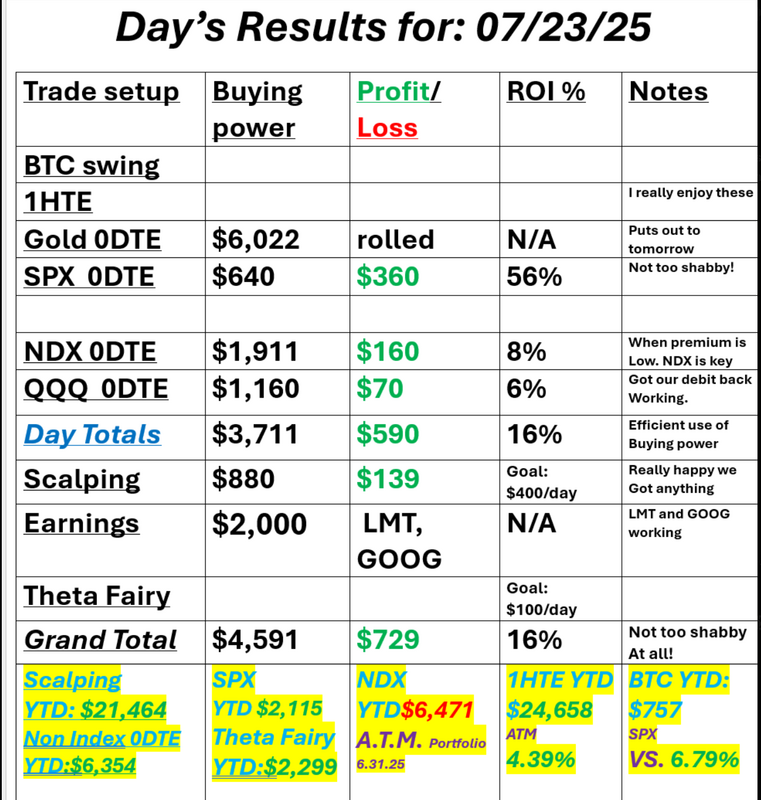

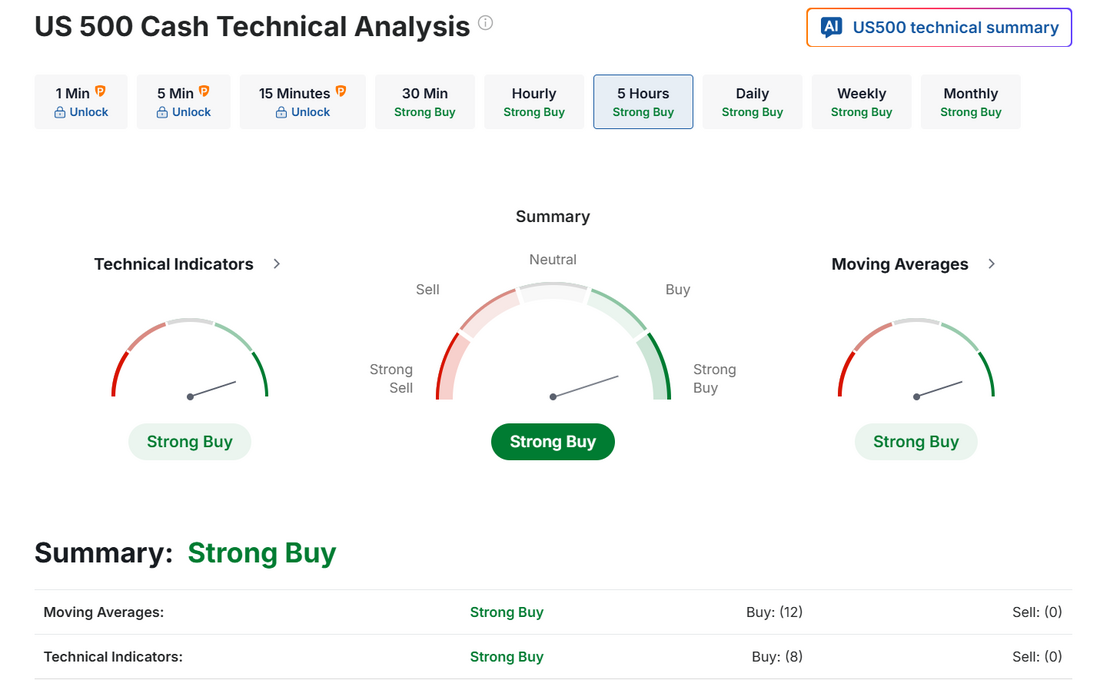

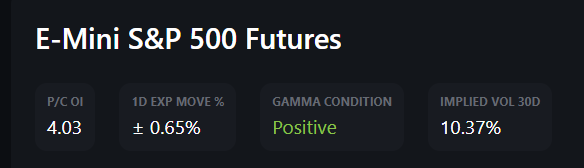

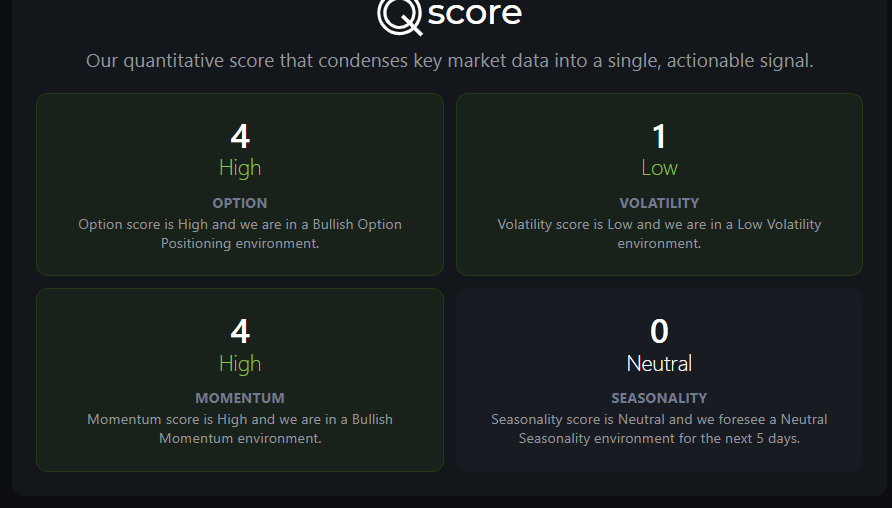

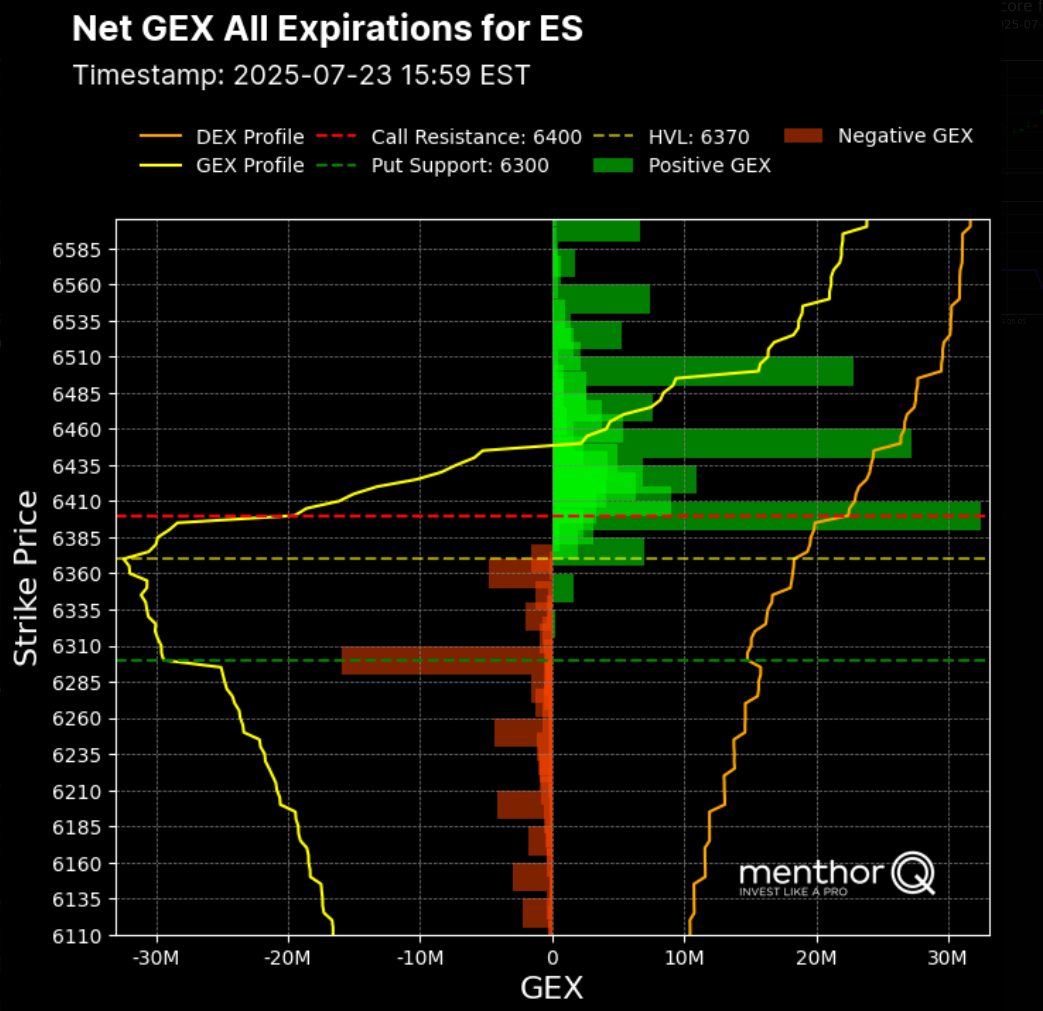

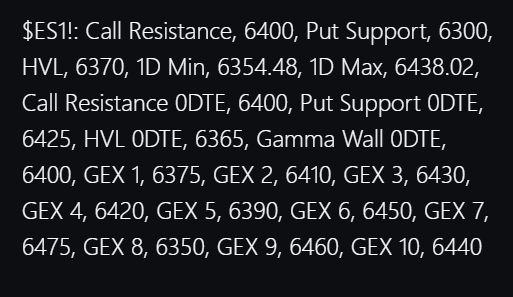

How good is your critical thinking?Happy 24th of July holiday! It's not a holiday for you? Well, for us Utahn's it is. It commemorates the first pioneers entering the Salt Lake valley and it's just as big as the 4th for us. I'm up in the mountains with the family for a much needed break. No. We are still trading every day! Just a break from home. Tesla reported earnings yesterday after the close and they were spot on, exactly...to a tee, what I thought they would be. We know sales are crashing. We know profit margins are shrinking. We know competitors are killing their market share. We know that robo taxis, AI and robots are not only not making a dime...yet, but they are actually a cash drain. None of this was conjecture or opinion before the earnings release. We already knew all this yet, everything , and I mean everything I could see online was bullish. People asking if we would see $400 a share today. Clearly all this was wishful thinking. Let me be clear. I'm not a hater. I have solar that powers my house. I own three Teslas. A model 3 and two powerwall back up battery stations. I'm also a critical thinker and so, we positioned for a slide in Tesla stock. What's the lesson here? Don't let personal bias entry the equation. Employee some critical thinking. Also...as I always say, it's way easier to make money to the downside than the upside. Let's take a look at our day yesterday: Let's take a look at the market today: Technicals continue to lean bullish. Trade deals and GOOG strong results are supporting the futures this morning. We come into the day still holding lots of positive Gamma, which is bullish. The Quant score is still very bullish. Positive GEX continues to build September Nasdaq 100 E-Mini futures (NQU25) are trending up +0.36% this morning as investors cheer forecast-beating quarterly results from Alphabet and remain optimistic that the U.S. may strike more trade deals soon. Alphabet (GOOGL) rose over +3% in pre-market trading after the Google parent reported stronger-than-expected Q2 results, boosted by demand for AI products. The company also projected a $10 billion increase in its capital spending for the year, with CEO Sundar Pichai attributing the move to the “strong and growing demand for our cloud products and services.” Also aiding sentiment, reports emerged that the European Union and the U.S. are making headway on a deal that would impose a 15% tariff on most EU imports. In addition, Bloomberg reported that the U.S. and South Korea have discussed creating a fund to invest in American projects as part of a trade agreement. Investors now look ahead to U.S. business activity data and the next round of corporate earnings reports. In yesterday’s trading session, Wall Street’s three main equity benchmarks ended higher. Lamb Weston Holdings (LW) surged over +16% and was the top percentage gainer on the S&P 500 after the producer of frozen potato products posted upbeat FQ4 results and introduced a new cost savings program. Also, Baker Hughes (BKR) climbed more than +11% and was the top percentage gainer on the Nasdaq 100 after the company reported better-than-expected Q2 results. In addition, GE Vernova (GEV) advanced over +14% after the company reported stronger-than-expected Q2 results and said it expects full-year revenue to trend toward the “higher end” of its $36B-$37B guidance. On the bearish side, Texas Instruments (TXN) plunged more than -13% and was the top percentage loser on the Nasdaq 100 after the semiconductor company issued disappointing Q3 earnings guidance. Economic data released on Wednesday showed that U.S. June existing home sales fell -2.7% m/m to a 9-month low of 3.93M, weaker than expectations of 4.00M. “With the Aug. 1 deadline looming, investors have been encouraged by the recent trade-deal announcements,” said Ian Lyngen and Vail Hartman at BMO Capital Markets. “The progress on the trade war will provide clarity and help the market move forward to incorporate the new global trade environment.” Second-quarter corporate earnings season continues in full flow, and investors look forward to fresh reports from notable companies today, including Blackstone (BX), Honeywell (HON), Union Pacific (UNP), Intel (INTC), and L3Harris Technologies (LHX). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +3.2% increase in quarterly earnings for Q2 compared to the previous year, slightly above the pre-season forecast of +2.8%. On the economic data front, all eyes are focused on S&P Global’s flash U.S. purchasing managers’ surveys, set to be released in a couple of hours. Economists, on average, forecast that the July Manufacturing PMI will come in at 52.7, compared to last month’s value of 52.9. Also, economists expect the July Services PMI to be 53.0, compared to 52.9 in June. Investors will also focus on U.S. New Home Sales data. Economists foresee this figure coming in at 649K in June, compared to 623K in May. U.S. Initial Jobless Claims data will be released today as well. Economists estimate this figure will come in at 227K, compared to last week’s number of 221K. Meanwhile, U.S. President Donald Trump is set to visit the Federal Reserve’s headquarters later today. President Trump has repeatedly criticized Fed Chair Jerome Powell for his reluctance to cut interest rates. U.S. rate futures have priced in a 97.4% probability of no rate change and a 2.6% chance of a 25 basis point rate cut at next week’s policy meeting. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.396%, up +0.16%. We've got PMI, home sales and Jobless claims all coming in this morning which could move markets. There's also the chance we get more good trade news dropping. All these things could be market movers today. My bias or lean is still bullish. Again...you just kind of have to be here. Ladies and Gentleman, I present to you the Shiller PE ratio. Currently only the tech bubble of 2000 has us at higher valuations. What could go wrong? We'll keep stacking bearish plays in our ATM portfolio. Trade docket for today: Very simple day today. Gold: still working our rolls. SPX 0DTE: This could be our main focus today. GOOG: book profit. LMT: Possible take profit today but we may need to work it into tomorrow. QQQ 0DTE: continue to bring in credit against the debit portion. Let's take a look at the intra-day numbers for /ES. As you can see, there are multiple (and tightly grouped) resistance levels with only one substantive support level which is much further down. 6410, 6419, 6437 are my resistance levels with 6366 working as the major support level. Very focused day today. We had another nice day yesterday. Let's see if we can repeat it today! As always, I look forward to seeing you all in the live trading room. Let's see if we can get another green day on our net liq.!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |