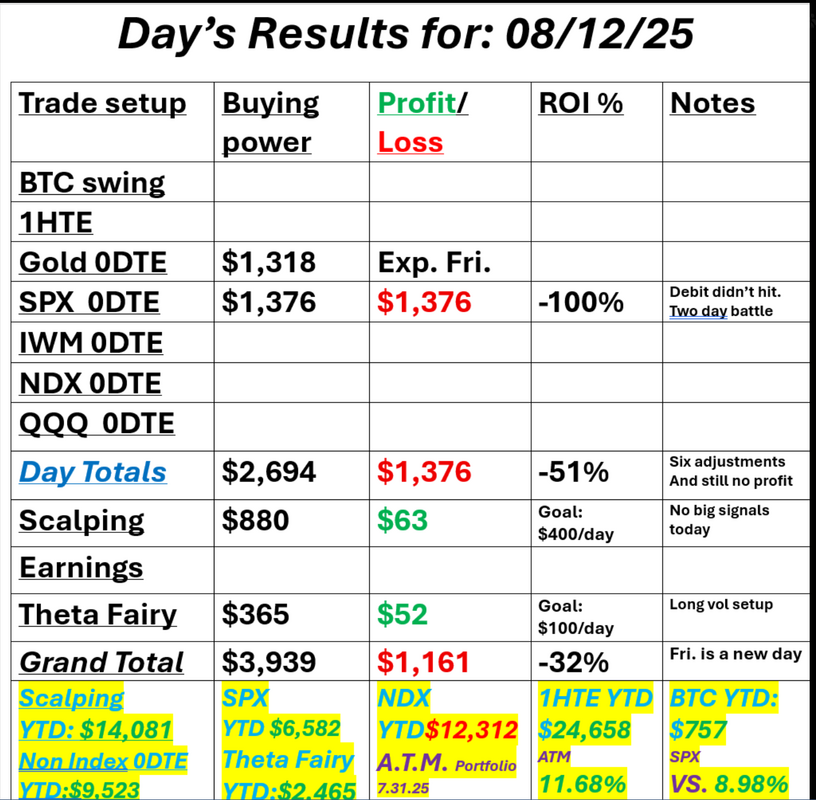

The battle of 6500The /ES is coiled tightly around the 6500 level. I battled it for two days with SPX 0DTE's and didn't get a directional move either days. Futures have been a bit higher and lower this morning but I believe this is the battle zone today. Below is bearish. Above is bullish. The real question I have is when will we get a move? You have to pick a directional bias to place trades and sometimes you're right...sometimes you're wrong. That's how it goes but what is really confusing to me is the tight range we are stuck in. A move will be incoming at some point so let's be patient and wait our turn. Here's my results from yesterday. I won't go over all the intra-day levels this morning as they are EXACTLY the same as yesterday but I do want to detail the 6500 level. This is the line in the sand. Will we get a substantive move today? That's really my only question. September S&P 500 E-Mini futures (ESU25) are trending up +0.17% this morning, bolstered by continued hopes for a Federal Reserve rate cut next month, while investors await U.S. retail sales data and high-stakes talks between U.S. President Donald Trump and Russia’s Vladimir Putin. In yesterday’s trading session, Wall Street’s major indices closed mixed. Tapestry (TPR) plunged over -15% and was the top percentage loser on the S&P 500 after the fashion-brand company issued below-consensus FY26 EPS guidance. Also, Deere & Company (DE) slumped more than -6% after the agricultural and construction equipment maker cut the upper end of its full-year net income guidance. In addition, Cisco Systems (CSCO) fell over -1% after the computer networking company gave a cautious full-year forecast. On the bullish side, Eli Lilly (LLY) rose over +3% after the drugmaker announced it would raise the list price of its Mounjaro weight-loss treatment in the U.K. by as much as 170%. Economic data released on Thursday showed that the U.S. producer price index for final demand rose +0.9% m/m and +3.3% y/y in July, much stronger than expectations of +0.2% m/m and +2.5% y/y. Also, the core PPI, which excludes volatile food and energy costs, rose +0.9% m/m and +3.7% y/y in July, stronger than expectations of +0.2% m/m and +2.9% y/y. In addition, the number of Americans filing for initial jobless claims in the past week fell by -3K to 224K, compared with the 225K expected. “This doesn’t slam the door on a September rate cut, but based on the market’s initial reaction, the opening may be a little smaller than it was a couple of days ago,” said Chris Larkin at E*Trade from Morgan Stanley. St. Louis Fed President Alberto Musalem said on Thursday that it is still too soon for him to determine whether to support an interest rate cut at next month’s meeting. Asked whether a 50 basis point cut could be warranted next month, Musalem said that, in his view, such a move would be “unsupported by the current state of the economy and the outlook for the economy.” Also, San Francisco Fed President Mary Daly said in an interview with the Wall Street Journal that she is not in favor of a 50 basis point rate cut at the September meeting, saying that “would send off an urgency signal that I don’t feel about the strength of the labor market.” U.S. rate futures have priced in a 92.6% probability of a 25 basis point rate cut and a 7.4% chance of no rate change at the next FOMC meeting in September. Investors await a meeting later today in Alaska between U.S. President Donald Trump and Russian President Vladimir Putin over the war in Ukraine. Trump cautioned there would be “very harsh consequences” if Putin failed to agree to a ceasefire with Ukraine, while suggesting the possibility of a follow-up meeting that could include Ukraine’s President Volodymyr Zelenskyy and some European leaders. Meanwhile, Putin looked to strengthen his relationship with Trump ahead of their summit, commending the U.S. leader’s attempts to mediate an end to the war in Ukraine and offering the prospect of economic cooperation along with a new arms control agreement. On the economic data front, all eyes are focused on U.S. Retail Sales data, which is set to be released in a couple of hours. Economists, on average, forecast that Retail Sales will show a +0.6% m/m rise in July, the same as the previous month. Investors will also focus on U.S. Core Retail Sales data, which rose +0.5% m/m in June. Economists expect the July figure to be +0.3% m/m. The University of Michigan’s U.S. Consumer Sentiment Index will be closely monitored today. Economists forecast that the preliminary August figure will stand at 61.9, compared to 61.7 in July. U.S. Industrial Production and Manufacturing Production data will be released today. Economists expect Industrial Production to be unchanged m/m and Manufacturing Production to drop -0.1% m/m in July, compared to the June figures of +0.3% m/m and +0.1% m/m, respectively. The Empire State Manufacturing Index will be reported today. Economists foresee the Empire State manufacturing index standing at -1.20 in August, compared to last month’s value of 5.50. U.S. Export and Import Price Indexes will be released today as well. Economists anticipate the export price index to rise +0.1% m/m and the import price index to rise +0.1% m/m in July, compared to the previous figures of +0.5% m/m and +0.1% m/m, respectively. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.289%, down -0.09%. Trade docket: I'm going to stick with the /MNQ futures today for scalping. We were able to squeeze a little profit out of that yesterday even without a lot of movement. We couldn't get a 0DTE Gold trade working yesterday so we went with a 1DTE which expires today. It's got $200 of potential profit in it so we'll continue to nurse that to the finish line today. I'll focus our other 0DTE effort on the SPX and patiently wait for a move off the 6500 area. We missed our entry on the Vampire trade yesterday. I apologize on that. It looks like it would be a solid result. New pairs trade will be pushed to Monday. I look forward to trading with you all today! We've got a good start today with our Gold 0DTE. Let's see what else we can produce!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |