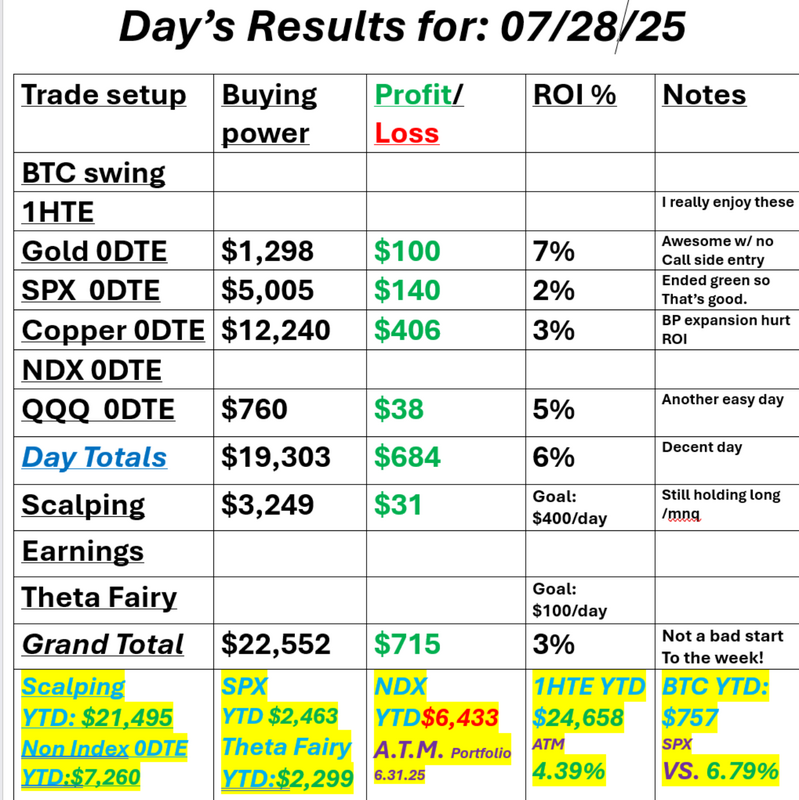

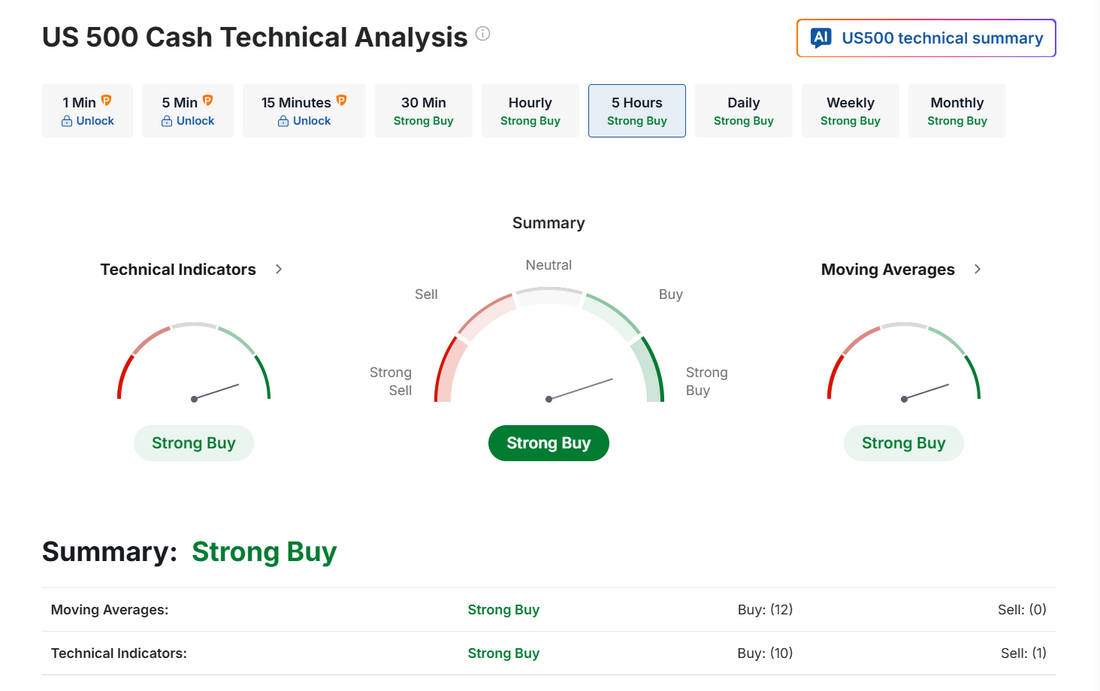

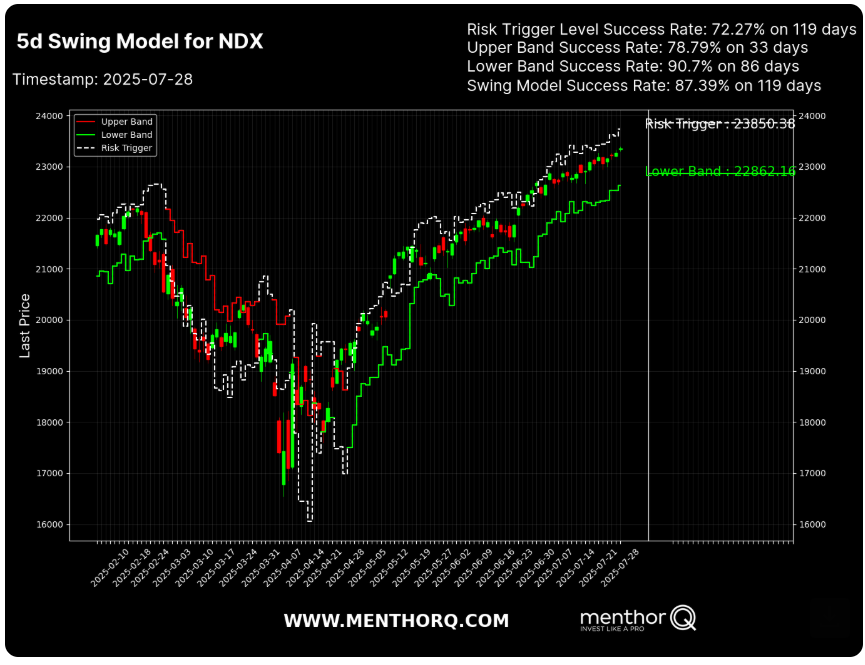

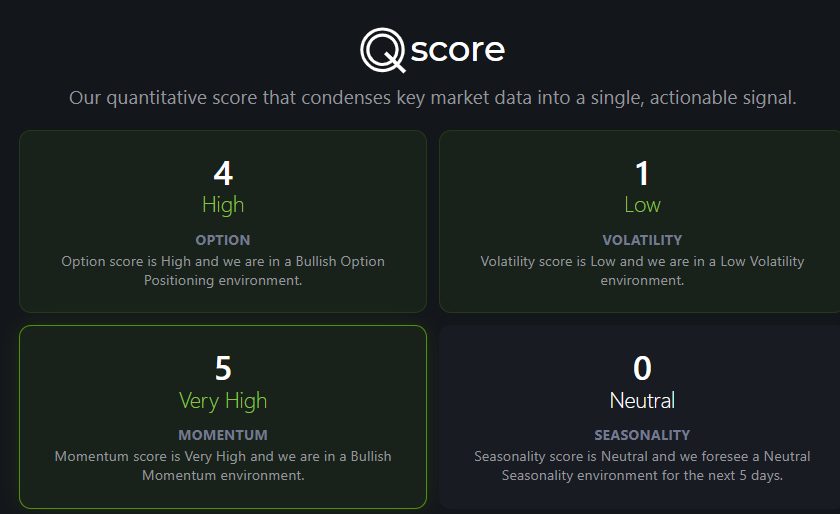

The market likes the trade dealsThe market continues to like the leverage Pres. Trump has created in the latest round of trade deals. They do clearly favor the U.S. and the market is responding with risk on trading. We had a solid day yesterday but that was largely helped by our Copper trade profits. We won't have those to depend on today so our 0DTE's will need to carry the load. Here's a look at our day. Let's take a look at the markets. Not much has changed from yesterday, except some intra-day levels. Bullish bias is holding firm. The SPX momentum chart as of July 28, 2025, reflects a strong short-term upward trajectory. The price action continues to form higher highs, with the SPX spot pushing near 6400, marking sustained bullish behavior since early May. Importantly, the momentum score has climbed back to the maximum level of 5 after briefly dipping to 4, suggesting that trend strength has re-accelerated. This recovery in momentum aligns with the consistent green candles seen recently, highlighting persistent buying pressure. Gamma still incredibly positive Here's what's crazy. 23 straight sessions without a 1% move. It's coming folks! I don't know when but it's coming. The 5-day Swing Model for the NDX as of July 28, 2025, shows the index continuing its climb toward the upper band, approaching the risk trigger level of 23,850.38. With recent price action hugging the higher end of the band, this suggests short-term bullish sentiment. The model's historical performance is notable, with a swing model success rate of 87.39% and particularly strong reliability at the lower band (90.7% success). This elevated positioning, near resistance levels, could imply a zone of caution for mean-reversion strategies, while still favoring momentum-based setups until a reversal signal or failure at the upper band emerges. Margin debt just hit $1.008 trillion, the highest level in history. That’s more leverage than at the peak of the dot-com bubble or the 2008 crash. This is the most dangerous signal in markets right now. The Quant score has turned even more bullish...if possible. September S&P 500 E-Mini futures (ESU25) are trending up +0.24% this morning, extending yesterday’s gains, while investors shift their focus from recent U.S. trade deals to economic data, a new round of corporate earnings reports, and the start of the Federal Reserve’s two-day policy meeting. In yesterday’s trading session, Wall Street’s main stock indexes closed mixed, with the S&P 500 and Nasdaq 100 notching new all-time highs. Super Micro Computer (SMCI) surged over +10% and was the top percentage gainer on the S&P 500 amid optimism that demand for its AI servers will remain strong. Also, Advanced Micro Devices (AMD) climbed more than +4% and was the top percentage gainer on the Nasdaq 100 following reports that the chipmaker plans to raise the price of its Instinct MI350 AI accelerator from $15,000 to $25,000. In addition, Nike (NKE) rose over +3% and was the top percentage gainer on the Dow after JPMorgan upgraded the stock to Overweight from Neutral with a price target of $93. On the bearish side, Revvity (RVTY) slumped more than -8% and was among the top percentage losers on the S&P 500 after the health sciences company cut its full-year adjusted EPS guidance. Chris Larkin at E*Trade from Morgan Stanley. “This week could make or break that momentum in the near term.” Meanwhile, U.S. President Donald Trump said on Monday that a blanket 15% to 20% “world tariff” rate would apply to trading partners that fail to strike separate trade deals with the U.S. before August 1st. The Federal Reserve kicks off its two-day meeting later in the day. The central bank is widely expected to leave the Fed funds rate unchanged in a range of 4.25% to 4.50% on Wednesday. The decision comes amid intense political pressure, evolving trade policy, and economic cross-currents. Investors will closely monitor Chair Jerome Powell’s post-policy meeting press conference for clues on a potential September rate cut. Second-quarter corporate earnings season is in full swing, with investors looking ahead to new reports from prominent companies today, including Visa (V), Procter & Gamble (PG), UnitedHealth (UNH), Merck & Co. (MRK), Booking (BKNG), Boeing (BA), Starbucks (SBUX), and PayPal (PYPL). According to Bloomberg Intelligence, companies in the S&P 500 are expected to post an average +4.5% increase in quarterly earnings for Q2 compared to the previous year, above the pre-season forecast of +2.8%. On the economic data front, all eyes are on the U.S. JOLTs Job Openings figures, set to be released in a couple of hours. Economists, on average, forecast that the June JOLTs Job Openings will arrive at 7.510 million, compared to the May figure of 7.769 million. Investors will also focus on the U.S. Conference Board’s Consumer Confidence Index, which came in at 93.0 in June. Economists expect the July figure to be 95.9. The U.S. S&P/CS HPI Composite - 20 n.s.a. will be reported today. Economists expect the May figure to ease to +2.9% y/y from +3.4% y/y in April. U.S. Wholesale Inventories data will be released today as well. Economists forecast the preliminary June figure at -0.1% m/m, compared to -0.3% m/m in May. In the bond market, the yield on the benchmark 10-year U.S. Treasury note is at 4.410%, down -0.72%. Trade docket for today: Gold 0DTE, SPX 0DTE, a good shot at a NDX 0DTE later in the day. QQQ 0DTE. BA, MRK, PYPL earnings trades with new earnings trades on SBUX. I'll continue to use the /MNQ for scalping. The profits haven't been big but they've been consistent. Let's take a look at the intra-day levels: 6446 is first resistance with 6453 next. Then comes 6458 that the current session high. Support comes in at 6427, 6420, 6408. My bias or lean today continues to be bullish. Until something changes that what I'm sticking with. See you all in the live trading room shortly!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

November 2025

AuthorScott Stewart likes trading, motocross and spending time with his family. |