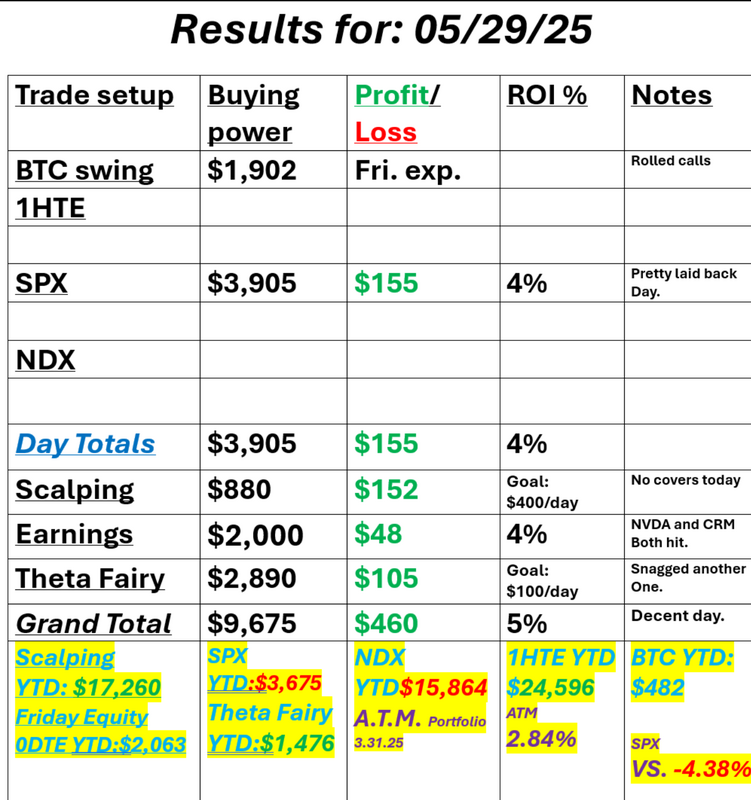

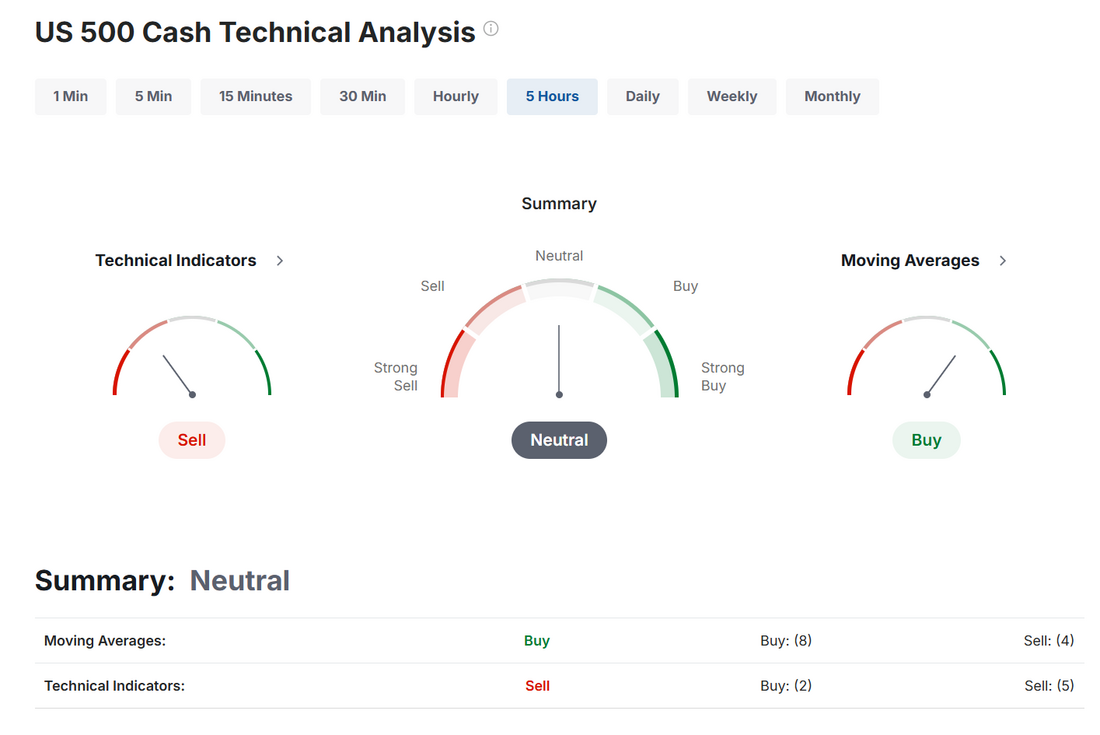

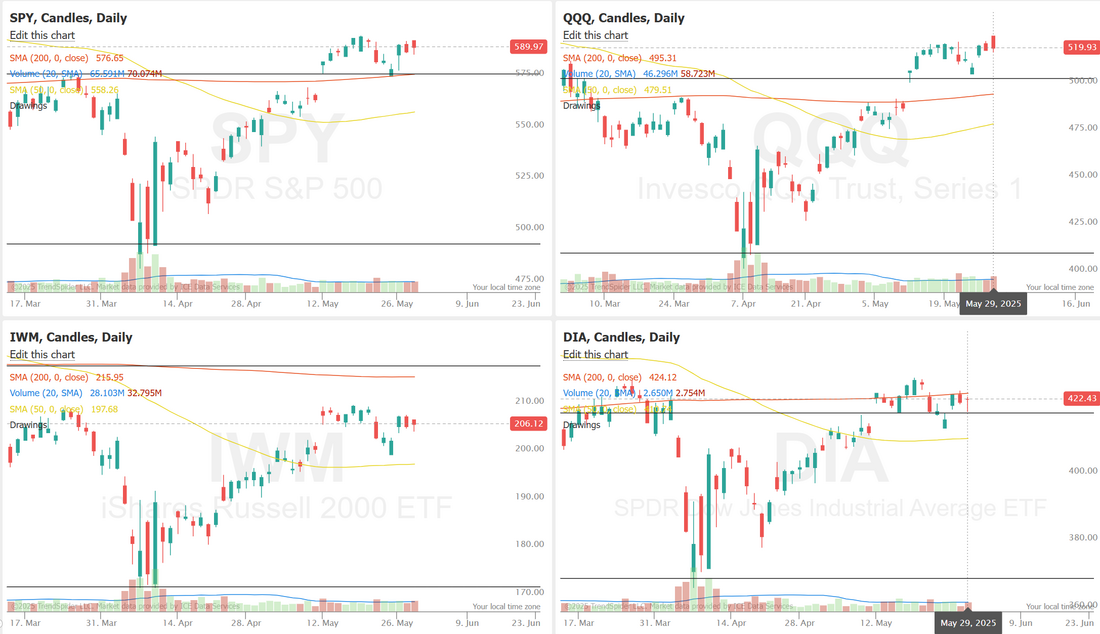

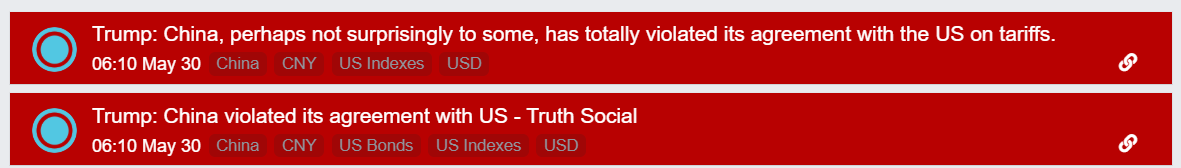

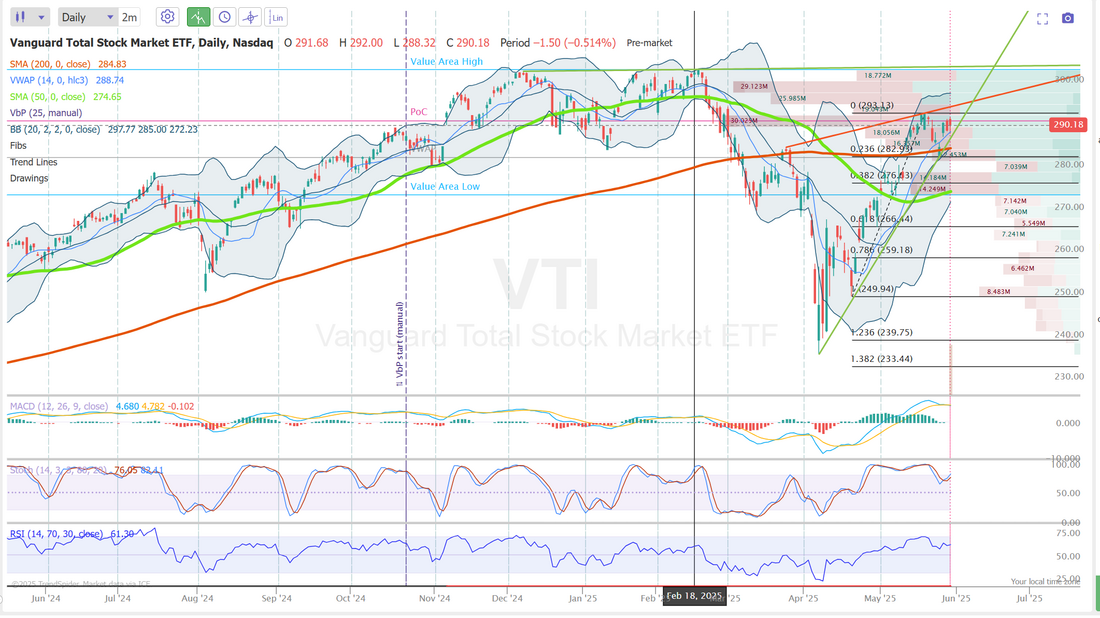

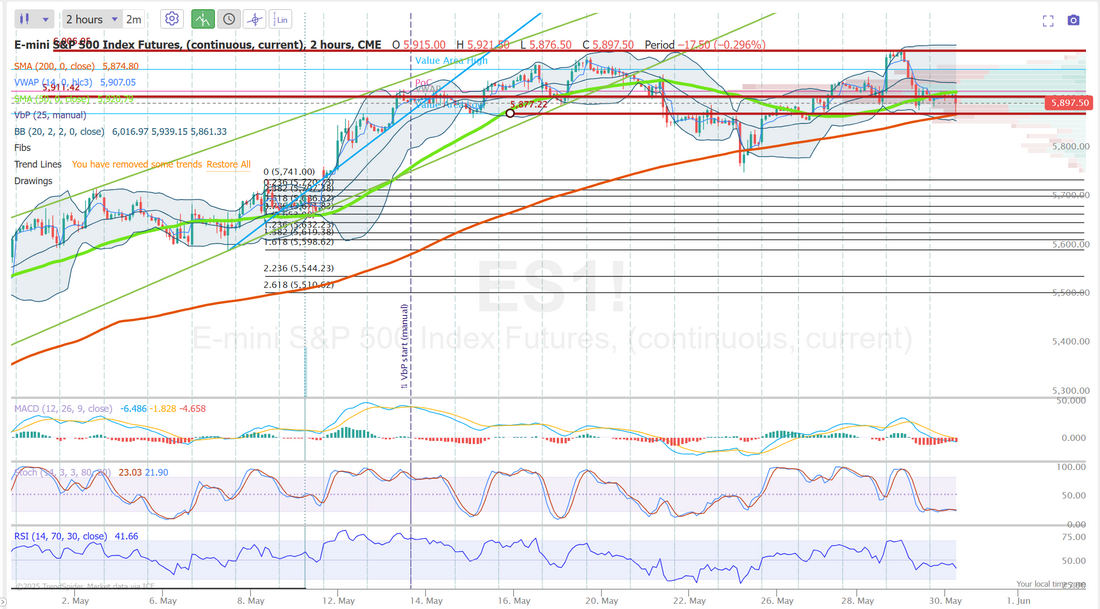

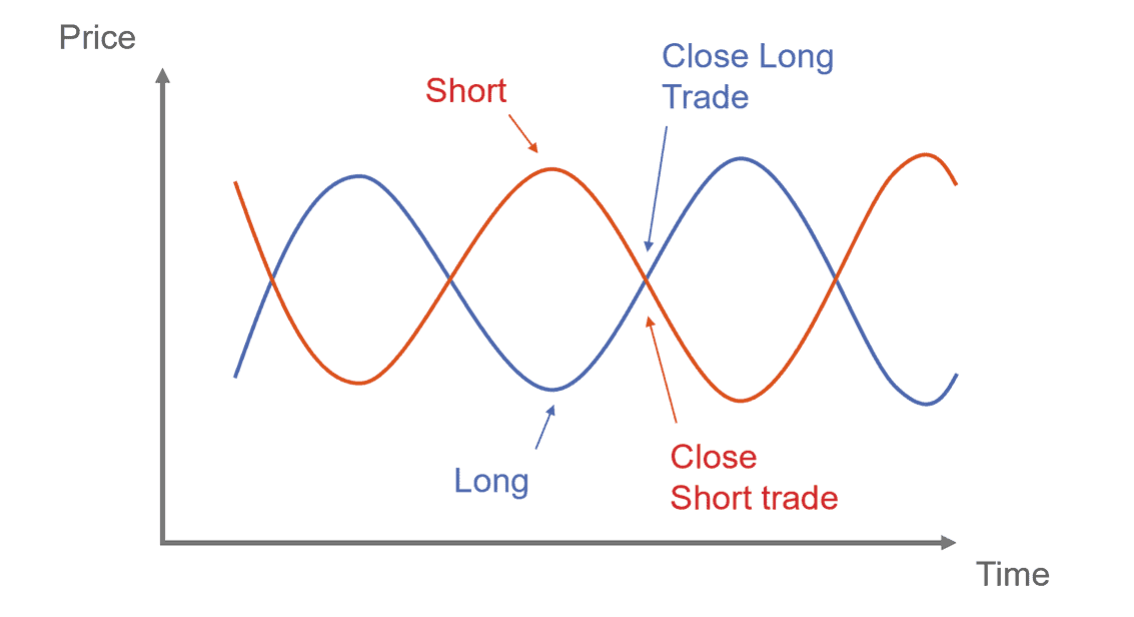

Not so fast...The market euphoria over tariffs going away "permanently" quickly dissipated as the White house got an appeal and through certain aspects that I don't care to delve into here, nor do I fully understand, Trumps ability to use tariffs may have actually increased! Oh, these markets...you've got to love them. We had a great day yesterday. It wasn't a $1,000+ profit day like we shoot for but it was easy and stress free and all our trades combined for a decent result, plus...we got another Theta fairy on! It's always nice to make money while you sleep. Here's a look at our results. June S&P 500 E-Mini futures (ESM25) are trending down -0.07% this morning as investors grappled with fresh uncertainty surrounding U.S. President Donald Trump’s tariff policies and looked ahead to the release of the Federal Reserve’s first-line inflation gauge. A U.S. federal appeals court on Thursday allowed President Trump’s tariffs to remain in place while the administration’s appeal proceeds. The Trump administration could still win the appeal, but may also pursue alternative measures to implement or maintain tariffs. The Wall Street Journal reported on Thursday that the administration is weighing a temporary measure to impose tariffs on large parts of the global economy using an existing law that permits duties of up to 15% for a duration of 150 days. In yesterday’s trading session, Wall Street’s major indexes ended in the green. Nvidia (NVDA) rose over +3% after the world’s most valuable chipmaker posted better-than-expected Q1 results and gave a solid Q2 revenue forecast. Also, Nordson (NDSN) climbed more than +6% and was the top percentage gainer on the S&P 500 after the industrial technology manufacturer reported upbeat FQ2 results and issued above-consensus FQ3 guidance. In addition, e.l.f. Beauty (ELF) soared over +23% after the cosmetics company reported stronger-than-expected FQ4 results and announced the acquisition of Hailey Bieber’s Rhode beauty brand for $1 billion. On the bearish side, HP Inc. (HPQ) slumped more than -8% and was the top percentage loser on the S&P 500 after the personal computer company posted weaker-than-expected FQ2 adjusted EPS and cut its full-year adjusted EPS guidance. The U.S. Bureau of Economic Analysis’ second estimate showed on Thursday that the economy contracted at a 0.2% annualized pace in the first quarter, compared with an initially reported 0.3% decline. Also, U.S. April pending home sales fell -6.3% m/m, weaker than expectations of -0.9% m/m and the largest decline in more than 2-1/2 years. In addition, the number of Americans filing for initial jobless claims in the past week rose +14K to 240K, compared with the 229K expected. “Historic and more current data brought no surprises. Even if that had been the case, the focus would have remained firmly on the here and now — tariffs, courts, China, Nvidia, yields, and equity markets,” said Neil Birrell at Premier Miton Investors. Meanwhile, Fed Chair Jerome Powell met with President Trump at the White House on Thursday. Trump pushed the Fed chief to cut interest rates during their first in-person meeting since the president’s inauguration, the White House said. The Fed said policy “depends entirely on incoming economic information and what that means for the outlook.” Chicago Fed President Austan Goolsbee said on Thursday that a resolution in trade policy could steer the U.S. economy back to its pre-tariff path, paving the way for officials to cut interest rates. “If you have stable full employment and inflation going to target, rates can come down to where they would eventually settle,” Goolsbee said. Also, San Francisco Fed President Mary Daly said that monetary policy is currently in a “good place” to keep driving inflation lower. In addition, Dallas Fed President Lorie Logan indicated it could be some time before policymakers understand how the economy will respond to tariffs and other policy shifts and, in turn, how interest rates should be adjusted. U.S. rate futures have priced in a 97.9% chance of no rate change and a 2.1% chance of a 25 basis point rate cut at June’s monetary policy meeting. Today, all eyes are focused on the U.S. core personal consumption expenditures price index, the Fed’s preferred price gauge, which is set to be released in a couple of hours. Economists, on average, forecast that the core PCE price index will stand at +0.1% m/m and +2.5% y/y in April, compared to the previous figures of unchanged m/m and +2.6% y/y. U.S. Personal Spending and Personal Income data will also be closely monitored today. Economists anticipate April Personal Spending to be +0.2% m/m and Personal Income to be +0.3% m/m, compared to the March figures of +0.7% m/m and +0.5% m/m, respectively. The University of Michigan’s U.S. Consumer Sentiment Index will be reported today. Economists expect the final May figure to be revised higher to 51.1 from the preliminary reading of 50.8. U.S. Wholesale Inventories data will come in today. Economists forecast the preliminary April figure at +0.4% m/m, the same as in March. The U.S. Chicago PMI will be released today as well. Economists expect this figure to come in at 45.1 in May, compared to the previous value of 44.6. In addition, market participants will hear perspectives from Atlanta Fed President Raphael Bostic and Chicago Fed President Austan Goolsbee throughout the day. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.434%, up +0.23%. PCE data as well as a few FED members speaking today should be our main news catalysts. Take a look at the market trends and tell me what you see. Technicals are stuck in a vacuum this morning. Markets are having up and down days but not really going anywhere. Futures just got hit as I type with this headline. The VTI is very neutral as well. I think its just a pure guess and speculation to try to divine a directional bias in these conditions. We have a fairly busy day for a Friday. Scalping again today with the /MNQ. We should be booking profits on our COST, MRVL, PATH, ULTA earnings trades. Possibly a TSLA equity 0DTE. We already booked our profit on our Theta fairy. BITO roll again today. SPX and possibly NDX 0DTE's and another shot at the 1HTE BTC trades this morning. Let's look at the intra-day levels on /ES. There are three main levels I'm interested in today with two being key. 5911 is a must retake for the bulls. We were above it before the China tweet. A recapture of that would be the first order of business for bulls. Then, a lesser level that is a bit far away is the 6004 area. For us to push out of this consolidation zone we've been in for a while, the bulls need to clear that level. On the downside I'm very focused on 5877. If bears can push below that I think we could easily see a 100+ point down move. Next week's training will be on pairs trades and our approach to them. How they work and why they may be a good fit for our ATM program. I look forward to seeing you all in the live trading room. I thought it might be a boring day but Pres. Trump came to the rescue...again!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |