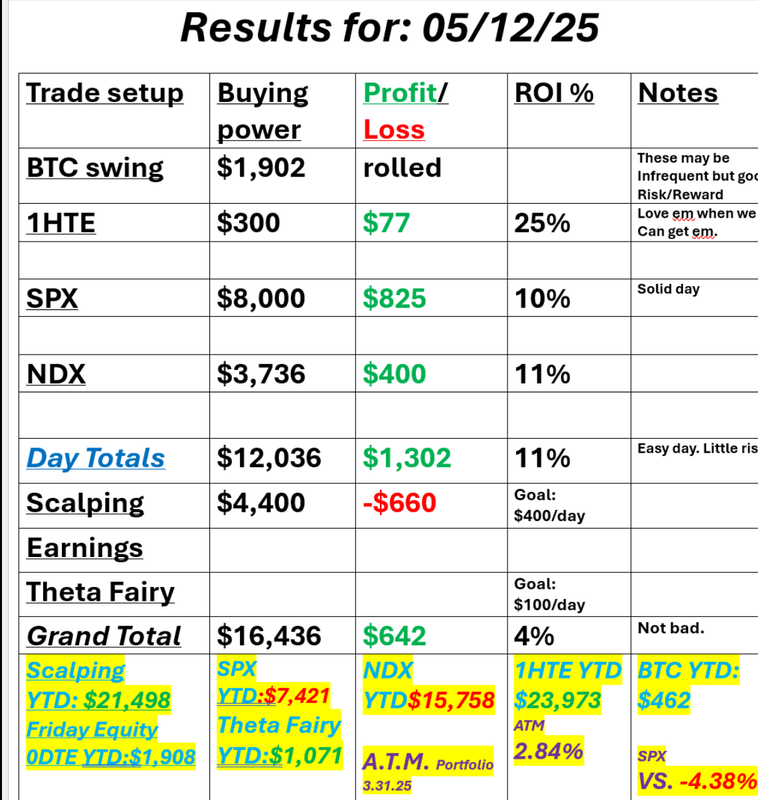

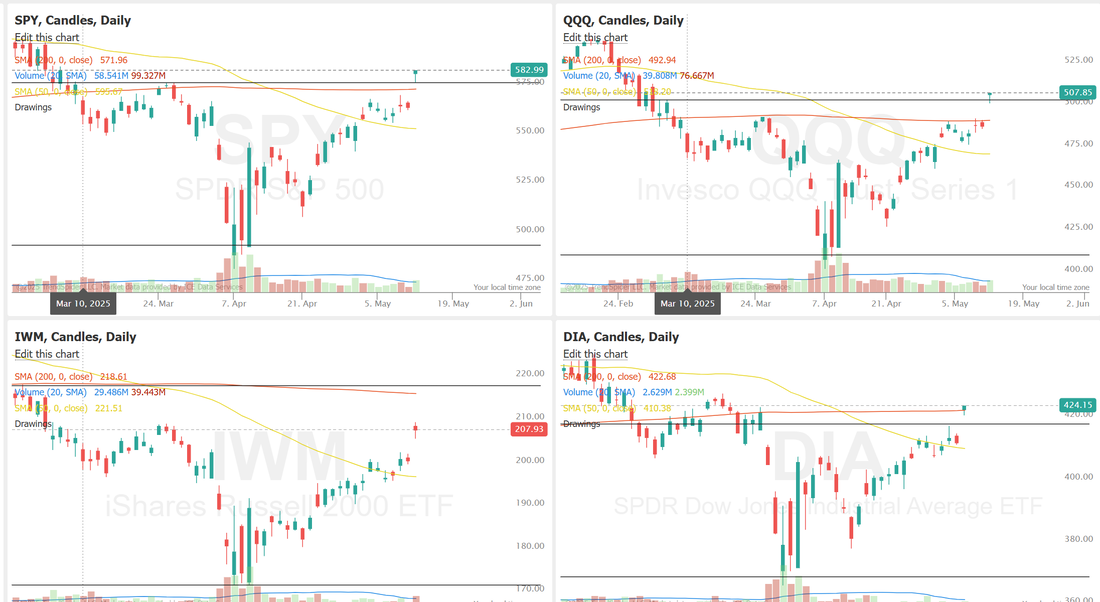

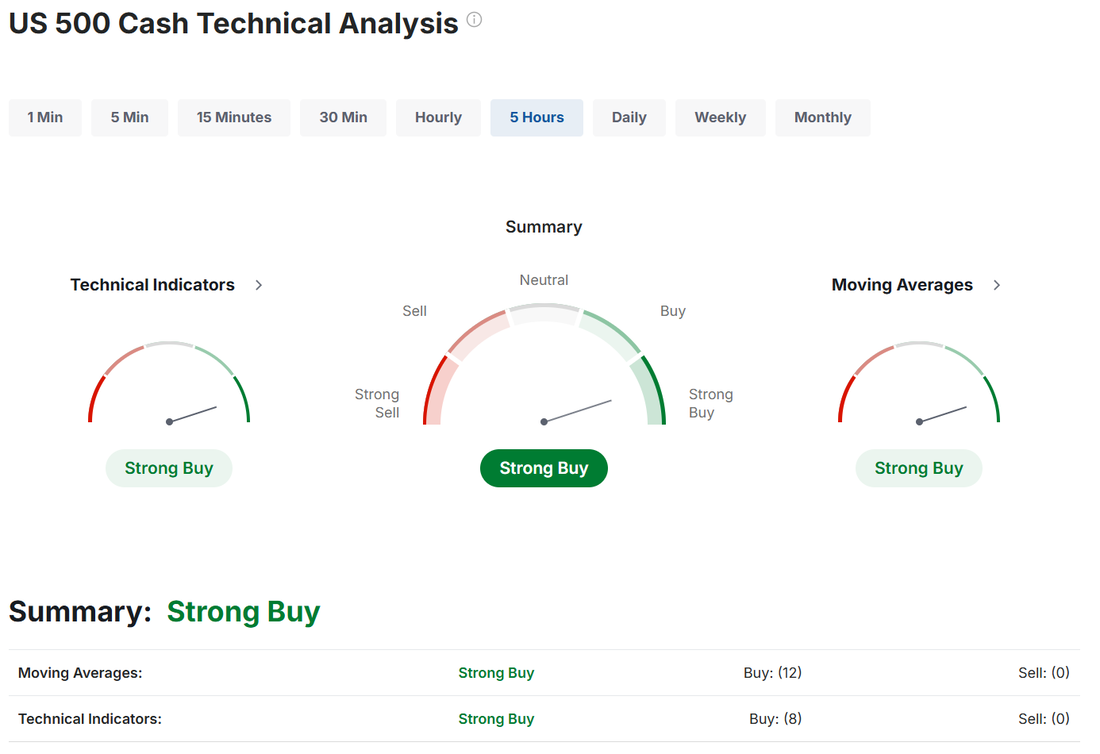

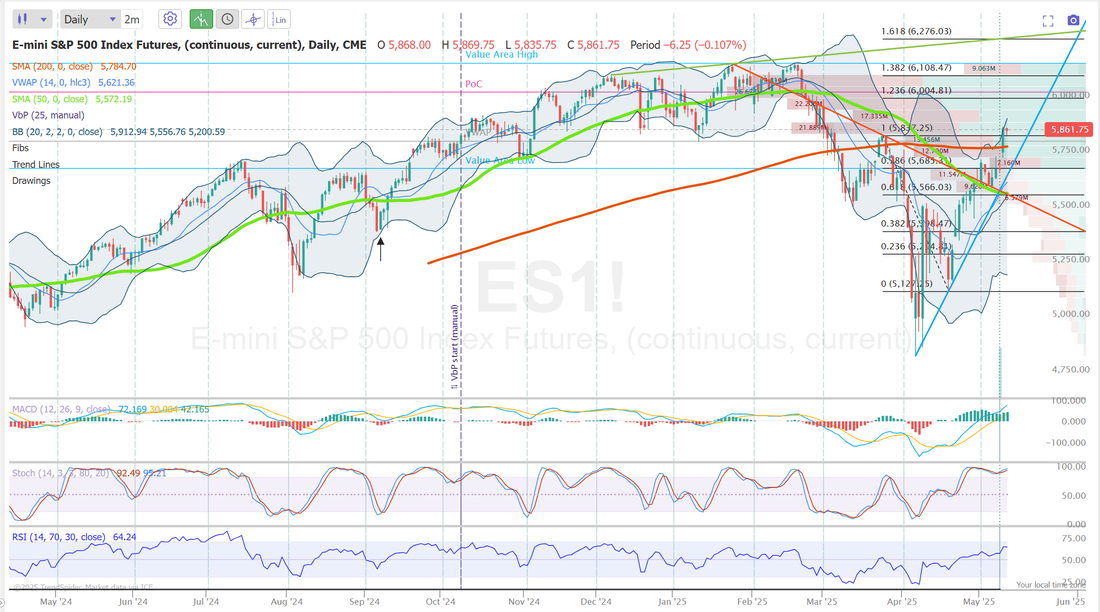

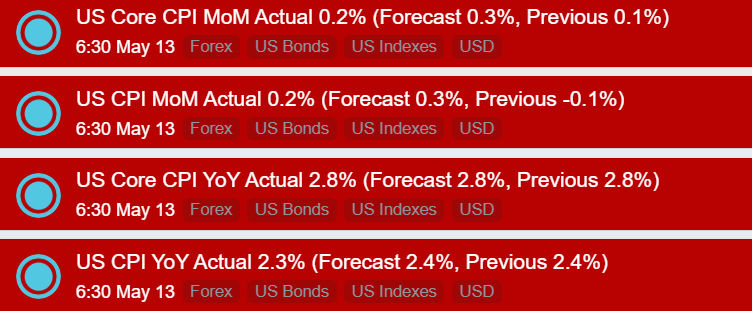

Did we get the "all clear" signal?Markets are back above their 200DMA. Recessionary fears that were strong just a few days ago have wilted. Tariff news seems to be about reductions now. Is this the signal bulls have been looking for to take the market to new all time highs? Well...that may be a bit too big of an ask right now but moving back above the 200DMA is significant and can't be ignored. Inflation numbers will be key this week. Today we get CPI. Let's take a look at the news of the day: June S&P 500 E-Mini futures (ESM25) are down -0.26%, and June Nasdaq 100 E-Mini futures (NQM25) are down -0.41% this morning, taking a breather after yesterday’s rally, while investors gear up for the release of key U.S. inflation data. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed sharply higher after the U.S. and China agreed to temporarily suspend most tariffs on each other’s products. The Magnificent Seven stocks rallied, with Amazon.com (AMZN) surging over +8% and Meta Platforms (META) rising more than +7%. Also, chip stocks jumped, with Microchip Technology (MCHP) climbing more than +10% and ON Semiconductor (ON) gaining over +8%. In addition, NRG Energy (NRG) soared more than +26% and was the top percentage gainer on the S&P 500 after the company posted upbeat Q1 results and acquired a fleet of natural gas-fired power plants from LS Power Equity Advisors for about $12 billion, including debt. On the bearish side, Cigna Group (CI) slid over -5% after President Trump proposed a plan to “cut out” drug industry middlemen in an effort to lower healthcare costs. “With good news on the trade front poised to give stocks a boost at the start of the week, it will be up to inflation data, retail sales, and earnings to sustain the momentum,” wrote Chris Larkin at E*Trade from Morgan Stanley. Meanwhile, a White House executive order overnight said the U.S. will reduce the so-called de minimis tariff on low-value packages from China, including Hong Kong, from 120% to 54% starting May 14th. However, a flat fee of $100 will still apply. Goldman Sachs lowered its estimated risk of a recession in the U.S. to 35% from 45% following a temporary tariff truce with China that raised hopes for a potential de-escalation in the global trade war. Fed Governor Adriana Kugler stated on Monday that despite the recently announced tariff reductions on China, U.S. tariff policies are likely to boost inflation and dampen economic growth. “Trade policies are evolving and are likely to continue shifting, even as recently as this morning. Still, they appear likely to generate significant economic effects even if tariffs stay close to the currently announced levels,” Kugler said. U.S. rate futures have priced in a 91.8% chance of no rate change and an 8.2% chance of a 25 basis point rate cut at the next central bank meeting in June. Today, all eyes are focused on the U.S. consumer inflation report, which is set to be released in a couple of hours. The report is expected to confirm that inflationary pressures are still too elevated to warrant a rate cut at this time. Economists, on average, forecast that the U.S. April CPI will come in at +0.3% m/m and +2.4% y/y, compared to the previous numbers of -0.1% m/m and +2.4% y/y. Also, the U.S. core CPI is expected to be +0.3% m/m and +2.8% y/y in April, compared to the March figures of +0.1% m/m and +2.8% y/y. “April inflation numbers are likely to show elevated inflation pressures persist with some evidence of pre-emptive price hikes as the influence of tariffs starts to show,” said James Knightley, economist at ING. He added that June is likely to be the point when price increases become more apparent. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.455%, down -0.04%. We had a good day yesterday. My scalps lost money but everything else we touched worked. See our results below: Trade docket today is simple: No earnings trades today but we'll get some later this week. We have a big scalp on with /NQ that I'll try to work towards our take profit goal of $400. SPX will be my main 0DTE focus with NDX a smaller goal. We should be able to get some 1HTE's working on BTC as well. Let's take a look at the markets: The only index not fully participating in this rally is the IWM and it still looks good. All the other indices are above my buy zones. Technicals are bullish My bias or lean today is bullish. We have CPI out shortly and that should drive the initial market but the uptrend right now is pretty strong. Let's take a look at the intra-day levels on /ES. Today could be a wide chop zone. 5903 is resistance. That's a ways up and 5786 is the 200DMA and acting as support. It's a wide zone. We'll use pivot points to guide us today. CPI was just released. A little softer than expected. Futures are a bit higher off the news. I'll see you all in the live trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |