|

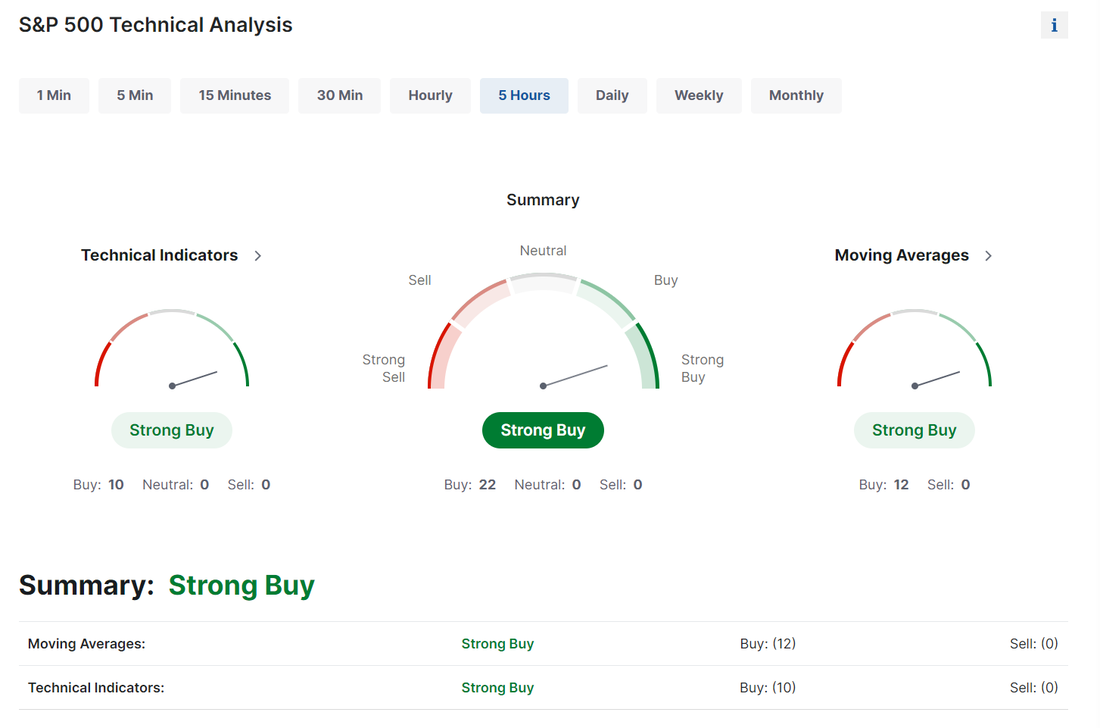

We had a really solid day yesterday with very few posiitons in the model portfolio needing attention. Our NDX 0DTE cash flowed over $1,000 profit, once again and my net liq. was up $4,500 for the day. Scalping was a huge success with over $1,300 profit and we now have automated timestamps! We look to close out a solid first month of they year today. MSFT, GOOG and AMD earnings drug the futures down overnight. The hightened I.V. allowed up to get an amazing entry in the 1DTE /NQ overnight setup and ThetaFairy. Both look good going into the open this morning. We've got BA, AAPL, META, AMZN reporting today and we look to play all of them. The overnight drop in futures didn't do much damage to our technicals. Dropping us from a "strong buy" rating to "buy". Today is news catalyst heavy with earnings, ADP and Canadian GDP as well as oil inventory numbers which we always watch closely with our oil ladder strategy. Of course, the big catalyst today should be FOMC and Powells testimony: Futures retace has placed us right back into our "chop zone" that we've been in for a little over a week. The Tech heavy /NQ is getting hit harder percentage wise. On FOMC days I don't give levels as frequently the price action won't adhere to them, depending on Powells testimony. Our approach on FOMC days is to double dip. We'll start with a very asymmetric, low prob/low risk, high return, high theta 0DTE right out out of the gate. The goal is to risk very little and get maximum theta errosion. Ideally we'd like to exit this within a 1-2 hour period and then we wait! FOMC minutes drop then 30 minutes later Powell starts his testimony. This, more times than not is what the algos queue off of and we'll start to get movement. More times than not the first move needs to be faded. With about 70-90 minutes left in the trading day we'll look to enter our second 0DTE.

1 Comment

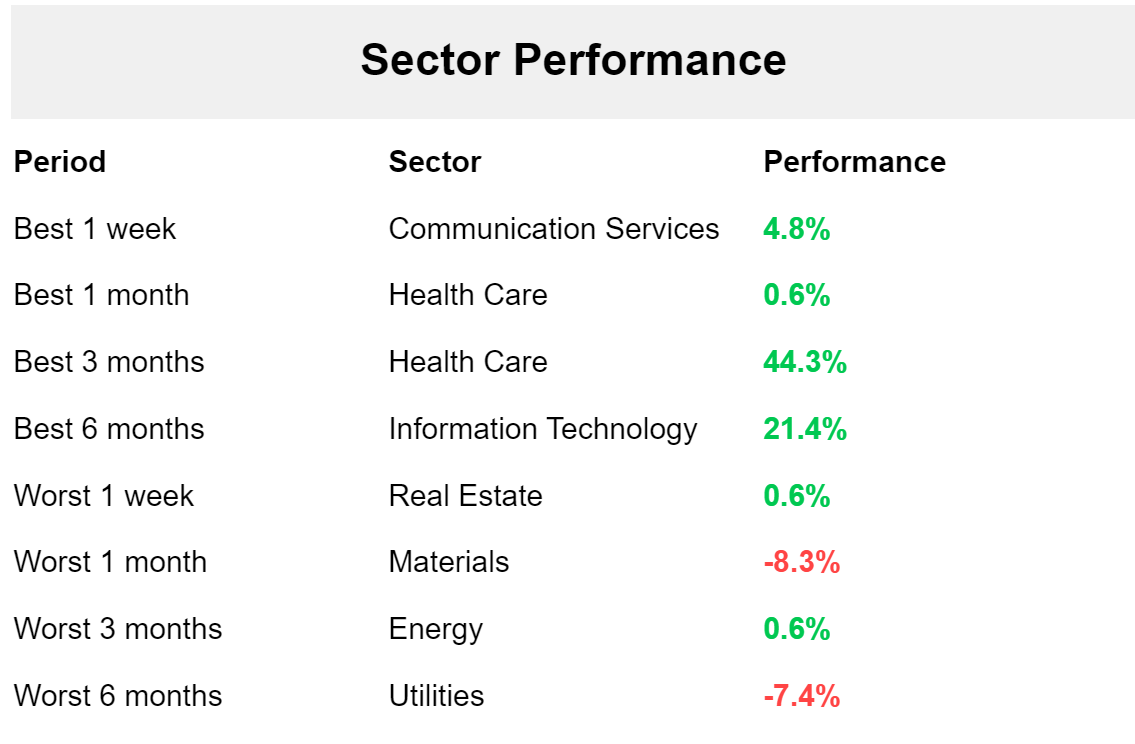

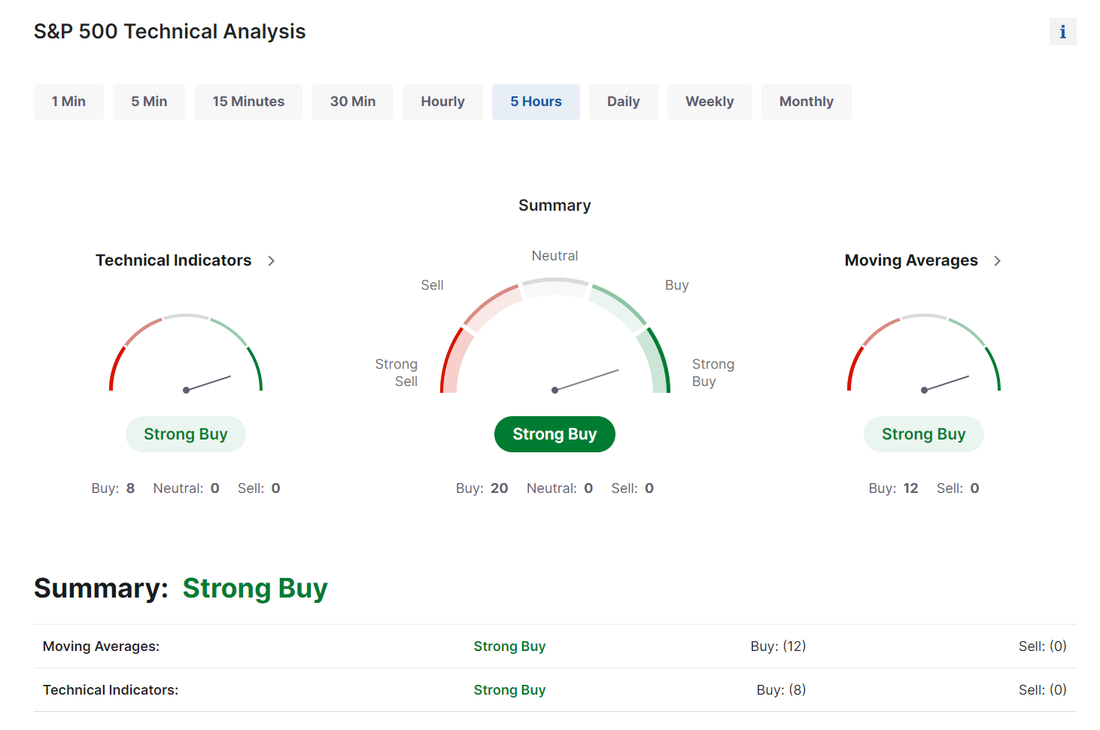

We had an "O.K" day yesterday. My net liq was up 2-3K most of the day but ended down $1,700 at the close. We were fairly delta negative so the push up didn't help us. Today will be busy. We have MSFT, GOOG, PFE, UPS, SBUX, AMD, BA, and AAPL earnings trades for today. We'll spend a good part of the day going through the data sets of each setup. It was a broad based rally yesterday that lifted all sectors. With energy being the only sector that didn't participate. All of the market internals look strong Here's an example of our data sets we use to build our earnings setups. It was a slow, relentless push higher yesterday. Intra day levels for me today: 4953/4957/4968/4978 to the upside on /ES. 4943/4935/4923/4919* (PoC on 2hr. chart)/4913 to the downside. Intra day levels for me today on /NQ: 17735/17791/17824/17870 to the upside. 17654/17603/17522/17468 to the downside.

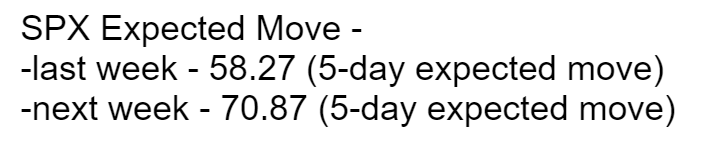

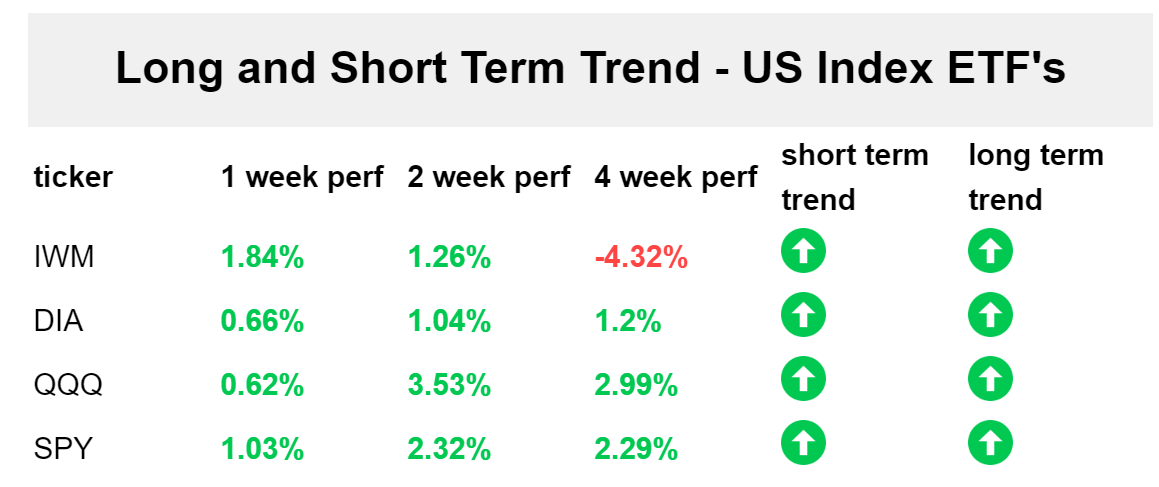

We ended last week on a bang with my net liq up almost $5,000. It was a successful week for us but we had to work for it every....single....day. It was a battle all week. Today should be busy for us with a restart on most of our weekly credit strangles and all of our ladder trades. Bullish bias continues to be in effect. This week should be busy. We don't have much coming today as far as catalysts but this is just the calm before the storm. Maybe the biggest and most anticipated earnings week, with MSFT, GOOG, AAPL, AMZN, META, AMD, FED, SBUX and BA all reporting this week. We'll try to get trades on as many of these as we can. We've also got Non-farm payrolls (which can be a big catalyst for moves) and, of course, FOMC on Weds. Futures are looking for the FED to hold rates at this meeting and then we have a 50.5% chance of a rate cut of 25 basis points at the March meeting and a 91% chance at the May meeting. Performance for the week was mostly positive with the IWM pushing the most. SPY is pushing up onto the 1.618 Fibonacci line. This is a critical level it needs to break through to continue this bullish push. The expected move for the week on SPY is 1.3% which may be way off with all the potential catalysts we have this week. This means we've finally got some I.V. back in this market! We may be back with the Theta fairy setup...finally. Sector performance shows health care and I.T. (tech) are still leading the way this year. Trends accross the board continue to look bullish As far as intra-day levels for our 0DTE setups, we continue to coil...awaiting a big move Levels for me today on /ES are: 4927/4933* (Key level. Would break us out of the current channel)/4941/4946 to the upside. 4914/4908/4901/4894* (Key level. Would break us out to the downside of current channel). On /NQ my intra day levels are: 17628/17669/11735 to the upside. 17527/17497/17458 to the downside.

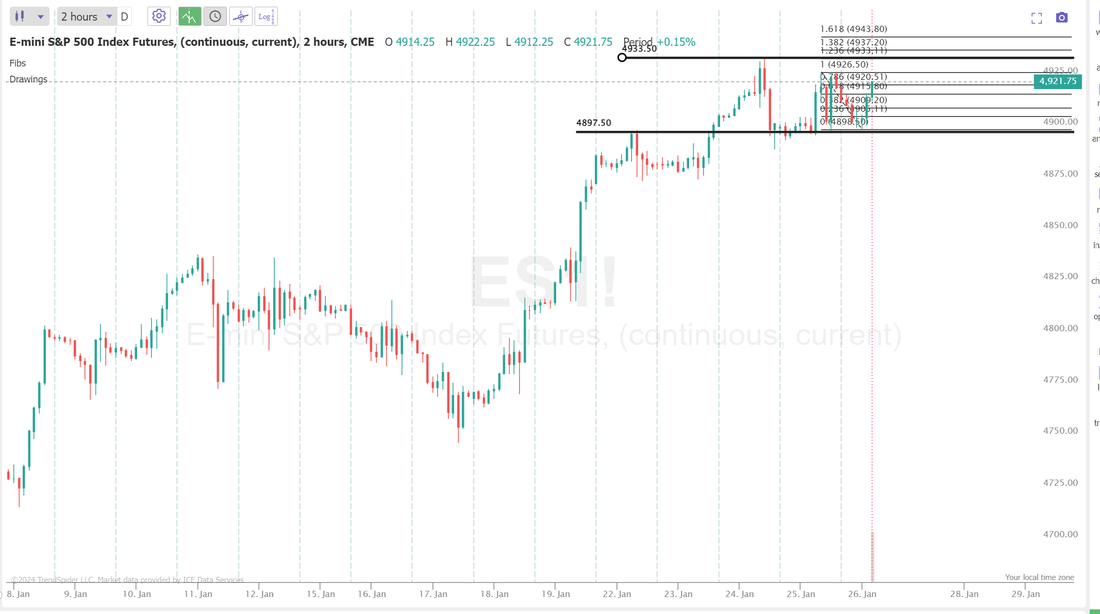

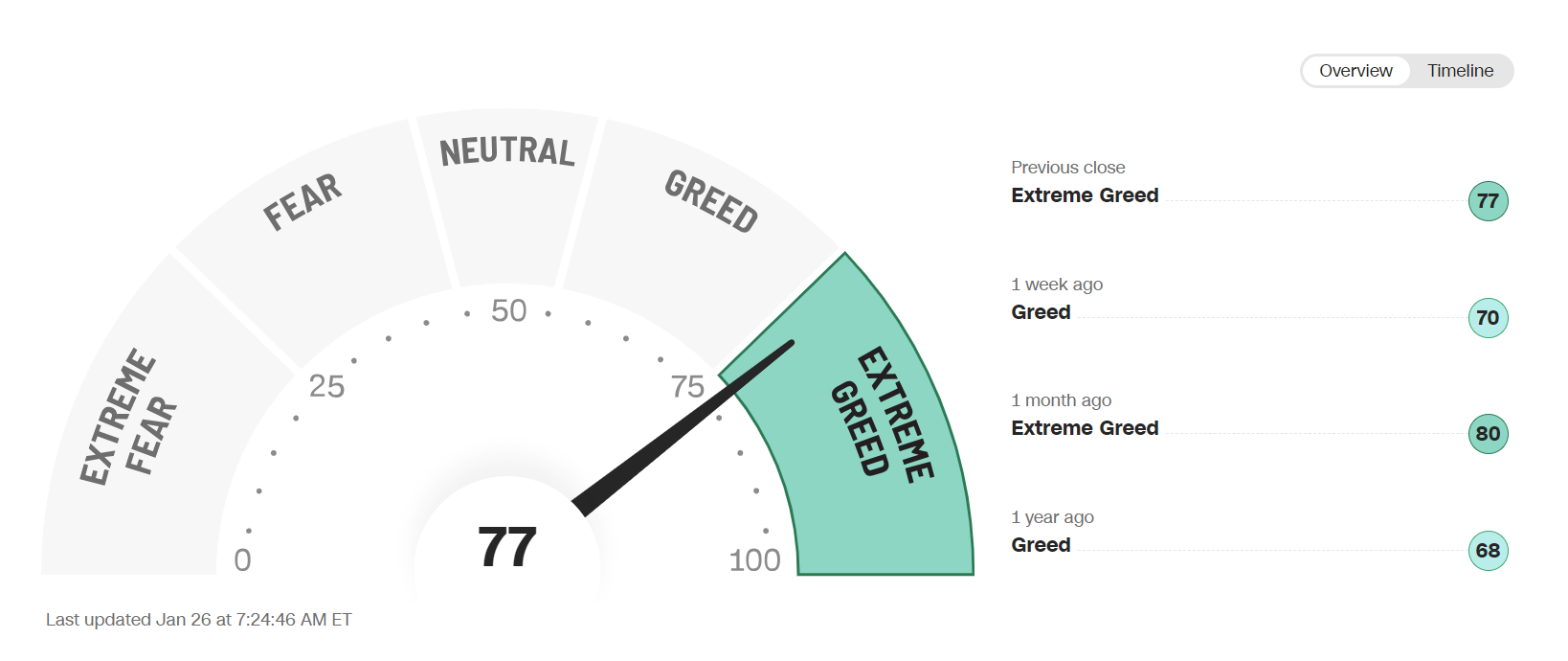

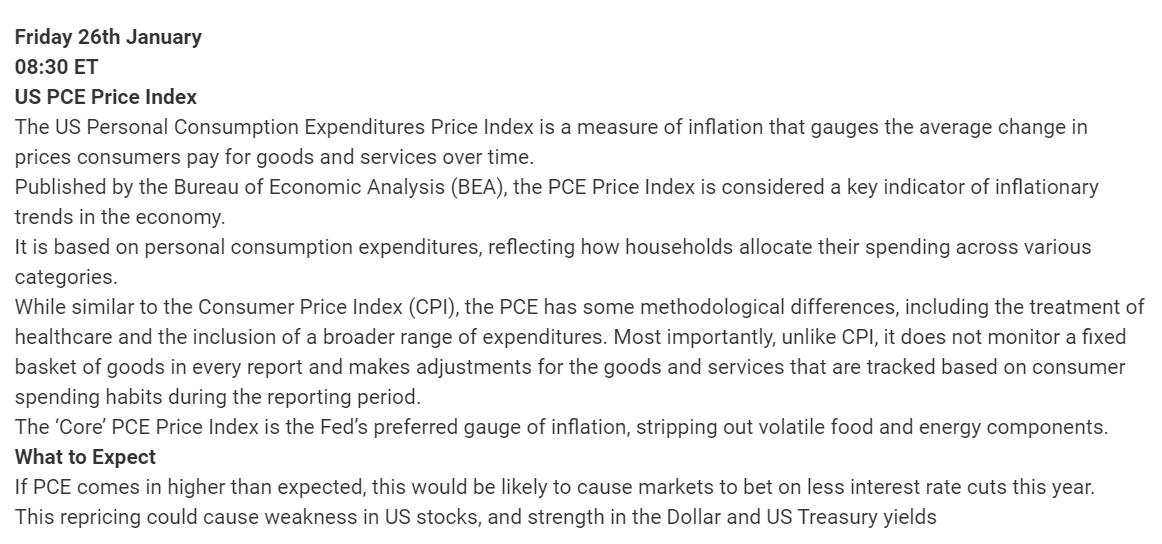

We had a solid day yesterday with our NDX 0DTE returning $5,000 profit. Our biggest 0DTE win of the year so far. Scalping helped out a bit and we brought in a lot of cash flow on our QQQ zebra cover. All in all, a pretty good day. The market continues to churn here.We hit a high on /ES of 4898 on Jan. 22nd. That resistance level then became support and our new resistance now sits at 4932. We've been just bouncing inside this range all week. Technicals are all still firmly bullish To say we are in a "risk on" enviroment is an understatment. Rotation into small caps. VIX hammered down. Fear-greed index pinned. This bull move has been strong but, it might be time to start taking some longs off and adding more shorts. We've added several bearish positions to the model portfolio this week. Futures are ticking down this morning. INTC reported yesterday and tumbled -11% in pre-market. Chipmakers may be hitting a wall. Our TSLA bearish setup was perfect as we get more dissapointing results. PCE is coming in this morning. It should be our main news catalyst of the day. Intra day levels for me: As I mentioned, 4898-4932 is the current chop zone. Price action inside this range is meaningless to me. 4926/4933/4937/4944 to the upside. 4915/4909/4905/4898 to the downside.

Yesterday was a tough one for us with our QQQ and NVDA trades giving us fits. We've restructured both setups and hopefully we can get some good cash flow with out QQQ trade today. Markets are still bullish There's an interesting rotation happening currently. While the Nasdaq is still leading the charge, small-cap stocks are starting to join in. The IWM an the QQQ are both up more that 19% of the past three months. This is a huge differentail compared to the 55% for QQQ and 17% for IWM last year. Futures are flat as I type this. Market is awaiting key U.S. GDP data and Tesla earnings from yesterday are weighing on the indicies. Our TSLA trade looks like it should be a full profit capture today. GDP and Jobless claims are the news catalysts for today: Two days now into this bull market where we ended with doji candles. It the bull running out of steam? Intra-day levels for me today: 4905/4916/4923/4933*(high of yesterday)/4944 to the upside. 4899/4888/4879/4863 to the downside.

I'm super proud of our results for this week. Not because we are killiing it...we arent, but we have turned some garbage into silk. Monday I started the day down 9k in net liq and battled back to a $550 loss. Yesterday's net liq started off slightly red and nothing we had was really working but we were still able to improve net liq by almost $4,000 dollars. We've certainly earned out profits so far this week. Markets continue to push. The bullish bias is now pretty intrenched with this latest breakout. We are back to our long VTI swing trade and as I've mentioned over and over, this is one of my favorite strategies. I'm going to be saddened if we can't return 36-50% ROI over the year with this setup. Technicals all continue to point up. Markets are looking for clear sailing to the upside right now. We've got several news catalyst that could affect us today. PMI is the big one and oil inventory numbers will guide us for our next oil ladder setup. With strong earnings overnight with NFLX leading the way (our NFLX earnings trade looks great BTW) and China working to pump up their economy the market is looking to move higher today. Intra day levels for me: 4930/4949/4972/4990 to the upside. 4898/4880/4863/4840 to the downside.

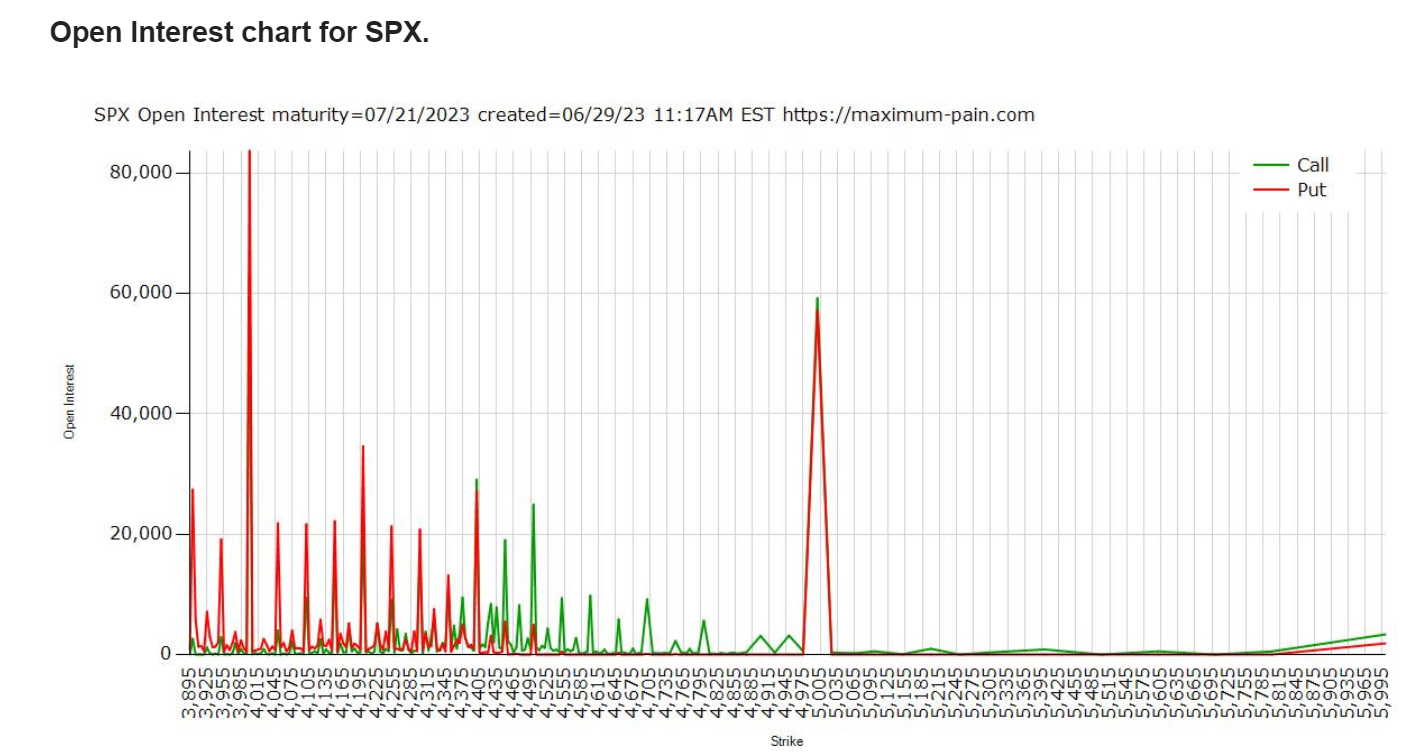

Depending on PMI action, I'm looking for all bullish setups today with our 0DTE's. Well, I'm calling yesterday a huge victory. My net liq ended down $550 bucks at the closing bell but I started off the day $9,000 in the hole. We worked trades all day long, right up to the bell to get most of that back. We did have some success with our 0DTE's and SPY trades. The market has broken through some key resistance levels. It's not clear sailing for the bulls yet but if the "trend is your friend" then your current freind is of the bullish persuasion. Most of the indices we trade are at new ATH's with the IWM (RUT) lagging a bit. Technicals are still firmly bullish: Now is a prime time to diversify your model portfolio into non-equity correlated underlyings. We are currently working Nat gas, Oil, Bonds and Wheat trades. These give us nice balance and usually have great income potential. We will be looking to add a Copper position today. Open interest walls continue to grow and squeeze with more and more put selling taking place. While bullish signals and directional bias continues on, there are some signs of being overstretched to the upside. We are pressing on the upper Bollinger band while Stoch and RSI are approaching over bought range. A pause of pullback here wouldn't neccessarily be bearish. We may be due for a pause. Market internals look fairly strong. Earnings season continues to ramp up. Our UAL and ZION trades from yesterday look to be full profits this morning and we'll continue to work these setups with NFLX, ISRG and TXN today. Crypto continues to be a "buy the rumor, sell the news" setup. After the Bitcoin spot ETF's were approved its been nothing but down with BITO losing $200 mil of withdrawals since approval. Yesterday was very much a consolidation day and today looks like it could be more of the same. My intra-day #0DTE levels: There are two standout levels for me today. 4898 to the upside and 4873 to the downside. Those correlate with yesterdays high and low respectively. Anything between these two levels is just meaningless chop to me. Levels of resistance to the upside are 4888/4892/4898/4903. To the downside: 4879/4873/4867/4859. Tight levels today. We may look to incorporate a butterfly into our 0DTE's today.

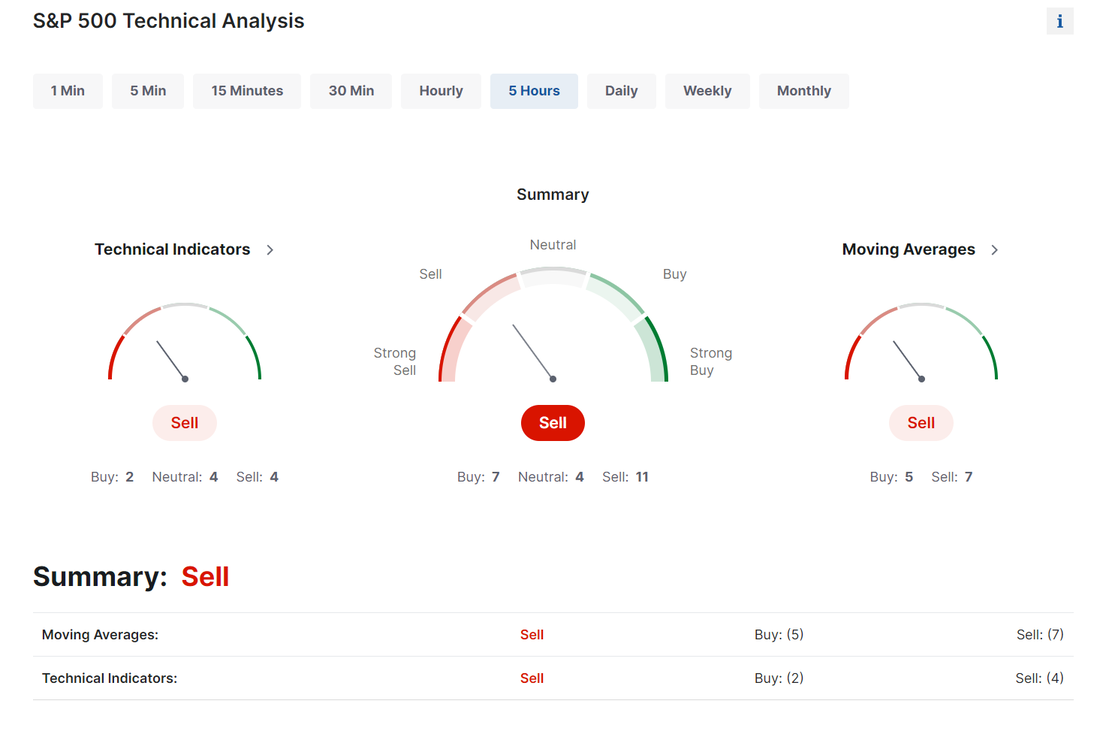

It was a messy day for us yesterday. Several hotspots but having a model portfolio and diversified strategies paid off for us. My net liq ended up $780 on the day. I was up 2k but we ended up rolling our SPX call side and gave some back. Scalping was awesome and really helped our net liq and the NDX 0DTE hit max profit target. We are right on track with our scalping goals this year of $50,000 of income from $3,500 of capital. If you aren't scalping with us come check it out. The slight sell signals we got yesterday lasted a few hours. We are now back to buy mode. This is getting a little deja vue but its ground hog day once again. Another day, another non directional day. We are now over a month of just treading water. It was a risk on day yesterday with mega cap techs strong and leading the charge with energy and utilites being the losers. News catalysts for today. If you look at the 2 hr. chart you'll see we are at a very critical level for bulls. This is a resistance level that we've been working on for quite some time. A substantive push above with a strong close on the day could be whats needed to unleash another bullish run. Conversly, the longer we take to try to break out of this resistance area, the stronger the resistance becomes and the more ammo the bears have. Intra day levels for me: 4842* (key level for bulls to clear)/4859/4878/4901 to the upside. 4822/4816/4800/4789 to the downside.

Yesterday was what I'd call a "perfect" day. Net liq was up $1,700 dollars. Perfect. When we get 15k days those are exciting but they also mean we are pretty leveraged to get that and the next day could easily be -15K. Slow and steady...consistency, that's what wins the race. Both our 0DTE's knocked it out of the park again. We are batting 100% success so far this year. The market weakness from yesterday finally got the technicals rolling over, if ever so slightly. 4732 is the key watch level for me on /ES. Below that could signal some bearish future action. Open interest walls are starting to shift. We still have a massive wall above 5000 on SPX but you can see the put side is now building posiitons as well. The market is prepping for a large move. We are back to losses on most the indices for the year. The QQQ's are just hanging on. Selling was broad based yesterday with all major sectors ending down on the day. News catalysts for today: Fed member Bostic will be speaking as well. I'm rolling out the performance reports for all our strategies from 2023. Bookmark this video as I'll drop a link for each individual report in this video so you have a one stop reference point to review them all. Starting tonight with undefined risk, credit strangles. Intra day levels for me: 4800/4815/4831/4842 to the upside. 4772/4761/4746/4735 to the downside.

We had an "O.K." day yesterday to start the holiday shortened trading week. My net liq was up $700 dollars which was a big victory as NVDA and BA both pressured us. Our 0DTE's poured in almost $1800 of profit. The DOW fell to a three week low on BA's downgrade by Wells Fargo. NY Empire State manufatuing index plunged yesterday and Fed Governor Waller stated that rate cuts need to be "carefully calibrated and not rushed. I see no reason to move as quickly or cut as raidly as in the past". The market didn't like either. Bad economic news out of China overnight have kept futures lower this morning. We have key, US retail sales numbers up before the bell this morning which could shape our opening. In spite of the weak catalysts, its not been enough to turn the indicators negative. Price action has brought us back to a very critical level of approx. 4785 on /ES. This is where we started the year and then dropped. Jan. 9th, 11th, 16th it acted as support. Will it hold as support today or turn into resistance? Tech was the only bright spot yesterday with NVDA continuing to shoot higher. We also have Fed's Bowman and Barr speaking this morning along with US industrial production numbers. Intra day levels for me: Tight ranges again today. 4788/4793/4801* (key level for bulls)/4809 to the upside. 4779/4769/4760/4749 to the downside.

|

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |