. After holding key support at the 21 EMA and a major high-volume node, it pushed higher, with the gap below now protected by multiple technical levels. With bullish momentum intact, the 127.2% Fibonacci extension stands out as the next upside target. Tech led the charge this week, with QQQ closing at $548.09 (+4.04%) and reaching new all-time highs. Semiconductors drove much of the rally, helping QQQ extend its bounce off the 21 EMA and break out from a key high-volume node. With rate cut expectations gaining traction, tech bulls appear well-positioned to keep the momentum going. With small-caps looking to play catch-up, IWM ended the week at $215.48 (+2.99%). Having firmly held the 21 EMA support, the ETF now faces a low-volume area overhead, presenting a potential pathway back to its year-to-date highs. Small-caps tend to fare better with lower rates, making the imminent rate cuts even more important for small-cap traders to keep an eye on. I'll skip looking at the expected moves for this week since we only have three full trading days. There are some intra-day levels I'd like to look at for today. The first is gold. The second is oil Lastly, /ES 6264 is resistance with support at 6160. Trade docket for today. With just three full trading days it makes it a bit tougher for some of our normal trades. I'd like to get a 0DTE going on QQQ, SPX, /GC and /CL however, some of those may need to be 1 or 2 DTE's to get the setup we desire. We will have one earnings trade tomorrow with STZ. We will continue to scalp the /MNQ. See you all in the live trading room shortly.

0 Comments

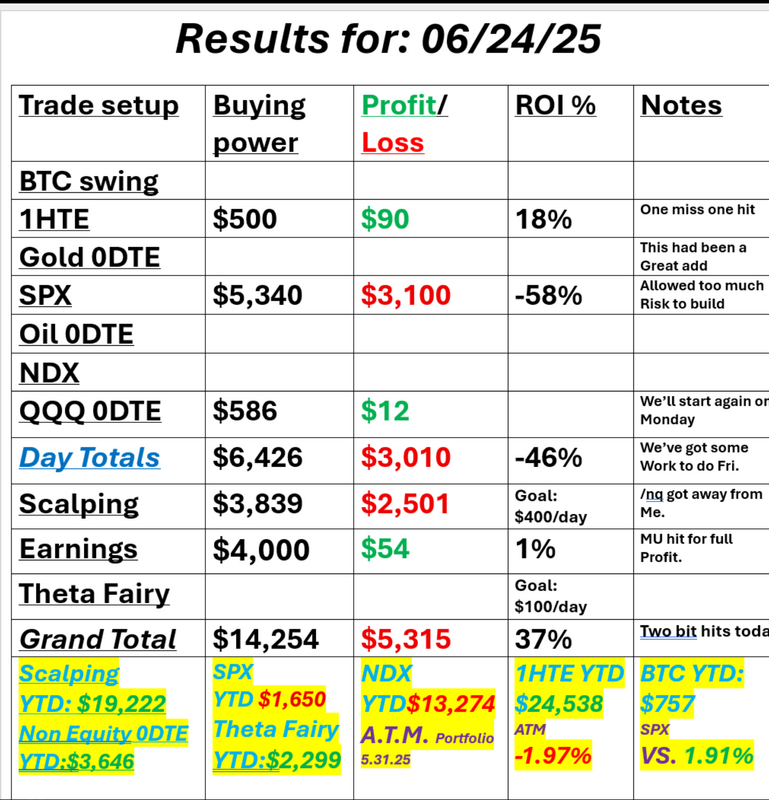

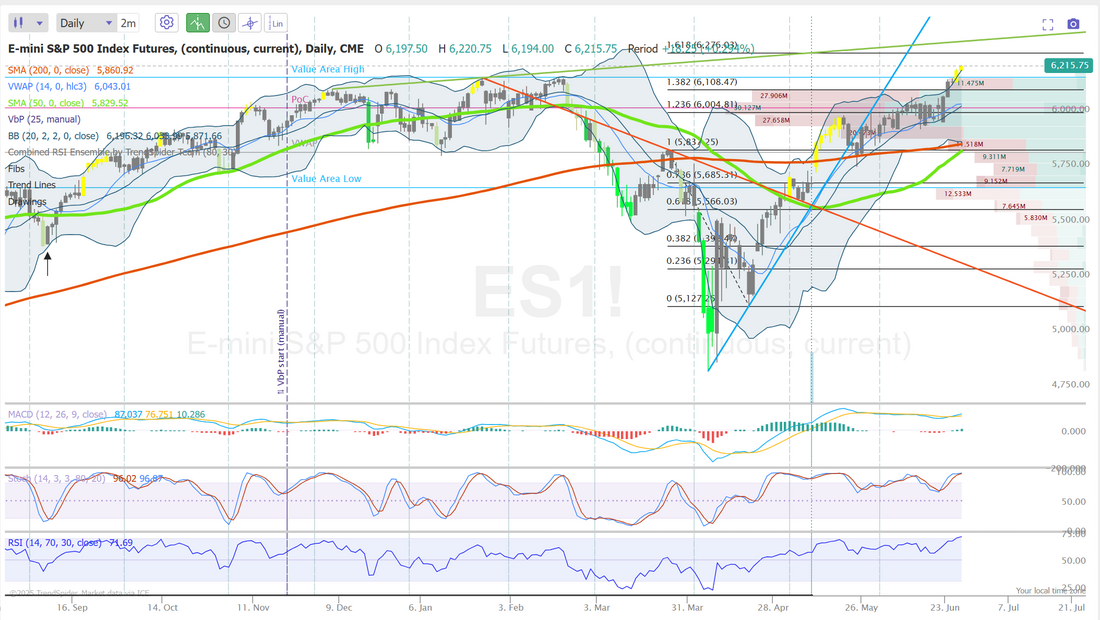

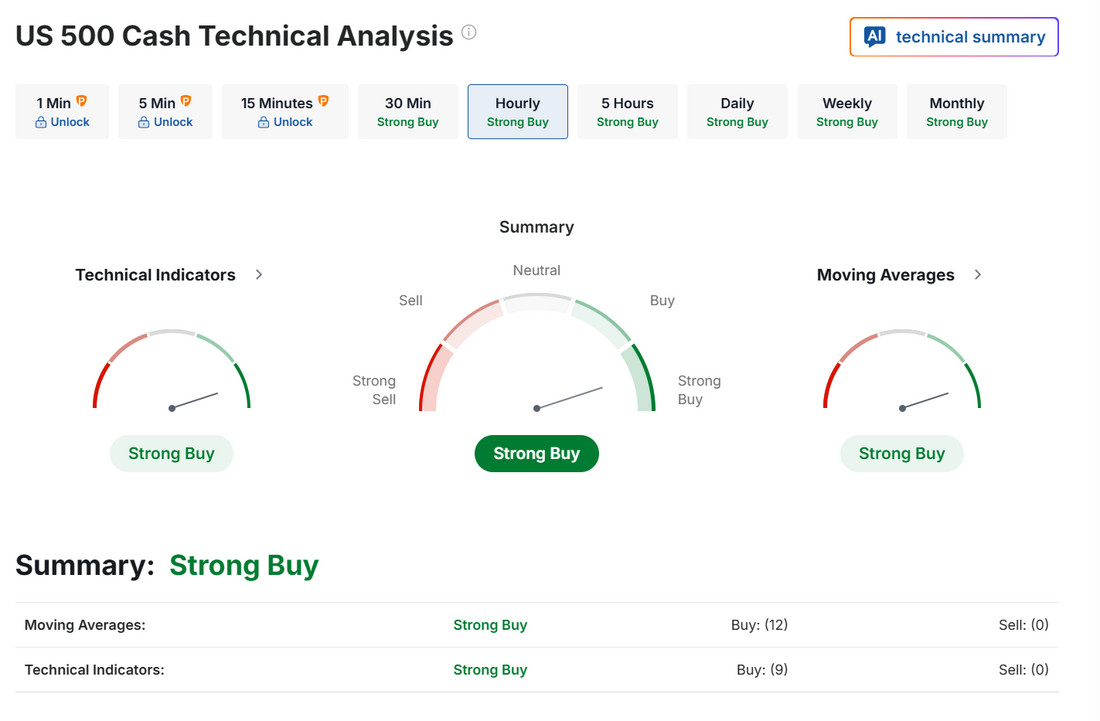

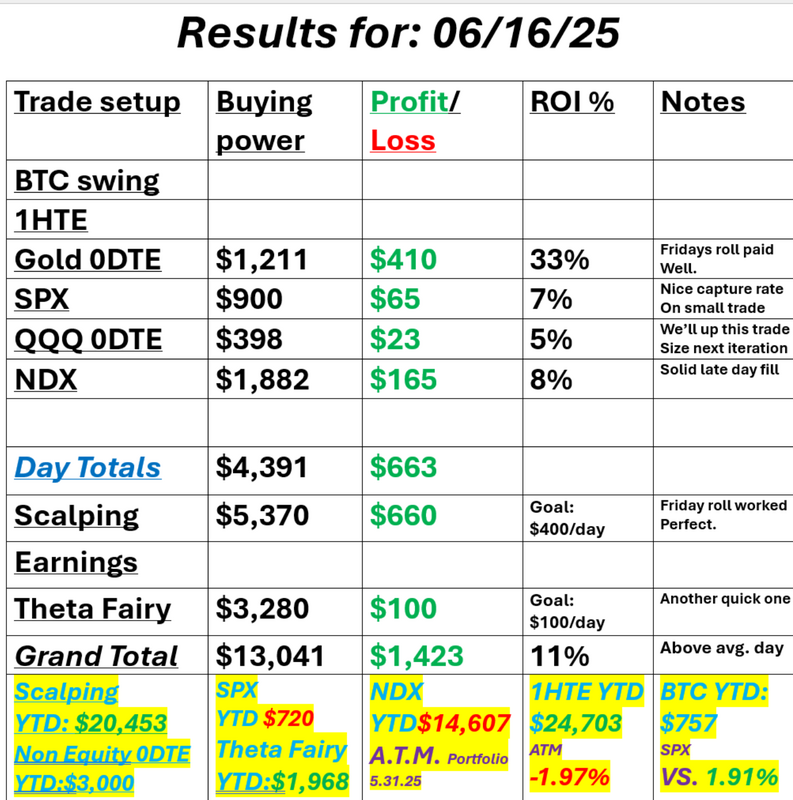

Time for some 1DTE'sWe've been missing some good setups lately because all the gains have come overnight. We talked about moving to some more 1DTE setups and that's what we'll be doing today. I'll focus on a 1DTE (actually 3DTE since it will be a Monday expiration) coupled with a 0DTE component on SPX. Yesterday was bad as I let risk get too far out of whack. I'll work to be better on that today. Here's a look at my day yesterday. September S&P 500 E-Mini futures (ESU25) are trending up +0.28% this morning amid renewed optimism about trade deals, while investors await the release of the Federal Reserve’s first-line inflation gauge. U.S. Commerce Secretary Howard Lutnick said late on Thursday that the U.S. and China had finalized an understanding on trade, and added that the White House is close to reaching agreements with 10 major trading partners ahead of a July 9th deadline when reciprocal tariffs are set to take effect. Also, the Treasury Department announced an agreement with G-7 allies that will exempt U.S. companies from certain foreign-imposed taxes in exchange for dropping the “revenge tax” provision from U.S. President Donald Trump’s tax bill. In yesterday’s trading session, Wall Street’s major indices closed higher. Enphase Energy (ENPH) surged over +12% and was the top percentage gainer on the S&P 500 on signs that Congress may not eliminate tax credits for rooftop solar panels. Also, chip stocks gained ground, with Marvell Technology (MRVL) climbing more than +5% to lead gainers in the Nasdaq 100 and Broadcom (AVGO) rising over +2%. In addition, McCormick & Co. (MKC) gained more than +5% after the spice maker posted better-than-expected FQ2 adjusted EPS and reaffirmed its full-year guidance. On the bearish side, Equinix (EQIX) slumped over -9% and was the top percentage loser on the S&P 500 after BMO Capital and Raymond James downgraded the stock. The U.S. Bureau of Economic Analysis’ third estimate showed on Thursday that the economy contracted at a 0.5% annualized pace in the first quarter, revised from the prior estimate of -0.2%. Also, U.S. durable goods orders shot up +16.4% m/m in May, stronger than expectations of +8.6% m/m, while core durable goods orders, which exclude transportation, rose +0.5% m/m, stronger than expectations of +0.1% m/m. In addition, U.S. pending home sales rose +1.8% m/m in May, stronger than expectations of +0.2% m/m. Finally, the number of Americans filing for initial jobless claims in the past week fell -10K to 236K, compared with the 244K expected. “The economy is slowing, but remains resilient. While the numbers as a whole don’t necessarily make a compelling case for bulls or bears, for the time being, the market appears fixated on tech strength and the S&P 500’s potential return to record levels,” said Chris Larkin at E*Trade from Morgan Stanley. Richmond Fed President Tom Barkin said on Thursday that he expects tariffs to exert upward pressure on prices, and with significant uncertainty still lingering, the central bank should wait for greater clarity before making any changes to interest rates. Also, Chicago Fed President Austan Goolsbee said the central bank could resume rate cuts if inflation shows a clear path toward the policymakers’ 2% target and uncertainty surrounding the economic outlook diminishes. In addition, San Francisco Fed President Mary Daly said she’s observing increasing evidence that tariffs may not trigger a significant or sustained inflation spike, supporting the argument for a rate cut in the fall. Meanwhile, U.S. rate futures have priced in a 79.3% chance of no rate change and a 20.7% chance of a 25 basis point rate cut at July’s monetary policy meeting. Today, all eyes are focused on the U.S. core personal consumption expenditures price index, the Fed’s preferred price gauge, which is set to be released in a couple of hours. Economists, on average, forecast that the core PCE price index will stand at +0.1% m/m and +2.6% y/y in May, compared to the previous figures of +0.1% m/m and +2.5% y/y. U.S. Personal Spending and Personal Income data will also be closely monitored today. Economists anticipate May Personal Spending to rise +0.1% m/m and Personal Income to grow +0.3% m/m, compared to the April figures of +0.2% m/m and +0.8% m/m, respectively. The University of Michigan’s U.S. Consumer Sentiment Index will be reported today as well. Economists expect the final June figure to be revised slightly lower to 60.4 from the preliminary reading of 60.5. In addition, market participants will be looking toward speeches from New York Fed President John Williams, Fed Governor Lisa Cook, and Cleveland Fed President Beth Hammack. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.270%, up +0.42%. The rare earth metals agreement with China is also helping lift the futures. Let's take a look at the technicals. New ATH's continuing to come in. Technicals are strongly bullish Trade docket is focused today: LULU and NKE with the main focus on a 3DTE/0DTE SPX setup. Let's take a look at the market levels: A look at the daily chart on VTI looks like clear sailing right now for bulls. The /ES futures look bullish as well albeit they do seem to be moving into an overbought zone. Let's see if we can define some zones to look at intra-day on /ES. This is always a bit tough when we are working in ATH areas. 6265 is the top resistance zone with 6165 working as support. 6109 is the next level down. This is a wide zone and while everything looks bullish we are overstretched. A bearish or neutral play may be in the cards for me today. I'll see you all in the live trading room! Let's get our risk right and let the trade do what it will do!

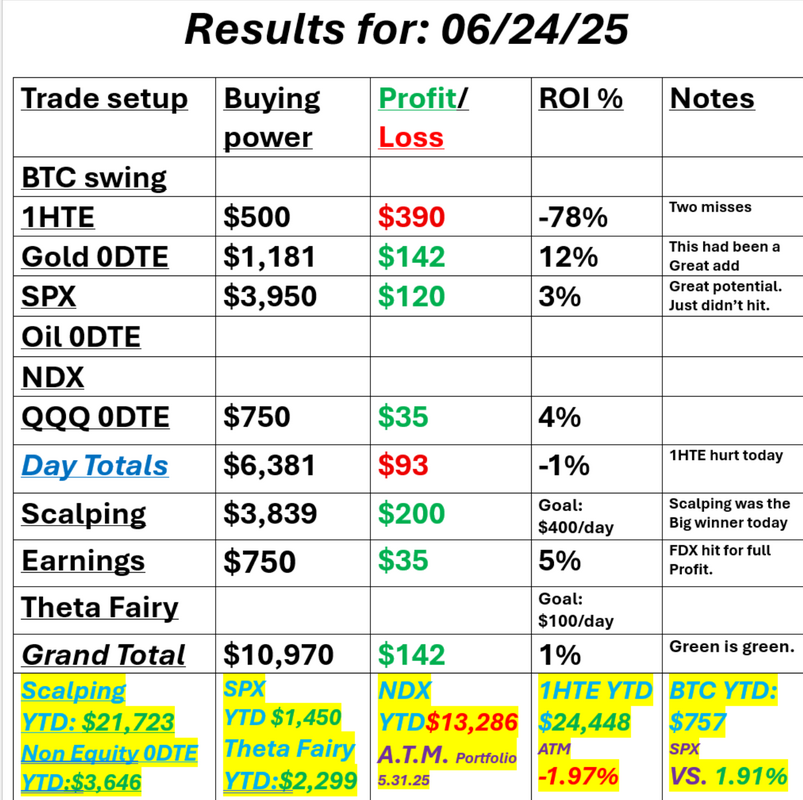

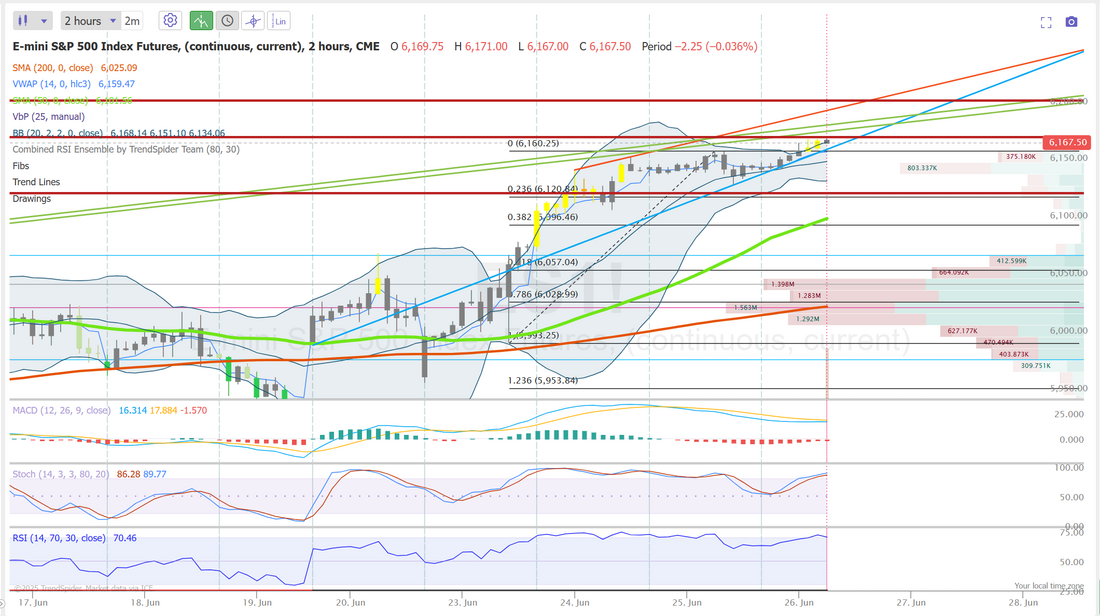

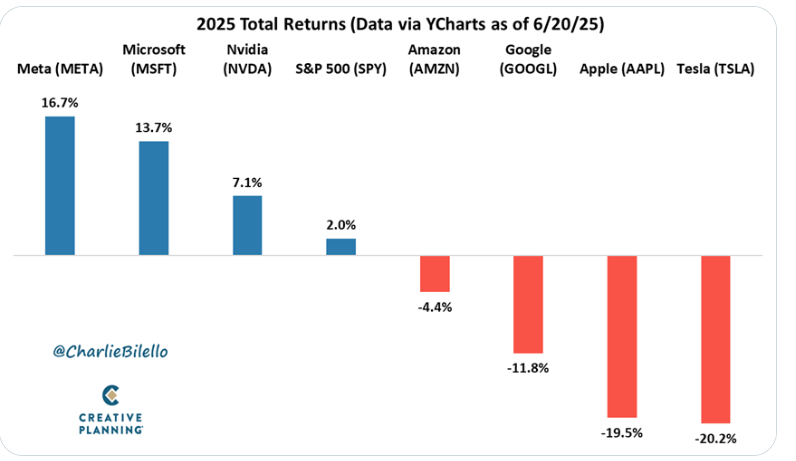

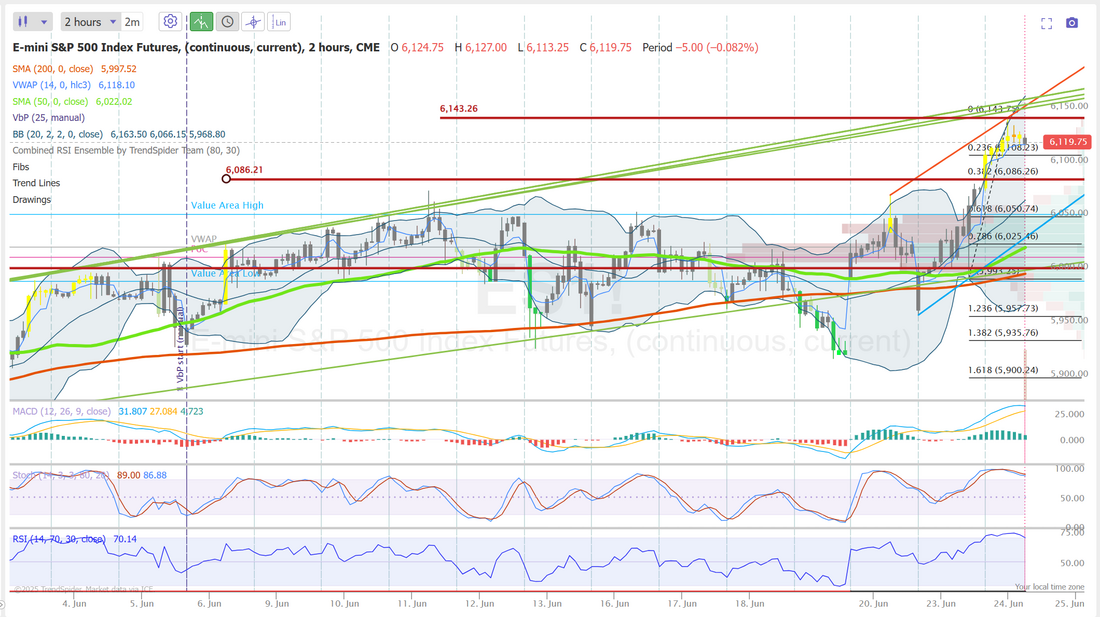

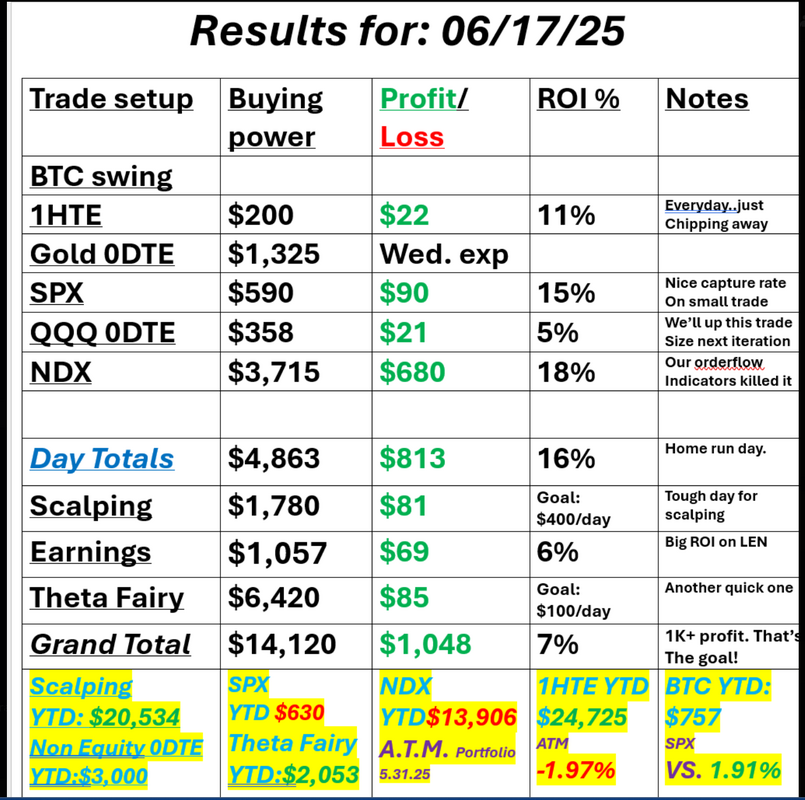

New highs incoming?Markets are finally breaking out and pushing up. Can we establish new highs? Well, eventually we always do right? It's hard to juxtapose the hightented risk economically that we face with the bullish price action but right now the market seems to want to stretch its legs. We had an o.k. day yesterday. We had two rare misses on 1HTE's which hurt and we didn't make much on our SPX 0DTE but I'm o.k. with all of that because we build our SPX for over $1,110 profit potential IF it hit. As long as we can build for big gains and keep our risk low if it doesn't hit then I'm happy. Our risk went a bit too high yesterday on our SPX but that happens from time to time. Here's a look at our day: Let's take a look at the market. Buy mode is fully engaged here. My intra-day levels are the same for me today as yesterday. 6171 is current resistance with 6205 next. 6123 is support. Indices are pushing towards those new ATH's. September S&P 500 E-Mini futures (ESU25) are up +0.33%, and September Nasdaq 100 E-Mini futures (NQU25) are up +0.41% this morning amid speculation that U.S. interest rate cuts could arrive earlier than expected, following a report that U.S. President Donald Trump may nominate the next Federal Reserve chair early. The Wall Street Journal reported that President Trump is considering announcing his pick to replace Jerome Powell as early as September amid his frustration over the Fed’s cautious pace on rate cuts. Typically, a Fed chair is nominated 3-4 months before taking office, and with Powell’s tenure not concluding until May 2026, this could effectively result in a shadow central bank chair with the ability to influence sentiment. OCBC strategists said, “Some believe that this may allow for the chair-in-waiting to influence market expectations about the potential path for rates.” Investors now await a flurry of U.S. economic data, including the third estimate of first-quarter GDP and jobless claims figures, remarks from Federal Reserve officials, and an earnings report from shoemaker Nike. In yesterday’s trading session, Wall Street’s major indexes ended mixed. Super Micro Computer (SMCI) climbed over +8% and was the top percentage gainer on the S&P 500 after GF Securities Ltd initiated coverage of the stock with a Buy rating and a price target of $59. Also, Nvidia (NVDA) rose more than +4% and was the top percentage gainer on the Nasdaq 100 and Dow after Loop Capital raised its price target on the stock to $250 from $175, citing what it described as a “$2 trillion AI data center opportunity” by 2028. In addition, QuantumScape (QS) jumped over +30% after the company announced it had successfully integrated its advanced Cobra separator process into baseline cell production. On the bearish side, Paychex (PAYX) plunged more than -9% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the company reported in-line FQ4 results. Economic data released on Wednesday showed that U.S. new home sales fell -13.7% m/m to a 7-month low of 623K in May, weaker than expectations of 694K. Fed Chair Jerome Powell said during a Senate Banking Committee hearing on Wednesday that the central bank is still struggling to determine the impact of tariffs on consumer prices. “The question is, who’s going to pay for the tariffs?” Powell told lawmakers in response to a question on the second day of his semi-annual testimony to Congress. “How much of it does show up in inflation. And honestly, it’s very hard to predict that in advance.” The Fed chief also stated that the U.S. has the world’s strongest economy and that moving cautiously is appropriate during periods of uncertainty. “If it were not for the uncertainty created by shifting trade policy, the Fed may have been able to cut interest rates this summer,” said Carol Schleif at BMO Private Wealth. “The Fed’s pause on interest-rate cuts is tariff-induced, and not necessarily reflective of economic progress. We expect one to two cuts in 2025, starting most likely in September.” U.S. rate futures have priced in a 75.2% probability of no rate change and a 24.8% chance of a 25 basis point rate cut at the next central bank meeting in July. Today, all eyes are focused on the U.S. Commerce Department’s final estimate of gross domestic product. Economists expect the U.S. economy to contract at an annual rate of 0.2% in the first quarter. Investors will also focus on U.S. Durable Goods Orders and Core Durable Goods Orders data. Economists expect May Durable Goods Orders to be +8.6% m/m and Core Durable Goods Orders to be +0.1% m/m, compared to the prior figures of -6.3% m/m and +0.2% m/m, respectively. U.S. Pending Home Sales data will be reported today. Economists foresee the May figure coming in at +0.2% m/m, compared to the previous figure of -6.3% m/m. U.S. Wholesale Inventories data will come in today. Economists forecast the preliminary May figure at +0.2% m/m, the same as in April. U.S. Initial Jobless Claims data will be released today as well. Economists estimate this figure will come in at 244K, compared to 245K last week. In addition, market participants will parse comments today from Richmond Fed President Tom Barkin, Cleveland Fed President Beth Hammack, Fed Governor Michael Barr, and Minneapolis Fed President Neel Kashkari. Meanwhile, notable companies like Nike (NKE), McCormick & Company (MKC), and Walgreens Boots Alliance (WBA) are set to report their quarterly results today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.283%, down -0.16%. My lean or bias is a bit contrary today. Technicals are all bullish. Price action is bullish. Indices are pushing to new ATH's. We've basically been trending up since May 23rd! That's a long, nice run. I think we may be getting a bit tired here. /NQ futures are up 100+ points as I type. I think we either hold these levels or give some back today. Trade docket for today: We've got our MU earnings trade to book profits on this morning. NKE will be our new earnings trade today. Three 0DTE's today with QQQ, SPX and Gold. LULU and ORCL continued work. 1HTE attempt again. We are continuing to scalp with a long /MNQ (/NQ cover). The mag seven are losing their leadership status in the market. I look forward to seeing you all in the live trading room!

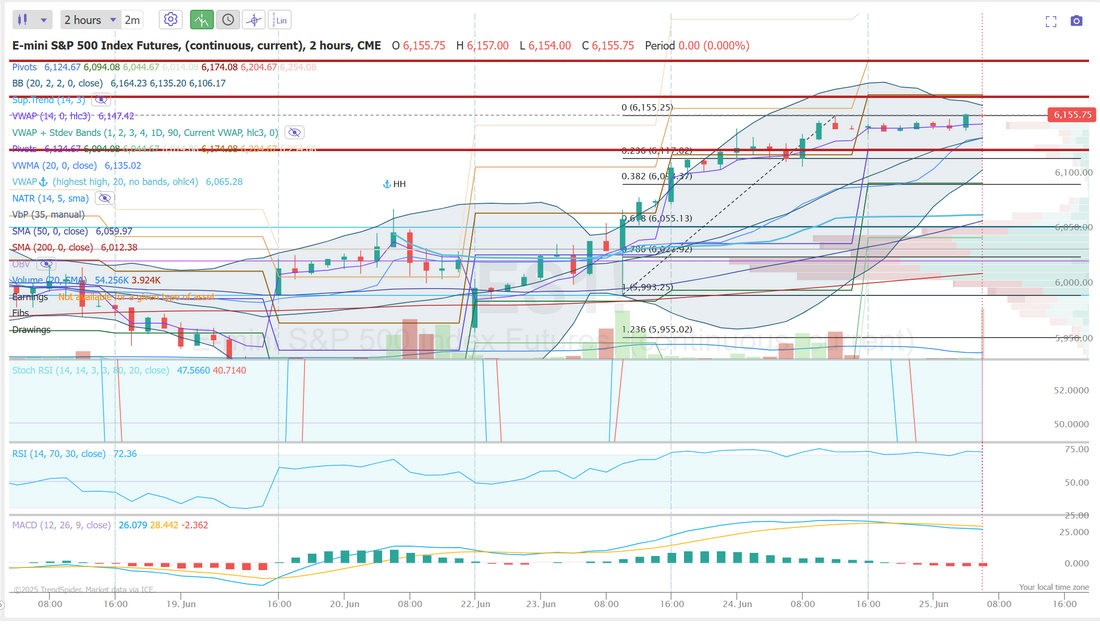

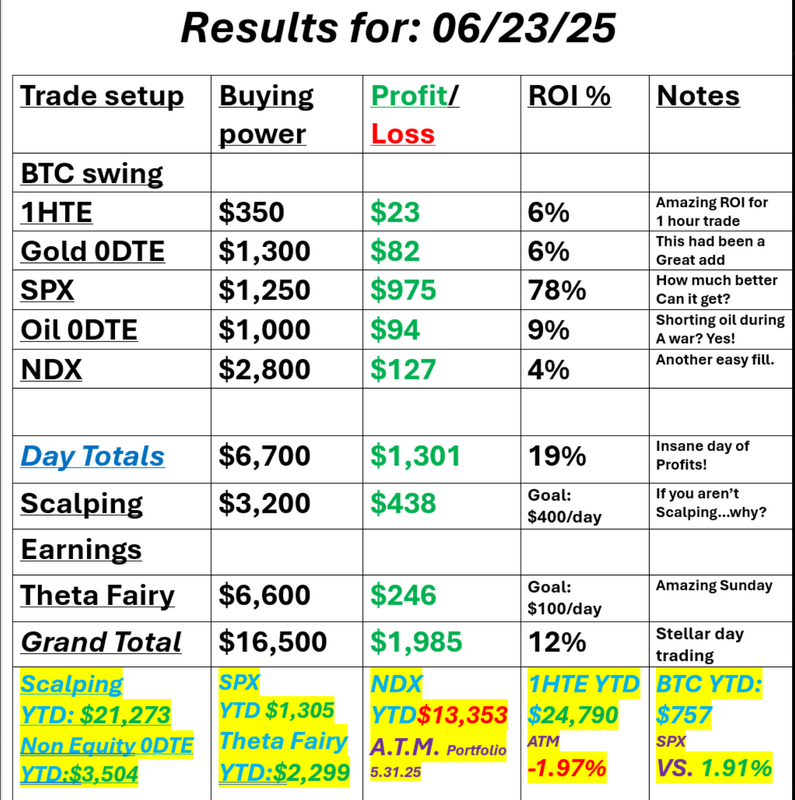

The power of gratitudeIt's interesting how each trading day is so different. Sunday night we were going full steam and that flowed into Monday. Everything was clicking and there were opportunities a plenty. Yesterday was the opposite for me. Even before the market opened I wasn't liking the futures action and didn't see anything that excited me. Ironically our ROI yesterday was amazing but I just never found anything that I was willing to put substantive buying power into. It was a long (very long), boring day. I wasn't stoked when the dust settled but...we made money. I'm big on gratitude. It's important to express gratitude daily because if you don't the negative will take you focus, and there's always negative! I've committed to myself that any day that is green is a good day and yesterday we were green. Here's our results: The path to higher valuations seems to be happening. After almost three weeks of consolidation the market seems to be having some success in pushing higher. With focus shifting away from the Israel-Iran war back to the economy, the FED and Tariffs. I'm bullish today. We've already setup a long /MNQ scalp to work around today. September S&P 500 E-Mini futures (ESU25) are trending up +0.01% this morning as investors shift their focus to fundamentals, with Federal Reserve Chair Jerome Powell’s congressional testimony set to resume later in the day. The ceasefire brokered by U.S. President Donald Trump between Iran and Israel appeared to be holding on Wednesday, with both sides declaring victory in the war. Trump’s Middle East envoy said late on Tuesday that talks between the U.S. and Iran were “promising” and that Washington remained hopeful for a long-term peace agreement. Investors are now turning their attention back to the U.S. economy and how trade tensions and fiscal pressures could impact corporate earnings and growth. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed higher. Chip stocks rallied, with Intel (INTC) and Advanced Micro Devices (AMD) climbing over +6%. Also, DexCom (DXCM) surged more than +9% and was the top percentage gainer on the Nasdaq 100 after U.S. Health and Human Services Secretary Robert F. Kennedy Jr. announced that his agency is launching one of the largest campaigns in history to promote the use of wearable health devices. In addition, Uber Technologies (UBER) gained over +7% after the company announced that it would begin offering driverless Waymo rides to its customers in Atlanta. On the bearish side, Dollar General (DG) fell more than -1% after Goldman Sachs downgraded the stock to Neutral from Buy. Economic data released on Tuesday showed that the U.S. Conference Board’s consumer confidence index unexpectedly fell to 93.0 in June, weaker than expectations of 99.4. Also, the U.S. April S&P/CS HPI Composite - 20 n.s.a. eased to +3.4% y/y from +4.1% y/y in March, weaker than expectations of +4.0% y/y. In addition, the U.S. Richmond Fed manufacturing index unexpectedly rose to -7 in June, stronger than expectations of -10. Fed Chair Jerome Powell told lawmakers on Tuesday that the central bank is not in a hurry to cut interest rates as officials await greater clarity on the economic effects of President Trump’s tariffs. “The effects of tariffs will depend, among other things, on their ultimate level,” Powell said in remarks before the House Financial Services Committee. “For the time being, we are well-positioned to wait to learn more about the likely course of the economy before considering any adjustments to our policy stance.” Should inflation come in below expectations or the labor market weaken, Powell said, the Fed could cut rates sooner. Cleveland Fed President Beth Hammack said that interest rates are only modestly restrictive and that policymakers may keep borrowing costs steady “for quite some time.” Also, New York Fed President John Williams said that “maintaining this modestly restrictive stance of monetary policy is entirely appropriate to achieve our maximum employment and price stability goals,” while policymakers assess the full impact of U.S. policy changes. In addition, Boston Fed President Susan Collins said that monetary policy is in the right place, emphasizing that the “modestly restrictive” stance of monetary policy is “necessary.” Finally, Fed Governor Michael Barr stated that he expects tariffs to push inflation higher and voiced support for maintaining a wait-and-see approach on interest rates. Meanwhile, U.S. rate futures have priced in an 81.4% chance of no rate change and an 18.6% chance of a 25 basis point rate cut at the July FOMC meeting. Today, investors will closely watch Fed Chair Jerome Powell’s semi-annual monetary policy testimony before the Senate Banking Committee. On the economic data front, investors will focus on U.S. New Home Sales data, which is set to be released in a couple of hours. Economists foresee this figure coming in at 694K in May, compared to 743K in April. U.S. Crude Oil Inventories data will be released today as well. Economists expect this figure to be -1.200M, compared to last week’s value of -11.473M. On the earnings front, notable companies like Micron Technology (MU), Paychex (PAYX), General Mills (GIS), and Jefferies Financial (JEF) are set to report their quarterly figures today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.287%, down -0.07%. Trade docket for today: We have four 0DTE's for today. Oil (/CL), SPX, QQQ, Gold (/GC). FDX earnings, MU earnings, LULU and ORCL, 1HTE BTC . We are continuing to scalp with the /MNQ long this morning. Let's take a look at our new intra-day levels. We've finally had some movement. The first key resistance is where we sit right now, as I type. 6155. We are literally pinned on that right now. Above 6155 comes 6173 with 6204 above that. What can the bulls do with these levels today? Support is 6124. I look forward to seeing you all again in the live trading room shortly.

Si vis pacem, para bellumThis latin saying hangs on a sign in my trading office. It means, "If you want peace, prepare for war." Below it I have the saying "Acta non verba" which means, "Actions not words". I was thinking about this lately as Trump used power to REDUCE global risk from the largest terrorist organisation in the world. It applies to our trading as well. One of our mantras is, "hope for the best, expect the worst". If we build trades hoping for the best case outcome but focus on the worst case scenarios and manage the trade from that viewpoint we tend to do better. We had a stellar day yesterday with multiple 0DTE's, one of them shorting oil (who would have thought?) Take a look at our day below: September S&P 500 E-Mini futures (ESU25) are up +0.67%, and September Nasdaq 100 E-Mini futures (NQU25) are up +0.89% this morning as sentiment got a boost after U.S. President Donald Trump announced a ceasefire between Israel and Iran. President Trump announced late on Monday that Israel and Iran had agreed to a ceasefire that could pave the way to ending the war. Hours later, Mr. Trump confirmed that the ceasefire was now in effect and called on both nations to honor the agreement. “PLEASE DO NOT VIOLATE IT!” he said in a social media post at 1:08 a.m. ET. Trump’s statement was soon followed by a confirmation from Israeli Prime Minister Benjamin Netanyahu that his country had agreed to a truce. Iranian Foreign Minister Abbas Araghchi said in an earlier post that his country would cease fire as long as Israel did. Stock index futures trimmed some gains after Israel reported detecting a missile launch from Iran just hours after the truce announcement and ordered the military to “respond forcefully to Iran’s violation of the ceasefire.” At the same time, Iran rejected claims it had launched the missiles after the truce, according to the state-run news agency. President Trump said on Tuesday that he believed both Israel and Iran breached the ceasefire he had announced just hours earlier, adding that he was not happy with both nations, but particularly with Israel. “I think they both violated it,” Trump said as he departed the White House to attend the NATO summit at The Hague. But when asked whether the ceasefire was breaking, Trump replied, “I don’t think so.” Investors now await a fresh batch of U.S. economic data and Federal Reserve Chair Jerome Powell’s congressional testimony. In yesterday’s trading session, Wall Street’s main stock indexes ended in the green. Tesla (TSLA) surged over +8% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the electric vehicle maker rolled out its robotaxi service to some riders in Austin, Texas. Also, Northern Trust (NTRS) climbed more than +8% after the Wall Street Journal reported that Bank of New York Mellon had approached the company last week to express interest in a merger. In addition, Estee Lauder (EL) gained over +4% after Deutsche Bank upgraded the stock to Buy from Hold with a price target of $95. On the bearish side, Hims Hers Health (HIMS) plummeted more than -34% after Novo Nordisk ended its partnership with the telehealth company. Economic data released on Monday showed that the U.S. S&P Global manufacturing PMI was unchanged at 52.0 in June, stronger than expectations of 51.1. Also, U.S. May existing home sales unexpectedly rose +0.8% m/m to 4.03M, stronger than expectations of 3.96M. At the same time, the U.S. S&P Global services PMI fell to 53.1 in June, though the decline was less than the expected 52.9. Chicago Fed President Austan Goolsbee said on Monday that the absence of evident inflation pressure following President Trump’s April 2nd tariffs could give the central bank room to resume cutting interest rates. “If we do not see inflation resulting from these tariff increases, then in my mind, we never left what I was calling the golden path before April 2,” Goolsbee said. Also, Fed Vice Chair for Supervision Michelle Bowman said, “Should inflation pressures remain contained, I would support lowering the policy rate as soon as our next meeting in order to bring it closer to its neutral setting and to sustain a healthy labor market.” Meanwhile, U.S. rate futures have priced in a 77.3% chance of no rate change and a 22.7% chance of a 25 basis point rate cut at the next FOMC meeting in July. Today, market participants will focus on Fed Chair Jerome Powell’s semi-annual monetary policy testimony before the House Financial Services Committee. Mr. Powell will likely stress that although rate cuts are possible this year, policymakers seek greater clarity on the economic effects of U.S. trade policy. Cleveland Fed President Beth Hammack, New York Fed President John Williams, Boston Fed President Susan Collins, and Fed Governor Michael Barr will also speak today. On the economic data front, all eyes are on the U.S. Conference Board’s Consumer Confidence Index, which is set to be released in a couple of hours. The reading will be closely monitored amid recent weak sentiment indicators that have been moving markets due to tariff concerns. Economists, on average, forecast that the June CB Consumer Confidence index will stand at 99.4, compared to last month’s figure of 98.0. Investors will also focus on the U.S. S&P/CS HPI Composite - 20 n.s.a. Economists expect the April figure to be +4.0% y/y, compared to +4.1% y/y in March. The U.S. Richmond Fed Manufacturing Index will be released today as well. Economists foresee this figure coming in at -10 in June, compared to the previous value of -9. On the earnings front, delivery giant FedEx (FDX) and cruise line operator Carnival Corp. (CCL) are slated to release their quarterly results today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.347%, up +0.65%. My bullish lean yesterday worked out well for us with a big win on our SPX 0DTE. Futures are up this morning as I type but I'm leary as to how much upside we'll have today. I may work more neutral to bearish positions today. Our technical matrix is flashing bullish with the push yesterday and this morning. The markets are looking (and trying) to break out to the upside. It's been a tough go though. Trade docket for today: QQQ restart with a 0DTE portion. GNE, UNFI, CTGO, KFS, SLP additions, ORCL, FDX earnings play, SPX 0DTE, 1HTE BTC trade, /MNQ scalping, New Gold 1DTE. Let's take a look at our intra-day /ES levels: 6143 is new resistance with 6088 working as support. you all in the live trading room shortly!

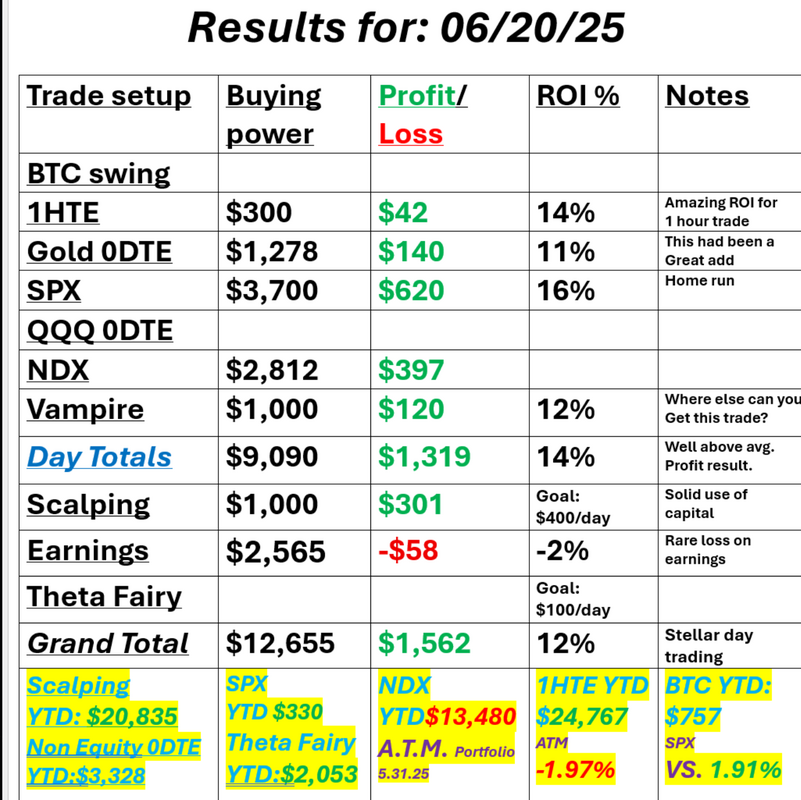

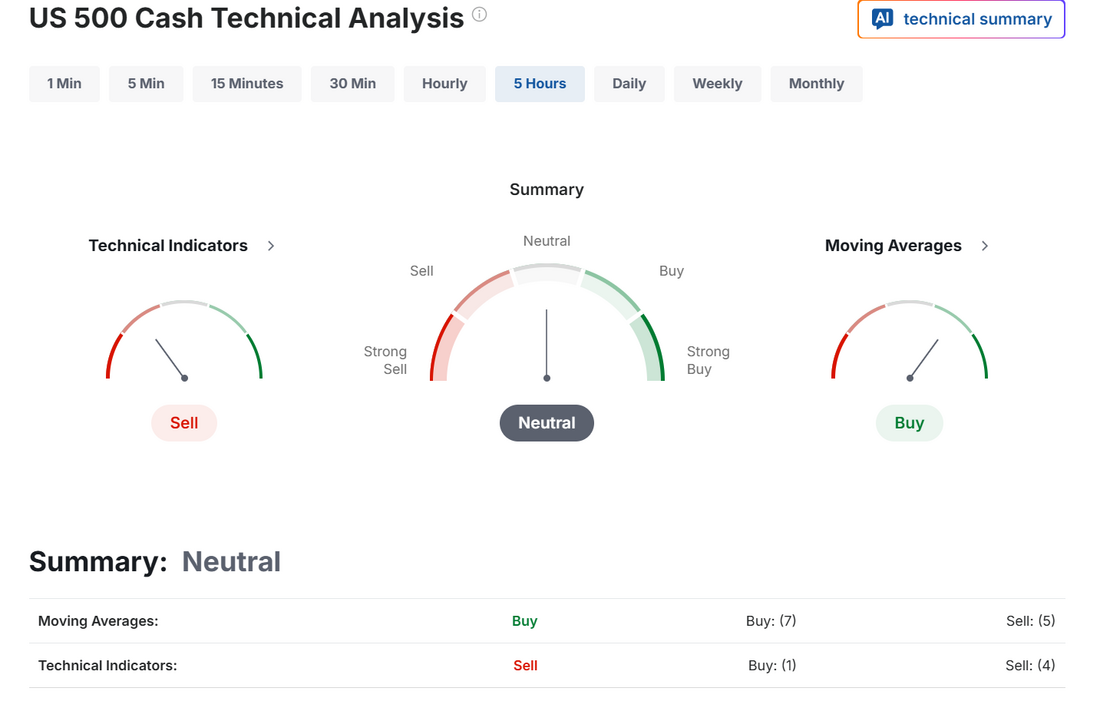

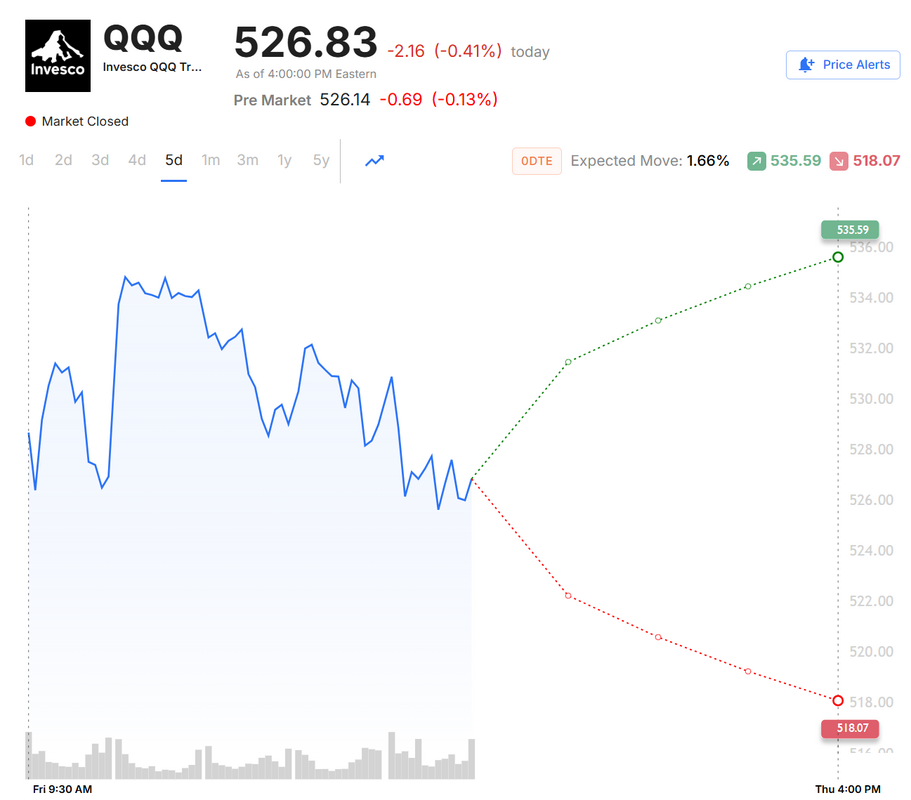

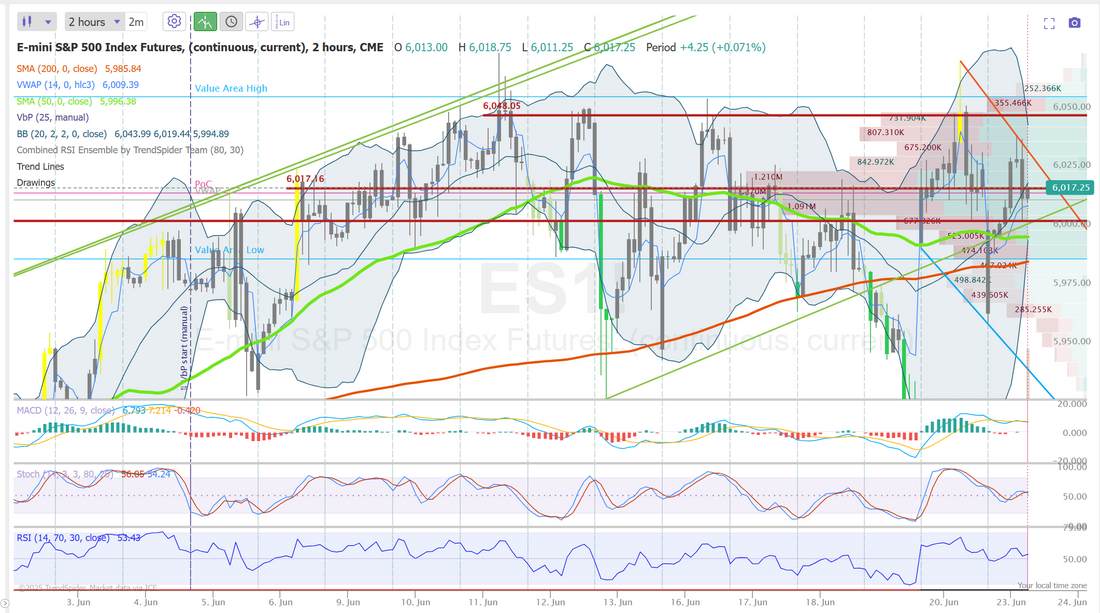

Do you trade on Sundays?One of the things I'm most proud about our trading room is that our trading week starts Sunday evening. Our daily profit goal is $1,000+ dollars of profit. Sometimes that's easy and sometimes it just seems like an impossible goal but getting a head start to the week certainly helps. We put over $500 dollar profit in our pockets Sunday night being on top of the Iran news. Starting today already half way to our profit goal is certainly nice and takes a bit of pressure off for today. Here's a look at our results from Friday. It was a well above goal, profit day, even with a rare overall loss on our earnings trades. September S&P 500 E-Mini futures (ESU25) are down -0.22%, and September Nasdaq 100 E-Mini futures (NQU25) are down -0.23% this morning, pointing to a slightly lower open on Wall Street as investors cautiously await Tehran’s response after the U.S. struck Iran’s nuclear facilities. The U.S. struck three Iranian sites over the weekend that form the backbone of the country’s nuclear infrastructure. U.S. President Donald Trump hailed the strikes as a “spectacular military success” in a Saturday night address, while cautioning that more could follow if “peace does not come quickly.” Investors are watching for Iran’s response to the airstrike, as it could drive sentiment. Tehran has stated that all options are on the table, including trade disruptions through the Strait of Hormuz, a key route for 20% of global oil and gas shipments. Still, crude prices gave up earlier gains amid speculation that the threat of oil trade disruption may not materialize. Analysts noted that Iran will likely avoid a full-scale retaliation. “Markets are still waiting to see what Iran will do next. Hormuz is still open, trade is flowing, Iran’s crude production facilities were untouched,” said analysts at Peak Trading Research. Investor focus this week is also on Federal Reserve Chair Jerome Powell’s congressional testimony, earnings reports from several high-profile companies, and the release of the Fed’s preferred inflation gauge and other key economic data. In Friday’s trading session, Wall Street’s major equity averages closed mixed. Chip stocks retreated after The Wall Street Journal reported that the U.S. might revoke waivers for allies with semiconductor plants in China, with KLA Corp. (KLAC) sliding over -2% and Lam Research (LRCX) falling more than -1%. Also, Accenture (ACN) slumped over -6% and was the top percentage loser on the S&P 500 after the IT services company reported weaker-than-expected FQ3 new bookings. In addition, Smith & Wesson Brands (SWBI) tumbled more than -19% after the gunmaker posted downbeat FQ4 results. On the bullish side, Kroger (KR) surged over +9% and was the top percentage gainer on the S&P 500 after the retailer reported better-than-expected Q1 adjusted EPS and raised its full-year same-store sales guidance. Economic data released on Friday showed that the U.S. Philly Fed manufacturing index came in at -4.0 in June, weaker than expectations of -1.7. Also, the Conference Board’s leading economic index for the U.S. fell -0.1% m/m in May, in line with expectations. Fed Governor Christopher Waller said on Friday that the central bank could cut interest rates as early as next month, reaffirming his view that the inflationary impact of tariffs is likely to be short-lived. At the same time, San Francisco Fed President Mary Daly said that lowering interest rates this fall looks more appropriate than making a move when policymakers meet in July. “For me, I look more to the fall. By then, we’ll have quite a bit more information, and businesses are telling me that’s what they’re going to look to for some resolution,” Daly said. Meanwhile, U.S. rate futures have priced in an 85.5% probability of no rate change and a 14.5% chance of a 25 basis point rate cut at the conclusion of the Fed’s July meeting. This week, the May reading of the U.S. core personal consumption expenditures price index, the Fed’s preferred inflation gauge, will be the main highlight, as it may provide clues on the path for interest rates. The Conference Board’s consumer confidence survey for June will also be closely monitored amid recent weak sentiment indicators that have been moving markets due to tariff concerns. Other noteworthy data releases include U.S. GDP (third estimate), the S&P/CS HPI Composite - 20 n.s.a., Current Account, the Richmond Fed Manufacturing Index, Building Permits, New Home Sales, Durable Goods Orders, Core Durable Goods Orders, Initial Jobless Claims, Wholesale Inventories (preliminary), Pending Home Sales, Personal Income, Personal Spending, and the University of Michigan’s Consumer Sentiment Index. Fed Chair Jerome Powell’s semi-annual monetary policy testimony on Capitol Hill will also be in focus this week. Powell will testify before the House Financial Services Committee on Tuesday and the Senate Banking Committee on Wednesday. The Fed chief will likely stress that although rate cuts are possible this year, policymakers seek greater clarity on the economic effects of U.S. trade policy. President Trump has relentlessly attacked Powell for the central bank’s reluctance to cut interest rates, a criticism that may be echoed by some lawmakers. In addition to Mr. Powell delivering the Fed’s policy report, a host of other Fed officials, including Goolsbee, Bowman, Kugler, Williams, Hammack, Barr, Barkin, and Cook, are scheduled to speak this week. Market participants will be watching earnings reports from several high-profile companies as well, with shoemaker Nike (NKE), package delivery service FedEx (FDX), and chipmaker Micron Technology (MU) scheduled to report their quarterly results this week. Today, all eyes are focused on S&P Global’s flash U.S. purchasing managers’ surveys, as they serve as an important gauge of economic growth. The data come amid concerns over President Trump’s tariff policy and the ongoing conflict between Israel and Iran. Economists, on average, forecast that the June Manufacturing PMI will come in at 51.1, compared to last month’s value of 52.0. Also, economists expect the June Services PMI to be 52.9, compared to 53.7 in May. U.S. Existing Home Sales data will be released today as well. Economists foresee the May figure standing at 3.96M, compared to 4.00M in April. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.387%, up +0.27%. There's not a lot to read into the markets here. Bombs dropping all over the Mid east and the market just doesn't care. Neutral rating to start the day. I'd say we still look a bit more bearish than anything. The SPY closed the week lower at $594.28 (-0.45%) as rising geopolitical risks pressured risk appetite. A bearish RSI divergence is emerging while price clings to key support at the 8/21 EMA cloud, which aligns with a prominent high-volume node. If this bearish divergence plays out, the unfilled gap below stands out as the next likely downside target. QQQ ended the week relatively flat at $526.83 (-0.03%), as many of the big tech names like $NVDA and $MSFT finished in the green. Despite the ETF holding strong, a war catalyst could trigger a further rotation out of risk assets into safe havens and oil, potentially causing the bearish RSI divergence to play out. For bulls, the key test lies at the volume shelf and the 8/21 EMA cloud. If these support levels fail, the bears could take control and target the gap below. Small caps remained resilient this week as IWM closed at $209.21 (+0.14%). With large-caps near all-time highs, investors may be looking to diversify as the IWM sits at a high volume node and EMA cloud support. The ETF has already filled its gap below and does not have a bearish RSI divergence, potentially giving bulls a bit more confidence that these support levels will hold. My bias or lean today is slightly bullish. The market likes certainty and as backwards as it seems, the U.S. dropping bombs removes some uncertainty. I think we finish green today. Let's check out the expected moves for the week. 1.46% for the SPY. 1.66% for QQQ. This means once again that there is not a premium in NDX. We've had some good late day setups with it but it's not our main focus. Trade docket for today: Lot's of 0DTE's today! Gold (/GC) 0DTE. Oil (/CL) 0DTE, SPX 0DTE, /NQ scalp, We've already booked a MASSIVE profit on our Theta fairy. /ZS (soybeans) trade. LULU trade, ORCL? 1HTE BTC trade. Let's take a look at the intra-day levels: Surprise, surprise, it's the same levels from Friday. 6017 is first resistance with 6048 the next upside target. 6003 continues to be support. Below 6003 we've got some good downside potential. I love it when the day hasn't even started and we are already half way to our income goal! See you all in the live trading room shortly!

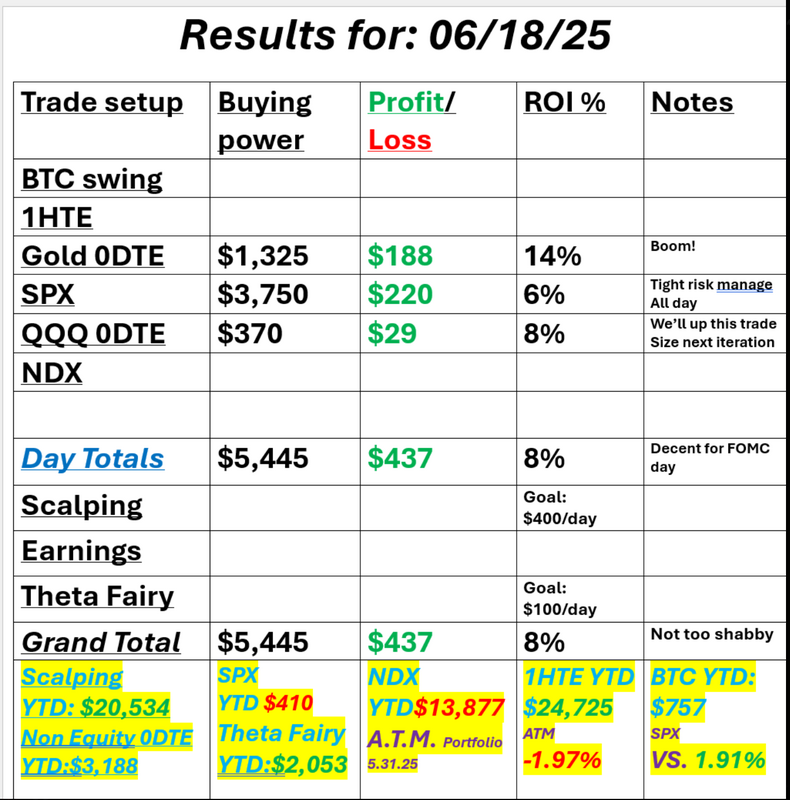

Triple witching and IranWelcome to Friday! Today could be an interesting one or...just a dud. It's a Friday. It's triple witching and we've got Iran news. Technicals are neutral and we are still stuck in the same range we've been in for over a month! As some point we'll break out of this consolidation zone. Tariff talk. The Fed. Iran war....none of it has been able to shake us out of this tight range. I'm not sure if today will be the day but it's coming...at some point. We've got our overnight Vampire trade expiring this morning and it looks like a profit which is a nice way to start the day. We weren't able to get anything working with scalping nor 1HTE's on Weds. so that hurt our potential for a $1,000+ profit day but it still ended up solid for us. Here's a look at our results. June S&P 500 E-Mini futures (ESM25) are trending up +0.15% this morning as cash trading resumed after the Juneteenth holiday, with investors digesting the White House’s signal that President Trump would delay a decision to launch strikes against Iran. The conflict between Israel and Iran entered its second week, with Israel hitting more nuclear sites in Iran on Thursday and warning that its strikes could bring down Tehran’s leadership, as both sides awaited a decision from U.S. President Donald Trump on whether to join the offensive. On Thursday afternoon, White House press secretary Karoline Leavitt said that President Trump would decide within two weeks whether the U.S. would participate in strikes against Iran, while noting there was a “substantial chance” of reaching a negotiated settlement. The news alleviated immediate concerns of U.S. military escalation, providing some relief to investors. As widely expected, the Federal Reserve left interest rates unchanged on Wednesday. The Federal Open Market Committee voted unanimously to keep the federal funds rate in a range of 4.25%-4.50% for the fourth consecutive meeting. In a post-meeting statement, officials said that “uncertainty about the economic outlook has diminished but remains elevated.” Policymakers also released updated quarterly rate projections and economic forecasts, lowering their estimates for economic growth this year while projecting higher inflation and unemployment. While the median projection for two rate cuts this year remained unchanged, officials now anticipate fewer cuts in 2026 and 2027. At a press conference, Fed Chair Jerome Powell reiterated his view that the central bank was “well positioned to wait to learn more about the likely course of the economy before considering any adjustments to our policy stance.” Powell also stated that rising tariffs are likely to push prices higher, cautioning that their impact on inflation could be more persistent. “They are clearly in wait-and-see mode. They are sitting on their hands, waiting to see if tariffs increase inflation or the jobs market starts to falter, and whichever part of their dual mandate is impacted first will likely guide whichever direction they take,” said Chris Zaccarelli at Northlight Asset Management. In Wednesday’s trading session, Wall Street’s major indexes ended mixed. Mastercard (MA) slid more than -5% to lead losers in the S&P 500, and Visa (V) fell over -4% to lead losers in the Dow amid continued worries about the impact of stablecoins on credit-card issuers. Also, Zoetis (ZTS) slid more than -4% after Stifel downgraded the stock to Hold from Buy. In addition, La-Z-Boy (LZB) fell over -1% after the furniture maker posted weaker-than-expected FQ4 adjusted EPS and issued soft FQ1 revenue guidance. On the bullish side, Coinbase (COIN) surged more than +16% and was the top percentage gainer on the S&P 500 after the Senate passed the Genius Act, legislation aimed at regulating stablecoins, and the company introduced Coinbase Payments, a stablecoin payments stack for commerce platforms. The Labor Department’s report on Wednesday showed that the number of Americans filing for initial jobless claims in the past week fell -5K to 245K, compared with the 246K expected. Also, U.S. May housing starts plunged -9.8% m/m to a 5-year low of 1.256M, weaker than expectations of 1.350M, while building permits, a proxy for future construction, fell -2.0% m/m to 1.393M, weaker than expectations of 1.420M. Meanwhile, Wall Street is bracing for a quarterly event known as “triple-witching,” during which derivatives contracts linked to equities, index options, and futures expire, prompting traders collectively to either roll over their current positions or initiate new ones. According to an estimate from Citi, $5.8 trillion of notional open interest across equities is set to expire today, including $4.2 trillion of index options, $708 billion of bets on U.S. ETFs, and $819 billion of single stock options. Rocky Fishman, founder of research firm Asym 500, estimated a larger figure of roughly $6.5 trillion, which also includes the notional value of options on equity index futures expiring today. On the economic data front, investors will focus on the U.S. Philadelphia Fed Manufacturing Index, which is set to be released in a couple of hours. Economists, on average, forecast that the June Philly Fed manufacturing index will stand at -1.7, compared to last month’s value of -4.0. The Conference Board’s Leading Economic Index for the U.S. will also be released today. Economists expect the May figure to be -0.1% m/m, compared to the previous number of -1.0% m/m. On the earnings front, notable companies like Accenture (ACN), Kroger (KR), Darden Restaurants (DRI), and CarMax (KMX) are slated to release their quarterly results today. U.S. rate futures have priced in a 91.7% chance of no rate change and an 8.3% chance of a 25 basis point rate cut at the next central bank meeting in July. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.403%, up +0.16%. Let's take a look at the markets. Technicals are a solid neutral to start the day. Not much to read into it. We see a tight range. A heavy overhang of resistance. A slight attempt to rollover but, still no definable trend. My lean or bias today is every so slightly bullish. Generally with neutral rated days we get a switch to bullish or bearish by the end of the day. Iran just said it was willing to come to the negotiation table and that popped the futures a bit. I'll be patient today with new 0DTE's. We've already got a Gold 0DTE and the Vampire 0DTE expiring today. Trade docket for today: We'll be unwinding our Gold 0DTE. Holy smoke these have been good. ACN, KMX, KR earnings trades should all print profits for us right at the open. LULU needs some work. Most of us got assigned the longs. I'd like to keep it but will need to scale down the size to be properly position sized. ORCL puts expire. QQQ will close today. /MNQ scalp is our focus in the scalping program and I believe we can get a 1HTE started this morning. Let's take a look at the intra-day levels on /ES. My levels are the same as Weds. 6047 is the resistance level and if bulls can push through that it could be what they need to start a new bullish uptrend. 6017 is support. It's pretty strong. Below that is the massive 6003 level that we've been trading around for what seems like an eternity. Let's have a great finish to a great week folks. See you in the trading room shortly!

More mechanical = less emotionsTheirs two camps on trading approach. Mechanical and discretionary. Mechanical is simply having a set of triggers and rules that dictate action. There is no emotion or thought that goes into your actions. Discretionary is all "gut". It's just you "thinking" what's right and jumping on it. I prefer to use both. Admittedly some of recent good results were discretionary setups. Situations where I said, "look, I don't see anything definitive here. I'm going to take a stab at this setup and manage with a tight stop if I'm wrong." Yesterday started off that way. No real signals. I told everyone to be patient and maybe something would appear. Late in the day we got that with the NDX. Our daily zoom feed from our scalping room is invaluable. It gave us a perfect setup and we were able to get our $1,000+ profit day after all. What was the signal? The exponential Stoc turned up. The Squeeze indicator fired buy. The Parabolic Sar flipped bullish as well as the Supertrend indicator. The current high candle got taken out and our audible order flow tracker was all buys. It was an automatic long. No thinking. No emotion. Just pull the trigger. The more you can implement mechanical entries into your trading, the less emotional you'll be and the better your results will be. Work to add as many mechanical triggers as you can to your trading. It will help you establish a stoic equanimity in your trading. Here's a look at our results from yesterday: une S&P 500 E-Mini futures (ESM25) are up +0.20%, and June Nasdaq 100 E-Mini futures (NQM25) are up +0.33% this morning, pointing to a slightly higher open on Wall Street after yesterday’s drop, while investors await the Federal Reserve’s policy decision and updated projections, as well as Chair Jerome Powell’s remarks. Investors also await updates on whether the U.S. plans to become directly involved in the conflict in the Middle East. The conflict between Israel and Iran entered a sixth day on Wednesday, showing no signs of easing. Reuters reported that U.S. President Donald Trump and his team were weighing several options, including joining Israel in strikes against Iranian nuclear facilities. President Trump demanded Iran’s unconditional surrender on Tuesday and threatened a potential strike against the country’s leader. Iran’s Supreme Leader rejected President Trump’s demand for unconditional surrender in a statement read by a television presenter on Wednesday, warning that U.S. military action would have “serious and irreparable consequences.” In yesterday’s trading session, Wall Street’s main stock indexes closed lower. Solar stocks cratered after Senate Republicans outlined revisions to President Trump’s tax-and-spending bill that would phase out solar, wind, and energy tax credits by 2028, with Sunrun (RUN) plummeting over -40%, and Enphase Energy (ENPH) tumbling more than -23% to lead losers in the S&P 500. Also, Lennar (LEN) slumped over -4% after the homebuilder posted weaker-than-expected FQ2 adjusted EPS. In addition, T-Mobile US (TMUS) slid over -4% after Bloomberg reported that shareholder SoftBank Group sold 21.5 million shares of the wireless network operator to finance its AI initiatives. On the bullish side, Jabil Circuit (JBL) climbed more than +8% and was the top percentage gainer on the S&P 500 after the supplier of electronic parts posted upbeat FQ3 results and raised its full-year revenue guidance. Economic data released on Tuesday showed that U.S. retail sales slumped -0.9% m/m in May, weaker than expectations of -0.5% m/m, while core retail sales, which exclude motor vehicles and parts, unexpectedly fell -0.3% m/m, weaker than expectations of +0.2% m/m. Also, U.S. May industrial production fell -0.2% m/m, weaker than expectations of no change m/m, while manufacturing production rose +0.1% m/m, in line with expectations. In addition, the U.S. import price index was unchanged m/m in May, stronger than expectations of -0.2% m/m. “Investors should still expect some volatility in economic data due to lingering effects of trade policy. The economy and the consumer are holding up for now, but there are signs of vulnerability. That could present risks in the second half of the year — particularly if we see a further slowdown in jobs or spending,” said Bret Kenwell at eToro. Today, all eyes are focused on the Federal Reserve’s monetary policy decision later in the day. The Federal Open Market Committee is widely expected to keep the Fed funds rate unchanged in a range of 4.25% to 4.50%. Market watchers will follow Chair Jerome Powell’s post-policy meeting press conference for hints on what could ultimately prompt the central bank to make a move on interest rates and when that might happen. The Fed’s quarterly “dot plot” in its Summary of Economic Projections, which shows FOMC members’ forecasts regarding the path of interest rates, will also be closely watched. Economists expect the Fed’s rate forecasts to remain largely unchanged – two cuts this year, followed by additional policy rate reductions in 2026. A survey conducted by 22V Research showed that the current tariff environment would lead to 25 basis points of cuts this year. “Investors believe that if the dot plot stays at two cuts, it will be because the inflation forecast doesn’t move up,” said Dennis DeBusschere, founder of 22V. On the economic data front, investors will focus on U.S. Initial Jobless Claims data, which is set to be released in a couple of hours. Economists expect this figure to be 246K, compared to last week’s number of 248K. U.S. Building Permits (preliminary) and Housing Starts data will also be reported today. Economists forecast May Building Permits at 1.420M and Housing Starts at 1.350M, compared to the prior figures of 1.422M and 1.361M, respectively. U.S. Crude Oil Inventories data will be released today as well. Economists foresee this figure standing at -2.300M, compared to last week’s value of -3.644M. Meanwhile, the U.S. stock markets will be closed tomorrow in observance of the Juneteenth federal holiday. The markets will reopen on Friday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.385%, down -0.11%. Trade docket for today is a bit different. With Thurs. being a holiday we'll get our Overnight Vampire trade started today. We have a Gold 0DTE today as well as a QQQ 0DTE. I'll also attempt to get three SPX 0DTE's working today. One at the open that is high theta and low prob. low risk that we can hopefully be able to take off in a couple hours. Another right before the FOMC min. release that we'll take back off right after the release and finally a third one after Powell starts speaking. ORCL will get some work. ACN, KR, KMX earnings trades. On FOMC days I don't provide a bias or levels as the algos will determine where we go today and we just need to remain flexible. There are a couple key levels I would keep and eye on, notwithstanding. 6003, 6017, 6047 are resistance levels. 5975 is support. Lot's to work on today. I'll see you all in the live trading room shortly.

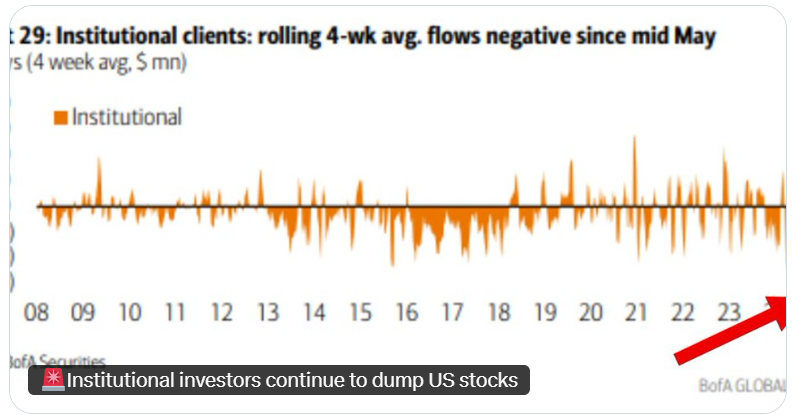

Planted seeds brought fruitWe had an excellent day yesterday and most of it was from trades we setup last Friday. We timed the rebound just right. Here's a look at our day: As the war drags on we'll see if the market fatigues or shrugs it off. FOMC is coming into focus and that should keep traders focus for the next couple days. Let's look at the markets. Still holding to a slight bullish bias. We find ourselves right back to the upper resistance band that we've been hitting up against for a while. My lean or bias today is more neutral, which probably means no debit entries. Trade docket for today: /MNQ scalp. LEN earnings. QQQ 0DTE. 1HTE BTC entry. SPX 0DTE, PX, SLP, UNFI long pair replacements. une S&P 500 E-Mini futures (ESM25) are trending down -0.46% this morning as the Israel-Iran conflict entered its fifth day, dimming investors’ hopes for a quick de-escalation between the two nations. Risk sentiment deteriorated after U.S. President Donald Trump called for the evacuation of Tehran, in comments that clashed with earlier optimism that Israel-Iran tensions would not escalate into a broader conflict. As Israel and Iran continued to trade missile strikes, President Trump abruptly ended his G-7 visit but stated that his return to Washington “has nothing to do with” a ceasefire. Trump said in a social media post on Tuesday that he had not contacted Iran for peace talks “in any way, shape or form.” “The degree of uncertainty is very high. So far, the market hasn’t captured an escalation of the conflict. Now we’re sailing in the fog,” said Laurent Lamagnere, head of development at AlphaValue. Investors also await the start of the Federal Reserve’s two-day policy meeting and a slew of U.S. economic data, with a particular focus on the retail sales report. In yesterday’s trading session, Wall Street’s three main equity benchmarks ended in the green. Chip stocks rallied, with Advanced Micro Devices (AMD) surging over +8% to lead gainers in the Nasdaq 100 and ON Semiconductor (ON) climbing more than +5%. Also, Roku (ROKU) gained over +10% after announcing an exclusive partnership with Amazon.com, enabling advertisers to tap into the largest authenticated Connected TV footprint in the U.S. through Amazon DSP. In addition, EchoStar (SATS) soared more than +49% after Bloomberg reported that U.S. President Trump stepped in to help settle the dispute between the FCC and the company regarding its spectrum licenses. On the bearish side, Sarepta Therapeutics (SRPT) cratered over -42% after suspending shipments of Elevidys for infusions in non-ambulatory patients following the death of a second patient from acute liver failure. Economic data released on Monday showed that the Empire State manufacturing index unexpectedly fell to -16.00 in June, weaker than expectations of -5.90. The Federal Reserve kicks off its two-day meeting later in the day. The central bank is widely expected to keep the Fed funds rate on hold in a range of 4.25% to 4.50% on Wednesday. Investors will follow Chair Jerome Powell’s post-policy meeting press conference for hints on what could ultimately prompt the central bank to make a move on interest rates and when that might happen. The Fed’s quarterly “dot plot” in its Summary of Economic Projections, which shows FOMC members’ forecasts regarding the path of interest rates, will also be closely watched. “[Powell] may describe recent inflation developments as encouraging, but also downplay their relevance given uncertainty ahead due to tariffs, fiscal policy, and the recent spike in the oil price due to geopolitical developments,” said David Doyle at Macquarie Group. On the economic data front, all eyes are focused on U.S. Retail Sales data, which is set to be released in a couple of hours. Economists, on average, forecast that May Retail Sales will stand at -0.5% m/m, compared to the April figure of +0.1% m/m. Investors will also focus on U.S. Core Retail Sales data, which came in at +0.1% m/m in April. Economists expect the May figure to be +0.2% m/m. U.S. Industrial Production and Manufacturing Production data will be reported today. Economists expect May Industrial Production to be unchanged m/m and Manufacturing Production to be +0.1% m/m, compared to the April figures of unchanged m/m and -0.4% m/m, respectively. U.S. Export and Import Price Indexes will be released today as well. Economists anticipate the export price index to be -0.1% m/m and the import price index to be -0.2% m/m in May, compared to the previous figures of +0.1% m/m and +0.1% m/m, respectively. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.427%, down -0.52%. Institutional investors have been selling US stocks almost every week in 2025: Professional investors sold $4.2 BILLION in US equities in the first week of June. The 4-week average of selling reached $2.0 billion. They continue to dump stocks Let's take a look at the key intra-day levels I'll be watching today: The 6000-6003 area continues to be a key support level. Below that and bears could build momentum. 6017 is the first resistance. If bulls can clear that 6048 could be the next upward target. I look forward to seeing you all in the live trading room shortly!

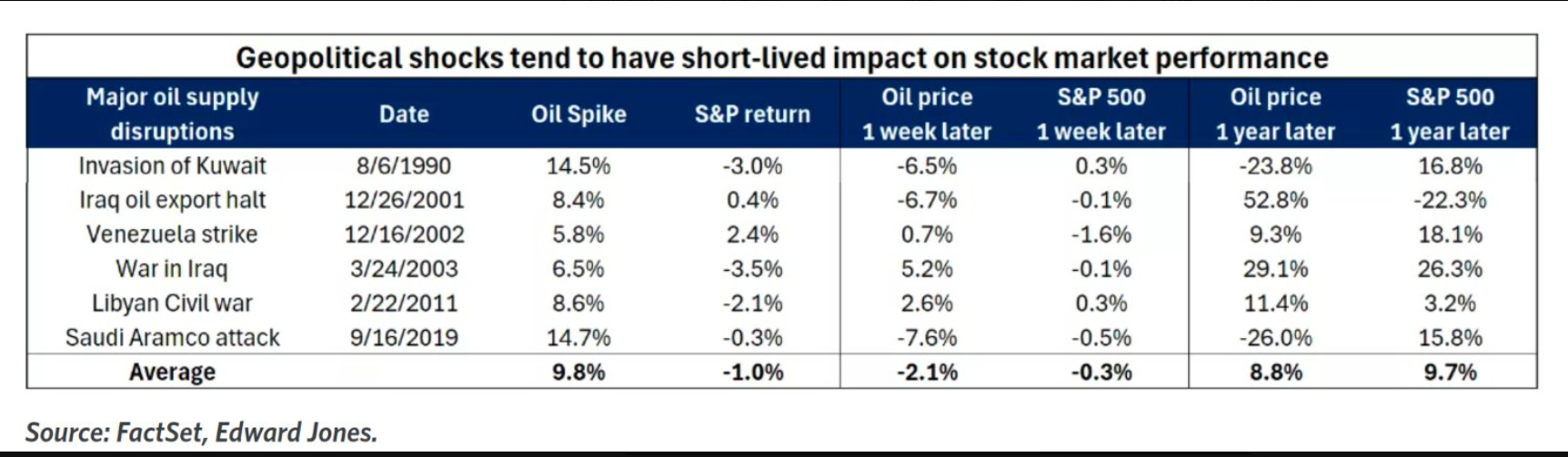

When bombs drop, markets pop...eventually.Welcome back to another holiday shortened trading week. It's been quite the year what with markets starting off with a correction. Then liberation day and tariffs. Now with the Iran/Israel war. We did well on Friday playing the rebound and we are already set for a good day today, having rolled a bullish /NQ scalp and a bearish /GC gold play to today. Those alone could give us our $1,000+ profit goal for the day. We also got a killer Theta fairy on last night, We started with the put side and it moved so fast we hit our take profit level before we could even get the call side on! I talked a lot of Friday about the undercut setup and we certainly took it to heart and have jumped all over it. Geo political events usually have little effect on markets, in the longer term. These are generally buying opportunities.

I've said this over and over. THE MARKET DOES NOT CARE ABOUT WARS! It cares greatly about uncertainty. Uncertainty is the boogie man to the stock market. It can deal with recessions, pandemics, wars, etc. It's the uncertainty of the future that it hates. We are set up for a banner day today but that is largely due to staring down the barrel of some scary news on Friday. We traded small on Friday as I thought that was appropriate. Here's a look at our day: Let's take a look at the markets. Indices are rolling over but we don't quite have a solid sell signal yet. Technicals this morning are back to neutral bias as it appears Israel will have largely accomplished it's mission to "de-nuke" Iran. SPY closed the week lower at $597.00 (-0.34%) as geopolitical tensions escalated with the outbreak of conflict between Israel and Iran. The recent peak coincided with a signal from TrendSpider CEO Dan Ushman’s custom QX QSB Score Markers Indicator, which integrates data from 14 technical indicators to identify overbought and oversold conditions. With 8 of the 14 signaling oversold territory, traders should watch closely to see if the high-volume node below can provide meaningful support. QQQ also ended the week in the red at $526.96 (-0.56%), but with a bit more optimistic signal from the QX QSB Score Markers Indicator. Only 5 of the 14 component indicators registered overbought conditions, suggesting tech may be showing relatively stronger momentum. Still, with global tensions elevated and a gap aligning with the 200-day SMA just below, bears could find an opening to press the index lower. Small caps took the hardest hit this week, with IWM closing at $208.89 (-1.41%). The index was firmly rejected at the 200-day SMA, coinciding with a 9-handle on the QX QSB Score Markers Indicator, making it the most bearish signal among the major indexes. With price now testing its YTD volume point of control, it’s up to the bulls to put in another higher low and flip prior resistance into support. Let's take a look at the daily on /ES. It still looks a little like a roll over to me. Just too early to tell. My lean or bias today is bullish. This was largely establish last Friday as we set up a bearish Gold trade and a bullish /NQ scalp. Trade docket for today: Most of our heavy hitter setups for today were put in place last Friday. We are already cash flowing this morning with a nice Theta fairy entry last night. It hit our profit target so fast we couldn't get the call side on. Our /GC, gold trade looks great this morning as we were looking for a pullback. We'll work to get a put side added today. Our bullish /NQ scalp looks set to be our biggest winner today. GNE DCA. LULU needs a bit more work. ORCL will also be worked again today. Our QQQ 0DTE will start us off today. We may also get a 1HTE BTC working today. We have one earnings play today in LEN. une S&P 500 E-Mini futures (ESM25) are up +0.40%, and June Nasdaq 100 E-Mini futures (NQM25) are up +0.45% this morning, signaling a partial rebound from Friday’s sell-off on Wall Street as investors dialed back some risk-off positioning sparked by the hostilities between Israel and Iran. Investors continued to keep a close eye on tensions between Israel and Iran, which showed no signs of easing. Iranian missiles hit Israel’s Tel Aviv and the port city of Haifa before dawn on Monday, marking the latest in a series of tit-for-tat attacks that began last week. Iran also warned that it may close the Strait of Hormuz, a key chokepoint for global oil shipments. Still, investors stepped in to buy the dip on Monday, expecting the conflict would be unlikely to draw in more parties. This week, investors look ahead to the Federal Reserve’s interest rate decision as well as a fresh batch of U.S. economic data, with a particular focus on the retail sales report. In Friday’s trading session, Wall Street’s major equity averages closed lower. Most of the Magnificent Seven stocks retreated amid risk-off sentiment, with Nvidia (NVDA) falling over -2% and Apple (AAPL) dropping more than -1%. Also, airline stocks lost ground as the jump in oil prices sparked concerns about rising fuel costs, with American Airlines Group (AAL) and United Airlines Holdings (UAL) sliding over -4%. In addition, Visa (V) and Mastercard (MA) slumped more than -4% after the Wall Street Journal reported that major retailers, including Amazon and Walmart, are exploring ways to use or issue stablecoins to bypass credit card fees. On the bullish side, RH (RH) climbed over +6% after the luxury furniture company maintained its full-year guidance. Economic data released on Friday showed that the preliminary University of Michigan’s U.S. consumer sentiment index rose to 60.5 in June, stronger than expectations of 53.5. Also, the University of Michigan’s U.S. June year-ahead inflation expectations fell to 5.1% from 6.6% in May, better than expectations of 6.4%, while 5-year implied inflation expectations edged down to 4.1% from 4.2% in May, in line with expectations. The U.S. Federal Reserve’s interest rate decision and Chair Jerome Powell’s post-policy meeting press conference will take center stage in this holiday-shortened week. The central bank is widely expected to keep the Fed funds rate on hold in a range of 4.25% to 4.50%. Focus will center on any indications of when policymakers might lower interest rates. Recent softer-than-expected consumer and producer inflation data led many market participants to bring forward their expectations for the next rate cut. Market watchers will closely monitor the Fed’s quarterly “dot plot” in its Summary of Economic Projections, which shows FOMC members’ forecasts regarding the path of interest rates. “The Fed will continue to prioritize the risk of higher inflation expectations, but as the unemployment rate moves further from the full employment rate level, they will pivot toward supporting the economy and labor market,” according to Scott Anderson, chief U.S. economist at BMO Capital Markets. Investors will also focus on a spate of economic data releases this week. The retail sales report for May will be the main highlight, as it will serve as another gauge of the economy’s health. Wells Fargo’s team of economists stated that the report is expected to indicate “the consumer has yet to run out of steam.” Other noteworthy data releases include U.S. Industrial Production, Manufacturing Production, the Export Price Index, the Import Price Index, Business Inventories, Building Permits (preliminary), Housing Starts, Initial Jobless Claims, Crude Oil Inventories, the Philadelphia Fed Manufacturing Index, and the Conference Board’s Leading Economic Index. In addition, several notable companies like homebuilder Lennar (LEN), accounting firm Accenture (ACN), grocery chain Kroger (KR), and online used car seller CarMax (KMX) are scheduled to release their quarterly results this week. Investors are also watching the G7 summit for potential responses to global flashpoints, including the conflict in the Middle East, the war in Ukraine, and ongoing trade tensions. Meanwhile, the U.S. stock markets will be closed on Thursday in observance of the Juneteenth federal holiday. The markets will reopen on Friday. Today, investors will focus on the Empire State Manufacturing Index, which is set to be released in a couple of hours. Economists foresee this figure coming in at -5.90 in June, compared to -9.20 in May. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.432%, up +0.18%. I look forward to seeing you all in the live trading room shortly. Most of our work was put in on Friday. Today we just need to harvest it.

|

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |