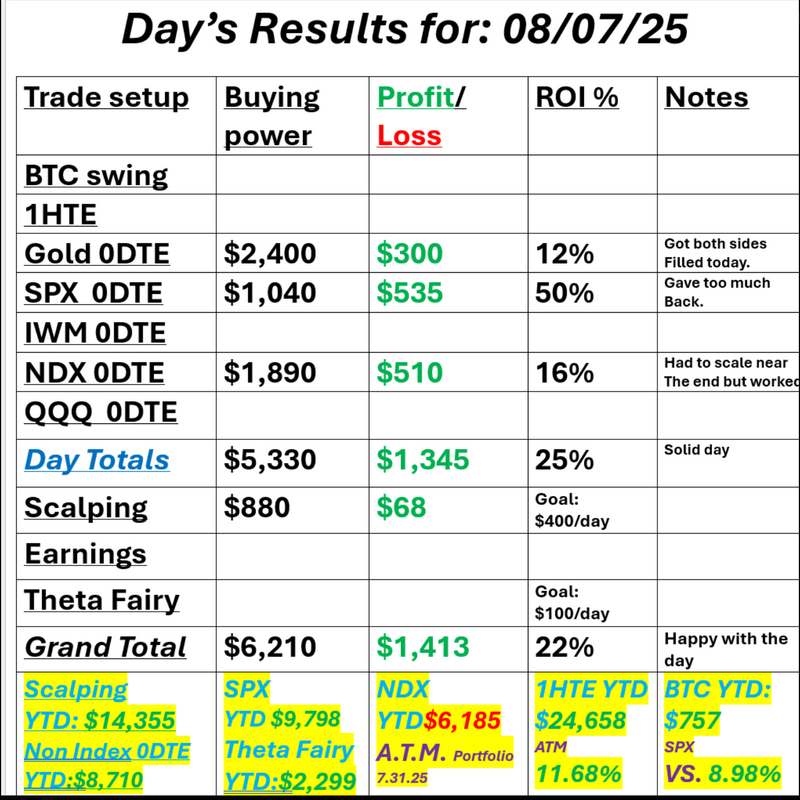

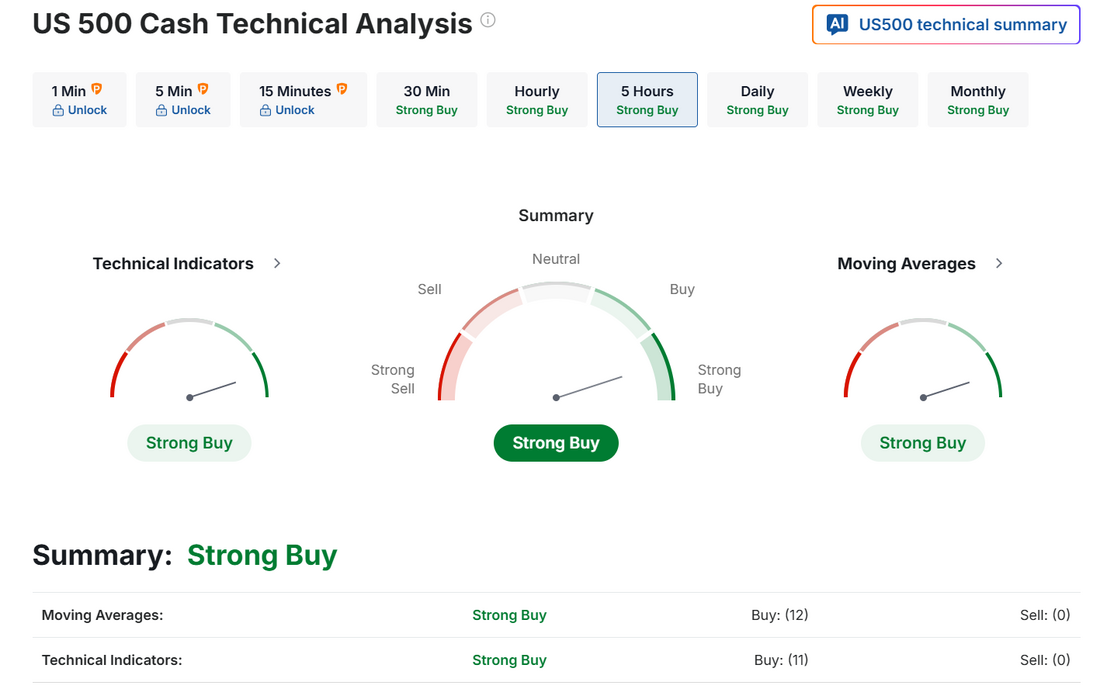

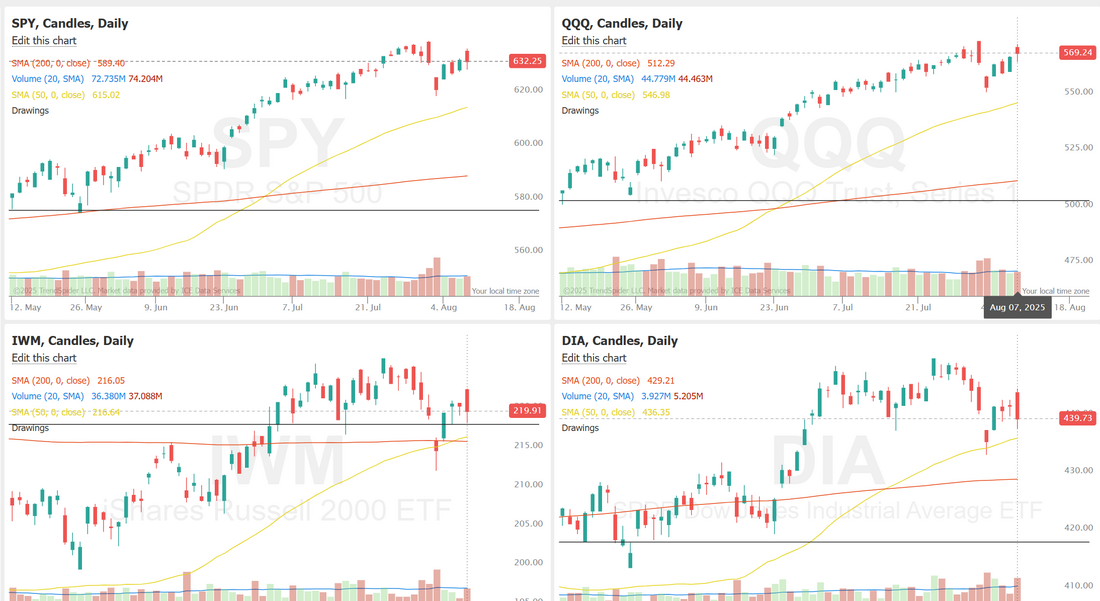

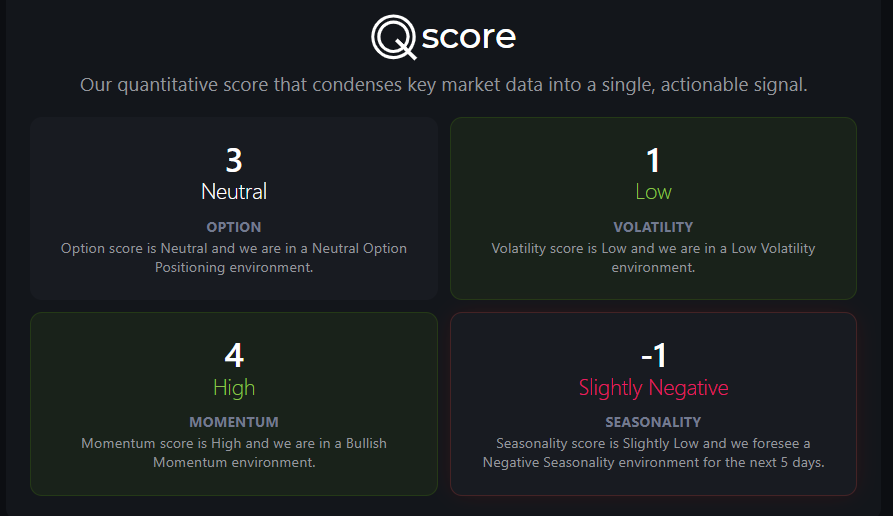

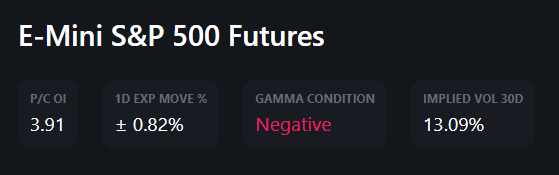

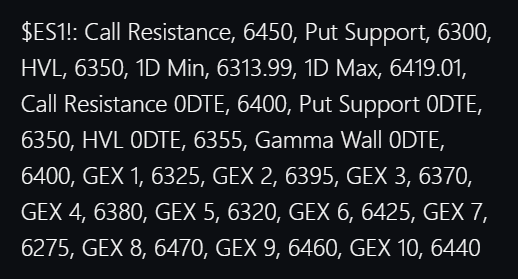

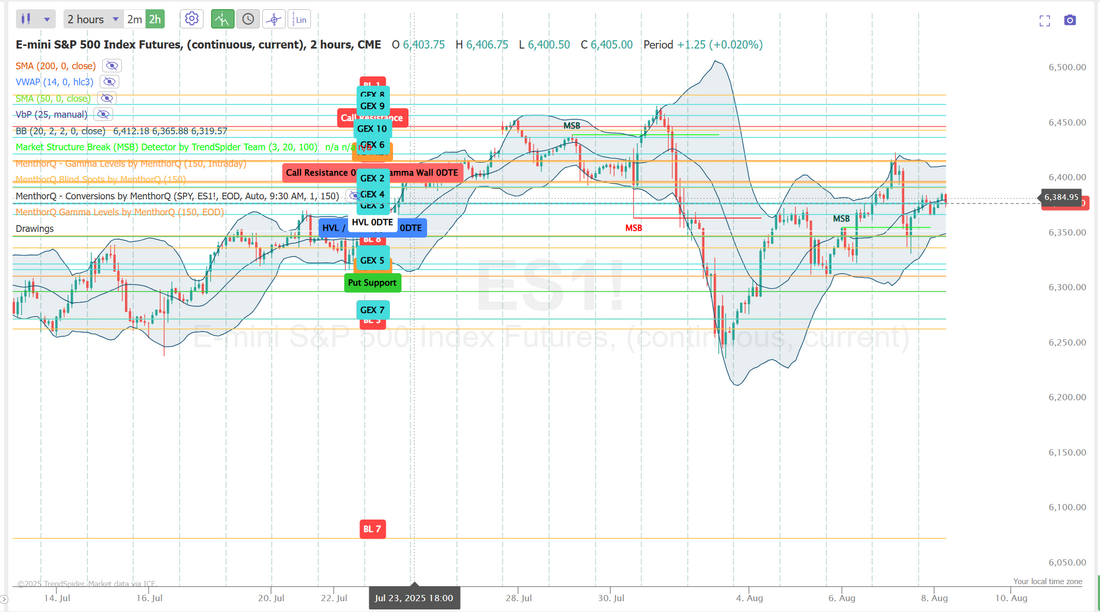

Now gold is tariffed?Most of you who trade with us know that we have a daily income goal of $1,000 dollars and our Gold 0DTE's generally can bring in 10-20% of that so it's frustrating when we can't get a setup working. Last night was NOT that! We got plenty of premium out of todays setup. Yesterday was a solid day for us. Debits all day long. I gave back a lot on the SPX setup but it still ended up well. Let's take a look at the markets: We start the day with a bullish lean but the price action doesn't look that impressive. My lean or bias today is bearish. I think we get a drawdown. Futures are up as I type. Trade docket for today: Gold 0DTE, ADMA, EHAB, FANG, KFS, PLTR, VRTX flip to a bullish zebra. SPX/NDX 0DTE September S&P 500 E-Mini futures (ESU25) are trending up +0.32% this morning, capping a week dominated by tariff and geopolitical developments, as well as a wave of earnings, with investors weighing U.S. President Donald Trump’s efforts to tighten his grip on the Federal Reserve. Gold futures in New York jumped after a Financial Times report said that U.S. imports of one-kilogram bullion bars are now subject to tariffs, posing a threat to trade flows from Switzerland and other major refining hubs. The most-active contract rose to a record intraday high above $3,534 an ounce. Late Thursday, President Trump said he had selected Council of Economic Advisers Chairman Stephen Miran to serve as a Fed governor. Mr. Trump said that Miran, who must be confirmed by the Senate, would serve only the remainder of Adriana Kugler’s term, which ends in January. In yesterday’s trading session, Wall Street’s major indices ended mixed. Fortinet (FTNT) plummeted over -22% and was the top percentage loser on the S&P 500 and Nasdaq 100 after the cybersecurity firm was hit with multiple downgrades and price target cuts following the release of its Q2 results and guidance. Also, Eli Lilly (LLY) plunged more than -14% after the drugmaker reported disappointing data on its new weight-loss pill. In addition, Caterpillar (CAT) fell over -2% after Morgan Stanley downgraded the stock to Underweight from Equal Weight with a price target of $350. On the bullish side, chip stocks climbed after President Trump said firms that relocate production to the U.S. will be exempt from the proposed 100% tariff on chip imports, with Advanced Micro Devices (AMD) rising more than +5% and Lam Research (LRCX) gaining over +3%. The Labor Department’s report on Thursday showed that the number of Americans filing for initial jobless claims in the past week rose by 7K to 226K, compared with the 221K expected. Also, U.S. Q2 nonfarm productivity rose +2.4% q/q, stronger than expectations of +1.9% q/q, and unit labor costs rose +1.6% q/q, in line with expectations. In addition, U.S. consumer credit rose by $7.37 billion in June, weaker than expectations of $7.40 billion. “With the jobless claims beginning to rise again, this adds to concerns about the employment picture that were raised last week,” said Matt Maley, chief market strategist at Miller Tabak + Co. Atlanta Fed President Raphael Bostic said on Thursday that he still sees one rate cut as likely this year, and reiterated that there are reasons to doubt that the inflationary effects from tariffs will be short-lived. “This question about whether tariffs are a one-time thing, or whether they’re going to be more persistent in their effects and might even cause structural changes, I think is perhaps the most important question that we have today,” Bostic said. In other news, Bloomberg reported that Fed Governor Christopher Waller is emerging as a top candidate to become the central bank’s chair among President Trump’s advisers as they seek a successor to Jerome Powell. Meanwhile, U.S. rate futures have priced in an 89.4% probability of a 25 basis point rate cut and a 10.6% chance of no rate change at the September FOMC meeting. The U.S. economic data slate is empty on Friday. However, investors will focus on a speech from St. Louis Fed President Alberto Musalem. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.249%, down -0.16%. Let's take a look at the intra-day levels in /ES. Quant score is more neutral. Negative gamma. We could get some movement. 6399 and 6418 are resistance with 6370, 6358, 6348 working as support. Let's finish strong today folks. See you all in the live trading room!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |