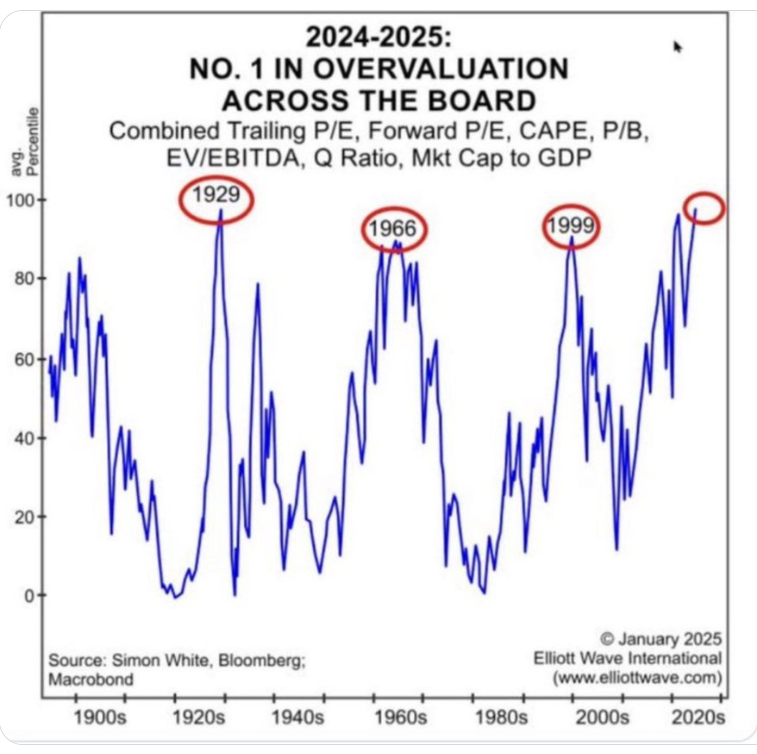

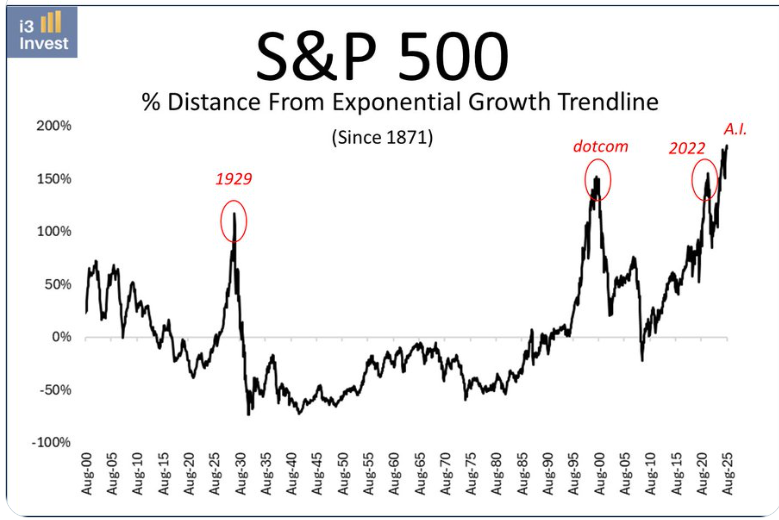

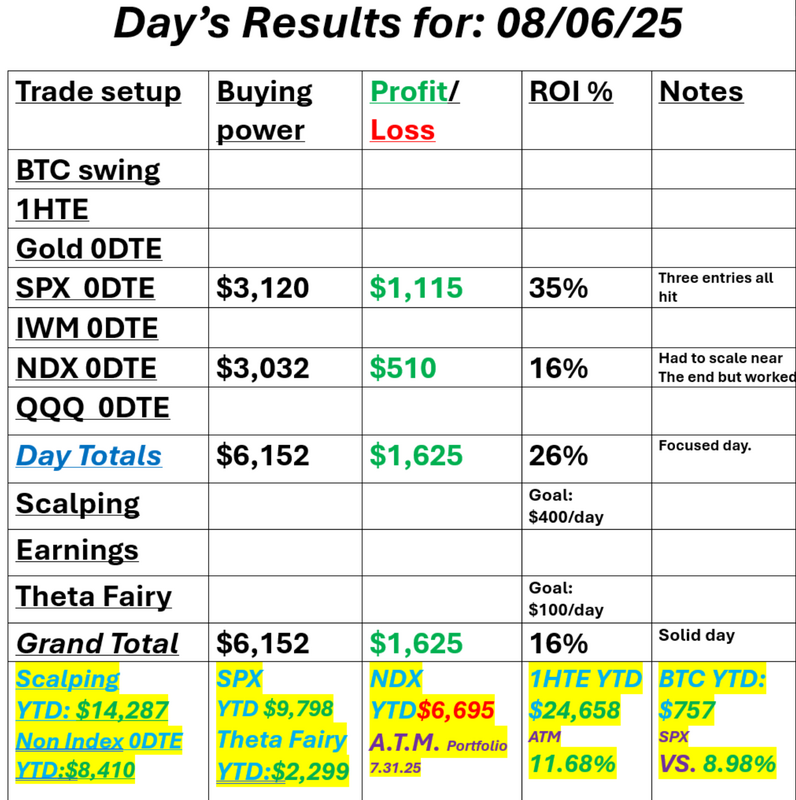

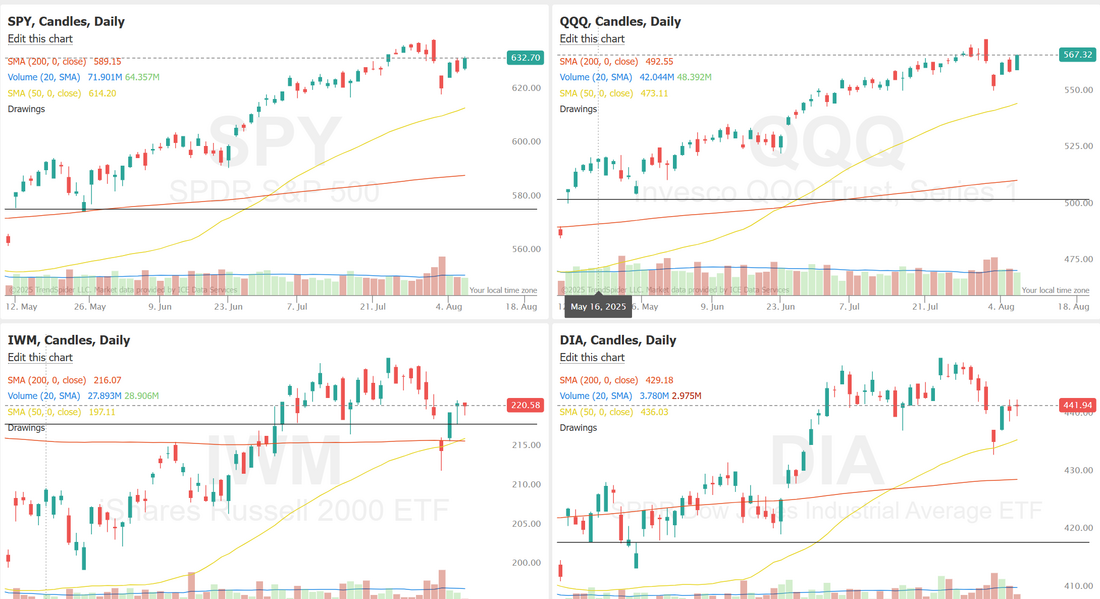

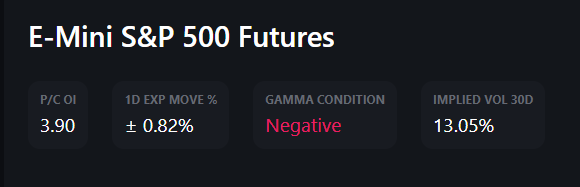

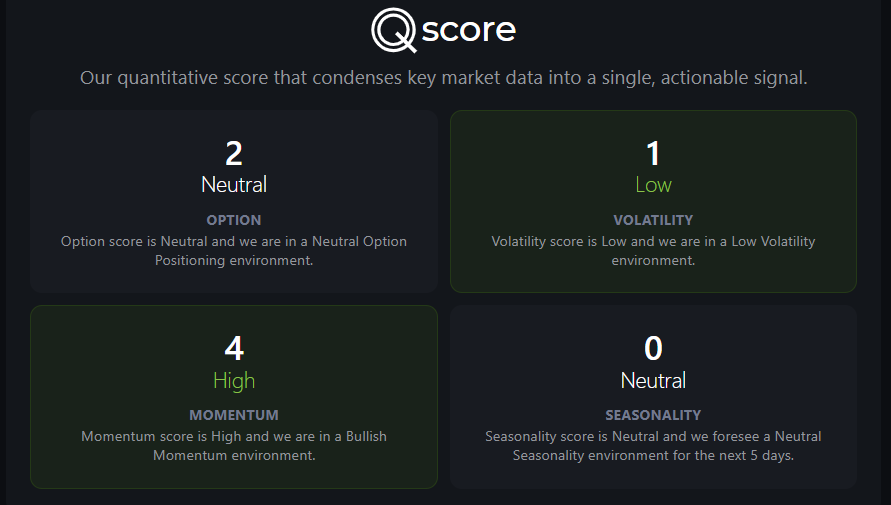

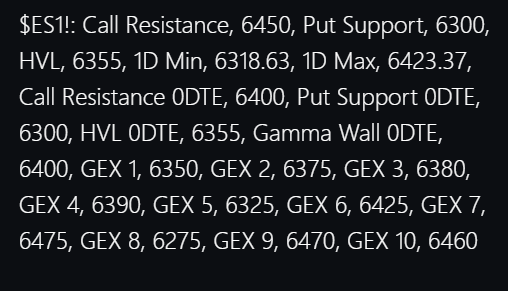

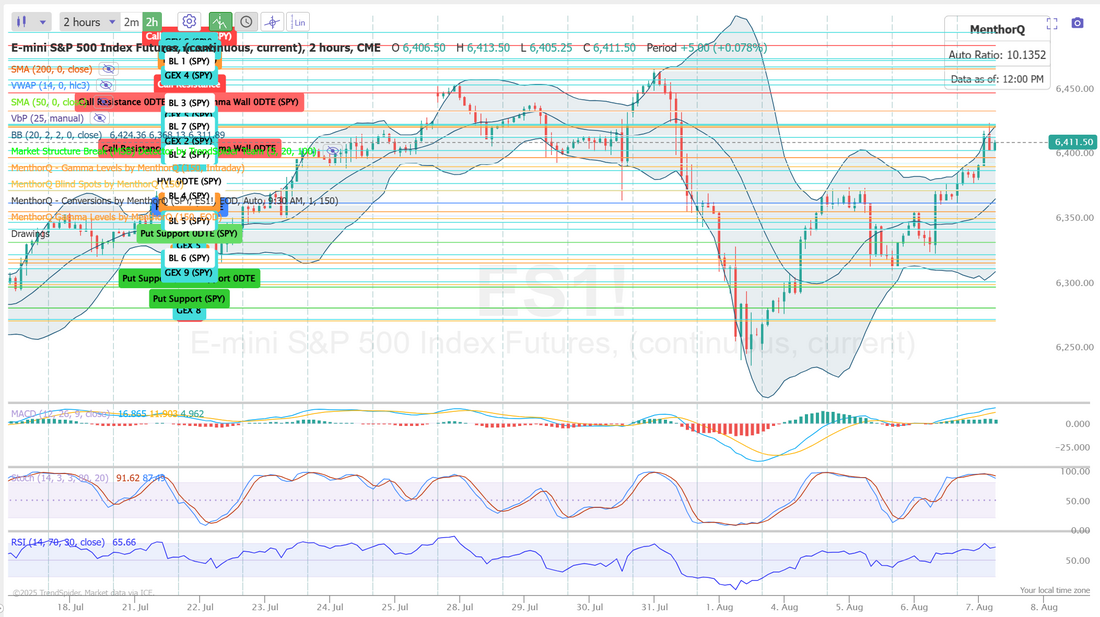

Fundamentals matter...eventually.Not to beat a dead horse but valuations are up there. We continue to look for opportunities to build bearish setups in our ATM portfolio. Yesterday was a focused effort for us on SPX and NDX 0DTE's and that paid off. See our results below: Let's take a look at the market. Yesterday was a largely bullish day for the indices. Negative gamma to start the day: Quant score is improving. September S&P 500 E-Mini futures (ESU25) are up +0.81%, and September Nasdaq 100 E-Mini futures (NQU25) are up +0.78% this morning as U.S. President Donald Trump’s 100% tariff threat on chip exporters included exemptions for firms investing in the U.S., while hopes for a truce in Russia’s war with Ukraine further boosted sentiment. President Trump announced late Wednesday a roughly 100% tariff on semiconductors entering the U.S., but noted that tech firms like Apple investing in domestic manufacturing would be exempt from the duties. Mr. Trump said that “if you’re building in the United States of America, there’s no charge.” Also aiding sentiment, the Kremlin confirmed that Presidents Donald Trump and Vladimir Putin are set to hold summit talks in the coming days, fueling hopes for a potential truce in Russia’s war with Ukraine. Increasing speculation that the Federal Reserve will resume rate cuts in September is also buoying sentiment as U.S. reciprocal tariffs took effect against dozens of countries a minute past midnight Washington time on Thursday. In a social-media post, Mr. Trump said, “Billions of dollars in tariffs are now flowing into the United States of America.” Investors now look ahead to U.S. jobless claims data for further insight into the health of the labor market. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed higher. Apple (AAPL) climbed over +5% and was the top percentage gainer on the Dow following reports that the tech titan is set to announce a fresh $100 billion investment in the U.S. in an effort to avoid steep tariffs on iPhones. Also, Arista Networks (ANET) surged more than +17% and was the top percentage gainer on the S&P 500 after the company reported stronger-than-expected Q2 results and issued solid Q3 revenue guidance. In addition, Shopify (SHOP) soared over +21% and was the top percentage gainer on the Nasdaq 100 after the company posted upbeat Q2 results. On the bearish side, Super Micro Computer (SMCI) plummeted more than -18% and was the top percentage loser on the S&P 500 after the AI server maker reported downbeat FQ4 results and provided disappointing FQ1 guidance. “There are a lot of narratives to keep track of in today’s investing environment, but earnings remain the main catalyst for stocks. While pullbacks are possible — particularly due to macro-related influences and poor seasonality trends — those pullbacks will likely prove to be buying opportunities,” said Bret Kenwell at eToro. Minneapolis Fed President Neel Kashkari said on Wednesday that a slowing of the U.S. economy could warrant an interest rate cut in the near term, and he still sees two cuts by the end of the year. Also, Fed Governor Lisa Cook described the July jobs report as “concerning” and suggested it may mark a turning point for the U.S. economy. “These revisions are somewhat typical of turning points,” Cook said. In addition, San Francisco Fed President Mary Daly said that policymakers will likely need to adjust interest rates in the coming months to prevent further labor market weakness. Meanwhile, U.S. rate futures have priced in a 93.2% chance of a 25 basis point rate cut and a 6.8% chance of no rate change at September’s monetary policy meeting. Today, investors will focus on U.S. Initial Jobless Claims data, which is set to be released in a couple of hours. Economists expect this figure to be 221K, compared to last week’s number of 218K. U.S. Unit Labor Costs and Nonfarm Productivity preliminary data will also be closely watched today. Economists forecast Q2 Unit Labor Costs to be +1.6% q/q and Nonfarm Productivity to be +1.9% q/q, compared to the first-quarter numbers of +6.6% q/q and -1.5% q/q, respectively. U.S. Wholesale Inventories data will be released today. Economists expect the final June figure to be +0.2% m/m, compared to -0.3% m/m in May. U.S. Consumer Credit data will be released today as well. Economists expect this figure to be $7.40 billion in June, compared to the previous figure of $5.10 billion. In addition, market participants will parse comments today from Atlanta Fed President Raphael Bostic. On the earnings front, notable companies like Eli Lilly (LLY), Gilead (GILD), ConocoPhillips (COP), Constellation Energy (CEG), Vistra Energy (VST), and Monster Beverage (MNST) are set to report their quarterly figures today. According to Bloomberg Intelligence, S&P 500 companies are on track to post a 9.1% increase in Q2 profits from a year earlier, well above analysts’ forecast of 2.8%. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.215%, down -0.35%. My bias or lean today is neutral to bearish. Futures are up a healthy .70% I don't think we hold these levels today. Trade docket: Gold 0DTE, ADMA, EHAB, FANG, GOGO, SPX/NDX 0DTE. Let's take a look at our intra-day /ES levels: 6424 is resistance with 6399, 6392, 6381, 6365 working as support levels. Let's have a great day folks. See you in the live trading room shortly.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |