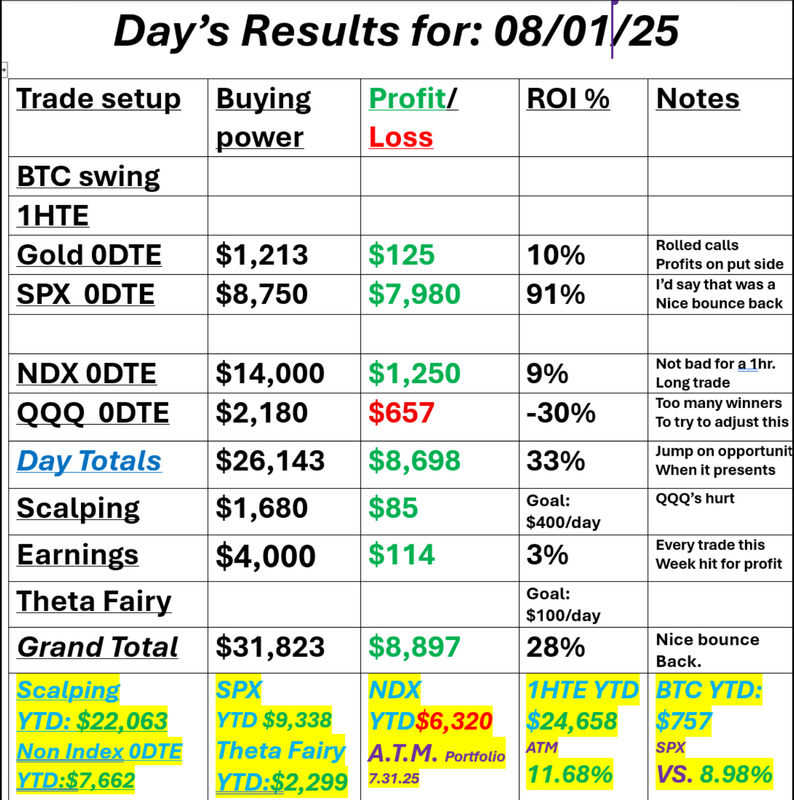

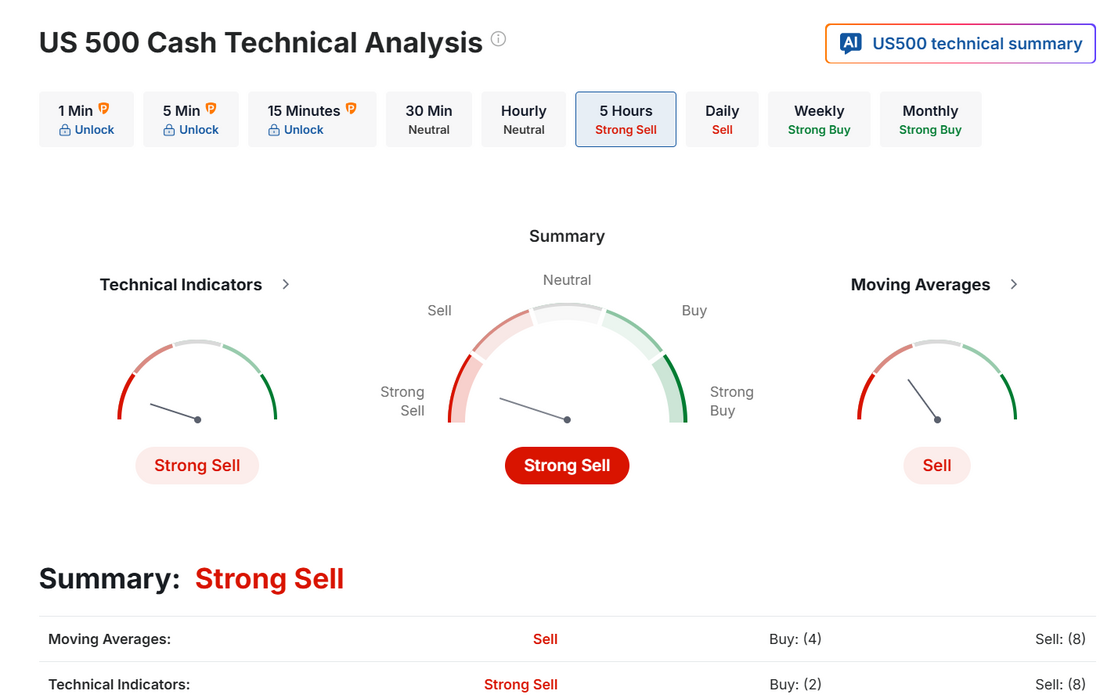

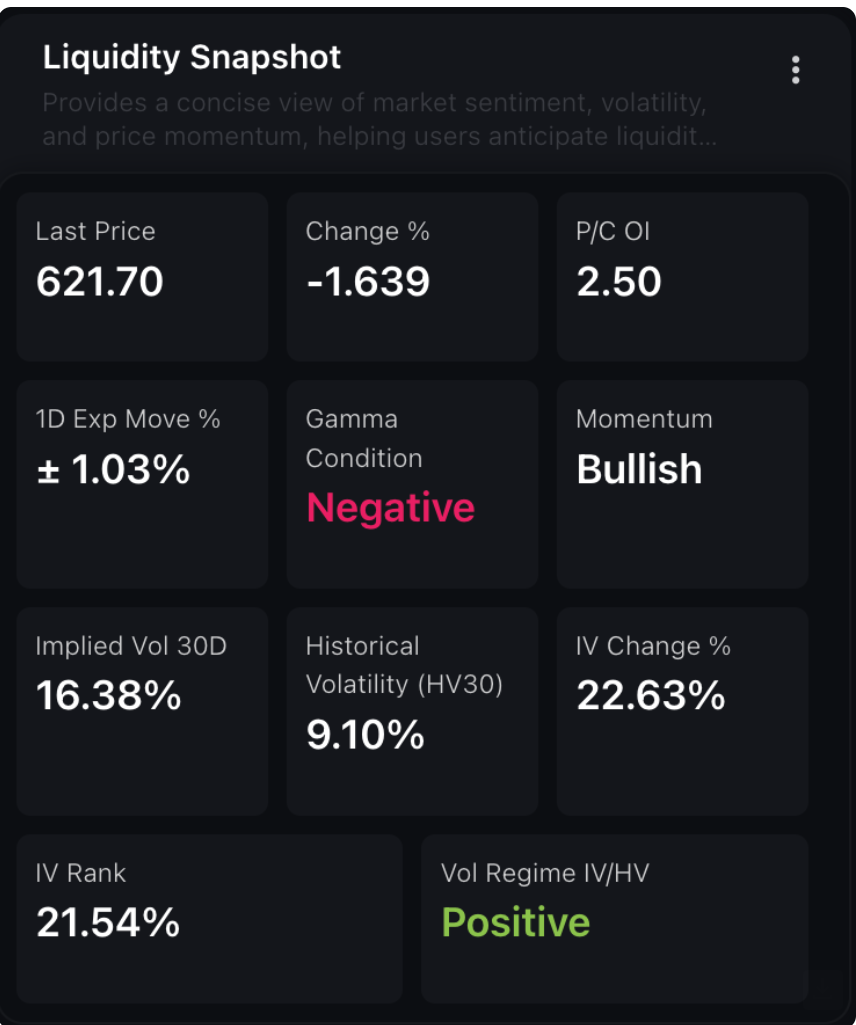

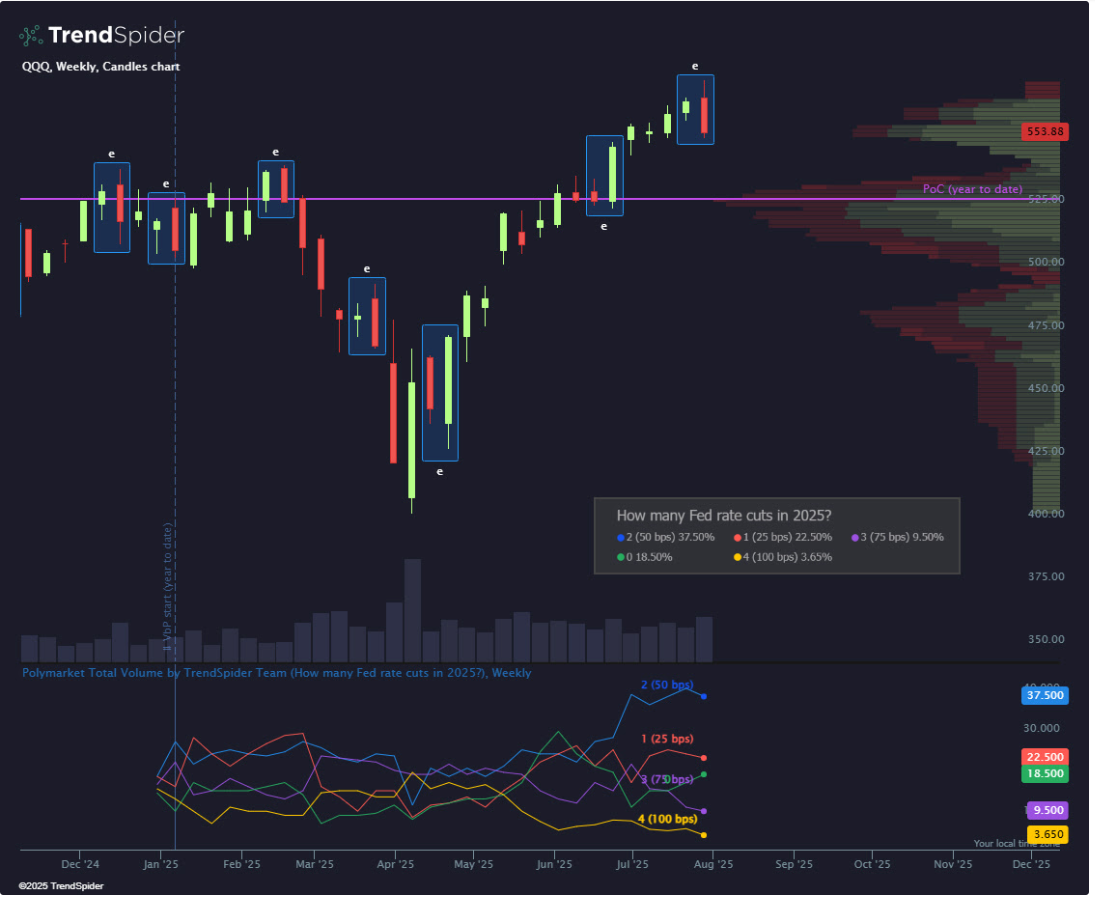

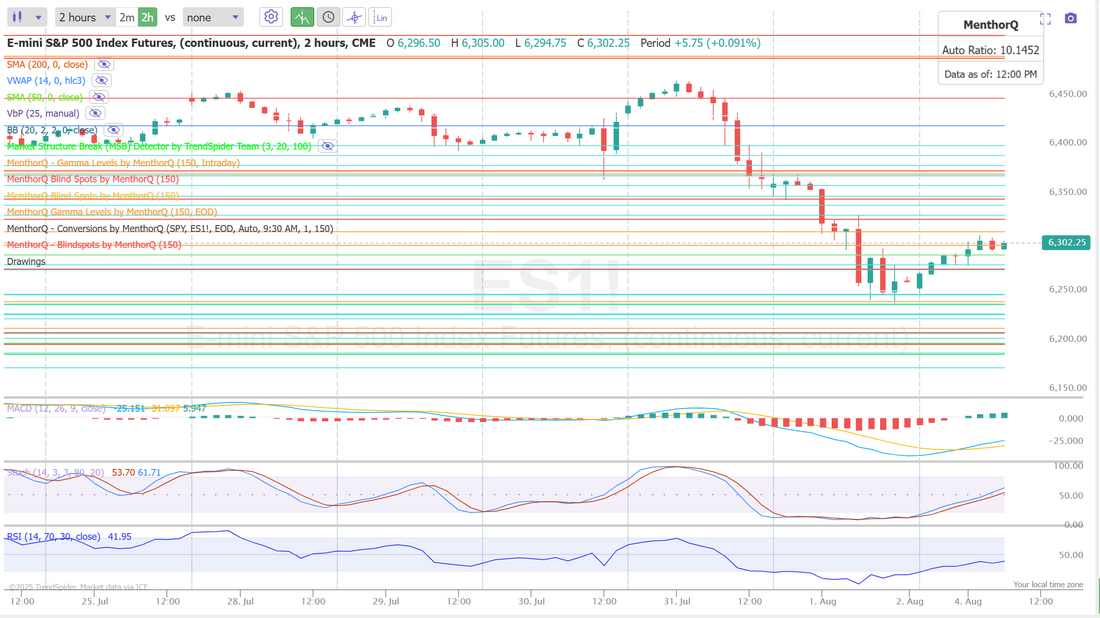

Finding OpportunityWe trade everyday the market is open. In fact, We start Sunday evening with the Futures. As you can imagine, some days offer up better opportunities than others. I always like to say, it's a bit like fishing. Some days you catch nothing. Some days you catch a few and every once in a while you catch a whopper. Regardless of result, everyday you are casting your line. Such is trading. There are days I look at the potential news catalysts and futures movement and think, "there's no opportunity today. We are wasting our time". Friday was not that day. /ES futures were down over 100+ points before the open and we knew it had all the makings of a great opportunity. We had one of our trading members who told me he cancelled a dentist appointment that day because the opportunity was so great. He was right. We had a blow out day. All we want is opportunity. Generally that means movement. Big movement. Preferably downward movement. We got it and fortunately were able to capitalize. See our results below: Fridays selloff also pushed our ATM asset allocation portfolio, briefly to a new ATH. It's still a thrill to me, after all these years, to see the market crashing and your portfolio rising. If you want a simple, passive portfolio that takes just 5 min. each morning to adjust, check out the ATM allocation. Let's take a look at the markets. With futures up this morning, it's not enough to swing us back to bullish sentiment. The SPX chart as of August 1, 2025, shows a sharp pullback in price following a steady upward trend through July. Notably, the Option Score has declined rapidly, dropping from a stable level of 4 to 0 in just a few sessions. This steep drop in the score may indicate rising uncertainty or a shift in sentiment within the options market, often associated with increased hedging or reduced directional conviction. In the short term, this could suggest caution around the recent price weakness, especially if follow-through selling continues. Monitoring whether the Option Score rebounds or remains suppressed could offer insight into whether this pullback is temporary or part of a broader change in trend. The SPY liquidity snapshot reveals a complex short-term picture. Despite a notable -1.64% price decline, momentum remains labeled as bullish, suggesting underlying strength or resilience. However, a negative gamma condition points to potential instability, where market makers may exacerbate volatility rather than dampen it. The put/call open interest ratio stands at a high 2.50, indicating elevated downside hedging or bearish sentiment in the options market. Implied volatility has spiked to 16.38%, up 22.63%, significantly above the historical 30-day volatility of 9.10%. With an IV Rank of 21.54% and a positive IV/HV volatility regime, the current environment reflects heightened caution and elevated premium pricing, which could impact short-term option dynamics. The SPY snapped its five-week winning streak, closing at $621.72 (-2.40%) and printing a weekly bearish engulfing candle, which TrendSpider automatically detected. Following the FOMC rate decision, the Polymarket Indicator showed declining odds of a rate cut, adding pressure to the tape. With a lighter catalyst calendar ahead, the YTD volume point of control now stands out as the next potential support level if bearish momentum persists. The QQQ closed at $553.88 (-2.21%) after a heavy week of tech earnings. Even as major holdings like $MSFT and $META posted strong power earnings gaps, macro pressures and fading rate cut odds weighed heavily on the ETF. After a five-week rally, the shift in sentiment may be opening the door for bears to take control and target the YTD volume point of control support below. Small caps took the hardest hit last week, with IWM closing at $214.92 (-4.22%). It’s no surprise that diminishing rate cut odds are hitting small-cap companies hardest, especially as the ETF decisively rejected the YTD volume point of control. Now sitting between two high-volume nodes, with the larger one overhead, bears appear to have the near-term leverage. September S&P 500 E-Mini futures (ESU25) are up +0.64%, and September Nasdaq 100 E-Mini futures (NQU25) are up +0.77% this morning, pointing to a higher open on Wall Street as investors placed their hopes on the Federal Reserve to step in with interest rate cuts following Friday’s weak U.S. payrolls data. This week, market participants look ahead to a new round of corporate earnings reports and U.S. economic data, as well as remarks from Fed officials. In Friday’s trading session, Wall Street’s major equity averages ended in the red. Amazon.com (AMZN) slumped over -8% and was the top percentage loser on the Dow after the tech and online retailing giant projected weaker-than-expected Q3 operating income. Also, chip stocks lost ground, with Marvell Technology (MRVL) sliding more than -7% and Micron Technology (MU) dropping over -3%. In addition, Eastman Chemical (EMN) plunged more than -19% and was the top percentage loser on the S&P 500 after the company posted downbeat Q2 results and issued below-consensus Q3 adjusted EPS guidance. On the bullish side, Reddit (RDDT) surged over +17% after the social media company posted better-than-expected Q2 results and issued upbeat Q3 revenue guidance. The U.S. Labor Department’s report on Friday showed that nonfarm payrolls rose 73K in July, weaker than expectations of 106K. Also, the U.S. unemployment rate ticked up to 4.2% in July, in line with expectations. In addition, U.S. July average hourly earnings rose +0.3% m/m and +3.9% y/y, compared to expectations of +0.3% m/m and +3.8% y/y. Finally, the U.S. ISM manufacturing index unexpectedly fell to 48.0 in July, weaker than expectations of 49.5. “What had looked like a Teflon labor market showed some scratches... A Fed that still appeared hesitant to lower rates may see a clearer path to a September cut, especially if data over the next month confirms the trend,” said Ellen Zentner at Morgan Stanley Wealth Management. Ahead of the jobs data, Fed Governors Christopher Waller and Michelle Bowman released statements explaining their dissent from Wednesday’s decision to hold rates steady, citing concerns that delaying rate cuts could cause unnecessary damage to the labor market. Cleveland Fed President Beth Hammack, speaking on Bloomberg Television following the release of the numbers, said the labor market still appeared healthy, though she acknowledged it was a “disappointing report to be sure.” U.S. rate futures have priced in a 79.7% chance of a 25 basis point rate cut and a 20.3% chance of no rate change at the September FOMC meeting. Second-quarter corporate earnings season continues, and investors await new reports from notable companies this week, including Advanced Micro Devices (AMD), Palantir (PLTR), McDonald’s (MCD), Walt Disney (DIS), Uber Technologies (UBER), Caterpillar (CAT), Amgen (AMGN), Eli Lilly (LLY), Pfizer (PFE), Gilead (GILD), and Shopify (SHOP). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +4.5% increase in quarterly earnings for Q2 compared to the previous year, exceeding the pre-season estimate of +2.8%. The U.S. economic calendar lightens up considerably following last week’s flurry of economic data releases. Investors will closely monitor the key ISM survey on U.S. services sector activity to assess the likelihood of interest rate cuts in the coming weeks. This data comes on the heels of the weaker-than-expected ISM manufacturing PMI, which, along with the soft jobs report, “amplifies concerns about economic slowdown,” according to FP Markets analyst Aaron Hill. Weakness in the services ISM could strengthen the case for a rate cut in September. Other noteworthy data releases include U.S. Trade Balance, the S&P Global Composite PMI, the S&P Global Services PMI, Initial Jobless Claims, Nonfarm Productivity (preliminary), Unit Labor Costs (preliminary), and Consumer Credit. Market participants will also parse comments from several Fed officials following the disappointing jobs report and the central bank’s decision to leave rates unchanged. San Francisco Fed President Mary Daly, Boston Fed President Susan Collins, Fed Governor Lisa Cook, Atlanta Fed President Raphael Bostic, and St. Louis Fed President Alberto Musalem are scheduled to speak this week. Meanwhile, investors will look for any signals from the White House on a potential nominee to replace Adriana Kugler, after the Fed board member announced her resignation on Friday. President Trump told reporters on Sunday that he plans to announce a new Fed governor in the coming days. In addition, investors will await further news on tariff agreements after President Trump announced steeper levies for dozens of trading partners last week, though the majority are set to take effect from August 7th. U.S. Trade Representative Jamieson Greer said that those tariffs are likely to remain in place rather than be reduced as part of continuing negotiations. Today, investors will focus on U.S. Factory Orders data, which is set to be released in a couple of hours. Economists expect this figure to drop -4.9% m/m in June following a +8.2% m/m jump in May. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.244%, up +0.33%. In terms of a bias of lean today that's a bit tricky for me. Futures are up this morning, as I type and that makes sense after a big retrace like we had Friday however, I think there was some real structural damage done to the bull market last week. Will it really shake it all off today, as if it never happened? My lean is that today's pump in the futures is a natural reaction to Fridays selloff and as we settle a bit today we'll continue to see weakness prevail. Today may be a neutral day but the bearishness is still trying to take control. I'll give you a bit of insight into our potential earnings plays this week: PLTR: 2025-08-04 AMC - Palantir Technologies IncAvg Move: ±24.66% | Last: -14.9% | Implied: ±12.01% AMD: 2025-08-05 AMC - Advanced Micro Devices IncAvg Move: ±11.62% | Last: 4.9% | Implied: ±9.3% PFE: 2025-08-05 BMO - Pfizer IncAvg Move: ±3.64% | Last: 4.6% | Implied: ±4.82% BP: 2025-08-05 BMO - British PetroleumAvg Move: ±4.19% | Last: 1.6% | Implied: ±4.23% SMCI: 2025-08-05 AMC - Super Micro Computer IncAvg Move: ±15.18% | Last: 23.4% | Implied: ±13.12% MCD: 2025-08-06 BMO - McDonalds CorpAvg Move: ±3.26% | Last: 5.4% | Implied: ±3.78% DIS: 2025-08-06 BMO - Walt Disney CoAvg Move: ±5.54% | Last: 12.1% | Implied: ±6.39% UBER: 2025-08-06 BMO - Uber Technologies IncAvg Move: ±9.41% | Last: -6.7% | Implied: ±8.12% SHOP: 2025-08-06 BMO - Shopify IncAvg Move: ±13.12% | Last: -6.7% | Implied: ±11.91% ABNB: 2025-08-06 AMC - Airbnb IncAvg Move: ±10.04% | Last: 16.2% | Implied: ±8.15% Taking a look at the weekly expected move. It's a bit better than we've had but not much. Trade docket for today: /GC 0DTE , SPX 0DTE, NDX 0DTE, QQQ 0DTE, IWM 0DTE, VRTX, PLTR, FANG, PFE, CAT, YUM, LULU. Another big earnings week for us. Still not enough premium for 1HTE's on BTC. Let's look at intra-day levels on /ES: 6326, 6333, 6346 are nearest resistance levels with 6289 acting as first support. 6275 is the most interesting support for me. If we can break below that 6251 is next and that could continue to open up downside potential. I look forward to seeing you all back in the live trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

September 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |