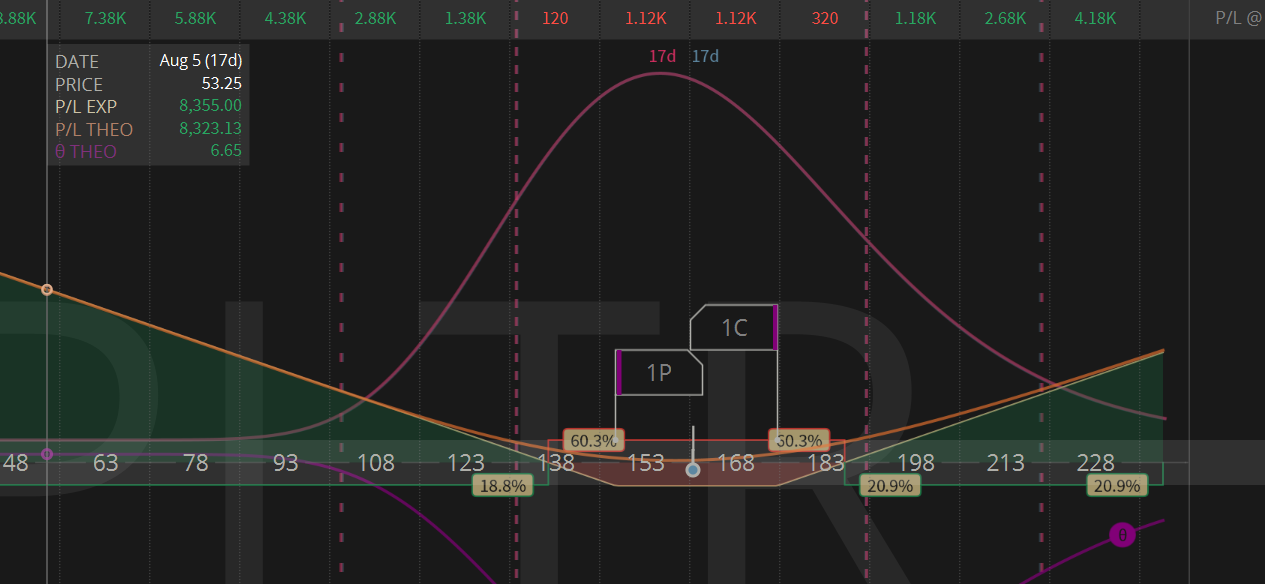

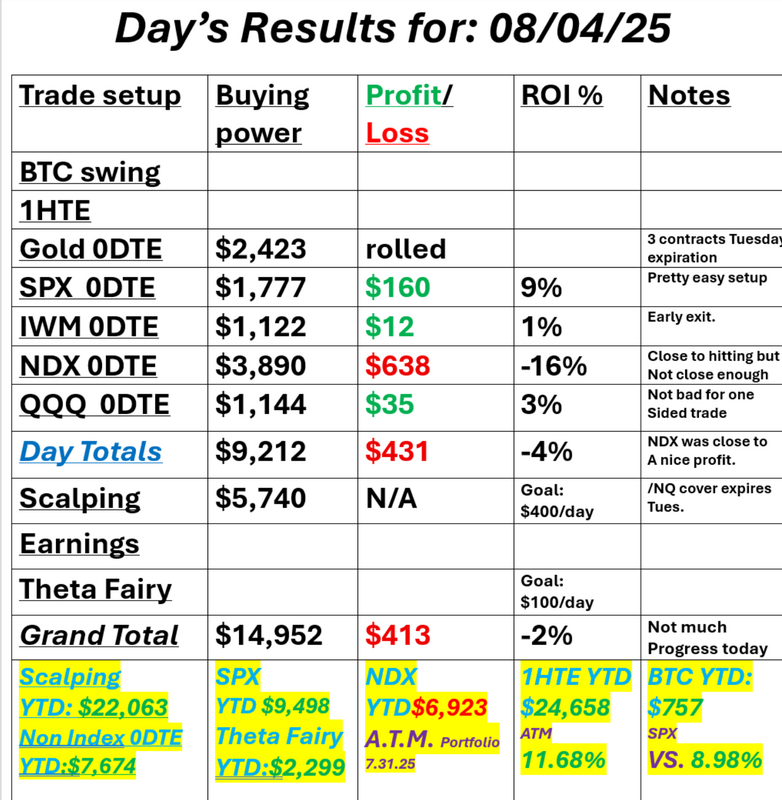

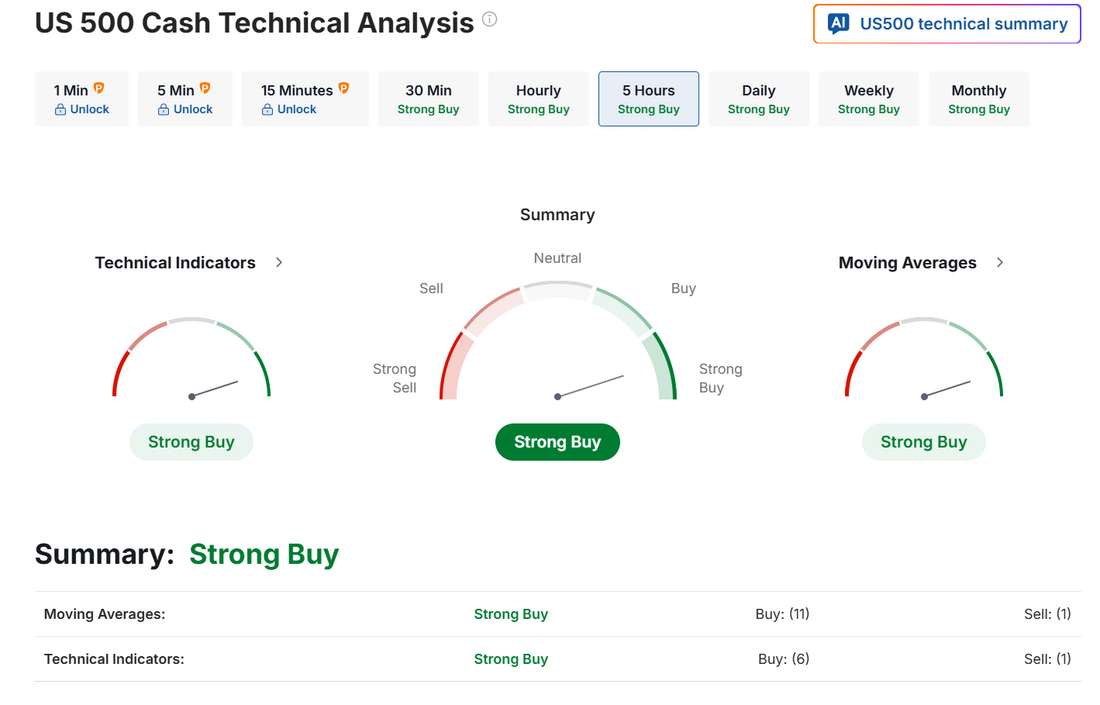

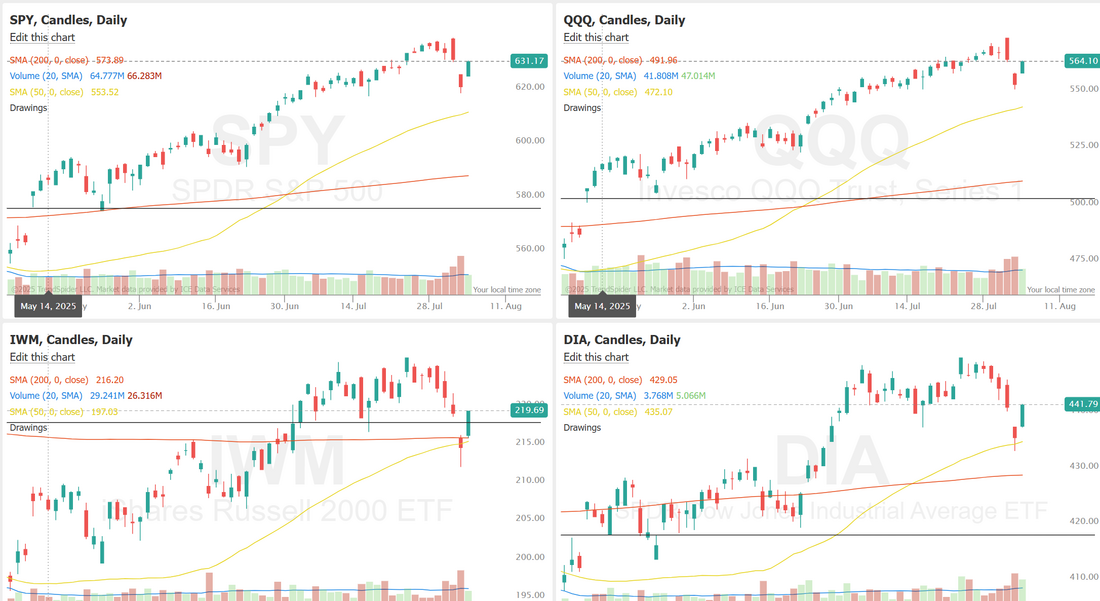

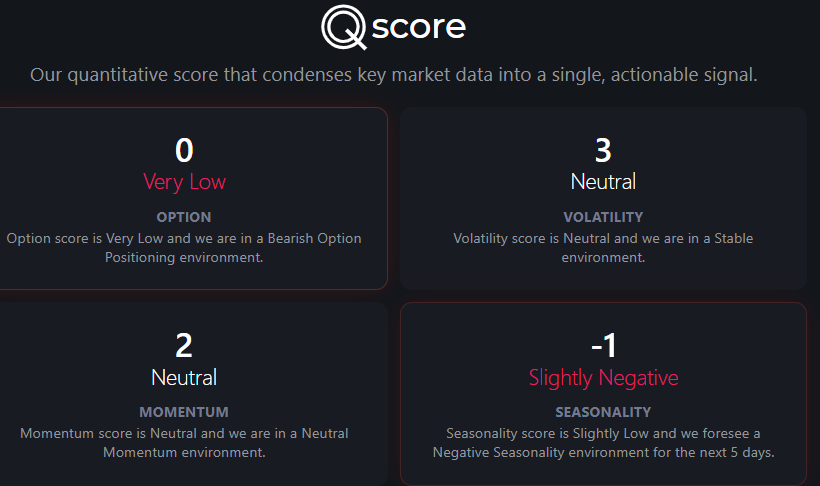

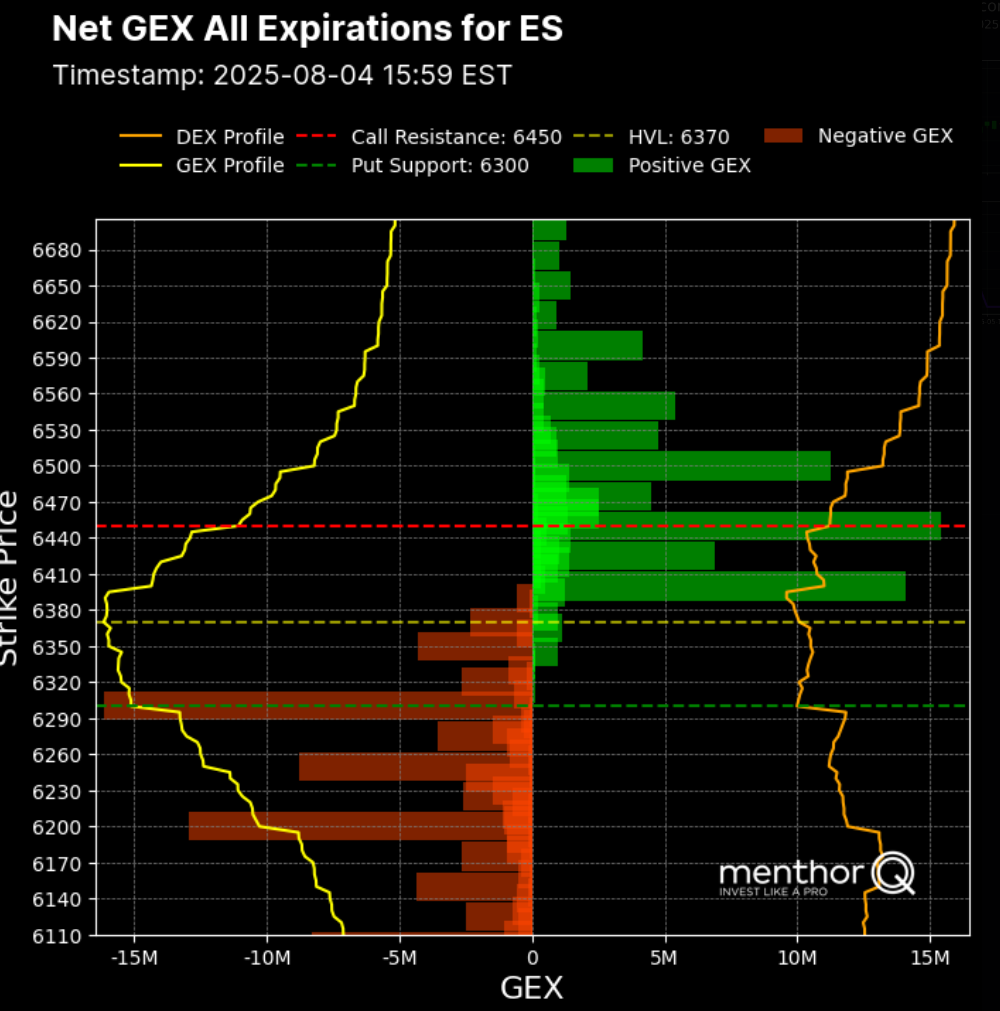

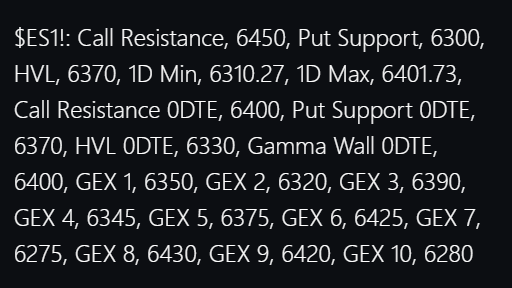

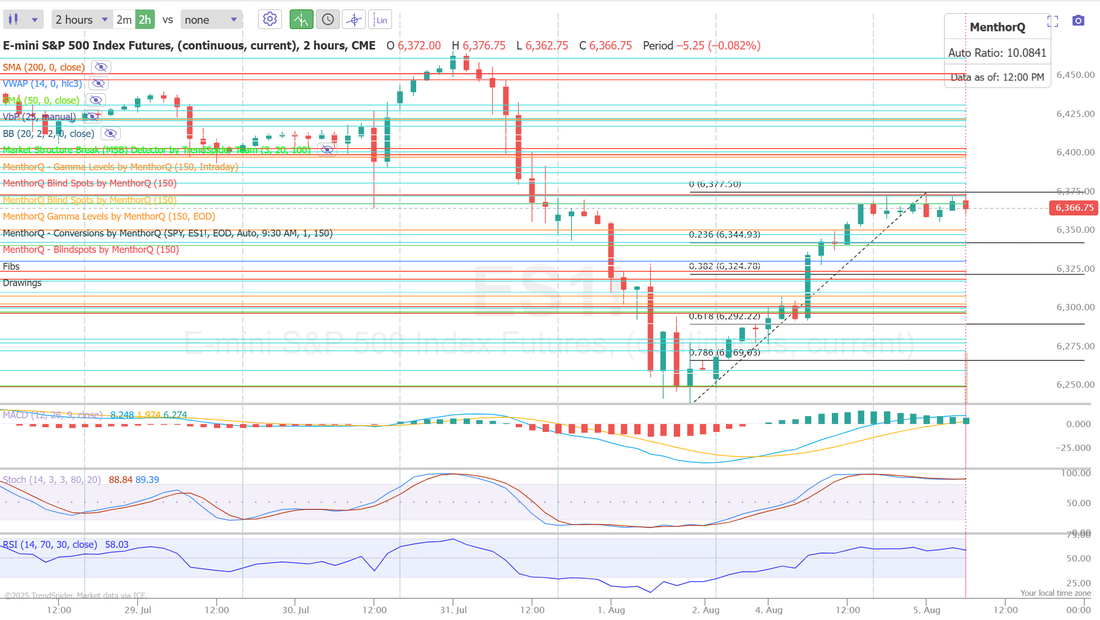

Palantir lifts all boatsPLTR earnings were a bigger blowout than the expected blowout and the stock is pushing up this morning carrying futures up with it. We have a long strangle on. It will be interesting to see what profit we can get out of it today. I didn't have much success in yesterday's trading session but that's o.k. I needed to roll my gold 0DTE to today. I was scalping short looking for a retrace that never came. I've covered it now for $1,000 of potential cash flow but that will go on todays results. The NDX had a $900 profit potential and was close but not close enough. Just too many things working against me. The bright spot yesterday was our ATM portfolio, once again, hitting a new ATH. Here's a look at my day yesterday: Let's take a look at the market. After a brief swoon the last part of last week we are back to bullish bias. The bulls still have some work to get the rally back on track but yesterday was a strong snap back and futures are up this morning. September S&P 500 E-Mini futures (ESU25) are up +0.24%, and September Nasdaq 100 E-Mini futures (NQU25) are up +0.30% this morning, extending a rebound driven by bets on Federal Reserve interest rate cuts and solid corporate earnings. Palantir Technologies (PLTR) was the latest company to impress Wall Street with its quarterly results. Shares of the data analysis software firm climbed over +5% in pre-market trading after it posted upbeat Q2 results and raised its full-year guidance. In yesterday’s trading session, Wall Street’s main stock indexes closed sharply higher. The Magnificent Seven stocks advanced, with Nvidia (NVDA) climbing over +3% to lead gainers in the Dow and Alphabet (GOOGL) rising more than +3%. Also, chip stocks gained ground, with Broadcom (AVGO) and KLA Corp. (KLAC) rising over +3%. In addition, IDEXX Laboratories (IDXX) soared more than +27% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the company posted upbeat Q2 results and raised its full-year guidance. On the bearish side, ON Semiconductor (ON) plunged over -15% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the chipmaker provided a weaker-than-expected Q3 adjusted gross margin forecast. Economic data released on Monday showed that U.S. factory orders fell -4.8% m/m in June, slightly better than expectations of a -4.9% m/m decline. Still, that marked the largest decline in more than 5 years. “This week is a quiet one on the economic calendar, so traders may be taking their cues from earnings, along with any new tariff and trade developments,” said Chris Larkin at E*Trade from Morgan Stanley. Larkin also noted that a key question now is whether traders will interpret any signs of economic weakness as a bearish signal for markets, or as a catalyst for the Fed to resume interest rate cuts. San Francisco Fed President Mary Daly said on Monday that the time for rate cuts is approaching amid growing signs of labor market weakness and the absence of persistent tariff-driven inflation, according to Reuters. Meanwhile, U.S. rate futures have priced in an 88.1% chance of a 25 basis point rate cut and an 11.9% chance of no rate change at the conclusion of the Fed’s September meeting. Second-quarter corporate earnings season rolls on, with investors awaiting fresh reports from high-profile companies today, including Advanced Micro Devices (AMD), Caterpillar (CAT), Amgen (AMGN), Arista Networks (ANET), Pfizer (PFE), and Duke Energy (DUK). According to Bloomberg Intelligence, S&P 500 companies are on track to post a 9.1% increase in Q2 profits from a year earlier, well above analysts’ forecast of 2.8%. On the economic data front, investors will closely monitor the U.S. ISM Non-Manufacturing PMI and S&P Global Services PMI, set to be released in a couple of hours. Economists expect the July ISM services index to be 51.5 and the S&P Global services PMI to be 55.2, compared to the previous values of 50.8 and 52.9, respectively. U.S. Trade Balance data will also be released today. Economists anticipate the trade deficit will narrow to -$62.60 billion in June from -$71.50 billion in May. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.212%, up +0.05%. Let's take a look at some of the internals: Quant score shows continued bearish option positioning. The big gamma walls sit at 6450 on the upside and 6300 on the downside. The SPX chart as of August 4, 2025, shows a recent short-term recovery following a brief but sharp pullback in spot price, with a notable rebound in the Momentum Score from 2 back up to 4. This bounce suggests buying interest has returned quickly after the dip, helping the index hold above prior consolidation levels. However, the score remains below peak levels seen in July, indicating that momentum, while positive, isn't at full strength. In the short term, traders may monitor whether the index can sustain this rebound or if momentum fades again potentially signaling continued choppiness or a need for stronger catalysts. My lean or bias today is neutral. We have PMI and Trade balance numbers this morning as well as Trump speaking on CNBC about tariffs as our main, planned news catalysts. With more tariffs coming between today and Thurs. I think we stall out here. Trade docket for today: Gold 0TE, QQQ 0DTE, IWM 0DTE, SPX 0DTE, NDX 0DTE. I'll continue working the /MNQ short scalp with the /NQ cover. CAT, FANG, PLTR, VRTX? earnings. New earnings trades in AMD, AMGN. Let's take a look at our intra-day levels on /ES: 6377, 6389, 6401 are my key resistance levels for today. 6354, 6344, 6325 are support. No revenge trading but....let's try to get a bit or redemption from yesterday! I look forward to chatting with you all in the live trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |