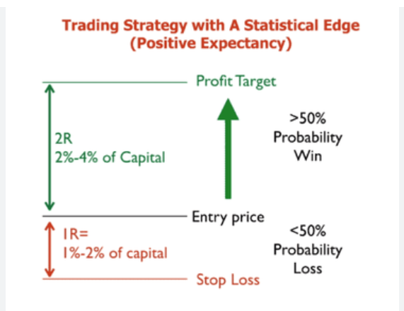

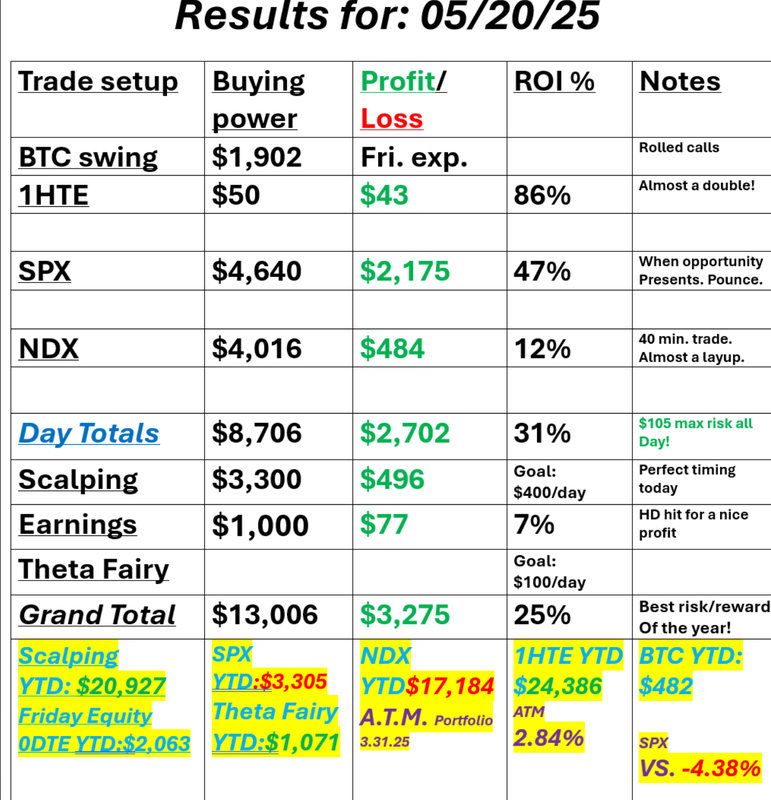

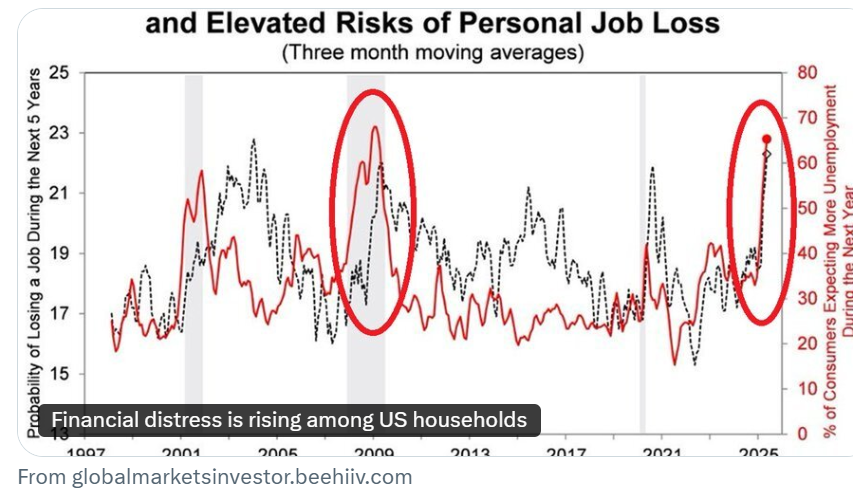

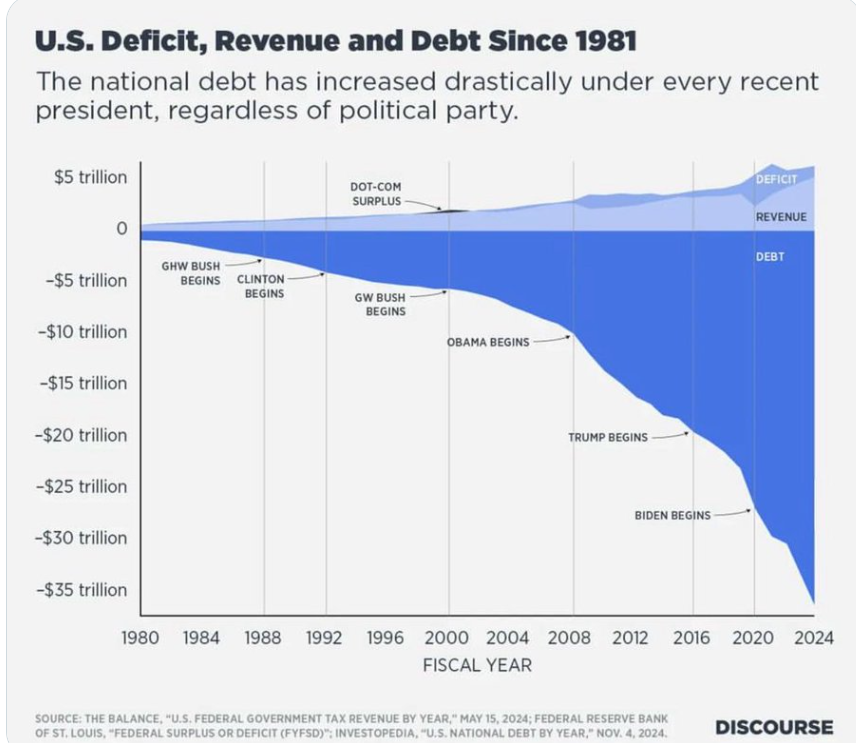

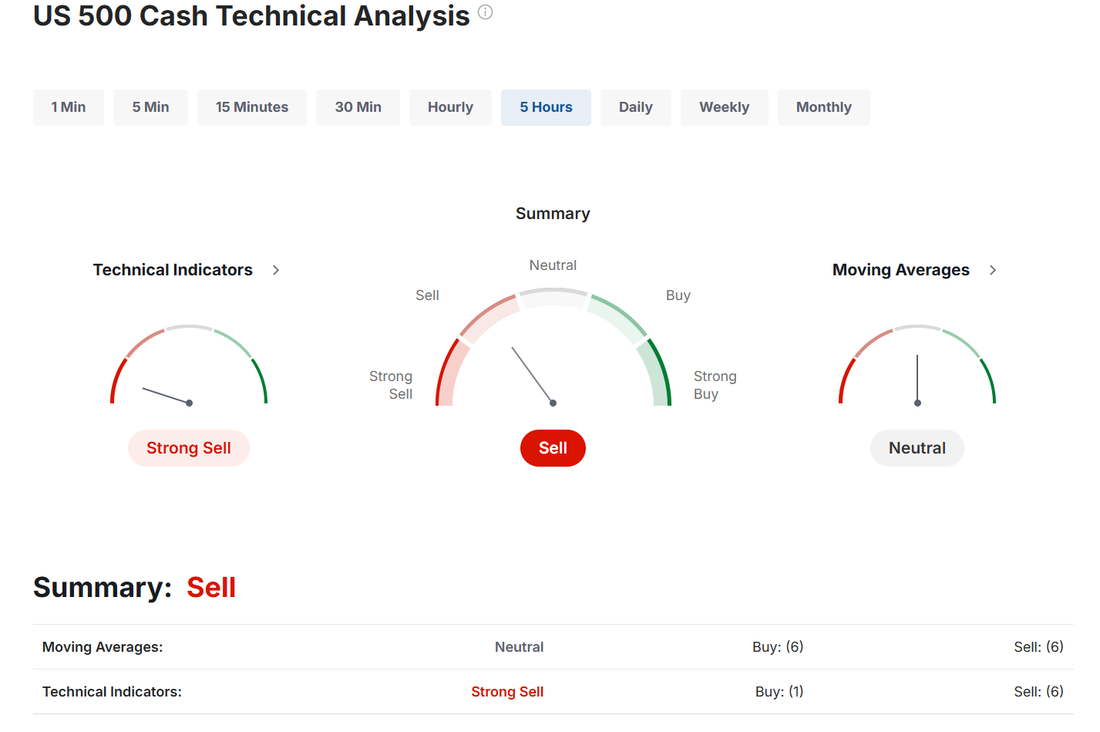

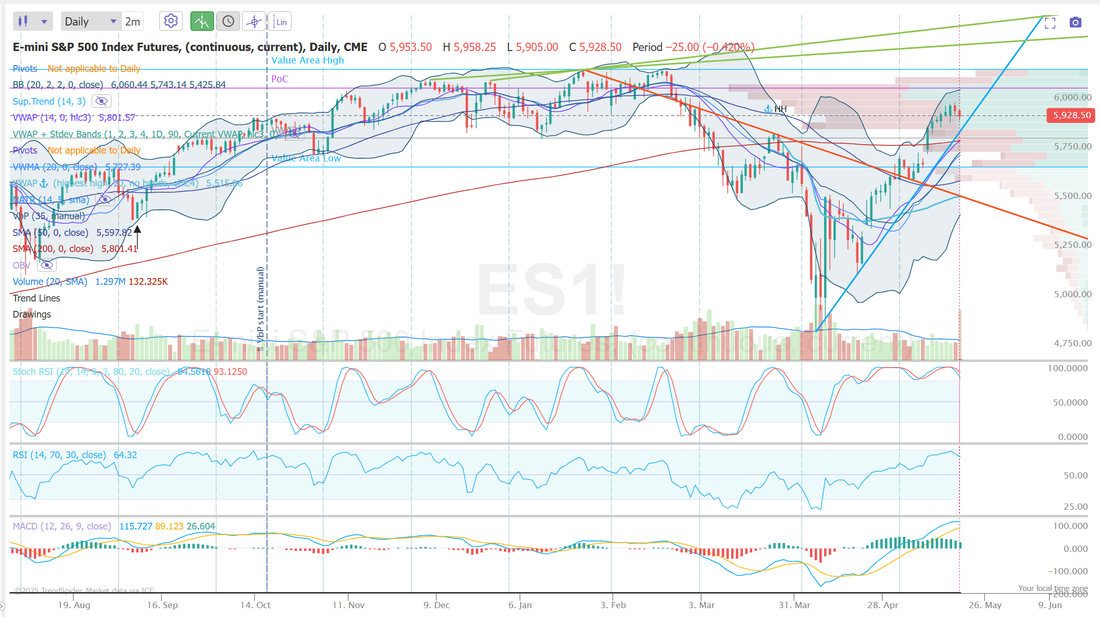

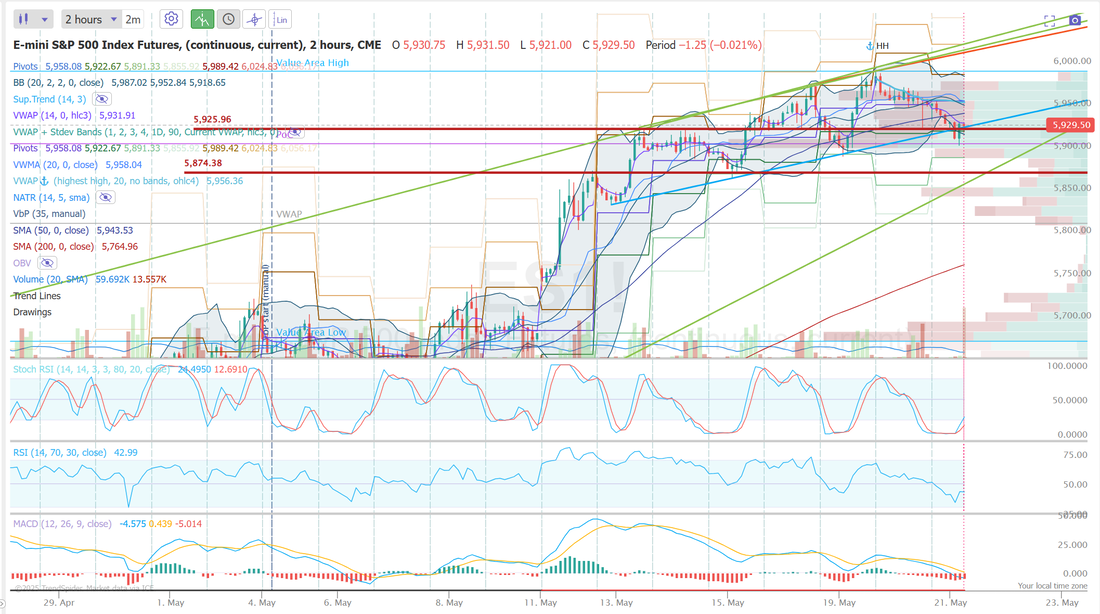

Does positive expectancy guarantee profits?If you can build and trade a system that has "positive expectancy" then you have "edge" If you have edge then you are a theoretical money printing machine. Is it really that simple? Of course not. Nothing in life is ever really as simple as it seems. Let's talk first about positive expectancy. The idea is simply that more profits come in than losses going out. It is NOT about avoiding or removing losses. It's simply about having a bigger green number than red at the end of the accounting period. If your system does that over time then you have what traders call edge. Edge is what the casinos have. Playing roulette and betting on either red or black is NOT a 50/50 shot. You've got a double zero on the wheel. That gives the house an edge of 5.2%. Could you win playing red or black 10 times in a row? Of course! Eventually though, the house will get that money back. Trying to maintain an edge in trading can be challenging at times but yesterday was our best day of the year. We've never risked so little to make so much. Our biggest risk or unrealized loss amount of the day was $105 dollars. We made over $3,200 in profit. We've made more and heavens knows we've risked more but we've rarely, if ever, had a risk/reward ratio like we had yesterday. Here's a look at our day. We got an early start on today's trading with our modified Theta fairy, a short /MNQ scalp with an ATM cover and a /NQ trade that looks amazing! Yeah, we have trades all day long because.... I didn't come into yesterday with a lean or bias, even though futures were down a bit. Once we started trading my signals kicked over to bearish and we took a larger bearish position than we normally start with. It paid off in spades for us yesterday. Today I'm sticking with a bearish bias. Let's all pray for another significant selloff! There's nothing better for a trader than a bear market. Job loss concern is exploding. National debt is exploding. Japan's bond market is imploding: Japan's 30Y Government Bond Yield has officially surged to its highest level in history, at 3.15%. For decades, Japan was known for low long-term interest rates. Now, they are dealing with high inflation, shifting policy outlook, and a whopping 260% Debt-to-GDP ratio. On top of this, Japan holds $1.1 TRILLION worth of US debt, making it the largest foreign holder of US debt. Yesterday, Japan’s Prime Minister Ishiba called the situation “worse than Greece.” There are some real ugly things developing in the macro economic picture. Let's take a look at the market. It sure looks like we are wanting to roll over. Is it too early to tell? Sure. We've been flat to slightly down for three days now. That doesn't make a trend change but it does look like the market is taking a pause here. With the selling yesterday and futures being down this morning we are still holding up fairly well technically speaking. We are getting a slight sell order this morning. Trade docket for today: ASML, MDB, aBNB, AAPL, "6 day candle rollover" trades. SNOW and ZM earnings, 1HTE, SPX, NDX 0DTE's TJX, LOW, PANW earnings take profits. Let's take a look at our intra-day level on /ES: On the daily chart is certainly looks like a rollover is being attempted. Price action, RSI and Stochastics are all rolling over with MACD almost there. On an intra-day chart: My key level is still the same. 5925. Bulls need to hold this level. If they can not the bears could easily take us down to 5874. As I type we sit down -31 points and at 5928. Just above that key 5925 level. We've got another great training coming up next week with the top trading keys from the infamous Richard Dennis. I look forward to having a good discussion with you all on that day. See you all in zoom shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |