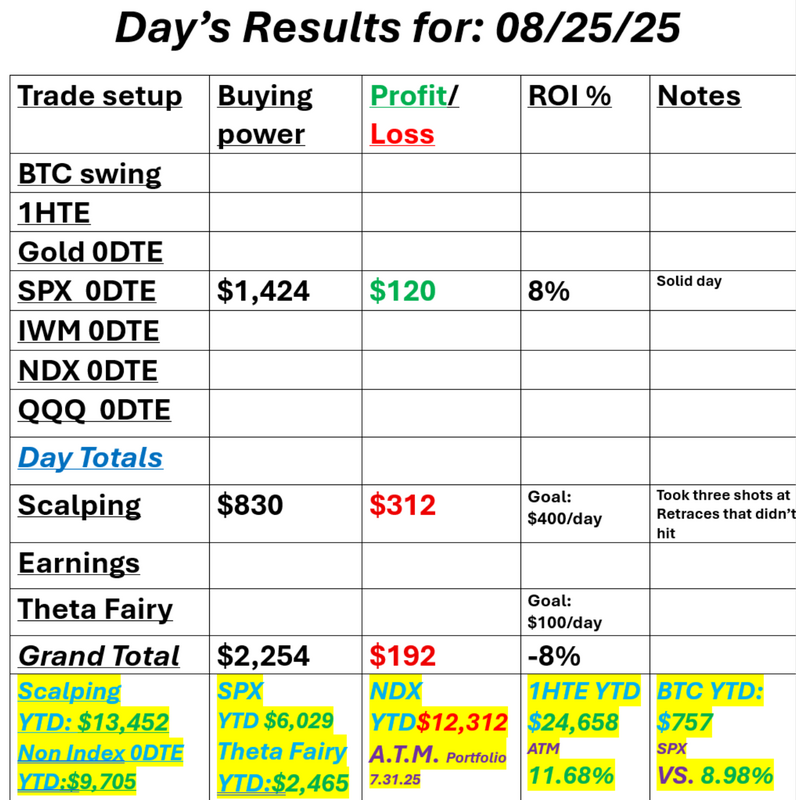

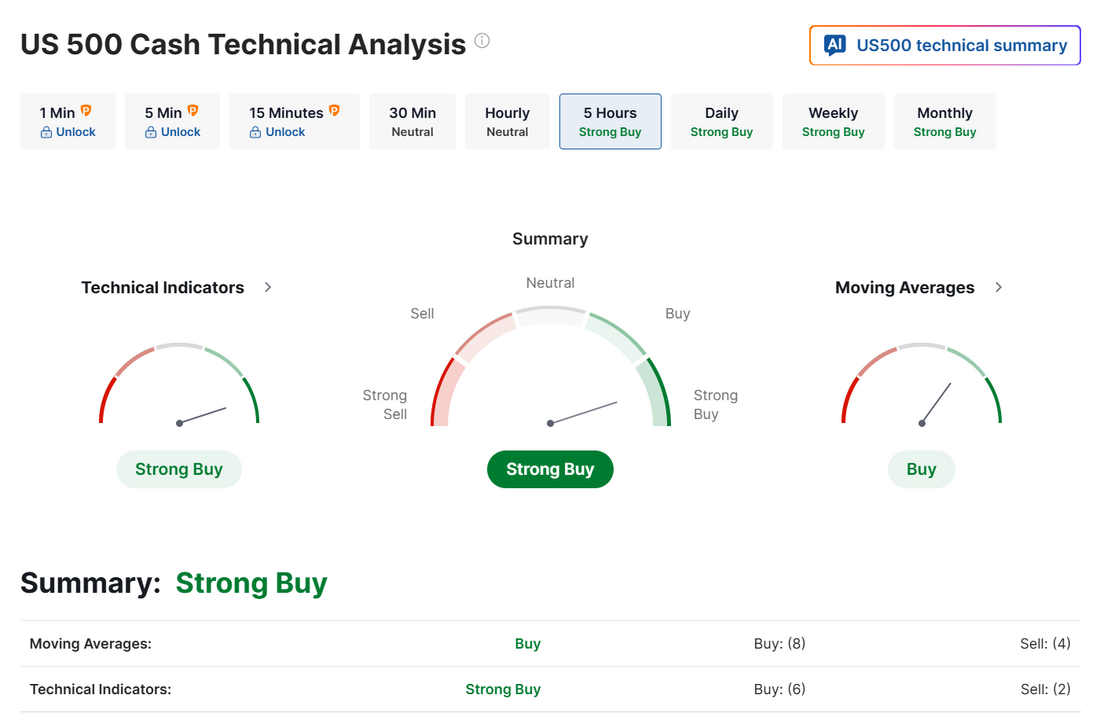

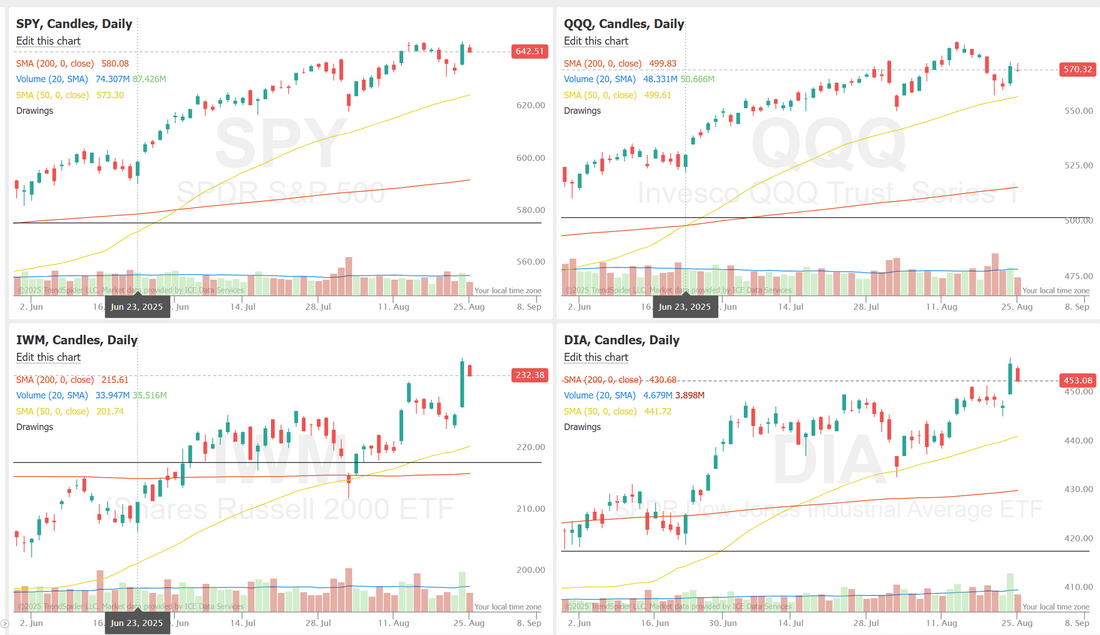

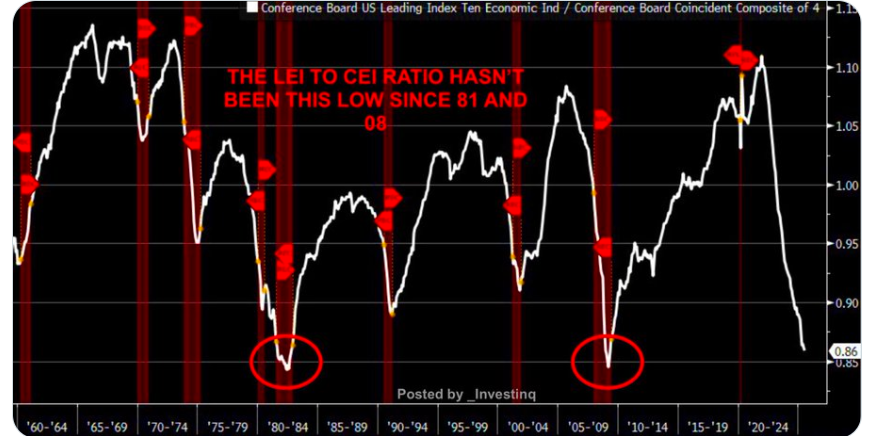

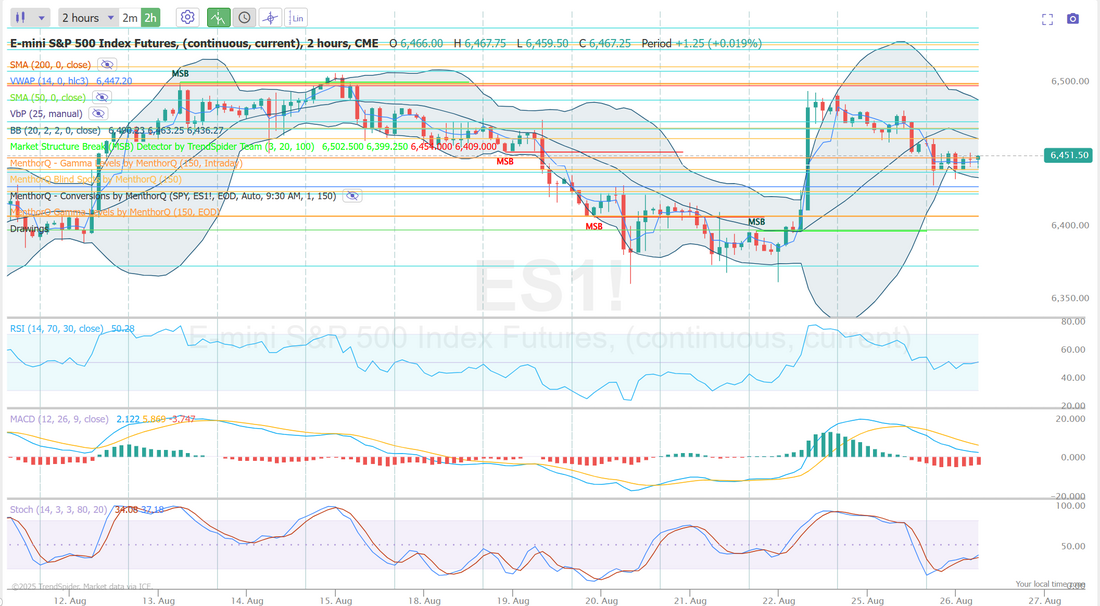

Is Lisa Cook really gone?I was working on the entry to our Gold trade last night when the futures went crazy on the indices and gold. The news had hit the wire that Trump was firing Cook from her FED post. We've learned with Trumps beef with Powell that a FED member CAN be fired, "for cause". There's got to be some dereliction of duty or malfeasance which seems to be a high bar. Cook said yesterday she's not leaving. Grab the popcorn because this should get interesting. I had a quiet day yesterday. Our SPX trade was good and ended up going to a full profit for those that held. I locked in a small gain before the close. With scalping, I tried three retrace setups that didn't work and that was that for the day. Let's take a look at the markets this morning. We are still clinging to a buy mode. It looks like we may be back to stalling out. I think it may take some big catalysts to get us up to new ATH's. My lean or bias yesterday was bearish which played out well. Futures are down this morning after the Cook news as well as new tariff news. I'm looking for more of a neutral day today. It doesn't look like the overnight news is tanking the futures and I don't see a big catalyst to take us much higher. September S&P 500 E-Mini futures (ESU25) are down -0.16%, and September Nasdaq 100 E-Mini futures (NQU25) are down -0.19% this morning as investors weigh U.S. President Donald Trump’s move to oust Federal Reserve Governor Lisa Cook and fresh tariff threats. President Trump announced on Monday that he was dismissing Cook “effective immediately.” The move is based on allegations from one of Trump’s allies that Cook engaged in mortgage fraud, though the claims have not been confirmed. Cook said Trump had no authority to fire her, and she would not resign. Cook’s lawyer, Abbe Lowell, said they intend to take “whatever actions are needed to prevent” Trump’s “illegal action.” Analysts said the episode sounded alarm bells over the central bank’s independence. Trump also threatened new tariffs and export restrictions on advanced technology and semiconductors in retaliation against digital services taxes abroad. In addition, Trump told reporters on Monday that China must supply the United States with magnets or “we have to charge them 200% tariffs or something.” Investors now await a fresh batch of U.S. economic data. In yesterday’s trading session, Wall Street’s main stock indexes ended lower. Keurig Dr Pepper (KDP) plunged over -11% and was the top percentage loser on the S&P 500 and Nasdaq 100 after it agreed to buy Dutch coffee firm JDE Peet’s for $18.4 billion. Also, furniture stocks slumped after President Trump announced last Friday that the U.S. would launch an investigation into tariffs on furniture imports, with Wayfair (W) and RH (RH) sliding more than -5%. In addition, CSX Corp. (CSX) fell over -5% after CNBC’s Becky Quick reported that Warren Buffett told her Berkshire Hathaway has no interest in acquiring another railroad. On the bullish side, chip stocks gained ground, with Nvidia (NVDA) rising more than +1% to lead gainers in the Dow and Lam Research (LRCX) advancing over +1%. Economic data released on Monday showed that U.S. new home sales unexpectedly fell -0.6% m/m to 652K in July from 656K in June (revised from 627K), though the figure was still stronger than expectations of 635K. Today, all eyes are focused on the U.S. Conference Board’s Consumer Confidence Index, which is set to be released in a couple of hours. Economists, on average, forecast that the August CB Consumer Confidence index will stand at 96.4, compared to last month’s figure of 97.2. Investors will also focus on U.S. Durable Goods Orders and Core Durable Goods Orders data. Economists expect July Durable Goods Orders to drop -3.8% m/m and Core Durable Goods Orders to rise +0.2% m/m, compared to the prior figures of -9.4% m/m and +0.2% m/m, respectively. The U.S. S&P/CS HPI Composite - 20 n.s.a. will be reported today. Economists expect the June figure to ease to +2.1% y/y from +2.8% y/y in May. The U.S. Richmond Fed Manufacturing Index will be released today as well. Economists foresee this figure coming in at -11 in August, compared to the previous value of -20. In addition, market participants will be anticipating a speech from Richmond Fed President Tom Barkin. On the earnings front, notable companies like MongoDB (MDB), Okta (OKTA), and Box (BOX) are slated to release their quarterly results today. U.S. rate futures have priced in an 84.3% chance of a 25 basis point rate cut and a 15.7% chance of no rate change at the next central bank meeting in September. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.302%, up +0.63%. The U.S. just triggered its fourth straight recession signal. The LEI vs. CEI ratio hasn’t been this low since ‘81 and ‘08. The last time it looked like this? Right before the economy broke. Trade docket today: BTC is still a bit sketchy for a 1DTE. We did get a new Gold 0DTE working for today. We'll also focus on an SPX 0DTE and /MNQ scalping. Let's take a look at the intra-day /ES levels. 6462, 6469, 6489, 6500 are resistance levels. 6439, 6430, 6425, 6409, 6400 are support. We had a good training session yesterday. We'll have another good one next week. I look forward to sharing these with you. I'll see you all in the live trading room shortly. Today could be a "mover day" which is what we look for.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |