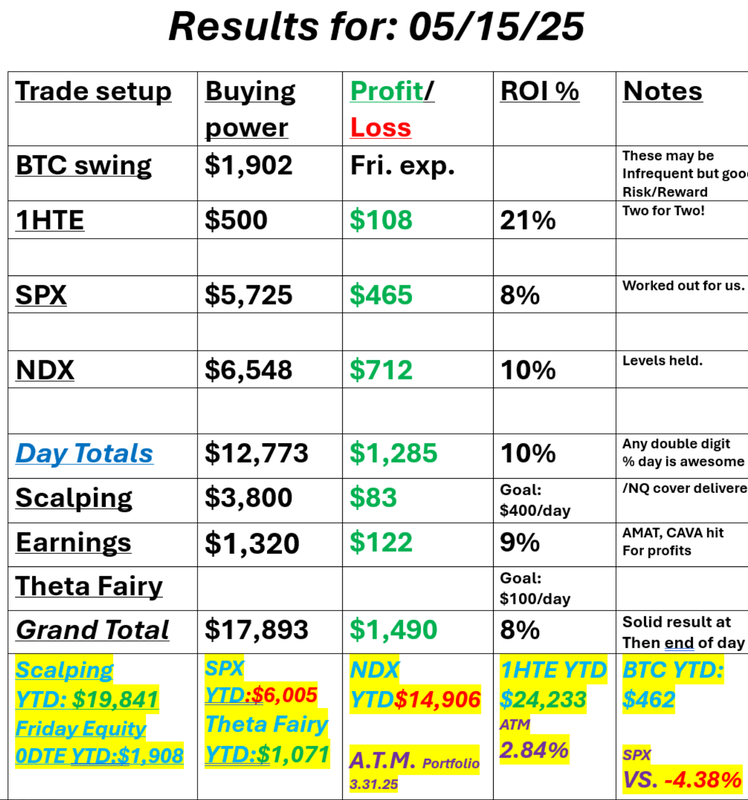

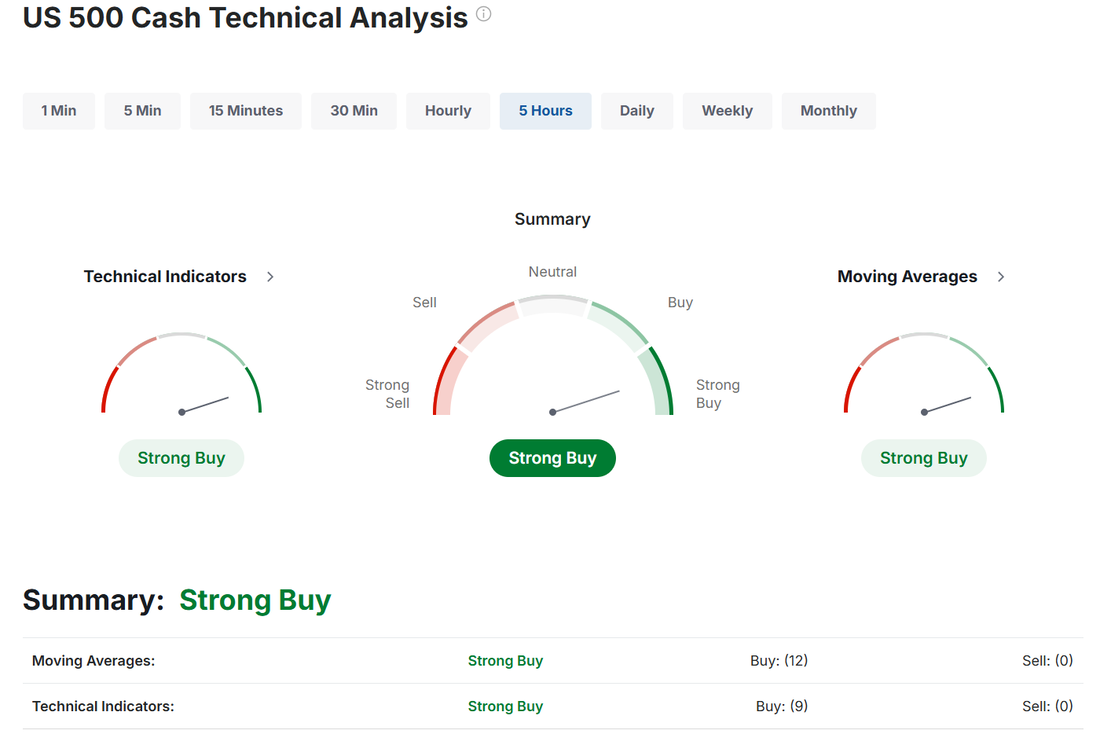

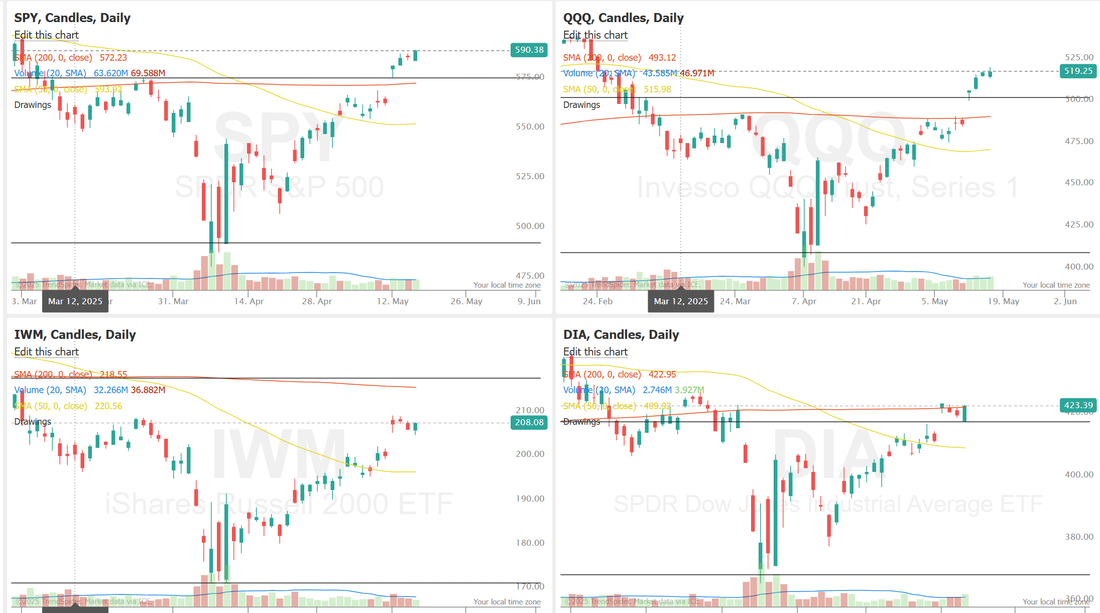

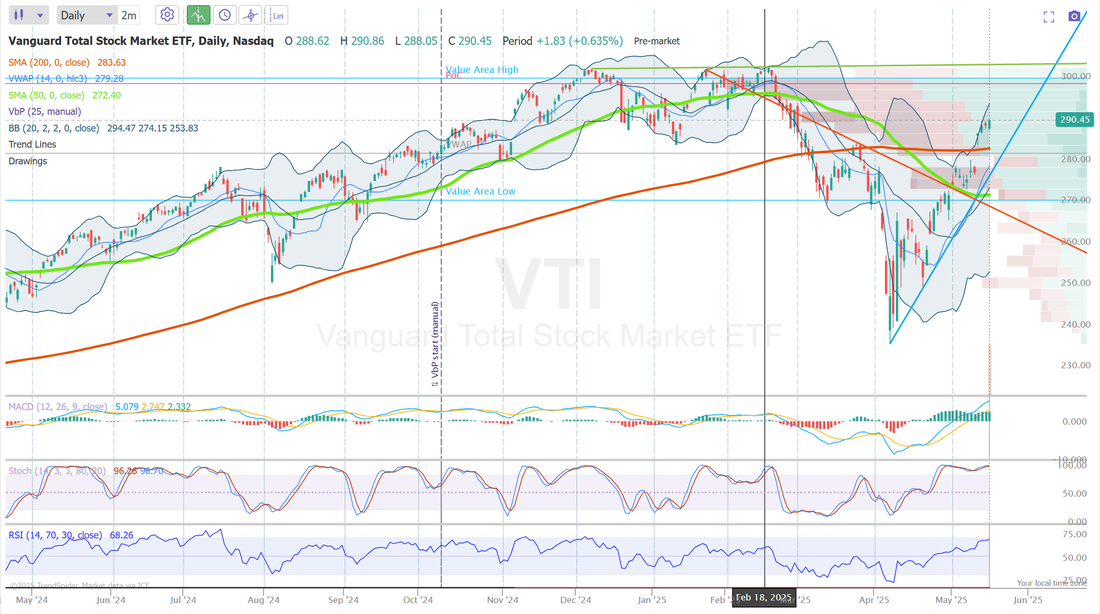

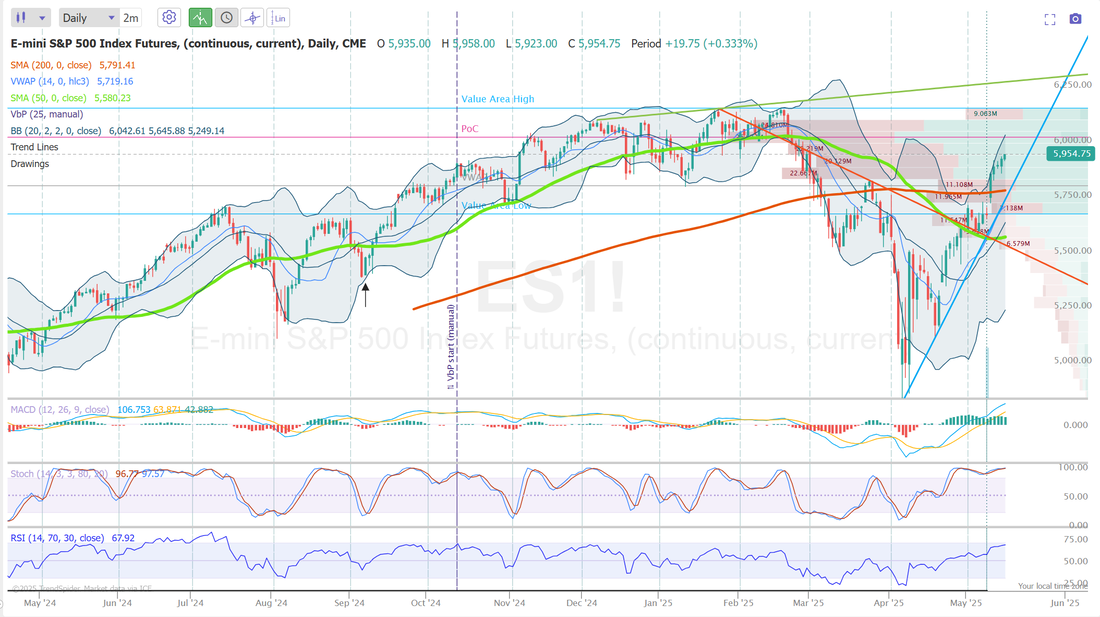

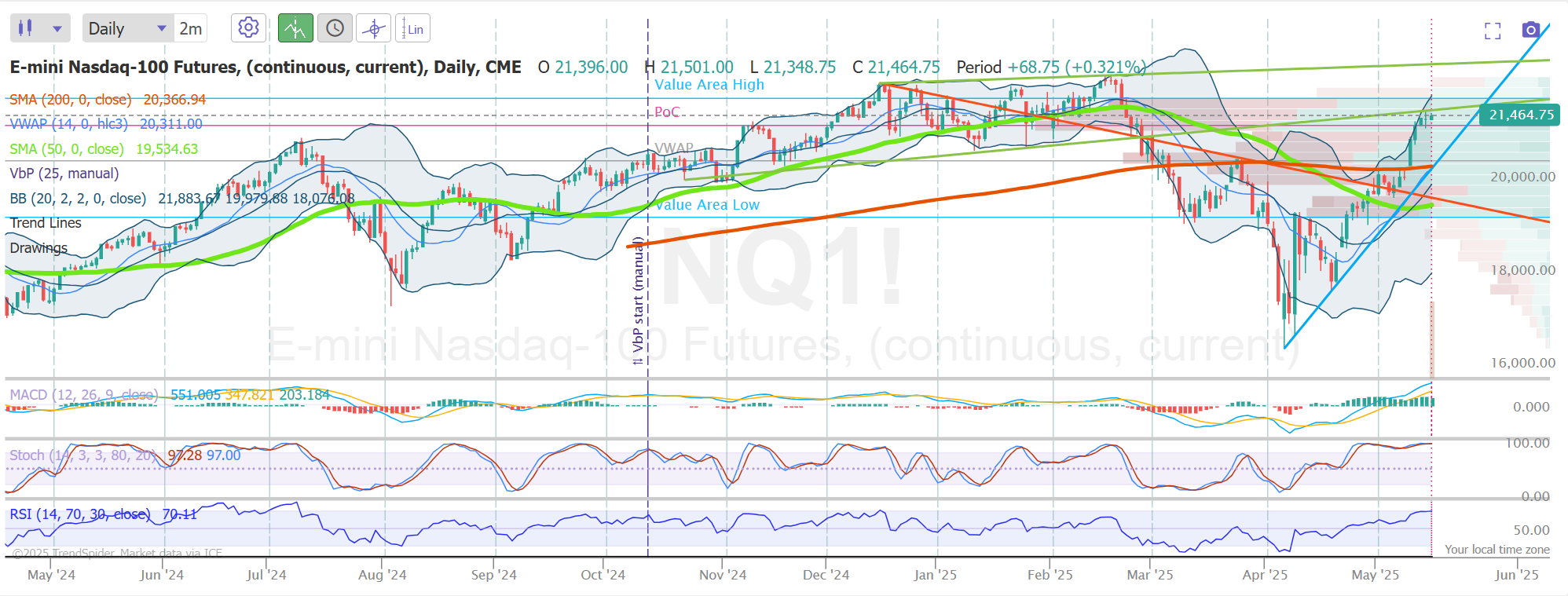

Can you make money being wrong?I love the study of great traders. Whether it's the book Market wizards or a documentary on Youtube, it's insightful to delve into the story of those that are successful in this game of trading. Not surprisingly, a lot of them are unique. They have high IQ's. They are math quants. They play bridge and poker at a high level, etc. In other words they are "special". Does that mean the average person can't succeed at this zero-sum game? Absolutely not! I'm a great example of that! I took a bearish stance yesterday. I thought we were due a retrace after a solid five day rally. Guess what? I was wrong. Markets went up. Not a lot, but they did move in exactly the opposite direction that I planned. I started the day with a short scalp on /MNQ and a bearish SPX 0DTE and then later with a bearish NDX 0DTE. Admittedly, my risk on the day rose above the $500/per trade goal that I have but ultimately EVERY SINGE TRADE I did made money. That's the power of dynamic trading and scaling into trades as the day progresses. Take a look at our day: Let's take a look at the market. Bullish technicals continue to look a tad overstretched and yet we continue higher. The charts certainly look impressive if you are bullish. Taking a look at VTI, which I think gives the best "clear" sign of where the overall market is at, I see a couple divergent signals. #1. Clearly the action is bullish. We are back above the 200DMA. We are gapping up. That's all bullish, however, this is a long bullish run. Indicators, particularly the RSI and Stochastics are really over stretched to the upside. Can they get even more over stretched? Of course however, markets NEVER move in a straight line forever and we have a straight line up right now. June S&P 500 E-Mini futures (ESM25) are trending up +0.19% this morning, with the benchmark index set for one of its strongest weeks this year, as the U.S.-China trade truce continues to bolster sentiment, while investors await a new batch of U.S. economic data and remarks from Federal Reserve officials. U.S. equity futures also drew support from falling Treasury yields, which continued their slide from Thursday after the latest economic data fueled speculation that the Fed may cut rates earlier than expected to avoid a recession. In yesterday’s trading session, Wall Street’s major indices ended mixed. Steris Plc (STE) climbed over +8% and was the top percentage gainer on the S&P 500 after the company reported better-than-expected FQ4 life sciences revenue. Also, Cisco Systems (CSCO) rose more than +4% and was the top percentage gainer on the Dow and Nasdaq 100 after the company posted upbeat FQ3 results and raised its full-year guidance. In addition, Foot Locker (FL) jumped over +85% after Dick’s Sporting Goods agreed to buy the company for about $2.4 billion. On the bearish side, UnitedHealth Group (UNH) plunged more than -10% and was the top percentage loser on the Dow after the Wall Street Journal reported that the U.S. Department of Justice was investigating the company for possible Medicare fraud. Economic data released on Thursday showed that U.S. retail sales rose +0.1% m/m in April, stronger than expectations of no change m/m. Also, the U.S. producer price index for final demand came in at -0.5% m/m and +2.4% y/y in April, weaker than expectations of +0.2% m/m and +2.5% y/y. In addition, U.S. industrial production was unchanged m/m in April, weaker than expectations of +0.2% m/m, while manufacturing production fell -0.4% m/m, weaker than expectations of -0.2% m/m. Finally, the number of Americans filing for initial jobless claims stood at 229K last week, in line with expectations. “[Yesterday’s] data doesn’t change the narrative. Retail sales suggest consumers are becoming pickier, while there remains no sign of broad-based layoffs. The slowdown in inflation in April provides little comfort as the impact from tariffs is yet to come,” said Ellen Zentner at Morgan Stanley Wealth Management. Fed Chair Jerome Powell said on Thursday that policymakers are considering adjustments to key elements of the framework that guides their monetary policy decisions, including their perspective on U.S. employment shortfalls and their strategy for achieving the inflation target. He added, “Anchored inflation expectations are critical to everything we do, and we remain fully committed to the 2% target today.” Also, Fed Governor Michael Barr stated that the economy remains on solid footing, but cautioned that tariff-related supply-chain disruptions could lead to slower growth and higher inflation. Meanwhile, U.S. rate futures have priced in a 91.8% probability of no rate change and an 8.2% chance of a 25 basis point rate cut at June’s policy meeting. Today, investors will focus on the University of Michigan’s U.S. Consumer Sentiment Index, which is set to be released in a couple of hours. Economists, on average, forecast that the preliminary May figure will stand at 53.1, compared to 52.2 in April. U.S. Building Permits (preliminary) and Housing Starts data will also be reported today. Economists expect April Building Permits to be 1.450M and Housing Starts to be 1.360M, compared to the prior figures of 1.467M and 1.324M, respectively. U.S. Export and Import Price Indexes will be released today as well. Economists anticipate the export price index to be -0.5% m/m and the import price index to be -0.4% m/m in April, compared to the previous figures of unchanged m/m and -0.1% m/m, respectively. In addition, market participants will be anticipating speeches from Richmond Fed President Tom Barkin and San Francisco Fed President Mary Daly. Later today, investors will also be monitoring negotiations surrounding the U.S. budget, with its proposed substantial tax cuts and the potential impact these could have on the fiscal deficit. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.415%, down -0.90%. My lean or bias today is bullish. If the "trend is your friend" then you kind of need to be bullish today. Trade docket today is a bit busy for a Friday. AMAT and CAVA earnings take profits. BITO partial take profit and call side roll. QTTB. SPX overnight Vampire trade. It looks like is should expire fully profitable at the open and not require hedging. We've got a 1HTE BTC trade working right now and will continue to trade these as long as the setup allows. This have been so good for us. SPX and NDX 0DTE's. Possibly a share trade on UNH. TESLA, MSTR, PLTR potential 0DTE's. We are working a long /MNQ scalp to start the day and looking to add an /NQ cover. Let's take a look at our intra-day levels for our 0DTE's today. /ES: I have two BIG levels. 6038 is the PoC on the daily chart. That's where the bulls want to take us. It's also the level that I would look for a reversal IF we get there. 5810 is the low volume level and works as support. These are admittedly wide zones so I'll once again use intra-day pivot points to guide our levels today. Those have been really solid lately. /NQ: 21,833 is the High value area and works as resistance with 21,286 being PoC and the immediate downside target. Again, pivot points will be what I queue off of today. BTC: We are headed to our first profit of the day on our first 1HTE. Levels for BTC haven't changed since yesterday. 105,633 is resistance with 102,012 support. I look forward to seeing you all in the live trading room shortly! Let's work hard and see if we can end the week putting another $1,000+ dollars in our pockets today! I'm also excited to do another training session with you all on Monday. I'm going to give you a definitive check list for planning your trading day. Pre-trade. During the trade. Post trade.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |