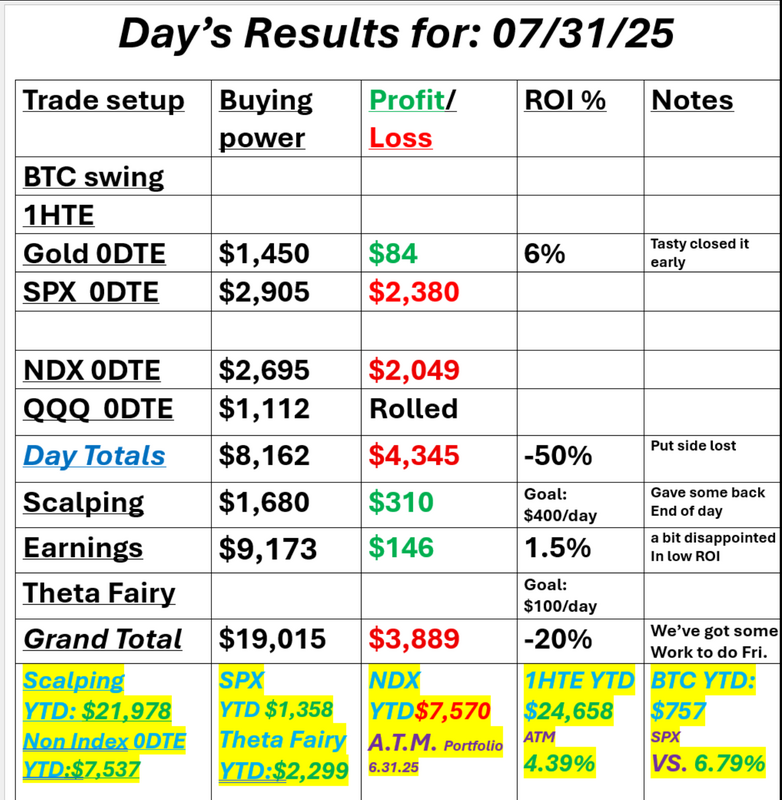

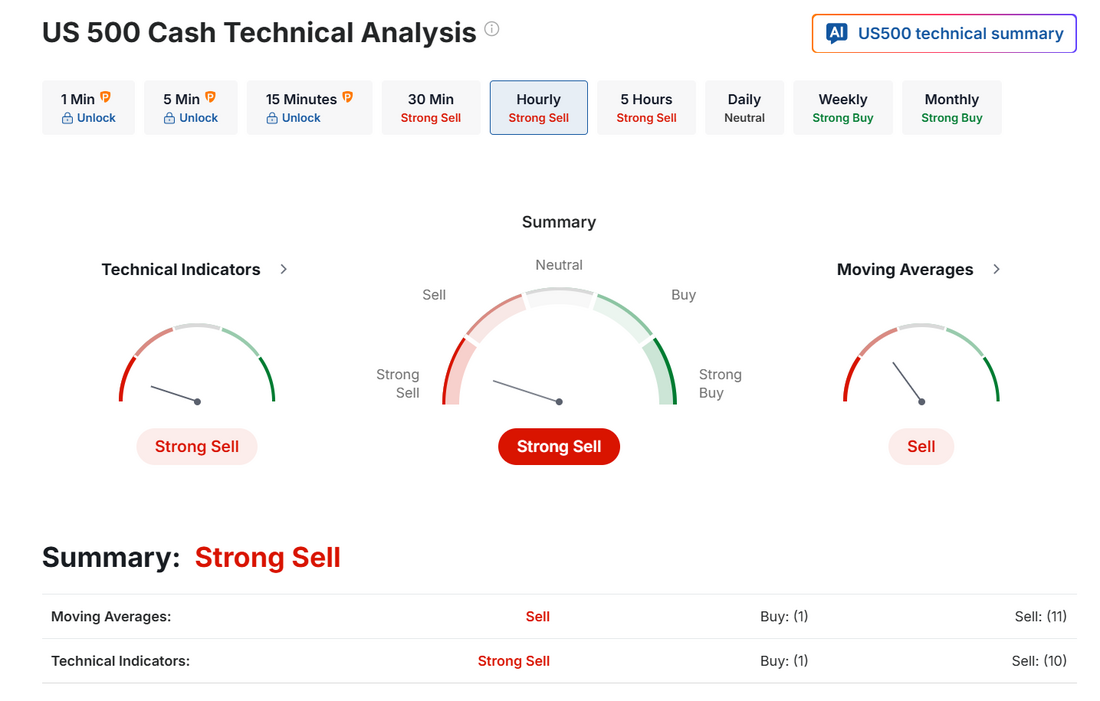

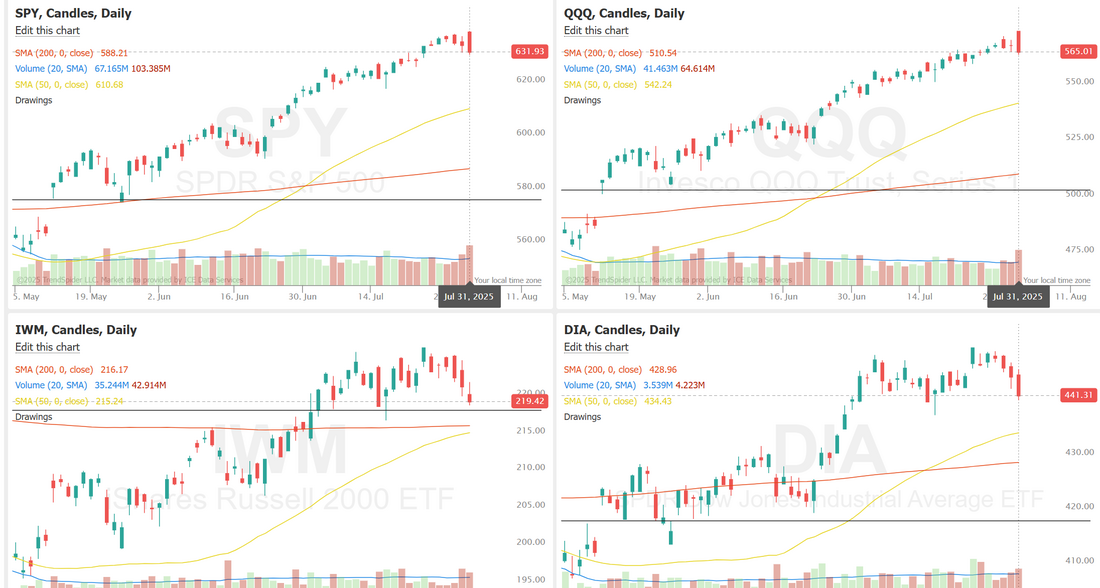

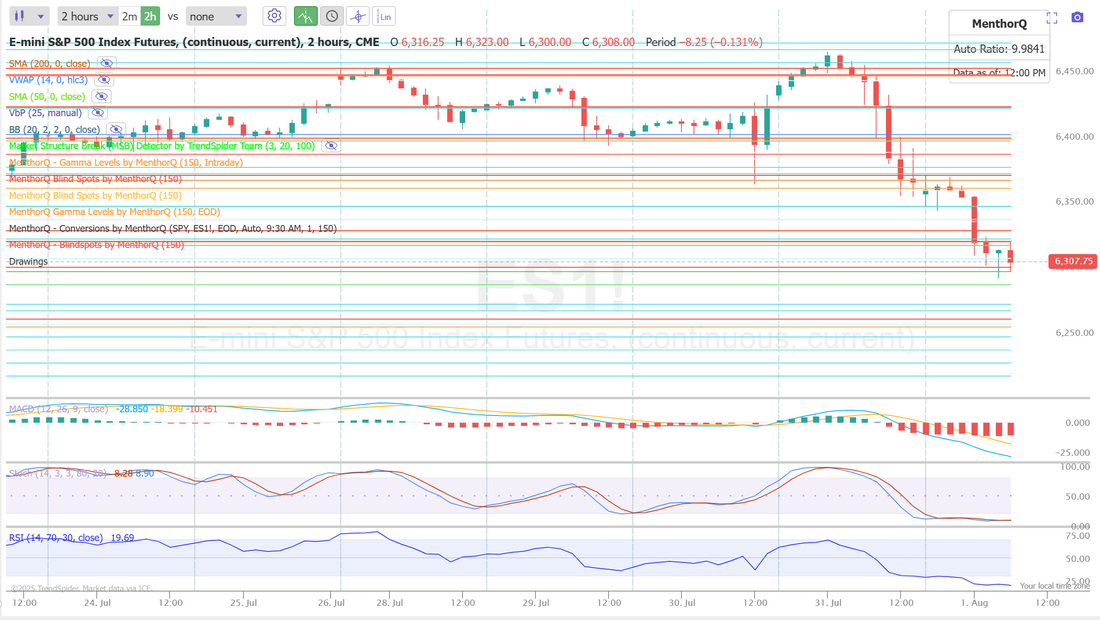

Is this it?Is this the crack in the markets we've been looking for? Waiting for? Wanting? Maybe! We are initiating our bearish anchor position in our ATM portfolio today. As that portfolio continues to outpace the SP500 I'll say it again. If you don't have something that hedges downside risk you are leaving yourself open to unnecessary potential losses. I got cooked yesterday on the downside. Yes, I called for a down day and that's what we got but it was way more downside than I thought we'd get. It buried my puts on SPX and NDX. Today looks like a great day for opportunity. Futures are buried today. We got a bearish engulfing candle yesterday. Here's hoping this is the correction we've been waiting for. We get better opportunities, I.V. etc. in down markets. We may even be able to get back on our Theta fairy's! Here's a look at my poor results yesterday. Let's see if I can redeem myself today! The opportunity should be there. It's just up to me to capitalize. Let's take a look at this "new" market. It's been the same for a while. Sell signals are finally kicking in. All four of the major indices are rolling over nicely. VTI is flashing "sell" Let's look at a downside target on /ES. 5960 is my downside target IF....the bears can take control, This is the first time in months that they've got a real shot. September S&P 500 E-Mini futures (ESU25) are down -0.93%, and September Nasdaq 100 E-Mini futures (NQU25) are down -1.03% this morning as U.S. President Donald Trump’s sweeping import tariffs fueled concerns about the outlook for economic growth. Late on Thursday, President Trump signed an executive order imposing tariffs between 10% and 41% on U.S. imports from foreign nations. Those hardest hit include Switzerland with a 39% tariff, Taiwan with a 20% tariff, and Canada, which is subject to a 35% levy on goods that do not comply with the U.S.-Mexico-Canada Agreement. Meanwhile, the U.S. president granted a one-week delay to trading partners that had received letters, with the exception of Canada. The average U.S. tariff would increase to 15.2% if the announced rates are implemented, according to Bloomberg Economics, up from 13.3% previously and well above the 2.3% level in 2024 before Trump took office. Also weighing on stock index futures, shares of Amazon.com (AMZN) slumped over -7% in pre-market trading after the tech and online retailing giant projected weaker-than-expected Q3 operating income. U.S. equity futures are also under pressure from rising Treasury yields after Trump said in a social-media post that the Fed’s board should “assume control” if Chair Jerome Powell doesn’t cut interest rates. Investor focus now turns to the key U.S. payrolls report. In yesterday’s trading session, Wall Street’s major indices closed lower. Align Technology (ALGN) plummeted over -36% and was the top percentage loser on the S&P 500 after the company posted downbeat Q2 results and issued below-consensus Q3 revenue guidance. Also, Arm Holdings (ARM) plunged more than -13% and was the top percentage loser on the Nasdaq 100 after the chip designer provided soft FQ2 adjusted EPS guidance. In addition, pharmaceutical stocks slumped after President Trump demanded that drugmakers slash U.S. prices, with Bristol-Myers Squibb (BMY) sliding over -5% and Merck & Co. (MRK) falling more than -4%. On the bullish side, Meta Platforms (META) surged over +11% and was the top percentage gainer on the Nasdaq 100 after the maker of Facebook and Instagram posted upbeat Q2 results and issued strong Q3 revenue guidance. Data from the U.S. Department of Commerce released on Thursday showed that the core PCE price index, a key inflation gauge monitored by the Fed, came in at +0.3% m/m and +2.8% y/y in June, compared to expectations of +0.3% m/m and +2.7% y/y. Also, U.S. June personal spending rose +0.3% m/m, weaker than expectations of +0.4% m/m, and personal income rose +0.3% m/m, stronger than expectations of +0.2% m/m. In addition, the U.S. employment cost index rose +0.9% q/q in the second quarter, stronger than expectations of +0.8% q/q. Finally, the number of Americans filing for initial jobless claims in the past week rose +1K to 218K, compared with the 222K expected. “Inflation remains sticky and justifies the Fed’s decision to keep interest rates unchanged at Wednesday’s meeting,” said Clark Bellin at Bellwether Wealth. “The stock market doesn’t need rate cuts in order to move higher and has already posted strong gains so far this year without any rate cuts.” Meanwhile, U.S. rate futures have priced in a 61.0% probability of no rate change and a 39.0% chance of a 25 basis point rate cut at the next FOMC meeting in September. Today, all eyes are focused on the U.S. monthly payroll report, which is set to be released in a couple of hours. Economists, on average, forecast that July Nonfarm Payrolls will come in at 106K, compared to the June figure of 147K. Investors will also focus on U.S. Average Hourly Earnings data. Economists expect July figures to be +0.3% m/m and +3.8% y/y, compared to the previous numbers of +0.2% m/m and +3.7% y/y. The U.S. Unemployment Rate will be reported today. Economists forecast that this figure will creep up a tick to 4.2% in July from 4.1% in the prior month. The U.S. ISM Manufacturing PMI and the S&P Global Manufacturing PMI will be closely watched today. Economists expect the July ISM Manufacturing PMI to be 49.5 and the S&P Global Manufacturing PMI to be 49.7, compared to the previous values of 49.0 and 52.9, respectively. U.S. Construction Spending data will be released today. Economists estimate this figure will be unchanged m/m in June, compared to -0.3% m/m in May. The University of Michigan’s U.S. Consumer Sentiment Index will be released today as well. Economists expect the final July figure to be revised slightly higher to 62.0 from the preliminary reading of 61.8. On the earnings front, notable companies like Exxon Mobil (XOM), Chevron (CVX), Enbridge (ENB), and Colgate-Palmolive (CL) are slated to release their quarterly results today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +4.5% increase in quarterly earnings for Q2 compared to the previous year, exceeding the pre-season estimate of +2.8%. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.391%, up +0.71%. Trade docket today: We got a fill on both sides of our Gold 0DTE for today so that should give us some good potential. We have AAPL, AMZN, META, MSFT earnings trades all expiring today and they all look great going into the open. We'll work our QQQ 0DTE as well as our main 0DTE focus, SPX. /MNQ has been very good to us lately with scalping so we'll stick with that today. Our big trade today should be SPX. I'll start with about 50% of my allocated BP, up from the usual 10%. As far as my lean or bias today it's just too early to tell. Futures are buried and we are seeing sell signals across the board but this market has been very resilient. Either way today I think we have a great chance for an outsized move. This selloff either continues or we get a retace but I doubt we finish close to where we will open. Let's pray it's to the downside! Don't fear down markets! Our traders have access to our ATM model portfolio that not only hedges downside but profits from it so if you have a retirement account of investment portfolio there's no concern and as far as trading goes, it's just easier in down markets. Way better opportunities. Let's all pray together that this is the turn we've been looking for! Intra-day levels on /ES. 6331, 6351, 6363, 6374 are resistance. 6303 is the first big support. A break below that would be a great start for the bears. 6289 and 6263 are next. I'll see you all in the live trading room shortly. Let's see if we can cap off this week with a big win today.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |