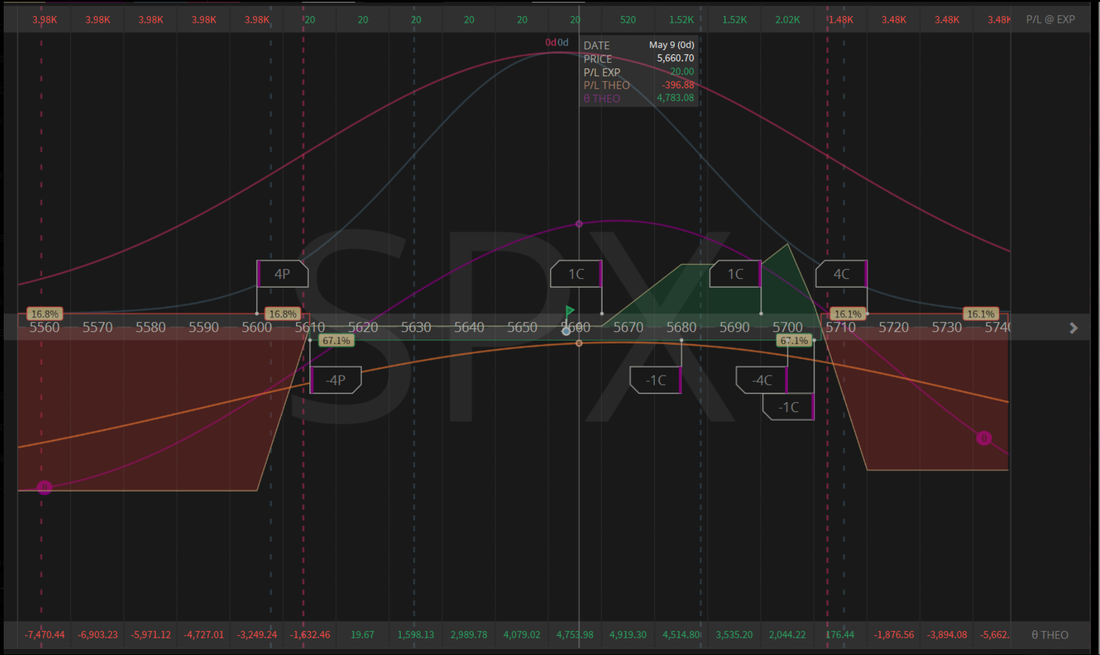

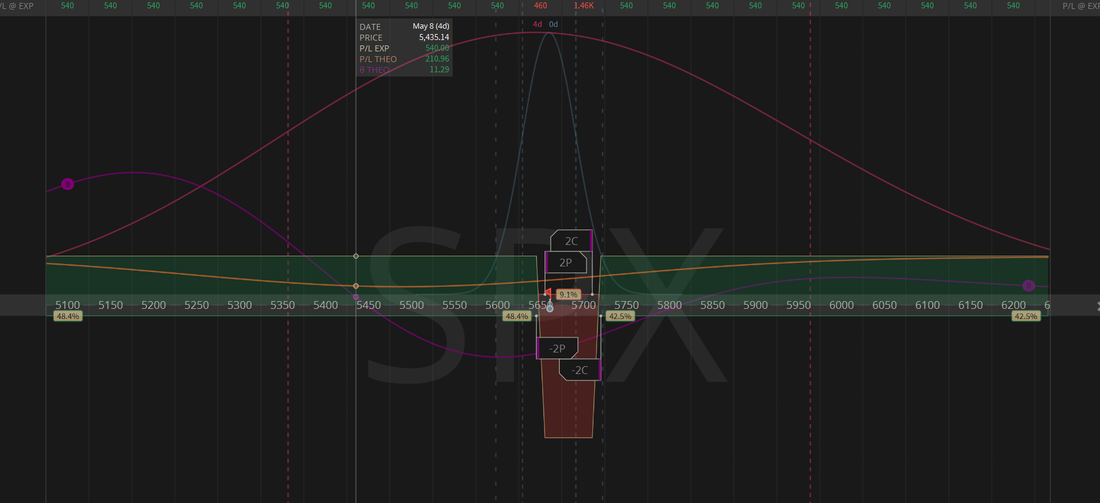

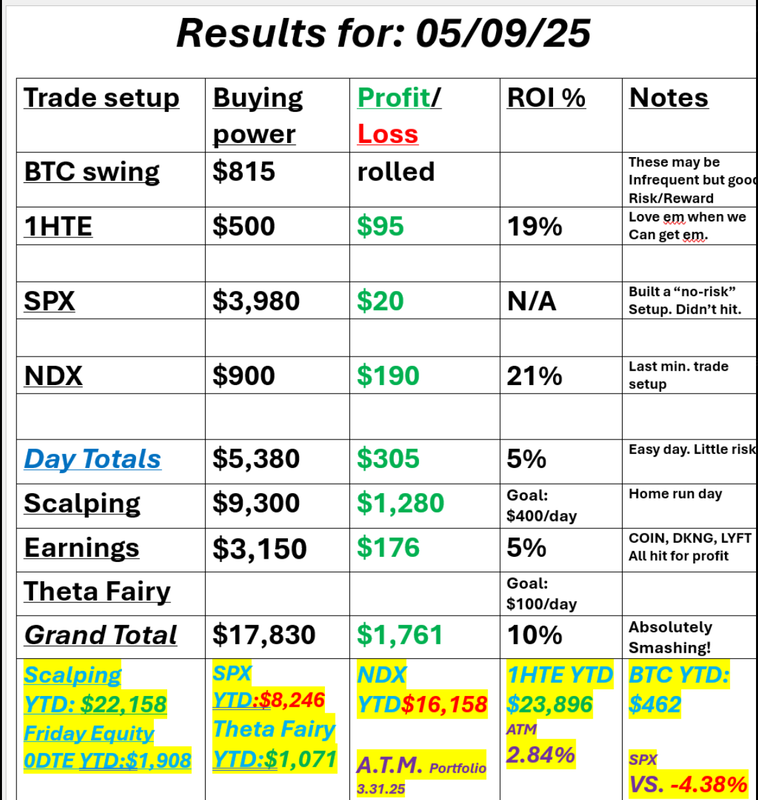

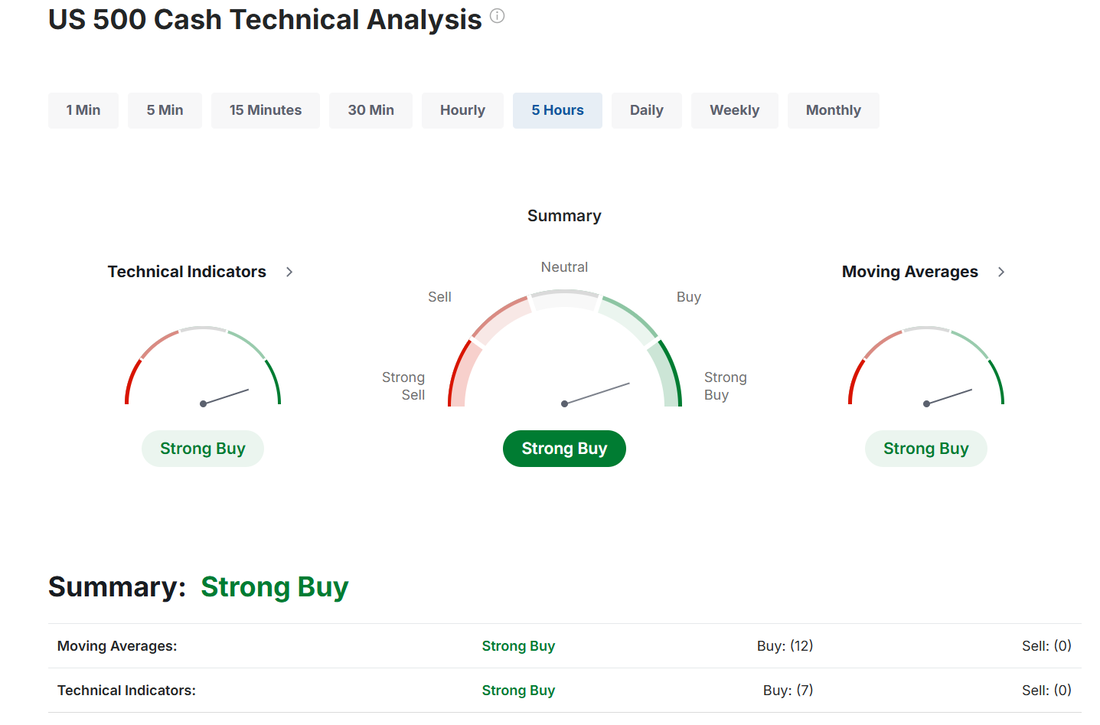

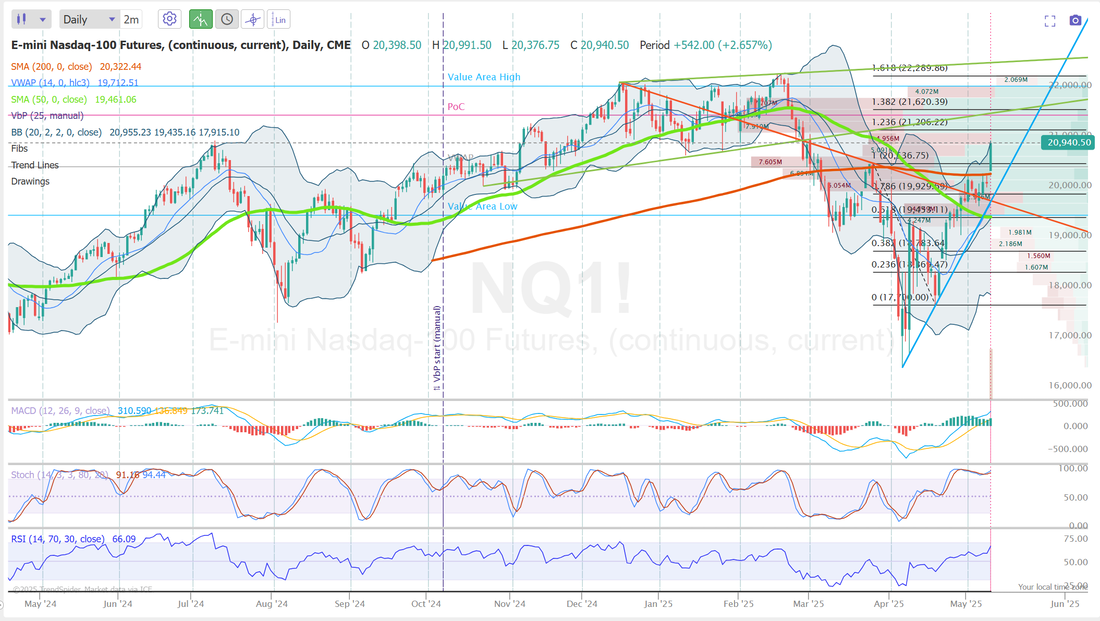

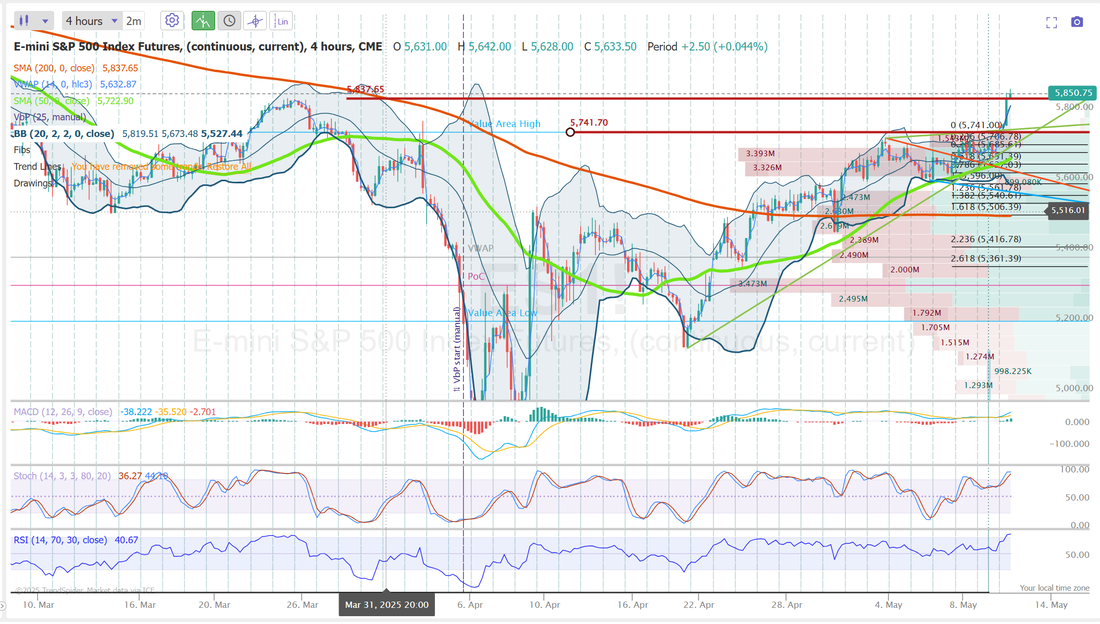

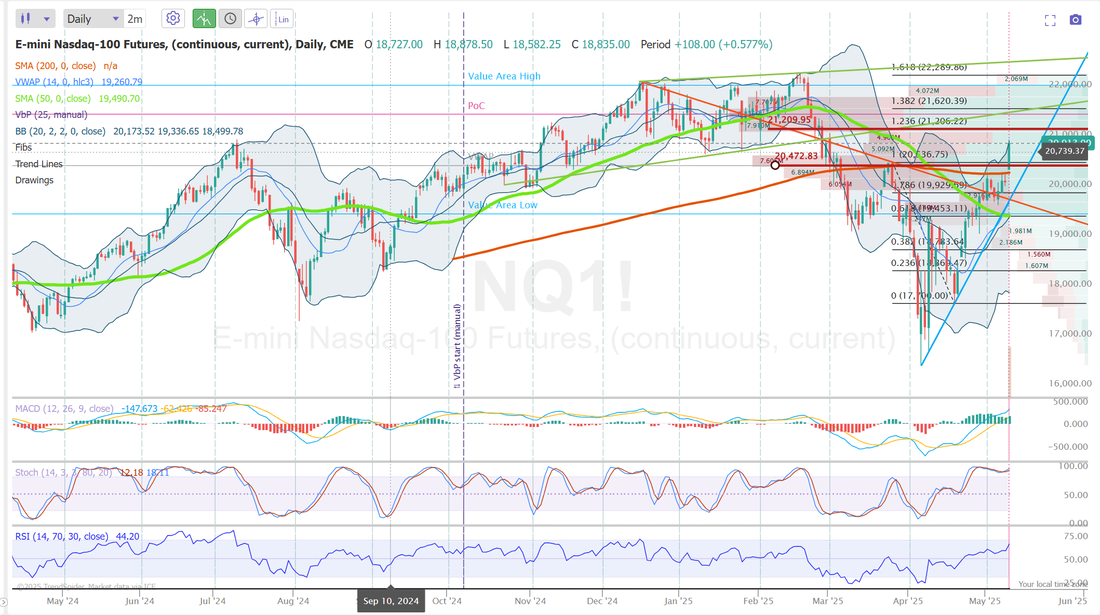

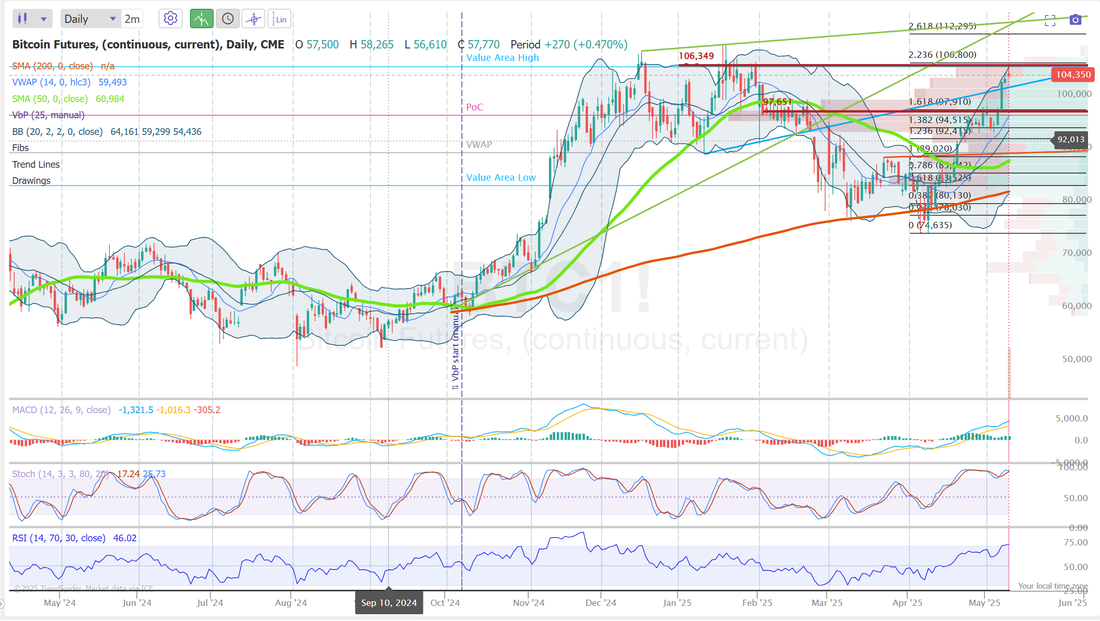

What is a perfect trade?That's so hard to define. Every trader is looking for different things. For me, it's a trade that has a potential profit that is big enough that I'd be thrilled with, should it hit but risk that is low enough that I don't feel stressed or worried. Our SPX 0DTE from last Friday was a perfect example. It was, oh-so-close to hitting a nice big juicy profit but...it didn't. That's always a bummer but the fact that is had no risk in the zone that is was trading in going into the close sure gave me comfort. Here's a look at it. We'll continue to build "forward thinking" setups. We have one already working for today that we started on Friday. Knowing the news catalysts is important. We know over the weekend that negotiations with China would happen and it was pretty clear that we would either get great news, or no news (which would be interpreted as bad new) buy Monday morning. We put on a long Iron condor (see below) This looks set to cash flow for us right out of the gate this morning! We also had a great day Friday, even with our SPX not hitting for max profit. Take a look below: You never know where the profit will come from. That's why we have so many diversified strategies. Let's take a look at this new week. Technicals are bullish. No surprise there with the China news. Maybe most important; The /NQ and /ES are breaking back up above their 200DMA. That's bullish, my friends. We've been looking for this signal for a while now. Will it be all lolly pop and rainbows going forward? Probably not...it never is but, this is a big accomplishment for the bulls. My lean or bias today is bullish. You kind of have to be. My question is, do we retrace this massive futures spike (/ES is currently up a massive 182 points as I type) or is there even more upside once the cash market opens up? Volatility is still with us. We've got over a 2% expected move in the SPY this week and it's already looking to open up 3.2% higher! June S&P 500 E-Mini futures (ESM25) are up +2.78%, and June Nasdaq 100 E-Mini futures (NQM25) are up +3.82% this morning after China and the U.S. agreed to reduce tariffs for 90 days following weekend trade talks in Geneva aimed at easing tensions. The U.S. announced it would reduce its “reciprocal” tariff on Chinese goods from 125% to 10%. Still, U.S. President Donald Trump’s 20% fentanyl-related tariffs on China will remain. At the same time, China said it would lower its tariff on U.S. goods to 10% from 125%. The mutual tariff adjustments will take effect by May 14th. “We are in agreement that neither side wants to decouple,” U.S. Treasury Secretary Scott Bessent said, adding that “we had a very robust and productive discussion on steps forward on fentanyl” and that the talks could result in “purchasing agreements” by China. This week, investors look ahead to the release of key U.S. inflation data, remarks from Federal Reserve Chair Jerome Powell and other Fed officials, and earnings reports from several high-profile companies. In Friday’s trading session, Wall Street’s major equity averages ended mixed. Insulet (PODD) soared over +20% and was the top percentage gainer on the S&P 500 after the company posted upbeat Q1 results and raised its full-year revenue growth guidance. Also, The Trade Desk (TTD) surged more than +18% and was the top percentage gainer on the Nasdaq 100 after the advertising-technology company reported stronger-than-expected Q1 results and gave solid Q2 revenue guidance. In addition, Microchip Technology (MCHP) climbed over +12% after the maker of chips and circuits for electronics reported better-than-expected FQ4 results and issued above-consensus FQ1 revenue guidance. On the bearish side, Akamai Technologies (AKAM) plunged more than -10% and was the top percentage loser on the S&P 500 after the cybersecurity company provided a soft full-year adjusted EPS forecast. Fed officials, speaking Friday at the Hoover Monetary Policy Conference at Stanford University, supported Chair Jerome Powell’s “wait-and-see” stance, stating that the central bank requires greater clarity on how the tariffs will affect the economy before making any changes to interest rates. Meanwhile, U.S. rate futures have priced in a 92.0% probability of no rate change and an 8.0% chance of a 25 basis point rate cut at the conclusion of the Fed’s June meeting. The U.S. consumer inflation report for April will be the main highlight this week. The report is expected to confirm that inflationary pressures are still too elevated to warrant a rate cut at this time. Retail sales data for April and the University of Michigan’s preliminary consumer sentiment index for May will also be closely monitored for indications of how the prospect of tariffs is affecting consumer sentiment and spending. Other noteworthy data releases include the U.S. PPI, the Core PPI, Initial Jobless Claims, the Empire State Manufacturing Index, the Philadelphia Fed Manufacturing Index, Industrial Production, Manufacturing Production, Business Inventories, Building Permits (preliminary), Housing Starts, the Export Price Index, and the Import Price Index. Fed Chair Jerome Powell is set to deliver remarks on the central bank’s monetary policy review at the Thomas Laubach Research Conference on Thursday. Several other Fed officials will also be making appearances throughout the week, including Kugler, Waller, Jefferson, and Daly. First-quarter corporate earnings season is winding down, but several notable companies are due to report this week, including Walmart (WMT), Deere & Company (DE), Applied Materials (AMAT), Cisco Systems (CSCO), and Take-Two Interactive (TTWO). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +6.7% increase in quarterly earnings for Q1 compared to the previous year. The U.S. economic data slate is mainly empty on Monday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.438%, up +1.44%. Trade docket for today: Scalping. It's hard to tell with the /NQ up 800+ points what will give us the best setups for today. QQQ's may work IF we get more movement. /NQ credit spreads could work as well. I'm leaning to an /NQ Credit call spread. 0DTE will focus again on SPX and look for a late day entry in NDX. 1HTE should be viable this morning and we've got more earnings trades this week. Today we'll start with ZI. We'll start our weekly oil trade back up with /MCL and may scale in on our GLD/SLV pairs trade. Let's look at our intra-day levels: /ES: I've got to go out to the 4hr. chart with todays massive upswing. There are two key levels for me today. 5837 is resistance. We are already above that now. This was the March 25th high. Above this is all blue sky so this is the bulls first order of business. Hold this line! Support is down at 5741. That will likely be many pivot points in between these so stay tuned to our zoom feed for those as the day progresses. /NQ: Nasdaq is a bit stronger and already well above the March highs. 21,209 is resistance with 20,472 support. This is again a wide range so look for the pivot points we'll give you in the zoom feed today. BTC: Bitcoin is now well above the 100K mark. $106,349 is the key resistance and that will likely be the area I play today with our 1HTE setups. Today should be another interesting day folks. Our SPX looks set to cash flow right out of the gate. I look forward to seeing you all in the live trading room. Remember today we have another training session. Today our focus is on retraining your brain and managing fear.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |