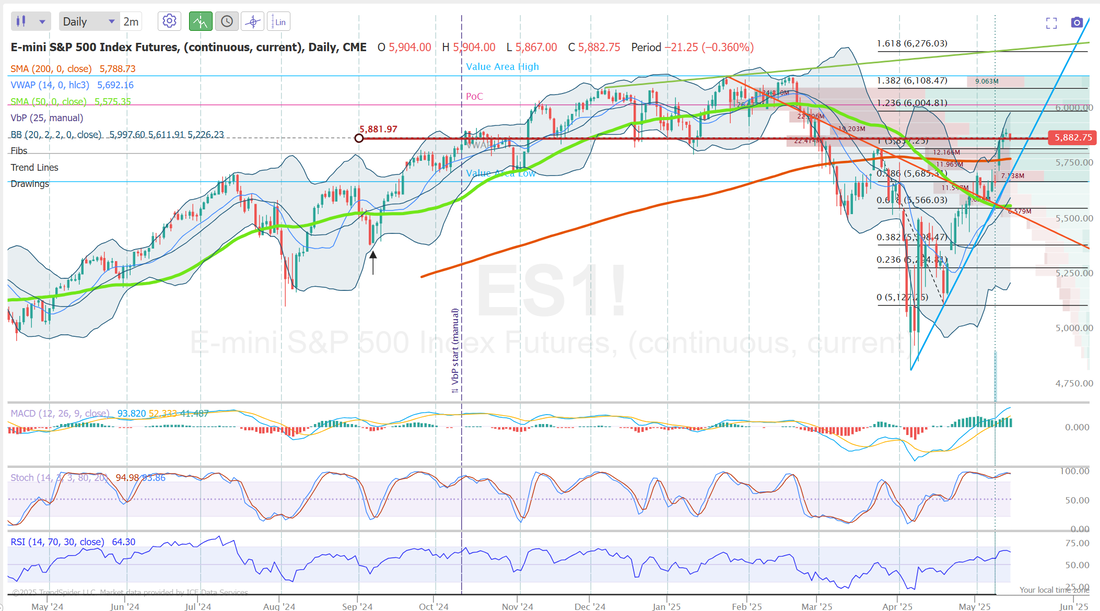

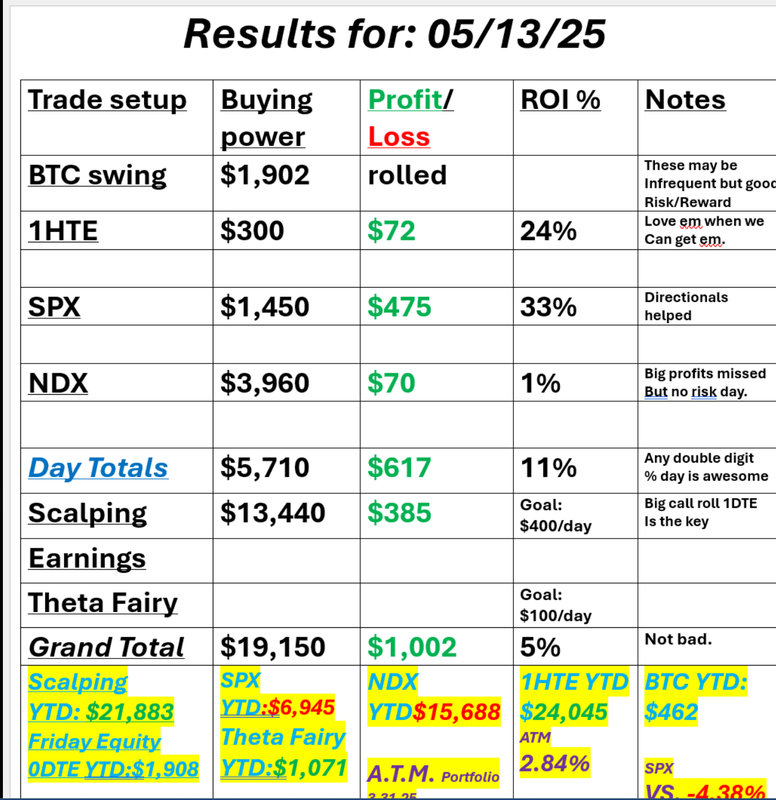

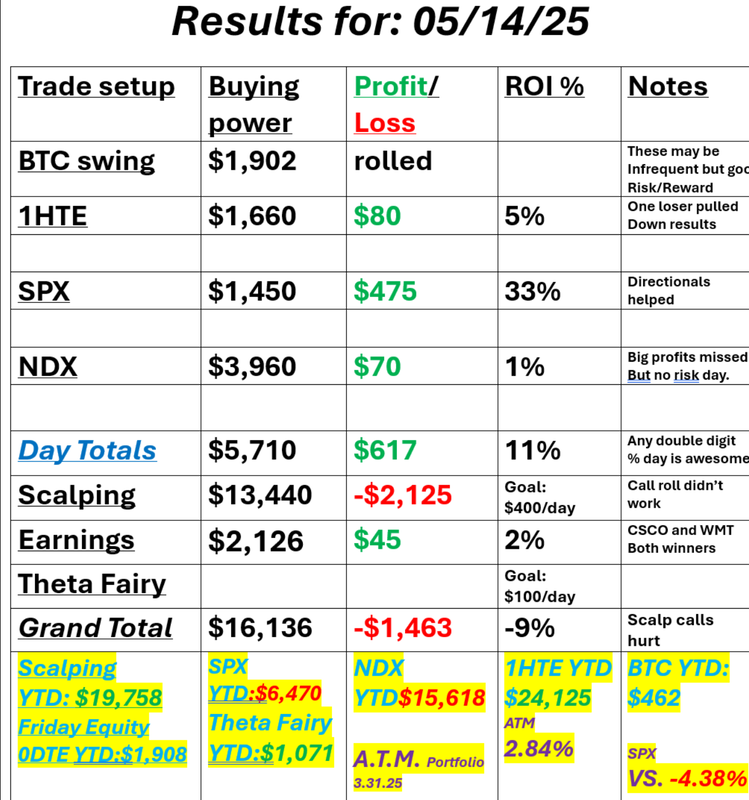

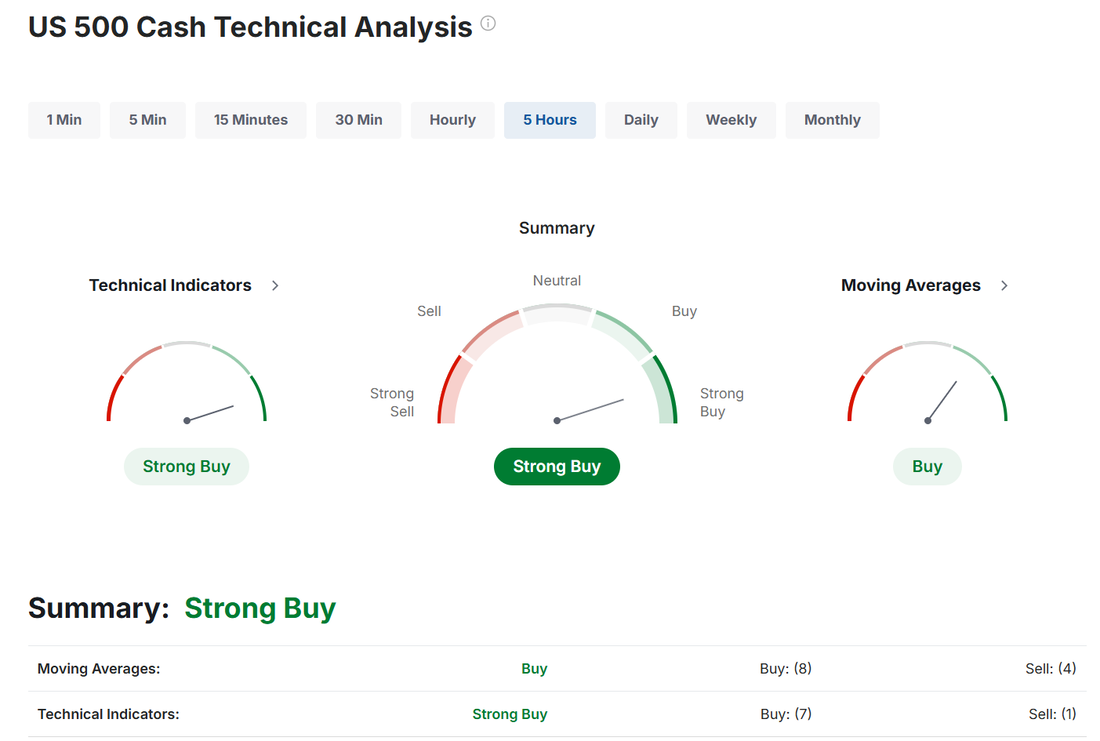

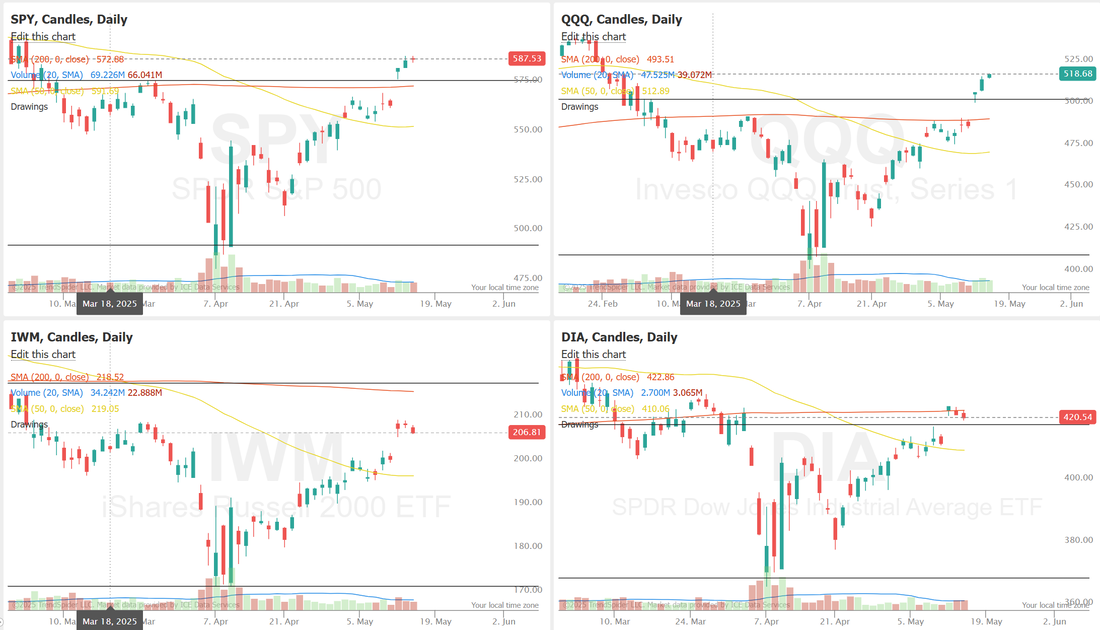

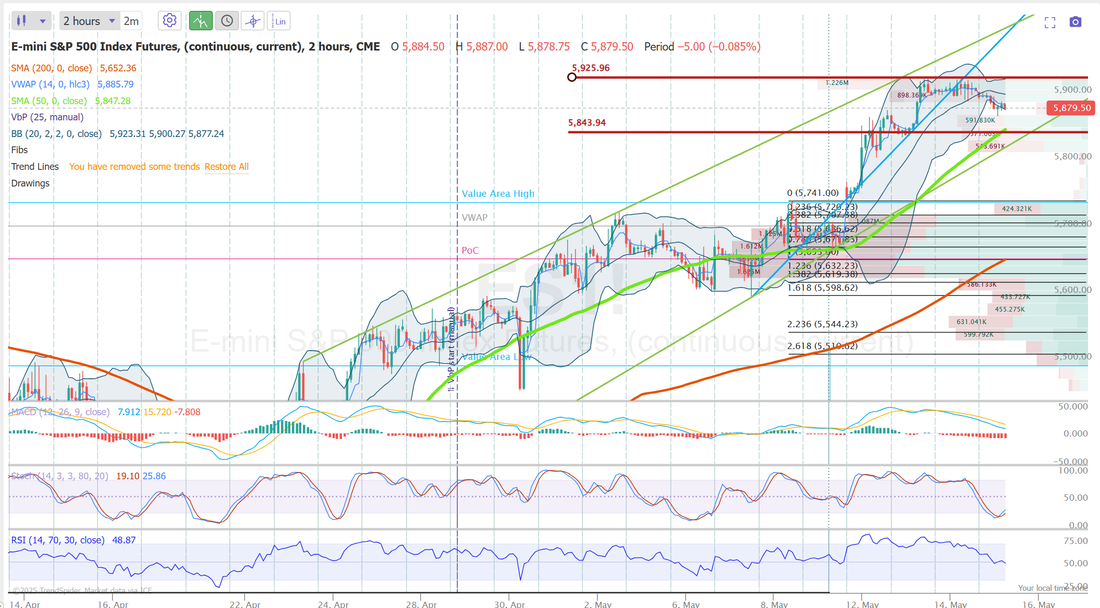

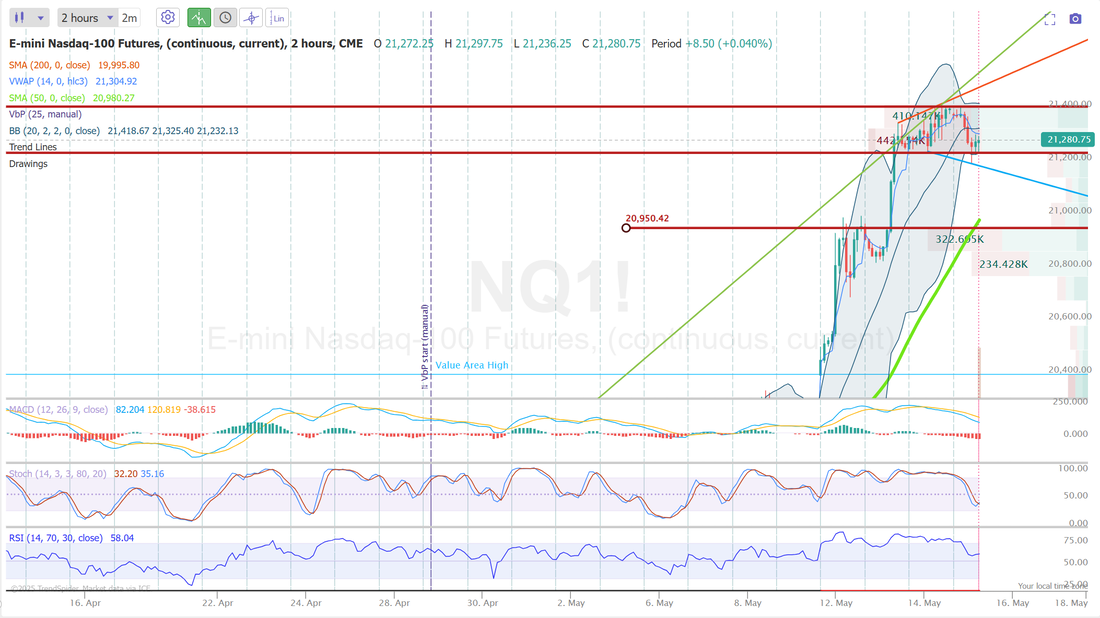

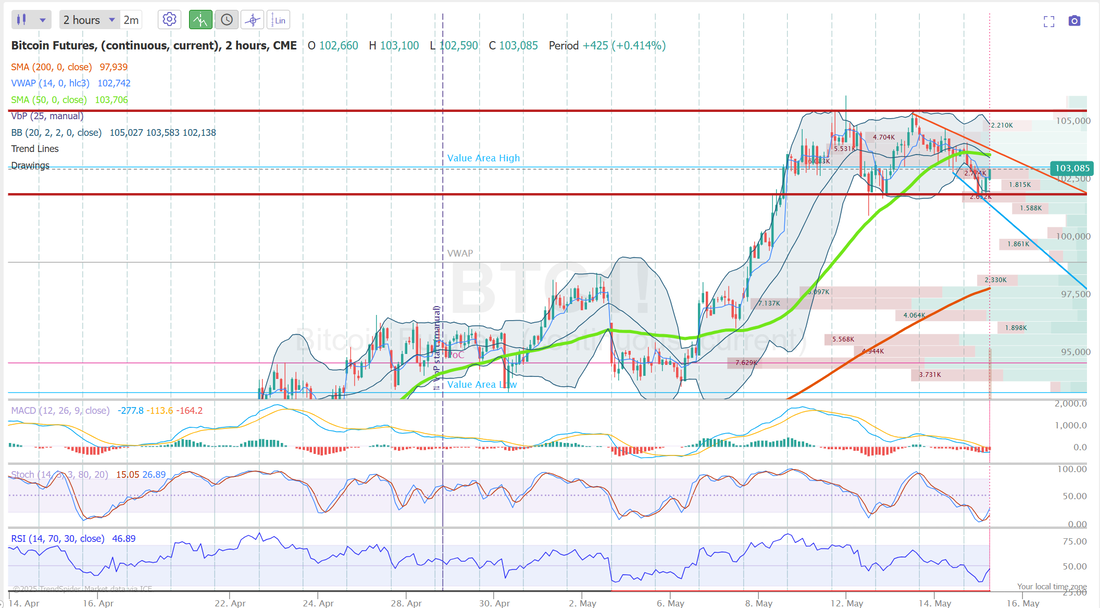

Headwinds now?I called for a neutral day yesterday and boy, that was spot on! We came back to a previous consolidation level that goes back to Oct. of last year. Can we go higher from here? Sure. Of course we can. And most assuredly we will, over the long term but short term I think we are stalling here. Stochastics and RSI are very overbought and looking to send us a sell signal. The blog was down yesterday. Here's a look at Tuesdays results: Here's our results from yesterday. We had a big scalp on with the /NQ and we just didn't get the retrace we needed but everything else hit for a profit. Let's take a look at the markets: Technicals are still bullish but very stretched to the upside. I wouldn't be surprised to see a pause or slight rollover soon. SPY stalled out. IWM and DIA are rolling over to the downside. QQQ is the strongest and holding tight. We've had a nice, multi-day run. It may be time for a retrace. June S&P 500 E-Mini futures (ESM25) are down -0.59%, and June Nasdaq 100 E-Mini futures (NQM25) are down -0.77% this morning, pointing to a lower open on Wall Street as a rally sparked by the U.S.-China tariff deal cooled, while investors look ahead to a raft of U.S. economic data, remarks from Federal Reserve Chair Jerome Powell, and an earnings report from retail giant Walmart. In yesterday’s trading session, Wall Street’s major indexes closed mixed. Super Micro Computer (SMCI) surged over +15% and was the top percentage gainer on the S&P 500, extending Tuesday’s gains after Saudi Arabia-based data center company DataVolt signed a multi-year partnership agreement with the company. Also, chip stocks advanced, with Arm Holdings (ARM) climbing more than +5% to lead gainers in the Nasdaq 100 and Advanced Micro Devices (AMD) rising over +4%. In addition, Exelixis (EXEL) soared more than +20% after the biotechnology firm posted upbeat Q1 results and raised its full-year revenue guidance. On the bearish side, American Eagle Outfitters (AEO) slumped over -6% after the apparel chain withdrew its full-year guidance due to macro uncertainty. “As trade tensions ease, investors are pivoting back to fundamentals, but they may not like what they see. The market has raced from oversold to overbought in record time. That limits near-term upside unless we see a clear re-acceleration in growth,” said Mark Hackett at Nationwide. Meanwhile, U.S. President Donald Trump stated on Thursday that India has proposed eliminating tariffs on U.S. goods, even as bilateral trade negotiations between the two nations continue. “They’ve offered us a deal where basically they’re willing to literally charge us no tariff,” Trump said. Fed Vice Chair Philip Jefferson stated on Wednesday that tariffs and the associated uncertainty could dampen growth and boost inflation this year, but monetary policy remains well-positioned to respond as needed. “If the increases in tariffs announced so far are sustained, they are likely to interrupt progress on disinflation and generate at least a temporary rise in inflation,” Jefferson said. Also, Chicago Fed President Austan Goolsbee emphasized that policymakers should avoid reacting to daily fluctuations in equities and policy announcements, noting that current economic data remain steady. U.S. rate futures have priced in a 91.7% chance of no rate change and an 8.3% chance of a 25 basis point rate cut at June’s monetary policy meeting. Fed Chair Jerome Powell is set to deliver remarks on the central bank’s monetary policy review at the Thomas Laubach Research Conference later today. Also, Fed Vice Chair for Supervision Michael Barr will speak today. On the earnings front, notable companies like Walmart (WMT), Applied Materials (AMAT), Deere & Company (DE), and Take-Two (TTWO) are scheduled to report their quarterly figures today. On the economic data front, all eyes are focused on U.S. Retail Sales data, which is set to be released in a couple of hours. Economists, on average, forecast that April Retail Sales will be unchanged m/m following a +1.4% m/m jump in March. Investors will also focus on U.S. Core Retail Sales data, which came in at +0.5% m/m in March. Economists expect the April figure to be +0.3% m/m. The U.S. Producer Price Index will be closely monitored today. Economists foresee the U.S. April PPI coming in at +0.2% m/m and +2.5% y/y, compared to the previous figures of -0.4% m/m and +2.7% y/y. The U.S. Core PPI will be released today. Economists expect April figures to be +0.3% m/m and +3.1% y/y, compared to the March numbers of -0.1% m/m and +3.3% y/y. U.S. Industrial Production and Manufacturing Production data will be reported today. Economists forecast April Industrial Production at +0.2% m/m and Manufacturing Production at -0.2% m/m, compared to the March figures of -0.3% m/m and +0.3% m/m, respectively. The U.S. Philadelphia Fed Manufacturing Index and the Empire State Manufacturing Index will come in today. Economists anticipate the Philly Fed manufacturing index to be -11.3 and the Empire State manufacturing index to be -8.20 in May, compared to last month’s values of -26.4 and -8.10, respectively. U.S. Initial Jobless Claims data will be released today as well. Economists estimate this figure will come in at 229K, compared to 228K last week. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.507%, down -0.46%. PPI could be the main news driver this morning. Trade docket for today. We'll be cashing in our profits on CSCO and WMT this morning. Adding AMAT and CAVA earnings trades later in the day. SPX and NDX 0DTE's. 1HTE on BTC. We've already got one working for you early risers. Let's take a look at our intra-day levels: /ES: 5925 is resistance with 5834 support. /NQ: 21,408 is resistance with 21,237 support. If we lose 21,237 support we could drop to 20,950. BTC: Bitcoin resistance is 105,590 with support at 102,050 My bias or lean today is bearish. I was looking for a stall or neutral day yesterday and that's what we got. Today seems like a good day for a retrace. Futures are down and PPI, Retail sales and Jobless claims are all out and not really pushing future higher. I'll see you all in the live trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |