|

Welcome to the weekend! I'm in Phoenix AZ. for the next three days at one of my annual masterminds. For those of you that don't know, #1. I'm a big believer in "sharpening the saw" and attend several masterminds each year. #2. I'm building a compound in Costa Rica as I speak (it's taking way longer than anticipated) with the idea of using it as a base for stock market masterminds. I'm looking forward to that day...whenever it gets done! Because of that, I won't be running the live zoom feed today and no scalping either. Lets talk about yesterdays results: We had a solid day yesterday with NVDA finally cooperating. We had four 0DTE's with Bitcoin, Etherium, SPX, NDX. They all made money. With approx. 13K in capital we generated over $3,500 profit! Our scalping efforts were strong as well with a $1,020 gross profit. Let's take a look at the price action in the markets: Sell mode continues. Most of the indices we trade continue to roll over. Unless your ticker symbol is NVDA, the last week has not been a good one. What leads us up is usually what leads us down. Tech is dragging. We re-initiated our VTI swing trade yesterday with a short, bearish bias. This has been a fabulous trade for us. Averaging 36%-50% annual returns and very little oversight or management. How far can we fall? I'm looking to target that purple line with is the high volume node area and PoC. We get PCE this morning. The U.S. Department of Commerce’s second estimate of Q1 GDP growth was revised downward to +1.3% (q/q annualized) from the initial estimate of +1.6%. Also, the Q1 core PCE price index was unexpectedly revised lower to +3.6% (q/q annualized) from +3.7%. In addition, U.S. pending home sales sank -7.7% m/m in April, weaker than expectations of -1.1% m/m and the biggest drop in more than three years. Finally, the number of Americans filing for initial jobless claims in the past week rose +3K to 219K, compared with 218K expected. “The name of the game is still inflation and interest rates, and despite an expected downward revision to GDP, there wasn’t much in [the] data to shake up the status quo,” said Chris Larkin at E*Trade from Morgan Stanley. New York Fed President John Williams said Thursday that he anticipates inflation to keep declining in the second half of this year, adding that high borrowing costs are holding back the economy. “The behavior of the economy over the past year provides ample evidence that monetary policy is restrictive in a way that helps us achieve our goals,” Williams said. In a moderated discussion following his remarks, the New York Fed chief stated that he couldn’t predict when he’d support a rate cut, stressing that it hinged on the information provided by incoming data regarding the economy. “I don’t feel any urgency or need that we have to make a decision now,” he said. Also, Dallas Fed President Lorie Logan remarked that high interest rates might not be curbing the economy to the extent that policymakers expect. “It also may be that policy is just not as restrictive as we think it might have been relative to the level of interest rates before the pandemic,” Logan said. “It’s really important to keep all options on the table and that we continue to be flexible.” Meanwhile, U.S. rate futures have priced in a 0% chance of a 25 basis point rate cut at June’s monetary policy meeting and a 12.3% chance of a 25 basis point rate cut at the July meeting. Today, all eyes are focused on the U.S. core personal consumption expenditures price index, the Fed’s preferred price gauge, in a couple of hours. Economists, on average, forecast that the core PCE price index will come in at +0.3% m/m and +2.8% y/y in April, compared to the previous figures of +0.3% m/m and +2.8% y/y. Also, investors will focus on the U.S. Chicago PMI, which stood at 37.9 in April. Economists foresee the May figure to be 41.1. U.S. Personal Spending and Personal Income data will be closely monitored today as well. Economists forecast April Personal Spending to be at +0.3% m/m and April Personal Income to stand at +0.3% m/m, compared to the March numbers of +0.8% m/m and +0.5% m/m, respectively. In addition, market participants will be anticipating a speech from Atlanta Fed President Raphael Bostic. My lean today is bearish. We have techs falling apart. Technicals pointing down and the Trump verdict yesterday all weighing on the futures. Trade docket for today: BA?, CCL, DELL, GRPN, NDX/SPX/E.C. NDX/BTC/ETH 0DTE's, SPY. Intra-day levels for me: /ES; 5250/5263/5272/5284 to the upside. 5229/5213/5196/5167 to the downside. /NQ; 18570/18611/1866/18709 to the upside. 18504/18448/18400/18336 to the downside. Bitcoin; 72,573 resistance. 65988 support. I hope you all have a nice, productive weekend! Let's hope for some bigger premiums next week!

0 Comments

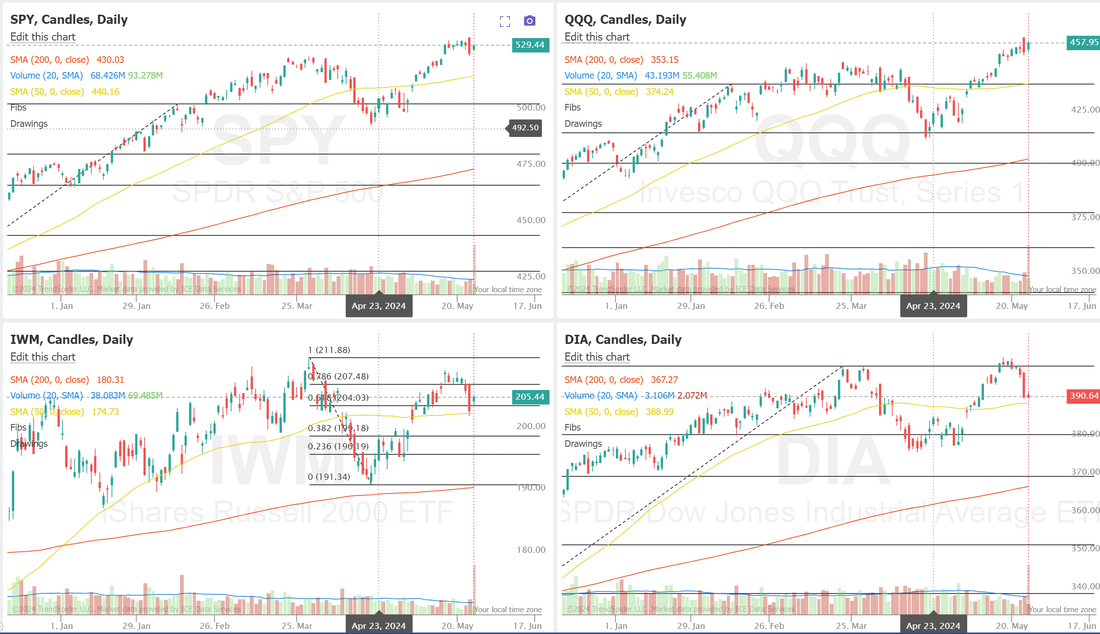

Welcome back traders. This has been an interesting week. Most of our regular setups this week simply don't have their normal reward to go with their normal risk. Premiums are low. We've been depending on Scalping and 0DTE's to pull the weight this week. Yesterday was solid on that front. We had a total of six 0DTE's. Three separate setups on NDX and SPX, BTC and ETH. With approx. 12k in buying power we generated $4,100 in profits. We continue to try to break $100,000 in profits YTD on the NDX. It's currently doing most of our 0DTE heavy lifting. We do have some news catalysts that could move the market today. On the economic data front, all eyes are on the Commerce Department’s second estimate of gross domestic product, due later in the day. Economists, on average, forecast that U.S. GDP will stand at +1.6% q/q in the first quarter, compared to +3.4% q/q in the fourth quarter. Also, investors will likely focus on U.S. Pending Home Sales data, which came in at +3.4% m/m in March. Economists foresee the April figure to be -1.1% m/m. U.S. Initial Jobless Claims data will be reported today. Economists estimate this figure to arrive at 218K, compared to last week’s number of 215K. U.S. Wholesale Inventories preliminary data will come in today. Economists expect April’s figure to be 0.0% m/m, compared to the previous figure of -0.4% m/m. U.S. Crude Oil Inventories data will be reported today as well. Economists estimate this figure to be -1.600M, compared to last week’s value of 1.825M. In addition, market participants will be looking toward speeches from New York Fed President John Williams and Dallas Fed President Lorie Logan. Lets take a look at the price action: We have a little bit of a mixed bag. The SPY and QQQ are trying to hold on to these near ATH levels while the IWM is just barely clinging to the 50DMA. The DIA has given up the ghost and is tanking. Down below the 50DMA. Short term indicators give us a sell rating. Our trade docket for today: DIA, DIS, FSLR, GRPN, NDX/SPX/E.C. NDX/BTC/ETH 0DTE's, NVDA, PYPL?, Scalping, SMCI? SPY. My bias for today: It's a little early to give before GDP and jobless claims come out but I'm sticking to the current technicals with a slight bearish lean. Intra day levels for me: /ES; 5271 is the first key level bulls need to capture. Then 5284. Above 5300 I'm back to bullish stance. /NQ; 18731 is key. It's PoC and a huge demarcation line in the sand. Above is bullish. Below is bearish. Next bullish target is 18856. 18657 to the downside the 18608 which is the 200 period moving avg. on the 2hr. chart. BTC: Bitcoin has been drifting slightly lower the last few days. 74,579 is resistance and 66,208 is support. Good luck traders. Be picky and don't chase today. We may be rewarded with some better setups later in the day.

Yesterday was an interesting one for me. One of the benefits of having a set playbook is that you get a pretty good idea of what trades you'll be looking at each week. Tuesdays implied volatility, or lack thereof, indicated that would be a tough go this week. Most all of our ladder trades and weekly strangles just don't have enough juice in them to make sense from a risk/reward ratio. I've lowered my income goal this week to just $5,000 dollars and am expecting most all of it to come from our 0DTE's. We'll wait patiently on the rest of out trades until we can get some premium back. Even with 0DTE's it was tough yesterday. We only got two of the planned four on. The SPX and NDX yielded $1,600 in profit. It was enough but not what we wanted. Scalping was a lesson in patience as well. Only two trades. $400 gross profit at the end of it all. NVDA's push up meant we needed to roll the call side out again so the trade continues. Let's look at the markets: The QQQ's continue to hold up well with NVDA strength. SPY is just treading water and the IWM and DIA are in full roll over mode. Futures are starting to flash sell signals this morning. Futures look weak in the pre-market. Our trade docket today is small and focused. We'll look to add to SPY trade and get all four 0DTE's on. SPX and NDX. Event contract NDX and either a Bitcoin or Etherium or possible both. We'll also look for any scalping opportunties. My lean today is slightly bearish: Intra-day levels for me: /ES; A couple key levels. 5322 is near term resistance and PoC. This is a key area for the bulls to break through. 5338 would potentially get things moving again for the bulls. 5288 is key support. Next support level is 5263. /NQ; 18896 is the first upward target. 18983 would break us out to new ATH's. 8732 is support and PoC. 18630 is next support. Bitcoin; 74,454 is resistance and 66,000 is support. Trade safe and trade small. Movement will come back at some point. Remember, sitting on our hands is a skill!

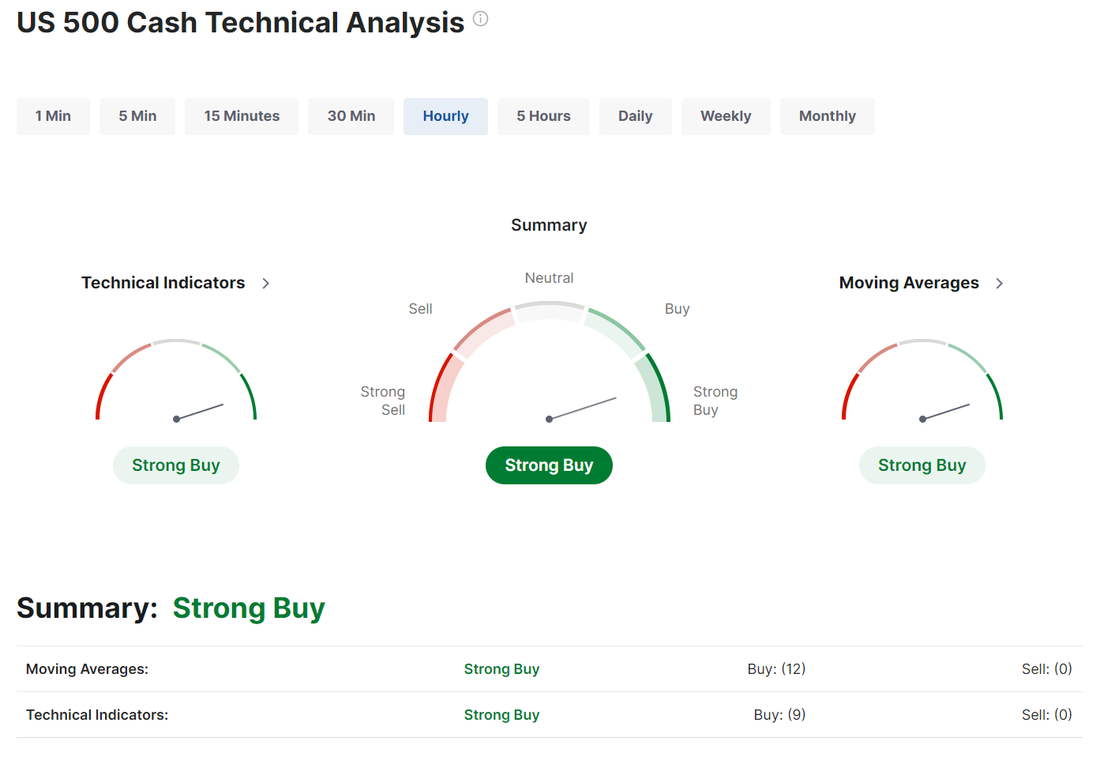

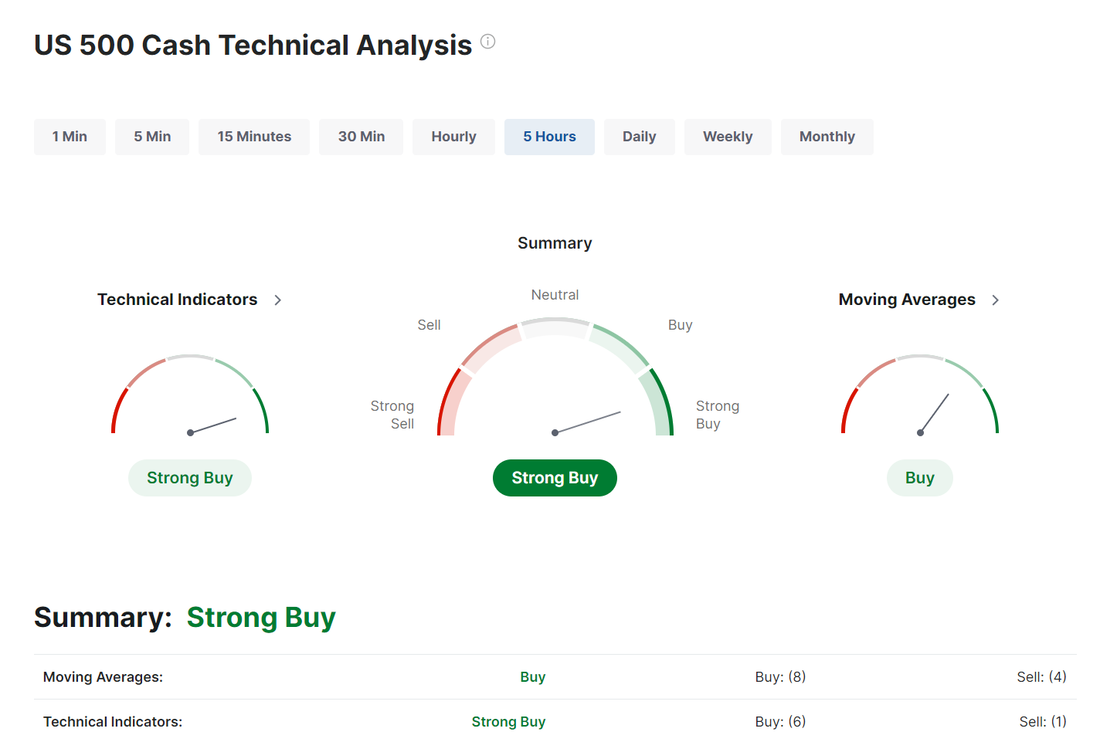

Welcome back traders! I hope everyone had a memorable Memorial day holiday. Our trading went well on Friday even with my shortened trading session as I went to catch a plane. We were still able to get two 0DTE's working with a successful SPX and NDX trade. With the shortened week this week our zoom feed will be in the scalping room today. Let's take a look at where the markets are to start this shortened trading week. Most of our indicators are flashing buy. It wasn't a resounding success last week as thte Energy/Healthcare/Financial sectors lagged while the Tech sector soared with NVDA leading the way. The SPY broke its four-week green streak, closing slightly lower at $529.51 (–0.002%), and nearly even with last week’s close. While Thursday’s selloff found the price testing the March highs, they appear to be acting as strong support for now. With a little help from NVDA earnings, the QQQ regained its place as the strongest of the three indexes this week, closing at $457.95 (+1.37%). Despite a nasty selloff on Thursday, support was found at the 8 EMA, and the price managed to stay above the March highs, as well. Small caps were again the underperformer this week, closing at $205.44 (-1.27%). IWM tested the top of the range on Monday but was immediately rejected. By week’s end, a powerful close below the 8 EMA coincided with a bearish MACD cross, suggesting the possibility of a short-term trend reversal. We aren't substantially different than where we've been for a while Volatility and expected moves are down in the dumps, once again. With SPY below 1% and QQQ below 1.3%. Our trade docket for today: Scalping, /ZN, BA, CVS, DELL, DIA, DIS, FSLR, GLD, IWM, NDX/SPX/E.C.NDX/Bitcoin, NVDA, PYPL, SMCI. My lean is bullish today. n this holiday-shortened week, the April reading of the U.S. core personal consumption expenditures price index, the Fed’s preferred inflation gauge, will be the main highlight. Also, market participants will be eyeing a spate of other economic data releases, including the U.S. GDP (second estimate), Richmond Manufacturing Index, Goods Trade Balance, Initial Jobless Claims, Wholesale Inventories (preliminary), Pending Home Sales, Crude Oil Inventories, Personal Income, Personal Spending, and Chicago PMI. Several notable companies like Salesforce (CRM), Dick’s Sporting Goods (DKS), Chewy (CHWY), HP Inc. (HPQ), C3.ai (AI), Best Buy (BBY), Dollar General (DG), Foot Locker (FL), Costco (COST), Gap (GPS), Marvell (MRVL), Dell (DELL), and Nordstrom (JWN) are slated to release their quarterly results this week. In addition, several Fed officials will be making appearances this week, including Cook, Daly, Williams, Bostic, and Logan. In other news, UBS Global Research adjusted its year-end target for the benchmark S&P 500 index on Tuesday, raising it to 5,600 from the previous estimate of 5,400, representing the most optimistic forecast among major brokerages. Today, all eyes are focused on the U.S. CB Consumer Confidence Index in a couple of hours. Economists, on average, forecast that the May CB Consumer Confidence index will stand at 96.0, compared to the previous figure of 97.0. My intra-day levels: /ES; 5333/5339/5351/5367 to the upside. 5323/5314/5305/5298 to the dowside. /NQ; 18950/18969/19022/19042 to the upside. 18896/18867/18842/18812 to the downside. Bitcoin; 74,285 is resistance and 65856 is support. Lets have a great week folks!

Welcome back traders! Yesterday was a bad one for me. Fortunatley, we don't get many reversal days like we had yesterday. It had a very "FOMC/Powell speech" feel to it. It knocked my net liq for -19K loss. That's two weeks work down the drain. We had some big success' like DIA popping for 3K profit and after three lack luster days in a row, scalping helped out with a nice 2K profit but BA dropping hit for -10K. NVDA looks great for us post earnings but it didn't cash flow for us and dropped -9k. MSTR dropped -2K and SPX dropped -6k. Just too many things all NOT working at one time. Our NDX 0DTE did hit for a nice 3K profit and maybe the highlight (if you can find one) in yesterdays results was that we crossed over 100K in profits YTD with just the NDX 0DTE's. Today will be a shortened trading session for me as I'm headed to the airport early for a few days in NYC for a family freinds, daughters wedding reception. Let's take a look at the market today: First off, in a surprise move the SEC approved the Etherium ETF's! The SEC hates crypto and it's primarily public pressure that they are bowing to. The ETF's themselves are not trading yet. It will be a few weeks but the questions everyone has is, will this do for Etherium what it did for Bitcoin? I think it will. It's a good time to hold some crypto (IMHO). Markets had a big reversal yesterday. Those are some big red candles. It also puts the IWM and DIA right back to the key support level of the 50DMA (yellow line). Futures this morning are looking up. A rebound like this, after a sell off like we had yesterday is expected and normal. What we don't know is if it will hold. If we get another fade like we had yesterday it will put us in a solid bearish bias. NVDA was really the only bright light in yesterdays price action. We continue to cash flow our NVDA positon and while it didn't produce results for us yesterday, it continues to be right were we want it. The last couple of weeks have been very profitable in this setup and let's hope we can get back to that trend today. Our trade docket today is, once again focused on three things: #1. Booking profits on any position we can. #2. De-risking the portfolio from the weeks setups. #3. Getting as much buying power back as we can to set us up to do it all over again next week. AMC, BA, CCL, DIA?, DIS, FSLR?, GLD?, GRPN?, IWM, MSTR, PYPL? SHOP, SMCI, SPY, WYNN, XBI, WOOF. As I type, we have a nice little rebound going in the futures. Notwithstanding, I'm looking for more weakness today. I was wrong on my bullish call yesterday. Let's see how todays pans out. Intra-day levels for me: /ES; 5308/5335* (key level. PoC and 50SMA on 2hr. chart)/5348/5369. I believe, if we can't break above and hold 5335 we will have more bearish action /NQ; 18767/18867/18936/19021 to the upside. 18714/18698*(PoC)/18623/18545 to the downside. Bitcoin; 74,417 is resistance. 65,856 is support. Have a great three day weekend folks. I know I always come back refreshed after a day away from the screens.

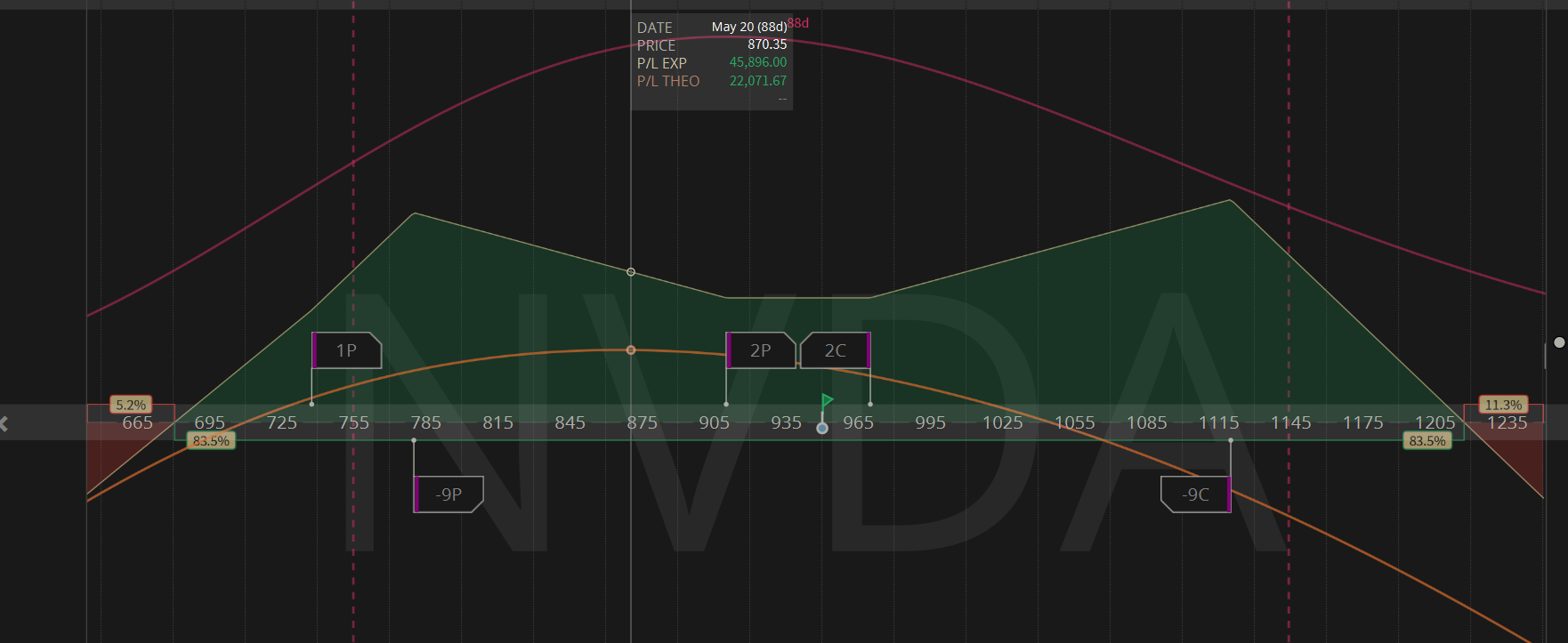

Good Thursday to you all! Yesterday was fairly uneventful for us as we anticipated the NVDA results. The stock is currently up 67 points pre-market. Our setup continues to look solid. Our 0DTE's were "mostly" successful. We didn't get an E.C. NDX one on but our Etherium 0DTE cash flowed as well as our NDX which hit for $2,400 of profit. We needed to roll the put side of the SPX to today but with the pre-market up 35 points it looks to be profitable today. Jobless claims and PMI are the main news catalysts for today: June Nasdaq 100 E-Mini futures (NQM24) are trending up +1.01% this morning as forecast-beating quarterly results and sales forecast from Nvidia boosted sentiment, with investors bracing for U.S. business activity data. Nvidia (NVDA) climbed over +6% in pre-market trading after the semiconductor giant reported stronger-than-expected Q1 results and provided above-consensus Q2 revenue guidance. The company also boosted its quarterly dividend by about 150% to $0.10 a share and announced a 10-for-1 stock split, effective June 7th. Yesterday, the minutes of the Federal Open Market Committee’s April 30-May 1 meeting revealed that Federal Reserve officials became increasingly worried about inflation. Policymakers noted that “recent data had not increased their confidence in progress toward 2 percent and, accordingly, had suggested that the disinflation process would likely take longer than previously thought.” Also, the minutes showed that “various participants” discussed a willingness to raise rates if inflation did not continue its downward trajectory toward the 2% goal. “Although monetary policy was seen as restrictive, many participants commented on their uncertainty about the degree of restrictiveness,” according to the FOMC minutes released on Wednesday. “Hawkish surprise (kind of) from the Fed minutes. The investing world will have to wait at least another month to hear anything about rate cuts - but the kicker in this report was the willingness of some participants to restrict policy further,” said Alex McGrath at NorthEnd Private Wealth. In yesterday’s trading session, Wall Street’s major indices closed lower. Target (TGT) plunged about -8% and was the top percentage loser on the S&P 500 after the retail giant reported weaker-than-expected Q1 adjusted EPS and expressed caution regarding discretionary spending in the coming months. Also, Lululemon Athletica (LULU) slid more than -7% and was the top percentage loser on the Nasdaq 100 after announcing the departure of its chief product officer, Sun Choe, and plans to revamp its product and brand teams. In addition, ViaSat (VSAT) tumbled over -16% after the company posted a surprise Q4 loss and said it expects “roughly flat” year-over-year revenue growth in fiscal 2025. On the bullish side, Analog Devices (ADI) surged more than +10% after the analog chip supplier reported upbeat Q2 results and offered above-consensus Q3 guidance. Economic data on Wednesday showed that U.S. existing home sales unexpectedly fell -1.9% m/m to 4.14M in April, weaker than expectations of 4.21M. Meanwhile, U.S. rate futures have priced in a 4.2% chance of a 25 basis point rate cut at the next FOMC meeting in June and a 17.4% probability of a 25 basis point rate cut at July’s policy meeting. On the earnings front, notable companies like Intuit (INTU), Medtronic (MDT), Ralph Lauren (RL), Ross Stores (ROST), and Workday (WDAY) are set to report their quarterly earnings today. Today, all eyes are focused on the U.S. S&P Global Manufacturing PMI preliminary reading in a couple of hours. Economists, on average, forecast that the May Manufacturing PMI will come in at 50.0, compared to the previous value of 50.0. Also, investors will focus on the U.S. S&P Global Services PMI, which stood at 51.3 in April. Economists foresee the preliminary May figure to be 51.2. U.S. New Home Sales data will be reported today. Economists foresee this figure to stand at 677K in April, compared to the previous number of 693K. The U.S. Building Permits data will come in today. Economists expect April’s figure to be 1.440M, compared to 1.485M in March. U.S. Initial Jobless Claims data will be reported today as well. Economists estimate this figure to be 220K, compared to last week’s value of 222K. In addition, market participants will be anticipating a speech from Federal Reserve Bank of Atlanta President Raphael Bostic. The markets are in a solid buy mode now having cleared the 50DMA and pushing higher today with tech leading the way. Our trade docket for today: /HG, /MCL, DIA, FSLR, SPX/NDX/E.C. NDX/Bitcoin or Etherium 0DTE's, NVDA? PLTR?, SPY/QQQ? SMCI, INTU, ROST. My lean today is bullish: Intra-day levels for me: I'm focused on more substantive, larger levels today. /ES; 5420/5472 to the upside. 5256/5192 to the downside. /NQ; 19073/19327 to the upside. 18691/18360 to the downside. I believe ETH will give us a better risk/reward today vs. BTC. ETH; 4070 is near term upside resistance and 3666 is downside support. Have a great day folks! I'm headed to NYC tomorrow with the family for a freinds daughters reception so tomorrow will be a shortened zoom session but we'll still have time to get everything done.

Welcome back traders! Yesterday was the day I wish we had everyday. Nothing amazing. No big surprises. Net liq didn't bounce around too much. I ended up the day $1,562 increase in Net liq. We got all four 0DTE's working well. Bitcoin hit for 7% ROI. NDX hit for 14% ROI. SPX hit for 8% ROI and E.C. NDX hit for 2% ROI. All told just under 12k of capital commited to make almost $1,500 profit. Let's take a look at the markets; The bullish trend continues but when will the market start moving again? We continue to camp out at these ATH levels. Will NVDA earnings today, after the close be the catalyst we are looking for? I'm sure it will have some effect. NVDA is a huge part of the overall indices cap weighting. This is a company that has added one trillion dollars to its market cap just this year. We have done about the best job I know how to with the structure below: We'll know tomorrow morning how well (or poorly) we did. Governor Christopher Waller said Tuesday that he needs to see several more favorable inflation reports before considering interest-rate cuts, adding that keeping rates steady for “three or four” months won’t harm the economy. “In the absence of a significant weakening in the labor market, I need to see several more months of good inflation data before I would be comfortable supporting an easing in the stance of monetary policy,” Waller said. In a discussion following his prepared remarks, he added that he expects the next move in borrowing costs will be downward. Also, Atlanta Fed President Raphael Bostic stated that the central bank will be in a position to begin cutting interest rates “by the end of the year,” though he does not anticipate this happening before the fourth quarter. In addition, Fed Vice Chair for Supervision Michael Barr reiterated that officials should keep interest rates steady for a longer duration than previously anticipated to effectively cool inflation. Finally, Cleveland Fed President Loretta Mester stated her preference for observing “a few more months of inflation data that looks like it’s coming down” before cutting interest rates. Meanwhile, U.S. rate futures have priced in a 0% chance of a 25 basis point rate cut at the next central bank meeting in June and an 18.3% probability of a 25 basis point rate cut at the July FOMC meeting. On the earnings front, major companies like Nvidia (NVDA), TJX Companies (TJX), Analog Devices (ADI), Target (TGT), and Snowflake (SNOW) are slated to release their quarterly results today. Today, investors will also closely monitor the publication of the Federal Reserve’s minutes from the April 30-May 1 meeting to gauge how close the central bank is to lowering borrowing costs. On the economic data front, investors will focus on U.S. Existing Home Sales data due later in the day. Economists, on average, forecast that April Existing Home Sales will stand at 4.21M, compared to the previous value of 4.19M. U.S. Crude Oil Inventories data will be reported today as well. Economists estimate this figure to be -2.400M, compared to last week’s figure of -2.508M. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.437%, up +0.53%. Here are the timestamps for each potential, market moving news item. Docket 10:00 ET US Existing Home Sales Median Forecast: 4.22M | Prior: 4.19M | Range: 4.3M / 4.08M 10:30 ET Weekly EIA Crude Oil Inventories Median Forecast: -2M | Prior: -2.508M | Range: 1M / -3.084M 13:00 ET The US Sells $16 Bln in 20-Year Bonds at Auction 14:00 ET FOMC Meeting Minutes My lean today is neutral. I think we continue to stall here, in anticipation of NVDA results after the bell. Trade docket today: FSLR, SPX/NDS/E.C. NDX/Bitcoin 0DTE's, TOL, PANW, EWW, XME, XRJ, VFS, UPST, SNOW, ELF. Intra-day levels for me: /ES; Very tight range today. 5339/5343/5349/5352 to the upside. 5332* (50 period moving avg. on 2 hr. chart)/5329* (PoC. This may be where we place a butterfly today)/5322/5316 to the downside. /NQ levels: 18824/18866/18888/18907 to the upside. 18768/18707/18678 to the downside. Bitcoin; 74417 is resistance. 65858 is support Lets have a great day! I'm sure I won't be the only one glued to the screen after the close. Let's see what NVDA does and how that effects the indices going into tomorrows open.

Welcome back traders! Yesterday was an "O.K." day. My net liq ended down $541 dollars. It bounced green/red all day long. We only got three 0DTE's on but still managed to squeeze our $1,000/day profit goal out. The SPX only had $1,437 of buying power but generated $120 profit. NDX Had $900 of buying power but hit for $850 profit and our Bitcoin had $1,038 buying power and hit for $61 profit. We are geared up for NVDA earnings Weds. and that's putting a sqeeze on my buying power as I,V. ramps into it. Our trade docket today: VTI?, DELL, DIA, DIS, FSLR, MSTR, NVDA, ZM, TOL, GME, AMC Lets take a quick look at the markets: We continue the churn here at the ATH's for most of the indices. These are the hardest levels for me to read. Everything is clearly bullish. We have bullish Zebras on with our 4DTE SPY/QQQ setup but...I don't think any of us should be surprised if we get a 3-4% retrace. Be prepared for movement either way. We never sit at ATH's for long. It either recharges and bases here for another push up or it retraces but I doubt we consolidate here for much longer. NVDA's earnings after the close tomorrow could be the catalyst. 08:30 ET Canadian CPI for April YoY – Median Forecast: 2.7% | Prior: 2.9% | Range: 2.9% / 2.6% MoM – Median Forecast: 0.5% | Prior: 0.6% | Range: 0.7% / 0.4% Speakers 09:00 ET Fed’s Barkin gives welcome and opening remarks at the Richmond Fed’s Investing in Rural America conference. Text release is still to be determined, there will be no Q&A. Event Details Here Fed’s Waller speaks on his outlook for the US economy and monetary policy. Text & Q&A are both expected. Watch Here 09:05 ET Fed’s Williams gives opening remarks at the 2024 Governance and Culture Reform Conference. No text or Q&A are expected. Event Details Here 09:10 ET Fed’s Bostic offers brief welcome remarks on day 2 of the Atlanta Fed’s Financial Markets Conference. Watch Here 11:45 ET Fed Vice Chair for Supervision Barr will discuss the economy, lessons learned from the 2023 liquidity crisis, and regional banking supervision in a fireside chat at the 2024 Regional State Member Bank Director and Executive Conference. No text is expected, though there will be a Q&A. Watch Here 13:00 ET Bank of England’s Governor Bailey delivers a lecture, in honor of London School of Economics Charles Goodhart, hosted by the Financial Markets Group Let's take a look at my intra-day levels: /ES; Quite simple for me today: Above 5348 I'm bullish. Belfow 5321 I'm bearish. /NQ; Same with the /NQ. Above 18791 I'm bullish. Below 18704 I'm bearish. Bitcoin; Bitcoin appears to be back to bullish mode. Two key levels today. 72412 is upside target. 70625 is downside support. My bias for today is neutral while everyone awaits the NVDA shoe to drop. Yesterday was an erratic day for me. We are now scalping five days a week so that should help smooth out the results for us on an overall basis. I do think if we are patient today we have a decent shot at our $1,000/day profit goal with our 0DTE's if...we can get all four on. We're going to need all of them pitching in today, I believe.

Have a great day! A lot of our "go-to" weekly trades that we put on yesterday came in below our income expectations. Remember to just "trade to trade well" and let the results fall where they may. Welcome back traders! I hope you all had a nice weekend. We finished up last week strong. We had set a goal that I thought was obtainable but also a stretch. We wanted to bring in $10,000 of profit for the week with all our 0DTE's combined. We blew that fiqure out of the water with over $17,000 of gains.The star of the show was our SPX trade. $2,000 of capital yielded $1,700 profit. More importantly, it was a low risk, nice reward potential trade. Even if you only made $80 dollars, the risk/reward was the key. Let's take a look at the markets for this week. All indicators are still firmly bullish. The SPY closed on Friday at $529.45 (+1.65%), marking a new all-time high weekly close. On the daily chart GoNoGo Trend shows that strong bullish momentum is maintained, however the platform is signaling the potential forming of a double top. Like SPY, the platform is flashing warning signs of a double for QQQ. Price closed the week at $451.76 (+2.19%) and is currently resting above the March 21st highs. If the pattern is invalidated and the next move is higher, the 1.618 fib extension sits at $471.75. Small caps IWM closed the week at $208.08 (+1.85%), but unlike the other two indexes the Russell 2000 was unable to make a new high, the beginnings of hidden bearish RSI divergence. The expected moves for our two major indices is, unfortunately back down in the dumps with a less than 1% implied move in the SPX and even with NVDA earnings out this week, the NDX is not much better. Most of the market internals looks healthy. Most of the activity from last week was generally bullish, looking at the heat map. As we hover near the ATH's of most indices, the question is, do we pause here and reverse or continue higher? We have been having tremendous success with our VTI montly swing trade. It's time to put the new version on. It will be a tough call today to go with a bullish or bearish setup. The indicators are all bullish but also overstretched to the upside. Economic data on Friday showed that the U.S. leading indicator index fell -0.6% m/m in April, weaker than expectations of -0.3% m/m and the biggest decline in 6 months. Fed Governor Michelle Bowman stated on Friday that she anticipates inflation to remain elevated for “some time,” yet she maintains her expectation that price pressures will eventually diminish with interest rates held at their current level. At the same time, Bowman repeated that she wouldn’t dismiss the possibility of raising rates if necessary. “While the current stance of monetary policy appears to be at a restrictive level, I remain willing to raise the target range for the federal funds rate at a future meeting should the incoming data indicate that progress on inflation has stalled or reversed,” she said. Meanwhile, U.S. rate futures have priced in a 9.1% chance of a 25 basis point rate cut at June’s monetary policy meeting and a 26.0% chance of a 25 basis point rate cut at the conclusion of the Fed’s July meeting. In the coming week, investors will be monitoring a spate of economic data releases, including the U.S. S&P Global Composite PMI (preliminary), S&P Global Manufacturing PMI (preliminary), S&P Global Services PMI (preliminary), Existing Home Sales, Crude Oil Inventories, Building Permits, Initial Jobless Claims, New Home Sales, Durable Goods Orders, Core Durable Goods Orders, and Michigan Consumer Sentiment Index. Several prominent companies like Nvidia (NVDA), Palo Alto Networks (PANW), Zoom Video (ZM), Analog Devices (ADI), Snowflake (SNOW), and Intuit (INTU), along with retailers including Target (TGT), Lowe’s (LOW), TJX (TJX), Dollar Tree (DLTR), and Ross Stores (ROST), are scheduled to release their quarterly results this week. In addition, market participants will closely monitor the publication of the Federal Reserve’s minutes from the April 30-May 1 meeting on Wednesday, during which Fed Chair Jerome Powell indicated that interest rates are expected to stay elevated for an extended period due to lingering inflationary pressures. A host of Fed officials will be making appearances throughout the week, including Bostic, Barr, Waller, Jefferson, Mester, Kroszner, Barkin, Williams, and Collins. My bias for today: It has to be bullish based on recent price action but don't be surprised if we get a retrace. As I mentioned, most of the technicals are flashing overbought here. Our trade docket for today, as every Monday is busy: /HG, /MCL, /NG, /ZN, BA, CCL, CVS, DELL, DIA, GLD, GRPN, IWM, MSTR, SPX/NDX/E.C. NDX/Bitcoin 0DTE's, ORCL, SMCI, FSLR, WYNN, CRM?, PYPL, SHOP, SPY/QQQ, VTI?, ZM. Intra-day levels for me: /ES; 5343/5373/5418/5490 to the upside. 5326/5303/5269/5253 to the downside. /NQ: 18702/18758/18866/18895 to the upside. 18646/18665/18546/18449 to the downside. Bitcoin; Back into a consolidation pattern with 65988 as key support with 74154 upside target and 60588 as downside target. Have a great day and a great week traders!

Welcome back to another Friday! Is is weird that I know what day of the week it is based on the trades I'm preparing? We certainly have a routine here. Today is about three things for us. #1. Book profits. #2. De-risk the account. #3. Build our buying power back up so we can do it all over again next week. Yesterday was a very nice bounce back from Weds. results. My net liq was up $5,600 but the 0DTE's were the stars, once agian. SPX had $9,600 capital and yielded $1,400 profit for a 14% ROI. NDX has $8,000 of capital and yielded $,3600 profit. BTC had $2,670 capital and yielded $330 profit. The E.C. NDX was our sole loser with a -$395 drawdown. All told, it was about a $4,700 gross profit on our cummulative 0DTE efforts. We set a goal this week to bring in $10,000 of profits from our 0DTE's. Most in the trading room thought that to be a tad aggressive. Well, we are now sitting on almost $17,000 dollars of profit for the week! $17,000!!!!!! Listen, not every week is going to be like this but I don't know of another 0DTE program that is generating enough for people to quit their jobs and create financial independence. I would put our YTD 0DTE performance up against any other program out there. I would recommend you come watch us for a week. Don't trade. Just watch, and see for yourself. Markets took a pause yesterday, which is exactly what I said might happen. Signals here are all still bullish. As the great Warren Buffett once said, "If you short the market every time it hits an ATH, eventually you'll be right!" It's hard to say when the next down turn will happen. It will happen. It always does but, right now we are bullish. Let me take a moment and heap some (more) praise on our VTI swing trade. This trade is one of my all time favorites. It's on track for 24% to 50% ROI YTD (depending on whether you are using portfolio margin or Reg. T) Even at 24% a year it can double your acct. value every three years. It's easy to trade. Takes very little oversight. It's not a completely "set it and forget it" trade but its close. Most importantly, it's scalable. I have put seven figures into this trade with no concern. If you're not trading this with us every month I think you should check it out. Also, we've got another Overnight Vampire trade working for us today. It looks like we should wake up to another $150 dollars in our pocket on a $1,000 dollar investment. I'm really proud of the unique setups we generate. You won't find these anywhere else. Lets do a quick overview of the markets: In yesterday’s trading session, Wall Street’s major indexes closed lower. Deere & Co. (DE) slumped over -4% after the farm equipment maker slashed its full-year net income guidance. Also, Cisco Systems (CSCO) slid more than -2% and was the top percentage loser on the Dow after the networking giant provided soft Q4 revenue guidance. In addition, Biogen (BIIB) fell over -2% following its decision to terminate the development of BIIB105, a treatment for amyotrophic lateral sclerosis, in collaboration with Ionis, citing poor topline results from a Phase 1-2 study. On the bullish side, Walmart (WMT) climbed about +7% and was the top percentage gainer on the Dow and S&P 500 after the retail giant reported better-than-expected Q1 U.S. comparable sales and said it now expects its full-year net sales and adjusted operating income to be at the “high-end or slightly above” its original guidance. Also, Chubb (CB) gained over +4% after Warren Buffett’s Berkshire Hathaway disclosed a $6.7 billion stake in the company. The Labor Department’s report on Thursday showed that the number of Americans filing for initial jobless claims in the past week fell -10K to 222K, compared with the 219K expected. Also, U.S. April housing starts rose +5.7% m/m to 1.360M, weaker than expectations of 1.420M, while U.S. building permits unexpectedly fell -3.0% m/m to a 15-month low of 1.440M in April, weaker than expectations of 1.480M. In addition, the U.S. May Philadelphia Fed’s manufacturing business outlook survey came in at 4.5, weaker than expectations of 7.7. At the same time, the U.S. import price index climbed +0.9% m/m in April, stronger than expectations of +0.2% m/m. Richmond Fed President Thomas Barkin stated Thursday that the U.S. central bank must keep borrowing costs elevated for an extended period to bring down inflation to its 2% target, highlighting higher prices in the services sector. “To get to 2% sustainably in the right kind of way, I just think it’s going to take a little bit more time,” Barkin said in a CNBC interview. Also, Cleveland Fed President Loretta Mester remarked that policymakers require additional data to be confident that inflation is progressing toward the central bank’s 2% target, suggesting officials should keep interest rates higher for longer to achieve this goal. “Holding our restrictive stance for longer is prudent at this point as we gain clarity about the path of inflation,” Mester said. In addition, New York Fed President John Williams stated that while the latest U.S. inflation data indicate a gradual easing of price pressures, he still requires further evidence before considering adjustments to interest rates. “I don’t see any indicators now telling me, oh, that there’s a reason to change the stance of monetary policy now, and I don’t expect that,” Williams said in an interview with Reuters published Thursday. Meanwhile, U.S. rate futures have priced in an 8.9% probability of a 25 basis point rate cut at June’s monetary policy meeting and a 27.6% chance of a 25 basis point rate cut at the July meeting. The swaps market now expects only one rate cut from the Fed this year. Today, investors will likely focus on the U.S. Conference Board Leading Index. Economists foresee this figure to stand at -0.3% m/m in April, compared to the previous number of -0.3% m/m. In addition, market participants will be anticipating speeches from Federal Reserve Governor Christopher Waller and San Francisco Federal Reserve President Mary Daly. Out trade docket today looks big but most of them are just booking profit trades to de-risk the acct. SPX Vampire trade, /MCL, /ZN, AMAT, CVNA, DOCS, FSLR, GME, MSTR, SPX/NDX/EC NDX/Bitcoin 0DTE's, NVDA, PYPL, SPY/QQQ 4DTE, SBUX, SMCI, TTWO, VTI, WYNN, XBI. Intra-day levels for me: /ES; For /ES today I'm looking at two levels. Above 5375 I'll go long. Below 5303 I'll go short. /NQ; On /NQ I'm looking to go long above 18704 with an upside target of 18865 and short below 18599 with a downside target of 18444. Bitcoin: With the monster move yesterday the levels have really expanded. I'm not sure how valuable they will be for us today. 72,452 is resistance. 61,581 is support. One other quick comment for today. As you've noted, I've transitioned a lot of my daily trades from youtube to here. I will still add to the youtube channel but it is easier for me to do these daily updates here. Over the next couple of weeks I'll be rolling out the same system for our Scalping program. Each weekend i'll update on the scalping website our YTD results, listed day by day. I'm also building out a website for our ATM asset allocation program. This has been a great program with the dual fold goals of #1. Beating the SP500 results and #2. Doing it with less volatility. With nearly four years under our belt with this program I'm on my way to tripling my initial investment. Look for these updates coming your way!

Have a great day folks. See you next week! |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |