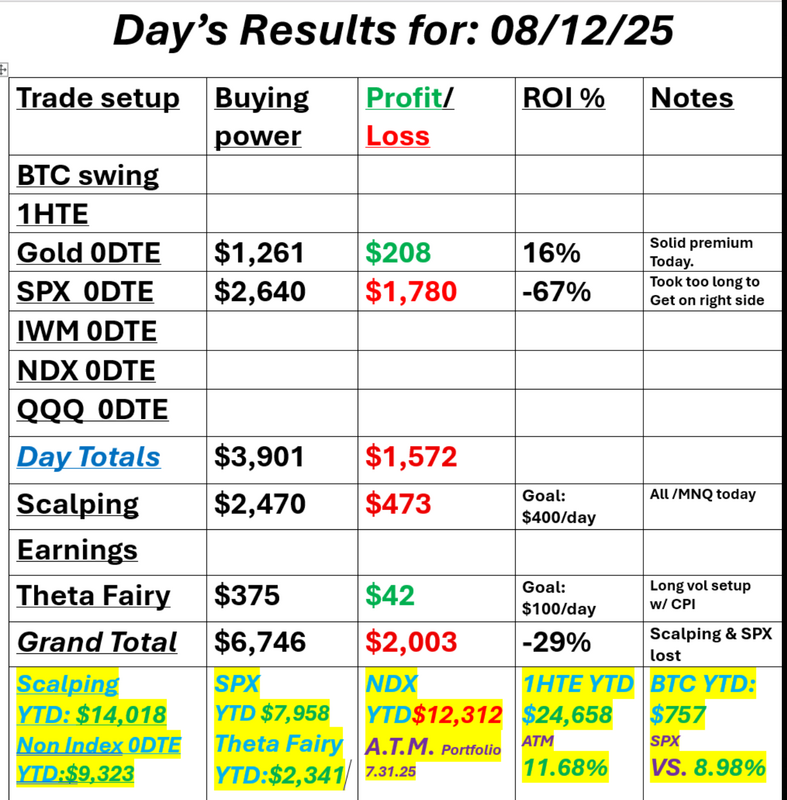

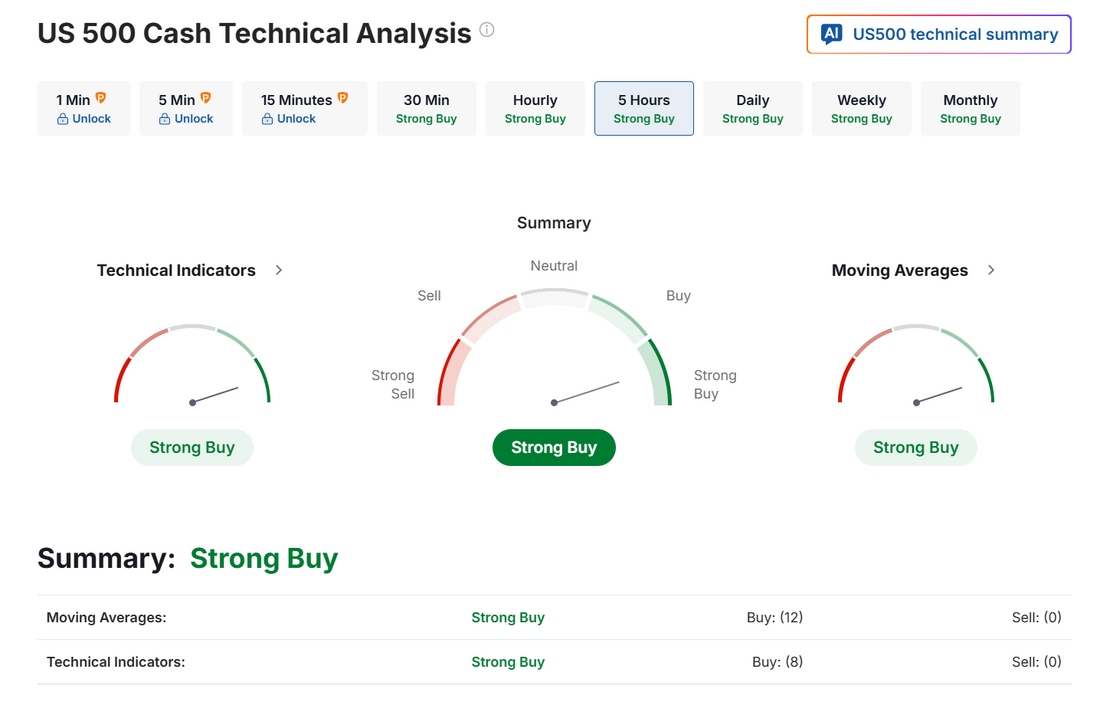

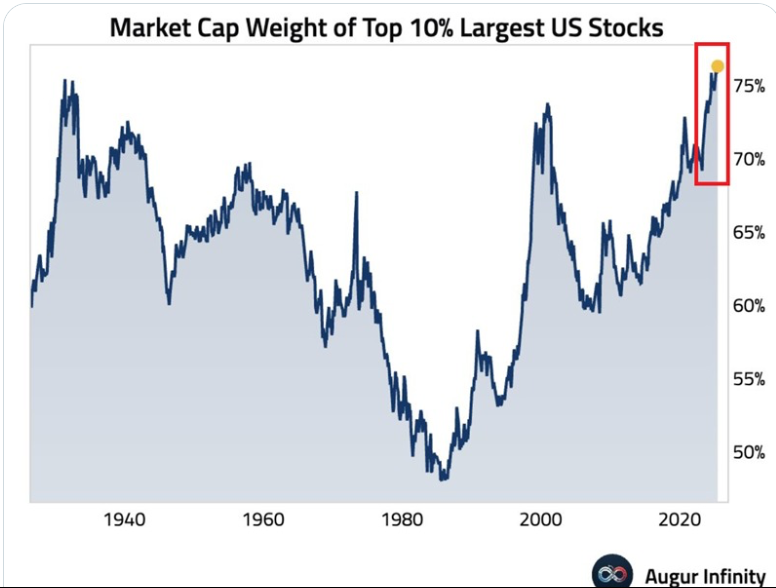

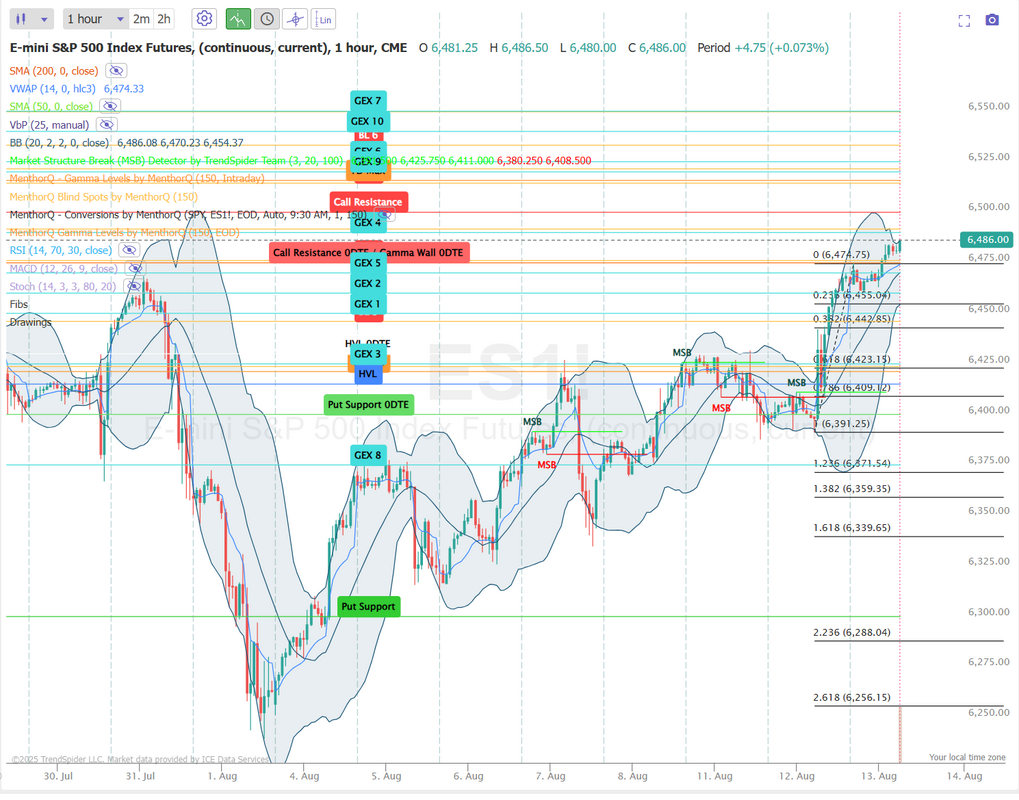

All clear for a rate cut?CPI came in below expectations and all bets are on now for a Sept. rate cut. PPI comes in tomorrow so there's still a bit of a potential overhang but it's looking clearer and clearer. Markets like it and the bullish bias is building. I had a losing day yesterday. I worked debits all day which means you have to be "right" and while I was right in the afternoon I wasn't right in the morning and the gains didn't cancel out the losses. Debits still seem the best approach for today. Here's a look at my day: We've got some FED speak today but most traders are looking towards tomorrows PPI. September S&P 500 E-Mini futures (ESU25) are trending up +0.24% this morning, extending yesterday’s gains as growing expectations for Federal Reserve interest rate cuts fueled risk-on sentiment. U.S. inflation data for July showed a modest increase in goods prices, reinforcing expectations that the Fed will resume rate cuts next month and move more aggressively to protect a labor market showing signs of strain. The data was accompanied by remarks from U.S. Treasury Secretary Scott Bessent, who suggested that the U.S. central bank should be open to a 50 basis-point rate cut in September. Optimism over a softer rate stance is further supported by easing global trade tensions and a much stronger-than-expected second-quarter earnings season in the U.S. In yesterday’s trading session, Wall Street’s three main equity benchmarks closed sharply higher. The Magnificent Seven stocks advanced, with Meta Platforms (META) rising over +3% and Microsoft (MSFT) gaining more than +1%. Also, chip stocks gained ground, with NXP Semiconductors N.V. (NXPI) climbing over +7% to lead gainers in the Nasdaq 100 and ON Semiconductor (ON) rising more than +6%. In addition, airline stocks surged after oil prices declined, with United Airlines (UAL) jumping over +10% to lead gainers in the S&P 500. On the bearish side, Cardinal Health (CAH) slumped more than -7% and was the top percentage loser on the S&P 500 after the drug distributor posted weaker-than-expected FQ4 revenue and announced it had agreed to acquire Solaris Health for $1.9 billion in cash. The U.S. Bureau of Labor Statistics report released on Tuesday showed that consumer prices rose +0.2% m/m in July, in line with expectations. On an annual basis, headline inflation rose +2.7% in July, the same as the previous month and slightly weaker than expectations of +2.8%. Also, the core CPI, which excludes volatile food and fuel prices, rose +0.3% m/m and +3.1% y/y in July, compared to expectations of +0.3% m/m and +3.0% y/y. “Inflation is on the rise, but it didn’t increase as much as some people feared. In the short term, markets will likely embrace these numbers because they should allow the Fed to focus on labor-market weakness and keep a September rate cut on the table,” said Ellen Zentner at Morgan Stanley Wealth Management. Richmond Fed President Tom Barkin said on Tuesday that uncertainty about the U.S. economy’s trajectory is easing, but it remains unclear whether the central bank should place greater focus on curbing inflation or supporting the labor market. “We may well see pressure on inflation, and we may also see pressure on unemployment, but the balance between the two is still unclear. As the visibility continues to improve, we are well-positioned to adjust our policy stance as needed,” Barkin said. At the same time, Kansas City Fed President Jeff Schmid said he supports holding interest rates steady for now to prevent strong economic activity from adding to inflation pressures. “With the economy still showing momentum, growing business optimism, and inflation still stuck above our objective, retaining a modestly restrictive monetary policy stance remains appropriate for the time being,” Schmid said. He added that he is prepared to shift his stance if demand growth begins “weakening significantly.” Meanwhile, U.S. rate futures have priced in a 96.2% chance of a 25 basis point rate cut and a 3.8% chance of no rate change at the conclusion of the Fed’s September meeting. Today, investors will hear perspectives from Richmond Fed President Tom Barkin, Chicago Fed President Austan Goolsbee, and Atlanta Fed President Raphael Bostic. On the earnings front, network infrastructure provider Cisco Systems (CSCO) is set to report its FQ4 earnings results today. On the economic data front, investors will focus on U.S. Crude Oil Inventories data, which is set to be released later in the day. Economists expect this figure to be -0.900M, compared to last week’s value of -3.029M. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.256%, down -1.21%. My lean or bias today is bullish. We've got new ATH's across the board! The Equal-Weighted Indexes are firing warning signals a major top is forming, which will likely commence the severest bear market since the 2008 GFC. It's official: The top 10% largest US stocks now reflect a record 76% of the US equity market. This has officially surpassed the previous record set before the Great Depression in the 1930s. By comparison, at the 2000 Dot-Com Bubble peak, the top 10%'s share was at ~73%. In the 1980s, this figure was below 50%. Meanwhile, the top 10 stocks in the S&P 500 now represent a record 40% of the index’s market cap. We are witnessing history. Is the market about to correct? My official stance is "who knows?" but... I can say, at these levels its probably a good idea to have a downside hedge. Trade docket for today: We've got out long vol Theta fairy again and I may let that run today to maximize potential. Our Gold 0DTE put side entry already filled and the call side is still working. SPX 0DTE again, focused on debit entries. Back on /MNQ futures for scalping. CENT is in a take profit zone. Let's take a look at our new intra-day zones on /ES after reaching a new ATH. 6500 is the new resistance target with 6514 above that. 6475 is support with 6455 below that. I look forward to seeing you all in the live trading room shortly. Let's get a win today!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |