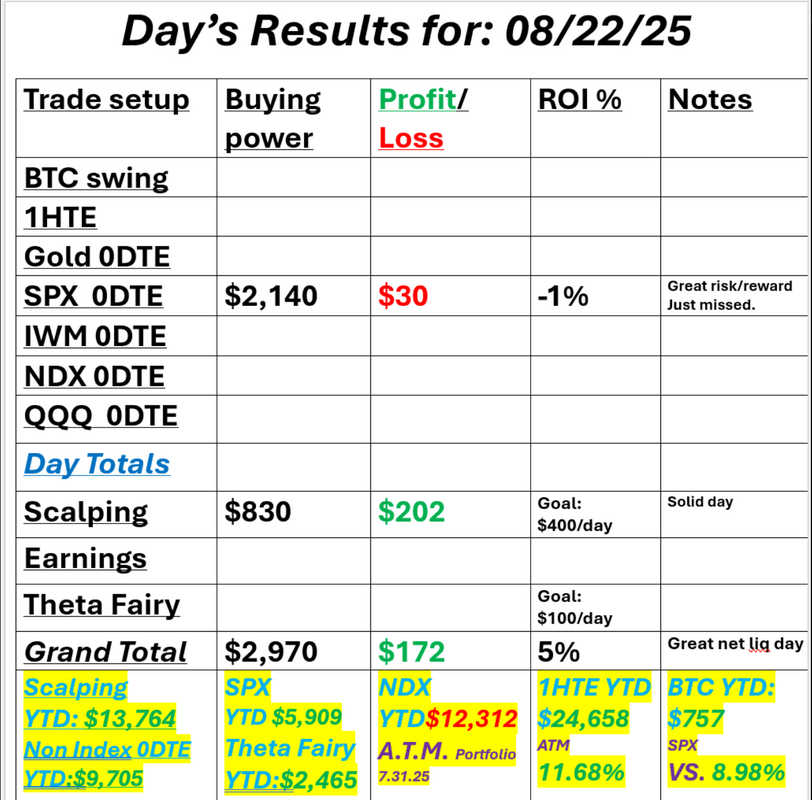

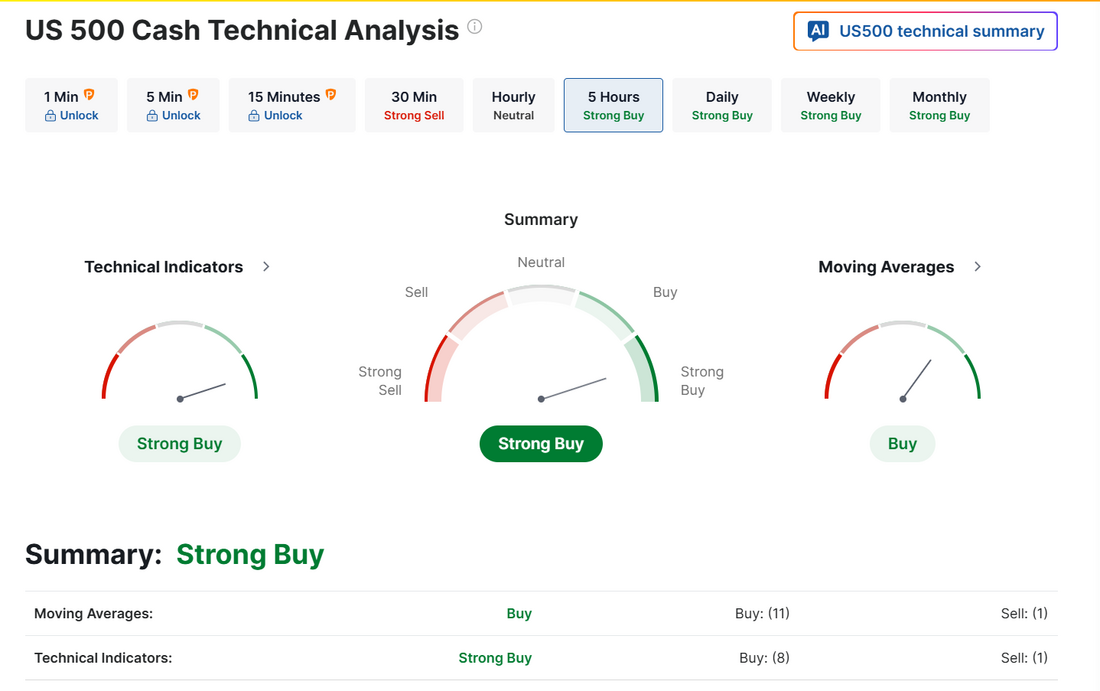

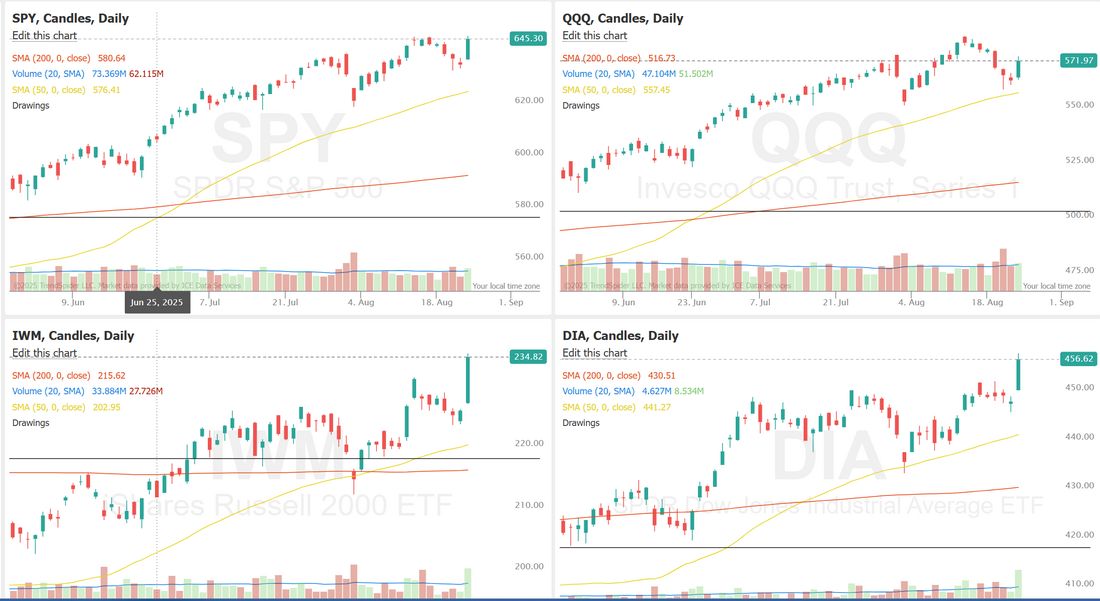

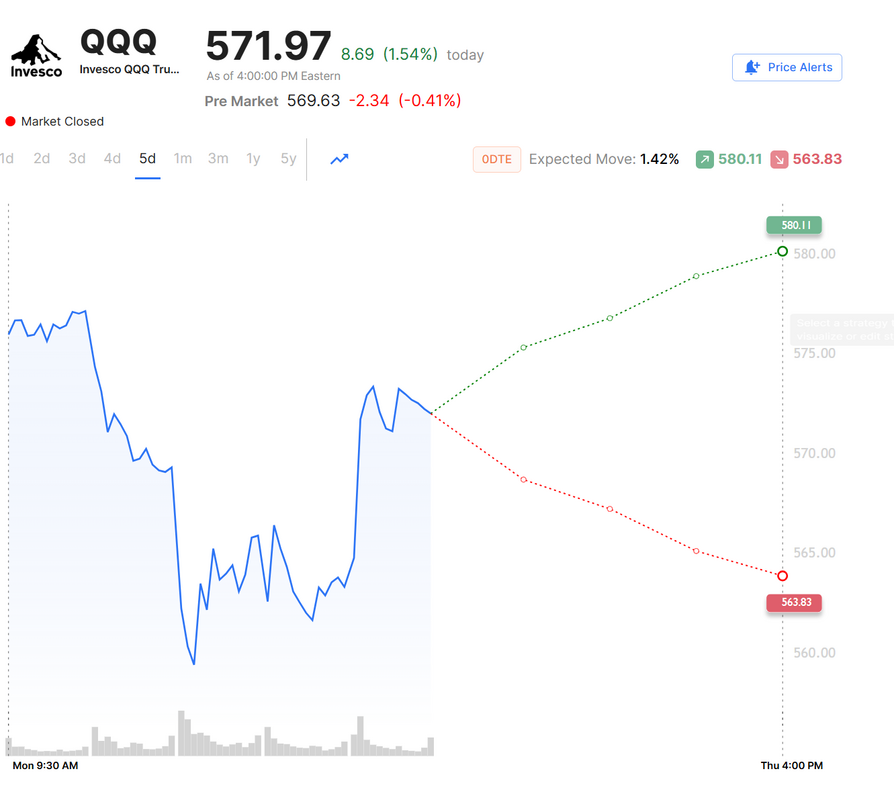

Back to ATH'sFriday was a big one with Powell hinting that a rate cut may finally be incoming. Markets loved it and pushed back to ATH levels. We had a really solid day, net liq wise with our LULU position continuing to push higher and our ATM portfolio pushing back towards it's ATH's. Scalping went well for us, as you would expect on a day like we had. Our SPX 0DTE didn't hit but it had great risk/reward with $135 risk and $865 max profit potential. These are the types of setups we want, even when they don't hit. Here's a look at my day Friday. Let's take a look at the markets: Slight bullish lean holding after Fridays push. Will the ATH's now be support or resistance? The SPX option score chart as of August 22, 2025, highlights an interesting short-term setup. After a steady uptrend in spot price from late June through mid-August, the index has recently shown some choppiness, with prices pulling back slightly from their highs. At the same time, the option score, which had been holding mid-range for weeks, dropped sharply twice in August before bouncing back toward higher levels again. This pattern suggests that short-term sentiment and positioning have been more volatile than the underlying index movement. The recent rebound in the option score indicates renewed interest and activity in the options market following brief periods of hesitation. In the near term, the focus will likely be on whether SPX can maintain stability around the 6,400 zone while option sentiment consolidates or strengthens further. September S&P 500 E-Mini futures (ESU25) are down -0.24%, and September Nasdaq 100 E-Mini futures (NQU25) are down -0.32% this morning, pointing to a slightly lower open on Wall Street after last Friday’s rally as some of the optimism around expectations for Federal Reserve interest rate cuts faded. Investor focus this week is on an earnings report from semiconductor stalwart Nvidia, comments from Fed officials, and the release of the Fed’s preferred inflation gauge. In Friday’s trading session, Wall Street’s major equity averages closed sharply higher, with the Dow notching a new all-time high. The Magnificent Seven stocks rallied, with Tesla (TSLA) climbing over +6% and Alphabet (GOOGL) gaining more than +3%. Also, chip stocks advanced, with ON Semiconductor (ON) surging over +6% and GlobalFoundries (GFS) rising more than +5%. In addition, Zoom Communications (ZM) jumped over +12% after the videoconferencing platform posted upbeat Q2 results and raised its full-year guidance. On the bearish side, Intuit (INTU) slid more than -5% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the company issued disappointing full-year guidance. Speaking Friday at the Fed’s annual conference in Jackson Hole, Wyoming, Chair Jerome Powell cautiously signaled the possibility of a September interest rate cut, citing rising risks to the labor market even as concerns over inflation persist. “The stability of the unemployment rate and other labor market measures allows us to proceed carefully as we consider changes to our policy stance. Nonetheless, with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance,” Powell said. “Powell has thrown the door wide open to a September cut with his Jackson Hole speech that sends a clear, strong signal the Fed is on track to reduce rates by 25 basis points at that meeting,” said Krishna Guha at Evercore. Meanwhile, U.S. rate futures have priced in an 87.3% probability of a 25 basis point rate cut and a 12.7% chance of no rate change at the conclusion of the Fed’s September meeting. On the trade front, U.S. President Donald Trump announced on Friday a “major” tariff probe targeting imported furniture. In a Truth Social post, President Trump stated, “Furniture coming from other Countries into the United States will be Tariffed at a Rate yet to be determined.” This week, market participants will focus on earnings reports from several major companies, with semiconductor giant Nvidia’s (NVDA) report on Wednesday attracting the most attention. Nvidia’s earnings reports have been market-moving since May 2023, when the company delivered the revenue growth forecast that reverberated globally. Analysts expect another record in sales, driven by the continued robust demand for the company’s GPU chips used in generative AI applications. Prominent companies like CrowdStrike Holdings (CRWD), Snowflake (SNOW), Dell Technologies (DELL), Marvell Technology (MRVL), HP Inc. (HPQ), and Autodesk (ADSK) are also set to release their quarterly results this week. Market watchers will also keep a close eye on a slew of U.S. economic data releases this week to assess whether tariffs are driving inflation higher and to gauge the extent to which the economy is slowing. The July reading of the U.S. core personal consumption expenditures price index, the Fed’s preferred inflation gauge, will be the main highlight. If the core PCE price index comes in strong, then the Fed may need another weak jobs report for August to justify lowering interest rates, according to Pepperstone head of research Chris Weston. Other data will provide insight into the state of the U.S. economy, including U.S. GDP (second estimate), the Conference Board’s Consumer Confidence Index, Durable Goods Orders, Core Durable Goods Orders, Initial Jobless Claims, Personal Income, and Personal Spending. In addition, investors will follow comments from Fed officials to gauge their appetite for a rate cut in September. Fed Governor Christopher Waller, Dallas Fed President Lorie Logan, New York Fed President John Williams, and Richmond Fed President Tom Barkin are scheduled to speak this week. Today, investors will focus on U.S. New Home Sales data, which is set to be released in a couple of hours. Economists, on average, forecast that July new home sales will stand at 635K, compared to 627K in June. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.273%, up +0.31%. The SPY hit another new all-time high last week and closed at $645.31 (+0.28%). The week began with a pullback, and the GoNoGo Trend Indicator shifted to aqua candles, signaling a deceleration in bullish momentum. That changed quickly on Friday, as Powell’s comments at Jackson Hole reignited buying pressure. SPY rallied back above the 1.236 Fibonacci extension, accompanied by a return to strong dark blue candles, confirming renewed strength at record highs. Let's look at expected moves. We were just building back some I.V. and then Fridays push up wiped it all out. My bias or lean today is bearish. Generally we get a retrace off days like Friday. Even with futures down, as I type, there is a chance the markets get one more push higher before the retrace. That's how I'm playing it today. Over the last 48 days, the US Federal Debt has surged by +$1 TRILLION, or +$21 billion PER DAY. Since August 11th, the US has added +$200 billion in debt. Why is US government spending running at WW2 levels in a "strong" economy? Trade docket: Scalping /MNQ with a SPX 0DTE and LULU cover. Gold still lacks premium for a 0DTE and BTC is too crazy right now to get a 1HTE working. Let's look at the intra-day levels. 6470, 6476, 6482, 6493 resistance with 6454, 6448, 6439, 6426 are support. We've got a great part-II training today to address some tendencies we have as traders. I look forward to seeing you all in the live trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |