|

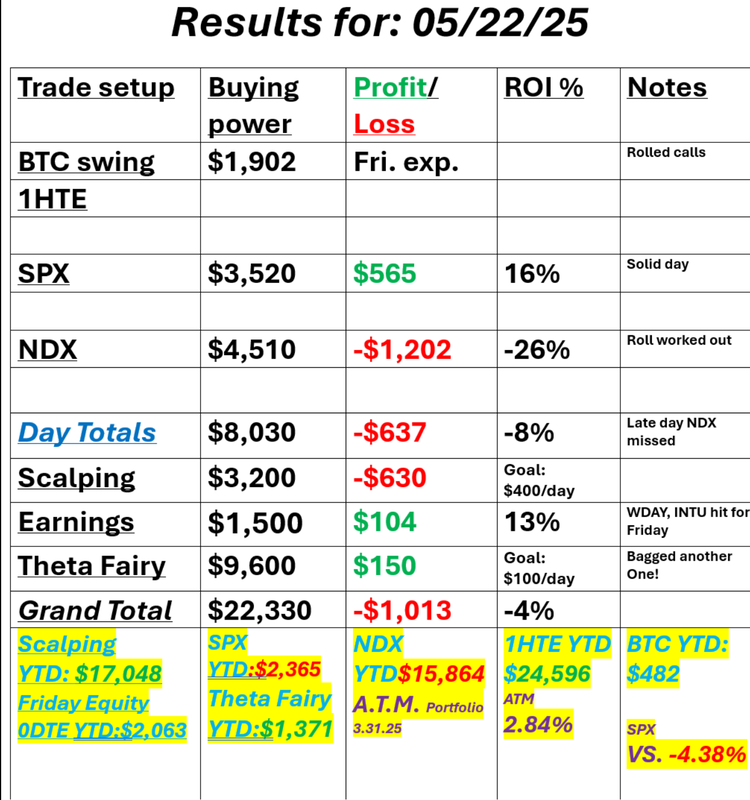

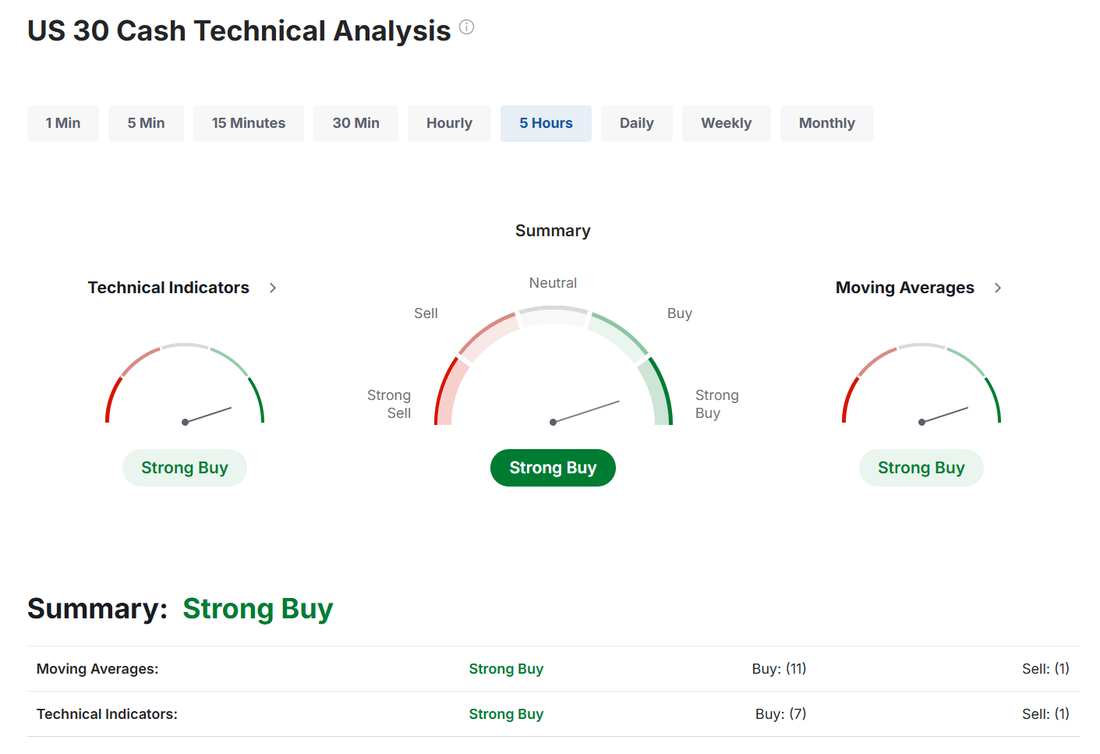

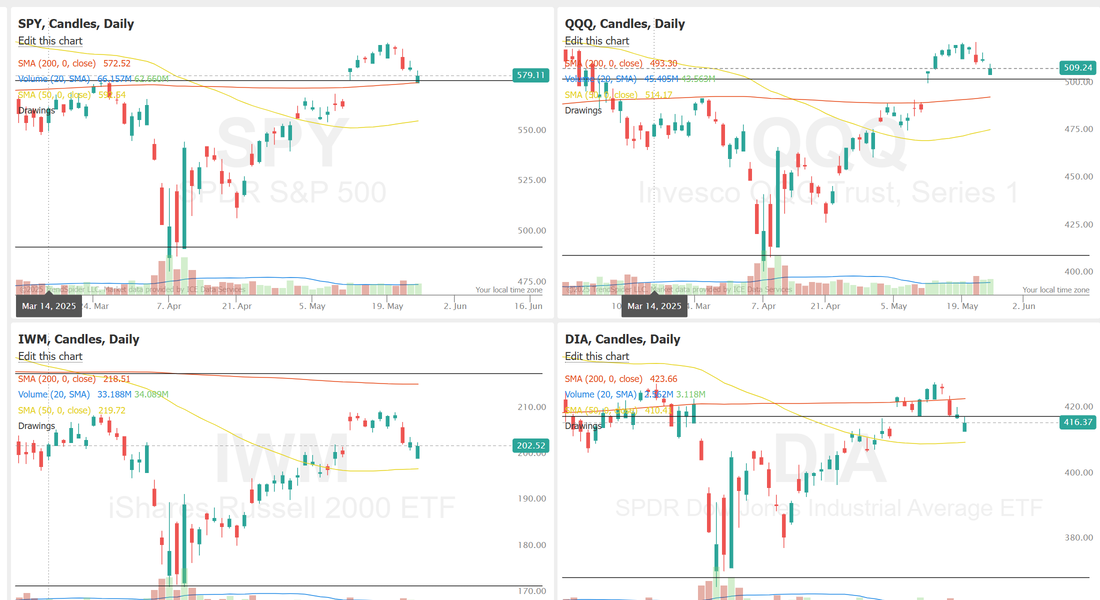

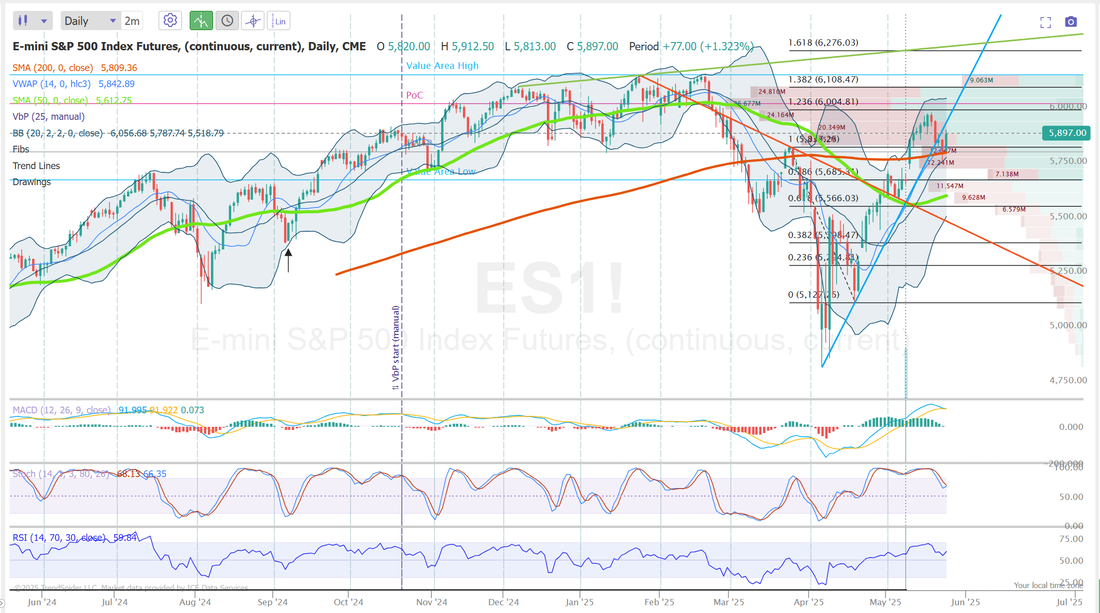

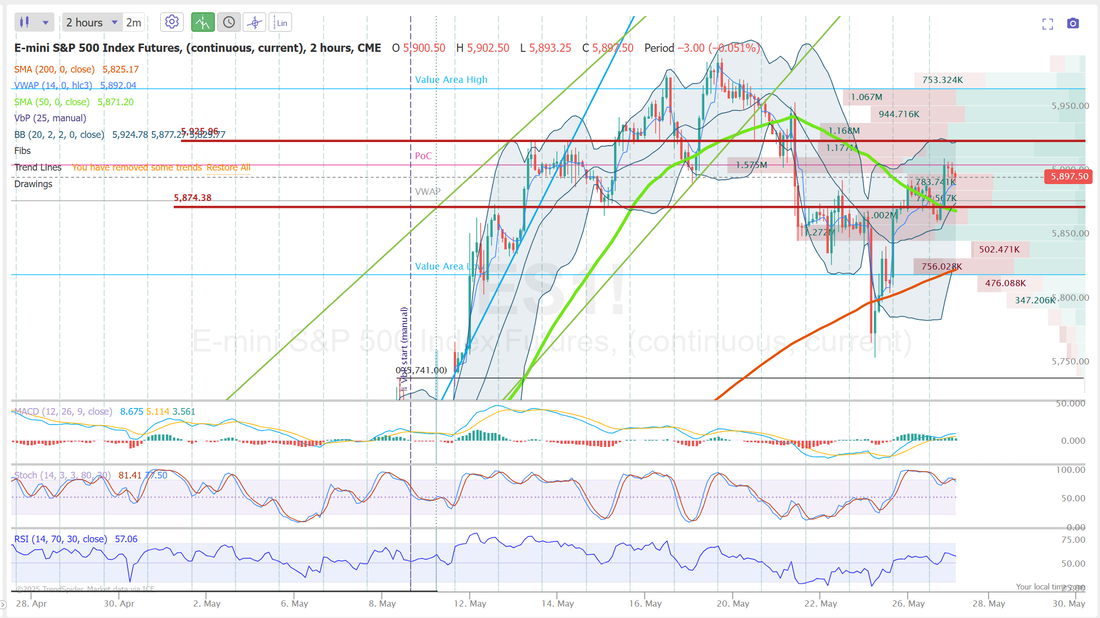

I hope you all had a wonderful Memorial day. I'm grateful for all who have served and will serve. On or off? Depends on the day.Markets were rocked last week with new Tariff news and futures are up a solid 1.5% this morning on news of a repreve. It's hard to say where this all ends up but it does illustrate the challenge of putting longer term trades together. Not many traders want duration risk in this market. My Friday was a mixed bag. Our SPX worked well but my late day NDX lost. Let's take a look at the markets for this shortened trading week. New's of the EU tariff delay have pushed us back into a buy signal. Yes, futures are popping this morning but the current trend has been down. That poses the question today. Do we continue higher once the cash market opens or do we retrace? My overall feeling is that this news of an E.U. delay will NOT be enough to carry up back to an overall bullish trend. I'd favor a bit of a retracement today. That puts my bias or lean slightly bearish from the highs of the futures this morning. June S&P 500 E-Mini futures (ESM25) are up +1.56%, and June Nasdaq 100 E-Mini futures (NQM25) are up +1.63% this morning, pointing to a sharply higher open on Wall Street after a long weekend, as sentiment got a boost from U.S. President Donald Trump’s decision to extend the deadline on sweeping euro area tariffs. President Trump said he would push back the deadline for the European Union to face 50% tariffs to July 9th from June 1st following a phone call with Commission President Ursula von der Leyen. “We had a very nice call and I agreed to move it,” Trump told reporters Sunday. Von der Leyen said Sunday in a post on X that “Europe is ready to advance talks swiftly and decisively,” but that “a good deal” will need “time until July 9.” That’s the date when Trump’s 90-day pause on his reciprocal tariffs was initially scheduled to expire. Also aiding sentiment, bond yields slumped worldwide after reports emerged that Japan is looking to stabilize its debt market following weeks of selloff. Investor focus this week is on an earnings report from semiconductor stalwart Nvidia, the minutes of the Federal Reserve’s latest policy meeting, and the release of the Fed’s preferred inflation gauge. In Friday’s trading session, Wall Street’s major equity averages closed lower after President Trump threatened to impose sweeping tariffs on the EU and Apple. Deckers Outdoor (DECK) plunged over -19% and was the top percentage loser on the S&P 500 after the maker of Hoka running shoes and UGG boots issued below-consensus FQ1 guidance. Also, chip stocks lost ground, with Microchip Technology (MCHP) sliding more than -3% and ON Semiconductor (ON) falling over -2%. In addition, Apple (AAPL) dropped more than -3% after President Trump stated that the company would face “at least” a 25% tariff if iPhones sold in the U.S. are not manufactured domestically. On the bullish side, Intuit (INTU) climbed over +8% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the financial software company posted upbeat FQ3 results and raised its full-year guidance. Economic data released on Friday showed that U.S. new home sales unexpectedly rose +10.9% m/m to a 3-year high of 743K in April, stronger than expectations of 694K. Minneapolis Fed President Neel Kashkari said on Monday that significant shifts in U.S. trade and immigration policy are creating uncertainty, making it difficult for Fed officials to move on interest rates before September. “Will the picture be clear enough by September? I am not sure right now. We will have to see what the data says, but also how the negotiations are going,” Kashkari said in an interview on Bloomberg Television. He noted that if the U.S. secures trade deals with other countries in the coming months, “that should provide a lot of the clarity we are looking for.” Meanwhile, U.S. rate futures have priced in a 97.9% probability of no rate change and a 2.1% chance of a 25 basis point rate cut at the conclusion of the Fed’s June meeting. In this holiday-shortened week, market participants will focus on earnings reports from several major companies, with semiconductor giant Nvidia’s (NVDA) report on Wednesday attracting the most attention. Wedbush analysts stated that the company is poised to remain a key beneficiary of massive AI infrastructure investments by hyperscalers. Retailers such as Costco Wholesale (COST), AutoZone (AZO), and Dick’s Sporting Goods (DKS), along with notable companies like Salesforce (CRM), Marvell Technology (MRVL), Dell Technologies (DELL), and HP Inc. (HPQ), are also set to release their quarterly results this week. On the economic data front, the April reading of the U.S. core personal consumption expenditures price index, the Fed’s preferred inflation gauge, will be the main highlight. Other noteworthy data releases include U.S. GDP (second estimate), the Richmond Fed Manufacturing Index, Initial Jobless Claims, Pending Home Sales, Crude Oil Inventories, Goods Trade Balance, Personal Income, Personal Spending, Wholesale Inventories (preliminary), the Chicago PMI, and the University of Michigan’s Consumer Sentiment Index. Market watchers will also closely monitor the Fed’s minutes from the May 6-7 meeting, set for release on Wednesday, for further insights into policymakers’ discussions on interest rates and the economy. The Fed signaled that rate cuts are unlikely for now due to inflation risks, though officials remain concerned about the potential economic damage from tariffs. In addition, several central bankers are scheduled to deliver remarks this week, including Kashkari, Williams, Waller, Barkin, Goolsbee, Kugler, Daly, Logan, and Bostic. Today, all eyes are focused on the U.S. Conference Board’s Consumer Confidence Index, which is set to be released in a couple of hours. Economists, on average, forecast that the May CB Consumer Confidence index will stand at 87.1, compared to last month’s figure of 86.0. Investors will also focus on U.S. Durable Goods Orders and Core Durable Goods Orders data. Economists expect April Durable Goods Orders to be -7.6% m/m and Core Durable Goods Orders to be -0.1% m/m, compared to the prior figures of +9.2% m/m and 0.0% m/m, respectively. The U.S. S&P/CS HPI Composite - 20 n.s.a. will be released today as well. Economists foresee the March figure coming in at +4.5% y/y, the same as in February. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.473%, down -0.84%. NVDA earnings this week will be closely watched. With a shortened week, the expected move is down. VXX is back to a more "normal" level. SPY closed the week strong at $594.20 (+5.31%), gapping above the 200-day moving average, a key level many trend followers watch as a potential signal of bullish continuation. Bulls remained firmly in control, with price action skipping the Weak Go phase and triggering a Strong Go signal on the GoNoGo Trend® Indicator. However, with RSI approaching overbought territory, traders may want to watch for signs of exhaustion heading into next week. QQQ closed even stronger at $521.51 (+6.87%), landing near its year-to-date volume point of control, a key zone of potential overhead supply. With RSI pushing into overbought territory, the stage is set for a tug-of-war between trend-followers riding momentum above the 200-day moving average and bears looking for signs of a reversal. The IWM small-cap ETF lagged behind last week, closing at $209.85 (+4.49%). A Strong Go signal has triggered, and with the index still trading roughly 3% below its 200-day moving average, bulls may have room to push higher before encountering resistance. Unlike its large-cap peers, IWM’s RSI remains below overbought territory, offering more room for near-term follow-through. Trade docket for today is very simple. Today my focus is on our BITO trade and SPX 0DTE. Tomorrow we get a slew of earnings setups with NVDA , CRM, SNPS, Thurs. will bring ULTA, BBY, PATH, DELL. With our day trade focus today on SPX, let's look at the /ES to divine intra-day levels. Looking at the daily chart I see a couple items that stick out to me. #1. The 200DMA is holding firm, for now, as a support level. #2. The Trend is still down, even with the futures bump this morning. On the 2hr. chart I have two key levels that, incidentally, were big levels for us from last week. 5925 as resistance. A break above here and it really looks to me that the bulls are back in business. 5874 as support. Below here I think we give back the gains from the futures this morning and the bearish trend continues. Tomorrow we'll have the training on Richard Dennis and the Turtle traders so don't miss that. I'll see you all in the live trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |