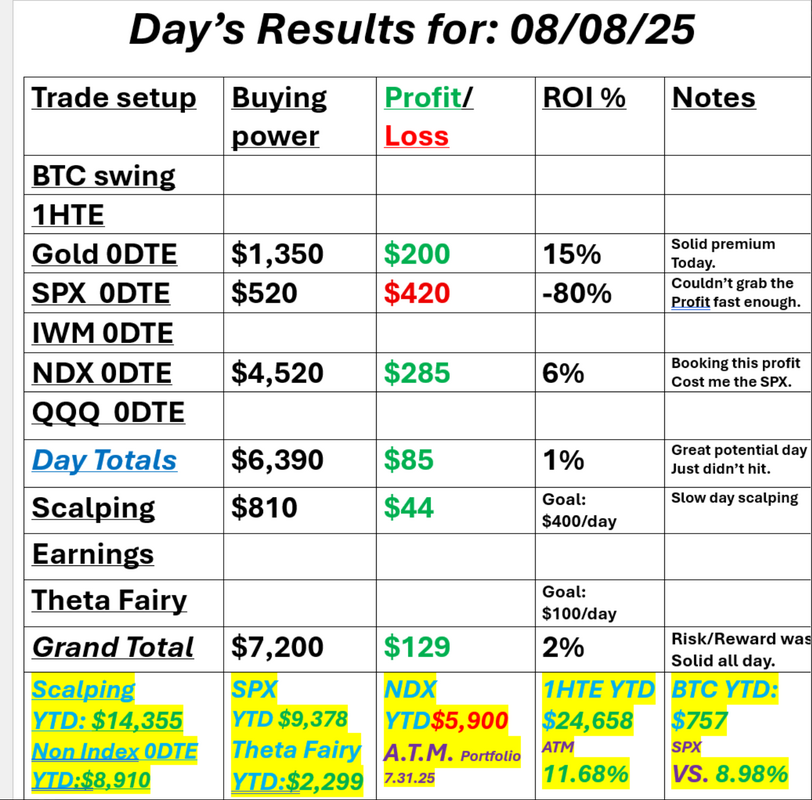

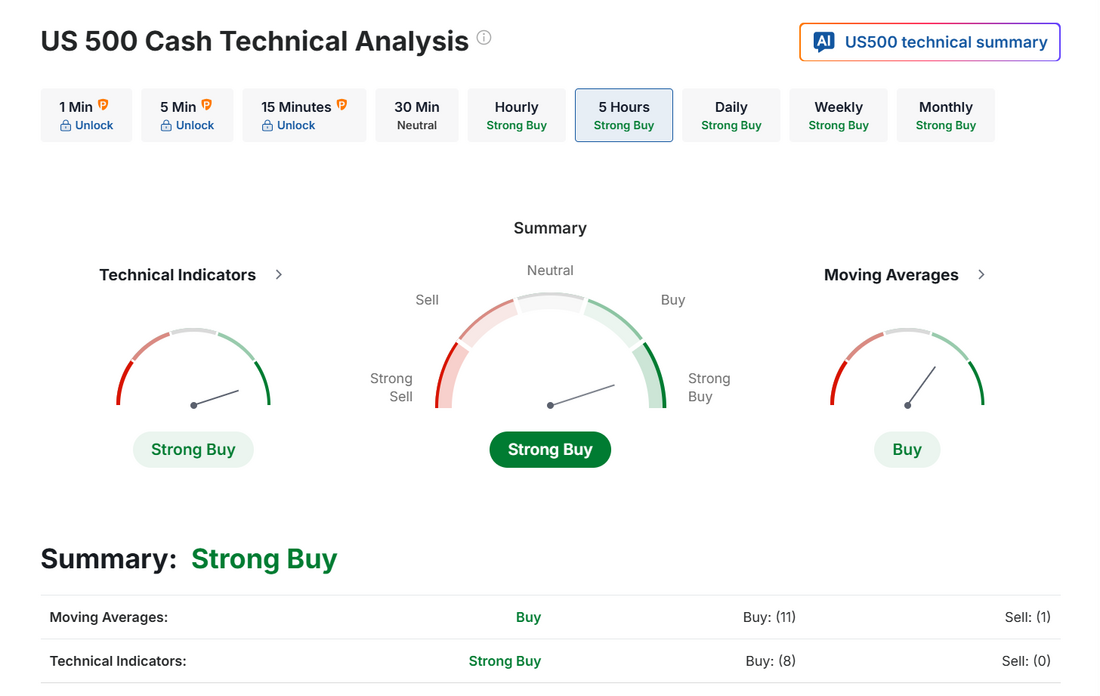

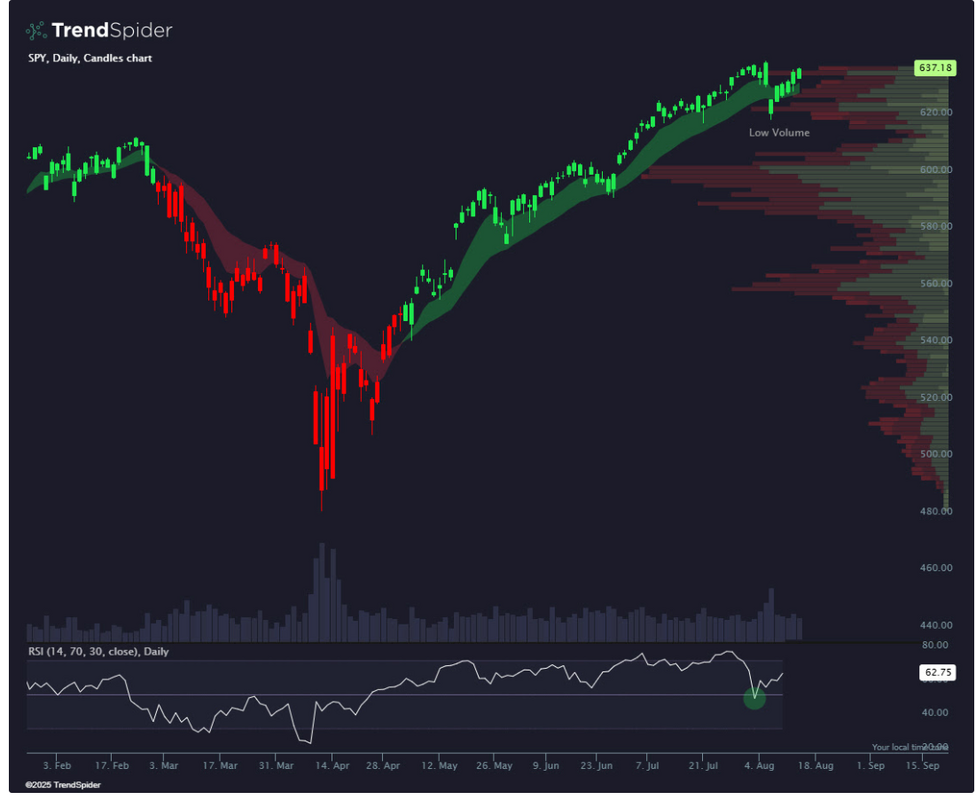

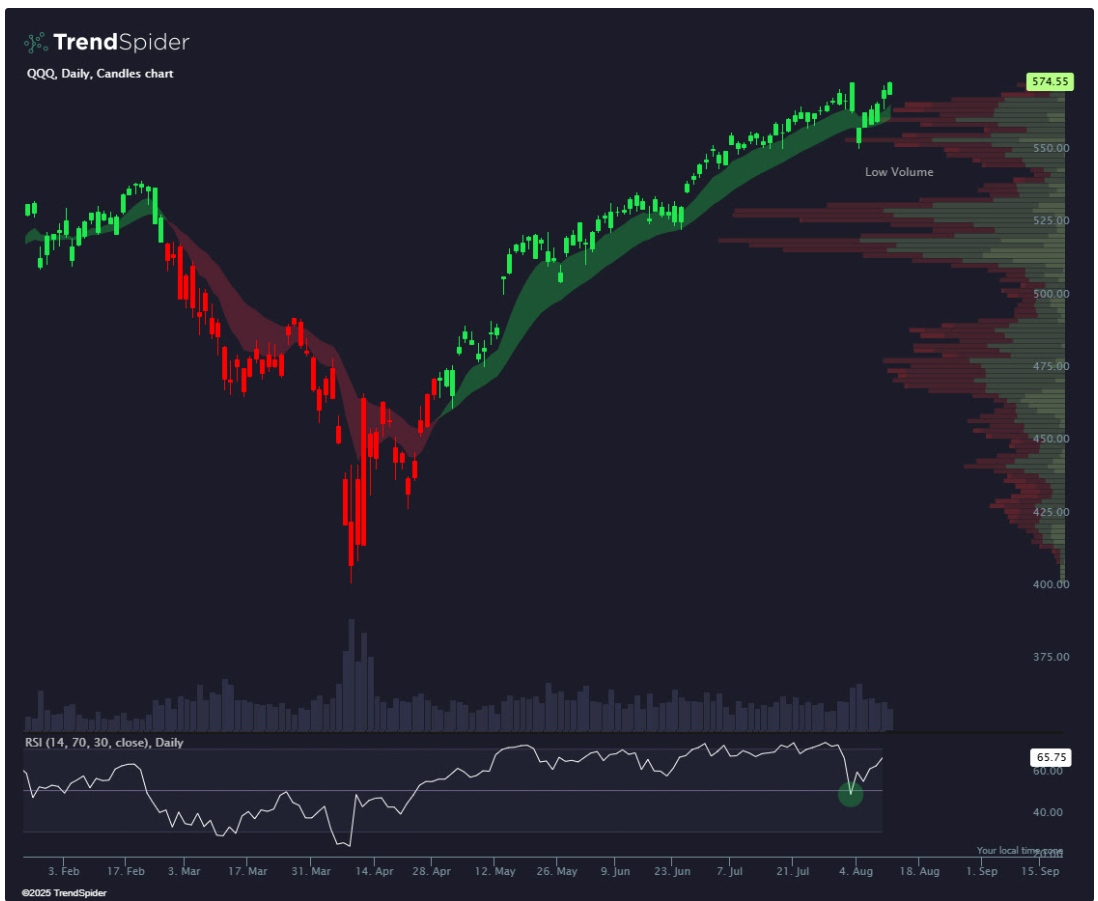

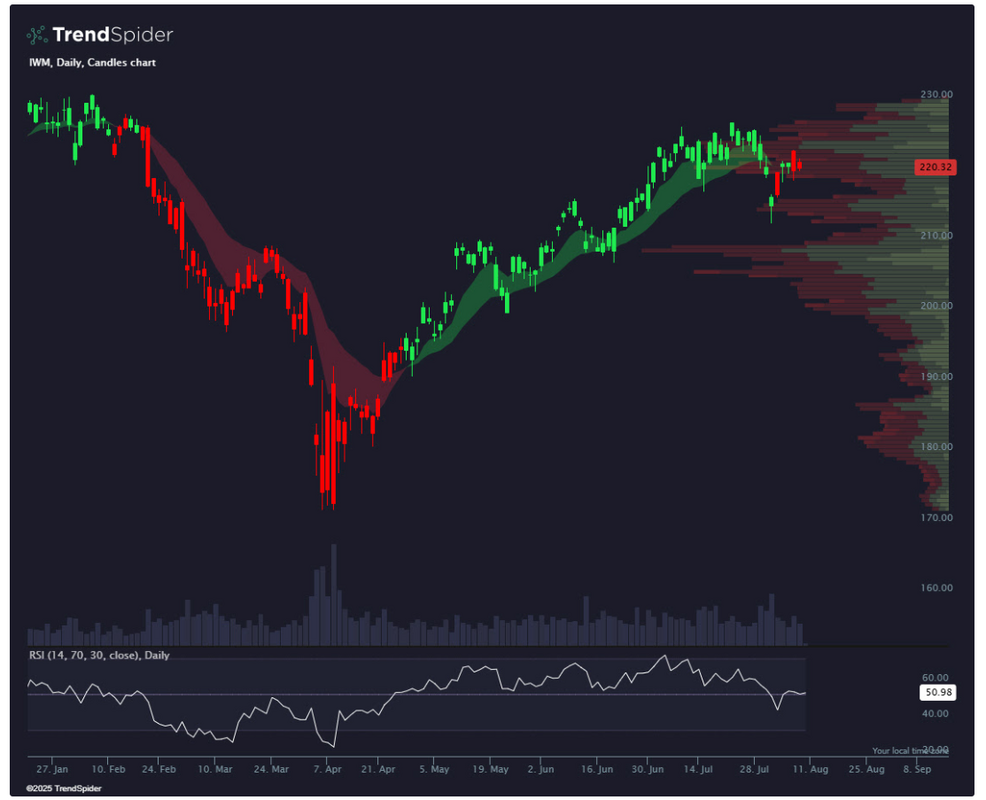

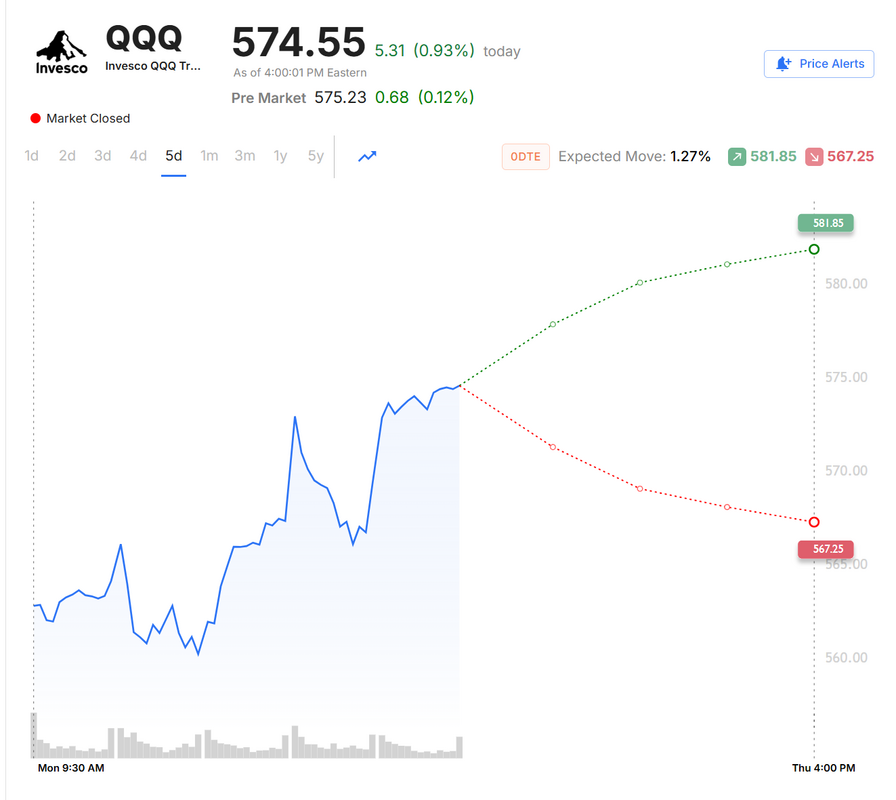

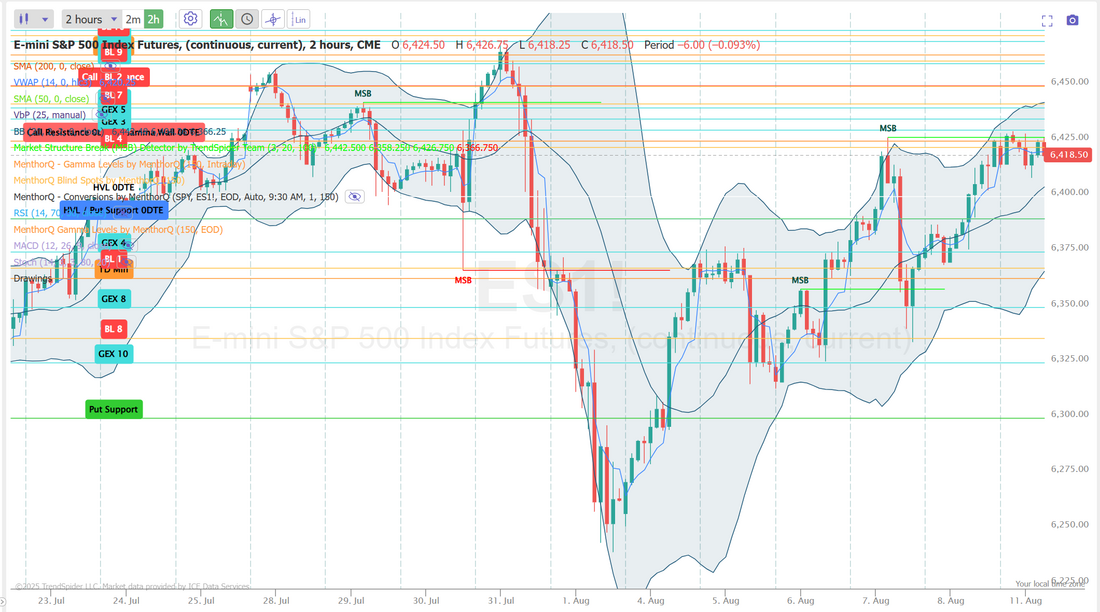

Higher highs...lower volumeThe market had a solid result last week, pushing higher. One of the concerning aspects of this recent push up is the lower volume we're getting. There's not much enthusiasm in the move but a move higher is still, a move higher. We weren't able to generate much success Friday. I had both the SPX and NDX in the profit zone but by the time I could log a profit on NDX the SPX slipped away. It was still a good setup day. We have over $2,000 in potential profits and risk was in check most of the day. With low I.V. the debit trades seem to be the best focus. Even when we get little movement. Here's a look at our day. Let's take a look at the markets: The bullish bias continues. The upcoming Alaska meeting between Presidents Vladimir Putin and Donald Trump is already being framed as a strategic win for Moscow, even before discussions begin. It marks Putin’s first invitation to meet a U.S. president on American soil since 2007, without conditions or Ukrainian and European participation a setup that Kyiv views warily. The talks come as Russia advances militarily in Ukraine’s south and east, with economic pressures mounting at home from sanctions, falling energy revenues, and persistent inflation. Moscow is expected to push for immediate sanctions relief and territorial concessions in exchange for a ceasefire, while signaling interest in joint economic ventures in Alaska and the Arctic. Markets have reacted positively to the prospect of negotiations, with European and U.S. equities gaining, though defense stocks dipped on speculation that peace could slow NATO-related spending. However, analysts note that defense names could benefit regardless of the outcome either from continued arms replenishment if talks fail or from sustained procurement needs even in a post-agreement environment. Gold prices slipped about 1% as geopolitical risk perceptions eased slightly. The outcome of Friday’s meeting remains uncertain, with Trump balancing pressure over sanctions against his stated interest in brokering a peace deal. The SPX chart for August 8 shows prices higher than levels seen in early August, moving toward the upper range observed in recent weeks near 6,400. The option score, which had declined sharply earlier in the month, is now recorded at 4 after reaching recent lows. This score change is concurrent with price movement during the same period and represents a difference from the quieter readings noted in late July and early August. The SPY snapped back from its gap down and closed at $637.12 (+2.47%). Once again, its dip into the 8/21 EMA cloud was quickly bought, with candles remaining green on the EMA Crossover Candle Colors Indicator, showing the bullish trend is still intact. However, with lower-than-average volume all week, bulls may remain cautious. A push back to all-time highs on stronger volume could help confirm continuation of the uptrend. Despite weak earnings from $AMD, the QQQ led the major indexes, pushing to all-time highs and closing the week at $574.55 (+3.73%). It fell below the 8/21 EMA cloud on Monday’s gap down, but found support at the RSI midpoint and quickly reclaimed the cloud, keeping bullish momentum intact. With names like $PLTR and $MSFT flashing on the power gap scan, tech stocks remain king in this market. IWM posted a solid week, closing at $220.62 (+2.50%), but unlike its large-cap peers, it remains well below all-time highs. Even with the Polymarket Indicator showing a 75% chance of a September rate cut, the EMA Crossover Candle Colors Indicator has begun flashing red, hinting at a potential bearish trend reversal. This week’s CPI and PPI releases could be key in shaping sentiment for the index going forward. Let's take a look at this weeks expected moves with CPI and PPI coming out. You can see, it's not much better than last week and we blew through last weeks expected move by more than 100%. Debits seem to be the way to go here. September S&P 500 E-Mini futures (ESU25) are up +0.09%, and September Nasdaq 100 E-Mini futures (NQU25) are up +0.05% this morning, pointing to a muted open on Wall Street as investors await key U.S. economic data, especially the inflation report, and a summit between U.S. President Donald Trump and Russia’s Vladimir Putin. Financial markets found some reassurance in renewed diplomatic efforts to end the Russia-Ukraine war, with Trump and Putin preparing to meet in Alaska on Friday. The weekend saw intense diplomacy between U.S., Ukrainian, and European officials, including meetings in the U.K. with U.S. Vice President JD Vance and British Foreign Secretary David Lammy. Still, Ukrainian President Volodymyr Zelenskiy has maintained his refusal to cede territory occupied by Russia. In Friday’s trading session, Wall Street’s major equity averages closed higher, with the S&P 500 posting a 1-week high and the Nasdaq 100 notching a new record high. Gilead Sciences (GILD) climbed over +8% and was the top percentage gainer on the S&P 500 and Nasdaq 100 after the biopharmaceutical giant posted upbeat Q2 results and raised its full-year guidance. Also, Monster Beverage (MNST) gained more than +6% after the company reported better-than-expected Q2 adjusted EPS. In addition, Expedia (EXPE) rose over +4% after the travel booking company posted stronger-than-expected Q2 results and raised its full-year gross bookings guidance. On the bearish side, Trade Desk (TTD) plummeted more than -38% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the ad-tech company issued weak Q3 revenue guidance and announced that CFO Laura Schenkein will be replaced by Alex Kayyal. St. Louis Fed President Alberto Musalem said on Friday that he backed policymakers’ recent decision to keep interest rates unchanged, adding that the central bank remains further from meeting the inflation side of its mandate. “Given the economy where it stands today, it seemed appropriate to maintain the policy rate at a constant for now,” Musalem said. He also said the most likely outcome is that the price effects from tariffs will be temporary, but added there is a “reasonable probability” they could prove more persistent. At the same time, Fed Governor Michelle Bowman said on Saturday that she favors three interest rate cuts this year. “With economic growth slowing this year and signs of a less dynamic labor market becoming clear, I see it as appropriate to begin gradually moving our moderately restrictive policy stance toward a neutral setting,” Bowman said. Meanwhile, U.S. rate futures have priced in an 88.4% chance of a 25 basis point rate cut and an 11.6% chance of no rate change at the Fed’s monetary policy committee meeting next month. The U.S. consumer inflation report for July will be the main highlight this week. The recent U.S. ISM services PMI showed an unexpected increase in the prices paid sub-index, serving as a reminder that “inflation is still a force to be reckoned with,” according to Chris Beauchamp, chief market analyst at IG. Citi economists said investors will be watching to gauge the extent to which tariffs are impacting prices after June’s report showed “early signs of larger increases in goods prices.” Investors will also monitor July retail sales data for clues on how tariffs are impacting consumers. Other noteworthy data releases include the U.S. PPI, the Core PPI, Initial Jobless Claims, the Export Price Index, the Import Price Index, the Empire State Manufacturing Index, Industrial Production, Manufacturing Production, and the University of Michigan’s Consumer Sentiment Index (preliminary). Second-quarter corporate earnings season is winding down, but several notable companies are due to report this week, including Cisco (CSCO), Applied Materials (AMAT), Deere & Company (DE), CoreWeave (CRWV), and Circle (CRCL). According to Bloomberg Intelligence, S&P 500 companies are on track to post a 9.1% increase in Q2 profits from a year earlier, well above analysts’ forecast of 2.8%. Market participants will also hear perspectives from several Fed officials, including Barkin, Schmid, Goolsbee, and Bostic, throughout the week. In addition, investors will closely watch for any further updates on U.S. tariff plans for specific sectors. Last week, President Trump said that U.S. tariffs on semiconductor and pharmaceutical imports would be announced “within the next week or so.” While some clarity was provided on chip tariffs last week, investors will be particularly eager for further updates on tariffs targeting the pharmaceutical sector. The U.S. economic data slate is empty on Monday. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.258%, down -0.58%. My bias or lean today is more neutral. Futures are slightly green, as I type. We've got CPI and PPI later this week, which will likely be the main drivers for the market. We'll look at levels in a moment. If we can break either level we could get some movement. Trade docket today: We've booked profits on almost all our pairs trades so today we'll start a new batch. BELFP, SXI, IRMD, GRC all short. CRMT, OBT, CENT, KALU all long. We are already working our Gold 0DTE this morning. We've got a big retrace going off the gold tariff pump so we'll keep an eye on this one with possible enhancements as the day progresses. LULU covered call again. SPX 0DTE. I think I'll focus on the SPX today and wait for a potential later entry on NDX. Let's take a look at the key intra-day levels for me today on /ES: I've got two big levels I'm watching today 6450 on the upside and 6340 on the downside. A break above or below these areas could signify the next directional move. I look forward to seeing you all in the live trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |