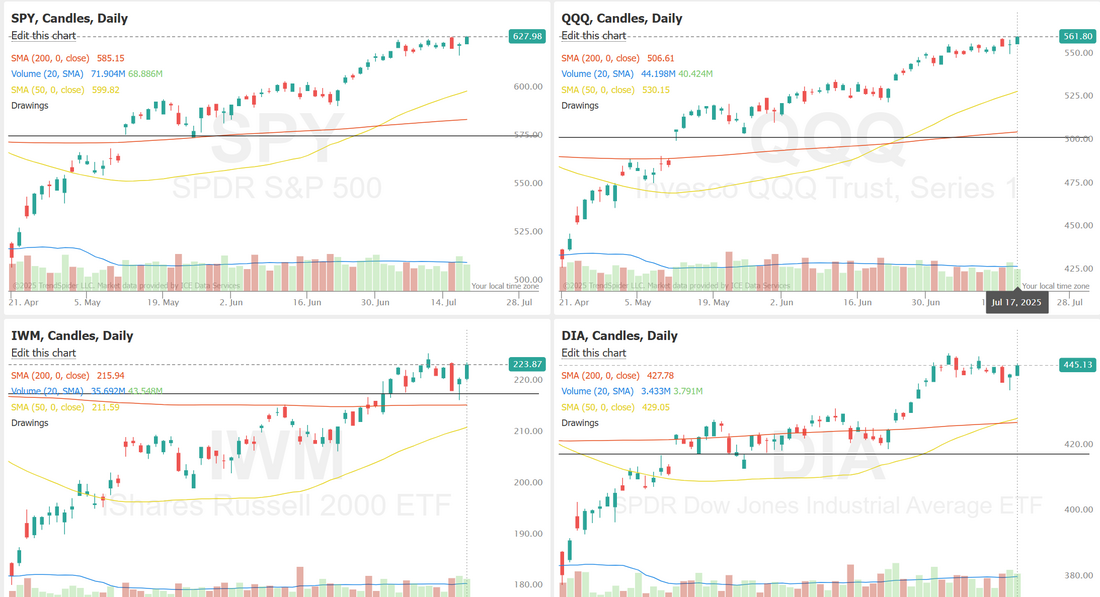

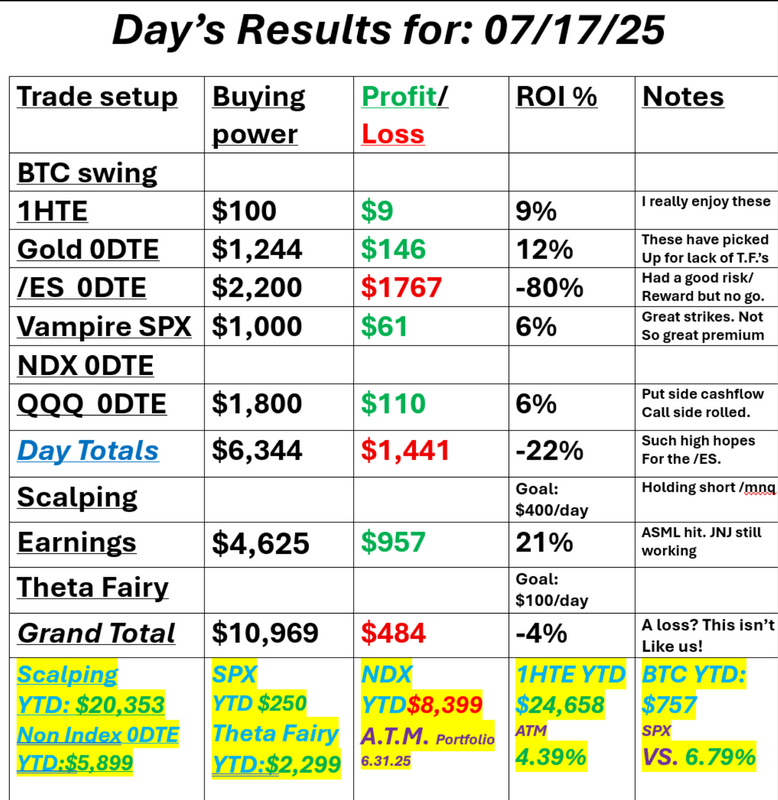

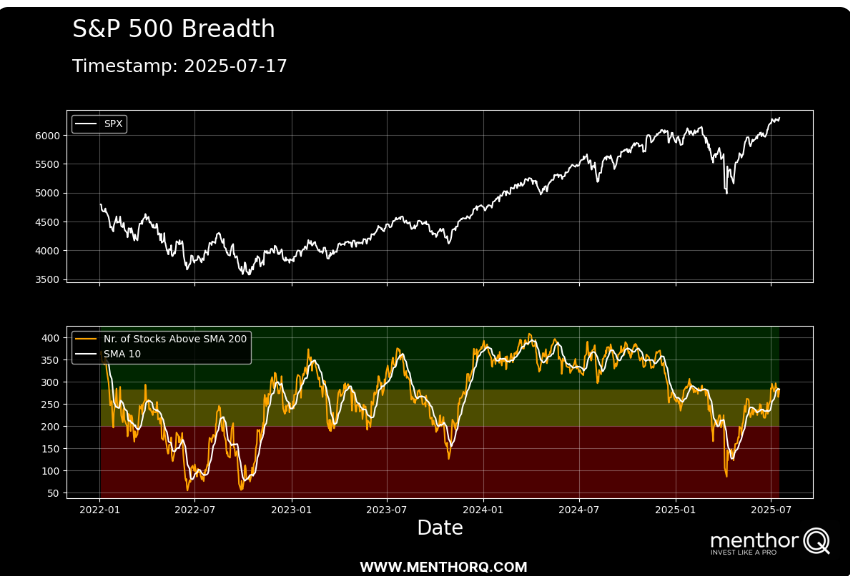

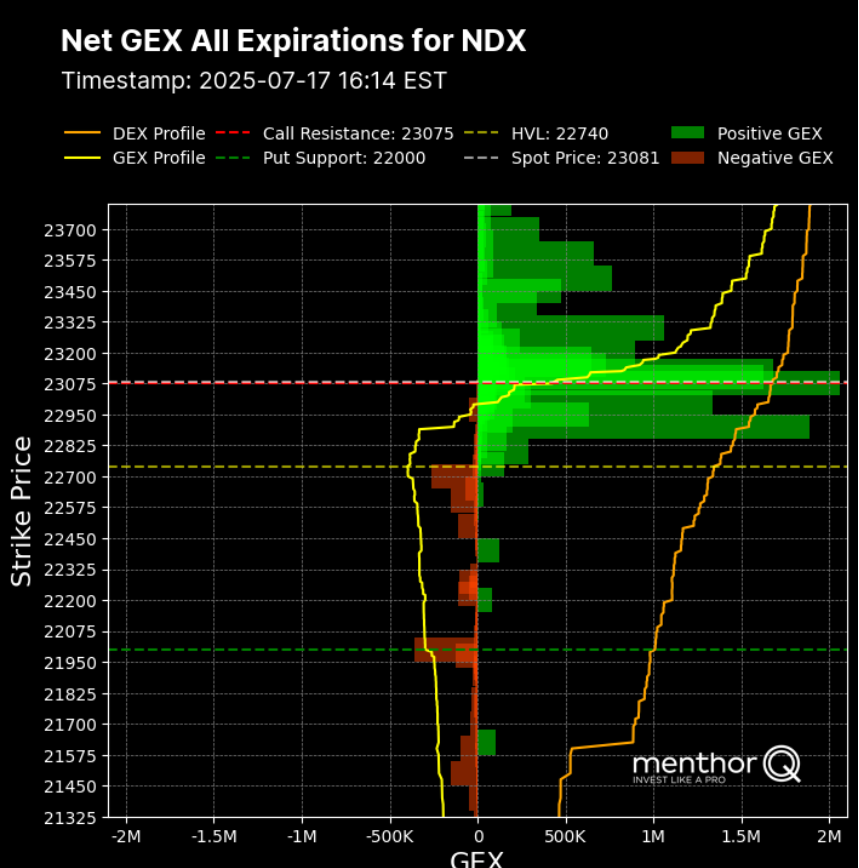

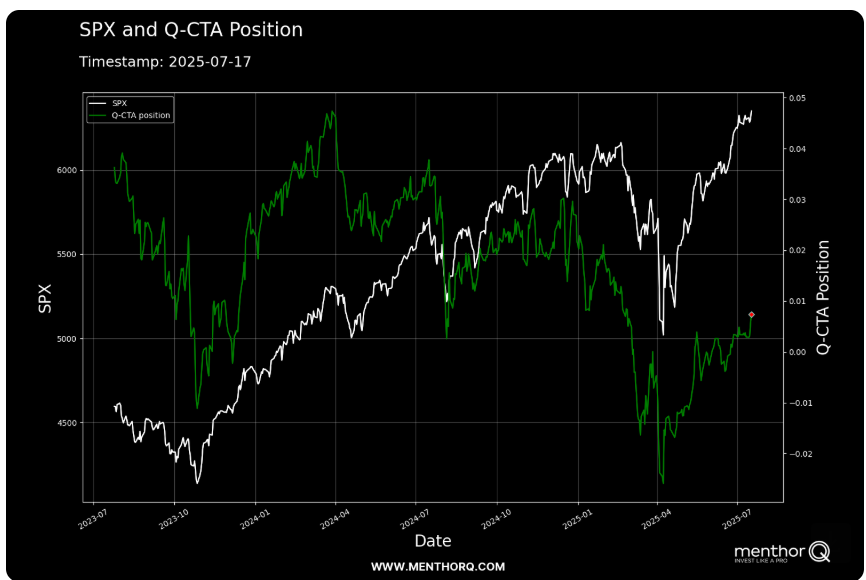

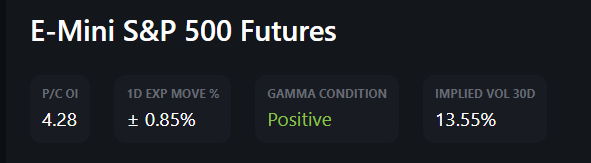

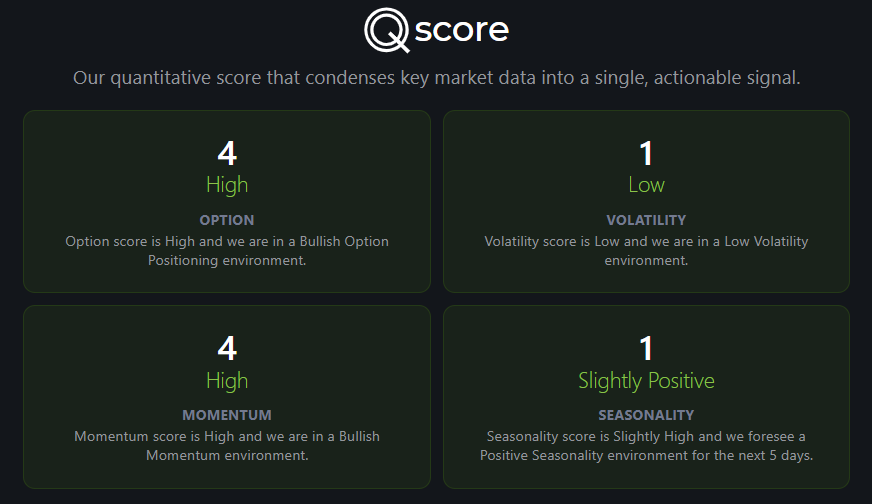

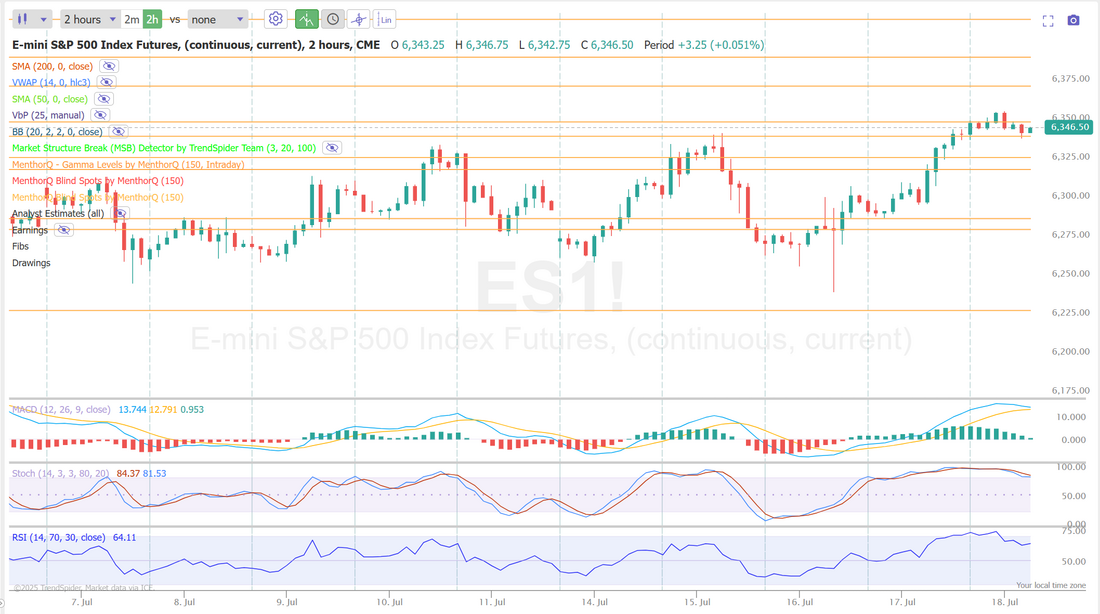

Are the bulls back?After several weeks of treading water the bulls had a slight breakout yesterday. It puts us right back up to those ATH's and what looks like some serious resistance. We had an "O.K." day yesterday. There are two facets to our day. #1. What did we generate cash flow wise on the day and #2. What did our net liq do? The cash flow is in our control. The net liq, not so much. What we hold will go up and down as it pleases so until that is realized we don't count it. Our net liq was good yesterday but our cash flow was negative. Our much vaulted /ES trade lost. Even up to the end it still had decent risk/reward of about 1to1 but in hindsight we should have just booked a profit when it was up $300 dollars. Lesson learned. Here's a look at our day: The S&P 500 breadth chart as of July 17, 2025, shows a noteworthy rebound in participation, with the number of stocks above their 200-day moving average rising steadily toward the mid-range zone. This uptick in breadth suggests improving internal market strength after a prolonged period of weakness earlier this year. The short-term 10-day moving average of breadth has also turned upward, reinforcing near-term momentum. While SPX itself remains near all-time highs, broader participation may lend support to the trend if sustained, indicating healthier market undercurrents in the immediate term. The Net GEX chart for NDX as of July 17, 2025, indicates a concentrated zone of positive gamma exposure just above the current spot price of 23,081, with notable resistance around the 23,075 strike reinforced by high call open interest. This suggests the index may be approaching a region of hedging-driven dampened volatility. Meanwhile, strong put support near 22,000 adds a potential downside buffer. With HVL marked at 22,740 and most gamma concentrated between this level and current price, the short-term range appears technically well-defined, offering insight into potential market stabilization or congestion zones near these strikes. The SPX and Q-CTA Position chart as of July 17, 2025, highlights a continued climb in SPX prices, reaching new highs, while Q-CTA positioning has recently turned positive after a prolonged period of neutrality to slight bearishness. The recent shift in systematic positioning suggests that trend-following models may be slowly re-engaging with the rally after previously staying defensive. September S&P 500 E-Mini futures (ESU25) are trending up +0.19% this morning, extending yesterday’s gains as rising confidence in the strength of the U.S. economy and positive earnings reports bolstered investors’ risk appetite. In yesterday’s trading session, Wall Street’s major indices closed higher, with the S&P 500 and Nasdaq 100 notching new record highs. Snap-On (SNA) surged nearly +8% and was the top percentage gainer on the S&P 500 after the company reported stronger-than-expected Q2 results. Also, PepsiCo (PEP) climbed more than +7% and was the top percentage gainer on the Nasdaq 100 after the beverages and snacks company posted better-than-expected Q2 results and maintained its full-year outlook. In addition, Lucid Group (LCID) jumped over +36% after the company announced a self-driving partnership with Uber and Nuro. On the bearish side, Elevance Health (ELV) plunged more than -12% and was the top percentage loser on the S&P 500 after the health insurer cut its full-year earnings guidance. Economic data released on Thursday showed that U.S. retail sales grew +0.6% m/m in June, stronger than expectations of +0.1% m/m, while core retail sales, which exclude motor vehicles and parts, increased +0.5% m/m, stronger than expectations of +0.3% m/m. Also, the U.S. Philly Fed manufacturing index rose to a 5-month high of 15.9 in July, stronger than expectations of -1.2. In addition, the number of Americans filing for initial jobless claims in the past week unexpectedly fell -7K to a 3-month low of 221K, compared with the 233K expected. Finally, the U.S. import price index rose +0.1% m/m in June, weaker than expectations of +0.3% m/m. “The consumer came back to life in June. Other data like initial jobless claims and Philly Fed also painted the picture of a strong economy,” said David Russell at TradeStation. “While it’s good for growth overall, it makes it harder to justify rate cuts.” Fed Governor Adriana Kugler said on Thursday that the central bank should continue to hold interest rates steady “for some time,” citing accelerating inflation as tariffs begin to drive up prices. At the same time, Fed Governor Christopher Waller stated that policymakers should lower interest rates this month to support a weakening labor market. Also, San Francisco Fed President Mary Daly stated that the inflationary impact of tariffs may be more muted than previously anticipated, reiterating that two interest rate cuts this year remain a “reasonable” expectation. Meanwhile, U.S. rate futures have priced in a 97.4% probability of no rate change and a 2.6% chance of a 25 basis point rate cut at the July FOMC meeting. Today, investors will focus on the University of Michigan’s U.S. Consumer Sentiment Index, which is set to be released in a couple of hours. Economists, on average, forecast that the preliminary July figure will stand at 61.4, compared to 60.7 in June. U.S. Building Permits (preliminary) and Housing Starts data will also be reported today. Economists expect June Building Permits to be 1.390M and Housing Starts to be 1.290M, compared to the prior figures of 1.394M and 1.256M, respectively. On the earnings front, notable companies like American Express (AXP), Charles Schwab (SCHW), 3M (MMM), Truist Financial (TFC), and Schlumberger (SLB) are slated to release their quarterly results today. According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average 3.2% increase in quarterly earnings for Q2 compared to the previous year, slightly ahead of pre-season expectations of 2.8%. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.443%, down -0.47%. We are starting the day off once again with positive Gamma. Quant score is still decidedly bullish Key intra-day /ES levels: Looking at in on a 2hr. chart. 6372 is nearest resistance with 6340 nearest support. If we lose 6340, 6327 is next. Trade docket for today: We've got a Gold 0DTE working order right now. I'm not sure if it will hit or not. Slim pickings today on one of our favorite trades. I'm continuing to work a scalp with short /mnq and one of my favorite covers. We'll look to exit our JNJ earnings trade. A possible cash flow on our LULU position. We should be booking a nice profit on our NFLX earnings trade right at the open. A big focus today will be to see if we can get a full profit on our QQQ 0DTE. We've been rolling the call side since last week! Our overnight Vampire trade on SPX looks to finish our this morning with a full profit so no futures hedging will be required. I look forward to a strong finish to the week and seeing you all in the live trading room shortly. Let's see if we can get our QQQ trade to the finish line!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |