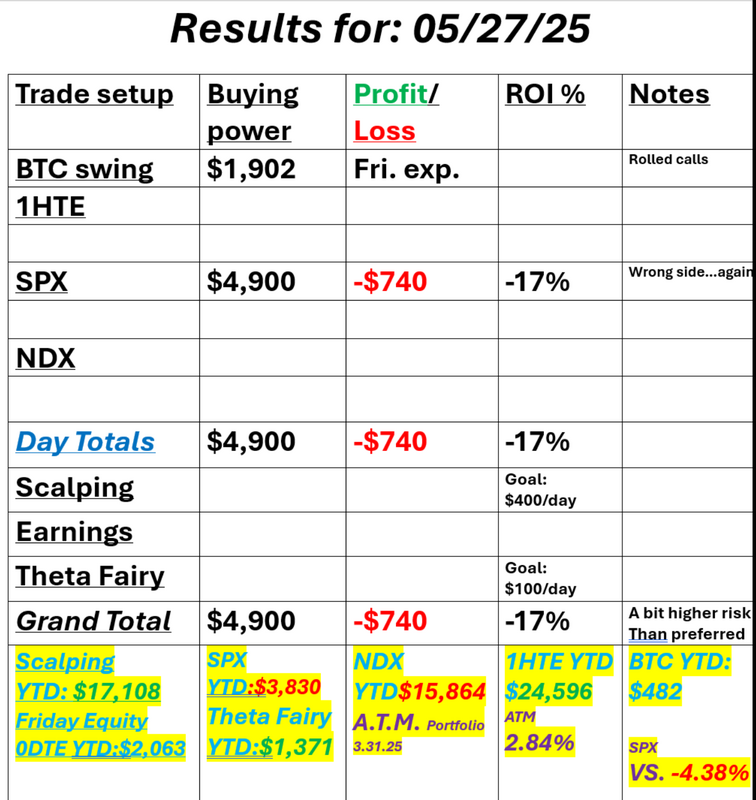

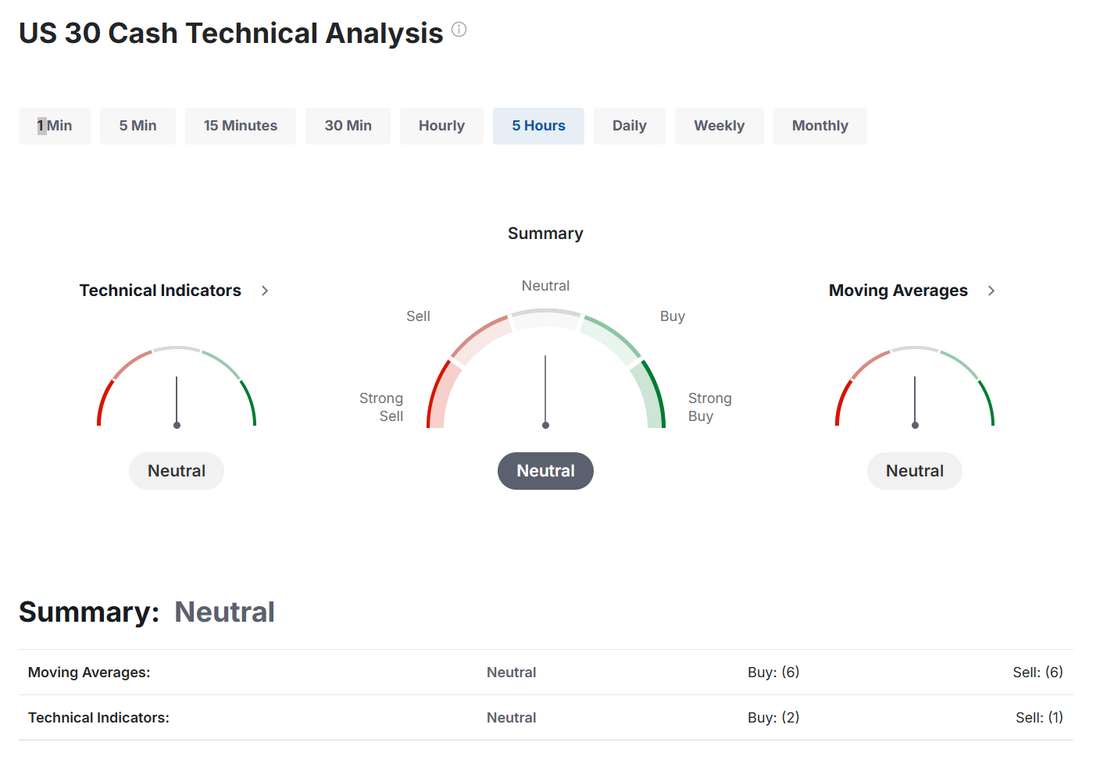

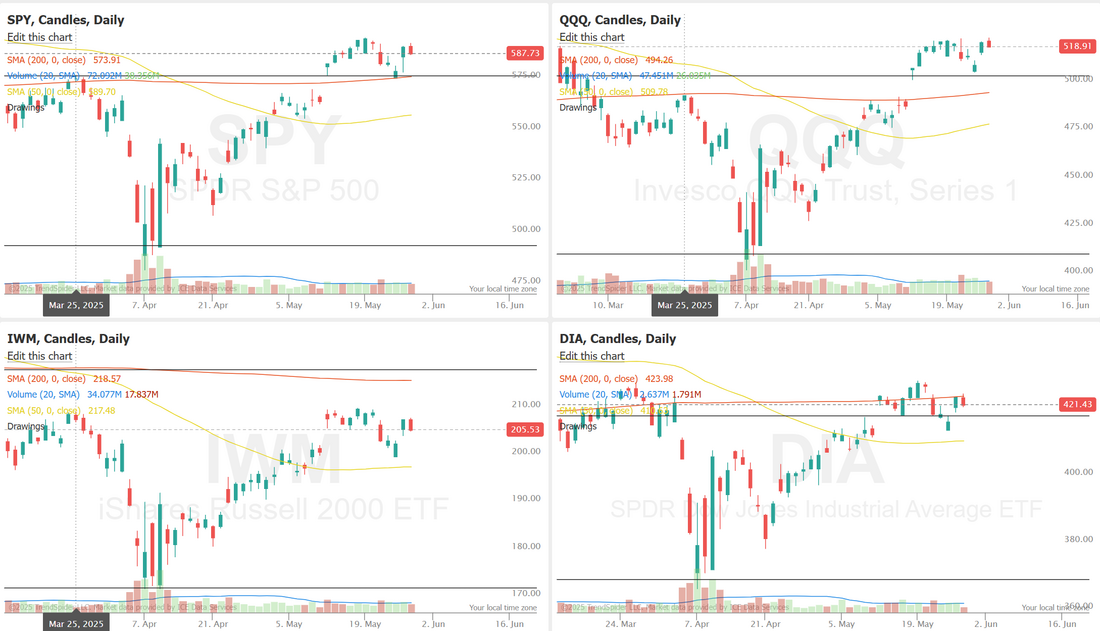

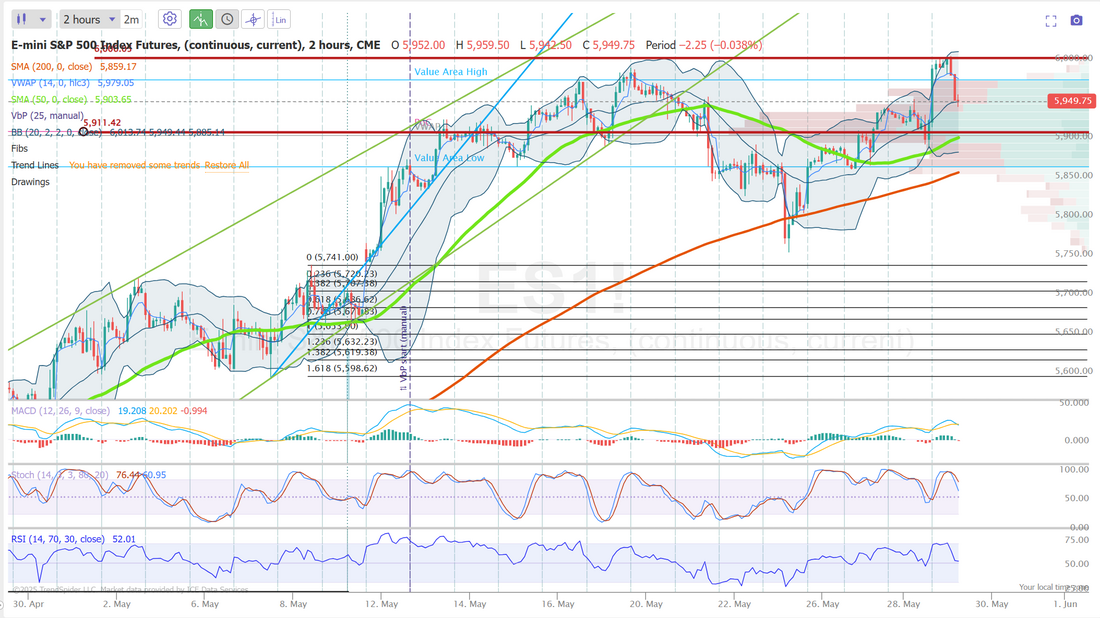

Tariffs are done? Not so fast.A Federal court kicked the reciprocal tariffs to the curb. That, combined with NVDA (the 800 pound gorilla) earnings have pushed the futures higher this morning. Does that mean we won't see or need to deal with tariffs anymore? Not so fast! The White house has appealed the verdict and as Adam Crisafulli said, " The tariff drama isn't over. Trump has other legal avenues to pursue." I'm running a two day losing streak. Two days ago I was bearish and we were up. Yesterday I was bullish and we were down. I had good risk/reward but it still stings. I'll try hard to reverse that today. Here was my trade yesterday. We do have CRM and NVDA earnings trades from yesterday that both look to cash flow for us today. Let's look at the market. We are back to the neutral rating. It's just impossible to judge these days and what we get. It's an "inflection" day. My bias or lean today: Two days ago we had a start to the day much like we should have today. Futures were up sharply and I looked for a retracement back down. That didn't happen. The market continued higher all day. We've had /ES futures up over 100+ points this morning and they've already given 60% of that gain back, as I type. I'm going to lean a bit bearish today...looking for that elusive retrace. June S&P 500 E-Mini futures (ESM25) are up +1.57%, and June Nasdaq 100 E-Mini futures (NQM25) are up +1.96% this morning as risk sentiment improved following upbeat earnings from Nvidia and after a federal trade court struck down U.S. President Donald Trump’s sweeping tariffs. A panel of three judges at the U.S. Court of International Trade in Manhattan ruled that President Trump didn’t have the authority to impose sweeping tariffs on nearly every nation. Trump was granted 10 days to suspend the tariffs. The court’s order covers Trump’s global flat tariff, increased duties on China and others, and his fentanyl-related tariffs on China, Canada, and Mexico. Still, other tariffs imposed under separate powers, such as the Section 232 and Section 301 levies, are unaffected and cover items like steel, aluminum, and automobiles. In a swift response, the Trump administration lodged an appeal and questioned the court’s authority. The final ruling in the high-stakes case could ultimately lie with higher courts, including the U.S. Supreme Court. Investors also digested Nvidia’s (NVDA) upbeat earnings. Shares of the world’s most valuable chipmaker climbed over +5% in pre-market trading after the company posted better-than-expected Q1 results and gave a solid Q2 revenue forecast. Investor focus now shifts to fresh U.S. economic data, including the second estimate of first-quarter GDP and jobless claims figures, as well as remarks from Federal Reserve officials. The minutes of the Federal Open Market Committee’s May 6-7 meeting, released Wednesday, revealed that officials broadly agreed that heightened economic uncertainty warranted their patient stance on interest-rate adjustments. Policymakers judged that the risks of both higher unemployment and inflation had increased since their prior meeting in March, largely due to the potential effects of tariffs. “Participants agreed that with economic growth and the labor market still solid and current monetary policy moderately restrictive, the committee was well positioned to wait for more clarity on the outlooks for inflation and economic activity,” according to the FOMC minutes. In addition, the minutes said, “Participants agreed that uncertainty about the economic outlook had increased further, making it appropriate to take a cautious approach until the net economic effects of the array of changes to government policies become clearer.” In yesterday’s trading session, Wall Street’s main stock indexes closed lower. U.S. chip software designers slumped after the Financial Times reported that the Trump administration told U.S. firms providing software for semiconductor design to stop selling their services to China, with Cadence Design Systems (CDNS) plunging over -10% to lead losers in the S&P 500 and Nasdaq 100 and Synopsys (SNPS) falling more than -9%. Also, PDD Holdings (PDD) slid over -4% after three brokerages downgraded the ADRs. In addition, Okta (OKTA) tumbled more than -16% after the identity access management company maintained its full-year revenue guidance, disappointing investors. On the bullish side, Fair Isaac (FICO) climbed over +7% and was the top percentage gainer on the S&P 500 after Baird upgraded the stock to Outperform from Neutral with a price target of $1,900. Economic data released on Wednesday showed that the U.S. Richmond Fed manufacturing index rose to -9 in May, in line with expectations. Today, all eyes are focused on the U.S. Commerce Department’s second estimate of gross domestic product. Economists expect the U.S. economy to contract at an annual rate of 0.3% in the first quarter, in line with initial estimates. Investors will also focus on U.S. Initial Jobless Claims data. Economists expect this figure to be 229K, compared to last week’s number of 227K. U.S. Pending Home Sales data will be reported today. Economists foresee the April figure standing at -0.9% m/m, compared to the previous figure of +6.1% m/m. U.S. Crude Oil Inventories data will be released today as well. Economists expect this figure to be 1.000M, compared to last week’s value of 1.328M. On the earnings front, notable companies like Dell Technologies (DELL), Marvell Technology (MRVL), Zscaler (ZS), Ulta Beauty (ULTA), and Best Buy (BBY) are slated to release their quarterly results today. In addition, market participants will be looking toward speeches from Fed officials Barkin, Goolsbee, Kugler, Daly, and Logan. U.S. rate futures have priced in a 97.7% probability of no rate change and a 2.3% chance of a 25 basis point rate cut at the Fed’s monetary policy committee meeting next month. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.522%, up +0.96%. Yesterdays bearish day did nothing to help the indices break out of this consolidation zone we've been in for a while now. Trade docket today. I think we can get a 1HTE on today with BTC. We have NVDA and CRM earnings plays that should go out at a profit for us today. COSt MRVL DELL, ULTA, PATH are new potential earnings setups. SPX 0DTE focus as well. Scalping I'll look at the /MNQ today. Let's look at the intra-day level on /ES for today: The 2hr. chart is bearish. The market pushed up overnight and early this morning to 6004. 6000 is a big psychological level as well as being a break above the May 19th high so it is important. That is our new target for bulls. Get back above that 6000 level. For bears they need to get back down below 5911. It's a neutral rated technical day, as I mentioned above so it's anybody's guess right now on how the day pans out. We had a good training yesterday on Richard Dennis' top 10 trading tips. Next week I'm planning on doing a training on pairs trades. It should be a good one also! See you all in the live trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |