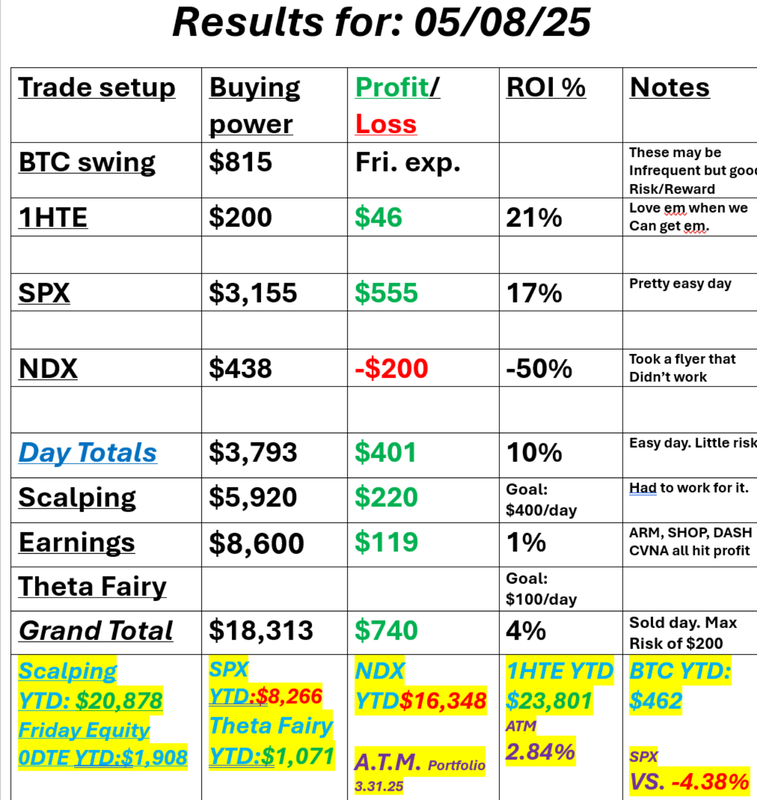

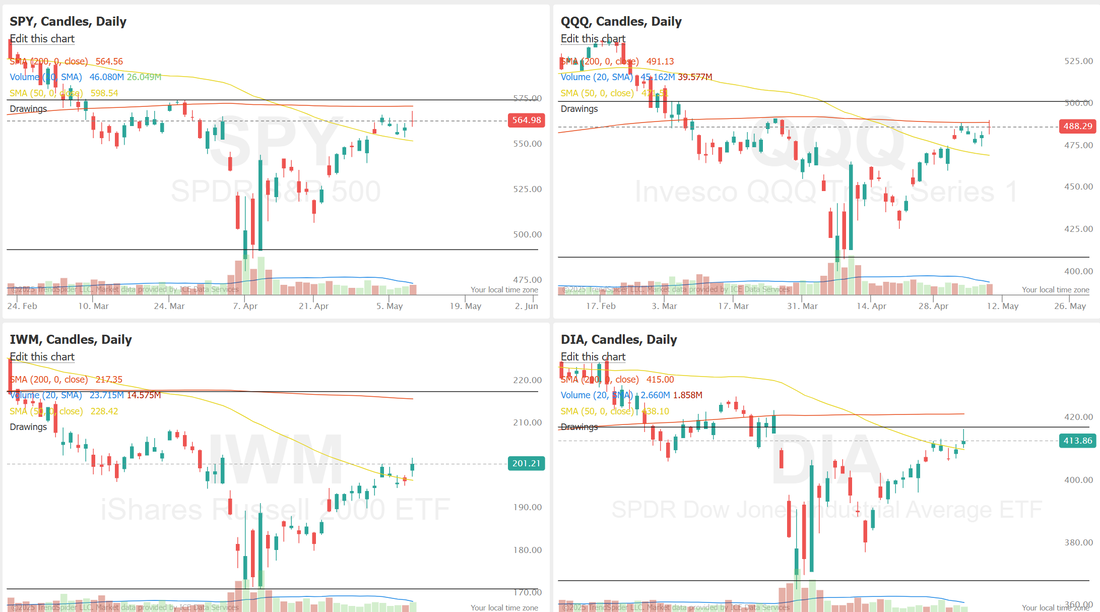

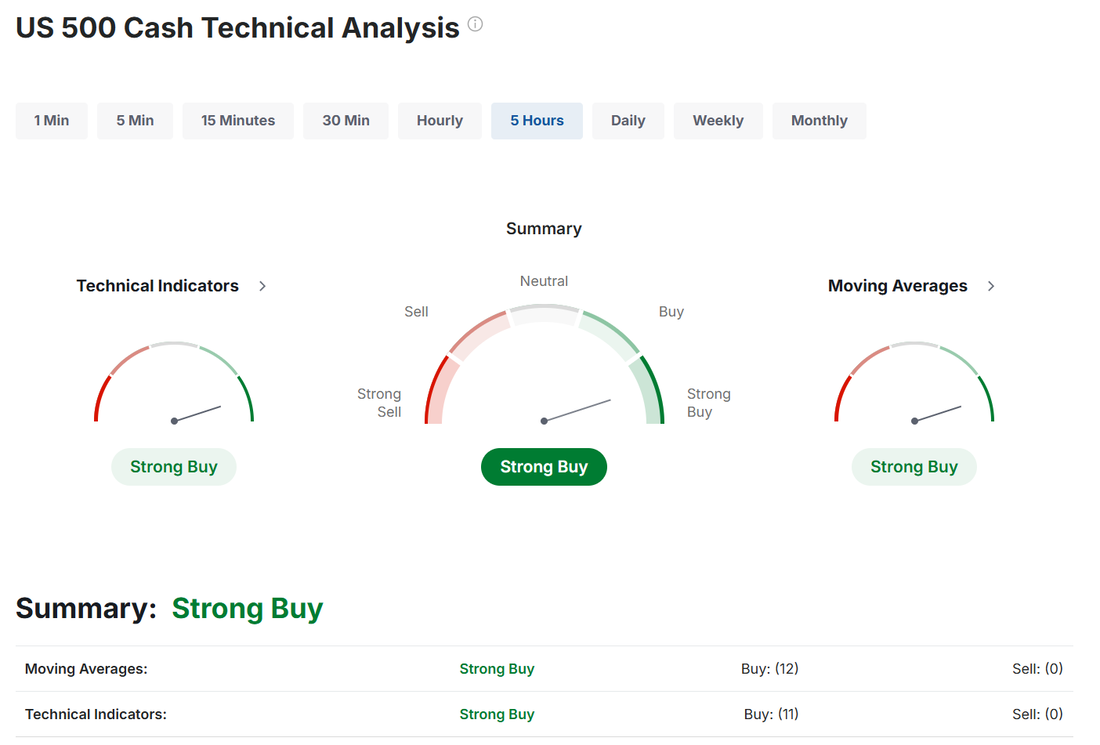

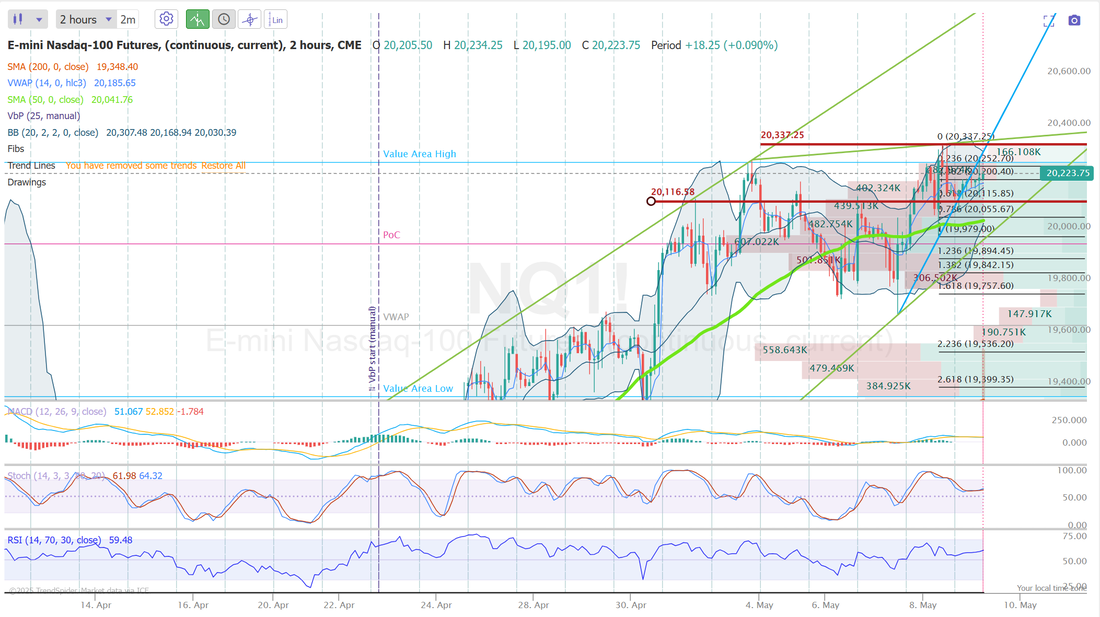

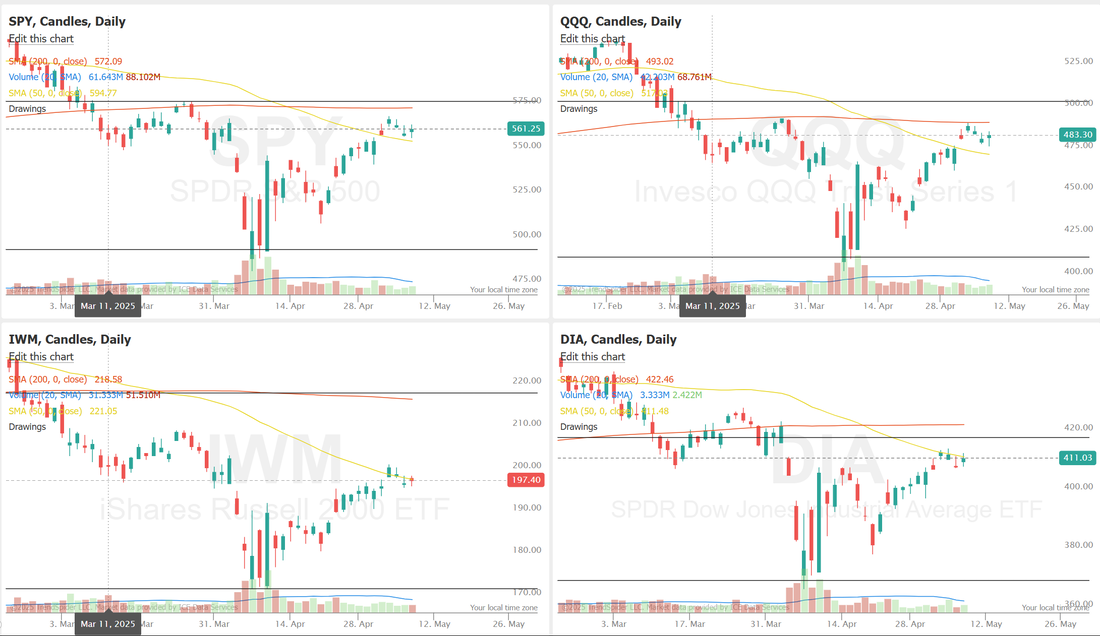

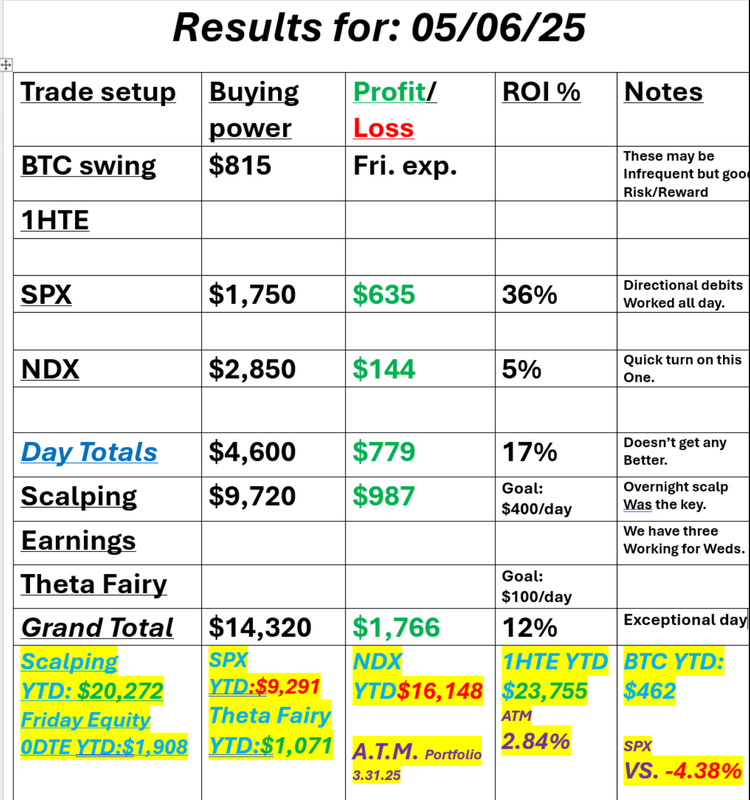

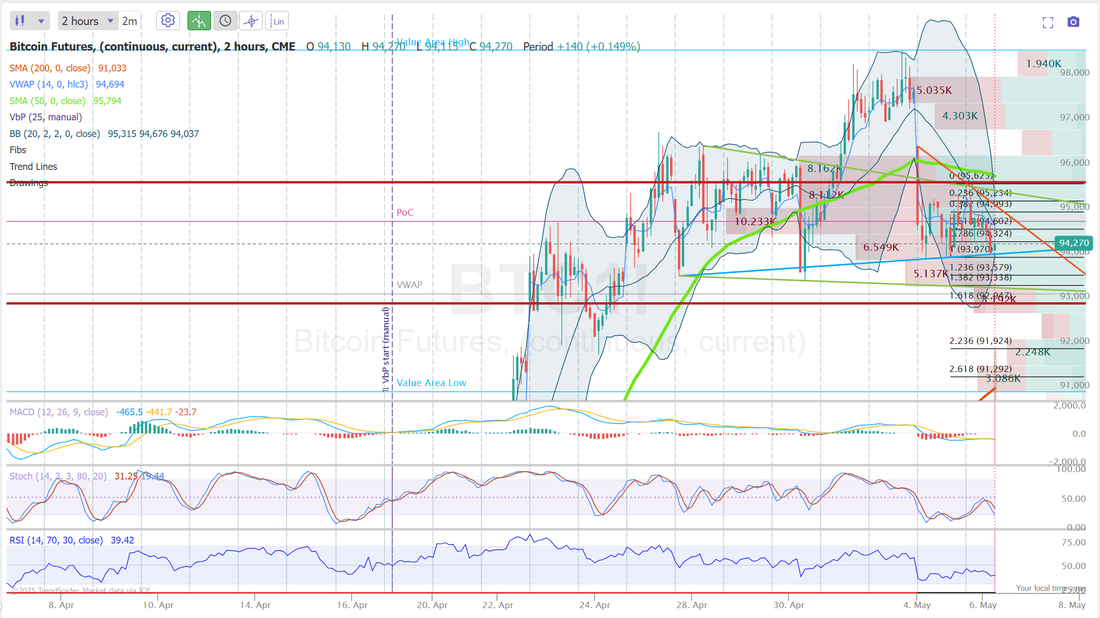

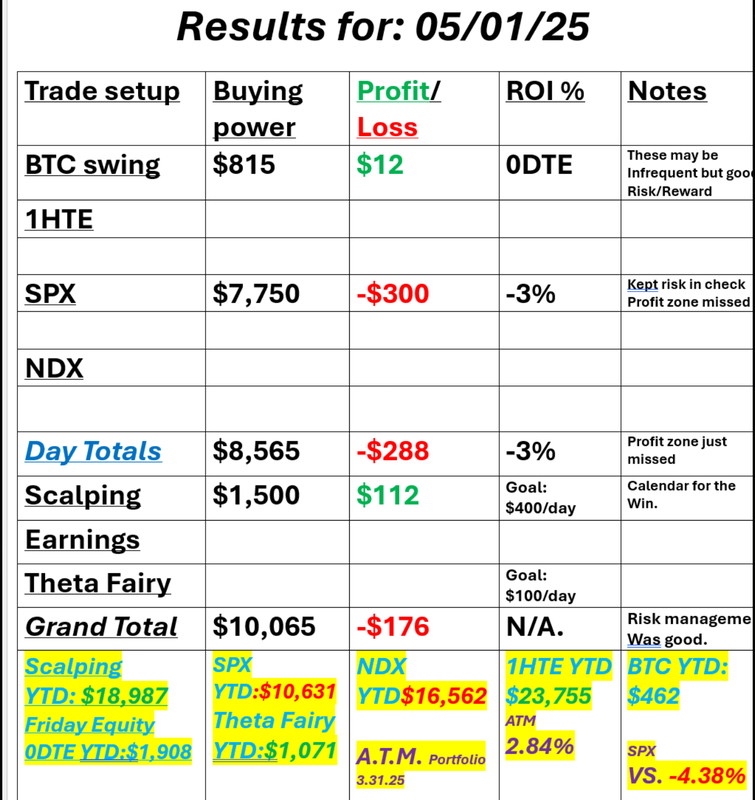

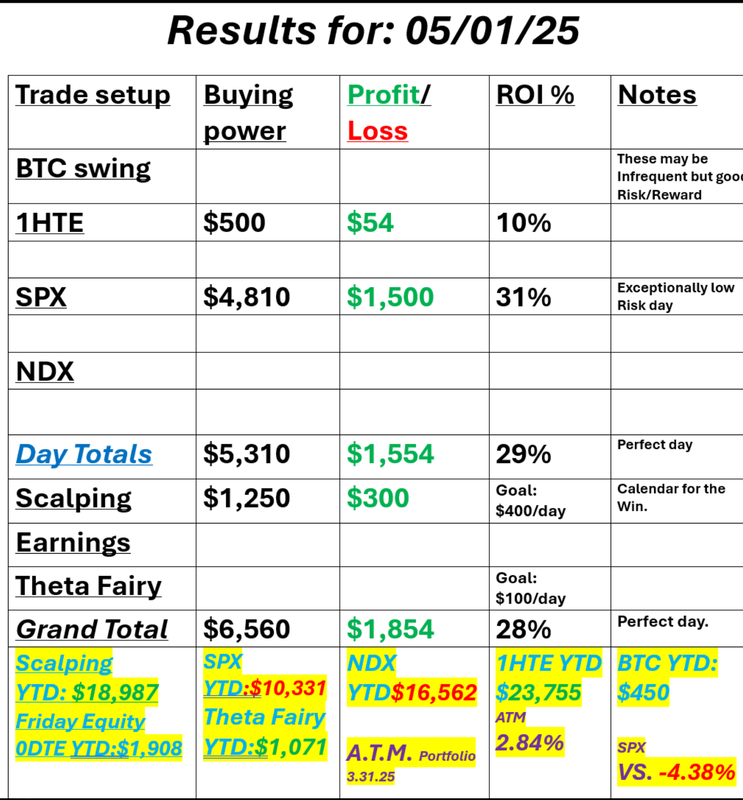

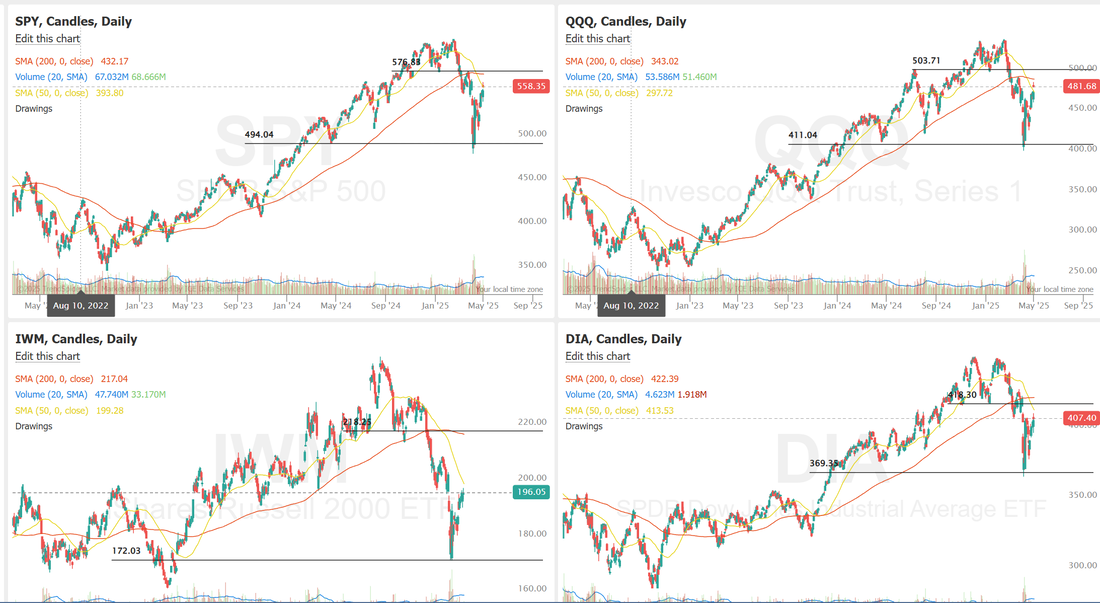

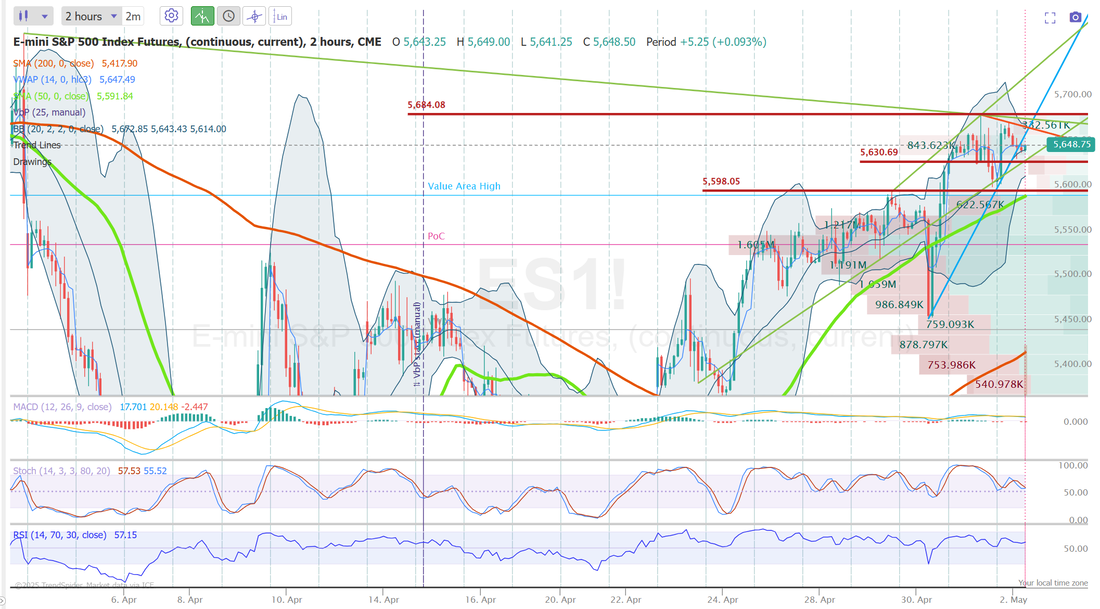

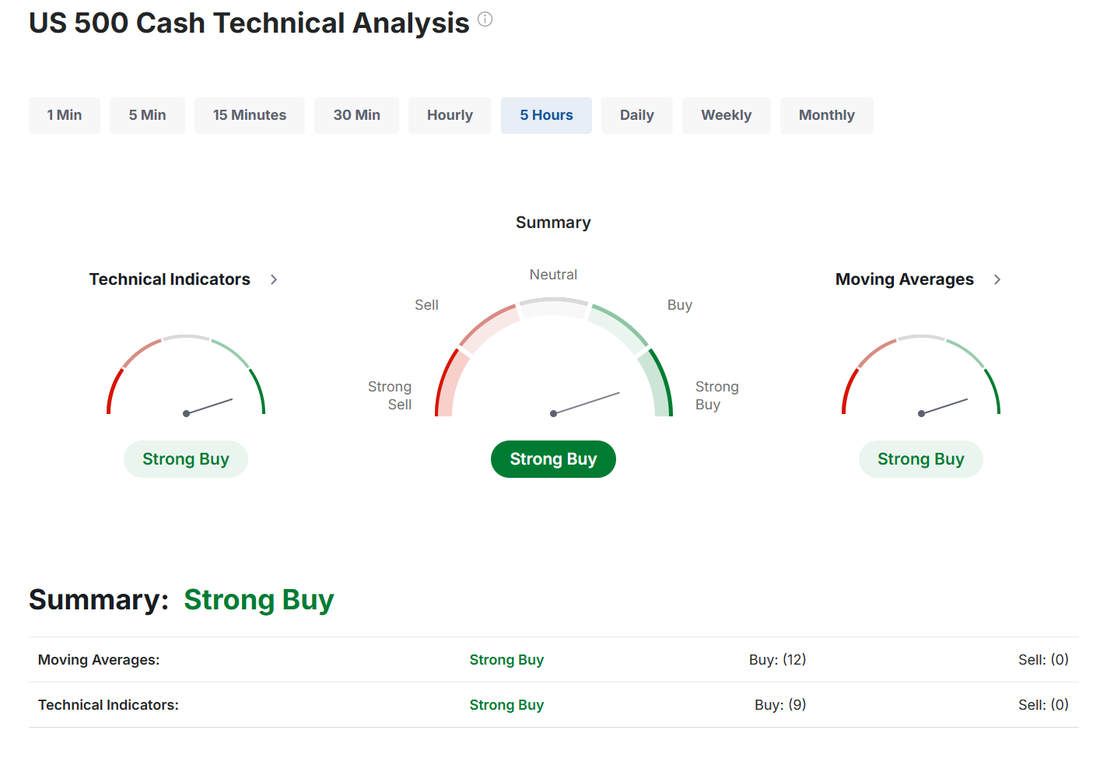

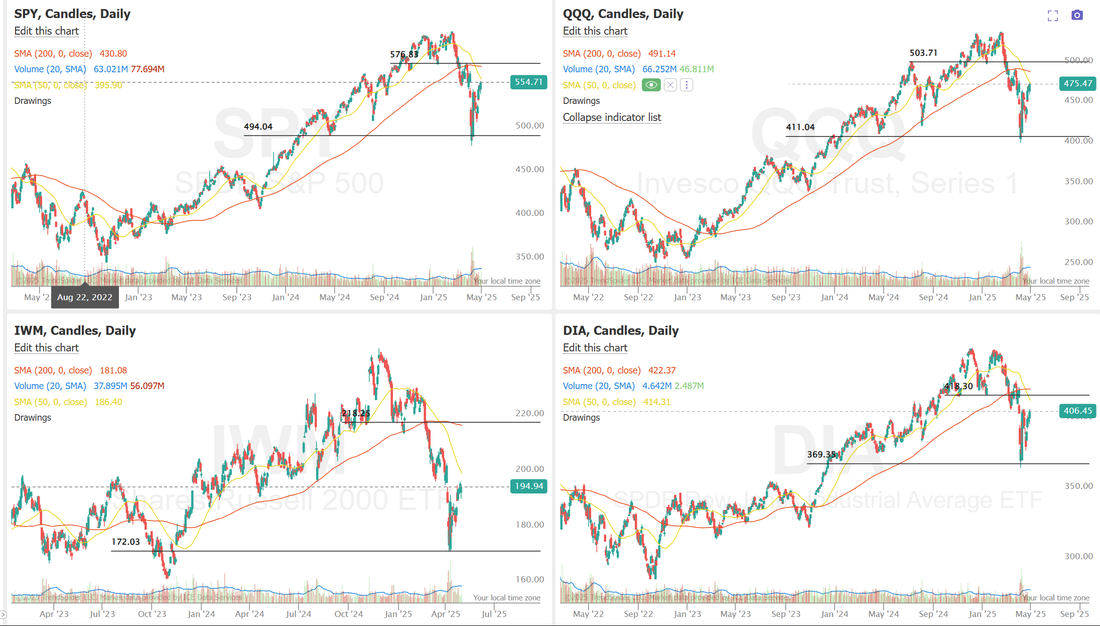

Are you trading with fear?Look, I get it. Ever since "Liberation day" trading has not been easy. In fact, it's been downright hard! It's also been mostly to the downside. Don't get me wrong. I vastly prefer a downward market to an upward trend. Bigger moves. Better premium. Easier to find things to short than long, etc. Most traders, however, are built to look for up trends. All this has had a mental effect on so many traders. The traders in our trading room are not exempt. From time to time we experience "performance drift". This phenomenon is seen when a large percentage of a unified trading group is experiencing different results (usually much worse results) than the "official" trade is producing. This week has been a breeze for us. Every day has not only got us close or surpassed our daily income goal of $1,000+ dollars but they've been pretty easy days. Very little work and very little risk. That is, if the trade was followed. Many of our traders skipped trades. Altered trades. Only did partial trades and not surprisingly, lost money. This coming Monday I'll be doing a two-hour training on Trading Psychology and how to overcome fear in your trading. I encourage you to tune in live or watch the recording at your leisure. As I mentioned, it's been a solid week of gains for us. Yesterday was no different. Our max risk all day was $200 dollars on an NDX flyer I took in the last hour of trading. I said this at the start of the week...we are in a real nice sweet spot right now in the market. We've still got great I.V. but the moves are more fluid and less erratic. Here's a look at our day yesterday (for those that followed the trades). I took a flyer on NDX going into the close. Had we left it, it would have made us $600 dollars but $200 dollars was all I was willing to risk. June S&P 500 E-Mini futures (ESM25) are trending up +0.13% this morning as investors refrain from making big bets ahead of trade negotiations between Washington and Beijing. Investors are eagerly awaiting the upcoming trade talks between the U.S. and China, set to take place in Switzerland this weekend, which President Trump expects to be “substantive.” U.S. Treasury Secretary Scott Bessent and U.S. Trade Representative Jamieson Greer are set to meet with Chinese Vice Premier He Lifeng. Trump stated that if the talks go well, he may consider reducing the 145% tariff he has imposed on numerous Chinese goods. Bloomberg reported on Friday that the U.S. side has set an initial goal of lowering tariffs to below 60%, a move they believe China may be willing to match. Progress during the two days of scheduled talks could lead to those tariff reductions being implemented as early as next week, according to the report. “As we ... find out how much progress the U.S. and China are making towards the most important trade deal this weekend, it should give investors some more clarity about how much of an impact the trade issue will have on the U.S. and global economy going forward,” said Matt Maley at Miller Tabak + Co. In yesterday’s trading session, Wall Street’s major indices closed higher. Axon Enterprises (AXON) surged over +14% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the company posted upbeat Q1 results and raised its full-year revenue guidance. Also, chip stocks advanced after the Commerce Department said it doesn’t intend to implement the AI Diffusion rule, with Intel (INTC) and Micron Technology (MU) rising more than +3%. In addition, Applovin (APP) climbed over +11% after the digital advertising company reported stronger-than-expected Q1 results and provided upbeat Q2 advertising revenue guidance. On the bearish side, Match Group (MTCH) slid more than -9% and was the top percentage loser on the S&P 500 after the company issued below-consensus Q2 adjusted operating income guidance and announced a 13% workforce reduction. The Labor Department’s report on Thursday showed that the number of Americans filing for initial jobless claims in the past week fell -13K to 228K, compared with the 231K expected. Also, U.S. Q1 nonfarm productivity fell -0.8% q/q, weaker than expectations of -0.4% q/q, while unit labor costs climbed +5.7% q/q, stronger than expectations of +5.3% q/q. In addition, U.S. March wholesale inventories were revised slightly lower to +0.4% m/m from the advance estimate of +0.5% m/m. Meanwhile, U.S. rate futures have priced in an 83.0% chance of no rate change and a 17.0% chance of a 25 basis point rate cut at the next FOMC meeting in June. The U.S. economic data slate is empty on Friday. However, investors will focus on a batch of speeches from Fed officials Williams, Kugler, Barkin, Goolsbee, Waller, and Cook. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.372%, down -0.02%. Trade docket today: BITO, we are looking at taking assignment on this. Booking profits on COIN, DKNG, LYFT. This makes 10 for 10 this week on profitable earnings setups! 1HTE. I think we can get another one working today. SPX 0DTE and a late day NDX 0DTE. In our scalping room we have a big neutral position working on the /NQ. This position alone has more than enough profit potential to get us our $1,000/day profit goal. My lean or bias today is bullish. We started a bullish SPY zebra position yesterday in our ATM portfolio. We then added a covered call to it for cash flow. We are now building more buying power to add a ratio cover to it. Ultimately this will be a 29K trade that yields $1,200 a month in cash flow. Let's take a look at the market. Well, well, well. SPY and QQQ are banging on the door of their respective 200DMA. IWM is in a nice upward trend and DIA is almost back to a key consolidation zone. Technicals are hanging on to a bullish bias. Let's take a look at the intra-day levels /ES: Levels are not too much different from yesterday. 5712 and 5741 are resistance with 5672 and 5653 working as support. /NQ: Two key levels for me today. 20,337 is resistance. Above that the bulls are in charge. 20,116 is support. Below that the bears are running the show. BTC: Bitcoin is rocking again! We got one 1HTE on yesterday and have one working right now, as I type. 106,349 is resistance and 98,000 is support. Its a wide range today. I look forward to finishing the week strong with you all today. Trade smart. Follow our rules based approach. I'll see you all in the live trading room!

0 Comments

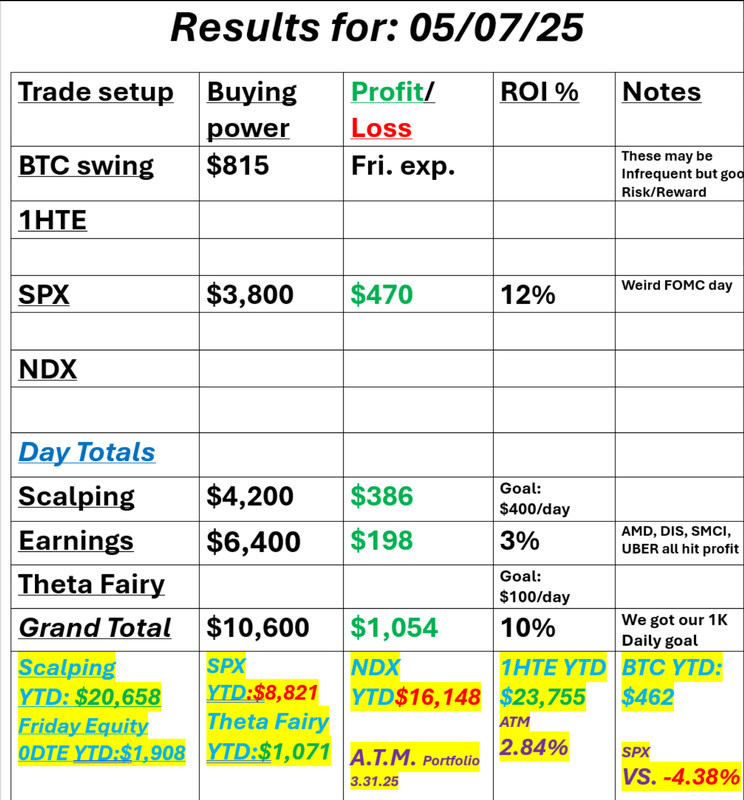

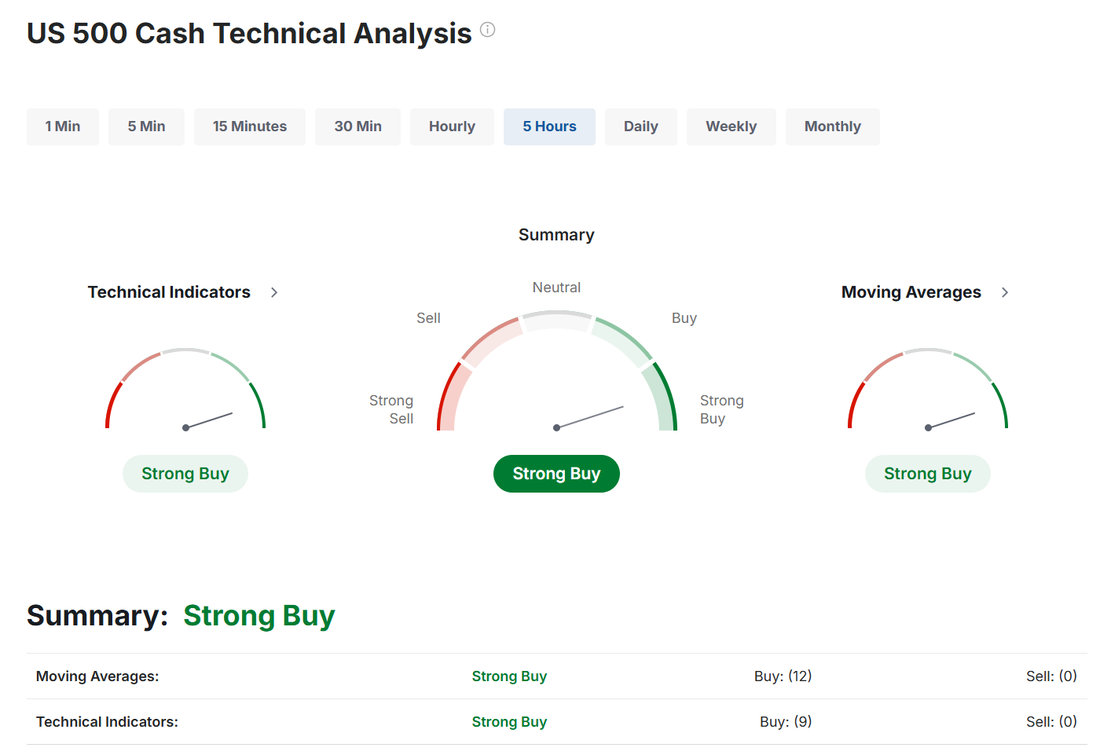

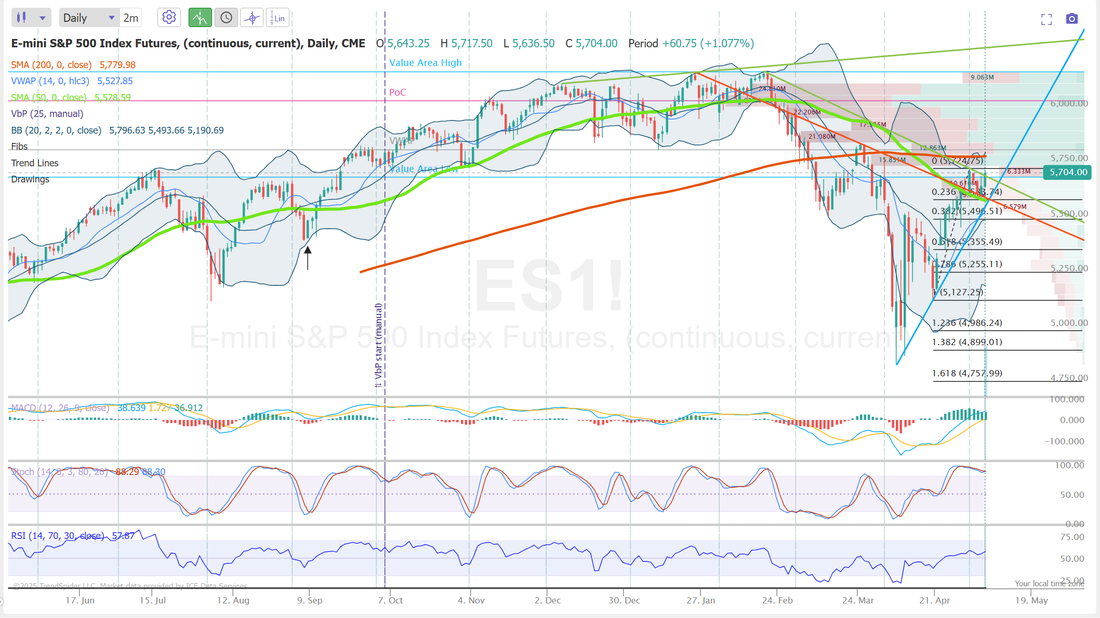

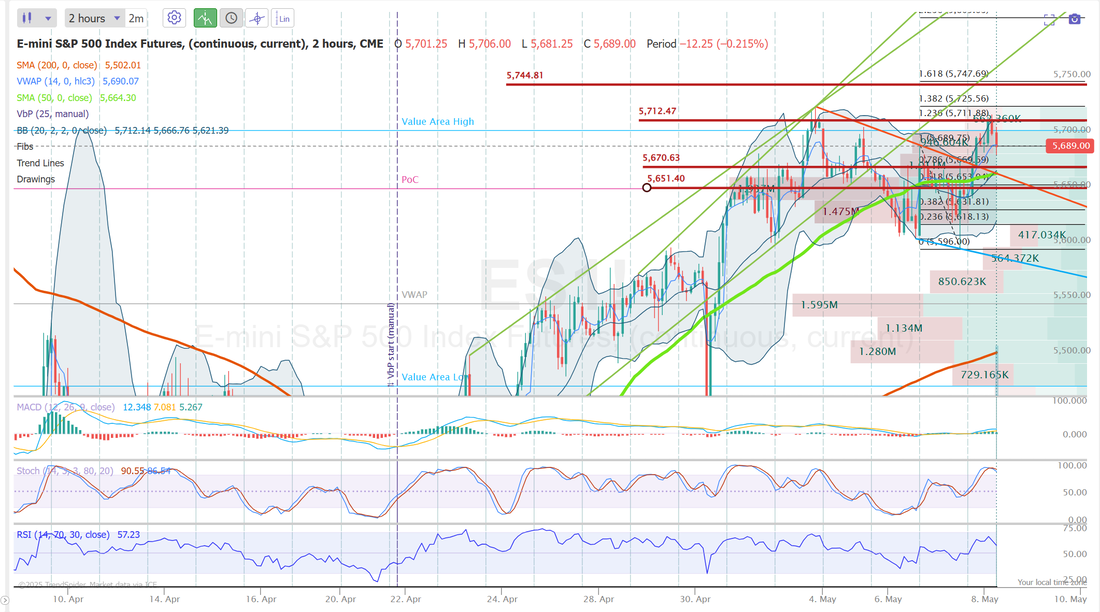

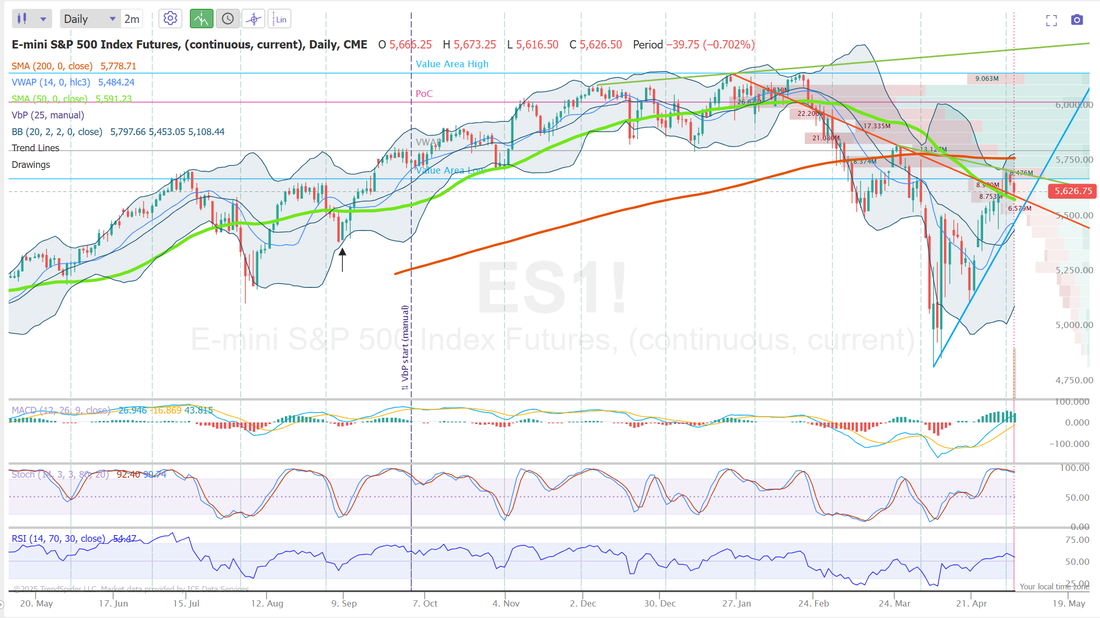

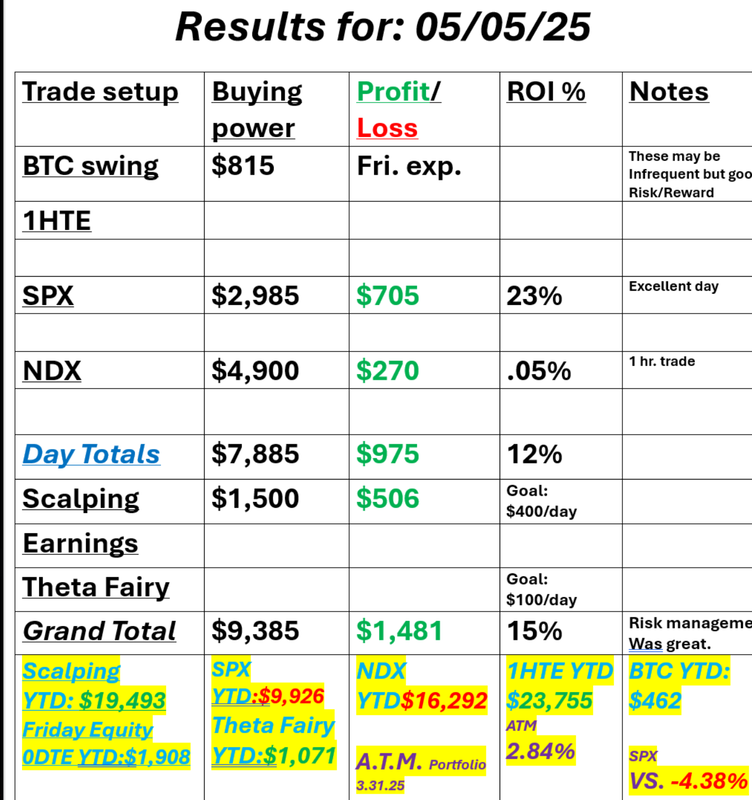

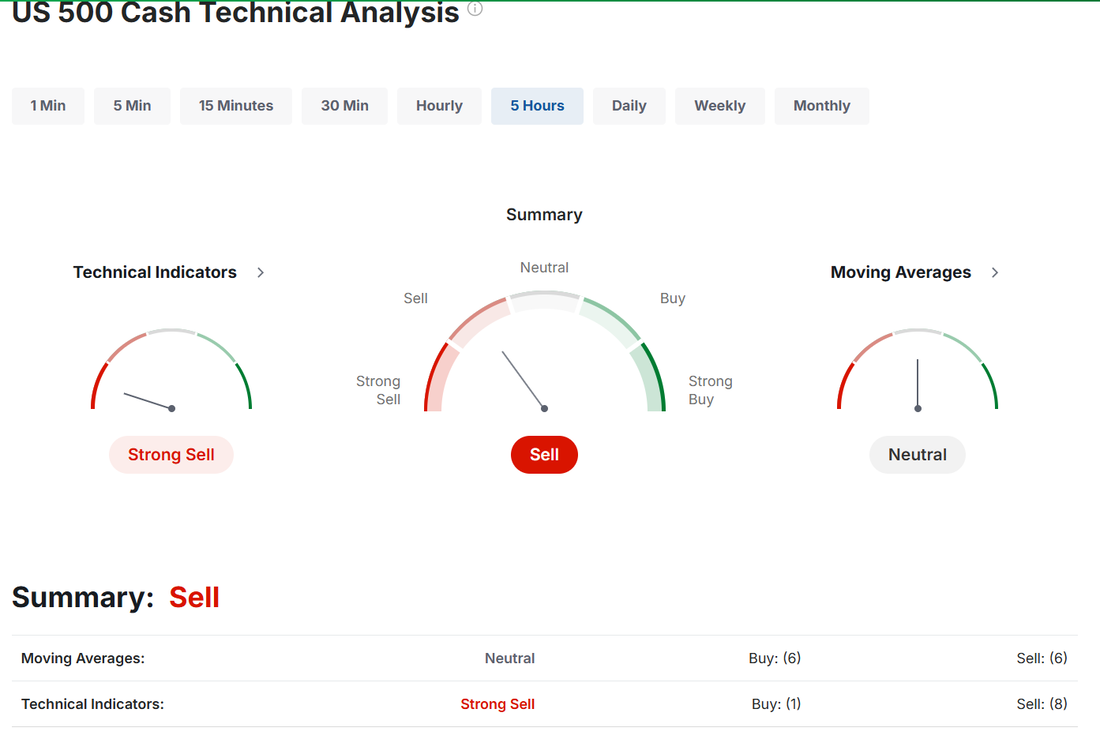

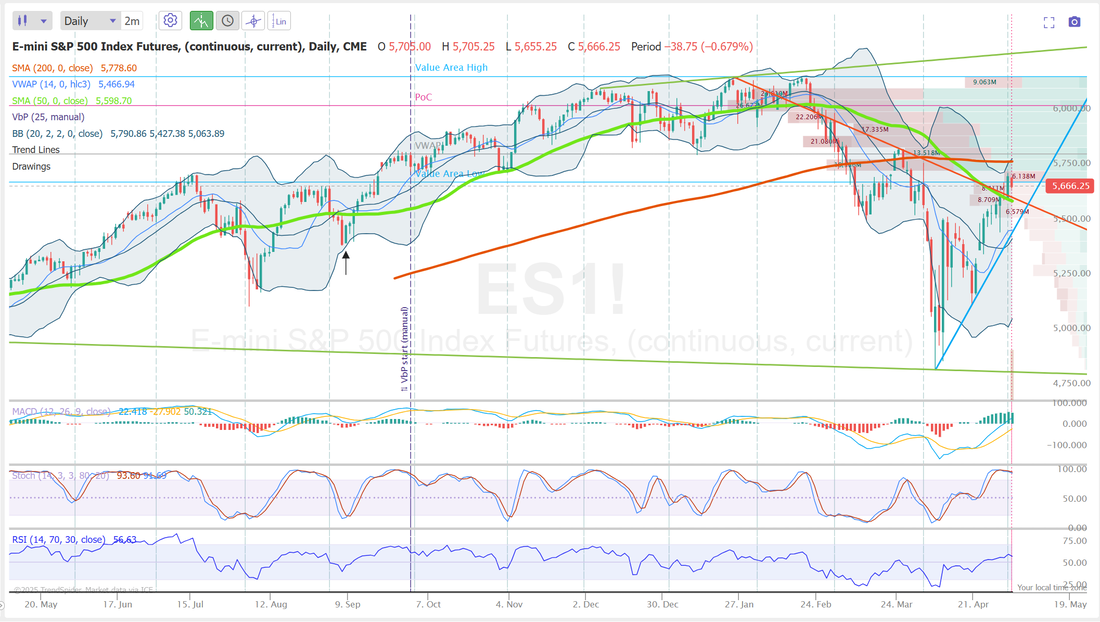

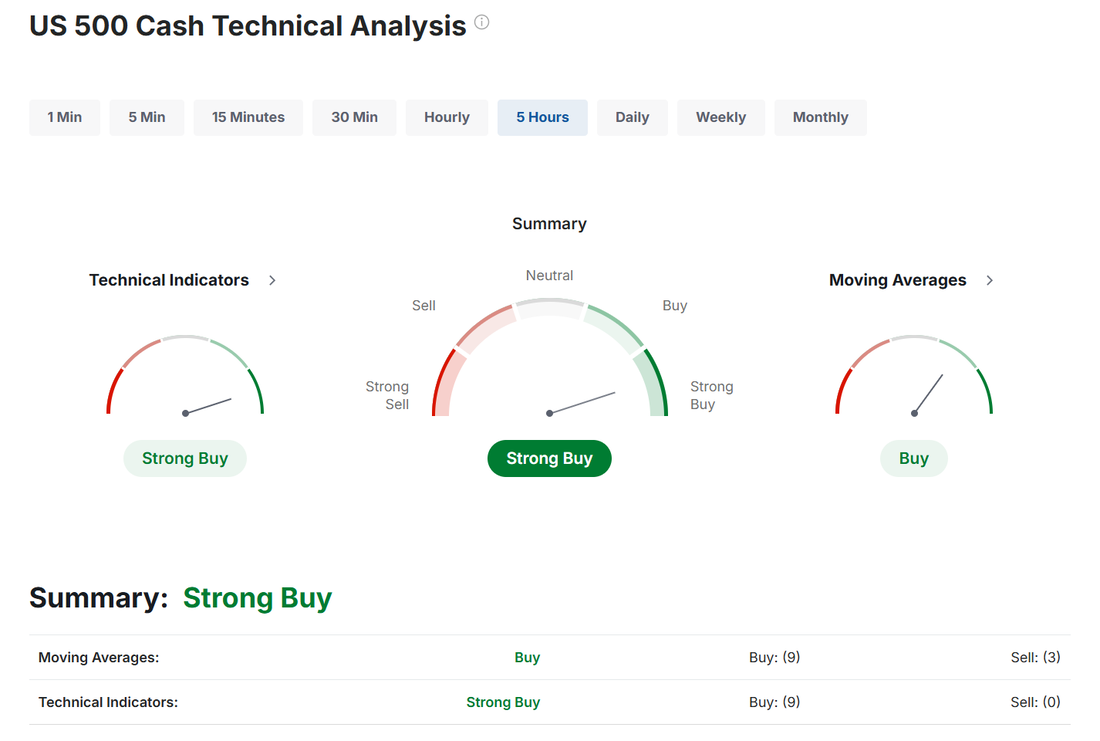

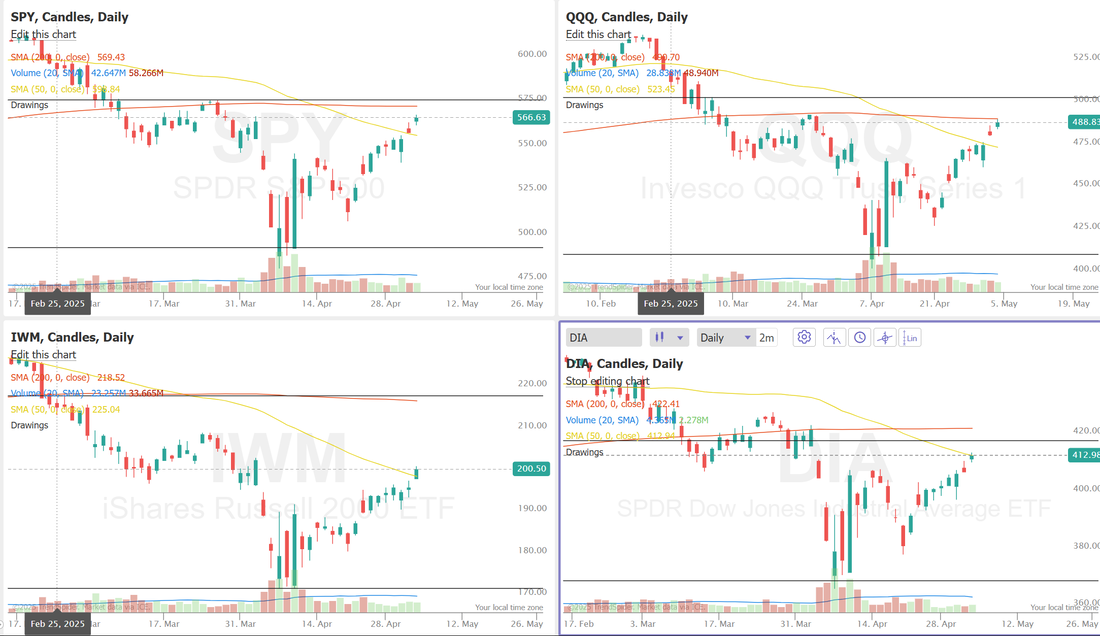

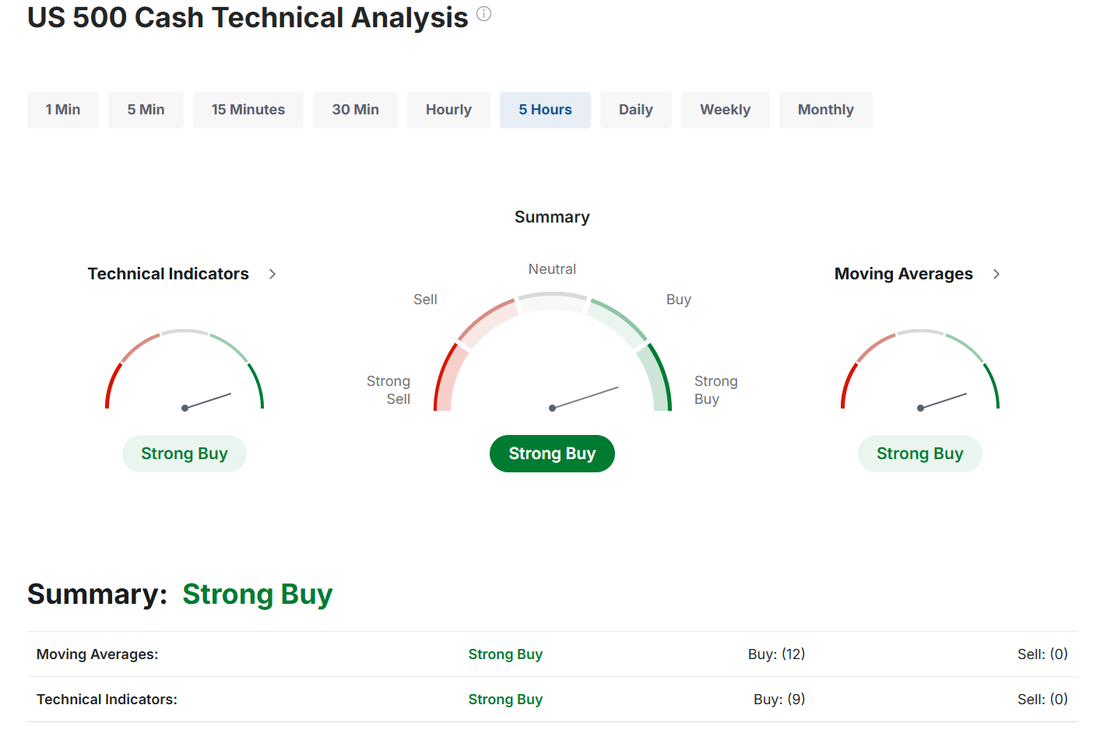

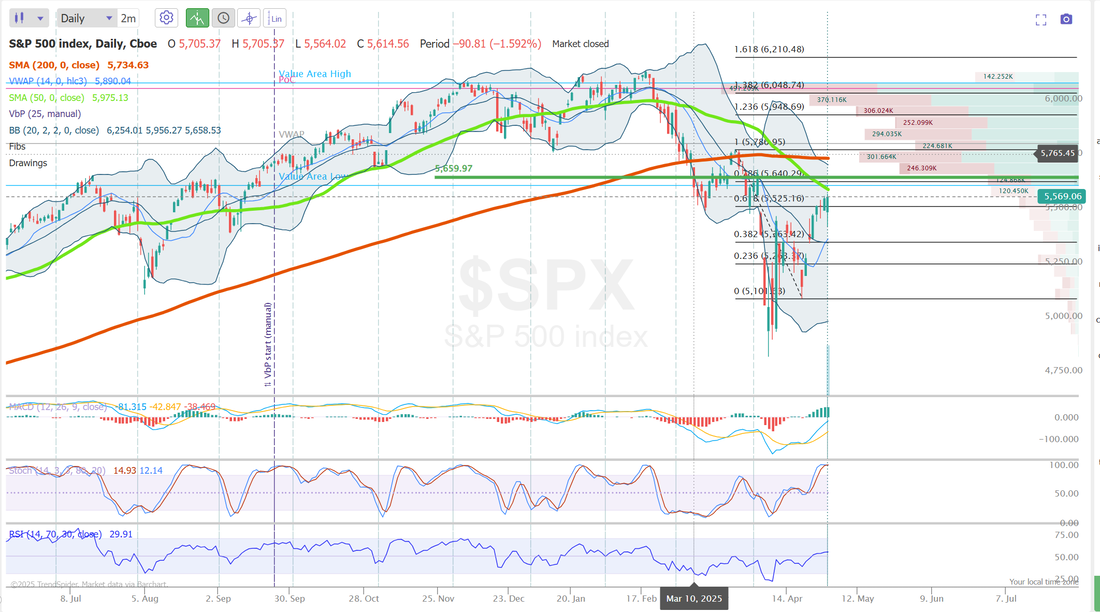

Trade deals coming?They say every dog has it's day. The Tariffs have knocked the market down but now here are starting to see some deals getting closer. Trump's talk of the first deal getting done with the UK has spiked the futures this morning. Are we out of the woods? Too early to tell, I think. We are adding a bullish zebra setup to our ATM portfolio this morning. FOMC has come and gone. It was a strange one, price action wise. Not as much movement as I thought we'd get and while we finished pretty flat on the day, I took it as bullish. Powell didn't sound like he had any answers other than "we just don't know" and "we'll need to be patient and see". Generally you'd see that tank the markets. I called it yesterday at the close that even though the market didn't shoot up, I thought it was bullish. We had a good day yesterday, however muted it was. Here's a look at my day. We got our $1,000 dollar profit goal...just barely. We've got a bullish scalp going this morning with /MNQ long and call options with an /NQ cover. We also have ARM, CVNA, DASH, SHOP earnings plays that should print profits for us at the open. Let's take a look at this "new" market. We start the dayf with a slight bullish buy signal. The indices are certainly trying to clear some key hurdles to the upside. They've all cleared their 50DMA. The next big hurdle? The 200DMA. June S&P 500 E-Mini futures (ESM25) are up +1.06%, and June Nasdaq 100 E-Mini futures (NQM25) are up +1.35% this morning as sentiment got a boost after U.S. President Donald Trump said the U.S. has reached a trade agreement with the U.K. In a Truth Social post on Wednesday night, President Trump announced plans to unveil a “major” trade deal on Thursday, without disclosing the name of the country. Bloomberg reported that the administration is likely to announce a deal with the United Kingdom. On Thursday morning, Mr. Trump confirmed in a post on his social media platform that the deal was indeed with the U.K. “The agreement with the United Kingdom is a full and comprehensive one that will cement the relationship between the United States and the United Kingdom for many years to come,” Trump wrote in a post. Futures linked to the tech-heavy Nasdaq 100 outperformed as chip stocks climbed in pre-market trading after the Commerce Department said it doesn’t intend to implement the AI Diffusion rule. Nvidia (NVDA), Broadcom (AVGO), and Micron Technology (MU) are up more than +1%. As widely anticipated, the Federal Reserve held interest rates steady yesterday. The Federal Open Market Committee voted unanimously to keep the federal funds rate in a range of 4.25%-4.50% for the third consecutive meeting. In a post-meeting statement, officials said that “uncertainty about the economic outlook has increased further,” adding that “the risks of higher unemployment and higher inflation have risen.” At a press conference, Fed Chair Jerome Powell stated that policymakers are in no rush to adjust interest rates, noting that tariffs could lead to higher inflation and unemployment. “The effects on inflation could be short-lived, reflecting a one-time shift in the price level,” he said, while warning that it’s “also possible that the inflationary effects could instead be more persistent.” “The Fed is content to stand pat until there is economic data that compels them to change interest rates. With inflation already elevated and expected to move higher, it will take evidence of a material downturn in the job market before the Fed resumes cutting interest rates,” said Greg McBride at Bankrate. In yesterday’s trading session, Wall Street’s major indexes ended in the green. Charles River Laboratories (CRL) surged over +18% and was the top percentage gainer on the S&P 500 after the drug development contractor raised its full-year adjusted EPS guidance and announced a strategic review of its business. Also, chip stocks gained ground after Bloomberg reported that the Trump administration plans to rescind Biden-era AI chip curbs, with Nvidia (NVDA) and Qualcomm (QCOM) rising more than +3%. In addition, Walt Disney (DIS) climbed over +10% and was the top percentage gainer on the Dow after the media and entertainment conglomerate posted upbeat FQ2 results and lifted its full-year adjusted EPS guidance. On the bearish side, Alphabet (GOOGL) slumped more than -7% and was the top percentage loser on the S&P 500 after Bloomberg reported that Apple is “actively looking” at reshaping the Safari browser on its devices to focus on AI-powered search engines amid the potential breakdown of its deal with Google. Economic data released on Wednesday showed that U.S. March consumer credit rose by $10.17B, stronger than expectations of $9.80B. Meanwhile, U.S. rate futures have priced in a 79.8% probability of no rate change and a 20.2% chance of a 25 basis point rate cut at the next central bank meeting in June. First-quarter corporate earnings season continues, with market participants anticipating fresh reports from prominent companies today, including Shopify (SHOP), ConocoPhillips (COP), Monster Beverage (MNST), Coinbase Global (COIN), and Kenvue (KVUE). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +6.7% increase in quarterly earnings for Q1 compared to the previous year. On the economic data front, investors will focus on U.S. Initial Jobless Claims data, which is set to be released in a couple of hours. Economists expect this figure to be 231K, compared to last week’s number of 241K. U.S. Unit Labor Costs and Nonfarm Productivity preliminary data will also be closely watched today. Economists forecast Q1 Unit Labor Costs to be +5.3% q/q and Nonfarm Productivity to be -0.4% q/q, compared to the fourth-quarter numbers of +2.2% q/q and +1.5% q/q, respectively. U.S. Wholesale Inventories data will be released today as well. Economists expect the final March figure to be +0.5% m/m, compared to +0.3% m/m in February. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.299%, up +0.56%. The trade docket for today continues with earnings setups. COIN, DKNG, AKAM, LYFT, YELP, AFMN, MARA are all possibilities. We will continue to work our bullish /MNQ scalp. SPX 0DTE and I think we can get a few 1HTE's working today. My bias or lean today is bullish. The UK announcement obviously helps but the price action yesterday off Powells less than impressive testimony is what really turned my bullish. Futures are already up 52+ points on /ES so I'm not sure how much upside it has for today but it certainly all looks like we are set for an up day. Let's look at the intra-day levels that I'll be watching today. Looking at the daily chart it's a very confusing set of signals. Sure...it's been a nice bullish move off the bottoms with that impressive 9 day bullish run. Yes, we are above the 50DMA but... and These are some big "buts". That 200DMA looms large. Add to that, the fact that all our indicators seem to be flashing "over bought" and look to be rolling over with sell signals. I think today may be bullish as in, we finish in the green but mostly getting a retrace off the big futures move this morning. Futures just took a bit of a hit with the announcement that 10% tariff will stay in place with US-UK deal. Looking at a 2hr. chart we have a couple key levels. 5712 is a key resistance. Above that we could get some good upside to 5744. 5370 is also a key support. Below that we start to run into the 50DMA and if we lose that we could easily see 5651. It should be another interesting day in the markets. It's not boring right now, that's for sure.

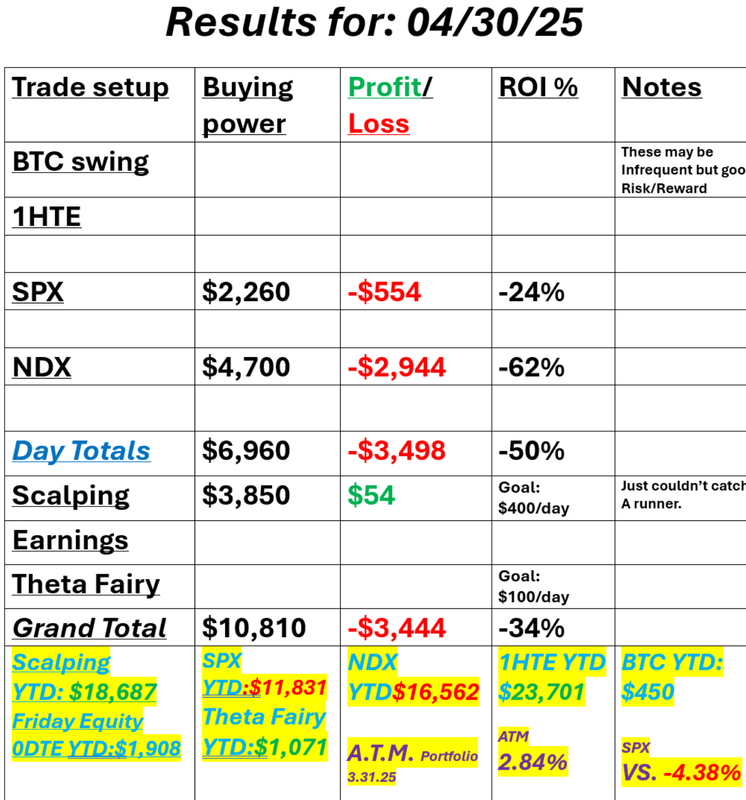

I'll see you all in the trading room shortly! Let's make it a great day! FOMC dayToday is the infamous FOMC day. We'll get the FED minutes from the recent meeting and most important, Powell will speak. It's his speech and the algos that trigger off of key words that he may or may not say that make today tricky. A lot of very good traders, that I respect, simply take today off. We love it and embrace it. We have an approach that usually works well for us. We started last night with an /NQ scalp that we'll likely cash flow all the way up to the minutes release. Once the cash markets open we'll start an SPX 0DTE that's rich in theta erosion and low risk. We take that off before the news catalyst and then we put another on once Powell starts speaking. Our day yesterday was amazing. Everything, and I mean everything we touched turned to gold. We played mostly directional setups in SPX which all worked. We doubled our money in a butterfly late in the day. Scalping brought in almost $1,000 in profit. We've got three earnings trades from yesterday which look to all be profitable this morning. We are in a really nice sweet spot right now in the market. I.V. (and premiums) are still elevated but the market price action is not as unpredictable as it has been. It's not back to "normal" by any means but it's tradable. This times (great premium/predictable moves) don't last. Enjoy it while we have it. Here's a look at our results from yesterday. I would also be remiss if I didn't mention our passive, asset allocation portfolio, The A.T.M. program. 2022 was our last bearish year and it was a banner year for us. This year looks even better! It was very gratifying yesterday to see our portfolio rise by 3.5% while the markets were tanking. The legendary investor, Paul Tudor Jones who, by the way, has an impressive track record of calling down markets said yesterday that the market will continue to push to "new lows". Who knows what the future holds but I do feel strongly that if you have a retirement fund or any portfolio that only has longs (can only make money if the market goes up) you are exposing yourself to a tremendous risk. Why put money in a place that only works in one direction? Our ATM portfolio can be a safe haven. Check it out. une S&P 500 E-Mini futures (ESM25) are up +0.58%, and June Nasdaq 100 E-Mini futures (NQM25) are up +0.64% this morning as optimism around U.S.-China trade talks boosted sentiment. U.S. Treasury Secretary Scott Bessent and U.S. Trade Representative Jamieson Greer will head to Switzerland on Thursday for trade negotiations with China, led by Vice Premier He Lifeng, fueling optimism that tensions between the world’s two largest economies may be easing. The trip was disclosed in statements issued Tuesday by both the Chinese and U.S. governments. It will mark the first confirmed trade talks between the nations since U.S. President Donald Trump imposed steep tariffs of 145% on China, which were met with retaliatory duties of 125% from Beijing. Investor focus is now on the Federal Reserve’s policy decision and Chair Jerome Powell’s comments. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed in the red. Moderna (MRNA) plunged over -12% and was the top percentage loser on the S&P 500 after the U.S. FDA appointed Vinay Prasad, a prominent critic of the drug industry and COVID-19 boosters, to lead the agency’s vaccine regulation division. Also, Palantir Technologies (PLTR) tumbled more than -12% and was the top percentage loser on the Nasdaq 100 after the data analytics company’s Q1 results fell short of investors’ loftiest expectations. In addition, Vertex Pharmaceuticals (VRTX) slumped over -10% after the drugmaker reported weaker-than-expected Q1 results. On the bullish side, Upwork (UPWK) soared more than +18% after the platform for freelancers posted upbeat Q1 results. Economic data released on Tuesday showed that the U.S. trade deficit was a record -$140.50B in March, wider than expectations of -$136.80B. “You have Trump, who’s locked in on tariffs; you have the Fed, who’s locked in on not cutting rates. That’s not good for the stock market,” said Paul Tudor Jones, founder of macro hedge fund Tudor Investment Corp. Today, all eyes are focused on the Federal Reserve’s monetary policy decision later in the day. The Federal Open Market Committee is widely expected to keep the Fed funds rate unchanged in a range of 4.25% to 4.50%, despite recent pressure from President Trump to cut interest rates. Market watchers will closely follow Chair Jerome Powell’s post-policy meeting press conference for clues on the path ahead. However, economists stated that Powell is unlikely to provide specific details about the policy-setting FOMC’s plans. “We expect the main message from Chair Powell’s press conference to be that the Committee is well-positioned to wait for greater clarity before making any changes to policy,” said Michael Feroli, J.P. Morgan’s chief U.S. economist. First-quarter corporate earnings season rolls on, and investors await new reports from high-profile companies today, including The Walt Disney Company (DIS), Uber Technologies (UBER), Arm Holdings (ARM), MercadoLibre (MELI), Applovin (APP), and Fortinet (FTNT). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +6.7% increase in quarterly earnings for Q1 compared to the previous year. On the economic data front, investors will focus on U.S. Consumer Credit data, which is set to be released later today. Economists, on average, forecast that March Consumer Credit will stand at $9.80B, compared to the previous figure of -$0.81B. U.S. Crude Oil Inventories data will be released today as well. Economists expect this figure to be -1.700M, compared to last week’s value of -2.696M. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.329%, up +0.25%. Today is FOMC day. It's a unique day for us. It's not a day that we look at levels or technicals. This will largely be an Algo driven day. Our plan is to start a large theta trade last night with the expectation that we get little movement as traders await the Fed. We started that last night in our scalping room and that trade looks to cash flow for us right out of the gate this morning. We then move to a very asymmetric, "high theta" low risk, high reward trade that we will take off before FOMC minutes release. We then sit patiently, waiting for Powell to speak. Usually somewhere in the first 10-20 minutes of his speech the Algos will catch something he says and the high frequency computer trading will kick off and move the market. Many times the first move is a head fake. The next move is where we pounce. Today is a lot of sitting around waiting for Powell. It take a stoic trader to trade today. Our daily income goal remains the same. Come trade with us and see if you can put some profits in your pocket today. Trade docket today: We've got our overnight scalp on /NQ that we'll need to book our profit on. We also have AMD, UBER, DIS, SMCI earnings trades to close. They all look profitable, pre-market. We've got new earnings setups in ARM, DASH and SHOP and CVNA. We'll work QQQ scalps later in the day after Powell starts speaking and We'll focus primarily on SPX today for 0DTE with a small chance of a dip into the NDX near the close. I'll see you all in the live trading room shortly! I have absolutely no question that we'll have the opportunity in todays market to put $1,000+ in our pockets. It's just up to us, as traders to make the right choices and make it happen.

RejectedThe streak came to an end. I called for a bearish day yesterday and that's what we got. A nine day winning streak comes to an end. That 200DMA is a big overhang. I'm sure we'll get back to it eventually but right now its the demarcation point. The death cross is still in place. We are still below the 200DMA. We look close to retracing back below the 50DMA as well. Add to all this, we have FOMC coming tomorrow. With futures down this morning...again, it seems unlikely we'll get much bullish price action prior to Powell speaking. We had a really great day yesterday. Our profit matrix will show that we used $9,300 of capital to generate our results but in fact, we had already closed our SPX trade when we opened the NDX so it was closer to 6K used to generate $1,400 in profit. Most important, however, for us is the risk management. I don't think we ever went above $240 dollars of risk. Here's a look at our results. Let's take a look at the markets: Yesterdays drawdown didn't materially change anything. Techninals have turned slightly bearish after yesterdays retrace and this mornings futures selloff. I was looking for a bearish day yesterday and that's what we got. I think today will be more of the same. It seems like a big ask for buyers to set up in any substantial way with FOMC waiting in the wings. June S&P 500 E-Mini futures (ESM25) are trending down -0.82% this morning as the latest batch of corporate earnings reports heightened worries about the negative impact of U.S. tariffs on businesses and the global economy, while investors awaited the start of the Federal Reserve’s two-day policy meeting. Palantir Technologies (PLTR) slumped over -7% in pre-market trading after the data analytics company’s Q1 results fell short of investors’ loftiest expectations, while analysts pointed to weakness in its international sales division. Also, Ford (F) slid more than -2% in pre-market trading after the automaker withdrew its full-year guidance and said it expects a $1.5 billion EBIT impact from auto tariffs this year. U.S. President Donald Trump on Sunday announced a 100% tariff on foreign-produced films imported into the U.S., and a day later said he plans to unveil pharmaceutical tariffs within the next two weeks. Analysts noted that this marks a notable escalation in the trade saga, adding further uncertainty to the global trade outlook. In yesterday’s trading session, Wall Street’s main stock indexes ended lower. Zimmer Biomet Holdings (ZBH) plunged over -11% and was the top percentage loser on the S&P 500 after the orthopedic products company cut its full-year adjusted EPS guidance. Also, ON Semiconductor (ON) slumped more than -8% and was the top percentage loser on the Nasdaq 100 after the maker of power chips gave a weak Q2 adjusted gross margin forecast. In addition, Berkshire Hathaway (BRK.A) fell over -4% after legendary investor Warren Buffett said he would step down as CEO of the conglomerate at the end of the year. On the bullish side, EQT Corp. (EQT) rose over +3% after UBS upgraded the stock to Buy from Neutral with a price target of $64. Economic data released on Monday showed that the U.S. ISM services index unexpectedly rose to 51.6 in April, stronger than expectations of 50.2. At the same time, the final estimate of the U.S. April S&P Global services PMI was revised lower to 50.8 from the 51.4 preliminary reading. The Federal Reserve kicks off its two-day meeting later in the day. The central bank is widely expected to keep the Fed funds rate unchanged in a range of 4.25% to 4.50% on Wednesday, despite recent pressure from President Trump to cut interest rates. Market watchers’ attention will be on any indications of whether rates might be lowered later this year to support the economy amid tariff-related pressures. “Uncertainty rules amid a trade war and the ever-changing landscape of tariffs, but with the hard data on consumer spending and employment still hanging in there, the Fed will remain firmly planted on the sidelines,” said Greg McBride at Bankrate. On the earnings front, notable companies like Advanced Micro Devices (AMD), Arista Networks (ANET), Duke Energy (DUK), Constellation Energy (CEG), Marriott International (MAR), and American Electric Power (AEP) are set to report their quarterly figures today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +6.7% increase in quarterly earnings for Q1 compared to the previous year. On the economic data front, investors will focus on U.S. Trade Balance data, which is set to be released in a couple of hours. Economists expect the U.S. trade deficit to widen to -$136.80B in March from -$122.70B in February. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.365%, up +0.51%. Trade docket today: We're going to try again to land some 1HTE's. Scalping has an overnight /NQ trade on that we are trying to squeeze a $300-$600 profit out of. SPX an NDX 0DTE's. We've also got AMD, UBER, DIS potential earings trades today. Let's take a look at the intra-day levels: /ES: Lots of levels to look at today. Be nimble. 5623 is the first key level for me. Futures are down again this morning and we are sitting right above this critiacl level. Bulls really need to hold this level. Resistance is way up at 5701 so support levels are probably more important. Below 5623 is 5602/5592/5572. /NQ: 20,178 is resistance but much like the /ES, there is more activity on the support side. 19,756 is first support then comes 19,492. BTC: Bitcoin has not given us any real setups so far this week. We'll try again today. It's in a pretty tight range with 95,642 acting as resistance and 92,942 working as support. I look forward to seeing you all in the live trading room shortly. Let's see if we can get repeat of yesterday's profits.

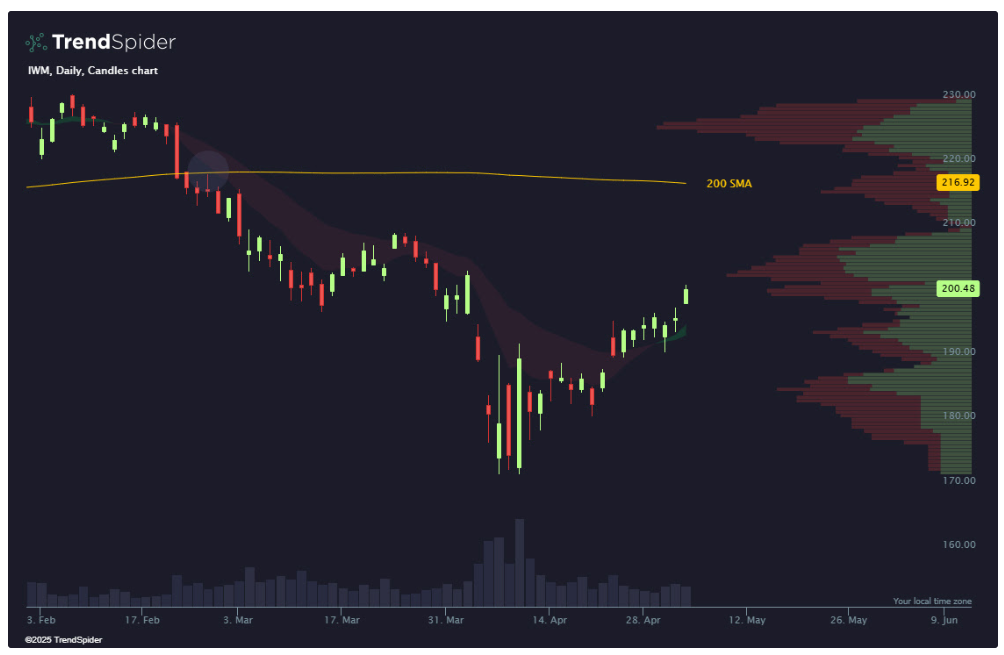

FOMC week= volatilityWelcome back traders. We get FOMC and Powell on Weds. this week. That should be the main news catalyst barring any Tariff news, which I'm sure will pop up at some inopportune time. The market is at a key level for me. I've been pointing this level out for some time to our ATM portfolio holders. It's not an easy call here. On the one hand, we've had one heck of a long rally with nine days straight up. On the other hand we are still in a death cross signal and while we've gotten back above the 50DMA we are still below the key 200DMA. Add to that, all our indicators appear to be very overstreched to the overbought zone. We are holding a lot of cash in the ATM program until Powell speaks. That should give us some directional help. Our day Friday was...O.K. Our SPX lost but we kept our risk low (below our $500 dollar goal) and the profit potential was huge...it just didn't hit for us. Scalping brought in a bit of income but our bearish puts from Friday should cash flow for us this morning with futures currently down. Let's take a look at the market: Futures are selling off this morning but not enough to change the technical outlook from bullish to bearish. The trend is surely up and bullish lately however, SPY and QQQ are now sitting below their respective 200DMA. This is a big line in the sand and with Powell speaking Weds. it could be a key area to watch. June S&P 500 E-Mini futures (ESM25) are down -0.75%, and June Nasdaq 100 E-Mini futures (NQM25) are down -1.02% this morning, pointing to a lower open on Wall Street as uncertainty about U.S. trade policy weighed on investors’ risk appetite. U.S. President Donald Trump on Sunday announced a 100% tariff on foreign-produced films imported into the U.S., tempering last week’s optimism about a potential easing of trade tensions. Also, President Trump stated that he had no plans to speak with his Chinese counterpart, Xi Jinping, this week, though he indicated that trade agreements with other unspecified partners could be announced as early as this week. This week, investors look ahead to the Federal Reserve’s interest rate decision as well as a fresh batch of U.S. economic data and corporate earnings reports. In Friday’s trading session, Wall Street’s major equity averages closed higher, with the S&P 500 and Nasdaq 100 notching 5-week highs and the Dow posting a 1-month high. DexCom (DXCM) surged over +16% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the medical devices maker reported better-than-expected Q1 revenue. Also, chip stocks rallied, with Arm Holdings (ARM) climbing more than +6% and ON Semiconductor (ON) gaining over +5%. In addition, Duolingo (DUOL) soared more than +21% after the mobile learning platform posted upbeat Q1 results and raised its full-year bookings guidance. On the bearish side, Apple (AAPL) fell over -3% and was the top percentage loser on the Dow after the iPhone maker reported weaker-than-expected revenue from Greater China in FQ2. The U.S. Labor Department’s report on Friday showed that nonfarm payrolls rose 177K in April, stronger than expectations of 138K. Also, U.S. April average hourly earnings rose +0.2% m/m and +3.8% y/y, weaker than expectations of +0.3% m/m and +3.9% y/y. In addition, the U.S. unemployment rate was unchanged at 4.2% in April, in line with expectations. Finally, U.S. March factory orders rose +4.3% m/m, slightly weaker than expectations of +4.4% m/m. “A lot of people — based on Liberation Day and the events since — have forecast economic Armageddon, and every time economic Armageddon doesn’t happen, it’s good news. Maybe it’s just too early. A lot of the phenomenon that people fear haven’t really had time to sink into the data yet,” said Lawrence Creatura, a fund manager at PRSPCTV Capital LLC. The U.S. Federal Reserve’s interest rate decision and Chair Jerome Powell’s post-policy meeting press conference will take center stage this week. The central bank is widely expected to keep the Fed funds rate unchanged in a range of 4.25% to 4.50%, despite recent pressure from President Trump to lower interest rates. Market watchers’ attention will be on any indications of whether rates might be lowered later this year to support the economy amid tariff-related pressures. The Fed is growing more concerned about economic growth and will likely “cut interest rates as soon as it can be reasonably sure that inflation is not spiraling out of control,” according to Commerzbank analysts. First-quarter corporate earnings season continues, and investors await new reports from notable companies this week, including Advanced Micro Devices (AMD), Arm (ARM), Palantir Technologies (PLTR), Arista Networks (ANET), Uber Tech (UBER), Ford (F), Walt Disney (DIS), Applovin (APP), DoorDash (DASH), and Shopify (SHOP). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +6.7% increase in quarterly earnings for Q1 compared to the previous year. In addition, investors will continue to monitor economic data for signs of how tariffs and the uncertainty they create are affecting economic activity. This week’s noteworthy data releases include U.S. Unit Labor Costs (preliminary), Nonfarm Productivity (preliminary), Initial Jobless Claims, Wholesale Inventories, Exports, Imports, Trade Balance, and Consumer Credit. On Friday, the Fed’s blackout period ends, with Fed officials Williams, Kugler, Goolsbee, Waller, and Cook set to deliver remarks. Today, investors will focus on the U.S. ISM Non-Manufacturing PMI and S&P Global Services PMI, set to be released in a couple of hours. Economists forecast the April ISM services index to be 50.2 and the S&P Global services PMI to be 51.4, compared to the previous values of 50.8 and 54.4, respectively. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.324%, up +0.09%. We've got several earning setups we'll look to work this week with AMD, ARM, PLTR, UBER, DIS, DASH, SHOP. We'll focus today on 1HTE's , SPX 0DTE, NDX 0DTE, BITO, trades. SPY closed the week in the green at $566.76 (+2.94%), breaking above a key resistance zone at its year-to-date high-volume node, a level that was initially rejected on Thursday. Notably, the ETF triggered its first bullish 8/21 EMA cross since January, adding fuel to the upside momentum. The next major hurdle lies at the 200-day moving average, a key level that could determine whether trend-following traders decide to get back in the markets. Powered by strong tech earnings, QQQ ended the week on a high note at $488.83 (+3.67%). It closed right below its 200-day moving average, the same level it rejected in late March. A bullish 8/21 EMA cross at its year-to-date high-volume node adds further weight to the shift in momentum favoring the bulls. With macro headwinds like tariffs and weak growth unable to overpower strong tech earnings, traders are beginning to ask: has the bad news already been priced in? With all eyes on big tech last week, IWM quietly finished in the green at $200.48 (+3.28%). Still lagging behind its large-cap peers, the ETF sits 8% below its 200-day moving average. As it pushes toward the upper boundary of its March trading range, bulls face a key challenge: reclaiming this pivotal high-volume node and flipping resistance into support Let's look at the weekly expected moves and I.V. 1.75% for SPY and 2.06% for QQQ, it's down a bit from last week but still high enough we should get decent premium. SPY is still close enough to QQQ that our main 0DTE focus of the SPX should continue. My lean or bias today is bearish. Futures are down, as I type. Trump has said there may be trade deals signed this week but I don't think we see it today. Traders are going to be cautious coming into Powells testimony on Weds. I always look forward to FOMC week. It's generally been very good to us and we've got lots of good earnings setups as well. I'll see you all in the live trading room shortly!

Markets still on edgeWeclome to Friday! Markets have had a nice bullish run to stave off what looked like an ugly bear market but, it still not healthy. Take a look at the close yesterday. We had an explosive out off strong META and MSFT earnings and then a 60 point sell off going into the close. This market is still jittery. Our day went almost perfectly for us. While we made more than our $1,000 per day profit goal it was really our risk management that I was most proud of. We never went above $240 risk all day. See our results below: Let's take a look at the markets. Technicals are still pointing bullish. The bull market stalled a bit yesterday with that late day sell off. My lean or bias today is neutral to bearish. We are working a bearish scalp on the QQQ. We took to view that AAPL and AMZN earnings would be a dissapointment and that looks to be the case. Futures are up, as I type but I'm looking for a flat to down day. June S&P 500 E-Mini futures (ESM25) are up +0.44%, and June Nasdaq 100 E-Mini futures (NQM25) are up +0.30% this morning as sentiment got a boost after China said it is assessing the possibility of trade talks with the U.S., with the focus now shifting to the key U.S. payrolls report. China’s Commerce Ministry stated on Friday that it had observed senior U.S. officials repeatedly voicing their readiness to engage with Beijing on tariffs, and called on Washington to demonstrate “sincerity” toward China. “The U.S. has recently sent messages to China through relevant parties, hoping to start talks with China. China is currently evaluating this,” the ministry added. However, disappointing earnings from Apple and Amazon limited gains in stock index futures. Apple (AAPL) fell over -2% in pre-market trading after the iPhone maker reported weaker-than-expected FQ2 sales in China. Also, Amazon.com (AMZN) slid more than -2% in pre-market trading after the world’s largest online retailer provided a below-consensus Q2 operating income forecast. In yesterday’s trading session, Wall Street’s major indices closed in the green, with the S&P 500 and Dow notching 4-week highs and the Nasdaq 100 posting a 5-week high. Microsoft (MSFT) surged over +7% and was the top percentage gainer on the Dow after the world’s largest software maker reported stronger-than-expected FQ3 results and provided an upbeat FQ4 revenue growth forecast for the Azure cloud unit. Also, Meta Platforms (META) climbed more than +4% after the maker of Facebook and Instagram posted upbeat Q1 results. In addition, Nvidia (NVDA) gained over +2% after Bloomberg reported that the U.S. was considering a possible relaxation of restrictions on the chipmaker’s sales to the United Arab Emirates. On the bearish side, Becton Dickinson & Co. (BDX) tumbled more than -18% and was the top percentage loser on the S&P 500 after cutting its annual adjusted EPS guidance. Also, Qualcomm (QCOM) slumped over -8% and was the top percentage loser on the Nasdaq 100 after the mobile chip designer provided a tepid FQ3 revenue forecast. Economic data released on Thursday showed that the U.S. ISM manufacturing index fell to a 5-month low of 48.7 in April, though it came in above expectations of 48.0. Also, U.S. March construction spending unexpectedly fell -0.5% m/m, weaker than expectations of +0.2% m/m and the largest decline in 6 months. In addition, the number of Americans filing for initial jobless claims in the past week rose +18K to a 2-month high of 241K, compared with the 224K expected. Meanwhile, U.S. rate futures have priced in a 93.2% probability of no rate change and a 6.8% chance of a 25 basis point rate cut at next week’s FOMC meeting. On the earnings front, notable companies like Exxon Mobil (XOM), Chevron (CVX), Cigna (CI), and Apollo Global Management (APO) are slated to release their quarterly results today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +6.7% increase in quarterly earnings for Q1 compared to the previous year. Today, all eyes are focused on the U.S. monthly payroll report, which is set to be released in a couple of hours. Economists, on average, forecast that April Nonfarm Payrolls will come in at 138K, compared to the March figure of 228K. U.S. Average Hourly Earnings data will also be closely watched today. Economists expect April figures to be +0.3% m/m and +3.9% y/y, compared to the previous numbers of +0.3% m/m and +3.8% y/y. U.S. Factory Orders data will be released today. Economists foresee this figure coming in at +4.4% m/m in March, compared to the previous number of +0.6% m/m. The U.S. Unemployment Rate will be reported today as well. Economists forecast that this figure will remain steady at 4.2% in April. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.202%, down -0.69%. NFP will be the main (planned) news catalyst today. We carried over our bearish QQQ scalp from yesterday. That has a lot of potential today if we choose to turn it back into a calendar spread. BTC doesn't have enough movement today to look at the 1HTE's. I'll focus our effort on SPX 0DTE and look for a late day entry to an NDX 0DTE. Let's take a look at /ES: I'm watching the 5684 resistance level. Above that I'm bullish. 5630 is first support. Below that comes 5598. Below that I'm bearish. We had a great day yesterday of solid risk management. Let's focus on that again today. See you all in the live trading room shortly.

Recession = Rally?The market kicked off the morning yesterday with a swoon to the downside as GDP came in negative. Two consecutive quarters of negative numbers and you know what that means. The talk of recession is getting real however, later in the day the soft numbers (vs. the hard numbers) showed that a lot of imports were being front run to avoid tariffs and the market shrugged it all off to finish in a major blast higher. META and MSFT earnings post market looked solid and that's pushed the futures up even more this morning. So which is it? I think it's still too early to tell but the bulls are making their case right now. 5650 is the next upward target on SPX and then the big one...the 200DMA. The bulls seem ready to run today. We has AAPL and AMZN earning after the bell. I suspect they may not be as rosy as META and MSFT were but we will see. My day yesterday was a losing day for me. I kept my risk in line with SPX but the NDX trade blew up as the market surged at the end of the day. The solution for 0DTE's is pretty simple and I know it. We've talked about it over and over. Win, lose or draw...just close it out before the power hour. That's when all the crazyness happens. We know that. It's not a surprise. The irony of it all was that we were in the middle of a training on how important it is to take losses early! That irony is not lost on me. I'll work to be more focused on sticking to our rules. Here's a look at my day yesterday: We are starting a new month. Let's look at the markets: Technicals are firmly bullish. The indices are all pushing higher now. This certainly appears more than just a snap back rally. Does it have the legs to breach the next resistance level? We may know that as early as today. My lean or bias today is bullish. This is a market that, while still jittery, wants to go higher. Trade docket for today: We may be able to get some 1HTE's today . I'll focus on the SPX 0DTE along with AAPL and AMZN earnings. Scalping will start with a QQQ focus. June S&P 500 E-Mini futures (ESM25) are up +1.18%, and June Nasdaq 100 E-Mini futures (NQM25) are up +1.68% this morning as forecast-beating quarterly results from Microsoft and Meta boosted sentiment. Microsoft (MSFT) surged over +8% in pre-market trading after the world’s largest software maker reported stronger-than-expected FQ3 results and provided an upbeat FQ4 revenue growth forecast for the Azure cloud unit. Also, Meta Platforms (META) climbed more than +6% in pre-market trading after the maker of Facebook and Instagram posted upbeat Q1 results. Also lifting sentiment were signs that the Trump administration could be nearing an announcement of the first round of trade deals to lower planned tariffs. On Wednesday, U.S. President Donald Trump’s trade representative stated that the nation was close to announcing a first tranche of trade agreements under which the White House would reduce planned tariffs on its trading partners. Investors now await a new round of U.S. economic data and earnings reports from “Magnificent Seven” companies Apple and Amazon. In yesterday’s trading session, Wall Street’s major indexes ended mixed. Seagate Technology (STX) surged over +11% and was the top percentage gainer on the S&P 500 after the data storage company posted upbeat FQ3 results. Also, Western Digital (WDC) climbed more than +7% after the company issued solid FQ4 guidance. In addition, Booking Holdings (BKNG) rose over +3% after reporting better-than-expected Q1 results. On the bearish side, Super Micro Computer (SMCI) plunged more than -11% and was the top percentage loser on the S&P 500 after the artificial intelligence server maker reported weaker-than-expected preliminary FQ3 results. Economic data released on Wednesday reinforced concerns about an economic slowdown. The U.S. Bureau of Economic Analysis’ advance estimate showed that the economy contracted at a 0.3% annualized pace in the first quarter, weaker than expectations of +0.2% q/q and the steepest pace of contraction in 3 years. Also, the U.S. ADP employment change rose by 62K in April, weaker than expectations of 114K and the smallest increase in 9 months. At the same time, the U.S. core PCE price index, a key inflation gauge monitored by the Fed, came in at unchanged m/m and +2.6% y/y in March, compared to expectations of +0.1% m/m and +2.6% y/y. “Weak data could hasten Fed cuts. The Fed is now more likely to step in sooner with its rate cuts to support an ailing economy, while the weakness in data could also encourage Trump to ease off on tariffs and make deals, quicker,” said Fawad Razaqzada at City Index and Forex.com. Meanwhile, U.S. rate futures have priced in a 95.0% chance of no rate change and a 5.0% chance of a 25 basis point rate cut at the Fed’s monetary policy committee meeting next week. First-quarter corporate earnings season continues in full swing, and market participants await reports today from high-profile companies such as Apple (AAPL), Amazon (AMZN), Eli Lilly (LLY), Mastercard (MA), McDonald’s (MCD), Amgen (AMGN), and CVS Health Corp. (CVS). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +6.7% increase in quarterly earnings for Q1 compared to the previous year. On the economic data front, all eyes are focused on the U.S. ISM Manufacturing PMI, which is set to be released in a couple of hours. Economists, on average, forecast that the April ISM manufacturing PMI will be 48.0, compared to the March figure of 49.0. Investors will also focus on the U.S. S&P Global Manufacturing PMI, which stood at 50.2 in March. Economists expect the final April figure to be 50.5. U.S. Construction Spending data will be reported today. Economists foresee this figure coming in at +0.2% m/m in March, compared to +0.7% m/m in February. U.S. Initial Jobless Claims data will be released today as well. Economists expect this figure to be 224K, compared to last week’s number of 222K. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.143%, down -0.77%. Let's look at the intra-day levels: On the daily chart, this has been a very strong bull run. 5680 is the next fib level and the comes the 200DMA. We are hovering around the 50DMA now. These are all potential resistance areas. On the 2hr. chart we are looking a bit overstretched to the upside. This 5680-5684 level is the first real resistance area. Above that is all blue sky and we could push to 5772. Support is 5630 and then 5598. These are the levels I'll be focusing on today. BTC: Bitcoin is getting some more movement now. It's still a tight range. 97,289 seems to be solid resistance with 95,781 working as support. I'll see you all in the trading rooms shortly. Let's get an early start and and early exit today on our 0DTE so we can just grab some popcorn and watch the PH on the sidelines!

|

Archives

August 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |