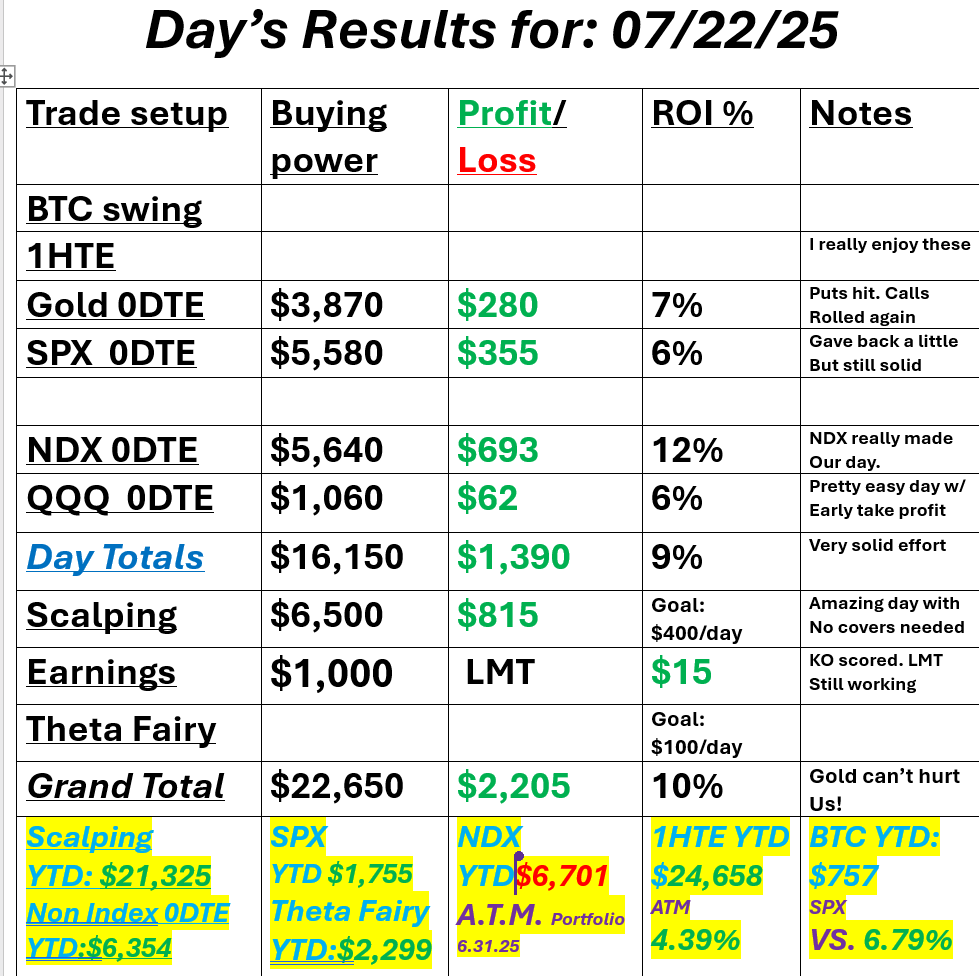

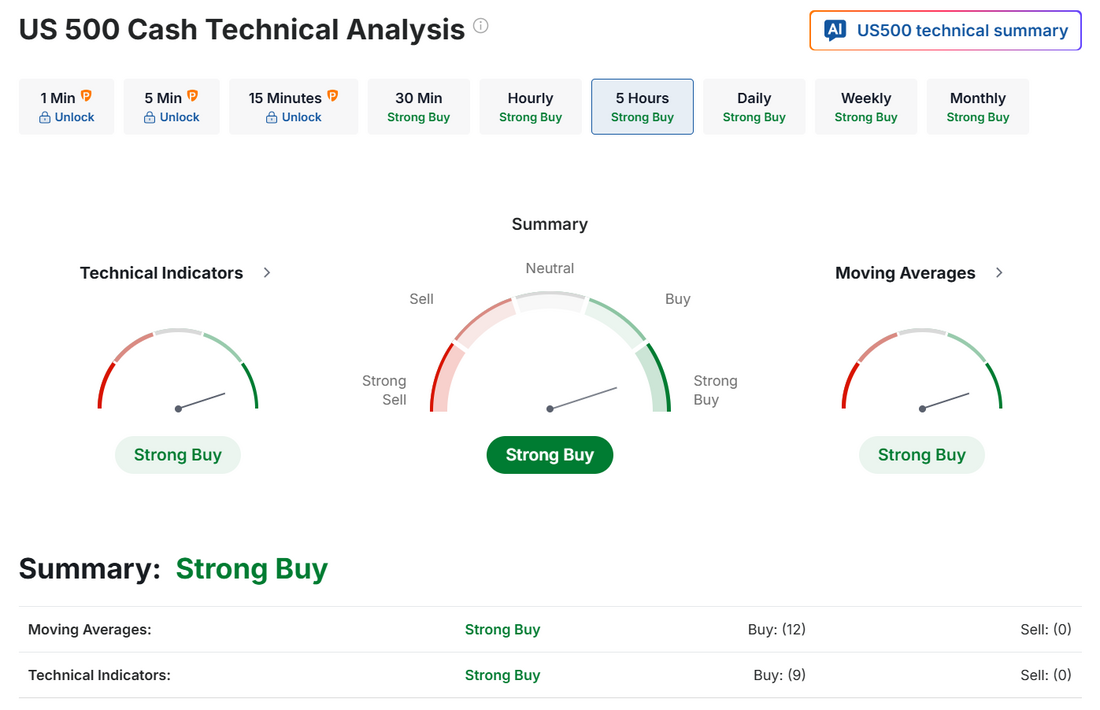

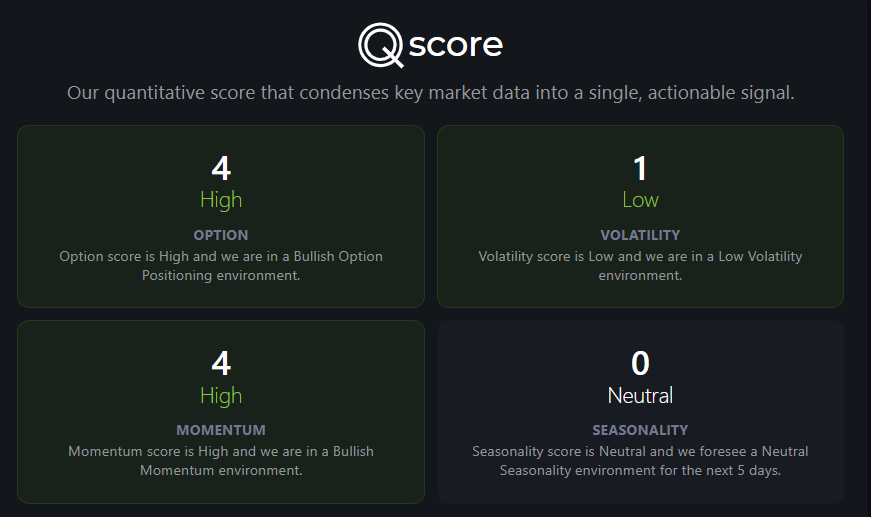

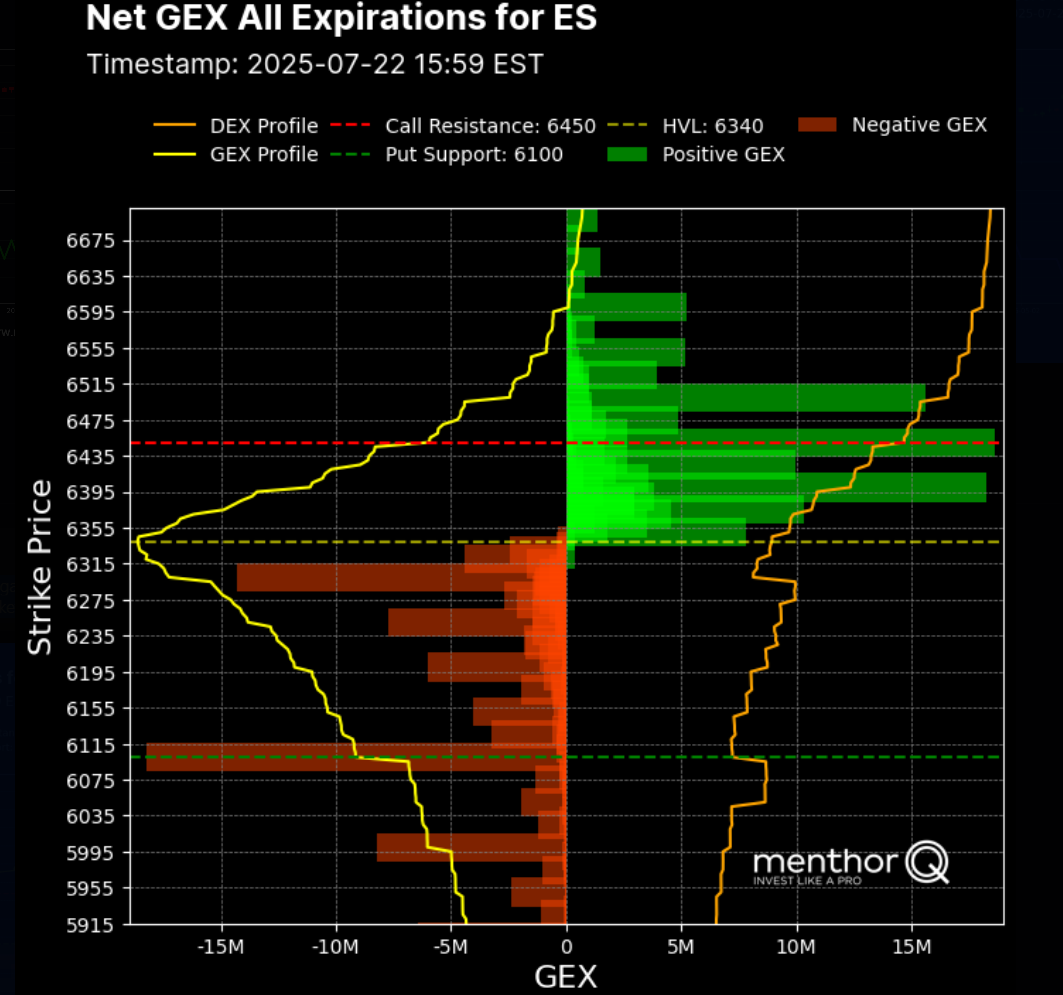

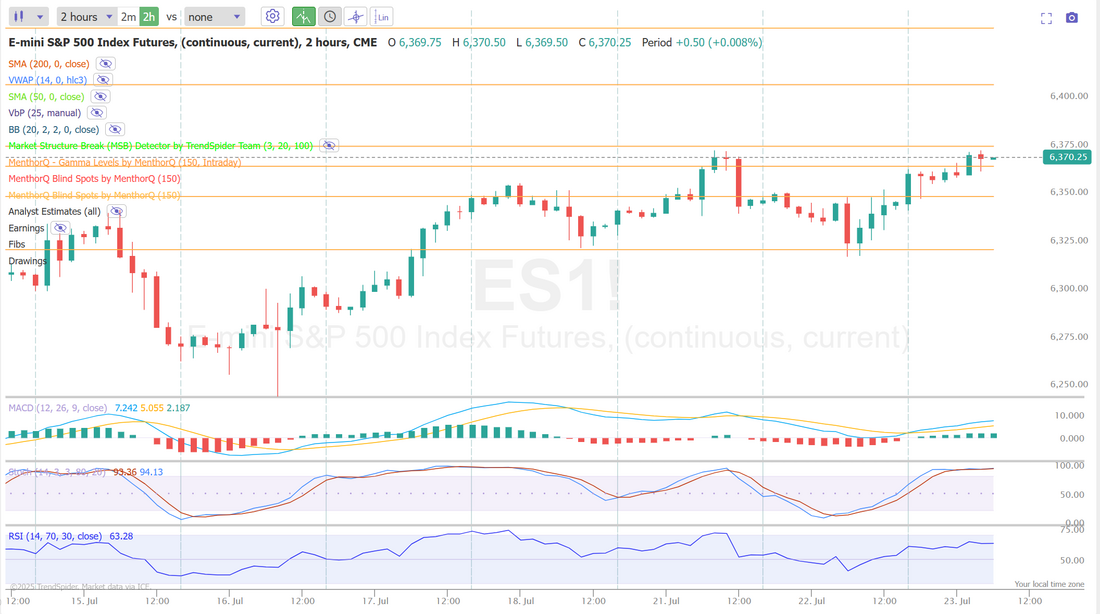

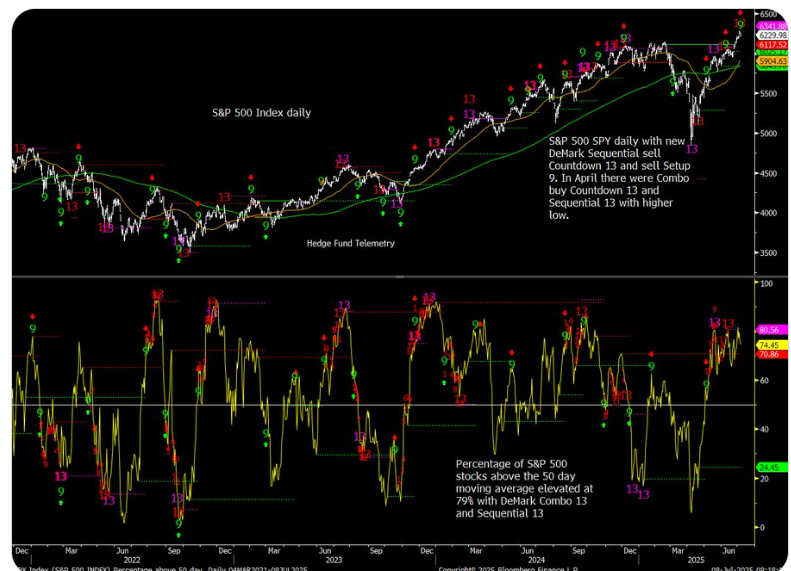

Trade deals incomingSeveral big trade deals announced with Japan leading the way. People like to derisively use the TACO acronym but not today. With 100+ billion having been poured into the U.S. treasury and looking like half a trillion a year coming in overall Trump is accomplishing what he set out to do. You can say the bulk of that cost is carried by the U.S. consumer but what I think is more interesting are the concessions he's getting out of these deals. While it's debatable about whether the tariffs are a good/bad deal for consumers, there's no debate he's strengthened the U.S. position in global trade. Markets like the news and futures are up. We had an absolutely stellar day yesterday. I say stellar because we continue to chase our Gold call side 0DTE with another roll higher and our LMT earnings trade also drug our net liq down. It was a battle all day but our traders who stuck it out ended the day up! Net liq was once again green. It was an all day effort but it paid off. Here's a look at our days results. Let's take a look at the market: With trade deals starting off the day everything continues to look bullish. Gamma continues to be positive and bullish Quant score is bullish Gamma walls continue to be skewed to more downside than upside percentage wise. Intra-day /ES levels: 6376 is first resistance with 6408 next. 6365 is first support with 6350 and 6322 next. Maybe this isn't the place you want to be adding longs? We continue to add bearish positions to our ATM portfolio, which is performing right in line with expectations. September S&P 500 E-Mini futures (ESU25) are up +0.39%, and September Nasdaq 100 E-Mini futures (NQU25) are up +0.19% this morning as sentiment got a boost after the U.S. announced a trade deal with Japan. U.S. President Donald Trump said in a post on Truth Social late Tuesday that the U.S. will impose a 15% tariff on Japanese goods, including autos, which is lower than the 25% rate he had previously threatened in a letter to the Japanese government. The deal will also see Japan invest $550 billion into the U.S. The U.S. also struck a deal with the Philippines, setting a 19% tariff on the nation’s exports. In addition, President Trump unveiled further details about a pact with Indonesia. However, gains in U.S. equity futures are limited amid investor caution ahead of earnings from “Magnificent Seven” companies Tesla and Alphabet. Higher bond yields today are also weighing on stock index futures. In yesterday’s trading session, Wall Street’s major indexes closed mixed. IQVIA Holdings (IQV) surged over +17% and was the top percentage gainer on the S&P 500 after the company reported stronger-than-expected Q2 results. Also, Paccar (PCAR) climbed more than +6% and was the top percentage gainer on the Nasdaq 100 after the company posted better-than-expected Q2 results. In addition, D.R. Horton (DHI) jumped over +16% after the homebuilder reported upbeat FQ3 results. On the bearish side, Lockheed Martin (LMT) slumped over -10% and was the top percentage loser on the S&P 500 after the defense contractor posted weaker-than-expected Q2 revenue and cut its full-year EPS guidance. Economic data released on Tuesday showed that the U.S. Richmond Fed manufacturing index unexpectedly fell to an 11-month low of -20 in July, weaker than expectations of -2. Second-quarter corporate earnings season is in full swing, with all eyes today on reports from two of this year’s laggards among the Magnificent Seven — Tesla (TSLA) and Alphabet (GOOGL). Investors will also monitor earnings reports from other prominent companies such as T-Mobile US (TMUS), International Business Machines (IBM), ServiceNow (NOW), AT&T (T), Thermo Fisher Scientific (TMO), and Chipotle Mexican Grill (CMG). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +3.2% increase in quarterly earnings for Q2 compared to the previous year, slightly above the pre-season forecast of +2.8%. On the economic data front, investors will focus on U.S. Existing Home Sales data, which is set to be released in a couple of hours. Economists, on average, forecast that June Existing Home Sales will stand at 4.00M, compared to 4.03M in May. U.S. Crude Oil Inventories data will be released today as well. Economists expect this figure to be -1.400M, compared to last week’s value of -3.859M. U.S. rate futures have priced in a 95.3% chance of no rate change and a 4.7% chance of a 25 basis point rate cut at next week’s policy meeting. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.381%, up +1.04%. Trade docket for today: /GC 0DTE, /HG next tranche addition, LMT continued work, GOOG earnings trade, QQQ 0DTE, SPX 0DTE, Possible NDX 0DTE again. These have been some of our biggest gainers lately. Possible /MNQ scalp again. Our scalping results yesterday were amazing considering we used /MNQ vs. QQQ options and never covered. No 1HTE's the rest of this week. I'm working remote on my laptop and don't have my screens to watch it. My bias or lean today is slightly bullish....hard not to be. Yesterday was amazing effort folks. I look forward to seeing what we can accomplish today. See you soon in the trading room.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |