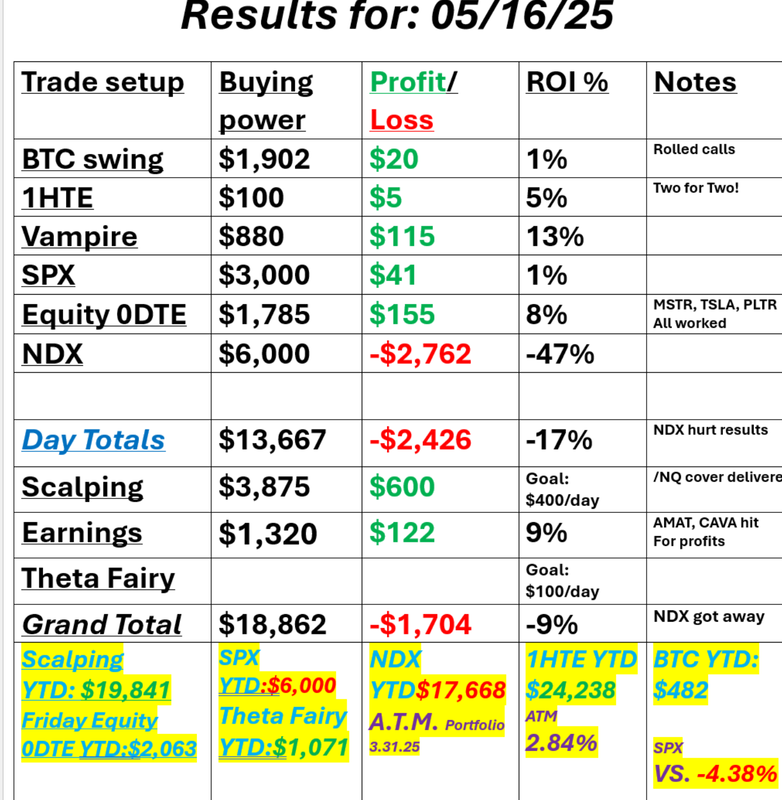

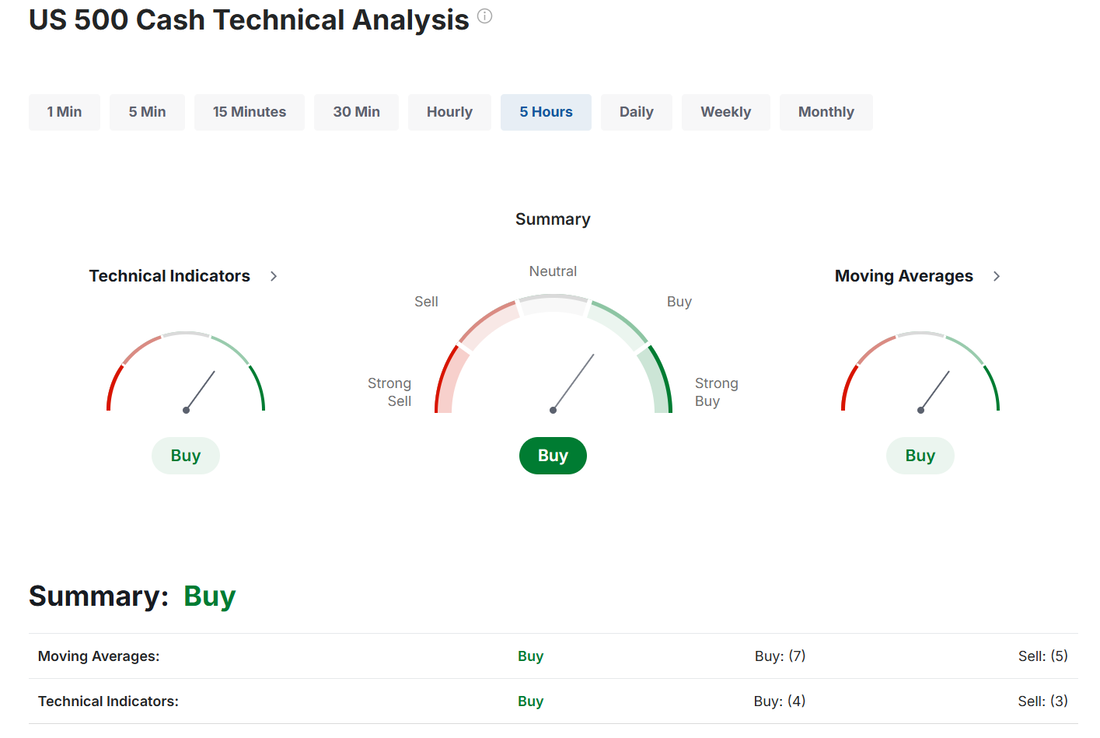

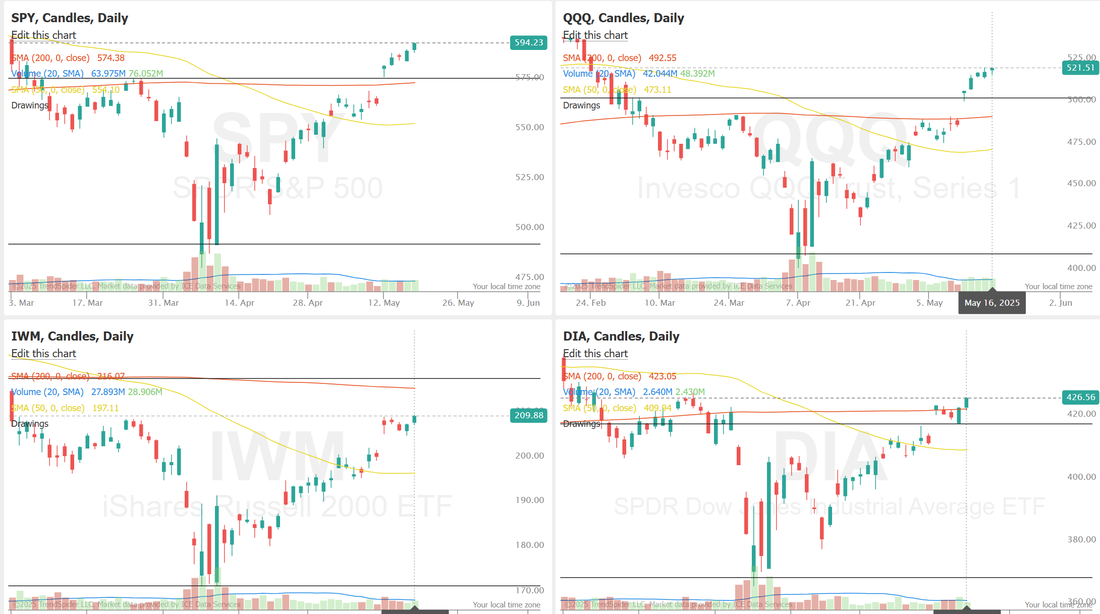

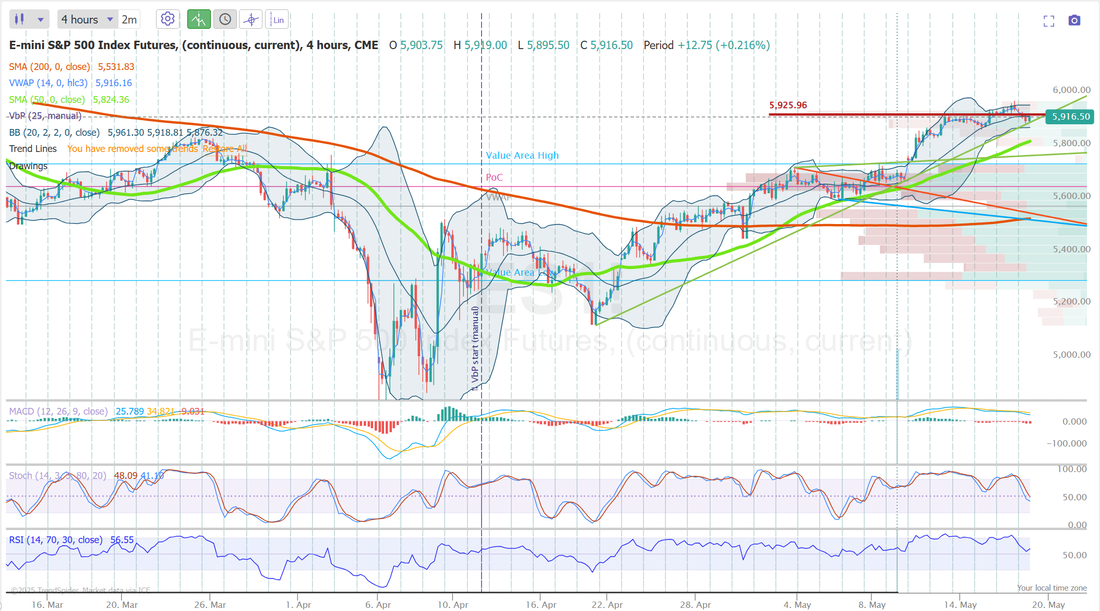

Deciphering real vs. potential.The markets have been moving a lot lately! That's probably not news to you. It's the "what" that has been moving it that is important. Tariff news has been the catalyst. Tariffs are announced and markets drop. Tariffs get a reprieve and markets pop. The reality however is tariffs, in the real world, have had little to no effect. Most companies have 3 month inventory on hand so prices haven't risen. Consumers are still buying at the same rate as before. Inflation is still coming down. Rating agencies say that the potential tariffs will NOT have an effect on GDP or growth. May this all change in the future? Of course! Today, however, we get "Real" news. Moody's dropping their rating on the U.S. due to the ballooning debt. This is real. This is actually happening. The U.S. debt is out of control and the markets are reacting today. Our ATM portfolio continues to carry a negative delta as these continue to be trying times. As I type, the market isn't open yet but futures are tanking. It's nice to know we should have a nice green number in our portfolio to start the day. Our trading on Friday was largely good with the exception of the NDX which put a damper on the day. See my results below: June S&P 500 E-Mini futures (ESM25) are down -1.22%, and June Nasdaq 100 E-Mini futures (NQM25) are down -1.59% this morning as sentiment took a hit after rating agency Moody’s downgraded the United States’ credit rating. Late Friday, Moody’s Ratings lowered the U.S. credit score by one notch to Aa1, aligning with Fitch Ratings and S&P Global Ratings in grading the world’s largest economy below the top, triple-A position. Moody’s said the downgrade “reflects the increase over more than a decade in government debt and interest payment ratios to levels that are significantly higher than similarly rated sovereigns.” Speaking on NBC’s Meet the Press with Kristen Welker on Sunday, U.S. Treasury Secretary Scott Bessent dismissed concerns about the government’s debt, calling Moody’s a “lagging indicator.” This week, investor focus is on a fresh batch of U.S. economic data, remarks from Federal Reserve officials, and earnings reports from retail heavyweights. In Friday’s trading session, Wall Street’s major equity averages closed higher. CoreWeave (CRWV) soared over +22% after a 13G filing revealed that Nvidia raised its stake in the cloud-computing provider to 7% from 5.2%. Also, recently beaten-down healthcare stocks rallied, with UnitedHealth Group (UNH) climbing more than +6% to lead gainers in the S&P 500 and Dow and Moderna (MRNA) rising over +5%. In addition, Archer Aviation (ACHR) surged more than +9% after being selected as the Official Air Taxi Provider for the 2028 Los Angeles Olympic and Paralympic Games. On the bearish side, Applied Materials (AMAT) slumped over -5% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the semiconductor equipment maker provided a tepid FQ3 revenue forecast. Economic data released on Friday showed that the University of Michigan’s U.S. consumer sentiment index unexpectedly fell to a nearly 3-year low of 50.8 in May, weaker than expectations of 53.1. Also, U.S. April housing starts rose +1.6% m/m to 1.361M, stronger than expectations of 1.360M, while building permits, a proxy for future construction, fell -4.7% m/m to 1.412M, weaker than expectations of 1.450M. In addition, the U.S. import price index unexpectedly rose +0.1% m/m in April, stronger than expectations of -0.4% m/m. Atlanta Fed President Raphael Bostic said on Friday that he anticipates the U.S. economy will slow this year but avoid a recession, and reaffirmed his expectation for one interest rate cut in 2025. U.S. rate futures have priced in a 91.7% chance of no rate change and an 8.3% chance of a 25 basis point rate cut at the Fed’s monetary policy committee meeting next month. Meanwhile, a key House committee advanced U.S. President Donald Trump’s massive tax and spending package after Republican hardliners secured a deal with party leaders to accelerate cuts to Medicaid health coverage. This week, market participants will keep a close eye on U.S. economic data releases for clues on how tariffs and the uncertainty surrounding them are affecting the economy. Preliminary purchasing managers’ surveys for May will provide a timely snapshot of the health of the U.S. manufacturing and services sectors as tariffs begin to take a greater toll on businesses. Other noteworthy data releases include U.S. Existing Home Sales, Initial Jobless Claims, and New Home Sales. “Global activity is still showing resilience, including in the U.S., where continued frontloading is supporting the ‘hard data,’” Citi analysts said in a recent note. However, they noted that ‘soft data,’ including activity and confidence surveys, “paint a potentially grimmer picture, particularly in the U.S., where consumer and business confidence are still deteriorating.” Investors will also monitor speeches from Fed officials as they look for signals on whether policymakers are moving closer to cutting interest rates following the latest soft inflation data. Bostic, Williams, Jefferson, Logan, Musalem, Daly, and Hammack are scheduled to speak this week. In addition, retailers such as Home Depot (HD), TJX Companies (TJX), Lowe’s (LOW), Target (TGT), and Ross Stores (ROST), along with notable companies like Palo Alto Networks (PANW), Medtronic (MDT), Snowflake (SNOW), Intuit (INTU), and Analog Devices (ADI), are slated to release their quarterly results this week. Investors will closely watch retail earnings for indications of consumer weakening amid reports of waning sentiment and worries that tariffs could push prices higher. Today, investors will focus on the Conference Board’s Leading Economic Index for the U.S., which is set to be released in a couple of hours. Economists expect the April figure to be -0.7% m/m, the same as in March. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.544%, up +2.37%. Let's take a look at the markets. In spite of the futures sell off with the credit downgrade, technicals are still holding to a slight buy signal. We were looking for a bullish day on Friday and that's what we got. All the indices are now solidly above their 200DMA. Futures being down today change the look a bit but we are still in a near term bullish trend. What the market does with today's news catalyst will be the tell. Does it shake it off today or use it to turn us to a bearish stance? SPY closed the week strong at $594.20 (+5.31%), gapping above the 200-day moving average, a key level many trend followers watch as a potential signal of bullish continuation. Bulls remained firmly in control, with price action skipping the Weak Go phase and triggering a Strong Go signal on the GoNoGo Trend® Indicator. However, with RSI approaching overbought territory, traders may want to watch for signs of exhaustion heading into next week. QQQ closed even stronger at $521.51 (+6.87%), landing near its year-to-date volume point of control, a key zone of potential overhead supply. With RSI pushing into overbought territory, the stage is set for a tug-of-war between trend-followers riding momentum above the 200-day moving average and bears looking for signs of a reversal. The IWM small-cap ETF lagged behind last week, closing at $209.85 (+4.49%). A Strong Go signal has triggered, and with the index still trading roughly 3% below its 200-day moving average, bulls may have room to push higher before encountering resistance. Unlike its large-cap peers, IWM’s RSI remains below overbought territory, offering more room for near-term follow-through. Taking a look at the weekly expected moves. In spite of this mornings futures selloff, the expected moves and I.V. for the week are back to "normal" levels. My bias or lean today is slightly bullish off the lows of the futures. As I type this the /ES is down -65 and the /NQ is down -340. I think we recoup some of that today. Maybe we don't finish green but I think we rise from here. Earnings season is winding down but we still have HD, TJX, LOW, TGT, PANW, MDT SNOW and INTU potentials this week. We'll work HD today. Our QTTB cover needs replacing. We are already scalping with a long /MNQ with a ratio cover. BITO needs the put side entry. SPX 0DTE with a low probability of a NDX entry today. Lastly, our 1HTE BTC should kick off shortly today. Let's take a look at the /ES as our main focus for today's intra-day levels. 5925 has been a key level for me for a while now on the 4hr. chart. We are back to being slightly below it this morning, as I type. The bulls first order of business today is to get back above that level. On a tighter, 2hr. chart that 5925 still holds key for the bulls. Above that and it's like the down grade never even happened. Support is down at 5874. Below that and well...you can see. There's plenty of downside for a potential retracement. Today we'll be doing another training on a traders checklist that will help all traders focus on what's most important! Either tune into the live zoom feed or watch the replay! See you all in the live trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |