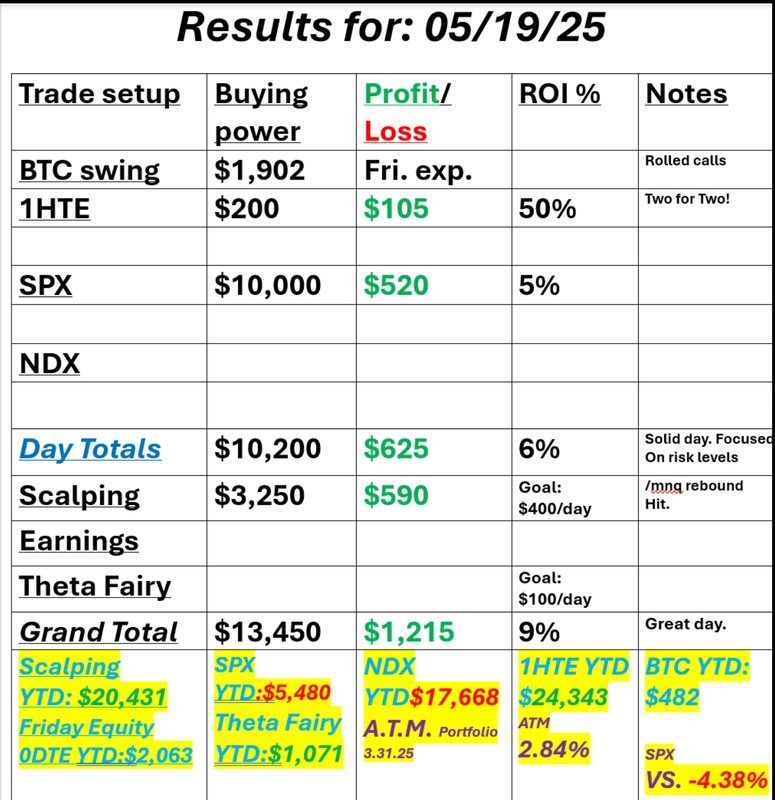

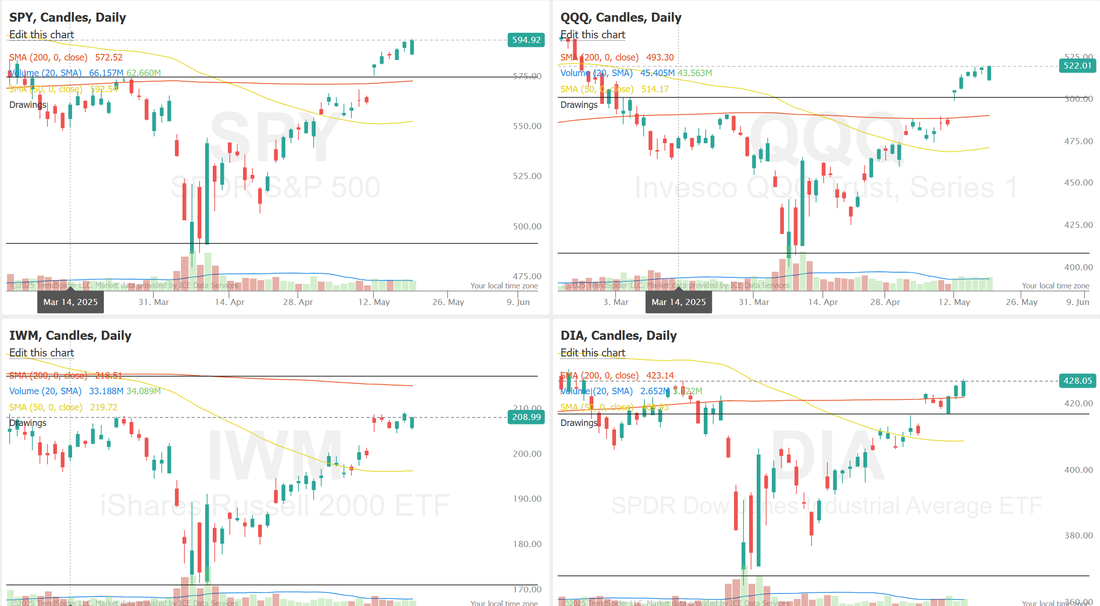

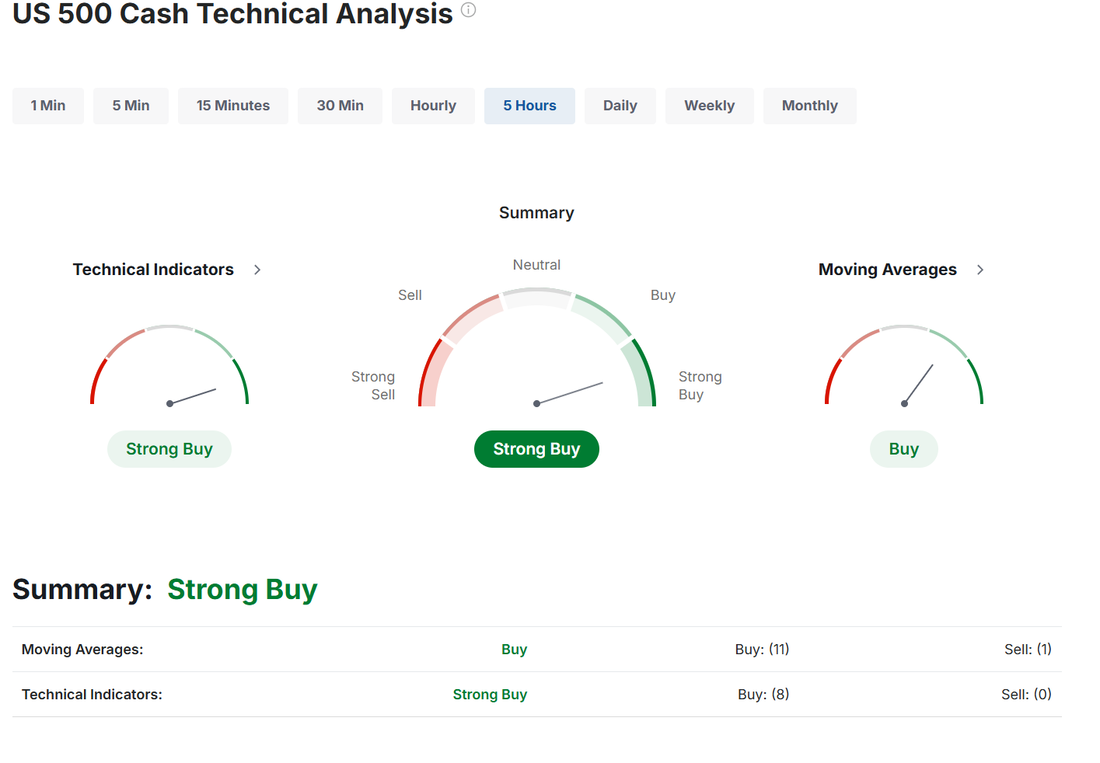

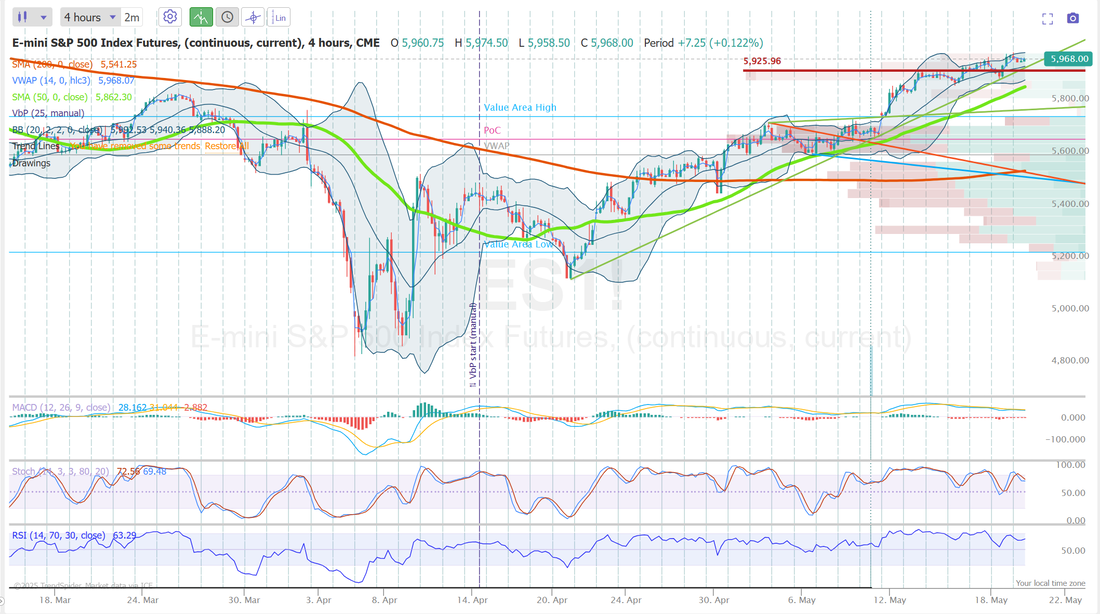

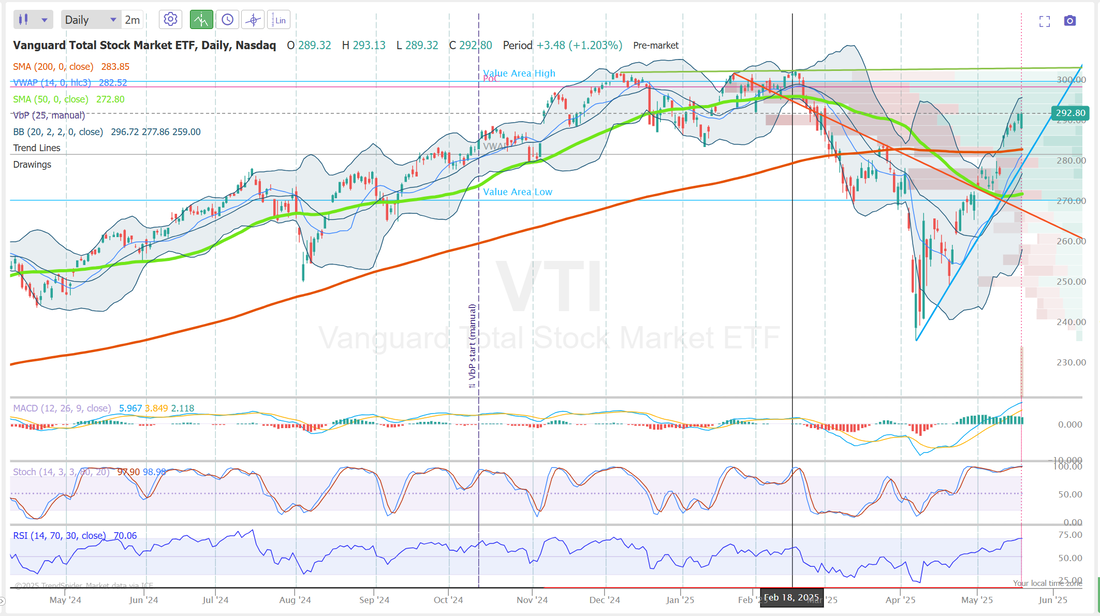

Just don't lose?With the credit downgrade yesterday the futures tanked. I knew that meant we had a bigger than normal opportunity so I used all my buying power right up front and managed it via stop losses. This is a bit different than a normal day for us where we start small and build, mold and shape the trade as the day progresses. I had to stop loss out four times before I finally got on the right side of the market! Ultimately it was a very successful day for us and it continued to remind us that really our main job, as traders is to just focus on the risk and let everything else fall where it may. Here's a look at our day: With futures buried early yesterday morning I was looking for a bullish day and that's what we got. The market retraced all of the selloff but I don't think that means the bulls are fully back in charge. I don't really have a lean or bias today. Futures are down every so slightly as I type. Based on the previous two credit downgrades, it may take a few days to see it's full effect. I'm going to try to be patient this morning and let the market sort out its directional bias. Let's take a look at the markets: That was quite the rebound yesterday and it puts most indices back up to it's near term high. Technicals were still flashing bullish yesterday morning, even with the early selloff. They continue to flash a buy signal. Our trade docket today is full. HD, TJX, LOW, PANW, MDT earnings trades. /MNQ scalp. SPX and possible NDX 0DTE's. 1HTE with BTC. QTTB, BITO. une S&P 500 E-Mini futures (ESM25) are down -0.33%, and June Nasdaq 100 E-Mini futures (NQM25) are down -0.49% this morning, pointing to a pause in the recent rally on Wall Street, while investors await further comments from Federal Reserve officials and an earnings report from home improvement chain Home Depot. In yesterday’s trading session, Wall Street’s main stock indexes ended slightly higher. UnitedHealth Group (UNH) surged over +8% and was the top percentage gainer on the S&P 500 and Dow on signs of insider buying after an SEC filing revealed that CEO Stephen Hemsley and CFO John Rex purchased about $30 million worth of shares last Friday. Also, recently beaten-down pharmaceutical stocks advanced, with Moderna (MRNA) climbing more than +6% and Gilead Sciences (GILD) rising over +3% to lead gainers in the Nasdaq 100. In addition, Take-Two Interactive Software (TTWO) gained more than +3% after Morgan Stanley raised its price target on the stock to $265 from $210. On the bearish side, chip stocks lost ground, with Arm Holdings (ARM) sliding over -2% to lead losers in the Nasdaq 100 and Advanced Micro Devices (AMD) falling more than -2%. Economic data released on Monday showed that the Conference Board’s leading economic index for the U.S. slid -1.0% m/m in April, weaker than expectations of -0.7% m/m and the largest decline in over two years. Fed Vice Chair Philip Jefferson said on Monday that the central bank must make sure any price increases stemming from policy changes in Washington don’t trigger a persistent rise in inflation, adding that monetary policy is in a “very good place.” Also, New York Fed President John Williams suggested that policymakers may hold off on cutting interest rates until at least September as they navigate an uncertain economic outlook. “It’s not going to be that in June we’re going to understand what’s happening here, or in July. It’s going to be a process of collecting data, getting a better picture, and watching things as they develop,” Williams said. In addition, Atlanta Fed President Raphael Bostic said, “Given the trajectory of our two mandates, our two charges, I worry a lot about the inflation side, and mainly because we’re seeing expectations move in a troublesome way,” repeating his expectation for one interest rate cut this year. Finally, Minneapolis Fed President Neel Kashkari stated that there is currently significant uncertainty in the economy. U.S. rate futures have priced in a 91.4% probability of no rate change and an 8.6% chance of a 25 basis point rate cut at the conclusion of the Fed’s June meeting. Meanwhile, JPMorgan CEO Jamie Dimon said Monday that he doesn’t believe the full impact of tariffs has yet passed through to the broader economy. He cautioned that the stock market could plunge as companies contend with added costs for supplies. Today, investors will focus on speeches from Fed officials Barkin, Bostic, Collins, Kugler, Daly, and Musalem. Market participants will also look forward to earnings reports from home improvement chain Home Depot (HD) and cybersecurity firm Palo Alto Networks (PANW). The U.S. economic data slate is empty on Tuesday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.436%, down -0.87%. Our training yesterday on a traders checklist was well received. I'll work on putting another training together for us for next week. These have been good additions to the trading room. Let's take a look at the intra-day levels we have on tap for today in /ES. Unfortunately, yesterdays amazing recovery for a big futures selloff early in the morning didn't really help us with divining any new or substantive levels. I believe I'll start today the same as yesterday with most of my capital invested upfront and manage through stop loss protection. I'm going to start with a bearish setup initially. 5925 is still my key level. I'm looking for a break back down below that. I think that could open up the flood gates to more downside, which we love! Taking a look at the VTI two things become apparent to me. #1. The trend is bullish. #2. Indicators are really overstretched to the upside here. No, there's no real sell signal...yet. Keep your head on a swivel. I look forward to seeing you all in the live trading room. We've got a lot of trades to focus on today.

Also, feel free to offer up any suggestions for next weeks training topic!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |