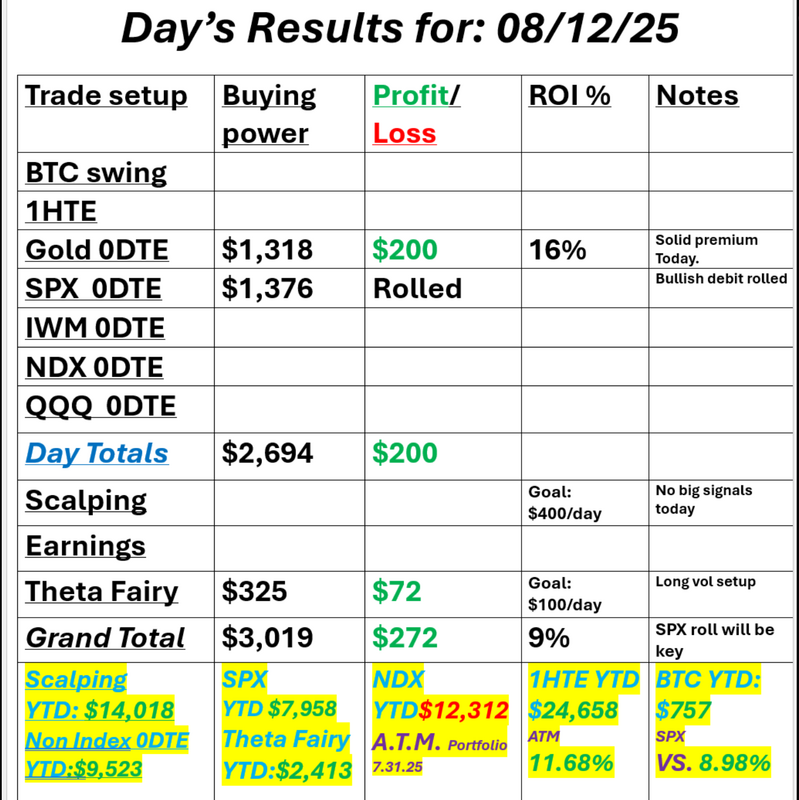

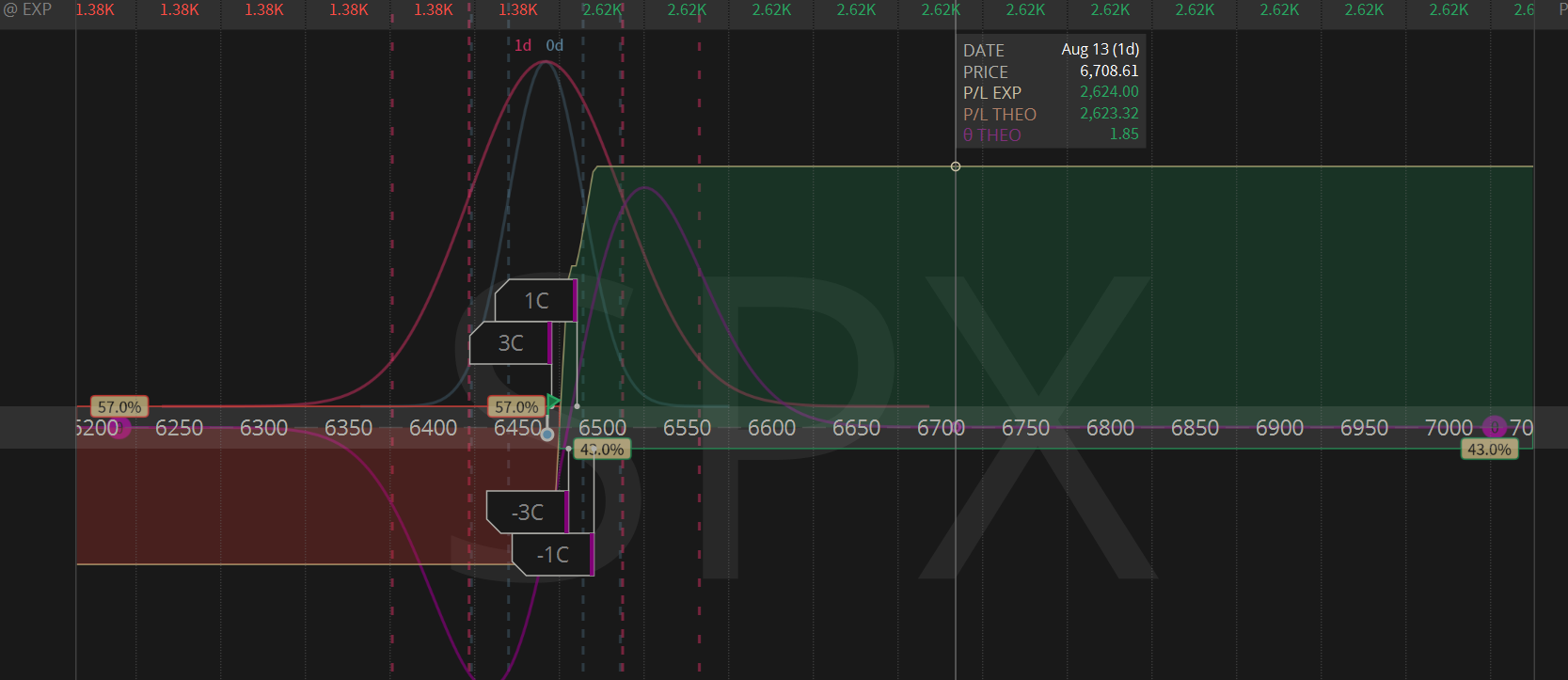

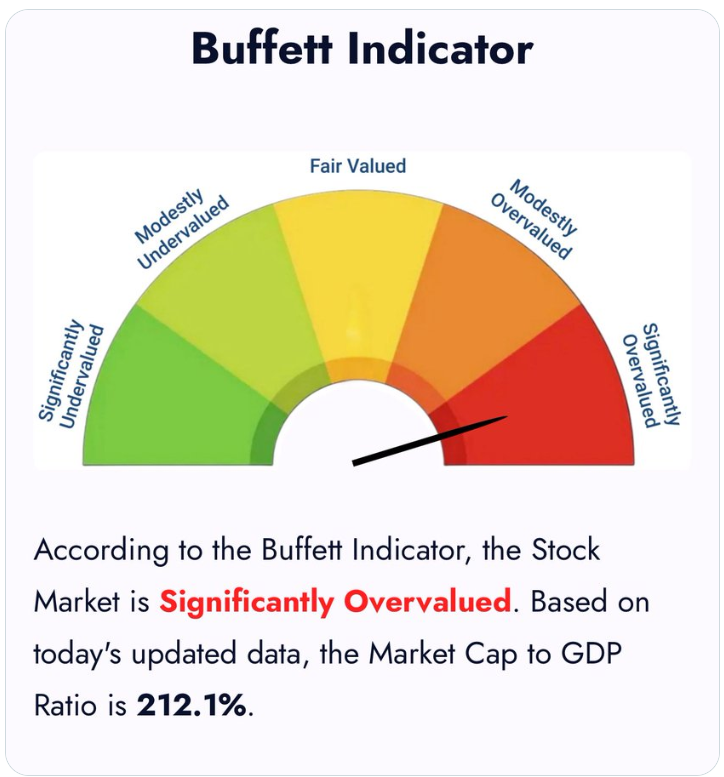

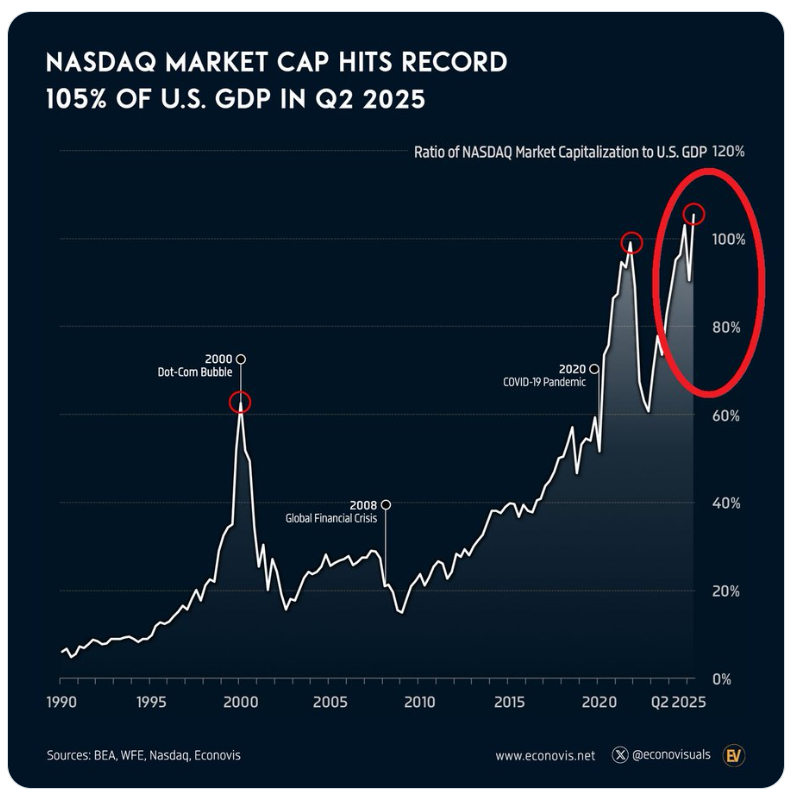

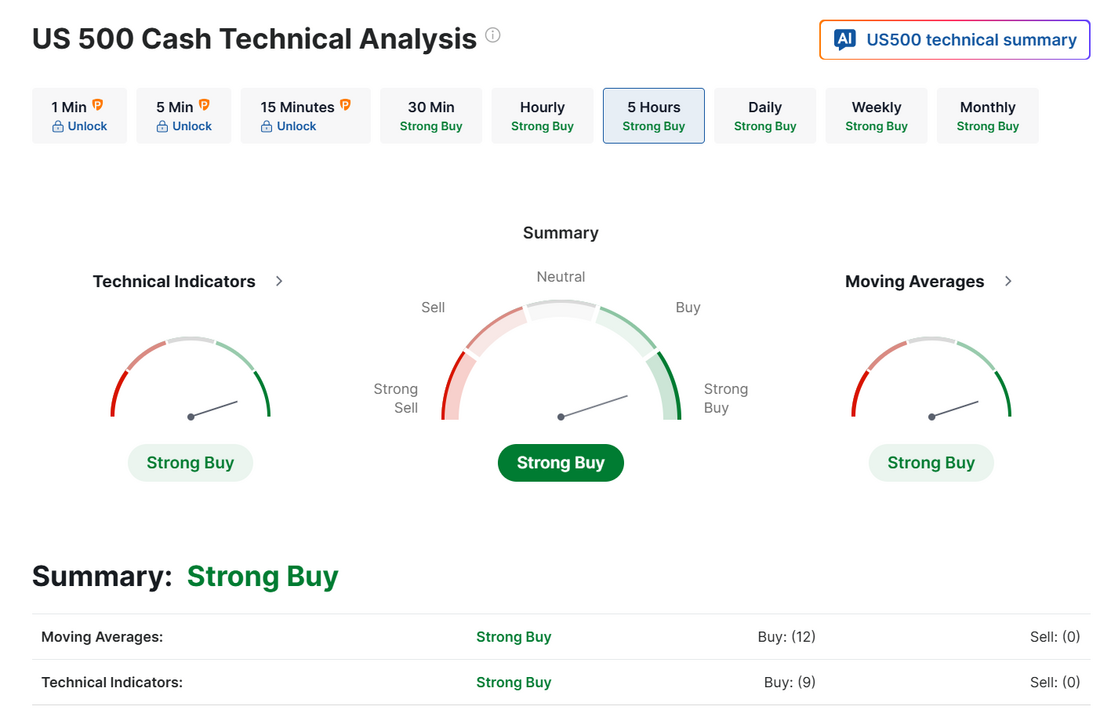

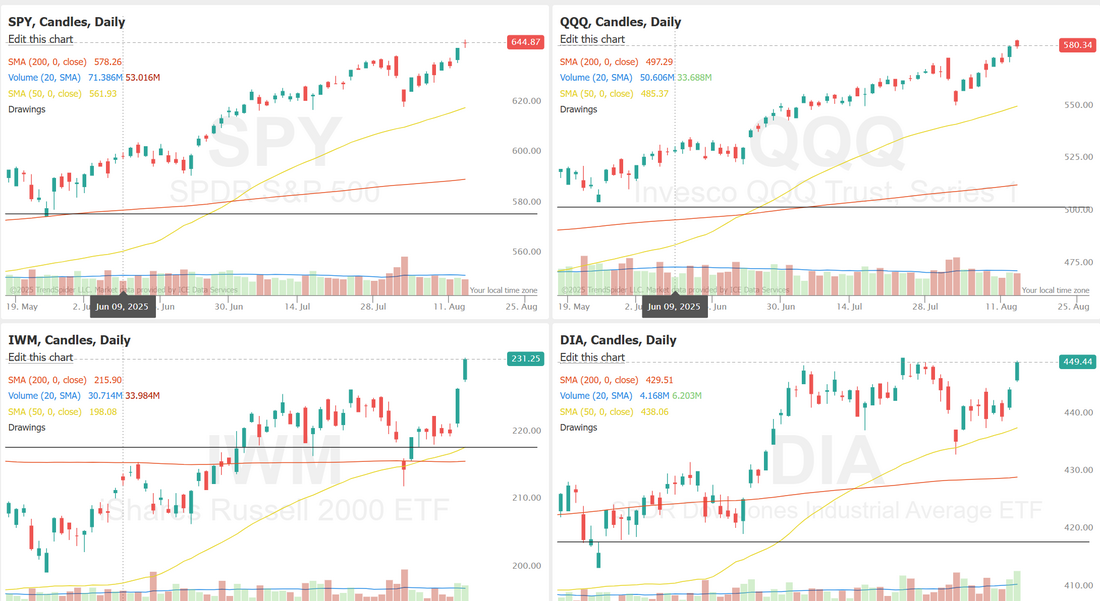

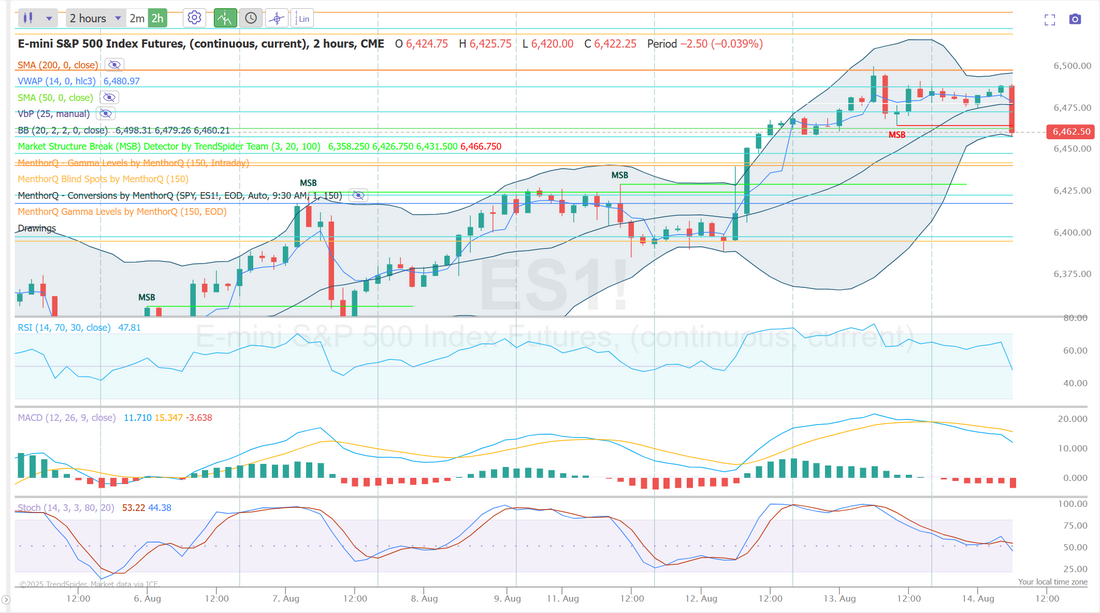

CPI down...PPI incomingMarket prognosticators are betting on a near certain rate cut come Sept. after a mild CPI. PPI will either confirm or deny that today but most market watchers think this should be enough data for the FED to take action. We didn't get any scalps working yesterday and our SPX was rolled to today so we only had our Theta fairy and Gold 0DTE to show for our efforts. Still...all in all, not a bad day. See our results below. Our SPX debit will be our key starting point today. It a bullish debit with two different tranches. It's got plenty of profit potential if we push higher. That would make for an easy day. If we drop we'll need to do some hedging. September S&P 500 E-Mini futures (ESU25) are down -0.02%, and September Nasdaq 100 E-Mini futures (NQU25) are down -0.08% this morning, taking a breather after recent gains, while investors look ahead to crucial U.S. producer inflation data for insight into how aggressively the Federal Reserve may cut interest rates. Today’s PPI data “could be make or break to cement a 25 basis-point rate cut from the Fed, or even to encourage the possibility of a jumbo cut,” said Andrea Gabellone, head of global equities at KBC Securities. In yesterday’s trading session, Wall Street’s major indexes ended in the green, with the S&P 500 and Nasdaq 100 posting new record highs. Chip stocks climbed amid growing expectations for Fed rate cuts, with Advanced Micro Devices (AMD) rising over +5% and NXP Semiconductors N.V. (NXPI) gaining more than +4%. Also, Amazon.com (AMZN) advanced over +1% after announcing plans to expand its same-day grocery delivery service to 2,300 cities by the end of the year. In addition, Intapp (INTA) surged more than +15% after the AI cloud company posted upbeat FQ4 results and announced a $150 million stock buyback. On the bearish side, CoreWeave (CRWV) tumbled more than -20% after the AI cloud vendor reported a wider-than-expected Q2 loss. Chicago Fed President Austan Goolsbee said on Wednesday that the central bank’s meetings this fall will be “live,” as he and his colleagues work to interpret mixed economic data and determine how best to adjust interest rates in response. “As we go into the fall, these are going to be some live meetings and we’re going to have to figure it out,” Goolsbee said. At the same time, Atlanta Fed President Raphael Bostic said he still considers one interest rate cut appropriate in 2025 if the labor market remains solid. Meanwhile, U.S. rate futures have priced in a 100% chance of a 25 basis point rate cut at September’s monetary policy meeting. Today, all eyes are focused on the U.S. Producer Price Index, which is set to be released in a couple of hours. Economists, on average, forecast that the U.S. July PPI will stand at +0.2% m/m and +2.5% y/y, compared to the previous figures of unchanged m/m and +2.3% y/y. The U.S. Core PPI will also be closely monitored today. Economists expect July figures to be +0.2% m/m and +2.9% y/y, compared to June’s numbers of unchanged m/m and +2.6% y/y. U.S. Initial Jobless Claims data will be released today as well. Economists estimate this figure will come in at 225K, compared to last week’s number of 226K. In addition, market participants will be looking toward a speech from Richmond Fed President Tom Barkin. On the earnings front, notable companies like Applied Materials (AMAT) and Deere & Company (DE) are scheduled to report their quarterly figures today. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.209%, down -0.68%. I will present this without comment. There's not a lot to find out there that makes this market look cheap. Technicals still look bullish. Markets continue to hold these nose bleed levels. Trade docket for today: We've got a long Theta fairy working going into PPI this morning. We've got a 1DTE Gold trade working now. We couldn't get enough premium from a 0DTE. We've got the SPX 0DTE that was rolled from yesterday. PPI should be the driver. Our SPX will likely be our main focus today. Let's take a look at intra-day levels on /ES: PPI came in worse than expected creating a bearish open. 6490 and 6500 are still the resistance areas. 6466, 6450, 6443, 6431 are support levels. I look forward to seeing you all in the live trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |