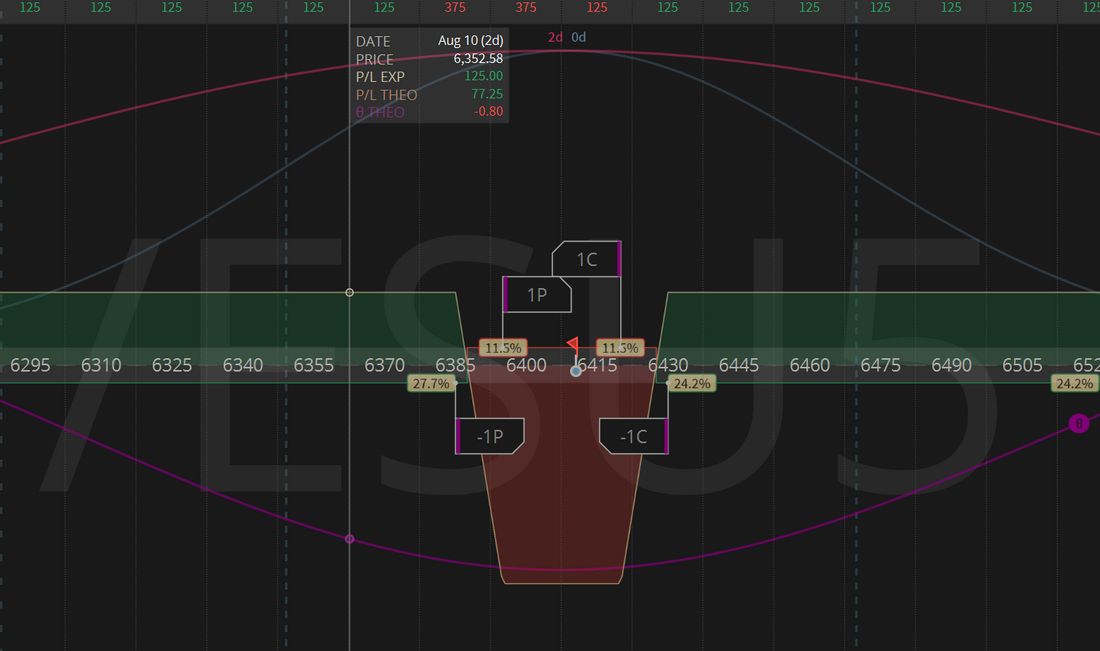

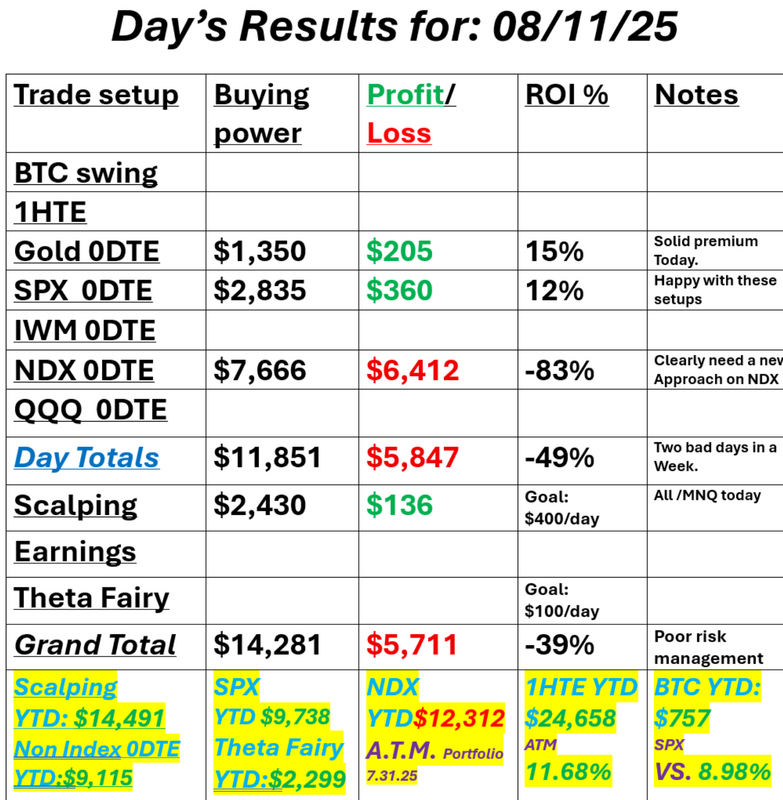

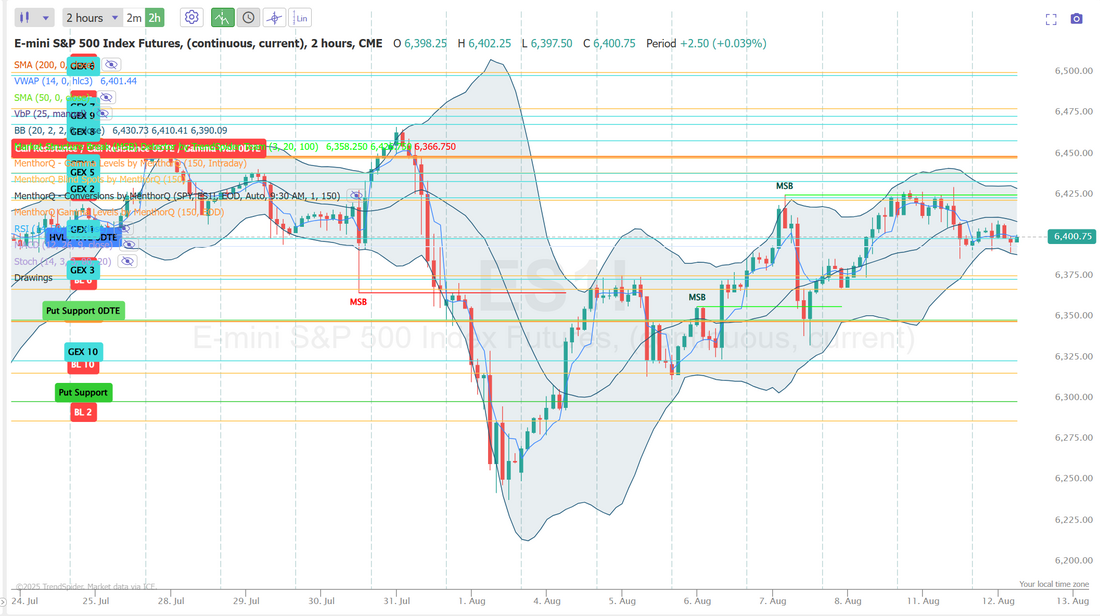

CPI day"Inflation watch" week is always big with CPI then PPI but this week seems bigger. The FED is closer than they've been all year to a possible rate cut and this weeks numbers could be key to either making that a reality or pushing it off for another time. We'll have the numbers shortly. We are working a long vol Theta fairy going into the open. Our day yesterday was lovely....with the exception (again) of the NDX. I clearly need a different approach with the NDX vs. the SPX. It's the one category that is dragging down our otherwise good year. Every other strategy we work is producing results. September S&P 500 E-Mini futures (ESU25) are up +0.06%, and September Nasdaq 100 E-Mini futures (NQU25) are up +0.02% this morning as investors refrained from making big bets ahead of key U.S. inflation data that could reshape expectations for Federal Reserve rate cuts. On Monday, U.S. President Donald Trump signed an executive order delaying hefty tariffs on Chinese imports through November 10th, stabilizing trade relations between the world’s two largest economies. China’s commerce ministry confirmed the move hours after Trump’s announcement, stating that the truce would be extended until mid-November. Still, some investors and analysts cautioned that the extension of the trade truce could prolong uncertainty and create a more persistent risk to inflation, complicating the outlook for Fed policymakers. In yesterday’s trading session, Wall Street’s main stock indexes ended in the red. Monday.com (MNDY) plummeted over -29% after the software company issued weak Q3 revenue guidance. Also, C3.ai (AI) tumbled more than -25% after the AI software company posted downbeat preliminary FQ1 results. In addition, Adobe (ADBE) fell over -2% after Melius Research downgraded the stock to Sell from Hold with a $310 price target. On the bullish side, TKO Group Holdings (TKO) surged more than +10% and was the top percentage gainer on the S&P 500 after Paramount Skydance agreed to pay more than $7 billion to make the newly formed media giant the exclusive distributor of the UFC. Meanwhile, President Trump named EJ Antoni, chief economist at the conservative Heritage Foundation, to lead the Bureau of Labor Statistics after firing the agency’s former head earlier this month. Today, all eyes are focused on the U.S. consumer inflation report, which is set to be released in a couple of hours. The report will provide an opportunity to assess the impact of tariffs on inflation amid a cooling labor market. The recent U.S. ISM services PMI showed an unexpected increase in the prices paid sub-index, serving as a reminder that “inflation is still a force to be reckoned with,” according to Chris Beauchamp, chief market analyst at IG. Economists, on average, forecast that the U.S. July CPI will come in at +0.2% m/m and +2.8% y/y, compared to the previous numbers of +0.3% m/m and +2.7% y/y. Also, the U.S. core CPI is expected to be +0.3% m/m and +3.0% y/y in July, compared to the June figures of +0.2% m/m and +2.9% y/y. A survey conducted by 22V Research revealed that only 18% of investors expect a “risk-on” market reaction to the CPI report, while 43% anticipate a “mixed” response and 39% foresee a “risk-off” reaction. “The market’s reaction to any surprises in the numbers could be exaggerated — especially if a significantly hotter-than-expected CPI print leads traders to believe the Fed may not cut rates at its next meeting,” said Chris Larkin at E*Trade from Morgan Stanley. U.S. rate futures have priced in an 84.5% probability of a 25 basis point rate cut and a 15.5% chance of no rate change at the September FOMC meeting. Market participants will also parse comments today from Richmond Fed President Tom Barkin and Kansas City Fed President Jeff Schmid. On the earnings front, notable companies like Sea Limited (SE), CoreWeave (CRWV), Cardinal Health (CAH), and Circle (CRCL) are scheduled to report their quarterly figures today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.276%, down -0.21%. With CPI today I won't start with a bias or lean. I'll just focus on price action. Trade docket today: We've got the long vol /ES trade that we'll work until it shows profit. Our Gold 0DTE has both sides filled. We'll continue to work that, if necessary. I'll focus on SPX 0DTE today. We scaled our scalping efforts yesterday using the /mnq and that worked quite well. I'll continue that approach today. Let's take a look at the intra-day levels that may come into play today. 6450 and 6350 continue to be the big demarcation zones with 6423/6378 the closest levels to watch today. I look forward to seeing you all in the live trading room. CPI days are usually pretty good to us!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |